Attached files

As filed with the Securities and Exchange Commission on February __, 2016 Registration No. ____

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

________________________________

RESULTS-BASED OUTSOURCING, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

7359

|

32-0416399

|

||

|

(State or other Jurisdiction of Incorporation)

|

(Primary Standard Classification Code)

|

(IRS Employer Identification No.)

|

Wework Commons

South Station

745 Alantic Ave.

Boston, MA 02111

Tel.: 203-635-7600

(Address and Telephone Number of Registrant’s Principal

Executive Offices and Principal Place of Business)

Mary Ellen Schloth

President

RESULTS-BASED OUTSOURCING, INC.

Wework Commons

South Station

745 Alantic Ave.

Boston, MA 02111

Tel: 203.635.7600þ (Name, Address and Telephone Number of Agent for Service)

Copies of communications to:

Daniel H. Luciano, Esq

242A West Valley Brook Road

Califon, New Jersey 07830

Tel No.: 908-832-5546

______

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration Statement number of the earlier effective registration statement for the same offering.o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

þ

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

|

Amount to be

Registered

|

Proposed Maximum

Offering Price

Per Share (1)

|

Proposed Maximum

Aggregate

Offering Price

|

Amount of

Registration Fee

|

|||||||||

|

Common Stock, par value $0.0001

|

569,500

|

$

|

0.10

|

$56,050

|

$

|

5.65

|

|||||||

|

(1)

|

The offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457(o). Our common stock is not traded on any national exchange and in accordance with Rule 457; the offering price was determined by the price shares were sold to our shareholders in a private placement memorandum. The price of $0.10 is a fixed price at which the selling security holders may sell their shares until our common stock is quoted on the OTC Bulletin Board at which time the shares may be sold at prevailing market prices or privately negotiated prices. The fixed price of $0.10 has been determined as the selling price based upon the original purchase price paid by certain selling shareholders of $0.02 plus an increase based on the fact the shares will be liquid and registered. There can be no assurance that a market maker will agree to file the necessary documents with the Financial Industry Regulatory Authority, nor can there be any assurance that such an application for quotation will be approved. There is no assurance that an active trading market for our shares will develop, or, if developed, that it will be sustained. In the absence of a trading market or an active trading market, investors may be unable to liquidate their investment or make any profit from the investment.

|

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the securities act of 1933 or until the registration statement shall become effective on such date as the commission, acting pursuant to said section 8(a), may determine.

2

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS

|

SUBJECT TO COMPLETION

|

DATED FEBRUARY __, 2016

|

569,500 Common Shares

RESULTS-BASED OUTSOURCING, INC.

This prospectus relates to periodic offers and sales of 569,500 shares of our common stock by the selling security holders. We are not selling any shares of common stock and therefore will not receive any proceeds from this offering. The selling stockholders will receive all proceeds from the sale of stock in this offering

3

Our common stock is presently not traded on any market or securities exchange. The 569,500 shares of our common stock can be sold by selling security holders at a fixed price of $0.10 per share until our shares are quoted on the OTC QB and thereafter at prevailing market prices or privately negotiated prices. There can be no assurance that a market maker will agree to file the necessary documents with the Financial Industry Regulatory Authority (“FINRA”), nor can there be any assurance that such an application for quotation will be approved. We have agreed to bear the expenses relating to the registration of the shares for the selling security holders. However, all commissions, selling and other expenses incurred by the selling stockholders to underwriters, agents, brokers and dealers will be borne by them. There is no assurance that an active trading market for our shares will develop, or, if developed, that it will be sustained. In the absence of a trading market or an active trading market, investors may be unable to liquidate their investment or make any profit from the investment.

Investing in our common stock involves a high degree of risk. Before buying any shares, you should carefully read the discussion of material risks of investing in our common stock in “Risk Factors” beginning on page 9 of this prospectus.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of anyone’s investment in these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The Date of This Prospectus Is: February __, 2016

4

TABLE OF CONTENTS

5

FORWARD-LOOKING STATEMENTS

This prospectus includes forward-looking statements. We have based these forward-looking statements on our current expectations and projections about future events. These forward-looking statements are subject to risks, uncertainties and assumptions about Results-Based Outsourcing Inc., including, among other things:

|

●

|

Our ability to successfully execute our business model.

|

|

●

|

Growth in demand for our consulting services.

|

Except as required by law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this prospectus might not occur.

The terms "Results-Based Outsourcing Inc" "our" and "we," as used in this prospectus, refer to Results-Based Outsourcing Inc.

You should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate as of the date on the front cover of this prospectus only. Our business, financial condition, results of operations and prospects may have changed since that date.

We intend to furnish our shareholders with annual reports containing consolidated financial statements audited by an independent accounting firm.

6

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider before investing in the common stock. You should carefully read the entire prospectus, including “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Consolidated Financial Statements, before making an investment decision.

We are a consulting company for the small business enterprise market (here-in-under, referred to as the “SME Market”). In general, SME Market companies range from sole proprietors – the one-person band running his or her business with no employees – through to those that have up to 50 employees. We target those SME companies with limited resources and/or infrastructure looking to outsource their operations and/or corporate level functions (our “Business Services”). Such Business Services might include; financial reporting, investor relations, accounting, sales and marketing, compliance, legal, human resource management. We also look to help clients identify, implement and maintain third-party "Software-as-a- Service" products that help streamline business operations through automation (our “Managed Software Services”). Our Business Services and Managed Software Services are collectively referred to as our Services.

Currently, our services are provided to clients on a project-based fee arrangement or a fixed term agreement with an initial retainer and monthly or periodic payments. We believe that by combining our outsourced business consulting services and existing software tools in the marketplace, we will help clients cost effectively and efficiently build and maintain their business plans.

The Company plans to become a public company. The reason for becoming a public company is to attract capital to fund further expansion and the development of our Services. Many investors prefer to invest in public companies because they deem their investment to have more liquidity in their investment. Another reason for becoming public is to increase public awareness of the Company. The negatives for being public are the cost of compliance with regulatory requirements, audits, and investor relations can be high. We believe the additional costs associated with being public will range up to $50,000 per year. This estimate could change dramatically depending on the level of our success. The Company, the Company’s officers and directors do not intend for the Company, once it is reporting, to be used as a vehicle for a private company to become a reporting company.

Since our inception (July 2013), through December 31, 2015, we have received over $235,000 in revenues. For the year ended December 31, 2015, we reported a profit of $9,012 and had working capital of $11,012. Through the date of this report we have acquired 11 clients. Two client’s represented approximately 34% and 21% of our revenue to date, respectively, and the remaining clients each represented 12% or less of our revenue. Our initial activities focused on developing our delivery service model that will enable us to best service clients and scale as our client base grows. With our delivery system now developed we plan to focus our efforts on sales and marketing and setting up our decentralized service locations.

