Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FEB 2016 INVESTOR PRESENTATION - SCHWEITZER MAUDUIT INTERNATIONAL INC | feb16investorpres8-k.htm |

Investor Presentation NYSE: SWM February 2016

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. Safe Harbor Statement This presentation may contain ―forward-looking statements.‖ All statements that address operating performance, events or developments that we expect or anticipate will occur in the future are forward- looking statements. Caution should be taken not to place undue reliance on any such forward-looking statements because actual results may differ materially from the results suggested by these statements. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our historical experience and present expectations or projections. These risks and uncertainties include, but are not limited to, those described in Part I, ―Item 1A. Risk Factors‖ and elsewhere in our Annual Report on Form 10-K for the period ending December 31, 2014, and those described from time to time in our periodic and other reports filed with the Securities and Exchange Commission. 2

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. Agenda Overview Engineered Papers Segment Advanced Materials & Structures Segment 3 Growth Opportunities Financials Annual Review / Outlook

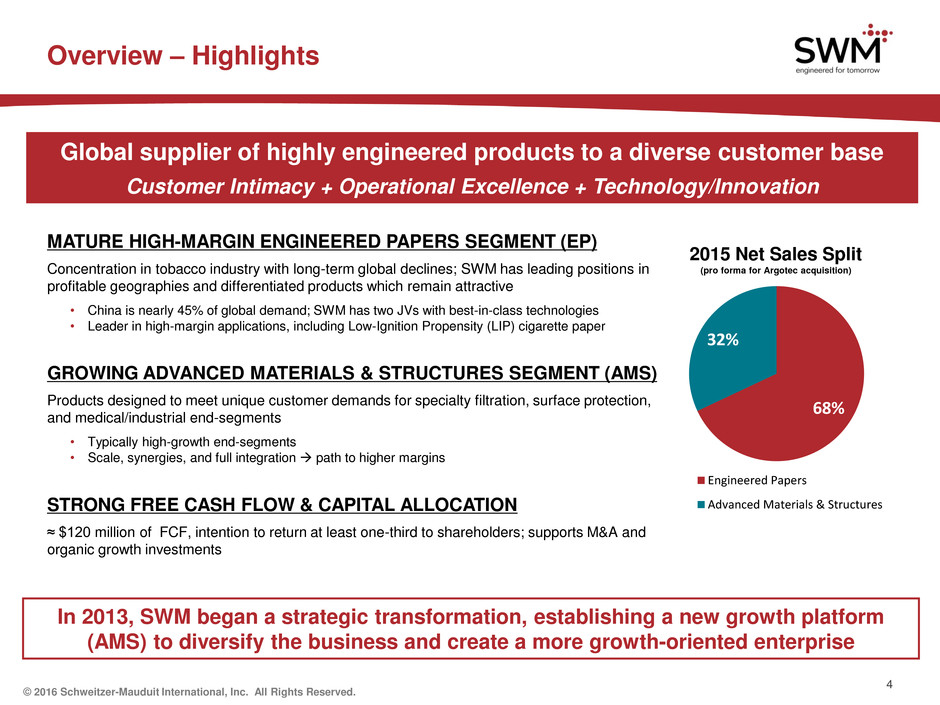

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. Overview – Highlights Global supplier of highly engineered products to a diverse customer base Customer Intimacy + Operational Excellence + Technology/Innovation MATURE HIGH-MARGIN ENGINEERED PAPERS SEGMENT (EP) Concentration in tobacco industry with long-term global declines; SWM has leading positions in profitable geographies and differentiated products which remain attractive • China is nearly 45% of global demand; SWM has two JVs with best-in-class technologies • Leader in high-margin applications, including Low-Ignition Propensity (LIP) cigarette paper GROWING ADVANCED MATERIALS & STRUCTURES SEGMENT (AMS) Products designed to meet unique customer demands for specialty filtration, surface protection, and medical/industrial end-segments • Typically high-growth end-segments • Scale, synergies, and full integration path to higher margins STRONG FREE CASH FLOW & CAPITAL ALLOCATION ≈ $120 million of FCF, intention to return at least one-third to shareholders; supports M&A and organic growth investments 4 In 2013, SWM began a strategic transformation, establishing a new growth platform (AMS) to diversify the business and create a more growth-oriented enterprise 68% 32% Engineered Papers Advanced Materials & Structures 2015 Net Sales Split (pro forma for Argotec acquisition)

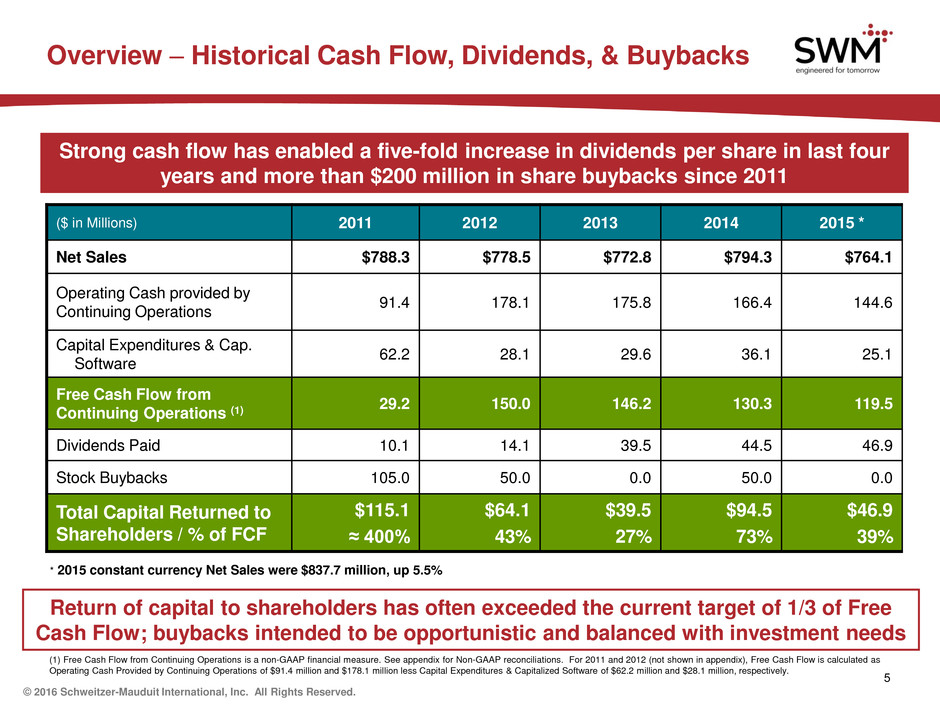

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. 5 Overview – Historical Cash Flow, Dividends, & Buybacks (1) Free Cash Flow from Continuing Operations is a non-GAAP financial measure. See appendix for Non-GAAP reconciliations. For 2011 and 2012 (not shown in appendix), Free Cash Flow is calculated as Operating Cash Provided by Continuing Operations of $91.4 million and $178.1 million less Capital Expenditures & Capitalized Software of $62.2 million and $28.1 million, respectively. Strong cash flow has enabled a five-fold increase in dividends per share in last four years and more than $200 million in share buybacks since 2011 Return of capital to shareholders has often exceeded the current target of 1/3 of Free Cash Flow; buybacks intended to be opportunistic and balanced with investment needs ($ in Millions) 2011 2012 2013 2014 2015 * Net Sales $788.3 $778.5 $772.8 $794.3 $764.1 Operating Cash provided by Continuing Operations 91.4 178.1 175.8 166.4 144.6 Capital Expenditures & Cap. Software 62.2 28.1 29.6 36.1 25.1 Free Cash Flow from Continuing Operations (1) 29.2 150.0 146.2 130.3 119.5 Dividends Paid 10.1 14.1 39.5 44.5 46.9 Stock Buybacks 105.0 50.0 0.0 50.0 0.0 Total Capital Returned to Shareholders / % of FCF $115.1 ≈ 400% $64.1 43% $39.5 27% $94.5 73% $46.9 39% * 2015 constant currency Net Sales were $837.7 million, up 5.5%

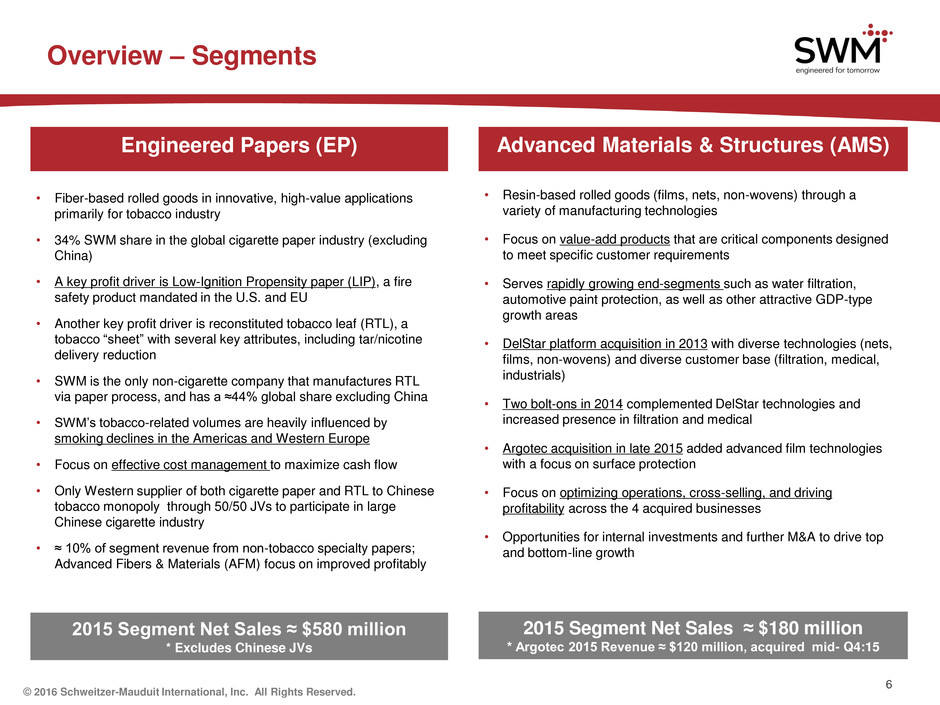

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. Overview – Segments 6 Engineered Papers (EP) • Fiber-based rolled goods in innovative, high-value applications primarily for tobacco industry • 34% SWM share in the global cigarette paper industry (excluding China) • A key profit driver is Low-Ignition Propensity paper (LIP), a fire safety product mandated in the U.S. and EU • Another key profit driver is reconstituted tobacco leaf (RTL), a tobacco ―sheet‖ with several key attributes, including tar/nicotine delivery reduction • SWM is the only non-cigarette company that manufactures RTL via paper process, and has a ≈44% global share excluding China • SWM’s tobacco-related volumes are heavily influenced by smoking declines in the Americas and Western Europe • Focus on effective cost management to maximize cash flow • Only Western supplier of both cigarette paper and RTL to Chinese tobacco monopoly through 50/50 JVs to participate in large Chinese cigarette industry • ≈ 10% of segment revenue from non-tobacco specialty papers; Advanced Fibers & Materials (AFM) focus on improved profitably Advanced Materials & Structures (AMS) 2015 Segment Net Sales ≈ $580 million * Excludes Chinese JVs • Resin-based rolled goods (films, nets, non-wovens) through a variety of manufacturing technologies • Focus on value-add products that are critical components designed to meet specific customer requirements • Serves rapidly growing end-segments such as water filtration, automotive paint protection, as well as other attractive GDP-type growth areas • DelStar platform acquisition in 2013 with diverse technologies (nets, films, non-wovens) and diverse customer base (filtration, medical, industrials) • Two bolt-ons in 2014 complemented DelStar technologies and increased presence in filtration and medical • Argotec acquisition in late 2015 added advanced film technologies with a focus on surface protection • Focus on optimizing operations, cross-selling, and driving profitability across the 4 acquired businesses • Opportunities for internal investments and further M&A to drive top and bottom-line growth 2015 Segment Net Sales ≈ $180 million * Argotec 2015 Revenue ≈ $120 million, acquired mid- Q4:15

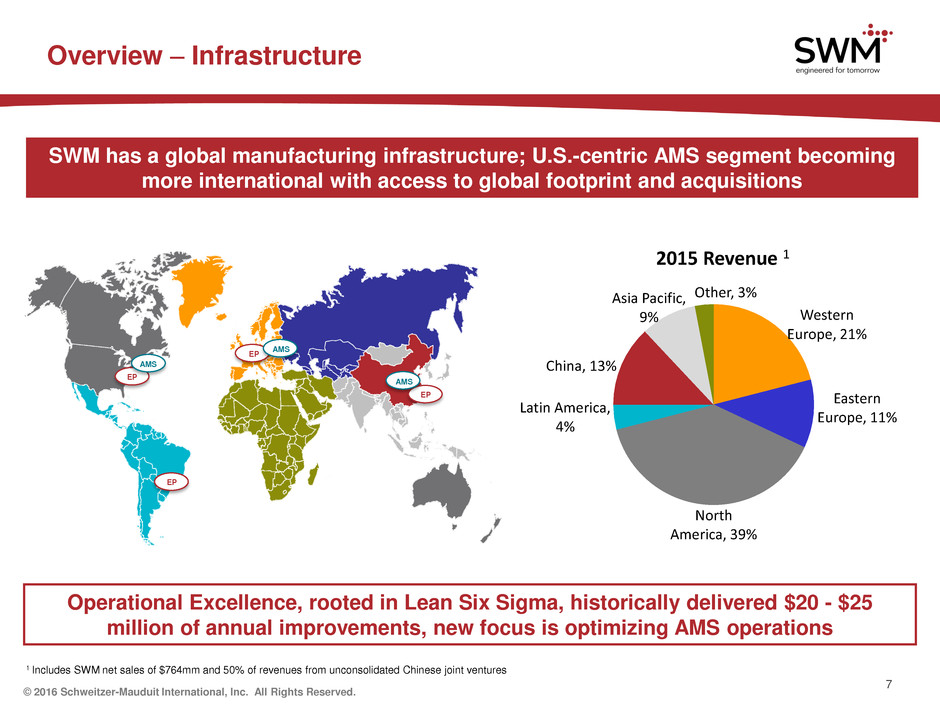

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. Overview – Infrastructure 7 SWM has a global manufacturing infrastructure; U.S.-centric AMS segment becoming more international with access to global footprint and acquisitions China 9% EP EP EP EP AMS AMS Operational Excellence, rooted in Lean Six Sigma, historically delivered $20 - $25 million of annual improvements, new focus is optimizing AMS operations AMS 1 Includes SWM net sales of $764mm and 50% of revenues from unconsolidated Chinese joint ventures Western Europe, 21% Eastern Europe, 11% North America, 39% Latin America, 4% China, 13% Asia Pacific, 9% Other, 3% 2015 Revenue 1

