Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Physicians Realty Trust | a8-k2015q4earnings.htm |

| EX-99.1 - EXHIBIT 99.1 - Physicians Realty Trust | exhibit9912015q4earningspr.htm |

TRUMAN MEDICAL CENTER Kansas City, MO SUPPLEMENTAL OPERATING & FINANCIAL INFORMATION FOURTH QUARTER 2015 PHYSICIANS REALTY TRUST NYSE: DOC PHYSICIANS MEDICAL PLAZA MOB Indianapolis, IN December 2015 Exhibit 99.2

2 COMPANY OVERVIEW ABOUT PHYSICIANS REALTY TRUST 5 FOURTH QUARTER HIGHLIGHTS 7 FINANCIAL HIGHLIGHTS 8 FINANCIAL INFORMATION RECONCILIATION OF NON-GAAP MEASURES: FUNDS FROM OPERATIONS (FFO), NORMALIZED FUNDS FROM OPERATIONS (NORMALIZED FFO), AND NORMALIZED FUNDS AVAILABLE FOR DISTRIBUTION (NORMALIZED FAD) 9 RECONCILIATION OF NON-GAAP MEASURES: NET OPERATING INCOME AND ADJUSTED EBITDA 10 MARKET CAPITALIZATION AND DEBT SUMMARY 11 FINANCIAL STATISTICS 12 SAME-STORE PORTFOLIO PERFORMANCE AND TENANT OCCUPANCY 13 INVESTMENT ACTIVITY AND LEASE EXPIRATION SCHEDULE 14 PORTFOLIO GEOGRAPHIC DISTRIBUTION 15 PORTFOLIO DIVERSIFICATION 16 TOP 10 HEALTH SYSTEM RELATIONSHIPS 17 CONSOLIDATED BALANCE SHEETS 18 CONSOLIDATED STATEMENTS OF OPERATIONS 19 REPORTING DEFINITIONS 20 TABLE OF CONTENTS Forward-looking statements: Certain statements made in this supplemental information package constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (set forth in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)). In particular, statements pertaining to our capital resources, portfolio performance and results of operations contain forward-looking statements. Likewise, our pro forma financial statements and our statements regarding anticipated market conditions are forward-looking statements. You can identify forward-looking statements by the use of forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “pro forma,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions.

3 Forward-looking statements reflect the views of our management regarding current expectations and projections about future events and are based on currently available information. These forward-looking statements are not guarantees of future performance and involve numerous risks and uncertainties and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods which may be incorrect or imprecise and we may not be able to realize them. We do not guarantee that the transactions and events described will happen as described (or that they will happen at all). The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: • general economic conditions; • adverse economic or real estate developments, either nationally or in the markets where our properties are located; • our failure to generate sufficient cash flows to service our outstanding indebtedness; • fluctuations in interest rates and increased operating costs; • the availability, terms and deployment of debt and equity capital, including our unsecured revolving credit facility; • our ability to make distributions on our common shares; • general volatility of the market price of our common shares; • our increased vulnerability economically due to the concentration of our investments in healthcare properties; • our geographic concentrations in Texas, Georgia, and Arizona cause us to be particularly exposed to downturns in these local economies or other changes in local real estate market conditions; • changes in our business or strategy; • our dependence upon key personnel whose continued service is not guaranteed; • our ability to identify, hire and retain highly qualified personnel in the future; • the degree and nature of our competition; • changes in governmental regulations, tax rates and similar matters; • defaults on or non-renewal of leases by tenants; • decreased rental rates or increased vacancy rates; • difficulties in identifying healthcare properties to acquire and completing acquisitions; • competition for investment opportunities; • our failure to successfully develop, integrate and operate acquired properties and operations; • the impact of our investment in joint ventures; • the financial condition and liquidity of, or disputes with, any joint venture and development partners with whom we may make co-investments in the future; • cybersecurity incidents could disrupt our business and result in the compromise of confidential information;

4 • our ability to operate as a public company; • changes in accounting principles generally accepted in the United States (GAAP); • lack of or insufficient amounts of insurance; • other factors affecting the real estate industry generally; • our failure to maintain our qualification as a real estate investment trust (or REIT) for U.S. federal income tax purposes; • limitations imposed on our business and our ability to satisfy complex rules in order for us to qualify as a REIT for U.S. federal income tax purposes; • changes in governmental regulations or interpretations thereof, such as real estate and zoning laws and increases in real property tax rates and taxation of REITs; and • factors that may materially adversely affect us or the per share trading price of our common shares, including: ◦ higher market interest rates; ◦ the number of our common shares available for future issuance or sale; ◦ our issuance of equity securities or the perception that such issuance might occur; ◦ future offerings of debt; ◦ failure of securities analysts to publish research or reports about our industry; and ◦ securities analysts’ downgrade of our common shares or the healthcare-related real estate sector. While forward-looking statements reflect our good faith beliefs, they are not guarantees of future performance. We disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, new information, data or methods, future events or other changes after the date of this supplemental information package, except as required by applicable law. You should not place undue reliance on any forward-looking statements that are based on information currently available to us or the third parties making the forward-looking statements. For a further discussion of these and other factors that could impact our future results, performance or transactions, see Part I, Item 1A (Risk Factors) of our Annual Report on Form 10-K for the fiscal year ended December 31, 2015. ADDITIONAL INFORMATION The information in this supplemental information package should be read in conjunction with the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, earnings press release dated February 29, 2016 and other information filed with, or furnished to, the SEC. You can access the Company’s reports and amendments to those reports filed or furnished to the Securities and Exchange Commission (the “SEC”) pursuant to Section 13(a) or 15(d) of the Exchange Act in the “Investor Relations” section on the Company’s website (www.docreit.com) under the tab “SEC Filings” as soon as reasonably practicable after they are filed with, or furnished to, the SEC. The information on or connected to the Company’s website is not, and shall not be deemed to be, a part of, or incorporated into this supplemental information package. You also can review these SEC filings and other information by accessing the SEC’s website at http://www.sec.gov.

