Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Sabra Health Care REIT, Inc. | a8-k2015holidayfinancials.htm |

| EX-23.1 - EXHIBIT 23.1 - Sabra Health Care REIT, Inc. | exhibit231eyconsent2015.htm |

C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S Holiday AL Holdings LP Years Ended December 31, 2015, 2014 and 2013 With Report of Independent Auditors

Holiday AL Holdings LP Consolidated Financial Statements Years Ended December 31, 2015, 2014 and 2013 Contents Report of Independent Auditors.......................................................................................................1 Consolidated Financial Statements Consolidated Balance Sheets ...........................................................................................................2 Consolidated Statements of Operations ...........................................................................................3 Consolidated Statements of Changes in Equity ...............................................................................4 Consolidated Statements of Cash Flows ..........................................................................................5 Notes to Consolidated Financial Statements ....................................................................................6

1 Ernst & Young LLP 155 North Wacker Drive Chicago, IL 60606-1789 Tel: +1 312 879 2000 Fax: +1 312 879 4000 ey.com Report of Independent Auditors The Partners Holiday AL Holdings LP We have audited the accompanying consolidated financial statements of Holiday AL Holdings LP (the Partnership), which comprise the consolidated balance sheets as of December 31, 2015 and 2014, and the related consolidated statements of operations, changes in equity and cash flows for each of the three years in the period ended December 31, 2015, and the related notes to the consolidated financial statements. Management’s Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these financial statements in conformity with U.S. generally accepted accounting principles; this includes the design, implementation and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free of material misstatement, whether due to fraud or error. Auditor’s Responsibility Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Opinion In our opinion, the financial statements referred to above present fairly, in all material respects, the consolidated financial position of the Partnership at December 31, 2015 and 2014, and the consolidated results of its operations and its cash flows for each of the three years in the period ended December 31, 2015 in conformity with U.S. generally accepted accounting principles. February 19, 2016

2015 2014 Assets Investment in real estate Land and land improvements $ 40,350 $ 40,312 Building and building improvements 267,610 265,637 Equipment 53,296 33,993 361,256 339,942 Less accumulated depreciation (84,379) (70,503) 276,877 269,439 Cash and cash equivalents 9,357 24,302 Cash and escrow deposits – restricted 1,096 1,174 Landlord required deposits 115,811 119,054 Accounts receivable, net 441 700 Prepaid expenses and other assets, net 39,609 20,644 Resident lease and other intangible assets, net 1,870 1,930 Total assets $ 445,061 $ 437,243 Liabilities and equity Accounts payable and accrued expenses $ 51,852 $ 29,970 Prepaid rent and deferred revenue 20,874 15,805 Tenant security deposits 2,970 3,623 Straight-line rent payable 106,736 55,873 Due to affiliate 10,731 22,127 Total liabilities 193,163 127,398 Equity: Partnership 270,773 309,845 Non-controlling interest (18,875) – Total Equity 251,898 309,845 Total liabilities and equity $ 445,061 $ 437,243 See accompanying notes to consolidated financial statements. Holiday AL Holdings LP Consolidated Balance Sheets (In Thousands) December 31 2

