Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Vista Outdoor Inc. | a2242016form8-k.htm |

| EX-99.1 - EXHIBIT 99.1 - Vista Outdoor Inc. | pressrelease_actionsportsa.htm |

Investor Overview

2 © 2016 | Vista Outdoor Presentation Forward Looking Statements Certain statements in this presentation and other oral and written statements made by Vista Outdoor from time to time are forward-looking statements, including those that discuss, among other things: Vista Outdoor’s plans, objectives, expectations, intentions, strategies, goals, outlook or other non-historical matters; projections with respect to future revenues, income, earnings per share or other financial measures for Vista Outdoor; and the assumptions that underlie these matters. The words ‘believe’, ‘expect’, ‘anticipate’, ‘intend’, ‘aim’, ‘should’ and similar expressions are intended to identify such forward-looking statements. To the extent that any such information is forward-looking, it is intended to fit within the safe harbor for forward-looking information provided by the Private Securities Litigation Reform Act of 1995. Numerous risks, uncertainties and other factors could cause Vista Outdoor’s actual results to differ materially from expectat ions described in such forward-looking statements, including the following: Vista Outdoor’s ability to realize anticipated benefits and cost savings from acquisitions; Vista Outdoor’s ability to retain and hire key personnel and maintain relationships with customers, suppliers and other business partners of acquired businesses; costs or difficulties related to the integration of acquired businesses; general economic and business conditions in the U.S. and Vista Outdoor’s other markets, including conditions affecting employment levels, consumer confidence and spending; Vista Outdoor’s ability to operate successfully as a standalone business; Vista Outdoor’s ability to retain and hire key personnel and maintain and grow its relationships with customers, suppliers and other business partners, including Vista Outdoor’s ability to obtain acceptable third party licenses; Vista Outdoor’s ability to adapt its products to changes in technology, the marketplace and customer preferences; Vista Outdoor’s ability to maintain and enhance brand recognition and reputation; reductions or unexpected changes in demand for ammunition, firearms or accessories or other outdoor sports and recreation products; risks associated with Vista Outdoor’s sales to significant retail customers, including unexpected cancellations, delays and other changes to purchase orders; supplier capacity constraints, production disruptions or quality or price issues affecting Vista Outdoor’s operating costs; seasonality and weather conditions in Vista Outdoor’s markets; Vista Outdoor’s competitive environment; risks associated with compliance and diversification into international and commercial markets; the supply, availability and costs of raw materials and components; changes in commodity, energy and production costs; changes in laws, rules and regulations relating to Vista Outdoor’s business, such as federal and state firearms and ammunition regulations; Vista Outdoor’s ability to execute its long-term growth strategy; Vista Outdoor’s ability to take advantage of growth opportunities in international and commercial markets; changes in interest rates or credit availability; foreign currency exchange rates and fluctuations in those rates; the outcome of contingencies, including with respect to litigation and other proceedings relating to intellectual property, product liability, warranty liability, personal injury and environmental remediation; risks associated with cybersecurity and other industrial and physical security threats; risks associated with pension asset returns and assumptions regarding future returns, discount rates and service costs; capital market volatility and the availability of financing; changes to accounting standards or policies; and changes in tax rules or pronouncements. Vista Outdoor undertakes no obligation to update any forward-looking statements. For further information on factors that could impact Vista Outdoor, and statements contained herein, please refer to Vista Outdoor’s filings with the Securities and Exchange Commission, including the company’s annual report on Form 10-K and any subsequent quarterly reports on Form 10-Q and current reports on Form 8-K filed with the U.S. Securities and Exchange Commission.

3 © 2016 | Vista Outdoor Presentation Non-GAAP Financial Measures Non-GAAP financial measures such as earnings before interest, tax, depreciation and amortization (“EBITDA”), Adjusted EBITDA and Free Cash Flow as included in this Presentation are supplemental measures that are not calculated in accordance with Generally Accepted Accounting Principles (“GAAP”). Please see the Appendix to this presentation for reconciliations of these Non-GAAP financial measures to their comparable GAAP financial measures. We define Adjusted EBITDA as EBITDA adjusted for the impact of asset impairments and for the impact of transaction costs, transition costs and certain other items related to our spin-off from Alliant Techsystems Inc. and acquisition transactions. We believe that the presentation of EBITDA and Adjusted EBITDA helps investors analyze underlying trends in our business, evaluate the performance of our business both on an absolute basis and relative to our peers and the broader market, provides useful information to both management and investors by excluding certain items that may not be indicative of the core operating results and operational strength of our business and helps investors evaluate our ability to service our debt. We define Free Cash Flow as cash provided by operating activities less capital expenditures, allocated interest expense, and excluding transaction costs incurred to date. Vista Outdoor management uses Free Cash Flow internally to assess both business performance and overall liquidity and we believe that Free Cash Flow provides investors with an important perspective on the cash available for debt repayment, share repurchases and acquisitions after making the capital investments required to support ongoing business operations. These non-GAAP financial measures have limitations as analytical and comparative tools and you should consider EBITDA, Adjusted EBITDA and Free Cash Flow in addition to, and not as a substitute for, operating income, cash from operating activities or any other measure of financial performance or liquidity reported in accordance with GAAP. Throughout the presentation, certain numbers will not sum to the total due to rounding.

Business Overview Section 1

Company Heritage © 2016 | Vista Outdoor Presentation 5 2001 20102008 2013 20151990 2009 Spin-off from ATK Spin-off from Honeywell New additions to Vista Outdoor portfolio post spin Giro, Bell, C-Preme and Blackburn expected to be acquired in April, 2016, subject to regulatory approvals and other customary closing conditions. 2016

Our Vision Be a leading provider of quality products for the outdoor enthusiast, while delivering superior long-term returns to our shareholders, value for our customers, and rewarding careers for our employees Bringing the World Outside © 2016 | Vista Outdoor Presentation 6 Our Mission To bring the world outside, leverage our capabilities and experience and instill passion into products that help the outdoor enthusiast achieve independence and success in the activity of their choice

We Know Our Core Customer © 2016 | Vista Outdoor Presentation 7 Diverse and Growing Participation with Passionate Consumers