5 ABOUT PHYSICIANS REALTY TRUST Physicians Realty Trust (NYSE:DOC) (the “Trust,” the “Company,” “DOC,” “we,” “our” and “us”) is a self-managed healthcare real estate company organized in 2013 to acquire, selectively develop, own and manage healthcare properties that are leased to physicians, hospitals and healthcare delivery systems. We invest in real estate that is integral to providing high quality healthcare services. Our properties typically are on a campus with a hospital or other healthcare facilities or strategically located and affiliated with a hospital or other healthcare facilities. Our management team has significant public healthcare REIT experience and long established relationships with physicians, hospitals and healthcare delivery system decision makers that we believe will provide quality investment opportunities to generate attractive risk-adjusted returns to our shareholders. We are a Maryland real estate investment trust and elected to be taxed as a REIT for U.S. federal income tax purposes beginning with our short taxable year ending December 31, 2013. We conduct our business through an UPREIT structure in which our properties are owned by Physicians Realty L.P., a Delaware limited partnership (the “operating partnership”), directly or through limited partnerships, limited liability companies or other subsidiaries. We are the sole general partner of the operating partnership and, as of December 31, 2015, own approximately 95.7% of the partnership interests in the operating partnership (“OP Units”). We had no business operations prior to completion of our initial public offering (the “IPO”) on July 24, 2013. Our predecessor, which is not a legal entity, is comprised of the four healthcare real estate funds managed by B.C. Ziegler & Company (“Ziegler”), which are referred to as the Predecessor Ziegler Funds, that owned directly or indirectly interests in entities that owned the initial properties we acquired through the operating partnership on July 24, 2013 in connection with completion of the IPO and related formation transactions. COMPANY SNAPSHOT As of December 31, 2015 Gross real estate investments (thousands) $ 1,664,783 Total properties 151 % Leased 95.8% Total portfolio gross leasable area 5,799,337 % of GLA on-campus / affiliated 74.0% Average remaining lease term for all buildings (years) 9.0 Cash and cash equivalents (thousands) $ 3,143 Total debt to firm value 23.9% Weighted average interest rate per annum on consolidated debt 2.3% Equity market cap (thousands) $ 1,469,786 Quarterly dividend $ 0.225 Quarter end stock price $ 16.86 Dividend yield 5.34% Common shares outstanding 87,175,904 OP Units outstanding and not owned by DOC 3,879,115 Total firm value (thousands) (1) $ 2,051,748 (1) Represents the value of outstanding shares and units based on the closing stock price on December 31, 2015 plus the amount of outstanding debt and redeemable equity at December 31, 2015.

6 ABOUT PHYSICIANS REALTY TRUST (CONTINUED) BOARD OF TRUSTEES Tommy G. Thompson Chairman John T. Thomas William A. Ebinger, M.D. Richard A. Weiss Chief Executive Officer Trustee Trustee President Albert C. Black Mark A. Baumgartner Stanton D. Anderson Compensation and Nominating Finance and Investment Audit Committee Chair Governance Committee Chair Committee Chair MANAGEMENT TEAM John T. Thomas Chief Executive Officer President John W. Sweet Jeffrey N. Theiler Deeni D. Taylor Executive Vice President Executive Vice President Executive Vice President Chief Investment Officer Chief Financial Officer Investments Bradley D. Page John W. Lucey Mark D. Theine Senior Vice President Senior Vice President Senior Vice President General Counsel Principal Accounting and Asset & Investment Reporting Officer Management LOCATION AND CONTACT INFORMATION Corporate Headquarters External Auditor Corporate and REIT Tax Counsel 309 N. Water Street, Suite 500 Ernst & Young Baker & McKenzie LLP Milwaukee, WI 53202 Chicago, IL 60606 Richard Lipton, Partner (414) 367-5600 (312) 879-2000 Chicago, IL 60601 (312) 861-8000 COVERING ANALYSTS J. Sanabria - Bank of America Merrill Lynch P. Martin - JMP Securities J. Kim - BMO Capital Markets Corp. J. Sadler - Keybanc Capital Markets Inc. P. Morgan - Canaccord Genuity Inc. V. Malhotra - Morgan Stanley K. Billingsley - Compass Pt Rch & Trading LLC J. Hughes - Raymond James Financial Inc. M. Gorman - Cowen & Co. M. Carroll - RBC Capital Markets LLC D. Altscher - FBR Capital Markets & Co. C. Kucera - Wunderlich Securities Inc. J. Roberts - J.J.B. Hilliard W.L. Lyons LLC The equity analysts listed above are those analysts that have published research material on the Company and are listed as covering the Company. Please note that any opinions, estimates, or forecasts regarding the Company's performance made by the analysts listed above do not represent the opinions, estimates, or forecasts of Physicians Realty Trust or its management. The Company does not by its reference above imply its endorsement of or concurrence with any information, conclusions or recommendations made by any of such analysts. Interested persons may obtain copies of analysts' reports on their own, as we do not distribute these reports. Several of these firms may, from time to time, own our stock and/or hold other long or short positions on our stock, and may provide compensated services to us.

