Attached files

| file | filename |

|---|---|

| 8-K - 8-K - REGIONS FINANCIAL CORP | rf-20160223168xk.htm |

® ® Investor Presentation 1Q2016 Exhibit 99.1

® Our banking franchise Regions aims to be the premier regional financial institution in America Corporate Banking Business Capital Capital Markets Dealer Finance Equipment Finance Government/Institutional Specialized Industry Institutional Services Insurance Private Wealth • • • • • • • • • (1) As of 12/31/2015 Alabama – 235 Louisiana – 109 Arkansas – 97 Mississippi – 137 Florida – 352 Missouri – 65 Georgia – 131 North Carolina - 6 Illinois – 59 South Carolina – 30 Indiana – 61 Tennessee – 238 Iowa – 11 Texas – 80 Kentucky – 15 Virginia - 1 • Line of Business CoverageBranch Locations by State (1) 2

® Strength of markets – our 16 state footprint Of all US auto manufacturing is within our footprint(2) 30% Of all US auto manufacturing employment is in our footprint(2) 46% All new jobs created in the US since 2009 were in our footprint(1) 41% Of the total US GDP is within our footprint(4) 39% Non-durable goods manufacturing occurs in our footprint(4) 53% Of all US port trade tonnage(3) travels through ports in our footprint 62% (1) U.S. Congress, Joint Economic Committee (Ranking Democrat Carolyn B. Maloney), September 2015 (2) Includes Motor Vehicle Manufacturing (NAICS 3361), Body and Trailer Manufacturing (NAICS 3362), and Parts Manufacturing (NAICS 3363). Source: Center for Automotive Research, January 2015 (3) Based on the Top 100 U.S. Ports by trade tonnage. Source: U.S. Army Corps of Engineers, Waterborne Commerce Statistics Center (4) U.S. Department of Commerce, Bureau of Economic Analysis 3

® Strength of markets Core markets provide a sound deposit franchise Regions Branches Regions Insurance Group 79% 79% of total deposits are in these six states AL –MS – FL LA – TN – AR Ranked 3rd or better in 14 of our Top 25 MSAs TOP 3 Source: SNL Financial as of 6/30/2015 FDIC summary 4

® Strategic initiatives Strengthen financial performance 5 Effectively Deploy Capital Disciplined organic growth Return appropriate capital to shareholders Use strategic investments to leverage our infrastructure and enhance revenue diversification Disciplined Expense Management Generate positive operating leverage Continuously focus on efficiency and effectiveness Define, develop and execute Six Sigma initiatives Make prudent investments with appropriate returns Grow and Diversify Revenue Leverage SM to grow customers and households and deepen existing relationships Prudently grow non-interest income Balance growth across geographies and businesses

® Financial Overview 6 Funding costs 1. Adjusted to include the impact of leases reclassified to other-earning assets. Non-GAAP; see appendix for reconciliation. 2. During the fourth quarter of 2015, Regions corrected the accounting for certain leases which had previously been included in loans. The cumulative effect on pre-tax income lowered net interest income and other financing income $15 million and reduced the net interest margin by 5 basis points in the quarter. The company does not expect this adjustment to have a material impact to net interest income and other financing income or net interest margin in any future reporting period. Net interest income and other financing income and NIM ($ in millions) $77.2 $77.9 $79.2 $80.6 $81.6 4Q14 1Q15 2Q15 3Q15 4Q15 $837 $832 $839 $855 $856 3.17% 3.18% 3.16% 3.13% 3.08% 4Q14 1Q15 2Q15 3Q15 4Q15 Net Interest Income (FTE) Net Interest Margin $94.0 $95.8 $97.1 $97.2 $97.5 4Q14 1Q15 2Q15 3Q15 4Q15 29 bps 29 bps 25 bps 25 bps 26 bps 4Q14 1Q15 2Q15 3Q15 4Q15 Loan and lease balances (On an average basis - $ in billions) (1) Deposit balances (On an average basis - $ in billions) (2)

