Attached files

| file | filename |

|---|---|

| EX-10.22 - EXHIBIT 10.22 - HMS HOLDINGS CORP | exh_1022.htm |

| EX-10.33 - EXHIBIT 10.33 - HMS HOLDINGS CORP | exh_1033.htm |

| EX-10.21 - EXHIBIT 10.21 - HMS HOLDINGS CORP | exh_1021.htm |

| EX-31.1 - EXHIBIT 31.1 - HMS HOLDINGS CORP | exh_311.htm |

| EX-32.1 - EXHIBIT 32.1 - HMS HOLDINGS CORP | exh_321.htm |

| EX-32.2 - EXHIBIT 32.2 - HMS HOLDINGS CORP | exh_322.htm |

| EX-23.1 - EXHIBIT 23.1 - HMS HOLDINGS CORP | exh_231.htm |

| EX-31.2 - EXHIBIT 31.2 - HMS HOLDINGS CORP | exh_312.htm |

| EX-21.1 - EXHIBIT 21.1 - HMS HOLDINGS CORP | exh_211.htm |

| EX-10.23 - EXHIBIT 10.23 - HMS HOLDINGS CORP | exh_1023.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2015 | |

| Or | |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to | |

Commission File Number 000-50194

HMS HOLDINGS CORP.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

11-3656261 (I.R.S. Employer Identification No.) |

5615 High Point Drive, Irving, TX (Address of principal executive offices) |

75038 (Zip Code) |

(Registrant’s telephone number, including area code)

(214) 453-3000

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Name of each exchange on which registered | |

| Common Stock $0.01 par value | NASDAQ Global Select Market |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer x | Accelerated Filer o | Non-Accelerated Filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes o No x

The aggregate market value of the registrant’s common stock held by non-affiliates as of June 30, 2015, the last business day of the registrant’s most recently completed second quarter was $1.5 billion based on the last reported sale price of the registrant’s Common Stock on the NASDAQ Global Select Market on that date. Solely for purposes of this disclosure, shares of common stock held by executive officers and directors of the registrant as of such date have been excluded because such persons may be deemed to be affiliates. This determination of executive officers and directors as affiliates is not necessarily a conclusive determination for any other purposes.

There were 84,005,986 shares of common stock outstanding as of February 25, 2016.

Documents Incorporated by Reference

Unless provided in an amendment to this Annual Report on Form 10-K, the information required by Part III is incorporated by reference to the registrant’s 2016 proxy statement, to the extent stated herein. Such proxy statement or amendment will be filed with the SEC within 120 days of the registrant’s fiscal year ended December 31, 2015.

HMS HOLDINGS CORP. AND SUBSIDIARIES

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

Special Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. From time to time, we also provide forward-looking statements in other materials we release to the public, as well as oral forward-looking statements. Such statements give our expectations or forecasts of future events; they do not relate strictly to historical or current facts.

We have tried, wherever possible, to identify such statements by using words such as “aim,” “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “intend,” “likely,” “may,” “plan,” “project,” “seek,” “target,” “will,” “would,” “could,” “should,” and similar expressions and references to guidance. In particular, these include statements relating to future actions, business plans, objectives and prospects, future operating or financial performance or results of current and anticipated services, acquisitions and the performance of companies we have acquired, sales efforts, expenses, interest rates, financial results, the outcome of contingencies, such as litigation, and the impact of current, pending and future U.S. healthcare legislation or changes to healthcare spending affecting Medicare, Medicaid or other publicly funded or subsidized health programs.

We cannot guarantee that any forward-looking statement will be realized. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Should known or unknown risks or uncertainties materialize, or should underlying assumptions prove inaccurate, actual results could differ materially from past results and those anticipated, estimated or projected. We caution you, therefore, against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in this Annual Report on Form 10-K and in particular, the risks discussed under the heading “Risk Factors” in Part I, Item 1A of this Annual Report on Form 10-K and those discussed in other documents we file with the Securities and Exchange Commission.

Any forward-looking statements made by us in this Annual Report on Form 10-K speak only as of the date on which they are made. Factors or events that could cause actual results to differ may emerge from time to time and it is not possible for us to predict all of them. We undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. You are advised, however, to consult any further disclosures we make on related subjects in our Form 10-Q and Form 8-K reports and our other filings with the Securities and Exchange Commission.

HMS Holdings Corp. is a holding company whose principal business is conducted through its operating subsidiaries. Unless the context otherwise indicates, references in this Annual Report to the terms “we,” “our” and “us” refer to HMS Holdings Corp., and its subsidiaries and its affiliates.

General Overview

We operate in the U.S. healthcare insurance benefit cost containment marketplace. We provide coordination of benefits services to government and private healthcare payers and sponsors to ensure that the responsible party pays healthcare claims. Our payment integrity services ensure that healthcare claims billed are accurate and appropriate. Together, these various services help customers recover improper payments, including those from liable third parties; prevent future improper payments; reduce fraud, waste and abuse; and ensure regulatory compliance.

Demand for our services arises, in part, from healthcare funds spent in error, where another payer was actually responsible for the cost of the healthcare claim, or a mistake was made in applying complex claim processing rules. According to the Centers for Medicare & Medicaid Services (“CMS”) National Health Expenditures 2014-2024 projections (the “CMS NHE Projections”) and error rates published on paymentaccuracy.gov, the government estimates that improper payments in the Medicaid and Medicare programs totaled $117 billion in 2015. Our services focus on containing costs by detecting and reducing the errors that result in improper payment, and our revenues are based, in part, on the amounts we recover for our customers.

| 1 |

Our customers are state Medicaid agencies, government health agencies and health plans, including Medicaid managed care, Medicare Advantage and group and individual health lines of business; government and private employers; and other healthcare payers and sponsors, including child support agencies. As of December 31, 2015, we served 45 state Medicaid programs and the District of Columbia, and government health agencies, including CMS and the Veterans Health Administration (“VHA”). We also provided services to approximately 250 health plans and supported their multiple lines of business. We additionally served as a subcontractor for certain business outsourcing and technology firms.

Our revenue for the year ended December 31, 2015 was $474.2 million, an increase of $31.0 million, or 7.0%, from 2014 revenue of $443.2 million, primarily as a result of the expansion of services to our existing customers and growth through serving private health plan customers which exceeded the decline in Medicare RAC revenue.

Over the years, we have grown both organically and through targeted acquisitions. Initially, we provided coordination of benefits services to state Medicaid agencies. When Medicaid began to delegate members to managed care organizations, we began providing similar coordination of benefits services to those health plans. We launched our payment integrity services in 2007 and subsequently acquired several businesses to expand our service offerings. In 2009, we began providing cost containment services for Medicare with our acquisition of IntegriGuard, LLC (“IntegriGuard”), which does business as our wholly owned subsidiary HMS Federal, providing fraud, waste and abuse analytical services to the Medicare program, the Veterans Health Administration (“VHA”) and the Department of Defense. In 2009 and 2010, we began providing cost containment services to large self-funded employers through our acquisitions of Verify Solutions, Inc. and Chapman Kelly, Inc. In 2011, we expanded our cost containment services among federal, state and health plan payers with our acquisition of HealthDataInsights, Inc. (“HDI”). HDI provides improper payment identification services for government and private health plans, and is the Medicare Recovery Audit Contractor (“RAC”) in CMS Region D, covering 17 states and three U.S. territories. In December 2012, we extended our workers’ compensation recovery services to health plans through our asset purchase of MedRecovery Management, LLC.

