Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DIGITAL REALTY TRUST, INC. | earningsdeckshell_123115.htm |

February 25, 2016

1 SUPERIOR RETURNS Deliver superior risk-adjusted total shareholder returns 2 CAPITAL ALLOCATION Prudently allocate capital to opportunistically extend global campus footprint 3 PRODUCT OFFERINGS Drive higher returns on the asset base by diversifying product offerings 4 OPERATING EFFICIENCIES Achieve operating efficiencies to accelerate growth in cash flow and value per share Our Focus Our philosophy is to deliver superior returns to our shareholders by capitalizing on our core competencies and tailoring them to meet the ever growing and evolving data center needs of our customers The Next Horizon Three-Year Guideposts 2

FUNNEL APPROACH TOWARDS CUSTOMERS ADVANCED SERVICES Cloud Hosting Cloud Apps MANAGED SERVICES Network Security Business Continuity FOUNDATIONAL SERVICES Scale / Colocation Connectivity Global Service Infrastructure Platform Deliver Basic Services, Enable Partners 3 Digital Realty is focused on foundational services to enable customers and partners to service thousands of their customers Customers & Partners Thousands of Customers FOCUSED ON FOUNDATIONAL SERVICES

Achieving Favorable Execution on Capital Recycling Redeploying Accretively, Enhancing Portfolio Quality 4 Property Kato & Page / Fremont, CA Sales Price $37.5 million Sales Price / s.f. $188 / s.f. Gain (Loss) on Sale $1.2 million Cap Rate 7.2% Closing Date January 2016 Property 650 Randolph / Somerset, NJ Sales Price $9.1 million Sales Price / s.f. $71 / s.f. Gain (Loss) on Sale ($0.1 million) Cap Rate N/A Closing Date December 2015

- 20 40 60 Boston Chicago Dallas Houston N Virginia NY Metro Phoenix Silicon Valley Current Supply New Construction Sub-Lease Availablility Digital Realty Inventory U.S. Major Market Data Center Supply (1) Fundamentals Firming Across the Board 1) Based on Digital Realty internal estimates. 2) Represents Digital Realty’s available finished data center space and available active data center construction. 5 in megawatts 4Q15 3Q15in megawatts (2) (2) - 20 40 60 Boston Chicago Dallas Houston N Virginia NY Metro Phoenix Silicon Valley Current Supply New Construction Sublease Availablility Digital Realty Inventory

3Q15 CALL October 29, 2015 CURRENT February 19, 2016 2016E 2017E Global GDP Growth Forecast (1) 2016E: 3.6% 2016E: 3.4% 3.4% 3.6% U.S. GDP Growth Forecast (1) 2016E: 2.8% 2016E: 2.6% 2.6% 2.6% U.S. Unemployment Rate (2) 5.2% 5.0% 4.8% 4.7% Inflation Rate – U.S. Annual CPI Index (2) 0.2% 0.7% 1.5% 2.2% Crude Oil ($/barrel) (3) $49 $32 $36 $41 Control of White House, Senate and HoR (4) D,R,R D,R,R D,R,R D,R,R One-Month Libor (USD) (2) 0.2% 0.4% 0.6% 0.9% 10-Yr U.S. Treasury Yield (2) 2.2% 1.7% 2.4% n/a S&P 500 (2) 2,089 (YTD 1.5%); P/E: 18.7x 1,918 (YTD -6.2%); P/E: 17.3x 14.3x 12.8x NASDAQ (2) 5,075 (YTD 7.1%); P/E: 29.9x 4,504 (YTD -10.0%); P/E: 38.7x 16.2x 13.9x RMZ (2) Average FFO Multiple (5) 1,109 (YTD -0.8%) 16.4x 1,038 (YTD -5.7%) 14.6x 14.6x n/a IT Spending Growth Worldwide (6) 2016E: 1.8% 2016E: 1.7% 1.7% 2.6% Server Shipment Worldwide (7) 2016E: 2.9% 2016E: 6.1% 6.1% 2.9% Global Data Center to Data Center IP Traffic (8) 25% CAGR 2014 – 2019E 25% CAGR 2014 – 2019E 25% CAGR 2014 – 2019E Global Cloud IP Traffic (8) 33% CAGR 2014 – 2019E 33% CAGR 2014 – 2019E 33% CAGR 2014 – 2019E Decelerating Global Economic Growth Outlook Data Center Demand Drivers Are a Bright Spot 6 MA C R O EC O N O M IC IN TE R ES T R A TE S EQU IT Y M A R K ET S IN D U ST R Y 1) IMF World Economic Outlook - January 2016. 2) Bloomberg - February 2016. 3) Bloomberg New York Mercantile WTI Crude Oil - February 2016. 4) Moody’s Analytics Presidential Election Model – February 2016. 5) Citi – October 2015 and February 2016. 6) Gartner: IT Spending, Worldwide, 4Q15. 7) Gartner: Servers Forecast Worldwide, 3Q15 / October 2015 and 4Q15 / December 2015. 8) Cisco Global Cloud Index: Forecast and Methodology, 2014-2019 - October 2015.

Graham’s Golden Rules Defensive Requirements for the Intelligent Investor (1) Adequate Size of the Enterprise $19 Bn ENTERPRISE VALUE (2) Sufficiently Strong Financial Condition BBB / Baa2 / BBB INVESTMENT GRADE BALANCE SHEET Earnings Stability GROWTH IN CORE FFO / SH EACH AND EVERY YEAR Dividend Record UNINTERRUPTED GROWTH IN DIVIDENDS PER SHARE Earnings Growth 14% CAGR IN CORE FFO PER SHARE SINCE 2005 Moderate Price / Earnings Ratio < 15x PRICE / 2016E FFO (2) Moderate Price to Assets Ratio < 15% PREMIUM TO CONSENSUS NAV (2) 12% CAGR 7 1 2 3 4 5 6 7 1) Graham, B. (1949). The Intelligent Investor. New York, NY: Harper & Brothers. 2) Based on consensus estimates. Pricing as of February 23, 2016. 05 06 07 08 09 10 11 12 13 14 15 GFC +

Financial Results

M&A Scorecard On Track to Meet Key 2016 Financial Targets 9 OPERATING REVENUE 2016 TARGET CORE EBITDA (1) 4Q15 ACTUAL 1Q15 ACTUAL 1) Represents EBITDA adjusted for deferred rent expense and excludes synergies. EXPENSE SYNERGIES Completed / On-Track Slightly Behind Off-Track $83.5 million $89.5 million $385+ million $33.4 million $30.4 million $148+ million $15+ million

