Attached files

| file | filename |

|---|---|

| EX-10.64 - EXHIBIT 10.64 - IONIS PHARMACEUTICALS INC | ex10_64.htm |

| EX-31.2 - EXHIBIT 31.2 - IONIS PHARMACEUTICALS INC | exhibit31_2.htm |

| EX-21.1 - EXHIBIT 21.1 - IONIS PHARMACEUTICALS INC | exhibit21_1.htm |

| EX-23.1 - EXHIBIT 23.1 - IONIS PHARMACEUTICALS INC | exhibit23_1.htm |

| EX-32 - EXHIBIT 32.1 - IONIS PHARMACEUTICALS INC | exhibit32_1.htm |

| EX-31.1 - EXHIBIT 31.1 - IONIS PHARMACEUTICALS INC | exhibit31_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

Commission file number 0-19125

Ionis Pharmaceuticals, Inc.

(Exact name of Registrant as specified in its charter)

|

Delaware

|

|

33-0336973

|

|

(State or other jurisdiction of

incorporation or organization) |

|

(IRS Employer Identification No.)

|

2855 Gazelle Court, Carlsbad, CA 92010

(Address of principal executive offices, including zip code)

760-931-9200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $.001 Par Value

Indicate by check mark whether the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No

Indicate by check mark whether the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

|

Accelerated filer

|

|

|

|

|

|

Non-accelerated filer

(Do not check if a smaller reporting company) |

|

Smaller reporting company

|

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes No

The approximate aggregate market value of the voting common stock held by non-affiliates of the Registrant, based upon the last sale price of the common stock reported on The NASDAQ Global Select Market was $5,760,508,916 as of June 30, 2015.*

The number of shares of voting common stock outstanding as of February 19, 2016 was 120,658,638.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive Proxy Statement to be filed on or about April 15, 2016 with the Securities and Exchange Commission in connection with the Registrant’s annual meeting of stockholders to be held on June 3, 2016 are incorporated by reference into Part III of this Report. The Exhibit Index (Item No. 15) located on pages 68 to 73 incorporates several documents by reference as indicated therein.

| * | Excludes 19,785,891 shares of common stock held by directors and officers and by stockholders whose beneficial ownership is known by the Registrant to exceed 10 percent of the common stock outstanding at June 30, 2015. Exclusion of shares held by any person should not be construed to indicate that such person possesses the power, direct or indirect, to direct or cause the direction of the management or policies of the Registrant, or that such person is controlled by or under common control with the Registrant. |

FORWARD-LOOKING STATEMENTS

This report on Form 10-K and the information incorporated herein by reference includes forward-looking statements regarding our business, the business of Akcea Therapeutics, Inc., a subsidiary of Ionis Pharmaceuticals, and the therapeutic and commercial potential of our technologies and products in development, including nusinersen, IONIS-TTRRx and volanesorsen. Any statement describing our goals, expectations, financial or other projections, intentions or beliefs, is a forward-looking statement and should be considered an at-risk statement. Such statements are subject to certain risks and uncertainties, particularly those inherent in the process of discovering, developing and commercializing drugs that are safe and effective for use as human therapeutics, and in the endeavor of building a business around such drugs. Our forward-looking statements also involve assumptions that, if they never materialize or prove correct, could cause our results to differ materially from those expressed or implied by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in this report on Form 10-K, including those identified in Item 1A entitled “Risk Factors”. Although our forward-looking statements reflect the good faith judgment of our management, these statements are based only on facts and factors currently known by us. As a result, you are cautioned not to rely on these forward-looking statements.

In this report, unless the context requires otherwise, “Ionis,” “Company,” “we,” “our,” and “us” refers to Ionis Pharmaceuticals, Inc. and its subsidiaries.

TRADEMARKS

Ionis PharmaceuticalsTM is a trademark of Ionis Pharmaceuticals, Inc.

Akcea Therapeutics™ is a trademark of Ionis Pharmaceuticals, Inc.

Regulus Therapeutics® is a registered trademark of Regulus Therapeutics Inc.

KYNAMRO® is a registered trademark of Genzyme Corporation

Glybera® is a registered trademark of uniQure NV

CORPORATE INFORMATION

We incorporated in California in 1989 and in January 1991 we changed our state of incorporation to Delaware. In December 2015, we changed our name to Ionis Pharmaceuticals, Inc. from Isis Pharmaceuticals, Inc. Our principal offices are in Carlsbad, California. We make available, free of charge, on our website, www.ionispharma.com, our reports on Forms 10-K, 10-Q, 8-K and amendments thereto, as soon as reasonably practical after we file such materials with the Securities and Exchange Commission. Any information that we include on or link to our website is not a part of this report or any registration statement that incorporates this report by reference. You may also read and copy our filings at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-732-0330. The SEC also maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that site is www.sec.gov.

In December 2014, we formed our wholly owned subsidiary, Akcea Therapeutics, Inc., as a Delaware corporation, with its principal office in Cambridge, Massachusetts, to develop and commercialize drugs for people with serious cardiometabolic disorders.

1

IONIS PHARMACEUTICALS, INC.

FORM 10-K

For the Fiscal Year Ended December 31, 2015

Table of Contents

|

PART I

|

||

|

Page

|

||

|

Item 1.

|

Business

|

3

|

|

Item 1A.

|

Risk Factors

|

35

|

|

Item 1B.

|

Unresolved Staff Comments

|

41

|

|

Item 2.

|

Properties

|

41

|

|

Item 3.

|

Legal Proceedings

|

41

|

|

Item 4.

|

Mine Safety Disclosures

|

41

|

|

PART II

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

41

|

|

Item 6.

|

Selected Financial Data

|

43

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

43

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

61

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

61

|

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

61

|

|

Item 9A.

|

Controls and Procedures

|

61

|

|

Item 9B.

|

Other Information

|

64

|

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

64

|

|

Item 11.

|

Executive Compensation

|

64

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

64

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

65

|

|

Item 14.

|

Principal Accounting Fees and Services

|

65

|

|

PART IV

|

||

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

66

|

|

Signatures

|

2

PART I

Item 1. Business

Overview

We are leaders in discovering and developing RNA-targeted therapeutics. We have created an efficient and broadly applicable drug discovery platform. Using this platform, we have developed a large, diverse and advanced pipeline of potentially first-in-class and/or best-in-class drugs that we believe can provide high value for patients with significant unmet medical needs. In this way, we believe that we are fundamentally changing medicine with the goal to improve the quality of and save lives.

We have discovered and are developing three potentially transformational drugs, nusinersen, IONIS-TTRRx and volanesorsen, which we believe are close to commercialization. We designed each of these three drugs to treat patients with orphan diseases who have limited or no therapeutic options. In total, we are developing these three drugs for six different patient populations. In 2015, we completed target enrollment in the first pivotal Phase 3 study for each of these three drugs, and we anticipate reporting data from these studies in the first half of 2017. We designed nusinersen to treat patients with spinal muscular atrophy, or SMA, a severe motor-neuron disease that is the leading genetic cause of infant mortality. We designed IONIS-TTRRx to treat patients with transthyretin amyloidosis, or TTR amyloidosis, a fatal disease in which patients experience progressive buildup of amyloid plaque deposits in tissues throughout the body, including peripheral nerves, heart, intestinal tract, kidney and bladder. We designed volanesorsen to treat patients with diseases associated with extremely high levels of triglycerides, including patients with two severe and rare genetic conditions called familial chylomicronemia syndrome, or FCS, and patients with familial partial lipodystrophy, or FPL. We anticipate that the data from our pivotal Phase 3 studies of these drugs, if positive, will support global regulatory filings for each drug. We believe that the significant unmet medical need and the severity of these diseases could warrant a rapid path to market. Already our partners for these programs, Biogen for nusinersen and GSK for IONIS-TTRRx, are preparing to commercialize these drugs. Our wholly owned subsidiary, Akcea Therapeutics Inc., or Akcea, is preparing to commercialize volanesorsen. All three companies are engaging in pre-commercialization activities to understand the patient journey, build disease awareness with physicians and patients and develop their launch plans.

Nusinersen has the potential to be a transformational drug for infants and children with SMA. We are evaluating nusinersen in a broad development program designed to support marketing authorization for infants and children with this devastating disease. In our open-label studies, we have observed increases in the median event-free age in infants and increases in muscle function scores in infants and children with SMA. Although the studies are open-label with small numbers of patients, the totality of the data across these studies and multiple measures of activity suggest nusinersen could provide significant therapeutic benefit. Together with Biogen, we are conducting a broad development plan that supports a potentially rapid path to market for nusinersen.

IONIS-TTRRx is potentially a first-in-class and best-in-class drug for the treatment of all forms of TTR amyloidosis. It is one drug, given as one subcutaneous injection, once a week. We and GSK are evaluating IONIS-TTRRx in a broad development program designed to support marketing authorization of IONIS-TTRRx for all forms of TTR amyloidosis: familial amyloid polyneuropathy, or FAP, and the cardiomyopathy form of TTR amyloidosis, which includes both familial amyloid cardiomyopathy, or FAC, and wild-type TTR, or wt-TTR. Together, these forms of TTR amyloidosis represent a large potential market for IONIS-TTRRx. In our open-label extension study we have observed substantial TTR reductions in patients with FAP. In a Phase 2 open-label, investigator-initiated study, Dr. Merrill Benson, professor of pathology and lab medicine and molecular genetics at Indiana University School of Medicine, observed sustained reductions in TTR and evidence of disease stabilization in patients with the cardiomyopathy form of TTR amyloidosis.

