Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HERC HOLDINGS INC | a2015yepressrelease8-k.htm |

| EX-99.1 - EXHIBIT 99.1 - HERC HOLDINGS INC | a2015pressrelease.htm |

4Q & FY2015 Earnings Call March 1, 2016 8:00am ET

2 Safe Harbor Statement Certain statements made within this presentation contain forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not guarantees of performance and by their nature are subject to inherent uncertainties. Actual results may differ materially. Any forward-looking information relayed in this presentation speaks only as of February 29, 2016, and the Company undertakes no obligation to update that information to reflect changed circumstances. Additional information concerning these statements is contained in the Company’s press release regarding its Fourth Quarter 2015 results issued on February 29, 2016, and the Risk Factors and Forward-Looking Statements sections of the Company’s 2015 Annual Report on Form 10-K and 2015 Quarterly Reports on Form 10-Q. Copies of these filings are available from the SEC, the Hertz website or the Company’s Investor Relations Department.

3 Non-GAAP Measures THE FOLLOWING NON-GAAP* MEASURES WILL BE USED IN THE PRESENTATION: Adjusted corporate EBITDA Adjusted corporate EBITDA margin Adjusted pre-tax income Adjusted net income Adjusted diluted earnings per share (Adjusted EPS) Revenue per available car day Total RPD Net depreciation per unit per month Net corporate debt Net fleet debt Free cash flow *Definitions and reconciliations of these non-GAAP measures are provided in the Company’s fourth quarter 2015 press release.

4 Agenda BUSINESS OVERVIEW John Tague President & Chief Executive Officer Hertz Global Holdings FINANCIAL RESULTS OVERVIEW Tom Kennedy Chief Financial Officer Hertz Global Holdings HERC OVERVIEW Larry Silber President & Chief Executive Officer Hertz Equipment Rental

5 2015 DRIVERS • Realized global cost savings of ~$230 million • Executed U.S. RAC fleet refresh, leveraging higher return alternative sales channels • Increased W.W. RAC fleet efficiency by 100 bps • Increased customer satisfaction scores worldwide • Integrated Hertz, Dollar and Thrifty systems • W.W. RAC adjusted Corporate EBITDA margin1 +~300 bps to 10% 2015 TRANSACTIONS • Acquired several U.S. franchisee locations to return key markets to sole corporate ownership • Reduced CAR Inc. (China Auto Rental) investment from ~16% to ~10%, yielding $236M in proceeds • Sold HERC France and Spain operations • Filed Form 10 for separation of worldwide RAC and HERC, reverse spin expected mid-2016 • Completed ~60% of $1B authorized share buy-back program; while reducing consolidated leverage ratio 2015 Overview: Consolidated adj. Corporate EBITDA margin improves 220 bps to 14% FY 2015 consolidated adj. Corporate EBITDA of $1.5 billion, in line with expectations 1Calculated as consolidated adj. Corporate EBITDA minus HERC segment adj. Corporate EBITDA FY:2015 GUIDANCE FY:2015 ACTUAL Adj. Corporate EBITDA – Consolidated HGH $1,450M - $1,550M $1,493M Adj. Corporate EBITDA – W.W. HERC $575M - $625M $610M U.S. RAC Net Monthly Depreciation per Unit $270 - $280 $267 U.S. RAC fleet capacity growth1 (1.0)% to Flat (0.9)% Net non-fleet capex $220M – $240M $212M 1Excludes Advantage sublease and Hertz 24/7 vehicles

TOM KENNEDY CHIEF FINANCIAL OFFICER Hertz Global Holdings Quarterly Overview

7 4Q:15 Consolidated Results GAAP 4Q:15 Results 4Q:14 Results YoY Change Revenue $2,413 $2,559 (6)% Income (loss) before income taxes $49 $(284) NM Net Income (loss) $70 $(234) NM Diluted earnings (loss) per share $0.16 $(0.51) NM Diluted shares outstanding 441 459 (4)% Non-GAAP* Adjusted Corporate EBITDA $266 $76 250% Adjusted Corporate EBITDA margin 11% 3% 805 bps Adjusted Pre-tax income (loss) $35 $(161) NM Adjusted Net income (loss) $22 $(101) NM Adjusted EPS (loss per share) $0.05 $(0.22) NM 4Q:15 adjusted EPS includes unfavorable FX impact of ~$(0.01) *Definitions and reconciliations of these non-GAAP measures are provided in the Company’s fourth quarter 2015 press release. NM – Not Meaningful

