Attached files

| file | filename |

|---|---|

| 8-K - HONEYWELL INTERNATIONAL INC | c84116_8k.htm |

Exhibit 99.1

Contacts:

| Media | Investor Relations |

| Robert C. Ferris | Mark Macaluso |

| (973) 455-3388 | (973) 455-2222 |

| rob.ferris@honeywell.com | mark.macaluso@honeywell.com |

HONEYWELL RELEASES DETAILS OF FEBRUARY 19, 2016 PROPOSAL

MADE TO UNITED TECHNOLOGIES

MORRIS PLAINS, N.J., February 26, 2016 -- Honeywell (NYSE: HON) has received a number of inquiries from investors regarding its proposal to acquire United Technologies. In order to help investors understand the proposal, attached is a presentation that Honeywell Chairman and CEO, Dave Cote, shared with United Technologies Chairman, Edward A. Kangas, and United Technologies CEO, Gregory J. Hayes, at their meeting on February 19, 2016. This presentation provides details regarding Honeywell’s offer.

Honeywell (www.honeywell.com) is a Fortune 100 diversified technology and manufacturing leader, serving customers worldwide with aerospace products and services; control technologies for buildings, homes, and industry; turbochargers; and performance materials. For more news and information on Honeywell, please visit www.honeywellnow.com.

This release contains certain statements that may be deemed “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, that address activities, events or developments that we or our management intends, expects, projects, believes or anticipates will or may occur in the future are forward-looking statements. Such statements are based upon certain assumptions and assessments made by our management in light of their experience and their perception of historical trends, current economic and industry conditions, expected future developments and other factors they believe to be appropriate. The forward-looking statements included in this release are also subject to a number of material risks and uncertainties, including but not limited to economic, competitive, governmental, and technological factors affecting our operations, markets, products, services and prices. Such forward-looking statements are not guarantees of future performance, and actual results, developments and business decisions may differ from those envisaged by such forward-looking statements. We identify the principal risks and uncertainties that affect our performance in our Form 10-K and other filings with the Securities and Exchange Commission.

# # #

HON AND UTX : A UNIQUE AND COMPELLING OPPORTUNITY FOR SHAREHOLDERS February 2016 Honeywell Confidential Information

PRIVILEGED AND CONFIDENTIAL ATTORNEY WORK PRODUCT AND CLIENT COMMUNICATION 1 BENEFITS OF A UNIQUE INDUSTRIAL COMBINATION • A Global Leader In Attractive End Markets Tied To Advantaged Secular Growth Themes - Technology Leadership with World - Class Aerospace, Buildings and Industrial Offerings • World - Class Technology And Software Platforms • Combined R&D Capacity Of Over $8B To Invest In Meaningful Growth Platforms • Substantial Operating Benefits , Cost Synergy Potential – Estimated $3.5B In Cost Synergies, ~20% Op Margin • Significant Commercial Opportunities To Drive Further Revenue Growth as Combined Company • Highly Experienced Leadership Teams And Deep Bench of Talent Across A Global Organization • Compelling, Transformational Opportunity for Both Sets of Shareholders; Meaningful Upfront Cash Proceeds + Substantial Value Creation for UTX • Now is the R ight Time – Unique Opportunity to Enhance Revenue and Earnings Growth While Taking Advantage of a Highly Favorable Financing Market • Confident in a Bright Future for HON Independent of a Combination with UTX, but the Compelling Nature of a Combination is Undeniable HONEYWELL CONFIDENTIAL Seeking To Re - engage And Work Towards An Agreement

