Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PINNACLE WEST CAPITAL CORP | march12016investormeetings.htm |

Powering Growth, Delivering Value UBS Utilities and Natural Gas Conference | March 1, 2016 POWERING GROWTH DELIVERING VALUE

Powering Growth, Delivering Value2 FORWARD LOOKING STATEMENTS This presentation contains forward-looking statements based on current expectations, including statements regarding our earnings guidance and financial outlook and goals. These forward-looking statements are often identified by words such as “estimate,” “predict,” “may,” “believe,” “plan,” “expect,” “require,” “intend,” “assume” and similar words. Because actual results may differ materially from expectations, we caution you not to place undue reliance on these statements. A number of factors could cause future results to differ materially from historical results, or from outcomes currently expected or sought by Pinnacle West or APS. These factors include, but are not limited to: our ability to manage capital expenditures and operations and maintenance costs while maintaining high reliability and customer service levels; variations in demand for electricity, including those due to weather, the general economy, customer and sales growth (or decline), and the effects of energy conservation measures and distributed generation; power plant and transmission system performance and outages; competition in retail and wholesale power markets; regulatory and judicial decisions, developments and proceedings; new legislation or regulation, including those relating to environmental requirements, nuclear plant operations and potential deregulation of retail electric markets; fuel and water supply availability; our ability to achieve timely and adequate rate recovery of our costs, including returns on and of debt and equity capital investments; our ability to meet renewable energy and energy efficiency mandates and recover related costs; risks inherent in the operation of nuclear facilities, including spent fuel disposal uncertainty; current and future economic conditions in Arizona, including in real estate markets; the development of new technologies which may affect electric sales or delivery; the cost of debt and equity capital and the ability to access capital markets when required; environmental and other concerns surrounding coal-fired generation, including regulation of greenhouse gas emissions; volatile fuel and purchased power costs; the investment performance of the assets of our nuclear decommissioning trust, pension, and other postretirement benefit plans and the resulting impact on future funding requirements; the liquidity of wholesale power markets and the use of derivative contracts in our business; potential shortfalls in insurance coverage; new accounting requirements or new interpretations of existing requirements; generation, transmission and distribution facility and system conditions and operating costs; the ability to meet the anticipated future need for additional generation and associated transmission facilities in our region; the willingness or ability of our counterparties, power plant participants and power plant land owners to meet contractual or other obligations or extend the rights for continued power plant operations; and restrictions on dividends or other provisions in our credit agreements and ACC orders. These and other factors are discussed in Risk Factors described in Part I, Item 1A of the Pinnacle West/APS Annual Report on Form 10-K for the fiscal year ended December 31, 2015, which you should review carefully before placing any reliance on our financial statements, disclosures or earnings outlook. Neither Pinnacle West nor APS assumes any obligation to update these statements, even if our internal estimates change, except as required by law.

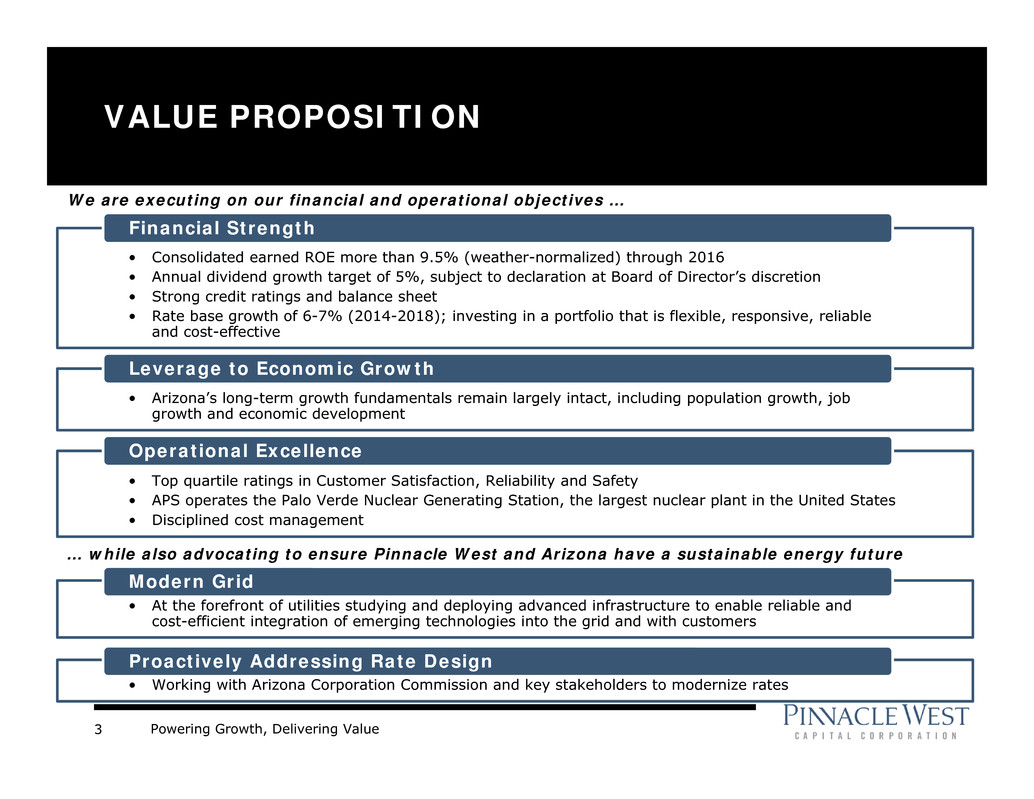

Powering Growth, Delivering Value3 • Consolidated earned ROE more than 9.5% (weather-normalized) through 2016 • Annual dividend growth target of 5%, subject to declaration at Board of Director’s discretion • Strong credit ratings and balance sheet • Rate base growth of 6-7% (2014-2018); investing in a portfolio that is flexible, responsive, reliable and cost-effective Financial Strength • Arizona’s long-term growth fundamentals remain largely intact, including population growth, job growth and economic development Leverage to Economic Growth • Top quartile ratings in Customer Satisfaction, Reliability and Safety • APS operates the Palo Verde Nuclear Generating Station, the largest nuclear plant in the United States • Disciplined cost management Operational Excellence VALUE PROPOSITION • At the forefront of utilities studying and deploying advanced infrastructure to enable reliable and cost-efficient integration of emerging technologies into the grid and with customers Modern Grid • Working with Arizona Corporation Commission and key stakeholders to modernize rates Proactively Addressing Rate Design We are executing on our financial and operational objectives … … while also advocating to ensure Pinnacle West and Arizona have a sustainable energy future

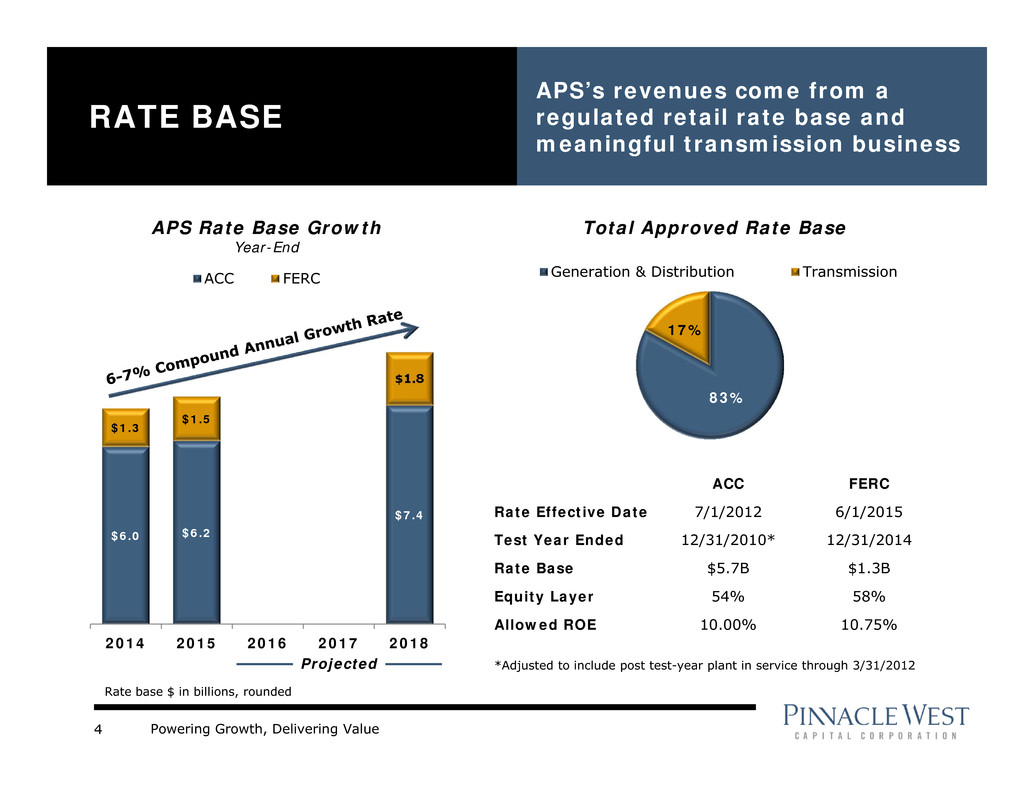

Powering Growth, Delivering Value4 RATE BASE APS’s revenues come from a regulated retail rate base and meaningful transmission business $6.0 $6.2 $7.4 $1.3 $1.5 $1.8 2014 2015 2016 2017 2018 APS Rate Base Growth Year-End ACC FERC Total Approved Rate Base Projected Most Recent Rate Decisions ACC FERC Rate Effective Date 7/1/2012 6/1/2015 Test Year Ended 12/31/2010* 12/31/2014 Rate Base $5.7B $1.3B Equity Layer 54% 58% Allowed ROE 10.00% 10.75% *Adjusted to include post test-year plant in service through 3/31/2012 83% 17% Generation & Distribution Transmission Rate base $ in billions, rounded

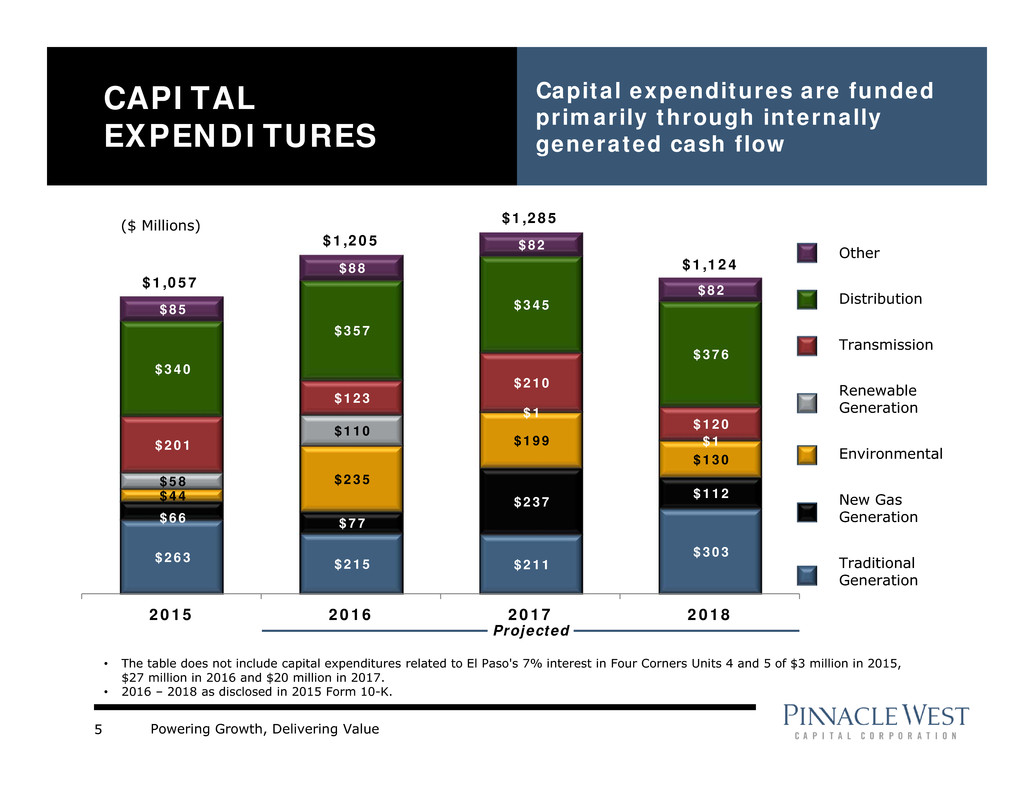

Powering Growth, Delivering Value5 $263 $215 $211 $303 $66 $77 $237 $112 $44 $235 $199 $130 $58 $110 $1 $1 $201 $123 $210 $120 $340 $357 $345 $376 $85 $88 $82 $82 2015 2016 2017 2018 CAPITAL EXPENDITURES Capital expenditures are funded primarily through internally generated cash flow ($ Millions) $1,205 $1,285 Other Distribution Transmission Renewable Generation Environmental Traditional Generation Projected $1,124 New Gas Generation $1,057 • The table does not include capital expenditures related to El Paso's 7% interest in Four Corners Units 4 and 5 of $3 million in 2015, $27 million in 2016 and $20 million in 2017. • 2016 – 2018 as disclosed in 2015 Form 10-K.

