Attached files

| file | filename |

|---|---|

| EX-23 - EX-23 - SABINE ROYALTY TRUST | d131485dex23.htm |

| EX-31 - EX-31 - SABINE ROYALTY TRUST | d131485dex31.htm |

| 10-K - FORM 10-K - SABINE ROYALTY TRUST | d131485d10k.htm |

| EX-32 - EX-32 - SABINE ROYALTY TRUST | d131485dex32.htm |

|

Exhibit 99.1

TAX INFORMATION 2015

This booklet contains tax information relevant to ownership of Units of Sabine Royalty Trust and should be retained. |

SABINE ROYALTY TRUST

February 2, 2016

To Unit Holders:

This booklet provides 2015 tax information, which will allow you to determine your pro rata share of income and deductions attributable to your investment in Sabine Royalty Trust (the “Trust”). Each Unit holder is encouraged to read the entire booklet very carefully.

The material included in this booklet enables you to compute the information to be included in your federal and state income tax returns, and the items of income, deduction, and any other information shown in this booklet must be taken into account in computing your taxable income and credits on your federal income tax return and any state tax returns. This booklet, as well as any Forms 1099-MISC received from the Trust relating to backup withholding (discussed on page 4) and any IRS Forms 1099 and written tax statements issued by certain middlemen (discussed in more detail on pg. A-1) that hold Trust Units on your behalf, are the only information sources for Unit holders to determine their share of the items of income and expense of the Trust for the entire 2015 calendar year. Unit holders should retain this booklet and any Forms 1099 and written tax statements received from middlemen and any Forms 1099-MISC received from the Trust as part of their tax records.

The material herein is not intended and should not be construed as professional tax or legal advice. Each Unit holder should consult the Unit holder’s own tax advisor regarding all tax compliance matters relating to the Units.

For your convenience, simple revenue/expense and cost depletion calculators are now available on the Sabine Royalty Trust website at: www.sbr-sabine.com, on both the “Home” page and “Tax Information” page.

Very truly yours,

Sabine Royalty Trust,

By Southwest Bank, Trustee

1-855-588-7839

2911 Turtle Creek Blvd., Ste. 850

Dallas, TX 75219

EIN 75-6297143

CUSIP 78568810

SABINE ROYALTY TRUST

TABLE OF CONTENTS

| Page | ||||

| 2015 TAX INFORMATION |

||||

| ● Reading the Income and Expense Schedules |

1 | |||

| ● Identifying Which Income and Expense Schedules to Use |

1 | |||

| ● Applying the Data From the Income and Expense Schedules |

1 | |||

| ● Computing Depletion |

2 | |||

| ● Asset Sales and Dispositions |

3 | |||

| ● Redemptions |

3 | |||

| ● Sale or Exchange of Units |

3 | |||

| ● Classification of Investment |

3 | |||

| ● Nonresident Foreign Unit Holders |

3 | |||

| ● Unrelated Business Taxable Income |

3 | |||

| ● Net Investment Income Tax |

3 | |||

| ● Backup Withholding |

4 | |||

| ● State Tax |

4 | |||

| ● Table of 2015 Monthly Record Dates and Cash Distributions Per Unit |

4 | |||

| ● Tax Information Schedules |

||||

| ● ● Form 1041, Grantor Trust for Calendar Year 2015 |

5 | |||

| ● ● Supplemental Tax Table I—Gross Royalty Income Federal |

6 | |||

| ● ● Supplemental Tax Table II—Severance Tax Federal |

6 | |||

| ● ● Supplemental Tax Table III—Interest Income Federal |

7 | |||

| ● ● Supplemental Tax Table IV—Trust Administrative Expense Federal |

7 | |||

| ● ● Supplemental Tax Tables A through D Texas |

8 | |||

| ● ● Supplemental Tax Tables A through C Oklahoma |

9 | |||

| ● ● Supplemental Tax Tables A through C Florida |

10 | |||

| ● ● Supplemental Tax Tables A through C Louisiana |

11 | |||

| ● ● Supplemental Tax Tables A through C Mississippi |

12 | |||

| ● ● Supplemental Tax Tables A through C New Mexico |

13 | |||

| ● ● Depletion Schedule D-I |

14 | |||

| ● ● Depletion Schedule D-II |

14 | |||

| ● ● Depletion Schedule D-III |

15 | |||

| ● ● Depletion Schedule D-IV |

16 | |||

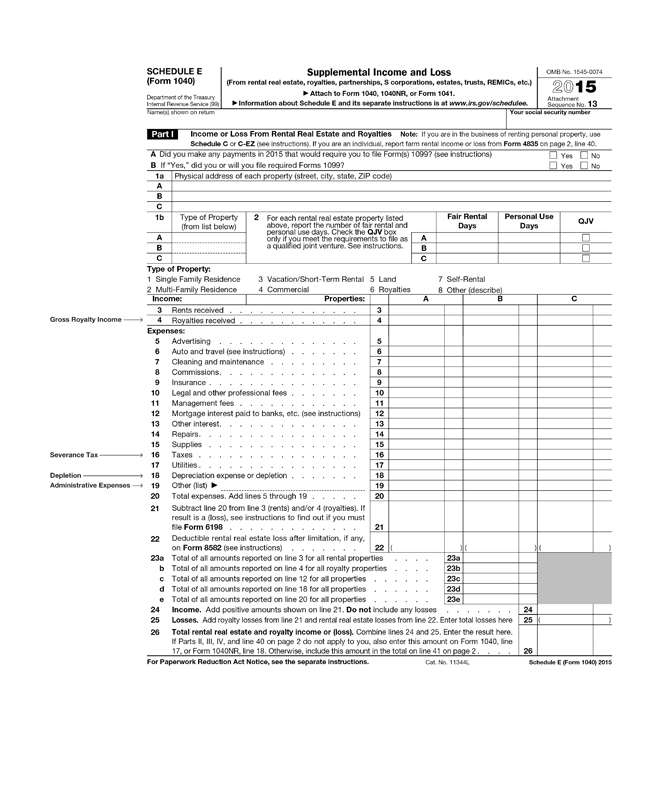

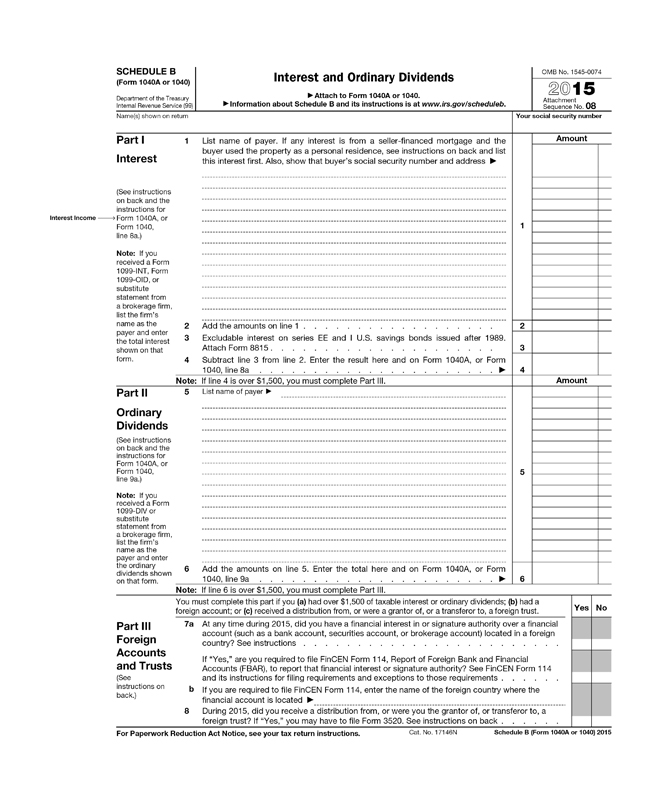

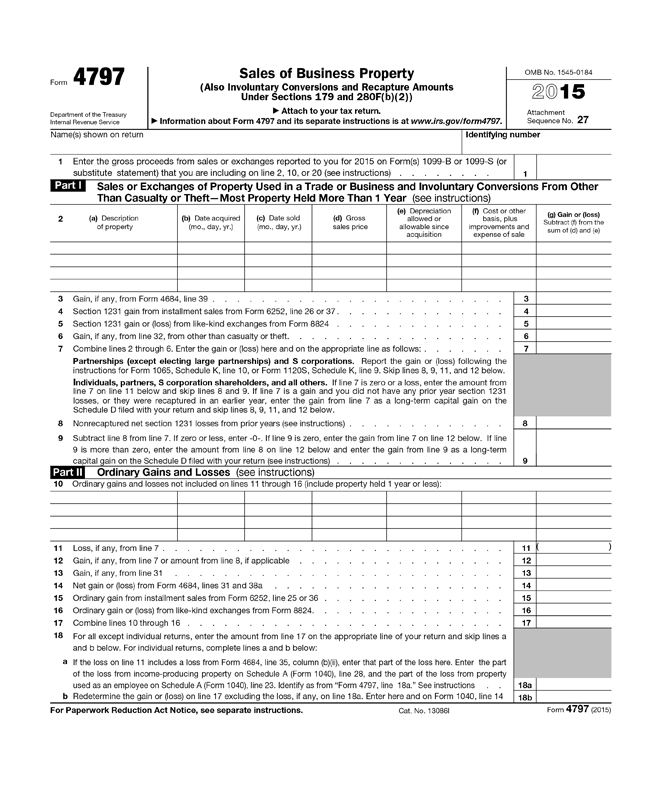

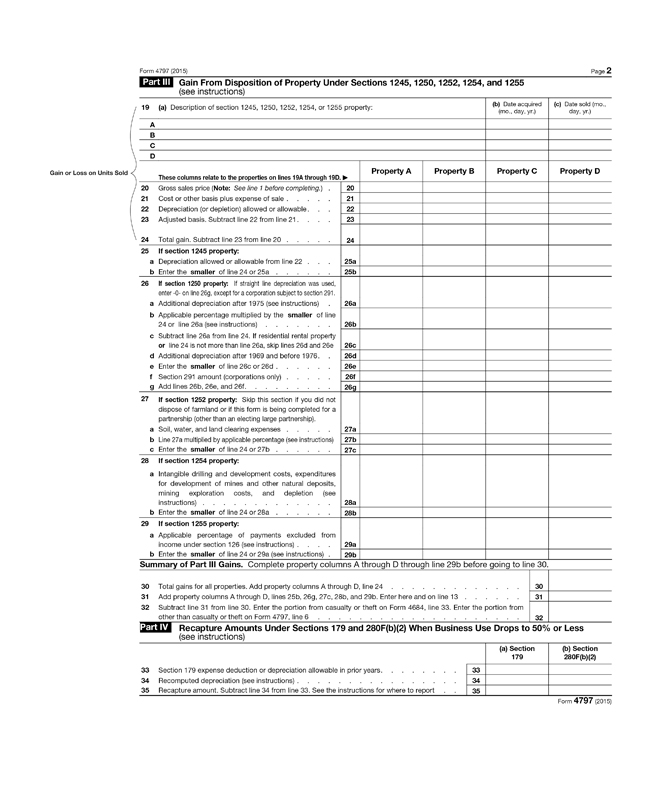

| ● Sample Tax Forms for Individual Unit Holders |

17 | |||

| ● Tax Computation Worksheets |

21 | |||

| ● Comprehensive Examples |

22 | |||

| ● Sabine Royalty Trust Historical Tax Worksheet |

25 | |||

| DISCUSSION OF TAX CONSIDERATIONS PERTAINING TO THE OWNERSHIP OF UNITS IN SABINE ROYALTY TRUST |

||||

| ● Tax Background and WHFIT Information |

A-1 | |||

| ● ● Effect of Escrow Arrangement |

A-2 | |||

| ● Depletion |

A-2 | |||

| ● ● Cost Depletion |

A-2 | |||

| ● ● Percentage Depletion |

A-3 | |||

| ● Adjustment to Basis |

A-3 | |||

| ● Non-Passive Activity Income, Credits and Loss |

A-3 | |||

| ● Revenue/Expense and Depletion Calculators |

A-3 | |||

| ● Nonresident Foreign Unit Holders |

A-3 | |||

| ● Sale or Exchange of Units |

A-4 | |||

| ●Backup Withholding |

A-5 | |||

| ● State Tax |

A-5 | |||

| ● List of states’ contact information |

A-7 | |||

| (SRT 2015 TAX) |

||||

SABINE ROYALTY TRUST

2015 TAX INFORMATION

Reading the Income and Expense Schedules

The accompanying income and expense schedule and tables reflect tax information attributable to Sabine Royalty Trust (the “Trust”) for 2015. This information has been assembled on a per Unit basis and is expressed in decimal fractions of one dollar. A cumulative schedule for the twelve months ended December 31, 2015 and separate cumulative tables at the federal level as well as tables for each of the states in which the Trust has properties are included. Separate depletion schedules are enclosed that provide the necessary information for Unit holders to compute cost and percentage depletion with respect to their interests in the Trust.

