Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - Front Yard Residential Corp | resi-20151231xex311.htm |

| EX-31.2 - EXHIBIT 31.2 - Front Yard Residential Corp | resi-20151231xex312.htm |

| EX-32.2 - EXHIBIT 32.2 - Front Yard Residential Corp | resi-20151231xex322.htm |

| EX-21 - EXHIBIT 21 - Front Yard Residential Corp | resi-20151231xex21.htm |

| EX-23 - EXHIBIT 23 - Front Yard Residential Corp | resi-20151231xex23.htm |

| EX-32.1 - EXHIBIT 32.1 - Front Yard Residential Corp | resi-20151231xex321.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2015 |

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

COMMISSION FILE NUMBER: 001-35657

Altisource Residential Corporation

(Exact name of registrant as specified in its charter)

MARYLAND | 46-0633510 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

c/o Altisource Asset Management Corporation

36C Strand Street

Christiansted, United States Virgin Islands 00820

(Address of principal executive office)

(340) 692-1055

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

(Title of Each Class) | (Name of exchange on which registered) |

Common stock, par value $0.01 per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer | x | Accelerated Filer | ¨ | ||

Non-Accelerated Filer | ¨ | (Do not check if a smaller reporting company) | Smaller Reporting Company | ¨ | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of common stock held by non-affiliates of the registrant was $587.3 million, based on the closing share price as reported on the New York Stock Exchange on June 30, 2015 and the assumption that all directors and executive officers of the registrant and their families and beneficial holders of 10% of the registrant's common stock are affiliates. This determination of affiliate status is not necessarily a conclusive determination for any other purpose.

As of February 22, 2016, 55,581,005 shares of our common stock were outstanding (excluding 1,645,075 shares held as treasury stock).

Portions of the registrant's definitive proxy statement for the registrant's 2016 annual meeting, to be filed within 120 days after the close of the registrant's fiscal year, are incorporated by reference into Part III of this Annual Report on Form 10-K.

Altisource Residential Corporation

December 31, 2015

Table of Contents

i

References in this report to "we," "our," "us," or the "Company" refer to Altisource Residential Corporation and its consolidated subsidiaries, unless otherwise indicated. References in this report to “AAMC” or to our “Manager” refer to Altisource Asset Management Corporation and its consolidated subsidiaries, unless otherwise indicated. References in this report to “Altisource” refer to Altisource Portfolio Solutions S.A. and its consolidated subsidiaries, unless otherwise indicated.

Special note on forward-looking statements

Our disclosure and analysis in this Annual Report on Form 10-K contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts” or “potential” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions.

The forward-looking statements contained in this report reflect our current views about future events and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause our actual results to differ significantly from those expressed in any forward-looking statement. Factors that may materially affect such forward-looking statements include, but are not limited to:

• | our ability to implement our business strategy; |

• | our ability to make distributions to our stockholders; |

• | our ability to acquire assets for our portfolio, including difficulties in identifying single-family rental assets and properties to acquire; |

• | our ability to sell residential mortgage assets on favorable terms; |

• | the impact of changes to the supply of, value of and the returns on residential mortgage or single-family rental assets; |

• | our ability to successfully modify or otherwise resolve sub-performing and non-performing loans; |

• | our ability to convert residential mortgage loans to rental properties or acquire single-family rental properties and generate attractive returns; |

• | our ability to predict our costs; |

• | our ability to effectively compete with our competitors; |

• | our ability to apply the proceeds from financing activities or residential mortgage loan asset sales to target assets in a timely manner; |

• | changes in the market value of our acquired real estate owned and single-family rental properties; |

• | changes in interest rates and in the market value of the collateral underlying our sub-performing and non-performing loan portfolios; |

• | our ability to obtain and access financing arrangements on favorable terms, or at all; |

• | our ability to maintain adequate liquidity; |

• | our ability to retain our engagement of AAMC; |

• | the failure of Altisource to effectively perform its obligations under various agreements with us; |

• | the failure of our mortgage loan servicers to effectively perform their servicing obligations; |

• | our failure to maintain qualification as a REIT; |

• | our failure to maintain our exemption from registration under the Investment Company Act; |

• | the impact of adverse real estate, mortgage or housing markets; |

• | the impact of adverse legislative, regulatory or tax changes; and |

• | general economic and market conditions. |

While forward-looking statements reflect our good faith beliefs, assumptions and expectations, they are not guarantees of future performance. Such forward-looking statements speak only as of their respective dates, and we assume no obligation to update them to reflect changes in underlying assumptions or factors, new information or otherwise. For a further discussion of these and other factors that could cause our future results to differ materially from any forward-looking statements contained herein, please refer to the section "Item 1A. Risk factors.”

ii

Part I

Item 1. Business

Overview

Altisource Residential Corporation is a Maryland real estate investment trust (“REIT”) focused on acquiring and managing quality, affordable single-family rental properties for working class families throughout the United States. We conduct substantially all of our activities through our wholly owned subsidiary, Altisource Residential, L.P., and its subsidiaries (the “Operating Partnership”). We operate in a single segment focused on the resolution of sub-performing and non-performing mortgages and acquisition and ownership of rental residential properties.

On December 21, 2012 we became a stand-alone publicly traded company with an initial capital contribution of $100 million. We have a long-term service agreement with Altisource Portfolio Solutions, SA (“Altisource”), a leading provider of real estate and mortgage portfolio management, asset recovery and customer relationship management services. We believe that our relationship with Altisource and access to its nationwide renovation and property management vendor network enables us to competitively bid on large portfolios of single-family residential properties or a multitude of targeted single-family properties on a one-by-one basis as well as sub-performing and non-performing mortgage loans, when and where deemed attractive by us. For the mortgage loans in our portfolio, we also have servicing agreements with three separate mortgage loan servicers.

We are managed by AAMC, which we rely on to administer our business and perform certain of our corporate governance functions. AAMC also provides portfolio management services in connection with the acquisition and management of our portfolio. AAMC was formed on March 15, 2012 as a wholly owned subsidiary of Altisource and was spun off from Altisource into a stand-alone publicly traded company concurrently with our separation from Altisource. On March 31, 2015, we entered into a new asset management agreement with AAMC (the “New AMA”) with an effective date of April 1, 2015.

Since we commenced operations, we have financed our business through a combination of equity offerings, repurchase

agreements, warehouse lines and securitizations.

Our Business Strategy

We are committed to becoming and maintaining our position as one of the top single-family rental REITs serving working class American families and their communities, while also providing consistent and robust returns on equity and long-term growth for our investors. We believe our business model provides us with operating capabilities that are difficult to replicate and positions us to opportunistically grow and effectively manage our portfolio of single-family rental properties.

First, we believe our diversified acquisition strategy enables us to acquire single-family rental properties at a high yield both (a) through the purchase of rental properties either in bulk or on a one-by-one basis and (b) through the acquisition and resolution of sub-performing and non-performing mortgage loans with the expectation of converting them into single-family rental properties. We believe this diversified approach provides us with more avenues of growth and provides us with an advantage over other acquisition strategies.

Second, our access to Altisource, which employs an established, nationwide renovation and property management infrastructure, provides us with immediate scale and a low cost structure that is unique in the industry today. With Altisource, we are not new to this industry. We are not just building a services platform, which most of our competitors are still doing. We do not need to determine out how to collect rents, complete renovations, manage properties on a large scale, determine how many call centers to have or how evictions really work when done carefully and thoughtfully, because Altisource has a well-developed platform to handle all of these things and more.