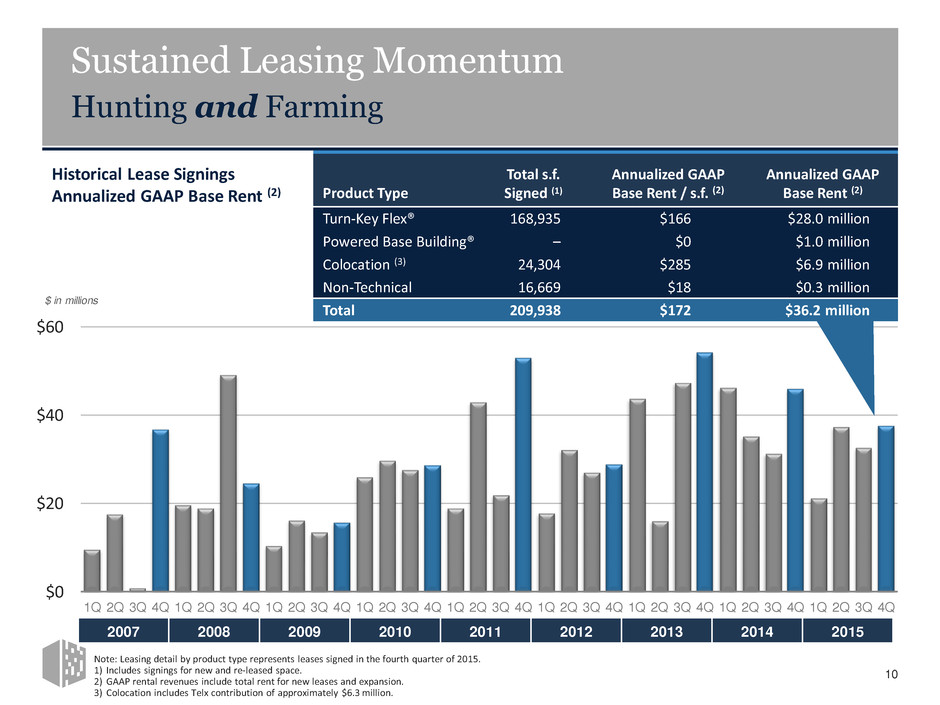

$0 $20 $40 $60 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q Historical Lease Signings Annualized GAAP Base Rent (2) Sustained Leasing Momentum Hunting and Farming Note: Leasing detail by product type represents leases signed in the fourth quarter of 2015. 1) Includes signings for new and re-leased space. 2) GAAP rental revenues include total rent for new leases and expansion. 3) Colocation includes Telx contribution of approximately $6.3 million. $ in millions 10 2007 2008 2009 2010 2011 2012 2013 2014 2015 Product Type Total s.f. Signed (1) Annualized GAAP Base Rent / s.f. (2) Annualized GAAP Base Rent (2) Turn-Key Flex® 168,935 $166 $28.0 million Powered Base Building® – $0 $1.0 million Colocation (3) 24,304 $285 $6.9 million Non-Technical 16,669 $18 $0.3 million Total 209,938 $172 $36.2 million

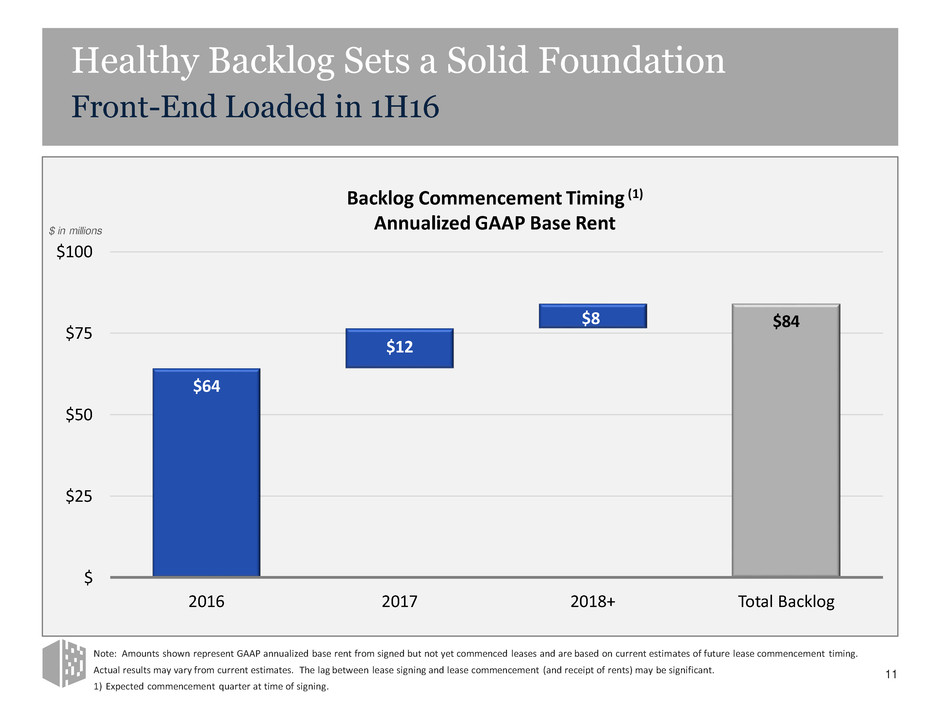

Healthy Backlog Sets a Solid Foundation Front-End Loaded in 1H16 Note: Amounts shown represent GAAP annualized base rent from signed but not yet commenced leases and are based on current estimates of future lease commencement timing. Actual results may vary from current estimates. The lag between lease signing and lease commencement (and receipt of rents) may be significant. 1) Expected commencement quarter at time of signing. $ in millions 11 $84 $64 $12 $8 $ $25 $50 $75 $100 2016 2017 2018+ Total Backlog Backlog Commencement Timing (1) Annualized GAAP Base Rent

Note: Represents Turn-Key Flex® and Powered Base Building® leases signed during the quarter ended 12/31/15. Rental rate changes on renewals are calculated as the cash rent from new leases divided by the cash rent from expiring leases, minus one. Cycling Through Peak Vintage Renewals Approaching Mark-to-Market Inflection Point 12 • Signed renewal leases representing $13 million of annualized GAAP rental revenue • Rental rates on renewals increased by 15% on a cash basis and increased by 40% on a GAAP basis for total data center space 40% GAAP Rent Change 15% Cash Rent Change 23% GAAP Rent Change (2%) Cash Rent Change 46% GAAP Rent Change 20% Cash Rent Change • Renewed 12,000 square feet of Turn-Key Flex® data centers at a rental rate decrease of 2% on a cash basis but increase of 23% on a GAAP basis • Renewed 313,000 square feet of Powered Base Building® data centers at a rental rate increase of 20% on a cash basis and 46% on a GAAP basis Total Data Center Turn-Key Flex® Powered Base Building®

$1.30 $1.38 $0.03 $0.02 $0.01 $0.01 $0.01 $1.20 $1.25 $1.30 $1.35 $1.40 4Q15 Core FFO Guidance G&A Telx Outperformance Synergies Lower Interest One-Time OpEx Savings 4Q15 Core FFO Actual 4Q15 Core FFO / Share Reconciliation 4Q15 Core FFO / Share Out-Performance Lower G&A + Telx Results Drive Upside to Forecast 13 Note: Core FFO is a non-GAAP financial measure. For a description of Core FFO and a reconciliation to net income, see the Appendix.

