Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - DIAMOND HILL INVESTMENT GROUP INC | dhil-20151231xexx231.htm |

| EX-32.1 - EXHIBIT 32.1 - DIAMOND HILL INVESTMENT GROUP INC | dhil-20151231xexx321.htm |

| EX-31.1 - EXHIBIT 31.1 - DIAMOND HILL INVESTMENT GROUP INC | dhil-20151231xexx311.htm |

| EX-21.1 - EXHIBIT 21.1 - DIAMOND HILL INVESTMENT GROUP INC | dhil-20151231xexx211.htm |

| EX-31.2 - EXHIBIT 31.2 - DIAMOND HILL INVESTMENT GROUP INC | dhil-20151231xexx312.htm |

United States

Securities and Exchange Commission

Washington, D.C. 20549

Form 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

Commission file number 000-24498

DIAMOND HILL INVESTMENT GROUP, INC.

(Exact name of registrant as specified in its charter)

Ohio | 65-0190407 | |

(State of incorporation) | (I.R.S. Employer Identification No.) | |

325 John H. McConnell Blvd., Suite 200, Columbus, Ohio 43215 | 43215 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant's telephone number, including area code: (614) 255-3333

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common shares, no par value | The NASDAQ Stock Market LLC | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | x | |||

Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Aggregate market value of the registrant’s common shares (the only common equity of the registrant) held by non-affiliates of the registrant, based on the closing price of $199.66 on June 30, 2015 on the NASDAQ Global Select Market was $593,336,011. Calculation of holdings by non-affiliates is based upon the assumption, for these purposes only, that the registrant’s executive officers and directors are affiliates.

The number of issuer's common shares outstanding, as of February 25, 2016, was 3,398,695 shares.

Documents Incorporated by Reference

Portions of the registrant’s definitive proxy statement for the 2016 Annual Meeting of Shareholders to be filed pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended, are incorporated by reference into Part III of this report.

Diamond Hill Investment Group, Inc.

Form 10-K

For the Fiscal Year Ended December 31, 2015

Index

Required Information | Page |

2

PART I

Item 1. | Business |

Forward-Looking Statements

Throughout this Annual Report on Form 10-K, Diamond Hill Investment Group, Inc. (the "Company," "we," "us" and "our") may make forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, relating to such matters as anticipated operating results, prospects and levels of assets under management, technological developments, economic trends (including interest rates and market volatility), expected transactions and similar matters. The words “believe,” “expect,” “anticipate,” “estimate,” “should,” “hope,” “seek,” “plan,” “intend” and similar expressions identify forward-looking statements that speak only as of the date thereof. While we believe that the assumptions underlying our forward-looking statements are reasonable, investors are cautioned that any of the assumptions could prove to be inaccurate and, accordingly, our actual results and experiences could differ materially from the anticipated results or other expectations expressed in our forward-looking statements. Factors that could cause such actual results or experiences to differ from results discussed in the forward-looking statements include, but are not limited to: the adverse effect from a decline in the securities markets; a decline in the performance of our products; changes in interest rates; changes in national and local economic and political conditions, the continuing economic uncertainty in various parts of the world; changes in government policy and regulation, including monetary policy; changes in our ability to attract or retain key employees; unforeseen costs and other effects related to legal proceedings or investigations of governmental and self-regulatory organizations; and other risks identified from time-to-time in other public documents on file with the U. S. Securities and Exchange Commission (“SEC”), including those discussed below in Item 1A. Throughout this Annual Report on Form 10-K, when we use the terms the “Company,” “management,” “we,” “us,” and “our,” we mean Diamond Hill Investment Group, Inc. and its subsidiaries.

Overview

The Company, an Ohio corporation organized in April 1990, derives its consolidated revenue and net income from investment advisory and fund administration services provided by its subsidiaries Diamond Hill Capital Management, Inc. (“DHCM”), Beacon Hill Fund Services, Inc. (“BHFS”), and BHIL Distributors, Inc. (“BHIL”). BHFS and BHIL collectively operate as "Beacon Hill". DHCM is a registered investment adviser under the Investment Advisers Act of 1940. DHCM sponsors, distributes, and provides investment advisory and related services to U.S. and foreign clients through Diamond Hill Funds (the "Funds"), institutional accounts, an exchange traded fund, and private investment funds (generally known as “hedge funds”). Beacon Hill provides fund administration and statutory underwriting services to U.S. and foreign clients, including the Funds.

The Company’s primary objective is to fulfill our fiduciary duty to our clients. Our secondary objective is to grow the intrinsic value of the Company in order to achieve an adequate long-term return for our shareholders.

Investment Advisory Activities

Clients

The Company provides investment advisory services to a broad range of clients, including corporations, mutual funds, retirement plans, public pension funds, endowments, foundations, financial institutions and high net worth individuals. We strive to expand our client base by attracting new clients and earning additional business from existing clients.

Investment Philosophy

We believe that a company’s intrinsic value is independent of its stock price. We also believe competitive long-term returns can be achieved by buying (shorting) companies when the current market price is at a discount (premium) to our estimate of intrinsic value, based upon a discounted cash flow methodology.

The following are the guiding principles for our philosophy:

• | Treat every investment as a partial ownership interest in that company. |

Investing is most intelligent when it is viewed through the lens of an owner.

3

• | Always invest with a margin of safety. |

Our discipline is to purchase (short) securities at a sufficient discount (premium) to our estimate of intrinsic value. We estimate the intrinsic value of the company independent of the current stock market price then compare our estimate to the price to determine if an opportunity exists. When we successfully identify securities trading below (above) our estimate of intrinsic value, it increases the potential reward and serves as the most effective risk control.

• | Possess a long-term investment temperament. |

In the short term, emotion as much as economic fundamentals drives market prices. Over time, the economic performance of the company and the price paid, versus the market, will determine investment return.

• | Recognize that market price and intrinsic value tend to converge over a reasonable period of time. |

Investment opportunity lies in the ability to buy (or short), when the current market price does not reflect a company’s intrinsic value, and to sell (or cover) when price and value converge.

Investment Process

DHCM’s investment process begins with fundamental research focusing on estimating a company’s intrinsic value independent of its current stock price. Bottom-up analysis, which takes into consideration earnings, revenue growth, operating margins and other economic factors, is of primary importance in estimating the intrinsic value of an individual company. A five-year discounted cash flow analysis is the primary methodology to determine whether there is a discrepancy between the current market price and DHCM’s estimate of intrinsic value. In order to forecast the amount and timing of cash flows, the research analysts concentrate on the fundamental economic drivers of the business, including competitive positioning, quality of management, and balance sheet strength. Research analysts also evaluate each company within the context of sector and industry secular trends. Key factors in analyzing sectors and industries include relative pricing power, ability to earn excess returns, long-term capital flow, and other fundamental factors. DHCM also applies an intrinsic value philosophy to the analysis of fixed income securities.

Only securities selling at a discount (premium) to intrinsic value will be purchased (sold short). A portfolio manager assigns the highest weights to the highest conviction names. Within certain diversification constraints, a portfolio manager is willing to take outsized positions in the highest conviction ideas and we will often have no exposure to industries without attractive intrinsic value opportunities. A stock will be sold (or covered) if its price reaches DHCM’s estimate of intrinsic value, if fundamentals deteriorate, if a more attractive opportunity is identified, or if the holding reaches a specified limit as a percent of the portfolio.

DHCM believes that many investors’ short-term focus hinders their long-term results, which creates market inefficiencies and, therefore, opportunities. In addition, not all investors are valuation sensitive. We believe that we can exploit these market anomalies/inefficiencies by possessing a long-term investment temperament and practicing a consistent and repeatable business appraisal approach to investing. Furthermore, DHCM believes that investing in securities whose market prices are significantly below its estimate of intrinsic value (or selling short securities whose market prices are above its estimate of intrinsic value) is a reliable method to achieve above average relative returns, as well as mitigate risk.

Investment Advisory Fees

The Company’s principal source of revenue is investment advisory fee income earned from managing client accounts under investment advisory and sub-advisory agreements. The fees earned depend on the type of investment strategy, account size and servicing requirements. Revenues depend on the total value and composition of assets under management (“AUM”). Accordingly, net cash flows from clients, market fluctuations in client portfolios, and the composition of AUM impact our revenues and results of operations. We also have certain agreements which allow us to earn variable fees in the event that investment returns exceed targeted amounts during a measurement period.