Company Snapshot © 2016 | Vista Outdoor Presentation 8 A World Leader with key brands in Outdoor Recreation and Shooting Sports Products Vista Outdoor Stand Alone FY15 Results (1)(2) Sales of $2.08 Billion Adj. EBIT margin of ~12% Adj. EBITDA of $320 Million Organic growth of ~17% since 2003 Attractive cash generation with FCF of $160 Million Net debt of $86 Million and total liquidity of $649 Million(3) Sales by Customer (4) Shooting Sports Consumer, 68% U.S. / Law Enforcement, 12% International, 20% Notes 1. Financial results are for the fiscal year ending March 31, 2015 and reflect 10 months ATK Sporting carve-out financials and 2 months Vista Outdoor financials 2. See financial details and reconciliation on pages 40-43 3. Estimated debt and liquidity as of March 31, 2015. Liquidity refers to cash on hand plus availability for drawings under our revolving credit facility 4. Reflects estimate of historical sales by customer category for all Vista Outdoor brands, including Bell, Giro, C-Preme and Blackburn brands expected to be acquired in April 2016. Provided for illustrative purposes only 5. Giro, Bell, C-Preme and Blackburn brands expected to be acquired in April 2016, subject to regulatory approvals and other customary closing conditions Outdoor Products

Portfolio Transformation – Sales Impact © 2016 | Vista Outdoor Presentation 9 March 31, 2015 (1) Notes 1. Financial results are for the fiscal year ending March 31,2015 2. Vista Outdoor Sales figures adjusted for the impact of acquisitions. Acquisitions of Giro, Bell, C-Preme and Blackburn subject to regulatory approvals and customary closing conditions Shooting Sports, 65% Outdoor Products, 35% LTM December 2015 (2) Shooting Sports, 51% Outdoor Products, 49% Significant portfolio reshaping executed in first year of spin-off

0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 2,200 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 A History of High Double Digit Growth © 2016 | Vista Outdoor Presentation 10 Growth Trajectory Reflects Market Growth, Increased Share and Diversification of Product Portfolio Annual Sales ($M) FY03 – FY15 CAGR Organic: 17.3% Total: 19.1%

Key Investment Highlights © 2016 | Vista Outdoor Presentation 11 Portfolio of Authentic Brands Focused on Outdoor Sports and Recreation 1 Large, Addressable and Growing Outdoor Recreation and Shooting Sports Market 2 Leading Innovation and Product Development Competencies 3 Proven Manufacturing, Global Sourcing and Distribution Platform 4 Proven M&A Capabilities 5 Long-Tenured and Highly Experienced Management Team 6 Opportunistic Execution of 2 Year $200M Share Repurchase Plan 7

Industry Leading Outdoor Product Brands © 2016 | Vista Outdoor Presentation 12 Binoculars & Riflescopes(1) #1 in units sold for over 10 years 13 point lead over binocular competitors over 3 years 7 point lead over riflescope competitors over 3 years Golf Laser Rangefinder(1) #1 market share 57% of all units sold in the category for calendar year 2014 Diverse Portfolio of Brands Notes 1. KeyStat Connect™ Report 2014 Created Hands-free hydration category in 1989 Leading market share in hands-free hydration and reusable water bottles Highly recognized brands Giro is a leader in the global specialty cycling helmet market Bell established its position in both mass and specialty markets Hydration Protective Gear

Industry Leading Shooting Sports Brands © 2016 | Vista Outdoor Presentation 13 Source Public company filings and USITC #1 in Ammunition Sales Since 2008 20 30 40 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 #1 Market Share#2 Market Share Segmented Brand Strategy With Leadership in Multiple Categories Leading Shooting Sports Brands % Proven Ability to Grow Share in a Competitive Market Category Brand Market Share Ammunition #1-Overall #1-Handgun #1-Rifle #2-Shotshell Rifles(1) #1 Note 1. Based on units sold in 2013, as reported in Southwick Hunting and Shooting Participation and Market Trends for Nov. – Dec. and Annual 2013

14 Vista Is Uniquely Positioned for Continued Outperformance Vista Is a Best-in-Class Operator… Vista experiences stronger growth during growth cycles and more modest declines during down cycles ‒ Evidenced by growth in market share since 2003 Good – better – best strategy allows wholesalers and retailers to interact with single ammunitions supplier across all price points ‒ In down cycle, importers and domestic competitors lose shelf space before Vista is impacted Scalable infrastructure allows for maximum flexibility to meet changes in demand Firearms make up <10% of Vista’s total revenue Ammunition is a consumable good whereby demand increases with a greater installed shooter base (akin to razor / razorblade model) Outdoor recreation products are a growing part of Vista’s business © 2016 | Vista Outdoor Presentation 0 5 10 15 20 25 30 35 40 45 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 …With the Leading Position in the Ammunition Market Share of US Ammunition Sales % Imports Source Public company filings Other

Vista Presence Expansion Opportunity Market Size ($B) (1) Camping 9 Cycling 7 Fishing 7 Golf(2) 5 Hunting / Shooting Sports(3) 14 Snow Sports 5 Trail Sports 7 Water Sports 2 Wildlife Viewing 7 Total Market Opportunity 63 Unique Opportunity in Attractive $63B Industry © 2016 | Vista Outdoor Presentation 15 Note 1. 2011 estimates of annual consumer spending on non-motorized outdoor recreation-related gear and accessories based on Outdoor Industry Association research (except where noted) 2. 2012 estimate of annual consumer spending on golf apparel, footwear and equipment based on National Sporting Goods Association research 3. 2011 estimate of annual consumer spending on hunting and shooting sports equipment and accessories based on Southwick & Associates research Source Outdoor Industry Association, National Sporting Goods Association, Southwick & Assoc. Opportunity to Expand Across Multiple Categories Scale Position, Common Distribution and Shared Customer Insights

© 2016 | Vista Outdoor Presentation 16 Leading Innovation and Product Development Competencies Standardize Market-Based Product Development Process to Drive Organic Growth Objectives Develop new and innovative performance-based differentiated products Secure partnerships that fill technology gaps and drive innovation Achieve ROI on discretionary and IR&D investments Deliver affordable, differentiated and innovative products to market – engage, activate, and capture new shooters Increase speed to market to capitalize on market opportunities Leverage technology and platforms to maximize value and by delivering common products to multiple markets 1 Initiatives Utilize the integrated product development process to bring ideas successfully and profitably to market Build in continuous consumer feedback loop Incorporate advanced technology – emerging and maturing Design for cost and manufacturability 2 Deliverables Full portfolio product and technology roadmaps Add new strategic partnerships Win product awards Drive innovation that targets key customer needs 3 Delivering Innovation to Create Competitive Separation