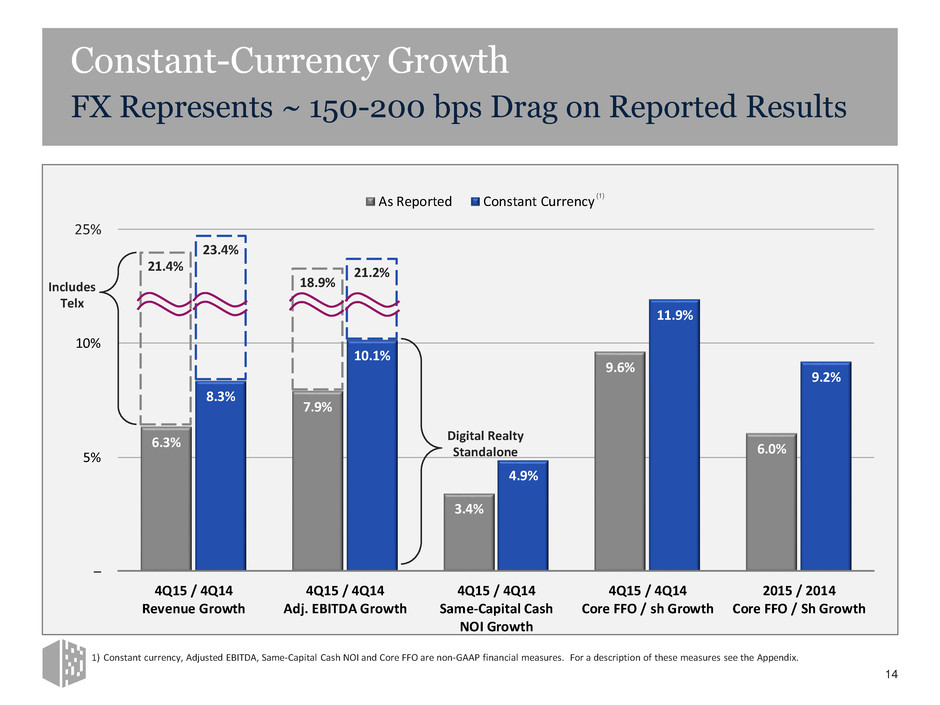

6.3% 7.9% 3.4% 9.6% 6.0% 8.3% 10.1% 4.9% 11.9% 9.2% – 5% 10% 15% 4Q15 / 4Q14 Revenue Growth 4Q15 / 4Q14 Adj. EBITDA Growth 4Q15 / 4Q14 Same-Capital Cash NOI Growth 4Q15 / 4Q14 Core FFO / sh Growth 2015 / 2014 Core FFO / Sh Growth As Reported Constant Currency Constant-Currency Growth FX Represents ~ 150-200 bps Drag on Reported Results 1) Constant currency, Adjusted EBITDA, Same-Capital Cash NOI and Core FFO are non-GAAP financial measures. For a description of these measures see the Appendix. (1) 14 Includes Telx Digital Realty Standalone 25% 23.4% 21.4% 21.2% 18.9%

Putting Exposure in Perspective Benefits of Diversification and Scale on Display 15 HOT BUTTON EXPOSURE BY ABR FFO CURRENCY EXPOSURE 1.6% ENERGY TENANTS 1.4% UNICORNS 1.3% HOUSTON (2) 2016 CORE FFO EXPOSURE (% OF GUIDANCE) (1) 10% BRITISH POUND 4% EURO 5% OTHER 96% NON-EXPOSED 1.3% GBP +/- 10% 0.4% EUR +/- 10% 0.1% WTI +/- $10 per barrel 0.7% LIBOR +/- 100 bps 1) Based on midpoint of 2016 Core FFO per share guidance of $5.45 – $5.60. 2) Includes 0.7% related to energy tenants. CURRENCY / COMMODITY EXPOSURE LESS THAN 3% Midpoint of Guidance $5.45 – $5.60 81% US DOLLAR NOT IMPACTED

Closing the GAAP on Straight-Line Rent Consistently Improving Quality of Earnings $21.2 $19.9 $19.7 $22.7 $21.3 $19.9 $17.6 $18.6 $13.4 $14.5 $13.6 $9.5 5.9% 5.5% 5.2% 6.0% 5.5% 5.0% 4.3% 4.5% 3.3% 3.5% 3.1% 1.9% 2% 3% 5% 6% $0 $10 $20 $30 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 Straight-Line Rental Revenue Straight-Line Rent as % of Revenue $ in millions 16

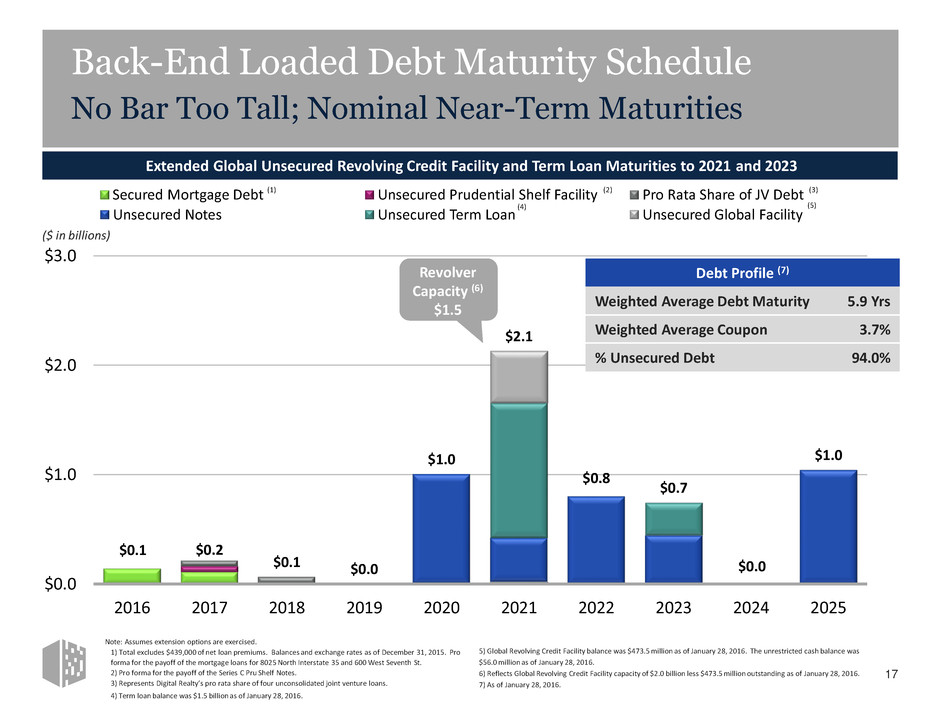

$0.1 $0.2 $0.1 $0.0 $1.0 $2.1 $0.8 $0.7 $1.0 $0.0 $1.0 $2.0 $3.0 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Secured Mortgage Debt Unsecured Prudential Shelf Facility Pro Rata Share of JV Debt Unsecured Notes Unsecured Term Loan Unsecured Global Facility $0.0 (1) Extended Global Unsecured Revolving Credit Facility and Term Loan Maturities to 2021 and 2023 (3) (4) (5) ($ in billions) Back-End Loaded Debt Maturity Schedule No Bar Too Tall; Nominal Near-Term Maturities Note: Assumes extension options are exercised. 1) Total excludes $439,000 of net loan premiums. Balances and exchange rates as of December 31, 2015. Pro forma for the payoff of the mortgage loans for 8025 North Interstate 35 and 600 West Seventh St. 2) Pro forma for the payoff of the Series C Pru Shelf Notes. 3) Represents Digital Realty’s pro rata share of four unconsolidated joint venture loans. 4) Term loan balance was $1.5 billion as of January 28, 2016. 17 (2) Revolver Capacity (6) $1.5 Debt Profile (7) Weighted Average Debt Maturity 5.9 Yrs Weighted Average Coupon 3.7% % Unsecured Debt 94.0% 5) Global Revolving Credit Facility balance was $473.5 million as of January 28, 2016. The unrestricted cash balance was $56.0 million as of January 28, 2016. 6) Reflects Global Revolving Credit Facility capacity of $2.0 billion less $473.5 million outstanding as of January 28, 2016. 7) As of January 28, 2016.

