Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Blue Capital Reinsurance Holdings Ltd. | d134823d8k.htm |

Blue Capital Reinsurance Holdings Ltd. (NYSE: BCRH) Investor Update Q4 2015 Blue Capital Management Ltd. is licensed to conduct investment business by the Bermuda Monetary Authority Blue Capital is a registered trademark Exhibit 99.1

Safe Harbor Statement Some of the statements in this presentation may include, and Blue Capital Reinsurance Holdings Ltd. (the “Company”) and the Company’s manager, Blue Capital Management Ltd. (“Blue Capital”) may make related oral forward-looking statements which reflect our current views with respect to future events and financial performance. Such statements may include forward-looking statements both with respect to us in general and the insurance and reinsurance sectors specifically, both as to underwriting and investment matters. Statements that include the words "should," “would,” "expect," "estimates", "intend," "plan," "believe," "project," “target,” "anticipate," "seek," "will," “deliver,” and similar statements of a future or forward-looking nature identify forward-looking statements in this press release for purposes of the U.S. federal securities laws or otherwise. We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in the Private Securities Litigation Reform Act of 1995. All forward-looking statements address matters that involve risks and uncertainties. Accordingly, there are or may be important factors that could cause actual results to differ materially from those indicated in the forward-looking statements. These factors include, but are not limited to, the effects of competitors’ pricing policies, greater frequency or severity of claims and loss activity, changes in market conditions, decreased demand for property and casualty reinsurance, changes in the availability, cost or quality of reinsurance or retrocessional coverage, our inability to renew business previously underwritten or acquired, uncertainties in our reserving process, changes to our tax status, reduced acceptance of our existing or new products and services, a loss of business from and credit risk related to our broker counterparties, assessments for high risk or otherwise uninsured individuals, possible terrorism or the outbreak of war, a loss of key personnel, political conditions, changes in insurance regulation, operational risk, including the risk of fraud and errors and omissions, as well as technology breaches or failure, changes in accounting policies, our investment performance, the valuation of our invested assets, a breach of our investment guidelines, potential treatment of us as an investment company or a passive foreign investment company for purposes of U.S. securities laws or U.S. federal taxation, respectively, our dependence as a holding company upon dividends or distributions from our operating subsidiaries, the unavailability of capital in the future, developments in the world’s financial and capital markets and our access to such markets, government intervention in the insurance and reinsurance industry, illiquidity in the credit markets, changes in general economic conditions and other factors described in our Annual Report on Form 10-K for the year ended December 31, 2014. The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included herein and elsewhere, including the risk factors included in the Company’s most recent report on Form 10-K and other documents on file with the Securities and Exchange Commission. Any forward-looking statements made in this material are qualified by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by the Company will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, the Company or its business or operations. Except as required by law, the Company undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. Regulation G Disclaimer In this presentation, management has included and discussed certain non-GAAP measures. Management believes that these non-GAAP measures, which may be defined differently by other companies, better explain the Company's results of operations in a manner that allows for a more complete understanding of the underlying trends in the Company's business. However, these measures should not be viewed as a substitute for those determined in accordance with GAAP. Return on Equity (ROE) is comprised using the average common equity calculated as the arithmetic average of the beginning and ending common equity balances by quarter for stated periods. The Company presents various measures of Return on Equity that are commonly recognized as a standard of performance by investors, analysts, rating agencies and other users of its financial information.

