Attached files

| file | filename |

|---|---|

| EX-21 - EXHIBIT 21 - CONMED Corp | exhibit212015.htm |

| EX-23 - EXHIBIT 23 - CONMED Corp | exhibit232015.htm |

| EX-32.1 - EXHIBIT 32.1 - CONMED Corp | exhibit3212015.htm |

| EX-31.2 - EXHIBIT 31.2 - CONMED Corp | exhibit3122015.htm |

| EX-31.1 - EXHIBIT 31.1 - CONMED Corp | exhibit3112015.htm |

United States

Securities and Exchange Commission

Washington, D.C.

20549

Form 10-K

Annual Report Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2015 | Commission file number 0-16093 |

CONMED CORPORATION

(Exact name of registrant as specified in its charter)

New York | 16-0977505 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

525 French Road, Utica, New York | 13502 |

(Address of principal executive offices) | (Zip Code) |

(315) 797-8375

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $.01 par value per share

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Act).

Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§232.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act (Check one).

Large accelerated filer ý Accelerated filer o Non-accelerated filer o Smaller reporting company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

As of June 30, 2015, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the shares of voting common stock held by non-affiliates of the registrant was approximately $1,613,906,000 based upon the closing price of the Company’s common stock on the NASDAQ Stock Market.

The number of shares of the registrant's $0.01 par value common stock outstanding as of February 15, 2016 was 27,712,715.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the Definitive Proxy Statement and any other informational filings for the 2016 Annual Meeting of Shareholders are incorporated by reference into Part III of this report.

CONMED CORPORATION

ANNUAL REPORT ON FORM 10-K

FOR YEAR ENDED DECEMBER 31, 2015

TABLE OF CONTENTS

Part I | ||

Page | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Part II | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Part III | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Part IV | ||

Item 15. | ||

1

CONMED CORPORATION

Item 1. Business

Forward Looking Statements

This Annual Report on Form 10-K for the Fiscal Year Ended December 31, 2015 (“Form 10-K”) contains certain forward-looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995) and information relating to CONMED Corporation (“CONMED”, the “Company”, “we” or “us” — references to “CONMED”, the “Company”, “we” or “us” shall be deemed to include our direct and indirect subsidiaries unless the context otherwise requires) which are based on the beliefs of our management, as well as assumptions made by and information currently available to our management.

When used in this Form 10-K, the words “estimate”, “project”, “believe”, “anticipate”, “intend”, “expect” and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors, including those identified under the caption “Item 1A-Risk Factors” and elsewhere in this Form 10-K which may cause our actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following:

• | general economic and business conditions; |

• | changes in foreign exchange and interest rates; |

• | cyclical customer purchasing patterns due to budgetary and other constraints; |

• | changes in customer preferences; |

• | competition; |

• | changes in technology; |

• | the introduction and acceptance of new products; |

• | the ability to evaluate, finance and integrate acquired businesses, products and companies; |

• | changes in business strategy; |

• | the availability and cost of materials; |

• | the possibility that United States or foreign regulatory and/or administrative agencies may initiate enforcement actions against us or our distributors; |

• | future levels of indebtedness and capital spending; |

• | quality of our management and business abilities and the judgment of our personnel; |

• | the availability, terms and deployment of capital; |

• | the risk of litigation, especially patent litigation as well as the cost associated with patent and other litigation; |

• | the risk of a lack of allograft tissues due to reduced donations of such tissues or due to tissues not meeting the appropriate high standards for screening and/or processing of such tissues; |

• | compliance with and changes in regulatory requirements; and |

• | various other factors referenced in this Form 10-K. |

See “Item 7-Management’s Discussion and Analysis of Financial Condition and Results of Operations”, “Item 1-Business” and “Item 1A-Risk Factors” for a further discussion of these factors. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. We do not undertake any obligation to publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date of this Form 10-K or to reflect the occurrence of unanticipated events.

General

CONMED Corporation was incorporated under the laws of the State of New York in 1970. CONMED is a medical technology company that provides surgical devices and equipment for minimally invasive procedures. The Company’s products are used by surgeons and physicians in a variety of specialties including orthopedics, general surgery, gynecology, neurosurgery and gastroenterology. Headquartered in Utica, New York, the Company’s 3,400 employees distribute its products worldwide from several manufacturing locations.

We have historically used strategic business acquisitions and exclusive distribution relationships to diversify our product offerings, increase our market share in certain product lines, realize economies of scale and take advantage of growth opportunities in the healthcare field.

2

We are committed to offering products with the highest standards of quality, technological excellence and customer service. Substantially all of our facilities have attained certification under the ISO international quality standards and other domestic and international quality accreditations.

Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports are accessible free of charge through the Investor Relations section of our website (http://www.conmed.com) as soon as practicable after such materials have been electronically filed with, or furnished to, the United States Securities and Exchange Commission (the "SEC"). Our SEC filings are also available for reading and copying at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site (http:/www.sec.gov) containing reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

Business Strategy

Our principal objectives are to improve the quality of surgical outcomes and patient care through the development of innovative medical devices, the refinement of existing products and the development of new technologies which reduce risk, trauma, cost and procedure time. We believe that by meeting these objectives we will enhance our ability to anticipate and adapt to customer needs and market opportunities, and provide shareholders with superior investment returns. We intend to achieve future growth and earnings through the following initiatives:

• | Introduction of New Products and Product Enhancements. We continually pursue organic growth through the development of new products and enhancements to existing products. We seek to develop new technologies which improve the durability, performance and usability of existing products. In addition to our internal research and development efforts, we receive new ideas for products and technologies, particularly in procedure-specific areas, from surgeons, inventors and other healthcare professionals. |

• | Pursue Strategic Acquisitions. We pursue strategic acquisitions, distribution and similar arrangements in existing and new growth markets to achieve increased operating efficiencies, geographic diversification and market penetration. Targeted companies have historically included those with proven technologies and established brand names which provide potential sales, marketing and manufacturing synergies. This includes the January 4, 2016 acquisition of SurgiQuest, Inc. ("SurgiQuest") as further described in Item 7 - Management's Discussion and Analysis of Financial Condition and Results of Operations and Note 15 to the Consolidated Financial Statements. |

• | Realize Manufacturing and Operating Efficiencies. We continually review our production systems for opportunities to reduce operating costs, consolidate product lines or identical process flows, reduce inventory requirements and optimize existing processes. Our vertically integrated manufacturing facilities allow for further opportunities to reduce overhead, increase operating efficiencies and capacity utilization. |

• | Geographic Diversification. We believe that significant growth opportunities exist for our surgical products outside the United States. Principal foreign markets for our products include Europe, Latin America and Asia/Pacific Rim. Critical elements of our future sales growth in these markets include leveraging our existing relationships with foreign surgeons, hospitals, third-party payers and foreign distributors (including sub-distributors and sales agents), maintaining an appropriate presence in emerging market countries and continually evaluating our routes-to-market. |

• | Active Participation in the Medical Community. We believe that excellent working relationships with physicians and others in the medical industry enable us to gain an understanding of new therapeutic and diagnostic alternatives, trends and emerging opportunities. Active participation allows us to quickly respond to the changing needs of physicians and patients. In addition, we are an active sponsor of medical education both in the United States and internationally, offering training on new and innovative surgical techniques as well as other medical education materials for use with our products. |

Products

The following table sets forth the percentage of net sales for each of our product lines during each of the three years ended December 31:

3

Year Ended December 31, | |||||||||||

2015 | 2014 | 2013 | |||||||||

Orthopedic surgery | 54 | % | 54 | % | 54 | % | |||||

General surgery | 38 | 38 | 37 | ||||||||

Surgical visualization | 8 | 8 | 9 | ||||||||

Consolidated net sales | 100 | % | 100 | % | 100 | % | |||||

Net sales (in thousands) | $ | 719,168 | $ | 740,055 | $ | 762,704 | |||||

Orthopedic Surgery

A significant portion of our business is derived from sales in our orthopedic surgery product lines, including sports medicine, powered surgical instruments, and sports biologics and tissue. These lines are marketed under a number of brands, including Hall®, CONMED Linvatec®, Concept® and Shutt®.