The Healthcare Environment

The largest government healthcare programs are Medicare, the healthcare program for aged and disabled citizens that is administered individually by CMS and Medicaid, the program that provides medical assistance to eligible low income individuals, which is also regulated by CMS, but administered by states. For 2016, Medicare and Medicaid are projected to pay approximately 44.9% of the nation’s healthcare expenditures and serve over 128 million beneficiaries. Many of these beneficiaries are enrolled in managed care plans, which have the responsibility for both patient care and claim adjudication, though many states also continue to manage the care for certain populations on a fee for service basis.

By law, the Medicaid program is required to be the payer of last resort; that is, all other available third party resources must meet their legal obligation to pay claims before the Medicaid program pays for the care of an individual enrolled in Medicaid. Under Title XIX of the Social Security Act, states are required to take all reasonable measures to ascertain the legal liability of “third parties” for healthcare services provided to Medicaid recipients. Since 1985, we have provided state Medicaid agencies with services to identify third parties with primary liability for Medicaid claims, and since 2005, we have provided similar services to Medicaid managed care plans.

In accordance with the Medicare Prescription Drug Improvement and Modernization Act of 2003, CMS began a demonstration project utilizing recovery audit contractors to assist Medicare in identifying improper payments made to healthcare providers and suppliers. The demonstration project began in 2005 with six pilot states and was viewed as a success with Medicare RACs identifying over $900 million in overpayments and underpayments on claims of healthcare services provided to Medicare beneficiaries. The success of the demonstration project led Congress to pass the Tax Relief and Health Care Act of 2006, which made the Medicare RAC Program permanent and authorized its expansion to all 50 states by January 1, 2010.

Signed into law in February 2006, the Deficit Reduction Act of 2005 (the “DRA”) established a Medicaid Integrity Program to increase the government’s capacity to prevent, detect and address fraud, waste and abuse in the Medicaid program. The DRA also added new entities, such as self-insured plans, Pharmacy Benefit Managers (“PBMs”) and other “legally responsible” parties to the list of entities subject to the third party liability (“TPL”) provisions of the Medicaid statute. These measures, at both the federal and state level, have strengthened our ability to identify and recover erroneous payments made by our customers.

| 2 |

The Patient Protection and Affordable Care Act (the “ACA”) was signed into law in 2010. This legislation touched almost every sector of the healthcare system, and affords us a range of growth opportunities across a number of services. We are focused on three critical areas related to this legislation:

| · | Medicaid Expansion |

| · | Payment Integrity, and |

| · | Employer-Sponsored Health Coverage |

Medicaid Expansion: States that expand their Medicaid programs in accordance with the ACA receive federal funding for the total cost of the expansion for a period of three years, and reduced funding thereafter. As of early 2016, approximately two-thirds of the states opted to expand their Medicaid programs as provided under the ACA. According to the CMS NHE Projections, the number of individuals enrolled in Medicaid and the Children’s Health Insurance Program (“CHIP”) is expected to increase from 77.9 million in 2016 to 84.6 million in 2024, with expenditures over the same period expected to increase from $585 billion to $915 billion. As a result, we anticipate continued demand for our cost containment services by states and the managed care organizations they contract with. We believe that our strong history of successful contracting with Medicaid agencies and Medicaid managed care organizations will enable us to continue providing value-added services to help control the escalating costs for this expanded population.

Payment Integrity: The ACA contained a number of provisions for combating fraud, waste and abuse throughout the healthcare system, including in Medicaid and Medicare. These initiatives include: (i) requiring state Medicaid agencies to contract with state Medicaid RACs and deploy programs modeled on the Medicare RAC Program administered by CMS, (ii) expanding the Medicare RAC Program to include Medicare Part C and D, (iii) establishing a national healthcare fraud, waste and abuse data collection program and (iv) increasing scrutiny of providers and suppliers who want to participate in Medicare, Medicaid and other federally-funded programs. The ACA further required that each state establish a Medicaid RAC program by January 1, 2012. In addition, the ACA allowed for significant increases in funding for these and other fraud, waste and abuse efforts. We continue to seek opportunities to expand our current partnerships with CMS, states and health plans and to provide innovative ideas to support their payment integrity initiatives.

Employer-Sponsored Health Coverage: The ACA largely preserves and builds upon the existing employer-sponsored health coverage model. Though not all employers will be required to provide healthcare coverage, large employers (i.e. those with 50 or more full time equivalents) will be penalized starting in 2016 if (i) they do not offer coverage (or if they offer coverage that does not meet certain requirements) and (ii) one or more of their full time employees receives a federal tax credit or cost sharing subsidy through a health insurance exchange. Employers will also be prohibited from imposing waiting periods for enrollment of more than 90 days. We expect that we will be able to offer a range of audit services to employers of all sizes, which will be valuable as these employers extend coverage to their employees.

The healthcare environment continues to change as new programs are established, such as the Medicare prescription drug program and the Marketplace Exchanges, and new opportunities for oversight and improved program integrity are created. Our expertise in helping healthcare payers control costs and recover improper payments through various cost saving measures add value to the sustainability of large government healthcare programs. Although these changes in the healthcare environment create opportunities for us, they sometimes cause us to reevaluate our current business. One primary example of this is the current Medicare RAC Program. As a result of increased Medicare RAC activity and other payer pressures, which include reducing overall costs and improving quality of services provided, healthcare systems have experienced an accelerated shift in patients moving from inpatient to outpatient care. In response to concerns over this growing trend, in August 2013, CMS issued CMS Rule 1599-F, Hospital Inpatient Admission Order and Certification and Two Midnight Benchmark for Inpatient Hospital Admissions for the Fiscal Year 2014 Inpatient Prospective Payment System / Long-Term Care Hospital (the “Two Midnight Rule”) in order to clarify Medicare’s inpatient policy around when it is appropriate to admit a patient to the hospital for an inpatient stay versus when they should receive outpatient services. The Two Midnight Rule redefined the requirements for an inpatient stay with a new formal time-based standard, which initially stated that surgical procedures, diagnostic tests and other treatments (in addition to services designated as inpatient-only), are generally appropriate for inpatient hospital admission and payment under Medicare Part A when a physician (i) expects the beneficiary to require a stay that crosses at least two midnights and (ii) admits the beneficiary to the hospital based upon that expectation.