Investment Strategies

The Company offers several traditional and alternative investment strategies, which are all based on the same intrinsic value philosophy. As of December 31, 2015, we offered the following representative investment strategies to our clients:

1. | Small Cap - Pursues long-term capital appreciation by investment in a portfolio of small-capitalization U.S. equity securities. |

2. | Small-Mid Cap - Pursues long-term capital appreciation by investing in a portfolio of small- and mid-capitalization U.S. equity securities. |

4

3. | Mid Cap - Pursues long-term capital appreciation by investing in a portfolio of mid-capitalization U.S. equity securities |

4. | Large Cap - Pursues long-term capital appreciation by investing in a portfolio of large-capitalization U.S. equity securities. |

5. | Select - Pursues long-term capital appreciation by investing in a concentrated portfolio of U.S. companies across a broad range of market capitalizations. |

6. | Long-Short - Pursues long-term capital appreciation by both investing long and selling short U.S. companies across a broad range of market capitalizations. |

7. | Research Opportunities - Pursues long-term capital appreciation by both investing long and selling short U.S. companies across a broad range of market capitalizations, as well as by investing up to 20% in international equities and up to 20% in fixed income investments. |

8. | Financial Long-Short - Pursues long-term capital appreciation by both investing long and selling short U.S. financial services companies across a broad range of market capitalizations. |

9. | Valuation-Weighted 500 - Pursues long-term capital appreciation by investing in large-capitalization U.S. equity securities that seek to track the price and total return of the Diamond Hill Valuation-Weighted 500 Index. |

10. | Strategic Income - Pursues high current income, preservation of capital, and total return by investing in corporate bonds across the credit spectrum. |

11. | High Yield - Pursues high current income with the opportunity for capital appreciation by investing in corporate bonds with a credit characteristics that are below investment grade. |

Investment Results

The Company believes that one of the most important characteristics exhibited by the best investment firms is excellent investment returns for their clients over a long period of time. We are pleased that, during our history as an investment advisory firm, we have delivered what we believe are strong long-term investment returns for our clients. Investment returns have been a key driver in the long-term success we have achieved in growing assets under management ("AUM").

In 2015, the Russell 1000 Index posted a total return, including dividends, of 0.92%, while the broader Russell 3000 Index posted a 0.48% total return. Small cap stocks fared worse than large cap stocks, with the Russell 2000 Index posting a total return of -4.41%. Absolute returns for our equity strategies were primarily negative in 2015, while returns relative to benchmarks were mixed. Across most of our equity strategies, holdings in the energy and industrials sectors were the primary detractors from return in 2015, reflecting concerns about the slowdown in China’s economic growth as well as exposure to commodity price declines. Nonetheless, as of December 31, 2015, the since-inception returns for all but one of our strategies with at least a five-year track record exceeded their respective benchmark returns. The only exception was our Research Opportunities Fund. As always, we remain focused on five-year periods to evaluate our results, as we believe five years is the shortest time period for statistical significance.

The performance of active strategies relative to a passive benchmark tends to be cyclical. These cycles are created because price momentum can persist in the short-term but reverts in the long-term. Market returns are often driven by investor emotions and unpredictable market psychology in the short-term, which has been extended in recent years by unprecedented monetary stimulus; an extended bull market characterized by lower volatility, lower dispersion, and higher correlations; less focus on individual, bottom-up company fundamentals; and self-reinforcing passive flows. While market conditions over the past five years have made it difficult for many active managers to outperform passive alternatives, we expect the cycle will turn in favor of active management, and we are beginning to see signs of a turning point. Dispersion between individual stock returns is increasing, and in December 2015 the Federal Reserve increased its Fed Funds target rate for the first time since 2006. We continue to believe that our intrinsic value-focused approach will outperform over a full market cycle, supported by our intrinsic value-based investment philosophy, long-term perspective, disciplined approach, and alignment with our clients’ interests. The following is a summary of the investment returns for each of our representative strategies as of December 31, 2015, relative to its respective passive benchmark.

5

As of December 31, 2015 | ||||||||||||||||

Inception | 1 Year | 3 Year | 5 Year | 10 Year | Since Inception | |||||||||||

Diamond Hill Small Cap Fund | 12/29/2000 | (3.47 | )% | 12.34 | % | 8.36 | % | 6.29 | % | 10.80 | % | |||||

Russell 2000 | (4.41 | )% | 11.65 | % | 9.19 | % | 6.80 | % | 7.27 | % | ||||||

Diamond Hill Small-Mid Cap Fund | 12/30/2005 | 1.32 | % | 15.50 | % | 11.38 | % | 8.71 | % | 8.71 | % | |||||

Russell 2500 | (2.90 | )% | 12.46 | % | 10.32 | % | 7.56 | % | 7.56 | % | ||||||

Diamond Hill Mid Cap Fund | 12/31/2013 | 0.74 | % | N/A | N/A | N/A | 4.27 | % | ||||||||

Russell Midcap | (2.44 | )% | N/A | N/A | N/A | 5.10 | % | |||||||||

Diamond Hill Large Cap Fund | 6/29/2001 | (0.85 | )% | 14.47 | % | 11.62 | % | 7.24 | % | 7.85 | % | |||||

Russell 1000 | 0.92 | % | 15.01 | % | 12.44 | % | 7.40 | % | 5.97 | % | ||||||

Diamond Hill Select Fund | 12/30/2005 | (1.14 | )% | 16.77 | % | 11.66 | % | 7.68 | % | 7.68 | % | |||||

Russell 3000 | 0.48 | % | 14.74 | % | 12.18 | % | 7.35 | % | 7.35 | % | ||||||

Diamond Hill Long-Short Fund | 6/30/2000 | (1.40 | )% | 9.32 | % | 7.98 | % | 4.94 | % | 6.76 | % | |||||

60% Russell 1000 / 40% BofA ML US 0-3 Month T-Bill | 0.75 | % | 8.93 | % | 7.50 | % | 5.17 | % | 3.64 | % | ||||||

Diamond Hill Research Opportunities Fund | 3/31/2009 | (5.00 | )% | 10.58 | % | 9.06 | % | N/A | 14.05 | % | ||||||

Russell 3000 | 0.48 | % | 14.74 | % | 12.18 | % | N/A | 17.61 | % | |||||||

Diamond Hill Financial Long-Short Fund | 8/1/1997 | (4.40 | )% | 12.49 | % | 9.42 | % | 2.13 | % | 6.98 | % | |||||

Russell 3000 Financials | 0.68 | % | 15.58 | % | 11.48 | % | 1.53 | % | 4.81 | % | ||||||

Diamond Hill Strategic Income Fund | 9/30/2002 | 1.49 | % | 3.05 | % | 4.87 | % | 5.66 | % | 6.88 | % | |||||

BofA ML US Corporate & High Yield | (1.37 | )% | 1.75 | % | 4.61 | % | 5.58 | % | 6.10 | % | ||||||

________________________

- | Fund returns are Class I shares net of fees |

- | Index returns do not reflect any fees |

Assets Under Management

The following tables show AUM by product and investment objective as well as net client cash flows for the past five years ended December 31, 2015:

Assets Under Management by Product As of December 31, | |||||||||||||||||||

(in millions) | 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||

Proprietary funds | $ | 11,505 | $ | 9,863 | $ | 7,600 | $ | 5,251 | $ | 4,405 | |||||||||

Sub-advised funds | 665 | 665 | 444 | 947 | 972 | ||||||||||||||

Institutional accounts | 4,671 | 5,128 | 4,142 | 3,231 | 3,294 | ||||||||||||||

Total AUM | $ | 16,841 | $ | 15,656 | $ | 12,186 | $ | 9,429 | $ | 8,671 | |||||||||

Assets Under Management by Investment Objective As of December 31, | |||||||||||||||||||