Third, our multi-faceted loan resolution methodologies, through our mortgage loan servicers, provide us with earnings capabilities in our non-performing loan portfolio that distinguish us from other single-family rental REITs. We have relationships with three separate, independent servicers who have broad experience in servicing non-performing loans and finding value in our loan portfolio. If we determine to continue building our single-family rental portfolio through additional non-performing and sub-performing loan portfolios, our experience with these servicers and their understanding of our business goals will enable us to continue to compete on various levels through the single-family rental conversion process.

1

We believe that our acquisition strategies, nationwide renovation and property management infrastructure and multi-faceted loan resolution capabilities provide us with multiple avenues of value creation that will help us to achieve our business objective of generating attractive risk-adjusted returns for our stockholders over the long term.

Acquisition Strategy

We employ a diversified single-family rental property acquisition strategy. Commencing in the second quarter of 2015, we expanded our acquisition strategy to opportunistically acquire portfolios of single-family rental properties in order to more quickly achieve scale in our rental portfolio. We expect to opportunistically source, bid on and acquire additional portfolios of single-family rental properties over the course of 2016.

In the second quarter of 2015, we also commenced a program to begin purchasing single-family residential properties on a one-by-one basis, sourcing listed properties from the Multiple Listing Service and alternative listing sources. Our first purchases of properties under this program occurred in the third quarter of 2015. As of February 22, 2016, we had purchased 124 properties pursuant to this one-by-one acquisition program and are continuing efforts to expand our capabilities to acquire more properties under this program on a quick and reliable basis.

Prior to the second quarter of 2015, our preferred acquisition strategy involved acquiring portfolios of sub-performing and non-performing mortgage loans. However, as market conditions evolved and the acquisition of sub-performing and non-performing mortgage loan pools became more competitive and higher-priced, we introduced the alternative single-family rental acquisition strategies described above. While we intend to continue to review and assess the acquisition of portfolios of sub-performing and non-performing mortgage loans, we believe that our strategy of acquiring portfolios of single-family rental properties will allow us to achieve scale in our rental portfolio more quickly and with more control over the value, location and projected returns on the targeted assets.

Access to Established Nationwide Property Management Infrastructure

We believe that our 15-year master services agreement with Altisource, pursuant to which Altisource provides us with property management, leasing, renovation management and valuation services, allows us to operate and manage single-family rental properties with cost and operational efficiency as well as predictability. This efficiency and predictability is driven by Altisource’s technology and global workforce. Altisource has developed a nationwide operating infrastructure enabled by technology and standardized and centrally managed processes. It also has a global back office organization that qualifies property management and renovation vendors, solicits the appropriate vendors to perform requested work, assigns the work to the vendor with the best possible combination of cost and delivery capabilities, provides uniform property management and inspection criteria and technology to review and assess properties, verifies that the vendor’s work is complete and pays the vendor. This technology and organizational infrastructure allows Altisource to provide services that we believe provide us with the following competitive advantages:

• | The cost structure associated with Altisource’s nationwide vendor network is not dependent upon scale; accordingly, unlike many of our competitors, we do not require a critical size of single-family rental properties to attain the operating efficiencies provided by Altisource's property management services; |

• | Single-family residential property and sub-performing and non-performing loan portfolios typically contain properties that are geographically dispersed, requiring a cost-effective nationwide property management system; we believe the use of Altisource positions us to bid effectively on single-family asset portfolios with large geographic dispersion; |

• | Altisource provides us with a low-cost, single source for full lifecycle rental property management services, including due diligence and acquisition support, renovations and repairs, lease marketing, tenant management and customer care; |

• | Altisource’s rental marketing strategy is specifically designed to advertise listings across popular industry-focused websites, utilizing their high organic and paid search rankings to generate large volumes of prospective tenants; |

• | Our contracted relationships with nationwide manufacturers and material suppliers, who are also used by Altisource, enable us to manage the ordering and delivery of flooring, appliances, paint, fixtures and lighting for all renovation and unit turn work (i.e. work associated with turnover from one tenant to the next); |

• | We have direct access to Altisource’s inspection and estimating application which is utilized by the third-party general contracting vendors to identify required renovation work and prepare detailed scopes of work to provide a consistent end product. In addition, this application catalogs major HVAC systems, appliances and construction materials, which can enable more accurate forecasting of long term maintenance requirements; and |

• | Ongoing tenant management services are coordinated through an internal “24x7” customer service center. |

2

As of December 31, 2015, Altisource managed more than 41,000 vacant pre-foreclosure and real estate owned (“REO”) assets in all 50 states, and these types of properties are far more intensive to manage than tenant-occupied rentals. Altisource has the capacity to conduct more than 247,000 inspections and 133,000 repair and maintenance orders on a monthly basis and has more than 9,300 centrally managed vendors operating nationwide. Altisource also leverages sophisticated systems and strong vendor oversight to mitigate risks for its clients, stringent enough to satisfy the requirements of two top-10 bank clients and one of the largest non-bank mortgage servicers in the United States. At least one analyst firm has ranked Altisource as the number seven brokerage company in the United States, operating in 50 states and managing over 32,000 transactions annually.

AAMC works directly with Altisource’s vendor management team on our behalf, and AAMC’s construction management team often interfaces with the general contractors and vendors to maintain relationships with the vendor network. Through AAMC’s team, we coordinate with Altisource and its personnel as well as the vendor network to establish a collective approach to the renovation management, maintenance, repair and materials supply chain to create a unified look and feel for our single-family rental properties.

Our master services agreement and other support agreements with Altisource are exclusive arrangements, and we believe that these relationships and our direct access to a large vendor network through Altisource provide us with significant competitive advantages over third parties with respect to acquiring and maintaining single-family rental properties. We expect to hold single-family rental property assets over the long term with a focus on developing brand and franchise value.

We also believe that the forecasted growth for the single-family rental marketplace, in combination with our projected asset management and acquisition costs and our ability to acquire high yielding assets nationwide, provides us with a significant opportunity to establish ourselves as a leading residential REIT.

Loan Resolution Activities

The management and/or sale of our legacy portfolio of residential mortgage loans is an important focus of our business. For the mortgage loans remaining in our portfolio, we seek to employ various loan resolution methodologies, through our servicers, with respect to our residential mortgage loans, including loan modification, collateral resolution and collateral disposition. To help us achieve our business objective, we continue to focus on converting a portion of our sub-performing and non-performing loans to performing status and managing the foreclosure process and timelines with respect to the remainder of those loans. Due to the continually evolving market dynamics and pricing of distressed mortgage loans, we are opportunistically evaluating the different alternatives with respect to our loan portfolio, including potential sales, continued resolution and possible acquisitions of such loans.

Disposition of Loans

As discussed above, our loan resolution strategy has typically led to the disposition of non-performing mortgage loans primarily through short sales, refinancing, foreclosure sales and the sale of loans that had transitioned to re-performing loans from prior non-performing loan acquisitions.

In the third quarter of 2015, we also commenced efforts to sell certain non-performing loans to take advantage of attractive market pricing and evolving market conditions. Sales of non-performing loans that do not meet our rental property criteria are expected to be a growth engine for our company, allowing us to recycle capital that we may use to purchase rental properties that meet our return profile. In the fourth quarter, we completed the first of such sales to two unaffiliated parties of 772 non-performing and re-performing loans with an aggregate unpaid principal balance (“UPB”) of approximately $309.6 million, representing 15% of our loan portfolio by UPB. The final sale price for these portfolios was within approximately 1% of the balance sheet carrying value.