As part of the Rule’s implementation, CMS suspended the Medicare RACs’ review of inpatient hospital claims paid between October 2013 and September 2014 to determine whether the inpatient hospital admission and patient status was appropriate. CMS subsequently extended the delay of the enforcement of Two Midnight Rule claims by Medicare RACs through January 2016 in accordance with the passage of certain legislative and regulatory actions. In October 2015, CMS released updates to the Two Midnight Rule as part of CMS’ final outpatient payment rule, Calendar Year (CY) 2016 Hospital Outpatient Prospective Payment System. The final rule provided, among other things, that inpatient admissions where a physician expects the patient to need less than two midnights would be payable under Medicare Part A on a case-by-case basis. CMS also announced that Quality Improvement Organizations (“QIOs”) would assume the responsibility for conducting initial reviews of short inpatient stays and refer claim denials to Medicare Administrative Contractors. Medicare RACs would resume patient status reviews for claims with admission dates of January 1, 2016 or later that were based on providers with high denial rates upon referral by QIOs.

| 3 |

In August 2014, in response to litigation by the American Hospital Association that cited (i) ambiguities around Medicare’s hospital inpatient payment policy, (ii) flaws with CMS’ policy to fully deny payments to hospitals for these claims and (iii) that hospitals were denied timely due process because the Office of Medicare Hearings and Appeals (OMHA) had a serious backlog and was not hearing hospital appeals, CMS announced it would settle with hospitals willing to withdraw inpatient status claims currently pending in the appeals process by offering to pay hospitals 68% for all eligible claims that they have billed to Medicare. On February 9, 2016, the D.C. Circuit Court of Appeals decided to remand the case to the U.S. District Court for the District of Columbia regarding mandamus relief for three hospitals whose appeals were significantly delayed due to OMHA’s appeals backlog. While the Circuit Court’s decision agrees with plaintiffs’ expectations of an appeals process that meets statutory timeframes and their argument that Medicare RAC denials have greatly contributed to the backlog, the decision also recognized that Congress’s recent introduction of Senate Bill 2368, the Audit & Appeals Fairness, Integrity, and Reforms in Medicare (AFIRM) Act of 2015, could be viewed as significant progress towards reducing the appeals backlog and solving many of the appeals issues cited in the AHA litigation. Even if the AFIRM Act is passed, however, it will take time to reduce the backlog and improve the appeals process. As such, we believe it is likely that the current ADR limits and other review restraints will continue until substantial changes to the appeals process are implemented. We will continue to closely follow developments related to this legislation in order to further evaluate the potential impact it may have on our business.

We believe that the need and desire to have a Medicare Recovery Audit program remains a goal for CMS, however the current constraints within the program regarding the number of claims that can be reviewed, the lack of an adequate structure for establishing contingent revenue and the general uncertainty around the program raises concerns about its viability. We remain confident that we have a robust business model that has demonstrated an ability to recover hundreds of millions of dollars for the customers we serve. Our commitment to reduce fraud, waste and abuse in these government healthcare systems remains strong and we will continue to review our business model while we work with our customers to improve the program.

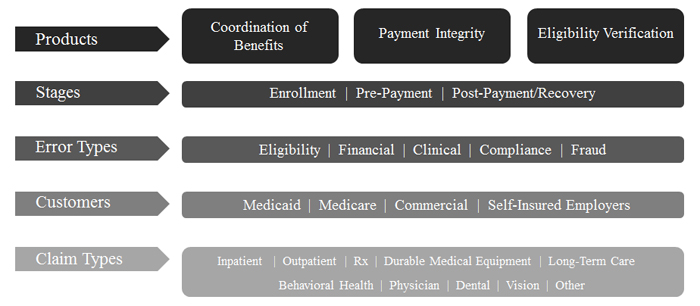

Principal Products and Services

Our coordination of benefits offering to customers consists of services that draw principally upon proprietary information management and data mining techniques designed to ensure that the right party pays a healthcare claim. Our payment integrity offering to customers also consists of a variety of services designed to ensure that the billing and/or payment is accurate and appropriate. As a result of our services, customers received billions of dollars in cash recoveries in 2015, and saved billions more through the prevention of erroneous payments.

Our services are applicable to federal, state and private health plans and address errors across the payment continuum, from an individual’s enrollment in a program before any medical service is rendered, to pre-payment review of a claim by a payer, through recovery audit where discovery of an improper payment is made. Our services also address the wide spectrum of payment errors, from eligibility and coordination of benefits errors, to the identification and investigation of potential fraud, and extend to most claim types.

In general, our range of services includes the following:

| · | Coordination of benefits services. We provide cost avoidance services, in which we provide validated insurance coverage information that is used by government-sponsored payers to coordinate benefits properly for future claims that they receive. With validated insurance information, Medicaid payers can avoid unnecessary costs by ensuring––– that they pay only after all other benefits available have been exhausted, thereby complying with federal regulations that require Medicaid to be the payer of last resort. Nevertheless, due to a variety of factors, some Medicaid claims are paid even when there is a known responsible third party. Our government-sponsored program customers rely on us to identify those claims that were paid in error and recover these payments from the liable third party. Further, we also provide services to assist customers in identifying other third-party insurance and recovering medical expenses where a member is involved in a casualty or tort incident. Lastly, for Medicaid agencies exclusively, we provide estate recovery services to identify and recover Medicaid expenditures from the estates of deceased Medicaid members in accordance with state policies. |

| 4 |

| · | Payment integrity services. Our payment integrity services are designed to verify that medical services are utilized, billed and paid appropriately. Our services combine data analytics, clinical expertise and proprietary technology to identify improper payments on both a pre-payment and post-payment basis; identify and recover overpayments/underpayments; detect and prevent fraud, waste and abuse; and identify process improvements. |

| · | Eligibility verification services. Our eligibility verification services are designed to ensure that individuals meet qualifying criteria for enrollment in a healthcare program. These services include premium assistance, dependent eligibility audits and other verification solutions. |

Customers

For the years ended December 31, 2015 and 2014, respectively, none of our customers accounted for more than 10% of our total revenue. For the year ended December 31, 2013, one customer accounted for 22.3% of our total revenue.

The list of our ten largest customers changes periodically. For the years ended December 31, 2015, 2014 and 2013, our ten largest customers represented 44.0%, 40.1% and 47.2% of our total revenue, respectively. The current terms of our agreements with these customers have expiration dates between 2016 and 2020. The failure to reprocure a contract with one of these customers may have a material adverse effect on our financial condition, results of operations and cash flows.

We provide products and services under contracts (or sub-contracts) that contain various revenue structures, including contingent revenue and fixed fee arrangements. Most of our contracts have terms of three to five years, including optional renewal terms. In many instances, we provide our services pursuant to agreements that are subject to periodic reprocurements. Several of our contracts, including those with some of our largest customers, may be terminated for convenience. Because we provide our services pursuant to agreements that are open to competition from various businesses in the U.S. healthcare insurance benefit cost containment marketplace, we cannot provide assurance that our contracts, including those with our largest customers, will not be terminated for convenience, awarded to other parties, or renewed, and, if renewed, that the fee structures will be equal to those currently in effect.

Industry Trends/Opportunities

As government healthcare programs continue to grow, their ability to contain healthcare expenditures presents challenges due to the number and variety of programs at the state and federal level, the government appropriations process and the rise in the cost of care and number of beneficiaries. CMS has projected that Medicaid, CHIP and Medicare expenditures will increase to nearly $2.1 trillion by 2024. The ACA further added increased pressure on states to cover more individuals, making cost containment a high priority.