® Favorable asset sensitivity position Positioned to win in any rate environment 7 Loan Mix(1) (1) As of 12/31/2015 Naturally asset-sensitive balance sheet Primarily core deposit funded 59% of loans have variable rates Asset sensitive under a range of deposit stress scenarios Net interest income increases even in a flat rate environment, commensurate with loan growth Impact from instantaneous increase in interest rate of +100 bps would increase pretax income an estimated $140 million. 59% 41% Variable Fixed

® Grow and diversify revenue 8 34% 20% 19% 8% 5% 14% Service charges Wealth Management Income Card and ATM fees Mortgage Income Capital Markets Other $1.9B Non-Interest Income(1) Mix – 2015 (1) Adjusted non-GAAP; see appendix for reconciliation Summary of 2015 Non-Interest Income Initiatives Achieved growth in checking accounts and households Increased credit card penetration 160bps Expanded Capital Markets capabilities Expanded Treasury Management capabilities Acquired Insurance agencies Hired Financial Services Consultants to grow Wealth Management Income

® Source of sustainable franchise value Evidence that our investments are paying off 9 Non-Interest Income(1) Mix – 2015 2015 GreenSky® Fundation™ Streamline of CreditSM Financial Consultants Insurance lift-outs and acquisitions M&A Advisory Multifamily Debt Placements Affordable Housing Treasury Management Platform 2016-2018 Additional point-of- sale opportunities CMBS Origination Loan Sales & Trading Fixed Income Sales & Trading Multifamily Debt Placements Affordable Housing Treasury Management Platform Insurance acquisitions Growth Initiatives Up 4.1% YOY 73 104 149 162 255 254 334 364 360 397 695 662 $1,866 $1,943 2014 2015 Service charges Wealth Management Card and ATM fees Other Mortgage Income Capital Markets ($ in millions) (1) Adjusted non-GAAP; see appendix for reconciliation.

® Disciplined Expense Management 10 (1) Adjusted non-GAAP; see appendix for reconciliation 54% 10% 9% 4% 3% 3% 3% 14% Salaries and Benefits Occupancy FF&E Outside Services Professional & Legal FDIC Marketing Other Total Expense(1) Mix - 2015 ($ in millions) $3,532 $3,471 $3,432 $3,358 $3,454 2011 2012 2013 2014 2015 Full Year Expenses(1)

® 11 Committed to improve efficiencies Hiring restrictions for non-customer facing positions started Oct 2015 Streamlining and automating processes to reduce personnel needs Partially through staffing reductions and through attrition Evaluate staffing models, spans and layers throughout the Company Ensure incentives align to the execution of this plan Leverage technology to reduce dependency on labor 60-65% Operational Efficiencies Branch reconfiguration and continued consolidations: 100-150 branches Targeted reduction in total occupancy of 1 million square feet or ~10% 10 - 15% Branch and Real Estate Optimization Reduce third-party spend Curtail discretionary expenditures 25 - 30% Third-Party, Discretionary and Other 2016 35-45% Elimination of core expenses of $300 million over the next 3 years Represents ~9% of 2015 adjusted expense base

® Effectively deploy capital Strength of our capital position 12 9.6% 9.8% 9.8% 10.0% 10.2% 10.4% 10.5% 10.5% 10.7% 10.9% 11.0% 11.1% 12.2% Peer #12 Peer #11 Peer #10 Peer #9 Peer #8 Peer #7 Peer #6 Peer #5 Peer #4 Regions Peer #3 Peer #2 Peer #1 Source: SNL Financial Peers include: BBT, CMA, FHN, FITB, HBAN, KEY, MTB, PNC, SNV, STI, USB & ZION Basel III Common equity Tier 1 – 4Q15 Payout ratio 13% 23% 31% 31% 23% 62% 6% 44% 46% 93% 2012 2013 2014 2015 Dividends Share Repurchases