In addition, in December 2015, we commenced an auction to sell an additional portfolio of 1,266 non-performing and re-performing mortgage loans with an aggregate UPB of $434.3 million, representing approximately 24% of our loan portfolio by UPB. On January 19, 2016, following the auction process, we agreed in principle to award the sale to an unrelated third party. The agreed upon price for this portfolio is within approximately 1% of our balance sheet carrying value. Subject to typical confirmatory due diligence and negotiation of a definitive purchase agreement, we expect to consummate this transaction in the first quarter of 2016. As is customary in these transactions, this confirmatory due diligence process may result in certain loans being removed from the sale or a repricing of certain loans; therefore, the final composition and proceeds of this portfolio sale are subject to adjustment depending on the final diligence results and further negotiation by the parties.

Following completion of the sale of this additional mortgage loan portfolio, we will have sold 2,227 non-performing and re-performing loans, including 189 loans sold during June 2015, with an aggregate UPB of $790.5 million. We may market

3

additional portfolios of non-performing loans in the future. It is anticipated that the proceeds generated from any such transactions would be utilized, in part, to facilitate our strategy to substantially grow its single-family rental assets through the purchase of portfolios of single-family residential properties and on a one-by-one basis.

We are currently contemplating additional sales of non-performing loan portfolios for assets that do not meet our rental criteria.

Resolution of Loans

For the non-performing and sub-performing mortgage loans that we continue to hold and acquire, our preferred resolution methodology has been to modify them. Once successfully modified, we expect that certain borrowers will refinance their loans with other lenders or we will sell the modified loans after establishing a payment history at or near the estimated value of the underlying property, potentially generating attractive returns for us. We believe modification followed by refinancing generates near-term cash flows, provides the highest possible economic outcome for us and is a socially responsible business strategy because it keeps more families in their homes.

Certain of our residential mortgage loans are liquidated as a result of a short sale, third party sale of the underlying property, refinancing or full debt pay-off of the loan. Upon liquidation of a loan, we record net realized gains, including the reclassification of previously accumulated net unrealized gains on those mortgage loans. We expect the timeline to liquidate loans will vary significantly by loan, which could result in fluctuations in revenue recognition and operating performance from period to period. Additionally, the proceeds from loan liquidations may vary significantly depending on the resolution methodology used by us for each loan.

A portion of our residential mortgage loans become REO either through foreclosure or as a result of our acquisition of the property via alternative resolution such as deed-in-lieu of foreclosure. Upon conversion of loans to REO, we mark the properties to the most recent market value and recognize net unrealized gains for the difference between the carrying value of the asset at the time of conversion and the most recent market value, which is based on broker price opinions (“BPOs”). The timeline to convert acquired loans into REO can vary significantly by loan, which can result in fluctuations in our revenue recognition and our operating performance from period to period. The factors that may affect the timelines to foreclose upon a residential mortgage loan include, without limitation, state foreclosure timelines and deferrals associated therewith; unauthorized parties occupying the property; federal, state or local legislative action or initiatives designed to provide homeowners with assistance in avoiding residential mortgage loan foreclosures; continued declines in real estate values and/or sustained high levels of unemployment that increase the number of foreclosures and that place additional pressure and/or delays on the already overburdened judicial and administrative proceedings.

We anticipate that REO properties that meet our investment criteria will be converted into single-family rental properties, which we believe will generate long-term returns for our stockholders. If an REO property does not meet our rental investment criteria, we expect to liquidate the property and generate cash for reinvestment in other acquisitions and dividend distributions.

Real Estate Assets

On August 18, 2015, we completed the acquisition of 1,314 single-family rental properties in the Atlanta, Georgia market, of which 94% were leased as of the acquisition date, from a third party seller for an aggregate purchase price of approximately $111.4 million. This purchase was completed following a diligence process in which we were able to access a large portion of the properties being sold and obtain detailed property and tenant information.

During the third quarter of 2015, we also initiated purchases under a program to acquire single-family residential properties on a one-by-one basis through the MLS and alternative listing sources to acquire more single-family rental properties at attractive and predictable values. We believe that the fact that, because these properties are listed on the MLS or another listing source and are unoccupied, they are available to be inspected in order to provide more clarity to the condition of the house. We acquired 98 residential rental properties under this program during 2015 and are continuing efforts to expand our capabilities to acquire more properties under this program at attractive and predictable values during 2016.

During the year ended December 31, 2014, we acquired 237 REO properties as part of our mortgage loan portfolio acquisitions. The aggregate purchase price attributable to these acquired REO properties was $34.1 million.

During the year ended December 31, 2013, we acquired 40 REO properties as part of our mortgage loan portfolio acquisitions. The aggregate purchase price attributable to these acquired REO properties was $6.2 million.

4

As of December 31, 2015, we had 6,516 REO properties, consisting of 4,933 REO properties held for use and 1,583 held for sale. Of the 4,933 REO properties held for use, 2,118 properties had been leased, 264 were listed and ready for rent, and 350 were in varying stages of renovation and unit turn status. With respect to the remaining 2,201 REO properties held for use, we will make a final determination whether each property meets our rental profile after (a) applicable state redemption periods have expired, (b) the foreclosure sale has been ratified, (c) we have recorded the deed for the property, (d) utilities have been activated and (e) we have secured access for interior inspection. A majority of the REO properties are subject to state regulations which require us to await the expiration of a redemption period before a foreclosure can be finalized. We include these redemption periods in our pricing which generally reduces the price we pay for the mortgage loans. Once the redemption period expires, we immediately proceed to record the new deed, take possession of the property, activate utilities, and start the inspection process in order to make a final determination on whether to rent or liquidate the property. If an REO property meets our rental investment criteria, we determine the extent of renovations that are needed to generate an optimal rent and maintain consistency of renovation specifications for future branding. If it is determined that the REO property will not meet our rental investment criteria, the property is listed for sale, in some instances after renovations are made to optimize the sale proceeds.

As of December 31, 2014, we had 3,960 REO properties, consisting of 3,349 REO properties held for use and 611 properties held for sale. Of the 3,349 properties held for use, 336 had been leased, 197 were listed and ready for rent and 254 were in various stages of renovation. With respect to the remaining 2,562 REO properties at December 31, 2014, we were in the process of determining whether these properties would meet our rental profile.

The table below provides a summary of our real estate assets and the carrying value by state as of December 31, 2015 ($ in thousands):

Property Location | Property Count | Carrying Value (1) | Weighted Average Age in Years (2) | ||||||