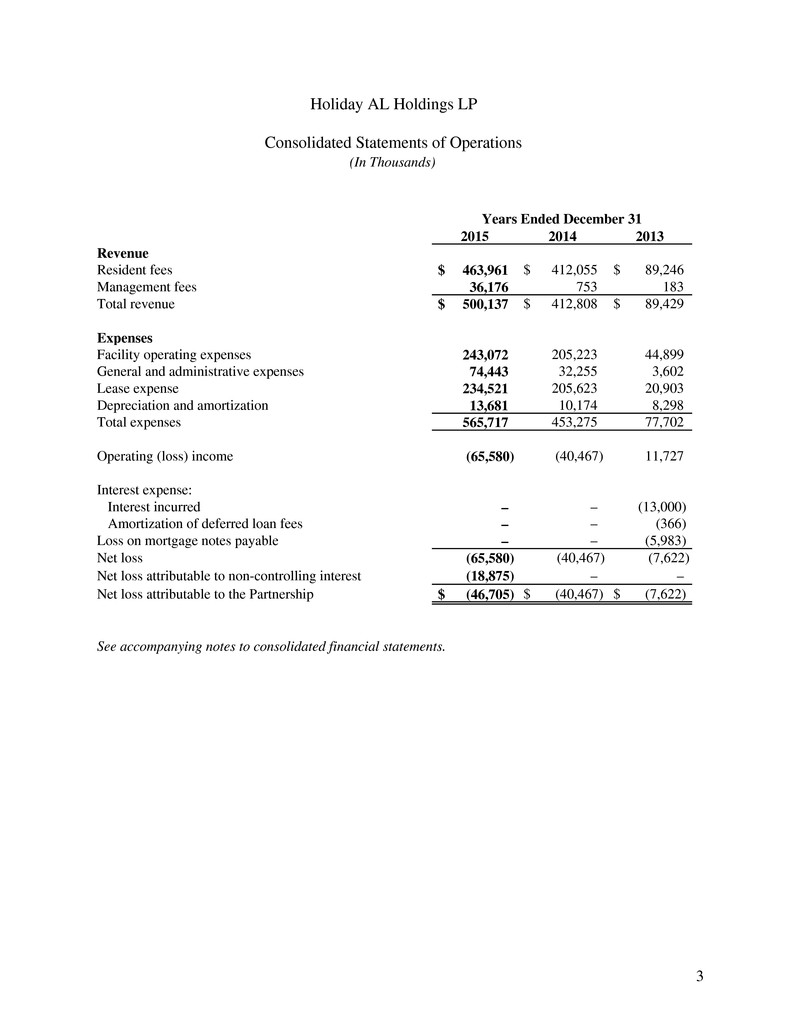

2015 2014 2013 Revenue Resident fees $ 463,961 $ 412,055 $ 89,246 Management fees 36,176 753 183 Total revenue $ 500,137 $ 412,808 $ 89,429 Expenses Facility operating expenses 243,072 205,223 44,899 General and administrative expenses 74,443 32,255 3,602 Lease expense 234,521 205,623 20,903 Depreciation and amortization 13,681 10,174 8,298 Total expenses 565,717 453,275 77,702 Operating (loss) income (65,580) (40,467) 11,727 Interest expense: Interest incurred – – (13,000) Amortization of deferred loan fees – – (366) Loss on mortgage notes payable – – (5,983) Net loss (65,580) (40,467) (7,622) Net loss attributable to non-controlling interest (18,875) – – Net loss attributable to the Partnership $ (46,705) $ (40,467) $ (7,622) See accompanying notes to consolidated financial statements. Holiday AL Holdings LP Consolidated Statements of Operations (In Thousands) Years Ended December 31 3

General Limited Non-controlling Total Partners Partners Interest Equity Balance at January 1, 2013 439$ 43,511$ $ – 43,950$ Net loss (76) (7,546) – (7,622) Contributions 3,231 319,835 – 323,066 Balance at December 31, 2013 3,594 355,800 – 359,394 Net loss (405) (40,062) – (40,467) Contributions 58 5,704 – 5,762 Distributions (149) (14,695) – (14,844) Balance at December 31, 2014 3,098 306,747 – 309,845 Net loss (467) (46,238) (18,875) (65,580) Contributions 184 18,260 – 18,444 Distributions (108) (10,703) – (10,811) Balance at December 31, 2015 2,707$ 268,066$ (18,875)$ 251,898$ See accompanying notes to consolidated financial statements. Holiday AL Holdings LP Consolidated Statements of Changes in Equity For the Years Ended December 31, 2015, 2014 and 2013 (In Thousands) 4

2015 2014 2013 Operating activities Net loss (65,580)$ (40,467)$ (7,622)$ Adjustments to reconcile net loss to net cash provided by (used in) operating activities: Depreciation and amortization 13,681 10,174 8,298 Amortization of deferred loan costs – – 366 Amortization of resident incentives 948 1,335 1,486 Straight-line rent expense 50,863 51,043 4,830 Amortization of community fees (7,404) (3,139) (580) Changes in operating assets and liabilities: Cash and escrow deposits – restricted 78 46 1,930 Landlord required deposits 3,243 (13,937) (105,117) Accounts receivable 259 89 (542) Prepaid expenses and other assets (19,983) (1,435) (15,739) Accounts payable and accrued expenses 20,991 7,344 6,695 Prepaid rent and deferred revenue 12,473 12,954 3,923 Tenant security deposits (653) (334) 1,132 Net cash provided by (used in) by operating activities 8,916 23,673 (100,940) Investing activities Additions to investment in real estate (20,098) (16,808) (3,425) Cash used in investing activities (20,098) (16,808) (3,425) Financing activities Repayment of principal on mortgage notes payable – – (234,319) Distributions (261) (14,844) – Contributions – 5,762 338,221 Due (from) to affiliate (3,502) 21,898 2,875 Net cash (used in) provided by financing activities (3,763) 12,816 106,777 Net (decrease) increase in cash and cash equivalents (14,945) 19,681 2,412 Cash and cash equivalents at beginning of year 24,302 4,621 2,209 Cash and cash equivalents at end of year 9,357$ 24,302$ 4,621$ Supplemental disclosure of cash flow information Cash paid for interest $ – $ – 14,040$ Supplemental disclosure of non-cash information Non-cash operating activities: Assumption of assets and related liabilities: Accounts payable and accrued expenses $ – (2,320)$ (12,272)$ Tenant security deposits – – (1,901) Prepaid rent – – (1,170) Cash and escrow deposits - restricted – 83 188 Prepaid expenses and other assets – 401 – Non-cash financing activites: Distributions (10,550)$ – – Contributions 18,444 – – Due (from) to affiliate (7,894) – – Consolidated Statements of Cash Flows (In Thousands) Years Ended December 31 See accompanying notes to consolidated financial statements. Holiday AL Holdings LP 5

6 Holiday AL Holdings LP Notes to Consolidated Financial Statements (In Thousands) December 31, 2015 1. Formation and Description of Operations Holiday AL Holdings LP (HAHLP or the Partnership), a Delaware limited partnership, is the owner and operator of assisted living and independent living facilities in the United States. As of December 31, 2015, the Partnership, directly or indirectly through its ownership entities, owned or leased 131 assisted living communities and independent living communities consisting of 16,364 apartment and townhouse units (unaudited), located in 41 states (unaudited). Properties Communities Units Owned communities 8 1,673 Leased communities 123 14,691 The “Owned Communities” are accounted for under the consolidation method of accounting and are reflected as investment in real estate. The “Leased Communities” are accounted for as operating leases, pursuant to Accounting Standards Codification (ASC) 840, Leases. The Partnership is owned by Holiday AL Acquisition, LLC (Holiday Acquisition, a limited liability company and a wholly owned subsidiary of investment funds managed by affiliates of Fortress Investment Group LLC), Holiday AL Holdings GP LLC (Holiday AL GP – the general partner and a wholly owned subsidiary of Holiday Acquisition), and Retained Interest LLC (Retained Interest – which is wholly owned by previous investors of Holiday Retirement). In 2015, the members and affiliates of Holiday Acquisition decided to utilize the Partnership as the operating and administrative platform to provide management services through a partially owned subsidiary, Holiday AL Management Sub, LLC (Management Company) (see Note 7). To effectuate this Harvest Facility Holdings LP (Harvest) transferred most of its employees to the Management Company, of which the Partnership owns a 51% ownership interest. During 2015 the Management Company entered into various agreements to provide management, leasing, and general and administrative services to the Partnership, Harvest and other third parties. Harvest is also owned by investment funds managed by affiliates of Fortress Investment Group LLC (see Note 10).