8 Consolidated Cost Savings • FY:15 realized ~$230M; exceeding target - 4Q:15 realized ~$75M Cost Initiatives Support Higher YoY Profit Margin Corporate/ Operations Overhead • Employee benefits redesigned • Eliminating Navigation Solutions redundancies • Closing unprofitable off-airport facilities • Consolidating third-party IT spend • Labor productivity Fleet Management • Reducing out-of-service cycle times through process efficiencies and increased accountability Sales and Marketing • Disciplined return on investment practices, including reorganizing rental car sales force FY:15 Consolidated adjusted Corporate EBITDA margin improves 220 bps - FY:15 consolidated DOE and SG&A expense as % of revenue decreased 110 bps

9 FY:15 (U.S., Int’l, Donlen) 4Q:15 (U.S., Int’l, Donlen) Worldwide RAC Revenues $9.0B+ $2.0B+ Worldwide RAC Adj. Corporate EBITDA Margin 10% 5% Margin Growth YoY ~300bps NM US RAC FY:15 Revenue by Location Type Excludes Donlen FY:15 Revenue By Geography Excludes Donlen 75%25% 74% 26% Worldwide RAC Revenue Overview Int’l RAC FY:15 Revenue by Location Type Excludes Donlen 53% 47% NM – Not Meaningful

10 2H:15 Revenue Efficiency Improved YoY 0.3%1.0% 1Q 2Q 3Q 4Q Note: Total RPD calculated using Total Revenue less ancillary retail car sales revenue 1 RACD calculated as Total Revenue / number of days in period X average total owned fleet size; captures the combined result of both revenue management and fleet management in one measurement 4.7% 6.0% 4Q:15 YoY Revenue per Available Car Day (RACD1) - More than 400 bps improvement in fleet efficiency offsets total RPD decline

11 4Q:15 U.S. RAC Total Revenue • Airport revenue: - Highly competitive market pricing • Top-tier markets with significantly more competitors experienced supply/demand imbalance - Volume growth in higher yielding inbound and leisure rentals - Lower business demand, primarily driven by weakness in energy- sector accounts and as we work to improve portfolio profitability - Airport RACD increased year over year • Off airport revenue: - Volume declined YoY due to 2Q:15 store closures and tighter debit card usage policies, both of which support margin improvement - Total RPD affected by higher mix of lower-yielding insurance replacement rentals • Conversion from Dollar Thrifty transaction day calculation to Hertz methodology1 - No impact to total revenue - 120 bps positive impact to transaction days; 120 bps negative impact to Total RPD Note: Total RPD calculated using Total Revenue less ancillary retail car sales revenue 1 The alignment of methodologies recognizes a greater volume of transaction days on Dollar Thrifty as compared to its previous practices; estimated impact of approximately 1% to transaction days prospectively, relative to the historic calculation Total On Airport Off Airport 5.3% 0.1% 6.0% 2.4% 5.3% 4.1% Total RPD Volume Total RPD Volume Total RPD Volume 74% of U.S. RAC Revenue 26% of U.S. RAC Revenue (5)% (4)% (9)% Total Revenue Total Revenue Total Revenue

12 4Q:15 U.S. RAC Ancillary revenue per transaction day, excluding fuel-related products, increased 6% YoY • Driving ancillary revenue growth through better pricing, technology and product presentation Improving revenue execution and systems capabilities • Deploying new pricing strategies and surveillance capabilities • Testing and launching new products into the marketplace • Continuing the technology work necessary to collect credit card information up front in the booking process • Implementing a sales effectiveness program to improve corporate margins • Taking actions to enhance the rental experience for our most valuable customers • Upgrading our e-commerce capabilities Launching Initiatives to Support Revenue Execution