Closed Telx Acquisition Truly transformational transaction – strategic, accretive in year one, and prudently financed Results Surpass Expectations Reported 4Q15 Core FFO / share of $1.38, above the high end of the forecast range Set the Stage for Double-Digit AFFO / Share Growth Quality of earnings improving, growth in cash flow accelerating Secured Supply Chain Provided significant expansion capacity in Ashburn and entered new target market with Frankfurt land acquisition Raised the Dividend Eleventh consecutive year of dividend per-share growth 18 Recreate S&U on previous page in Column Graphs Consistent Execution on Strategic Vision Steady Per-Share Growth in FFO, AFFO and Dividends Successful 4Q15 Initiatives

Appendix

Definitions of Non-GAAP Financial Measures The information included in this presentation contains certain non-GAAP financial measures that management believes are helpful in understanding our business, as further described below. Our definition and calculation of non-GAAP financial measures may differ from those of other REITs, and, therefore, may not be comparable. The non-GAAP financial measures should not be considered an alternative to net income or any other GAAP measurement of performance and should not be considered an alternative to cash flows from operating, investing or financing activities as a measure of liquidity. FUNDS FROM OPERATIONS (FFO) We calculate Funds from Operations, or FFO, in accordance with the standards established by the National Association of Real Estate Investment Trusts, or NAREIT. FFO represents net income (loss) (computed in accordance with GAAP), excluding gains (or losses) from sales of property, impairment charges, real estate related depreciation and amortization (excluding amortization of deferred financing costs) and after adjustments for unconsolidated partnerships and joint ventures. Management uses FFO as a supplemental performance measure because, in excluding real estate related depreciation and amortization and gains and losses from property dispositions, it provides a performance measure that, when compared year over year, captures trends in occupancy rates, rental rates and operating costs. We also believe that, as a widely recognized measure of the performance of REITs, FFO will be used by investors as a basis to compare our operating performance with that of other REITs. However, because FFO excludes depreciation and amortization and captures neither the changes in the value of our properties that result from use or market conditions, nor the level of capital expenditures and capitalized leasing commissions necessary to maintain the operating performance of our properties, all of which have real economic effect and could materially impact our financial condition and results from operations, the utility of FFO as a measure of our performance is limited. Other REITs may not calculate FFO in accordance with the NAREIT definition and, accordingly, our FFO may not be comparable to such other REITs’ FFO. Accordingly, FFO should be considered only as a supplement to net income computed in accordance with GAAP as a measure of our performance. ADJUSTED FUNDS FROM OPERATIONS (AFFO) We present adjusted funds from operations, or AFFO, as a supplemental operating measure because, when compared year over year, it assesses our ability to fund dividend and distribution requirements from our operating activities. We also believe that, as a widely recognized measure of the operations of REITs, AFFO will be used by investors as a basis to assess our abil ity to fund dividend payments in comparison to other REITs, including on a per share and unit basis. We calculate AFFO by adding to or subtracting from FFO (i) non-real estate depreciation, (ii) amortization of deferred financing costs, (iii) amortization of debt discount/premium, (iv) non-cash stock-based compensation, (v) non-cash stock-based compensation acceleration, (vi) loss from early extinguishment of debt, (vii) straight-line rents, net, (viii) above-and below-market rent amortization, (ix) change in fair value of contingent consideration, (x) gain on sale of investment, (xi) non-cash tax expense/(benefit), (xii) capitalized leasing compensation, (xiii) recurring capital expenditures and (xiv) capitalized internal leasing commissions. Other REITs may not calculate AFFO in a consistent manner. Accordingly, our AFFO may not be comparable to other REITs’ AFFO. AFFO should be considered only as a supplement to net income computed in accordance with GAAP as a measure of our performance CORE FUNDS FROM OPERATATIONS (Core FFO) We present core funds from operations, or core FFO, as a supplemental operating measure because, in excluding certain items that do not reflect core revenue or expense streams, it provides a performance measure that, when compared year over year, captures trends in our core business operating performance. We calculate core FFO by adding to or subtracting from FFO (i) termination fees and other non-core revenues, (ii) gain on sale of investment, (iii) significant transaction expenses, (iv) loss from early extinguishment of debt, (v) change in fair value of contingent consideration, (vi) equity in earnings adjustment for non-core items, (vii) severance accrual, equity acceleration, and legal expenses and (viii) other non-core expense adjustments. Because certain of these adjustments have a real economic impact on our financial condition and results from operations, the utility of core FFO as a measure of our performance is limited. Other REITs may not calculate core FFO in a consistent manner. Accordingly, our core FFO may not be comparable to other REITs' core FFO. Core FFO should be considered only as a supplement to net income computed in accordance with GAAP as a measure of our performance. CONSTANT CURRENCY CORE FUNDS FROM OPERATIONS We calculate "constant currency" core funds from operations by adjusting the core funds from operations for foreign currency translations. NET OPERATING INCOME (NOI) AND CASH NOI NOI represents rental revenue and tenant reimbursement revenue less utilities, rental property operating expenses, repair and maintenance expenses, property taxes and insurance expenses (as reflected in statement of operations). NOI is commonly used by stockholders, company management and industry analysts as a measurement of operating performance of the company’s ren tal portfolio. Cash NOI is NOI less straight-line rents and above and below market rent amortization. Cash NOI is commonly used by stockholders, company management and industry analysts as a measure of property operating performance on a cash basis. However, because NOI and cash NOI exclude depreciation and amortization and capture neither the changes in the value of our properties that result from use or market conditions, nor the level of capital expenditures and capitalized leasing commissions necessary to maintain the operating performance of our properties, all of which have real economic effect and could materially impact our results from operations, the utility of NOI and cash NOI as measures of our performance is limited. Other REITs may not calculate NOI and cash NOI in the same manner we do and, accordingly, our NOI and cash NOI may not be comparable to such other REITs’ NOI and cash NOI. Accordingly, NOI and cash NOI should be considered only as supplements to net income computed in accordance with GAAP as measures of our performance. 20