(in millions) | 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||

Small Cap | $ | 1,703 | $ | 1,575 | $ | 1,402 | $ | 939 | $ | 932 | |||||||||

Small-Mid Cap | 2,088 | 1,295 | 780 | 364 | 277 | ||||||||||||||

Large Cap | 7,547 | 7,926 | 6,254 | 5,211 | 4,885 | ||||||||||||||

Select (All Cap) | 545 | 432 | 327 | 258 | 321 | ||||||||||||||

Long-Short | 4,597 | 4,179 | 3,213 | 2,455 | 2,082 | ||||||||||||||

Strategic Income | 361 | 249 | 210 | 202 | 174 | ||||||||||||||

Total AUM | $ | 16,841 | $ | 15,656 | $ | 12,186 | $ | 9,429 | $ | 8,671 | |||||||||

6

Change in Assets Under Management For the Year Ended December 31, | |||||||||||||||||||

(in millions) | 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||

AUM at beginning of the year | $ | 15,656 | $ | 12,186 | $ | 9,429 | $ | 8,671 | $ | 8,623 | |||||||||

Net cash inflows (outflows) | |||||||||||||||||||

proprietary funds | 1,916 | 1,618 | 713 | 429 | 56 | ||||||||||||||

sub-advised funds | (6 | ) | 166 | (758 | ) | (149 | ) | 21 | |||||||||||

institutional accounts | (443 | ) | 478 | (263 | ) | (499 | ) | (74 | ) | ||||||||||

1,467 | 2,262 | (308 | ) | (219 | ) | 3 | |||||||||||||

Net market appreciation (depreciation) and income | (282 | ) | 1,208 | 3,065 | 977 | 45 | |||||||||||||

Increase during the year | 1,185 | 3,470 | 2,757 | 758 | 48 | ||||||||||||||

AUM at end of the year | $ | 16,841 | $ | 15,656 | $ | 12,186 | $ | 9,429 | $ | 8,671 | |||||||||

Capacity

The Company’s primary goal is to fulfill our fiduciary duty to clients. We understand that our ability to retain and grow assets as a firm has been, and will be, driven primarily by delivering attractive long-term investment results to our clients. When we have determined that the size of any of our strategies hinders our ability to add value over a passive alternative, we have closed those strategies to new clients and we will continue to do so, which will impact our ability to grow AUM. We have prioritized, and will continue to prioritize, investment results over asset accumulation. The Small Cap strategy was closed to new investors as of December 31, 2015 and the Long-Short strategy was closed to new investors as of June 12, 2015. We estimate our AUM capacity to be approximately $30-$40 billion, with AUM of $16.8 billion as of December 31, 2015.

Distribution Channels

The Company’s investment advisory services are distributed through multiple channels. Our institutional sales efforts include building relationships with institutional consultants and also establishing direct relationships with institutional clients. Our sales efforts for the Funds include wholesaling to third-party financial intermediaries, including independent registered investment advisers, brokers, financial planners, and wealth advisers, who utilize the Funds in investment programs they construct for their clients.

7

AUM by Channel

Below is a summary of our AUM by distribution channel for the past five years ended December 31, 2015:

AUM by Distribution Channel As of December 31, | |||||||||||||||||||

(in millions) | 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||

Proprietary funds: | |||||||||||||||||||

Registered investment advisers | $ | 2,723 | $ | 2,363 | $ | 1,678 | $ | 1,258 | $ | 1,049 | |||||||||

Independent broker/dealers | 2,329 | 1,862 | 1,400 | 917 | 665 | ||||||||||||||

Wirehouse broker/dealers | 1,963 | 1,760 | 1,261 | 758 | 674 | ||||||||||||||

Banks | 2,735 | 2,176 | 1,668 | 1,407 | 927 | ||||||||||||||

Defined contribution | 1,218 | 1,232 | 1,226 | 739 | 737 | ||||||||||||||

Other | 537 | 470 | 367 | 172 | 353 | ||||||||||||||

Total proprietary funds | 11,505 | 9,863 | 7,600 | 5,251 | 4,405 | ||||||||||||||

Sub-advised funds | 665 | 665 | 444 | 947 | 972 | ||||||||||||||

Institutional accounts: | |||||||||||||||||||

Institutional consultant | 2,370 | 2,681 | 1,965 | 1,857 | 1,836 | ||||||||||||||

Financial intermediary | 1,474 | 1,573 | 1,488 | 1,164 | 1,237 | ||||||||||||||

Direct | 827 | 874 | 689 | 210 | 221 | ||||||||||||||

Total institutional accounts | 4,671 | 5,128 | 4,142 | 3,231 | 3,294 | ||||||||||||||

Total AUM | $ | 16,841 | $ | 15,656 | $ | 12,186 | $ | 9,429 | $ | 8,671 | |||||||||

Growth Strategy

The Company’s growth strategy will remain focused on achieving excellent investment results in all our strategies and providing the highest level of client service. We will continue to focus on the development of distribution channels to enable us to offer our various investment strategies to a broad array of clients. We seek to continue to grow our AUM through our proprietary funds and institutional accounts. We have a targeted strategic business plan to further penetrate our existing distribution channels. Our business development efforts are focused on expanding the institutional consultant channel and plan sponsor network on the separate account side, as well as our intermediary network on the fund side.

Fund Administration Activities

Fund Administration Services

The Company provides fund administration services to the Funds and other third party mutual fund companies and investment advisers. Fund administration services are broadly defined as portfolio and regulatory compliance, treasury and financial oversight, statutory underwriting, oversight of back-office service providers such as the custodian, fund accountant, and transfer agent, and general business management and governance of the mutual fund complex. These services are offered on a stand-alone basis, as well as through a series or "umbrella" trust whereby individual investment advisers can establish a mutual fund under a fund complex sponsored by the Company.

Fund Administration Fees

The Company earns revenue from performing the various fund administration activities described above under individual client agreements. The fees earned depend on the type of service, fund size, and/or servicing requirements. Certain client agreements have a fixed fee arrangement while others have a fee derived as a percentage of assets under administration.

Competition

Competition in the area of investment management and fund administration is intense, and our competitors include investment management firms, broker-dealers, banks and insurance companies, some of whom offer various investment alternatives, including passive index strategies. Many competitors are better known than the Company, offer a broader range of investment products and have more offices, employees and business development representatives. We compete primarily on the basis of philosophy, performance and client service.

8

Regulation

The Company and our business are subject to various federal, state and foreign laws and regulations. As a matter of public policy, regulatory bodies are charged with safeguarding the integrity of the securities and other financial markets and with protecting the interests of participants in those markets, including investment advisory clients and shareholders of investment funds. Under these laws and regulations, agencies that regulate investment advisers have broad administrative powers, including the power to limit, restrict or prohibit an investment adviser from carrying on its business in the event the adviser fails to comply with such laws and regulations. Possible sanctions that may be imposed include civil and criminal liability, the suspension of individual employees, limitations on engaging in certain lines of business for specified periods of time, revocation of investment adviser, broker/dealer, and other registrations, censures and fines.

DHCM is registered with the SEC under the Investment Advisers Act of 1940 (the “Advisers Act”) and operates in a highly regulated environment. The Advisers Act imposes numerous obligations on registered investment advisers, including fiduciary duties, recordkeeping requirements, operational requirements and disclosure obligations. All Diamond Hill Funds are registered with the SEC under the Investment Company Act of 1940 and are required to make notice filings with all states where the Funds are offered for sale. BHIL is registered with the SEC as a broker/dealer and is a member of the Financial Industry Regulatory Authority, Inc. (“FINRA”). Virtually all aspects of our investment advisory and fund administration business are subject to various federal and state laws and regulations.

To the extent that DHCM is a “fiduciary” under the Employee Retirement Income Security Act of 1974 (“ERISA”) with respect to benefit plan clients, it is subject to ERISA regulations. ERISA and applicable provisions of the Internal Revenue Code impose certain duties on persons who are fiduciaries, prohibit certain transactions involving ERISA plan clients, and provide monetary penalties for violations of these prohibitions. The U.S. Department of Labor, which administers ERISA, has been increasingly active in proposing and adopting regulations affecting the asset management industry.

The Company’s trading activities for client accounts are regulated under the Securities Exchange Act of 1934 (the “Exchange Act”), as well as as various FINRA rules, including laws governing trading on inside information, market manipulation and a broad number of trading requirements (e.g., volume limitations, reporting obligations) and market regulation policies in the United States.