Our working capital as of December 31, 2015 is $11,012. We project that our monthly expenditures (burn rate) is approximately $1,000 consisting of generally office overhead. In addition, we project the cost of being a public company to be approximately $4,000 per month. Thus, our total monthly overhead is approximately $5,000. If we lose clients and are unable to continue to grow our revenue, we estimate that we will exhaust our available capital within three to five months from the date of the financial statements (December 31, 2015). For these and other reasons, our independent auditors have raised substantial doubt about our ability to continue as a going concern. Accordingly, we may require additional financing, including the debt or equity funding.

7

We have no present plans to be acquired or to merge with another company nor do we, nor any of our shareholders, have any plans to enter into a change of control or similar transaction. We may, as stated below under “Our Strategy”, look to acquire complementary service providers or software product companies in the future to grow our operations. Our offices are located at Wework Commons,South Station, 745 Alantic Ave., Boston, MA 02111. Our telephone number is 203.635.7600 and our website is www.rboutsourceing.com.

The Offering

|

Common stock offered by selling security holders

|

569,500 shares of common stock.

|

|

Common stock outstanding before the offering :

|

4,107,000 shares of common stock.

|

|

Common stock outstanding after the offering

|

4,107,000 shares of common stock

|

|

Terms of the Offering

|

The selling security holders will determine when and how they will sell the common stock offered in this prospectus.

|

|

Use of Proceeds

|

We are not selling any shares of the common stock covered by this prospectus, and, as a result, will not receive any proceeds from this offering.

|

|

Risk Factors

|

The common stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors” below.

|

8

Summary Financial Data

The summary financial information set forth below has been derived from our financial statements for the year ended December 31, 2015 and and 2014 and should be read in conjunction with the financial statements and the notes thereto included elsewhere in this Prospectus and in the information set forth in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

|

Year Ending December 31, 2015

|

Year Ending December 31, 2014

|

|||||||

|

Revenues

|

$

|

170,697

|

$

|

56,786

|

||||

|

Cost of Revenues

|

$

|

62,223

|

$

|

23,750

|

||||

|

Operating Expenses

|

$

|

99,462

|

$

|

38,063

|

||||

|

Net Income (Loss) from operations

|

$

|

9,012

|

|

$

|

(5,027)

|

|||

|

As of December

31, 2015

|

As of December 31, 2014

|

|||||||

|

Total Assets

|

$

|

26,203

|

$

|

18,372

|

||||

|

Total Liabilities

|

$

|

11,941

|

$

|

13,122

|

||||

|

Working Capital

|

$

|

11,012

|

$

|

5,250

|

||||

|

Shareholder’s Equity

|

$

|

14,262

|

$

|

5,250

|

||||

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this prospectus before investing in our common stock. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed. Please note that throughout this prospectus, the words “we”, “our”, “us”, or “Results-Based Outsourcing” refer to the Company and its subsidiaries and not to the selling stockholders.

Risks Related to Our Business

WE HAVE A LIMITED OPERATING HISTORY THAT YOU CAN USE TO EVALUATE US, AND THE LIKELIHOOD OF OUR SUCCESS MUST BE CONSIDERED IN LIGHT OF THE PROBLEMS, EXPENSES, DIFFICULTIES, COMPLICATIONS AND DELAYS FREQUENTLY ENCOUNTERED BY A SMALL DEVELOPING COMPANY.

We were incorporated in Delaware on July 22, 2013. Although we are generating revenue, we have no significant financial resources. The likelihood of our success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered by a small developing company starting a new business enterprise and the highly competitive environment in which we will operate. Since we have a limited operating history, we cannot assure you that our business will be profitable or that we will ever generate sufficient revenues to meet our expenses and support our anticipated activities.

WE DEPEND ON OUR SOLE DIRECTOR AND OFFICER (‘SHE”, “HER”) AND THE LOSS OF HER SERVICES WOULD FORCE US TO EXPEND TIME AND RESOURCES IN PURSUIT OF REPLACEMENTS WHICH COULD ADVERSELY AFFECT OUR BUSINESS.

We consider our current director and officer to be essential to the success of the business. We have no employment contract with her and do not maintain key man life insurance on her. Although she has not indicated any intention of leaving us, if she did leave for any reason it could have very negative impact on our ability to fulfill our business plan.

9

WE MAY INCUR SIGNIFICANT COSTS TO BE A PUBLIC COMPANY TO ENSURE COMPLIANCE WITH U.S. CORPORATE GOVERNANCE AND ACCOUNTING REQUIREMENTS AND WE MAY NOT BE ABLE TO ABSORB SUCH COSTS.

We may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the Securities and Exchange Commission. We expect these costs to approximate $50,000 per year, consisting of $25,000 in legal, $20,000 in audit and $5,000 for EDGAR filing and transfer agent fees. We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. We may not be able to cover these costs from our operations and may need to raise or borrow additional funds. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs. In addition, we may not be able to absorb these costs of being a public company which will negatively affect our business operations.

OUR SOLE DIRECTOR AND CHIEF EXECUTIVE OFFICER BENEFICIALLY OWN’S APPROXIMATELY 85% OF THE SHARES OF OUR COMMON STOCK GIVING HER CONTROL OVER DECISIONS AND HER INTEREST COULD CONFLICT WITH THE INVESTORS WHICH COULD CAUSE THE INVESTOR TO LOSE ALL OR PART OF THE INVESTMENT.

Our sole director and chief executive officer owns approximately 85% of our issued and outstanding common stock. As such, these officers have complete control over decisions, including, but not limited to all employment decisions, appointment of other management positions and whether to enter into material transactions with related parties. Such concentration of ownership may also have the effect of delaying or preventing a change in control, which may be to the benefit of our management but not in the interest of the shareholders. This beneficial ownership and potential effective control on all matters relating to our business and operations could eliminate the possibility of shareholders changing the management in the event that the shareholders did not agree with the conduct of the officers and directors. Additionally, the shareholders would potentially not be able to obtain the necessary shareholder vote to affect any change in the course of our business. This lack of shareholder control could prevent the shareholders from removing from the Board of Directors any directors who are not managing the company with sufficient skill to make it profitable, which could prevent us from becoming profitable.

OUR SOLE DIRECTOR AND CHIEF EXECUTIVE OFFICER INTENDS TO DEVOTE ONLY PART TIME EFFORTS TO OUR BUSINESS, MAY HAVE CONFLICTS OF INTERESTS IN ALLOCATING HER TIME BETWEEN OUR COMPANY AND THOSE OF OTHER BUSINESSES AND DETERMINING TO WHICH ENTITY A PARTICULAR BUSINESS OPPORTUNITY SHOULD BE PRESENTED WHICH MAY NOT BE SUFFICIENT TO SUCCESSFULLY DEVELOP OUR BUSINESS.