Volanesorsen has the potential to significantly improve the lives of patients who, because of their severely elevated triglycerides, are at constant risk of pancreatitis, which can require hospitalization and can be life-threatening. In our Phase 2 clinical program, patients with elevated triglycerides treated with volanesorsen showed significantly improved lipid profiles with substantial reductions of triglycerides and other risk factors of cardiovascular disease. To maximize the value of volanesorsen and other earlier-stage drugs for serious cardiometabolic disorders, we formed Akcea Therapeutics to focus on developing and commercializing these drugs. Akcea’s pipeline includes volanesorsen, IONIS-APOCIII-LRx, IONIS-APO(a)-LRx and IONIS-ANGPTL3-LRx. Moving these drugs into a company that we own and control allows us to retain substantial value from them and ensures Ionis’ core focus remains on innovation. Akcea is building development and commercialization expertise in lipid and cardiometabolic diseases, including highly trained, specialized medical, marketing and sales teams, to successfully commercialize volanesorsen and the other lipid drugs in its pipeline.

In addition to our Phase 3 programs, we have a pipeline of drugs with the potential to be first-in-class and/or best-in-class drugs to treat patients with inadequately treated diseases. Our pipeline has over a dozen drugs in Phase 2 development, many of which we believe have the potential to be significant commercial opportunities. In particular, IONIS-FXIRx and IONIS-APO(a)-LRx are representative of the value we have created. IONIS-FXIRx is the first antithrombotic in development that has shown it can decrease the risk of blood vessel obstruction caused by a blood clot without increasing bleeding risk. Given the unique profile of IONIS-FXIRx, we believe that IONIS-FXIRx has the potential to be an important therapy for the many patients who need an antithrombotic but cannot take currently available therapies due to the high risk of bleeding. Because of the significant commercial opportunities for this drug, we licensed it to Bayer HealthCare, a leader in developing and commercializing antithrombotics. Bayer plans to conduct a robust development program to maximize the commercial value of IONIS-FXIRx. We are eligible to participate in this value through significant milestone payments and substantial royalties in the low-to-high 20 percent range on gross margins. IONIS-APO(a)-LRx is the first and only drug in clinical development designed to selectively and robustly lower Lp(a), a key driver of cardiovascular disease. We believe that addressing Lp(a) is the next important horizon in lipid-focused cardiovascular disease treatment. In our clinical studies, we observed significant and sustained reductions in Lp(a) after only a single dose of IONIS-APO(a)-LRx. With our support, Akcea has designed a broad development program to evaluate IONIS-APO(a)-LRx in patients who are at significant cardiovascular risk due to their high Lp(a) levels. In addition to these two examples, our Phase 2 pipeline includes drugs to treat patients with diseases spanning numerous therapeutic areas, including severe and rare diseases, viral infections, ocular diseases, metabolic disorders and cardiovascular diseases. We plan to expand the therapeutic reach of our technology by adding three to five new drugs to our pipeline every year.

3

We believe that our technology is the most versatile and most efficient drug discovery technology today. We can develop drugs to act upon disease targets in many different tissues, including the liver, muscle, kidney, brain, lung, eye, tumors and others. Many of these disease targets are inaccessible with other types of drugs. Our drugs also work through numerous different cellular mechanisms, allowing us to develop drugs that can decrease or increase the production of a target protein involved in disease and remove disease-causing RNAs. In our clinical studies, we have demonstrated that we can administer our drugs by numerous different routes of administration, including oral, local, intrathecal and subcutaneous administration. The recent advances we have made in our technology have already translated into significant value in many of our newer drugs, which patients tolerate better and which are more potent than our earlier Generation 2 drugs. We continue to advance our RNA technology to create even better medicines and to expand the reach of our technology. We actively patent the advances we have made across all areas of our technology and the drugs we are developing. In this way, we have amassed a substantial intellectual property position that provides us with extensive protection for our drugs and our technology.

We have established alliances with a cadre of leading global pharmaceutical companies that are working alongside us in developing our drugs, advancing our technology and preparing to commercialize our products. Our partners bring resources and expertise that augment and build upon our internal capabilities. The depth of our knowledge and expertise with antisense technology provides us the flexibility to partner our drugs at what we believe is the optimal time to maximize the near- and long-term value of our drugs. We have distinct partnering strategies that we employ based on the specific program, therapeutic area and the expertise and resources our potential partners may bring to the collaboration. We have strategic partnerships with Biogen and AstraZeneca through which we can broadly expand our drug discovery efforts to new disease targets in specific therapeutic areas that are outside of our expertise or in which our partners can provide tools and resources to complement our drug discovery efforts. We also form early stage research and development partnerships that allow us to expand the application of our technology to new therapeutic areas. For example, we established a collaboration with Janssen, which brings together our RNA-targeted technology platform and Janssen’s expertise in autoimmune disorders and therapeutic formulation to discover and develop antisense drugs to treat autoimmune disorders in the gastrointestinal, or GI, tract. Additionally, we form development and commercialization partnerships that enable us to leverage our partner’s global expertise and resources needed to support large commercial opportunities. For example, we licensed IONIS-FXIRx to Bayer to develop and commercialize IONIS-FXIRx for the prevention of thrombosis. As a leader in the antithrombotic market, Bayer has the expertise, resources and commitment to broadly develop IONIS-FXIRx. Lastly, we also work with a consortium of companies that can exploit our drugs and technologies outside our primary areas of focus. We refer to these companies as satellite companies.

Through our partnerships, we have created a broad and sustaining base of potential license fees, upfront payments, milestone payments, royalties, and earn out payments while controlling our drug development expenses. We have the potential to earn significant revenue from all of our partnerships. Since 2007, we have received more than $1.7 billion in cash from upfront and licensing fees, equity purchase payments, milestone payments and research and development funding from our partnerships. We have the potential to earn nearly $12 billion in future milestone payments and licensing fees from our current partnerships. We also have the potential to share in the future commercial success of our inventions and drugs resulting from our partnerships through earn out or royalty arrangements.

Corporate Highlights in 2015 and early 2016

| ● | We formed a wholly owned subsidiary, Akcea Therapeutics, to develop and commercialize our lipid drugs, volanesorsen, IONIS-APOCIII-LRx, IONIS-APO(a)-LRx and IONIS-ANGPTL3-LRx. |

| ● | We licensed IONIS-FXIRx to Bayer to develop and commercialize IONIS-FXIRx for the prevention of thrombosis. |

| ● | We and AstraZeneca formed a strategic collaboration to discover and develop antisense therapies for treating cardiovascular and metabolic diseases, primarily focused on targets in the kidney, and renal diseases. |

| ● | We formed an alliance with Janssen to discover and develop antisense drugs to treat autoimmune disorders of the gastrointestinal tract. |

| ● | We received more than $320 million in payments from our partners in 2015. |

| ● | We changed our name to Ionis Pharmaceuticals, Inc. in December 2015 and our stock now trades under the ticker symbol “IONS”. |

Drug Development Highlights in 2015 and early 2016

| ● | We continued to make significant advances in our pipeline and completed target enrollment for three pivotal phase 3 studies, including: |

| ● | CHERISH, a Phase 3 study evaluating nusinersen in children with SMA. |

| ● | NEURO-TTR, a Phase 3 study evaluating IONIS-TTRRx in patients with FAP. |

| ● | APROACH, a Phase 3 study evaluating volanesorsen in patients with FCS. |

| ● | We and our partners reported positive data from 13 clinical studies. These data exemplify the broad applicability and potential for antisense drugs to provide therapeutic benefit for many different diseases. These data include: |

| ● | Phase 2 data from two ongoing open-label studies in which infants and children with SMA treated with nusinersen experienced increases in muscle function scores. Additionally, there were no events of death or permanent ventilation reported in 2015 in nusinersen-treated infants in the ongoing Phase 2 clinical study. |

| ● | Data from the ongoing open-label extension study of NEURO-TTR in which patients with FAP treated with IONIS-TTRRx for at least three months experienced reductions in TTR protein of up to 92 percent with a mean maximum (nadir) reduction of 76 percent compared to baseline. |

| ● | Phase 2 data from an ongoing open-label, investigator-initiated study in patients with FAC and patients with wt-TTR treated with IONIS-TTRRx for 12 months preliminarily evidencing disease stabilization and sustained TTR reductions. |

| ● | Phase 2 data in which patients with high lipoprotein(a), or Lp(a), treated with IONIS-APO(a)Rx experienced reductions in Lp(a) of up to 94 percent. |

4

| ● | Phase 1/2 data in which patients with high Lp(a) treated with IONIS-APO(a)-LRx experienced a greater than 30-fold increase in potency over IONIS-APO(a)Rx, the non-LICA Lp(a) drug. Patients also experienced dose-dependent reductions in Lp(a) of up to 97 percent and 99 percent after a single dose and multiple doses of IONIS-APO(a)-LRx, respectively. |

| ● | Clinical and preclinical data in patients with cancer, including advanced/metastatic hepatocellular carcinoma and diffuse large B cell lymphoma, treated with IONIS-STAT3-2.5Rx evidencing antitumor activity. |

| ● | Phase 2 data in which patients with type 2 diabetes treated with IONIS-PTP1BRx experienced statistically significant mean reductions in body weight and HbA1c (0.7 percentage point). |

| ● | Phase 1 results in which healthy volunteers dosed with IONIS-ANGPTL3Rx experienced significant reductions of up to 93 percent in angiopoietin-like 3 protein, up to 63 percent in triglycerides and up to 46 percent in total cholesterol. |

| ● | Phase 1 results in which healthy volunteers dosed with IONIS-PKKRx experienced significant, dose-dependent reductions of prekallikrein of up to 95 percent. |

| ● | Phase 3 data from the FOCUS FH study evaluating Kynamro in patients with severe heterozygous familial hypercholesterolemia. This study met its primary endpoint with a statistically significant reduction of LDL-Cholesterol, or LDL-C. |

| ● | We published clinical data from our novel lipid drugs, volanesorsen and IONIS-APO(a)Rx, in the New England Journal of Medicine and The Lancet, respectively. |

| ● | The U.S. Food and Drug Administration, or FDA, granted volanesorsen orphan drug designation for the treatment of patients with FCS. |

| ● | The European Medicines Agency, or EMA, granted IONIS-HTTRx orphan drug designation for the treatment of patients with Huntington’s Disease. |

| ● | We, together with our partners, continued to advance our pipeline of drugs, initiating 11 clinical studies, including one Phase 3 study and six Phase 2 studies. |