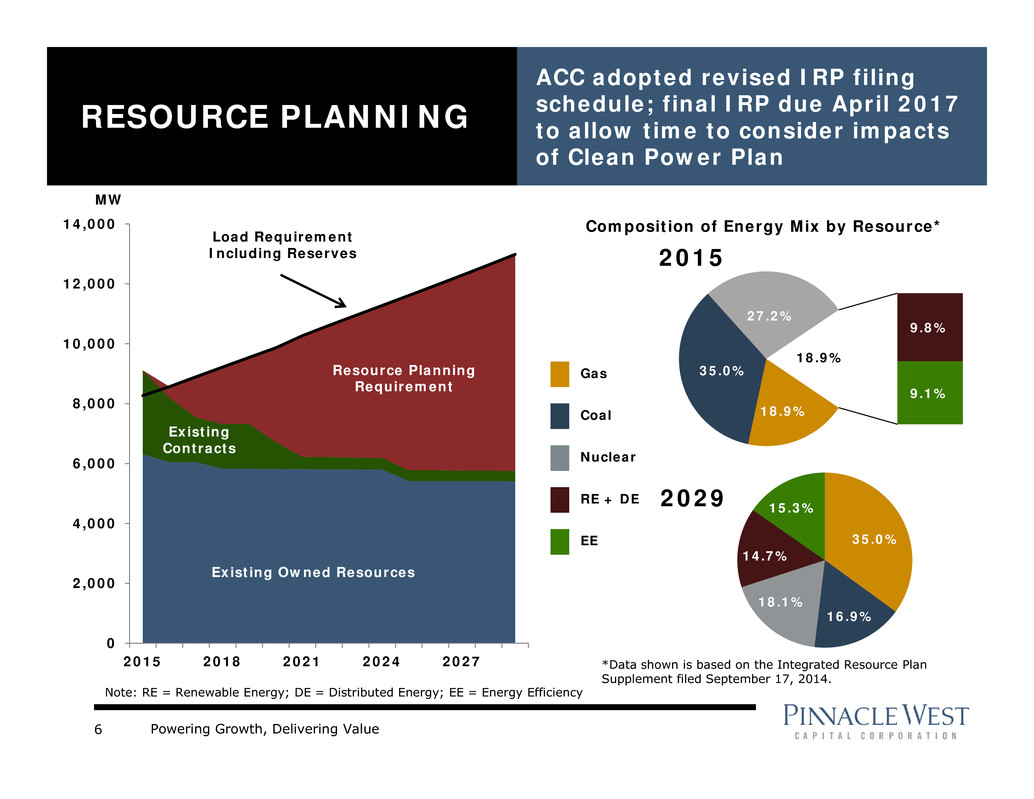

Powering Growth, Delivering Value6 RESOURCE PLANNING ACC adopted revised IRP filing schedule; final IRP due April 2017 to allow time to consider impacts of Clean Power Plan 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 2015 2018 2021 2024 2027 Existing Owned Resources Existing Contracts Resource Planning Requirement Load Requirement Including Reserves MW 18.9% 35.0% 27.2% 9.8% 9.1% 18.9% 2015 Gas Coal Nuclear RE + DE EE Composition of Energy Mix by Resource* Note: RE = Renewable Energy; DE = Distributed Energy; EE = Energy Efficiency 35.0% 16.9% 18.1% 14.7% 15.3% *Data shown is based on the Integrated Resource Plan Supplement filed September 17, 2014. 2029

Powering Growth, Delivering Value7 ECONOMIC INDICATORS Arizona and Metro Phoenix remain attractive places to live and do business Single Family & Multifamily Housing Permits Maricopa County Job Growth (Total Nonfarm) – Metro Phoenix (10.0)% (5.0)% 0.0% 5.0% 10.0% '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 Metro Phoenix U.S. YoY Change 0 5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 Single Family Multifamily Construction, healthcare, tourism, financial activities, business services, and consumer services adding jobs at a rate above 3% Phoenix ranked 1st in tech industry job growth over last 2 years (tied with San Francisco) - CBRE September 2015 Phoenix ranked 6th for commercial real estate investment (3rd excluding Texas cities) - Situs RERC, August 2015 Arizona ranked 1st for projected job growth - Forbes September 2015 E Total

Powering Growth, Delivering Value8 THE GRID IS EVOLVING – INCREASINGLY DYNAMIC AND COMPLEX Drivers for Change – Traditional grid built for one-way flow – Technology advancements (storage, home energy management) – Changing customer needs and demands – Proliferation of distributed solar energy, which does not align with peak The Modern Grid – New technologies to enable two-way flow – Proactive vs. reactive operations and maintenance – Modern rate structure – New ways to interact with customer – Mobility for our field personnel – Smarter, more flexible real- time system operations – Support consumer products and services – Addresses cybersecurity APS Laying Foundation for the Future – Solar R&D initiatives • Solar Partner Program • Solar Innovation Study – Smart meters fully deployed – Investing in peaking capacity upgrades (Ocotillo) – Evaluating storage • Battery pilot investments • Microgrids (Marine Corps Air Station Yuma) – Software upgrades for distribution operations and customer service – Ensuring our people have the relevant skill sets • Grid stability, power quality and reliability remain the core of a sustainable electrical system • APS is at the forefront of utilities designing and planning for the electric grid • Rates need to be modernized to enable advanced technologies and to reflect the true cost of service

Powering Growth, Delivering Value9 SOLAR PARTNER PROGRAM Learning how to efficiently enable the integration of rooftop solar and battery storage with our grid • Overview – Installing 10 MW of APS-owned residential PV systems on 1,500 homes – Advanced controllable inverters that can vary power output depending on grid conditions – Includes 4 MW of grid-tied battery storage on 2 of the participating feeders – Collect and analyze real time data on energy production, energy usage, power regulation capabilities and curtailment options – Participating customers receive monthly bill credits through 20-year life • Benefits − Study system benefits (i.e. strategic deployment orientation, advanced inverters, etc.) − Provides support for advanced rate structure − Provides an alternative for customers who cannot afford solar or do not want a lease • Expected timeline – Installations through mid-2016 – Technology evaluation in 2016/2017

Powering Growth, Delivering Value10 SOLAR INNOVATION STUDY Examining the integration of behind the meter advanced technologies with demand-based rates • Overview – Installing APS-owned residential PV systems on 75 homes with various configurations of battery storage, energy efficiency, demand controls and smart thermostats connected to a cloud based energy management system • Benefits – Identify effective technology packages that can shift load and minimize grid challenges – Gain insight into customer behavior and preferences in use of ‘next generation’ demand control and load shifting technologies – Identify strategies to support sustainable growth of renewable resources – Inform rate design in development of modernized demand based residential rates • Expected timeline – Design and installation in 2016 – 5-year study

Powering Growth, Delivering Value11 ADVANCED METERING INFRASTRUCTURE (AMI 2.0) • Overview – APS began deploying advanced “smart” meters in 2006, reaching full deployment with 1.2 million meters in 2014 – In 2015, APS started replacing 140,000 end-of-life meters with advanced meters • Benefits – Building a more interoperable advanced metering infrastructure – New network with ability to support Smart Grid and Distribution Automation devices – Improves outage and restoration communications with customers – Provides support for advanced rate structure – More than 1.7 million AMI avoided field orders since 2011 • Expected timeline – Q1 2015 – Q2 2016

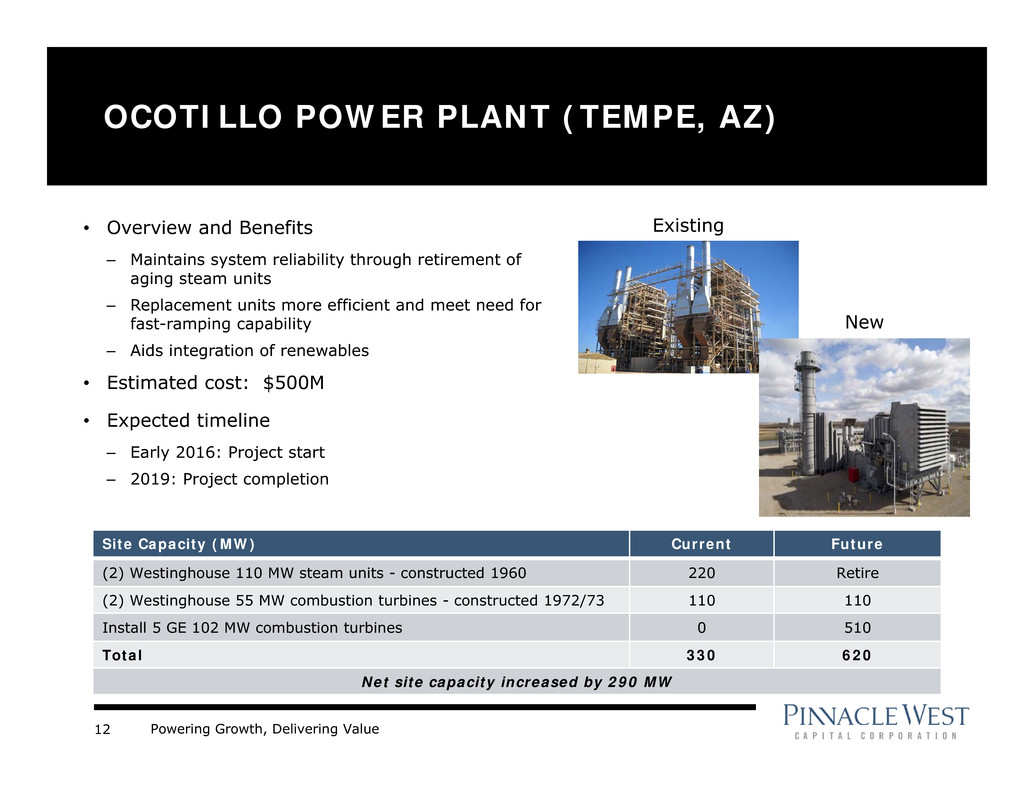

Powering Growth, Delivering Value12 OCOTILLO POWER PLANT (TEMPE, AZ) • Overview and Benefits – Maintains system reliability through retirement of aging steam units – Replacement units more efficient and meet need for fast-ramping capability – Aids integration of renewables • Estimated cost: $500M • Expected timeline – Early 2016: Project start – 2019: Project completion Site Capacity (MW) Current Future (2) Westinghouse 110 MW steam units - constructed 1960 220 Retire (2) Westinghouse 55 MW combustion turbines - constructed 1972/73 110 110 Install 5 GE 102 MW combustion turbines 0 510 Total 330 620 Net site capacity increased by 290 MW Existing New