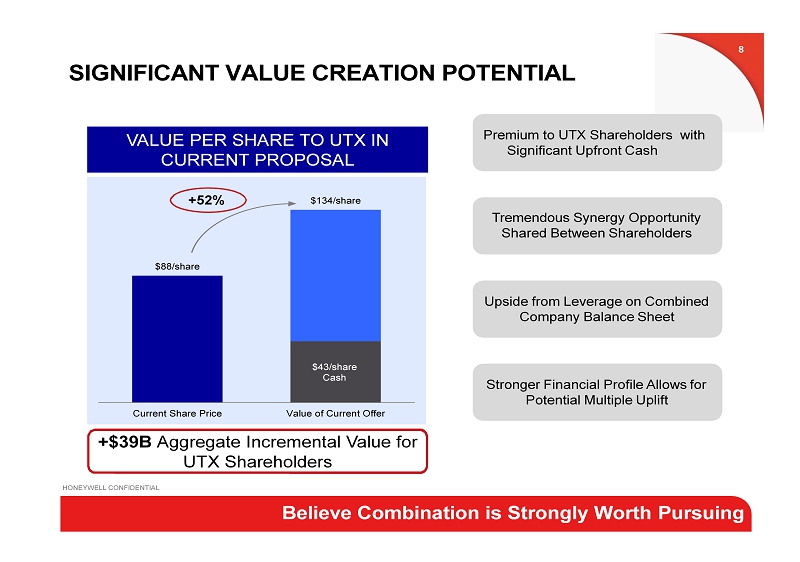

PRIVILEGED AND CONFIDENTIAL ATTORNEY WORK PRODUCT AND CLIENT COMMUNICATION • Over $39B In Value Creation for UTX Shareholders • Over $ 72 B In Value Creation To All Shareholders • $ 3.5B Estimated Cost Synergies; ~ $ 20/share in Synergy Value Proposed Structure 2 ELEMENTS OF CURRENT PROPOSAL • Cash and Stock Transaction At $108/share or a 22 % Premium to UTX ’ s share price as of 2/18/16 and a 24% Premium to 10 - day VWAP • UTX Shareholders Receive $ 42.63 Per Share In Cash , Plus • 0.614 shares of HON per current UTX share • Chairman/CEO : David M. Cote • “Best Of Both, Best Athlete” M anagement Philosophy For Combined Board of Directors and Management Team • Pro Forma 3 .5 x Net Debt / EBITDA Ratio With ~$ 36 B New Debt Raised • Strong Investment Grade Credit Rating With Rapid De - leveraging Profile Consideration Value Creation Capital Structure Leadership and Governance $108/share with ~$36B in Immediate Cash Benefit HONEYWELL CONFIDENTIAL $108/share with ~$36B in Immediate Cash Benefit

PRIVILEGED AND CONFIDENTIAL ATTORNEY WORK PRODUCT AND CLIENT COMMUNICATION 3 ~$ 9 7 B in sales ~20% Double Digit + ~$ 10 B Target 100% conversion Strong Investment Grade ++ + ++ + / = = • Enhanced global scale with strong set of focused businesses • Impact of synergies and operating efficiencies • Cost synergy benefits plus deleveraging; revenue synergies all upside • Strong FCF plus working capital efficiencies • Strong balance sheet with rapid deleveraging; flexibility for investment Combined Metric Benefits Transaction Impact Scale Operating Margin EPS Growth Free Cash Flow Balance Sheet/ Credit Rating STRENGTHENED FINANCIAL PROFILE HONEYWELL CONFIDENTIAL Enhanced Earnings Growth + Strong FCF