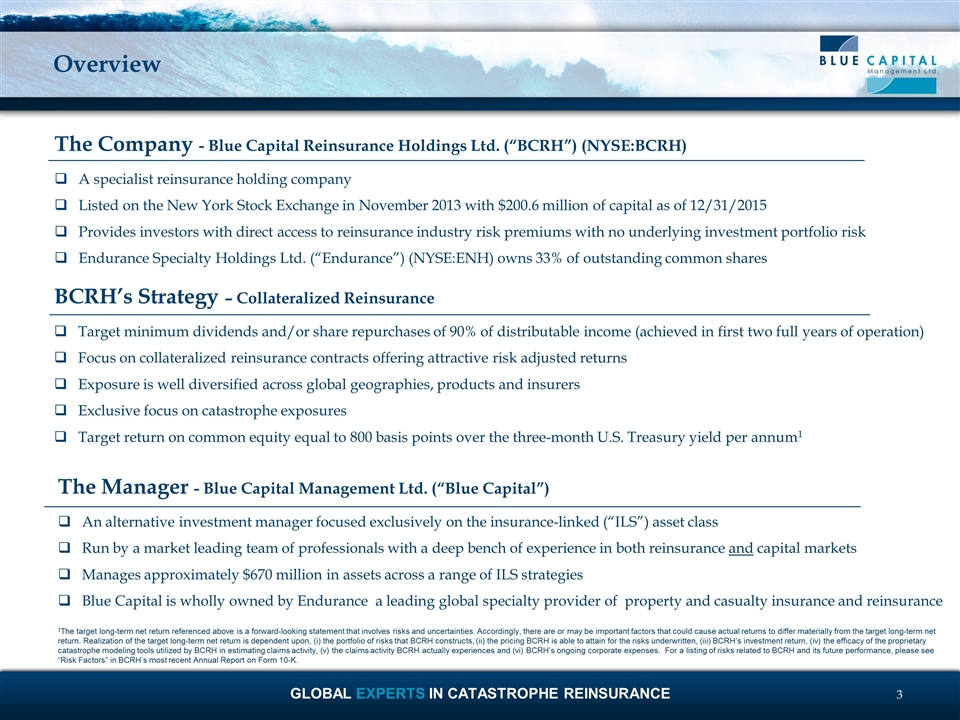

Overview The Manager - Blue Capital Management Ltd. (“Blue Capital”) An alternative investment manager focused exclusively on the insurance-linked (“ILS”) asset class Run by a market leading team of professionals with a deep bench of experience in both reinsurance and capital markets Manages approximately $670 million in assets across a range of ILS strategies Blue Capital is wholly owned by Endurance a leading global specialty provider of property and casualty insurance and reinsurance 1The target long-term net return referenced above is a forward-looking statement that involves risks and uncertainties. Accordingly, there are or may be important factors that could cause actual returns to differ materially from the target long-term net return. Realization of the target long-term net return is dependent upon, (i) the portfolio of risks that BCRH constructs, (ii) the pricing BCRH is able to attain for the risks underwritten, (iii) BCRH’s investment return, (iv) the efficacy of the proprietary catastrophe modeling tools utilized by BCRH in estimating claims activity, (v) the claims activity BCRH actually experiences and (vi) BCRH’s ongoing corporate expenses. For a listing of risks related to BCRH and its future performance, please see “Risk Factors” in BCRH’s most recent Annual Report on Form 10-K. BCRH’s Strategy – Collateralized Reinsurance Target minimum dividends and/or share repurchases of 90% of distributable income (achieved in first two full years of operation) Focus on collateralized reinsurance contracts offering attractive risk adjusted returns Exposure is well diversified across global geographies, products and insurers Exclusive focus on catastrophe exposures Target return on common equity equal to 800 basis points over the three-month U.S. Treasury yield per annum1 The Company - Blue Capital Reinsurance Holdings Ltd. (“BCRH”) (NYSE:BCRH) A specialist reinsurance holding company Listed on the New York Stock Exchange in November 2013 with $200.6 million of capital as of 12/31/2015 Provides investors with direct access to reinsurance industry risk premiums with no underlying investment portfolio risk Endurance Specialty Holdings Ltd. (“Endurance”) (NYSE:ENH) owns 33% of outstanding common shares