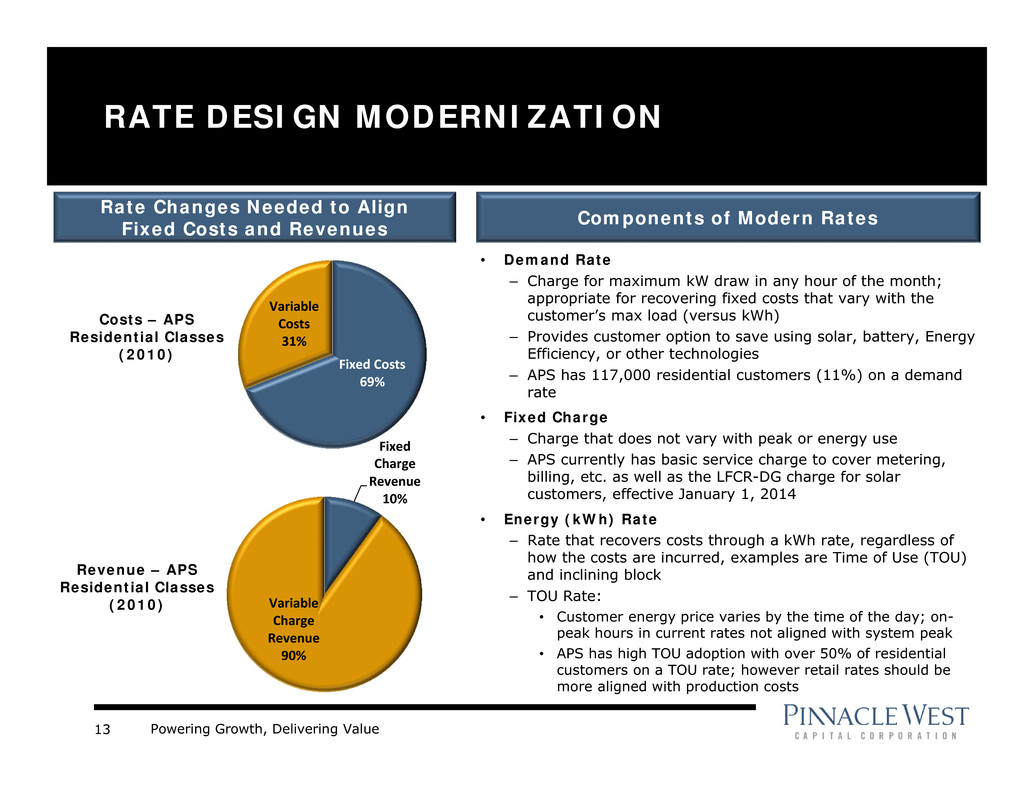

Powering Growth, Delivering Value13 RATE DESIGN MODERNIZATION Components of Modern RatesRate Changes Needed to Align Fixed Costs and Revenues • Demand Rate – Charge for maximum kW draw in any hour of the month; appropriate for recovering fixed costs that vary with the customer’s max load (versus kWh) – Provides customer option to save using solar, battery, Energy Efficiency, or other technologies – APS has 117,000 residential customers (11%) on a demand rate • Fixed Charge – Charge that does not vary with peak or energy use – APS currently has basic service charge to cover metering, billing, etc. as well as the LFCR-DG charge for solar customers, effective January 1, 2014 • Energy (kWh) Rate – Rate that recovers costs through a kWh rate, regardless of how the costs are incurred, examples are Time of Use (TOU) and inclining block – TOU Rate: • Customer energy price varies by the time of the day; on- peak hours in current rates not aligned with system peak • APS has high TOU adoption with over 50% of residential customers on a TOU rate; however retail rates should be more aligned with production costs Fixed Costs 69% Variable Costs 31% Costs – APS Residential Classes (2010) Fixed Charge Revenue 10% Variable Charge Revenue 90% Revenue – APS Residential Classes (2010)

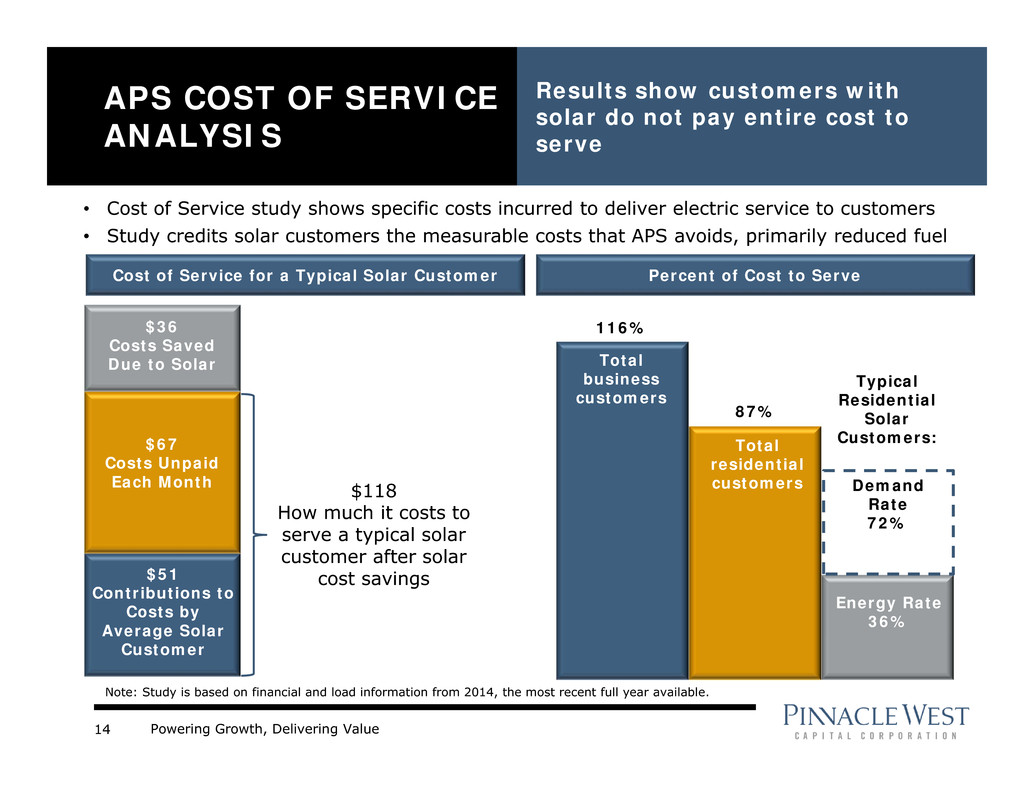

Powering Growth, Delivering Value14 APS COST OF SERVICE ANALYSIS Results show customers with solar do not pay entire cost to serve $118 How much it costs to serve a typical solar customer after solar cost savings $36 Costs Saved Due to Solar $51 Contributions to Costs by Average Solar Customer $67 Costs Unpaid Each Month 116% 87% Total business customers Energy Rate 36% Total residential customers • Cost of Service study shows specific costs incurred to deliver electric service to customers • Study credits solar customers the measurable costs that APS avoids, primarily reduced fuel Note: Study is based on financial and load information from 2014, the most recent full year available. Percent of Cost to ServeCost of Service for a Typical Solar Customer Typical Residential Solar Customers: Demand Rate 72%

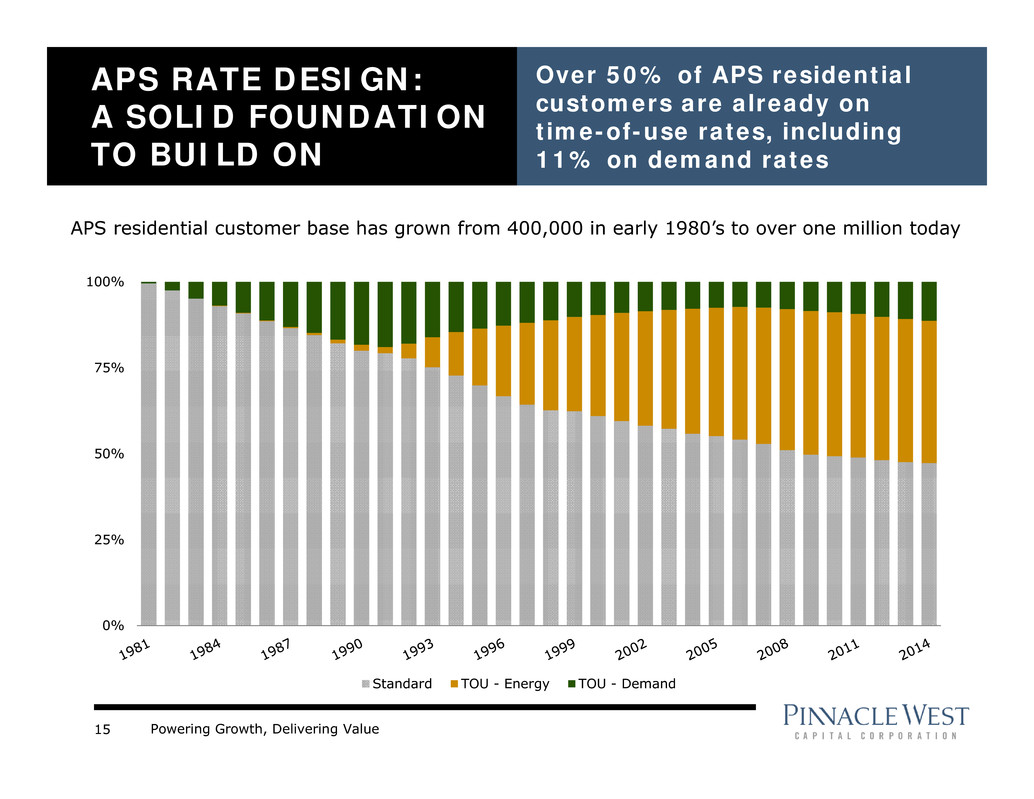

Powering Growth, Delivering Value15 APS RATE DESIGN: A SOLID FOUNDATION TO BUILD ON Over 50% of APS residential customers are already on time-of-use rates, including 11% on demand rates 0% 25% 50% 75% 100% Standard TOU - Energy TOU - Demand APS residential customer base has grown from 400,000 in early 1980’s to over one million today

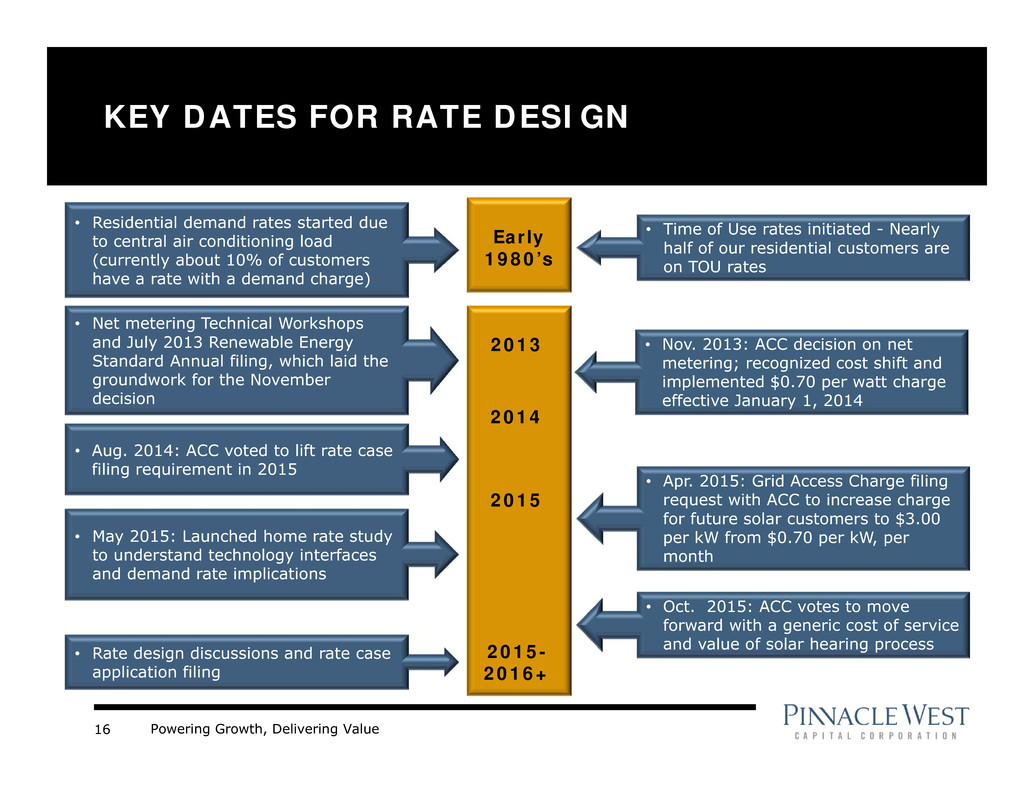

Powering Growth, Delivering Value16 KEY DATES FOR RATE DESIGN 2013 2014 2015 • Net metering Technical Workshops and July 2013 Renewable Energy Standard Annual filing, which laid the groundwork for the November decision • Nov. 2013: ACC decision on net metering; recognized cost shift and implemented $0.70 per watt charge effective January 1, 2014 • Time of Use rates initiated - Nearly half of our residential customers are on TOU rates • Residential demand rates started due to central air conditioning load (currently about 10% of customers have a rate with a demand charge) 2015- 2016+ • Aug. 2014: ACC voted to lift rate case filing requirement in 2015 • May 2015: Launched home rate study to understand technology interfaces and demand rate implications • Apr. 2015: Grid Access Charge filing request with ACC to increase charge for future solar customers to $3.00 per kW from $0.70 per kW, per month • Oct. 2015: ACC votes to move forward with a generic cost of service and value of solar hearing process • Rate design discussions and rate case application filing Early 1980’s