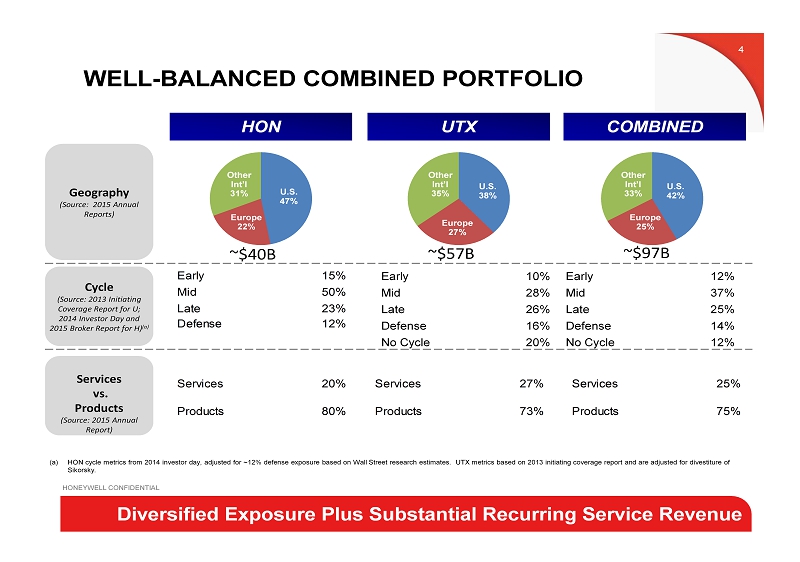

WELL - BALANCED COMBINED PORTFOLIO Geography (Source: 2015 Annual Reports) Cycle (Source: 2013 Initiating Coverage Report for U; 2014 Investor Day and 2015 Broker Report for H) (a) Services vs. Products (Source: 2015 Annual Report) HON UTX COMBINED 4 Services 20% Products 80% Services 27% Products 73% Services 25% Products 75% Early 15% Mid 50% Late 23% Defense 12% (a) HON cycle metrics from 2014 investor day, adjusted for ~12% defense exposure based on Wall Street research estimates. UTX me tri cs based on 2013 initiating coverage report and are adjusted for divestiture of Sikorsky. ~$40B ~$57B ~$97B U.S. 47% Europe 22% Other Int’l 31% U.S. 38% Europe 27% Other Int’l 35% U.S. 42% Europe 25% Other Int’l 33% Early 10% Mid 28% Late 26% Defense 16 % No Cycle 20 % Early 12% Mid 37% Late 25% Defense 14% No Cycle 12% HONEYWELL CONFIDENTIAL PRIVILEGED AND CONFIDENTIAL ATTORNEY WORK PRODUCT AND CLIENT COMMUNICATION Diversified Exposure Plus Substantial Recurring Service Revenue

PRIVILEGED AND CONFIDENTIAL ATTORNEY WORK PRODUCT AND CLIENT COMMUNICATION WELL - BALANCED COMBINED PORTFOLIO TO BETTER SERVE CUSTOMERS x Global Franchises x High - Growth Regions Presence x Strong Aftermarket Content x Technology Leadership in Key Segments A DIVERSIFIED GLOBAL BUSINESS LEADER Homes & Bu il d i ngs 24% C ommercial Aero space 18% Oil & Gas 16% Defense & Space 12% Vehicles 9% In d ustrial 21% HON UTX C om m ercial & Industrial 50% C om m ercial Aerospace 36 % Military A er o space & Space 14% Homes & B u ildi ngs 39% Co m m e r cial Aero space 28% Oil & Gas 7% Defense & Space 13% I nd u st r i al 12% 5 Note: Figures exclude Sikorsky . ~$ 4 0 B ~$ 5 7 B ~$ 9 7 B HONEYWELL CONFIDENTIAL PRIVILEGED AND CONFIDENTIAL ATTORNEY WORK PRODUCT AND CLIENT COMMUNICATION Creates a ~$100B World Class Global Organization

6 SIGNIFICANT SYNERGY OPPORTUNITY IDENTIFIED Anticipated Cost Synergies Sales Synergy Upside Purchasing / Raw Material Spend Indirect SG&A Corporate Other ~$3.5B • ~ 3.5% Of Combined Company Sales , Fully Realized By Year 4 , consistent with experience and precedents • Substantial Commercial Opportunities In A Combination • Channel Expansion • Vertical Segment Growth • Geographic Expansion • Product Pull - Through • Travel, Logistics, Supplies, Etc. • Benefits In Contract Manufacturing • Real Estate Consolidation • Electronics, Metals / Mechanical • Purchase Volume Leverage • Duplicative SG&A Functions • Complementary Businesses • Finance, IT, HR, Legal, Etc. • Public Company Costs HONEYWELL CONFIDENTIAL PRIVILEGED AND CONFIDENTIAL ATTORNEY WORK PRODUCT AND CLIENT COMMUNICATION PRIVILEGED AND CONFIDENTIAL ATTORNEY WORK PRODUCT AND CLIENT COMMUNICATION Represents Substantial Capitalized Value Before Commercial Opportunities