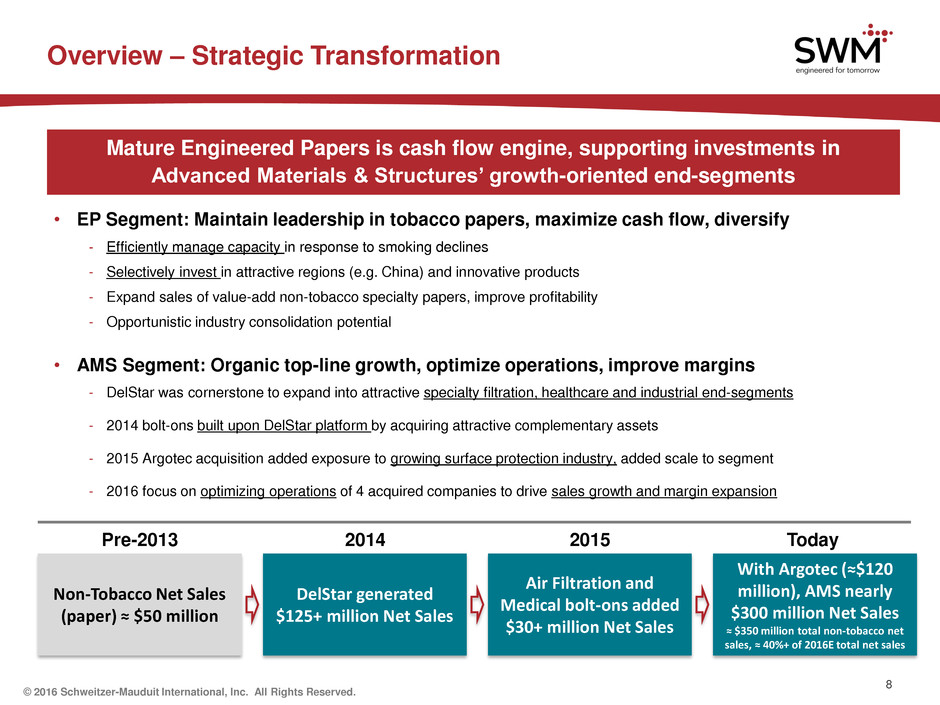

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. Overview – Strategic Transformation 8 Mature Engineered Papers is cash flow engine, supporting investments in Advanced Materials & Structures’ growth-oriented end-segments • EP Segment: Maintain leadership in tobacco papers, maximize cash flow, diversify - Efficiently manage capacity in response to smoking declines - Selectively invest in attractive regions (e.g. China) and innovative products - Expand sales of value-add non-tobacco specialty papers, improve profitability - Opportunistic industry consolidation potential • AMS Segment: Organic top-line growth, optimize operations, improve margins - DelStar was cornerstone to expand into attractive specialty filtration, healthcare and industrial end-segments - 2014 bolt-ons built upon DelStar platform by acquiring attractive complementary assets - 2015 Argotec acquisition added exposure to growing surface protection industry, added scale to segment - 2016 focus on optimizing operations of 4 acquired companies to drive sales growth and margin expansion Non-Tobacco Net Sales (paper) ≈ $50 million DelStar generated $125+ million Net Sales Air Filtration and Medical bolt-ons added $30+ million Net Sales With Argotec (≈$120 million), AMS nearly $300 million Net Sales ≈ $350 million total non-tobacco net sales, ≈ 40%+ of 2016E total net sales Pre-2013 2014 2015 Today

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. Agenda Overview Engineered Papers Segment Advanced Materials & Structures Segment 9 Growth Opportunities Financials Annual Review / Outlook

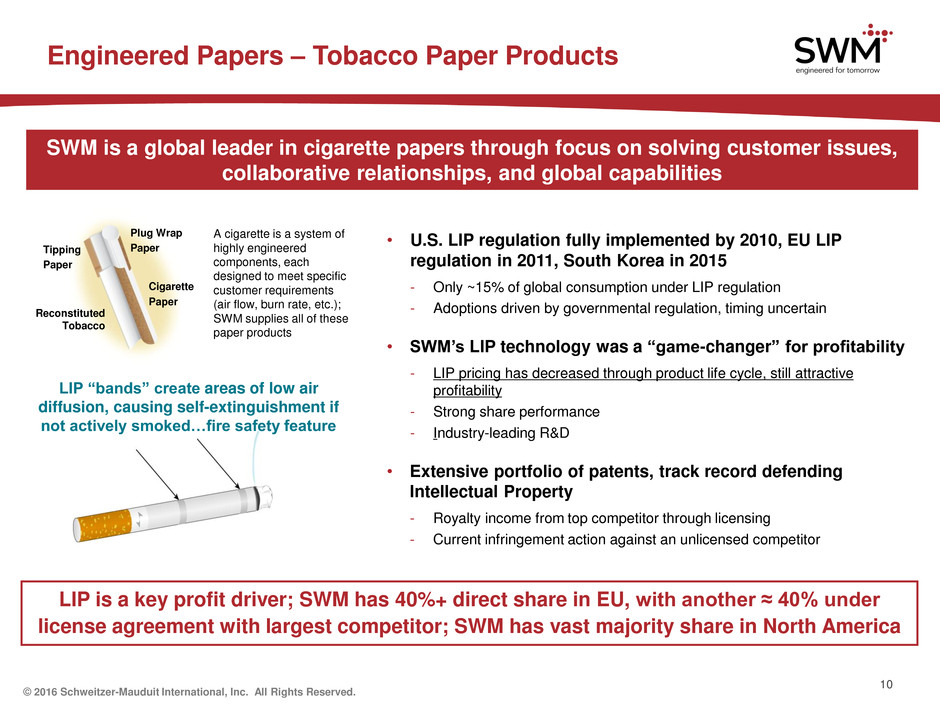

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. Engineered Papers – Tobacco Paper Products SWM is a global leader in cigarette papers through focus on solving customer issues, collaborative relationships, and global capabilities 10 LIP is a key profit driver; SWM has 40%+ direct share in EU, with another ≈ 40% under license agreement with largest competitor; SWM has vast majority share in North America Plug Wrap Paper Tipping Paper Reconstituted Tobacco Cigarette Paper LIP “bands” create areas of low air diffusion, causing self-extinguishment if not actively smoked…fire safety feature A cigarette is a system of highly engineered components, each designed to meet specific customer requirements (air flow, burn rate, etc.); SWM supplies all of these paper products • U.S. LIP regulation fully implemented by 2010, EU LIP regulation in 2011, South Korea in 2015 - Only ~15% of global consumption under LIP regulation - Adoptions driven by governmental regulation, timing uncertain • SWM’s LIP technology was a “game-changer” for profitability - LIP pricing has decreased through product life cycle, still attractive profitability - Strong share performance - Industry-leading R&D • Extensive portfolio of patents, track record defending Intellectual Property - Royalty income from top competitor through licensing - Current infringement action against an unlicensed competitor

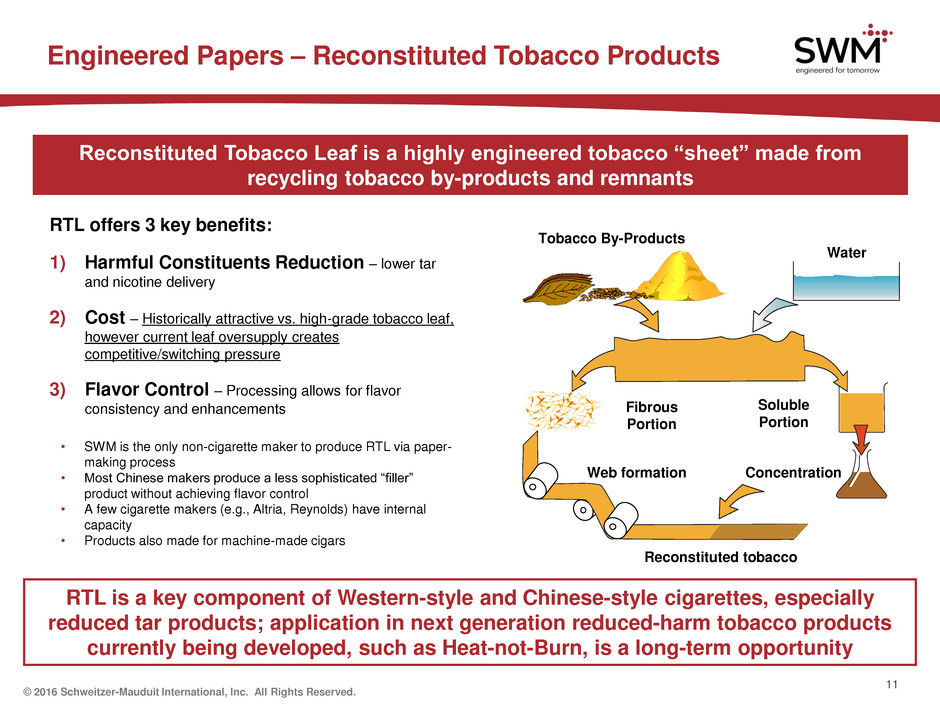

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. Engineered Papers – Reconstituted Tobacco Products RTL offers 3 key benefits: 1) Harmful Constituents Reduction – lower tar and nicotine delivery 2) Cost – Historically attractive vs. high-grade tobacco leaf, however current leaf oversupply creates competitive/switching pressure 3) Flavor Control – Processing allows for flavor consistency and enhancements • SWM is the only non-cigarette maker to produce RTL via paper- making process • Most Chinese makers produce a less sophisticated ―filler‖ product without achieving flavor control • A few cigarette makers (e.g., Altria, Reynolds) have internal capacity • Products also made for machine-made cigars 11 Tobacco By-Products Water Fibrous Portion Web formation Soluble Portion Concentration Reconstituted tobacco Reconstituted Tobacco Leaf is a highly engineered tobacco “sheet” made from recycling tobacco by-products and remnants RTL is a key component of Western-style and Chinese-style cigarettes, especially reduced tar products; application in next generation reduced-harm tobacco products currently being developed, such as Heat-not-Burn, is a long-term opportunity

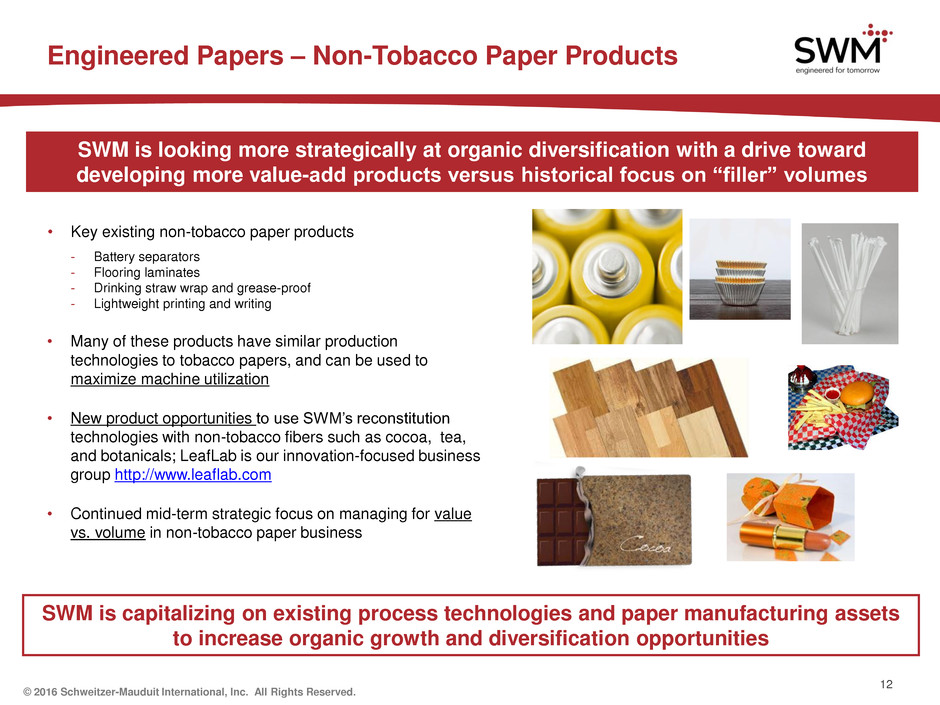

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. SWM is looking more strategically at organic diversification with a drive toward developing more value-add products versus historical focus on “filler” volumes 12 SWM is capitalizing on existing process technologies and paper manufacturing assets to increase organic growth and diversification opportunities • Key existing non-tobacco paper products - Battery separators - Flooring laminates - Drinking straw wrap and grease-proof - Lightweight printing and writing • Many of these products have similar production technologies to tobacco papers, and can be used to maximize machine utilization • New product opportunities to use SWM’s reconstitution technologies with non-tobacco fibers such as cocoa, tea, and botanicals; LeafLab is our innovation-focused business group http://www.leaflab.com • Continued mid-term strategic focus on managing for value vs. volume in non-tobacco paper business Engineered Papers – Non-Tobacco Paper Products