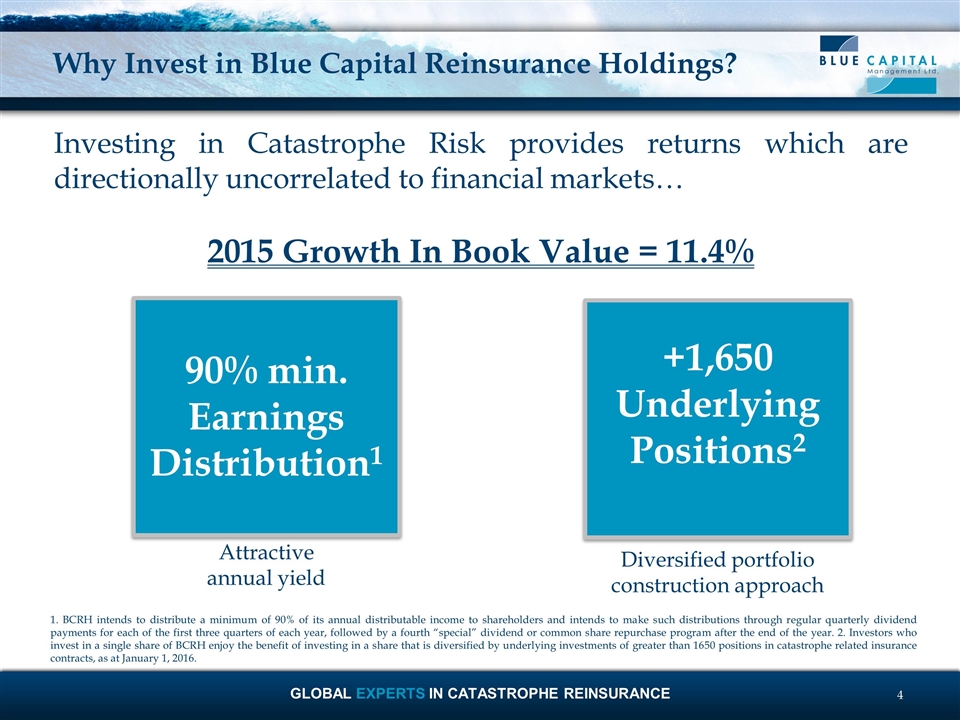

Why Invest in Blue Capital Reinsurance Holdings? 90% min. Earnings Distribution1 +1,650 Underlying Positions2 Investing in Catastrophe Risk provides returns which are directionally uncorrelated to financial markets… 2015 Growth In Book Value = 11.4% 1. BCRH intends to distribute a minimum of 90% of its annual distributable income to shareholders and intends to make such distributions through regular quarterly dividend payments for each of the first three quarters of each year, followed by a fourth “special” dividend or common share repurchase program after the end of the year. 2. Investors who invest in a single share of BCRH enjoy the benefit of investing in a share that is diversified by underlying investments of greater than 1650 positions in catastrophe related insurance contracts, as at January 1, 2016. Attractive annual yield Diversified portfolio construction approach