Identifying Which Income and Expense Schedules to Use

Pursuant to the terms of the Trust agreement and the escrow agreement (discussed below on page A-2), the Trust receives income and incurs expenses only on the Monthly Record Dates listed on page 4. Furthermore, only Unit holders of record on Monthly Record Dates are entitled to cash distributions. On the basis of these agreements, both cash and accrual basis Unit holders should be considered as realizing income and incurring expenses only on Monthly Record Dates. Therefore, if you were not the Unit holder of record on a specified Monthly Record Date, you should not use the tax information for the month in which that Monthly Record Date falls. A table of Monthly Record Dates and cash distributions per Unit is included on page 4.

The appropriate schedules to be used by a Unit holder will depend upon (i) the date the Unit holder became a holder of record of the Units, (ii) if applicable, the date the Unit holder ceased to be the holder of record of the Units, and (iii) the tax year-end of the Unit holder. For instance, a Unit holder reporting on the calendar year basis who acquired Units and became a Unit holder of record on June 16, 2015 and who still owned only those Units on December 15, 2015 must use the federal and individual state, where applicable, tables to determine their proportionate income and expenses (located on pages 6-13), and Depletion Schedules D-I and D-II or Depletion Schedule D-IV, as appropriate (located on pages 14 and 16, respectively) for such Units. However, Unit holders reporting on a calendar year basis who became Unit holders of record prior to January 15, 2015 and who continued to own only those Units on December 15, 2015, can use either the cumulative schedule for calendar year 2015 (located on page 5) or the tables (located on pages 6-13) and Depletion Schedule D-III (located on page 15) or Depletion Schedule D-IV (located on page 16), as appropriate. As discussed in more detail herein, Unit holders may be entitled to a deduction for either cost depletion or percentage depletion (but not both), depending upon each Unit holder’s individual facts relating to the ownership of Trust Units.

Applying the Data From the Income and Expense Schedules

Unit holders who must use the separate income and expense tables should read the tables in the following manner: the months on the left-hand side of each table denote the month in which a Unit holder first became a Unit holder of record in 2015. Reading across from that month, choose the last month in 2015 in which the Unit holder was a holder of record with respect to those Units. Multiply that factor by the number of Units held for that specific period of time. For example, if Units were purchased on May 1, 2015 and held until December 31, 2015, a Unit holder would choose May from the left-hand side of the table and then choose the factor located under “December” from that row. For a worksheet approach to computing a Unit holder’s income and expense amounts, see the Tax Computation Worksheet on page 21.

(SRT 2015 TAX)

1

Computing Depletion

Depletion schedules are included that provide information for Unit holders to compute cost depletion and percentage depletion deductions with respect to their interests in the Trust. To compute cost depletion for any taxable period, Unit holders should multiply the cost depletion factor indicated on the relevant schedule times their original tax basis in the respective Unit(s) as reduced by the cost depletion and percentage depletion that was allowable as a deduction (whether or not deducted) in prior calendar years during which they owned the Units.

For your convenience, a simple cost depletion calculator is now available on the Sabine Royalty Trust website at: www.sbr-sabine.com, on both the “Home” page and “Tax Information” page.

A factor for percentage depletion is also included on Depletion Schedule D-IV (located on page 16). A Unit holder may be entitled to a percentage depletion deduction, in lieu of a cost depletion deduction, if percentage depletion exceeds cost depletion for any taxable period. To compute percentage depletion for any taxable period, Unit holders should multiply the appropriate percentage depletion factor indicated on Depletion Schedule D-IV by the number of Units owned by such Unit holder. Unlike cost depletion, percentage depletion is not limited to a Unit holder’s depletable tax basis in the Units. Rather, a Unit holder is entitled to a percentage depletion deduction as long as the applicable Trust properties generate gross income.

As discussed at page A-2 in the back portion of this booklet, the composite cost depletion factors are determined on the basis of a weighted average ratio of current production from each Trust property to the estimated future production from such property. This method of weighting the cost depletion factors permits the presentation of a single cost depletion factor for all Unit holders acquiring Units during a period in which there is no substantial change in the relative fair market values of the Trust properties. Primarily as a result of the decline in oil prices that occurred during 1986, there was a change in the relative fair market values of the Trust properties. Accordingly, two mutually exclusive cost depletion computations are included herein reflecting the composite cost depletion factors required to compute cost depletion for Units acquired in 1986.

The proper cost depletion schedule to use in computing 2015 cost depletion depends on the date when the Units were acquired, as described below. Therefore, Unit holders are encouraged to maintain records indicating the date of acquisition and the acquisition price for each Unit or lot of Units acquired.

Unit holders taking a cost depletion deduction who acquired Units before 2015 should use Depletion Schedule D-III (located on page 15). The federal cost depletion factors in Depletion Schedule D-III are presented on a cumulative basis for 2015. Depletion Schedule D-III contains no state-specific cost depletion factors. Unit holders should refer to Depletion Schedule D-II (located on page 14) for the state-specific cost depletion factors.

Unit holders who acquired Units in 2015 should use Depletion Schedule D-I (located on page 14). The federal cost depletion factors in Depletion Schedule D-I are presented on a cumulative and noncumulative basis for 2015. Depletion Schedule D-I contains no state-specific cost depletion factors. Unit holders should refer to Depletion Schedule D-II (located on page 14) for the state-specific cost depletion factors.

Depletion Schedule D-II (located on page 14) contains state-specific cost depletion factors, which are presented on a noncumulative basis for all years. These factors are appropriate for use in calculating the 2015 cost depletion allowance for Units purchased in all years. You may calculate state cost depletion by either (a) calculating the amount of state depletion for each month and adding together the monthly depletion amounts or (b) adding together the applicable monthly depletion factors for the relevant state to create a composite depletion factor for such state and, in both cases, multiplying that factor by the adjusted basis of your Units. Both methods should produce the same result.

(SRT 2015 TAX)

2

Asset Sales and Dispositions

There have been no sales or dispositions of Trust assets during the year.

Redemptions

There have been no redemptions of Trust interests during the year.

Sale or Exchange of Units

A discussion concerning the tax consequences associated with the sale or exchange of Units is presented on pages A-4 to A-5 in the back portion of this booklet.

Classification of Investment

Tax reform measures enacted in 1986 and 1987 require items of income and expense to be categorized as “passive,” “active” or “portfolio” in nature. An explanation of how these rules apply to the items of income and expense reported by the Trust is on page A-1 in the back portion of this booklet.

Nonresident Foreign Unit Holders

Nonresident alien individual and foreign corporation Unit holders (“Foreign Taxpayer(s)”) are subject to special tax rules with respect to their investments in the Trust. These rules are outlined on pages A-3 to A-4 in the back portion of this booklet.

Unrelated Business Taxable Income

Certain organizations that are generally exempt from federal income tax under Internal Revenue Code Section 501 are subject to federal income tax on certain types of business income defined in Section 512 as unrelated business taxable income (“UBTI”). The income of the Trust as to any tax-exempt organization should not be UBTI so long as the Trust Units are not “debt-financed property” within the meaning of Section 514(b) of the Internal Revenue Code. In general, a Trust Unit would be debt-financed if the Trust incurs debt or if the tax-exempt organization that is a Trust Unit holder incurs debt to acquire a Trust Unit or otherwise incurs or maintains a debt that would not have been incurred or maintained if the Trust Unit had not been acquired. A real property exception applies to the debt-financed property rules for certain types of exempt organizations. Consult your tax advisor if applicable.

Net Investment Income Tax

Section 1411 of the Code imposes a 3.8% Medicare tax on certain investment income earned by individuals, estates, and trusts for taxable years beginning after December 31, 2012. For these purposes, investment income generally will include a Unit holder’s allocable share of the Trust’s interest and royalty income plus the gain recognized from a sale of Trust Units. In the case of an individual, the tax is imposed on the lesser of (i) the individual’s net investment income from all investments, or (ii) the amount by which the individual’s modified adjusted gross income exceeds specified threshold levels depending on such individual’s federal income tax filing status ($250,000 for married persons filing a joint return and $200,000 in most other cases). In the case of an estate or trust, the tax is imposed on the lesser of (i) undistributed net investment income, or (ii) the excess adjusted gross income over the dollar amount at which the highest income tax bracket applicable to an estate or trust begins ($12,300 for 2015).

(SRT 2015 TAX)

3

Backup Withholding

Unit holders, other than Foreign Taxpayers, who have had amounts withheld in 2015 pursuant to the federal backup withholding provisions should have received a Form 1099-MISC from the Trust. The Form 1099-MISC reflects the total federal income tax withheld from distributions. Unlike other Forms 1099 that you may receive, the amount reported on the Form 1099-MISC received from the Trust should not be included as additional income in computing taxable income, as such amount is already included in the per Unit income items on the income and expense schedules included herein. The federal income tax withheld, as reported on the Form 1099-MISC, should be considered as a credit by the Unit holder in computing any federal income tax liability. Individual Unit holders should include the amount of backup withholding in the “Payments” section of the Unit holder’s 2015 Form 1040. For a further discussion of backup withholding, see page A-5 in the back portion of this booklet. For amounts withheld from Foreign Taxpayers, see pages A-3 to A-4 in the back portion of this booklet.

State Tax

Because the Trust holds royalty interests and receives income that is attributable to properties located in various states, Unit holders may be obligated to file a return and may have a tax liability in those states in addition to their state of residence. The accompanying tables have been prepared in such a manner that income and deductions attributable to the various states may be determined by each Unit holder. State tax matters are more fully discussed on pages A-5 to A-6 in the back portion of this booklet.