© 2016 | Vista Outdoor Presentation 17 Integrated Supply Chain Management Core to Our Business Model Scope and scale is difficult to replicate Obtain the best price and delivery available on our raw materials Source finished product domestically and internationally for global distribution Continuously seek to strengthen our vendor base and produce year-over-year product cost reductions Expansive Sourcing Network Facilities in the US, Puerto Rico, Mexico, Canada and other countries Adherence to strict regulatory standards and certifications — Regulations and cost to build new facilities create significant barriers to entry for potential competitors Ability to leverage the scale and scope of the Vista Performance Management system across our supply chain to be the low-cost producer in many of our product categories State-of-the-Art Manufacturing Global network covering North and South America, Europe, Asia and Australia Consolidated North American distribution centers to increase efficiencies Ongoing implementation of automated process in key locations Efficient Global Distribution

Proven M&A Capabilities © 2016 | Vista Outdoor Presentation 18 Weaver (Optics): technologically advanced and rigorously tested scopes and binoculars — Brand has experienced ~7% revenue CAGR since acquisition(1) BLACKHAWK!: top-quality tactical accessories with #1 share of the consumer holster market — Industry leader with a broad customer base that depends on the brand’s performance and durability Savage Arms: prominent brands known for accuracy, innovation, quality, and affordability — Over 100 years of market leading innovation in the long-gun category Bushnell: high-quality, affordable and innovative optics and accessories brands — Complements existing portfolio — Provides outdoor recreation expansion opportunities Jimmy Styks: leading designer and marketer of stand up paddle (“SUP”) boards and accessories — SUP industry is one of the fastest growing segments within water sports CamelBak: created the hands-free hydration category with the introduction of ThermoBakTM in 1989 — Leading market share for hands-free hydration packs and reusable water bottles Action Sports (Bell, Blackburn, C-Preme & Giro)(2): leader in outdoor recreation helmets & other products for cycling, snow sports and powersports — Balances Vista portfolio while expanding presence in cycling and winter sports Highly Strategic Acquisitions that Strengthen Vista’s Product Offering Note 1. FY09 – FY15 revenue CAGR for Weaver optics product line 2. Bell, Blackburn, C-Preme & Giro brands expected to be acquired via acquisition of Bell Sports Corp from BRG Sports Inc., subject to regulatory approvals and other customary closing conditions Vista’s Brand Portfolio is the Result of Executing the Acquisition Strategy Beginning in 2001

Key Growth Strategies Section 2

© 2016 | Vista Outdoor Presentation 20 Growth Engine: Organic and Acquired Product Development M&A Multiplier Effect Acquisition of Assets Inorganic GrowthOrganic Growth Product Innovation Engineering and Innovation Drive Core Customer Following and Organic Growth Acquisitions Leverage Existing Infrastructure and Channels Note Giro, Bell, C-Preme and Blackburn brands expected to be acquired via acquisition of Bell Sports Corp from BRG Sports Inc., subject to regulatory approvals and other customary closing conditions

© 2016 | Vista Outdoor Presentation 21 Our Growth Strategies Capitalize on a Growing and Fragmented Market 1 Expand Into Complementary or Adjacent Categories Through M&A 2 Develop New and Innovative Products to Drive Organic Growth and Customer Loyalty 3 Leverage Relationships With Our Wholesale and Retail Channel 4 Continuously Improve Operations 5 A Leading Global Provider in Outdoor Sports and Recreation

© 2016 | Vista Outdoor Presentation 22 Capitalize on a Growing and Fragmented Market Outdoor Recreation and Shooting Sports Experiencing Positive Trends that Support Demand Established Leading Brand Positions Opportunity for Brand Consolidation Branded Equipment Market Share (3) Top Five Companies, 20% Rest of Market, 80% Notes 1. FBI Adjusted NICS CAGR 2009-2014 2. New shooters defined as having begun shooting in the last 5 years 3. Represents 2013 wholesale value of branded sporting goods equipment Source: NSSF and FBI Adjusted Source: Sporting Goods Intelligence Shooting Participants, 2009 – 2014 New Shooters(2) Aged 18 – 34 New Shooters(2) are Female +17M 68%51% Shooting Sports Has Grown 7% Since 2009 (1) Hydration Golf rangefinders Stand up paddle (“SUP”) boards Cycling and snow sports Optics