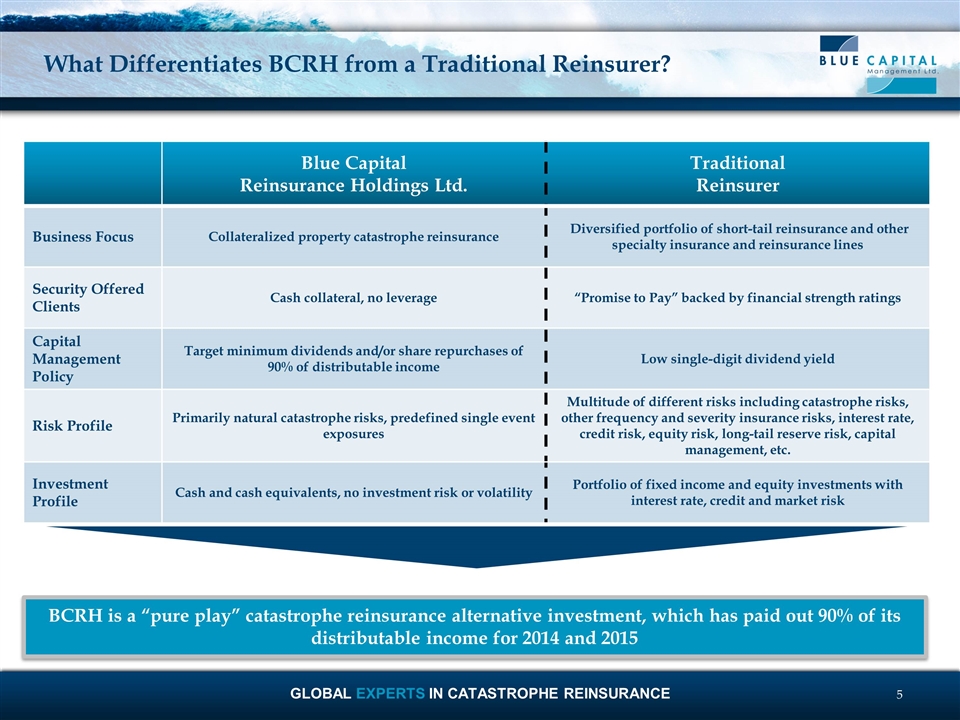

What Differentiates BCRH from a Traditional Reinsurer? Blue Capital Reinsurance Holdings Ltd. Traditional Reinsurer Business Focus Collateralized property catastrophe reinsurance Diversified portfolio of short-tail reinsurance and other specialty insurance and reinsurance lines Security Offered Clients Cash collateral, no leverage “Promise to Pay” backed by financial strength ratings Capital Management Policy Target minimum dividends and/or share repurchases of 90% of distributable income Low single-digit dividend yield Risk Profile Primarily natural catastrophe risks, predefined single event exposures Multitude of different risks including catastrophe risks, other frequency and severity insurance risks, interest rate, credit risk, equity risk, long-tail reserve risk, capital management, etc. Investment Profile Cash and cash equivalents, no investment risk or volatility Portfolio of fixed income and equity investments with interest rate, credit and market risk BCRH is a “pure play” catastrophe reinsurance alternative investment, which has paid out 90% of its distributable income for 2014 and 2015

Execution of a Successful Strategy Preferred access to catastrophe market opportunities Returns are generated from the construction of a portfolio of investments in catastrophic reinsurance contracts Low underlying asset risk Invested collateral is held in Bank of New York Mellon trusts account in cash or 3 Month T-Bills Disciplined approach to portfolio execution by seasoned team equipped with analytics and optimized pricing metrics Risk management provided by our proprietary pricing and portfolio management system Endurance ownership of the Manager Allows broad access through a global network of operations headquartered in Bermuda and leverages Endurance’s staffing and global catastrophe book of business Blue Capital is well placed to manage the cycle with strong brand recognition, a successful multiyear track record and its strategic relationship with Endurance

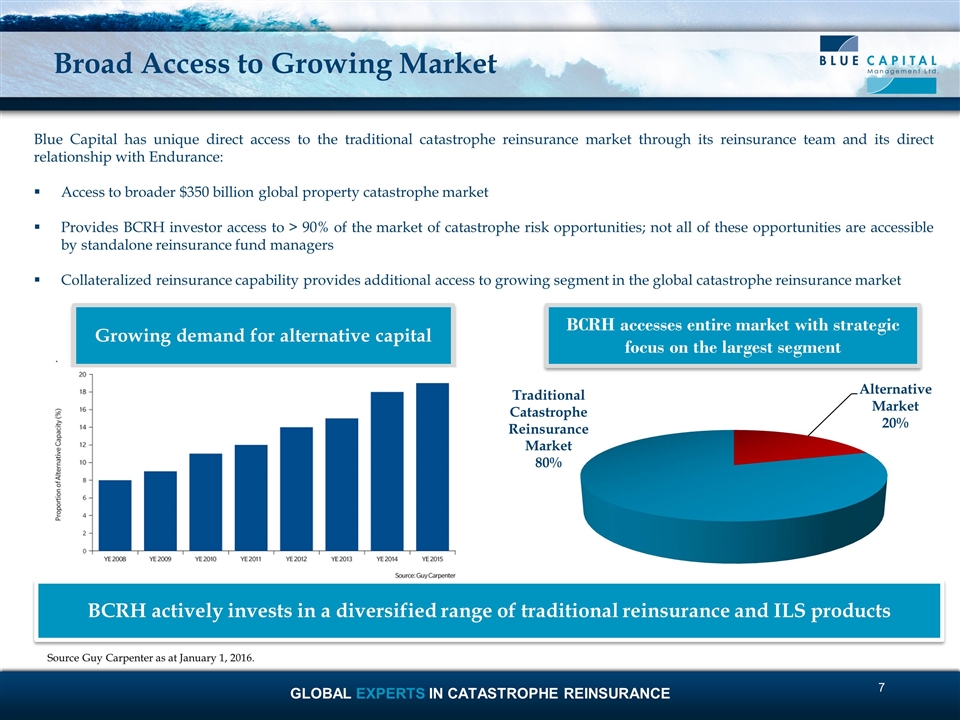

Blue Capital has unique direct access to the traditional catastrophe reinsurance market through its reinsurance team and its direct relationship with Endurance: Access to broader $350 billion global property catastrophe market Provides BCRH investor access to > 90% of the market of catastrophe risk opportunities; not all of these opportunities are accessible by standalone reinsurance fund managers Collateralized reinsurance capability provides additional access to growing segment in the global catastrophe reinsurance market . BCRH actively invests in a diversified range of traditional reinsurance and ILS products Broad Access to Growing Market Growing demand for alternative capital BCRH accesses entire market with strategic focus on the largest segment Source Guy Carpenter as at January 1, 2016.