Table of 2015 Monthly Record Dates and Cash Distributions Per Unit

Unit holders, as reflected in the transfer books of the Trust on a Monthly Record Date, received the following per Unit cash distributions for 2015. The per Unit cash distributions reflected below have not been reduced by any taxes that may have been withheld from distributions to Foreign Taxpayers or from distributions to Unit holders subject to the federal backup withholding rules. The distribution checks were dated and mailed on the corresponding Date Payable.

| Monthly Record Date |

Date Payable |

Distribution Per Unit |

||||

| January 15, 2015 |

January 29, 2015 | 0.28281 | ||||

| February 17, 2015 |

February 27, 2015 | 0.27708 | ||||

| March 16, 2015 |

March 30, 2015 | 0.44414 | ||||

| April 15, 2015 |

April 29, 2015 | 0.27658 | ||||

| May 15, 2015 |

May 29, 2015 | 0.22925 | ||||

| June 15, 2015 |

June 29, 2015 | 0.21873 | ||||

| July 15, 2015 |

July 29, 2015 | 0.18255 | ||||

| August 17, 2015 |

August 31, 2015 | 0.33120 | ||||

| September 15, 2015 |

September 29, 2015 | 0.35285 | ||||

| October 15, 2015 |

October 29, 2015 | 0.19259 | ||||

| November 16, 2015 |

November 30, 2015 | 0.27481 | ||||

| December 15, 2015 |

December 29, 2015 | 0.04261 | ||||

(SRT 2015 TAX)

4

Cumulative 2015

SABINE ROYALTY TRUST

EIN 75-6297143

FORM 1041, GRANTOR TRUST

Federal and State Income Tax Information

See Instructions for Use

SECTION I

INCOME AND EXPENSE PER UNIT

| ROYALTY INCOME AND EXPENSE | OTHER INCOME AND EXPENSE |

|||||||||||||||||||

| Source |

Gross Income |

Severance Tax |

Net Royalty Payments |

Interest Income |

Administrative Expense |

|||||||||||||||

| Florida |

$ | .028343 | $ | 0.000682 | $ | .027661 | $ | * | $ | .001532 | ||||||||||

| Louisiana |

.047917 | 0.004145 | .043772 | * | .002836 | |||||||||||||||

| Mississippi |

.168364 | 0.015197 | .153167 | * | .013035 | |||||||||||||||

| New Mexico |

.203536 | 0.023690 | .179846 | * | .013901 | |||||||||||||||

| Oklahoma |

.548884 | 0.050040 | .498844 | * | .031268 | |||||||||||||||

| Texas |

2.835397 | 0.419989 | 2.415408 | .000134 | .150981 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| TOTAL |

$ | 3.832441 | $ | 0.513743 | $ | 3.318698 | $ | .000134 | $ | .213553 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

SECTION II

RECONCILIATION OF CASH DISTRIBUTIONS PER UNIT

| Item |

AMOUNT | |||

| 1. Total Net Royalty Payments |

$ | 3.318698 | ||

| 2. Interest Income |

.000134 | |||

| 3. Administrative Expense |

(.213553 | ) | ||

|

|

|

|||

| 4. Cash Distribution Per Unit ** |

$ | 3.105279 | ||

|

|

|

|||

| * | Revenue attributable to these states was invested and earned interest income. Since the investments were made in Dallas, Texas, and the interest was paid there, such interest is included in the Texas interest income. |

| ** | Includes amounts withheld by the Trust from distributions to nonresident alien individuals and foreign corporations and remitted directly to the United States Treasury. This also includes amounts withheld pursuant to the backup withholding provisions. |

(SRT 2015 TAX)

5

SABINE ROYALTY TRUST FEDERAL

Table I: 2015 Gross Royalty Income (Cumulative $ per Unit)

| FIRST MONTH DATE IN 2015 |

LAST MONTH IN WHICH UNITS WERE OWNED ON THE MONTHLY RECORD DATE IN 2015 | |||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | ||||||||||||||||||||||||||||||||||||||||||||||||

| January | February | March | April | May | June | July | August | September | October | November | December | |||||||||||||||||||||||||||||||||||||

| JANUARY |

0.396965 | 0.727355 | 1.219243 | 1.535955 | 1.829224 | 2.100878 | 2.324078 | 2.687230 | 3.100027 | 3.326370 | 3.685658 | 3.832441 | ||||||||||||||||||||||||||||||||||||

| FEBRUARY |

0.330390 | 0.822278 | 1.138990 | 1.432259 | 1.703913 | 1.927113 | 2.290265 | 2.703062 | 2.929405 | 3.288693 | 3.435476 | |||||||||||||||||||||||||||||||||||||

| MARCH |

0.491888 | 0.808600 | 1.101869 | 1.373523 | 1.596723 | 1.959875 | 2.372672 | 2.599015 | 2.958303 | 3.105086 | ||||||||||||||||||||||||||||||||||||||

| APRIL |

0.316712 | 0.609981 | 0.881635 | 1.104835 | 1.467987 | 1.880784 | 2.107127 | 2.466415 | 2.613198 | |||||||||||||||||||||||||||||||||||||||

| MAY |

0.293269 | 0.564923 | 0.788123 | 1.151275 | 1.564072 | 1.790415 | 2.149703 | 2.296486 | ||||||||||||||||||||||||||||||||||||||||

| JUNE |

0.271654 | 0.494854 | 0.858006 | 1.270803 | 1.497146 | 1.856434 | 2.003217 | |||||||||||||||||||||||||||||||||||||||||

| JULY |

0.223200 | 0.586352 | 0.999149 | 1.225492 | 1.584780 | 1.731563 | ||||||||||||||||||||||||||||||||||||||||||

| AUGUST |

0.363152 | 0.775949 | 1.002292 | 1.361580 | 1.508363 | |||||||||||||||||||||||||||||||||||||||||||

| SEPTEMBER |

0.412797 | 0.639140 | 0.998428 | 1.145211 | ||||||||||||||||||||||||||||||||||||||||||||

| OCTOBER |

0.226343 | 0.585631 | 0.732414 | |||||||||||||||||||||||||||||||||||||||||||||

| NOVEMBER |

0.359288 | 0.506071 | ||||||||||||||||||||||||||||||||||||||||||||||

| DECEMBER |

0.146783 | |||||||||||||||||||||||||||||||||||||||||||||||

Table II: 2015 Severance Tax (Cumulative $ per Unit)

| FIRST MONTH DATE IN 2015 |

LAST MONTH IN WHICH UNITS WERE OWNED ON THE MONTHLY RECORD DATE IN 2015 | |||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | ||||||||||||||||||||||||||||||||||||||||||||||||

| January | February | March | April | May | June | July | August | September | October | November | December | |||||||||||||||||||||||||||||||||||||

| JANUARY |

0.102438 | 0.140394 | 0.176939 | 0.205147 | 0.240887 | 0.266729 | 0.287198 | 0.301099 | 0.342491 | 0.360092 | 0.427897 | 0.513743 | ||||||||||||||||||||||||||||||||||||

| FEBRUARY |

0.037956 | 0.074501 | 0.102709 | 0.138449 | 0.164291 | 0.184760 | 0.198661 | 0.240053 | 0.257654 | 0.325459 | 0.411305 | |||||||||||||||||||||||||||||||||||||

| MARCH |

0.036545 | 0.064753 | 0.100493 | 0.126335 | 0.146804 | 0.160705 | 0.202097 | 0.219698 | 0.287503 | 0.373349 | ||||||||||||||||||||||||||||||||||||||

| APRIL |

0.028208 | 0.063948 | 0.089790 | 0.110259 | 0.124160 | 0.165552 | 0.183153 | 0.250958 | 0.336804 | |||||||||||||||||||||||||||||||||||||||

| MAY |

0.035740 | 0.061582 | 0.082051 | 0.095952 | 0.137344 | 0.154945 | 0.222750 | 0.308596 | ||||||||||||||||||||||||||||||||||||||||

| JUNE |

0.025842 | 0.046311 | 0.060212 | 0.101604 | 0.119205 | 0.187010 | 0.272856 | |||||||||||||||||||||||||||||||||||||||||

| JULY |

0.020469 | 0.034370 | 0.075762 | 0.093363 | 0.161168 | 0.247014 | ||||||||||||||||||||||||||||||||||||||||||

| AUGUST |

0.013901 | 0.055293 | 0.072894 | 0.140699 | 0.226545 | |||||||||||||||||||||||||||||||||||||||||||

| SEPTEMBER |

0.041392 | 0.058993 | 0.126798 | 0.212644 | ||||||||||||||||||||||||||||||||||||||||||||

| OCTOBER |

0.017601 | 0.085406 | 0.171252 | |||||||||||||||||||||||||||||||||||||||||||||

| NOVEMBER |

0.067805 | 0.153651 | ||||||||||||||||||||||||||||||||||||||||||||||

| DECEMBER |

0.085846 | |||||||||||||||||||||||||||||||||||||||||||||||

(SRT 2015 TAX)

6

SABINE ROYALTY TRUST FEDERAL

Table III: 2015 Interest Income (Cumulative $ per Unit)

| FIRST MONTH |

LAST MONTH IN WHICH UNITS WERE OWNED ON THE MONTHLY RECORD DATE IN 2015 | |||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | ||||||||||||||||||||||||||||||||||||||||||||||||

| January | February | March | April | May | June | July | August | September | October | November | December | |||||||||||||||||||||||||||||||||||||

| JANUARY |

0.000009 | 0.000022 | 0.000034 | 0.000048 | 0.000061 | 0.000072 | 0.000077 | 0.000088 | 0.000096 | 0.000110 | 0.000123 | 0.000134 | ||||||||||||||||||||||||||||||||||||

| FEBRUARY |

0.000013 | 0.000025 | 0.000039 | 0.000052 | 0.000063 | 0.000068 | 0.000079 | 0.000087 | 0.000101 | 0.000114 | 0.000125 | |||||||||||||||||||||||||||||||||||||

| MARCH |

0.000012 | 0.000026 | 0.000039 | 0.000050 | 0.000055 | 0.000066 | 0.000074 | 0.000088 | 0.000101 | 0.000112 | ||||||||||||||||||||||||||||||||||||||

| APRIL |

0.000014 | 0.000027 | 0.000038 | 0.000043 | 0.000054 | 0.000062 | 0.000076 | 0.000089 | 0.000100 | |||||||||||||||||||||||||||||||||||||||

| MAY |

0.000013 | 0.000024 | 0.000029 | 0.000040 | 0.000048 | 0.000062 | 0.000075 | 0.000086 | ||||||||||||||||||||||||||||||||||||||||

| JUNE |

0.000011 | 0.000016 | 0.000027 | 0.000035 | 0.000049 | 0.000062 | 0.000073 | |||||||||||||||||||||||||||||||||||||||||

| JULY |

0.000005 | 0.000016 | 0.000024 | 0.000038 | 0.000051 | 0.000062 | ||||||||||||||||||||||||||||||||||||||||||

| AUGUST |

0.000011 | 0.000019 | 0.000033 | 0.000046 | 0.000057 | |||||||||||||||||||||||||||||||||||||||||||

| SEPTEMBER |

0.000008 | 0.000022 | 0.000035 | 0.000046 | ||||||||||||||||||||||||||||||||||||||||||||

| OCTOBER |

0.000014 | 0.000027 | 0.000038 | |||||||||||||||||||||||||||||||||||||||||||||

| NOVEMBER |

0.000013 | 0.000024 | ||||||||||||||||||||||||||||||||||||||||||||||

| DECEMBER |

0.000011 | |||||||||||||||||||||||||||||||||||||||||||||||

Table IV: 2015 Trust Administrative Expense (Cumulative $ per Unit)

| FIRST MONTH |

LAST MONTH IN WHICH UNITS WERE OWNED ON THE MONTHLY RECORD DATE IN 2015 | |||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | ||||||||||||||||||||||||||||||||||||||||||||||||

| January | February | March | April | May | June | July | August | September | October | November | December | |||||||||||||||||||||||||||||||||||||