13 77% 79% 76% 75% 80% 75% 73% 75% 83% 79% 1Q 2Q 3Q 4Q 2013 2014 2015 U.S. RAC Fleet Management • FY:15 monthly depreciation per unit $267, a 9% improvement YoY - 4Q:15 monthly depreciation per unit $269, a 26% improvement YoY - Residual values remained strong throughout year - Rightsized fleet, FY:15 capacity (1)% YoY - FY:15 fleet efficiency improved 100 bps - Optimizing fleet rotation, timing, sales distribution - Model year 2015 program/risk mix balanced; capitalized on favorable program car incentives • FY:16E monthly depreciation per unit $290-$300 - Assuming (2.5)% in residual values - Model year 2016 fleet purchase weighted significantly toward risk cars due to lower availability and higher cost of program cars 4Q:15 Fleet Efficiency +400 bps Quarterly trends reflect seasonality 4Q:15 Alternative Resale Channels Wholesale Auction 33% Alternative Channels 67% FY:15 Alternative Resale Channels Wholesale Auction 42% Alternative Channels 58%

14 4Q:15 U.S. RAC Cost Management • 4Q:15 direct operating expense as a % revenue decreased 230 bps YoY • Fleet refresh significantly reduced maintenance expense • Transportation costs decreased due to improved fleet management • Labor productivity improved due to enhanced scheduling tools • Fuel expense declined due to lower commodity prices DOE + SG&A as % of Revenue 4Q 2014 71% 2015 70% 4Q:15 Operating Efficiency 100 bps better

15 4Q:15 International Rental Car • 4Q:15 Revenue increased 3% YoY, excluding FX - Total RPD 3% higher, in constant currency, benefitting from higher yielding insurance replacement and inbound business - Volume flat due to challenging macroeconomic conditions in Canada and Brazil European volume increased 2%, despite geopolitical events and airlines strikes during the quarter • Revenue per available car day increased 2% YoY in constant currency • Record customer service scores achieved • DOE + SG&A expense declined 250 bps as a % of revenue • Net monthly depreciation per unit decreased 12% in constant currency • Quarterly adjusted Corporate EBITDA margin improved 500 bps Full Year 2015 • Total Revenue 4% higher YoY, ex-FX • Adjusted Corporate EBITDA margin 12%, a 400 bps improvement over FY:14 • Improvements driven by the culmination of a successful 3-year restructuring program

HERC OVERVIEW LARRY SILBER PRESIDENT & CHIEF EXECUTIVE OFFICER Hertz Equipment Rental

17 HERC Transforming the Business Organizational Redesign • Align sales and fleet by removing silos • Align compensation to drive performance and EBITDA • Align territories to drive new accounts • Target specific metropolitan markets to drive sales Fleet Optimization • Consolidate fleet spend • Enhance buying power and remove complexity Revenue Growth and Operational Efficiencies • Diversify fleet to higher ROI assets and deliver value-added solutions through consultative selling • Develop new productivity tools to improve fleet availability and increase dollar utilization • Increase density in key markets through branch expansion Sales Effectiveness • Maximize new CRM system • Utilize newly integrated real-time pricing and productivity tools Industry savvy leadership team driving new initiatives

18 4Q:15 and FY:15 Pricing and Volume 4Q:15 FY:15 Worldwide (0.7)% 0.3% North America (0.6)% 0.5% 4Q:15 FY:15 Worldwide (2.6)% 1.6% North America 0.9% 2.7% Assumes constant FX rates Pricing and volume affected by weakness in upstream oil & gas markets PRICING VOLUME