7 FOURTH QUARTER 2015 HIGHLIGHTS OPERATING • Fourth quarter 2015 total revenue of $40.4 million, up 105% over the prior year period • Fourth quarter 2015 rental revenue of $31.9 million, an increase of 89% over the prior year period • Generated quarterly normalized funds from operations (Normalized FFO) of $0.26 per share on a fully diluted basis • Closed on 11 acquisitions totaling 494,567 square feet for total fourth quarter property investments of $142.6 million • Funded $10.2 million of loan investments during the fourth quarter • Declared quarterly dividend of $0.225 per share for the fourth quarter • 95.8% of portfolio square footage leased as of December 31, 2015 • Net increase to gross leasable square footage of 9.3% to 5,799,337 square feet as of December 31, 2015 from 5,303,970 as of September 30, 2015 FOURTH QUARTER INVESTMENTS 2016 SUBSEQUENT ACQUISITIONS • Catalyst Portfolio, AL & FL • Randall Road MOB - Suite 380, Elgin, IL • Arete Surgical Center, Johnstown, CO • Great Falls Hospital, Great Falls, MT • Cambridge Professional Center MOB, Waldorf, MD • Monterey Medical Center ASC, Stuart, FL • HonorHealth 44th Street MOB, Phoenix, AZ • Physicians Medical Plaza MOB, Indianapolis, IN • Mercy Medical Center MOB, Fenton, MO • Mezzanine Loan - Davis, Minneapolis, MN • Nashville MOB, Nashville, TN • Park Nicollet Clinic, Chanhassen, MN • Hillside Medical Center - Suite 100, Hanover, PA • HEB Cancer Center, Bedford, TX • Randall Road MOB - Suite 170, Elgin, IL • Riverview Medical Center, Lancaster, OH • KSF Orthopaedic MOB, Houston, TX • St. Luke's Cornwall MOB, Cornwall, NY • Great Falls Clinic MOB, Great Falls, MT • Randall Road MOB - Suite 320, Elgin, IL • Mezz Loan - Truman Medical Center, Kansas City, MO • Mezz Loan - GF Surgical Hospital, Great Falls, MT • Construction Loan - Tinseltown Draw 4, Jacksonville, FL • Mezz Loan - Wilson Surgery Center, Wilson, NC COMPANY ANNOUNCEMENTS • October 13, 2015: Announced $297 million of acquisitions and $91.5 million of executed purchase and sale agreements. • October 19, 2015: Announced the closing of its upsized underwritten public offering of 15,812,500 common shares of beneficial interest, including 2,062,500 common shares issued pursuant to the exercise of an option to purchase additional common shares granted to the underwriters, at a price per share of $15.00, for net proceeds of $226.8 million after deducting the underwriting discount and commissions and estimated offering expenses payable by the Company. • January 4, 2016: Announced a quarterly cash dividend of $0.225 per common share for the quarter ending December 31, 2015, which was paid on January 29, 2016 to shareholders of record on January 15, 2016. • January 7, 2016: Announced completion of a private placement of $150 million principal amount of senior unsecured notes. The weighted average maturity on the placement is 11.8 years, with a weighted average interest rate of 4.5%. • January 19, 2016: Announced $152.8 million of acquisitions, $99.6 million of executed purchase and sale agreements, and $167 million of executed letters of intent. • January 19, 2016: Announced commencement of public offering of 17,000,000 common shares and plans to grant the underwriters a 30-day option to purchase up to an additional 2,550,000 common shares. • January 25, 2016: Announced the closing of its upsized underwritten public offering of 21,275,000 common shares of beneficial interest, including 2,775,000 common shares issued pursuant to the exercise of an option to purchase additional common shares granted to the underwriters, at a price per share of $15.75, for net proceeds of $320.9 million after deducting the underwriting discount and commissions and estimated offering expenses payable by the Company.

8 FINANCIAL HIGHLIGHTS (Unaudited and in thousands, except sq. ft. and per share data) (1) Outstanding common shares and OP Units at quarter end, multiplied by share price at quarter end INCOME Three Months Ended December 31, 2015 September 30, 2015 Revenues $ 40,404 $ 34,870 NOI 30,333 26,968 Annualized Adjusted EBITDA 109,776 95,652 Normalized FFO 22,723 19,091 Normalized FAD 21,160 16,707 Net income available to common shareholders per common share $ 0.06 $ 0.05 Normalized FAD per common share and OP Unit $ 0.24 $ 0.22 CAPITALIZATION As of ASSETS December 31, 2015 September 30, 2015 Gross Real Estate Investments (including gross lease intangibles) 1,664,783 1,500,868 Total Assets 1,644,871 1,478,825 DEBT AND EQUITY Total Debt 489,600 568,195 Total Equity 1,076,461 856,368 Equity Market Capitalization 1,469,786 1,076,221 Implied Equity Market Capitalization (1) 1,535,188 1,134,209 Total Debt / Implied Equity Market Capitalization 32% 50% Gross Real Estate Investments Real Estate Investments/Quarter Total GLA Portfolio Growth Since IPO $1,600,000 $1,400,000 $1,200,000 $1,000,000 $800,000 $600,000 $400,000 $200,000 $0 G ro ss R ea lE st at e In ve st m en ts 6,000,000 5,000,000 4,000,000 3,000,000 2,000,000 1,000,000 0 G LA in SF IPO Q3-2013 Q4-2013 Q1-2014 Q2-2014 Q3-2014 Q4-2014 Q1-2015 Q2-2015 Q3-2015 Q4-2015 $123,998 $234,467 $255,967 $412,011 $484,714 $712,951 $819,219 $1,047,575 $1,204,354 $1,500,868 $1,664,783

9 RECONCILIATION OF NON-GAAP MEASURES: FUNDS FROM OPERATIONS (FFO), NORMALIZED FUNDS FROM OPERATIONS (NORMALIZED FFO) AND NORMALIZED FUNDS AVAILABLE FOR DISTRIBUTION (NORMALIZED FAD) (Unaudited and in thousands, except share and per share data) Three Months Ended December 31, 2015 Twelve Months Ended December 31, 2015 Net Income $ 5,909 $ 12,741 Net (income) attributable to NCI - partially owned properties (122) (377) Preferred distributions (398) (1,189) Depreciation and amortization expense 14,390 45,445 Depreciation and amortization expense - partially owned properties (135) (484) Gain on the sale of investment properties — (130) FFO applicable to common shares and OP Units $ 19,644 $ 56,006 FFO per common share and OP Unit $ 0.22 $ 0.73 Net change in fair value of derivative (50) (166) Acquisition related expenses 3,129 14,893 Normalized FFO applicable to common shares and OP Units $ 22,723 $ 70,733 Normalized FFO per common share and OP Unit $ 0.26 $ 0.92 Normalized FFO applicable to common shares and OP Units 22,723 70,733 Non-cash share compensation expense 660 3,084 Straight-line rent adjustments (2,738) (9,000) Amortization of acquired above/below market leases 681 1,832 Amortization of lease inducements 158 572 Amortization of deferred financing costs 420 1,373 TI/LC and recurring capital expenditures (1,014) (4,988) Seller master lease and rent abatement payments 270 1,321 Normalized FAD applicable to common shares and OP Units $ 21,160 $ 64,927 Normalized FAD per common share and OP Unit $ 0.24 $ 0.85 Weighted average number of common shares and OP Units outstanding 87,911,097 76,792,073