Drug Discovery and Development

Introduction to Drug Discovery

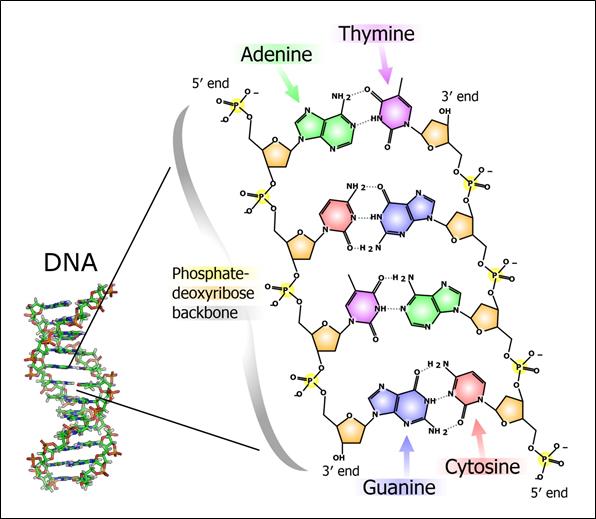

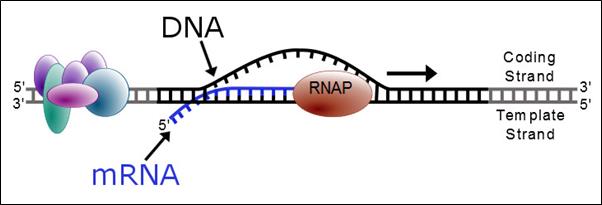

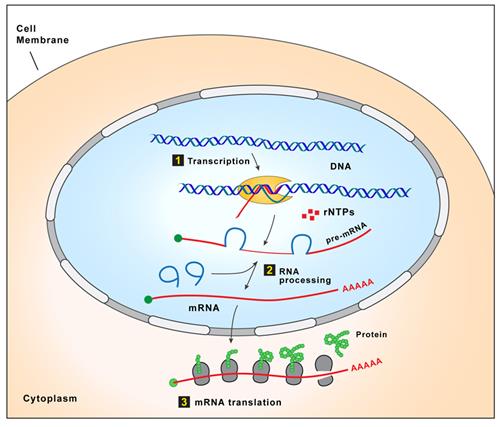

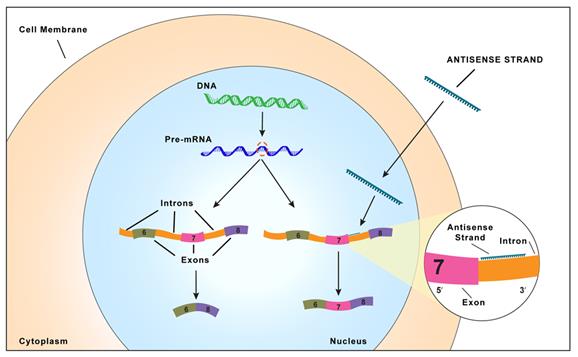

Proteins are essential working molecules in a cell. Almost all human diseases result from inappropriate protein production, improper protein activity or loss of a protein. Scientists use traditional drug discovery methods to design drugs to interact with the proteins in the body that are supporting or causing a disease. Antisense drugs are different from traditional small molecule drugs because antisense drugs can modify the production of proteins by targeting RNAs. In this way, antisense drugs can reduce the production of a disease-causing protein or increase the production of a protein that, when absent, causes disease. Antisense drugs also can treat disease by targeting and reducing RNAs that may be causing disease. RNAs are naturally occurring molecules in the body that primarily provide the information the cell needs to produce proteins. When our antisense drugs bind to the specific RNAs of a particular gene, they will ultimately alter the production of the protein encoded in the target gene or, in the case of disease-causing RNAs, degrade the RNA.

Our Development Projects

We are the leader in the discovery and development of an exciting class of RNA-targeted drugs called antisense drugs. With our proprietary drug discovery platform, we can rapidly identify drugs from a wealth of potential targets to treat a broad range of diseases. We focus our efforts in therapeutic areas where our drugs will work best, efficiently screening many targets in parallel and carefully selecting the best drugs. By combining this efficiency with our rational approach to selecting disease targets, we have built a large and diverse portfolio of drugs we designed to treat a variety of health conditions, with an emphasis on cardiovascular, metabolic, severe and rare diseases, including neurological diseases, and cancer. We are developing antisense drugs for systemic, intrathecal and local delivery. We expect to continue to add new drugs to our pipeline, building a broad proprietary portfolio of drugs to treat many diseases and creating opportunities to generate substantial revenue. We also continue to improve our scientific understanding of our drugs, including how our drugs impact the biological processes of the diseases we target.

With our expertise in discovering and characterizing novel antisense drugs, our scientists can optimize the properties of our antisense drugs for use with particular targets. Our scientists have made significant advances in chemistries. Our Generation 2.0+ antisense drugs have increased potency and an improved side effect profile over our earlier generation drugs. Our scientists have further improved upon our second-generation chemistry with our Generation 2.5 chemistry, an advancement that further increases the potency of our drugs and broadens the tissues in which our drugs can work. We currently have four Generation 2.5 drugs in development, and we expect that some of our future drugs will also incorporate our Generation 2.5 chemistry. In addition to improving the chemical foundation of our drugs, we have also created LIgand-Conjugated Antisense, or LICA, technology, which we designed to enhance the delivery of our drugs to particular tissues. We believe that our LICA technology could further enhance the potency of our drugs. For example, our LICA technology directed toward liver targets produced a ten-fold increase in potency in preclinical studies in both our second-generation and our Generation 2.5 drugs. Our first clinical data from a LICA drug demonstrated an increase in potency that was more than 30-fold greater than what we observed with our non-LICA drug to the same target. We currently have eight second-generation LICA drugs in our pipeline, all of which we designed to inhibit targets in the liver. We expect we can also enhance some of our future drugs, including our Generation 2.5 drugs, with our LICA technology.

We have utilized our chemistry advancements to expand the therapeutic and commercial opportunities of our pipeline. These advancements, along with the manufacturing and analytical processes that are the same for all of our drugs, shorten our timeline from initial concept to the first human dose when compared to small molecule drugs.