We offer a comprehensive range of devices and products to repair injuries which have occurred in the articulating joint areas of the body. Many of these injuries are the result of sports related events or similar traumas. Our sports medicine products include powered resection instruments, arthroscopes, reconstructive systems, tissue repair sets, metal and bioabsorbable implants as well as related disposable products and fluid management systems. It is our standard practice to place some of these products, such as shaver consoles and pumps, with certain customers at no charge in exchange for commitments to purchase disposable products over certain time periods. This capital equipment is loaned and subject to return if certain minimum single-use purchases are not met. Single-use products include products such as shaver blades, burs and pump tubing. We have benefited from the introduction of new arthroscopic products and technologies, such as bioabsorbable screws, “push-in” and “screw-in” suture anchors and resection shavers.

In sports medicine, we compete with Smith & Nephew, plc; Arthrex, Inc.; Stryker Corporation; Johnson & Johnson: DePuy Mitek, Inc. and Zimmer Biomet, Inc.

Our powered instruments offering is sold principally under the Hall® Surgical brand name, for use in large and small bone orthopedic, arthroscopic, oral/maxillofacial, podiatric, plastic, ENT, neurological, spinal and cardiothoracic surgeries. Our newest product is the Hall 50™ Powered Instrument System, specifically designed to meet the requirements of most orthopedic applications. The modularity and versatility of the Hall 50™ Powered Instrument System allows a facility to purchase a single power system to perform total joint arthroplasty, trauma, arthroscopy and some small bone procedures.

In powered instruments, our competition includes Stryker Corporation; Medtronic plc, (Midas Rex and Xomed divisions); Johnson & Johnson: DePuy Synthes, Inc.; MicroAire Surgical Instruments, LLC, and Zimmer Holdings, Inc.

As more fully described in Note 4 to the Consolidated Financial Statements, on January 3, 2012, the Company entered into the Sports Medicine Joint Development and Distribution Agreement (the "JDDA") with Musculoskeletal Transplant Foundation (“MTF”) to obtain MTF's worldwide promotion rights with respect to allograft tissues within the field of sports medicine and related products. Under the terms of this agreement, we are now the exclusive worldwide promoter of these allograft tissues, which includes the reconstruction and/or replacement of tendon, ligament, cartilage or menisci, along with the correction of deformities within the extremities.

General Surgery

Our general surgery product line offers a large range of products in the areas of advanced surgical, endoscopic technologies, and critical care.

Our advanced surgical product offering includes an extensive line of state-of-the-art electrosurgical generators, handpieces, smoke management systems and accessories. Our endomechanical instrumentation products offer a full line of instruments including trocars, suction irrigation devices, graspers, scissors and dissectors used in minimally invasive surgery. We offer a unique and premium uterine manipulator called VCARE® for use in increasing the efficiency of laparoscopic hysterectomies and other gynecologic laparoscopic procedures. Our competition includes Medtronic plc: Covidien; Ethicon Endo-Surgery, Inc.; ERBE Elektromedizin GmbH; Megadyne; Johnson & Johnson: and Applied Medical Resources Corporation.

On January 4, 2016, we acquired SurgiQuest for $265 million in cash (on a cash-free, debt-free basis). SurgiQuest develops, manufactures and markets the AirSeal® System, the first integrated access management technology for use in laparoscopic

4

and robotic procedures. This proprietary and differentiated access system is complementary to our current advanced surgical offering.

Our endoscopic technologies offering includes a comprehensive line of minimally invasive diagnostic and therapeutic products used in conjunction with procedures which require flexible endoscopy. This offering includes mucosal management devices, forceps, scope management accessories, bronchoscopy devices, dilatation, stricture management devices, hemostasis, biliary devices and polypectomy. Our competition includes Boston Scientific Corporation - Endoscopy; Cook Medical, Inc.; Merit Medical Endotek; Olympus, Inc.; STERIS Corporation - U.S. Endoscopy; and EndoChoice, Inc.

Our critical care offering includes a line of vital signs and cardiac monitoring products including pulse oximetry sensors, ECG electrodes & accessories, and cardiac defibrillation & pacing pads. We also offer a complete line of suction instruments and tubing that are used throughout all areas of the hospital as well as in Ambulatory Surgery Centers and the emergency medical market. In addition, we offer a line of IV products for use in the critical care areas of the hospital and the emergency medical market. This offering's competition includes Medtronic plc: (Covidien Ltd) and 3M Company.

Surgical Visualization

Our surgical visualization product line offers imaging systems for use in minimally invasive orthopedic and general surgery procedures including 2DHD and 3DHD vision technologies. Competition includes Smith & Nephew, plc; Arthrex, Inc.; Stryker Corporation; Olympus, Inc.; Richard Wolf and Karl Storz GmbH.

International

Maintaining and expanding our international presence is an important component of our long-term growth plan. Our products are sold in over 100 foreign countries. International sales efforts are coordinated through local country dealers (including sub-distributors or sales agents) or through direct in-country sales. We distribute our products through sales subsidiaries and branches with offices located in Australia, Austria, Belgium, Canada, China, Denmark, Finland, France, Germany, Italy, Korea, the Netherlands, Poland, Spain, Sweden and the United Kingdom. In these countries, our sales are denominated in the local currency and amounted to approximately 34% of our total net sales in 2015. In the remaining countries where our products are sold through independent distributors, sales are denominated in United States dollars.

Competition

We compete in orthopedic, surgical visualization and general surgery medical device markets across the world. Our competitors range from large manufacturers with multiple business units to smaller manufacturers with limited product offerings. We believe we have appropriate product offerings and adequate market share to compete effectively in these markets. The global markets are constantly changing due to technological advances. We seek to closely align our research and development with our key business objectives, namely developing and improving products and processes, applying innovative technology to the manufacture of products for new global markets and reducing the cost of producing core products.

The breadth of our product lines in our key product areas enables us to meet a wide range of customer requirements and preferences. This has enhanced our ability to market our products to surgeons, hospitals, surgery centers, group purchasing organizations ("GPOs"), integrated delivery networks ("IDNs") and other customers, particularly as institutions seek to reduce costs and minimize the number of suppliers.

Marketing

A significant portion of our products are distributed domestically directly to more than 6,000 hospitals and other healthcare institutions as well as through medical specialty distributors. We are not dependent on any single customer and no single customer accounted for more than 10% of our net sales in 2015, 2014 and 2013.

A significant portion of our U.S. sales are to customers affiliated with GPOs, IDNs and other large national or regional accounts, as well as to the Veterans Administration and other hospitals operated by the Federal government. For hospital inventory management purposes, some of our customers prefer to purchase our products through independent third-party medical product distributors.