The amount of time our sole director and officer intends to devote to our business is limited currently expected to be approximately 15%, of her working time to our company. She has other business interests, although these business interests are not competitive to our operations. While we expect her to increase the percentage of the working time she devotes to our company if our operations increase, the amount of time which she devotes to our business may not be sufficient to fully develop our business.

Additionally, she may encounter a conflict of interest in allocating their time between our operations and those of other businesses. In the course of her other business activities, she may become aware of investment and business opportunities which may be appropriate for presentation to us as well as other entities to which she owes a fiduciary duty. As a result, she may have conflicts of interest in determining to which entity a particular business opportunity should be presented. Such conflicts of interests, should they arise, may be detrimental to our business.

10

BECAUSE OUR MANAGEMENT DOES NOT HAVE PRIOR EXPERIENCE RUNNING A PUBLIC COMPANY, WE MAY HAVE TO HIRE INDIVIDUALS OR SUSPEND OR CEASE OPERATIONS.

Because our management has limited prior experience in running a public company, including the preparation of reports under the Securities Act of 1934, we may have to hire additional experienced personnel to assist us with the preparation thereof. If we need the additional experienced personnel and we do not hire them, we could fail in our plan of operations and have to suspend operations or cease operations entirely

BECAUSE OUR OFFICER AND DIRECTOR HAS LIMITED FORMAL TRAINING OR EXPERIENCE IN FINANCIAL ACCOUNTING AND MANAGEMENT, THERE MAY NOT BE EFFECTIVE DISCLOSURE AND ACCOUNTING CONTROLS TO COMPLY WITH APPLICABLE LAWS AND REGULATIONS WHICH COULD RESULT IN FINES, PENALTIES AND ASSESSMENTS AGAINST US.

Our sole director and chief executiveofficer/chief financial officer has limited formal training or experience in financial accounting and management, however, she responsible for our managerial and organizational structure which will include preparation of disclosure and accounting controls under the Sarbanes Oxley Act of 2002. While she has limited formal training in financial accounting matters and limited experience U.S. Generally Accepted Accounting Principals, she has been preparing the financial statements that have been audited and reviewed by our auditors and included in this prospectus. When the disclosure and accounting controls referred to above are implemented, she will be responsible for the administration of them. Should she not have sufficient experience, she may be incapable of creating and implementing the controls. Lack of proper controls could cause our financial statements to be inaccurate which will give us an incorrect view of our financial condition and mislead us into believing our operations are being conducted correctly. As a result, investors will be misled about our financial condition and the quality of our operations. This inaccurate reporting could cause us to be subject to sanctions and fines by the SEC which ultimately could cause you to lose your investment, however, because of the small size of our expected operations, we believe that she will be able to monitor the controls he will have created and will be accurate in assembling and providing information to investors.

WE EXPECT OUR QUARTERLY RESULTS TO FLUCTUATE WHICH MAY ADVERSELY AFFECT OUR STOCK PRICE.

We expect that our quarterly results will fluctuate significantly. We believe that period-to-period comparisons of our operating results are not meaningful. Additionally, if our operating results in one or more quarters do not meet securities analysts' or your expectations, the price of our common stock could decrease.

IF OUR COSTS AND EXPENSES ARE GREATER THAN ANTICIPATED AND WE ARE UNABLE TO RAISE ADDITIONAL WORKING CAPITAL, WE MAY BE UNABLE TO FULLY FUND OUR OPERATIONS AND TO OTHERWISE EXECUTE OUR BUSINESS PLAN.

We believe that our currently available working capital and current client base will be sufficient to continue our business for at least the next 3 to 5 months, absent continuing revenue. Should our costs and expenses prove to be greater than we currently anticipate, or should we change our current business plan in a manner that will increase or accelerate our anticipated costs and expenses, the depletion of our working capital would be accelerated. To the extent it becomes necessary to raise additional cash in the future as our current cash and working capital resources are depleted, we will seek to raise it through the public or private sale of debt or equity securities, funding from joint-venture or strategic partners, debt financing or short-term loans, or a combination of the foregoing. We may also seek to satisfy indebtedness without any cash outlay through the private issuance of debt or equity securities. We currently do not have any binding commitments for, or readily available sources of, additional financing. We cannot give you any assurance that we will be able to secure the additional cash or working capital we may require to continue our operations.

11

IF WE REQUIRE ADDITIONAL CAPITAL AND EVEN IF WE ARE ABLE TO RAISE ADDITIONAL FINANCING, WE MIGHT NOT BE ABLE TO OBTAIN IT ON TERMS THAT ARE NOT UNDULY EXPENSIVE OR BURDENSOME TO THE COMPANY OR DISADVANTAGEOUS TO OUR EXISTING SHAREHOLDERS.

If we require additional capital and even if we are able to raise additional cash or working capital through the public or private sale of debt or equity securities, funding from joint-venture or strategic partners, debt financing or short-term loans, or the satisfaction of indebtedness without any cash outlay through the private issuance of debt or equity securities, the terms of such transactions may be unduly expensive or burdensome to the Company or disadvantageous to our existing shareholders. For example, we may be forced to sell or issue our securities at significant discounts to market, or pursuant to onerous terms and conditions, including the issuance of preferred stock with disadvantageous dividend, voting or veto, board membership, conversion, redemption or liquidation provisions; the issuance of convertible debt with disadvantageous interest rates and conversion features; the issuance of warrants with cashless exercise features; the issuance of securities with anti-dilution provisions; and the grant of registration rights with significant penalties for the failure to quickly register. If we raise debt financing, we may be required to secure the financing with all of our business assets, which could be sold or retained by the creditor should we default in our payment obligations.

A CONFLICT OF INTEREST MAY ARISE WITH OUR CONSULTANT

We have entered into a consulting contract with the spouse of our sole director/officer and majority stockholder’s spouse. We believe this contract provides for terms which are customary in the industry, however, it may be considered a non arm's length transaction due to the relationship of the parties. As a result, a potential conflict of interest between the interest of the Company and that of the consultant, which could have an adverse effect on our business.

WE FACE INTENSE COMPETITION AND OPERATE IN AN INDUSTRY WITH LIMITED BARRIERS TO ENTRY, AND MOST OF OUR COMPETITORS ARE BETTER POSITIONED THAN WE ARE.

The start-up, emerging business professional services market is competitive with limited barriers to entry. Our competitors include established professional service providers, including without limitation, the Boston Consulting Group, Kimley Horn & Associates, TEK Systems, Deloitte Touche, Proviti, or ManPower, who have longer operating histories, larger customer bases, greater brand recognition and significantly greater financial, marketing, technical, management and other resources than we do. We expect competition will intensify in the future. Increased competition may result in reduced operating margins, reduced profitability, loss of market share and diminished brand recognition. These and other competitive pressures may have a material adverse effect on our business, financial condition and results of operations.