According to the CMS HNE projections, Medicare programs in 2015 covered approximately 54.5 million people and spent approximately $646 billion and Medicaid/CHIP programs covered approximately 76 million people and spent approximately $560 billion. Altogether, it is projected that the government programs we serve covered approximately 131 million people and spent $1.2 trillion in 2015. We believe that enrollment in these programs will continue to increase as a result of the ACA.

According to the CMS NHE Projections, Medicaid enrollment is projected to grow by 2.1% in 2016 over 2015, and 2.5% in 2017 over 2016. Total Medicaid spending is projected to increase at a rate of 4.5% in 2016 over 2015, and at a rate of 5.3% in 2017 over 2016. In addition, Medicare spending is projected to grow 6.1% in 2016 over 2015 and up to 20% in 2018 over 2015. There are a number of factors that could impact these projections, including medical utilization by the new enrollees under the ACA and any legislative action taken to reduce spending.

| 5 |

In response to pressures to contain the growth of state and federal Medicaid spending and to concerns about access to healthcare for low-income individuals, the use of managed care arrangements in Medicaid continues to grow. In 2015, 38 states and the District of Columbia contracted with managed care organizations to provide care to some or all of their Medicaid beneficiaries. In addition, many states have expanded the use of managed care organizations to new regions or to serve beneficiaries with more complex conditions. Of the 31 states and the District of Columbia that opted to expand Medicaid eligibility levels by early 2016 pursuant to the ACA, all except for four use Medicaid managed care organizations. The majority of new lives that have entered the Medicaid program as a result of the ACA are enrolled in managed care organizations.

Similarly, health plans also continue to assume risk for Medicare lives, with the Kaiser Family Foundation estimating that in 2015, nearly one-third of all Medicare recipients had enrolled in a Medicare Advantage plan. As health plans continue to focus on strategies to contain costs across their different lines of business, we’ll continue to focus on serving these health plans and meet their evolving needs. Regardless of the program, coordinating benefits among a growing number of healthcare payers and ensuring that claims are paid appropriately represents an enormous challenge for our customers and an ongoing opportunity for us.

Competition

The U.S. healthcare insurance benefit cost containment marketplace is a dynamic industry with a range of businesses currently able to offer cost containment services, both directly or indirectly (through subcontracting), to some or all of the various healthcare payers. In addition, with improvements in technology and the growth in healthcare spending, new businesses are incentivized to enter this marketplace. Competition is therefore robust as customers have many alternatives available to them in their effort to contain healthcare costs. In addition, many healthcare payers have the ability to perform some or all of these cost containment services themselves and choose to exercise that option.

Within our core coordination of benefits services, we compete primarily with large business outsourcing and technology firms, claims processors (including PBMs), clearinghouses, healthcare consulting firms, smaller regional vendors and other TPL service providers; these companies include Optum, Inc., Public Consulting Group, Inc., Emdeon Inc., HP and Xerox. In addition, as noted, we frequently work with customers who may elect to perform some or all of their recovery and cost avoidance functions in-house.

The competitive environment for payment integrity services includes some of the same companies that provide coordination of benefits services, as well as other Medicare RACs (CGI Federal, Inc., Cotiviti and Performant Financial Corp.); other claim audit vendors (including Cognosante and Myers & Stauffer LC); fraud, waste and abuse claim edit and predictive analysis companies (such as Emdeon, Inc., Verisk Health, Inc. and LexisNexis Risk Solutions); and numerous regional utilization management companies.

We compete based on a variety of factors, including our ability to perform a wide range of coordination of benefits-and payment integrity related functions; maximize recoveries and cost avoidance; apply our in-depth government healthcare program experience, clinical staff expertise, extensive insurance eligibility database, proprietary systems and processes; leverage our existing relationships; and sustain operations under contingency fee structures.

Business Strategy

Over the course of 2016, we expect to grow our business through a number of strategic objectives or initiatives that may include:

| · | Retain existing customers and expand scope. We will seek to retain our current customer base and expand our role with them via new audit strategies, services and claim types. |

| · | Add new customers. We will continue to market to government healthcare payers; private health plans, including Medicaid managed care, Medicare Advantage and group and individual health lines of business; and private employers. |

| · | Add new services. We will continue to look for opportunities to add services closely related to cost containment through internal development and/or acquisition. |

| · | Drive organic growth. We will seek to tap demand for our services created by steadily increasing healthcare expenditures, in particular in the managed care environment. |

| · | Improve the quality and effectiveness of our services. We will continue implementing new technology and process improvements, which we expect will enable us to increase recovery yields and promote customer satisfaction. |

| 6 |

| · | Opportunistic growth via acquisition. Strategic acquisitions are part of our growth strategy, so we will continue selectively seeking strategic assets to acquire in our target industries in order to further enhance our product offerings. Our focus is on acquisitions that have long-term growth potential, target high-growth areas and fill a strategic need in our business portfolio as we seek to provide comprehensive solutions to our customers. |

Employees

As of December 31, 2015, we had 2,316 employees, of which 2,251 were full time. Of our total employees, 208 support selling, general and administrative activities.

Financial Information About Industry Segments

Since the beginning of 2007, we have been managed and operated as one business, with a single management team that reports to the chief executive officer. We do not operate separate lines of business with respect to any of our product lines. Accordingly, we do not prepare discrete financial information with respect to separate product lines or by location and do not have separately reportable segments as defined by the guidance provided by the Financial Accounting Standards Board (the “FASB”).

Available Information

We maintain a website (www.hms.com) that contains various information about our company and our services. Through our website, we make available, free of charge, access to all reports filed with the U.S. Securities and Exchange Commission (the “SEC”), including our Annual Reports on Form 10-K, our Quarterly Reports on Form 10-Q, our Current Reports on Form 8-K and our Proxy Statements, as well as amendments to these reports or statements, as filed with or furnished to the SEC pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”) as soon as reasonably practical after we electronically file such material with, or furnish it to, the SEC. In addition, the SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. You may also read and copy this information, including any materials we file with the SEC, for a copying fee, at the SEC’s Public Reference Room at 100 F Street NE, Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 to obtain information on the operation of the Public Reference Room. The content on any website referred to in this Annual Report on Form 10-K is not incorporated by reference into this Annual Report on Form 10-K unless expressly noted.

We also make current copies of the following documents available on our website under the Investor Relations/Corporate Governance tabs (http://investor.hms.com/corporate-governance.cfm) the Audit Committee Charter, the Compensation Committee Charter, the Nominating & Governance Committee Charter, the Compliance Committee Charter, our Code of Conduct and our Corporate Governance Guidelines. You may also obtain a copy of any of the foregoing documents, free of charge, if you submit a written request to Attention: Investor Relations, 5615 High Point Drive, Irving, Texas, 75038. We intend to disclose any future amendments or waivers to the provisions of our Code of Conduct that relate to our principal executive officer, principal financial officer, principal accounting officer, controller or persons performing similar functions by filing such information on a Current Report on Form 8-K with the SEC within four business days, to the extent such filing is required by the NASDAQ Marketplace Rules; otherwise, we will disclose such amendments or waivers by posting such information on our website.