Our employee sales representatives are specially trained in our various product offerings. Each employee sales representative is assigned a defined geographic area and compensated on a commission basis or through a combination of salary and commission. The sales force is supervised and supported by either area directors or district managers. In certain geographies,

5

sales agent groups are used in the United States to sell our orthopedic products. These sales agent groups are paid a commission for sales made to customers while home office sales and marketing management provide the overall direction for marketing and positioning of our products. Our sales professionals provide surgeons and medical personnel with information relating to the technical features and benefits of our products.

Our health systems organization is responsible for interacting with large regional and national accounts (e.g. GPOs, IDNs, etc.). We have contracts with many such organizations and believe that the loss of any individual group purchasing contract will not materially impact our business. In addition, all of our sales professionals are required to work closely with distributors where applicable and maintain close relationships with end-users.

We sell to a diversified base of customers around the world and, therefore, believe there is no material concentration of credit risk.

Manufacturing

Raw material costs constitute a substantial portion of our cost of production. Substantially all of our raw materials and select components used in the manufacturing process are procured from external suppliers. We work closely with multiple suppliers to ensure continuity of supply while maintaining high quality and reliability. As a consequence of best supply chain practices, new product development and acquisitions, we often form strategic partnerships with key suppliers. As a consequence of these supplier partnerships, components and raw materials may be sole sourced. Due to the strength of these suppliers and the variety of products we provide, we do not believe the risk of supplier interruption poses an overall material adverse effect on our financial and operational performance. We schedule production and maintain adequate levels of safety stock based on a number of factors, including experience, knowledge of customer ordering patterns, demand, manufacturing lead times and optimal quantities required to maintain the highest possible service levels. Customer orders are generally processed for immediate shipment and backlog of firm orders is therefore not considered material to an understanding of our business.

Research and Development

New and improved products play a critical role in our continued sales growth. Internal research and development efforts focus on the development of new products and product technological and design improvements aimed at complementing and expanding existing product lines. We continually seek to leverage new technologies which improve the durability, performance and usability of existing products. In addition, we maintain close working relationships with surgeons, inventors and operating room personnel who often make new product and technology disclosures, principally in procedure-specific areas. For clinical and commercially promising disclosures, we seek to obtain rights to these ideas through negotiated agreements. Such agreements typically compensate the originator through payments based upon a percentage of licensed product net sales. Annual royalty expense approximated $2.3 million, $2.6 million and $2.7 million in 2015, 2014 and 2013, respectively.

Amounts expended for Company research and development were approximately $27.4 million, $27.8 million and $25.8 million during 2015, 2014 and 2013, respectively.

Intellectual Property

Patents and other proprietary rights, in general, are important to our business. We have rights to intellectual property, including United States patents and foreign equivalent patents which cover a wide range of our products. We own a majority of these patents and have exclusive and non-exclusive licensing rights to the remainder. In addition, certain of these patents have currently been licensed to third parties on a non-exclusive basis. We believe that the development of new products and technological and design improvements to existing products will continue to be of primary importance in maintaining our competitive position.

Government Regulation and Quality Systems

The development, manufacture, sale and distribution of our products are subject to regulation by numerous agencies and legislative bodies, including the U.S. Food and Drug Administration ("FDA") and comparable foreign counterparts. In the United States, these regulations were enacted under the Medical Device Amendments of 1976 to the Federal Food, Drug and Cosmetic Act and its subsequent amendments, and the regulations issued or proposed thereunder.

The FDA’s Quality System Regulations set forth requirements for our product design and manufacturing processes, require the maintenance of certain records, provide for on-site inspection of our facilities and continuing review by the FDA. Many of our products are also subject to industry-defined standards. Authorization to commercially market our products in the U.S. is granted by the FDA under a procedure referred to as a 510(k) pre-market notification. This process requires us to notify the FDA

6

of the new product and obtain FDA clearance before marketing the device. We believe that our products and processes presently meet applicable standards in all material respects.

Medical device regulations continue to evolve world-wide. Products marketed in the European Union and other countries require preparation of technical files and design dossiers which demonstrate compliance with applicable international regulations. As government regulations continue to change, there is a risk that the distribution of some of our products may be interrupted or discontinued if they do not meet the country specific requirements.

We market our products in numerous foreign countries and therefore are subject to regulations affecting, among other things, product standards, sterilization, packaging requirements, labeling requirements, import laws and onsite inspection by independent bodies with the authority to issue or not issue certifications we may require to be able to sell products in certain countries. Many of the regulations applicable to our devices and products in these countries are similar to those of the FDA. The member countries of the European Union have adopted the European Medical Device Directives, which create a single set of medical device regulations for all member countries. These regulations require companies that wish to manufacture and distribute medical devices in the European Union to maintain quality system certifications through European Union recognized Notified Bodies. These Notified Bodies authorize the use of the CE Mark allowing free movement of our products throughout the member countries. Requirements pertaining to our products vary widely from country to country, ranging from simple product registrations to detailed submissions such as those required by the FDA. We believe that our products and quality procedures currently meet applicable standards for the countries in which they are marketed.

As noted above, our facilities are subject to periodic inspection by the United States Food and Drug Administration (“FDA”) and foreign regulatory agencies or notified bodies for, among other things, conformance to Quality System Regulation and Current Good Manufacturing Practice (“CGMP”) requirements and foreign or international standards. During the third quarter of 2013, the FDA inspected our Centennial, Colorado manufacturing facility and issued a Form 483 with observations on September 20, 2013. We subsequently submitted responses to the Observations, and the FDA issued a Warning Letter on January 30, 2014 relating to the inspection and the responses to the Form 483 Observations. Accordingly, we undertook corrective actions. During the fourth quarter of 2014, the FDA again inspected our Centennial, Colorado manufacturing facility and, on November 18, 2014, issued a Form 483 with eight observations, three of which the FDA characterized as repeat observations. On December 10, 2014, we responded to the Form 483 Observations. We have received some additional questions from the FDA and responded to these questions on April 25, 2015. The remediation costs to date have not been material, although there can be no assurance that responding to the Form 483 observations or a future inspection by the FDA will not result in an additional Form 483 or warning letter, or other regulatory actions, which may include consent decrees or fines.

Employees

As of December 31, 2015, we had approximately 3,400 full-time employees, including approximately 2,300 in operations, 140 in research and development and the remaining in sales, marketing and related administrative support. We believe that we have good relations with our employees and have never experienced a strike or similar work stoppage. None of our domestic employees are represented by a labor union.

Item 1A. Risk Factors

An investment in our securities, including our common stock, involves a high degree of risk. Investors should carefully consider the specific factors set forth below as well as the other information included or incorporated by reference in this Form 10-K. See “Forward Looking Statements”.

Our financial performance is dependent on conditions in the healthcare industry and the broader economy.

The results of our business are directly tied to the economic conditions in the healthcare industry and the broader economy as a whole. We will continue to monitor and manage the impact of the overall economic environment on the Company. Approximately 21% of our revenues are derived from the sale of capital products. The sales of such products are negatively impacted if hospitals and other healthcare providers are unable to secure the financing necessary to purchase these products or otherwise defer purchases.

Our significant international operations subject us to foreign currency fluctuations and other risks associated with operating in foreign countries.