5

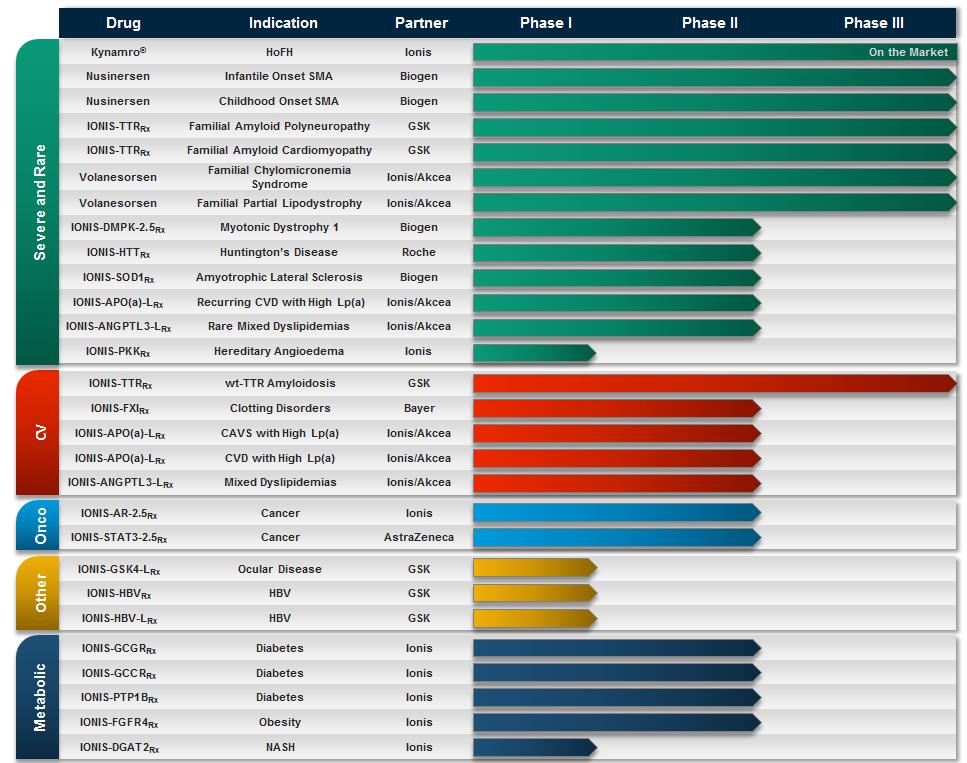

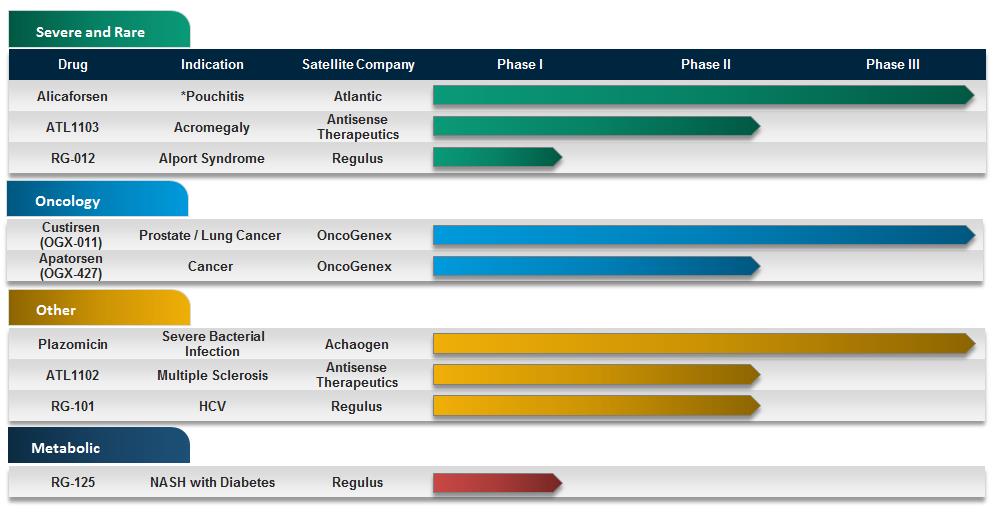

The above table lists our pipeline, including the disease indications, our development partner if the drug is partnered, and the development status of each drug. Typically, the names of our drugs incorporate the target of the drug, such as IONIS-TTRRx. In this case, TTR is the target of the drug. Unless indicated otherwise, the majority of the drugs in our pipeline are Generation 2.0+ antisense drugs. We differentiate our Generation 2.5 drugs by adding a 2.5 notation at the end of the drug name, such as IONIS-DMPK-2.5Rx. We differentiate our LICA drugs by adding an L at the end of the drug name, such as IONIS-APO(a)-LRx. We also plan to add Generation 2.5 drugs that incorporate our LICA technology. We will identify these drugs by the addition of both the 2.5 and L into the drug name. As the drugs in our pipeline advance in clinical development, we will adopt nonproprietary names given to each drug from the United States Adopted Names Council. For example, nusinersen is a nonproprietary name that we obtained for ISIS-SMNRx. Once we or our partners establish a brand name, we will adopt the brand name.

With a pipeline as large and advanced as ours, we have a number of clinical events each year as we initiate new clinical studies, complete and report data from clinical studies and add new drugs to our pipeline. In 2016, we plan to initiate multiple clinical studies, report data on multiple drugs and add three to five new drugs into development.

Our Phase 3 Drugs

We have three drugs for which we are conducting pivotal Phase 3 studies: nusinersen, IONIS-TTRRx and volanesorsen. Each of these drugs has the potential to transform the treatment of patients with an orphan disease, and we believe all three of these drugs are close to commercialization. In 2015,we completed target enrollment in a Phase 3 study for each of these drugs. We expect to have Phase 3 data for all three drugs in the first half of 2017 and potentially file for marketing authorization in the 2017/2018 timeframe if the data are positive.

Nusinersen – Nusinersen is an antisense drug we and Biogen are developing to treat patients with spinal muscular atrophy, or SMA. SMA is a severe motor-neuron disease that is the leading genetic cause of infant mortality. SMA occurs from a deletion or mutation of a gene responsible for producing a protein critical for normal cellular function. We designed nusinersen to compensate for this underlying genetic defect by increasing the production of the protein from a closely related gene. In January 2012, we and Biogen entered into an alliance that provides Biogen with an option to develop and commercialize nusinersen. We discovered nusinersen in collaboration with Dr. Adrian R. Krainer at Cold Spring Harbor Laboratory.

6

SMA affects approximately 30,000 to 35,000 patients in the United States, Europe and Japan. One in 50 people, approximately six million people in the United States, carry the gene mutation that causes SMA. Carriers experience no symptoms and do not develop the disease. When both parents are carriers, however, there is a one in four chance their child will have SMA. SMA is caused by a loss of, or defect in, the survival motor neuron 1, or SMN1, gene leading to a decrease in the survival motor neuron, or SMN protein. SMN is critical to the health and survival of nerve cells in the spinal cord that are responsible for neuro-muscular growth and function. The severity of SMA correlates with the amount of SMN protein produced in motor neurons. Infants with Type I SMA, the most severe life-threatening form, produce very little SMN protein and have a significantly shortened life expectancy of less than two years according to natural history studies that researchers have conducted in patients with SMA. In a 2009 paper by Rudnik-Schöneborn, the median age for event-free survival in infants with Type I SMA was 6.2 months. In a contemporaneous study published in 2014 by the Pediatric Neuromuscular Clinical Research group, or PNCR, the median age for event-free survival in infants with two copies of SMN2 was 10.5 months. Children with Type II SMA generally have more copies of the SMN2 gene and have greater amounts of SMN protein than Type 1 infants but still have a shortened lifespan. Type II SMA patients are never able to walk. Children with Type III SMA have a normal lifespan but incur additional life-long physical disabilities as they grow.

We are evaluating nusinersen in a broad Phase 3 program. We have completed target enrollment in the Phase 3 study, CHERISH, in children with SMA and expect to complete enrollment in the Phase 3 study, ENDEAR, in infants with SMA in the second quarter of 2016. CHERISH is a randomized, international, double-blind, sham-procedure controlled fifteen month study in approximately 120 children with SMA who are non-ambulatory. We designed this study to support an application for marketing authorization of nusinersen in children with SMA. CHERISH is evaluating the efficacy and safety of a 12 mg dose of nusinersen with a primary endpoint of a change in the Hammersmith Functional Motor Scale-Expanded, or HFMSE, a validated method to measure changes in muscle function in children with SMA. We also included additional efficacy endpoints in the study. ENDEAR is a randomized, international, double-blind, sham-procedure controlled, thirteen month study in approximately 110 infants diagnosed with SMA. We designed this study to support an application for marketing authorization of nusinersen in infants with SMA. ENDEAR is evaluating the efficacy and safety of a 12 mg dose of nusinersen with a primary endpoint of survival or time to permanent ventilation. We also included additional efficacy endpoints in the study. We plan to report data from both ENDEAR and CHERISH in 2017.

The FDA has granted Orphan Drug Designation and Fast Track Status to nusinersen for the treatment of patients with SMA. The EMA has granted Orphan Drug Designation to nusinersen for the treatment of patients with SMA.

IONIS-TTRRx – IONIS-TTRRx is an antisense drug we and GSK are developing to treat patients with all forms of TTR amyloidosis. TTR amyloidosis is a severe, progressive and fatal disease. In all forms of TTR amyloidosis TTR protein forms amyloid deposits in various tissues and organs, including peripheral nerves, heart, intestinal tract, eyes, kidneys, central nervous system, thyroid and bone. The progressive accumulation of TTR amyloid deposits in these tissues and organs leads to organ failure and eventually death. Together with GSK, we are developing IONIS-TTRRx as one drug with one product presentation, in one broad development plan for the treatment of patients with all forms of TTR amyloidosis. We designed IONIS-TTRRx to be administered as one subcutaneous injection, once a week for all TTR amyloidosis patients.

TTR amyloidosis is a single disease that clinicians characterize into three forms that can have multiple overlapping clinical manifestations: FAP, FAC and wt-TTR. FAP affects approximately 10,000 patients worldwide. FAP patients primarily have TTR build up in the peripheral nervous system, but can also have significant TTR build up in multiple organs. FAP is a painful, fatal disease that ultimately leads to multi-organ failure and death within five to 15 years after symptom onset and diagnosis. FAC affects approximately 40,000 patients worldwide and wt-TTR amyloidosis affects approximately 200,000 patients worldwide. While both FAC and wt-TTR differ in the genetic cause of TTR amyloidosis, both diseases progress in similar ways. Patients with FAC and wt-TTR amyloidosis have TTR build up in the heart muscle and succumb to heart failure within three to five years after symptom onset and diagnosis. TTR amyloidosis is fatal and there are limited therapeutic options to treat patients with this disease.

We are evaluating IONIS-TTRRx in a broad Phase 3 development program. We have completed target enrollment in the NEURO-TTR study which is a randomized, double-blind, placebo-controlled, international, Phase 3 study of IONIS-TTRRx in FAP patients. We plan to report data from this study in 2017. We designed this study to support an application for marketing authorization of IONIS-TTRRx in patients with FAP. Our study is measuring the effects of IONIS-TTRRx on neurological dysfunction and on quality-of-life. In 2016, our partner, GSK, plans to initiate a Phase 3 outcome study, CARDIO-TTR, in all forms of TTR amyloid cardiomyopathy, including both FAC and wt-TTR amyloidosis. In 2016, GSK is also planning to initiate a small Phase 3 study in Japan in patients with FAP to support Japanese regulatory filings.

The FDA has granted Orphan Drug Designation and Fast Track Status to IONIS-TTRRx for the treatment of patients with FAP. The EMA has granted Orphan Drug Designation to IONIS-TTRRx for the treatment of patients with all types of TTR amyloidosis.