Corporate Information

We are incorporated in the State of Delaware. We were originally incorporated on October 2, 2002 in the State of New York. On March 3, 2003, we adopted a holding company structure and assumed the business of our predecessor, Health Management Systems, Inc. In connection with the adoption of this structure, Health Management Systems, Inc., which began doing business in 1974, became our wholly owned subsidiary.

| 7 |

We provide the following cautionary discussion of risks, uncertainties and possibly inaccurate assumptions relevant to our business that, individually or in the aggregate, may cause our actual results to differ materially from expected and historical results. We note these factors for investors as permitted by the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. You should consider these factors, but understand that it is not possible to predict or identify all such factors. Consequently, you should not consider the following to be a complete discussion of all potential risks or uncertainties involved with investing in our stock. These risk factors should be read in connection with other information set forth in this Annual Report, including our Consolidated Financial Statements and the related Notes.

Risks Relating to Our Business

Changes in the United States healthcare environment, or in laws relating to healthcare programs and policies, and steps we take in anticipation of such changes, particularly as they relate to the ACA and the Medicare and Medicaid programs, could have a material adverse effect on our business, financial condition, results of operations and cash flows.

The healthcare industry in the United States is subject to changing political, economic and regulatory influences that may affect the procurement practices and operations of federal, state and private healthcare organizations and agencies. In general, the ACA sought to improve access to healthcare by making health insurance available to more legal U.S. residents. The legislation’s strong emphasis on program integrity and cost containment, along with its expansion of Medicaid, created new opportunities to grow our business and our service offerings. However, it will be difficult to predict its full impact and influence on future changes to Medicare policy, due not only to its complexity, but also to the wide range of other factors contributing to uncertainty of the healthcare landscape. Chief among these are the 2016 elections, where several candidates on the federal level have expressed their opposition to the ACA, and some on the state level oppose Medicaid expansion. In addition, certain provisions of the legislation may be repealed or modified. The Medicare RAC Program also faces increased opposition and ongoing legal challenges.

We have made and will continue to make investments in personnel, infrastructure and product development, as well as in the overall expansion of the services that we offer in order to support existing and new customers as they implement the requirements of the ACA. As states seek to contain costs with an expanding Medicaid population, we expect to continue to see an increase in the migration of Medicaid lives from fee-for-service to managed care plans. However, future changes to the ACA and to the Medicare and Medicaid programs may also lower reimbursement rates, establish new payment models, increase or decrease government involvement in healthcare, decrease the Medicare RAC Program, and/or otherwise change the operating environment for our customers. Healthcare organizations may react to such changed circumstances and financial pressures, including those surrounding the implementation of the ACA, by taking actions such as curtailing or deferring their retention of service providers like us, which could reduce the demand for our services. Our business, financial condition, results of operations and cash flows could be adversely affected if efforts to waive, modify or otherwise change the ACA, in whole or in part, are successful, if we are unable to adapt our products and services to meet changing requirements or expand service delivery into new areas, or the demand for our services is reduced as a result of healthcare organizations’ reactions to changed circumstances and financial pressures.

Healthcare spending fluctuations, simplification of the healthcare payment process or other aspects of the healthcare financing system, budgetary pressures and/or programmatic changes diminishing the scope of program benefits, or limiting payment integrity initiatives, could reduce the need for and the price of our services, which would have a material adverse effect on our business, financial condition, results of operations and cash flows.

Our projections and expectations are premised upon consistent growth rates in spending in the Medicare and Medicaid programs, the current healthcare financing system and the need for our services within that existing framework. As enrollment in government healthcare programs continue to grow, particularly under the ACA, we expect the complexities of the healthcare benefit and payment system to continue to grow (due to factors such as the expansion of pay-for-performance programs). Our success as a company is based on offering services that improve the ability of our customers to recover revenue that would otherwise be lost often as a result of procedural inefficiencies and complexities in that system. However, the need for our services, the price customers are willing to pay for them and/or the scope and profitability of our contracts could be negatively affected by a number of factors, including a lower than projected growth in Medicare and Medicaid programs due to developments such as lower medical utilization by new enrollees under the ACA and any legislative action taken to reduce spending. Compounding this are budgetary pressures that may drive changes at the state level, including shifting lives from traditional fee-for-service plans into Medicaid managed care plans to achieve cost savings.

| 8 |

The demand for our services could also be impacted by other changes in government healthcare programs or in the level of government spending, such as: the simplification of the healthcare benefit and payment system through legislative or regulatory changes at the federal or state level (for example, legislative changes impacting the scope of mandatory audits; limiting or reducing the amount of reviewable claims and/or the look-back period for review in areas where we conduct audits); unanticipated reductions in the scope of program benefits (such as, for example, state decisions to eliminate coverage of optional Medicaid services or shifting lives into managed care plans); and/or limits placed on ongoing program integrity initiatives. Modifications in provider billing behavior and habits, often in response to the success of our services or to legislative changes to reduce healthcare spending, could also reduce the profitability of our contracts and reduce the need for our services. For example, during 2014 and 2015, HDI’s recovery audit services under its existing Medicare RAC contract were limited because of delays in the award of the new contracts resulting from pre-award protests and ongoing litigation regarding certain payment terms proposed by CMS as part of the new Medicare RAC proposals. In addition, due to CMS’ implementation of the Two-Midnight Rule, HDI’s review of inpatient hospital claims lasting less than two midnights was suspended beginning in October 2013 and Medicare RACs are no longer permitted to conduct initial medical reviews of such short inpatient stays. Instead, Medicare RACs are now restricted to reviewing hospitals that have consistently high denial rates based on QIO patient status reviews or fail to improve their performance after QIO educational intervention and are subsequently referred to a Medicare RAC by QIOs. Moreover, in connection with the rule’s restrictions, CMS proposed a reimbursement cut in Medicare payments to hospitals in order to offset an anticipated increase in the number of inpatient admissions that would likely result from hospitals no longer having the ability to bill CMS for outpatient services on hospital stays lasting less than two midnights. Federal lawsuits have been filed by hospitals challenging the Two-Midnight Rule on the grounds that the proposed payment reduction violates the Administrative Procedure Act. Revenue associated with Two-Midnight Rule recoveries initiated by Medicare RACs historically were a significant finding for the Medicare RAC program prior to implementation of the moratorium; as a result, the continued suspension or termination of this type of review activity under the Two-Midnight Rule may have a material impact on our future revenue if HDI is awarded a new Medicare RAC contract, depending upon, among other factors, how the Two Midnight Rule is applied by providers, the review strategies ultimately approved by CMS, the scope of improper claims that CMS allows HDI, and the outcome of the federal court challenges to the Two-Midnight Rule. Any of these factors could cause our financial projections to differ from our actual results, and could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Further, in August 2014, CMS announced it would settle with hospitals willing to withdraw inpatient status claims currently pending in the RAC appeals process by offering to pay hospitals 68% for all eligible claims they had billed to Medicare. In June 2015, CMS notified HDI that based on the initial lists of finalized settlements, HDI owed CMS approximately $28.6 million due to adjustments in contingency fees pursuant to HDI’s contract with CMS. HDI had previously advised CMS that it disagreed with CMS’ interpretation of the contract and has requested additional support and accurate backup data for specific audits from CMS to further evaluate the potential impact of the hospital settlement on fees that it has been, or is due to be paid, and its respective position with respect to the resolution of the matter, which continues to remain uncertain at this time. While there are uncertainties in any dispute resolution and results cannot be guaranteed, HDI accrues an estimated liability for appeals based on the amount of fees that are subject to appeals, closures or other adjustments, which we estimate are probable of being returned to providers following a successful appeal. A portion of our reserve for estimated liability for appeals recorded as of December 31, 2015 may apply to this population, and there could be a material negative impact on our future revenue in future periods to the extent that (i) any final determination of amounts owed by HDI to CMS under the current Medicare RAC contract materially exceeds our accrued reserves for such appeals, (ii) HDI is required to return certain fees which have been paid or (iii) HDI’s ability to collect fees for audits already performed is affected.