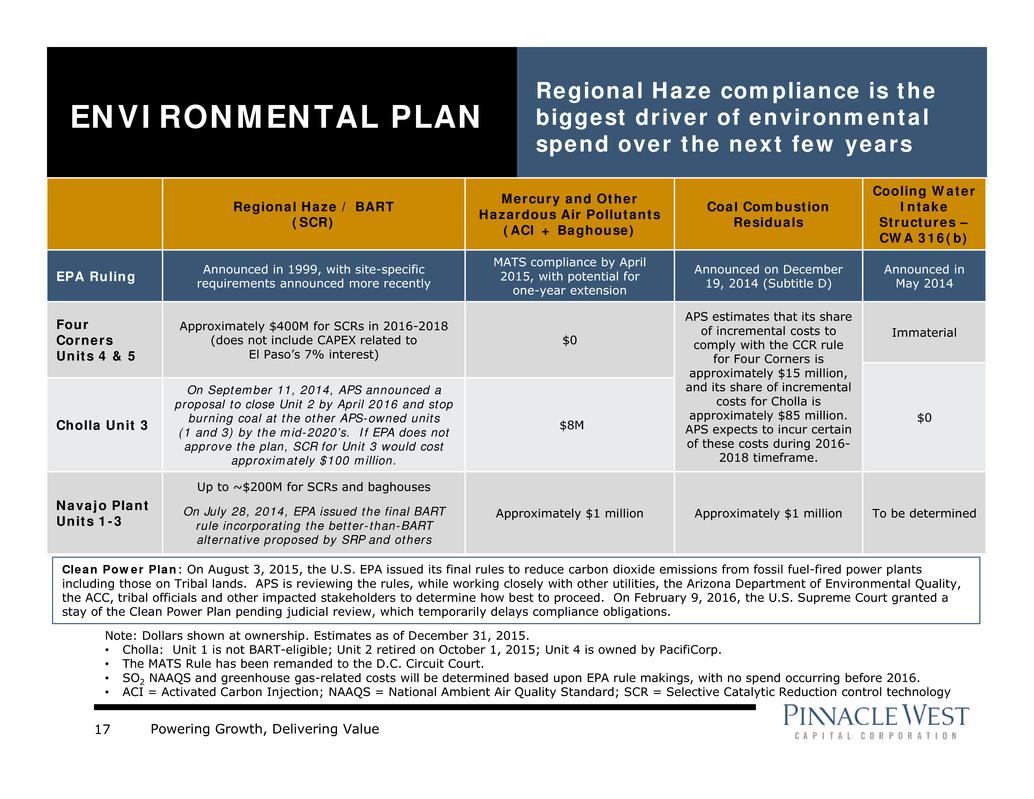

Powering Growth, Delivering Value17 Regional Haze / BART (SCR) Mercury and Other Hazardous Air Pollutants (ACI + Baghouse) Coal Combustion Residuals Cooling Water Intake Structures – CWA 316(b) EPA Ruling Announced in 1999, with site-specific requirements announced more recently MATS compliance by April 2015, with potential for one-year extension Announced on December 19, 2014 (Subtitle D) Announced in May 2014 Four Corners Units 4 & 5 Approximately $400M for SCRs in 2016-2018 (does not include CAPEX related to El Paso’s 7% interest) $0 APS estimates that its share of incremental costs to comply with the CCR rule for Four Corners is approximately $15 million, and its share of incremental costs for Cholla is approximately $85 million. APS expects to incur certain of these costs during 2016- 2018 timeframe. Immaterial $0Cholla Unit 3 On September 11, 2014, APS announced a proposal to close Unit 2 by April 2016 and stop burning coal at the other APS-owned units (1 and 3) by the mid-2020’s. If EPA does not approve the plan, SCR for Unit 3 would cost approximately $100 million. $8M Navajo Plant Units 1-3 Up to ~$200M for SCRs and baghouses On July 28, 2014, EPA issued the final BART rule incorporating the better-than-BART alternative proposed by SRP and others Approximately $1 million Approximately $1 million To be determined ENVIRONMENTAL PLAN Regional Haze compliance is the biggest driver of environmental spend over the next few years Clean Power Plan: On August 3, 2015, the U.S. EPA issued its final rules to reduce carbon dioxide emissions from fossil fuel-fired power plants including those on Tribal lands. APS is reviewing the rules, while working closely with other utilities, the Arizona Department of Environmental Quality, the ACC, tribal officials and other impacted stakeholders to determine how best to proceed. On February 9, 2016, the U.S. Supreme Court granted a stay of the Clean Power Plan pending judicial review, which temporarily delays compliance obligations. Note: Dollars shown at ownership. Estimates as of December 31, 2015. • Cholla: Unit 1 is not BART-eligible; Unit 2 retired on October 1, 2015; Unit 4 is owned by PacifiCorp. • The MATS Rule has been remanded to the D.C. Circuit Court. • SO2 NAAQS and greenhouse gas-related costs will be determined based upon EPA rule makings, with no spend occurring before 2016. • ACI = Activated Carbon Injection; NAAQS = National Ambient Air Quality Standard; SCR = Selective Catalytic Reduction control technology

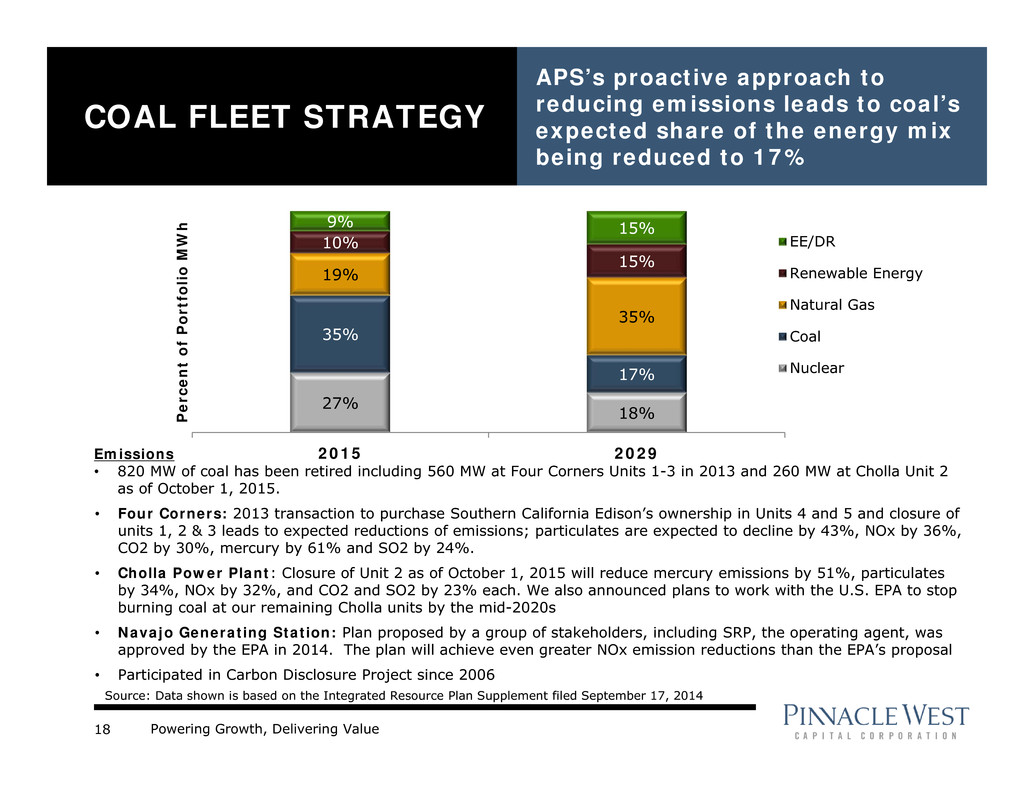

Powering Growth, Delivering Value18 Emissions • 820 MW of coal has been retired including 560 MW at Four Corners Units 1-3 in 2013 and 260 MW at Cholla Unit 2 as of October 1, 2015. • Four Corners: 2013 transaction to purchase Southern California Edison’s ownership in Units 4 and 5 and closure of units 1, 2 & 3 leads to expected reductions of emissions; particulates are expected to decline by 43%, NOx by 36%, CO2 by 30%, mercury by 61% and SO2 by 24%. • Cholla Power Plant: Closure of Unit 2 as of October 1, 2015 will reduce mercury emissions by 51%, particulates by 34%, NOx by 32%, and CO2 and SO2 by 23% each. We also announced plans to work with the U.S. EPA to stop burning coal at our remaining Cholla units by the mid-2020s • Navajo Generating Station: Plan proposed by a group of stakeholders, including SRP, the operating agent, was approved by the EPA in 2014. The plan will achieve even greater NOx emission reductions than the EPA’s proposal • Participated in Carbon Disclosure Project since 2006 COAL FLEET STRATEGY APS’s proactive approach to reducing emissions leads to coal’s expected share of the energy mix being reduced to 17% 27% 18% 35% 17% 19% 35% 10% 15% 9% 15% 2015 2029 P e r c e n t o f P o r t f o l i o M W h EE/DR Renewable Energy Natural Gas Coal Nuclear Source: Data shown is based on the Integrated Resource Plan Supplement filed September 17, 2014

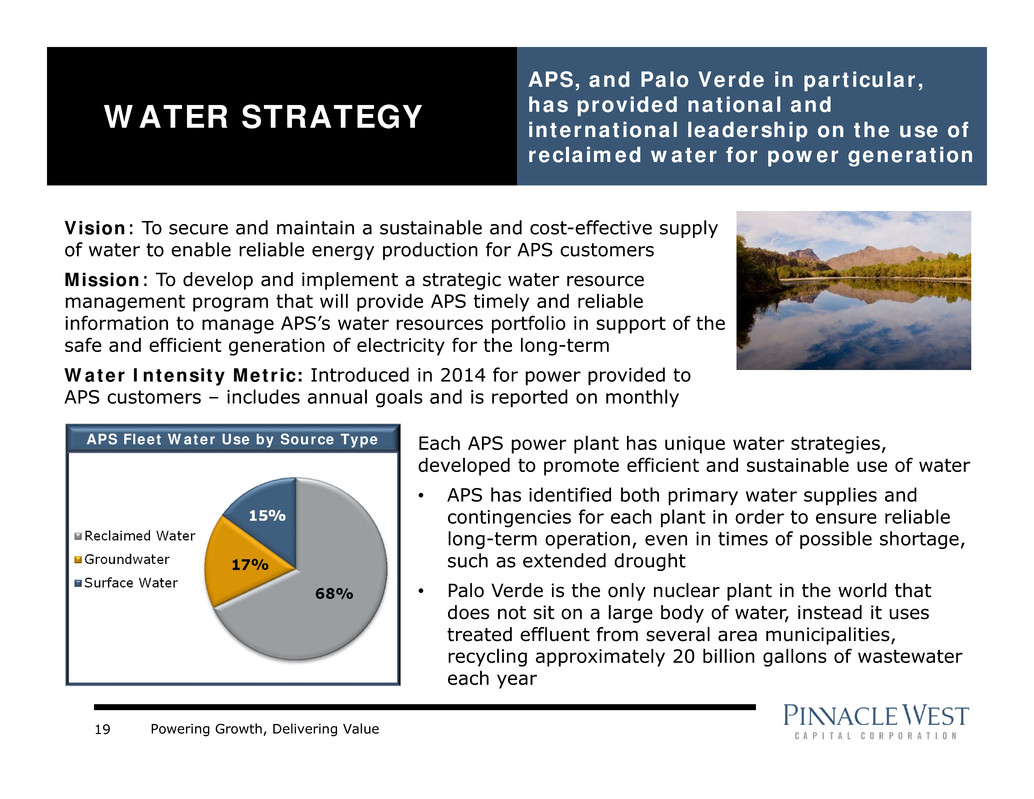

Powering Growth, Delivering Value19 WATER STRATEGY APS, and Palo Verde in particular, has provided national and international leadership on the use of reclaimed water for power generation Vision: To secure and maintain a sustainable and cost-effective supply of water to enable reliable energy production for APS customers Mission: To develop and implement a strategic water resource management program that will provide APS timely and reliable information to manage APS’s water resources portfolio in support of the safe and efficient generation of electricity for the long-term Water Intensity Metric: Introduced in 2014 for power provided to APS customers – includes annual goals and is reported on monthly 68% 17% 15% Reclaimed Water Groundwater Surface Water Each APS power plant has unique water strategies, developed to promote efficient and sustainable use of water • APS has identified both primary water supplies and contingencies for each plant in order to ensure reliable long-term operation, even in times of possible shortage, such as extended drought • Palo Verde is the only nuclear plant in the world that does not sit on a large body of water, instead it uses treated effluent from several area municipalities, recycling approximately 20 billion gallons of wastewater each year APS Fleet Water Use by Source Type