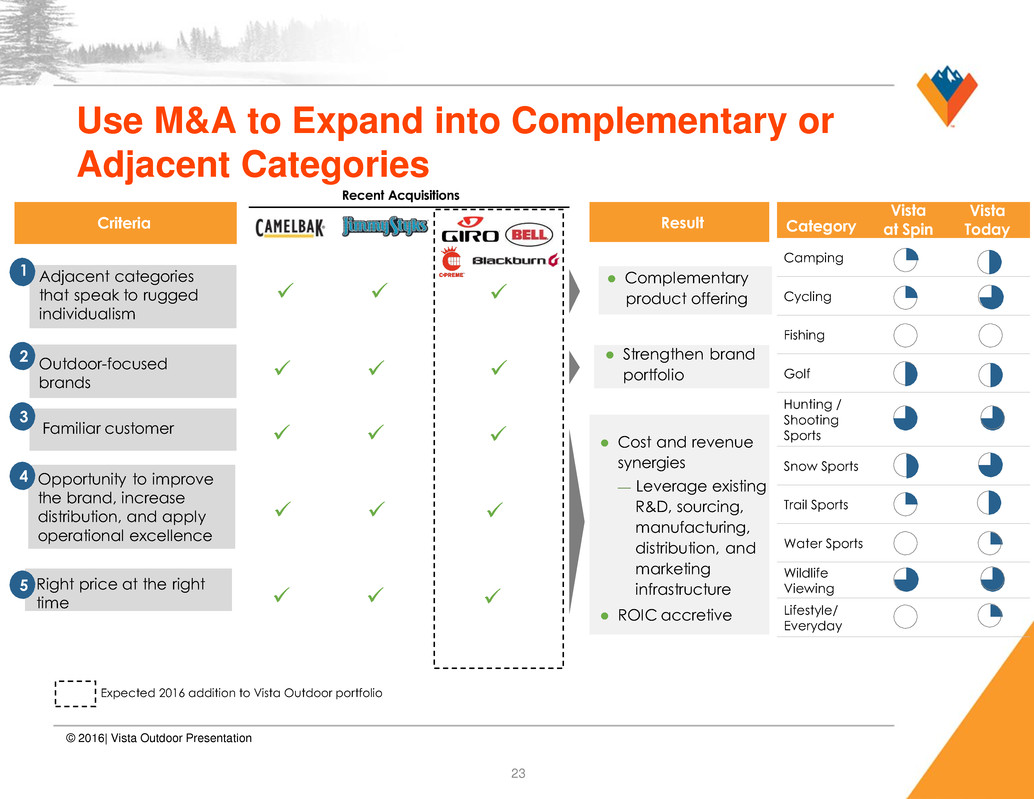

Adjacent categories that speak to rugged individualism 1 Outdoor-focused brands 2 Familiar customer 3 Opportunity to improve the brand, increase distribution, and apply operational excellence 4 Right price at the right time 5 Complementary product offering Strengthen brand portfolio Criteria Result Cost and revenue synergies — Leverage existing R&D, sourcing, manufacturing, distribution, and marketing infrastructure ROIC accretive 23 Use M&A to Expand into Complementary or Adjacent Categories Recent Acquisitions Camping Cycling Fishing Golf Hunting / Shooting Sports Snow Sports Trail Sports Water Sports Wildlife Viewing Lifestyle/ Everyday Category Vista at Spin Vista Today © 2016| Vista Outdoor Presentation Expected 2016 addition to Vista Outdoor portfolio

© 2016 | Vista Outdoor Presentation 24 Company Overview Multiple Use Applications Leading designer and marketer of stand up paddle (“SUP”) boards and accessories ‒ Founded in 2009 and headquartered in Huntington Beach, California Portfolio of nearly 30 SKUs in epoxy, inflatable, soft and thermoform boards, as well as accessories Management highly engaged in day-to-day operations, market trends and customer satisfaction Operating Characteristics Coastal Cruising Fishing Exploration Relaxation Yoga Flat-water Paddling Competition Riding Waves SUP industry is one of the fastest growing segments within water sports, growing due to its mainstream appeal / ease of use Rapid Market Expansion Multi- Platform Product Efficient Business Model SUP is a “blank” canvas for individuals offering an easy and affordable way to get on the water to enjoy multiple pursuits Dedicated manufacturing capacity Source accessories direct from manufacturers Direct ship to customers’ warehouses Advertising integrated into customers campaigns Leading Brand in Attractive Category

Personal Hydration Market Leader © 2016 | Vista Outdoor Presentation 25 Continuously Reinventing the Way People Hydrate and Perform Created the hands-free hydration category with the introduction of ThermoBakTM in 1989 First to market with entirely BPA-free plastic bottle product line and ongoing new product developments in filtration and purification Leading market share for hands-free hydration packs and reusable water bottles for recreational use and key supplier of hydration systems to the U.S. military Expanding product portfolio driving growth in sales to the recreational market Total net sales of $148.7M year ended December 31, 2014 up 6% compared to prior year period – Recreation sales account for ~79% of total gross sales compared to ~71% in prior year period – International sales account for ~25% of total gross sales compared to ~22% in prior year period Comprehensive Product Portfolio Gloves Accessories Hydration Packs Bottles Easily cleaned and filled reservoir Simple and intuitive drinking through connecting tube and self-sealing mouthpiece (“bite valve”) Better BottleTM offers patented spill-proof bite valve and insulated stainless steel canister GrooveTM’s integrated straw assembly filters water on-the-go Multiple accessories to complement each hydration solution Elixir – flavored electrolyte supplement for performance athletes All ClearTM – portable microbiological UV water purifier Government / military product with highly-technical design and construction Source: Compass Diversified Holdings public filings

Outdoor Protective Products Market Leader © 2016 | Vista Outdoor Presentation 26 Products Spanning Cycling, Snow Sports, and Powersports Action Sports, based in Scotts Valley, California., is a collection of branded sports equipment and protection products. It represents a portion of BRG Sports − Brands include Bell, Blackburn, C-Preme and Giro, all brands focused on cycling and snow sports protection. − Dominant market share in cycling helmets Bell’s line of powersports products includes motorcycle helmets, dirt helmets, snowmobiling helmets and related accessories Bell largely distributes its powersports products through independent retailers Diverse Product Portfolio Accessories Powersports Cycling Helmets Snow Sports Giro is a leader in the global specialty cycling helmet market Bell established its own position in both mass and specialty markets Bell juvenile licensing and C-Preme children's products Giro maintains market leading position in both helmets and goggles Bell’s line of powersports products includes motorcycle helmets, dirt helmets, snowmobiling helmets and related accessories Bell largely distributes its powersports products through independent retailers Product categories in both cycling and snowsports

© 2016 | Vista Outdoor Presentation Transaction Rationale 27 Complementary Product Offering Reinforces Vista Outdoor’s position as a leading provider of quality products for the outdoor enthusiast Increases scale of business and contribution of Outdoor Products segment Market Leading Brand Highly visible and recognized as leader in hydration products Innovative culture focused on delivering high- quality, technologically advanced products Synergy Opportunity Limited overlap between key customers creates significant cross-selling opportunities Synergies to come through additional sales opportunities along with conservative cost savings Proven Scalability CamelBak’s recreation product sales have experienced strong growth, steadily increasing as a portion of total gross sales Ample production capacity allows for further increase in scale Strong Leadership & Shared Culture CamelBak’s leadership team has extensive experience in outdoor recreation, sporting goods, and consumer products Vista and CamelBak executives have shared culture of innovation, active engagement in the outdoor industry, and conservationism CamelBak Jimmy Styks Increases product scope to reach broader range of customers Allows entry into water sports market segment Leading designer and manufacturer of stand up paddle boards Track record of delivering high quality, competitively priced products Access to top sellers of water sports products Platform to introduce Jimmy Styks to key Vista customers Strength of supply chain supported by exclusive manufacturing partnerships Management highly engaged in day- to-day operations, market trends and customer satisfaction Action Sports Serves the specialty and mass cycling and snow sports markets Enhance Vista Outdoor’s pure play outdoor retailer presence Giro and Bell represent leading brands in cycling and snow sports. An industry pioneer in premium protective gear with proven success in R&D and product design International expansion opportunities Expanded product offering for good, better, best strategy in winter sports Introduced and scaled adjacent products (e.g., cycling shoes, goggles) Leading geographic footprint and retail presence Large, mature company with standalone processes and functions that support immediate independence with a seasoned, experienced management team