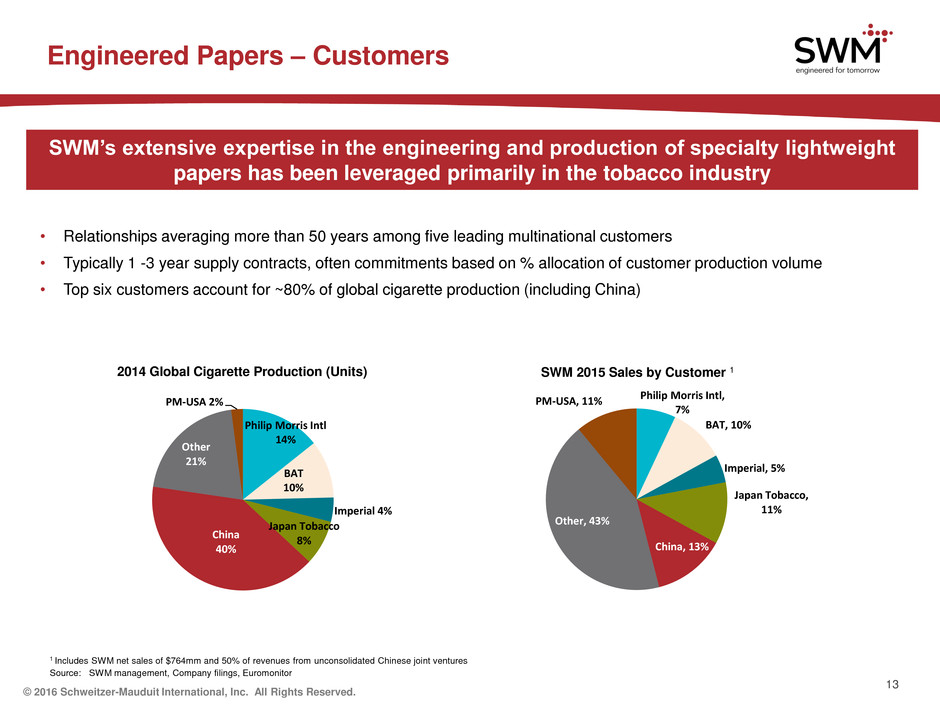

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. Engineered Papers – Customers 13 SWM’s extensive expertise in the engineering and production of specialty lightweight papers has been leveraged primarily in the tobacco industry • Relationships averaging more than 50 years among five leading multinational customers • Typically 1 -3 year supply contracts, often commitments based on % allocation of customer production volume • Top six customers account for ~80% of global cigarette production (including China) 1 Includes SWM net sales of $764mm and 50% of revenues from unconsolidated Chinese joint ventures Source: SWM management, Company filings, Euromonitor Philip Morris Intl 14% BAT 10% Imperial 4% Japan Tobacco 8% China 40% Other 21% PM-USA 2% 2014 Global Cigarette Production (Units) Philip Morris Intl, 7% BAT, 10% Imperial, 5% Japan Tobacco, 11% China, 13% Other, 43% PM-USA, 11% China 9% SWM 2015 Sales by Customer 1

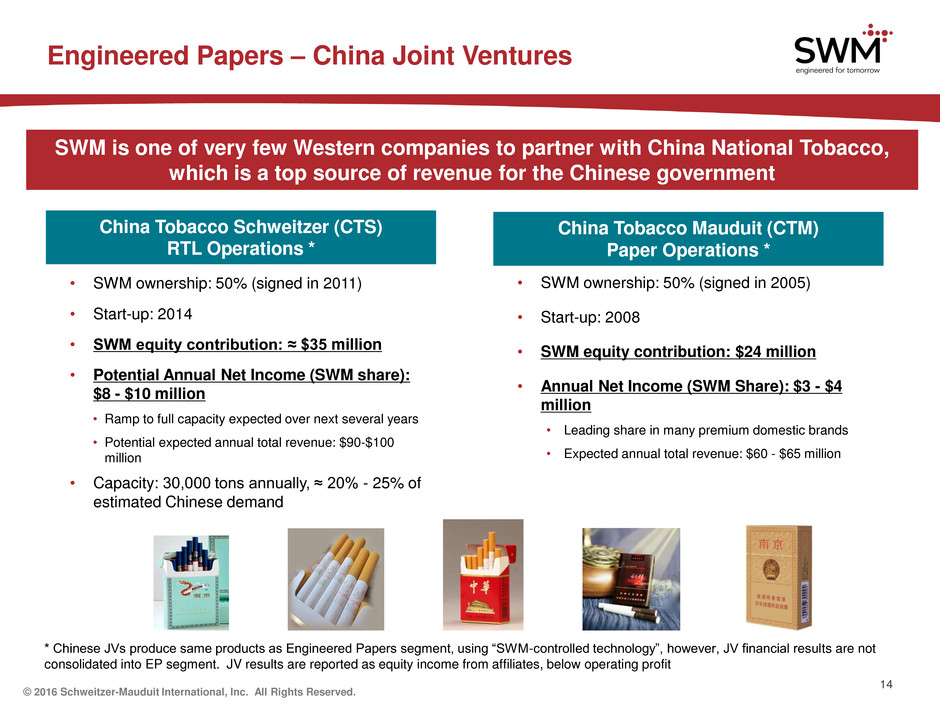

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. Engineered Papers – China Joint Ventures • SWM ownership: 50% (signed in 2011) • Start-up: 2014 • SWM equity contribution: ≈ $35 million • Potential Annual Net Income (SWM share): $8 - $10 million • Ramp to full capacity expected over next several years • Potential expected annual total revenue: $90-$100 million • Capacity: 30,000 tons annually, ≈ 20% - 25% of estimated Chinese demand 14 • SWM ownership: 50% (signed in 2005) • Start-up: 2008 • SWM equity contribution: $24 million • Annual Net Income (SWM Share): $3 - $4 million • Leading share in many premium domestic brands • Expected annual total revenue: $60 - $65 million China Tobacco Schweitzer (CTS) RTL Operations * China Tobacco Mauduit (CTM) Paper Operations * SWM is one of very few Western companies to partner with China National Tobacco, which is a top source of revenue for the Chinese government * Chinese JVs produce same products as Engineered Papers segment, using ―SWM-controlled technology‖, however, JV financial results are not consolidated into EP segment. JV results are reported as equity income from affiliates, below operating profit

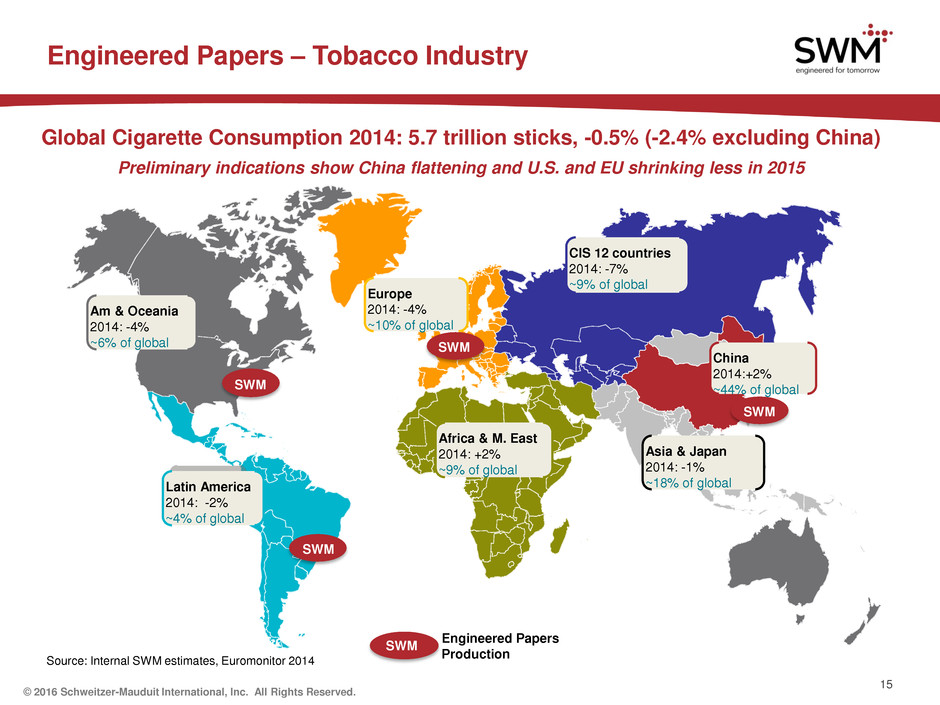

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. Engineered Papers – Tobacco Industry 15 Global Cigarette Consumption 2014: 5.7 trillion sticks, -0.5% (-2.4% excluding China) Preliminary indications show China flattening and U.S. and EU shrinking less in 2015 Am & Oceania 2014: -4% ~6% of global Latin America 2014: -2% ~4% of global Europe 2014: -4% ~10% of global China 2014:+2% ~44% of global Asia & Japan 2014: -1% ~18% of global CIS 12 countries 2014: -7% ~9% of global Africa & M. East 2014: +2% ~9% of global SWM SWM SWM SWM SWM Engineered Papers Production Source: Internal SWM estimates, Euromonitor 2014

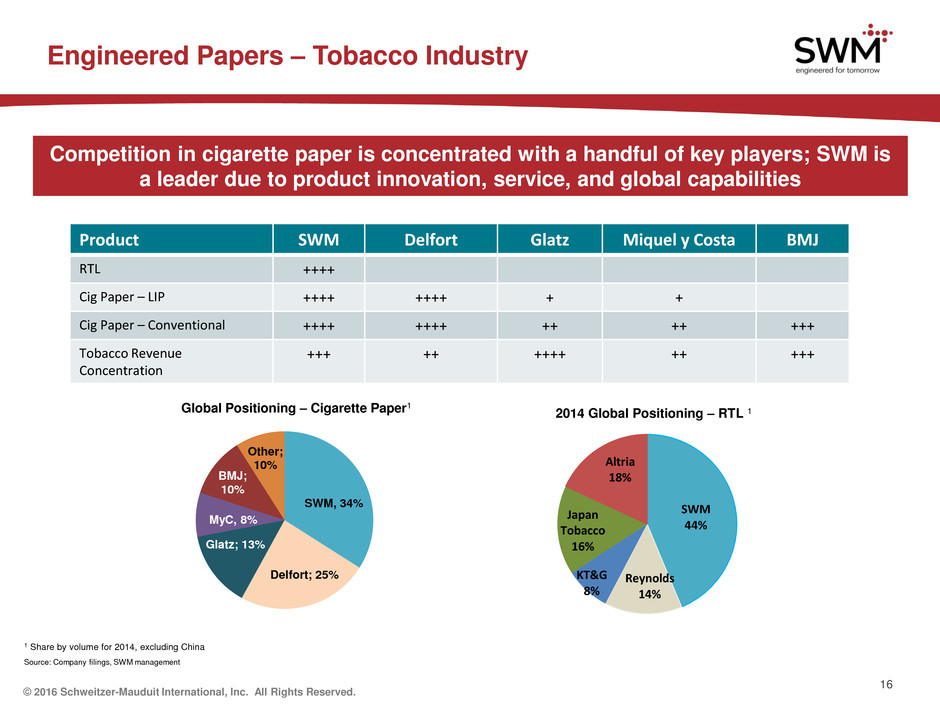

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. SWM, 34% Delfort; 25% Glatz; 13% MyC, 8% BMJ; 10% Other; 10% Engineered Papers – Tobacco Industry 1 Share by volume for 2014, excluding China Source: Company filings, SWM management 16 Product SWM Delfort Glatz Miquel y Costa BMJ RTL ++++ Cig Paper – LIP ++++ ++++ + + Cig Paper – Conventional ++++ ++++ ++ ++ +++ Tobacco Revenue Concentration +++ ++ ++++ ++ +++ Competition in cigarette paper is concentrated with a handful of key players; SWM is a leader due to product innovation, service, and global capabilities Global Positioning – Cigarette Paper1 SWM 44% Reynolds 14% KT&G 8% Japan Tobacco 16% Altria 18% 2014 Global Positioning – RTL 1

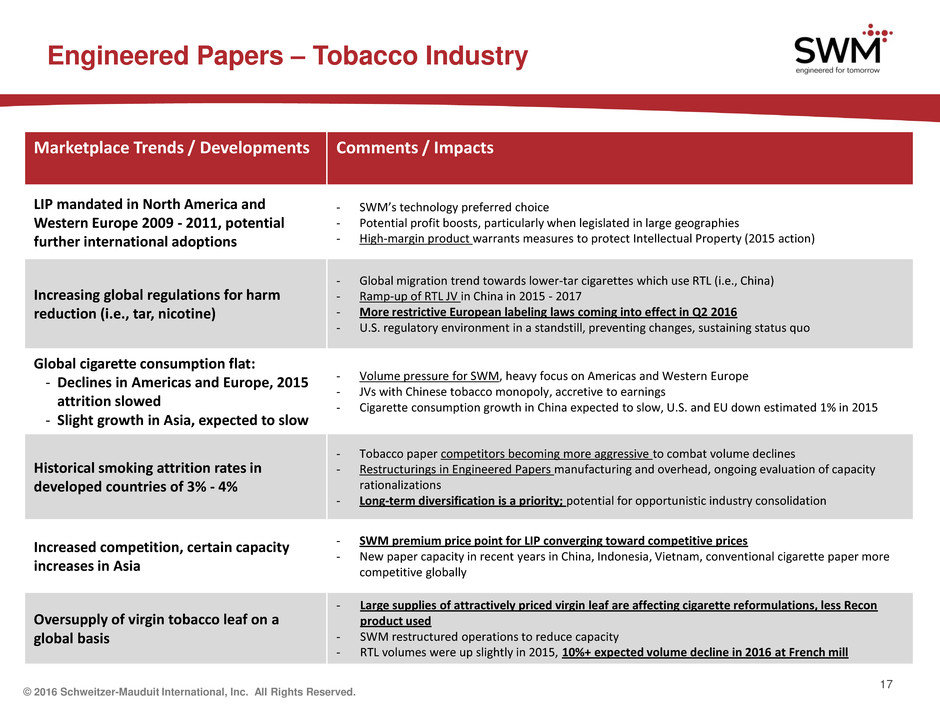

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. Engineered Papers – Tobacco Industry 17 Marketplace Trends / Developments Comments / Impacts LIP mandated in North America and Western Europe 2009 - 2011, potential further international adoptions - SWM’s technology preferred choice - Potential profit boosts, particularly when legislated in large geographies - High-margin product warrants measures to protect Intellectual Property (2015 action) Increasing global regulations for harm reduction (i.e., tar, nicotine) - Global migration trend towards lower-tar cigarettes which use RTL (i.e., China) - Ramp-up of RTL JV in China in 2015 - 2017 - More restrictive European labeling laws coming into effect in Q2 2016 - U.S. regulatory environment in a standstill, preventing changes, sustaining status quo Global cigarette consumption flat: - Declines in Americas and Europe, 2015 attrition slowed - Slight growth in Asia, expected to slow - Volume pressure for SWM, heavy focus on Americas and Western Europe - JVs with Chinese tobacco monopoly, accretive to earnings - Cigarette consumption growth in China expected to slow, U.S. and EU down estimated 1% in 2015 Historical smoking attrition rates in developed countries of 3% - 4% - Tobacco paper competitors becoming more aggressive to combat volume declines - Restructurings in Engineered Papers manufacturing and overhead, ongoing evaluation of capacity rationalizations - Long-term diversification is a priority; potential for opportunistic industry consolidation Increased competition, certain capacity increases in Asia - SWM premium price point for LIP converging toward competitive prices - New paper capacity in recent years in China, Indonesia, Vietnam, conventional cigarette paper more competitive globally Oversupply of virgin tobacco leaf on a global basis - Large supplies of attractively priced virgin leaf are affecting cigarette reformulations, less Recon product used - SWM restructured operations to reduce capacity - RTL volumes were up slightly in 2015, 10%+ expected volume decline in 2016 at French mill