Holiday AL Holdings LP Notes to Consolidated Financial Statements (continued) (In Thousands) 7 2. Summary of Significant Accounting Policies The consolidated financial statements have been prepared on the accrual basis of accounting in accordance with U.S. generally accepted accounting principles (U.S. GAAP). The significant accounting policies are summarized below. Principles of Consolidation The consolidated financial statements represent the Partnership’s financial condition and results of operations and those of its subsidiaries. Properties and other subsidiaries which are wholly owned, controlled by the Partnership or variable-interest entities in which the Partnership is the primary beneficiary are consolidated. The Partnership has an interest in one variable-interest entity for which it is considered to be the primary beneficiary (see Note 7). All intercompany transactions and balances have been eliminated in consolidation. Non-controlling Interests A non-controlling interest in a subsidiary is generally an ownership interest in the consolidated entity that should be reported as equity in the consolidated financial statements and separate from the parent company’s equity. In addition, consolidated net (loss) income is required to be reported at amounts that include the amounts attributable to both the parent and the non-controlling interest and the amount of consolidated net (loss) income attributable to the parent and the non-controlling interest are required to be disclosed on the face of the consolidated statements of operations (see Note 7). Reclassifications Certain reclassifications considered necessary for a fair presentation have been made to the prior period financial statements in order to conform to the current year presentation. These reclassifications have not changed the results of operations or financial position of the Partnership. Use of Estimates The preparation of the consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported and disclosed in the consolidated financial statements and accompanying notes. Estimates are used for, but not limited to, the allocation of purchase price to tangible and intangible assets and liabilities, the evaluation of asset impairments, insurance reserves, depreciation and amortization, allowance for doubtful accounts, and other contingencies. Actual results could differ from those estimates and assumptions.

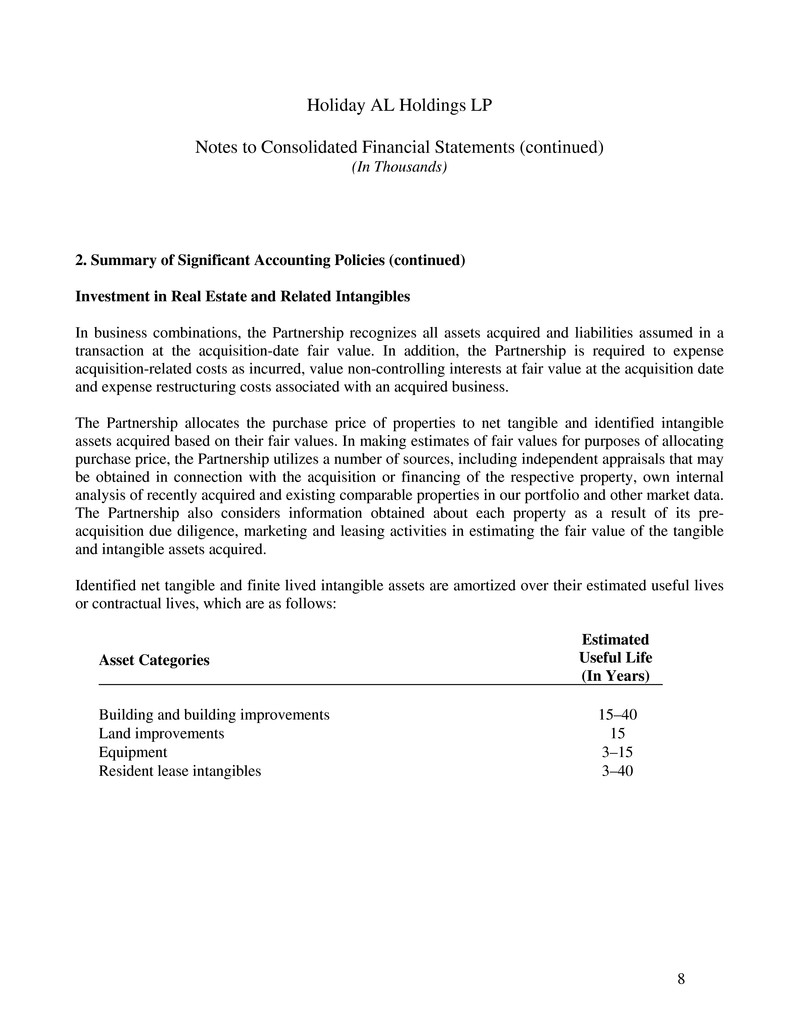

Holiday AL Holdings LP Notes to Consolidated Financial Statements (continued) (In Thousands) 8 2. Summary of Significant Accounting Policies (continued) Investment in Real Estate and Related Intangibles In business combinations, the Partnership recognizes all assets acquired and liabilities assumed in a transaction at the acquisition-date fair value. In addition, the Partnership is required to expense acquisition-related costs as incurred, value non-controlling interests at fair value at the acquisition date and expense restructuring costs associated with an acquired business. The Partnership allocates the purchase price of properties to net tangible and identified intangible assets acquired based on their fair values. In making estimates of fair values for purposes of allocating purchase price, the Partnership utilizes a number of sources, including independent appraisals that may be obtained in connection with the acquisition or financing of the respective property, own internal analysis of recently acquired and existing comparable properties in our portfolio and other market data. The Partnership also considers information obtained about each property as a result of its pre- acquisition due diligence, marketing and leasing activities in estimating the fair value of the tangible and intangible assets acquired. Identified net tangible and finite lived intangible assets are amortized over their estimated useful lives or contractual lives, which are as follows: Asset Categories Estimated Useful Life (In Years) Building and building improvements 15–40 Land improvements 15 Equipment 3–15 Resident lease intangibles 3–40