Financial Highlights BCRH has generated very strong results in its first two full years of operations 11.4% Growth in Book Value Per Share inclusive of dividends paid in 2015 Benign catastrophe losses have contributed to strong earnings and book value growth Returned 90.4% of distributable income through regular and special dividends Financial Results 2014 2015 Production: Gross Premiums Written (in millions) $45 $38.6 Net Premiums Earned (in millions) $43.9 $38.299999999999997 Underwriting Results: Loss Ratio 0.39 6.9% Expense Ratio 0.28199999999999997 0.38400000000000001 Combined Ratio 0.67200000000000004 0.45300000000000001 Per Share Data: Earnings per Share $1.72 $2.36 Regular Dividends Declared $0.9 $0.9 Special Dividends Declared $0.66 $1.24 Total Dividends Declared $1.56 $2.14 Earnings Payout Ratio 0.90400000000000003 0.90400000000000003 Fully Converted Book Value Per Share $20.62 $21.41 Growth in Book Value Per Share, Including Dividends Paid 8.7% 0.114

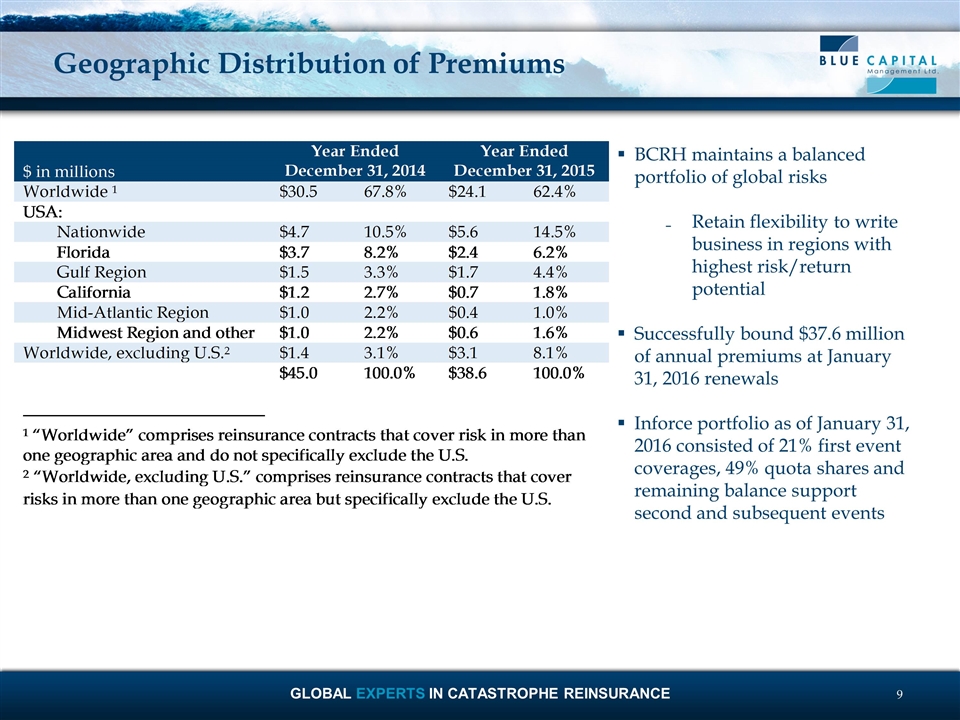

Geographic Distribution of Premiums BCRH maintains a balanced portfolio of global risks Retain flexibility to write business in regions with highest risk/return potential Successfully bound $37.6 million of annual premiums at January 31, 2016 renewals Inforce portfolio as of January 31, 2016 consisted of 21% first event coverages, 49% quota shares and remaining balance support second and subsequent events$ in millionsYear Ended December 31, 2014Year Ended December 31, 2015Worldwide $30.567.8%$24.162.4%USA: Nationwide$4.710.5%$5.614.5% Florida$3.78.2%$2.46.2% Gulf Region$1.53.3%$1.74.4% California$1.22.7%$0.71.8% Mid-Atlantic Region$1.02.2%$0.41.0% Midwest Region and other$1.02.2%$0.61.6%Worldwide, excluding U.S.$1.43.1%$3.18.1%$45.0100.0%$38.6100.0%