| JANUARY |

0.011718 | 0.027079 | 0.038286 | 0.050216 | 0.078501 | 0.105593 | 0.125772 | 0.143832 | 0.162387 | 0.178544 | 0.195223 | 0.213553 | ||||||||||||||||||||||||||||||||||||

| FEBRUARY |

0.015361 | 0.026568 | 0.038498 | 0.066783 | 0.093875 | 0.114054 | 0.132114 | 0.150669 | 0.166826 | 0.183505 | 0.201835 | |||||||||||||||||||||||||||||||||||||

| MARCH |

0.011207 | 0.023137 | 0.051422 | 0.078514 | 0.098693 | 0.116753 | 0.135308 | 0.151465 | 0.168144 | 0.186474 | ||||||||||||||||||||||||||||||||||||||

| APRIL |

0.011930 | 0.040215 | 0.067307 | 0.087486 | 0.105546 | 0.124101 | 0.140258 | 0.156937 | 0.175267 | |||||||||||||||||||||||||||||||||||||||

| MAY |

0.028285 | 0.055377 | 0.075556 | 0.093616 | 0.112171 | 0.128328 | 0.145007 | 0.163337 | ||||||||||||||||||||||||||||||||||||||||

| JUNE |

0.027092 | 0.047271 | 0.065331 | 0.083886 | 0.100043 | 0.116722 | 0.135052 | |||||||||||||||||||||||||||||||||||||||||

| JULY |

0.020179 | 0.038239 | 0.056794 | 0.072951 | 0.089630 | 0.107960 | ||||||||||||||||||||||||||||||||||||||||||

| AUGUST |

0.018060 | 0.036615 | 0.052772 | 0.069451 | 0.087781 | |||||||||||||||||||||||||||||||||||||||||||

| SEPTEMBER |

0.018555 | 0.034712 | 0.051391 | 0.069721 | ||||||||||||||||||||||||||||||||||||||||||||

| OCTOBER |

0.016157 | 0.032836 | 0.051166 | |||||||||||||||||||||||||||||||||||||||||||||

| NOVEMBER |

0.016679 | 0.035009 | ||||||||||||||||||||||||||||||||||||||||||||||

| DECEMBER |

0.018330 | |||||||||||||||||||||||||||||||||||||||||||||||

(SRT 2015 TAX)

7

SABINE ROYALTY TRUST TEXAS

TABLE A TEXAS: Gross Royalty Income

| FIRST |

LAST MONTH IN WHICH UNITS WERE OWNED ON THE MONTHLY RECORD DATE IN 2015 | |||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | ||||||||||||||||||||||||||||||||||||||||||||||||

| January | February | March | April | May | June | July | August | September | October | November | December | |||||||||||||||||||||||||||||||||||||

| January |

0.311421 | 0.557103 | 0.981955 | 1.217477 | 1.332824 | 1.547426 | 1.715181 | 1.939162 | 2.279549 | 2.444518 | 2.736226 | 2.835397 | ||||||||||||||||||||||||||||||||||||

| February |

0.245682 | 0.670534 | 0.906056 | 1.021403 | 1.236005 | 1.403760 | 1.627741 | 1.968128 | 2.133097 | 2.424805 | 2.523976 | |||||||||||||||||||||||||||||||||||||

| March |

0.424852 | 0.660374 | 0.775721 | 0.990323 | 1.158078 | 1.382059 | 1.722446 | 1.887415 | 2.179123 | 2.278294 | ||||||||||||||||||||||||||||||||||||||

| April |

0.235522 | 0.350869 | 0.565471 | 0.733226 | 0.957207 | 1.297594 | 1.462563 | 1.754271 | 1.853442 | |||||||||||||||||||||||||||||||||||||||

| May |

0.115347 | 0.329949 | 0.497704 | 0.721685 | 1.062072 | 1.227041 | 1.518749 | 1.617920 | ||||||||||||||||||||||||||||||||||||||||

| June |

0.214602 | 0.382357 | 0.606338 | 0.946725 | 1.111694 | 1.403402 | 1.502573 | |||||||||||||||||||||||||||||||||||||||||

| July |

0.167755 | 0.391736 | 0.732123 | 0.897092 | 1.188800 | 1.287971 | ||||||||||||||||||||||||||||||||||||||||||

| August |

0.223981 | 0.564368 | 0.729337 | 1.021045 | 1.120216 | |||||||||||||||||||||||||||||||||||||||||||

| September |

0.340387 | 0.505356 | 0.797064 | 0.896235 | ||||||||||||||||||||||||||||||||||||||||||||

| October |

0.164969 | 0.456677 | 0.555848 | |||||||||||||||||||||||||||||||||||||||||||||

| November |

0.291708 | 0.390879 | ||||||||||||||||||||||||||||||||||||||||||||||

| December |

0.099171 | |||||||||||||||||||||||||||||||||||||||||||||||

TABLE B TEXAS: Severance Tax

| FIRST |

LAST MONTH IN WHICH UNITS WERE OWNED ON THE MONTHLY RECORD DATE IN 2015 | |||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | ||||||||||||||||||||||||||||||||||||||||||||||||

| January | February | March | April | May | June | July | August | September | October | November | December | |||||||||||||||||||||||||||||||||||||

| January |

0.092776 | 0.122502 | 0.151061 | 0.170888 | 0.184900 | 0.203573 | 0.217403 | 0.226697 | 0.268402 | 0.278552 | 0.339019 | 0.419989 | ||||||||||||||||||||||||||||||||||||

| February |

0.029726 | 0.058285 | 0.078112 | 0.092124 | 0.110797 | 0.124627 | 0.133921 | 0.175626 | 0.185776 | 0.246243 | 0.327213 | |||||||||||||||||||||||||||||||||||||

| March |

0.028559 | 0.048386 | 0.062398 | 0.081071 | 0.094901 | 0.104195 | 0.145900 | 0.156050 | 0.216517 | 0.297487 | ||||||||||||||||||||||||||||||||||||||

| April |

0.019827 | 0.033839 | 0.052512 | 0.066342 | 0.075636 | 0.117341 | 0.127491 | 0.187958 | 0.268928 | |||||||||||||||||||||||||||||||||||||||

| May |

0.014012 | 0.032685 | 0.046515 | 0.055809 | 0.097514 | 0.107664 | 0.168131 | 0.249101 | ||||||||||||||||||||||||||||||||||||||||

| June |

0.018673 | 0.032503 | 0.041797 | 0.083502 | 0.093652 | 0.154119 | 0.235089 | |||||||||||||||||||||||||||||||||||||||||

| July |

0.013830 | 0.023124 | 0.064829 | 0.074979 | 0.135446 | 0.216416 | ||||||||||||||||||||||||||||||||||||||||||

| August |

0.009294 | 0.050999 | 0.061149 | 0.121616 | 0.202586 | |||||||||||||||||||||||||||||||||||||||||||

| September |

0.041705 | 0.051855 | 0.112322 | 0.193292 | ||||||||||||||||||||||||||||||||||||||||||||

| October |

0.010150 | 0.070617 | 0.151587 | |||||||||||||||||||||||||||||||||||||||||||||

| November |

0.060467 | 0.141437 | ||||||||||||||||||||||||||||||||||||||||||||||

| December |

0.080970 | |||||||||||||||||||||||||||||||||||||||||||||||

TABLE C TEXAS: Interest Income

| FIRST |

LAST MONTH IN WHICH UNITS WERE OWNED ON THE MONTHLY RECORD DATE IN 2015 | |||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | ||||||||||||||||||||||||||||||||||||||||||||||||

| January | February | March | April | May | June | July | August | September | October | November | December | |||||||||||||||||||||||||||||||||||||

| January |

0.000009 | 0.000022 | 0.000034 | 0.000048 | 0.000061 | 0.000072 | 0.000077 | 0.000088 | 0.000096 | 0.000110 | 0.000123 | 0.000134 | ||||||||||||||||||||||||||||||||||||

| February |

0.000013 | 0.000025 | 0.000039 | 0.000052 | 0.000063 | 0.000068 | 0.000079 | 0.000087 | 0.000101 | 0.000114 | 0.000125 | |||||||||||||||||||||||||||||||||||||

| March |

0.000012 | 0.000026 | 0.000039 | 0.000050 | 0.000055 | 0.000066 | 0.000074 | 0.000088 | 0.000101 | 0.000112 | ||||||||||||||||||||||||||||||||||||||

| April |

0.000014 | 0.000027 | 0.000038 | 0.000043 | 0.000054 | 0.000062 | 0.000076 | 0.000089 | 0.000100 | |||||||||||||||||||||||||||||||||||||||

| May |

0.000013 | 0.000024 | 0.000029 | 0.000040 | 0.000048 | 0.000062 | 0.000075 | 0.000086 | ||||||||||||||||||||||||||||||||||||||||

| June |

0.000011 | 0.000016 | 0.000027 | 0.000035 | 0.000049 | 0.000062 | 0.000073 | |||||||||||||||||||||||||||||||||||||||||

| July |

0.000005 | 0.000016 | 0.000024 | 0.000038 | 0.000051 | 0.000062 | ||||||||||||||||||||||||||||||||||||||||||

| August |

0.000011 | 0.000019 | 0.000033 | 0.000046 | 0.000057 | |||||||||||||||||||||||||||||||||||||||||||

| September |

0.000008 | 0.000022 | 0.000035 | 0.000046 | ||||||||||||||||||||||||||||||||||||||||||||

| October |

0.000014 | 0.000027 | 0.000038 | |||||||||||||||||||||||||||||||||||||||||||||

| November |

0.000013 | 0.000024 | ||||||||||||||||||||||||||||||||||||||||||||||

| December |

0.000011 | |||||||||||||||||||||||||||||||||||||||||||||||

TABLE D TEXAS: Administrative Expense

| FIRST |

LAST MONTH IN WHICH UNITS WERE OWNED ON THE MONTHLY RECORD DATE IN 2015 | |||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | ||||||||||||||||||||||||||||||||||||||||||||||||

| January | February | March | April | May | June | July | August | September | October | November | December | |||||||||||||||||||||||||||||||||||||

| January |

0.009192 | 0.020613 | 0.030292 | 0.039161 | 0.050282 | 0.071683 | 0.086848 | 0.097986 | 0.113286 | 0.125060 | 0.138600 | 0.150981 | ||||||||||||||||||||||||||||||||||||

| February |

0.011421 | 0.021100 | 0.029969 | 0.041090 | 0.062491 | 0.077656 | 0.088794 | 0.104094 | 0.115868 | 0.129408 | 0.141789 | |||||||||||||||||||||||||||||||||||||

| March |

0.009679 | 0.018548 | 0.029669 | 0.051070 | 0.066235 | 0.077373 | 0.092673 | 0.104447 | 0.117987 | 0.130368 | ||||||||||||||||||||||||||||||||||||||

| April |

0.008869 | 0.019990 | 0.041391 | 0.056556 | 0.067694 | 0.082994 | 0.094768 | 0.108308 | 0.120689 | |||||||||||||||||||||||||||||||||||||||

| May |

0.011121 | 0.032522 | 0.047687 | 0.058825 | 0.074125 | 0.085899 | 0.099439 | 0.111820 | ||||||||||||||||||||||||||||||||||||||||

| June |

0.021401 | 0.036566 | 0.047704 | 0.063004 | 0.074778 | 0.088318 | 0.100699 | |||||||||||||||||||||||||||||||||||||||||

| July |

0.015165 | 0.026303 | 0.041603 | 0.053377 | 0.066917 | 0.079298 | ||||||||||||||||||||||||||||||||||||||||||

| August |

0.011138 | 0.026438 | 0.038212 | 0.051752 | 0.064133 | |||||||||||||||||||||||||||||||||||||||||||

| September |

0.015300 | 0.027074 | 0.040614 | 0.052995 | ||||||||||||||||||||||||||||||||||||||||||||

| October |

0.011774 | 0.025314 | 0.037695 | |||||||||||||||||||||||||||||||||||||||||||||

| November |

0.013540 | 0.025921 | ||||||||||||||||||||||||||||||||||||||||||||||

| December |

0.012381 | |||||||||||||||||||||||||||||||||||||||||||||||

(SRT 2015 TAX)