YOU MAY NOT BE ABLE TO LIQUIDATE YOUR INVESTMENT SINCE THERE IS NO ASSURANCE THAT A PUBLIC MARKET WILL DEVELOP FOR OUR COMMON STOCK OR THAT OUR COMMON STOCK WILL EVER BE APPROVED FOR TRADING ON A RECOGNIZED EXCHANGE

There is no established public trading market for our securities. Although we intend to be quoted on the OTC QB tier of OTC Markets in the United States, our shares are not and have not been quoted on any exchange or quotation system. We cannot assure you that a market maker will agree to file the necessary documents with the FINRA, nor can there be any assurance that such an application for quotation will be approved or that a regular trading market will develop or that if developed, will be sustained. In the absence of a trading market, an investor may be unable to liquidate its investment, which will result in the loss of your investment.

12

THE OFFERING PRICE OF THE SHARES WAS SOLELY DETERMINED BASED UPON THE PRICE THE SHARES WERE SOLD IN THE PRIVATE PLACEMENT, AND THEREFORE SHOULD NOT BE USED AS AN INDICATOR OF THE FUTURE MARKET PRICE OF THE SECURITIES. THEREFORE, THE OFFERING PRICE BEARS NO RELATIONSHIP TO THE ACTUAL VALUE OF THE COMPANY, AND MAY MAKE OUR SHARES DIFFICULT TO SELL.

Since our shares are not listed or quoted on any exchange or quotation system, the offering price of $0.10 for the shares of common stock was determined based upon the price the shares were sold to the investors in private placements of $0.02 plus an increase based on the fact the shares will be liquid and registered. The facts considered in determining the offering price were our financial condition and prospects, our limited operating history and the general condition of the securities market. The offering price bears no relationship to the book value, assets or earnings of our company or any other recognized criteria of value. The offering price should not be regarded as an indicator of the future market price of the securities.

SHOULD OUR STOCK BECOME QUOTED ON THE OTC QB TIER OF OTC MARKETS IF WE FAIL TO REMAIN CURRENT ON OUR REPORTING REQUIREMENTS, WE COULD BE REMOVED FROM THE OTC QB WHICH WOULD LIMIT THE ABILITY OF BROKER-DEALERS TO SELL OUR SECURITIES AND THE ABILITY OF STOCKHOLDERS TO SELL THEIR SECURITIES IN THE SECONDARY MARKET.

Companies quoted on the OTC QB tier of OTC Markets, such as we are seeking to become, must be reporting issuers under Section 12 of the Securities Exchange Act of 1934, as amended, and must be current in their reports under Section 13, in order to maintain price quotation privileges on the OTC QB. If we fail to remain current on our reporting requirements, we could be removed from the OTC QB. As a result, the market liquidity for our securities could be severely adversely affected by limiting the ability of broker-dealers to sell our securities and the ability of stockholders to sell their securities in the secondary market. In addition, we may be unable to get re-quoted on the OTC QB, which may have an adverse material effect on our Company.

ONCE PUBLICLY TRADING, THE APPLICATION OF THE “PENNY STOCK” RULES COULD ADVERSELY AFFECT THE MARKET PRICE OF OUR COMMON SHARES AND INCREASE YOUR TRANSACTION COSTS TO SELL THOSE SHARES.

The Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

|

●

|

that a broker or dealer approve a person's account for transactions in penny stocks; and

|

|

●

|

the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

|

13

In order to approve a person's account for transactions in penny stocks, the broker or dealer must:

|

●

|

obtain financial information and investment experience objectives of the person; and

|

|

●

|

make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

|

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the Commission relating to the penny stock market, which, in highlight form:

|

●

|

sets forth the basis on which the broker or dealer made the suitability determination; and

|

|

●

|

that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

|

Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

WE DO NOT EXPECT TO PAY DIVIDENDS IN THE FUTURE; ANY RETURN ON INVESTMENT MAY BE LIMITED TO THE VALUE OF OUR COMMON STOCK.

We do not currently anticipate paying cash dividends in the foreseeable future. The payment of dividends on our Common Stock will depend on earnings, financial condition and other business and economic factors affecting it at such time as the board of directors may consider relevant. Our current intention is to apply net earnings, if any, in the foreseeable future to increasing our capital base and development and marketing efforts. There can be no assurance that the Company will ever have sufficient earnings to declare and pay dividends to the holders of our Common Stock, and in any event, a decision to declare and pay dividends is at the sole discretion of our Board of Directors. If we do not pay dividends, our Common Stock may be less valuable because a return on your investment will only occur if its stock price appreciates.

14

OUR COMMON STOCK PRICE IS LIKELY TO BE HIGHLY VOLATILE WHICH MAY SUBJECT US TO SECURITIES LITIGATION THEREBY DIVERTING OUR RESOURCES WHICH MAY AFFECT OUR PROFITABILITY AND RESULTS OF OPERATION.

The market price for our common stock is likely to be highly volatile as the stock market in general and the market for Internet-related stocks.

The following factors will add to our common stock price's volatility:

|

●

|

actual or anticipated variations in our quarterly operating results;

|

|

●

|

announcements by us of acquisitions;

|

|

●

|

additions or departures of our key personnel; and.

|

|

●

|

sales of our common stock

|

Many of these factors are beyond our control. These factors may decrease the market price of our common stock, regardless of our operating performance. In the past, plaintiffs have initiated securities class action litigation against a company following periods of volatility in the market price of its securities. We may in the future be the target of similar litigation. Securities litigation could result in substantial costs and liabilities and could divert management’s attention and resources.

REDUCED DISCLOSURE REQUIREMENTS APPLICABLE TO EMERGING GROWTH COMPANIES MAY MAKE OUR COMMON STOCK LESS ATTRACTIVE TO INVESTORS. We qualify as an "emerging growth company" under the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

|

●

|

have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act;

|

|

|

●

|

comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit

firm rotation or a supplement to the

auditor's report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis);

|

|

|

●

|

submit certain executive compensation matters to shareholder advisory votes, such as "say-on-pay" and "say-on-frequency;" and

|

|

|

●

|

disclose certain executive compensation related items such as the correlation between executive compensation and performance

and comparisons of the CEO's compensation to median employee compensation.

|

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We will remain an emerging growth company for up to five full fiscal years, although if the market value of our common stock that is held by non-affiliates exceeds $700 million as of any January 31 before that time, we would cease to be an emerging growth company as of the following December 31, or if our annual revenues exceed $1 billion, we would cease to be an emerging growth company the following fiscal year, or if we issue more than $1 billion in non-convertible debt in a three-year period, we would cease to be an emerging growth company immediately.