A significant portion of our revenues are derived from foreign sales. Approximately 50% of our total 2015 consolidated net sales were to customers outside the United States. We have sales subsidiaries in a significant number of countries in Europe as well as Australia, Canada, China and Korea. In those countries in which we have a direct presence, our sales are denominated in the local

7

currency and those sales denominated in local currency amounted to approximately 34% of our total net sales in 2015. The remaining 16% of sales to customers outside the United States was on an export basis and transacted in United States dollars.

Because a significant portion of our operations consist of sales activities in foreign jurisdictions, our financial results may be affected by factors such as changes in foreign currency exchange rates or weak economic conditions in the markets in which we distribute products. While we have implemented a hedging strategy involving foreign currency forward contracts for 2015, our revenues and earnings are only partially protected from foreign currency translation if the United States dollar strengthens as compared with currencies such as the Euro. Further, as of the date of this Form 10-K, we have not entered into any foreign currency forward contracts beyond 2017. Our international presence exposes us to certain other inherent risks, including:

• | imposition of limitations on conversions of foreign currencies into dollars or remittance of dividends and other payments by international subsidiaries; |

• | imposition or increase of withholding and other taxes on remittances and other payments by international subsidiaries; |

• | trade barriers; |

• | political risks, including political instability; |

• | reliance on third parties to distribute our products; |

• | hyperinflation in certain foreign countries; and |

• | imposition or increase of investment and other restrictions by foreign governments. |

We cannot assure you that such risks will not have a material adverse effect on our business and results of operations.

Our financial performance is subject to the risks inherent in our acquisition strategy, including the effects of increased borrowing and integration of newly acquired businesses or product lines.

A key element of our business strategy has been to expand through acquisitions and we may seek to pursue additional acquisitions in the future. Our success is dependent in part upon our ability to integrate acquired companies or product lines into our existing operations. For example, we completed the acquisition of SurgiQuest, Inc. (“SurgiQuest”) on January 4, 2016 and are in the process of integrating SurgiQuest into our business. We may not have sufficient management and other resources to accomplish the integration of our past and future acquisitions and implementing our acquisition strategy may strain our relationship with customers, suppliers, distributors, personnel or others. There can be no assurance that we will be able to identify and make acquisitions on acceptable terms or that we will be able to obtain financing for such acquisitions on acceptable terms. In addition, while we are generally entitled to customary indemnification from sellers of businesses for any difficulties that may have arisen prior to our acquisition of each business, acquisitions may involve exposure to unknown liabilities and the amount and time for claiming under these indemnification provisions is often limited. As a result, our financial performance is now, and will continue to be, subject to various risks associated with the acquisition of businesses, including the financial effects associated with any increased borrowing required to fund such acquisitions or with the integration of such businesses. We incurred substantial additional debt in connection with the SurgiQuest acquisition, and we cannot ensure that we will be able to successfully integrate and advance SurgiQuest’s product lines or that risks related to the SurgiQuest acquisition will not negatively impact our financial performance.

Our financial performance may be adversely impacted by healthcare reform legislation.

Provisions of healthcare legislation, including provisions of the Patient Protection and Affordable Care Act, could meaningfully change the way health care is developed and delivered and may adversely affect our business and results of operations. For example, the Patient Protection and Affordable Care Act includes provisions aimed at improving quality and decreasing costs of Medicare, governing comparative effectiveness research, and implementing an independent payment advisory board and pilot programs to evaluate alternative payment methodologies. That legislation also included a 2.3% excise tax imposed upon sales within the U.S. of certain medical device products, which has recently been delayed until 2018. We cannot predict what healthcare programs and regulations will be ultimately implemented at the federal or state level, or the effect of any future legislation or regulation in the U.S. or internationally. However, any changes that lower reimbursements or otherwise causing pricing pressures to hospitals for surgical procedures or reduce medical procedure volumes could adversely affect our results of operations and cash flows.

Failure to comply with regulatory requirements may result in recalls, fines or materially adverse implications.

Substantially all of our products are classified as class II medical devices subject to regulation by numerous agencies and legislative bodies, including the FDA and comparable foreign counterparts. As a manufacturer of medical devices, our manufacturing processes and facilities are subject to on-site inspection and continuing review by the FDA for compliance with the Quality System Regulations. We received a warning letter from the FDA related to our Centennial, CO facility on January 30, 2014. Accordingly, we undertook corrective actions. During the fourth quarter of 2014, the FDA again inspected our Centennial, CO manufacturing

8

facility and, on November 18, 2014, issued a Form 483 with eight observations, three of which the FDA characterized as repeat observations. On December 10, 2014, we responded to the Form 483 Observations. We have received some additional questions from the FDA and responded to these questions on April 25, 2015. The remediation costs to date have not been material, although there can be no assurance that responding to the Form 483 observations or a future inspection by the FDA will not result in an additional Form 483 or warning letter, or other regulatory actions, which may include consent decrees or fines. Manufacturing and sales of our products outside the United States are also subject to foreign regulatory requirements which vary from country to country. Moreover, we are generally required to obtain regulatory clearance or approval prior to marketing a new product. The time required to obtain approvals from foreign countries may be longer or shorter than that required for FDA clearance, and requirements for foreign approvals may differ from FDA requirements. Failure to comply with applicable domestic and/or foreign regulatory requirements may result in:

• | fines or other enforcement actions; |

• | recall or seizure of products; |

• | total or partial suspension of production; |

• | loss of certification; |

• | withdrawal of existing product approvals or clearances; |

• | refusal to approve or clear new applications or notices; |

• | increased quality control costs; or |

• | criminal prosecution. |

Failure to comply with Quality System Regulations and applicable foreign regulations could result in a material adverse effect on our business, financial condition or results of operations.

If we are not able to manufacture products in compliance with regulatory standards, we may decide to cease manufacturing of those products and may be subject to product recall.

In addition to the Quality System Regulations, many of our products are also subject to industry-defined standards. We may not be able to comply with these regulations and standards due to deficiencies in component parts or our manufacturing processes. If we are not able to comply with the Quality System Regulations or industry-defined standards, we may not be able to fill customer orders and we may decide to cease production of non-compliant products. Failure to produce products could affect our profit margins and could lead to loss of customers.

Our products are subject to product recall and we have conducted product recalls in the past. Although no recall has had a material adverse effect on our business or financial condition, we cannot assure you that regulatory issues will not have a material adverse effect on our business, financial condition or results of operations in the future or that product recalls will not harm our reputation and our customer relationships.

The highly competitive market for our products may create adverse pricing pressures.

The market for our products is highly competitive and our customers have numerous alternatives of supply. Many of our competitors offer a range of products in areas other than those in which we compete, which may make such competitors more attractive to surgeons, hospitals, group purchasing organizations and others. In addition, many of our competitors are large, technically competent firms with substantial assets. Competitive pricing pressures or the introduction of new products by our competitors could have an adverse effect on our revenues. See “Products” in Item 1 - Business for a further discussion of these competitive forces.

Factors which may influence our customers’ choice of competitor products include:

•changes in surgeon preferences;

•increases or decreases in healthcare spending related to medical devices;

•our inability to supply products to them as a result of product recall, market withdrawal or back-order;

•the introduction by competitors of new products or new features to existing products;

•the introduction by competitors of alternative surgical technology; and

•advances in surgical procedures, discoveries or developments in the healthcare industry.

We use a variety of raw materials in our businesses, and significant shortages or price increases could increase our operating costs and adversely impact the competitive positions of our products.