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. Agenda Overview Engineered Papers Segment Advanced Materials & Structures Segment 18 Growth Opportunities Financials Annual Review / Outlook

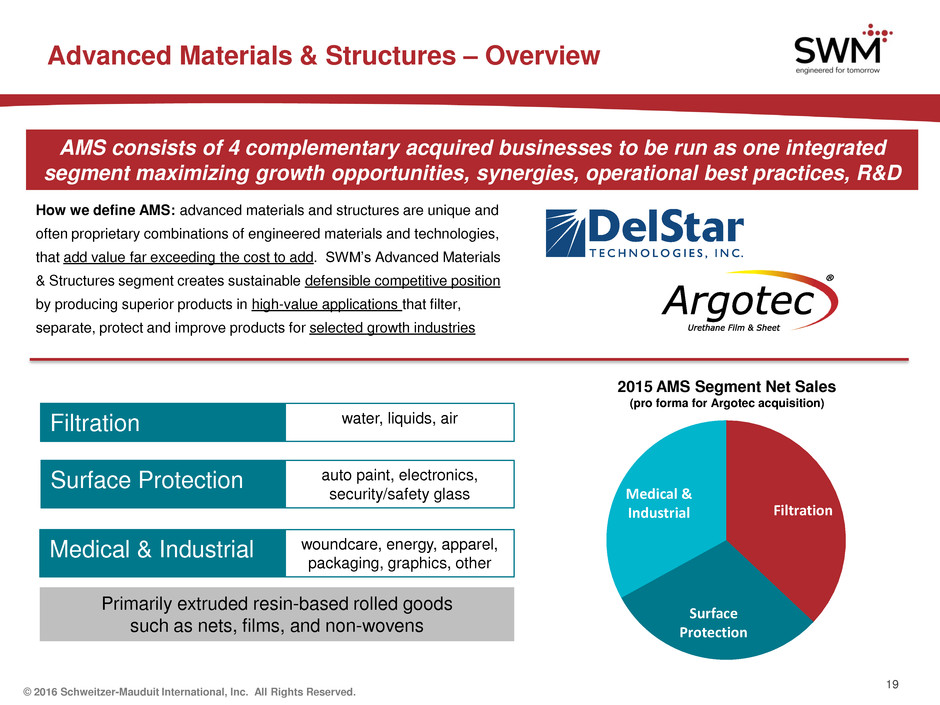

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. AMS consists of 4 complementary acquired businesses to be run as one integrated segment maximizing growth opportunities, synergies, operational best practices, R&D Advanced Materials & Structures – Overview How we define AMS: advanced materials and structures are unique and often proprietary combinations of engineered materials and technologies, that add value far exceeding the cost to add. SWM’s Advanced Materials & Structures segment creates sustainable defensible competitive position by producing superior products in high-value applications that filter, separate, protect and improve products for selected growth industries Filtration Surface Protection Medical & Industrial water, liquids, air auto paint, electronics, security/safety glass woundcare, energy, apparel, packaging, graphics, other 19 Filtration Surface Protection Medical & Industrial 2015 AMS Segment Net Sales (pro forma for Argotec acquisition) Primarily extruded resin-based rolled goods such as nets, films, and non-wovens

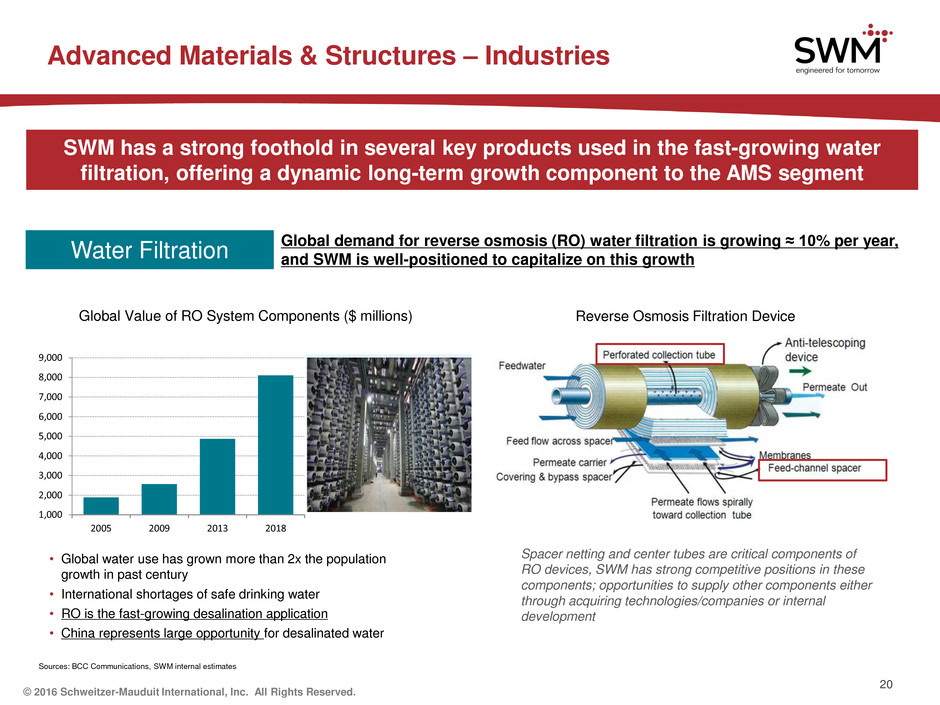

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. Advanced Materials & Structures – Industries 20 Global demand for reverse osmosis (RO) water filtration is growing ≈ 10% per year, and SWM is well-positioned to capitalize on this growth SWM has a strong foothold in several key products used in the fast-growing water filtration, offering a dynamic long-term growth component to the AMS segment Reverse Osmosis Filtration Device Spacer netting and center tubes are critical components of RO devices, SWM has strong competitive positions in these components; opportunities to supply other components either through acquiring technologies/companies or internal development • Global water use has grown more than 2x the population growth in past century • International shortages of safe drinking water • RO is the fast-growing desalination application • China represents large opportunity for desalinated water 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 2005 2009 2013 2018 Global Value of RO System Components ($ millions) Sources: BCC Communications, SWM internal estimates Water Filtration

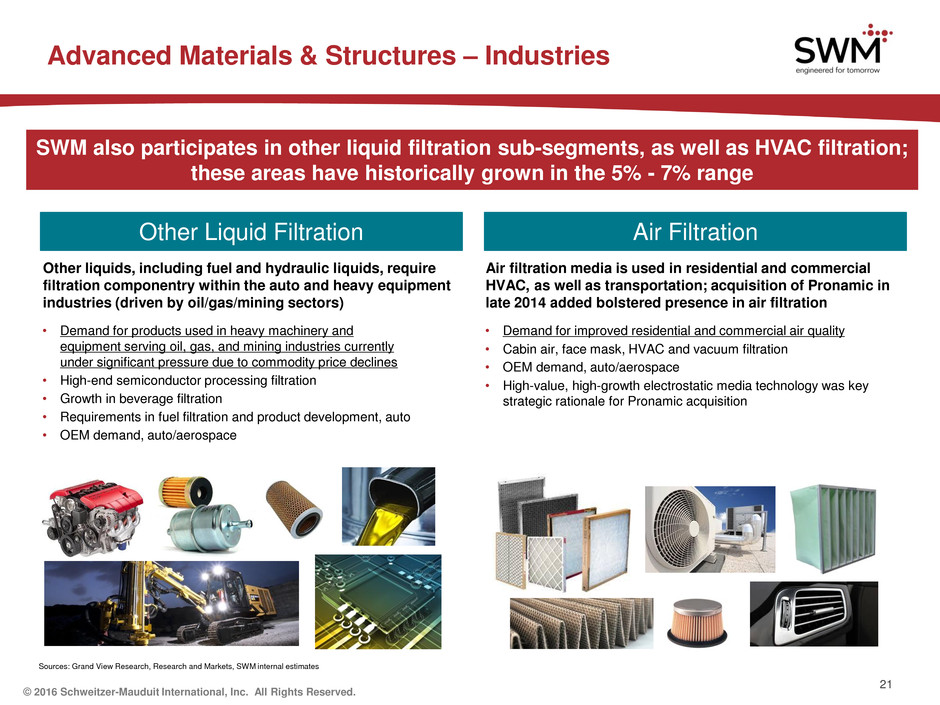

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. • Demand for improved residential and commercial air quality • Cabin air, face mask, HVAC and vacuum filtration • OEM demand, auto/aerospace • High-value, high-growth electrostatic media technology was key strategic rationale for Pronamic acquisition Advanced Materials & Structures – Industries 21 Other liquids, including fuel and hydraulic liquids, require filtration componentry within the auto and heavy equipment industries (driven by oil/gas/mining sectors) • Demand for products used in heavy machinery and equipment serving oil, gas, and mining industries currently under significant pressure due to commodity price declines • High-end semiconductor processing filtration • Growth in beverage filtration • Requirements in fuel filtration and product development, auto • OEM demand, auto/aerospace Sources: Grand View Research, Research and Markets, SWM internal estimates SWM also participates in other liquid filtration sub-segments, as well as HVAC filtration; these areas have historically grown in the 5% - 7% range Air filtration media is used in residential and commercial HVAC, as well as transportation; acquisition of Pronamic in late 2014 added bolstered presence in air filtration Other Liquid Filtration Air Filtration

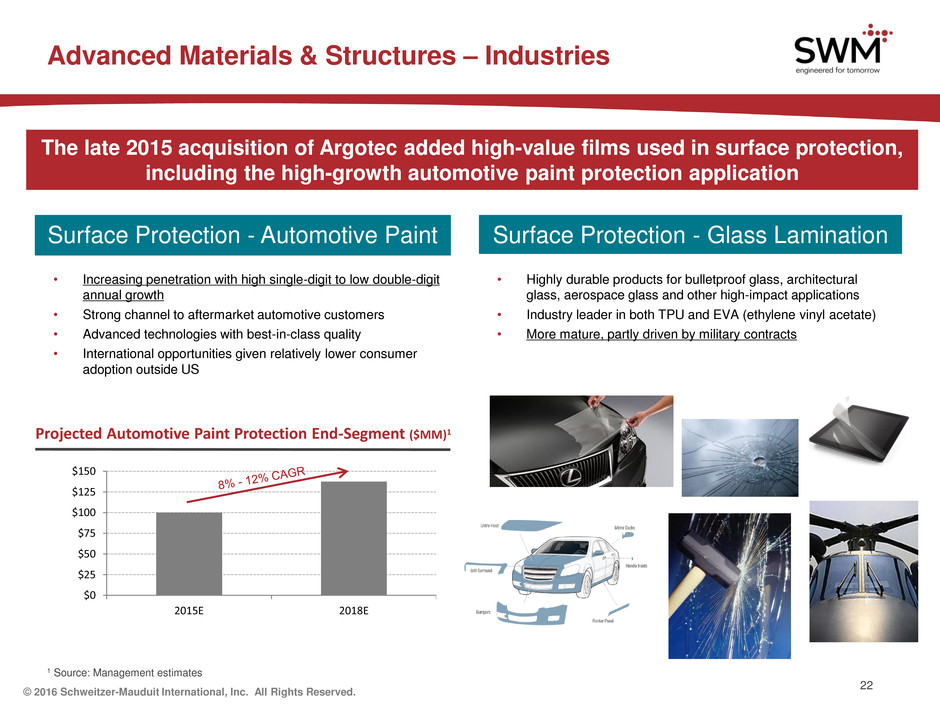

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. $0 $25 $50 $75 $100 $125 $150 2015E 2018E Projected Automotive Paint Protection End-Segment ($MM)1 1 Source: Management estimates 22 Advanced Materials & Structures – Industries The late 2015 acquisition of Argotec added high-value films used in surface protection, including the high-growth automotive paint protection application Surface Protection - Automotive Paint Surface Protection - Glass Lamination • Increasing penetration with high single-digit to low double-digit annual growth • Strong channel to aftermarket automotive customers • Advanced technologies with best-in-class quality • International opportunities given relatively lower consumer adoption outside US • Highly durable products for bulletproof glass, architectural glass, aerospace glass and other high-impact applications • Industry leader in both TPU and EVA (ethylene vinyl acetate) • More mature, partly driven by military contracts