Powering Growth, Delivering Value20 Bob Stump (R)* Tom Forese (R) Doug Little (R) Chairman Terms to January 2019Terms to January 2017 Bob Burns (R) Other State Officials Andy Tobin (R) ARIZONA CORPORATION COMMISSION * Term limited - elected to four-year terms (limited to two consecutive) ACC Utility Division Director - Tom Broderick RUCO Director - David Tenney

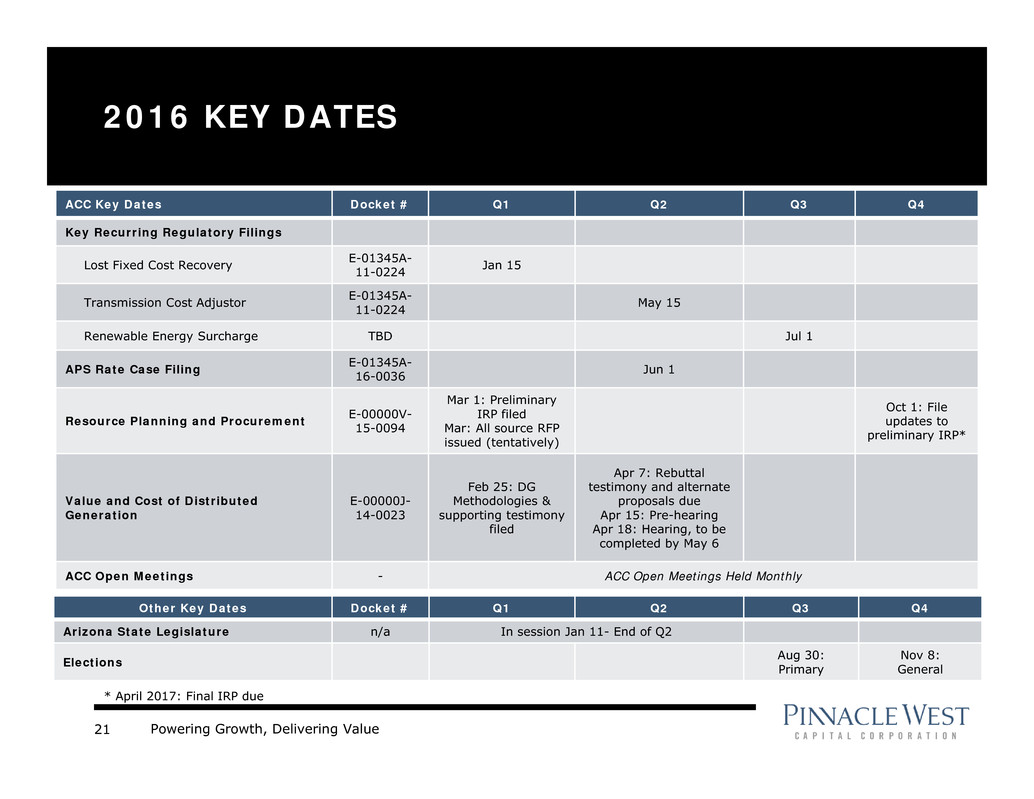

Powering Growth, Delivering Value21 2016 KEY DATES ACC Key Dates Docket # Q1 Q2 Q3 Q4 Key Recurring Regulatory Filings Lost Fixed Cost Recovery E-01345A-11-0224 Jan 15 Transmission Cost Adjustor E-01345A-11-0224 May 15 Renewable Energy Surcharge TBD Jul 1 APS Rate Case Filing E-01345A-16-0036 Jun 1 Resource Planning and Procurement E-00000V-15-0094 Mar 1: Preliminary IRP filed Mar: All source RFP issued (tentatively) Oct 1: File updates to preliminary IRP* Value and Cost of Distributed Generation E-00000J- 14-0023 Feb 25: DG Methodologies & supporting testimony filed Apr 7: Rebuttal testimony and alternate proposals due Apr 15: Pre-hearing Apr 18: Hearing, to be completed by May 6 ACC Open Meetings - ACC Open Meetings Held Monthly * April 2017: Final IRP due Other Key Dates Docket # Q1 Q2 Q3 Q4 Arizona State Legislature n/a In session Jan 11- End of Q2 Elections Aug 30:Primary Nov 8: General

Powering Growth, Delivering Value22 APS NOTICE OF INTENT TO FILE RATE CASE APPLICATION • APS intends to file rate case application on June 1, 2016, using adjusted test year for the twelve months ended December 31, 2015 – 120 days’ Notice of Intent filed on January 29, 2016 • APS will propose new rates go into effect on July 1, 2017 • Rate case matters include: – Residential rate redesign – Revenue per customer decoupling mechanism – Deferral of costs related to the Ocotillo Modernization projects – Deferral of costs related to Environmental Protections (SCRs at Four Corners) – Adjustor mechanisms

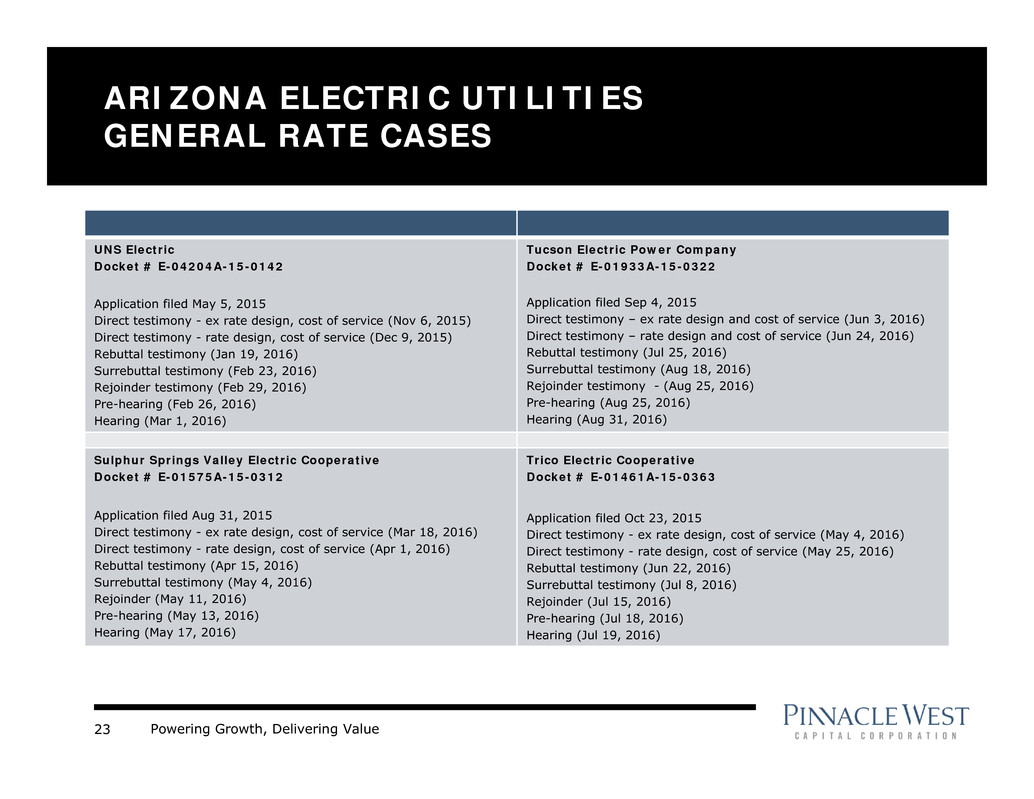

Powering Growth, Delivering Value23 ARIZONA ELECTRIC UTILITIES GENERAL RATE CASES UNS Electric Docket # E-04204A-15-0142 Application filed May 5, 2015 Direct testimony - ex rate design, cost of service (Nov 6, 2015) Direct testimony - rate design, cost of service (Dec 9, 2015) Rebuttal testimony (Jan 19, 2016) Surrebuttal testimony (Feb 23, 2016) Rejoinder testimony (Feb 29, 2016) Pre-hearing (Feb 26, 2016) Hearing (Mar 1, 2016) Tucson Electric Power Company Docket # E-01933A-15-0322 Application filed Sep 4, 2015 Direct testimony – ex rate design and cost of service (Jun 3, 2016) Direct testimony – rate design and cost of service (Jun 24, 2016) Rebuttal testimony (Jul 25, 2016) Surrebuttal testimony (Aug 18, 2016) Rejoinder testimony - (Aug 25, 2016) Pre-hearing (Aug 25, 2016) Hearing (Aug 31, 2016) Sulphur Springs Valley Electric Cooperative Docket # E-01575A-15-0312 Application filed Aug 31, 2015 Direct testimony - ex rate design, cost of service (Mar 18, 2016) Direct testimony - rate design, cost of service (Apr 1, 2016) Rebuttal testimony (Apr 15, 2016) Surrebuttal testimony (May 4, 2016) Rejoinder (May 11, 2016) Pre-hearing (May 13, 2016) Hearing (May 17, 2016) Trico Electric Cooperative Docket # E-01461A-15-0363 Application filed Oct 23, 2015 Direct testimony - ex rate design, cost of service (May 4, 2016) Direct testimony - rate design, cost of service (May 25, 2016) Rebuttal testimony (Jun 22, 2016) Surrebuttal testimony (Jul 8, 2016) Rejoinder (Jul 15, 2016) Pre-hearing (Jul 18, 2016) Hearing (Jul 19, 2016)

Powering Growth, Delivering Value APPENDIX

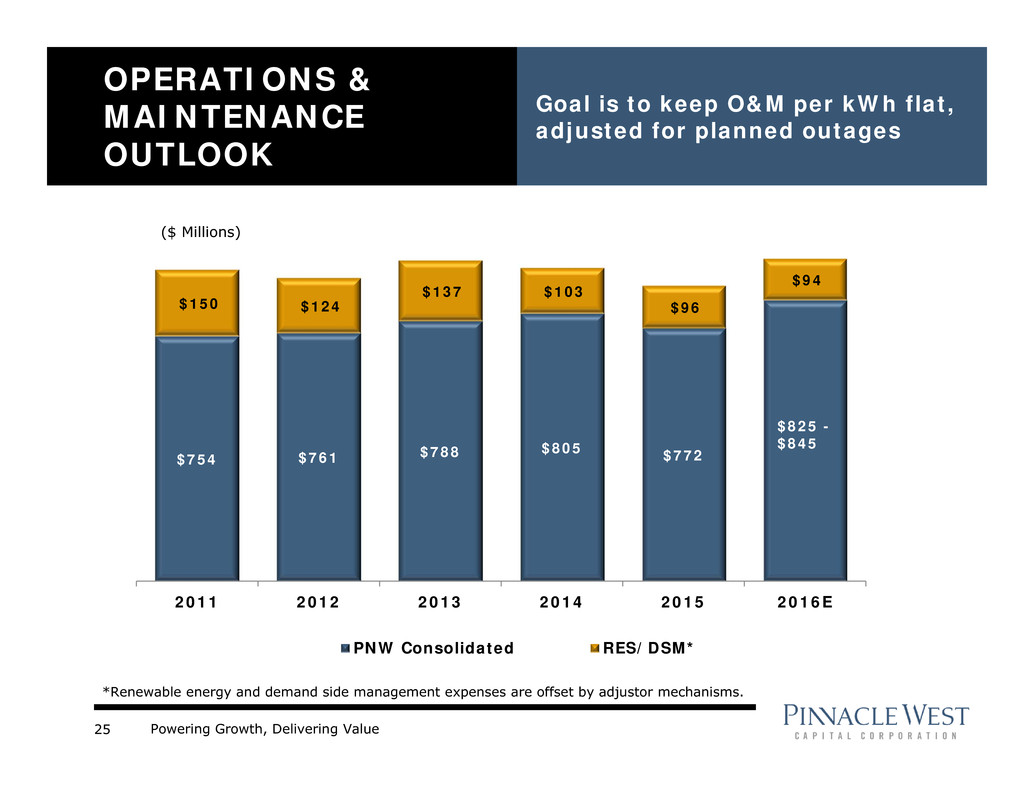

Powering Growth, Delivering Value25 OPERATIONS & MAINTENANCE OUTLOOK Goal is to keep O&M per kWh flat, adjusted for planned outages $754 $761 $788 $805 $772 $150 $124 $137 $103 $96 $94 2011 2012 2013 2014 2015 2016E PNW Consolidated RES/DSM* *Renewable energy and demand side management expenses are offset by adjustor mechanisms. ($ Millions) $825 - $845