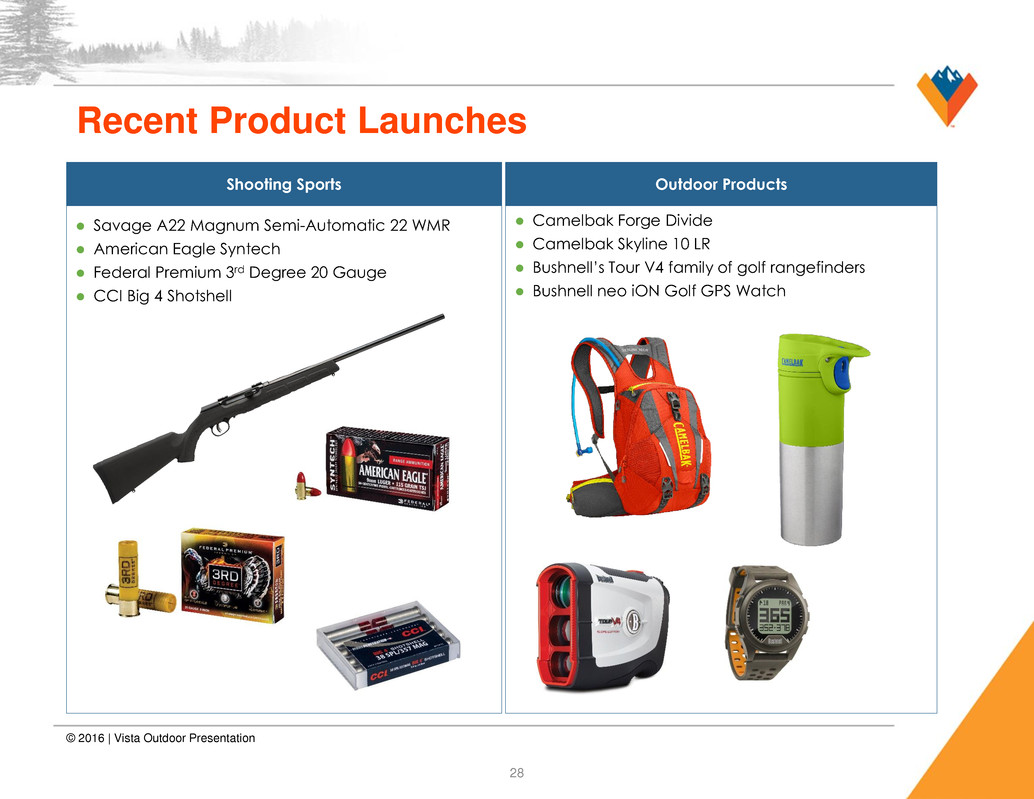

© 2016 | Vista Outdoor Presentation 28 Recent Product Launches Shooting Sports Savage A22 Magnum Semi-Automatic 22 WMR American Eagle Syntech Federal Premium 3rd Degree 20 Gauge CCI Big 4 Shotshell Outdoor Products Camelbak Forge Divide Camelbak Skyline 10 LR Bushnell’s Tour V4 family of golf rangefinders Bushnell neo iON Golf GPS Watch

© 2016 | Vista Outdoor Presentation 29 Long-Tenured Customer Relationships 2016 Enduro Magazine Design & Innovation Award 2015 Guns & Ammo Rifle of The Year 2015 Optics Planet Brilliance Award Highly Valued Retail Partner with Award-Winning Products Broad Demand for Vista Products % of FY 2015 Sales Top Ten Retail Customers 40% Walmart, 9% Other Retailers & Distributors, 60% Expansive Network of Marquee Customers Develop Synergistic Relationships as Supplier of Choice Across Product Categories