Alabama | 39 | $ | 4,958 | 23.8 | |||||

Alaska | 1 | 185 | 32.0 | ||||||

Arizona | 110 | 22,933 | 21.0 | ||||||

Arkansas | 30 | 2,447 | 36.7 | ||||||

California | 624 | 199,165 | 36.1 | ||||||

Colorado | 37 | 8,981 | 28.5 | ||||||

Connecticut | 53 | 9,148 | 59.1 | ||||||

Delaware | 21 | 2,821 | 43.5 | ||||||

District of Columbia | 1 | 218 | 105.0 | ||||||

Florida | 922 | 141,152 | 27.1 | ||||||

Georgia | 1,753 | 164,500 | 36.3 | ||||||

Hawaii | 3 | 530 | 42.2 | ||||||

Idaho | 19 | 2,919 | 33.9 | ||||||

Illinois | 387 | 58,851 | 42.8 | ||||||

Indiana | 188 | 20,246 | 30.6 | ||||||

Iowa | 12 | 1,125 | 46.5 | ||||||

Kansas | 23 | 1,739 | 54.1 | ||||||

Kentucky | 58 | 5,797 | 35.3 | ||||||

Louisiana | 21 | 2,004 | 35.9 | ||||||

Maine | 6 | 668 | 166.2 | ||||||

Maryland | 310 | 60,590 | 37.2 | ||||||

Massachusetts | 56 | 11,335 | 76.3 | ||||||

Michigan | 95 | 11,781 | 41.0 | ||||||

Minnesota | 62 | 9,970 | 43.7 | ||||||

Mississippi | 14 | 1,065 | 30.4 | ||||||

Missouri | 57 | 5,573 | 43.9 | ||||||

Montana | 3 | 635 | 28.8 | ||||||

Nebraska | 5 | 520 | 59.8 | ||||||

Nevada | 25 | 3,748 | 21.0 | ||||||

New Hampshire | 13 | 1,868 | 73.4 | ||||||

5

New Jersey | 89 | 14,688 | 60.4 | ||||||

New Mexico | 34 | 4,838 | 20.4 | ||||||

New York | 68 | 12,917 | 71.8 | ||||||

North Carolina | 222 | 27,106 | 19.7 | ||||||

Ohio | 118 | 13,293 | 41.2 | ||||||

Oklahoma | 17 | 1,831 | 35.1 | ||||||

Oregon | 16 | 2,718 | 45.5 | ||||||

Pennsylvania | 250 | 31,806 | 54.6 | ||||||

Rhode Island | 54 | 6,900 | 83.6 | ||||||

South Carolina | 127 | 15,740 | 23.1 | ||||||

South Dakota | 3 | 390 | 50.4 | ||||||

Tennessee | 73 | 9,283 | 24.4 | ||||||

Texas | 176 | 26,045 | 25.2 | ||||||

Utah | 73 | 12,342 | 31.7 | ||||||

Vermont | 5 | 793 | 108.6 | ||||||

Virginia | 86 | 26,083 | 28.6 | ||||||

Washington | 49 | 10,751 | 33.8 | ||||||

West Virginia | 2 | 456 | 12.1 | ||||||

Wisconsin | 105 | 10,765 | 50.3 | ||||||

Wyoming | 1 | 209 | 25.0 | ||||||

Total real estate assets | 6,516 | $ | 986,426 | 36.4 | |||||

_____________

(1) | The carrying value of an asset is based on historical cost, which generally consists of the market value at the time of acquisition plus renovation costs, net of any accumulated depreciation and impairment. Assets held for sale are carried at the lower of the carrying amount or estimated fair value less costs to sell. |

(2) | Weighted average age is based on the age of each property weighted by its proportion of the total carrying value for its respective state. |

As of December 31, 2015, our highest concentrations of real estate were in three states, California, Florida and Georgia, which accounted for 3,300 properties (50.6% of our real estate assets) with an aggregate carrying value of $504.8 million (51.2% of the carrying value of our real estate assets), with the remainder dispersed among 46 other states and the District of Columbia.

Mortgage Loans

We did not complete any residential mortgage loan portfolio acquisitions during the year ended December 31, 2015.

During 2014, we completed the acquisition of an aggregate of 7,326 residential mortgage loans, substantially all of which were non-performing, having an aggregate UPB of approximately $1.9 billion and an aggregate market value of underlying properties of approximately $1.8 billion. The aggregate purchase price for these acquisitions was approximately $1.2 billion. Additionally, in June 2014, we acquired 879 re-performing mortgage loans with an aggregate market value of underlying properties of $271.1 million for an aggregate purchase price of $144.6 million.

During 2013, we completed the acquisition of an aggregate of 8,491 residential mortgage loans, substantially all of which were non-performing, having an aggregate UPB of approximately $2.2 billion and an aggregate market value of underlying properties of approximately $1.8 billion. The aggregate purchase price for these acquisitions was approximately $1.2 billion.

As of December 31, 2015, we had 5,739 mortgage loans at fair value with an aggregate carrying value of $1.0 billion. The carrying value of mortgage loans is based on our Manager's proprietary pricing model. The significant unobservable inputs used in the fair value measurement of our mortgage loans at fair value are discount rates, forecasts of future home prices, alternate resolution probabilities and foreclosure timelines. Significant changes in any of these inputs in isolation could result in a significant change to the fair value measurement. For a more complete description of the fair value measurements and the factors that may significantly affect the carrying value of our mortgage loans at fair value, please see Note 7 to our consolidated financial statements.

Our sub-performing and non-performing mortgage loans become REO properties when we obtain legal title to the property upon completion of the foreclosure process or as a result of our acquisition of the property via alternative resolution, such as

6

deed-in-lieu of foreclosure. Additionally, some of the portfolios we purchase may, from time to time, contain a small number of residential mortgage loans that have already been converted to REO.

The remainder of our mortgage loans at fair value consists of a diversified pool of sub-performing and non-performing residential mortgage loans with the underlying properties located across the United States. The aggregate purchase price of our mortgage loans at fair value was 67% of the aggregate market value as determined by the most recent BPO provided by the applicable seller for each property in the respective portfolio as of its cut-off date.

The table below provides a summary of our mortgage loans at fair value based on the respective carrying value, UPB and market values of underlying properties as of December 31, 2015 ($ in thousands):

Location | Loan Count | Carrying Value | UPB | Market Value of Underlying Properties (1) | |||||||||||