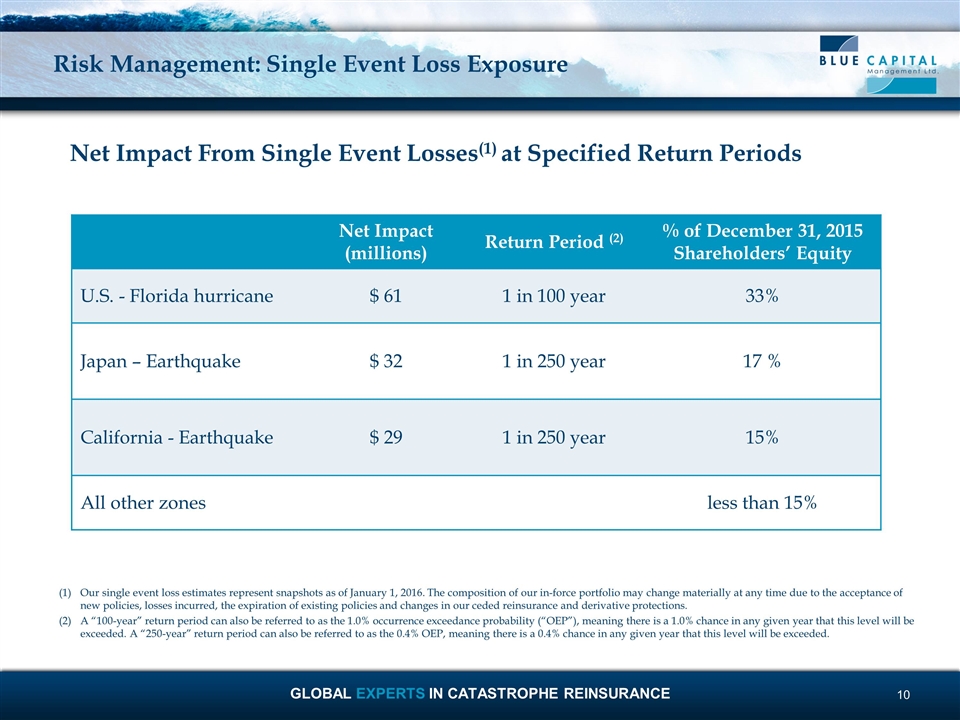

Risk Management: Single Event Loss Exposure Our single event loss estimates represent snapshots as of January 1, 2016. The composition of our in-force portfolio may change materially at any time due to the acceptance of new policies, losses incurred, the expiration of existing policies and changes in our ceded reinsurance and derivative protections. A “100-year” return period can also be referred to as the 1.0% occurrence exceedance probability (“OEP”), meaning there is a 1.0% chance in any given year that this level will be exceeded. A “250-year” return period can also be referred to as the 0.4% OEP, meaning there is a 0.4% chance in any given year that this level will be exceeded. Net Impact From Single Event Losses(1) at Specified Return Periods Net Impact (millions) Return Period (2) % of December 31, 2015 Shareholders’ Equity U.S. - Florida hurricane $ 61 1 in 100 year 33% Japan – Earthquake $ 32 1 in 250 year 17 % California - Earthquake $ 29 1 in 250 year 15% All other zones less than 15%

Conclusion Exposure to catastrophe reinsurance, directionally uncorrelated to financial markets Attractive return profile with negligible risk from financial assets Leverages Endurance, a market recognized leading global specialty insurer and reinsurer Provides access to greater than 90% of market of catastrophe risk opportunities Differentiated reinsurance risk selection & portfolio construction approach Close alignment of interest between Endurance, BCRH and shareholders

Appendix Blue Capital Management Ltd. is licensed to conduct investment business by the Bermuda Monetary Authority Blue Capital is a registered trademark