Our business could be adversely affected if we fail to maintain a high level of customer retention, lose a major customer or fail to renew or reprocure a contract, or if customers elect to reduce the scope of our contracts or terminate them before their scheduled expiration dates.

Although each of our customers accounted for less than 10% of revenue from continuing operations in 2015, we generate a significant portion of our revenue from a limited number of large customers at the federal and state level. Our contracts with these customers are subject to periodic renewal and/or re-bidding processes and permit them to terminate their contracts on short notice, with or without cause. Since several of our contracts, including those with many of our largest customers, may be terminated upon short notice for convenience, dissatisfied customers might seek to exit existing contracts prior to their scheduled expiration date and could direct future business to our competitors. Government customers are also subject to financial pressures or pressure from stakeholders that may cause them to redefine or reduce the scope of our contracts (by, for example, significantly reducing the volume of data that we are permitted to audit) or terminate contracts for our services that may be regarded as non-essential. Despite our right to prompt and full payment under the terms of our contracts, we could face challenges in obtaining timely or full payments for our properly provided services from customers and parties who we provide services to. The unexpected termination, substantial reduction or failure to reprocure or renew a contract with a major customer could reduce our revenue and adversely affect our business.

| 9 |

Our success also depends on relationships we develop with our customers that enable us to understand our customers’ needs and deliver solutions and services that are tailored to meet those needs. If a customer is dissatisfied with the quality of our work or we fail to meet performance standards under our contracts, or if our products, technical infrastructure or services do not comply with the provisions of our contractual agreements or applicable regulatory requirements, we could incur additional costs that may impair the profitability of a contract and damage our ability to obtain additional work from that customer, or other current or prospective customers. For example, some of our contracts contain liquidated damages provisions and financial penalties related to performance failures, which if triggered, could adversely affect our reputation, business, financial condition, results of operations and cash flows. Although we have liability insurance, the policy coverage and limits may not be adequate to provide protection against all potential liabilities, and we may encounter, and have to litigate, disputes with our insurers over the existence and scope of coverage under those policies. We also may be required to disclose liquidated damages or other financial penalties assessed against us in connection with future bids for services with other customers, which may reduce our chances of winning such procurements. Further, under the terms of one of our contracts, we issued an irrevocable letter of credit for $3.0 million to secure our performance, which we established against our existing revolving credit facility. If a claim is made against this letter of credit or any similar instrument that we obtain in the future, we would be required to reimburse the issuer of the letter of credit for the amount of the claim.

If we lose a major customer; if we fail to maintain a high level of customer retention; if we fail to reprocure a contract; if our customers reduce the scope of our contracts or limit future contracting opportunities; or if we are exposed to significant costs, liabilities or negative publicity, our ability to compete for new contracts with current or prospective customers could be damaged and our business, financial condition, reputation, results of operations and cash flows could be materially adversely affected.

We face significant competition for our services and we expect competition to increase.

Competition among U.S. healthcare insurance benefit cost containment service providers is intense and we expect to encounter additional competition due primarily to advances in technology. Many of the cost containment services we provide are being targeted by formidable competitors with national reputations, and their success in attracting business or winning contract bids could significantly and/or adversely affect our business. Our current competitors include large business outsourcing and technology firms; the other Medicare RACs; Medicaid Management Information Systems (“MMIS”) vendors; other claim audit vendors; fraud, waste and abuse claim edit and predictive analysis companies; primary claims processors; numerous regional utilization management companies; analytics and software vendors; as well as clearinghouses, healthcare consulting firms and other TPL service providers.

In addition, current and prospective customers could compete by electing to perform some or all of their recovery and cost avoidance functions in-house, or they could develop in-house capacities for some of the services that we provide or hope to provide, therefore deciding not to engage us or reducing the quality of service they purchase from us. Certain state customers may decide to combine or “bundle” TPL services under large-scale IT procurements, allowing MMIS vendors to partner with less experienced TPL identification vendors based on preferred relationships or favorable pricing. Some of our competitors have also merged or formed business alliances with other competitors, which may affect our ability to work with potential customers. In some areas of our business, we could face potential competition from our current or former subcontractors or teaming partners, who may use their position to establish their own relationships with our customers and seek to become prime contractors on similar work in the future. As certain vendors and healthcare providers consolidate to create integrated systems with greater market recognition and financial resources, these entities may be able to offer lower prices or negotiate fee reductions on our current products and services. Although we attempt to protect ourselves against such conduct through the terms of our subcontracts and teaming agreements, a subcontractor or teaming partner may determine that the benefits of violating its contract with us outweigh the costs and risks.

We must remain competitive with our existing business and service capabilities and develop new products and services, which will require not only that we make substantial financial and resource investments, but that we quickly respond to new or emerging technologies and to changes in customer requirements and the healthcare industry. As industry standards continue to rapidly evolve, companies that have invested in proprietary technology different from our own product and service offerings, such as front-end analytics, have emerged as new competitors. There is also increasing sophistication in certain services and our competitors are constantly developing products and services that may become more efficient or appealing to our customers. Although the quality and value of new products introduced by competitors may be unknown, our current and future customers may decide to try these untested solutions because of the lower pricing models offered by our competitors. In certain cases, our competitors and potential competitors have significantly greater resources and market recognition than we have and may be able to devote greater resources to the sale of their services, the development and implementation of new and improved systems and solutions for the customers that we serve, or the pursuit of various acquisitions that allows them to quickly amass a wide array of capabilities. We cannot provide assurance that our new or modified product and service innovations will be responsive to customer preferences or industry changes, or that the product development initiatives that we prioritize will yield the gains that we anticipate, if any.

| 10 |

We cannot provide assurance that we will be able to compete successfully against existing or new competitors. In addition, we may be forced to lower our pricing, unexpectedly increase or enhance our technological or data capabilities, or modify our service offerings, or the demand for our services may decrease as a result of increased competition. Further, a failure to be responsive to our existing and potential customers’ needs or to the changing industry landscape could hinder our ability to maintain or expand our customer base, hire and retain new employees, pursue new business opportunities, complete future acquisitions and operate our business effectively. Any inability to compete effectively could materially adversely affect our business, financial condition, results of operations and cash flows.