9

Our reliance on certain suppliers and commodity markets to secure raw materials used in our products exposes us to volatility in the prices and availability of raw materials. In some instances, we participate in commodity markets that may be subject to allocations by suppliers. A disruption in deliveries from our suppliers, price increases or decreased availability of raw materials or commodities could have an adverse effect on our ability to meet our commitments to customers or increase our operating costs. We believe that our supply management practices are based on an appropriate balancing of the foreseeable risks and the costs of alternative practices. Nonetheless, price increases or the unavailability of some raw materials may have an adverse effect on our results of operations or financial condition.

Cost reduction efforts in the healthcare industry could put pressures on our prices and margins.

In recent years, the healthcare industry has undergone significant change driven by various efforts to reduce costs. Such efforts include national healthcare reform, trends towards managed care, cuts in Medicare, consolidation of healthcare distribution companies and collective purchasing arrangements by GPOs and IDNs. Demand and prices for our products may be adversely affected by such trends.

We may not be able to keep pace with technological change or to successfully develop new products with wide market acceptance, which could cause us to lose business to competitors.

The market for our products is characterized by rapidly changing technology. Our future financial performance will depend in part on our ability to develop and manufacture new products on a cost-effective basis, to introduce them to the market on a timely basis and to have them accepted by surgeons.

We may not be able to keep pace with technology or to develop viable new products. In addition, many of our competitors are substantially larger with greater financial resources which may allow them to more rapidly develop new products. Factors which may result in delays of new product introductions or cancellation of our plans to manufacture and market new products include:

• | capital constraints; |

• | research and development delays; |

• | delays in securing regulatory approvals; and |

• | changes in the competitive landscape, including the emergence of alternative products or solutions which reduce or eliminate the markets for pending products. |

Our new products may fail to achieve expected levels of market acceptance.

New product introductions may fail to achieve market acceptance. The degree of market acceptance for any of our products will depend upon a number of factors, including:

• | our ability to develop and introduce new products and product enhancements in the time frames we currently estimate; |

• | our ability to successfully implement new technologies; |

• | the market’s readiness to accept new products; |

• | having adequate financial and technological resources for future product development and promotion; |

• | the efficacy of our products; and |

• | the prices of our products compared to the prices of our competitors’ products. |

If our new products do not achieve market acceptance, we may be unable to recover our investments and may lose business to competitors.

In addition, some of the companies with which we now compete, or may compete in the future, have or may have more extensive research, marketing and manufacturing capabilities and significantly greater technical and personnel resources than we do, and may be better positioned to continue to improve their technology in order to compete in an evolving industry. See “Products” in Item 1 - Business for a further discussion of these competitive forces.

Our senior credit agreement contains covenants which may limit our flexibility or prevent us from taking actions.

Our senior credit agreement contains, and future credit facilities are expected to contain, certain restrictive covenants which will affect, and in many respects significantly limit or prohibit, among other things, our ability to:

•incur indebtedness;

•make investments;

10

•engage in transactions with affiliates;

•pay dividends or make other distributions on, or redeem or repurchase, capital stock;

•sell assets; and

•pursue acquisitions.

These covenants, unless waived, may prevent us from pursuing acquisitions, significantly limit our operating and financial flexibility and limit our ability to respond to changes in our business or competitive activities. Our ability to comply with such provisions may be affected by events beyond our control. In the event of any default under our credit agreement, the credit agreement lenders may elect to declare all amounts borrowed under our credit agreement, together with accrued interest, to be due and payable. If we were unable to repay such borrowings, the credit agreement lenders could proceed against collateral securing the credit agreement which consists of substantially all of our property and assets. Our credit agreement also contains a material adverse effect clause which may limit our ability to access additional funding under our credit agreement should a material adverse change in our business occur.

Our leverage and debt service requirements may require us to adopt alternative business strategies.

As of December 31, 2015, we had $270.8 million of debt outstanding, representing 25% of total capitalization. On January 4, 2016, we entered into our fifth amended and restated senior credit agreement consisting of: (a) a $175.0 million term loan facility and (b) a $525.0 million revolving credit facility. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources” and Note 15 to our Consolidated Financial Statements.

The degree to which we are leveraged could have important consequences to investors, including but not limited to the following:

• | a portion of our cash flow from operations must be dedicated to debt service and will not be available for operations, capital expenditures, acquisitions, dividends and other purposes; |

• | our ability to obtain additional financing in the future for working capital, capital expenditures, acquisitions or general corporate purposes may be limited or impaired or may be at higher interest rates; |

• | we may be at a competitive disadvantage when compared to competitors that are less leveraged; |

• | we may be hindered in our ability to adjust rapidly to market conditions; |

• | our degree of leverage could make us more vulnerable in the event of a downturn in general economic conditions or other adverse circumstances applicable to us; and |

• | our interest expense could increase if interest rates in general increase because a portion of our borrowings, including our borrowings under our credit agreement, are and will continue to be at variable rates of interest. |

We may not be able to generate sufficient cash to service our indebtedness, which could require us to reduce our expenditures, sell assets, restructure our indebtedness or seek additional equity capital.

Our ability to satisfy our obligations will depend upon our future operating performance, which will be affected by prevailing economic conditions and financial, business and other factors, many of which are beyond our control. We may not have sufficient cash flow available to enable us to meet our obligations. If we are unable to service our indebtedness, we will be forced to adopt an alternative strategy that may include actions such as foregoing acquisitions, reducing or delaying capital expenditures, selling assets, restructuring or refinancing our indebtedness or seeking additional equity capital. We cannot assure you that any of these strategies could be implemented on terms acceptable to us, if at all. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources” for a discussion of our indebtedness and its implications.

We rely on a third party to obtain, process and distribute sports medicine allograft tissue. If such tissue cannot be obtained, is not accepted by the market or is not accepted under numerous government regulations, our results of operations could be negatively impacted.

As described in Note 4 to the Consolidated Financial Statements, on January 3, 2012, we entered into an agreement with Musculoskeletal Transplant Foundation ("MTF") to obtain MTF's worldwide promotional, marketing and distribution rights with respect to allograft tissues within the field of sports medicine. The supply of human tissue is dependent on donors and MTF has numerous relationships with donor groups. Likewise, the supply of tissues available for use as allografts depends on the continued successful processing of donated tissues by MTF at its processing facilities. We cannot be certain, however, that the supply of human tissue will continue to be available at current levels or will be of sufficiently high standards to meet the high processing standards maintained for such tissues by MTF, or in volumes sufficient to meet our customers' needs or that MTF will be able to continue to process tissues to its high standards in volumes sufficient to keep pace with demand. We expect that the Company's share of revenue streams related to MTF's sports medicine allograft product line would decline in proportion to any decline or disruption in the supply of processed tissues.

11

The FDA and several states have statutory authority to regulate allograft processing and allograft-based materials. The FDA could identify deficiencies in future inspections of MTF or MTF's suppliers or promulgate future regulatory rulings that could disrupt our business, reducing profitability.

Our recent management and organizational changes could adversely affect our business.

In the latter half of 2014, Curt Hartman became our President & Chief Executive Officer, having significant industry experience. Since this time, he has implemented organizational changes within our Company, including senior management changes. The experience of our senior executives is a valuable asset to us and, although we believe that our current senior management team has the combination of company and industry experience to be successful, our recent management and organizational changes could adversely affect our business, including through any disruption that may be associated with the organizational changes.

If the Company or our business partners are unable to adequately protect our information assets from cyber-based attacks or other security incidents, our operations could be disrupted.