Definitions of Non-GAAP Financial Measures (cont.) The information included in this presentation contains certain non-GAAP financial measures that management believes are helpful in understanding our business, as further described below. Our definition and calculation of non-GAAP financial measures may differ from those of other REITs, and, therefore, may not be comparable. The non-GAAP financial measures should not be considered an alternative to net income or any other GAAP measurement of performance and should not be considered an alternative to cash flows from operating, investing or financing activities as a measure of liquidity. SAME-CAPITAL CASH NOI Same-capital Cash NOI is Cash NOI (as defined above) calculated for “Same-capital” properties. “Same-capital” properties are defined as properties owned as of December 31, 2013 with less than 5% of total rentable square feet under development and excludes properties that were undergoing, or were expected to undergo, development activities in 2014-2015, properties classified as held for sale, and properties sold or contributed to joint ventures for all periods presented. EBITDA AND ADJUSTED EBITDA We believe that earnings before interest expense, loss from extinguishment of debt, income taxes, depreciation and amortization, and impairment of investments in real estate, or EBITDA, and Adjusted EBITDA (as defined below), are useful supplemental performance measures because they allow investors to view our performance without the impact of non-cash depreciation and amortization or the cost of debt and, with respect to Adjusted EBITDA, change in fair value of contingent consideration, severance related accrual, equity acceleration, and legal expenses, transaction expenses, gain (loss) on sale of property, gain on sale of investment, gain on settlement of pre-existing relationship with Telx, other non-core expense adjustments, noncontrolling interests, and preferred stock dividends. Adjusted EBITDA is EBITDA excluding change in fair value of contingent consideration, severance related accrual, equity acceleration, and legal expenses, transaction expenses, gain (loss) on sale of property, gain on sale of investment, gain on settlement of pre-existing relationship with Telx, other non-core expense adjustments, noncontrolling interests, and preferred stock dividends. In addition, we believe EBITDA and Adjusted EBITDA are frequently used by securities analysts, investors and other interested parties in the evaluation of REITs. Because EBITDA and Adjusted EBITDA are calculated before recurring cash charges including interest expense and income taxes, exclude capitalized costs, such as leasing commissions, and are not adjusted for capital expenditures or other recurring cash requirements of our business, their utility as a measure of our performance is limited. Other REITs may calculate EBITDA and Adjusted EBITDA differently than we do; accordingly, our EBITDA and Adjusted EBITDA may not be comparable to such other REITs’ EBITDA and Adjusted EBITDA. Accordingly, EBITDA and Adjusted EBITDA should be considered only as supplements to net income computed in accordance with GAAP as a measure of our financial performance. CORE EBITDA Core EBITDA is a non-GAAP financial metric that Telx uses as a supplemental measure of its operating performance that adjusts net loss to eliminate the impact of certain items that it does not consider indicative of its core operating performance. We believe that Core EBITDA is a useful supplemental performance measure because it allows investors to view Telx’s performance without the impact of non-cash depreciation and amortization, the cost of debt, deferred rent expenses, stock-based compensation expenses, sponsor management fees and transaction costs. Core EBITDA is calculated as EBITDA (earnings before interest expenses, interest and other income, income taxes, depreciation and amortization), excluding deferred rent expense, stock based compensation expense, sponsor management fees and transaction costs. Other companies may calculate Core EBITDA or similar metrics differently; accordingly, the Core EBITDA presented herein may not be comparable to other companies’ Core EBITDA or similar metrics. Accordingly, Core EBITDA should be considered only as a supplement to net come (loss) computed in accordance with GAAP as a measure of Telx’s operating performance. 21

December 31, 2015 December 31, 2014 December 31, 2015 December 31, 2014 Operating Revenues: Rental 366,814$ 319,816$ 1,354,986$ 1,256,086$ Tenant reimbursements 90,990 88,717 359,875 350,234 Interconnection 40,759 - 40,759 - Fee income 1,880 1,871 6,638 7,268 Other - 1,812 1,078 2,850 Total operating revenues 500,443 412,216 1,763,336 1,616,438 Operating Expenses: Rental property operating and maintenance 155,384 127,554 549,885 503,140 Property taxes 28,472 23,053 92,588 91,538 Insurance 2,360 2,180 8,809 8,643 Construction management - - - - Change in fair value of contingent consideration - (3,991) (44,276) (8,093) Depreciation and amortization 172,956 133,327 570,527 538,513 General and administrative 35,987 21,480 105,549 93,188 Transactions 3,099 323 17,400 1,303 Impairment of investments in real estate - 113,970 - 126,470 Other 60,914 486 60,943 3,070 Total operating expenses 459,172 418,382 1,361,425 1,357,772 Operating income 41,271 (6,166) 401,911 258,666 Other Income (Expenses): Equity in earnings of unconsolidated joint ventures 3,321 3,776 15,491 13,289 Gain on sale of property 322 - 94,604 15,945 Gain on contribution of properties to unconsolidated joint ventures - - - 95,404 Interest and other income 498 641 (2,381) 2,663 Interest expense (61,717) (46,396) (201,435) (191,085) Tax expense (268) (1,201) (6,451) (5,238) Loss from early extinguishment of debt - - (148) (780) Net Income (16,573) (34,795) 301,591 203,415 Net income attributable to noncontrolling interests 590 961 (4,902) (3,229) Net Income Attributable to Digital Realty Trust, Inc. (15,983) (33,834) 296,689 200,186 Preferred stock dividends (24,056) (18,455) (79,423) (67,465) Net Income Available to Common Stockholders (40,039)$ (52,289)$ 217,266$ 132,721$ Net income per share available to common stockholders: Basic (0.28)$ (0.39)$ 1.57$ 1.00$ Diluted (0.28)$ (0.39)$ 1.56$ 1.00$ Weighted average shares outstanding: Basic 145,561,559 135,544,597 138,247,606 132,635,894 Diluted 145,561,559 135,544,597 138,865,421 132,852,966 Three Months Ended Year Ended Digital Realty Trust, Inc. and Subsidiaries Condensed Consolidated Income Statements (in thousands, except share and per share data) (unaudited) Reconciliation of Non-GAAP Items To Their Closest GAAP Equivalent 22