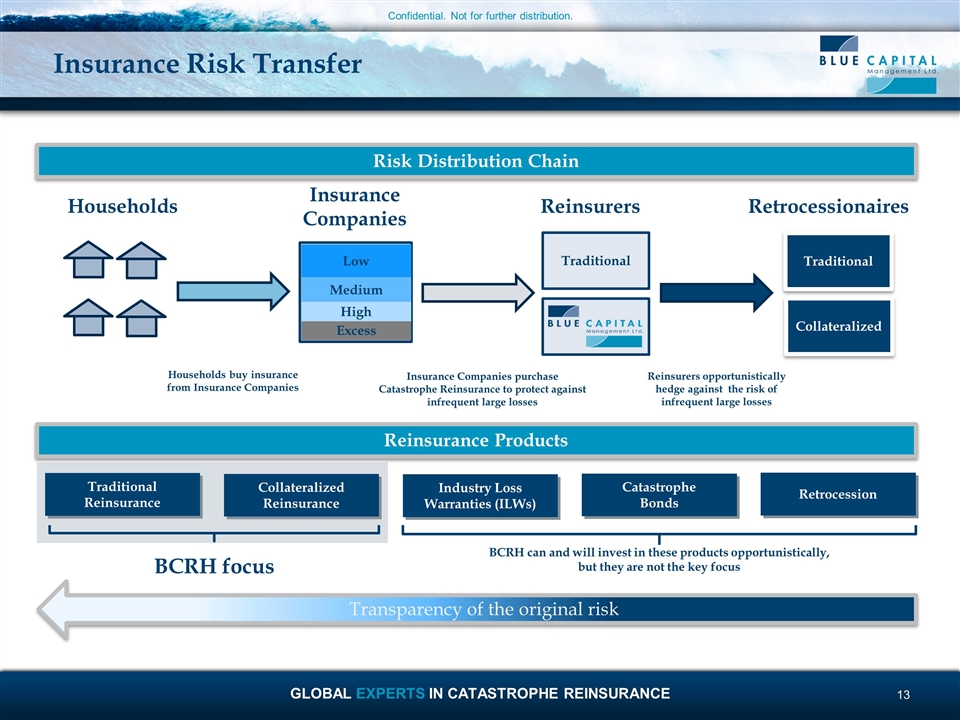

Insurance Risk Transfer Confidential. Not for further distribution. Liquidity Risk Distribution Chain Households buy insurance from Insurance Companies Reinsurers opportunistically hedge against the risk of infrequent large losses Traditional Insurance Companies purchase Catastrophe Reinsurance to protect against infrequent large losses Insurance Companies Reinsurers Retrocessionaires Traditional Collateralized Reinsurance Industry Loss Warranties (ILWs) Catastrophe Bonds BCRH focus Reinsurance Products Retrocession BCRH can and will invest in these products opportunistically, but they are not the key focus Households Traditional Reinsurance Transparency of the original risk Excess Low Medium High Collateralized

