Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CAFEPRESS INC. | a8-kx2016xcantorfitzgerald.htm |

All content copyright © CafePress. All rights reserved. 1

2 This document contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. The Private Securities Litigation Reform Act of 1995 (the “Act”) provides certain “safe harbor” provisions for forward-looking statements. All forward-looking statements are made pursuant to the Act. The reader is cautioned that such forward-looking statements are based on information available at the time and/or management’s good faith belief with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements. Forward-looking statements speak only as of the date the statement was made. We assume no obligation to update forward-looking information to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information. Forward-looking statements are typically identified by the use of terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “predict,” “project,” “seek,” “should,” “will,” and similar words, although some forward-looking statements are expressed differently. Important factors that could cause actual results to differ materially from expectations include, among others, the following: the effect of global economic conditions, including any disruptions in the credit markets; a decrease in consumers’ discretionary income; additional taxes and fees; our ability to integrate any businesses we acquire into our existing operations, including our ability to maintain revenues at anticipated levels and achieve anticipated cost savings; the effect of claims of third parties to intellectual property rights; the unauthorized disclosure of our source code; the loss of key personnel; the effect (including possible increases in the cost of doing business) resulting from catastrophic events, including future war and terrorist activities or political uncertainties, or the impact of natural or other disasters on our operations and our ability to obtain insurance recoveries in respect of such losses (including losses related to business interruption); the impact of work stoppages and other labor problems on current and future operations; our ability to comply with governmental regulation and/or other legal obligations related to the privacy of personal information and other data, including the improper disclosure thereof; the impact of system failures or damage from natural disasters, power loss, telecommunications failures, cyber-attacks, or other unforeseen events; the impact of security breaches, computer viruses and hacking attacks on our business and operations; our ability to respond to rapid technological changes in a timely manner; our ability to prevent payment related risks, such as fraudulent use of credit or debit cards; our ability to comply with the Foreign Corrupt Practices Act; our ability to maintain customer confidence in the integrity of our business; our ability to operate www.cafepress.com in an evolving and highly competitive market segment; our ability to secure new or ongoing content from third party partners; our ability to provide a high-quality customer experience with minimal programming errors, flows and/or technical difficulties; our ability to adequately protect our intellectual property; and, our ability to maintain or hire additional personnel. For more information regarding the risks and uncertainties that could cause actual results to differ materially from those expressed or implied herein, we refer you to the "Risk Factors" sections of the Company's quarterly and annual reports on Form 10-Q and Form 10-K as filed with the Securities and Exchange Commission, and in other reports we file with the Securities and Exchange Commission from time to time, which are available on the Securities and Exchange Commission’s Website at www.sec.gov. Safe Harbor Language All content copyright © CafePress. All rights reserved.

All content copyright © CafePress. All rights reserved. 3 Agenda • Who We Are • Opportunity • Customers • Go to Market Strategy • 2015 Focus and Financial Highlights • 2016 Vision and Beyond • Team

All content copyright © CafePress. All rights reserved. 4 Who We Are Our purpose is to help you express yourself and connect with others by bringing passions to life through unique items. Our promise is to help you discover the perfect item for every passion. Our vision is to be the leading retailer of unique items that bring your passions to life, connecting you to others.

5 Our Opportunity: Market Size • $350 Billion Online TV and Catalog - $15-$20 Billion US Gifts, Novelty and Personalization - $4.3B US Market Non-Photo Personalized Gifts - Up to 11% 5 Year CAGR Dependent on Economy • Market is Shifting Online - US Retail Growing at 15% YOY in 2015 A Lifetime of Moments: CafePress is ready to capitalize on those unique moments in time All content copyright © CafePress. All rights reserved.

All content copyright © CafePress. All rights reserved. 6 Our Opportunity Unparalleled selection can't be met via traditional offline retail. 1B+ Community Designed Products World Class Licenses Personalization and Customization The Perfect Item for Every Passion + + =

All content copyright © CafePress. All rights reserved. 7 Our Customers Predominantly Women 35-64 years old Up-to-date on News and Trends Suburban Enjoys Shopping Higher Income Consider Themselves Creative Customers come to CafePress.com to: • Purchase pre-designed merchandise from over 1 billion products • Customize/personalize merchandise • Create designs to share their passions.

8 Go to Market Strategy 1 Million+ Content Providers CafePress.com Content 35 Million+ Images Licensed Content Create Your Own 400+ Base Goods Personalized Template 1 Billion+ SKUs illi + te t r vi ers Retail Partner Channels Content Limited Licensed Properties Popular CafePress Designs Limited Base Goods Limited Personalized Templates >1M CafePress Branded SKUs All content copyright © CafePress. All rights reserved.

9 2015 Focus – Stabilize Key Metrics $1.7 -$6.4 $3.9 7% 4% 5% 0% 1% 2% 3% 4% 5% 6% 7% 8% -$8 -$6 -$4 -$2 $0 $2 $4 $6 $8 $10 $12 FY'13 FY'14 FY'15 Adj. EBITDA* and Capex Trends EBITDA $ M Capex $ M Capex % of revenue $38.2 $35.7 $27.0 $50.3 $20 $25 $30 $35 $40 $45 $50 $55 FY'12 FY'13 FY'14 FY'15 Cash and Investments Cash and Investments $ M Cash Stabilize the balance sheet by divesting and focusing on cash management Adjusted EBITDA* and Capex Stabilize the operation. Focus on returning to positive EBITDA in 2015 Capex for projects that met future needs only Unaudited *Adjusted EBITDA is a non-GAAP financial measure which we define as net income (loss) from continuing operations less interest and other income (expense), provision for (benefit from) income taxes, depreciation and amortization, stock-based compensation, acquisition-related costs, impairment charges, and restructuring costs. All content copyright © CafePress. All rights reserved.