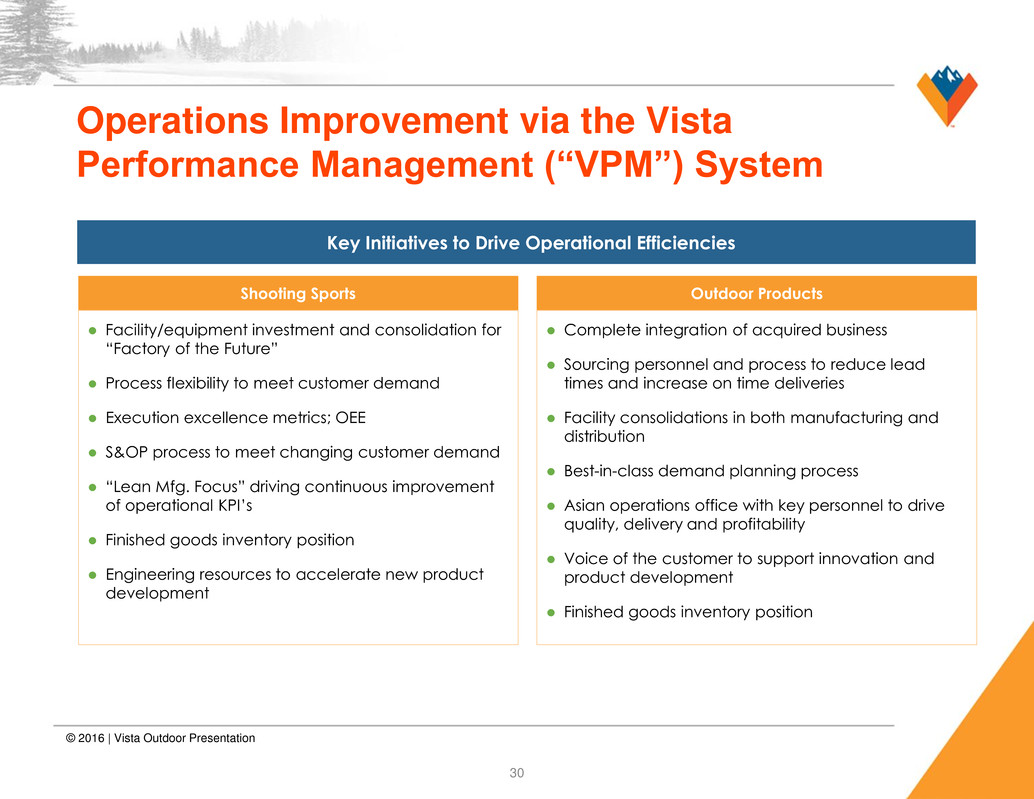

© 2016 | Vista Outdoor Presentation 30 Operations Improvement via the Vista Performance Management (“VPM”) System Key Initiatives to Drive Operational Efficiencies Facility/equipment investment and consolidation for “Factory of the Future” Process flexibility to meet customer demand Execution excellence metrics; OEE S&OP process to meet changing customer demand “Lean Mfg. Focus” driving continuous improvement of operational KPI’s Finished goods inventory position Engineering resources to accelerate new product development Shooting Sports Complete integration of acquired business Sourcing personnel and process to reduce lead times and increase on time deliveries Facility consolidations in both manufacturing and distribution Best-in-class demand planning process Asian operations office with key personnel to drive quality, delivery and profitability Voice of the customer to support innovation and product development Finished goods inventory position Outdoor Products

Financial Overview Section 3

Historical Financial Highlights © 2016 | Vista Outdoor Presentation 32 $M Notes 1. Unaudited financial results. Pro forma 2014 for acquisitions of Bushnell and Savage Arms. See Amendment No. 3 to Registration Statement on Form 10, filed with the SEC on January 16, 2015, for detailed adjustments 2. See appendix for non-GAAP reconciliation 1,196 1,874 2,280 2,083 0 1,000 2,000 3,000 FY2013 FY2014 PF2014 FY 2015 Revenue $M Adj. EBITDA (Non-GAAP) (2) 112 302 370 319 0 150 300 450 FY2013 FY2014 PF2014 FY2015 9.3% 16.1% 16.2% 15.3% (1) Adj. EBITDA Margin: (1) (2)

Historical Cash Flow & Capital Spend Summary 33 © 2016 | Vista Outdoor Presentation 52 159 160 0 50 100 150 200 FY2013 FY2014 FY2015 Disciplined Capital ExpendituresStrong Free Cash Flow Generation Profile (1) 23 40 43 0 10 20 30 40 50 FY2013 FY2014 FY2015 ($M) ($M) 2.0% 2.2% 2.1%% of Sales: 4.4% 8.5% 7.7% Notes 1. Represents Cash from Operations less Capital Expenditures, allocated interest expense and transaction expense (non-GAAP measure; see appendix for reconciliation)

$- $200 $400 $600 $800 History of Strong Ammunition Sales Growth Following Down Cycles Firearms and Related Accessories Have Historically Followed Similar Trends Actual Ammunition Sales Based on Reported Excise Taxes (1) ($M) Down Cycle 15 months Down Cycle 22 months Note 1. Rolling 4 Quarter average, adjusted for inflation as of 2014 Source: National Shooting Sports Foundation © 2016 | Vista Outdoor Presentation 34 Mid-Term Outlook for Ammunition Sales Down cycle beginning in 2014 expected to last approximately 18 months ‒ Ammunition sales cycle typically lags firearms and experiences less severe peaks and troughs Strong trends in shooting sports participation expected to drive next growth cycle ‒ ~17M increase in new participants engaged in shooting sports 2009-2014 ‒ New shooters are younger 68% and female participation (51%) continues to grow ‒ Number of shooting ranges has grown at a 12% CAGR since 2006 Source: National Shooting Sports Foundation

Conclusion Section 4

Key Investment Highlights © 2016 | Vista Outdoor Presentation 36 Portfolio of Authentic Brands Focused on Outdoor Sports and Recreation 1 Large, Addressable and Growing Outdoor Recreation and Shooting Sports Market 2 Leading Innovation and Product Development Competencies 3 Proven Manufacturing, Global Sourcing and Distribution Platform 4 Proven M&A Capabilities 5 Long-Tenured and Highly Experienced Management Team 6 1, 2, or 3 in Market Position in 21 Categories $63B Market and Proven Share Growth New Product Awards and a Development Pipeline Modernized Facilities and Efficient Operational Model A Track Record of Strategic Acquisitions; recent actions include Jimmy Styks and CamelBak A Seasoned Team Committed to Value Creation Opportunistic Execution of 2 Year $200M Share Repurchase Plan 7 Repurchases of $138 million executed to date as of February 10, 2016

FY 2016 Outlook as of February 11, 2016 © 2016 | Vista Outdoor Presentation 37 * See reconciliation table for details. ** Non-GAAP financial measure. See reconciliation table for details.