® (1) Excludes loans held for sale (2) Includes commercial and investor real estate loans only (3) The All Other category includes TDRs classified as held for sale for the following periods : $29MM in 4Q14, $19MM in 1Q15, $18MM in 2Q15, $14MM in 3Q15 and $8MM in 4Q15. $83 $54 $46 $60 $78 0.42% 0.28% 0.23% 0.30% 0.38% 4Q14 1Q15 2Q15 3Q15 4Q15 Net Charge-Offs Net Charge-Offs ratio 468 478 471 480 479 750 666 576 483 483 368 361 357 349 341 $1,586 $1,505 $1,404 $1,312 $1,303 4Q14 1Q15 2Q15 3Q15 4Q15 Residential First Mortgage All Other⁽³⁾ Home Equity $829 $800 $751 $789 $782 133% 137% 149% 141% 141% 4Q14 1Q15 2Q15 3Q15 4Q15 NPLs Coverage Ratio 1,493 1,727 1,787 1,838 1,937 1,206 1,097 1,163 1,416 1,434 $2,699 $2,824 $2,950 $3,254 $3,371 4Q14 1Q15 2Q15 3Q15 4Q15 Classified Loans Special Mention Asset quality 13 Net charge-offs and ratio ($ in millions) NPLs and coverage ratio(1) ($ in millions) Troubled debt restructurings ($ in millions) Criticized and classified loans(2) ($ in millions)

® Energy lending ⦁ Reserves at 6% of direct energy exposure. ⦁ Negligible amount of second lien loans within the energy portfolio ⦁ Leveraged loans account for approximately 10% of energy related balances; the majority are Midstream. ⦁ Expectations for energy related charge-offs for the remainder of 2016 are $50 - $75 million ⦁ Should oil prices average $25 per barrel over the next two years, Regions could experience additional charge-offs of approximately $100 million ⦁ During the fourth quarter, Regions corrected the accounting for certain operating leases which had previously been included in loans. The total impact to the energy portfolio is $162 million. ⦁ Securities portfolio contained ~$229MM of high quality, investment grade corporate bonds that are energy related at 12/31/15. Loan/Lease Balances Balances Including Related Commitments Criticized ($ in millions) As of 6/30/15 As of 9/30/15 As of 12/31/15 As of 12/31/15 As of 12/31/15 Oilfield services and supply $1,216 $1,095 $969 $1,565 $329 Exploration and production (Upstream) 958 960 910 1,748 433 Midstream 284 405 441 970 40 Downstream 67 71 71 394 — Other 176 174 142 317 21 Total direct exposure 2,701 2,705 2,533 4,994 823 Indirect loans 570 554 519 965 62 Direct and indirect exposure $3,271 $3,259 $3,052 $5,959 $885 Operating leases — — 162 162 15 Total energy loans / leases $3,271 $3,259 $3,214 $6,121 $900 Oil Field Services Detail Type As of 12/31/15 # of Clients* Commentary Marine $431 10 Shelf operators are under stress, but remain well collateralized. Deepwater operators remain stable. Integrated OFS 254 11 Diverse client base with access to liquidity and capital markets. However, additional downgrades are likely. Compression 133 4 Linked to movement of natural gas, sector is stable and lower risk. Fluid Management 51 3 Future downgrades are expected. Pre-drilling / Drilling 79 2 Clients are liquid with strong backlogs. Sand 21 2 Small number of outstandings. Total OFS $969 32 Outstanding Balances and Commitments *Represents the number of clients that make up 75% of the loan balances outstanding 14

® Commercial - Energy (Direct), $534 Commercial - Non-Energy, $2,369 Investor Real Estate, $254 Consumer Real Estate Secured, $1,092 Consumer Non- Real Estate Secured, $281 $4.5 B 15 Loan Balances by Select States Louisiana Commercial - Energy (Direct), $1,273 Commercial - Non-Energy, $4,499 Investor Real Estate, $1,475 Consumer Real Estate Secured, $827 Consumer Non- Real Estate Secured, $848 $8.9 B Texas Investor Real Estate Balances by City ($ in millions) Office Retail Multi- Family Single Family Other Total Houston $7 $45 $362 $93 $18 $525 Dallas 183 27 183 36 67 496 San Antonio 0 26 69 52 40 187 Other 62 39 150 3 13 267 Total $252 $137 $764 $184 $138 $1,475 Investor Real Estate Balances by City ($ in millions) Office Retail Multi- Family Single Family Other Total Baton Rouge $49 $5 $14 $35 $19 $122 New Orleans 6 16 1 3 16 42 Other 3 33 24 2 28 90 Total $58 $54 $39 $40 $63 $254