If we are unable to protect our intellectual property rights the value of our products and services may be diminished and our business may be adversely affected.

Our success as a company depends in part upon our ability to protect our core technology and intellectual property. Our expanding operations and efforts to develop new products and services also make protection of our intellectual property more critical. However, the steps we have taken to deter misappropriation of intellectual property may be insufficient to protect our proprietary information. From time to time, competitors have attempted to use state open records and/or federal Freedom of Information Act laws to obtain our proposal responses and other documents we provide to our government customers. We cannot be certain that our efforts to protect the confidential and proprietary trade secret information or intellectual property in these proposals or other documents will always be successful, due to the many factors that go into the various state and federal decisions to release information in response to open records requests (even in spite of our objections and responses). In addition, misappropriation of our intellectual property by third parties, or any disclosure or dissemination of our confidential and proprietary business intelligence, queries, algorithms and other similar information by any means, could undermine any competitive advantage we currently derive or may derive from that intellectual property. For example, our current or former employees, consultants or other third parties may unintentionally or willfully disclose our trade secrets, know-how or other confidential and proprietary information to competitors. In order to enforce our rights, we may be required to engage in costly and time-consuming litigation or legal proceedings in which we may not ultimately prevail. On the other hand, third parties may claim that we are infringing upon or misappropriating their intellectual property. Our exposure to risks related to the use of intellectual property may also increase as a result of acquisitions since third parties may make infringement and similar or related claims after we have acquired technology. Any of these situations could cause us to expend significant time and resources and to incur substantial costs associated with litigation that may be necessary to defend ourselves or to enforce our intellectual property rights and could result in our being prevented from furnishing certain products and services. Although we have taken measures to protect our proprietary rights, we cannot provide assurance that others will not compete with our business by offering products or concepts that are substantially similar to ours. If the protection of our proprietary rights is inadequate to prevent unauthorized use or appropriation by third parties or our employees, the value of our brand and other intangible assets may be diminished and competitors may be able to more effectively mimic our products and services, which could have an adverse effect on our business, financial condition, results of operations and cash flows.

A federal or state government agency’s determination to award a contract may be challenged by an interested party. As a result, even if we win a bid, the contract may be delayed or may never be implemented if such a challenge is successful.

In order to market our services to customers, we are often required to respond to government-issued requests for proposals (“RFPs”) to compete for a contract. The state and federal laws and regulations governing procurements of goods and services provide procedures by which other bidders and other interested parties may challenge the award of a government contract. Challenges or protests to government awards may be filed even if there are no valid legal grounds on which to base the protest. If any such protests are filed, the government agency may decide to withhold a contract award or suspend performance under the contract while the protest is being considered, or may choose to take corrective action on its own, in each case, potentially delaying the start of the contract. If we are the original awardee of a protested contract, we could be forced to expend considerable funds to defend a potential award, while also incurring expenses to maintain our ability to timely start implementation in case the protest is resolved in our favor. It can take many months to resolve these protests, and even if it is resolved in our favor, the resulting delay in the start-up and funding of our work under the contracts may cause our actual results to differ materially and adversely from those anticipated. In the event of irregularities we perceive or learn of in the award or bidding process, we also may be forced to file protests in response to RFP awards to other bidders, at significant cost to us. In addition, a contract award may be terminated or the government agency may opt to solicit new bids and award a new contract if a protest is successful or the government agency chooses not to uphold its original award. We cannot provide assurance that we will prevail if a contract we are awarded is protested or that if we protest an award our challenge will be successful. Extended implementation delays or successful protests of our contract awards could have a material adverse effect on our financial condition or results of operations.

| 11 |

For example, our wholly owned subsidiary HDI has served as the Medicare RAC for Region D since October 2008. After multiple contract modifications due to the delay in procurement of the new Medicare RAC contract awards, HDI’s Medicare RAC contract now provides for a term that expires on July 31, 2016. The most recent extension further requires HDI to continue to support the appeal process from August 1, 2016 through January 31, 2018. CMS has also implemented new ADR limits for inpatient providers that set the ADR requirement to 0.5%, from the standards through 2015 of 2.0%. This change significantly impacts the volumes of claims Medicare RACs will review for inpatient providers and reduces their ability to identify overpayments and underpayments. On November 6, 2015, CMS released a new RFP for recovery audit services, including those currently performed by HDI, for each of the CMS Recovery Audit regions. This reprocurement replaces the procurement activities begun in February 2013 for the new Medicare RAC contracts, which were significantly delayed, in part, by the cancellation of the original and second procurements following the Government Accountability Office’s denial of pre-award protests and the ongoing litigation in regards to certain procurements terms. The current procurement has paused, pending the results of a second Request for Information (“RFI”) released by CMS on December 31, 2015 that sought to gather requirements for recovery auditing work for health plans. Changes to the procurement based on the RFI have not yet been made known. Currently, CMS’ answers to questions submitted regarding the Medicare RAC procurement are pending and a proposal due date has not been published. The timing and outcome of the new Medicare RAC contract awards continue to remain uncertain and the prolonged delay of the new contract awards may further impact our business. In addition, in the event HDI is awarded one or more regions, the new Medicare RAC contract may contain substantially different terms from HDI’s current contract and such terms may change or delay the timing of HDI’s revenue recognition under the current contract.

We obtain a significant portion of our business through competitive bidding in response to government requests for proposals and future contracts may not be awarded through this process on the same level and we may not reprocure certain contracts.

To effectively respond to government RFPs, we are often required to accurately estimate our cost structure for servicing a proposed contract, the time required to establish operations and the likely terms of any proposals submitted by our competitors. We must also assemble and submit a large volume of information within a RFP’s rigid timetable, and our ability to provide timely and complete responses to RFPs will greatly impact our business. Should any part of our business suffer a negative event, such as customer dispute, a government inquiry or an adverse judgment or settlement in a litigation proceeding, we may be required to disclose the occurrence of that event in a RFP, which could impact our ability to win the contract at issue. Even if we win these contracts, we are not always able to secure the most favorable contract terms and conditions with our government customers, which may impact our ability to protect our rights relating to payment, our intellectual property, our employees, and other contractual rights. We also cannot provide assurance that we will continue to obtain contracts in response to government RFPs, that we will be successful in re-winning contracts after they expire, or that our proposals will result in profitable contracts. In addition, if we are unable to win reprocurements on particular contracts, we may be precluded from entering certain customer markets for the term of the contract awarded to another party. If we are unable to consistently win new contract awards over any extended period, our business and prospects will be adversely affected.

Our ability to expand our business will be adversely affected if we fail to implement our growth strategy.