Volanesorsen – Volanesorsen is an antisense drug we and Akcea are developing to treat patients with FCS and patients with FPL. We designed volanesorsen to reduce ApoC-III, a protein the liver produces that regulates triglyceride metabolism in the blood. Physicians associate higher levels of ApoC-III with a higher risk of cardiovascular disease. Akcea is responsible for developing and commercializing volanesorsen.

Both FCS and FPL are ultra-orphan diseases, each affecting an estimated 3,000 to 5,000 patients worldwide. FCS is often associated with triglyceride levels higher than 2,000 mg/dL. Because of their extremely high triglyceride levels, FCS patients are at significant risk of many serious health conditions, including frequent episodes of pancreatitis, which can require hospitalization and can be life-threatening. FPL is associated with the inability of a patient to store fat, resulting in high triglyceride levels that are often above 1,000 mg/dL and increased risk for pancreatitis. In addition, most patients with FPL have diabetes and other metabolic abnormalities. Current treatment options do not reduce triglyceride levels enough to reduce the risk of serious illness in patients with FCS or FPL. We believe that the robust triglyceride reduction and the improvements in glucose control we observed in our Phase 2 program support our evaluation of volanesorsen in both of these patient populations.

7

We are evaluating volanesorsen in a broad Phase 3 development program. We have completed target enrollment in the APPROACH study, which is a randomized, double-blind, placebo-controlled, international Phase 3 study in patients with FCS. We are also evaluating volanesorsen in a Phase 3 study, BROADEN, in patients with FPL. BROADEN is a randomized, double-blind, placebo-controlled, international study in patients with FPL. The primary endpoint of both APPROACH and BROADEN is percent change in fasting triglycerides from baseline after three months of dosing with volanesorsen.

The FDA and EMA have granted Orphan Drug Designation to volanesorsen for the treatment of patients with FCS.

Akcea Therapeutics: Our Wholly Owned Subsidiary to Develop and Commercialize Drugs for Cardiometabolic Disorders

Akcea Therapeutics, our wholly owned subsidiary, is a company focused on developing and commercializing potentially transformative medicines for people with serious cardiometabolic diseases caused by lipid disorders. This report includes financial information for this separate business segment in Note 7, Segment Information and Concentration of Business Risk, in the Notes to the Consolidated Financial Statements. Since its formation in late 2014, Akcea has advanced its portfolio of development-stage drugs covering multiple targets and diseases. We believe each drug in the Akcea portfolio has the potential to treat several diseases with substantial overlap in the treating physician community, particularly among lipid disease thought leaders. Akcea is building expertise in lipids and cardiometabolic diseases which it can leverage across its entire portfolio.

Akcea plans to develop and successfully commercialize globally a portfolio of our cardiometabolic drugs. These drugs include volanesorsen, IONIS-APOCIII-LRx, IONIS-APO(a)-LRx and IONIS-ANGPTL3-LRx. In 2015, Akcea enhanced its development and commercial capabilities by hiring several seasoned professionals whose collective experience includes multiple rare disease launches over two decades and deep clinical and commercial experience focused primarily on lipid disorders, cardiovascular disease and endocrinology.

Also in 2015, Akcea advanced the commercial development activities for volanesorsen in patients with FCS. These activities include:

|

●

|

Increasing the understanding of the patients and treating physicians who take care of these patients;

|

|

●

|

Increasing awareness of FCS;

|

|

●

|

Enhancing the speed and quality of diagnosis; and

|

|

●

|

Understanding the burden of disease.

|

Akcea plans to leverage these same commercialization activities across its portfolio to commercialize its drugs for rare populations. Akcea may establish relationships with large pharmaceutical companies to co-commercialize select Akcea drugs for large patient populations that require a substantial sales force.

In 2016, Akcea plans to prepare the regulatory filings for volanesorsen so it can file for marketing authorization as quickly as possible after reporting Phase 3 FCS data in 2017, assuming the data are positive. Akcea also plans to continue to build the development, regulatory, and commercial infrastructure required to commercialize volanesorsen, including a specialized clinical field force and physician and patient support teams. Akcea intends to build these functions in the United States and Europe first.

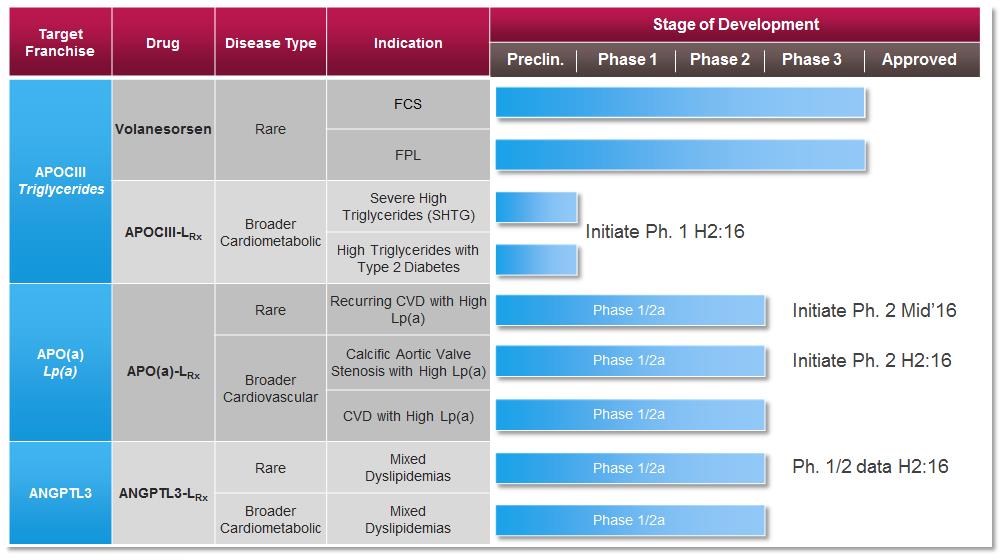

We granted Akcea exclusive rights to develop and commercialize volanesorsen, IONIS-APOCIII-LRx, IONIS-APO(a)-LRx, and IONIS-ANGPTL3-LRx as part of its formation. Akcea is responsible for globally developing and commercializing these drugs. Ionis will provide business support services to Akcea and Akcea will compensate Ionis for providing such services. Below is Akcea’s product pipeline that includes the disease type, disease indication and the stage of development for each drug.

Akcea’s Cardiometabolic Disease Pipeline

8

Volanesorsen – Volanesorsen is an antisense drug we and Akcea are developing to treat patients with FCS and FPL. For more information on the development plan for volanesorsen see the drug description under Our Phase 3 Drugs.

IONIS-APO(a)-LRx – IONIS-APO(a)-LRx is a LICA drug we designed to reduce apolipoprotein(a) in the liver to offer a direct approach for reducing lipoprotein(a), or Lp(a). Lp(a) is an independent risk factor for cardiovascular disease. Physicians associate high levels of Lp(a) with an increased risk of atherosclerosis, coronary heart disease, heart attack and stroke. IONIS-APO(a)-LRx is the first and only clinical program to selectively reduce Lp(a) in patients by inhibiting apo(a).

Unlike other cardiovascular risk factors, Lp(a) levels are genetically determined and remain constant throughout the life of the individual. This means that patients who have high Lp(a) levels have been exposed to high levels of Lp(a) for their entire life. The European Atherosclerosis Society recommends that Lp(a) be less than or equal to 50 mg/dL. Diet and lifestyle changes have little impact on Lp(a) levels and current therapies do not adequately reduce Lp(a) to acceptable levels in patients with elevated Lp(a). Even patients who can control their LDL-C remain at high-risk of cardiovascular events if they have high levels of Lp(a). As a result, there is a significant need for a highly specific drug that can lower Lp(a).

Physicians characterize calcific aortic valve stenosis, or CAVS, as the progressive restriction of a patient’s supply of oxygenated blood to the rest of the patient’s body due to calcium deposits on the aortic valve. Aortic valve replacement, or AVR, is the only option once CAVS progresses to a severe stage and/or the patient is symptomatic with fainting, shortness of breath, or congestive heart failure. Patients with elevated Lp(a) levels experience a faster progression of CAVS leading to the need for AVR. Therefore, an effective medical therapy to reduce the progression of CAVS and delay the need for AVR could potentially improve symptoms, enhance heart function and reduce mortality in patients with CAVS.

We completed a Phase 1/2 study for IONIS-APO(a)-LRx in subjects with high Lp(a). We and Akcea plan to develop IONIS-APO(a)-LRx in a broad program that addresses near, mid and long-term commercial opportunities that include patients with recurrent cardiovascular events and high Lp(a); patients with CAVS and high Lp(a); and patients with cardiovascular disease and high Lp(a).

IONIS-ANGPTL3-LRx – IONIS-ANGPTL3-LRx is a LICA drug we designed to reduce angiopoietin-like 3 protein, or ANGPTL3, an independent risk factor for cardiovascular disease. ANGPTL3 is a glycoprotein that is principally expressed in the liver and regulates lipid, glucose and energy metabolism. People with elevated levels of ANGPTL3 have high LDL-C and triglyceride levels, which physicians associate with an increased risk of premature heart attacks, increased arterial wall thickness and multiple metabolic abnormalities, such as insulin resistance. In contrast, people with lower levels of ANGPTL3 have lower LDL-C and triglyceride levels. We designed IONIS-ANGPTL3-LRx to treat multiple dyslipidemias from rare lipid disorders to broader cardiometabolic disease, including mixed dyslipidemia. Akcea is responsible for developing and commercializing IONIS-ANGPTL3-LRx.