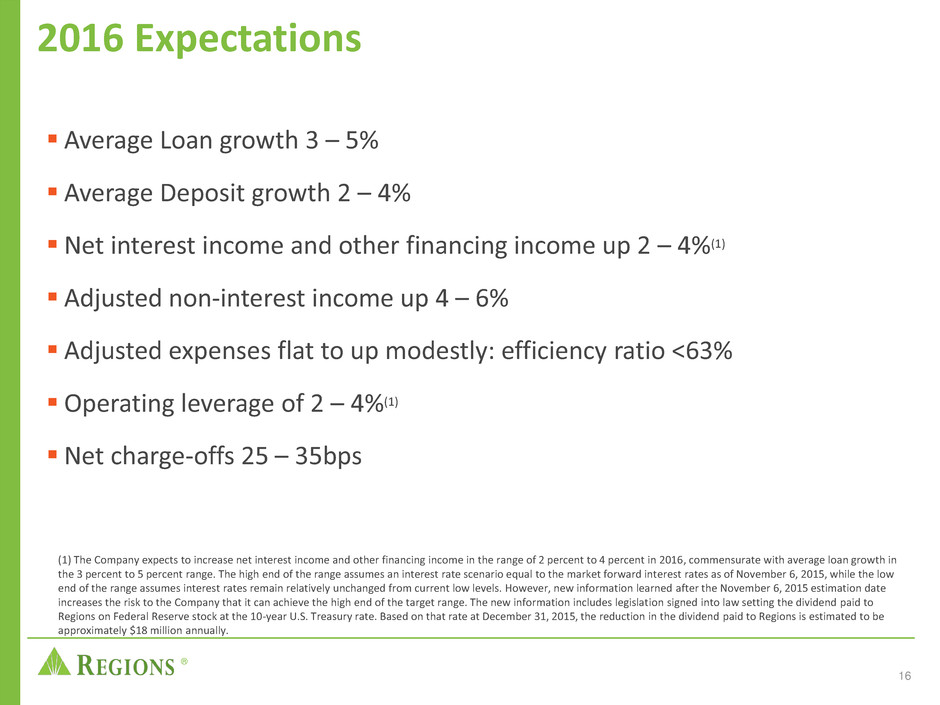

® 2016 Expectations Average Loan growth 3 – 5% Average Deposit growth 2 – 4% Net interest income and other financing income up 2 – 4%(1) Adjusted non-interest income up 4 – 6% Adjusted expenses flat to up modestly: efficiency ratio <63% Operating leverage of 2 – 4%(1) Net charge-offs 25 – 35bps 16 (1) The Company expects to increase net interest income and other financing income in the range of 2 percent to 4 percent in 2016, commensurate with average loan growth in the 3 percent to 5 percent range. The high end of the range assumes an interest rate scenario equal to the market forward interest rates as of November 6, 2015, while the low end of the range assumes interest rates remain relatively unchanged from current low levels. However, new information learned after the November 6, 2015 estimation date increases the risk to the Company that it can achieve the high end of the target range. The new information includes legislation signed into law setting the dividend paid to Regions on Federal Reserve stock at the 10-year U.S. Treasury rate. Based on that rate at December 31, 2015, the reduction in the dividend paid to Regions is estimated to be approximately $18 million annually.

® Why Regions? – Building sustainable franchise value 17 Effectively Deploy Capital Grow and Diversify Revenue Disciplined Expense Management Adjusted EPS growth of 12-15% (CAGR) Adjusted efficiency ratio of <60% Adjusted ROATCE 12-14% Three pillars of execution Long-term expected results How we intend to deliver Leverage our strengths Team Culture Execution Markets Investing in growth initiatives Expense eliminations Grow earnings Leverage capital Return capital