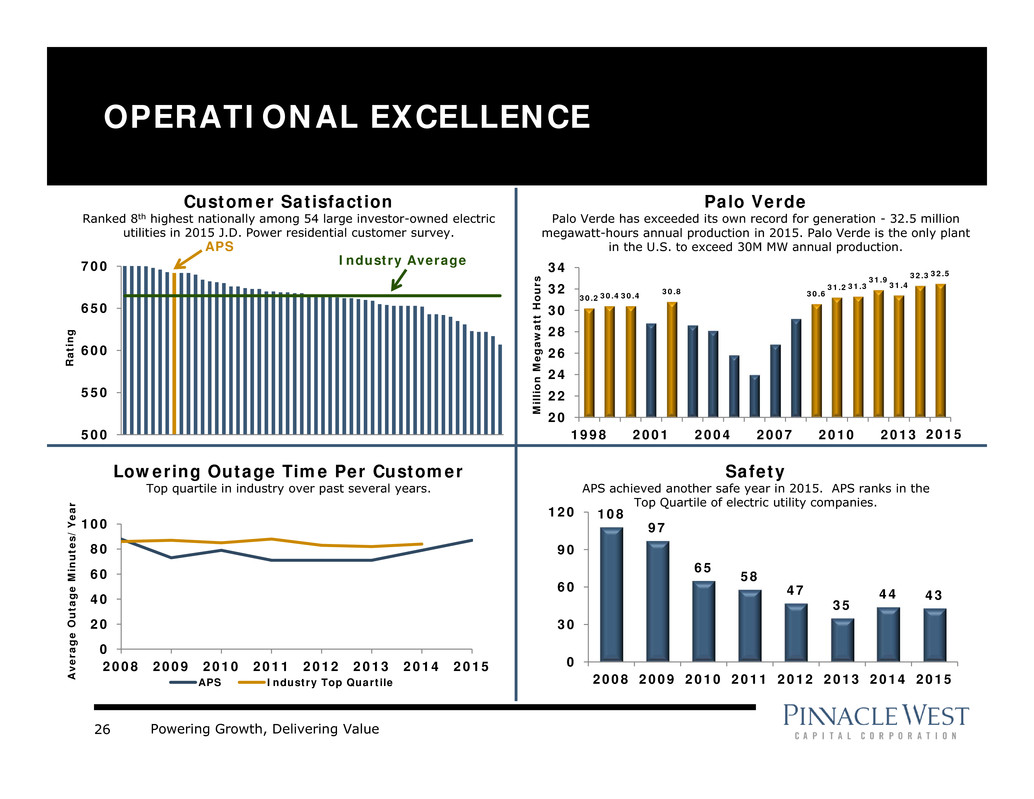

Powering Growth, Delivering Value26 500 550 600 650 700 OPERATIONAL EXCELLENCE 30.230.430.4 30.8 30.6 31.231.3 31.9 31.4 32.332.5 20 22 24 26 28 30 32 34 1998 2001 2004 2007 2010 2013 108 97 65 58 47 35 44 43 0 30 60 90 120 2008 2009 2010 2011 2012 2013 2014 2015 Palo Verde Palo Verde has exceeded its own record for generation - 32.5 million megawatt-hours annual production in 2015. Palo Verde is the only plant in the U.S. to exceed 30M MW annual production. Safety APS achieved another safe year in 2015. APS ranks in the Top Quartile of electric utility companies. 0 20 40 60 80 100 2008 2009 2010 2011 2012 2013 2014 2015 APS Industry Top Quartile Customer Satisfaction Ranked 8th highest nationally among 54 large investor-owned electric utilities in 2015 J.D. Power residential customer survey. Lowering Outage Time Per Customer Top quartile in industry over past several years. A v e r a g e O u t a g e M i n u t e s / Y e a r M i l l i o n M e g a w a t t H o u r s R a t i n g Industry Average APS 2015

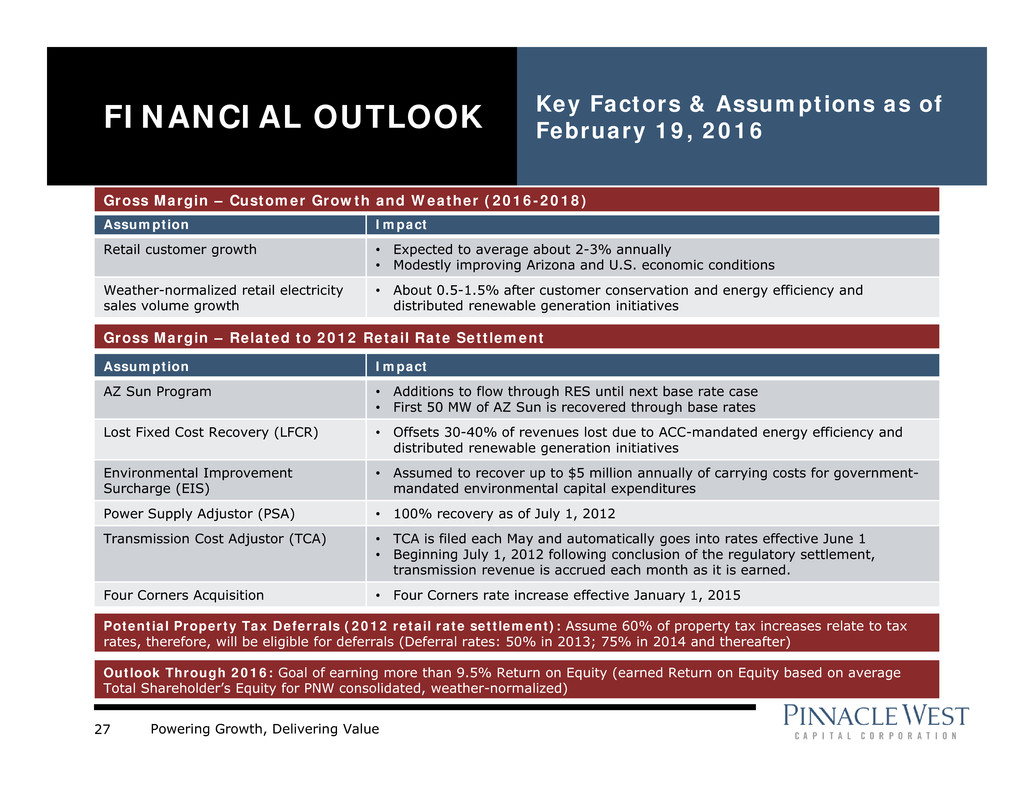

Powering Growth, Delivering Value27 FINANCIAL OUTLOOK Key Factors & Assumptions as of February 19, 2016 Assumption Impact Retail customer growth • Expected to average about 2-3% annually • Modestly improving Arizona and U.S. economic conditions Weather-normalized retail electricity sales volume growth • About 0.5-1.5% after customer conservation and energy efficiency and distributed renewable generation initiatives Assumption Impact AZ Sun Program • Additions to flow through RES until next base rate case • First 50 MW of AZ Sun is recovered through base rates Lost Fixed Cost Recovery (LFCR) • Offsets 30-40% of revenues lost due to ACC-mandated energy efficiency and distributed renewable generation initiatives Environmental Improvement Surcharge (EIS) • Assumed to recover up to $5 million annually of carrying costs for government- mandated environmental capital expenditures Power Supply Adjustor (PSA) • 100% recovery as of July 1, 2012 Transmission Cost Adjustor (TCA) • TCA is filed each May and automatically goes into rates effective June 1 • Beginning July 1, 2012 following conclusion of the regulatory settlement, transmission revenue is accrued each month as it is earned. Four Corners Acquisition • Four Corners rate increase effective January 1, 2015 Potential Property Tax Deferrals (2012 retail rate settlement): Assume 60% of property tax increases relate to tax rates, therefore, will be eligible for deferrals (Deferral rates: 50% in 2013; 75% in 2014 and thereafter) Gross Margin – Customer Growth and Weather (2016-2018) Gross Margin – Related to 2012 Retail Rate Settlement Outlook Through 2016: Goal of earning more than 9.5% Return on Equity (earned Return on Equity based on average Total Shareholder’s Equity for PNW consolidated, weather-normalized)

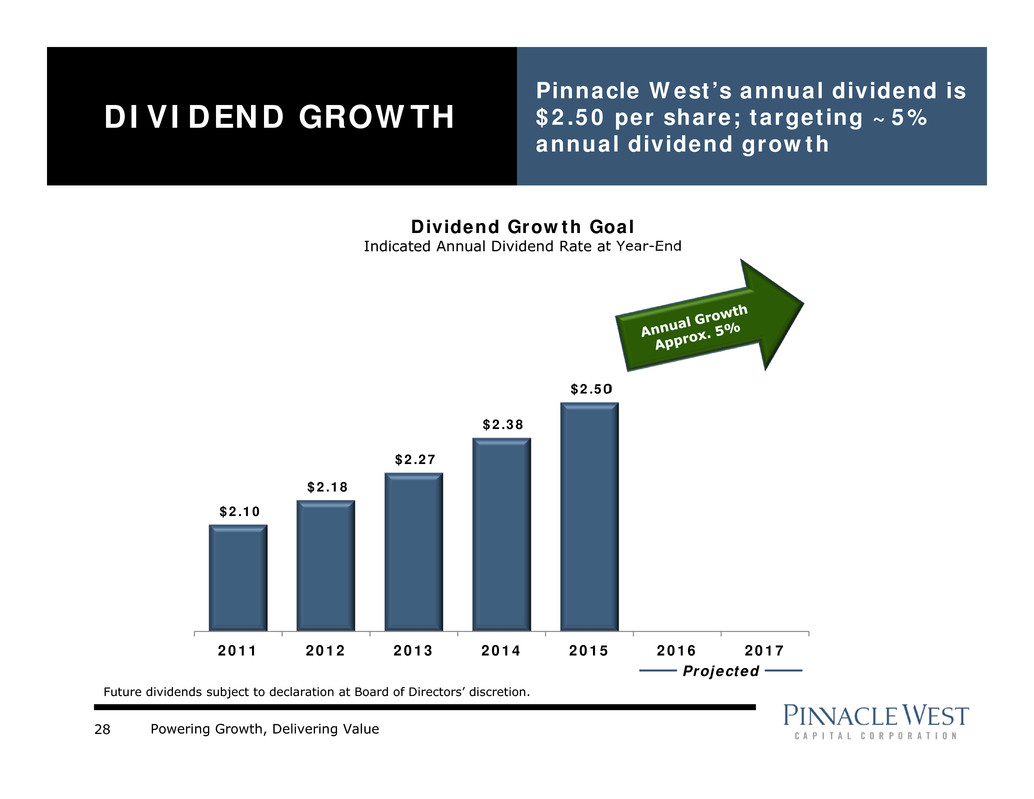

Powering Growth, Delivering Value28 DIVIDEND GROWTH Pinnacle West’s annual dividend is $2.50 per share; targeting ~5% annual dividend growth $2.10 $2.18 $2.27 $2.38 $2.50 2011 2012 2013 2014 2015 2016 2017 Dividend Growth Goal Indicated Annual Dividend Rate at Year-End Projected Future dividends subject to declaration at Board of Directors’ discretion.