8

SABINE ROYALTY TRUST OKLAHOMA

TABLE A OKLAHOMA: Gross Royalty Income

| FIRST |

LAST MONTH IN WHICH UNITS WERE OWNED ON THE MONTHLY RECORD DATE IN 2015 | |||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | ||||||||||||||||||||||||||||||||||||||||||||||||

| January | February | March | April | May | June | July | August | September | October | November | December | |||||||||||||||||||||||||||||||||||||

| January |

0.059366 | 0.110589 | 0.145190 | 0.202603 | 0.239013 | 0.274473 | 0.304038 | 0.413100 | 0.454050 | 0.480527 | 0.521823 | 0.548884 | ||||||||||||||||||||||||||||||||||||

| February |

0.051223 | 0.085824 | 0.143237 | 0.179647 | 0.215107 | 0.244672 | 0.353734 | 0.394684 | 0.421161 | 0.462457 | 0.489518 | |||||||||||||||||||||||||||||||||||||

| March |

0.034601 | 0.092014 | 0.128424 | 0.163884 | 0.193449 | 0.302511 | 0.343461 | 0.369938 | 0.411234 | 0.438295 | ||||||||||||||||||||||||||||||||||||||

| April |

0.057413 | 0.093823 | 0.129283 | 0.158848 | 0.267910 | 0.308860 | 0.335337 | 0.376633 | 0.403694 | |||||||||||||||||||||||||||||||||||||||

| May |

0.036410 | 0.071870 | 0.101435 | 0.210497 | 0.251447 | 0.277924 | 0.319220 | 0.346281 | ||||||||||||||||||||||||||||||||||||||||

| June |

0.035460 | 0.065025 | 0.174087 | 0.215037 | 0.241514 | 0.282810 | 0.309871 | |||||||||||||||||||||||||||||||||||||||||

| July |

0.029565 | 0.138627 | 0.179577 | 0.206054 | 0.247350 | 0.274411 | ||||||||||||||||||||||||||||||||||||||||||

| August |

0.109062 | 0.150012 | 0.176489 | 0.217785 | 0.244846 | |||||||||||||||||||||||||||||||||||||||||||

| September |

0.040950 | 0.067427 | 0.108723 | 0.135784 | ||||||||||||||||||||||||||||||||||||||||||||

| October |

0.026477 | 0.067773 | 0.094834 | |||||||||||||||||||||||||||||||||||||||||||||

| November |

0.041296 | 0.068357 | ||||||||||||||||||||||||||||||||||||||||||||||

| December |

0.027061 | |||||||||||||||||||||||||||||||||||||||||||||||

TABLE B OKLAHOMA: Severance Tax

| FIRST |

LAST MONTH IN WHICH UNITS WERE OWNED ON THE MONTHLY RECORD DATE IN 2015 | |||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | ||||||||||||||||||||||||||||||||||||||||||||||||

| January | February | March | April | May | June | July | August | September | October | November | December | |||||||||||||||||||||||||||||||||||||

| January |

0.007462 | 0.012655 | 0.017585 | 0.023645 | 0.030214 | 0.034935 | 0.039166 | 0.041492 | 0.038313 | 0.042564 | 0.046950 | 0.050040 | ||||||||||||||||||||||||||||||||||||

| February |

0.005193 | 0.010123 | 0.016183 | 0.022752 | 0.027473 | 0.031704 | 0.034030 | 0.030851 | 0.035102 | 0.039488 | 0.042578 | |||||||||||||||||||||||||||||||||||||

| March |

0.004930 | 0.010990 | 0.017559 | 0.022280 | 0.026511 | 0.028837 | 0.025658 | 0.029909 | 0.034295 | 0.037385 | ||||||||||||||||||||||||||||||||||||||

| April |

0.006060 | 0.012629 | 0.017350 | 0.021581 | 0.023907 | 0.020728 | 0.024979 | 0.029365 | 0.032455 | |||||||||||||||||||||||||||||||||||||||

| May |

0.006569 | 0.011290 | 0.015521 | 0.017847 | 0.014668 | 0.018919 | 0.023305 | 0.026395 | ||||||||||||||||||||||||||||||||||||||||

| June |

0.004721 | 0.008952 | 0.011278 | 0.008099 | 0.012350 | 0.016736 | 0.019826 | |||||||||||||||||||||||||||||||||||||||||

| July |

0.004231 | 0.006557 | 0.003378 | 0.007629 | 0.012015 | 0.015105 | ||||||||||||||||||||||||||||||||||||||||||

| August |

0.002326 | (0.000853 | ) | 0.003398 | 0.007784 | 0.010874 | ||||||||||||||||||||||||||||||||||||||||||

| September |

(0.003179 | ) | 0.001072 | 0.005458 | 0.008548 | |||||||||||||||||||||||||||||||||||||||||||

| October |

0.004251 | 0.008637 | 0.011727 | |||||||||||||||||||||||||||||||||||||||||||||

| November |

0.004386 | 0.007476 | ||||||||||||||||||||||||||||||||||||||||||||||

| December |

0.003090 | |||||||||||||||||||||||||||||||||||||||||||||||

TABLE C OKLAHOMA: Administrative Expense

| FIRST |

LAST MONTH IN WHICH UNITS WERE OWNED ON THE MONTHLY RECORD DATE IN 2015 | |||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | ||||||||||||||||||||||||||||||||||||||||||||||||

| January | February | March | April | May | June | July | August | September | October | November | December | |||||||||||||||||||||||||||||||||||||

| January |

0.001754 | 0.004137 | 0.004926 | 0.007090 | 0.010602 | 0.014139 | 0.016813 | 0.022237 | 0.024078 | 0.025969 | 0.027887 | 0.031268 | ||||||||||||||||||||||||||||||||||||

| February |

0.002383 | 0.003172 | 0.005336 | 0.008848 | 0.012385 | 0.015059 | 0.020483 | 0.022324 | 0.024215 | 0.026133 | 0.029514 | |||||||||||||||||||||||||||||||||||||

| March |

0.000789 | 0.002953 | 0.006465 | 0.010002 | 0.012676 | 0.018100 | 0.019941 | 0.021832 | 0.023750 | 0.027131 | ||||||||||||||||||||||||||||||||||||||

| April |

0.002164 | 0.005676 | 0.009213 | 0.011887 | 0.017311 | 0.019152 | 0.021043 | 0.022961 | 0.026342 | |||||||||||||||||||||||||||||||||||||||

| May |

0.003512 | 0.007049 | 0.009723 | 0.015147 | 0.016988 | 0.018879 | 0.020797 | 0.024178 | ||||||||||||||||||||||||||||||||||||||||

| June |

0.003537 | 0.006211 | 0.011635 | 0.013476 | 0.015367 | 0.017285 | 0.020666 | |||||||||||||||||||||||||||||||||||||||||

| July |

0.002674 | 0.008098 | 0.009939 | 0.011830 | 0.013748 | 0.017129 | ||||||||||||||||||||||||||||||||||||||||||

| August |

0.005424 | 0.007265 | 0.009156 | 0.011074 | 0.014455 | |||||||||||||||||||||||||||||||||||||||||||

| September |

0.001841 | 0.003732 | 0.005650 | 0.009031 | ||||||||||||||||||||||||||||||||||||||||||||

| October |

0.001891 | 0.003809 | 0.007190 | |||||||||||||||||||||||||||||||||||||||||||||

| November |

0.001918 | 0.005299 | ||||||||||||||||||||||||||||||||||||||||||||||

| December |

0.003381 | |||||||||||||||||||||||||||||||||||||||||||||||

(SRT 2015 TAX)

9

SABINE ROYALTY TRUST FLORIDA

TABLE A FLORIDA: Gross Royalty Income

| FIRST UNITS |

LAST MONTH IN WHICH UNITS WERE OWNED ON THE MONTHLY RECORD DATE IN 2015 | |||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | ||||||||||||||||||||||||||||||||||||||||||||||||

| January | February | March | April | May | June | July | August | September | October | November | December | |||||||||||||||||||||||||||||||||||||

| January |

0.003503 | 0.006712 | 0.009270 | 0.011280 | 0.013078 | 0.013301 | 0.013382 | 0.018400 | 0.021366 | 0.024193 | 0.026228 | 0.028343 | ||||||||||||||||||||||||||||||||||||

| February |

0.003209 | 0.005767 | 0.007777 | 0.009575 | 0.009798 | 0.009879 | 0.014897 | 0.017863 | 0.020690 | 0.022725 | 0.024840 | |||||||||||||||||||||||||||||||||||||

| March |

0.002558 | 0.004568 | 0.006366 | 0.006589 | 0.006670 | 0.011688 | 0.014654 | 0.017481 | 0.019516 | 0.021631 | ||||||||||||||||||||||||||||||||||||||

| April |

0.002010 | 0.003808 | 0.004031 | 0.004112 | 0.009130 | 0.012096 | 0.014923 | 0.016958 | 0.019073 | |||||||||||||||||||||||||||||||||||||||

| May |

0.001798 | 0.002021 | 0.002102 | 0.007120 | 0.010086 | 0.012913 | 0.014948 | 0.017063 | ||||||||||||||||||||||||||||||||||||||||

| June |

0.000223 | 0.000304 | 0.005322 | 0.008288 | 0.011115 | 0.013150 | 0.015265 | |||||||||||||||||||||||||||||||||||||||||

| July |

0.000081 | 0.005099 | 0.008065 | 0.010892 | 0.012927 | 0.015042 | ||||||||||||||||||||||||||||||||||||||||||

| August |

0.005018 | 0.007984 | 0.010811 | 0.012846 | 0.014961 | |||||||||||||||||||||||||||||||||||||||||||

| September |

0.002966 | 0.005793 | 0.007828 | 0.009943 | ||||||||||||||||||||||||||||||||||||||||||||

| October |

0.002827 | 0.004862 | 0.006977 | |||||||||||||||||||||||||||||||||||||||||||||

| November |

0.002035 | 0.004150 | ||||||||||||||||||||||||||||||||||||||||||||||

| December |

0.002115 | |||||||||||||||||||||||||||||||||||||||||||||||

TABLE B FLORIDA: Severance Tax

| FIRST 2015 |

LAST MONTH IN WHICH UNITS WERE OWNED ON THE MONTHLY RECORD DATE IN 2015 |

|||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | ||||||||||||||||||||||||||||||||||||||||||||||||

| January | February | March | April | May | June | July | August | September | October | November | December | |||||||||||||||||||||||||||||||||||||

| January |

0.000104 | 0.000187 | 0.000246 | 0.000291 | 0.000334 | 0.000340 | 0.000344 | 0.000433 | 0.000493 | 0.000556 | 0.000606 | 0.000682 | ||||||||||||||||||||||||||||||||||||