Holiday AL Holdings LP Notes to Consolidated Financial Statements (continued) (In Thousands) 9 2. Summary of Significant Accounting Policies (continued) Expenditures for ordinary maintenance and repairs are expensed to operations as incurred. Renovations and upgrades that improve and/or extend the life of the assets are capitalized and depreciated over their estimated useful lives. Long-lived assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of long-lived assets held for use is assessed by a comparison of the carrying amount of the asset to the estimated future undiscounted net cash flows expected to be generated by the asset. If estimated future undiscounted net cash flows are less than the carrying amount of the asset, then the fair value of the asset is estimated. The impairment expense is determined by comparing the estimated fair value of the asset to its carrying value, with any excess of carrying value over fair value recognized as an expense in the current period. During the years ended December 31, 2015, 2014 and 2013, the Partnership evaluated all long-lived depreciable assets for indicators of impairment, noting none. As a result, no impairment charges were recorded on the Partnership’s long-lived assets. Property sales or dispositions are recorded when title transfers to unrelated third parties, contingencies have been removed and sufficient cash consideration has been received by the Partnership. Upon disposition, the related costs and accumulated depreciation are removed from the respective accounts and any gain or loss on sale is recognized. Leases Leases for which we are the lessee are accounted for as operating, capital, or financing leases based on the underlying terms. The classification criteria are based on estimates regarding the fair value of the leased communities, minimum lease payments, effective cost of funds, the economic life of the community, and certain other terms in the respective lease agreements. Communities under operating leases are not included in investment in real estate in the consolidated balance sheets. The Partnership accounts for leases with rent holiday provisions or that contain fixed payment escalators on a straight-line basis as if the lease payments were fixed evenly over the life of each lease. Straight-line rent payable in the consolidated balance sheets represents the difference between straight line rent expense and the rent that is contractually due during the period. The Partnership capitalizes out-of-pocket costs incurred to enter into lease contracts as lease acquisition costs and amortizes them over the lives of the respective leases as additional community lease expense.

Holiday AL Holdings LP Notes to Consolidated Financial Statements (continued) (In Thousands) 10 2. Summary of Significant Accounting Policies (continued) Cash and Cash Equivalents Cash and cash equivalents consist of cash and highly liquid short-term investments with original maturities of three months or less from the date of purchase. Landlord Required Deposits Landlord required deposits consist primarily of funds required by various landlords to be placed on deposit as security for the Partnership’s performance under lease agreements and will generally be held until lease termination. A summary is as follows: December 31 2015 2014 Security deposits $ 112,404 $ 112,404 Property tax and reserves 3,407 6,650 Total landlord required deposits $ 115,811 $ 119,054 Allowance for Doubtful Accounts Allowance for doubtful accounts are recorded by management based upon the Partnership’s historical write-off experience, analysis of accounts receivable aging, and historic resident payment trends. Management reviews material past due balances on a monthly basis. Account balances are charged off against the allowance when management determines it is probable that the receivable will not be recovered. Allowance for doubtful accounts was $394 and $564 at December 31, 2015 and 2014, respectively.

Holiday AL Holdings LP Notes to Consolidated Financial Statements (continued) (In Thousands) 11 2. Summary of Significant Accounting Policies (continued) Deferred Loan Costs Deferred loan costs include direct costs to obtain financing. Such costs are deferred and amortized using the straight-line method, which approximates the effective interest method, over the terms of the underlying debt agreements. Revenue Recognition Resident fee revenue is recorded as it becomes due as provided for in the residents’ lease agreements. Residents’ agreements are generally for a term of 30 days with resident fees due monthly in advance. Certain communities have residency agreements that require the resident to pay an upfront fee prior to occupying the community. Community fees are non-refundable after a stated period (typically 90 days) and are initially recorded as deferred revenue and recognized on a straight-line basis as part of resident fee revenue over an estimated three-year average stay of the residents in the communities. Deferred revenue totaled $16,834 and $11,110 at December 31, 2015 and 2014, respectively. Certain residency agreements provide for free rent or incentives for a stated period of time. Incentives are initially recorded in other assets and recognized on a straight-line basis as a reduction of resident fee revenue over an estimated three-year average stay of the residents in the communities. Income Taxes The Partnership is not subject to federal income tax and therefore does not record a provision for federal income tax. Each partner is allocated their respective share of income and pays the related tax. The Partnership is subject to certain state and local income tax in a few jurisdictions and has provided for those taxes. Advertising Costs The Partnership expenses advertising costs as incurred. Advertising costs were $6,233, $5,493 and $691 for the periods ended December 31, 2015, 2014 and 2013, respectively, and are included in facility operating expenses in the consolidated statements of operations.

Holiday AL Holdings LP Notes to Consolidated Financial Statements (continued) (In Thousands) 12 2. Summary of Significant Accounting Policies (continued) General and Administrative Expenses On January 1, 2015, the Management Company entered into an agreement to provide property management services as an independent contractor to Harvest in exchange for a fee equal to 7% of monthly gross revenues of the Harvest communities plus reimbursements of certain general and administrative costs that the Management Company incurs on behalf of Harvest (see Note 10). Prior to January 1, 2015 certain employees of Harvest Management Sub, LLC (Management Sub), a wholly owned subsidiary of Harvest provided management services to the Partnership related to the Partnership’s underlying communities. Pursuant to a services agreement the Partnership reimbursed Management Sub for a portion of the employee cost which was based on an estimate of each individuals time spent working on the Partnership’s communities. Such reimbursement included a 10% markup as detailed in the agreement (see Note 10). Fair Value of Financial Instruments Cash and cash equivalents and cash and escrow deposits – restricted are reflected in the accompanying consolidated balance sheets at amounts considered by management to reasonably approximate fair value. The Partnership follows the provisions of Accounting Standards Codification (ASC) 820, Fair Value Measurement, when valuing its financial instruments. The statement emphasizes that fair value is a market-based measurement, not an entity-specific measurement, and should be determined based on the assumptions that market participants would use in pricing the asset or liability. As a basis for considering market-priced assumptions in fair value measurements, the statement establishes a fair value hierarchy that distinguishes between market-participant assumptions based on market data obtained from sources independent of the reporting entity (observable inputs that are classified within Level 1 and Level 2 of the hierarchy) and the reporting entity’s own assumptions about market- participant assumptions (unobservable inputs classified within Level 3 of the hierarchy).