The preceding descriptions of the regulatory and statutory provisions applicable to us are not complete and are qualified in their entirety by reference to their respective statutory or regulatory provisions. Failure to comply with these requirements could have a material adverse effect on our business.

Contractual Relationships with the Diamond Hill Funds

The Company is very dependent on our contractual relationships with the Funds. In the event our advisory or administration agreements with the Funds are terminated, not renewed, or amended to reduce fees, we would be materially and adversely affected. We generated approximately 75%, 73% and 71% of our 2015, 2014 and 2013 revenues, respectively, from our advisory and administrative contracts with the Funds. We consider our relationship with the Funds and their board of trustees to be good, and have no reason to believe that these advisory or administration contracts will not be renewed in the future; however, there is no assurance that the Funds will choose to continue their relationships with the Company. Please see Item 1A for risk factors regarding this relationship.

Employees

As of December 31, 2015, the Company and its subsidiaries employed 126 full-time equivalent employees. As of December 31, 2014, the comparable number was 107. We believe that our relationship with our employees is good. Our employee count has been growing over the past several years and we expect that general trend to continue.

SEC Filings

The Company maintains an Internet website at www.diamond-hill.com. Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, XBRL instance documents, Current Reports on Form 8-K and amendments to those reports that we file or furnish pursuant to Section 13(a) or 15(d) of the Exchange Act, are made available free of charge, on or through our website, as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. The contents of our website are not incorporated into, or otherwise made a part of, this Annual Report on Form 10-K. Our filings with the Commission may be read and copied at the Commission's Public Reference Room at 100F Street, NE, Washington, DC 20549. These filings are also available on the Commission's web-site at http://www.sec.gov free of charge.

9

ITEM 1A. | Risk Factors |

The Company’s future results of operations, financial condition, liquidity, and the market price of our common shares are subject to various risks, including those mentioned below and those that are discussed from time-to-time in our other periodic filings with the SEC. Investors should carefully consider these risks, along with the other information contained in this report, before making an investment decision regarding our common shares. There may be additional risks of which we are currently unaware, or which we currently consider immaterial. The occurrence of any of these risks could have a material adverse effect on our financial condition, results of operations, liquidity, and value of our common shares. Please see “Forward Looking Statements” within Item 1 of Part I of this Form 10-K.

Poor investment results of our products could affect our ability to attract new clients or reduce the amount of assets under management, potentially negatively impacting revenue and net income.

If we fail to deliver acceptable investment results for our clients, both in the short and long term, we will likely experience diminished investor interest and potentially a diminished level of AUM. Adverse opinions of the funds we administer or advise published by third parties, including rating agencies and industry analysts, could also decrease our AUM and our revenues.

Investment funds are assessed and rated by independent third parties, including rating agencies, industry analysts and publications. Investors can be influenced by such ratings. If any of the funds we administer or advise receives an adverse report, it could negatively influence the amount of money invested into the fund and increase withdrawals from the fund reducing our AUM and our revenue.

The Company’s success depends on our key personnel, and our financial performance could be negatively affected by the loss of their services.

Our success depends on highly skilled personnel, including portfolio managers, research analysts, and management, many of whom have specialized expertise and extensive experience in the investment management industry. Financial services professionals are in high demand, and we face significant competition for qualified employees. With the exception of R. H. Dillon, our Chairman and a portfolio manager, our employees do not have employment contracts and generally can terminate their employment at any time. The Company cannot assure that we will be able to retain or replace key personnel. In order to retain or replace our key personnel, we may be required to increase compensation, which would decrease net income. The loss of key personnel could damage our reputation and make it more difficult to retain and attract new employees and clients. A loss of client assets resulting from the departure of key personnel may materially decrease our revenues and net income.

The Company's AUM, which impacts revenue, is subject to significant fluctuations.

A large majority of our revenue is calculated as a percentage of AUM or is related to the general performance of the equity securities market. A decline in securities prices or in the sale of investment products, or an increase in fund redemptions, generally would reduce fee income. Financial market declines would generally negatively impact the level of our AUM and consequently our revenue and net income. A recession or other economic or political events, both in the United States as well as globally, could also adversely impact our revenue, if such events led to a decreased demand for products, a higher redemption rate, or a decline in securities prices.

The Company's investment results and/or the growth in our AUM may be constrained if appropriate investment opportunities are not available or if we close certain of our portfolios.

The Company’s ability to deliver strong investment results depends in large part on our ability to identify appropriate investment opportunities in which to invest client assets. If we are unable to identify sufficient investment opportunities for existing and new client assets on a timely basis, our investment results could be adversely affected. The risk that appropriate investment opportunities may be unavailable is influenced by a number of factors, including general market conditions, and is likely to increase if our AUM increases rapidly. In addition, if we determine that sufficient investment opportunities are not available for a portfolio strategy, or we believe that in order to continue to produce attractive returns from a portfolio, we will consider closing the portfolio to new investors. The Small Cap strategy was closed to new investors as of December 31, 2015 and the Long-Short strategy was closed to new investors as of June 12, 2015. If we misjudge the point at which it would be optimal to close a portfolio, the investment results of the portfolio could be negatively impacted.

The Company is subject to substantial competition in all aspects of our business.

Our investment products compete against a number of investment products and services from:

• | asset management firms; |

• | mutual fund companies; |

10

• | commercial banks and thrift institutions; |

• | insurance companies; |

• | exchange traded funds; |

• | hedge funds; and |

• | brokerage and investment banking firms. |

Many of our competitors have substantially greater resources than the Company and may operate in more markets or offer a broader range of products, including passively managed or “index” products. Some of these institutions operate in a different regulatory environment, which may give them certain competitive advantages in the investment products and portfolio structures that they offer. We compete with other providers of investment services primarily based upon our philosophy, performance and client service. Some institutions have a broad array of products and distribution channels that make it more difficult for us to compete with them. If current or potential customers decide to use one of our competitors, we could face a significant decline in market share, AUM, revenues, and net income. If we are required to lower our fees in order to remain competitive, our net income could be significantly reduced because some of our expenses are fixed, especially over shorter periods of time, and our expenses may not decrease in proportion to the decrease in revenues.

The loss of access to or increased fees required by third party distribution sources to market our portfolios and access our client base could adversely affect our results of operations.

The Company’s ability to attract additional AUM is dependent on our relationship with third-party financial intermediaries. We compensate some of these intermediaries for access to investors and for various marketing services provided. These distribution sources and client bases may not continue to be accessible to us for reasonable terms, or at all. If such access is restricted or eliminated, it could have an adverse effect on our results of operations. Fees paid to financial intermediaries for investor access and marketing services have generally increased over the past few years. If such fee increases continue, refusal to pay them could restrict our access to those client bases while paying them could adversely affect our profitability.

A significant portion of the Company’s revenues are based on contracts with the Funds that are subject to termination without cause and on short notice.

The Company is very dependent on our contractual relationships with the Funds. If our advisory or administration agreements with the Funds were terminated, not renewed, or amended to reduce fees, we would be materially and adversely affected. Generally, these agreements are terminable by either party upon 60 days written notice without penalty. The agreements are subject to annual approval by either (i) the board of trustees of the Funds or (ii) a vote of the majority of the outstanding voting securities of each Fund. The agreements automatically terminate in the event of their assignment by either the Company or the Fund. We generated approximately 75%, 73%, and 71% of our 2015, 2014 and 2013 revenues, respectively, from our advisory and administrative contracts with the Funds, including 30%, 15%, and 10% from the advisory contracts with the Diamond Hill Long-Short Fund, Large Cap Fund, and Small Cap Fund, respectively, during 2015. The loss of the Long-Short Fund, Large Cap Fund, or Small Cap Fund contracts would have a material adverse effect on the Company. We consider our relationship with the Funds and their board of trustees to be good, and we have no reason to believe that these advisory or administration contracts will not be renewed in the future; however, there can be no assurance that the Funds will choose to continue their relationships with us.

Operational risks may disrupt our business, result in losses or limit our growth.

The Company is dependent on the capacity and reliability of the communications, information and technology systems supporting our operations, whether developed, owned and operated by the Company or by third parties. Operational risks such as trading or operational errors, interruption of our financial, accounting, trading, compliance and other data processing systems, the loss of data contained in the systems, or compromised systems due to cyber-attack, could result in a disruption of our business, liability to clients, regulatory intervention or reputational damage, and thus adversely affect our business.