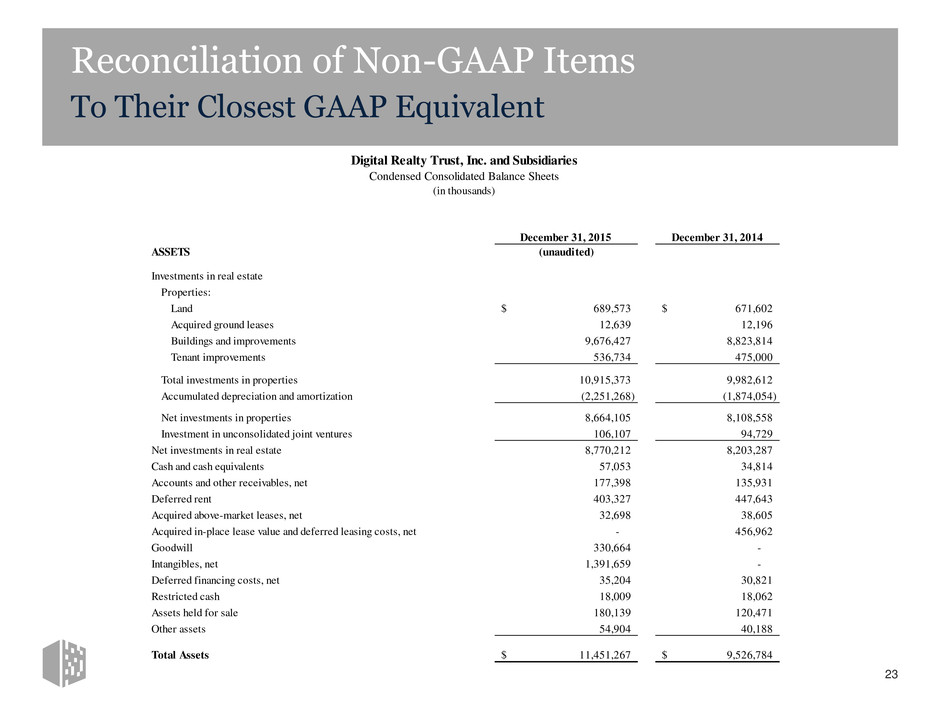

Reconciliation of Non-GAAP Items To Their Closest GAAP Equivalent 23 December 31, 2015 December 31, 2014 ASSETS (unaudited) Investments in real estate Properties: Land 689,573$ 671,602$ Acquired ground leases 12,639 12,196 Buildings and improvements 9,676,427 8,823,814 Tenant improvements 536,734 475,000 Total investments in properties 10,915,373 9,982,612 Accumulated depreciation and amortization (2,251,268) (1,874,054) Net investments in properties 8,664,105 8,108,558 Investment in unconsolidated joint ventures 106,107 94,729 Net investments in real estate 8,770,212 8,203,287 Cash and cash equivalents 57,053 34,814 Accounts and other receivables, net 177,398 135,931 Deferred rent 403,327 447,643 Acquired above-market leases, net 32,698 38,605 Acquired in-place lease value and deferred leasing costs, net - 456,962 Goodwill 330,664 - Intangibles, net 1,391,659 - Deferred financing costs, net 35,204 30,821 Restricted cash 18,009 18,062 Assets held for sale 180,139 120,471 Other assets 54,904 40,188 Total Assets 11,451,267$ 9,526,784$ Digital Realty Trust, Inc. and Subsidiaries Condensed Consolidated Balance Sheets (in thousands)

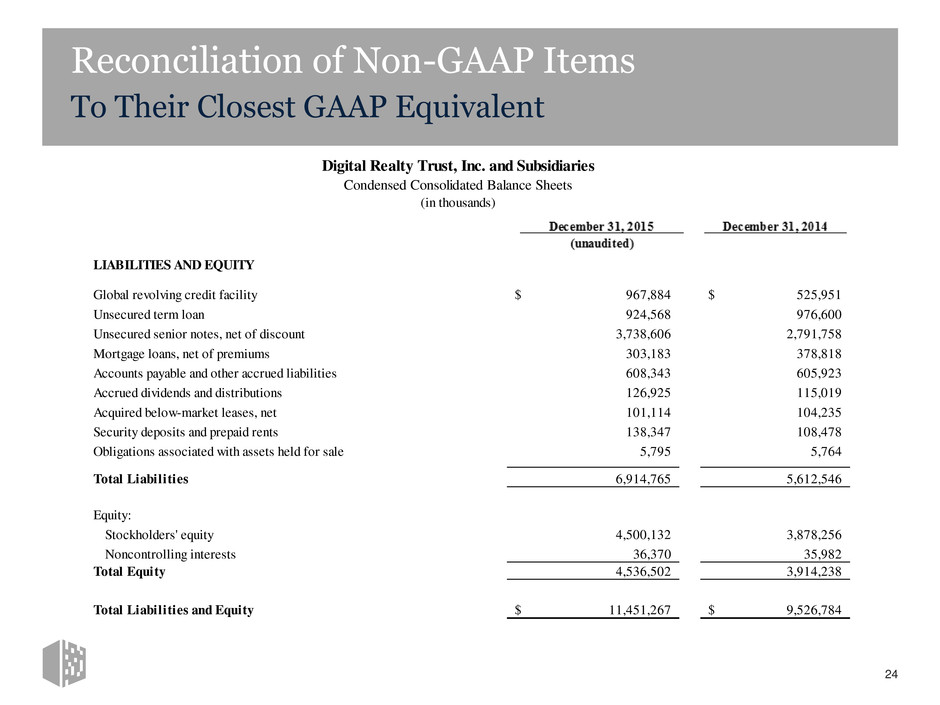

Reconciliation of Non-GAAP Items To Their Closest GAAP Equivalent 24 LIABILITIES AND EQUITY Global revolving credit facility 967,884$ 525,951$ Unsecured term loan 924,568 976,600 Unsecured senior notes, net of discount 3,738,606 2,791,758 Mortgage loans, net of premiums 303,183 378,818 Accounts payable and other accrued liabilities 608,343 605,923 Accrued dividends and distributions 126,925 115,019 Acquired below-market leases, net 101,114 104,235 Security deposits and prepaid rents 138,347 108,478 Obligations associated with assets held for sale 5,795 5,764 Total Liabilities 6,914,765 5,612,546 Equity: Stockholders' equity 4,500,132 3,878,256 Noncontrolling interests 36,370 35,982 Total Equity 4,536,502 3,914,238 Total Liabilities and Equity 11,451,267$ 9,526,784$ Digital Realty Trust, Inc. and Subsidiaries Condensed Consolidated Balance Sheets (in thousands)