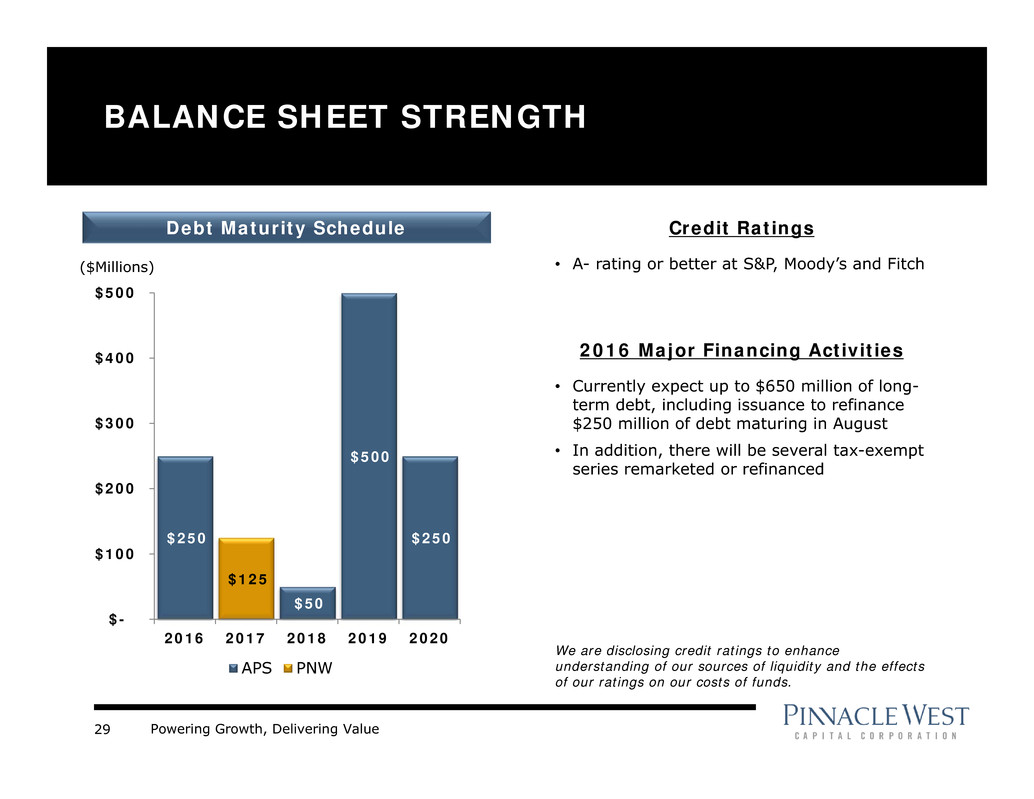

Powering Growth, Delivering Value29 Credit Ratings • A- rating or better at S&P, Moody’s and Fitch 2016 Major Financing Activities • Currently expect up to $650 million of long- term debt, including issuance to refinance $250 million of debt maturing in August • In addition, there will be several tax-exempt series remarketed or refinanced We are disclosing credit ratings to enhance understanding of our sources of liquidity and the effects of our ratings on our costs of funds. BALANCE SHEET STRENGTH $250 $50 $500 $250 $125 $- $100 $200 $300 $400 $500 2016 2017 2018 2019 2020 APS PNW ($Millions) Debt Maturity Schedule

Powering Growth, Delivering Value30 • On December 30, 2013, APS and Southern California Edison (“SCE”) completed previously announced transaction whereby APS agreed to purchase SCE’s 48% interest in Units 4 and 5 of Four Corners – Final purchase price: $182 million – APS will continue to operate Four Corners and now has total interest of about 970 MW • APS filed Four Corners-specific revenue requirement on docket 11-0224 − On December 19, 2014, ACC passed the rate rider ($57.05 million), new rates effective January 1, 2015; appeal pending • APS notified EPA that the Four Corners participants selected the BART alternative requiring APS to retire Units 1-3 by January 1, 2014 and install and operate Selective Catalytic Reduction (“SCR”) control technology on Units 4-5 by July 31, 2018 – APS has obtained the environmental permit to allow the installation of the SCRs; construction expected to begin in 2016 – Estimated environmental compliance: Approximately $400 million, primarily in 2016-2018 FOUR CORNERS POWER PLANT

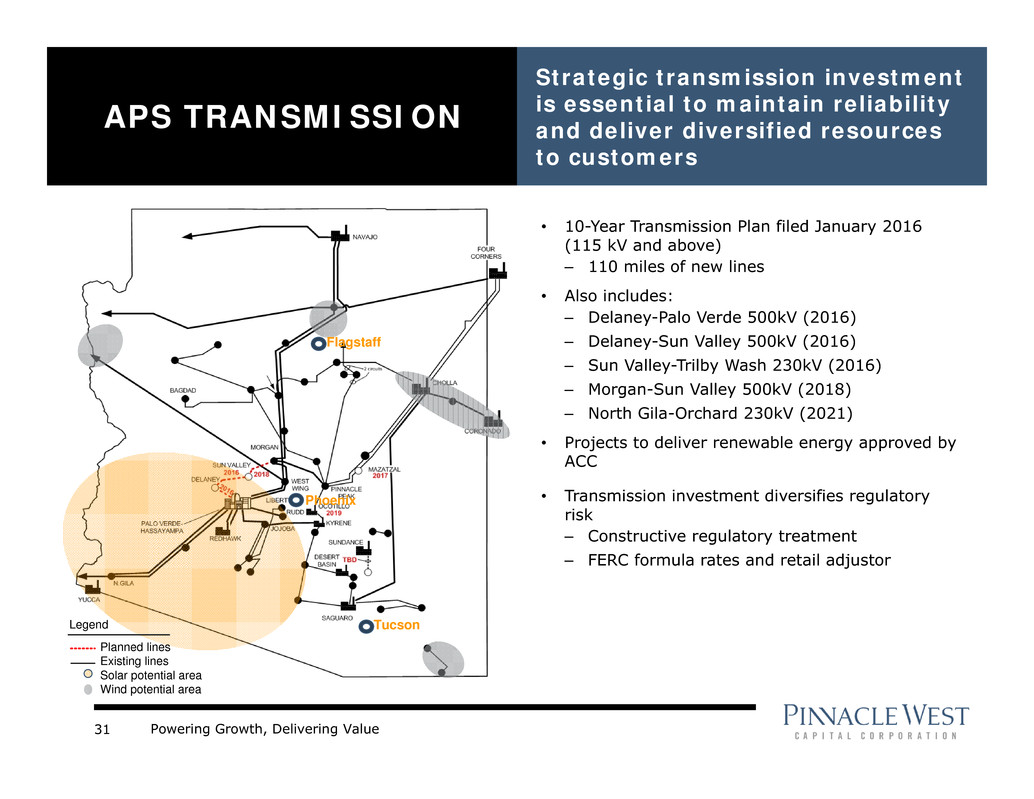

Powering Growth, Delivering Value31 • 10-Year Transmission Plan filed January 2016 (115 kV and above) – 110 miles of new lines • Also includes: – Delaney-Palo Verde 500kV (2016) – Delaney-Sun Valley 500kV (2016) – Sun Valley-Trilby Wash 230kV (2016) – Morgan-Sun Valley 500kV (2018) – North Gila-Orchard 230kV (2021) • Projects to deliver renewable energy approved by ACC • Transmission investment diversifies regulatory risk – Constructive regulatory treatment – FERC formula rates and retail adjustor APS TRANSMISSION Strategic transmission investment is essential to maintain reliability and deliver diversified resources to customers Legend Planned lines Existing lines Solar potential area Wind potential area Phoenix Flagstaff Tucson

Powering Growth, Delivering Value32 BRIGHT CANYON ENERGY – TRANSMISSION GROWTH TRANSCANYON A 50/50 Joint Venture formed with BHE U.S. Transmission, subsidiary of Berkshire Hathaway Energy, to pursue transmission opportunities in the western United States BRIGHT CANYON ENERGY Pinnacle West subsidiary formed to pursue new growth opportunities WECC WECC = Western Electricity Coordinating Council

Powering Growth, Delivering Value33 • Cumulative savings from energy efficiency programs must be equivalent to 22% of annual retail sales by 2020 • Annual milestones in place to measure progress toward cumulative 2020 goal – 9.5% by 2015 – 22% by 2020 ARIZONA’S RENEWABLE RESOURCE AND ENERGY EFFICIENCY STANDARDS • Portion of retail sales to be supplied by renewable resources – 6% by 2016 – 15% by 2025 • Distributed energy component – 30% of total requirement Energy Efficiency RequirementsRenewable Energy (RES) Requirements APS on track to exceed 2016 requirement APS on track to meet target

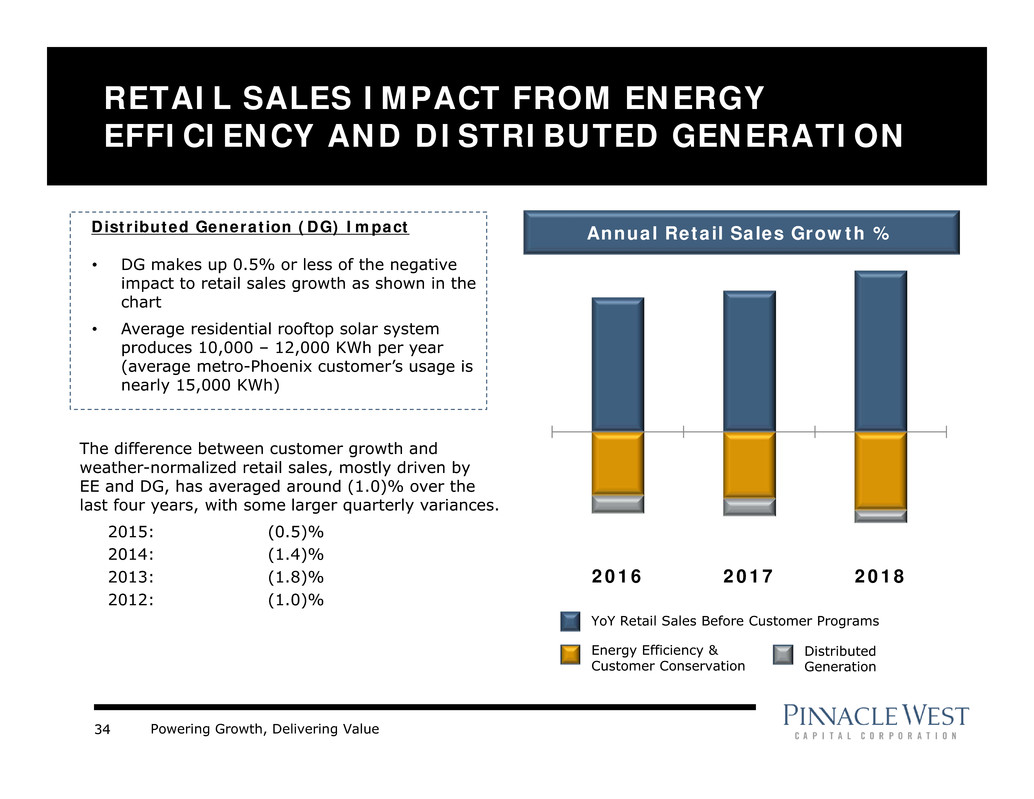

Powering Growth, Delivering Value34 2016 2017 2018 RETAIL SALES IMPACT FROM ENERGY EFFICIENCY AND DISTRIBUTED GENERATION YoY Retail Sales Before Customer Programs Energy Efficiency & Customer Conservation Distributed Generation Distributed Generation (DG) Impact • DG makes up 0.5% or less of the negative impact to retail sales growth as shown in the chart • Average residential rooftop solar system produces 10,000 – 12,000 KWh per year (average metro-Phoenix customer’s usage is nearly 15,000 KWh) The difference between customer growth and weather-normalized retail sales, mostly driven by EE and DG, has averaged around (1.0)% over the last four years, with some larger quarterly variances. 2015: (0.5)% 2014: (1.4)% 2013: (1.8)% 2012: (1.0)% Annual Retail Sales Growth %