11

The Company’s business is subject to substantial governmental regulation.

Our business is subject to a variety of federal securities laws, including the Investment Advisers Act of 1940, the Investment Company Act of 1940, the Securities Exchange Act of 1934, the Sarbanes-Oxley Act of 2002, and the U.S. PATRIOT Act of 2001. In addition, we are subject to significant regulation and oversight by the SEC and FINRA. Changes in legal, regulatory, accounting, tax and compliance requirements could have a significant effect on our operations and results, including but not limited to increased expenses and reduced investor interest in certain funds and other investment products we offer. We continually monitors legislative, tax, regulatory, accounting, and compliance developments that could impact our business. We and our directors, officers and employees could be subject to lawsuits or regulatory proceedings for violations of such laws and regulations, which could result in the payment of fines or penalties and cause reputational harm to the Company. Such harm could negatively affect our financial condition and results of operations, as well as divert management's attention from operations.

We continue to seek to understand, evaluate and, when possible, manage and control these and other business risks.

Trading in our common shares is limited, which may adversely affect the time and the price at which you can sell your shares of the Company.

Although our common shares are listed on the NASDAQ Global Select Market, the shares are held by a relatively small number of shareholders, and trading in our common shares is not active. The spread between the bid and the asked prices is often wide. As a result, you may not be able to sell your shares on short notice, and the sale of a large number of shares at one time could temporarily depress the market price. In addition, certain shareholders, including certain directors and officers of the Company, own a significant number of shares. The sale of a large number of shares by any such individual could temporarily depress the market price.

ITEM 1B. | Unresolved Staff Comments |

None.

ITEM 2. | Properties |

The Company leases office space at one location in Columbus, Ohio and one location in Berwyn, Pennsylvania.

The Company does not own any real estate or interests in real estate.

ITEM 3. | Legal Proceedings |

From time to time, the Company is party to ordinary routine litigation that is incidental to its business. There are currently no material legal proceedings.

ITEM 4. | Mine Safety Disclosures |

Not applicable.

12

PART II

ITEM 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

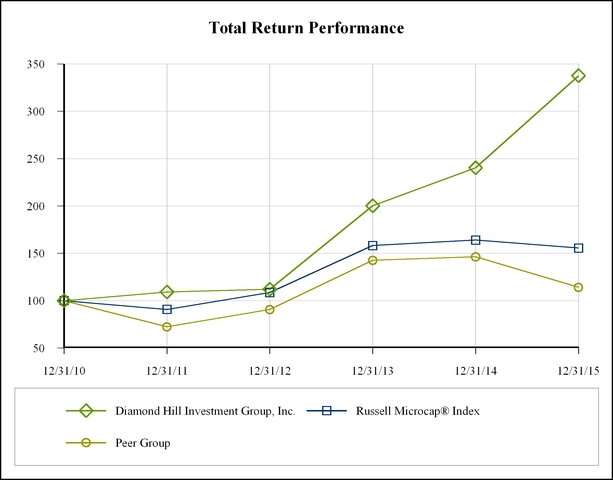

The following performance graph compares the total shareholder return of an investment in our common shares to that of the Russell Microcap® Index, and to a peer group index of publicly traded asset management firms for the five-year period ending on December 31, 2015. The graph assumes that the value of the investment in our common shares and each index was $100 on December 31, 2010. Total return includes reinvestment of all dividends. The Russell Microcap® Index makes up less than 3% of the U.S. equity market and is a market-value-weighted index of the smallest 1,000 securities in the small-cap Russell 2000® Index plus the next 1,000 smallest securities. Peer Group returns are weighted by the market capitalization of each firm at the beginning of the measurement period. The historical information set forth below is not necessarily indicative of future performance. We do not make or endorse any predictions as to future stock performance.

12/31/2010 | 12/31/2011 | 12/31/2012 | 12/31/2013 | 12/31/2014 | 12/31/2015 | Cumulative 5 Year Total Return | |||||||

Diamond Hill Investment Group, Inc. | $100 | $109 | $112 | $200 | $240 | $338 | 238 | % | |||||

Russell Microcap® Index | $100 | $91 | $109 | $158 | $164 | $156 | 56 | % | |||||

Peer Group* | $100 | $72 | $91 | $143 | $146 | $114 | 14 | % | |||||

* The Peer Group is based upon all asset managers with market cap of less than $5 billion excluding firms whose primary business is hedge fund or private equity, and firms with multiple lines of business. The following companies are included in the Peer Group: Alliance Bernstein Holding L.P.; Calamos Asset Management, Inc.; Cohen & Steers, Inc.; Eaton Vance Corp.; Federated Investors, Inc.; GAMCO Investors, Inc.; Hennessy Advisors, Inc.; Janus Capital Group, Inc.; Legg Mason, Inc.; Pzena Investment Management, Inc.; Teton Advisors, Inc.; U.S. Global Investors, Inc.; Virtus Investment Partners, Inc.; Waddell & Reed Financial, Inc.; Wisdomtree Investments, Inc.; and Westwood Holdings Group, Inc.

13

The Company’s common shares trade on the NASDAQ Global Select Market under the symbol DHIL. The following table sets forth the high and low sales prices during each quarter of 2015 and 2014:

2015 | 2014 | ||||||||||||||||||||||

High Price | Low Price | Dividend Per Share | High Price | Low Price | Dividend Per Share | ||||||||||||||||||

Quarter ended: | |||||||||||||||||||||||

March 31 | $ | 164.49 | $ | 129.76 | $ | — | $ | 130.57 | $ | 112.83 | $ | — | |||||||||||

June 30 | $ | 208.96 | $ | 161.92 | $ | — | $ | 133.50 | $ | 115.86 | $ | — | |||||||||||

September 30 | $ | 202.50 | $ | 184.20 | $ | — | $ | 133.62 | $ | 122.89 | $ | — | |||||||||||

December 31 | $ | 228.79 | $ | 187.75 | $ | 5.00 | $ | 143.06 | $ | 114.57 | $ | 4.00 | |||||||||||

Due to the relatively low volume of traded shares, bid/ask spreads can be fairly wide at times and therefore, quoted prices may not be indicative of the price a shareholder may receive in an actual transaction. During the years ended December 31, 2015 and 2014, approximately 2,320,086 and 1,553,212, respectively, of our common shares were traded. The dividends indicated above were special dividends. We have not paid regular quarterly dividends in the past, and have no present intention of paying regular dividends in the future. The approximate number of record holders of our common shares at December 31, 2015 was 219, although we believe that the number of beneficial owners of our common shares is substantially greater.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

The Company did not purchase any of our common shares through the repurchase program during the year ended December 31, 2015. The following table sets forth information regarding our repurchase program of our common shares and shares withheld for tax payments due upon vesting of employee restricted stock units and restricted stock awards which vested during the fourth quarter of fiscal year 2015:

Period | Total Number of Shares Purchased(a) | Average Price Paid Per Share | Total Number of Shares Purchased as part of Publicly Announced Plans or Programs | Maximum Number of Shares That May Yet Be Purchased Under the Plans or Programs(b) | ||||||||

October 1, 2015 through October 31, 2015 | 666 | $ | 189.29 | — | 318,433 | |||||||

November 1, 2015 through November 30, 2015 | — | $ | — | — | 318,433 | |||||||

December 1, 2015 through December 31, 2015 | 1,932 | $ | 227.40 | — | 318,433 | |||||||

Total | 2,598 | $ | 217.63 | — | 318,433 | |||||||

(a) | All of the 2,598 shares of the Company's common shares purchased during the quarter ended December 31, 2015 represented shares which were withheld for tax payments due upon the vesting of employee restricted stock units and restricted share awards which vested during the quarter. |

(b) | The Company’s current share repurchase program was announced on August 9, 2007. The board of directors authorized management to repurchase up to 350,000 of our common shares in the open market and in private transactions in accordance with applicable securities laws. Our repurchase program is not subject to an expiration date. |

We sold no equity securities of the Company during 2015 that were not registered under the Securities Act of 1933.

14

ITEM 6. | Selected Financial Data |

The following selected financial data should be read in conjunction with our Consolidated Financial Statements and related notes and Management’s Discussion and Analysis of Financial Condition and Results of Operations contained in this Annual Report on Form 10-K.