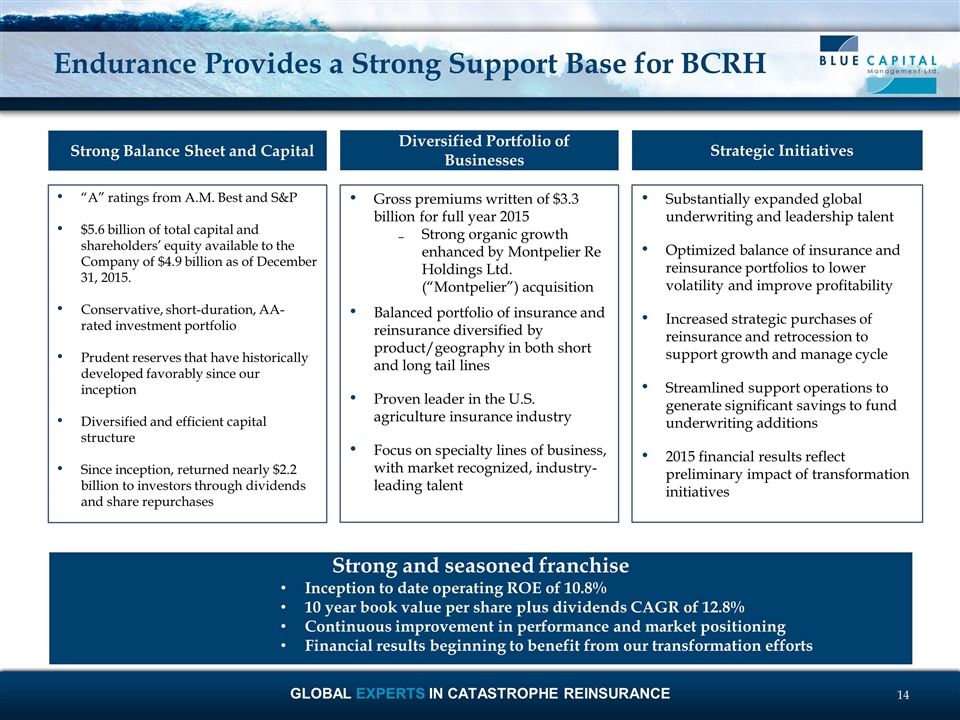

Endurance Provides a Strong Support Base for BCRH “A” ratings from A.M. Best and S&P $5.6 billion of total capital and shareholders’ equity available to the Company of $4.9 billion as of December 31, 2015. Conservative, short-duration, AA- rated investment portfolio Prudent reserves that have historically developed favorably since our inception Diversified and efficient capital structure Since inception, returned nearly $2.2 billion to investors through dividends and share repurchases Strategic Initiatives Substantially expanded global underwriting and leadership talent Optimized balance of insurance and reinsurance portfolios to lower volatility and improve profitability Increased strategic purchases of reinsurance and retrocession to support growth and manage cycle Streamlined support operations to generate significant savings to fund underwriting additions 2015 financial results reflect preliminary impact of transformation initiatives Diversified Portfolio of Businesses Gross premiums written of $3.3 billion for full year 2015 Strong organic growth enhanced by Montpelier Re Holdings Ltd. (“Montpelier”) acquisition Balanced portfolio of insurance and reinsurance diversified by product/geography in both short and long tail lines Proven leader in the U.S. agriculture insurance industry Focus on specialty lines of business, with market recognized, industry-leading talent Strong Balance Sheet and Capital Strong and seasoned franchise Inception to date operating ROE of 10.8% 10 year book value per share plus dividends CAGR of 12.8% Continuous improvement in performance and market positioning Financial results beginning to benefit from our transformation efforts

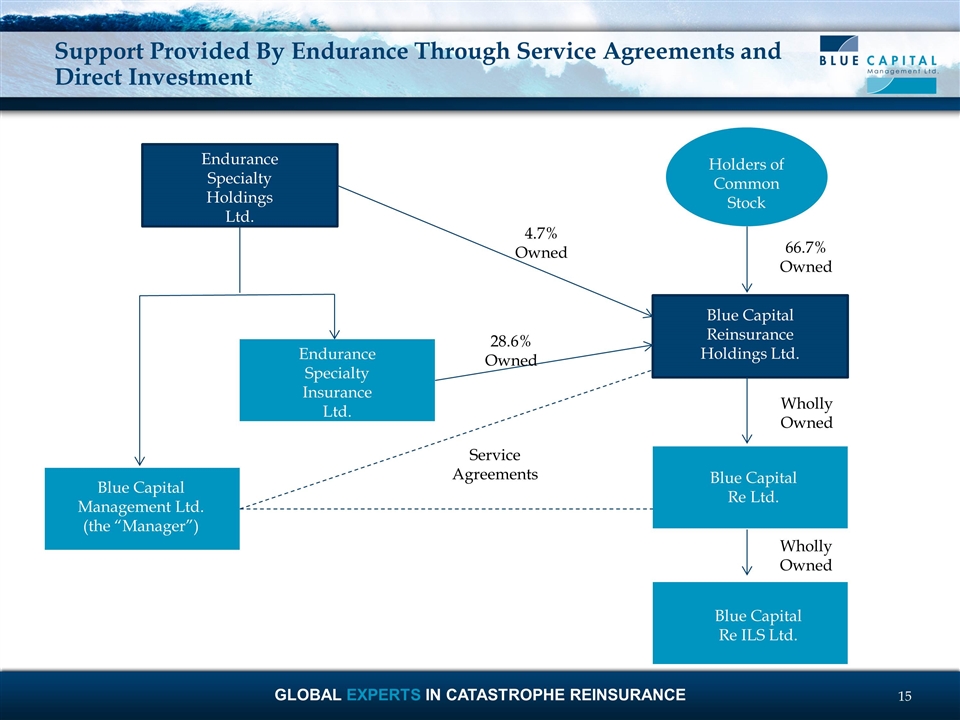

Support Provided By Endurance Through Service Agreements and Direct Investment 15 Holders of Common Stock Blue Capital Reinsurance Holdings Ltd. Blue Capital Re Ltd. Blue Capital Re ILS Ltd. Endurance Specialty Holdings Ltd. Endurance Specialty Insurance Ltd. Blue Capital Management Ltd. (the “Manager”) 4.7% Owned 28.6% Owned Service Agreements 66.7% Owned Wholly Owned Wholly Owned

CONTACT: Adam Szakmary President and CEO +1-441-278-0485 Adam.Szakmary@bluecapital.bm BLUE CAPITAL MANAGEMENT LTD. Waterloo House, 100 Pitts Bay Road PO Box HM2079, Hamilton, Bermuda, HM HX