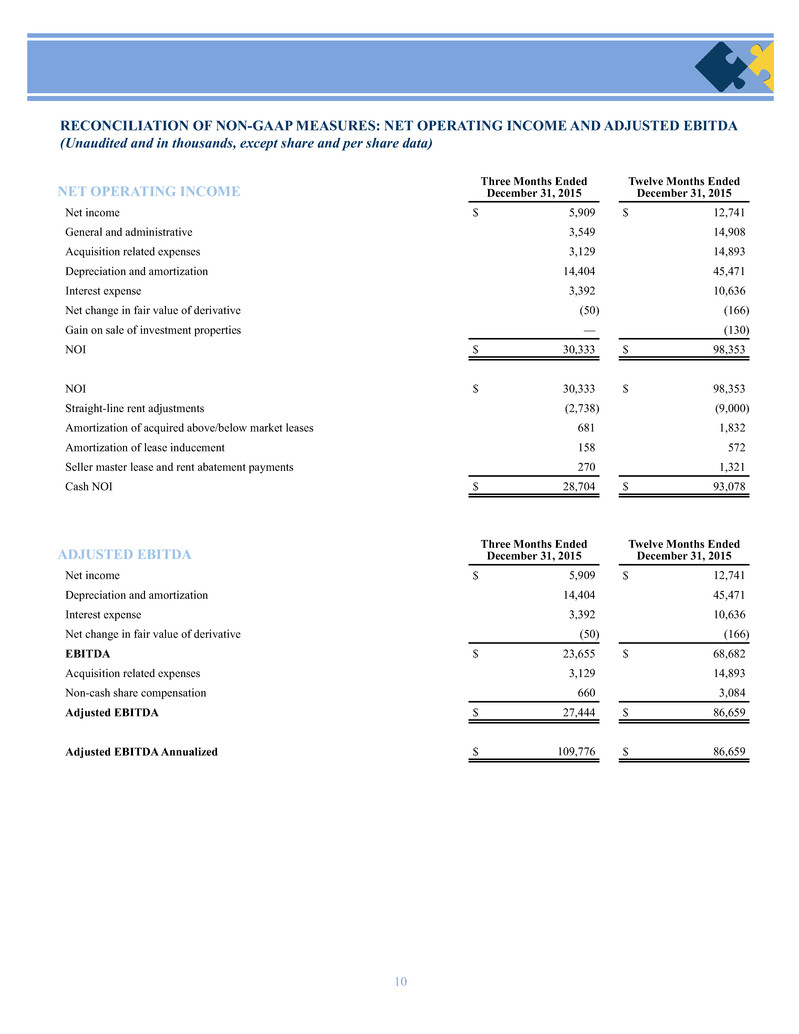

10 RECONCILIATION OF NON-GAAP MEASURES: NET OPERATING INCOME AND ADJUSTED EBITDA (Unaudited and in thousands, except share and per share data) NET OPERATING INCOME Three Months Ended December 31, 2015 Twelve Months Ended December 31, 2015 Net income $ 5,909 $ 12,741 General and administrative 3,549 14,908 Acquisition related expenses 3,129 14,893 Depreciation and amortization 14,404 45,471 Interest expense 3,392 10,636 Net change in fair value of derivative (50) (166) Gain on sale of investment properties — (130) NOI $ 30,333 $ 98,353 NOI $ 30,333 $ 98,353 Straight-line rent adjustments (2,738) (9,000) Amortization of acquired above/below market leases 681 1,832 Amortization of lease inducement 158 572 Seller master lease and rent abatement payments 270 1,321 Cash NOI $ 28,704 $ 93,078 ADJUSTED EBITDA Three Months Ended December 31, 2015 Twelve Months Ended December 31, 2015 Net income $ 5,909 $ 12,741 Depreciation and amortization 14,404 45,471 Interest expense 3,392 10,636 Net change in fair value of derivative (50) (166) EBITDA $ 23,655 $ 68,682 Acquisition related expenses 3,129 14,893 Non-cash share compensation 660 3,084 Adjusted EBITDA $ 27,444 $ 86,659 Adjusted EBITDA Annualized $ 109,776 $ 86,659

11 MARKET CAPITALIZATION AND DEBT SUMMARY (Unaudited and in thousands, except share and per share data) As of MARKET CAPITALIZATION December 31, 2015 Revolving credit facility debt $ 395,000 Mortgage debt 94,600 Total Debt $ 489,600 Redeemable equity $ 26,960 Share price $ 16.86 Total common shares outstanding 87,175,904 Total OP Units outstanding 3,879,115 Implied equity market capitalization $ 1,535,188 Total Firm Value (Debt + Pref. + Equity) $ 2,051,748 Total Debt/Total Assets 29.8% Total Debt/Total Firm Value 23.9% Debt Equity Debt is 24% of Firm Value Balance as of DEBT SUMMARY December 31, 2015 Interest Rate Maturity Date Revolving Credit Facility Debt $ 395,000 1.6 % 9/18/2019 (3) Mortgage Debt Canton MOB 6,099 5.9 % 6/6/2017 Firehouse Square 2,699 6.6 % 9/6/2017 Hackley Medical Center 5,283 5.9 % 1/6/2017 MeadowView Professional Center 10,225 5.8 % 6/6/2017 Mid Coast Hospital MOB 7,656 4.9 % 5/16/2016 Remington Medical Commons 4,262 3.1 % 9/28/2017 Valley West Hospital MOB 4,768 4.8 % 12/1/2020 Oklahoma City, OK MOB 7,473 4.7 % 1/10/2021 Crescent City Surgical Center 18,750 5.0 % 1/23/2019 San Antonio Hospital 9,120 5.0 % 6/26/2022 Savage MOB (2) 5,753 5.5 % 2/1/2022 Plaza HCA MOB (2) 11,838 6.1 % 8/1/2017 $ 488,926 2.3% 2.93 (1) (1) Weighted average maturity of mortgage debt only (2) Excludes market value adjustments totaling $0.7 million (3) Extended one year on July 22, 2015 Debt Maturity Schedule as of December 31, 2015 $500,000 $400,000 $300,000 $200,000 $100,000 $0 2015 2016 2017 2018 2019 2020 2021 2022 $— $7,656 $40,406 $— $413,750 $4,768 $7,473 $14,873