The size and the scope of our business operations have expanded over the past several years, and we expect that we will continue to grow and expand into new areas within the government and private healthcare space; however, such growth and expansion carries costs and risks that, if not properly managed, could adversely affect our business. Our future growth will depend, among other things, on our ability to successfully execute our business plans and continued efforts to improve our operations, all while remaining competitive. We must also be flexible and responsive to our customers’ needs and to changes in the political, economic and regulatory environment in which we operate. The greater size and complexity of our expanding business puts additional strain on our administrative, operational and financial resources and makes the determination of optimal resource allocation more difficult. We cannot provide assurance that we will be able to maintain or accelerate our growth. A failure to anticipate or properly address the demands and challenges that our growth strategy and potential diversification may have on our resources and existing infrastructure may result in unanticipated costs and inefficiencies and could negatively impact our ability to execute on our business plans and growth goals, which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

| 12 |

Our operating results are subject to significant fluctuations due to factors including variability in the timing of when we recognize contingency fee revenue and the challenges associated with forecasting revenue for new products and services. As a result, you will not be able to rely on our operating results in any particular period as an indication of our future performance.

Our operating results may fail to match our past or projected performance. We have experienced significant variations in our revenue between reporting periods due to the timing of periodic revenue recovery projects, the timing and delays in third party payers’ claim adjudication and ultimate payment to our customers where our revenue is contingent upon such collections and delays in receiving payment for our services. Our revenue and operating results have also been impacted from period to period as a result of a number of factors, including:

| · | fluctuations in sales activity given our sales cycle |

| · | the commencement, completion or termination of contracts during any particular quarter; |

| · | expenses related to certain contracts which may be incurred in periods prior to revenue being recognized; |

| · | the timing of government contract awards; |

| · | the time required to resolve bid protests; |

| · | contract renewal discussions, which result in delayed payments for previously provided services; |

| · | technological and operational issues affecting our customers, including delays in payment receipt for previously recognized revenue due to delays in certain customers processing our findings through their systems; |

| · | adjustments to age/quality of receivables and accruals as a result of delays involving contract limitations and changes or subcontractor performance deficiencies or internal managerial decision not to pursue identified claim revenue from customers; and |

| · | regulatory changes or general economic conditions as they affect healthcare providers and payers. |

Occasionally our state and federal customers are requested by third party payers to refund payments that we previously recovered for our customers. If our state and federal customers choose to refund money in response to these requests, regardless of whether an error actually occurred in connection with the payments, we may also be required to return contingent revenue which we were previously paid associated with such refunded payments. We also typically face a long implementation period with a new customer of a new contract with an existing customer and may not be able to estimate with certainty the period in which implementation may be completed. Although we do not consider our operations to be seasonal to any material degree, we have experienced some seasonal trends in our operational volume that have caused our operating results to fluctuate.

In addition, we may not be able to accurately estimate the factors upon which we base our contract pricing, or the costs and timing for implementing and completing contracts when we introduce new products and services into the marketplace, making it difficult to reliably forecast revenue under those contracts. For a majority of our customer contracts, the payment of our fee is contingent upon the recoveries received by our customers. We also have cost-plus or time-and-material based contracts with the federal government where our revenue is recognized based on costs incurred plus an estimate of the negotiated fee earned. Our ability to earn a profit on these contracts requires that we accurately estimate the costs involved with these contracts and assess the probability of achieving certain outcomes or milestones within the contracted time period. If we do not accurately estimate the costs and timing for completing projects, or if we encounter increased or unexpected costs, delays, failures, liabilities or risks, including those outside of our control, our contracts could prove unprofitable for us or yield lower profit margins than anticipated. Although we believe that we have recorded adequate provisions in our financial statements for losses on our fixed-price and cost-plus contracts where applicable, as required under United States generally accepted accounting principles (“U.S. GAAP”), we cannot provide assurance that our contract loss provisions will be adequate to cover all actual future losses. We cannot predict the extent to which future revenue variations could occur due to these or other factors. Consequently, our results of operations are subject to significant fluctuation and our results of operations for any particular quarter or fiscal year may not be indicative of results of operations for future periods.

| 13 |

We must comply with laws and regulations regarding individual privacy and information security, including taking steps to ensure that our workforce, vendors, subcontractors and other business associates who obtain access to sensitive information about individuals maintain its confidentiality. Our failure, or a failure by our business associates, to comply with those laws and regulations, whether or not inadvertent, could subject us to legal actions, fines and penalties and negatively impact our reputation and operations.

As a service provider, we often receive, process, transmit and store protected health information (“PHI”) of individuals, as well as other financial, confidential and proprietary information belonging to our customers, our subsidiaries and third parties (e.g., private insurance companies, financial institutions) from which we obtain information. The use and disclosure of that information is regulated through federal and state laws and rules, which are changed frequently by legislation, regulatory issuances and/or administrative interpretation. Various state laws address the use and disclosure of individually identifiable financial and health data. Some are derived from the privacy and security provisions such as in the federal Gramm-Leach-Bliley Act, the Health Insurance Portability and Accountability Act of 1996 (“HIPAA”), as amended by the Health Information Technology for Economic and Clinical Health Act (“HITECH”), and the regulations implementing these laws. HIPAA also imposes standards and requirements on our business associates (as this term is defined in the HIPAA regulations), including our subcontractors and many of our vendors.

In January 2013, the U.S. Department of Health and Human Services issued Final Omnibus Privacy, Security, Breach Notification, and Enforcement Rules that modified and supplemented many of the standards and regulations under HIPAA and HITECH. These rules significantly increased the risk of liability to us and our business associates and subcontractors and made more incidents of inadvertent disclosure reportable and subject to penalties. Even though we take measures to comply with all applicable regulations and to ensure our business associates and subcontractors comply with these laws, regulations and rules, we have less than complete control over our business associates’ and subcontractors’ actions and practices. In addition, we could also be exposed to data breach risk if there is unauthorized access to one of our or our subcontractors’ secure facilities or from lost or stolen laptops, other portable media from current or former employee theft of data containing PHI, from misdirected mailings containing PHI, or other forms of administrative or operational error. If we or our subcontractors fail to comply with applicable laws; if unauthorized parties gain physical access to one of our facilities and steals or misuses confidential information; if we erroneously use or disclose data in a way that is inconsistent with our granted rights; or if such information is misdirected, lost or stolen during transmission or transport, we may suffer damage to our reputation, potential loss of existing customers and difficulty attracting new customers. We could also be exposed to, among other things, unfavorable publicity, governmental inquiry and oversight, allegations by our customers that we have not performed our contractual obligations, costs to provide notifications to affected individuals, or litigation by affected parties and possible financial obligations for damages or indemnification obligations related to the theft or misuse of such information, any of which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Further, as regulatory focus on privacy issues continues to increase and laws and regulations concerning the protection of personal information expand and become more complex, these potential risks to our business could intensify. Changes in laws or regulations associated with the enhanced protection of certain types of sensitive data, such as healthcare data or other personally identifiable information, along with increased customer demands for enhanced data security infrastructure, could greatly increase our cost of providing our services. See Risk Factor - “Our systems and networks may be subject to cyber security breaches and other disruptions that could compromise our information and harm our business" for additional information.

System interruptions or failures could expose us to liability and harm our business.