We are increasingly dependent on information technology, including the internet, for the storage, processing, and transmission of our electronic, business-related, information assets. We leverage our internal information technology infrastructures, and those of our business partners, to enable, sustain, and support our global business interests. In the event that the Company or our business partners are unable to prevent, detect, and remediate cyber-based attacks or other security incidents in a timely manner, our operations could be disrupted or we may incur financial or reputational losses arising from the theft, alteration, misuse, unauthorized disclosure, or destruction of our information assets.

If we infringe third parties’ patents, or if we lose our patents or they are held to be invalid, we could become subject to liability and our competitive position could be harmed.

Much of the technology used in the markets in which we compete is covered by patents. We have numerous U.S. patents and corresponding foreign patents on products expiring at various dates from 2016 through 2038 and have additional patent applications pending. See Item 1 Business “Research and Development” and “Intellectual Property” for a further description of our patents. The loss of our patents could reduce the value of the related products and any related competitive advantage. Competitors may also be able to design around our patents and to compete effectively with our products. In addition, the cost of enforcing our patents against third parties and defending our products against patent infringement actions by others could be substantial. We cannot assure you that:

• | pending patent applications will result in issued patents; |

• | patents issued to or licensed by us will not be challenged by competitors; |

• | our patents will be found to be valid or sufficiently broad to protect our technology or provide us with a competitive advantage; or |

• | we will be successful in defending against pending or future patent infringement claims asserted against our products. |

Ordering patterns of our customers may change resulting in reductions in sales.

Our hospital and surgery center customers purchase our products in quantities sufficient to meet their anticipated demand. Likewise, our healthcare distributor customers purchase our products for ultimate resale to healthcare providers in quantities sufficient to meet the anticipated requirements of the distributors’ customers. Should inventories of our products owned by our hospital, surgery center and distributor customers grow to levels higher than their requirements, our customers may reduce the ordering of products from us. This could result in reduced sales during a financial accounting period.

We can be sued for producing defective products and our insurance coverage may be insufficient to cover the nature and amount of any product liability claims.

The nature of our products as medical devices and today’s litigious environment should be regarded as potential risks which could significantly and adversely affect our financial condition and results of operations. The insurance we maintain to protect against claims associated with the use of our products has deductibles and may not adequately cover the amount or nature of any claim asserted against us. We are also exposed to the risk that our insurers may become insolvent or that premiums may increase substantially. See “Item 3 - Legal Proceedings” for a further discussion of the risk of product liability actions and our insurance coverage.

12

Damage to our physical properties as a result of windstorm, earthquake, fire or other natural or man-made disaster may cause a financial loss and a loss of customers.

Although we maintain insurance coverage for physical damage to our property and the resultant losses that could occur during a business interruption, we are required to pay deductibles and our insurance coverage is limited to certain caps. For example, our deductible for windstorm damage to our Florida property amounts to 2% of any loss.

Further, while insurance reimburses us for our lost gross earnings during a business interruption, if we are unable to supply our customers with our products for an extended period of time, there can be no assurance that we will regain the customers’ business once the product supply is returned to normal.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

Facilities

The following table sets forth certain information with respect to our principal operating facilities. We believe that our facilities are generally well maintained, are suitable to support our business and adequate for present and anticipated needs.

Location | Square Feet | Own or Lease | Lease Expiration | ||||

Utica, NY | 500,000 | Own | — | ||||

Largo, FL | 278,000 | Own | — | ||||

Centennial, CO | 87,500 | Own | — | ||||

Chihuahua, Mexico | 207,720 | Lease | September 2019 | ||||

Lithia Springs, GA | 188,400 | Lease | December 2019 | ||||

Brussels, Belgium | 45,531 | Lease | June 2024 | ||||

Mississauga, Canada | 22,378 | Lease | December 2016 | ||||

Westborough, MA | 19,515 | Lease | June 2020 | ||||

Frenchs Forest, Australia | 16,912 | Lease | July 2020 | ||||

Seoul, Korea | 15,554 | Lease | January 2017 | ||||

Anaheim, CA | 14,037 | Lease | August 2018 | ||||

Frankfurt, Germany | 13,606 | Lease | March 2023 | ||||

Milan, Italy | 13,024 | Lease | March 2017 | ||||

Beijing, China | 10,255 | Lease | June 2016 | ||||

Swindon, Wiltshire, UK | 8,562 | Lease | December 2020 | ||||

Askim, Sweden | 8,353 | Lease | May 2019 | ||||

Barcelona, Spain | 8,073 | Lease | December 2018 | ||||

Rungis Cedex, France | 7,406 | Lease | December 2016 | ||||

Copenhagen, Denmark | 5,899 | Lease | December 2018 | ||||

New York, NY | 3,473 | Lease | September 2022 | ||||

Warsaw, Poland | 3,222 | Lease | February 2018 | ||||

Espoo, Finland | 3,078 | Lease | Open Ended | ||||

Shanghai, China | 2,269 | Lease | February 2018 | ||||

Innsbruck, Austria | 1,820 | Lease | June 2020 | ||||

Our principal manufacturing facilities are located in Utica, NY, Largo, FL, Anaheim, CA and Chihuahua, Mexico. Lithia Springs, GA and Brussels, Belgium are our principal distribution centers. The remaining facilities are sales and administrative offices with certain offices also including smaller distribution centers.

Item 3. Legal Proceedings

We are involved in various proceedings, legal actions and claims arising in the normal course of business, including proceedings related to product, labor and intellectual property and other matters that are more fully described in Note 10 to the

13

Consolidated Financial Statements. We are not a party to any pending legal proceedings other than ordinary routine litigation incidental to our business.

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock, par value $.01 per share, is traded on the NASDAQ Stock Market under the symbol “CNMD”. At January 29, 2016, there were 637 registered holders of our common stock and approximately 5,973 accounts held in “street name”.

The following table sets forth quarterly high and low closing sales prices for the years ended December 31, 2015 and 2014, as reported by the NASDAQ Stock Market.

2015 | |||||||

Period | High | Low | |||||

First Quarter | $ | 51.88 | $ | 44.90 | |||

Second Quarter | 59.11 | 48.29 | |||||

Third Quarter | 60.19 | 47.09 | |||||

Fourth Quarter | 49.99 | 38.34 | |||||

2014 | |||||||

Period | High | Low | |||||

First Quarter | $ | 48.54 | $ | 41.33 | |||

Second Quarter | 49.65 | 42.23 | |||||

Third Quarter | 45.46 | 36.53 | |||||

Fourth Quarter | 45.33 | 37.31 | |||||

Our Board of Directors has authorized a share repurchase program; see Note 7 to the Consolidated Financial Statements.

On February 29, 2012, the Board of Directors adopted a cash dividend policy and declared an initial quarterly dividend of $0.15 per share. On October 28, 2013, the Board of Directors increased the quarterly dividend to $0.20 per share. The fourth quarter dividend for 2015 was paid on January 5, 2016 to shareholders of record as of December 15, 2015. The total dividend payable at December 31, 2015 was $5.5 million and is included in other current liabilities in the consolidated balance sheet. Future decisions as to the payment of dividends will be at the discretion of the Board of Directors, subject to conditions then existing, including our financial requirements and condition and the limitation and payment of cash dividends contained in debt agreements.