Patients with mixed dyslipidemia often have elevated LDL-C, and triglyceride levels. These patients frequently also have low levels of HDL. A growing body of clinical data demonstrates an association between elevated cholesterol and triglycerides and increased cardiovascular risk. Further, the increasing obesity rates throughout the world have fueled the development of metabolic syndrome, a disorder characterized by dyslipidemia, loss in insulin sensitivity and increased fat accumulation in the liver.

Genome-wide association studies have confirmed the association of mutations in ANGPTL3 with improvements in lipid levels. Patients with dyslipidemia often have multiple cardiovascular and metabolic risk factors that remain challenging to treat. Despite existing therapies, there remains an unmet need for a therapy that could significantly decrease multiple cardiovascular risk factors, such as LDL-C and triglycerides. Our preclinical data suggests that reducing ANGPTL3 could improve lipid parameters, including LDL-C, triglycerides, and total cholesterol, as well as metabolic parameters, such as insulin sensitivity.

Akcea is evaluating IONIS-ANGPTL3-LRx in a randomized, placebo-controlled, dose-escalation Phase 1/2 study in healthy volunteers with elevated triglycerides and in patients with familial hypercholesterolemia.

Cardiovascular Franchise

Cardiovascular disease is an area of focus for us. Our cardiovascular franchise includes the drugs Akcea is developing that we describe above and other drugs. The drugs in our cardiovascular franchise target all the key components of cardiovascular disease, including various atherogenic lipids, inflammation and thrombosis. Volanesorsen is our most advanced drug in this franchise.

IONIS’ Cardiovascular Disease Pipeline

IONIS-TTRRx – IONIS-TTRRx is an antisense drug we designed to reduce the production of TTR to treat patients with all forms of TTR amyloidosis, including the cardiomyopathy forms in which TTR protein accumulates in heart muscle leading to heart failure. For more information on the development plan for IONIS-TTRRx see the drug description under Our Phase 3 Drugs.

9

IONIS-FXIRx – IONIS-FXIRx is an antisense drug we designed to reduce the production of Factor XI. Factor XI is important in the growth of blood clots. High levels of Factor XI increase the risk of thrombosis, which is the formation of a blood clot inside blood vessels. Thrombosis can cause heart attacks and strokes. People who are deficient in Factor XI have a lower incidence of these events with minimal increase in bleeding risk. Although currently available anticoagulants reduce the risk of thrombosis, physicians associate these anticoagulants with increased bleeding, which can be fatal. Given the mechanism of Factor XI inhibition, IONIS-FXIRx has the potential for physicians to use it broadly as an antithrombotic in many different therapeutic settings for which there is a need for additional safe and well tolerated antithrombotic drugs.

In May 2015, we exclusively licensed IONIS-FXIRx to Bayer. Bayer plans to evaluate the therapeutic profile of IONIS-FXIRx in patients for whom currently available antithrombotics may not be used, such as in patients with a high risk of bleeding due to multiple co-morbidities. After successful completion of ongoing activities at Ionis, Bayer will assume all global development, regulatory and commercialization responsibilities for IONIS-FXIRx.

We completed a Phase 2 open-label, comparator-controlled global study evaluating IONIS-FXIRx in patients undergoing total knee replacement surgery. The study compared the safety and activity of IONIS-FXIRx to enoxaparin. In this study patients treated with 300 mg of IONIS-FXIRx experienced a seven-fold lower rate of venous thromboembolic events, such as blood clots in a deep vein or in a lung, compared to those patients treated with enoxaparin. The data from this study was published in the New England Journal of Medicine in December 2014.

We are currently evaluating IONIS-FXIRx in a Phase 2 study in patients with end-stage renal disease on hemodialysis. We designed this study to further characterize the profile of IONIS-FXIRx and to provide essential data for Bayer’s future clinical development program for IONIS-FXIRx.

IONIS-APO(a)-LRx – IONIS-APO(a)-LRx is a LICA drug we designed to reduce apolipoprotein(a) in the liver to offer a direct approach for reducing Lp(a). We and Akcea are developing IONIS-APO(a)-LRx for patients with high Lp(a). For more information on the development plan for IONIS-APO(a)-LRx, see the drug description under Akcea Therapeutics.

IONIS-ANGPTL3-LRx – IONIS-ANGPTL3-LRx is a LICA drug we designed to reduce ANGPTL3, an independent risk factor for cardiovascular disease. We and Akcea are developing IONIS-ANGPTL3-LRx for patients with mixed dyslipidemias. For more information on the development plan for IONIS-ANGPTL3-LRx, see the drug description under Akcea Therapeutics.

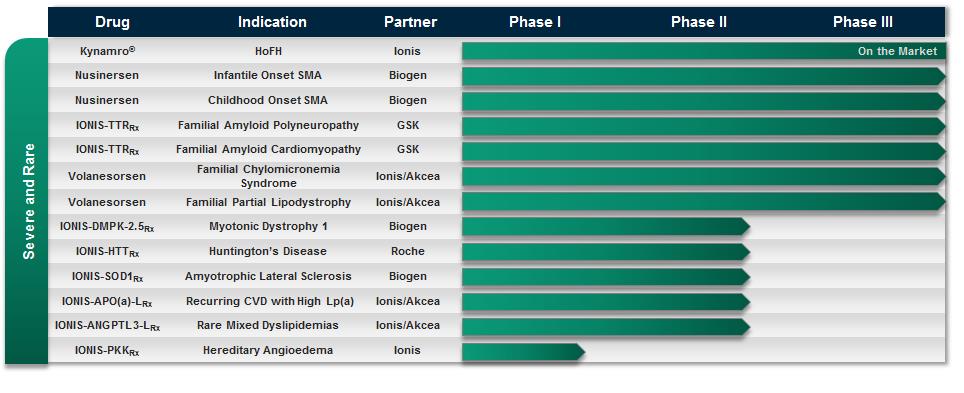

Severe and Rare Disease Franchise

Our severe and rare disease franchise is the largest franchise in our pipeline. We are discovering and developing antisense drugs to treat patients with severe and rare and neurological diseases who need new treatment options. We believe our antisense technology could offer effective therapies for these patients. According to the National Institutes of Health, or NIH, there are approximately 5,000 to 8,000 rare diseases and more than 600 neurological diseases, many life-threatening or fatal. Unfortunately, patients with many of these severe and rare diseases have few effective therapies available. Since most of these diseases are genetic or have a genetic component, parents often pass the disease to their children, creating a legacy of the disease and resulting in profound effects on the family. We are evaluating nusinersen, the most advanced neurological drug in our pipeline, in two Phase 3 studies to treat infants and children with SMA.

Due to the severe nature of these diseases and the lack of available treatments, there is an opportunity for more flexible and efficient development paths to the market. This means that, in some cases, the studies necessary for us to demonstrate proof-of-concept with a particular drug may also be the studies that complete our marketing registration package, thereby providing us with a relatively rapid path to market for potential new treatments for these devastating and often fatal diseases.

IONIS’ Severe and Rare Disease Pipeline

10

Kynamro – Kynamro (mipomersen sodium) injection is an oligonucleotide inhibitor of apolipoprotein B-100 synthesis indicated as an adjunct to lipid-lowering medications and diet, to reduce low density lipoprotein-cholesterol, or LDL-C, apolipoprotein B, total cholesterol, and non-high density lipoprotein-cholesterol in patients with HoFH. Kynamro is approved for use in patients with HoFH in the United States and several other countries.

Nusinersen – Nusinersen is an antisense drug we designed to treat patients with SMA. SMA is a severe motor-neuron disease that is the leading genetic cause of infant mortality. Together with Biogen, we are developing nusinersen to treat all forms of SMA. For more information on the development plan for nusinersen, see the drug description under Our Phase 3 Drugs.

IONIS-TTRRx – IONIS-TTRRx is an antisense drug we designed to treat all forms of TTR amyloidosis. TTR amyloidosis is a severe, progressive and fatal disease. For more information on the development plan for IONIS-TTRRx see the drug description under Our Phase 3 Drugs.

Volanesorsen – Volanesorsen is an antisense drug we and Akcea are developing to treat patients with FCS and FPL. For more information on the development plan for volanesorsen see the drug description under Our Phase 3 Drugs.

IONIS-DMPK-2.5Rx – IONIS-DMPK-2.5Rx is an antisense drug we designed to reduce the toxic dystrophia myotonica-protein kinase, or DMPK, RNA to treat patients with myotonic dystrophy type 1, or DM1. Together with Biogen, we are developing IONIS-DMPK-2.5Rx to treat patients with DM1.

DM1 is a genetic neuromuscular disease caused by a defect in the DMPK gene which causes the accumulation of toxic DMPK RNA. Physicians characterize DM1 by progressive muscle atrophy, weakness, disabling muscle spasms and prolonged muscle contractions. DM1 also affects many other organs within the body and patients can also experience insulin insensitivity, cataracts and infertility. Currently, there are no disease-modifying therapies for patients with DM1 and currently available treatments are intended only to manage symptoms.

We are evaluating IONIS-DMPK-2.5Rx in a randomized, placebo-controlled, dose-escalation Phase 1/2 clinical study in patients with DM1.

The FDA has granted Orphan Drug Designation for IONIS-DMPK-2.5Rx for the treatment of patients with DM1.

IONIS-HTTRx – IONIS-HTTRx is an antisense drug we designed to reduce the production of the huntingtin, or HTT, protein, which is the genetic cause of Huntington's disease, or HD. We are collaborating with Roche to develop IONIS-HTTRx to treat patients with HD.