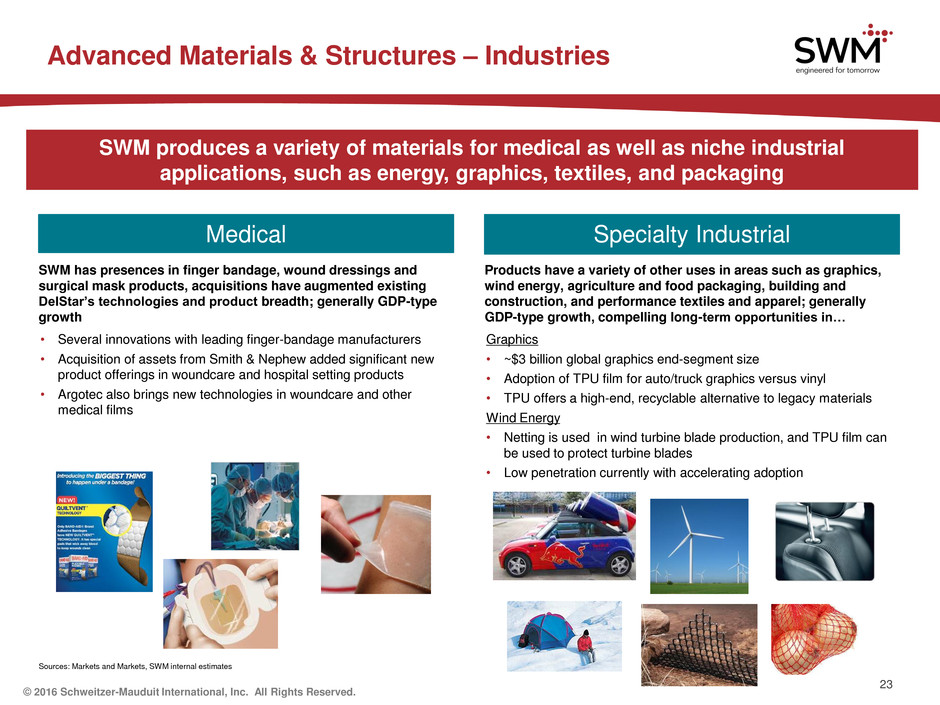

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. Advanced Materials & Structures – Industries 23 SWM has presences in finger bandage, wound dressings and surgical mask products, acquisitions have augmented existing DelStar’s technologies and product breadth; generally GDP-type growth • Several innovations with leading finger-bandage manufacturers • Acquisition of assets from Smith & Nephew added significant new product offerings in woundcare and hospital setting products • Argotec also brings new technologies in woundcare and other medical films Products have a variety of other uses in areas such as graphics, wind energy, agriculture and food packaging, building and construction, and performance textiles and apparel; generally GDP-type growth, compelling long-term opportunities in… Sources: Markets and Markets, SWM internal estimates Graphics • ~$3 billion global graphics end-segment size • Adoption of TPU film for auto/truck graphics versus vinyl • TPU offers a high-end, recyclable alternative to legacy materials Wind Energy • Netting is used in wind turbine blade production, and TPU film can be used to protect turbine blades • Low penetration currently with accelerating adoption Medical Specialty Industrial SWM produces a variety of materials for medical as well as niche industrial applications, such as energy, graphics, textiles, and packaging

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. Advanced Materials & Structures – Customers 24 A culture of customer intimacy and innovation results in collaborative product development and often times unique long-term value-based relationships Filtration ≈ 1/3 of Segment Net Sales * Medical & Industrial ≈ 1/3 of Segment Net Sales * Top customers are blue chip companies and leaders in their industries, however, none are expected to be more than 10% of segment revenue Spacer netting and center cores to major global RO filter manufacturers Support materials to major specialty cartridge filter makers in semi-conductor, beverage, power generation, and process water industries Support netting and composites to top global producers of filters for automotive and heavy industrial applications in the oil, gas, and mining sectors Air filter media for a prominent US based HVAC filter manufacturer Supplier of bandage pad materials to top brands, as well as generics Specialty components to leading professional and hospital wound care manufacturers Netting to leading North American oil and gas pipeline distributor Niche specialty nettings and nonwovens to top apparel, packaging, and agricultural companies Waterproof, breathable films to laminators serving the apparel and footwear industries Surface Protection ≈ 1/3 Segment Net Sales * Multilayer films to suppliers of paint protection kits for the automotive aftermarket Optical interlayer films to manufacturers of reinforced and bullet-resistant glass * Pro Forma for Argotec acquisition

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. Advanced Materials & Structures – Products 25 Products are highly engineered to meet customer needs; key attributes such as, thickness, clarity, UV resistant, waterproof, puncture proof, heat tolerance, flow- through, are critical to performance customers’ finished products Nets • Spacer material between reverse osmosis (RO) filter membranes • Cartridge filter pleat support and protective pipeline casings for oil, gas, and mining industries • Requires precision control of thickness, aperture size, and flow performance • Extruded nets typically made from commodity- grade resins using proprietary manufacturing technologies Films • Thermoplastic polyurethane (TPU) extruded films made from specialty resins offer unique UV resistance, clarity and puncture resistance • TPU films are used in surface protection such as automotive paint and bulletproof/shatterproof glass • Apertured films used in medical/woundcare applications Tubes/Cores • Highly engineered extruded rods, cores, tubes, and pipes • An industry leader in center cores for reverse osmosis water filters • Other industrial applications Non-Wovens • Airlaid technologies using mainly commodity grade resins • Liquid filtration products predominantly sold into non-water filtration applications such as fuel and other hydraulic liquids • Also components in air filtration products such as residential and commercial HVAC filters Composites • Engineered composite – lamination of multiple layers of nets, nonwovens or textile products • Primary product is composite of Delnet and non-wovens, used in finger bandages • As AMS technology portfolio expands, additional opportunities to combine materials

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. Agenda Overview Engineered Papers Segment Advanced Materials & Structures Segment 26 Growth Opportunities Financials Annual Review / Outlook

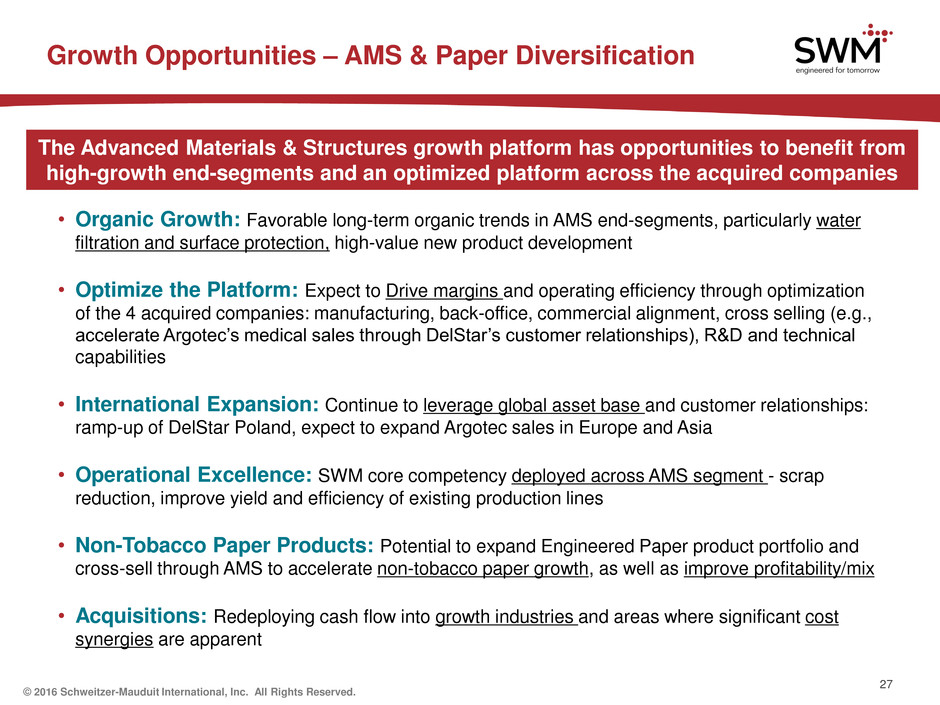

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. 27 Growth Opportunities – AMS & Paper Diversification The Advanced Materials & Structures growth platform has opportunities to benefit from high-growth end-segments and an optimized platform across the acquired companies • Organic Growth: Favorable long-term organic trends in AMS end-segments, particularly water filtration and surface protection, high-value new product development • Optimize the Platform: Expect to Drive margins and operating efficiency through optimization of the 4 acquired companies: manufacturing, back-office, commercial alignment, cross selling (e.g., accelerate Argotec’s medical sales through DelStar’s customer relationships), R&D and technical capabilities • International Expansion: Continue to leverage global asset base and customer relationships: ramp-up of DelStar Poland, expect to expand Argotec sales in Europe and Asia • Operational Excellence: SWM core competency deployed across AMS segment - scrap reduction, improve yield and efficiency of existing production lines • Non-Tobacco Paper Products: Potential to expand Engineered Paper product portfolio and cross-sell through AMS to accelerate non-tobacco paper growth, as well as improve profitability/mix • Acquisitions: Redeploying cash flow into growth industries and areas where significant cost synergies are apparent

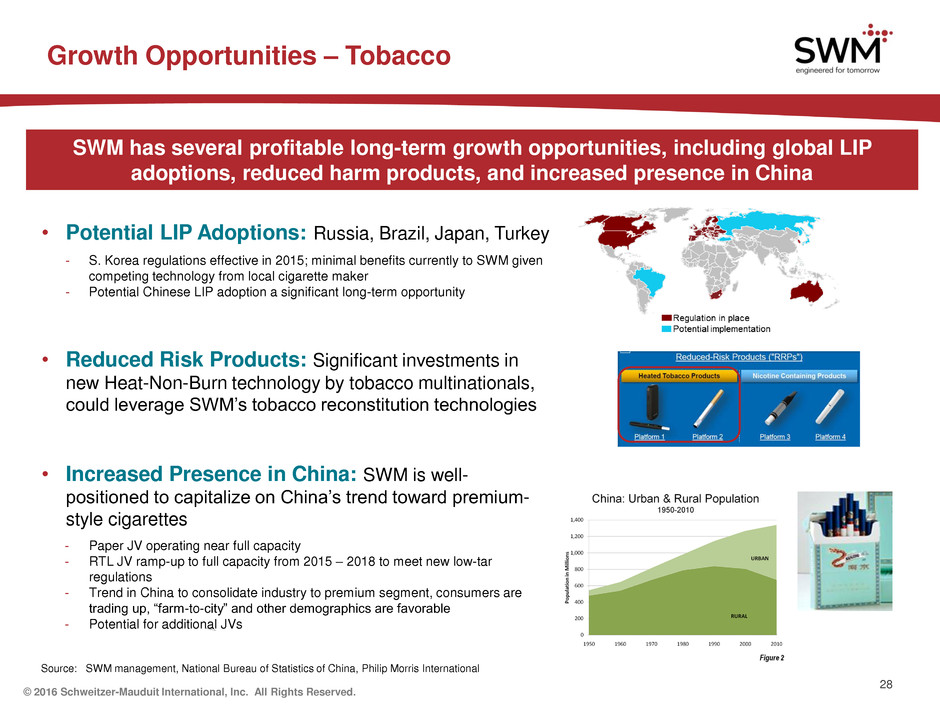

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. Growth Opportunities – Tobacco Source: SWM management, National Bureau of Statistics of China, Philip Morris International 28 SWM has several profitable long-term growth opportunities, including global LIP adoptions, reduced harm products, and increased presence in China • Potential LIP Adoptions: Russia, Brazil, Japan, Turkey - S. Korea regulations effective in 2015; minimal benefits currently to SWM given competing technology from local cigarette maker - Potential Chinese LIP adoption a significant long-term opportunity • Reduced Risk Products: Significant investments in new Heat-Non-Burn technology by tobacco multinationals, could leverage SWM’s tobacco reconstitution technologies • Increased Presence in China: SWM is well- positioned to capitalize on China’s trend toward premium- style cigarettes - Paper JV operating near full capacity - RTL JV ramp-up to full capacity from 2015 – 2018 to meet new low-tar regulations - Trend in China to consolidate industry to premium segment, consumers are trading up, ―farm-to-city‖ and other demographics are favorable - Potential for additional JVs

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. Agenda Overview Engineered Papers Segment Advanced Materials & Structures Segment 29 Growth Opportunities Financials Annual Review / Outlook

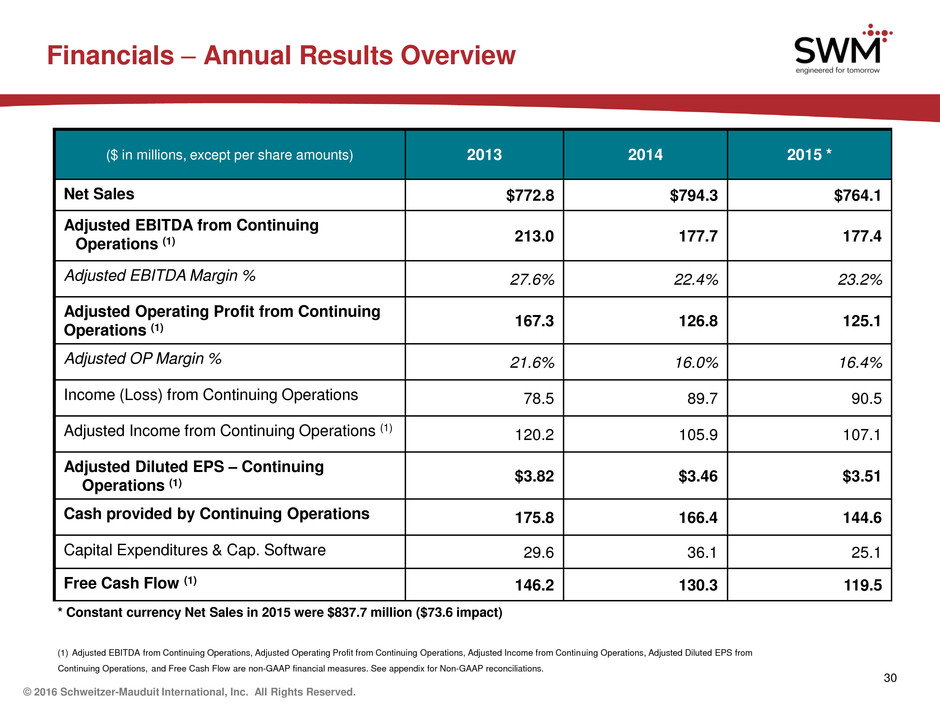

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. 30 Financials – Annual Results Overview (1) Adjusted EBITDA from Continuing Operations, Adjusted Operating Profit from Continuing Operations, Adjusted Income from Continuing Operations, Adjusted Diluted EPS from Continuing Operations, and Free Cash Flow are non-GAAP financial measures. See appendix for Non-GAAP reconciliations. ($ in millions, except per share amounts) 2013 2014 2015 * Net Sales $772.8 $794.3 $764.1 Adjusted EBITDA from Continuing Operations (1) 213.0 177.7 177.4 Adjusted EBITDA Margin % 27.6% 22.4% 23.2% Adjusted Operating Profit from Continuing Operations (1) 167.3 126.8 125.1 Adjusted OP Margin % 21.6% 16.0% 16.4% Income (Loss) from Continuing Operations 78.5 89.7 90.5 Adjusted Income from Continuing Operations (1) 120.2 105.9 107.1 Adjusted Diluted EPS – Continuing Operations (1) $3.82 $3.46 $3.51 Cash provided by Continuing Operations 175.8 166.4 144.6 Capital Expenditures & Cap. Software 29.6 36.1 25.1 Free Cash Flow (1) 146.2 130.3 119.5 * Constant currency Net Sales in 2015 were $837.7 million ($73.6 impact)