Notwithstanding the above, we also are currently a "smaller reporting company," meaning that we are not an investment company, an asset-backed issuer, nor a majority-owned subsidiary of a parent company that is not a smaller reporting company, and has a public float of less than $75 million and annual revenues of less than $50 million during the most recently completed fiscal year. If we are still considered a "smaller reporting company" at such time as we cease to be an "emerging growth company," we will be subject to increased disclosure requirements. However, the disclosure requirements will still be less than they would be if we were not considered either an "emerging growth company" or a "smaller reporting company." Specifically, similar to "emerging growth companies", "smaller reporting companies" are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; are not required to conduct say-on-pay and frequency votes until annual meetings occurring on or after January 21, 2015; and have certain other decreased disclosure obligations in their SEC filings, including, among other things, only being required to provide two years of audited financial statements in annual reports. Decreased disclosures in its SEC filings due to its status as an "emerging growth company" or "smaller reporting company" may make us less attractive to investors given that it will be harder for investors to analyze the Company's results of operations and financial prospects and, as a result, it may be difficult for us to raise additional capital as and when we need it.

USE OF PROCEEDS

The selling stockholders are selling shares of common stock covered by this prospectus for their own account. We will not receive any of the proceeds from the sale of these shares. We have agreed to bear the expenses relating to the registration of the shares for the selling security holders.

DETERMINATION OF OFFERING PRICE

Since our shares are not listed or quoted on any exchange or quotation system, the offering price of the shares of common stock of $0.10 was determined as the selling price based upon the original purchase price paid by certain selling shareholders of $0.02 plus an increase based on the fact the shares will be liquid and registered.

The offering price of the shares of our common stock has been determined arbitrarily by us and does not necessarily bear any relationship to our book value, assets, past operating results, financial condition or any other established criteria of value. The facts considered in determining the offering price were our financial condition and prospects, our limited operating history and the general condition of the securities market. Although our common stock is not listed on a public exchange, we will be filing to obtain a listing on the OTC QB tier of OTC Markets. In order to be quoted on the OTC QB, a market maker must file an application on our behalf in order to make a market for our common stock. There can be no assurance that a market maker will agree to file the necessary documents with FINRA, nor can there be any assurance that such an application for quotation will be approved.

In addition, there is no assurance that our common stock will trade at market prices in excess of the initial public offering price as prices for the common stock in any public market which may develop will be determined in the marketplace and may be influenced by many factors, including the depth and liquidity.

15

The common stock to be sold by the selling shareholders is common stock that is currently issued. Accordingly, there will be no dilution to our existing shareholders.

PENNY STOCK CONSIDERATIONS

Our common stock will be a penny stock; therefore, trading in our securities is subject to penny stock considerations. Broker-dealer practices in connection with transactions in “penny stocks” are regulated by certain penny stock rules adopted by the Securities and Exchange Commission.

Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system). Penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. The broker-dealer must also make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a security that becomes subject to the penny stock rules. The additional burdens imposed upon broker-dealers by such requirements may discourage broker-dealers from effecting transactions in our securities, which could severely limit their market price and liquidity of our securities. These requirements may restrict the ability of broker-dealers to sell our common stock and may affect your ability to resell our common stock.

State Securities - Blue Sky Laws

There is no public market for our common stock, and there can be no assurance that any market will develop in the foreseeable future. Transfer of our common stock may also be restricted under the securities regulations or laws promulgated by various states and foreign jurisdictions, commonly referred to as “Blue Sky” laws. Absent compliance with such individual state laws, our common stock may not be traded in such jurisdictions. Because the securities registered hereunder have not been registered for resale under the Blue Sky laws of any state, the holders of such shares and persons who desire to purchase them in any trading market that might develop in the future, should be aware that there may be significant state Blue-Sky law restrictions upon the ability of investors to sell the securities and of purchasers to purchase the securities. Accordingly, investors may not be able to liquidate their investments and should be prepared to hold the shares of our common stock for an indefinite period of time.

Selling security holders may contact us directly to ascertain procedures necessary for compliance with Blue Sky Laws in the applicable states relating to sellers and/or purchasers of our shares of common stock.

Limitations Imposed by Regulation M

Under applicable rules and regulations under the Securities Exchange Act of 1934, as amended, any person engaged in the distribution of the shares may not simultaneously engage in market making activities with respect to our common stock for a period of two business days prior to the commencement of such distribution. In addition and without limiting the foregoing, each selling security holder will be subject to applicable provisions of the Securities Exchange Act of 1934, as amended, and the associated rules and regulations thereunder, including, without limitation, Regulation M, which may limit the timing of purchases and sales of shares of our common stock by the selling security holders. We will make copies of this Prospectus available to the selling security holders and will inform them of the need for delivery of copies of this Prospectus to purchasers at or prior to the time of any sale of the shares offered hereby. We assume no obligation to so deliver copies of this Prospectus or any related Prospectus supplement.

16

SELLING SHAREHOLDERS

We are registering an aggregate of 569,500 shares of common stock for resale by the selling security holders listed in the table below.

All expenses incurred with respect to the registration of the common stock will be borne by us, but we will not be obligated to pay any underwriting fees, discounts, commissions or other expenses incurred by the selling security holders in connection with the sale of such shares.

The following tables set forth information with respect to the maximum number of shares of common stock beneficially owned by the selling security holders named below and as adjusted to give effect to the sale of the shares offered hereby. The shares beneficially owned have been determined in accordance with rules promulgated by the Securities and Exchange Commission, and the information is not necessarily indicative of beneficial ownership for any other purpose. The information in the table below is current as of the date of this Prospectus. All information contained in the table below is based upon information provided to us by the selling security holders and we have not independently verified this information. The selling security holders are not making any representation that any shares covered by this Prospectus will be offered for sale. The selling security holders may from time to time offer and sell pursuant to this Prospectus any or all of the common stock being registered.

Except as indicated in the notes to the table below, none of the selling security holders held any position or office with us, nor are any of the selling security holders associates or affiliates of any of our officers or directors. Except as indicated below, no selling security holder is the beneficial owner of any additional shares of common stock or other equity securities issued by us or any securities convertible into, or exercisable or exchangeable for, our equity securities. Except as indicated below, no selling security holder is a registered broker-dealer or an affiliate of a broker-dealer.

For purposes of this table, beneficial ownership is determined in accordance with the Securities and Exchange Commission rules, and includes investment power with respect to shares and shares owned pursuant to warrants or options exercisable within 60 days.

The percentages of shares beneficially owned are based on 4,107,000 shares of our common stock issued and outstanding as of the date hereof on a fully diluted basis.

We may require the selling security holders to suspend the sales of the securities offered by this Prospectus upon the occurrence of any event that makes any statement in this Prospectus or the related Registration Statement untrue in any material respect or that requires the changing of statements in these documents in order to make statements in those documents not misleading.

