Attached files

| file | filename |

|---|---|

| 8-K - TRUIST FINANCIAL CORP | cgsc8k.htm |

| EX-99.1 - EXHIBIT 99.1 - TRUIST FINANCIAL CORP | exhibit991.htm |

Exhibit 99.2

Forward - Looking Statements 2 This communication contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, but not limited to, Swett & Crawford’s and BB&T’s expectations or predictions of future financial or business performance or conditions. Forward - looking statements are typically identified by words such as “believe,” “expect,” “anticipate ,” “intend,” “target,” “estimate,” “continue,” “positions,” “prospects” or “potential,” by future conditional verbs such as “wil l,” “would,” “should,” “could” or “may”, or by variations of such words or by similar expressions. These forward - looking statements are subje ct to numerous assumptions, risks and uncertainties, which change over time. Forward - looking statements speak only as of the date they are made and we assume no duty to update forward - looking statements. Actual results may differ materially from current projections. In addition to factors previously disclosed in BB&T’s reports filed with the U.S. Securities and Exchange Commission (the “SE C”) and those identified elsewhere in this document, the following factors among others, could cause actual results to differ mat eri ally from forward - looking statements or historical performance: ability to obtain regulatory approvals and meet other closing conditi ons to the merger; delay in closing the merger; difficulties and delays in integrating the Swett & Crawford business or fully rea liz ing cost savings and other benefits; business disruption following the merger; the inability to sustain revenue and earnings grow th; customer acceptance of BB&T products and services; the introduction, withdrawal, success and timing of business initiatives; competitive conditions; the inability to realize cost savings or revenues or to implement integration plans and other consequ enc es associated with mergers, acquisitions and divestitures; economic conditions; state of the insurance industry; changes in prem ium rates; insurance market conditions; the impact, extent and timing of technological changes; inability to retain key employees ; a nd changes in the regulatory environment. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results.

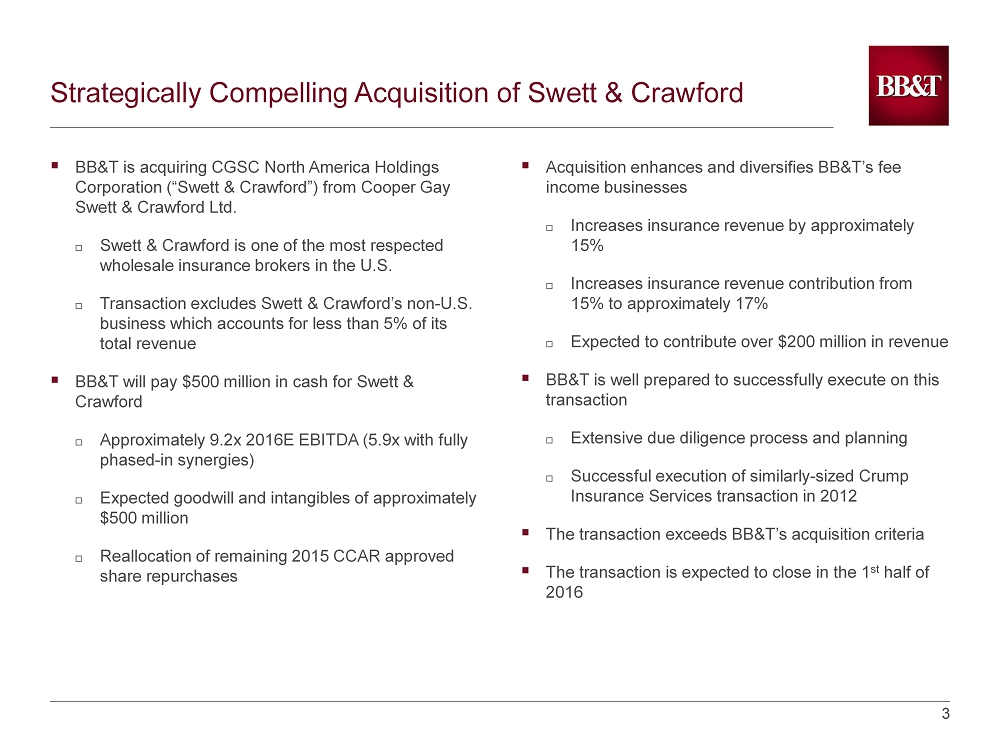

3 3 Strategically Compelling Acquisition of Swett & Crawford ▪ BB&T is acquiring CGSC North America Holdings Corporation (“Swett & Crawford”) from Cooper Gay Swett & Crawford Ltd. Swett & Crawford is one of the most respected wholesale insurance brokers in the U.S. Transaction excludes Swett & Crawford’s non - U.S. business which accounts for less than 5% of its total revenue ▪ BB&T will pay $500 million in cash for Swett & Crawford Approximately 9.2x 2016E EBITDA (5.9x with fully phased - in synergies) Expected goodwill and intangibles of approximately $500 million Reallocation of remaining 2015 CCAR approved share repurchases ▪ Acquisition enhances and diversifies BB&T’s fee income businesses Increases insurance revenue by approximately 15 % Increases insurance revenue contribution from 15% to approximately 17% Expected to contribute over $200 million in revenue ▪ BB&T is well prepared to successfully execute on this transaction Extensive due diligence process and planning Successful execution of similarly - sized Crump Insurance Services transaction in 2012 ▪ The transaction exceeds BB&T’s acquisition criteria ▪ The transaction is expected to close in the 1 st half of 2016

4 4 BB&T Insurance Overview ▪ CRC Insurance Services, Inc . – 46 locations offering wholesale brokerage and managing general agency services Swett & Crawford – 35 locations offering wholesale brokerage and managing general agency services ▪ BB&T Insurance Services, Inc. – Over 100 retail insurance agency locations in the BB&T footprint. Key unit for carrying out Integrated Relationship Management strategy (IRM). Multi - line insurance offerings ▪ McGriff, Seibels and Williams, Inc. – 12 retail insurance operation locations, with 7 outside the BB&T (bank) footprint. Large account (Fortune 1000) emphasis. Multi - line insurance offerings ▪ AmRisc, LLC – Managing General Underwriter (no risk assumption) for primarily wind - based, catastrophe - prone property. Underwriters for a number of top rated insurance companies ▪ Crump Life Insurance Services – 25+ regional locations in the U.S ., brokerage operation for life insurance ▪ BB&T Insurance Services of California, Inc. – 10 retail insurance locations in California. Multi - line insurance offerings ▪ BB&T Assurance, Ltd. – Bermuda - based captive that supplies alternative risk transfer and specialty - program expertise, consulting and program management BB&T Insurance is composed of 7 separate and complementary businesses

5 5 BB&T Insurance Pro Forma Revenue by Company BB&T Insurance Revenue Profile Source: Company filings. 2015 Pro Forma Total Revenue: $1.8 billion 2015 Total Revenue: $1.6 billion BB&T Insurance Revenue by Company CRC / Swett & Crawford 37% BB&T Insurance Services 25% McGriff 15% AmRisc 7% Crump Life 10% BB&T Insurance Services of California 5% BB&T Assurance 1% CRC 29% BB&T Insurance Services 28% McGriff 17% AmRisc 8% Crump Life 12% BB&T Insurance Services of California 5% BB&T Assurance 1%