HD is a rare, genetic, progressive neurological disease resulting in deterioration in mental abilities and physical control. HD is a triplet repeat disorder and is one of a large family of genetic diseases in which the body mistakenly repeats certain gene sequences. The resulting HTT protein gradually damages neurons in the brain. Symptoms of HD usually appear between the ages of 30 to 50 years and continually worsen over a 10 to 25 year period. Ultimately, the weakened individual succumbs to pneumonia, heart failure or other complications. Presently, there is no effective disease-modifying treatment, and current approaches only focus on managing the severity of some disease symptoms.

We are evaluating IONIS-HTTRx in a randomized, placebo-controlled, dose escalation, Phase 1/2 clinical study in patients with early stage HD.

The FDA and EMA have granted Orphan Drug Designation for IONIS-HTTRx to treat patients with HD.

IONIS-SOD1Rx – IONIS-SOD1Rx is an antisense drug we designed to reduce the production of superoxide dismutase 1, or SOD1, which is the best understood genetic cause of familial amyotrophic lateral sclerosis, or ALS. We are collaborating with Biogen to develop IONIS-SOD1Rx to treat patients with an inherited form of ALS, SOD1-ALS.

ALS is a rare, fatal neurodegenerative disorder. Patients with ALS suffer progressive degeneration of the motor neurons, which results in a declining quality of life and ultimately death. The second most common familial form of ALS is SOD1-ALS, in which patients have a mutation in the SOD1 gene that causes a progressive loss of motor neurons. As a result, patients with SOD1-ALS experience muscle weakness, loss of movement, difficulty in breathing and swallowing and eventually succumb to their disease. Currently, treatment options for patients with ALS are extremely limited with no drugs that significantly slow disease progression.

We are evaluating IONIS-SOD1Rx in a randomized, placebo-controlled, dose escalation, Phase 1/2 clinical study in patients with ALS, including patients with SOD1-ALS.

IONIS-APO(a)-LRx – IONIS-APO(a)-LRx is a LICA drug we designed to reduce apolipoprotein(a) in the liver to offer a direct approach for reducing Lp(a). We and Akcea are developing IONIS-APO(a)-LRx for patients with recurrent cardiovascular disease and high Lp(a). For more information on the development plan for IONIS-APO(a)-LRx, see the drug description under Akcea Therapeutics.

IONIS-ANGPTL3-LRx – IONIS-ANGPTL3-LRx is a LICA drug designed to reduce ANGPTL3, an independent risk factor for cardiovascular disease. We and Akcea are developing IONIS-ANGPTL3-LRx for patients with mixed dyslipidemias. For more information on the development plan for IONIS-ANGPTL3-LRx, see the drug description under Akcea Therapeutics.

11

IONIS-PKKRx – IONIS-PKKRx is an antisense drug we designed to reduce the production of prekallikrein, or PKK, to treat patients with hereditary angioedema, or HAE. HAE is a rare genetic disease that is characterized by rapid and painful attacks of inflammation in the hands, feet, limbs, face, abdomen, larynx and trachea and can be fatal if swelling occurs in the larynx. PKK plays an important role in acute attacks of HAE. By inhibiting the production of PKK, IONIS-PKKRx could be an effective prophylactic approach to preventing HAE attacks. In patients with frequent or severe attacks, doctors may use prophylactic treatment approaches to prevent and reduce the severity of HAE attacks. However, current prophylactic treatment approaches are very limited and have significant tolerability issues leaving patients with few therapeutic options.

We have completed a Phase 1 study evaluating IONIS-PKKRx in healthy volunteers.

Cancer Franchise

Cancer is an area of significant unmet medical need. Cancer is an extremely complex disease that involves a large number of targets. With our technology, we can evaluate a very broad and diverse range of targets and identify their involvement in different types of cancers. Using the information we gain early in research on each of these targets, we can quickly identify promising targets for anti-cancer drugs. We preferentially select anti-cancer targets that provide a multi-faceted approach to treating cancer.

Our cancer franchise consists of anti-cancer antisense drugs that act upon biological targets associated with cancer progression and/or treatment resistance. We have a strategic alliance with AstraZeneca, which includes an anti-cancer collaboration that expands our anti-cancer efforts and supports an aggressive and broad clinical development plan for IONIS-STAT3-2.5Rx. AstraZeneca brings significant experience that enables the identification of novel genetic and epigenetic targets for cancer. Combining AstraZeneca’s expertise with our drug discovery technology, we plan to expand our cancer franchise with a number of promising new anti-cancer targets.

Our Generation 2.5 chemistry enhances the potency and effectiveness of our antisense drugs, and potentially allows us to extend the applicability of our technology to cancers that are difficult to treat. For instance, data from a Phase 1/2 clinical study of IONIS-STAT3-2.5Rx showed evidence of antitumor activity in patients with cancer, including advanced/metastatic hepatocellular carcinoma.

IONIS’ Oncology Pipeline

IONIS-AR-2.5Rx – IONIS-AR-2.5Rx is an antisense drug we designed to treat patients with prostate cancer by reducing the production of all known forms of androgen receptor, or AR, including variants of the AR gene. Prostate cancer is the second leading cause of cancer deaths in American men. Prostate cancer growth, proliferation and progression are all androgen-dependent, and AR function is involved in disease progression at all stages of prostate cancer. For patients diagnosed with metastatic prostate cancer, current treatments largely involve opposing the action of androgens by blocking the AR or removing circulating androgens. Although androgen deprivation therapy approaches are initially effective in delaying disease progression, patients with metastatic prostate cancer will progress in their disease. Resistance to current therapies is frequent and can occur through a variety of mechanisms, including the activation of AR signaling in tumor cells through the amplification, over expression and mutation of the AR gene. Because IONIS-AR-2.5Rx can inhibit the production of all known forms of AR, we believe that this drug has the potential to be useful in treating patients with all stages of prostate cancer, including those who are resistant to current therapies.

AstraZeneca completed an open-label, dose-escalation, Phase 1/2 clinical study of IONIS-AR-2.5Rx in patients with advanced tumors for which the androgen receptor pathway is potentially a contributing factor. We plan to continue developing IONIS-AR-2.5Rx, independent of AstraZeneca.

IONIS-STAT3-2.5Rx – IONIS-STAT3-2.5Rx, also referred to as AZD9150, is an antisense drug we designed to reduce the production of signal transducer and activator of transcription 3, or STAT3, to treat patients with cancer. IONIS-STAT3-2.5Rx is a part of our collaboration with AstraZeneca to discover and develop anti-cancer drugs. We believe the significant potency we observed in our preclinical studies with IONIS-STAT3-2.5Rx broadens the therapeutic opportunities for IONIS-STAT3-2.5Rx into many different types of cancer where STAT3 is implicated.

STAT3 is a protein involved in the translation of key factors critical for tumor cell growth and survival. STAT3 is over-active in a variety of cancers, including brain, lung, breast, bone, liver and multiple myeloma. Physicians believe that overactivity in STAT3 prevents cancer cell death and promotes tumor cell growth.

We and AstraZeneca have evaluated IONIS-STAT3-2.5Rx in patients with advanced metastatic hepatocellular carcinoma and advanced lymphoma. AstraZeneca is evaluating IONIS-STAT3-2.5Rx in combination with MEDI4736, AstraZeneca's investigational anti-PD-L1 drug, in patients with head and neck cancer. AstraZeneca also plans to start an additional clinical study evaluating IONIS-STAT3-2.5Rx in combination with MEDI4736 in patients with diffuse large B cell lymphoma.

12

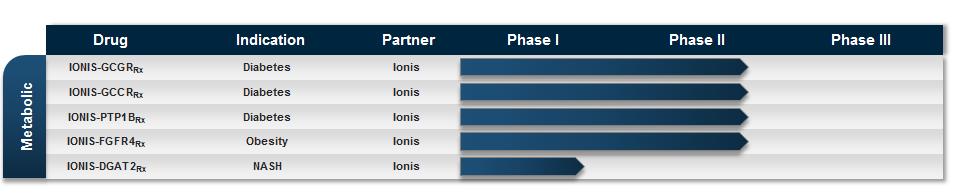

Metabolic Franchise

Metabolic disorders are chronic diseases that affect millions of people. There is a significant need for new therapies for these patients. According to the Centers for Disease Control and Prevention, diabetes affects more than 29 million people in the United States, or nine percent of the population, with type 2 diabetes constituting 90 to 95 percent of those cases.

We designed the majority of our drugs in our metabolic disease franchise to be effective alone or when added to existing therapies to treat metabolic diseases, such as diabetes. One hurdle for traditional drug development is that most traditional drugs cannot selectively target a disease-causing protein without also affecting closely related proteins, which often results in unwanted side effects. We design our antisense drugs to target the gene responsible for producing the disease-causing protein while avoiding unwanted effects on closely related proteins, thereby reducing the risk of side effects.