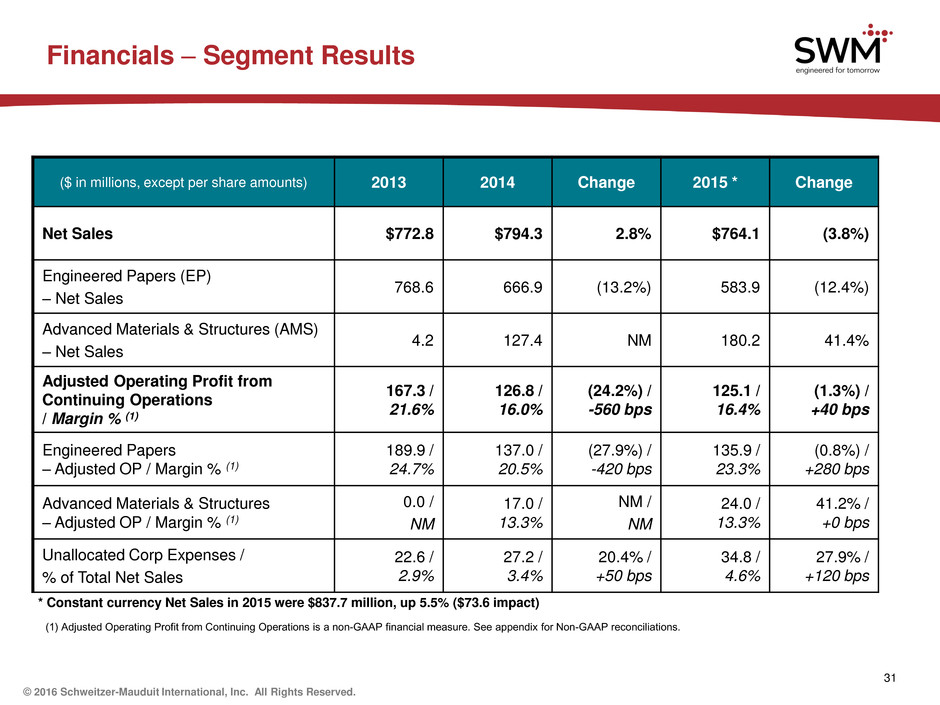

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. 31 Financials – Segment Results (1) Adjusted Operating Profit from Continuing Operations is a non-GAAP financial measure. See appendix for Non-GAAP reconciliations. ($ in millions, except per share amounts) 2013 2014 Change 2015 * Change Net Sales $772.8 $794.3 2.8% $764.1 (3.8%) Engineered Papers (EP) – Net Sales 768.6 666.9 (13.2%) 583.9 (12.4%) Advanced Materials & Structures (AMS) – Net Sales 4.2 127.4 NM 180.2 41.4% Adjusted Operating Profit from Continuing Operations / Margin % (1) 167.3 / 21.6% 126.8 / 16.0% (24.2%) / -560 bps 125.1 / 16.4% (1.3%) / +40 bps Engineered Papers – Adjusted OP / Margin % (1) 189.9 / 24.7% 137.0 / 20.5% (27.9%) / -420 bps 135.9 / 23.3% (0.8%) / +280 bps Advanced Materials & Structures – Adjusted OP / Margin % (1) 0.0 / NM 17.0 / 13.3% NM / NM 24.0 / 13.3% 41.2% / +0 bps Unallocated Corp Expenses / % of Total Net Sales 22.6 / 2.9% 27.2 / 3.4% 20.4% / +50 bps 34.8 / 4.6% 27.9% / +120 bps * Constant currency Net Sales in 2015 were $837.7 million, up 5.5% ($73.6 impact)

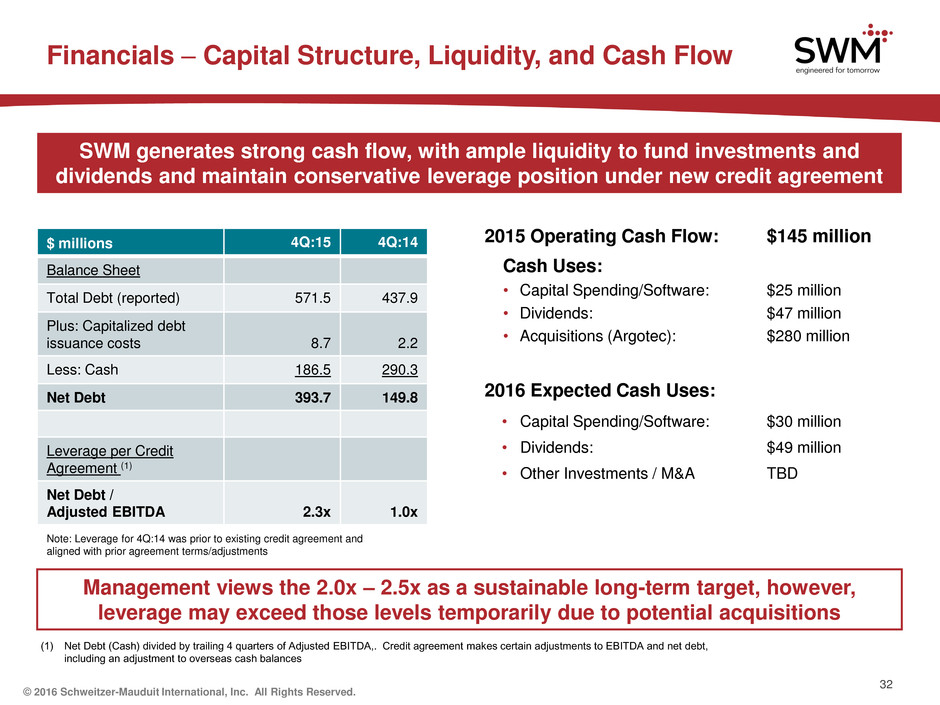

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. 2015 Operating Cash Flow: $145 million Cash Uses: • Capital Spending/Software: $25 million • Dividends: $47 million • Acquisitions (Argotec): $280 million 2016 Expected Cash Uses: • Capital Spending/Software: $30 million • Dividends: $49 million • Other Investments / M&A TBD (1) Net Debt (Cash) divided by trailing 4 quarters of Adjusted EBITDA,. Credit agreement makes certain adjustments to EBITDA and net debt, including an adjustment to overseas cash balances 32 Financials – Capital Structure, Liquidity, and Cash Flow SWM generates strong cash flow, with ample liquidity to fund investments and dividends and maintain conservative leverage position under new credit agreement Management views the 2.0x – 2.5x as a sustainable long-term target, however, leverage may exceed those levels temporarily due to potential acquisitions $ millions 4Q:15 4Q:14 Balance Sheet Total Debt (reported) 571.5 437.9 Plus: Capitalized debt issuance costs 8.7 2.2 Less: Cash 186.5 290.3 Net Debt 393.7 149.8 Leverage per Credit Agreement (1) Net Debt / Adjusted EBITDA 2.3x 1.0x Note: Leverage for 4Q:14 was prior to existing credit agreement and aligned with prior agreement terms/adjustments

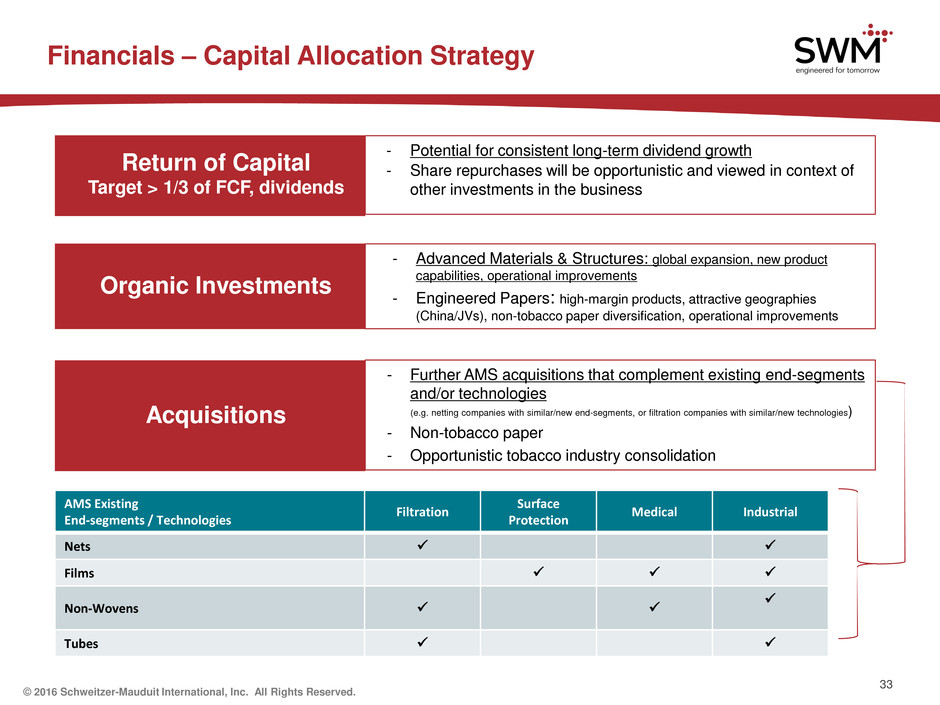

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. 33 Financials – Capital Allocation Strategy AMS Existing End-segments / Technologies Filtration Surface Protection Medical Industrial Nets Films Non-Wovens Tubes Return of Capital Target > 1/3 of FCF, dividends Organic Investments Acquisitions - Further AMS acquisitions that complement existing end-segments and/or technologies (e.g. netting companies with similar/new end-segments, or filtration companies with similar/new technologies) - Non-tobacco paper - Opportunistic tobacco industry consolidation - Advanced Materials & Structures: global expansion, new product capabilities, operational improvements - Engineered Papers: high-margin products, attractive geographies (China/JVs), non-tobacco paper diversification, operational improvements - Potential for consistent long-term dividend growth - Share repurchases will be opportunistic and viewed in context of other investments in the business

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. Agenda Overview Engineered Papers Segment Advanced Materials & Structures Segment 34 Growth Opportunities Financials Annual Review / Outlook

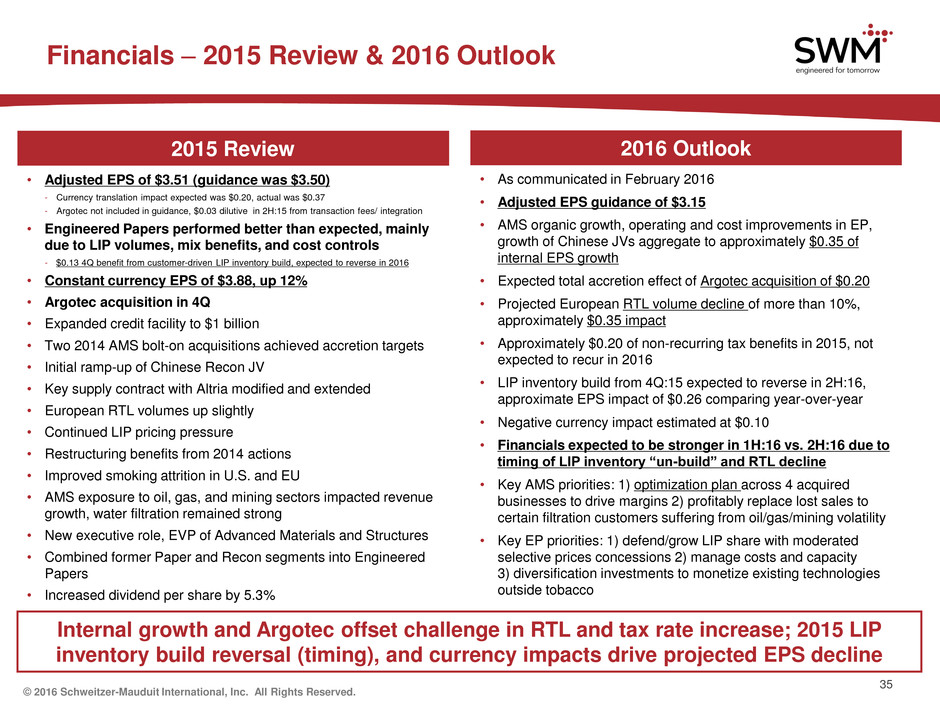

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. 35 Financials – 2015 Review & 2016 Outlook 2015 Review 2016 Outlook Internal growth and Argotec offset challenge in RTL and tax rate increase; 2015 LIP inventory build reversal (timing), and currency impacts drive projected EPS decline • Adjusted EPS of $3.51 (guidance was $3.50) - Currency translation impact expected was $0.20, actual was $0.37 - Argotec not included in guidance, $0.03 dilutive in 2H:15 from transaction fees/ integration • Engineered Papers performed better than expected, mainly due to LIP volumes, mix benefits, and cost controls - $0.13 4Q benefit from customer-driven LIP inventory build, expected to reverse in 2016 • Constant currency EPS of $3.88, up 12% • Argotec acquisition in 4Q • Expanded credit facility to $1 billion • Two 2014 AMS bolt-on acquisitions achieved accretion targets • Initial ramp-up of Chinese Recon JV • Key supply contract with Altria modified and extended • European RTL volumes up slightly • Continued LIP pricing pressure • Restructuring benefits from 2014 actions • Improved smoking attrition in U.S. and EU • AMS exposure to oil, gas, and mining sectors impacted revenue growth, water filtration remained strong • New executive role, EVP of Advanced Materials and Structures • Combined former Paper and Recon segments into Engineered Papers • Increased dividend per share by 5.3% • As communicated in February 2016 • Adjusted EPS guidance of $3.15 • AMS organic growth, operating and cost improvements in EP, growth of Chinese JVs aggregate to approximately $0.35 of internal EPS growth • Expected total accretion effect of Argotec acquisition of $0.20 • Projected European RTL volume decline of more than 10%, approximately $0.35 impact • Approximately $0.20 of non-recurring tax benefits in 2015, not expected to recur in 2016 • LIP inventory build from 4Q:15 expected to reverse in 2H:16, approximate EPS impact of $0.26 comparing year-over-year • Negative currency impact estimated at $0.10 • Financials expected to be stronger in 1H:16 vs. 2H:16 due to timing of LIP inventory “un-build” and RTL decline • Key AMS priorities: 1) optimization plan across 4 acquired businesses to drive margins 2) profitably replace lost sales to certain filtration customers suffering from oil/gas/mining volatility • Key EP priorities: 1) defend/grow LIP share with moderated selective prices concessions 2) manage costs and capacity 3) diversification investments to monetize existing technologies outside tobacco