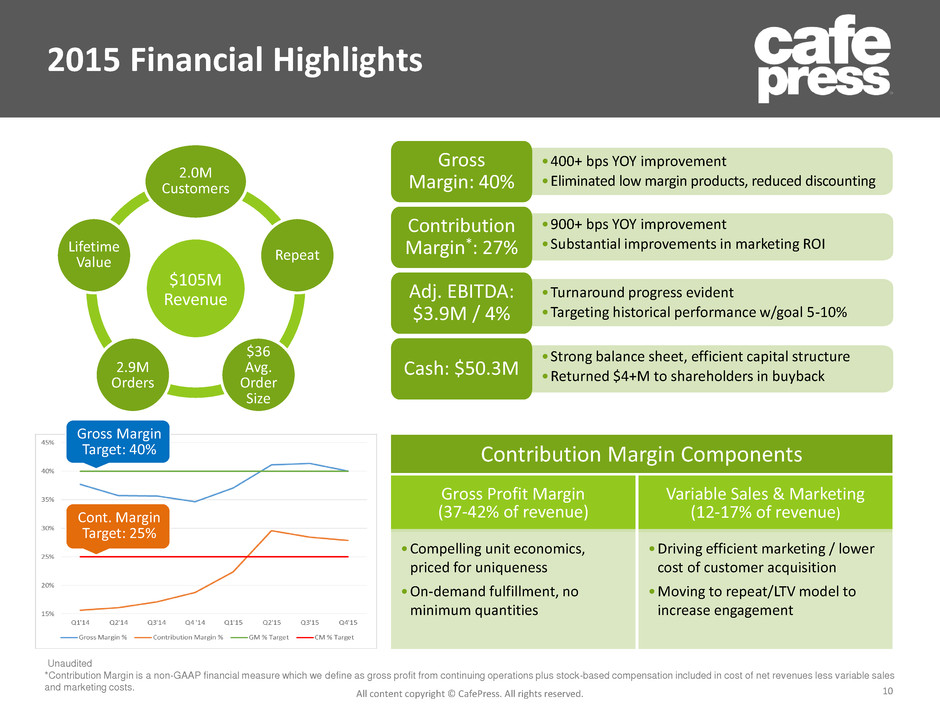

10 2015 Financial Highlights $105M Revenue 2.0M Customers Repeat $36 Avg. Order Size 2.9M Orders Lifetime Value •400+ bps YOY improvement •Eliminated low margin products, reduced discounting Gross Margin: 40% •900+ bps YOY improvement •Substantial improvements in marketing ROI Contribution Margin*: 27% •Turnaround progress evident •Targeting historical performance w/goal 5-10% Adj. EBITDA: $3.9M / 4% •Strong balance sheet, efficient capital structure •Returned $4+M to shareholders in buyback Cash: $50.3M Gross Margin Target: 40% Cont. Margin Target: 25% Gross Profit Margin (37-42% of revenue) •Compelling unit economics, priced for uniqueness •On-demand fulfillment, no minimum quantities Variable Sales & Marketing (12-17% of revenue) •Driving efficient marketing / lower cost of customer acquisition •Moving to repeat/LTV model to increase engagement Contribution Margin Components Unaudited *Contribution Margin is a non-GAAP financial measure which we define as gross profit from continuing operations plus stock-based compensation included in cost of net revenues less variable sales and marketing costs. All content copyright © CafePress. All rights reserved.

All content copyright © CafePress. All rights reserved. 11 Vision 2016 & Beyond • Divestitures and Margin Stabilization are Behind Us - Divested non-core assets/ Strengthened balance sheet - Drove contribution margin and Adjusted EBITDA • Focus Areas for 2016 - Transition from marketplace to focused e-commerce store - Maintain strong contribution margin - Move from transactions to customer relationships - Leverage CRM to drive repeat customers - Rebrand the company, including refreshing the customer experience - Invest prudently / prepare for return to growth - Maintain healthy balance sheet • Vision - Be the leading retailer of unique items that bring your passions to life, connecting you to others - Deliver profitable growth and strong shareholder returns

12 Leadership/Board Fred Durham Co-Founder & CEO Chairman of the Board Technology-focused with attention to strategy and operations Northwestern Univ., BA Executive Management Team Co-Founder led, experienced and disciplined management team Board of Directors Brad W. Buss Chairman, Audit Committee Board Member since 2007 Former CFO, SolarCity Corporation Former EVP and CFO, Cypress Semiconductor Corp. Director, Tesla Motors Patrick J. Connolly Lead Independent Director since 2015 Board Member since 2007 Chairman, Compensation & Governance Committees EVP, CSO, and Director of Williams-Sonoma (35 year tenure) Anthony C. Allen VP and CFO, Sypris Solutions Board Member since 2015 Nick Swinmurn • Founder, Zappos.com • Board Member since 2015 Fred E. Durham, III Co-Founder, Chairman & CEO, CafePress Kenneth T. McBride Chairman & CEO, Stamps.com Board Member since 2015 Ekumene Lysonge VP, General Counsel Experience in highly regulated industries Formerly with Churchill Downs, Inc. Vanderbilt Univ., JD Maheesh Jain Co-Founder & CMO Marketing-focused with extensive background in mobile, social, and product development Northwestern Univ., BA Tracey Meyer VP, Engineering Technology infrastructure, IT and project management experience Indiana Univ., BS Garett Jackson CFO & CIO Significant audit, tax, and IT consulting background CFO since 2014 Bellarmine Univ., BA Mary Shelley VP, Human Capital Multi-industry talent acquisition and development experience Purdue Univ., BA All content copyright © CafePress. All rights reserved.