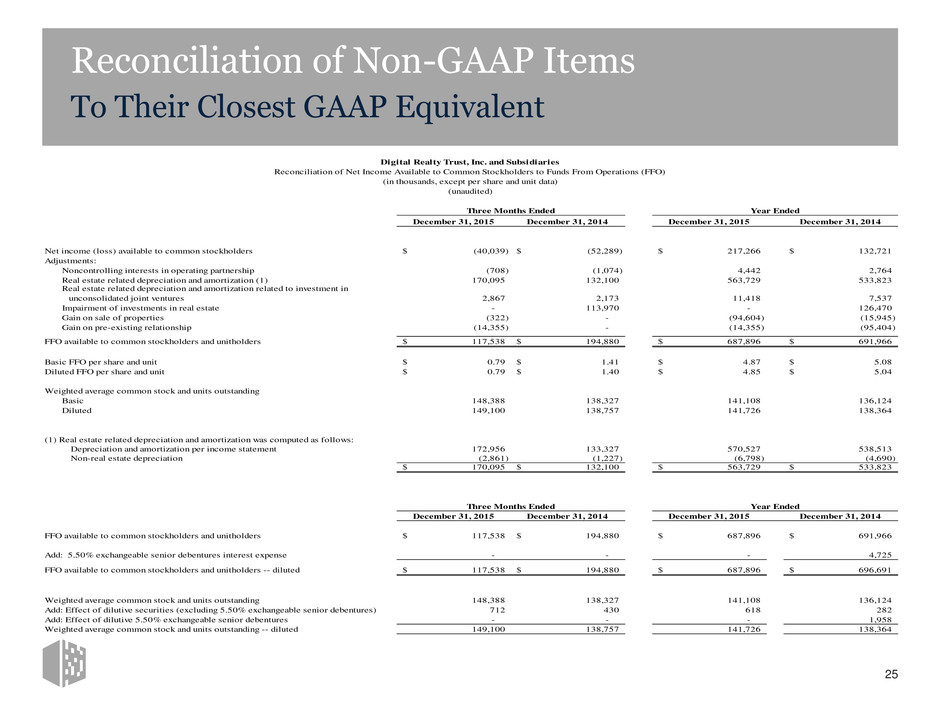

Reconciliation of Non-GAAP Items To Their Closest GAAP Equivalent 25 December 31, 2015 December 31, 2014 December 31, 2015 December 31, 2014 Net income (loss) available to common stockholders (40,039)$ (52,289)$ 217,266$ 132,721$ Adjustments: Noncontrolling interests in operating partnership (708) (1,074) 4,442 2,764 Real estate related depreciation and amortization (1) 170,095 132,100 563,729 533,823 Real estate related depreciation and amortization related to investment in unconsolidated joint ventures 2,867 2,173 11,418 7,537 Impairment of investments in real estate - 113,970 - 126,470 Gain on sale of properties (322) - (94,604) (15,945) Gain on pre-existing relationship (14,355) - (14,355) (95,404) FFO available to common stockholders and unitholders 117,538$ 194,880$ 687,896$ 691,966$ Basic FFO per share and unit 0.79$ 1.41$ 4.87$ 5.08$ Diluted FFO per share and unit 0.79$ 1.40$ 4.85$ 5.04$ Weighted average common stock and units outstanding Basic 148,388 138,327 141,108 136,124 Diluted 149,100 138,757 141,726 138,364 (1) Real estate related depreciation and amortization was computed as follows: Depreciation and amortization per income statement 172,956 133,327 570,527 538,513 Non-real estate depreciation (2,861) (1,227) (6,798) (4,690) 170,095$ 132,100$ 563,729$ 533,823$ December 31, 2015 December 31, 2014 December 31, 2015 December 31, 2014 FFO available to common stockholders and unitholders 117,538$ 194,880$ 687,896$ 691,966$ Add: 5.50% exchangeable senior debentures interest expense - - - 4,725 FFO available to common stockholders and unitholders -- diluted 117,538$ 194,880$ 687,896$ 696,691$ Weighted average common stock and units outstanding 148,388 138,327 141,108 136,124 Add: Effect of dilutive securities (excluding 5.50% exchangeable senior debentures) 712 430 618 282 Add: Effect of dilutive 5.50% exchangeable senior debentures - - - 1,958 Weighted average common stock and units outstanding -- diluted 149,100 138,757 141,726 138,364 Year Ended Digital Realty Trust, Inc. and Subsidiaries Reconciliation of Net Income Available to Common Stockholders to Funds From Operations (FFO) (in thousands, except per share and unit data) (unaudited) Three Months Ended Three Months Ended Year Ended

Reconciliation of Non-GAAP Items To Their Closest GAAP Equivalent 26 December 31, 2015 December 31, 2014 December 31, 2015 December 31, 2014 Net income (loss) available to common stockholders (40,039)$ (52,289)$ 217,266$ 132,721$ Interest 61,717 46,396 201,435 191,085 Loss from early extinguishment of debt - - 148 780 Taxes 268 1,201 6,451 5,238 Depreciation and amortization 172,956 133,327 570,527 538,513 Impairment of investments in real estate - 113,970 - 126,470 EBITDA 194,902 242,605 995,827 994,807 Change in fair value of contingent consideration - (3,991) (44,276) (8,093) Severance accrual and equity acceleration 6,125 - 5,146 12,690 Transactions 3,099 323 17,400 1,303 Gain on sale of properties (322) - (94,604) (15,945) Gain o sale of investment - (14,551) - (14,551) Gain on contribution of properties to unconsolidated joint ventures (14,355) - (14,355) (95,404) Other non-core expense adjustments 75,269 453 75,261 2,692 Noncontrolling interests (590) (961) 4,902 3,229 Preferred stock dividends 24,056 18,455 79,423 67,465 Adjusted EBITDA 288,184$ 242,333$ 1,024,724$ 948,193$ Digital Realty Trust, Inc. and Subsidiaries Reconciliation of Net Income Available to Common Stockholders to Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) and Adjusted EBITDA (in thousands) (unaudited) Year EndedThree Months Ended

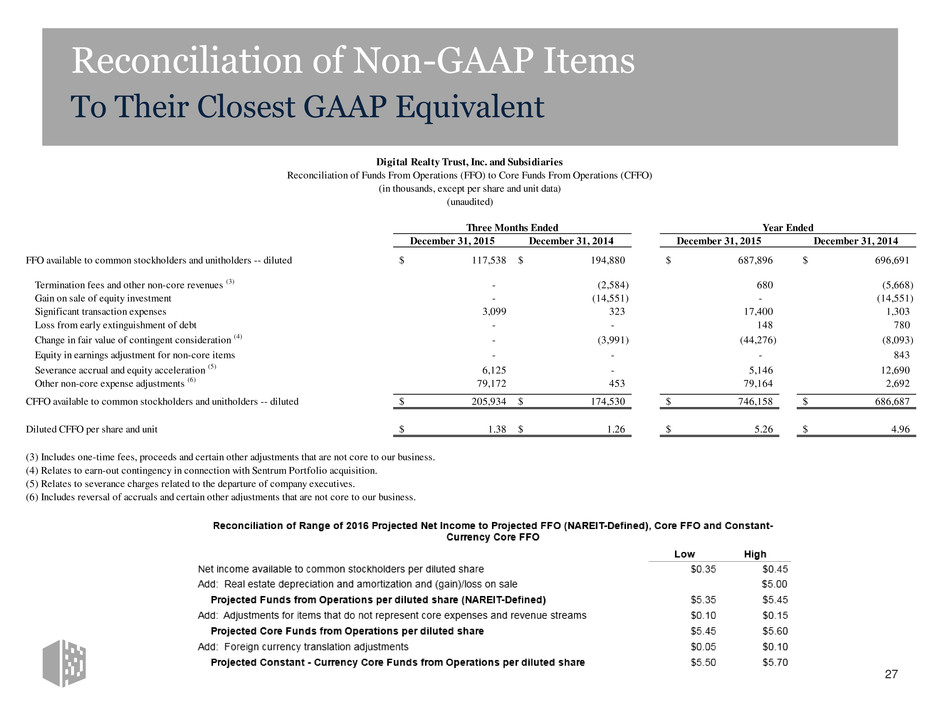

Reconciliation of Non-GAAP Items To Their Closest GAAP Equivalent 27 December 31, 2015 December 31, 2014 December 31, 2015 December 31, 2014 FFO available to common stockholders and unitholders -- diluted 117,538$ 194,880$ 687,896$ 696,691$ Termination fees and other non-core revenues (3) - (2,584) 680 (5,668) Gain on sale of equity investment - (14,551) - (14,551) Significant transaction expenses 3,099 323 17,400 1,303 Loss from early extinguishment of debt - - 148 780 Change in fair value of contingent consideration (4) - (3,991) (44,276) (8,093) Equity in earnings adjustment for non-core items - - - 843 Severance accrual and equity acceleration (5) 6,125 - 5,146 12,690 Other non-core expense adjustments (6) 79,172 453 79,164 2,692 CFFO available to common stockholders and unitholders -- diluted 205,934$ 174,530$ 746,158$ 686,687$ Diluted CFFO per share and unit 1.38$ 1.26$ 5.26$ 4.96$ (3) Includes one-time fees, proceeds and certain other adjustments that are not core to our business. (4) Relates to earn-out contingency in connection with Sentrum Portfolio acquisition. (5) Relates to severance charges related to the departure of company executives. (6) Includes reversal of accruals and certain other adjustments that are not core to our business. Digital Realty Trust, Inc. and Subsidiaries Reconciliation of Funds From Operations (FFO) to Core Funds From Operations (CFFO) (in thousands, except per share and unit data) (unaudited) Three Months Ended Year Ended

