Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EQT RE, LLC | d31361d8k.htm |

Exhibit 99.1

FOR IMMEDIATE RELEASE

Rice Energy Closes Strategic Midstream Equity Investment by EIG Global Energy Partners

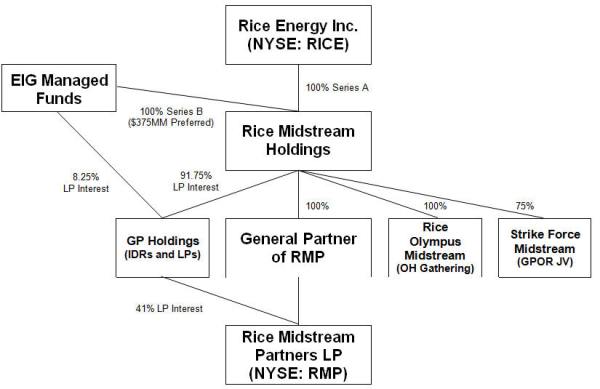

CANONSBURG, Pa. – February 22, 2016 /PRNewswire/ – Rice Energy Inc. (NYSE: RICE) (“Rice”) today announced it has completed a $375 million equity investment by EIG Global Energy Partners (“EIG”), on behalf of EIG managed funds, into Rice Midstream Holdings LLC (“RMH”) in exchange for $375 million of Series B Units (“Preferred Equity”) in RMH and common units representing an 8.25% limited partner interest in Rice Midstream GP Holdings LP (“GP Holdings”), a newly-formed subsidiary of RMH that holds all of the common units, subordinated units and incentive distribution rights in Rice Midstream Partners LP (NYSE: RMP) previously held by RMH. The Preferred Equity has an 8.0% distribution rate with an option to pay in kind for the first two years. RMH will use approximately $75 million of the proceeds to repay all outstanding borrowings under its revolving credit facility and to pay transaction fees and expenses, and the remaining $300 million will be distributed to Rice Energy to fund a portion of its 2016 development program in the cores of the Marcellus and Utica Shales. In addition, RMH will have an additional $125 million commitment from EIG (subject to designated drawing conditions precedent) for a period of 18 months.

Transaction Highlights

| • | Attractive equity capital with a strong financial partner amidst a challenging market |

| • | Proceeds to Rice provide ample liquidity, together with cash on hand and operating cash flow, to fully fund its 2016 E&P capital expenditures |

| • | Illuminates the significant embedded value of Rice’s Ohio midstream assets and GP Holdings |

Commenting on the announcement, Grayson T. Lisenby, Chief Financial Officer, said, “We are pleased to work with EIG, a premier energy investor with an exceptional reputation and extensive track record. By fully funding our 2016 E&P budget without incurring any debt, we expect to exit 2016 with E&P leverage of 3.0x, strong operating cash flow and a healthy backlog of wells in progress that favorably positions Rice Energy for seamless, economic growth in 2017. Along with the immediate benefit to our balance sheet, we believe this transaction highlights the quality of our assets, the strength of our strategy and supports our belief that RMP’s continued strong distribution growth will result in a long-term GP Holdings valuation in excess of $1 billion.”

“We are delighted to support Rice with our capital,” said EIG Managing Director Wallace C. Henderson, who added, “Rice has a demonstrated operational track record in the most prolific areas of the Marcellus and Utica Shales. The opportunity to invest in essential midstream infrastructure that simultaneously services and benefits from Rice’s upstream operations was very attractive. We look forward to working with Rice as it seeks to continue to create value for our midstream investment.”

1

Upon the third anniversary of the closing, RMH may redeem the Preferred Equity at a price equal to EIG’s invested amount plus any accrued but unpaid distributions. In addition, RMH will have an additional $125 million commitment from EIG for a period of 18 months with each $25 million drawn resulting in an issuance of an additional $25 million of Preferred Equity in RMH and common units representing an additional 0.55% limited partner interest in GP Holdings. EIG has an irrevocable option to cause RMH to redeem the Preferred Equity upon the tenth anniversary of the closing. The common units in GP Holdings representing a limited partner interest in GP Holdings will be entitled to pro rata distributions.

Barclays Capital Inc. acted as financial advisor and Vinson & Elkins L.L.P. served as legal counsel to Rice. Kirkland & Ellis LLP represented EIG.

Conference Call

Rice Energy plans to announce fourth quarter and full-year 2015 results and 2016 capital budget and guidance after market close on Wednesday, February 24, 2016. In conjunction with the release, Rice Energy will host a conference call to discuss its results on February 25, 2016 at 9:30 a.m. Eastern time (8:30 a.m. Central time). To listen to a live audio webcast of the conference call, please visit Rice Energy’s website at www.riceenergy.com.

About Rice Energy

Rice Energy Inc. is an independent natural gas and oil company engaged in the acquisition, exploration and development of natural gas and oil properties in the Appalachian Basin. For more information, please visit our website at www.riceenergy.com.

About EIG

EIG is a leading institutional investor to the global energy sector with $14.7 billion under management as of December 31, 2015. EIG specializes in private investments in energy and energy-related infrastructure on a global basis. During its 34-year history, EIG has invested over $21.5 billion in the sector through more than 300 projects or companies in 35 countries on six continents. EIG’s clients include many of the leading pension plans, insurance companies, endowments, foundations and sovereign wealth funds in the U.S., Asia and Europe. EIG is headquartered in Washington, D.C. with offices in Houston, London, Sydney, Rio de Janeiro, Hong Kong and Seoul.

2

Please note that the ownership structure above is a simplified structure and does not show all subsidiaries.

Forward Looking Statements

This release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond our control. All statements, other than historical facts included or incorporate herein that address activities, events or developments that we expect or anticipate will or may occur in the future, including such things as the closing of the additional discretionary investments in RMH and GP Holdings on the terms outlined in this announcement and future capital expenditures (including the amount and nature thereof), are forward-looking statements. All forward-looking statements speak only as of the date of this release. Although we believe that the plans, intentions and expectations reflected in or suggested by the forward-looking statements are reasonable, there is no assurance that these plans, intentions or expectations will be achieved. Therefore, actual outcomes and results could materially differ from what is expressed, implied or forecast in such statements.

We caution you that these forward-looking statements are subject to risks and uncertainties, most of which are difficult to predict and many of which are beyond our control. Furthermore, the additional discretionary investments in RMH and GP Holdings and related transactions may not be completed as described or at all. Information concerning these and other factors can be

3

found in our filings with the Securities and Exchange Commission, including our Forms 10-K, 10-Q and 8-K. Consequently, all of the forward-looking statements made in this news release are qualified by these cautionary statements and there can be no assurances that the actual results or developments anticipated by us will be realized, or even if realized, that they will have the expected consequences to or effects on us, our business or operations. We have no intention, and disclaim any obligation, to update or revise any forward-looking statements, whether as a result of new information, future results or otherwise.

Contact:

Julie Danvers, Director of Investor Relations

(832) 708-3437

Julie.Danvers@RiceEnergy.com

4