Holiday AL Holdings LP Notes to Consolidated Financial Statements (continued) (In Thousands) 13 2. Summary of Significant Accounting Policies (continued) • Level 1 inputs utilize unadjusted quoted prices in active markets for identical assets or liabilities that the Partnership has the ability to access. • Level 2 inputs are inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. Level 2 inputs may include quoted prices for similar assets and liabilities in active markets, as well as inputs that are observable for the asset or liability, other than quoted prices, such as interest rates, foreign exchange rates, and yield curves that are observable at commonly quoted intervals. • Level 3 inputs are unobservable inputs for the asset or liability, which are typically based on an entity’s own assumptions, as there is little, if any, related market activity. In instances where the determination of the fair value measurement is based on inputs from different levels of the fair value hierarchy, the level in the fair value hierarchy within which the entire fair value measurement falls is based on the lowest level of input that is significant to the fair value measurement in its entirety. The Partnership’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment and considers factors specific to the asset or liability. Recently Issued Accounting Standards In April 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update No. 2014-08, “Presentation of Financial Statements (Topic 205) and Property, Plant, and Equipment (Topic 360): Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity” (“ASU 2014-08”), which amends U.S. GAAP to require reporting of discontinued operations only if the disposal represents a strategic shift that has (or will have) a major effect on an entity’s operations and financial results. This pronouncement becomes effective for the first annual reporting period beginning after December 15, 2014 with early adoption permitted. The Partnership adopted ASU 2014-08 for the annual reporting period ending December 31, 2015 on a prospective basis. The adoption of this guidance did not have a material impact on the Partnership's consolidated cash flows, results of operations, financial position, or liquidity.

Holiday AL Holdings LP Notes to Consolidated Financial Statements (continued) (In Thousands) 14 2. Summary of Significant Accounting Policies (continued) In May 2014, the FASB issued ASU No. 2014-09, Revenue from Contracts with Customers ("ASU 2014-09"). ASU 2014-09 affects any entity that either enters into contracts with customers to transfer goods or services or enters into contracts for the transfer of nonfinancial assets. Under ASU 2014-09, an entity will recognize revenue when it transfers promised goods or services to customers in an amount that reflects what it expects in exchange for the goods or services. The new standard will be effective for the Company beginning on January 1, 2018 and early adoption will be permitted beginning on January 1, 2017. The Company is currently evaluating the impact the adoption of ASU 2014-09 will have in its consolidated financial statements and disclosures. 3. Resident Lease Intangibles, Net At December 31, 2015 and 2014, resident lease intangibles, net were as follows: Resident Lease Intangibles, Net Balance at January 1, 2014 $ 1,990 Amortization (60) Balance at December 31, 2014 1,930 Amortization (60) Balance at December 31, 2015 $ 1,870

Holiday AL Holdings LP Notes to Consolidated Financial Statements (continued) (In Thousands) 15 3. Resident Lease Intangibles, Net (continued) Future amortization expense related to the resident lease intangibles over the next five years and thereafter, is as follows: Estimated Amortization of Resident Lease Intangibles, Net Years: 2016 $ 60 2017 60 2018 60 2019 60 2020 60 Thereafter 1,570 Total $ 1,870 4. Other Balance Sheet Data Prepaid expenses and other assets, net consisted of the following as of December 31, 2015 and 2014: 2015 2014 Deferred rent incentives, net $ 1,050 $ 1,636 Prepaid real & personal property tax 1,483 1,210 Prepaid insurance 862 389 Other assets 20,841 5,867 Pre-paid lease expense - 927 Due from affiliate (see Note 10) 15,373 10,615 Total $ 39,609 $ 20,644