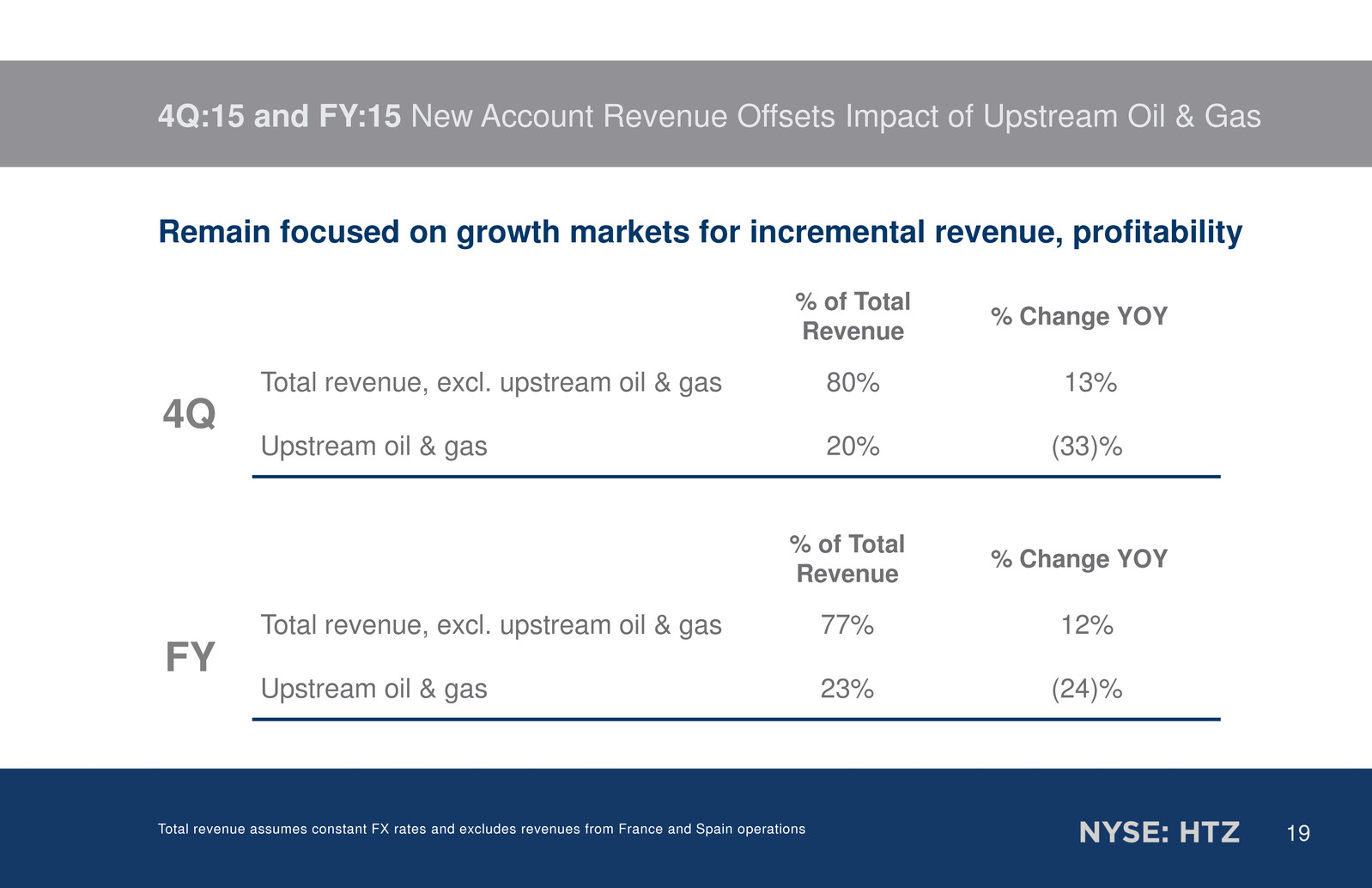

19 4Q:15 and FY:15 New Account Revenue Offsets Impact of Upstream Oil & Gas % of Total Revenue % Change YOY Total revenue, excl. upstream oil & gas 80% 13% Upstream oil & gas 20% (33)% % of Total Revenue % Change YOY Total revenue, excl. upstream oil & gas 77% 12% Upstream oil & gas 23% (24)% Total revenue assumes constant FX rates and excludes revenues from France and Spain operations 4Q FY Remain focused on growth markets for incremental revenue, profitability

20 Revenue Growth • New account revenue in North America increased 42% in 4Q:15 YoY and 52% for the full year • Local revenue as a percent of total business increased 330 basis points in 4Q:15 • Diversifying account mix to drive volume, reduce risk and improve pricing Controlling Costs • Redeployed or disposed of ~$150M in original equipment cost (OEC) fleet from upstream oil & gas markets in 2015 • Reducing costs in upstream oil & gas markets • Reducing capital expenditures in upstream oil & gas markets Focus on Revenue Growth and Controlling Costs *Data is based on constant FX rates