® Appendix 18

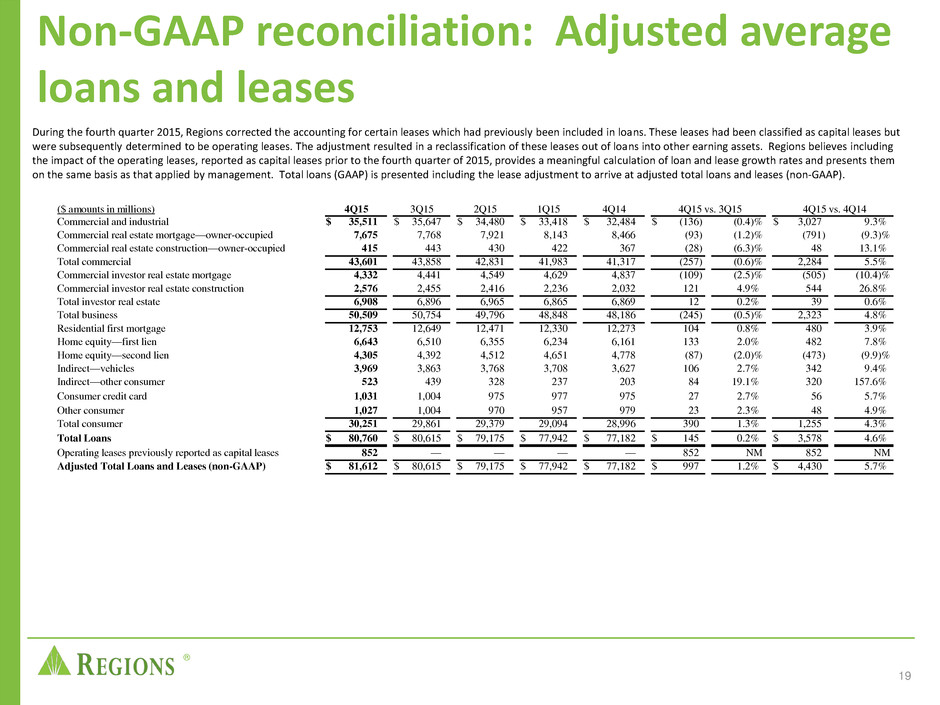

® During the fourth quarter 2015, Regions corrected the accounting for certain leases which had previously been included in loans. These leases had been classified as capital leases but were subsequently determined to be operating leases. The adjustment resulted in a reclassification of these leases out of loans into other earning assets. Regions believes including the impact of the operating leases, reported as capital leases prior to the fourth quarter of 2015, provides a meaningful calculation of loan and lease growth rates and presents them on the same basis as that applied by management. Total loans (GAAP) is presented including the lease adjustment to arrive at adjusted total loans and leases (non-GAAP). ($ amounts in millions) 4Q15 3Q15 2Q15 1Q15 4Q14 4Q15 vs. 3Q15 4Q15 vs. 4Q14 Commercial and industrial $ 35,511 $ 35,647 $ 34,480 $ 33,418 $ 32,484 $ (136) (0.4)% $ 3,027 9.3% Commercial real estate mortgage—owner-occupied 7,675 7,768 7,921 8,143 8,466 (93) (1.2)% (791) (9.3)% Commercial real estate construction—owner-occupied 415 443 430 422 367 (28) (6.3)% 48 13.1% Total commercial 43,601 43,858 42,831 41,983 41,317 (257) (0.6)% 2,284 5.5% Commercial investor real estate mortgage 4,332 4,441 4,549 4,629 4,837 (109) (2.5)% (505) (10.4)% Commercial investor real estate construction 2,576 2,455 2,416 2,236 2,032 121 4.9% 544 26.8% Total investor real estate 6,908 6,896 6,965 6,865 6,869 12 0.2% 39 0.6% Total business 50,509 50,754 49,796 48,848 48,186 (245) (0.5)% 2,323 4.8% Residential first mortgage 12,753 12,649 12,471 12,330 12,273 104 0.8% 480 3.9% Home equity—first lien 6,643 6,510 6,355 6,234 6,161 133 2.0% 482 7.8% Home equity—second lien 4,305 4,392 4,512 4,651 4,778 (87) (2.0)% (473) (9.9)% Indirect—vehicles 3,969 3,863 3,768 3,708 3,627 106 2.7% 342 9.4% Indirect—other consumer 523 439 328 237 203 84 19.1% 320 157.6% Consumer credit card 1,031 1,004 975 977 975 27 2.7% 56 5.7% Other consumer 1,027 1,004 970 957 979 23 2.3% 48 4.9% Total consumer 30,251 29,861 29,379 29,094 28,996 390 1.3% 1,255 4.3% Total Loans $ 80,760 $ 80,615 $ 79,175 $ 77,942 $ 77,182 $ 145 0.2% $ 3,578 4.6% Operating leases previously reported as capital leases 852 — — — — 852 NM 852 NM Adjusted Total Loans and Leases (non-GAAP) $ 81,612 $ 80,615 $ 79,175 $ 77,942 $ 77,182 $ 997 1.2% $ 4,430 5.7% Non-GAAP reconciliation: Adjusted average loans and leases 19