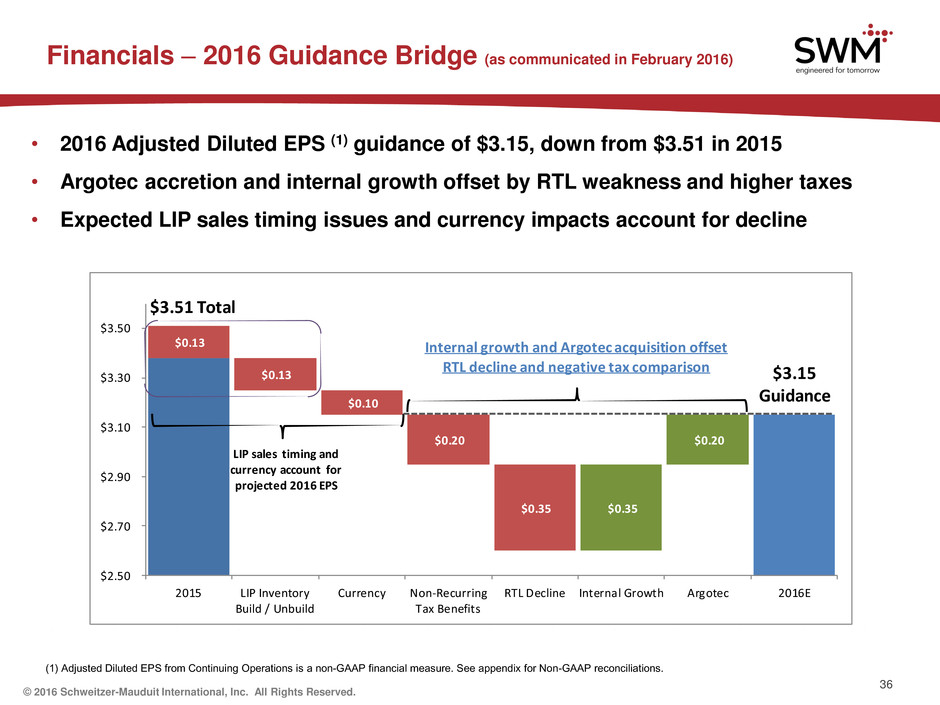

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. 36 Financials – 2016 Guidance Bridge (as communicated in February 2016) (1) Adjusted Diluted EPS from Continuing Operations is a non-GAAP financial measure. See appendix for Non-GAAP reconciliations. • 2016 Adjusted Diluted EPS (1) guidance of $3.15, down from $3.51 in 2015 • Argotec accretion and internal growth offset by RTL weakness and higher taxes • Expected LIP sales timing issues and currency impacts account for decline $2.95 $0.13 $0.13 $0.35 $0.20 $0.35 $0.20 $0.10 $2.50 $2.70 $2.90 $3.10 $3.30 $3.50 2015 LIP Inventory Build / Unbuild Currency Non-Recurring Tax Benefits RTL Decline Internal Growth Argotec 2016E $3.51 Total $3.15 Guidance LIP sales timing and currency account for projected 2016 EPS Internal growth and Argotec acquisition offset RTL decline and negative tax comparison

Appendix - Non-GAAP Reconciliations - Historical Segment Financials 37

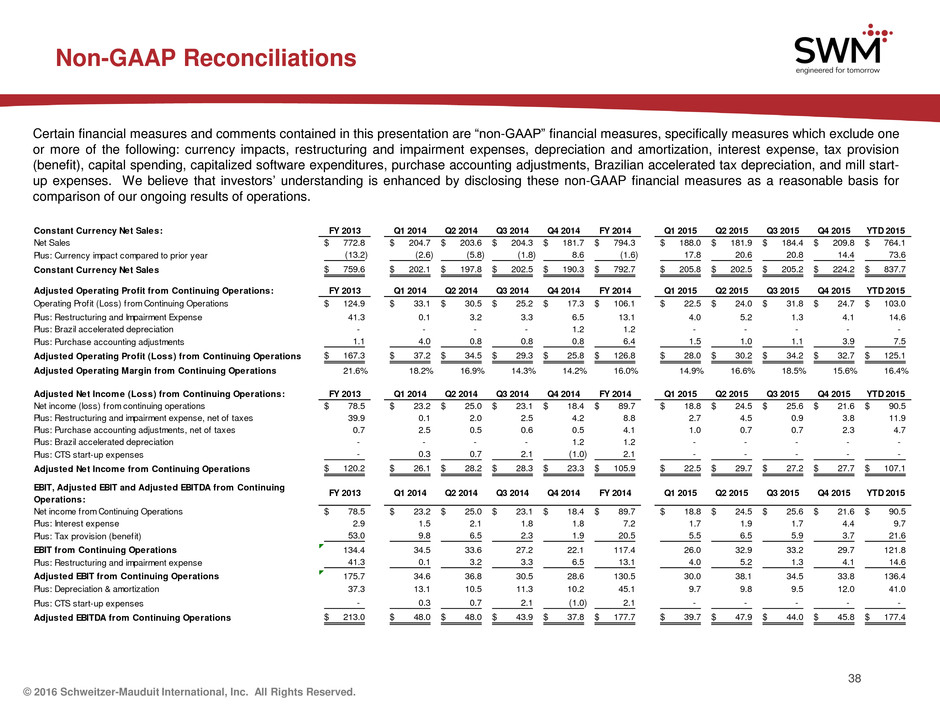

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. Non-GAAP Reconciliations Note: Non-GAAP info spreadsheet saved in applicable SEC filing folder. Copy, paste as enhanced metafile with white fill to eliminate grid lines Certain financial measures and comments contained in this presentation are ―non-GAAP‖ financial measures, specifically measures which exclude one or more of the following: currency impacts, restructuring and impairment expenses, depreciation and amortization, interest expense, tax provision (benefit), capital spending, capitalized software expenditures, purchase accounting adjustments, Brazilian accelerated tax depreciation, and mill start- up expenses. We believe that investors’ understanding is enhanced by disclosing these non-GAAP financial measures as a reasonable basis for comparison of our ongoing results of operations. Constant Currency Net Sales: FY 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 FY 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 YTD 2015 Net Sales 772.8$ 204.7$ 203.6$ 204.3$ 181.7$ 794.3$ 188.0$ 181.9$ 184.4$ 209.8$ 764.1$ Plus: Currency impact compared to prior year (13.2) (2.6) (5.8) (1.8) 8.6 (1.6) 17.8 20.6 20.8 14.4 73.6 Constant Currency Net Sales 759.6$ 202.1$ 197.8$ 202.5$ 190.3$ 792.7$ 205.8$ 202.5$ 205.2$ 224.2$ 837.7$ Adjusted Operating Profit from Continuing Operations: FY 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 FY 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 YTD 2015 Operating Profit (Loss) from Continuing Operations 124.9$ 33.1$ 30.5$ 25.2$ 17.3$ 106.1$ 22.5$ 24.0$ 31.8$ 24.7$ 103.0$ Plus: Restructuring and Impairment Expense 41.3 0.1 3.2 3.3 6.5 13.1 4.0 5.2 1.3 4.1 14.6 Plus: Brazil accelerated depreciation - - - - 1.2 1.2 - - - - - Plus: Purchase accounting adjustments 1.1 4.0 0.8 0.8 0.8 6.4 1.5 1.0 1.1 3.9 7.5 Adjusted Operating Profit (Loss) from Continuing Operations 167.3$ 37.2$ 34.5$ 29.3$ 25.8$ 126.8$ 28.0$ 30.2$ 34.2$ 32.7$ 125.1$ Adjusted Operating Margin from Continuing Operations 21.6% 18.2% 16.9% 14.3% 14.2% 16.0% 14.9% 16.6% 18.5% 15.6% 16.4% Adjusted Net Income (Loss) from Continuing Operations: FY 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 FY 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 YTD 2015 Net income (loss) from continuing operations 78.5$ 23.2$ 25.0$ 23.1$ 18.4$ 89.7$ 18.8$ 24.5$ 25.6$ 21.6$ 90.5$ Plus: Restructuring and impairment expense, net of taxes 39.9 0.1 2.0 2.5 4.2 8.8 2.7 4.5 0.9 3.8 11.9 Plus: Purchase accounting adjustments, net of taxes 0.7 2.5 0.5 0.6 0.5 4.1 1.0 0.7 0.7 2.3 4.7 Plus: Brazil accelerated depreciation - - - - 1.2 1.2 - - - - - Plus: CTS start-up expenses - 0.3 0.7 2.1 (1.0) 2.1 - - - - - Adjusted Net Income from Continuing Operations 120.2$ 26.1$ 28.2$ 28.3$ 23.3$ 105.9$ 22.5$ 29.7$ 27.2$ 27.7$ 107.1$ EBIT, Adjusted EBIT and Adjusted EBITDA from Continuing Operations: FY 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 FY 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 YTD 2015 Net income from Continuing Operations 78.5$ 23.2$ 25.0$ 23.1$ 18.4$ 89.7$ 18.8$ 24.5$ 25.6$ 21.6$ 90.5$ Plus: Interest expense 2.9 1.5 2.1 1.8 1.8 7.2 1.7 1.9 1.7 4.4 9.7 Plus: Tax pr vi i (benefit) 53.0 9.8 6.5 2.3 1.9 20.5 5.5 6.5 5.9 3.7 21.6 EBIT from Continuing Operations 134.4 34.5 33.6 27.2 22.1 117.4 26.0 32.9 33.2 29.7 121.8 Plus: Restructuring and impairment expense 41.3 0.1 3.2 3.3 6.5 13.1 4.0 5.2 1.3 4.1 14.6 Adjusted EBIT from Continuing Operations 175.7 34.6 36.8 30.5 28.6 130.5 30.0 38.1 34.5 33.8 136.4 Plus: Depreciation & amortization 37.3 13.1 10.5 11.3 10.2 45.1 9.7 9.8 9.5 12.0 41.0 Plus: CTS start-up expenses - 0.3 0.7 2.1 (1.0) 2.1 - - - - - Adjusted EBITDA from Continuing Operations 213.0$ 48.0$ 48.0$ 43.9$ 37.8$ 177.7$ 39.7$ 47.9$ 44.0$ 45.8$ 177.4$ 38