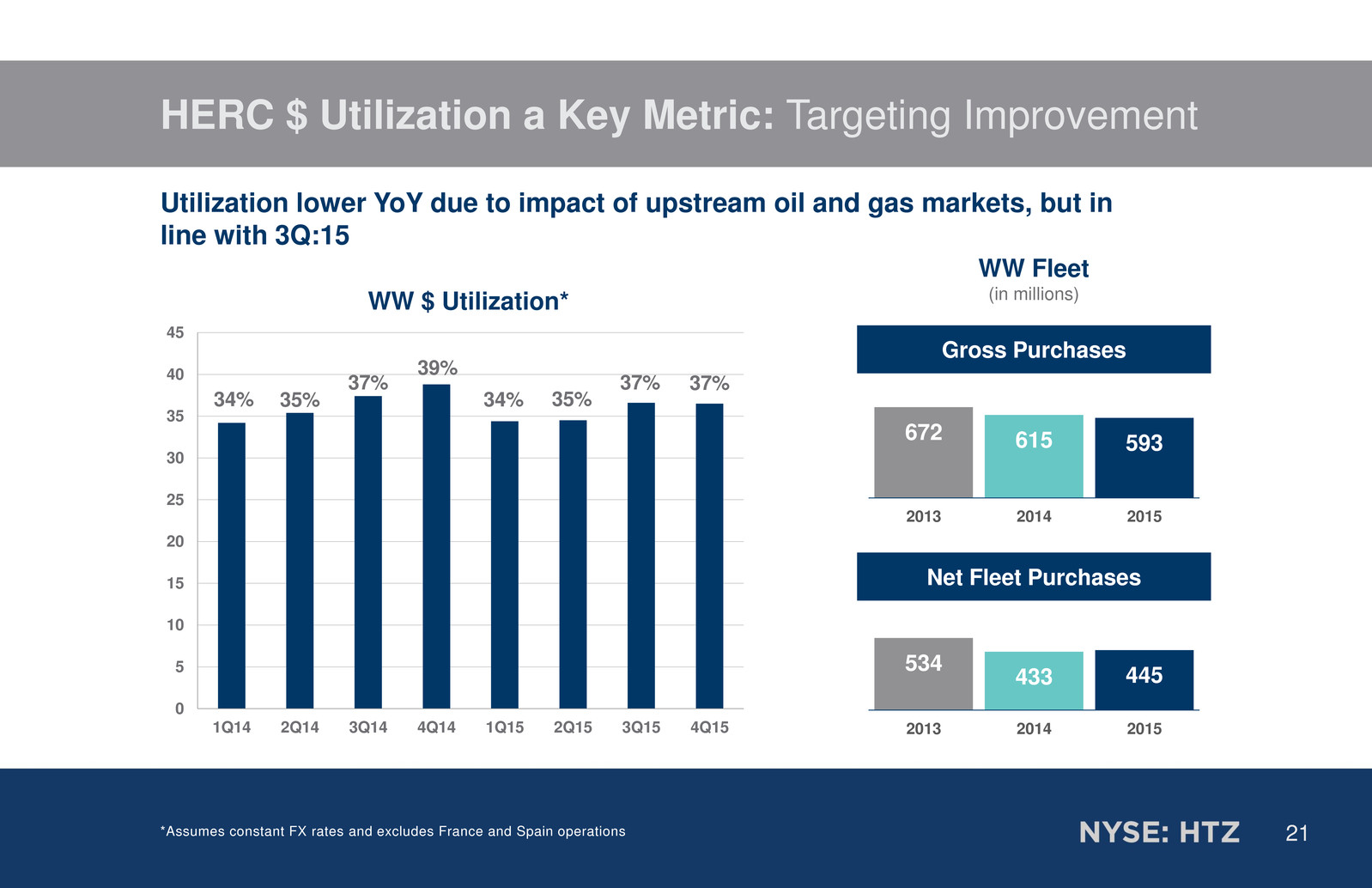

21 HERC $ Utilization a Key Metric: Targeting Improvement WW Fleet (in millions)WW $ Utilization* *Assumes constant FX rates and excludes France and Spain operations Utilization lower YoY due to impact of upstream oil and gas markets, but in line with 3Q:15 534 433 445 2013 2014 2015 Net Fleet Purchases 672 615 593 2013 2014 2015 Gross Purchases 34% 35% 37% 39% 34% 35% 37% 37% 0 5 10 15 20 25 30 35 40 45 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15

22 Adjusted Corporate EBITDA Growth, Excl. Upstream Oil & Gas, Improved Each Quarter New initiatives began to take hold in second half of 2015 Adj. Corp. EBITDA* (YOY % Δ) 1Q 2Q 3Q 4Q FY Excl. upstream oil & gas 7% 7% 12% 21% 12% Total (7)% (9)% (4)% (2)% (5)% *Data is based on constant FX rates and excludes France and Spain operations