® NM - Not Meaningful (1) Regions recorded $50 million and $100 million of contingent legal and regulatory accruals during the second quarter of 2015 and the fourth quarter of 2014, respectively, related to previously disclosed matters. The fourth quarter of 2014 accruals were settled in the second quarter of 2015 for $2 million less than originally estimated and a corresponding recovery was recognized. (2) In the fourth quarter of 2013, Regions recorded a non-tax deductible charge of $58 million related to previously disclosed inquiries from government authorities concerning matters from 2009. The 2013 matters were settled in the second quarter of 2014 for $7 million less than originally estimated and a corresponding recovery was recognized. (3) In the fourth quarter of 2012, Regions entered into an agreement with a third party investor in Regions Asset Management Company, Inc., pursuant to which the investment was fully redeemed. This resulted in extinguishing a $203 million liability, including accrued, unpaid interest, as well as incurring early termination costs of approximately $42 million on a pre-tax basis ($38 million after tax). (4) Insurance proceeds recognized in 2015 are related to the settlement of the previously disclosed 2010 class-action lawsuit. (5) In the third quarter of 2013, Regions recorded a $24 million gain on sale of a non-core portion of a Wealth Management business. The table below presents computations of the efficiency ratio (non-GAAP), which is a measure of productivity, generally calculated as non-interest expense divided by total revenue. Management uses this ratio to monitor performance and believes this measure provides meaningful information to investors. Non-interest expense (GAAP) is presented excluding certain adjustments to arrive at adjusted non-interest expense (non-GAAP), which is the numerator for the efficiency ratio. Non-interest income (GAAP) is presented excluding certain adjustments to arrive at adjusted non-interest income (non- GAAP). Net interest income and other financing income on a taxable-equivalent basis and non-interest income are added together to arrive at total revenue on a taxable-equivalent basis. Adjustments are made to arrive at adjusted total revenue on a taxable-equivalent basis (non-GAAP), which is the denominator for the efficiency ratio. Regions believes that the exclusion of these adjustments provides a meaningful base for period-to-period comparisons, which management believes will assist investors in analyzing the operating results of the Company and predicting future performance. These non-GAAP financial measures are also used by management to assess the performance of Regions’ business. It is possible that the activities related to the adjustments may recur; however, management does not consider the activities related to the adjustments to be indications of ongoing operations. Regions believes that presentation of these non-GAAP financial measures will permit investors to assess the performance of the Company on the same basis as that applied by management. Non-GAAP reconciliation: Non-interest expense and efficiency ratio 20 Year Ended December 31 2015 2014 2013 2012 2011 (Dollars in millions, except per share data) ADJUSTED EFFICIENCY RATIOS Non-interest expense from continuing operations (GAAP) $ 3,607 $ 3,432 $ 3,556 $ 3,526 $ 3,862 Significant items: Professional, legal and regulatory expenses (1)(2) (48) (93) (58) — — Branch consolidation, property and equipment charges (56) (16) (5) — (75) Goodwill impairment — — — — (253) Securities impairment, net — — — (2) (2) Gain on sale of TDRs held for sale, net — — — — — Loss on early extinguishment of debt (43) — (61) (11) — Regulatory charge (credit) Salary and employee benefits—severance charges (6) — — — — Gain on sale of TDRs held for sale, net — 35 — — — REIT investment early termination costs (3) — — — (42) — Adjusted non-interest expense (non-GAAP) A $ 3,454 $ 3,358 $ 3,432 $ 3,471 $ 3,532 Net interest income and other financing income (GAAP) $ 3,307 $ 3,280 $ 3,263 $ 3,301 $ 3,410 Taxable-equivalent adjustment 75 63 54 50 35 Net interest income and other financing income, taxable-equivalent basis B 3,382 3,343 3,317 3,351 3,445 Non-interest income from continuing operations (GAAP) 2,071 1,903 2,096 2,201 2,226 Significant items: Securities gains, net (29) (27) (26) (48) (112) Insurance proceeds (4) (91) — — — — Leveraged lease termination gains, net (8) (10) (39) (14) (8) Loss on sale of mortgage loans — — — — 3 Gain on sale of other assets (5) — — (24) — — Adjusted non-interest income (non-GAAP) C 1,943 1,866 2,007 2,139 2,109 Adjusted total revenue, taxable equivalent adjustment (non-GAAP) B+C=D $ 5,325 $ 5,209 $ 5,324 $ 5,490 $ 5,554 Adjusted efficiency ratio (non-GAAP) A/D 64.87% 64.45% 64.46% 63.21% 63.57%