Alabama | 26 | $ | 2,416 | $ | 3,683 | $ | 3,122 | ||||||||

Arizona | 30 | 6,531 | 8,722 | 8,697 | |||||||||||

Arkansas | 36 | 2,225 | 3,205 | 3,228 | |||||||||||

California | 401 | 158,270 | 180,063 | 213,557 | |||||||||||

Colorado | 22 | 3,602 | 3,759 | 4,640 | |||||||||||

Connecticut | 76 | 11,919 | 19,728 | 17,790 | |||||||||||

Delaware | 37 | 5,153 | 6,973 | 6,790 | |||||||||||

District of Columbia | 42 | 7,403 | 8,791 | 9,882 | |||||||||||

Florida | 1,239 | 176,140 | 273,714 | 242,570 | |||||||||||

Georgia | 138 | 14,891 | 20,538 | 19,648 | |||||||||||

Hawaii | 21 | 7,992 | 9,893 | 10,816 | |||||||||||

Idaho | 5 | 559 | 648 | 761 | |||||||||||

Illinois | 196 | 29,216 | 44,667 | 38,602 | |||||||||||

Indiana | 148 | 14,289 | 18,915 | 19,026 | |||||||||||

Iowa | 10 | 595 | 789 | 922 | |||||||||||

Kansas | 8 | 527 | 712 | 874 | |||||||||||

Kentucky | 33 | 2,629 | 4,040 | 3,692 | |||||||||||

Louisiana | 15 | 1,652 | 2,116 | 2,376 | |||||||||||

Maine | 23 | 2,261 | 3,738 | 3,505 | |||||||||||

Maryland | 318 | 54,887 | 79,834 | 71,814 | |||||||||||

Massachusetts | 176 | 31,548 | 45,250 | 48,663 | |||||||||||

Michigan | 30 | 3,472 | 4,261 | 4,857 | |||||||||||

Minnesota | 20 | 3,615 | 4,197 | 4,821 | |||||||||||

Mississippi | 12 | 1,408 | 1,802 | 1,820 | |||||||||||

Missouri | 41 | 2,261 | 3,571 | 3,356 | |||||||||||

Montana | 1 | 172 | 257 | 230 | |||||||||||

Nebraska | 4 | 314 | 462 | 436 | |||||||||||

Nevada | 90 | 16,629 | 26,699 | 22,212 | |||||||||||

New Hampshire | 6 | 1,232 | 1,807 | 1,689 | |||||||||||

New Jersey | 739 | 108,953 | 197,781 | 156,328 | |||||||||||

New Mexico | 104 | 9,852 | 13,121 | 13,335 | |||||||||||

New York | 504 | 114,396 | 156,336 | 166,797 | |||||||||||

North Carolina | 99 | 11,181 | 14,699 | 15,211 | |||||||||||

North Dakota | 1 | 85 | 123 | 130 | |||||||||||

Ohio | 50 | 4,558 | 6,777 | 6,368 | |||||||||||

Oklahoma | 14 | 1,818 | 2,462 | 2,340 | |||||||||||

Oregon | 64 | 13,965 | 17,576 | 17,959 | |||||||||||

Pennsylvania | 132 | 13,552 | 20,102 | 19,170 | |||||||||||

Puerto Rico | 1 | 105 | 189 | 190 | |||||||||||

7

Rhode Island | 28 | 3,115 | 6,172 | 4,381 | |||||||||||

South Carolina | 109 | 11,833 | 15,429 | 15,832 | |||||||||||

Tennessee | 37 | 4,375 | 5,756 | 5,974 | |||||||||||

Texas | 264 | 29,312 | 28,690 | 40,780 | |||||||||||

Utah | 24 | 4,538 | 5,222 | 5,762 | |||||||||||

Vermont | 5 | 545 | 822 | 846 | |||||||||||

Virginia | 34 | 7,027 | 9,497 | 9,486 | |||||||||||

Washington | 294 | 55,044 | 67,848 | 70,680 | |||||||||||

West Virginia | 3 | 279 | 520 | 368 | |||||||||||

Wisconsin | 29 | 2,193 | 3,598 | 3,162 | |||||||||||

Total mortgage loans at fair value | 5,739 | $ | 960,534 | $ | 1,355,554 | $ | 1,325,495 | ||||||||

_____________

(1) | Market value is based on the most recent BPO provided to us by the applicable seller for each property in the respective portfolio as of its cut-off date or an updated BPO received since the acquisition was completed. Although we performed diligence on a representative sample of the properties to confirm the accuracy of the BPOs provided by the sellers, we cannot assure you that the BPOs set forth in this table accurately reflected the actual market value of the related property at the purported time or accurately reflect such market value today. |

As of December 31, 2015, our highest concentrations of loans were in four states, which accounted for 2,883 loans (50.2% of our mortgage loans at fair value) with an aggregate UPB of $807.9 million (59.6% of the UPB of our mortgage loans at fair value), with the remainder dispersed among 43 other states, Puerto Rico and the District of Columbia.

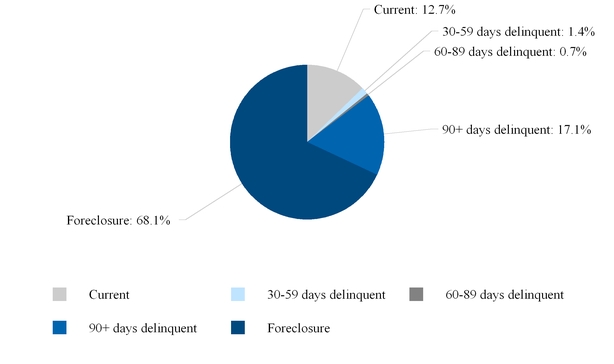

As set forth in the chart below, approximately 86% of our mortgage loans at fair value were 60 days or more delinquent as of December 31, 2015.

Our Strengths

We are committed to a business strategy that will enable us to grow and maintain a substantial single-family rental portfolio and become one of the largest nationwide single-family rental REITs. Our goal is to enhance long-term stockholder value through the execution of our business plan with a focus on our competitive strengths. Our strong competitive position is based on the following factors:

8

• | Acquisition Strategy Enables us to Build a Portfolio that can Provide High Yields to Stockholders. Through AAMC’s personnel and technical expertise, we have developed a valuation model that uses proprietary historical data to evaluate and project the performance of single-family rental assets and residential mortgage loans. This valuation model has been built with multiple broad economic inputs as well as individual property-level inputs to determine which properties will produce the highest possible yields and how much to pay for these properties to best achieve optimal results. These internally-developed tools not only help us to evaluate the most attractive single-family rental portfolios for sale, but they also have assisted us in developing a robust one-by-one purchase program that levers the Altisource property inspection, management and rental infrastructure and related data flows to identify and acquire higher yielding assets at any progression in the loan-to-REO cycle and in any geographical location into which we desire to expand. We intend to continue to build this one-by-one infrastructure and employ regional teams that will focus on specified geographical areas and use their developed regional experience and anecdotal operating results to continually build a better, more predictable model meant to achieve high rental yield portfolio growth with properties marked by strong stabilized occupancy rates and optimal economic returns. |

• | Relationship with Altisource and its Nationwide Property Management Infrastructure. We believe that we are strategically positioned to operate single-family rental properties across the United States at an attractive cost structure with the support of Altisource’s nationwide vendor network, which provides services in 208 major markets across the United States. In 2015, Altisource conducted more than 247,000 inspections and 133,000 repair and maintenance orders on a monthly basis and has more than 9,300 centrally managed vendors operating nationwide. This vendor network infrastructure has been developed over many years, and we believe this infrastructure would be difficult and expensive for our competitors and/or new market participants to replicate. We believe, therefore, that our existing relationships with Altisource and its vendor network, as described above in “Access to Established Nationwide Property Management Infrastructure,” gives us a distinct advantage as it allows us to bid on large attractive portfolios at an attractive cost structure. We also believe that AAMC’s established relationships with the Altisource network management team and our ongoing experience with the service providers in Altisource’s vendor network who know our renovation, maintenance and repair standards would likely provide us with an advantage over others in replicating and/or acquiring this nationwide property management infrastructure, if necessary. |

• | Depth of Management Experience. We believe the experience and technical expertise of our management team and the personnel from AAMC is one of our key strengths. Our team has a broad and deep knowledge of the mortgage and real estate markets with decades of experience in real estate, mortgage trading, housing, financial services and asset management markets. Their experience in the real estate industry brings a wealth of understanding of the markets in which we interact and can help us build our portfolio in locations that bring the highest potential returns to stockholders. Management and its supporting teams have a multitude of contacts and significant business acumen that enable us to source single-family rental assets through access to auctions and sellers of single-family rental assets and obtain important financing to optimize available leverage for quick and efficient growth of our portfolio. This is of tremendous value to our company as we have been able to strategically sell non-performing and re-performing loans to create taxable income and sustain a strong dividend while using liquidity generated from these sales to increase our single-family rental portfolio by approximately 247% in 2015. |

• | Strong Understanding and Interaction with Mortgage Loan Servicers. Our key personnel have extensive experience with our mortgage loan servicers and managing mortgage loan assets that allows us to capitalize on the servicing capabilities of our third party servicers and ensure cost effective servicing of our residential mortgage loan portfolios. We have directed and will continue to direct our mortgage servicers to employ various loan resolution methodologies with respect to our residential mortgage loans, including loan modification, collateral resolution and collateral disposition. To help us achieve our business objective, we instruct our mortgage servicers to focus on (1) converting a portion of our sub-performing and non-performing loans to performing status and (2) managing the foreclosure process and timelines with respect to the remainder of those loans. Importantly, by modifying as many loans as possible, we seek to keep more families in their homes because of our efforts. In 2015, we substantially diversified our servicer base by engaging additional alternate mortgage loan servicers to service our loans. |

Other Services Provided by Altisource

In addition to the Altisource master services agreement described above, we also have a trademark license agreement with Altisource that provides us with a non-exclusive, non-transferable, non-sublicensable, royalty free license to use the name “Altisource.” We also have a support services agreement with Altisource, pursuant to which Altisource may provide services to us in such areas as human resources, vendor management operations, corporate services, risk management, quality assurance, consumer psychology, treasury, finance and accounting, legal, tax and compliance.