| February |

0.000083 | 0.000142 | 0.000187 | 0.000230 | 0.000236 | 0.000240 | 0.000329 | 0.000389 | 0.000452 | 0.000502 | 0.000578 | |||||||||||||||||||||||||||||||||||||

| March |

0.000059 | 0.000104 | 0.000147 | 0.000153 | 0.000157 | 0.000246 | 0.000306 | 0.000369 | 0.000419 | 0.000495 | ||||||||||||||||||||||||||||||||||||||

| April |

0.000045 | 0.000088 | 0.000094 | 0.000098 | 0.000187 | 0.000247 | 0.000310 | 0.000360 | 0.000436 | |||||||||||||||||||||||||||||||||||||||

| May |

0.000043 | 0.000049 | 0.000053 | 0.000142 | 0.000202 | 0.000265 | 0.000315 | 0.000391 | ||||||||||||||||||||||||||||||||||||||||

| June |

0.000006 | 0.000010 | 0.000099 | 0.000159 | 0.000222 | 0.000272 | 0.000348 | |||||||||||||||||||||||||||||||||||||||||

| July |

0.000004 | 0.000093 | 0.000153 | 0.000216 | 0.000266 | 0.000342 | ||||||||||||||||||||||||||||||||||||||||||

| August |

0.000089 | 0.000149 | 0.000212 | 0.000262 | 0.000338 | |||||||||||||||||||||||||||||||||||||||||||

| September |

0.000060 | 0.000123 | 0.000173 | 0.000249 | ||||||||||||||||||||||||||||||||||||||||||||

| October |

0.000063 | 0.000113 | 0.000189 | |||||||||||||||||||||||||||||||||||||||||||||

| November |

0.000050 | 0.000126 | ||||||||||||||||||||||||||||||||||||||||||||||

| December |

0.000076 | |||||||||||||||||||||||||||||||||||||||||||||||

TABLE C FLORIDA: Administrative Expense

| FIRST |

LAST MONTH IN WHICH UNITS WERE OWNED ON THE MONTHLY RECORD DATE IN 2015 | |||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | ||||||||||||||||||||||||||||||||||||||||||||||||

| January | February | March | April | May | June | July | August | September | October | November | December | |||||||||||||||||||||||||||||||||||||

| January |

0.000103 | 0.000252 | 0.000310 | 0.000386 | 0.000559 | 0.000581 | 0.000588 | 0.000838 | 0.000971 | 0.001173 | 0.001268 | 0.001532 | ||||||||||||||||||||||||||||||||||||

| February |

0.000149 | 0.000207 | 0.000283 | 0.000456 | 0.000478 | 0.000485 | 0.000735 | 0.000868 | 0.001070 | 0.001165 | 0.001429 | |||||||||||||||||||||||||||||||||||||

| March |

0.000058 | 0.000134 | 0.000307 | 0.000329 | 0.000336 | 0.000586 | 0.000719 | 0.000921 | 0.001016 | 0.001280 | ||||||||||||||||||||||||||||||||||||||

| April |

0.000076 | 0.000249 | 0.000271 | 0.000278 | 0.000528 | 0.000661 | 0.000863 | 0.000958 | 0.001222 | |||||||||||||||||||||||||||||||||||||||

| May |

0.000173 | 0.000195 | 0.000202 | 0.000452 | 0.000585 | 0.000787 | 0.000882 | 0.001146 | ||||||||||||||||||||||||||||||||||||||||

| June |

0.000022 | 0.000029 | 0.000279 | 0.000412 | 0.000614 | 0.000709 | 0.000973 | |||||||||||||||||||||||||||||||||||||||||

| July |

0.000007 | 0.000257 | 0.000390 | 0.000592 | 0.000687 | 0.000951 | ||||||||||||||||||||||||||||||||||||||||||

| August |

0.000250 | 0.000383 | 0.000585 | 0.000680 | 0.000944 | |||||||||||||||||||||||||||||||||||||||||||

| September |

0.000133 | 0.000335 | 0.000430 | 0.000694 | ||||||||||||||||||||||||||||||||||||||||||||

| October |

0.000202 | 0.000297 | 0.000561 | |||||||||||||||||||||||||||||||||||||||||||||

| November |

0.000095 | 0.000359 | ||||||||||||||||||||||||||||||||||||||||||||||

| December |

0.000264 | |||||||||||||||||||||||||||||||||||||||||||||||

(SRT 2015 TAX)

10

SABINE ROYALTY TRUST LOUISIANA

TABLE A LOUISIANA: Gross Royalty Income

| FIRST |

LAST MONTH IN WHICH UNITS WERE OWNED ON THE MONTHLY RECORD DATE IN 2015 | |||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | ||||||||||||||||||||||||||||||||||||||||||||||||

| January | February | March | April | May | June | July | August | September | October | November | December | |||||||||||||||||||||||||||||||||||||

| January |

0.005968 | 0.008791 | 0.015336 | 0.019575 | 0.022497 | 0.025812 | 0.029349 | 0.032862 | 0.037331 | 0.040334 | 0.043525 | 0.047917 | ||||||||||||||||||||||||||||||||||||

| February |

0.002823 | 0.009368 | 0.013607 | 0.016529 | 0.019844 | 0.023381 | 0.026894 | 0.031363 | 0.034366 | 0.037557 | 0.041949 | |||||||||||||||||||||||||||||||||||||

| March |

0.006545 | 0.010784 | 0.013706 | 0.017021 | 0.020558 | 0.024071 | 0.028540 | 0.031543 | 0.034734 | 0.039126 | ||||||||||||||||||||||||||||||||||||||

| April |

0.004239 | 0.007161 | 0.010476 | 0.014013 | 0.017526 | 0.021995 | 0.024998 | 0.028189 | 0.032581 | |||||||||||||||||||||||||||||||||||||||

| May |

0.002922 | 0.006237 | 0.009774 | 0.013287 | 0.017756 | 0.020759 | 0.023950 | 0.028342 | ||||||||||||||||||||||||||||||||||||||||

| June |

0.003315 | 0.006852 | 0.010365 | 0.014834 | 0.017837 | 0.021028 | 0.025420 | |||||||||||||||||||||||||||||||||||||||||

| July |

0.003537 | 0.007050 | 0.011519 | 0.014522 | 0.017713 | 0.022105 | ||||||||||||||||||||||||||||||||||||||||||

| August |

0.003513 | 0.007982 | 0.010985 | 0.014176 | 0.018568 | |||||||||||||||||||||||||||||||||||||||||||

| September |

0.004469 | 0.007472 | 0.010663 | 0.015055 | ||||||||||||||||||||||||||||||||||||||||||||

| October |

0.003003 | 0.006194 | 0.010586 | |||||||||||||||||||||||||||||||||||||||||||||

| November |

0.003191 | 0.007583 | ||||||||||||||||||||||||||||||||||||||||||||||

| December |

0.004392 | |||||||||||||||||||||||||||||||||||||||||||||||

TABLE B LOUISIANA: Severance Tax

| FIRST |

LAST MONTH IN WHICH UNITS WERE OWNED ON THE MONTHLY RECORD DATE IN 2015 | |||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | ||||||||||||||||||||||||||||||||||||||||||||||||

| January | February | March | April | May | June | July | August | September | October | November | December | |||||||||||||||||||||||||||||||||||||

| January |

0.000566 | 0.000777 | 0.001384 | 0.001741 | 0.002016 | 0.002303 | 0.002617 | 0.002884 | 0.003256 | 0.003504 | 0.003830 | 0.004145 | ||||||||||||||||||||||||||||||||||||

| February |

0.000211 | 0.000818 | 0.001175 | 0.001450 | 0.001737 | 0.002051 | 0.002318 | 0.002690 | 0.002938 | 0.003264 | 0.003579 | |||||||||||||||||||||||||||||||||||||

| March |

0.000607 | 0.000964 | 0.001239 | 0.001526 | 0.001840 | 0.002107 | 0.002479 | 0.002727 | 0.003053 | 0.003368 | ||||||||||||||||||||||||||||||||||||||

| April |

0.000357 | 0.000632 | 0.000919 | 0.001233 | 0.001500 | 0.001872 | 0.002120 | 0.002446 | 0.002761 | |||||||||||||||||||||||||||||||||||||||

| May |

0.000275 | 0.000562 | 0.000876 | 0.001143 | 0.001515 | 0.001763 | 0.002089 | 0.002404 | ||||||||||||||||||||||||||||||||||||||||

| June |

0.000287 | 0.000601 | 0.000868 | 0.001240 | 0.001488 | 0.001814 | 0.002129 | |||||||||||||||||||||||||||||||||||||||||

| July |

0.000314 | 0.000581 | 0.000953 | 0.001201 | 0.001527 | 0.001842 | ||||||||||||||||||||||||||||||||||||||||||

| August |

0.000267 | 0.000639 | 0.000887 | 0.001213 | 0.001528 | |||||||||||||||||||||||||||||||||||||||||||

| September |

0.000372 | 0.000620 | 0.000946 | 0.001261 | ||||||||||||||||||||||||||||||||||||||||||||

| October |

0.000248 | 0.000574 | 0.000889 | |||||||||||||||||||||||||||||||||||||||||||||

| November |

0.000326 | 0.000641 | ||||||||||||||||||||||||||||||||||||||||||||||

| December |

0.000315 | |||||||||||||||||||||||||||||||||||||||||||||||

TABLE C LOUISIANA: Administrative Expense

| FIRST |

LAST MONTH IN WHICH UNITS WERE OWNED ON THE MONTHLY RECORD DATE IN 2015 | |||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | ||||||||||||||||||||||||||||||||||||||||||||||||

| January | February | March | April | May | June | July | August | September | October | November | December | |||||||||||||||||||||||||||||||||||||

| January |

0.000176 | 0.000307 | 0.000456 | 0.000616 | 0.000898 | 0.001229 | 0.001549 | 0.001724 | 0.001925 | 0.002139 | 0.002287 | 0.002836 | ||||||||||||||||||||||||||||||||||||

| February |

0.000131 | 0.000280 | 0.000440 | 0.000722 | 0.001053 | 0.001373 | 0.001548 | 0.001749 | 0.001963 | 0.002111 | 0.002660 | |||||||||||||||||||||||||||||||||||||

| March |

0.000149 | 0.000309 | 0.000591 | 0.000922 | 0.001242 | 0.001417 | 0.001618 | 0.001832 | 0.001980 | 0.002529 | ||||||||||||||||||||||||||||||||||||||

| April |

0.000160 | 0.000442 | 0.000773 | 0.001093 | 0.001268 | 0.001469 | 0.001683 | 0.001831 | 0.002380 | |||||||||||||||||||||||||||||||||||||||

| May |

0.000282 | 0.000613 | 0.000933 | 0.001108 | 0.001309 | 0.001523 | 0.001671 | 0.002220 | ||||||||||||||||||||||||||||||||||||||||

| June |

0.000331 | 0.000651 | 0.000826 | 0.001027 | 0.001241 | 0.001389 | 0.001938 | |||||||||||||||||||||||||||||||||||||||||

| July |

0.000320 | 0.000495 | 0.000696 | 0.000910 | 0.001058 | 0.001607 | ||||||||||||||||||||||||||||||||||||||||||

| August |

0.000175 | 0.000376 | 0.000590 | 0.000738 | 0.001287 | |||||||||||||||||||||||||||||||||||||||||||

| September |

0.000201 | 0.000415 | 0.000563 | 0.001112 | ||||||||||||||||||||||||||||||||||||||||||||

| October |

0.000214 | 0.000362 | 0.000911 | |||||||||||||||||||||||||||||||||||||||||||||

| November |

0.000148 | 0.000697 | ||||||||||||||||||||||||||||||||||||||||||||||

| December |

0.000549 | |||||||||||||||||||||||||||||||||||||||||||||||

(SRT 2015 TAX)