® • Current and future economic and market conditions in the United States generally or in the communities we serve, including the effects of declines in property values, unemployment rates and potential reductions of economic growth, which may adversely affect our lending and other businesses and our financial results and conditions. • Possible changes in trade, monetary and fiscal policies of, and other activities undertaken by, governments, agencies, central banks and similar organizations, which could have a material adverse effect on our earnings. • The effects of a possible downgrade in the U.S. government’s sovereign credit rating or outlook, which could result in risks to us and general economic conditions that we are not able to predict. • Possible changes in market interest rates or capital markets could adversely affect our revenue and expense, the value of assets and obligations, and the availability and cost of capital and liquidity. • Any impairment of our goodwill or other intangibles, or any adjustment of valuation allowances on our deferred tax assets due to adverse changes in the economic environment, declining operations of the reporting unit, or other factors • Possible changes in the creditworthiness of customers and the possible impairment of the collectability of loans. • Changes in the speed of loan prepayments, loan origination and sale volumes, charge-offs, loan loss provisions or actual loan losses where our allowance for loan losses may not be adequate to cover our eventual losses. • Possible acceleration of prepayments on mortgage-backed securities due to low interest rates, and the related acceleration of premium amortization on those securities. • Our ability to effectively compete with other financial services companies, some of whom possess greater financial resources than we do and are subject to different regulatory standards than we are. • Loss of customer checking and savings account deposits as customers pursue other, higher-yield investments, which could increase our funding costs. • Our inability to develop and gain acceptance from current and prospective customers for new products and services in a timely manner could have a negative impact on our revenue. • The effects of any developments, changes or actions relating to any litigation or regulatory proceedings brought against us or any of our subsidiaries. • Changes in laws and regulations affecting our businesses, such as the Dodd-Frank Act and other legislation and regulations relating to bank products and services, as well as changes in the enforcement and interpretation of such laws and regulations by applicable governmental and self-regulatory agencies, which could require us to change certain business practices, increase compliance risk, reduce our revenue, impose additional costs on us, or otherwise negatively affect our businesses. • Our ability to obtain a regulatory non-objection (as part of the CCAR process or otherwise) to take certain capital actions, including paying dividends and any plans to increase common stock dividends, repurchase common stock under current or future programs, or redeem preferred stock or other regulatory capital instruments, may impact our ability to return capital to stockholders and market perceptions of us. • Our ability to comply with stress testing and capital planning requirements (as part of the CCAR process or otherwise) may continue to require a significant investment of our managerial resources due to the importance and intensity of such tests and requirements. • Our ability to comply with applicable capital and liquidity requirements (including, among other things, the Basel III capital standards and the LCR rule), including our ability to generate capital internally or raise capital on favorable terms, and if we fail to meet requirements, our financial condition could be negatively impacted. • The Basel III framework calls for additional risk-based capital surcharges for globally systemically important banks. Although we are not subject to such surcharges, it is possible that in the future we may become subject to similar surcharges. • The costs, including possibly incurring fines, penalties, or other negative effects (including reputational harm) of any adverse judicial, administrative, or arbitral rulings or proceedings, regulatory enforcement actions, or other legal actions to which we or any of our subsidiaries are a party, and which may adversely affect our results. • Our ability to manage fluctuations in the value of assets and liabilities and off-balance sheet exposure so as to maintain sufficient capital and liquidity to support our business. • Our ability to execute on our strategic and operational plans, including our ability to fully realize the financial and non-financial benefits relating to our strategic initiatives. • The success of our marketing efforts in attracting and retaining customers. • Possible changes in consumer and business spending and saving habits and the related effect on our ability to increase assets and to attract deposits, which could adversely affect our net income. • Our ability to recruit and retain talented and experienced personnel to assist in the development, management and operation of our products and