12 FINANCIAL STATISTICS (Unaudited and in thousands, except share and per share data) Quarter Ended December 31, 2015 Annualized dividend rate(1) $ 0.90 Price per share(2) $ 16.86 Annualized dividend yield 5.34% Total debt $ 489,600 Net debt (less cash) 486,457 Adjusted EBITDA (annualized)* 109,776 Net Debt / Adjusted EBITDA Ratio 4.43x Adjusted EBITDA (annualized)* $ 109,776 Cash interest expense (annualized)* 11,888 Interest Coverage Ratio 9.23x Total interest $ 3,392 Secured debt principal amortization 535 Total fixed charges $ 3,927 Adjusted EBITDA 27,444 Adjusted EBITDA fixed charge coverage ratio 6.99x Equity market cap $ 1,535,188 Redeemable equity 26,960 Total debt 489,600 Total Firm Value 2,051,748 Total debt $ 489,600 Total assets 1,644,871 Total Debt / Total Assets 29.8% Total Debt / Total Firm Value 23.9% Weighted average common shares 83,761,536 Weighted average unvested restricted common shares and share units 345,815 Weighted average OP Units not owned by DOC 3,803,746 Weighted Average Common Shares and OP Units - Diluted 87,911,097 (1) Annualized rate based on $0.225 quarterly dividend for the quarter ending December 31, 2015. Actual dividend amounts will be determined by the Trust's board of trustees based on a variety of factors. (2) Closing common share price of $16.86 as of December 31, 2015 * Amounts are annualized and actual amounts may differ significantly from the annualized amounts shown.

13 SAME-STORE PORTFOLIO PERFORMANCE AND TENANT OCCUPANCY (Unaudited and in thousands, except share and per share data) SAME-STORE PORTFOLIO ANALYSIS Portfolio Same-Store Quarter Ended Quarter Ended December 31, 2015 December 31, 2015 Number of properties 151 62 Gross leasable area 5,799,337 2,478,224 Cash NOI $ 28,704 $ 13,801 % Leased 95.8% 97.0% SAME-STORE PORTFOLIO PERFORMANCE Year-Over-Year Comparison Sequential Comparison Q4'15 Q4'14 Change Q4'15 Q3'15 Change Number of properties 62 62 — 62 62 — Gross leasable area 2,478,224 2,478,224 — 2,478,224 2,478,224 — % Leased 97.0% 97.2% -20 bps 97.0% 97.1% -10 bps Rental revenues 17,378 17,005 +2.2% 17,378 17,242 +0.8% Operating expenses (3,577) (3,503) +2.1% (3,577) (3,738) -4.3% Same-property Cash NOI 13,801 13,502 +2.2% 13,801 13,504 +2.2% TENANT OCCUPANCY Quarter Ended Percentage of total GLA December 31, 2015 December 31, 2015 Total GLA Total square feet beginning of quarter 5,303,970 91.5 % Acquired GLA (1) 495,367 8.5 % Disposed GLA — — % Total square feet end of quarter 5,799,337 100.0 % Occupied GLA Occupied GLA beginning of quarter 5,065,211 87.3 % Leases expiring in quarter (43,257) (0.7)% Leases renewed in quarter 33,715 0.6 % Retention Rate 78% New leases commencing in quarter 21,988 0.4 % Net absorption / (vacancy loss) 12,446 0.2 % Net occupied GLA acquired / (disposed) 480,579 8.3 % Occupied GLA end of quarter 5,558,236 95.8 % Same-Store Cash NOI, 48% Other Cash NOI, 52% (1) Acquired GLA for the quarter ending December 31, 2015 includes 800 square feet of space added to an existing property (Grove City, Ohio) during the period.

14 INVESTMENT ACTIVITY AND LEASE EXPIRATION SCHEDULE LEASE EXPIRATION SCHEDULE (As of December 31, 2015) Expiration Expiring Expiring Lease % of Total Expiring Lease % of Total Average Rent Year Leases GLA GLA ABR ABR per SF 2015 (1) 7 47,375 0.8% $ 1,136 0.9% $ 23.98 2016 44 186,504 3.2% 3,889 3.3% 20.85 2017 79 315,342 5.4% 7,291 5.9% 23.12 2018 68 345,789 6.0% 6,600 5.4% 19.09 2019 46 307,057 5.3% 6,977 5.7% 22.72 2020 51 197,014 3.4% 3,746 3.0% 19.01 2021 31 190,700 3.3% 3,857 3.1% 20.23 2022 28 294,163 5.1% 6,163 5.0% 20.95 2023 39 365,650 6.3% 7,406 6.0% 20.25 2024 55 583,469 10.1% 11,360 9.2% 19.47 Thereafter: 168 2,686,306 46.2% 64,244 52.3% 23.92 MTM 15 38,867 0.7% 264 0.2% 6.79 Vacant 241,101 4.2% Total / W.A. 631 5,799,337 100% $ 122,933 100% $ 22.36 INVESTMENT ACTIVITY Acquisition First Year Purchase Property Location Date Cash Yield % Leased Price GLA Tinseltown Construction Loan (1) Jacksonville, FL 9.0% — $ 1,006 — Catalyst Portfolio (12 MOBs) AL & FL 10/13/2015 7.2% 90.9% 23,805 93,512 Mezzanine Loan - Truman Medical Center Kansas City, MO 10/16/2015 8.0% — 4,500 — Arete Surgical Center Johnstown, CO 10/19/2015 6.6% 100.0% 9,100 15,000 Cambridge Professional Center MOB Waldorf, MD 10/30/2015 7.0% 100.0% 11,550 41,493 Mezz Loan - GF Replacement Surgical Hospital Great Falls, MT 11/2/2015 9.0% — 4,500 — HonorHealth 44th Street MOB Phoenix, AZ 11/13/2015 6.3% 100.0% 7,163 27,270 Mercy Medical Center MOB Fenton, MO 12/1/2015 6.5% 100.0% 9,850 30,000 Nashville MOB Nashville, TN 12/17/2015 6.0% 100.0% 45,440 108,853 Mezzanine Loan - Wilson Surgery Center Wilson, NC 12/17/2015 8.8% — 216 — Hillside Medical Center - Suite 100 Hanover, PA 12/18/2015 7.2% 100.0% 4,240 16,669 Randall Road MOB - Suite 170 Elgin, IL 12/21/2015 8.1% 100.0% 408 1,786 KSF Orthopaedic MOB Houston, TX 12/22/2015 7.2% 89.0% 6,250 49,868 Great Falls Clinic MOB Great Falls, MT 12/29/2015 6.8% 100.0% 24,244 108,000 Randall Road MOB - Suite 320 Elgin, IL 12/30/2015 8.1% 100.0% 500 2,116 Total / Weighted Average 6.7% 97.2% $ 152,772 494,567 (1) Of the 0.8% of leases that expired on December 31, 2015, 0.6% rolled into long-term leases. The remainder are vacant as of January 1, 2016. (1) We made additional advances on a construction loan to Tinseltown Partners, LLC to fund the renovations and additions of two re-purposed buildings in Jacksonville, Florida. The additional advances total $1.0 million and accrue at an interest rate of 9.0% per year.