For the Years Ended December 31, | |||||||||||||||||||

(in thousands, except per share data) | 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||

Income Statement Data: | |||||||||||||||||||

Total revenues | $ | 124,426 | $ | 104,559 | $ | 81,432 | $ | 66,657 | $ | 63,895 | |||||||||

Compensation and related costs | 47,951 | 43,892 | 40,852 | 33,868 | 32,875 | ||||||||||||||

Other expenses | 17,755 | 13,206 | 9,898 | 8,361 | 7,959 | ||||||||||||||

Total expenses | 65,706 | 57,098 | 50,750 | 42,229 | 40,834 | ||||||||||||||

Net operating income | 58,720 | 47,460 | 30,682 | 24,428 | 23,061 | ||||||||||||||

Operating profit margin | 47.2 | % | 45.4 | % | 37.7 | % | 36.6 | % | 36.1 | % | |||||||||

Net income | 37,074 | 31,581 | 22,155 | 16,931 | 14,353 | ||||||||||||||

Per Share Information: | |||||||||||||||||||

Basic earnings | $ | 11.31 | $ | 9.88 | $ | 7.05 | $ | 5.44 | $ | 4.86 | |||||||||

Diluted earnings | 11.03 | 9.67 | 6.94 | 5.44 | 4.86 | ||||||||||||||

Cash dividend declared | 5.00 | 4.00 | 3.00 | 8.00 | 5.00 | ||||||||||||||

Weighted Average Shares Outstanding | |||||||||||||||||||

Basic | 3,278 | 3,196 | 3,142 | 3,111 | 2,952 | ||||||||||||||

Diluted | 3,360 | 3,266 | 3,194 | 3,111 | 2,952 | ||||||||||||||

At December 31, | |||||||||||||||||||

2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||||||

Balance Sheet Data (in thousands): | |||||||||||||||||||

Total assets | $ | 145,187 | $ | 107,709 | $ | 75,353 | $ | 41,236 | $ | 37,720 | |||||||||

Long-term debt | — | — | — | — | — | ||||||||||||||

Shareholders equity | 105,314 | 74,319 | 44,943 | 21,736 | 18,050 | ||||||||||||||

Assets Under Management (in millions) | $ | 16,841 | $ | 15,656 | $ | 12,186 | $ | 9,429 | $ | 8,671 | |||||||||

Net Client Flows (in millions) | 1,467 | 2,262 | (308 | ) | (219 | ) | 3 | ||||||||||||

ITEM 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

In this section, we discuss and analyze the consolidated results of operations for the past three fiscal years and other factors that may affect future financial performance. This discussion should be read in conjunction with our Consolidated Financial Statements, Notes to Consolidated Financial Statements, and Selected Financial Data contained in this Form 10-K.

Business Environment

U.S. stocks rose modestly in the first half of 2015 but lost momentum in the third quarter as investor concerns over a slowdown in China’s economic growth negatively impacted commodity prices. China is the world’s largest importer of raw materials. This slowdown has also strained many other developing countries and large portions of the global industrial sector as China has been a meaningful source of incremental demand for key industrial end markets. A strong fourth quarter was not enough to completely save the year and most major market indexes ended 2015 somewhere close to even.

In 2015, market returns were very narrow with much of the strength in a handful of stocks. Netflix (+134%) and Amazon (+118%) were the best performers for the year, far outpacing the Russell 1000 Index return. The energy sector posted the largest decline (-22% within the Russell 1000 Index) as oil prices fell meaningfully for the second consecutive year. The price of oil at the end of 2015 was approximately $37 per barrel, down from more than $100 per barrel in 2014. Robust production from U.S. shale-oil fields pushed the global crude market into oversupply in late 2014, and production rose again in 2015 as producers worldwide chose to maintain high production levels. U.S inventories of crude oil are near an eight-decade high.

15

Thus far, it appears consumers have largely used the money saved from lower gasoline prices to pay down debt and to increase savings. However, we would expect increases in household spending associated with lower gasoline prices to occur with a meaningful lag as consumers gain confidence that the decline is long-term. Any incremental consumer spending in the coming year could provide a modest boost to the economy, partially offset by job losses in the energy sector.

In December, the Federal Reserve increased its Fed Funds target rate for the first time since 2006, moving to 50 basis points from 25 basis points. U.S. government bond yields rose only modestly over the past twelve months, indicating investors were not yet ready to leave the relative safety of government bonds.

The U.S. economy appears to be continuing the healing process with real growth generally staying in the 2% - 3% range. However, as we have experienced numerous times over the past few years, domestic politics, geo-political events and even extreme weather are all variables which can exert meaningful near-term pressure on overall growth.

Globally, central banks remain extraordinarily accommodative in an attempt to provide a backdrop for increased economic growth. Europe, which has been an economic laggard over the past few years, has shown some signs of stabilization. However, China has seen a significant slowdown in its rate of economic expansion. While the U.S. Federal Funds rate remains extremely low, the 25 basis point increase in December indicates policymakers’ confidence in the recovery of U.S. labor markets and an expectation of slowly rising inflation. It is expected that further rate increases will come at a gradual pace, which may be affected by volatility in global financial markets.

We continue to expect positive but below average equity market returns over the next five years. Our conclusion is primarily based on the combination of above average price/earnings multiples applied to already very strong levels of corporate profit margins, which likely tempers prospective returns. This expectation also seems consistent with the current interest rate environment. We believe that we can achieve better-than-market returns over the next five years through active portfolio management.

A large majority of our revenue is calculated as a percentage of AUM and is therefore impacted by the overall business and economic environment described above. Financial market declines or deterioration in the economic environment would generally negatively impact the level of our AUM, and consequently our revenue and net income.

Key Financial Performance Indicators

There are a variety of key performance indicators the Company monitors in order to evaluate our business results. The following table presents the results of certain key performance indicators over the past three fiscal years:

For the Years Ended December 31, | |||||||||||

2015 | 2014 | 2013 | |||||||||

Ending AUM (in millions) | $ | 16,841 | $ | 15,656 | $ | 12,186 | |||||

Average AUM (in millions) | 16,415 | 13,847 | 10,817 | ||||||||

Total Revenue (in thousands) | 124,426 | 104,559 | 81,432 | ||||||||

Total Expenses (in thousands) | 65,706 | 57,099 | 50,750 | ||||||||

Average Advisory Fee Rate | 0.66 | % | 0.65 | % | 0.65 | % | |||||

Operating Profit Margin | 47.2 | % | 45.4 | % | 37.7 | % | |||||

Assets Under Management

Our revenue is derived primarily from investment advisory and administration fees. Investment advisory and administration fees paid to the Company are generally based on the value of the investment portfolios we manage and fluctuate with changes in the total value of the AUM. Substantially all of our AUM (97.9%) is valued based on readily available market quotations. AUM in our fixed income strategies (2.1%) is valued using evaluated prices from an independent third-party provider. Fees are recognized in the period that the Company manages these assets.

Revenues are highly dependent on both the value and composition of AUM. The following is a summary of our AUM by product, investment objective, and a roll-forward of the change in AUM for the years ended December 31, 2015, 2014, and 2013:

16

Assets Under Management by Product As of December 31, | |||||||||||

(in millions) | 2015 | 2014 | 2013 | ||||||||

Proprietary funds | $ | 11,505 | $ | 9,863 | $ | 7,600 | |||||

Sub-advised funds | 665 | 665 | 444 | ||||||||

Institutional accounts | 4,671 | 5,128 | 4,142 | ||||||||

Total AUM | $ | 16,841 | $ | 15,656 | $ | 12,186 | |||||

Assets Under Management by Investment Objective As of December 31, | |||||||||||

(in millions) | 2015 | 2014 | 2013 | ||||||||

Small Cap | $ | 1,703 | $ | 1,575 | $ | 1,402 | |||||

Small-Mid Cap | 2,088 | 1,295 | 780 | ||||||||

Large Cap | 7,547 | 7,926 | 6,254 | ||||||||

Select (All Cap) | 545 | 432 | 327 | ||||||||

Long-Short | 4,597 | 4,179 | 3,213 | ||||||||

Strategic Income | 361 | 249 | 210 | ||||||||

Total AUM | $ | 16,841 | $ | 15,656 | $ | 12,186 | |||||

Change in Assets Under Management For the Year Ended December 31, | |||||||||||

(in millions) | 2015 | 2014 | 2013 | ||||||||

AUM at beginning of the year | $ | 15,656 | $ | 12,186 | $ | 9,429 | |||||

Net cash inflows (outflows) | |||||||||||

proprietary funds | 1,916 | 1,618 | 713 | ||||||||

sub-advised funds | (6 | ) | 166 | (758 | ) | ||||||

institutional accounts | (443 | ) | 478 | (263 | ) | ||||||

1,467 | 2,262 | (308 | ) | ||||||||

Net market appreciation (depreciation) and income | (282 | ) | 1,208 | 3,065 | |||||||

Increase during the year | 1,185 | 3,470 | 2,757 | ||||||||

AUM at end of the year | $ | 16,841 | $ | 15,656 | $ | 12,186 | |||||

Consolidated Results of Operations

The following is a discussion of our consolidated results of operations.