17

|

Name of selling shareholder

|

Number of shares to be sold

|

Maximum # of shares to be offered

|

Ownership % after Sale

|

|||||||||

|

Howard Kaplan (17)

|

80,000 | 75,000 | * | |||||||||

|

Kelly Kaplan (18)

|

80,000 | 5,000 | * | |||||||||

|

Michael E Tobler (3)

|

75,000 | 75,000 | * | |||||||||

|

Launa Whalen (5)

|

10,000 | 5,000 | * | |||||||||

|

Edward Whalen (6)

|

10,000 | 5,000 | * | |||||||||

|

Victor Uscilla (10)

|

10,000 | 5,000 | * | |||||||||

|

Theresa Uscilla (11)

|

10,000 | 5,000 | * | |||||||||

|

Linda Carlsen

|

5,000 | 5,000 | * | |||||||||

|

Conrad Huss

|

5,000 | 5,000 | * | |||||||||

|

Lisa North (9)

|

10,000 | 5,000 | * | |||||||||

|

Thaddeus North (3),(8)

|

10,000 | 5,000 | * | |||||||||

|

Ryan Onthank (12)

|

12,500 | 5,000 | * | |||||||||

|

R. Pierce Onthank Sr (1)

|

42,500 | 12,500 | * | |||||||||

|

R. Pierce Onthank Jr (4)

|

12,500 | 12,500 | * | |||||||||

|

Susan Onthank (16)

|

42,500 | 12,500 | * | |||||||||

|

Jeremy Curtis Quinn

|

12,500 | 12,500 | * | |||||||||

|

Sean Vazquez (7)

|

37,500 | 12,500 | * | |||||||||

|

Grace Neuert (7)

|

37,500 | 12,500 | * | |||||||||

|

Chris Neuert (7)

|

37,500 | 12,500 | * | |||||||||

|

Derek Cahill

|

12,500 | 12,500 | * | |||||||||

|

Robert Kudrick Jr

|

12,500 | 12,500 | * | |||||||||

|

Henry Howard

|

12,500 | 12,500 | * | |||||||||

|

Narine Persaud (13)

|

25,000 | 12,500 | * | |||||||||

|

Sabrina Persaud (14)

|

25,000 | 12,500 | * | |||||||||

|

Richard Persaud (15)

|

12,500 | 12,500 | * | |||||||||

|

John Murphy

|

12,500 | 12,500 | * | |||||||||

|

Michael George (3)

|

12,500 | 12,500 | * | |||||||||

|

Criag Lenahan (2)

|

12,500 | 12,500 | * | |||||||||

|

Marianne Lenahan (7)

|

12,500 | 12,500 | * | |||||||||

|

Benjamin Prince

|

12,500 | 12,500 | * | |||||||||

|

Shane Miller

|

12,500 | 12,500 | * | |||||||||

|

Leam B Odette

|

12,500 | 12,500 | * | |||||||||

|

Ryan Alan Neely

|

12,500 | 12,500 | * | |||||||||

|

James Cavallo

|

12,500 | 12,500 | * | |||||||||

|

David Kliminzak

|

12,500 | 12,500 | * | |||||||||

|

Daniel Luciano (19)

|

82,000 | 82,000 | * | |||||||||

|

Totals

|

569,500 | |||||||||||

|

*less than 1%

|

|

|

(1) Includes 12,500 shares held by Susan Onthank, Mr. Onthank Sr.’s spouse. Mr. Onthank is the father of Ryan and R. Pierce Onthank, Jr., his adult sons.

|

|

|

(2) Mr. Lenahan is the adult son of Marianne Lenahan. Mr. Lenahan is of legal age, has sole and dispositive rights over the disposal of her shares and the voting rights attached thereto and is not directly or indirectly influenced or controlled by his parents.

|

|

|

(3) Affiliate of a broker-dealer. Selling stockholder has certified that at the time he/she purchased the shares being registered hereunder, he/she had no agreements or understandings, directly or indirectly with any person to distribute the subject securities. All of these shares were purchased in the ordinary course of business.

|

|

|

(4) Mr. Onthank,Jr. is the adult son of R. Pierce Onthank, Sr. and Susan Onthank and brother of Ryan Onthank. Mr. Onthank is of legal age, has sole and dispositive rights over the disposal of his shares and the voting rights attached thereto and is not directly or indirectly influenced or controlled by his parents or siblings.

|

|

|

(5) Includes 5,000 shares held by Edward Whalen, Mrs. Whelan’s spouse.

|

|

|

(6) Includes 5,000 shares held by Launa Whalen, Mr. Whelan’s spouse.

|

|

|

(7) Mother of Craig Lenahan, her adult son.

|

|

|

(8) Includes 5,000 shares held by Lisa North, Mr. North’s spouse.

|

|

|

(9) Includes 5,000 shares held by Thaddeus North, Mrs. North’s spouse.

|

|

|

(10) Includes 5,000 shares held by Theresa Uscilla, Mr. Uscilla’s spouse.

|

|

|

(11) Includes 5,000 shares held by Victor Uscilla, Mrs. Uscilla’s spouse.

|

|

|

(12) Mr. Onthank is the adult son of R. Pierce Onthank, Sr. and Susan Onthank and brother of Pierce Onthank, Jr.. Mr. Onthank is of legal age, has sole and dispositive rights over the disposal of his shares and the voting rights attached thereto and is not directly or indirectly influenced or controlled by his parents or siblings.

|

|

|

(13) Includes 12,500 shares held by Sabrina Persaud, Mr. Persaud’s spouse. Mr. Persaud is also the father of Richard Persaud, his adult son.

|

|

|

(14) Includes 12,500 shares held by Bodhnarine Persaud, Mrs. Persaud’s spouse. Mrs. Persaud is also the mother of Richard Persaud, her adult son.

|

|

|

(15) Mr. Persaud is the adult son of Bodhnarine and Sabrina Persaud. Mr. Persuad is of legal age, has sole and dispositive rights over the disposal of his shares and the voting rights attached thereto and is not directly or indirectly influenced or controlled by his parents.

|

|

|

(16) Includes 12,500 shares held by R. Pierce Onthank, Sr., Ms. Onthank’s spouse. Ms. Onthank is also the mother of Ryan and R. Pierce Onthank, Jr., her adult sons.

|

|

|

(17) Includes 5,000 shares held by Kelly Kaplan, Mr. Kaplan’s spouse.

|

|

|

(18) Includes 75,000 shares held by Howard Kaplan, Mrs. Kaplan’s spouse.

|

|

|

(19) Daniel Luciano is legal counsel to the Company and is providing the legal opinion for the validity of the common stock being offered by this prospectus.

|

|

18

The selling security holders may sell some or all of their shares at a fixed price of $0.10 per share until our shares are quoted on the OTC QB and thereafter at prevailing market prices or privately negotiated prices. The fixed price of $0.10 has been determined as the selling price based upon the original purchase price paid by certain selling shareholders of $0.02 plus an increase based on the fact the shares will be liquid and registered. Prior to being quoted on the OTC QB, shareholders may sell their shares in private transactions to other individuals. Although our common stock is not listed on a public exchange, we will be filing to obtain a listing on the OTC QB soon after the effectiveness of this Registration Statement. In order to be quoted on the OTC QB, a market maker must file an application on our behalf in order to make a market for our common stock. There can be no assurance that a market maker will agree to file the necessary documents with FINRA, nor can there be any assurance that such an application for quotation will be approved. There is no assurance that an active trading market for our shares will develop, or, if developed, that it will be sustained. In the absence of a trading market or an active trading market, investors may be unable to liquidate their investment or make any profit from the investment.