Information relating to compensation plans under which equity securities of CONMED Corporation are authorized for issuance is set forth below:

14

Equity Compensation Plan Information | |||||||

Plan category | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | Weighted-average exercise price of outstanding options, warrants and rights (b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) | ||||

Equity compensation plans approved by security holders | 1,030,670 | $43.47 | 2,141,538 | ||||

Equity compensation plans not approved by security holders | — | — | — | ||||

Total | 1,030,670 | $43.47 | 2,141,538 | ||||

The number of securities included in column (a) above consists of outstanding share appreciation rights (“SARs”) and performance share units, however the weighted-average exercise price in column (b) is for SARs only.

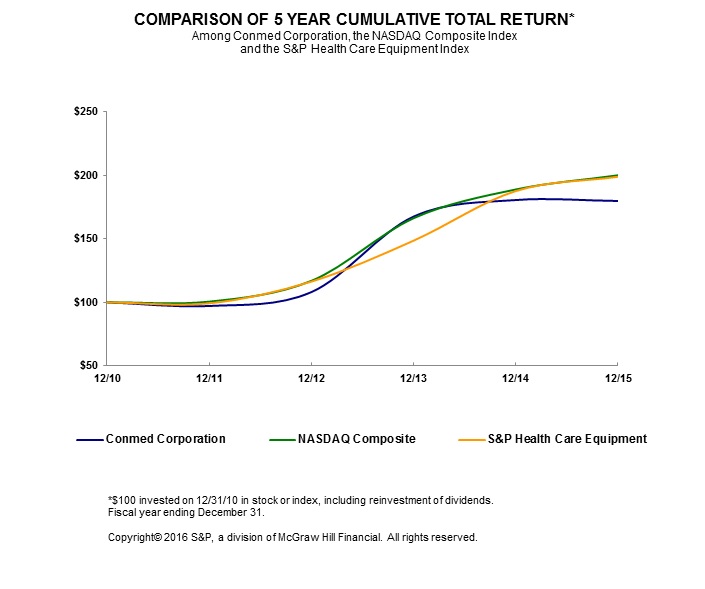

Performance Graph

The performance graph below compares the yearly percentage change in the Company’s Common Stock with the cumulative total return of the NASDAQ Composite Index and the cumulative total return of the Standard & Poor’s Health Care Equipment Index. In each case, the cumulative total return assumes reinvestment of dividends into the same class of equity securities at the frequency with which dividends are paid on such securities during the applicable fiscal year.

15

16

Item 6. Selected Financial Data

The following table sets forth selected historical financial data for the years ended December 31, 2015, 2014, 2013, 2012 and 2011. The financial data set forth below should be read in conjunction with the information under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in Item 7 of this Form 10-K and the Financial Statements of the Company and the notes thereto.

FIVE YEAR SUMMARY OF SELECTED FINANCIAL DATA

Years Ended December 31, | |||||||||||||||||||

2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||||||

(In thousands, except per share data) | |||||||||||||||||||

Statements of Operations Data (1): | |||||||||||||||||||

Net sales | $ | 719,168 | $ | 740,055 | $ | 762,704 | $ | 767,140 | $ | 725,077 | |||||||||

Cost of sales (2) | 337,466 | 335,998 | 350,287 | 361,297 | 350,143 | ||||||||||||||

Gross profit | 381,702 | 404,057 | 412,417 | 405,843 | 374,934 | ||||||||||||||

Selling and administrative expense (3) | 303,091 | 323,492 | 330,078 | 312,419 | 277,707 | ||||||||||||||

Research and development expense | 27,436 | 27,779 | 25,831 | 28,214 | 28,651 | ||||||||||||||

Impairment of goodwill (4) | — | — | — | — | 60,302 | ||||||||||||||

Income from operations | 51,175 | 52,786 | 56,508 | 65,210 | 8,274 | ||||||||||||||

Loss on early extinguishment of debt (5) | — | — | 263 | — | — | ||||||||||||||

Amortization of debt discount | — | — | — | — | 3,903 | ||||||||||||||

Interest expense | 6,031 | 6,111 | 5,613 | 5,730 | 6,676 | ||||||||||||||

Income (loss) before income taxes | 45,144 | 46,675 | 50,632 | 59,480 | (2,305 | ) | |||||||||||||

Provision (benefit) for income taxes | 14,646 | 14,483 | 14,693 | 18,999 | (3,057 | ) | |||||||||||||

Net income | $ | 30,498 | $ | 32,192 | $ | 35,939 | $ | 40,481 | $ | 752 | |||||||||

Per Share Data: | |||||||||||||||||||

Basic earnings per share | $ | 1.10 | $ | 1.17 | $ | 1.30 | $ | 1.43 | $ | 0.03 | |||||||||

Diluted earnings per share | $ | 1.09 | $ | 1.16 | $ | 1.28 | $ | 1.41 | $ | 0.03 | |||||||||

Dividends per share of common stock | $ | 0.80 | $ | 0.80 | $ | 0.65 | $ | 0.60 | $ | — | |||||||||

Weighted Average Number of Common Shares In Calculating: | |||||||||||||||||||

Basic earnings per share | 27,653 | 27,401 | 27,722 | 28,301 | 28,246 | ||||||||||||||

Diluted earnings per share | 27,858 | 27,769 | 28,114 | 28,653 | 28,633 | ||||||||||||||

Other Financial Data: | |||||||||||||||||||

Depreciation and amortization | $ | 43,879 | $ | 45,734 | $ | 47,867 | $ | 46,616 | $ | 42,687 | |||||||||

Capital expenditures | 15,009 | 15,411 | 18,445 | 21,532 | 17,552 | ||||||||||||||

Balance Sheet Data (at period end): | |||||||||||||||||||

Cash and cash equivalents | $ | 72,504 | $ | 66,332 | $ | 54,443 | $ | 23,720 | $ | 26,048 | |||||||||

Total assets | 1,112,944 | 1,098,194 | 1,090,508 | 1,078,849 | 935,594 | ||||||||||||||

Long-term obligations | 408,153 | 400,940 | 372,924 | 346,637 | 231,339 | ||||||||||||||

Total shareholders’ equity | 585,073 | 581,298 | 606,319 | 606,998 | 573,071 | ||||||||||||||

(1) | Results of operations of acquired businesses have been recorded in the financial statements since the date of acquisition. Refer to Note 4. |

17

(2) | In 2015, 2014, 2013, 2012 and 2011, we incurred charges related to the restructuring of certain of our manufacturing operations of $8.0 million, $5.6 million, $6.5 million, $7.1 million and $3.5 million, respectively; in 2013 we incurred charges of $2.1 million related to the termination of a product offering. See additional discussion in Note 11 to the Consolidated Financial Statements. |

(3) | Restructuring and other expense included in selling and administrative costs are the following: |

2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||||||

Restructuring costs | $ | 13,655 | $ | 3,354 | $ | 8,750 | $ | 6,497 | $ | 792 | |||||||||

Business and asset acquisition costs | 2,543 | 722 | — | 1,898 | 300 | ||||||||||||||

Management restructuring costs | — | 12,546 | — | — | — | ||||||||||||||

Shareholder activism costs | — | 3,966 | — | — | — | ||||||||||||||

Patent dispute and other matters | — | 3,374 | 3,206 | 1,555 | — | ||||||||||||||

Pension settlement expense | — | — | 1,443 | — | — | ||||||||||||||

Restructuring and other expense included in selling and administrative expense | $ | 16,198 | $ | 23,962 | $ | 13,399 | $ | 9,950 | $ | 1,092 | |||||||||

See additional discussion in Note 11 to the Consolidated Financial Statements.