Powering Growth, Delivering Value35 APS IS A LEADER IN SOLAR AZ Sun Projects Capacity Developer Actual COD* Paloma 17 MW First Solar Sep 2011 Cotton Center 17 MW Solon Oct 2011 Hyder Phase 1 11 MW SunEdison Oct 2011 Hyder Phase 2 5 MW SunEdison Feb 2012 Chino Valley 19 MW SunEdison Nov 2012 Yuma Foothills Phase 1 17 MW AMEC Jun 2013 Yuma Foothills Phase 2 18 MW AMEC Dec 2013 Hyder II 14 MW McCarthy Dec 2013 Gila Bend 32 MW Black & Veatch Oct 2014 Desert Star 10 MW McCarthy Sep 2015 Luke Air Force Base 10 MW McCarthy Sep 2015 Total 170 MW As of Dec 31, 2015 * Commercial Operation Date AZ Sun represents a total capital investment of $675 million, or $3,970/kW average for the 170 MW portfolio APS Solar Portfolio AZ Sun includes 4 MW of other APS owned utility scale solar; Distributed Generation (DG) includes 15 MW of APS owned PPA is primarily 250 MW Solana Concentrated Solar Facility PPA 310 MW DG 475 MW AZ Sun 174 MW

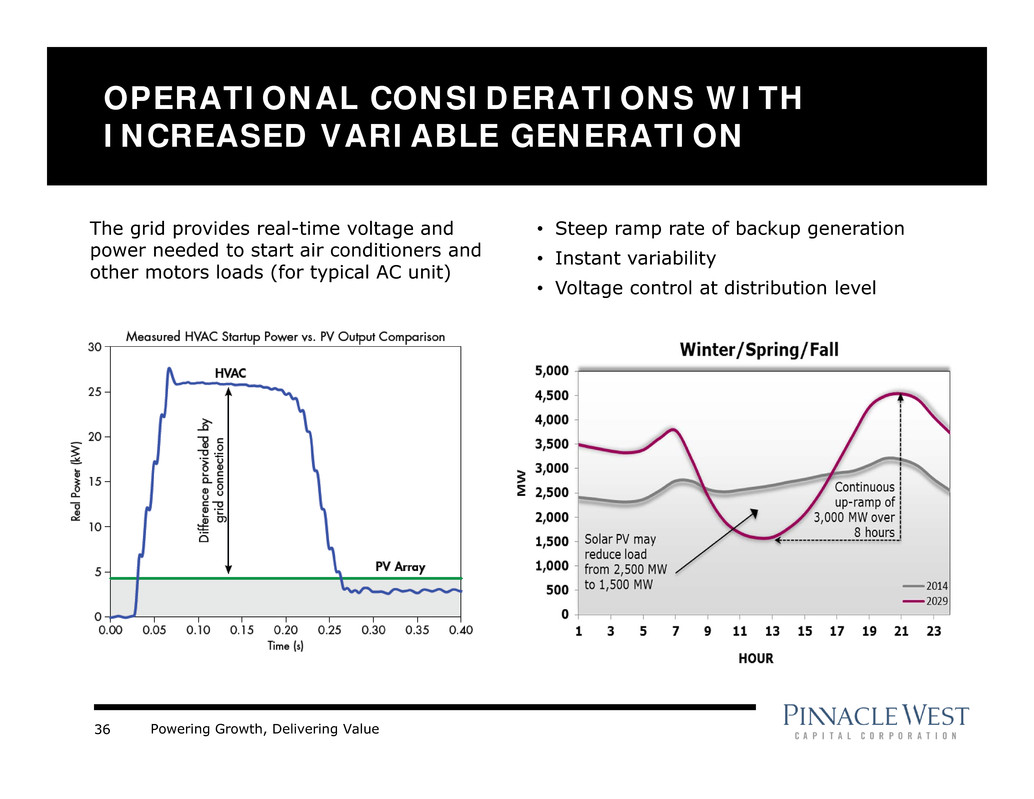

Powering Growth, Delivering Value36 OPERATIONAL CONSIDERATIONS WITH INCREASED VARIABLE GENERATION The grid provides real-time voltage and power needed to start air conditioners and other motors loads (for typical AC unit) • Steep ramp rate of backup generation • Instant variability • Voltage control at distribution level

Powering Growth, Delivering Value37 RESIDENTIAL VS. UTILITY-SCALE SOLAR Performance at system peak 0 2,000 4,000 6,000 8,000 0 100 200 300 400 500 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 M W Hour Ending On August 15th, APS customers hit “peak demand” for 2015 using more than 7,300 MW of electricity 0 2,000 4,000 6,000 8,000 0 100 200 300 400 500 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 M W Hour Ending Rooftop Output System Load 6,315 166 7,362 75 6,952 0 AZ Sun Output System Load 7,362 140 • Noon: Customer demand still increasing; rooftop solar peaks and begins to decline • 5PM: Customer demand peaks; rooftop solar producing at 38% of total capacity • 7PM: Rooftop output at zero, but demand still above 6,900 MW of power • Solar panels at 8 of the AZ Sun plants rotate to track the sun, achieving highest production earlier in the day and maintaining it later • At peak demand, utility-scale solar producing at nearly 80% of total capacity Residential Rooftop Solar AZ Sun Utility-Scale Solar

Powering Growth, Delivering Value38 GENERATION PORTFOLIO* Plant Location No. of Units Dispatch COD Ownership Interest1 Net Capacity (MW) NUCLEAR 1,146 MW Palo Verde Wintersburg, AZ 3 Base 1986-1989 29.1% 1,146 COAL 1,672 MW Cholla Joseph City, AZ 2 Base 1962-1980 100 387 Four Corners Farmington, NM 2 Base 1969-1970 63 970 Navajo Page, AZ 3 Base 1974-1976 14 315 GAS - COMBINED CYCLE 1,871 MW Redhawk Arlington, AZ 2 Intermediate 2002 100 984 West Phoenix Phoenix, AZ 5 Intermediate 1976-2003 100 887 GAS - STEAM TURBINE 220 MW Ocotillo Tempe, AZ 2 Peaking 1960 100 220 GAS / OIL COMBUSTION TURBINE 1,088 MW Sundance Casa Grande, AZ 10 Peaking 2002 100 420 Yucca Yuma, AZ 6 Peaking 1971-2008 100 243 Saguaro Red Rock, AZ 3 Peaking 1972-2002 100 189 West Phoenix Phoenix, AZ 2 Peaking 1972-1973 100 110 Ocotillo Tempe, AZ 2 Peaking 1972-1973 100 110 Douglas Douglas, AZ 1 Peaking 1972 100 16 SOLAR 189 MW Hyder & Hyder II Hyder, AZ - As Available 2011-2013 100 30 Paloma Gila Bend, AZ - As Available 2011 100 17 Cotton Center Gila Bend, AZ - As Available 2011 100 17 Chino Valley Chino Valley, AZ - As Available 2012 100 19 Foothills Yuma, AZ - As Available 2013 100 35 Distributed Energy Multiple AZ Facilities - As Available Various 100 15 Gila Bend Gila Bend, AZ - As Available 2015 100 32 Luke Air Force Base Glendale, AZ - As Available 2015 100 10 Desert Star Buckeye, AZ - As Available 2015 100 10 Various Multiple AZ Facilities - As Available 1996-2006 100 4 Total Generation Capacity 6,186 MW 1 Includes leased generation plants* As disclosed in 2015 Form 10-K.

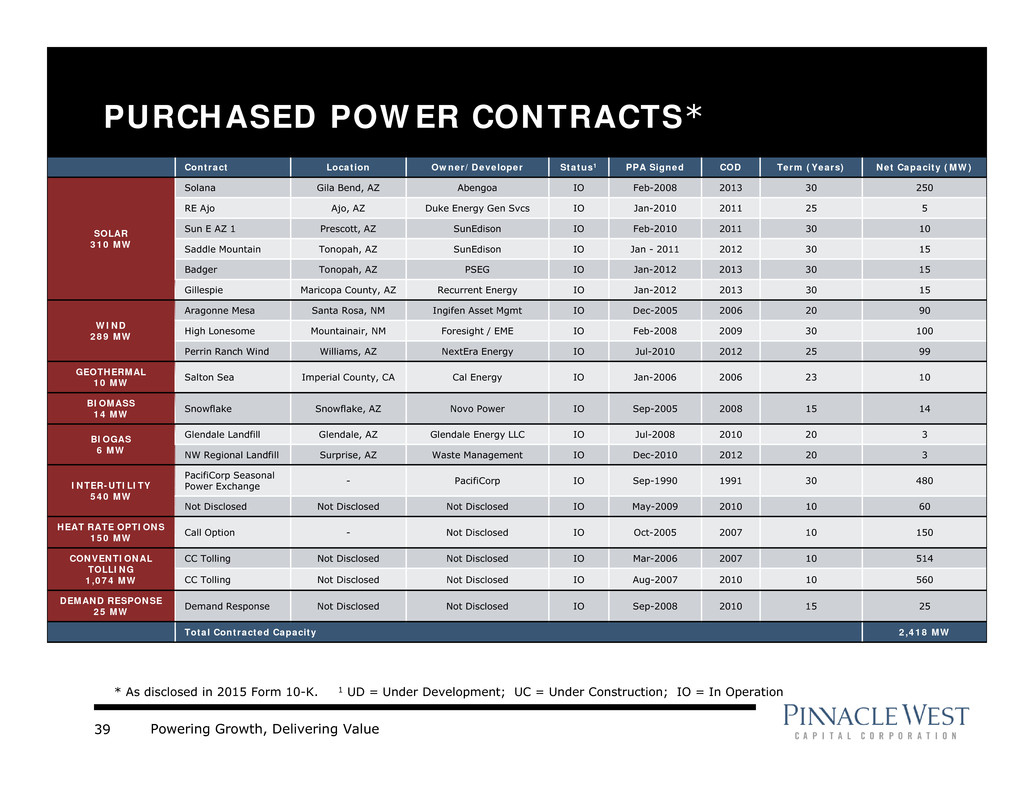

Powering Growth, Delivering Value39 PURCHASED POWER CONTRACTS* Contract Location Owner/Developer Status1 PPA Signed COD Term (Years) Net Capacity (MW) SOLAR 310 MW Solana Gila Bend, AZ Abengoa IO Feb-2008 2013 30 250 RE Ajo Ajo, AZ Duke Energy Gen Svcs IO Jan-2010 2011 25 5 Sun E AZ 1 Prescott, AZ SunEdison IO Feb-2010 2011 30 10 Saddle Mountain Tonopah, AZ SunEdison IO Jan - 2011 2012 30 15 Badger Tonopah, AZ PSEG IO Jan-2012 2013 30 15 Gillespie Maricopa County, AZ Recurrent Energy IO Jan-2012 2013 30 15 WIND 289 MW Aragonne Mesa Santa Rosa, NM Ingifen Asset Mgmt IO Dec-2005 2006 20 90 High Lonesome Mountainair, NM Foresight / EME IO Feb-2008 2009 30 100 Perrin Ranch Wind Williams, AZ NextEra Energy IO Jul-2010 2012 25 99 GEOTHERMAL 10 MW Salton Sea Imperial County, CA Cal Energy IO Jan-2006 2006 23 10 BIOMASS 14 MW Snowflake Snowflake, AZ Novo Power IO Sep-2005 2008 15 14 BIOGAS 6 MW Glendale Landfill Glendale, AZ Glendale Energy LLC IO Jul-2008 2010 20 3 NW Regional Landfill Surprise, AZ Waste Management IO Dec-2010 2012 20 3 INTER-UTILITY 540 MW PacifiCorp Seasonal Power Exchange - PacifiCorp IO Sep-1990 1991 30 480 Not Disclosed Not Disclosed Not Disclosed IO May-2009 2010 10 60 HEAT RATE OPTIONS 150 MW Call Option - Not Disclosed IO Oct-2005 2007 10 150 CONVENTIONAL TOLLING 1,074 MW CC Tolling Not Disclosed Not Disclosed IO Mar-2006 2007 10 514 CC Tolling Not Disclosed Not Disclosed IO Aug-2007 2010 10 560 DEMAND RESPONSE 25 MW Demand Response Not Disclosed Not Disclosed IO Sep-2008 2010 15 25 Total Contracted Capacity 2,418 MW 1 UD = Under Development; UC = Under Construction; IO = In Operation* As disclosed in 2015 Form 10-K.

Powering Growth, Delivering Value40 INVESTOR RELATIONS CONTACTS Paul J. Mountain, CFA Director, Investor Relations Telephone: (602) 250-4952 E-mail: paul.mountain@pinnaclewest.com Chalese Haraldsen Telephone: (602) 250-5643 E-mail: chalese.haraldsen@pinnaclewest.com Pinnacle West Capital Corporation P.O. Box 53999, Mail Station 9998 Phoenix, Arizona 85072-3999 Fax: (602) 250-2601 Visit us online at: www.pinnaclewest.com