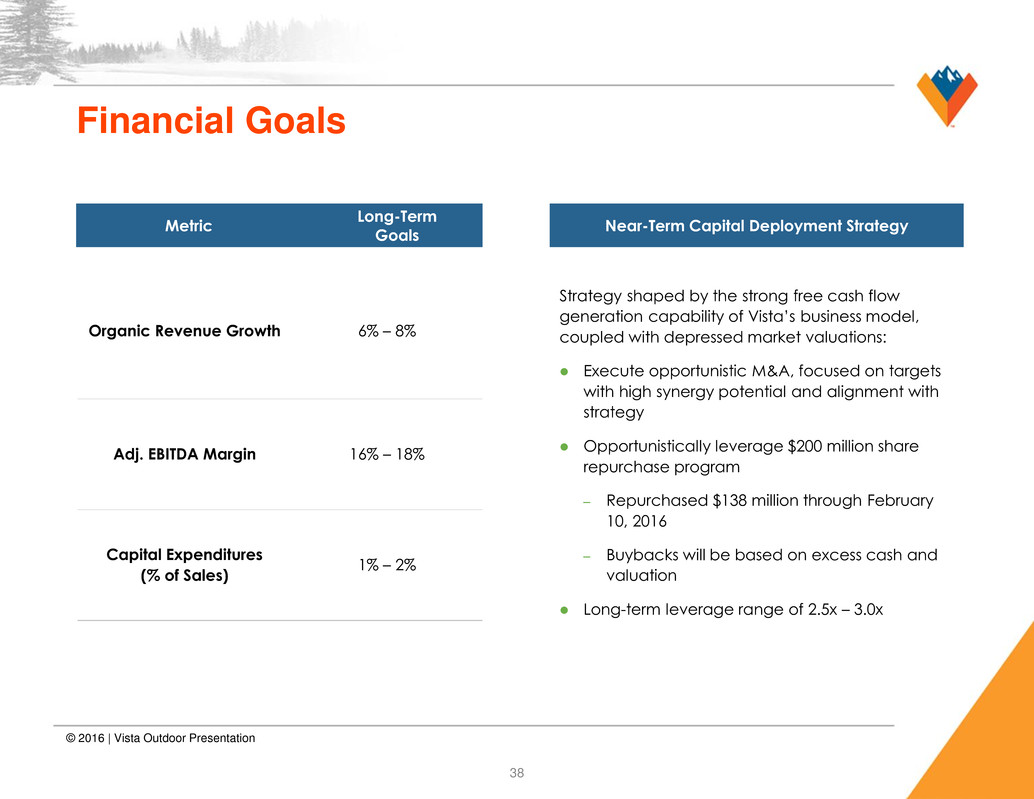

Financial Goals Organic Revenue Growth 6% – 8% Adj. EBITDA Margin 16% – 18% Capital Expenditures (% of Sales) 1% – 2% 38 © 2016 | Vista Outdoor Presentation Near-Term Capital Deployment Strategy Strategy shaped by the strong free cash flow generation capability of Vista’s business model, coupled with depressed market valuations: Execute opportunistic M&A, focused on targets with high synergy potential and alignment with strategy Opportunistically leverage $200 million share repurchase program ‒ Repurchased $138 million through February 10, 2016 ‒ Buybacks will be based on excess cash and valuation Long-term leverage range of 2.5x – 3.0x Metric Long-Term Goals

Appendix

Historical Financial Summary 40 Notes 1. Unaudited financial results. Pro forma 2014 for acquisitions of Bushnell and Savage Arms. See Amendment No. 3 to Registration Statement on Form 10, filed with the SEC on January 16, 2015, for detailed adjustments 2. Includes $52M goodwill/trade name impairment Years Ended March 31, ($M) FY2013 FY2014 PF 2014 (1) FY2015 Net Sales $1,196 $1,874 $2,280 $2,083 % Growth 14.7% 56.7% N/M N/M Gross Profit 242 467 649 529 % Margin 20.3% 24.9% 28.5% 25.4% Operating Income 101 234 293 184(2) % Margin 8.5% 12.5% 12.8% 8.8% D&A 25 45 67 67 EBITDA (Non-GAAP) 127 279 359 251 % Margin 10.6% 14.9% 15.7% 12.0% Adj. EBITDA (Non-GAAP) 112 302 370 320 % Margin 9.3% 16.1% 16.2% 15.3% © 2016 | Vista Outdoor Presentation Select Financials

Non-GAAP Reconciliation 41 Notes 1. Unaudited financial results. Pro forma 2014 for acquisitions of Bushnell and Savage Arms. See Amendment No. 3 to Registration Statement on Form 10, filed with the SEC on January 16, 2015, for detailed adjustments 2. Unaudited financial results. Pro forma 2015 reflects removal of ATK allocated interest as reported and replacing with interest expense at Vista debt levels. Pro forma does not include the acquisitions of CamelBak or Jimmy Styks 3. Due to conditions in the firearms market, in Q3 FY15 the Company recorded a non-cash goodwill impairment related to Savage Arms 4. Represents transaction costs, including accounting, legal and advisor fees, and transition costs, in each case incurred in connection with our spin-off transaction and the acquisitions of Bushnell and Savage Arms 5. Represents our estimate of costs that we would have incurred in excess of the applicable corporate allocation had we operated as a standalone public company during the period 6. Represents inventory step-up recorded in connection with our acquisitions of Bushnell and Savage Arms as part of their respective purchase price allocations 7. Represents (a) elimination of management fees of approximately $1.6M paid by Bushnell, which will not be paid in the future; (b) compensation and fees paid by Bushnell to its board of directors and with respect to certain professional services of approximately $0.2M, which will not be paid in the future; and, (c) transaction costs of approximately $3.0M incurred by Bushnell in connection with its acquisition, including accounting, legal, advisor fees and management bonuses 8. Impact of reduced cost of sales as a result of the revised pricing under the Lake City Supply Agreement between Vista Outdoor and Orbital ATK Years Ended March 31, ($000) FY2013 FY2014 PF 2014(1) FY2015 PF FY 2015(2) Net income $64,692 $133,257 $175,907 $79,528 $92,517 Interest expense (income), net (7) 15,469 6,744 30,108 10,125 Income tax provision 36,770 85,081 110,129 74,518 81,512 Depreciation and amortization 25,128 44,902 66,550 66,551 66,551 EBITDA 126,583 278,709 359,330 250,705 250,705 Goodwill impairment(3) - - - 52,220 52,220 Transaction costs(4) - 16,780 - 19,461 19,461 Transition costs(4) - 5,700 5,700 5,988 5,988 Standalone and public company costs(5) (15,000) (15,000) (15,000) (15,000) (15,000) Inventory step-up(6) - 15,500 15,500 - - Bushnell adjustments(7) - - 4,728 - - Lake City Supply Agreement adjustment(8) 4,945 6,174 6,174 Adjusted EBITDA $116,528 $301,689 $370,258 $319,548 $319,548 © 2016 | Vista Outdoor Presentation