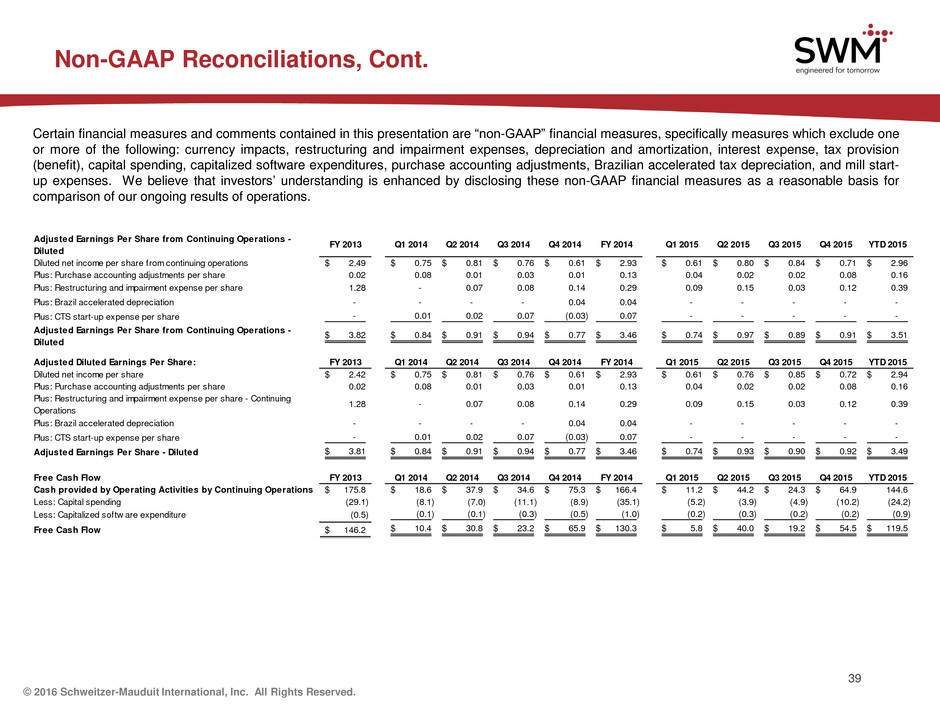

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. Non-GAAP Reconciliations, Cont. Note: Non-GAAP info spreadsheet saved in applicable SEC filing folder. Copy, paste as enhanced metafile with white fill to eliminate grid lines Certain financial measures and comments contained in this presentation are ―non-GAAP‖ financial measures, specifically measures which exclude one or more of the following: currency impacts, restructuring and impairment expenses, depreciation and amortization, interest expense, tax provision (benefit), capital spending, capitalized software expenditures, purchase accounting adjustments, Brazilian accelerated tax depreciation, and mill start- up expenses. We believe that investors’ understanding is enhanced by disclosing these non-GAAP financial measures as a reasonable basis for comparison of our ongoing results of operations. Adjusted Earnings Per Share from Continuing Operations - Diluted FY 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 FY 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 YTD 2015 Diluted net income per share from continuing operations 2.49$ 0.75$ 0.81$ 0.76$ 0.61$ 2.93$ 0.61$ 0.80$ 0.84$ 0.71$ 2.96$ Plus: Purchase accounting adjustments per share 0.02 0.08 0.01 0.03 0.01 0.13 0.04 0.02 0.02 0.08 0.16 Plus: Restructuring and impairment expense per share 1.28 - 0.07 0.08 0.14 0.29 0.09 0.15 0.03 0.12 0.39 Plus: Brazil accelerated depreciation - - - - 0.04 0.04 - - - - - Plus: CTS start-up expense per share - 0.01 0.02 0.07 (0.03) 0.07 - - - - - Adjusted Earnings Per Share from Continuing Operations - Diluted 3.82$ 0.84$ 0.91$ 0.94$ 0.77$ 3.46$ 0.74$ 0.97$ 0.89$ 0.91$ 3.51$ Adjusted Diluted Earnings Per Share: FY 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 FY 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 YTD 2015 Diluted net income per share 2.42$ 0.75$ 0.81$ 0.76$ 0.61$ 2.93$ 0.61$ 0.76$ 0.85$ 0.72$ 2.94$ Plus: Purchase accounting adjustments per share 0.02 0.08 0.01 0.03 0.01 0.13 0.04 0.02 0.02 0.08 0.16 Plus: Restructuring and impairment expense per share - Continuing Operations 1.28 - 0.07 0.08 0.14 0.29 0.09 0.15 0.03 0.12 0.39 Plus: Brazil accelerated depreciation - - - - 0.04 0.04 - - - - - Plu : CTS t r - p xpense per share - 0.01 0.02 0.07 (0.03) 0.07 - - - - - Adj ted Earnings Per Share - Diluted 3.81$ 0.84$ 0.91$ 0.94$ 0.77$ 3.46$ 0.74$ 0.93$ 0.90$ 0.92$ 3.49$ Free Cash Flow FY 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 FY 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 YTD 2015 Cash provided by Operating Activities by Continuing Operations 175.8$ 18.6$ 37.9$ 34.6$ 75.3$ 166.4$ 11.2$ 44.2$ 24.3$ 64.9$ 144.6 Less: Capital spending (29.1) (8.1) (7.0) (11.1) (8.9) (35.1) (5.2) (3.9) (4.9) (10.2) (24.2) Less: Capitalized softw are expenditure (0.5) (0.1) (0.1) (0.3) (0.5) (1.0) (0.2) (0.3) (0.2) (0.2) (0.9) Free Cash Flow 146.2$ 10.4$ 30.8$ 23.2$ 65.9$ 130.3$ 5.8$ 40.0$ 19.2$ 54.5$ 119.5$ 39

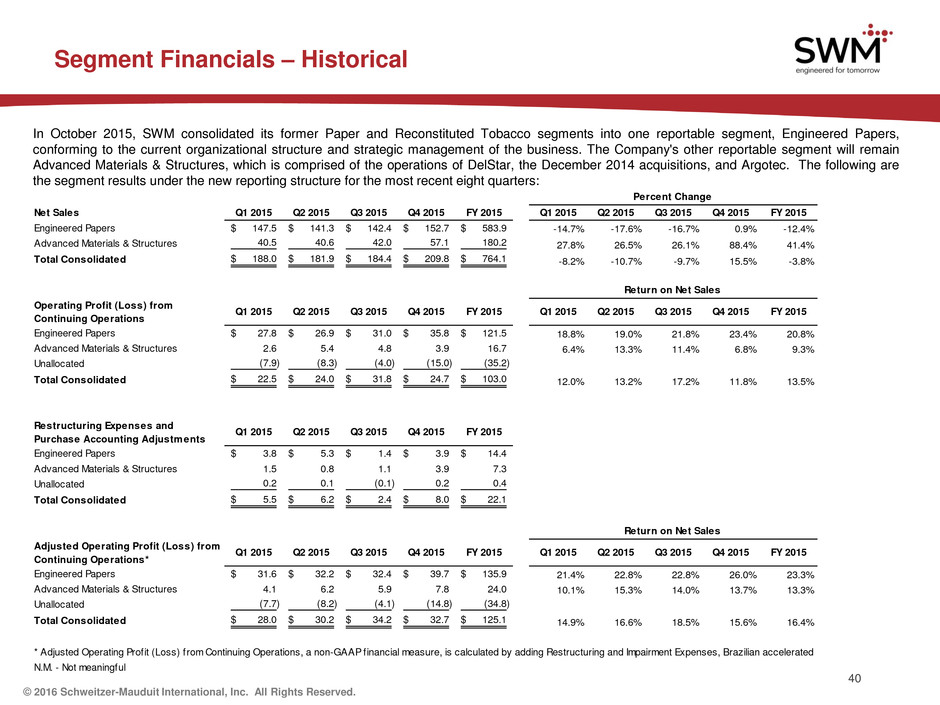

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. Segment Financials – Historical Note: Non-GAAP info spreadsheet saved in applicable SEC filing folder. Copy, paste as enhanced metafile with white fill to eliminate grid lines In October 2015, SWM consolidated its former Paper and Reconstituted Tobacco segments into one reportable segment, Engineered Papers, conforming to the current organizational structure and strategic management of the business. The Company's other reportable segment will remain Advanced Materials & Structures, which is comprised of the operations of DelStar, the December 2014 acquisitions, and Argotec. The following are the segment results under the new reporting structure for the most recent eight quarters: Net Sales Q1 2015 Q2 2015 Q3 2015 Q4 2015 FY 2015 Q1 2015 Q2 2015 Q3 2015 Q4 2015 FY 2015 Engineered Papers 147.5$ 141.3$ 142.4$ 152.7$ 583.9$ -14.7% -17.6% -16.7% 0.9% -12.4% Advanced Materials & Structures 40.5 40.6 42.0 57.1 180.2 27.8% 26.5% 26.1% 88.4% 41.4% Total Consolidated 188.0$ 181.9$ 184.4$ 209.8$ 764.1$ -8.2% -10.7% -9.7% 15.5% -3.8% Operating Profit (Loss) from Continuing Operations Q1 2015 Q2 2015 Q3 2015 Q4 2015 FY 2015 Q1 2015 Q2 2015 Q3 2015 Q4 2015 FY 2015 Engineered Papers 27.8$ 26.9$ 31.0$ 35.8$ 121.5$ 18.8% 19.0% 21.8% 23.4% 20.8% Advanced Materials & Structures 2.6 5.4 4.8 3.9 16.7 6.4% 13.3% 11.4% 6.8% 9.3% Unallocated (7.9) (8.3) (4.0) (15.0) (35.2) Total Consolidated 22.5$ 24.0$ 31.8$ 24.7$ 103.0$ 12.0% 13.2% 17.2% 11.8% 13.5% Restructuring Expenses and Purchase Accounting Adjustments Q1 2015 Q2 2015 Q3 2015 Q4 2015 FY 2015 Engineered Papers 3.8$ 5.3$ 1.4$ 3.9$ 14.4$ Advanced Materials & Structures 1.5 0.8 1.1 3.9 7.3 Unallocated 0.2 0.1 (0.1) 0.2 0.4 Total Consolidated 5.5$ 6.2$ 2.4$ 8.0$ 22.1$ Adjusted Operating Profit (Loss) from Continuing Operations* Q1 2015 Q2 2015 Q3 2015 Q4 2015 FY 2015 Q1 2015 Q2 2015 Q3 2015 Q4 2015 FY 2015 Engineered Papers 31.6$ 32.2$ 32.4$ 39.7$ 135.9$ 21.4% 22.8% 22.8% 26.0% 23.3% Advanced Materials & Structures 4.1 6.2 5.9 7.8 24.0 10.1% 15.3% 14.0% 13.7% 13.3% Unallocated (7.7) (8.2) (4.1) (14.8) (34.8) Total Consolidated 28.0$ 30.2$ 34.2$ 32.7$ 125.1$ 14.9% 16.6% 18.5% 15.6% 16.4% Return on Net Sales Percent Change Return on Net Sales * Adjusted Operating Profit (Loss) from Continuing Operations, a non-GAAP financial measure, is calculated by adding Restructuring and Impairment Expenses, Brazilian accelerated depreciation and Purchase Accounting Adjustments to Operating Profit from Continuing Operations.N.M. - Not me ingful 40

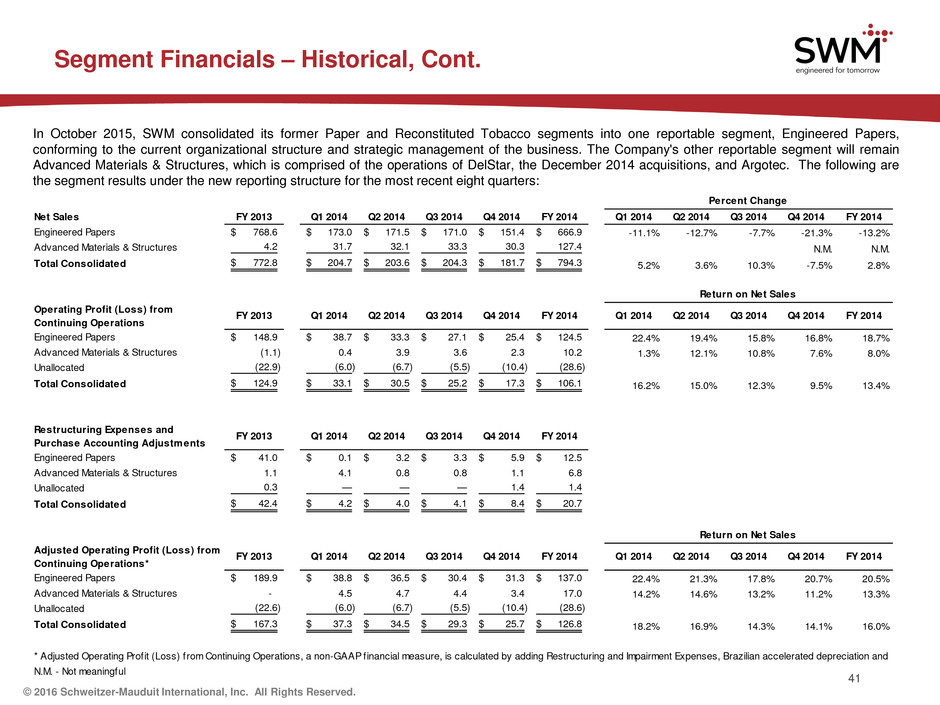

© 2016 Schweitzer-Mauduit International, Inc. All Rights Reserved. Segment Financials – Historical, Cont. Note: Non-GAAP info spreadsheet saved in applicable SEC filing folder. Copy, paste as enhanced metafile with white fill to eliminate grid lines In October 2015, SWM consolidated its former Paper and Reconstituted Tobacco segments into one reportable segment, Engineered Papers, conforming to the current organizational structure and strategic management of the business. The Company's other reportable segment will remain Advanced Materials & Structures, which is comprised of the operations of DelStar, the December 2014 acquisitions, and Argotec. The following are the segment results under the new reporting structure for the most recent eight quarters: Net Sales FY 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 FY 2014 Q1 2014 Q2 2014 Q3 2014 Q4 2014 FY 2014 Engineered Papers 768.6$ 173.0$ 171.5$ 171.0$ 151.4$ 666.9$ -11.1% -12.7% -7.7% -21.3% -13.2% Advanced Materials & Structures 4.2 31.7 32.1 33.3 30.3 127.4 N.M. N.M. Total Consolidated 772.8$ 204.7$ 203.6$ 204.3$ 181.7$ 794.3$ 5.2% 3.6% 10.3% -7.5% 2.8% Operating Profit (Loss) from Continuing Operations FY 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 FY 2014 Q1 2014 Q2 2014 Q3 2014 Q4 2014 FY 2014 Engineered Papers 148.9$ 38.7$ 33.3$ 27.1$ 25.4$ 124.5$ 22.4% 19.4% 15.8% 16.8% 18.7% Advanced Materials & Structures (1.1) 0.4 3.9 3.6 2.3 10.2 1.3% 12.1% 10.8% 7.6% 8.0% Unallocated (22.9) (6.0) (6.7) (5.5) (10.4) (28.6) Total Consolidated 124.9$ 33.1$ 30.5$ 25.2$ 17.3$ 106.1$ 16.2% 15.0% 12.3% 9.5% 13.4% Restructuring Expenses and Purchase Accounting Adjustments FY 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 FY 2014 Engineered Papers 41.0$ 0.1$ 3.2$ 3.3$ 5.9$ 12.5$ Advanced Materials & Structures 1.1 4.1 0.8 0.8 1.1 6.8 Unallocated 0.3 — — — 1.4 1.4 Total Consolidated 42.4$ 4.2$ 4.0$ 4.1$ 8.4$ 20.7$ Adjusted Operating Profit (Loss) from Continuing Operations* FY 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 FY 2014 Q1 2014 Q2 2014 Q3 2014 Q4 2014 FY 2014 Engin red Pa rs 189.9$ 38.8$ 36.5$ 30.4$ 31.3$ 137.0$ 22.4% 21.3% 17.8% 20.7% 20.5% Advanced Materials & Structures - 4.5 4.7 4.4 3.4 17.0 14.2% 14.6% 13.2% 11.2% 13.3% Unallocated (22.6) (6.0) (6.7) (5.5) (10.4) (28.6) Total Consolidated 167.3$ 37.3$ 34.5$ 29.3$ 25.7$ 126.8$ 18.2% 16.9% 14.3% 14.1% 16.0% * Adjusted Operating Profit (Loss) from Continuing Operations, a non-GAAP financial measure, is calculated by adding Restructuring and Impairment Expenses, Brazilian accelerated depreciation and Purchase Accounting Adjustments to Operating Profit from Continuing Operations.N.M. - Not meaningful Percent Change Return on Net Sales Return on Net Sales 41