11

SABINE ROYALTY TRUST MISSISSIPPI

TABLE A MISSISSIPPI: Gross Royalty Income

| FIRST |

LAST MONTH IN WHICH UNITS WERE OWNED ON THE MONTHLY RECORD DATE IN 2015 | |||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | ||||||||||||||||||||||||||||||||||||||||||||||||

| January | February | March | April | May | June | July | August | September | October | November | December | |||||||||||||||||||||||||||||||||||||

| January |

0.007959 | 0.016104 | 0.026147 | 0.033352 | 0.120193 | 0.124572 | 0.132305 | 0.139773 | 0.147562 | 0.155154 | 0.161625 | 0.168364 | ||||||||||||||||||||||||||||||||||||

| February |

0.008145 | 0.018188 | 0.025393 | 0.112234 | 0.116613 | 0.124346 | 0.131814 | 0.139603 | 0.147195 | 0.153666 | 0.160405 | |||||||||||||||||||||||||||||||||||||

| March |

0.010043 | 0.017248 | 0.104089 | 0.108468 | 0.116201 | 0.123669 | 0.131458 | 0.139050 | 0.145521 | 0.152260 | ||||||||||||||||||||||||||||||||||||||

| April |

0.007205 | 0.094046 | 0.098425 | 0.106158 | 0.113626 | 0.121415 | 0.129007 | 0.135478 | 0.142217 | |||||||||||||||||||||||||||||||||||||||

| May |

0.086841 | 0.091220 | 0.098953 | 0.106421 | 0.114210 | 0.121802 | 0.128273 | 0.135012 | ||||||||||||||||||||||||||||||||||||||||

| June |

0.004379 | 0.012112 | 0.019580 | 0.027369 | 0.034961 | 0.041432 | 0.048171 | |||||||||||||||||||||||||||||||||||||||||

| July |

0.007733 | 0.015201 | 0.022990 | 0.030582 | 0.037053 | 0.043792 | ||||||||||||||||||||||||||||||||||||||||||

| August |

0.007468 | 0.015257 | 0.022849 | 0.029320 | 0.036059 | |||||||||||||||||||||||||||||||||||||||||||

| September |

0.007789 | 0.015381 | 0.021852 | 0.028591 | ||||||||||||||||||||||||||||||||||||||||||||

| October |

0.007592 | 0.014063 | 0.020802 | |||||||||||||||||||||||||||||||||||||||||||||

| November |

0.006471 | 0.013210 | ||||||||||||||||||||||||||||||||||||||||||||||

| December |

0.006739 | |||||||||||||||||||||||||||||||||||||||||||||||

TABLE B MISSISSIPPI: Severance Tax

| FIRST |

LAST MONTH IN WHICH UNITS WERE OWNED ON THE MONTHLY RECORD DATE IN 2015 | |||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | ||||||||||||||||||||||||||||||||||||||||||||||||

| January | February | March | April | May | June | July | August | September | October | November | December | |||||||||||||||||||||||||||||||||||||

| January |

0.000479 | 0.000903 | 0.001694 | 0.002207 | 0.011632 | 0.012005 | 0.012589 | 0.012940 | 0.013566 | 0.014030 | 0.014650 | 0.015197 | ||||||||||||||||||||||||||||||||||||

| February |

0.000424 | 0.001215 | 0.001728 | 0.011153 | 0.011526 | 0.012110 | 0.012461 | 0.013087 | 0.013551 | 0.014171 | 0.014718 | |||||||||||||||||||||||||||||||||||||

| March |

0.000791 | 0.001304 | 0.010729 | 0.011102 | 0.011686 | 0.012037 | 0.012663 | 0.013127 | 0.013747 | 0.014294 | ||||||||||||||||||||||||||||||||||||||

| April |

0.000513 | 0.009938 | 0.010311 | 0.010895 | 0.011246 | 0.011872 | 0.012336 | 0.012956 | 0.013503 | |||||||||||||||||||||||||||||||||||||||

| May |

0.009425 | 0.009798 | 0.010382 | 0.010733 | 0.011359 | 0.011823 | 0.012443 | 0.012990 | ||||||||||||||||||||||||||||||||||||||||

| June |

0.000373 | 0.000957 | 0.001308 | 0.001934 | 0.002398 | 0.003018 | 0.003565 | |||||||||||||||||||||||||||||||||||||||||

| July |

0.000584 | 0.000935 | 0.001561 | 0.002025 | 0.002645 | 0.003192 | ||||||||||||||||||||||||||||||||||||||||||

| August |

0.000351 | 0.000977 | 0.001441 | 0.002061 | 0.002608 | |||||||||||||||||||||||||||||||||||||||||||

| September |

0.000626 | 0.001090 | 0.001710 | 0.002257 | ||||||||||||||||||||||||||||||||||||||||||||

| October |

0.000464 | 0.001084 | 0.001631 | |||||||||||||||||||||||||||||||||||||||||||||

| November |

0.000620 | 0.001167 | ||||||||||||||||||||||||||||||||||||||||||||||

| December |

0.000547 | |||||||||||||||||||||||||||||||||||||||||||||||

TABLE C MISSISSIPPI: Administrative Expense

| FIRST |

LAST MONTH IN WHICH UNITS WERE OWNED ON THE MONTHLY RECORD DATE IN 2015 | |||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | ||||||||||||||||||||||||||||||||||||||||||||||||

| January | February | March | April | May | June | July | August | September | October | November | December | |||||||||||||||||||||||||||||||||||||

| January |

0.000235 | 0.000614 | 0.000843 | 0.001115 | 0.009493 | 0.009930 | 0.010629 | 0.011000 | 0.011350 | 0.011892 | 0.012193 | 0.013035 | ||||||||||||||||||||||||||||||||||||

| February |

0.000379 | 0.000608 | 0.000880 | 0.009258 | 0.009695 | 0.010394 | 0.010765 | 0.011115 | 0.011657 | 0.011958 | 0.012800 | |||||||||||||||||||||||||||||||||||||

| March |

0.000229 | 0.000501 | 0.008879 | 0.009316 | 0.010015 | 0.010386 | 0.010736 | 0.011278 | 0.011579 | 0.012421 | ||||||||||||||||||||||||||||||||||||||

| April |

0.000272 | 0.008650 | 0.009087 | 0.009786 | 0.010157 | 0.010507 | 0.011049 | 0.011350 | 0.012192 | |||||||||||||||||||||||||||||||||||||||

| May |

0.008378 | 0.008815 | 0.009514 | 0.009885 | 0.010235 | 0.010777 | 0.011078 | 0.011920 | ||||||||||||||||||||||||||||||||||||||||

| June |

0.000437 | 0.001136 | 0.001507 | 0.001857 | 0.002399 | 0.002700 | 0.003542 | |||||||||||||||||||||||||||||||||||||||||

| July |

0.000699 | 0.001070 | 0.001420 | 0.001962 | 0.002263 | 0.003105 | ||||||||||||||||||||||||||||||||||||||||||

| August |

0.000371 | 0.000721 | 0.001263 | 0.001564 | 0.002406 | |||||||||||||||||||||||||||||||||||||||||||

| September |

0.000350 | 0.000892 | 0.001193 | 0.002035 | ||||||||||||||||||||||||||||||||||||||||||||

| October |

0.000542 | 0.000843 | 0.001685 | |||||||||||||||||||||||||||||||||||||||||||||

| November |

0.000301 | 0.001143 | ||||||||||||||||||||||||||||||||||||||||||||||

| December |

0.000842 | |||||||||||||||||||||||||||||||||||||||||||||||

(SRT 2015 TAX)

12

SABINE ROYALTY TRUST NEW MEXICO

TABLE A NEW MEXICO: Gross Royalty Income

| FIRST |

LAST MONTH IN WHICH UNITS WERE OWNED ON THE MONTHLY RECORD DATE IN 2015 | |||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | ||||||||||||||||||||||||||||||||||||||||||||||||

| January | February | March | April | May | June | July | August | September | October | November | December | |||||||||||||||||||||||||||||||||||||

| January |

0.008748 | 0.028056 | 0.041345 | 0.051668 | 0.101619 | 0.115294 | 0.129823 | 0.143933 | 0.160169 | 0.181644 | 0.196231 | 0.203536 | ||||||||||||||||||||||||||||||||||||

| February |

0.019308 | 0.032597 | 0.042920 | 0.092871 | 0.106546 | 0.121075 | 0.135185 | 0.151421 | 0.172896 | 0.187483 | 0.194788 | |||||||||||||||||||||||||||||||||||||

| March |

0.013289 | 0.023612 | 0.073563 | 0.087238 | 0.101767 | 0.115877 | 0.132113 | 0.153588 | 0.168175 | 0.175480 | ||||||||||||||||||||||||||||||||||||||

| April |

0.010323 | 0.060274 | 0.073949 | 0.088478 | 0.102588 | 0.118824 | 0.140299 | 0.154886 | 0.162191 | |||||||||||||||||||||||||||||||||||||||

| May |

0.049951 | 0.063626 | 0.078155 | 0.092265 | 0.108501 | 0.129976 | 0.144563 | 0.151868 | ||||||||||||||||||||||||||||||||||||||||

| June |

0.013675 | 0.028204 | 0.042314 | 0.058550 | 0.080025 | 0.094612 | 0.101917 | |||||||||||||||||||||||||||||||||||||||||

| July |

0.014529 | 0.028639 | 0.044875 | 0.066350 | 0.080937 | 0.088242 | ||||||||||||||||||||||||||||||||||||||||||

| August |

0.014110 | 0.030346 | 0.051821 | 0.066408 | 0.073713 | |||||||||||||||||||||||||||||||||||||||||||

| September |

0.016236 | 0.037711 | 0.052298 | 0.059603 | ||||||||||||||||||||||||||||||||||||||||||||

| October |

0.021475 | 0.036062 | 0.043367 | |||||||||||||||||||||||||||||||||||||||||||||

| November |

0.014587 | 0.021892 | ||||||||||||||||||||||||||||||||||||||||||||||

| December |

0.007305 | |||||||||||||||||||||||||||||||||||||||||||||||

TABLE B NEW MEXICO: Severance Tax

| FIRST |

LAST MONTH IN WHICH UNITS WERE OWNED ON THE MONTHLY RECORD DATE IN 2015 | |||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | ||||||||||||||||||||||||||||||||||||||||||||||||

| January | February | March | April | May | June | July | August | September | October | November | December | |||||||||||||||||||||||||||||||||||||

| January |

0.001051 | 0.003370 | 0.004969 | 0.006375 | 0.011791 | 0.013573 | 0.015079 | 0.016653 | 0.018461 | 0.020886 | 0.022842 | 0.023690 | ||||||||||||||||||||||||||||||||||||

| February |

0.002319 | 0.003918 | 0.005324 | 0.010740 | 0.012522 | 0.014028 | 0.015602 | 0.017410 | 0.019835 | 0.021791 | 0.022639 | |||||||||||||||||||||||||||||||||||||

| March |

0.001599 | 0.003005 | 0.008421 | 0.010203 | 0.011709 | 0.013283 | 0.015091 | 0.017516 | 0.019472 | 0.020320 | ||||||||||||||||||||||||||||||||||||||