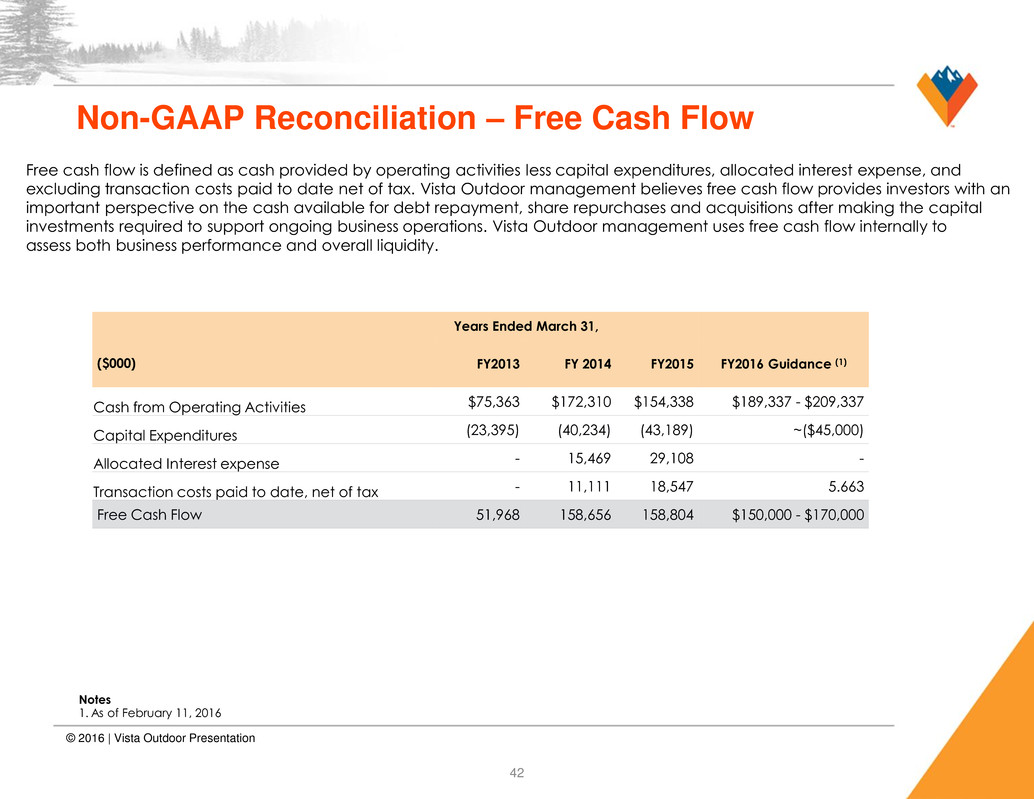

Non-GAAP Reconciliation – Free Cash Flow 42 Years Ended March 31, ($000) FY2013 FY 2014 FY2015 FY2016 Guidance (1) Cash from Operating Activities $75,363 $172,310 $154,338 $189,337 - $209,337 Capital Expenditures (23,395) (40,234) (43,189) ~($45,000) Allocated Interest expense - 15,469 29,108 - Transaction costs paid to date, net of tax - 11,111 18,547 5.663 Free Cash Flow 51,968 158,656 158,804 $150,000 - $170,000 © 2016 | Vista Outdoor Presentation Free cash flow is defined as cash provided by operating activities less capital expenditures, allocated interest expense, and excluding transaction costs paid to date net of tax. Vista Outdoor management believes free cash flow provides investors with an important perspective on the cash available for debt repayment, share repurchases and acquisitions after making the capital investments required to support ongoing business operations. Vista Outdoor management uses free cash flow internally to assess both business performance and overall liquidity. Notes 1. As of February 11, 2016

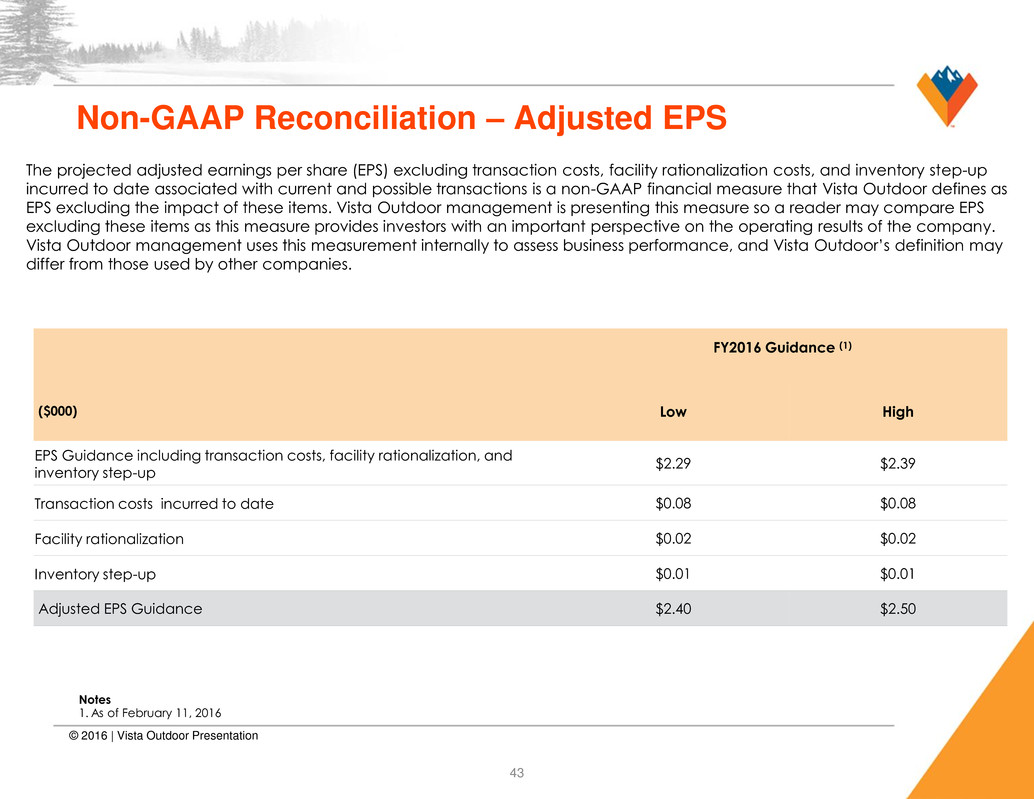

Non-GAAP Reconciliation – Adjusted EPS 43 FY2016 Guidance (1) ($000) Low High EPS Guidance including transaction costs, facility rationalization, and inventory step-up $2.29 $2.39 Transaction costs incurred to date $0.08 $0.08 Facility rationalization $0.02 $0.02 Inventory step-up $0.01 $0.01 Adjusted EPS Guidance $2.40 $2.50 © 2016 | Vista Outdoor Presentation The projected adjusted earnings per share (EPS) excluding transaction costs, facility rationalization costs, and inventory step-up incurred to date associated with current and possible transactions is a non-GAAP financial measure that Vista Outdoor defines as EPS excluding the impact of these items. Vista Outdoor management is presenting this measure so a reader may compare EPS excluding these items as this measure provides investors with an important perspective on the operating results of the company. Vista Outdoor management uses this measurement internally to assess business performance, and Vista Outdoor’s definition may differ from those used by other companies. Notes 1. As of February 11, 2016