Reconciliation of Non-GAAP Items To Their Closest GAAP Equivalent 28 Core EBITDA is a non-GAAP financial metric that Telx uses as a supplemental measure of its operating performance that adjusts net loss to eliminate the impact of certain items that it does not consider indicative of its core operating performance. We believe that Core EBITDA is a useful supplemental performance measure because it allows investors to view Telx’s performance without the impact of non- cash depreciation and amortization, the cost of debt, deferred rent expenses, stock-based compensation expenses, sponsor management fees and transaction costs. Other companies may calculate Core EBITDA or similar metrics differently; accordingly, the Core EBITDA presented herein may not be comparable to other companies ’ Core EBITDA or similar metrics. Net loss (6,185)$ Income tax benefit (2,254) Interest expense, net 283 Depreciation & Amortization 32,429 EBITDA 24,273$ Non-Cash Rent 8,642 Non-Cash Compensation 532 Core EBITDA 33,447$ Note: Results are for the entire quarter ending December 31, 2015 Reconciliation of Core EBITDA (unaudited) (in thousands)

Reconciliation of Non-GAAP Items To Their Closest GAAP Equivalent 29 Digital Realty Trust, Inc. and Subsidiaries Reconciliation of Same-Capital Cash Net Operating Income (in thousands) (unaudited) December 31, 2015 December 31, 2014 December 31, 2015 December 31, 2014 Rental revenues 198,704$ 197,950$ 784,946$ 790,245$ Tenant reimbursements - Utilities 34,293 36,242 145,998 151,437 Tenant reimbursements - Other 20,989 19,080 71,486 70,368 Total Revenue 253,986$ 253,272$ 1,002,430$ 1,012,050$ Utilities 35,572$ 37,735$ 151,383$ 157,804$ Rental property operating 20,892 20,103 84,699 78,533 Repairs & maintenance 15,463 17,016 59,670 62,862 Property taxes 16,159 13,537 53,947 56,897 Insurance 1,437 1,466 5,765 5,831 Total Expenses 89,523$ 89,857$ 355,464$ 361,927$ Net Operating Income 164,463$ 163,415$ 646,966$ 650,123$ Less: Stabilized straight-line rent 2,414$ 6,344$ 10,611$ 26,682$ Above and below market rent 3,050 3,326 12,910 14,023 Cash Net Operating Income 158,999$ 153,745$ 623,445$ 609,418$ Three Months Ended Twelve Months Ended

Forward-Looking Statements The information included in this presentation contains forward-looking statements. Such statements are based on management’s beliefs and assumptions made based on information currently available to management. Such forward-looking statements include statements relating to: our economic outlook; our expected benefits from the acquisition of Telx Holdings, Inc.; opportunities and strategies, including ROIC, recycling assets and capital, and sources of growth; the expected effect of foreign currency translation adjustments on our financials; business drivers; sources and uses; our expected development plans and completions, including timing, total square footage, IT capacity and raised floor space upon completion; expected availability for leasing efforts, sales incentive program, mid-market and colocation initiatives; organizational initiatives; joint venture opportunities; occupancy and total investment; our expected investment in our properties; our estimated time to stabilization and targeted returns at stabilization of our properties; our expected future acquisitions; acquisitions strategy; available inventory and development strategy; the signing and commencement of leases, and related rental revenue; lag between signing and commencement of leases; our expected same store portfolio growth; our expected growth and stabilization of development completions and acquisitions; our expected mark-to- market rates on lease expirations, lease rollovers and expected rental rate changes; our expected yields on investments; our expectations with respect to capital investments at lease expiration on existing Turn-Key Flex space; barriers to entry; competition; debt maturities; lease maturities; our expected returns on invested capital; estimated absorption rates; our other expected future financial and other results, and the assumptions underlying such results; our top investment markets and market opportunities; our ability to access the capital markets; expected time and cost savings to our customers; our customers’ capital investments; our plans and intentions; future data center utilization, utilization rates, growth rates, trends, supply and demand, and demand drivers; datacenter outsourcing trends; datacenter expansion plans; estimated kW/MW requirements; growth in the overall Internet infrastructure sector and segments thereof; the market effects of regulatory requirements; the replacement cost of our assets; the development costs of our buildings, and lead times; estimated costs for customers to deploy or migrate to a new data center; capital expenditures; the effect new leases and increases in rental rates will have on our rental revenues and results of operations; lease expiration rates; our ability to borrow funds under our credit facilities; estimates of the value of our development portfolio; our ability to meet our liquidity needs, including the ability to raise additional capital; credit ratings; capitalization rates, or cap rates, potential new markets; dividend payments and our dividend policy; projected financial information and covenant metrics; annualized, projected and run-rate NOI; other forward-looking financial data; leasing expectations; Digital Realty Ecosystem, our connectivity initiative; Digital Open Internet Exchange; our exposure to tenants in certain industries; our characterization as a defensive stock; our expectations and underlying assumptions regarding our sensitivity to fluctuations in foreign exchange rates and energy prices; and the sufficiency of our capital to fund future requirements. You can identify forward-looking statements by the use of forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “pro forma,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and discussions which do not relate solely to historical matters. Such statements are subject to risks, uncertainties and assumptions, are not guarantees of future performance and may be affected by known and unknown risks, trends, uncertainties and factors that are beyond our control that may cause actual results to vary materially. Some of the risks and uncertainties include, among others, the following: the impact of current global economic, credit and market conditions; current local economic conditions in our geographic markets; decreases in information technology spending, including as a result of economic slowdowns or recession; adverse economic or real estate developments in our industry or the industry sectors that we sell to (including risks relating to decreasing real estate valuations and impairment charges); our dependence upon significant tenants; bankruptcy or insolvency of a major tenant or a significant number of smaller tenants; defaults on or non-renewal of leases by tenants; our failure to obtain necessary debt and equity financing; risks associated with using debt to fund our business activities, including re-financing and interest rate risks, our failure to repay debt when due, adverse changes in our credit ratings or our breach of covenants or other terms contained in our loan facilities and agreements; financial market fluctuations; changes in foreign currency exchange rates; our inability to manage our growth effectively; difficulty acquiring or operating properties in foreign jurisdictions; our failure to successfully integrate and operate acquired or developed properties or businesses; the suitability for our properties and data center infrastructure, delays or disruptions in connectivity, failure of our physical infrastructure or services or availability of power; risks related to joint venture investments, including as a result of our lack of control of such investments; delays or unexpected costs in development of properties; decreased rental rates, increased operating costs or increased vacancy rates; increased competition or available supply of data center space; our inability to successfully develop and lease new properties and development space; difficulties in identifying properties to acquire and completing acquisitions; our inability to acquire off-market properties; our inability to comply with the rules and regulations applicable to reporting companies; our failure to maintain our status as a REIT; possible adverse changes to tax laws; restrictions on our ability to engage in certain business activities; environmental uncertainties and risks related to natural disasters; losses in excess of our insurance coverage; changes in foreign laws and regulations, including those related to taxation and real estate ownership and operation; and changes in local, state and federal regulatory requirements, including changes in real estate and zoning laws and increases in real property tax rates. The risks described above are not exhaustive, and additional factors could adversely affect our business and financial performance, including those discussed under the heading “Risks Related to the Proposed Telx Acquisition” in our Current Report on Form 8-K filed on July 14, 2015, in our annual report on Form 10-K for the year ended December 31, 2014, and subsequent filings with the Securities and Exchange Commission. We expressly disclaim any responsibility to update forward-looking statements, whether as a result of new information, future events or otherwise. 30