(4) | During 2011, we recorded a $60.3 million charge for the impairment of goodwill related to the legacy CONMED Patient Care reporting unit. |

(5) | Includes a charge of $0.3 million in 2013 related to a loss on the early extinguishment of debt. See additional discussion in Note 5 to the Consolidated Financial Statements. |

18

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with Selected Financial Data (Item 6), and our Consolidated Financial Statements and related notes contained elsewhere in this report.

Overview of CONMED Corporation

CONMED Corporation (“CONMED”, the “Company”, “we” or “us”) is a medical technology company that provides surgical devices and equipment for minimally invasive procedures. The Company’s products are used by surgeons and physicians in a variety of specialties including orthopedics, general surgery, gynecology, neurosurgery and gastroenterology.

Our product lines consist of orthopedic surgery, general surgery and surgical visualization. Orthopedic surgery consists of sports medicine instrumentation and small bone, large bone and specialty powered surgical instruments and service fees related to the promotion and marketing of sports medicine allograft tissue. General surgery consists of a complete line of endo-mechanical instrumentation for minimally invasive laparoscopic and gastrointestinal procedures, a line of cardiac monitoring products as well as electrosurgical generators and related instruments. Surgical visualization consists of imaging systems for use in minimally invasive orthopedic and general surgery procedures including 2DHD and 3DHD vision technologies. These product lines as a percentage of consolidated net sales are as follows:

2015 | 2014 | 2013 | ||||||

Orthopedic surgery | 54 | % | 54 | % | 54 | % | ||

General surgery | 38 | 38 | 37 | |||||

Surgical visualization | 8 | 8 | 9 | |||||

Consolidated net sales | 100 | % | 100 | % | 100 | % | ||

A significant amount of our products are used in surgical procedures with approximately 79% of our revenues derived from the sale of disposable products. Our capital equipment offerings also facilitate the ongoing sale of related disposable products and accessories, thus providing us with a recurring revenue stream. We manufacture substantially all of our products in facilities located in the United States and Mexico. We market our products both domestically and internationally directly to customers and through distributors. International sales approximated 50%, 51% and 51% in 2015, 2014 and 2013, respectively.

Business Environment

2015 was a year of continued change and transformation for CONMED Corporation. During the year, we filled the remaining executive positions in a now entirely revamped leadership team. We also aligned our marketing product strategy road map with our research and development resource allocation to re-invigorate our organic product pipeline, while leveraging our restored business development function to actively pursue additional acquisitions. During the year, we had three business acquisitions as more fully disclosed in Note 4 to the Consolidated Financial Statements.

On January 4, 2016, we acquired SurgiQuest, Inc. ("SurgiQuest") for $265 million in cash (on a cash-free, debt-free basis). SurgiQuest develops, manufactures, and markets the AirSeal® System, the first integrated access management technology for use in laparoscopic and robotic procedures. This proprietary and differentiated access system is complementary to our current advanced surgical offering. We expect this access system to generate approximately $55 to $60 million in revenue in 2016.

We plan to continue to restructure both operations and administrative functions as necessary throughout the organization. We have successfully completed our restructuring plans over the past few years, however, we cannot be certain further activities, will be completed in the estimated time period or that planned cost savings will be achieved.

Finally, our facilities are subject to periodic inspection by the United States Food and Drug Administration (“FDA”) and foreign regulatory agencies or notified bodies for, among other things, conformance to Quality System Regulation and Current Good Manufacturing Practice (“CGMP”) requirements and foreign or international standards. During the third quarter of 2013, the FDA inspected our Centennial, Colorado manufacturing facility and issued a Form 483 with observations on September 20, 2013. We subsequently submitted responses to the Observations, and the FDA issued a Warning Letter on January 30, 2014 relating to the inspection and the responses to the Form 483 Observations. Accordingly, we undertook corrective actions. During the fourth quarter of 2014, the FDA again inspected our Centennial, Colorado manufacturing facility and, on November 18, 2014, issued a Form 483 with eight observations, three of which the FDA characterized as repeat observations. On December 10, 2014,

19

we responded to the Form 483 Observations. We have received some additional questions from the FDA and responded to these questions on April 25, 2015. The remediation costs to date have not been material, although there can be no assurance that responding to the Form 483 observations or a future inspection by the FDA will not result in an additional Form 483 or warning letter, or other regulatory actions, which may include consent decrees or fines.

Critical Accounting Policies

Preparation of our financial statements requires us to make estimates and assumptions which affect the reported amounts of assets, liabilities, revenues and expenses. Note 1 to the Consolidated Financial Statements describes the significant accounting policies used in preparation of the Consolidated Financial Statements. The most significant areas involving management judgments and estimates are described below and are considered by management to be critical to understanding the financial condition and results of operations of CONMED Corporation.

Revenue Recognition

Revenue is recognized when title has been transferred to the customer which is at the time of shipment. The following policies apply to our major categories of revenue transactions:

• | Sales to customers are evidenced by firm purchase orders. Title and the risks and rewards of ownership are transferred to the customer when product is shipped under our stated shipping terms. Payment by the customer is due under fixed payment terms and collectability is reasonably assured. |

• | We place certain of our capital equipment with customers on a loaned basis in return for commitments to purchase related single-use products over time periods generally ranging from one to three years. In these circumstances, no revenue is recognized upon capital equipment shipment as the equipment is loaned and subject to return if certain minimum single-use purchases are not met. Revenue is recognized upon the sale and shipment of the related single-use products. The cost of the equipment is amortized over its estimated useful life. |

• | We recognize revenues related to the promotion and marketing of sports medicine allograft tissue in accordance with the contractual terms of our agreement with Musculoskeletal Transplant Foundation (“MTF”) on a net basis as our role is limited to that of an agent earning a commission or fee. MTF records revenue when the tissue is shipped to the customer. Our services are completed at this time and net revenues for the “Service Fee” for our promotional and marketing efforts are then recognized based on a percentage of the net amounts billed by MTF to its customers. The timing of revenue recognition is determined through review of the net billings made by MTF each month. Our net commission Service Fee is based on the contractual terms of our agreement and is currently 50%. This percentage can vary over the term of the agreement but is contractually determinable. Our Service Fee revenues are recorded net of amortization of the acquired assets, which are being expensed over the expected useful life of 25 years. |

• | Product returns are only accepted at the discretion of the Company and in accordance with our “Returned Goods Policy”. Historically, the level of product returns has not been significant. We accrue for sales returns, rebates and allowances based upon an analysis of historical customer returns and credits, rebates, discounts and current market conditions. |

• | Our terms of sale to customers generally do not include any obligations to perform future services. Limited warranties are provided for capital equipment sales and provisions for warranty are provided at the time of product sale based upon an analysis of historical data. |

• | Amounts billed to customers related to shipping and handling have been included in net sales. Shipping and handling costs included in selling and administrative expense were $12.6 million, $13.6 million and $12.6 million for 2015, 2014 and 2013, respectively. |

• | We sell to a diversified base of customers around the world and, therefore, believe there is no material concentration of credit risk. |

• | We assess the risk of loss on accounts receivable and adjust the allowance for doubtful accounts based on this risk assessment. Historically, losses on accounts receivable have not been material. Management believes that the allowance for doubtful accounts of $1.3 million at December 31, 2015 is adequate to provide for probable losses resulting from accounts receivable. |

20

Inventory Valuation