Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Magyar Bancorp, Inc. | form8k-15242_mgyr.htm |

2016 Annual Shareholders Meeting 1 February 24, 2016

Forward Looking Statements This presentation contains statements about future events that constitute forward - looking statements within the meaning of the Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward - looking statements may be identified by reference to a future period or periods, or by the use of forward - looking terminology, such as “may,” “will,” “believe,” “expect,” or similar terms or variations on those terms, or the negative of those terms. Forward - looking statements are subject to numerous risks and uncertainties, including, but not limited to, those risk - factors previously disclosed in the Company’s filings with the SEC, general economic conditions, changes in interest rates, regulatory considerations, competition, technological developments, retention and recruitment of qualified personnel, and market acceptance of the Company’s pricing, products and services, and with respect to the loans extended by the Bank and real estate owned, the following: risks related to the economic environment in the market areas in which the Bank operates, particularly with respect to the real estate market in New Jersey; the risk that the value of the real estate securing these loans may decline in value; and the risk that significant expense may be incurred by the Company in connection with the resolution of these loans. The Company wishes to caution readers not to place undue reliance on any such forward - looking statements, which speak only as of the date made. The Company does not undertake and specifically declines any obligation to publicly release the result of any revisions that may be made to any forward - looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. 2

Company Overview

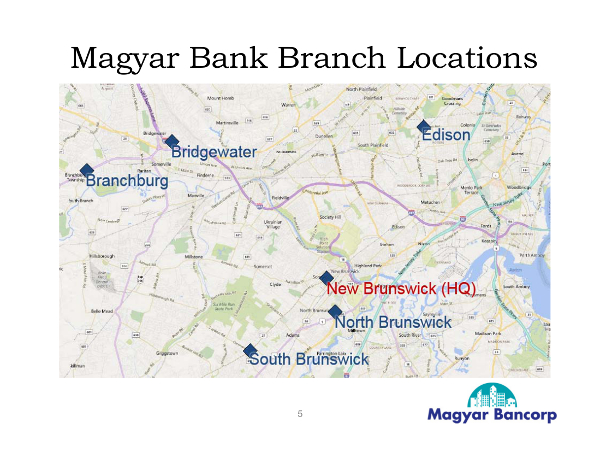

Magyar Bancorp, Inc. Overview ▪ Magyar Bank, a New Jersey chartered savings bank originally founded in 1922, is the wholly owned subsidiary of Magyar Bancorp, Inc. ▪ Magyar Bancorp, Inc., trades on NASDAQ under the symbol MGYR. Currently 45.0% is owned by public shareholders. The balance of the shares outstanding are owned by Magyar Bancorp, MHC. ▪ As of September 30, 2015, we had $550 million in total assets, $420 million in net loans, $466 million in deposits and $46 million in stockholders’ equity. ▪ Magyar Bank conducts its business from its main office in New Brunswick and five additional branch offices located in North Brunswick, South Brunswick, Branchburg, Bridgewater, and North Edison, New Jersey. 4

5 Magyar Bank Branch Locations

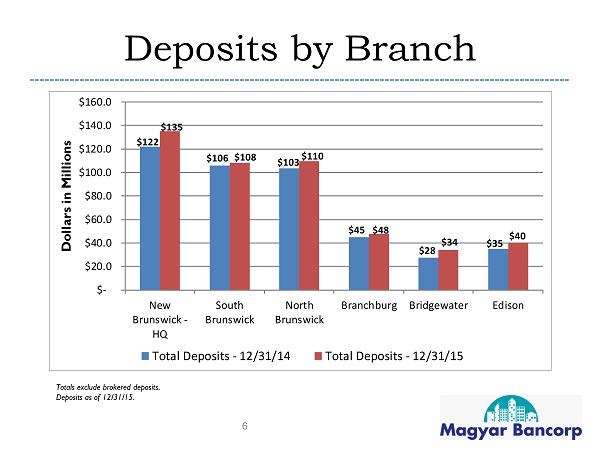

Deposits by Branch $122 $106 $103 $45 $28 $35 $135 $108 $110 $48 $34 $40 $- $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 $160.0 New Brunswick - HQ South Brunswick North Brunswick Branchburg Bridgewater Edison Dollars in Millions Total Deposits - 12/31/14 Total Deposits - 12/31/15 6 Totals exclude brokered deposits . Deposits as of 12/31/15.