The selling shareholders may use any one or more of the following methods when disposing of shares or interests therein:

| ● |

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

| ● |

block trades in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction;

|

| ● |

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

| ● |

an exchange distribution in accordance with the rules of the applicable exchange;

|

| ● |

privately negotiated transactions;

|

| ● |

short sales effected after the date the registration statement of which this Prospectus is a part is declared effective by the SEC;

|

| ● |

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

|

| ● |

broker-dealers may agree with the selling shareholders to sell a specified number of such shares at a stipulated price per share; and

|

| ● |

a combination of any such methods of sale.

|

19

The selling shareholders may, from time to time, pledge or grant a security interest in some or all of the common stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the common stock, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending the list of selling shareholders to include the pledgee, transferee or other successors in interest as selling shareholders under this prospectus. The selling shareholders also may transfer the securities in other circumstances, in which case the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

In connection with the sale of our common stock or interests therein, the selling shareholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the common stock in the course of hedging the positions they assume. The selling shareholders may also sell shares of our common stock short and deliver these securities to close out their short positions, or loan or pledge the common stock to broker-dealers that in turn may sell these securities. The selling shareholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The aggregate proceeds to the selling shareholders from the sale of the common stock offered by them will be the purchase price of the common stock less discounts or commissions, if any. Each of the selling shareholders reserves the right to accept and, together with their agents from time to time, to reject, in whole or in part, any proposed purchase of common stock to be made directly or through agents. We will not receive any of the proceeds from this offering.

Broker-dealers engaged by the selling shareholders may arrange for other broker-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling shareholders (or, if any broker-dealer acts as agent for the purchase of shares, from the purchaser) in amounts to be negotiated. The selling shareholders do not expect these commissions and discounts to exceed what is customary in the types of transactions involved, and in no case will the maximum compensation received by any broker-dealer exceed eight percent (8%).

The selling shareholders also may resell all or a portion of the shares in open market transactions in reliance upon Rule 144 under the Securities Act, provided that they meet the criteria and conform to the requirements of that rule.

Any underwriters, agents, or broker-dealers, and any selling shareholders who are affiliates of broker-dealers, that participate in the sale of the common stock or interests therein may be “underwriters” within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale of the shares may be underwriting discounts and commissions under the Securities Act. Selling shareholders who are “underwriters” within the meaning of Section 2(11) of the Securities Act will be subject to the prospectus delivery requirements of the Securities Act. We know of no existing arrangements between any of the selling shareholders and any other stockholder, broker, dealer, underwriter, or agent relating to the sale or distribution of the shares, nor can we presently estimate the amount, if any, of such compensation. See “Selling shareholders” for description of any material relationship that a stockholder has with us and the description of such relationship.

To the extent required, the shares of our common stock to be sold, the names of the selling shareholders, the respective purchase prices and public offering prices, the names of any agents, dealer or underwriter, any applicable commissions or discounts with respect to a particular offer will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this prospectus.

In order to comply with the securities laws of some states, if applicable, the common stock may be sold in these jurisdictions only through registered or licensed brokers or dealers. In addition, in some states the common stock may not be sold unless it has been registered or qualified for sale or an exemption from registration or qualification requirements is available and is complied with.

We have advised the selling shareholders that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of shares in the market and to the activities of the selling shareholders and their affiliates. In addition, we will make copies of this prospectus (as it may be supplemented or amended from time to time) available to the selling shareholders for the purpose of satisfying the prospectus delivery requirements of the Securities Act. The selling shareholders may indemnify any broker-dealer that participates in transactions involving the sale of the shares against certain liabilities, including liabilities arising under the Securities Act.

20

Authorized Capital Stock

We are authorized to issue 75,000,000 shares of common stock, $0.0001 par value per share, and 15,000,000 shares of preferred stock, $0.0001.

Common Stock

As of the date hereof, 4,107,000 shares of common stock are issued and outstanding.

The holders of our common stock have equal ratable rights to dividends from funds legally available if and when declared by our board of directors and are entitled to share ratably in all of our assets available for distribution to holders of common stock upon liquidation, dissolution or winding up of our affairs. Our common stock does not provide the right to a preemptive, subscription or conversion rights and there are no redemption or sinking fund provisions or rights. Our common stock holders are entitled to one non-cumulative vote per share on all matters on which shareholders may vote.

We refer you to our Articles of Incorporation, Bylaws and the applicable statutes of the state of Delaware for a more complete description of the rights and liabilities of holders of our securities. All material terms of our common stock have been addressed in this section.

Holders of shares of our common stock do not have cumulative voting rights, which means that the holders of more than 50% of the outstanding shares, voting for the election of directors, can elect all of the directors to be elected, if they so choose, and, in that event, the holders of the remaining shares will not be able to elect any of our directors.

21

Holders

As of the date hereof, we have 40 shareholders holding 4,107,000 shares of our issued and outstanding common stock.

Dividend Policy

It is unlikely that we will declare or pay cash dividends in the foreseeable future. We intend to retain earnings, if any, to expand our operations. To date, we have paid no dividends on our shares of common stock and have no present intention of paying any dividends on our shares of common stock in the foreseeable future. The payment by us of dividends on the shares of common stock in the future, if any, rests solely within the discretion of our board of directors and will depend upon, among other things, our earnings, capital requirements and financial condition, as well as other factors deemed relevant by our board of directors.

Undesignated Preferred

We are also authorized to issue 15,000,000 shares of undesignated preferred stock. Pursuant to our Articles of Incorporation, our Board of Directors has the power, without further action by the holders of the common stock, to designate the relative rights and preferences of the preferred stock, and issue the preferred stock in one or more series as designated by the Board of Directors. The designation of rights and preferences could include preferences as to liquidation, redemption and conversion rights, voting rights, dividends or other preferences, any of which may be dilutive of the interest of the holders of the common stock or the preferred stock of any other series. The Board of Directors effects a designation of each series of preferred stock by filing with the Delaware Secretary of State a Certificate of Designation defining the rights and preferences of each series. Documents so filed are matters of public record and may be examined according to procedures of the Delaware Secretary of State, or copies may be obtained from us. Our Board of Directors has not designated any series or issued any shares of preferred stock at this time.