7 BENEFITS TO COMMERCIAL AND DEFENSE CUSTOMERS Operational Efficiency World - Class Technology • Aerospace industry requires heavy investments in technology while meeting aggressive price targets • Both companies are recognized technology & thought leaders • Software & connectivity are key capabilities for future growth • Complementary business base enables better utilization of both company’s asset base and lower raw material costs Portfolio Fit • Use of fundamental technologies and R&D budget to wider array of aircraft systems and products • Commercially - derived R&D investments benefit DoD and offset concerns over fewer suppliers • HON brings software/connectivity capability to UTX mechanical products • Meets OEMs demand for year - on - year productivity. • DoD benefits from flow - through of overhead savings on cost - reimbursement contracts Description Benefits • Cost efficiencies – driven by HOS & ACE systems • History of HON inorganic growth & asset utilization maximization • Reduction in SG&A, footprint, SKUs, and corporate overhead • “Great positions in good industry” analysis to determine best - in - class performance • Highly complementary offerings will lead to product innovation • Limited overlap. Potential regulatory issues easily resolved • Hybrid organizations – both commercial & defense • Common cultures – multi - industry aerospace Tier 1 suppliers HONEYWELL CONFIDENTIAL Great Technology, Complementary Offerings, Common Industries & Culture Proven Track Record of Synergies

$43/share Cash $88/share $134/share Current Share Price Value of Current Offer 8 SIGNIFICANT VALUE CREATION POTENTIAL Premium to UTX Shareholders with Significant Upfront Cash Upside from Leverage on Combined Company Balance Sheet Tremendous Synergy Opportunity Shared Between Shareholders Stronger Financial Profile Allows for Potential Multiple Uplift +$39B Aggregate Incremental Value for UTX Shareholders + 5 2 % VALUE PER SHARE TO UTX IN CURRENT PROPOSAL HONEYWELL CONFIDENTIAL Believe Combination is Strongly Worth Pursuing

9 TWO INDUSTRIAL LEADERS COMING TOGETHER • Leader In Global Aerospace Systems • One Of Top Aerospace Engine Players • One Of Top Commercial And Residential HVAC Platforms Globally • #1 in Elevators • Leader In Security • Achieving Competitive Excellence (ACE) Delivering Benefits To Customers & Shareowners • Leader in Building/Control Systems • A Top Aerospace And Defense Technology Platform • #1 in Industrial & Fire Safety • #1 in Refining & Petrochemicals • #1 in Global Turbocharger Sales • HON Operating System (HOS) Driving Operating Benefits with Seed - planting to Accelerate Growth HONEYWELL CONFIDENTIAL Creating One of the Best Industrial Companies in the World

DETAILS OF VALUE CREATION FOR UTX 10 Notes Figures above rounded. Calculation results based on non-rounded numbers. (a) Closing Price as of 2/18/16. (b) Assumes fully diluted shares of 833.0 at closing price and 839.9 at offer price. (c) 40% ownership based on 515.7 shares of 1,300.2 total pro forma HON shares. (d) Net income based on current median 2016 consensus for both companies. (e) Assumes 26.0% tax rate on incremental interest and synergies. (f) Assumes $35.8bn incremental debt raised in the transaction at 3.75% interest rate. (g) Includes interest impact (3.75% interest rate) of funding of $5.6bn total pre-tax cost to achieve synergies. HONEYWELL CONFIDENTIAL Immediate Premium + Cash UTX Per Share ($) (b) Aggregate ($bn) Closing Price (2/18/16) $88.36 $73.6 Offer UTX shareholders receive cash $42.63 $35.8 UTX shareholders receive shares (0.614x HON Price of $106.47 (a) ) 65.37 54.9 Total Consideration $108.00 $90.7 % premium vs. 2/18/16 Close +22% % premium vs. 10 - Day VWAP +24% Shares in HON 515.7 % Ownership (c) 40% Significant Shareholder Value Creation Value to UTX Value of NewCo Per Share ($) (b) Aggregate ($bn) UTX 2016 Consensus Net Income (d) $5.4 Cash $42.63 $35.8 HON 2016 Consensus Net Income (d) 5.2 Share of HON Stock 91.53 76.9 Synergies Before Tax 3.5 Total $134.16 $112.7 (Less): Interest and Taxes (e)(f)(g) (2.1) Pro Forma Net Income $12.0 Total Value Uplift $45.80 $39.1 HON 2016E P/E 16.1x Total Value Uplift (%) +52% Pro Forma HON Equity Value $193.8 Pro Forma HON Shares Outstanding 1,300.2 Pro Forma HON Equity Value per Share $149.08 UTX per - share value = 0.614 x $149.08 $91.53