2015 Review ▪ Net Income for FY15 increased 56% over FY14 ▪ Non - performing loans declined 40% during FY15 ▪ Non - performing assets declined 19% ▪ Sold twenty OREO properties with a carrying value of $6.4 million ▪ Year End Net Interest Margin held steady at 3.35% in 2015 despite historically low interest rates 7

2015 Review ▪ Checking deposits as a percentage of total deposits on 9/30/15 were 27.8% ▪ Successful launch of upgraded Web site and Online Banking service with new features including Popmoney and Account to Account transfer ▪ Debit Card incentive campaigns implemented in 2015 increased usage by 14% ▪ MGYR stock price up 15% during Fiscal Year 2015 8

Financial Highlights 9

Asset Trend $524.0 $508.8 $537.7 $530.4 $550.6 $571.5 $470.0 $480.0 $490.0 $500.0 $510.0 $520.0 $530.0 $540.0 $550.0 $560.0 $570.0 $580.0 Dollars in Millions Total Assets 10

Loan Composition $- $50.0 $100.0 $150.0 $200.0 $250.0 $300.0 $350.0 $400.0 $450.0 9/30/11 9/30/12 9/30/13 9/30/14 9/30/15 12/31/15 Dollars in Millions 1-4 Family Residential Commercial Real Estate Construction Commercial/Business HELOC Other 11 $406.8 $419.3 $384.9 $388.9 $399.6 $423.3

Non - Performing Loans $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 9/30/11 9/30/12 9/30/13 9/30/14 9/30/15 12/31/15 Dollars in Thousands Other HELOC 1-4 Family Residential Commercial/Business Commercial RE Construction $6,600 $5,900 $28,160 $20,074 $15,656 $9,785 12

Other Real Estate Owned $16,595 $13,381 $14,756 $17,342 $16,192 $15,680 $- $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 $16,000 $18,000 $20,000 9/30/11 9/30/12 9/30/13 9/30/14 9/30/15 12/31/15 Dollars in Thousands 13

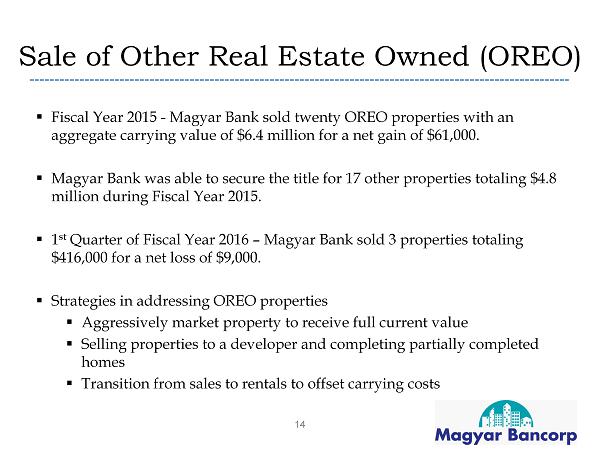

Sale of Other Real Estate Owned (OREO) ▪ Fiscal Year 2015 - Magyar Bank sold twenty OREO properties with an aggregate carrying value of $6.4 million for a net gain of $61,000. ▪ Magyar Bank was able to secure the title for 17 other properties totaling $ 4.8 million during Fiscal Year 2015. ▪ 1 st Quarter of Fiscal Year 2016 – Magyar Bank sold 3 properties totaling $416,000 for a net loss of $9,000. ▪ Strategies in addressing OREO properties ▪ Aggressively market property to receive full current value ▪ Selling properties to a developer and completing partially completed homes ▪ Transition from sales to rentals to offset carrying costs 14

Non - Performing Assets/Assets 5.37% 3.95% 2.91% 2.41% 1.84% 1.16% 3.17% 2.62% 2.74% 2.70% 3.27% 2.74% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% 9/30/11 9/30/12 9/30/13 9/30/14 9/30/15 12/31/15 Non-Performing Loans OREO 15 5.11% 3.90% 8.54% 6.57% 5.65% 4.01%