| April |

0.001406 | 0.006822 | 0.008604 | 0.010110 | 0.011684 | 0.013492 | 0.015917 | 0.017873 | 0.018721 | |||||||||||||||||||||||||||||||||||||||

| May |

0.005416 | 0.007198 | 0.008704 | 0.010278 | 0.012086 | 0.014511 | 0.016467 | 0.017315 | ||||||||||||||||||||||||||||||||||||||||

| June |

0.001782 | 0.003288 | 0.004862 | 0.006670 | 0.009095 | 0.011051 | 0.011899 | |||||||||||||||||||||||||||||||||||||||||

| July |

0.001506 | 0.003080 | 0.004888 | 0.007313 | 0.009269 | 0.010117 | ||||||||||||||||||||||||||||||||||||||||||

| August |

0.001574 | 0.003382 | 0.005807 | 0.007763 | 0.008611 | |||||||||||||||||||||||||||||||||||||||||||

| September |

0.001808 | 0.004233 | 0.006189 | 0.007037 | ||||||||||||||||||||||||||||||||||||||||||||

| October |

0.002425 | 0.004381 | 0.005229 | |||||||||||||||||||||||||||||||||||||||||||||

| November |

0.001956 | 0.002804 | ||||||||||||||||||||||||||||||||||||||||||||||

| December |

0.000848 | |||||||||||||||||||||||||||||||||||||||||||||||

TABLE C NEW MEXICO: Administrative Expense

| FIRST |

LAST MONTH IN WHICH UNITS WERE OWNED ON THE MONTHLY RECORD DATE IN 2015 | |||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | ||||||||||||||||||||||||||||||||||||||||||||||||

| January | February | March | April | May | June | July | August | September | October | November | December | |||||||||||||||||||||||||||||||||||||

| January |

0.000258 | 0.001156 | 0.001459 | 0.001848 | 0.006667 | 0.008031 | 0.009345 | 0.010047 | 0.010777 | 0.012311 | 0.012988 | 0.013901 | ||||||||||||||||||||||||||||||||||||

| February |

0.000898 | 0.001201 | 0.001590 | 0.006409 | 0.007773 | 0.009087 | 0.009789 | 0.010519 | 0.012053 | 0.012730 | 0.013643 | |||||||||||||||||||||||||||||||||||||

| March |

0.000303 | 0.000692 | 0.005511 | 0.006875 | 0.008189 | 0.008891 | 0.009621 | 0.011155 | 0.011832 | 0.012745 | ||||||||||||||||||||||||||||||||||||||

| April |

0.000389 | 0.005208 | 0.006572 | 0.007886 | 0.008588 | 0.009318 | 0.010852 | 0.011529 | 0.012442 | |||||||||||||||||||||||||||||||||||||||

| May |

0.004819 | 0.006183 | 0.007497 | 0.008199 | 0.008929 | 0.010463 | 0.011140 | 0.012053 | ||||||||||||||||||||||||||||||||||||||||

| June |

0.001364 | 0.002678 | 0.003380 | 0.004110 | 0.005644 | 0.006321 | 0.007234 | |||||||||||||||||||||||||||||||||||||||||

| July |

0.001314 | 0.002016 | 0.002746 | 0.004280 | 0.004957 | 0.005870 | ||||||||||||||||||||||||||||||||||||||||||

| August |

0.000702 | 0.001432 | 0.002966 | 0.003643 | 0.004556 | |||||||||||||||||||||||||||||||||||||||||||

| September |

0.000730 | 0.002264 | 0.002941 | 0.003854 | ||||||||||||||||||||||||||||||||||||||||||||

| October |

0.001534 | 0.002211 | 0.003124 | |||||||||||||||||||||||||||||||||||||||||||||

| November |

0.000677 | 0.001590 | ||||||||||||||||||||||||||||||||||||||||||||||

| December |

0.000913 | |||||||||||||||||||||||||||||||||||||||||||||||

(SRT 2015 TAX)

13

SABINE ROYALTY TRUST

Depletion Schedule D-I

The cumulative and noncumulative cost depletion factors reflected in Depletion Schedule D-I should be used to compute 2015 federal cost depletion amounts attributable to Units purchased for which the Unit holder initially became entitled to distributions in 2015. This schedule should not be used to compute depletion for any other Units owned. (See accompanying information for computation instructions.)

| FIRST |

January | February | March | April | May | June | July | August | September | October | November | December | ||||||||||||||||||||||||||||||||||||

| January |

0.013134 | 0.023166 | 0.035270 | 0.047060 | 0.061641 | 0.072896 | 0.081425 | 0.094260 | 0.111716 | 0.120847 | 0.137148 | 0.143705 | ||||||||||||||||||||||||||||||||||||

| February |

— | 0.010032 | 0.022136 | 0.033926 | 0.048507 | 0.059762 | 0.068291 | 0.081126 | 0.098582 | 0.107713 | 0.124014 | 0.130571 | ||||||||||||||||||||||||||||||||||||

| March |

— | — | 0.012104 | 0.023894 | 0.038475 | 0.049730 | 0.058259 | 0.071094 | 0.088550 | 0.097681 | 0.113982 | 0.120539 | ||||||||||||||||||||||||||||||||||||

| April |

— | — | — | 0.011790 | 0.026371 | 0.037626 | 0.046155 | 0.058990 | 0.076446 | 0.085577 | 0.101878 | 0.108435 | ||||||||||||||||||||||||||||||||||||

| May |

— | — | — | — | 0.014581 | 0.025836 | 0.034365 | 0.047200 | 0.064656 | 0.073787 | 0.090088 | 0.096645 | ||||||||||||||||||||||||||||||||||||

| June |

— | — | — | — | — | 0.011255 | 0.019784 | 0.032619 | 0.050075 | 0.059206 | 0.075507 | 0.082064 | ||||||||||||||||||||||||||||||||||||

| July |

— | — | — | — | — | — | 0.008529 | 0.021364 | 0.038820 | 0.047951 | 0.064252 | 0.070809 | ||||||||||||||||||||||||||||||||||||

| August |

— | — | — | — | — | — | — | 0.012835 | 0.030291 | 0.039422 | 0.055723 | 0.062280 | ||||||||||||||||||||||||||||||||||||

| September |

— | — | — | — | — | — | — | — | 0.017456 | 0.026587 | 0.042888 | 0.049445 | ||||||||||||||||||||||||||||||||||||

| October |

— | — | — | — | — | — | — | — | — | 0.009131 | 0.025432 | 0.031989 | ||||||||||||||||||||||||||||||||||||

| November |

— | — | — | — | — | — | — | — | — | — | 0.016301 | 0.022858 | ||||||||||||||||||||||||||||||||||||

| December |

— | — | — | — | — | — | — | — | — | — | — | 0.006557 | ||||||||||||||||||||||||||||||||||||

Depletion Schedule D-II

The non-cumulative cost depletion factors reflected in Depletion Schedule D-II should be used to compute 2015 state cost depletion amounts attributable to Units purchased for which the Unit holder initially became entitled to distributions in any year. The applicable number to use is the number related to the last month in which the Units were owned in 2015. (See accompanying information for computation instructions.)

| STATE |

January | February | March | April | May | June | July | August | September | October | November | December | ||||||||||||||||||||||||||||||||||||

| Florida |

0.000168 | 0.000170 | 0.000173 | 0.000174 | 0.000156 | 0.000018 | 0.000005 | 0.000346 | 0.000191 | 0.000216 | 0.000190 | 0.000187 | ||||||||||||||||||||||||||||||||||||

| Louisiana |

0.000409 | 0.000081 | 0.000227 | 0.000182 | 0.000139 | 0.000160 | 0.000175 | 0.000152 | 0.000207 | 0.000138 | 0.000145 | 0.000228 | ||||||||||||||||||||||||||||||||||||

| Mississippi |

0.000216 | 0.000249 | 0.000317 | 0.000301 | 0.005034 | 0.000212 | 0.000362 | 0.000313 | 0.000330 | 0.000314 | 0.000320 | 0.000355 | ||||||||||||||||||||||||||||||||||||

| New Mexico |

0.000311 | 0.000527 | 0.000437 | 0.000419 | 0.001584 | 0.000594 | 0.000533 | 0.000574 | 0.000613 | 0.000657 | 0.000647 | 0.000325 | ||||||||||||||||||||||||||||||||||||

| Oklahoma |

0.001660 | 0.001648 | 0.001087 | 0.001929 | 0.001447 | 0.001360 | 0.001167 | 0.001762 | 0.001454 | 0.001087 | 0.001492 | 0.001155 | ||||||||||||||||||||||||||||||||||||

| Texas |

0.010370 | 0.007357 | 0.009863 | 0.008785 | 0.006221 | 0.008911 | 0.006287 | 0.009688 | 0.014661 | 0.006719 | 0.013507 | 0.004307 | ||||||||||||||||||||||||||||||||||||

| TOTAL |

0.013134 | 0.010032 | 0.012104 | 0.011790 | 0.014581 | 0.011255 | 0.008529 | 0.012835 | 0.017456 | 0.009131 | 0.016301 | 0.006557 | ||||||||||||||||||||||||||||||||||||

(SRT 2015 TAX)

14

SABINE ROYALTY TRUST

Depletion Schedule D-III

The cumulative federal cost depletion factors reflected in Depletion Schedule D-III should be used to compute 2015 federal cost depletion amounts attributable to Units purchased for which the Unit holder initially became entitled to distributions in the year stated. For depletion factors relating to the individual states, please use Depletion Schedule D-II on page 14. (See accompanying information for computation instructions.)

| For a Unit acquired |

LAST MONTH IN WHICH UNITS WERE OWNED ON THE MONTHLY RECORD DATE IN 2015 | |||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | ||||||||||||||||||||||||||||||||||||||||||||||||

| January | February | March | April | May | June | July | August | September | October | November | December | |||||||||||||||||||||||||||||||||||||

| Original Distribution |

.013663 | .024077 | .036808 | .049155 | .067892 | .079690 | .088695 | .101935 | .120374 | .129715 | .146905 | .153652 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| 1983 |

.012904 | .022416 | .034470 | .045762 | .055691 | .066811 | .074875 | .087143 | .104899 | .113428 | .129895 | .135662 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| 1984 |

.008142 | .014114 | .021721 | .028823 | .034952 | .041948 | .047011 | .054729 | .065938 | .071293 | .081679 | .085295 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| 1985 |

.010936 | .018976 | .029225 | .038773 | .047364 | .056795 | .063629 | .074024 | .089130 | .096365 | .110366 | .115236 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Before March 17, 1986 |

.008645 | .014992 | .023101 | .030636 | .037226 | .044684 | .050075 | .058286 | .070246 | .075961 | .087043 | .090874 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| After March 17, 1986 |

.006622 | .011492 | .017708 | .023486 | .028615 | .034334 | .038476 | .044773 | .053940 | .058330 | .066826 | .069769 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| 1987 |

.009154 | .015886 | .024467 | .032454 | .039374 | .047267 | .052973 | .061683 | .074340 | .080403 | .092134 | .096200 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| 1988 |

.009882 | .017180 | .026409 | .035064 | .042469 | .050982 | .057147 | .066566 | .080163 | .086705 | .099320 | .103740 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| 1989 |

.009439 | .016464 | .025239 | .033568 | .041012 | .049125 | .055033 | .064069 | .076965 | .083232 | .095214 | .099506 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| 1990 |

.008909 | .015557 | .023843 | .031710 | .038652 | .046319 | .051901 | .060457 | .072633 | .078579 | .089894 | .093958 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| 1991 |