9

During 2015, AAMC internalized certain of the support services that had been provided to us by Altisource by directly hiring 31 of the Altisource employees that had provided those services. We believe the direct hire of these employees has further increased the infrastructure of our manager so that they are better able to serve us operationally while enabling Altisource to focus on the property management, maintenance and brokerage services that matter most to us.

Expertise of Our Manager

The senior management team of our Manager includes individuals with significant experience in the real estate, mortgage trading, housing, financial services and asset management markets. Throughout their careers, these executives have managed various real estate-related businesses and executed structured real estate and financing transactions through multiple market cycles. As described in more detail above under “Acquisition Strategy Enables us to Build a Portfolio that can Provide High Yields to Stockholders,” AAMC has also internally developed a valuation model that uses proprietary historical data to evaluate and project the performance of residential mortgage loans and single-family rental assets. We believe that AAMC’s asset evaluation process and the experience and judgment of its executive management team in identifying, assessing, valuing and acquiring new single-family rental assets will help us to appropriately value the portfolios at the time of purchase and operate them profitably as we continue to grow.

Our Investment Process

Acquisition Process for Bulk Single-Family Rental Properties

Our Manager has continued to hire key personnel and portfolio managers with substantial experience in the real estate market. Using deep market connections and employing advanced quantitative models and reasoning, the capital markets group focuses on sourcing, analyzing and negotiating the purchase of large, meaningful portfolios of rented single-family properties. This experience and execution of the business model has enabled us to purchase a portfolio of 1,314 single-family rental properties in Atlanta, of which more than 94% were occupied by tenants with a stabilized rental income. In December 2015, we also bid for, and were awarded, a portfolio of 627 rental properties in Illinois, North Carolina, South Carolina, Georgia and Florida. The size, composition and location of the properties were analyzed and negotiated on our behalf by AAMC's portfolio management team, which is in the process of conducting advance due diligence on the properties. Such due diligence is being conducted with the assistance of our property manager and involves physical inspection of the homes and analysis of the rent rolls and projected rental income for the properties. No assurance can be given that we will consummate this acquisition on a timely basis or at all.

Acquisition Process for One-by-One Real Estate Purchases

Our program to purchase residential rental properties on a one-by-one basis targets residential real estate listed on the MLS and alternative listing sources in strategically selected markets. Through analysis of local demographic, housing and crime-related metrics, our Manager is able to identify potentially attractive market sub-segments and pursue properties in such areas, often shortly after they become available. Our Manager’s review process depends on the characteristics of each property being evaluated for purchase, and the due diligence process may include an assessment of the applicable HOA requirements, neighborhood walkthroughs, property inspections and final rental suitability evaluations, all prior to acquiring the asset. Through December 31, 2015, we acquired 98 residential properties, and we expect to continue to purchase residential rental properties throughout 2016.

Acquisition Process for Sub-performing and Non-performing Mortgage Loans

Our underwriting analysis for acquiring sub-performing and non-performing loan portfolios on a national basis relies on extensive analysis of the target portfolio’s characteristics and the use of our proprietary model in determining future cash flows and returns from various resolution methodologies. We estimate our resolution timelines using advanced modeling techniques. We use regression-based models to determine the expected probabilities of different loan resolutions, including modification, rental and liquidation. We also use an extensive due diligence process to validate data accuracy, compliance with laws and enforceability of liens among other factors.

10

Our Financing Strategy

We intend to continue to finance our investments with leverage, the level of which may vary based upon the particular characteristics of our portfolio and on market conditions. To the extent available at the relevant time, our financing sources may include bank credit facilities, warehouse lines of credit, securitization financing, structured financing arrangements and repurchase agreements, among others. We may also seek to raise additional capital through public or private offerings of debt or equity securities, depending upon market conditions. For additional information on our financing arrangements, see “Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations–Liquidity and Capital Resources.”

Investment Committee and Investment Policy

Substantially all of our investment activities are conducted by AAMC on our behalf pursuant to the New AMA. Our principal objective is to generate attractive risk-adjusted returns for our stockholders over the long-term through dividends and capital appreciation.

Our Board of Directors has adopted a broad investment policy designed to facilitate the management of our capital and assets and the maintenance of an investment portfolio profile that meets our objectives. Our Board has appointed an Investment Committee consisting of our Chairman, our Chief Executive Officer and our Chief Financial Officer, whose role is to act in accordance with the investment policy and guidelines approved by our Board of Directors for the investment of our capital. As part of an overall investment portfolio strategy, the investment policy provides that we can purchase or sell non-performing or sub-performing residential mortgage loans, residential mortgage backed securities and real estate assets. We are also authorized to offer leases on acquired single-family residential real estate. The investment policy may be modified by our Board of Directors without the approval of our stockholders.

The objective of the investment policy is to oversee our efforts to achieve a return on assets consistent with our business objective and to maintain adequate liquidity to meet financial covenants and regular cash requirements.

The Investment Committee is authorized to approve the financing of our investment positions through repurchase agreements, warehouse lines of credit, securitized debt and other financing arrangements, provided such agreements are negotiated with counterparties approved by the Investment Committee. We are also permitted to hedge our interest rate exposure on our financing activities through the use of interest rate swaps, forwards, futures and options, subject to prior approval from the Investment Committee.

Investment Committee Approval of Counterparties

The Investment Committee is authorized to consider and approve:

• | the financial soundness of institutions with which we plan to transact business and make recommendations with respect thereto; |

• | our risk exposure limits with respect to the dollar amounts of total exposure with a given institution; and |

• | investment accounts and trading accounts to be opened with banks, broker-dealers and financial institutions. |

Investment Committee Guidelines

The activities of our Investment Committee are subject to the following guidelines:

• | No investment will be made that would cause us or any of our subsidiaries to fail to qualify as a REIT for U.S. federal income tax purposes; |

• | No investment will be made that would cause us to be required to register as an investment company under the Investment Company Act of 1940, as amended (the “Investment Company Act”); and |

• | Until appropriate investments can be identified, we may invest available cash in interest-bearing and short-term investments that are consistent with (a) our intention to qualify as a REIT and (b) our exemption from registration as an investment company under the Investment Company Act. |

11

Broad Investment Policy Risks

Our investment policy is very broad and provides our Investment Committee and AAMC with extensive latitude to determine the types of assets that are appropriate investments for us and to make individual investment decisions. In the future, AAMC may make investments with lower rates of return than those anticipated under current market conditions and/or may make investments with greater risks to achieve those anticipated returns. Our Board of Directors will periodically review our investment policy and our investment portfolio but will not review or approve each proposed investment by AAMC unless it falls outside our previously approved investment policy or constitutes a related party transaction.