services may be affected by changes in laws and regulations in effect from time to time. • Fraud or misconduct by our customers, employees or business partners. • Any inaccurate or incomplete information provided to us by our customers or counterparties. • The risks and uncertainties related to our acquisition and integration of other companies. • Inability of our framework to manage risks associated with our business such as credit risk and operational risk, including third-party vendors and other service providers, which could, among other things, result in a breach of operating or security systems as a result of a cyber attack or similar act. • The inability of our internal disclosure controls and procedures to prevent, detect or mitigate any material errors or fraudulent acts. • The effects of geopolitical instability, including wars, conflicts and terrorist attacks and the potential impact, directly or indirectly, on our businesses. • The effects of man-made and natural disasters, including fires, floods, droughts, tornadoes, hurricanes, and environmental damage, which may negatively affect our operations and/or our loan portfolios and increase our cost of conducting business. • Changes in commodity market prices and conditions could adversely affect the cash flows of our borrowers operating in industries that are impacted by changes in commodity prices (including businesses indirectly impacted by commodities prices such as businesses that transport commodities or manufacture equipment used in the production of commodities), which could impair their ability to service any loans outstanding to them and/or reduce demand for loans in those industries. • Our inability to keep pace with technological changes could result in losing business to competitors. • Our ability to identify and address cyber-security risks such as data security breaches, “denial of service” attacks, “hacking” and identity theft, a failure of which could disrupt our business and result in the disclosure of and/or misuse or misappropriation of confidential or proprietary information; increased costs; losses; or adverse effects to our reputation. • Significant disruption of, or loss of public confidence in, the Internet and services and devices used to access the Internet could affect the ability of our customers to access their accounts and conduct banking transactions. • Possible downgrades in our credit ratings or outlook could increase the costs of funding from capital markets. • The effects of problems encountered by other financial institutions that adversely affect us or the banking industry generally could require us to change certain business practices, reduce our revenue, impose additional costs on us, or otherwise negatively affect our businesses. • The effects of the failure of any component of our business infrastructure provided by a third party could disrupt our businesses; result in the disclosure of and/or misuse of confidential information or proprietary information; increase our costs; negatively affect our reputation; and cause losses. • Our ability to receive dividends from our subsidiaries could affect our liquidity and ability to pay dividends to stockholders. • Changes in accounting policies or procedures as may be required by the FASB or other regulatory agencies could materially affect how we report our financial results. • Other risks identified from time to time in reports that we file with the SEC. • The effects of any damage to our reputation resulting from developments related to any of the items identified above. The foregoing list of factors is not exhaustive. For discussion of these and other factors that may cause actual results to differ from expectations, look under the captions “Forward-Looking Statements” and “Risk Factors" of Regions' Annual Report on Form 10-K for the year ended December 31, 2015, as filed with the Securities and Exchange Commission. The words “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” “targets,” “projects,” “outlook,” “forecast,” “will,” “may,” “could,” “should,” “can,” and similar expressions often signify forward-looking statements. You should not place undue reliance on any forward-looking statements, which speak only as of the date made. We assume no obligation to update or revise any forward-looking statements that are made from time to time. This presentation may include forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995, which reflect Regions’ current views with respect to future events and financial performance. Forward- looking statements are not based on historical information, but rather are related to future operations, strategies, financial results or other developments. Forward-looking statements are based on management’s expectations as well as certain assumptions and estimates made by, and information available to, management at the time the statements are made. Those statements are based on general assumptions and are subject to various risks, uncertainties and other factors that may cause actual results to differ materially from the views, beliefs and projections expressed in such statements. These risks, uncertainties and other factors include, but are not limited to, those described below: Forward-looking statements 21