(in thousands, except per share data) | 2015 | 2014 | % Change | 2014 | 2013 | % Change | |||||||||||||

Net operating income | $ | 58,720 | $ | 47,460 | 24% | $ | 47,460 | $ | 30,682 | 55% | |||||||||

Net operating income after tax(a) | $ | 37,546 | $ | 29,759 | 26% | $ | 29,759 | $ | 19,077 | 56% | |||||||||

Net income | $ | 37,074 | $ | 31,581 | 17% | $ | 31,581 | $ | 22,155 | 43% | |||||||||

Net operating income after tax per diluted share(a) | $ | 11.17 | $ | 9.11 | 23% | $ | 9.11 | $ | 5.97 | 53% | |||||||||

Net income per diluted share | $ | 11.03 | $ | 9.67 | 14% | $ | 9.67 | $ | 6.94 | 39% | |||||||||

Operating profit margin | 47.2 | % | 45.4 | % | NM | 45.4 | % | 37.7 | % | NM | |||||||||

(a) | Net operating income after tax is a non-GAAP performance measure. See Use of Supplemental Data as Non-GAAP Performance Measure section within this report. |

17

Year Ended December 31, 2015 compared with Year Ended December 31, 2014

The Company generated net income of $37.1 million ($11.03 per diluted share) for the year ended December 31, 2015, compared with net income of $31.6 million ($9.67 per diluted share) for the year ended December 31, 2014. Revenue increased $19.9 million period over period due to an increase in AUM, resulting in an $11.3 million increase in operating income. The revenue increase was offset by an increase in operating expenses of $8.6 million, primarily related to increases in compensation and related expenses, general and administrative expenses, and sales and marketing expenses. The Company had $0.7 million in investment losses due to market depreciation in 2015 compared to investment income of $2.9 million in 2014. Income tax expense increased $2.1 million from 2014 to 2015 due to the overall increase in income before taxes.

Net operating income after tax, which excludes the impact of investment gains or losses, increased $7.8 million, or 26%, from 2014 to 2015 consistent with the increase in net operating income.

Operating profit margin increased to 47.2% for 2015 from 45.4% for 2014. We expect that our operating margin will fluctuate, sometimes substantially, from year to year based on various factors including revenues; investment results; employee performance; staffing levels; development of investment strategies, products, or channels; and industry comparisons.

Year Ended December 31, 2014 compared with Year Ended December 31, 2013

The Company earned net income of $31.6 million ($9.67 per diluted share) for the year ended December 31, 2014, compared with net income of $22.2 million ($6.94 per diluted share) for the year ended December 31, 2013. Operating income increased by $16.8 million from 2013 to 2014 primarily due to an increase in AUM, resulting in a $23.1 million increase in revenue. The revenue increase was offset by an increase in operating expenses of $6.3 million, primarily related to higher compensation due to staffing and merit increases and increases in incentive compensation. A positive return on our corporate investments further contributed to the overall increase in net income. Investment income of $2.9 million in 2014 was due to net portfolio appreciation. The income tax provision increased $5.3 million from the year ended December 31, 2013 to December 31, 2014 primarily due to an overall increase in book income.

Net operating income after tax, which excludes the impact of investment gains or losses, increased $10.7 million, or 56.0%, from 2013 to 2014 consistent with the increase in net operating income.

Operating profit margin increased to 45.4% for 2014 from 37.7% for 2013. We expect that our operating margin will fluctuate, sometimes substantially, from year to year based on various factors including revenues; investment results; employee performance; staffing levels; development of investment strategies, products, or channels; and industry comparisons.

Revenue

(in thousands) | 2015 | 2014 | % Change | 2014 | 2013 | % Change | |||||||||||||

Investment advisory | $ | 107,916 | $ | 89,901 | 20% | $ | 89,901 | $ | 69,967 | 28% | |||||||||

Mutual fund administration, net | 16,510 | 14,658 | 13% | 14,658 | 11,465 | 28% | |||||||||||||

Total | 124,426 | 104,559 | 19% | 104,559 | 81,432 | 28% | |||||||||||||

Revenue for the Year Ended December 31, 2015 compared with Year Ended December 31, 2014

As a percent of total 2015 revenues, investment advisory fees accounted for 87% and mutual fund administration fees made up the remaining 13%. This compared to 86% and 14%, respectively, for 2014.

Investment Advisory Fees. Investment advisory fees increased by $18.0 million, or 20%, from the year ended December 31, 2014 to the year ended December 31, 2015. Investment advisory fees are calculated as a percentage of average AUM at various rates depending on the investment product. The increase in investment advisory fees was primarily driven by an increase of 19% in average AUM year over year. The average advisory fee rate in 2015 and 2014 was 0.66% and 0.65%, respectively. Effective June 12, 2015, the Diamond Hill Long-Short Fund, which has a 0.90% advisory fee, was closed to new investors. In addition, effective December 31, 2015, the Diamond Hill Small Cap Fund, which has a 0.80% advisory fee, was closed to new investors. As a result, the Company expects the recent growth in AUM in these funds to decline, which could negatively impact the average advisory fee rate. Effective January 1, 2016, the Company voluntarily reduced the investment advisory fee it charges on the Large Cap Fund and certain institutional accounts by 0.05%. Based upon assets held as of December 31, 2015 in large cap strategies, the Company expects this fee reduction could potentially reduce revenue by approximately $2.4 million during 2016.

18

Mutual Fund Administration Fees. Mutual fund administration fees increased by $1.9 million, or 13%, from the year ended December 31, 2014 to the year ended December 31, 2015. Mutual fund administration fees include administration fees received from the Funds, which are calculated as a percentage of average mutual fund AUM, and all Beacon Hill fee revenue. The increase in the mutual fund administration fee is due to a 24% increase in average Fund AUM which increased from $8.6 billion for the year ended December 31, 2014 to $10.7 billion for the year ended December 31, 2015. This increase was offset by a reduction in the net administration fee rate by 0.02% to 0.12% for the year ended 2015 from 0.14% for the year ended 2014. This decrease in the net administration fee rate was due to a reduction in the Funds' administration fee rate by one basis point, which was effective January 1, 2015 for assets held in Class A, C, and I shares for all Diamond Hill Funds and the further reduction in the administration fee rate charged on assets held in Class I shares from 0.24% to 0.21% effective July 1, 2015. In addition, effective January 1, 2016, the Company further reduced the administration fee rate charged on assets held in Class I shares from 0.21% to 0.20%. As of December 31, 2015, assets held in class I shares for the Diamond Hill Funds totaled $6.9 billion.

Revenue for the Year Ended December 31, 2014 compared with Year Ended December 31, 2013

As a percent of total 2014 revenues, investment advisory fees accounted for 86% and mutual fund administration fees made up the remaining 14%. This compared to 87% and 13%, respectively, for 2013.

Investment Advisory Fees. Investment advisory fees increased by $19.9 million, or 28%, from the year ended December 31, 2013 to the year ended December 31, 2014. Investment advisory fees are calculated as a percentage of average AUM at various rates depending on the investment product. The increase in investment advisory fees was driven by an increase of 28% in average AUM year over year. The average advisory fee rate for both periods was 0.65%.