We have reported positive Phase 2 data from IONIS-GCGRRx and IONIS-PTP1BRx, the most advanced drugs in our metabolic franchise. We designed these two drugs and our third drug, IONIS-GCCRRx, to act upon targets in the liver or fat tissue through a distinct mechanism to improve insulin sensitivity, reduce glucose production, or affect other metabolic aspects of this complex disease. In addition to our work in diabetes, we are also evaluating other metabolic syndromes, including obesity and nonalcoholic steatohepatitis, or NASH. Obesity has reached global epidemic proportions in both adults and children. According to the World Health Organization, in 2014, there were more than 600 million adults over the age of 18 who were obese and in 2013, there were 42 million children under the age of five who were overweight or obese. Obesity is a major risk factor for a number of chronic diseases, including type 2 diabetes, dyslipidemia, hypertension and cardiovascular diseases. Despite the growing epidemic, there are very few weight loss drugs that have been approved to treat patients with obesity. Although many anti-obesity drugs have entered development, most of them have not been approved due to their adverse effects in the CNS and/or heart. There is an unmet medical need for drugs that can cause weight loss by acting on peripheral tissues without causing cardiac or CNS related side effects. In 2015, we initiated a Phase 2 clinical study evaluating IONIS-FGFR4Rx in patients who are obese. Currently, it is estimated that two to three percent of the general population have NASH. However, with the growing obesity epidemic, the number of patients with NASH should also continue to rise. About 20 percent of NASH patients are reported to develop cirrhosis, and 30 to 40 percent of patients with NASH cirrhosis experience liver-related death. IONIS-DGAT2Rx is an antisense drug we designed to treat patients with NASH.

IONIS’ Metabolic Disease Pipeline

IONIS-GCGRRx – IONIS-GCGRRx is an antisense drug we designed to reduce the production of glucagon receptors, or GCGR, to treat patients with type 2 diabetes. GCGR is a receptor for the hormone glucagon. Glucagon is a hormone that opposes the action of insulin and stimulates the liver to produce glucose, particularly in type 2 diabetes. We are developing IONIS-GCGRRx to provide better glucose control for patients with type 2 diabetes. Given the unique mechanism of action, we believe that physicians could use IONIS-GCGRRx in diabetic patients with severe hyperglycemia who are not controlled with current treatments and who could benefit from a drug that significantly decreases glucose levels and preserves pancreatic function.

Although glucose is an important source of energy for people’s bodies and is vital to people’s health, uncontrolled increases in glucose can lead to serious health problems, such as diabetes. In patients with advanced diabetes, uncontrolled glucagon action can lead to a significant increase in blood glucose level. In addition, reducing GCGR produces more active glucagon-like peptide, or GLP-1, a hormone that preserves pancreatic function and enhances insulin secretion.

We completed a double-blind, randomized, placebo-controlled, Phase 2 study of IONIS-GCGRRx in patients with type 2 diabetes who were poorly controlled on stable metformin therapy. We have initiated a second Phase 2 study of IONIS-GCGRRx in patients with type 2 diabetes to identify the optimal dose and schedule to achieve glucose control with manageable glucagon receptor-related liver enzyme elevations.

IONIS-GCCRRx- IONIS-GCCRRx is an antisense drug we designed to reduce the production of glucocorticoid receptor, or GCCR, to treat patients with type 2 diabetes. Glucocorticoid hormones affect a variety of processes throughout the body, including the production of liver glucose and fat storage. Excessive GCCR activity in the liver and fat is associated with obesity, insulin resistance and glucose intolerance.

Physicians recognize that inhibiting GCCR is an attractive strategy for improving glycemic and lipid control in patients with type 2 diabetes. However, the side effects associated with systemic GCCR inhibition have challenged traditional drug developers. Targeted reduction of GCCR in the liver and fat tissues with antisense drugs is an attractive therapeutic approach because it can lower glucose and lipids without causing potential side effects associated with systemic GCCR inhibition.

We completed a Phase 2 study of IONIS-GCCRRx in patients with type 2 diabetes.

IONIS-PTP1BRx – IONIS-PTP1BRx is an antisense drug we designed to reduce the production of protein tyrosine phosphatase-1B, or PTP-1B, to treat patients with type 2 diabetes. PTP-1B is a phosphatase that negatively regulates insulin receptor signaling and is responsible for turning off the activated insulin receptor. Reducing PTP-1B enhances insulin activity. We designed IONIS-PTP1BRx to increase the body's sensitivity to the natural hormone, insulin, resulting in better glucose control for patients with type 2 diabetes. Because of its unique mechanism, IONIS-PTP1BRx may help treat patients with type 2 diabetes without causing weight gain or hypoglycemia, also known as low blood sugar.

13

Scientists have long recognized PTP-1B as an attractive target for treating diabetes. However, efforts to develop drugs that target PTP-1B have been challenging due to the structural similarities among closely related protein phosphatases. Targeted reduction of PTP-1B with an antisense drug represents an ideal therapeutic approach because we design our drugs to specifically reduce the PTP-1B mRNA, without affecting mRNAs of other protein phosphatases. This approach eliminates the off-target side effects observed with traditional small-molecule drugs.

We believe that physicians may use IONIS-PTP1BRx in combination with most of the other commonly used diabetes drugs, including insulin, GLP-1 agonists, and more traditional drugs like metformin, to treat patients with diabetes. The clinical development plan for IONIS-PTP1BRx focuses on two types of diabetic patients. The first type are those who are inadequately controlled on insulin, helping them utilize insulin more efficiently and the second type are those who are beginning to fail oral therapies, extending the time they have before becoming dependent on insulin.

We have completed a randomized, double-blind, placebo-controlled, Phase 2 study of IONIS-PTP1BRx study in obese patients with type 2 diabetes taking metformin or metformin plus sulfonylurea.

IONIS-FGFR4Rx – IONIS-FGFR4Rx is an antisense drug we designed to reduce the production of fibroblast growth factor receptor 4, or FGFR4, to treat obese patients. FGFR4 is expressed in the liver and fat tissues, and plays an important role regulating fat burning and body weight. Reducing FGFR4 decreases the body's ability to store fat while it simultaneously increases fat burning and energy expenditure. Many anti-obesity drugs act in the brain to suppress appetite, commonly resulting in central nervous system, or CNS, side effects. However, IONIS-FGFR4Rx does not distribute to the brain or CNS and therefore should not produce any CNS side effects. IONIS-FGFR4Rx is the first drug in our metabolic franchise to treat obesity and utilizes technology we in-licensed from Verva Pharmaceuticals Ltd.

We completed a Phase 1 study of IONIS-FGFR4Rx in healthy volunteers. We initiated a double blind, placebo-controlled, Phase 2 study of IONIS-FGFR4Rx in obese patients in July 2015.

IONIS-DGAT2Rx – IONIS-DGAT2Rx is an antisense drug we designed to reduce the production of DGAT2, or diacylglycerol acyltransferase 2, to treat patients with NASH. NASH is a common liver disease characterized by excessive triglycerides in the liver with concurrent inflammation and cellular damage. As NASH progresses, scarring, or fibrosis, begins to accumulate in the liver. Ultimately, cirrhosis of the liver develops and the liver can no longer function normally. Currently, liver transplantation is the only treatment for advanced cirrhosis and liver failure. Because of the high prevalence of NASH, it has recently become the third most common indication for liver transplantation in the United States.

DGAT2 is an enzyme that catalyzes the final step in triglyceride synthesis in the liver. Reducing the production of DGAT2 should therefore decrease triglyceride synthesis in the liver. In animal models of obesity and fatty liver disease, antisense inhibition of DGAT2 significantly improved liver damage, lowered blood lipid levels and reversed diet-induced insulin resistance.

We are evaluating IONIS-DGAT2Rx in a randomized, placebo-controlled, dose-escalation, Phase 1 study in healthy, overweight volunteers. We designed this study to give us valuable insights on the effects of IONIS-DGAT2Rx in a patient population that is closely matched to patients with NASH.

Other Drugs in Development

Together with our partners, we continue to advance drugs in clinical development that are outside of our core therapeutic areas, such as the antiviral drugs we and GSK are developing.

IONIS’ Pipeline of Drugs in Development for Viral Infection or Ocular Disease

IONIS-GSK4-LRx – IONIS-GSK4-LRx is a LICA drug we designed to reduce an undisclosed ocular target. Together with GSK, we are developing IONIS-GSK4-LRx to treat patients with an undisclosed ocular disease.

IONIS-HBVRx and IONIS-HBV-LRx – IONIS-HBVRx and IONIS-HBV-LRx are antisense drugs we designed to reduce the production of viral proteins associated with hepatitis B virus, or HBV. These include proteins associated with infection and replication, including the hepatitis B surface antigen, which is present in both acute and chronic infections and is associated with a poor prognosis in patients with chronic HBV infection. IONIS-HBV-LRx is the first anti-infective drug in development that incorporates our LICA technology, which we designed to increase drug potency by enhancing drug delivery to target tissue. Together with GSK, we are evaluating IONIS-HBVRx and IONIS-HBV-LRx to treat HBV infection.

HBV infection is a serious health problem that can lead to significant and potentially fatal health conditions. Chronic HBV infection is one of the most common persistent viral infections in the world. Currently available therapies, including oral antiviral agents or injectable interferons, do not clear HBV and do not effectively clear HBV antigens from these patients. As a result, patients cannot fully control their HBV infection and therefore, achieve sustained disease remission. Many of these patients are at elevated risk for severe liver complications such as cirrhosis and primary liver cancer.

14

We have completed a randomized, placebo-controlled, dose-escalation, Phase 1 study of IONIS-HBVRx in healthy volunteers. In January 2016, GSK initiated a Phase 1 study evaluating IONIS-HBV-LRx in healthy volunteers. The Phase 1 study of IONIS-HBV-LRx is a randomized, placebo-controlled, dose-escalation study in healthy volunteers. We have designed this study to evaluate the safety, tolerability, and pharmacokinetics of single and multiple doses of IONIS-HBV-LRx.

Preclinical Drugs in Development