The ability of directors, without security holder approval, to issue additional shares of preferred stock could be used as an anti-takeover measure. Anti-takeover measures may result in you receiving less compensation for your stock.

The issuance of preferred stock creates additional securities with dividend and liquidation preferences over common stock, and may have the effect of delaying or preventing a change in control without further security holder action and may adversely affect the rights and powers, including voting rights, of the holders of common stock. In certain circumstances, the issuance of preferred stock could depress the market price of the common stock.

Market for Securities

There is currently no public trading market for our common stock. We intend to apply for quotation of our common stock on the OTC QB.

Equity Compensation Plan Information

We have no plans for establishing an equity compensation plan, but reserve the right to do so in the future.

We currently do not have any equity compensation plans or securities authorized for issuance under equity compensation plans.

Warrants and Options

There are no outstanding warrants or options to purchase our securities.

22

Transfer Agent

The transfer agent for our common stock is Issuer Direct Corporation, 500 Perimeter Park Drive, Suite D, Morrisville, North Carolina 27560, telephone: (919) 481-4000.

The validity of the common stock offered by this prospectus will be passed upon for us by Daniel H. Luciano, Esq., Califon New Jersey.

EXPERTS

The financial statements of our company included in this prospectus and in the registration statement have been audited by Rosenberg, Rich, Baker Berman & Co., independent registered public accounting firm, to the extent and for the periods set forth in their report appearing elsewhere herein and in the registration statement, and are included in reliance on such report, given the authority of said firm as an expert in auditing and accounting.

23

We are a consulting company for the small business enterprise market (here-in-under, referred to as the “SME Market”). In general, SME Market companies range from sole proprietors – the one-person band running his or her business with no employees – through to those that have up to 50 employees. We target those SME companies with limited resources and/or infrastructure looking to outsource their operations and/or corporate-level functions (our “Business Services”). Our Business Services might include; financial reporting, accounting, sales and marketing, compliance, legal, human resource management or investor relations. We also look to help clients identify, implement and maintain third-party "Software-as-a- Service" products that help streamline business operations through automation (our “Managed Software Services”). Our Business Services and Managed Software Services are collectively referred to as our Services.

Currently, we provide our Services on a project-based fee arrangement or a recurring monthly charge. We believe that by combining our outsourced business consulting services and existing software tools in the marketplace, we will help clients cost effectively and efficiently build and maintain their business plans.

Our Market

Within the SME Market classification there are considerable company variation. There are hundreds if not thousands of types of small businesses. Just taking the NAICS (the North American Industry Classification System) or the SIC codes (the UK Standard Industrial Classification), there are over 1,000 classifications of business types from suppliers of asbestos products to X-ray apparatus. However, we try to collapse these many categories into three broad groups:

|

●

|

Companies that produce, manufacture or process things;

|

|

●

|

Companies that retail, distribute or merchant things; or

|

|

●

|

Companies that offer professional advice or knowledge-based services.

|

Within SME Market, we understand that the sole proprietor is very different to the company that employs 50 people. We believe enterprises experience a change of focus once they employ just a few people. Once an enterprise employs additional staff, we believe management begins to place more emphasis on the subject of revenue growth and expense management.

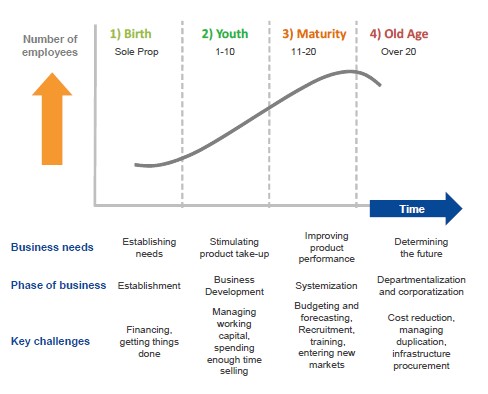

We use a business life cycle approach and consider how the needs of SME businesses change as they grow and mature within the cycle.

24

A framework for such thinking about this is presented in Figure 1 below.

Figure 1.

Our Opportunity

SME company owners and managers often are tasked with functioning in a number of capacities in order to grow their business. However, at some point in time in the growth curve (Figure 1), a business owner or manager is faced with the decision of continuing to function in a number of capacities or to seek outside assistance. To help with this decision, we bring outsourced people, business processes and software tools to businesses to reduce costs and to run more efficiently and effectively. We believe that if a small business doesn’t embrace and leverage the power of outsourcing and automation, it significantly limits the company’s ability to keep pace with business growth goals and objectives. As such, we believe that our Services met a large un-met need for SME companies.

The SME Market is particularly attractive because:

| ● |

it is large, continues to grow and remains underserved by professional services companies; and

|

| ● |

it typically has fewer in-house resources than larger businesses and, as a result, is generally more dependent on external resources;

|

25

Our Strategy

Our strategy for growing our operations includes:

|

●

|

Rolling out various outbound sales and marketing campaigns to grow our client base;

|

|

●

|

Expanding our outsourced consultant base to assist in cost efficiently delivering our services; and

|

|

●

|

Growth through acquisition or strategic reseller agreements with complementary service providers and software product companies.

|

26

Our Clients and Client Contracts

Currently, our services are provided to clients on a project-based fee arrangement or a fixed term agreement with an initial retainer and monthly or periodic payments. Our client relationships are codified in a client services agreement. Generally the agreements permits cancellation by either party upon 30 days’ written notice. In addition, we may terminate the agreement at any time for specified breach of contract, including nonpayment or failure to follow our workplace safety recommendations.

The client services agreement also provides for indemnification of us by the client against losses arising out of any default by the client under the agreement, including failure to comply with any employment-related, health and safety, or immigration laws or regulations.

As of the date of this prospectus, we have agreements with 4 client companies. Since inception we have had eleven different clients.

Competition

The business environment in which we operate is characterized by intense competition and fragmentation. We are not aware of reliable statistics regarding the number of its competitors, but certain large, well-known companies typically compete with us in the same markets and also have greater financial and marketing resources than we do, including Automatic Data Processing, Inc., Manpower, Inc., Kelly Services, Inc., Insperity, Inc., TriNet, Group, Inc. and Paychex, Inc. We may face additional competition in the future from new entrants to the field, including other staffing services companies, payroll processing companies and insurance companies. The principal competitive factors in the business environment in which we operate are price and level of service.

Our Sales and Marketing Plans

Initial marketing efforts will be geared toward raising awareness of our Services. This will primarily be accomplished by standard lead generation activities such as pay-per-click advertising, search engine optimization and standard email, phone call and letter correspondence to targeting client listing. We anticipate that in the future our clients will be a good resource for referring clients to the business.

We believe the SME Market is easier to reach than medium-large corporate organizations. The small size makes them more accessible. In most cases, the business owner controls the check-book, very often answers the phone and generally makes quick decisions.