Mutual Fund Administration Fees. Mutual fund administration fees increased by $3.2 million, or 28%, from the year ended December 31, 2013 to the year ended December 31, 2014. Mutual fund administration fees include administration fees received from Diamond Hill Funds, which are calculated as a percentage of average mutual fund AUM, and all Beacon Hill fee revenue. The increase in the mutual fund administration fee is due to a 36% increase in average Diamond Hill Fund AUM which increased from $6.3 billion for the year ended December 31, 2013 to $8.6 billion for the year ended December 31, 2014. The increase was also partially due to an increase in Beacon Hill's administered umbrella trust AUM period over period. The overall blended net administration fee rate for the Diamond Hill Funds decreased by 1 basis point to 0.14% in 2014.

Expenses

(in thousands) | 2015 | 2014 | % Change | 2014 | 2013 | % Change | |||||||||||||

Compensation and related costs | $ | 47,951 | $ | 43,892 | 9% | $ | 43,892 | $ | 40,852 | 7% | |||||||||

General and administrative | 10,246 | 8,099 | 27% | 8,099 | 6,043 | 34% | |||||||||||||

Sales and marketing | 4,179 | 2,222 | 88% | 2,222 | 2,099 | 6% | |||||||||||||

Mutual fund administration | 3,330 | 2,885 | 15% | 2,885 | 1,756 | 64% | |||||||||||||

Total | 65,706 | 57,098 | 15% | 57,098 | 50,750 | 13% | |||||||||||||

Expenses for the Year Ended December 31, 2015 compared with Year Ended December 31, 2014

Compensation and Related Costs. Employee compensation and benefits increased by $4.1 million, or 9%, from the year ended December 31, 2014 to the year ended December 31, 2015, due to an increase of $3.8 million in salaries and related benefits due to an increase in staffing and merit levels and an increase of $0.5 million in incentive compensation during fiscal year 2015 due to growth in the business partially offset by a reduction in deferred compensation expense of $0.2 million. Incentive compensation expense can fluctuate significantly period over period as we evaluate incentive compensation by reviewing investment performance, individual performance, Company performance and other factors.

General and Administrative. General and administrative expenses increased by $2.1 million, or 27%, from the year ended December 31, 2014 to the year ended December 31, 2015. This increase was due to additional research expenses of $0.4 million to support our investment team, an increase in information technology expense of $0.3 million, an increase in depreciation expense of $0.4 million due to the expansion of our office space, an increase in charitable donations of $0.4 million, an increase in consulting expense of $0.5 million, and an increase in general office expenses of $0.1 million.

19

Sales and Marketing. Sales and marketing expenses increased by $2.0 million, or 88%, from the year ended December 31, 2014 to the year ended December 31, 2015. This increase was primarily due to additional payments made to third party intermediaries of $1.7 million and increased business development expenses of $0.3 million.

Mutual Fund Administration. Mutual fund administration expenses increased by $0.4 million, or 15%, from the year ended December 31, 2014 to the year ended December 31, 2015. Mutual fund administration expenses consist of both variable and fixed expenses. The variable expenses are based on mutual fund AUM and the number of shareholder accounts.

Expenses for the Year Ended December 31, 2014 compared with Year Ended December 31, 2013

Compensation and Related Costs. Employee compensation and benefits increased by $3.0 million, or 7%, due to an increase of $2.4 million in salaries and related benefits due to an increase in staffing and merit levels and an increase of $0.6 million in incentive compensation during fiscal year 2014 due to growth in the business. Incentive compensation expense can fluctuate significantly period over period as we evaluate incentive compensation by reviewing investment performance, individual performance, company performance and other factors.

General and Administrative. General and administrative expenses increased by $2.1 million, or 34%, from the year ended December 31, 2013 to the year ended December 31, 2014. This increase was primarily due to an additional $1.1 million of charitable contributions in 2014. The remaining increase was due to additional research expenses to support our investment team, additional rent related to the expansion of our office space and non-income related taxes.

Sales and Marketing. Sales and marketing expenses increased by $0.1 million, or 6%, from the year ended December 31, 2013 to the year ended December 31, 2014. This increase was due to an overall increase in travel and other expenses related to business development efforts. We expect revenue sharing to financial intermediaries who support the distribution of the Funds to increase between $0.5 million and $1.0 million in 2015.

Mutual Fund Administration. Mutual fund administration expenses increased by $1.1 million, or 64%, from the year ended December 31, 2013 to the year ended December 31, 2014. Mutual fund administration expenses consist of both variable and fixed expenses. The variable expenses are based on mutual fund AUM and the number of shareholder accounts. The increase is primarily due to a restructuring of certain servicing contracts for the Funds to shift the expense obligation from the Funds to the Company. This effectively lowered the expense ratio of the Funds by approximately one basis point and increased the mutual fund administration expense of the Company by an equivalent dollar amount. An increase in the average Funds AUM of 36% from the year ended December 31, 2013 to December 31, 2014 also contributed to the increase.

Liquidity and Capital Resources

Sources of Liquidity

The Company's main source of liquidity is cash flow from operating activities which are generated from investment advisory and fund administration fees. Our investment portfolio is primarily in readily marketable securities, which provide for cash liquidity, if needed. Investments in mutual funds are valued at their quoted current net asset value. Investments in private investment funds are valued independently using net asset value ("NAV") as a practical expedient. Equity securities in private investment funds are based on readily available market quotations. Debt securities in private investment funds are valued using pricing techniques which take into account factors such as trading activity, readily available market quotations, yield, quality, coupon rate, maturity, type of issue, trading characteristics, call features, credit rates and other observable inputs. Inflation is expected to have no material impact on our performance. Cash and cash equivalents, accounts receivable, and investments represented approximately 89% and 91% of total assets as of December 31, 2015 and 2014 respectively. We believe these sources of liquidity, as well as our continuing cash flows from operating activities, will be sufficient to meet our current and future operating needs for at least the next 12 months.

Uses of Liquidity

In line with the Company’s primary objective to fulfill our fiduciary duty to clients and secondary objective to achieve an adequate long-term return for shareholders, we anticipate our main uses of cash will be operating expenses and seed capital to fund new investment strategies.

The Board of Directors and management regularly review various factors to determine whether we have capital in excess of that required for the business and the appropriate use of any excess capital. The factors considered include our investment opportunities, capital needed for investment strategies, risks, and future dividend and capital gain tax rates. Evaluating management’s stewardship of capital for shareholders is a central part of our investment discipline that we practice for our clients. We hold ourselves to the same standard that we look for when evaluating investments for our clients.

20

While this is the eighth consecutive year that the Company has paid a special dividend, there can be no assurance that we will pay a dividend in the future. We have paid out special dividends totaling $58.00 per share from 2008 through 2015. These special dividends reduced shareholders’ equity by $167.2 million over the past 8 years. The 2015, 2014, and 2013 special dividend reduced shareholders' equity by $17.0 million, $13.2 million, and $9.8 million, respectively. The 2015, 2014, and 2013 special dividends were each qualified dividends for tax purposes and were recorded as a reduction to retained earnings.

Working Capital

As of December 31, 2015, the Company had working capital of approximately $91.9 million compared to $66.2 million at December 31, 2014. Working capital includes cash, securities owned, current receivables and other current assets, net of all liabilities. On October 28, 2015, our Board of Directors declared a $5.00 per share dividend payable on December 14, 2015 to shareholders of record on December 4, 2015. The payment of the special cash dividend reduced our working capital balance by approximately $17.0 million. The Company has no debt, and we believe our available working capital is sufficient to cover current expenses and presently anticipated capital expenditures.

Cash Flow Analysis

Cash Flows from Operating Activities

The Company’s cash flows from operating activities are calculated by adjusting net income to reflect other significant operating sources and uses of cash, certain significant non-cash items such as share-based compensation, and timing differences in the cash settlement of operating assets and liabilities.

For the years ended December 31, 2015, 2014, and 2013, net cash provided by operating activities totaled $52.0 million, $42.6 million, and $34.6 million, respectively. The changes in net cash provided by operating activities generally reflects net income plus the effect of non-cash items and the timing differences in the cash settlement of assets and liabilities.

Cash Flows from Investing Activities

The Company’s cash flows from investing activities consist primarily of capital expenditures and purchases and redemptions in our investment portfolio.