23 2016 WW HERC Guidance WW HERC 2016 Guidance Adjusted Corporate EBITDA*: $600 to $650M Net Fleet CapEx: Approximately $400-$425M *Adjusted Corporate EBITDA Guidance excludes the standalone costs of being a public company

24 Our New Look and Brand

25 • Form 10 Update - Initial Form 10 filed 12/21/15 - Amendment #1 filed 2/4/16 • Operational Readiness Update - Senior management team in place - Transition services agreement under review - Other governance and corporate matters on track • Capital Markets Update - Flexibility in leverage ratio target, depending on market conditions RAC and HERC Remain On Track for mid-2016 Separation Even in Current Environment, a Spin can be Executed in Capital Markets

TOM KENNEDY CHIEF FINANCIAL OFFICER Hertz Global Holdings CASH FLOW / BALANCE SHEET OVERVIEW

27 Free Cash Flow ($ in millions) 2015 2014 GAAP Pretax Income $341 $(23) PP&E (non fleet) depr. exp. + amortization exp. 412 412 Cash Taxes (34) (64) Net Working Capital/Other (77) 173 Operating Cash Flow excl. fleet depr. add-back $642 $498 RAC Fleet Growth (net capex + depr. exp. & net fleet financing) 441 207 HERC Fleet Growth (net capex + depr. exp.) (116) (103) PP&E Net Capital Expenditures (212) (281) Net Investment $113 $(177) FREE CASH FLOW $755 $321

28 • Highest level of liquidity since 2011 • No meaningful Corporate debt maturities until 2018 (excluding ABL, which is primarily secured by HERC assets) • Fleet debt funds RAC and Donlen fleet-related assets - Largely non-recourse to operating companies - 1Q:15 issued ~$1B Term ABS notes to replace floating rate bank funded ABS debt - Roughly half of U.S. RAC 2016 ABS funding target satisfied through $1B February issuance Liquidity and Debt Overview Corporate Liquidity at December 31, 2015 ABL Availability $1,668 Unrestricted Cash 486 Corporate Liquidity $2,154 4.4x 4.5x 4.8x 4.4x 3.7x 12/31/14 3/31/15 6/30/15 9/30/15 12/31/15 Net Corporate Debt/LTM Adj. Corporate EBITDA

29 Refinancings 4Q:15 Actions Completed • 4Q:15 - Issued $600M U.S. RAC term ABS notes • 4Q:15 - Extended $3.325B of commitments to U.S. RAC securitization facilities until October 2017 • 4Q:15 - Extended €400M of commitments to the European securitization facility until October 2017 2016 Actions Completed • 1Q:16 - Issued $1B U.S. RAC term ABS notes to pay down floating rate bank ABS funding - Transaction upsized due to demand 2016 Planned Refinancings • Execute HERC spin and normal-course fleet debt extensions • Continue to prudently access the ABS term market to re-balance mix of U.S. RAC fixed/floating rate fleet ABS debt

OUTLOOK

31 FY:2016 Financial Guidance Revised FY:2016 assumptions include: • Advanced economies global GDP growth of 2.1%1 - U.S. GDP growth of 2.5%1 • U.S. RAC residual decline of ~2.5% • $350M incremental RAC cost savings • HERC net non-fleet capex of ~$50M - Included in Consolidated guidance • HERC net fleet capex of $400M-$425M • Consolidated 37% effective tax rate 1 Source: IMF, World Economic Outlook Update, January 2016 FY:2016 Guidance FY:2016 Preliminary Guidance Adj. Corporate EBITDA Consolidated HGH $1,600M - $1,700M $1,700M - $1,800M Adj. Corporate EBITDA W.W. HERC $600M - $650M $625M - $675M Consolidated corporate interest expense $330M – $345M Consolidated net non-fleet capex $200M – $225M $250M – 275M Consolidated cash taxes $125M – $150M Consolidated Free Cash Flow $400M – $500M U.S. RAC net monthly depreciation per unit $290 - $300 $290 - $300 U.S. RAC fleet capacity growth (2.0)% to (3.0)% (0.5)% to 0.5% U.S. RAC revenue growth 1.5% to 2.5% 2.5% to 3.5%

Q&A