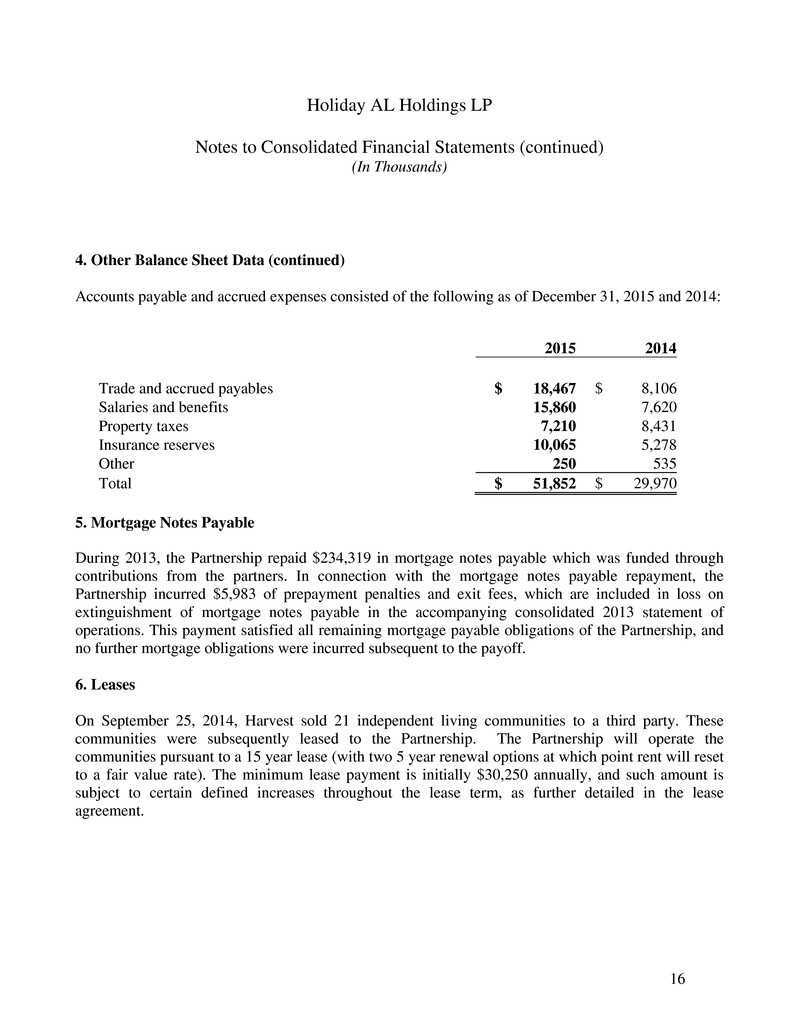

Holiday AL Holdings LP Notes to Consolidated Financial Statements (continued) (In Thousands) 16 4. Other Balance Sheet Data (continued) Accounts payable and accrued expenses consisted of the following as of December 31, 2015 and 2014: 2015 2014 Trade and accrued payables $ 18,467 $ 8,106 Salaries and benefits 15,860 7,620 Property taxes 7,210 8,431 Insurance reserves 10,065 5,278 Other 250 535 Total $ 51,852 $ 29,970 5. Mortgage Notes Payable During 2013, the Partnership repaid $234,319 in mortgage notes payable which was funded through contributions from the partners. In connection with the mortgage notes payable repayment, the Partnership incurred $5,983 of prepayment penalties and exit fees, which are included in loss on extinguishment of mortgage notes payable in the accompanying consolidated 2013 statement of operations. This payment satisfied all remaining mortgage payable obligations of the Partnership, and no further mortgage obligations were incurred subsequent to the payoff. 6. Leases On September 25, 2014, Harvest sold 21 independent living communities to a third party. These communities were subsequently leased to the Partnership. The Partnership will operate the communities pursuant to a 15 year lease (with two 5 year renewal options at which point rent will reset to a fair value rate). The minimum lease payment is initially $30,250 annually, and such amount is subject to certain defined increases throughout the lease term, as further detailed in the lease agreement.

Holiday AL Holdings LP Notes to Consolidated Financial Statements (continued) (In Thousands) 17 6. Leases (continued) On December 23, 2013, Harvest sold 25 independent living communities to a third party. These communities were subsequently leased to the Partnership. The Partnership will operate the communities pursuant to a 17 year lease. The minimum lease payment is initially $31,915 annually, and such amount is subject to certain defined increases throughout the lease term, as further detailed in the lease agreement. On December 23, 2013, Harvest sold 51 independent living communities to a third party. These communities were subsequently leased to the Partnership. The Partnership will operate the communities pursuant to a 17 year lease. The minimum lease payment is initially $65,031 annually, and such amount is subject to certain defined increases throughout the lease term, as further detailed in the lease agreement. On September 19, 2013, Harvest sold 26 independent living communities to a third party. These communities were subsequently leased to the Partnership. The Partnership will operate the communities pursuant to a 15 year lease (with two 5 year renewal options at which point rent will reset to a fair value rate). The minimum lease payment is initially $49,016 annually, and such amount is subject to certain defined increases throughout the lease term, as further detailed in the lease agreement. Lease expense under noncancelable operating leases was as follows: Year Ended December 31 2015 2014 2013 Contractual operating lease expense $ 183,658 $ 154,580 $ 16,073 Noncash straight-line lease expense 50,863 51,043 4,830 Lease expense $ 234,521 $ 205,623 $ 20,903