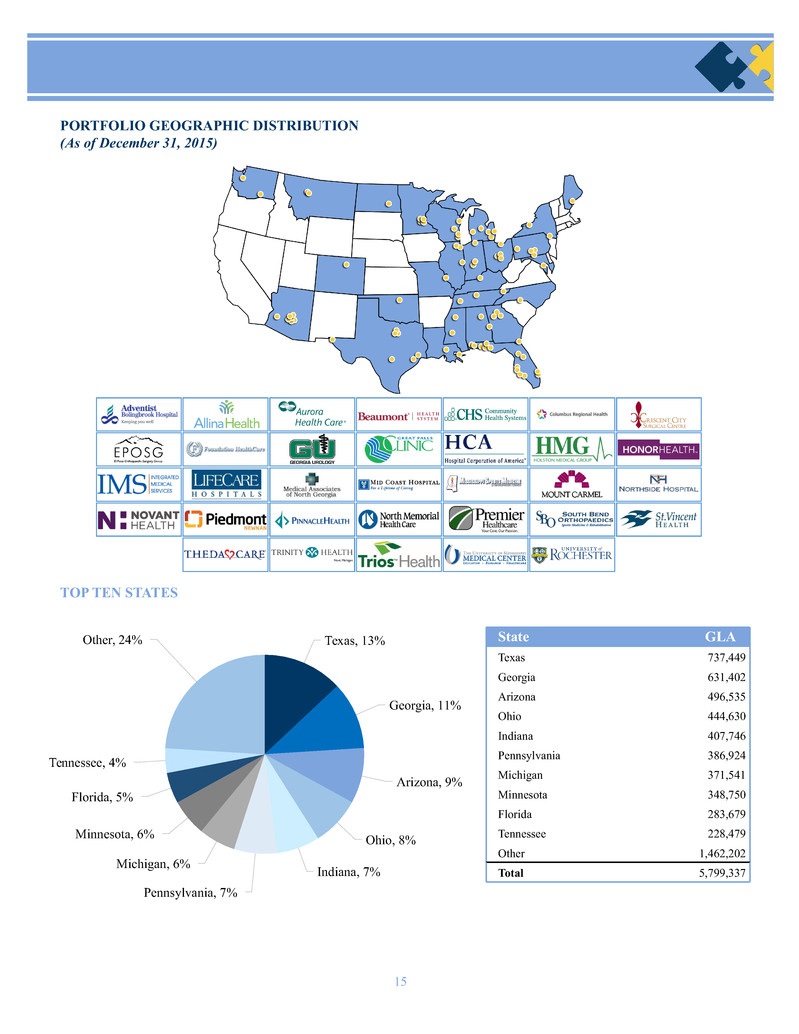

15 PORTFOLIO GEOGRAPHIC DISTRIBUTION (As of December 31, 2015) TOP TEN STATES State GLA Texas 737,449 Georgia 631,402 Arizona 496,535 Ohio 444,630 Indiana 407,746 Pennsylvania 386,924 Michigan 371,541 Minnesota 348,750 Florida 283,679 Tennessee 228,479 Other 1,462,202 Total 5,799,337 Texas, 13% Georgia, 11% Arizona, 9% Ohio, 8% Indiana, 7% Pennsylvania, 7% Michigan, 6% Minnesota, 6% Florida, 5% Tennessee, 4% Other, 24%

16 Campus Proximity (Based on Cash NOI) Off-Campus, 22% On-Campus / Affiliated, 78% PORTFOLIO DIVERSIFICATION (As of December 31, 2015) THREE MONTHS ENDED DECEMBER 31, 2015 Coverage # of Properties GLA % of Total % Leased Ratio Single-tenant MOBs 68 2,047,167 35.3% 99.4% N/A Multi-tenant MOBs 75 3,063,050 52.8% 93.3% N/A Hospitals 4 269,925 4.7% 100.0% 4.1x LTACHs 3 310,352 5.4% 100.0% 3.5x Corporate Office 1 108,843 1.8% 76.6% N/A Total 151 5,799,337 100.0% 95.8% Lease Type (Based on Revenue) Absolute Net, 27% NNN, 58% Modified Gross, 9% Gross, 6% Hospital and LTACH Payor Mix (Trailing Twelve Months) Medicare, 44% Private Pay, 56% Building Type (Based on Cash NOI) MOB, 86% LTACH, 4% Hospital, 10%

17 TOP 10 HEALTH SYSTEM RELATIONSHIPS (As of December 31, 2015, $ in thousands, determined by ABR) Weighted Avg. % of Total Remaining Leased % of Total Annualized Annualized Tenant Lease Term GLA GLA Base Rent Base Rent LifeCare 12.0 310,352 5.4% $ 4,803 3.9% Trios Health 29.6 161,885 2.8% 4,250 3.5% East El Paso Physicians Medical Center 12.7 77,000 1.3% 3,585 2.9% Wayne State University Physician Group 13.7 176,000 3.0% 3,247 2.6% Crescent City Surgical Centre 12.8 60,000 1.0% 3,183 2.6% FSH Hospital of San Antonio 10.7 68,786 1.2% 2,988 2.4% Mid-Ohio Oncology/Hematology 8.4 98,325 1.7% 2,322 1.9% Northside Hospital 6.9 88,003 1.5% 2,291 1.9% Great Falls Clinic 20.0 108,000 1.9% 2,235 1.8% Columbus Regional Healthcare System 8.9 125,189 2.2% 1,956 1.6% Total / W.A. 14.2 1,273,540 22.0% $ 30,860 25.1% Cambridge Professional Center Waldorf, MD Arete Surgical Center Johnstown, CO Mercy Health MOB Fenton, MO Monterey Medical Center ASC Stuart, FL