In addition, in conducting its periodic reviews, our Board of Directors will rely primarily on information provided to it by AAMC. Furthermore, AAMC may use complex strategies, and transactions entered into by AAMC may be costly, difficult or impossible to unwind by the time they are reviewed by our Board of Directors. Further, we may change our investment policy and targeted asset classes at any time without the consent of our stockholders, which could result in our making investments that are different in type from, and possibly riskier than, our current investments or the investments currently contemplated. Changes in our investment strategy, investment policy and targeted asset classes may increase our exposure to interest rate risk, counterparty risk, default risk and real estate market fluctuations, which could materially and adversely affect us.

Our Manager and the Asset Management Agreement

We are externally managed by AAMC, an asset management company that provides portfolio management and corporate governance services. Under the New AMA, AAMC is responsible for, among other duties: (1) performing and administering all of our day-to-day operations, (2) defining investment criteria in our investment policy in cooperation with our Board of Directors, (3) sourcing, analyzing and executing asset acquisitions, including the related financing activities, (4) analyzing and executing sales of properties and residential mortgage loans, (5) overseeing Altisource’s renovation, leasing and property management of our single-family rental properties, (6) overseeing the servicing of our residential mortgage loan portfolios, (7) performing asset management duties and (8) performing corporate governance and other management functions, including financial, accounting and tax management services.

AAMC provides us with a management team and appropriate support personnel who have substantial experience in the management of residential mortgage loans and residential rental properties. AAMC’s management also has significant corporate governance experience that enables us to manage our business and organizational structure efficiently. AAMC has agreed not to provide the same or substantially similar services without the prior written consent of our board of directors to any business or entity competing against us in (a) the acquisition or sale of portfolios of REO properties, (b) the carrying on of a single-family rental business, (c) the acquisition or sale of single-family rental properties, non-performing and re-performing mortgage loans or other similar assets, (d) the purchase of portfolios of sub-performing or non-performing residential mortgage loans or (e) any other activity in which we engage. Notwithstanding the foregoing, AAMC may engage in any other business or render similar or different services to any businesses engaged in lending or insurance activities or any other activity other than those described above. Further, at any time following our determination and announcement that we will no longer engage in any of the above-described competitive activities, AAMC would be entitled to provide advisory or other services to businesses or entities in such competitive activities without our prior consent.

On March 31, 2015, we entered into the New AMA with AAMC. The New AMA, which became effective on April 1, 2015, provides for a new management fee structure that replaces the incentive fee structure under the original asset management agreement with AAMC (the “Original AMA”) as follows:

• | Base Management Fee. AAMC is entitled to a quarterly Base Management Fee equal to 1.5% of the product of (i) our average invested equity capital for the quarter multiplied by (ii) 0.25 while we have fewer than 2,500 single-family rental properties actually rented (“Rental Properties”). The Base Management Fee percentage increases to 1.75% of invested capital while we have between 2,500 and 4,499 Rental Properties and increases to 2.0% of invested capital while we have 4,500 or more Rental Properties; |

• | Incentive Management Fee. AAMC is entitled to a quarterly Incentive Management Fee equal to 20% of the amount by which our return on invested capital (based on AFFO, defined as our net income attributable to holders of common stock calculated in accordance with GAAP plus real estate depreciation expense minus recurring capital expenditures on all of our real estate assets owned) exceeds an annual hurdle return rate of between 7.0% and 8.25% (depending on the 10-year treasury rate). The Incentive Management Fee increases to 22.5% while we have between 2,500 and 4,499 Rental Properties and increases to 25% while we have 4,500 or more Rental Properties; and |

12

• | Conversion Fee. AAMC is entitled to a quarterly Conversion Fee equal to 1.5% of the market value of assets converted into leased single-family homes by us for the first time during the quarter. |

We have the flexibility to pay up to 25% of the incentive management fee to AAMC in shares of our common stock.

Under the New AMA, AAMC will continue to be the exclusive asset manager for us for an initial term of 15 years from April 1, 2015, with two potential five-year extensions, subject to our achieving an average annual return on invested capital of at least 7.0%.

Neither party is entitled to terminate the New AMA prior to the end of the initial term, or each renewal term, other than termination (a) by us and/or AAMC “for cause” for certain events such as a material breach of the New AMA and failure to cure such breach, (b) by us for certain other reasons such as our failure to achieve a return on invested capital of at least 7.0% for two consecutive fiscal years after the third anniversary of the New AMA or (c) by us in connection with certain change of control events.

If the New AMA were terminated by AAMC, our financial position and future prospects for revenues and growth could be materially adversely affected.

Manager’s Management of the Operating Partnership

General

Substantially all of our assets are and will be held by, and substantially all of our operations will be conducted through, the operating partnership, either directly or through its subsidiaries or trusts for its benefit. Altisource Residential GP, LLC is the sole general partner of the operating partnership (the “General Partner”). We own 100% of the membership interests in the General Partner. We also own 100% of the limited partnership interests of the Operating Partnership. We do not intend to list any Operating Partnership interests on any exchange or any national market system. The provisions of the limited partnership agreement are described below.

The General Partner is managed by AAMC through our asset management agreement with AAMC. Except as otherwise expressly provided in the limited partnership agreement and subject to the rights of holders of any class or series of operating partnership interests, all management powers over the business and affairs of the Operating Partnership are exclusively vested in AAMC through its management of us and the General Partner, subject to the oversight of our Board of Directors. No limited partner, in its capacity as a limited partner, has any right to participate in or exercise control or management power over the Operating Partnership’s business and affairs other than through our Board of Directors’ oversight of AAMC’s executive officers who manage our business and that of the General Partner. With limited exceptions, the General Partner, through its management by AAMC, may execute, deliver and perform agreements and transactions on behalf of the Operating Partnership without the approval or consent of any limited partner.

Terms of the Limited Partnership Agreement

Capital Contributions, Profits and Losses and Distributions

Neither the General Partner nor the limited partner is required to make any additional capital contribution to the Operating Partnership, although we intend to contribute funds generally from equity offerings, repurchase facilities or securitization financings into the Operating Partnership in order to (a) make additional acquisitions of portfolios of sub-performing and non-performing residential mortgage loans and/or single-family rental properties, (b) pay servicing fees and other related expenses for the residential mortgage loans we acquire; (c) conduct the renovation, leasing and property management services for single-family rental properties and (d) provide funds for general corporate purposes.

The profits and losses of the Operating Partnership shall be allocated in proportion to the capital contributions of the partners of the Operating Partnership.

At the time or times determined by the General Partner, the General Partner may cause the Operating Partnership to distribute any cash held by it that is not reasonably necessary for the operation of the Operating Partnership. If the General Partner determines that cash will be distributed, the cash available for distribution will be distributed to us, as the sole limited partner of the Operating Partnership and sole contributor of all the funds in the Operating Partnership’s capital account.

13

Restrictions on Transfer of Partnership Interests; Withdrawals

Any partner of the Operating Partnership may transfer all or any part of its interest in the Operating Partnership only with the consent of the General Partner. Because we are the only limited partner and control the General Partner, we do not expect to transfer our limited partnership interests for the foreseeable future.

No partner may withdraw from the Operating Partnership except pursuant to an amendment to the limited partnership agreement signed by all of the partners. The withdrawal of the limited partner, and admission of a new or substitute limited partner, as applicable, will be effective as of the date of any such amendment. Upon the withdrawal of any partner, the withdrawing partner shall, to the extent permitted by Delaware Revised Uniform Limited Partnership Act, or “DRULPA,” be entitled to payment of the balance of its capital account and shall have no further right, interest or obligation of any kind whatsoever as a partner in the Operating Partnership. We do not intend to withdraw as a partner of the Operating Partnership for the foreseeable future.