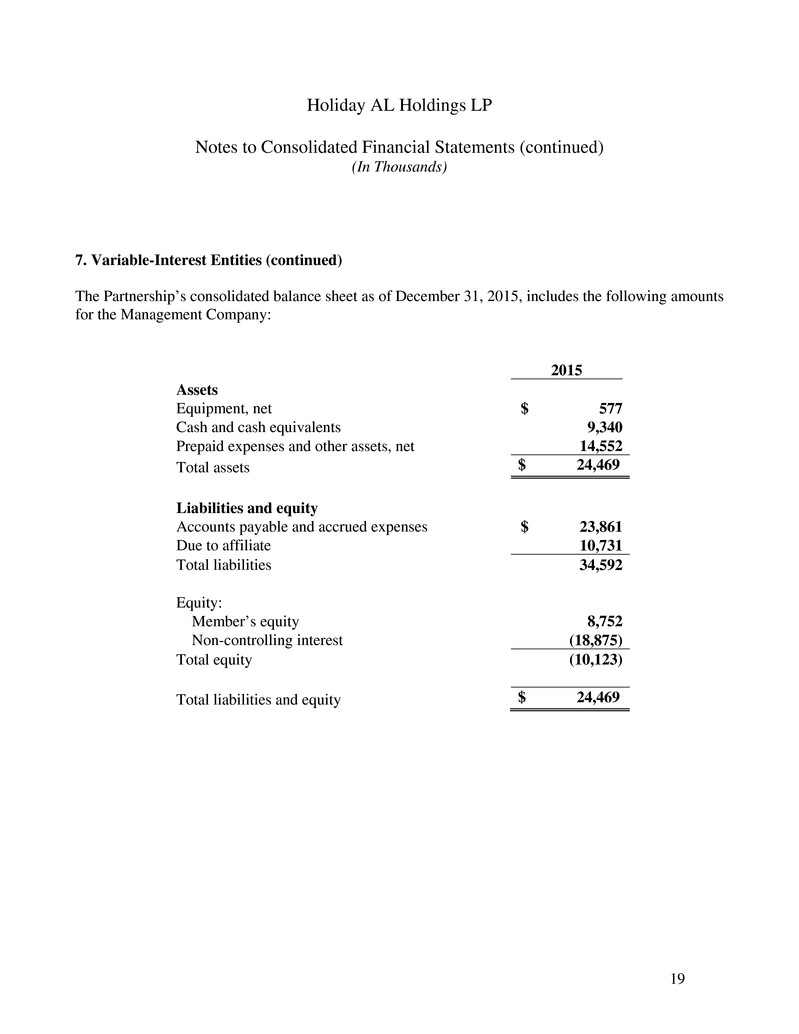

Holiday AL Holdings LP Notes to Consolidated Financial Statements (continued) (In Thousands) 18 6. Leases (continued) Minimum future cash lease payments under noncancelable operating leases which include 123 communities at December 31, 2015, are as follows: 2016 $ 191,770 2017 199,956 2018 206,532 2019 213,326 2020 220,347 Thereafter 2,403,147 Total $ 3,435,078 As of December 31, 2015, the Partnership was in compliance with all lease covenant requirements. 7. Variable-Interest Entities Under the provisions for the consolidation of variable-interest entities in ASC 810-10, the Partnership consolidates the assets, liabilities, and results of operations of the Management Company, the entity that performs property management services and holds various management agreements with Harvest and third parties. The Partnership has a 51% interest in the Management Company. As a result of this ownership position, the Partnership determined that it is the primary beneficiary of this variable-interest entity because the Partnership has the power to direct the activities that most significantly impact the entity’s economic performance. The Partnership’s maximum exposure to loss as a result of the investment is equal to $16.3 million, the amount the Partnership has contributed, and any additional funds which the Partnership may be required to contribute to the entity in the event of a cash shortfall.

Holiday AL Holdings LP Notes to Consolidated Financial Statements (continued) (In Thousands) 19 7. Variable-Interest Entities (continued) The Partnership’s consolidated balance sheet as of December 31, 2015, includes the following amounts for the Management Company: 2015 Assets Equipment, net $ 577 Cash and cash equivalents 9,340 Prepaid expenses and other assets, net 14,552 Total assets $ 24,469 Liabilities and equity Accounts payable and accrued expenses $ 23,861 Due to affiliate 10,731 Total liabilities 34,592 Equity: Member’s equity 8,752 Non-controlling interest (18,875) Total equity (10,123) Total liabilities and equity $ 24,469

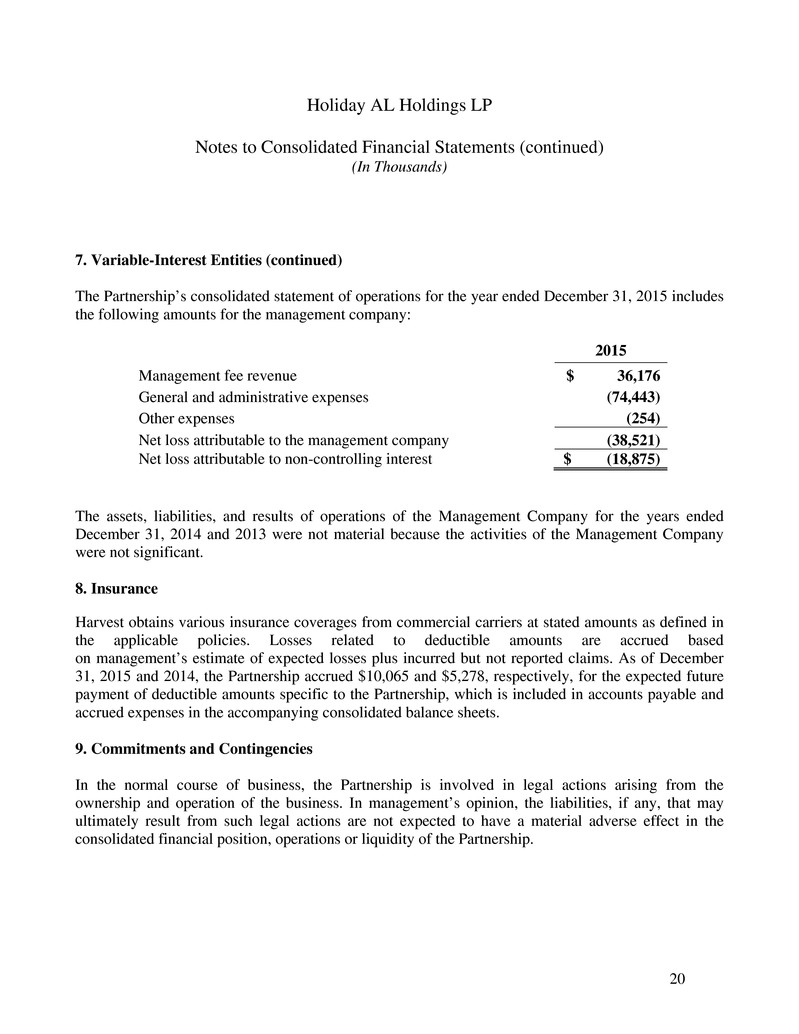

Holiday AL Holdings LP Notes to Consolidated Financial Statements (continued) (In Thousands) 20 7. Variable-Interest Entities (continued) The Partnership’s consolidated statement of operations for the year ended December 31, 2015 includes the following amounts for the management company: 2015 Management fee revenue $ 36,176 General and administrative expenses (74,443) Other expenses (254) Net loss attributable to the management company (38,521) Net loss attributable to non-controlling interest $ (18,875) The assets, liabilities, and results of operations of the Management Company for the years ended December 31, 2014 and 2013 were not material because the activities of the Management Company were not significant. 8. Insurance Harvest obtains various insurance coverages from commercial carriers at stated amounts as defined in the applicable policies. Losses related to deductible amounts are accrued based on management’s estimate of expected losses plus incurred but not reported claims. As of December 31, 2015 and 2014, the Partnership accrued $10,065 and $5,278, respectively, for the expected future payment of deductible amounts specific to the Partnership, which is included in accounts payable and accrued expenses in the accompanying consolidated balance sheets. 9. Commitments and Contingencies In the normal course of business, the Partnership is involved in legal actions arising from the ownership and operation of the business. In management’s opinion, the liabilities, if any, that may ultimately result from such legal actions are not expected to have a material adverse effect in the consolidated financial position, operations or liquidity of the Partnership.