18 CONSOLIDATED BALANCE SHEETS (In thousands, except share data) December 31, 2015 December 31, 2014 ASSETS Investment properties: Land and improvements $ 130,788 $ 79,334 Building and improvements 1,284,863 644,086 Tenant improvements 9,243 5,614 Acquired lease intangibles 205,168 72,985 1,630,062 802,019 Accumulated depreciation (91,250) (45,569) Net real estate property 1,538,812 756,450 Real estate loans receivable 39,349 15,876 Investment in unconsolidated entity 1,322 1,324 Net real estate investments 1,579,483 773,650 Cash and cash equivalents 3,143 15,923 Tenant receivables, net 2,977 1,324 Deferred costs, net 7,037 4,870 Other assets 52,231 15,806 Total assets $ 1,644,871 $ 811,573 LIABILITIES AND EQUITY Liabilities: Credit facility $ 395,000 $ 138,000 Mortgage debt 94,600 78,105 Accounts payable 644 700 Dividends payable 20,783 16,548 Accrued expenses and other liabilities 24,473 6,140 Acquired lease intangibles, net 5,950 2,871 Total liabilities 541,450 242,364 Redeemable noncontrolling interest - Operating Partnership and partially owned properties 26,960 — Equity: Common shares, $0.01 par value, 500,000,000 common shares authorized, 86,864,063 and 50,640,863 common shares issued and outstanding as of December 31, 2015 and December 31, 2014, respectively. 872 510 Additional paid-in capital 1,129,284 586,017 Accumulated deficit (109,024) (51,797) Total shareholders' equity 1,021,132 534,730 Noncontrolling interests: Operating Partnership 45,451 33,727 Partially owned properties 9,878 752 Total noncontrolling interest 55,329 34,479 Total equity 1,076,461 569,209 Total liabilities and equity $ 1,644,871 $ 811,573

19 CONSOLIDATED STATEMENT OF OPERATIONS (In thousands, except share and per share data) Three Months Ended December 31, Twelve Months Ended December 31, 2015 2014 2015 2014 Revenues: Rental revenues $ 31,863 $ 16,842 $ 103,974 $ 46,397 Expense recoveries 7,322 2,426 21,587 5,871 Interest income on real estate loans and other 1,219 426 3,880 1,066 Total revenues 40,404 19,694 129,441 53,334 Expenses: Interest expense 3,392 2,058 10,636 6,907 General and administrative 3,549 2,573 14,908 11,440 Operating expenses 10,047 3,787 31,026 10,154 Depreciation and amortization 14,404 6,166 45,471 16,731 Acquisition expenses 3,129 1,643 14,893 10,897 Impairment loss — 1,500 — 1,750 Total expenses 34,521 17,727 116,934 57,879 Income (loss) before equity in income of unconsolidated entity, loss on sale of investment property, and noncontrolling interests: 5,883 1,967 12,507 (4,545) Equity in income of unconsolidated entity 26 26 104 95 Gain (loss) on sale of investment properties — (2) 130 32 Net income (loss) 5,909 1,991 12,741 (4,418) Net (income) loss attributable to noncontrolling interests: Operating Partnership (243) (192) (576) 695 Partially owned properties (122) (88) (377) (314) Net income (loss) attributable to controlling interest 5,544 1,711 11,788 (4,037) Preferred distributions (398) — (1,189) — Net income (loss) attributable to common shareholders $ 5,146 $ 1,711 $ 10,599 $ (4,037) Net income (loss) per share: Basic $ 0.06 $ 0.04 $ 0.15 $ (0.12) Diluted $ 0.06 $ 0.04 $ 0.15 $ (0.12) Weighted average common shares Basic 83,761,536 48,145,409 72,750,724 33,063,093 Diluted 87,911,097 48,354,493 76,792,073 33,063,093 Dividends and distributions declared per common share and OP Unit $ 0.225 $ 0.225 $ 0.900 $ 0.900