Amendments; Admission of Additional Partners

Without our approval as the limited partner, the General Partner may amend, and may amend and restate, the limited partnership agreement. The General Partner may admit additional limited partners to the Operating Partnership. The admission of additional limited partners to the Operating Partnership may be accomplished by the amendment, or the amendment and restatement, of the limited partnership agreement without our consent, and, if required by DRULPA, the filing of an appropriate amendment of the Operating Partnership’s certificate of formation.

NewSource Investment and Divestiture

On October 17, 2013, we invested $18.0 million in the non-voting preferred stock of NewSource Reinsurance Company Ltd. (“NewSource”), an insurance and reinsurance company focused on real estate related insurance products in Bermuda. On September 14, 2015, NewSource completed the repurchase of all of our shares of non-voting preferred stock for aggregate proceeds of $18.0 million, which was the aggregate par value of the shares being repurchased. Until September 10, 2015, we were eligible to receive a 12% annual cumulative preferred dividend on our investment. In connection with the repurchase of the preferred stock, NewSource also paid to us the accrued but unpaid dividend on our shares from January 1, 2015 through September 10, 2015 amounting to $1.5 million.

Policies with Respect to Certain Other Activities

We intend to raise additional funds through equity offerings, repurchase facilities, securitization financings, other debt arrangements, the retention of cash flow (subject to REIT distribution requirements) or a combination of these methods. In the event that our Board of Directors determines to raise additional equity capital, it has the authority, without stockholder approval, to issue additional common stock or preferred stock in any manner and on such terms and for such consideration as it deems appropriate, at any time, subject to compliance with NYSE listing requirements.

In addition, we have borrowed and intend to continue to borrow money to finance or refinance the acquisition of sub-performing and non-performing residential mortgage loans and single-family residential properties and for general corporate purposes. Our investment policy, the assets in our portfolio, the decision to use leverage and the appropriate level of leverage will be based on AAMC’s assessment of a variety of factors, including our historical and projected financial condition, liquidity, results of operations, financing covenants, the cash flow generation capability of assets, the availability of credit on favorable terms, our outlook for borrowing costs relative to the unlevered yields on our assets, maintenance of our REIT qualification, applicable law and other factors as AAMC and/or our Board of Directors may deem relevant from time to time. Our decision to use leverage will be at AAMC’s discretion and will not be subject to the approval of our stockholders. We are not restricted by our governing documents in the amount of leverage that we may use.

As of the date of this report, we do not intend to invest in the securities of other REITs, other entities engaged in real estate activities or securities of other issuers for the purpose of exercising control over such entities. We do not intend that our investments in securities will require us to register as an investment company under the Investment Company Act, and we would intend to divest such securities before any such registration would be required. We do not intend to underwrite securities of other issuers.

Our Board of Directors may change any of these policies without prior notice to, or the consent of, our stockholders.

14

REIT Qualification

We elected and qualified to be taxed as a REIT under Sections 856 through 859 of the Internal Revenue Code of 1986 (the “Code”) beginning with our taxable year ended December 31, 2013, and we currently expect to maintain this status for the foreseeable future. Our qualification as a REIT depends upon our ability to meet on a continuing basis, through actual investment and operating results, various complex requirements under the Code relating to, among other things, the sources of our gross income, the composition and values of our assets, our distribution levels and the diversity of ownership of our common shares. We believe that we are organized in conformity with the requirements for qualification and taxation as a REIT under the Code, and that our manner of operation enables us to meet the requirements for qualification and taxation as a REIT. As a REIT, we generally are not subject to U.S. federal income tax on the REIT taxable income we distribute to our stockholders.

Even though we elected to be taxed as a REIT, we are subject to some U.S. federal, state and local taxes on our income or property. A portion of our business is expected to be conducted through, and a portion of our income is expected to be earned in, one or more taxable REIT subsidiaries, each of which we refer to as a “TRS.” In general, a TRS may hold assets and engage in activities that the REIT cannot hold, may choose not to hold to maintain REIT compliance and cannot engage in directly. Additionally, a TRS may engage in any real estate or non-real estate related business. A TRS is subject to U.S. federal, state and local corporate income taxes. To maintain our REIT election, at the end of each quarter no more than 25% of the value of a REIT’s assets may consist of stock or securities of one or more TRSs. If our TRS generates net income, our TRS can declare dividends to us, which will be included in our taxable income and necessitate a distribution to our stockholders. Conversely, if we retain earnings at the TRS level, no distribution is required, and we can increase stockholders’ equity of the consolidated entity. As discussed under “Item 1A. Risk Factors–Risks Related to Our Qualification as a REIT,” the combination of the requirement to maintain no more than 25% of our assets in the TRS coupled with the effect of TRS dividends on our income tests creates compliance complexities for us in the maintenance of our qualified REIT status.

Exemption from Investment Company Act

We rely on the exception from the Investment Company Act set forth in Section 3(c)(5)(C) of the Investment Company Act, which excludes from the definition of investment company “any person who is not engaged in the business of issuing redeemable securities, face-amount certificates of the installment type or periodic payment plan certificates, and who is primarily engaged in one or more of the following businesses… (C) purchasing or otherwise acquiring mortgages and other liens on and interests in real estate.” The SEC Staff generally requires that, for the exception provided by Section 3(c)(5)(C) to be available, at least 55% of an entity’s assets be comprised of mortgages and other liens on and interests in real estate, also known as “qualifying interests,” and at least another 25% of the entity’s assets must be comprised of additional qualifying interests or real estate-type interests (with no more than 20% of the entity’s assets comprised of miscellaneous assets). Any significant acquisition by us of non-real estate assets without the acquisition of substantial real estate assets could cause us to meet the definitions of an “investment company.” If we are deemed to be an investment company, we may be required to register as an investment company if we are unable to dispose of the disqualifying assets, which could have a material adverse effect on us. See “Item 1A. Risk Factors–Risks Related to Our Structure–We could be materially and adversely affected if we are deemed to be an investment company under the Investment Company Act.”

Employees

We do not currently have any employees and do not expect to have any employees in the foreseeable future. Currently, services necessary for our business are provided by individuals who are employees of AAMC and our service providers. Each of our executive officers is an employee, officer or both of AAMC, and they are paid by AAMC. As of December 31, 2015, AAMC had 46 full-time employees.

On January 18, 2016, AAMC hired a new dedicated General Counsel for our company. Although he is not employed by us, his primary duties are to act as our General Counsel, and he reports to our Board of Directors. We also direct and approve his compensation and reimburse AAMC for all costs associated with his employment.

Competition

We face competition from various sources for the acquisition of residential rental properties and residential mortgage loans. Our competition includes other REITs, hedge funds, private equity funds and partnerships. To effectively compete, we will rely upon AAMC's management team and their substantial industry expertise, which we believe provides us with a competitive advantage and helps us assess the investment risks and determine appropriate pricing. We expect our integrated approach of acquiring residential rental properties, both in bulk and on a one-by-one basis, as well as converting sub-performing and non-

15

performing residential mortgage loans into rental properties will enable us to compete more effectively for attractive investment opportunities. However, we cannot assure you that we will be able to achieve our business goals or expectations due to the competitive pricing and other risks that we face. Our competitors may have greater resources and access to capital and higher risk tolerances than we have, may be able to pay higher prices for assets or may be willing to accept lower returns on investment. As the inventory of available residential rental properties and related assets will fluctuate, the competition for assets and financing may increase.