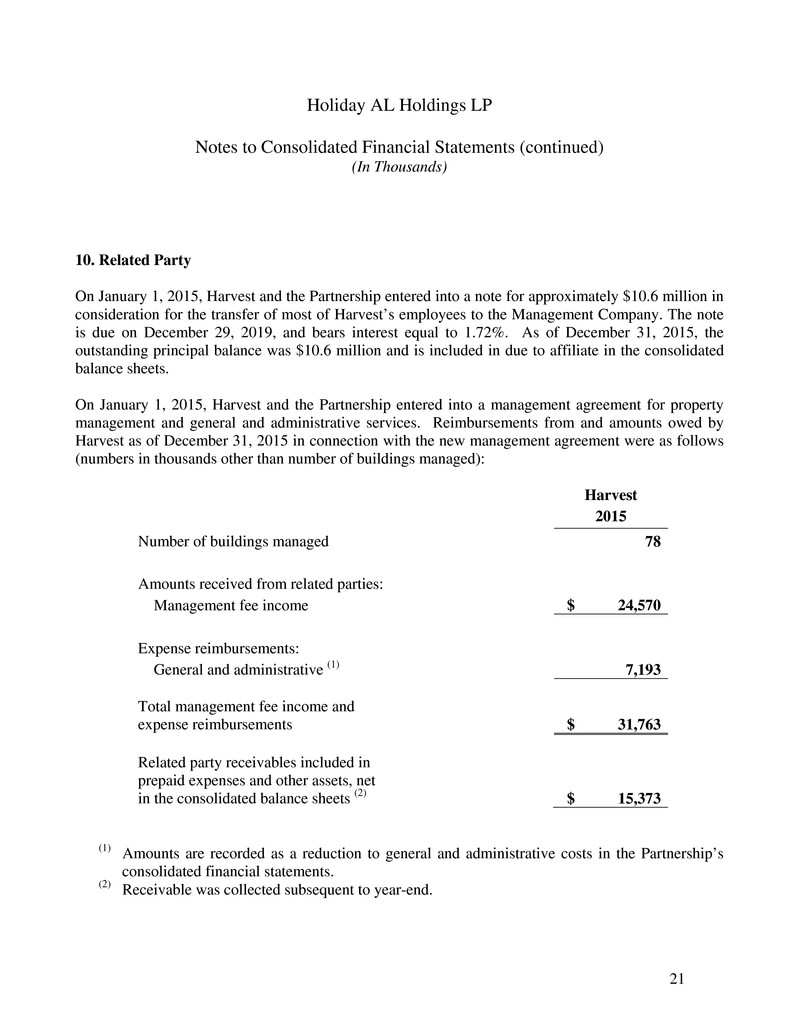

Holiday AL Holdings LP Notes to Consolidated Financial Statements (continued) (In Thousands) 21 10. Related Party On January 1, 2015, Harvest and the Partnership entered into a note for approximately $10.6 million in consideration for the transfer of most of Harvest’s employees to the Management Company. The note is due on December 29, 2019, and bears interest equal to 1.72%. As of December 31, 2015, the outstanding principal balance was $10.6 million and is included in due to affiliate in the consolidated balance sheets. On January 1, 2015, Harvest and the Partnership entered into a management agreement for property management and general and administrative services. Reimbursements from and amounts owed by Harvest as of December 31, 2015 in connection with the new management agreement were as follows (numbers in thousands other than number of buildings managed): Harvest 2015 Number of buildings managed 78 Amounts received from related parties: Management fee income $ 24,570 Expense reimbursements: General and administrative (1) 7,193 Total management fee income and expense reimbursements $ 31,763 Related party receivables included in prepaid expenses and other assets, net in the consolidated balance sheets (2) $ 15,373 (1) Amounts are recorded as a reduction to general and administrative costs in the Partnership’s consolidated financial statements. (2) Receivable was collected subsequent to year-end.

Holiday AL Holdings LP Notes to Consolidated Financial Statements (continued) (In Thousands) 22 10. Related Party (continued) As of December 31, 2014, the Partnership had a receivable due from Harvest in the amount of $10.6 million which represents expenses of Harvest paid by the Partnership. In connection with the previous management agreement with Harvest that ended December 31, 2014, the Partnership had a payable due to Harvest in the amount $0 and $3.9 million, as of December 31, 2015 and 2014, respectively. On September 25, 2014, the Partnership and Harvest entered into a note for approximately $18.1 million, the proceeds of which were used primarily to fund the security deposit for the operating lease of the 21 communities (see Note 6). The note was forgiven on April 30, 2015 and treated as a non-cash contribution in the consolidated statement of changes in equity. As of December 31, 2015 and 2014 the outstanding principal balance was $0.0 million and $18.1 million, respectively, in due to affiliate in the consolidated balance sheets. 11. Subsequent Events The Partnership has evaluated its subsequent events through February 19, 2016, the date the Partnership’s consolidated financial statements for the year ended December 31, 2015, were available for issuance. No subsequent events occurred which required accrual or disclosure in the consolidated financial statements.