20 REPORTING DEFINITIONS Adjusted Earnings Before Interest Taxes, Depreciation and Amortization (Adjusted EBITDA): We define Adjusted EBITDA for DOC as net (loss) income computed in accordance with GAAP plus depreciation, amortization, interest expense and net change in the fair value of derivative financial instruments, net (loss) included from discontinued operations, stock based compensation, acquisition-related expenses, and other non- reoccurring items. We consider Adjusted EBITDA an important measure because it provides additional information to allow management, investors, and our current and potential creditors to evaluate and compare our core operating results and our ability to service debt. Annualized Base Rent (ABR): Annualized base rent is calculated by multiplying contractual base rent for December 2015 by 12 (but excluding the impact of concessions and straight-line rent). Earnings Before Interest Taxes, Depreciation, Amortization and Rent (EBITDAR): We define EBITDAR for DOC as net (loss) income computed in accordance with GAAP plus depreciation, amortization, interest expense and net change in the fair value of derivative financial instruments, net (loss) included from discontinued operations, stock based compensation, acquisition-related expenses and lease expense. We consider EBITDAR an important measure because it provides additional information to allow management, investors, and our current and potential creditors to evaluate and compare our tenants ability to fund their rent obligations. Funds From Operations (FFO): Funds from operations, or FFO, is a widely recognized measure of REIT performance. Although FFO is not computed in accordance with generally accepted accounting principles, or GAAP, we believe that information regarding FFO is helpful to shareholders and potential investors because it facilitates an understanding of the operating performance of our initial properties without giving effect to real estate depreciation and amortization, which assumes that the value of real estate assets diminishes ratably over time. Because real estate values have historically increased or decreased with market conditions, we believe that FFO provides a more meaningful and accurate indication of our performance. We calculate FFO in accordance with standards established by the National Association of Real Estate Investment Trusts, ("NAREIT"). NAREIT defines FFO as net income (computed in accordance with GAAP) before noncontrolling interests of holders of OP units, excluding preferred distributions, gains (or losses) on sales of depreciable operating property, impairment write-downs on depreciable assets and extraordinary items (computed in accordance with GAAP), plus real estate related depreciation and amortization (excluding amortization of deferred financing costs). Our FFO computation may not be comparable to FFO reported by other REITs that do not compute FFO in accordance with NAREIT definition or that interpret the NAREIT definition differently than we do. The GAAP measure that we believe to be most directly comparable to FFO, net income (loss), includes depreciation and amortization expenses, gains or losses on property sales, impairments and noncontrolling interests. In computing FFO, we eliminate these items because, in our view, they are not indicative of the results from the operations of our properties. To facilitate a clear understanding of our historical operating result, FFO should be examined in conjunction with net income (determined in accordance with GAAP) as presented in our financial statements. FFO does not represent cash generated from operating activities in accordance with GAAP, should not be considered to be an alternative to net income (loss) (determined in accordance with GAAP) as a measure of our liquidity and is not indicative of funds available for our cash needs, including our ability to make cash distributions to shareholders. Gross Leasable Area (GLA): Gross leasable area (in square feet). Gross Real Estate Investments: Based on acquisition price (and includes lease intangibles). Health System-Affiliated: Properties are considered affiliated with a health system if one or more of the following conditions are met: 1) the land parcel is contained within the physical boundaries of a hospital campus; 2) the land parcel is located adjacent to the campus; 3) the building is physically connected to the hospital regardless of the land ownership structure; 4) a ground lease is maintained with a health system entity; 5) a master lease is maintained with a health system entity; 6) significant square footage is leased to a health system entity; 7) the property includes an ambulatory surgery center with a hospital partnership interest; or 8) a significant square footage is leased to a physician group that is either employed, directly or indirectly by a health system, or has a significant clinical and financial affiliation with the health system. Hospitals: Hospitals refer to specialty surgical hospitals. These hospitals provide a wide range of inpatient and outpatient services, including but not limited to, surgery and clinical laboratories. LTACHs: Long-term acute care hospitals (LTACH) provide inpatient services for patients with complex medical conditions who require more sensitive care, monitoring or emergency support than that available in most skilled nursing facilities. Medical Office Building (MOB): Medical office buildings are office and clinic facilities, often located near hospitals or on hospital campuses, specifically constructed and designed for use by physicians and other health care personnel to provide services to their patients. They may also include ambulatory surgery centers that are used for general or specialty surgical procedures not requiring an overnight stay in a hospital. Medical office buildings may contain sole and group physician practices and may provide laboratory and other patient services.

21 REPORTING DEFINITIONS (continued) Net Operating Income (NOI): NOI is a non-GAAP financial measure that is defined as net income or loss, computed in accordance with GAAP, generated from DOC’s total portfolio of properties before general and administrative expenses, acquisition-related expenses, depreciation and amortization expense, REIT expenses, interest expense and net change in the fair value of derivative financial instruments, and gains or loss on the sale of discontinued properties. DOC believes that NOI provides an accurate measure of operating performance of its operating assets because NOI excludes certain items that are not associated with management of the properties. Additionally, DOC’s use of the term NOI may not be comparable to that of other real estate companies as they may have different methodologies for computing this amount. Cash Net Operating Income (NOI): Cash NOI is a non-GAAP financial measure which excludes from NOI straight-line rent adjustments, amortization of acquired below and above market leases and other non-cash and normalizing items. Other non-cash and normalizing items include items such as the amortization of lease inducements, and payment received from a seller master lease. DOC believes that Cash NOI provides an accurate measure of the operating performance of its operating assets because it excludes certain items that are not associated with management of the properties. Additionally, DOC believes that Cash NOI is a widely accepted measure of comparative operating performance in the real estate community. However, DOC’s use of the term Cash NOI may not be comparable to that of other real estate companies as such other companies may have different methodologies for computing this amount. Normalized Funds Available for Distribution (Normalized FAD): DOC defines Normalized FAD, a non-GAAP measure, which excludes from Normalized FFO, non-cash compensation expense, straight-line rent adjustments, amortization of acquired above market leases, amortization of deferred financing costs and amortization of lease inducements and recurring capital expenditures, including leasing costs and tenant and capital improvements. FAD includes payments received from a seller master lease. DOC believes Normalized FAD provides a meaningful supplemental measure of its ability to fund its ongoing distributions. Normalized FAD should not be considered as an alternative to net income or loss attributable to controlling interest (computed in accordance with GAAP) as an indicator of DOC’s financial performance or to cash flow from operating activities (computed in accordance with GAAP) as an indicator of DOC’s liquidity. Normalized FAD should be reviewed in connection with other GAAP measurements. Normalized Funds From Operations (Normalized FFO): Changes in the accounting and reporting rules under GAAP have prompted a significant increase in the amount of non-operating items included in FFO, as defined. Therefore, DOC uses Normalized FFO, which excludes from FFO acquisition-related expenses, net change in fair value of derivative financial instruments, non-controlling income from operating partnership units included in diluted shares, acceleration of deferred financing costs, and other normalizing items. However, DOC’s use of the term Normalized FFO may not be comparable to that of other real estate companies as they may have different methodologies for computing this amount. Normalized FFO should not be considered as an alternative to net income or loss attributable to controlling interest (computed in accordance with GAAP) as an indicator of DOC’s financial performance or to cash flow operating activities (computed in accordance with GAAP) as an indicator of DOC’s liquidity, nor its indicative of funds available to fund DOC’s cash needs, including its ability to make distributions. Normalized FFO should be reviewed in connection with other GAAP measurements. Occupancy: Occupancy represents the percentage of total gross leasable area that is leased, including month-to-month leases and leases that are signed but not yet commenced, as of the date reported. Off-Campus: A building portfolio that is not located on or adjacent to key hospital based-campuses and is not affiliated with recognized healthcare systems. On-Campus / Affiliated: On-campus refers to a property that is located on or within a quarter mile to a healthcare system. Affiliated refers to a property that is not on the campus of a healthcare system, but anchored by a healthcare system. Same-Store Portfolio: The same-store portfolio consists of properties held by the Company for the entire preceding year and not currently slated for disposition.