Deposit Composition $- $50.0 $100.0 $150.0 $200.0 $250.0 $300.0 $350.0 $400.0 $450.0 $500.0 9/30/11 9/30/12 9/30/13 9/30/14 9/30/15 12/31/15 Dollars in Millions CDs (inc. IRA) Savings Accounts Money Market Accounts Checking $466.3 $487.1 $424.9 $416.6 $453.3 $448.5 16

Checking Deposit Growth $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 $140,000 $160,000 9/30/11 9/30/12 9/30/13 9/30/14 9/30/15 12/31/15 Dollars in Thousands Non-Interest Checking Interest Checking 17 $82,161 $134,621

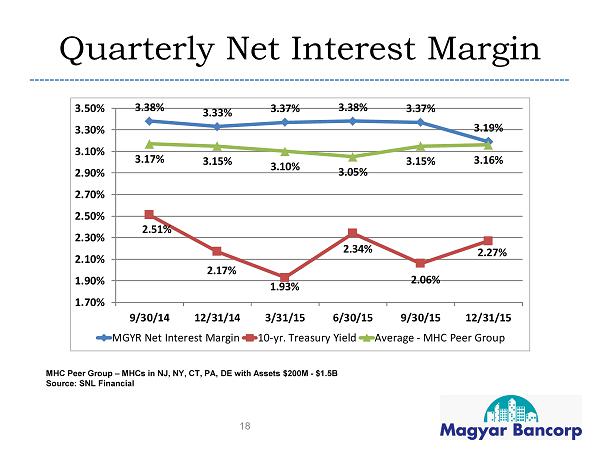

Quarterly Net Interest Margin 3.38% 3.33% 3.37% 3.38% 3.37% 3.19% 2.51% 2.17% 1.93% 2.34% 2.06% 2.27% 3.17% 3.15% 3.10% 3.05% 3.15% 3.16% 1.70% 1.90% 2.10% 2.30% 2.50% 2.70% 2.90% 3.10% 3.30% 3.50% 9/30/14 12/31/14 3/31/15 6/30/15 9/30/15 12/31/15 MGYR Net Interest Margin 10-yr. Treasury Yield Average - MHC Peer Group 18 MHC Peer Group – MHCs in NJ, NY, CT, PA, DE with Assets $200M - $1.5B Source: SNL Financial

Pre - Tax Quarterly Net Income $272 $256 $199 $364 $493 $502 $- $100 $200 $300 $400 $500 $600 9/30/14 12/31/14 3/31/15 6/30/15 9/30/15 12/31/15 Dollars in Thousands 19

Stockholders Equity 20 MGYR Remains Well - Capitalized $45.0 $46.9 $44.0 $44.5 $45.0 $45.5 $46.0 $46.5 $47.0 $47.5 9/30/12 9/30/13 9/30/14 9/30/15 12/31/15 (Dollars in Millions) Total Equity $7.75 $8.05 $7.60 $7.65 $7.70 $7.75 $7.80 $7.85 $7.90 $7.95 $8.00 $8.05 $8.10 9/30/12 9/30/13 9/30/14 9/30/15 12/31/15 Book Value Per Share

Stock Price Performance 21

MGYR Stock Performance – 1 Year (5.00) 0.00 5.00 10.00 15.00 20.00 25.00 30.00 35.00 Percentage Change MGYR (18.34%) SNL U.S. Thrift (1.61%) SNL Thrift MHCs (16.43%) MGYR Stock Price 2/17/2015 - $8.45 2/17/2016 - $10.00 22

MGYR Stock Performance – 3 Year (20.00) 0.00 20.00 40.00 60.00 80.00 100.00 120.00 140.00 Percentage Change MGYR (100.00%) SNL U.S. Thrift (26.58%) SNL Thrift MHCs (63.45%) MGYR Stock Price 2/15/2013 - $5.00 2/17/2016 - $10.00 23

Fiscal Year 2016 Outlook 24

Fiscal Year 2016 Outlook • Focus on residential and commercial lending • Manage interest rate risk in an increasing rate environment • Deposit Strategy – focus remains on relationship banking and our community banking strategy • Continued focus on non - interest expenses 25

Fiscal Year 2016 Outlook • Continued reduction in non - performing assets • These strategies will result in continued income growth and enhanced shareholder value • Regulatory Impact 26

Questions? 27