Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LABORATORY CORP OF AMERICA HOLDINGS | form8-kq42015ppt21816.htm |

8-K FILED FEBRUARY 18, 2016 FOURTH QUARTER 2015 SUPPLEMENTAL FINANCIAL INFORMATION

1 FORWARD LOOKING STATEMENT This presentation contains forward-looking statements which are subject to change based on various important factors, including without limitation, competitive actions in the marketplace, adverse actions of governmental and other third-party payers and the results from the Company’s acquisition of Covance. Actual results could differ materially from those suggested by these forward- looking statements. Further information on potential factors that could affect LabCorp’s operating and financial results is included in the Company’s Form 10-K for the year ended December 31, 2014, and the Company’s Form 10-Q for the quarter ended September 30, 2015, including under the heading risk factors, and in the Company’s other filings with the SEC, as well as in the risk factors included in Covance’s filings with the SEC. The Company has no obligation to provide any updates to these forward-looking statements even if its expectations change.

2 LabCorp Diagnostics The LabCorp Diagnostics segment includes historical LabCorp business units, excluding its Clinical Trials operations (which are part of the Covance Drug Development segment), and including the Nutritional Chemistry and Food Safety operations acquired as part of the Covance acquisition. Covance Drug Development The Covance Drug Development segment includes historical Covance business units, excluding its Nutritional Chemistry and Food Safety operations (which are part of the LabCorp Diagnostics segment), and including the LabCorp Clinical Trials operations. OPERATING SEGMENT OVERVIEW

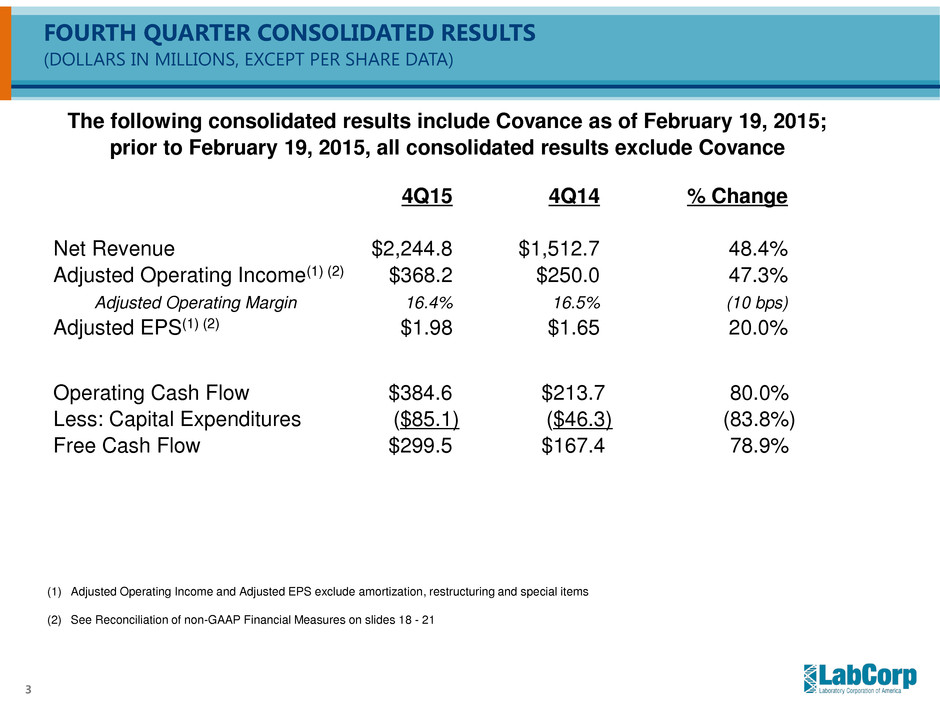

3 FOURTH QUARTER CONSOLIDATED RESULTS (DOLLARS IN MILLIONS, EXCEPT PER SHARE DATA) (1) Adjusted Operating Income and Adjusted EPS exclude amortization, restructuring and special items (2) See Reconciliation of non-GAAP Financial Measures on slides 18 - 21 The following consolidated results include Covance as of February 19, 2015; prior to February 19, 2015, all consolidated results exclude Covance 4Q15 4Q14 % Change Net Revenue $2,244.8 $1,512.7 48.4% Adjusted Operating Income(1) (2) $368.2 $250.0 47.3% Adjusted Operating Margin 16.4% 16.5% (10 bps) Adjusted EPS(1) (2) $1.98 $1.65 20.0% Operating Cash Flow $384.6 $213.7 80.0% Less: Capital Expenditures ($85.1) ($46.3) (83.8%) Free Cash Flow $299.5 $167.4 78.9%

4 2015 CONSOLIDATED RESULTS (DOLLARS IN MILLIONS, EXCEPT PER SHARE DATA) (1) Adjusted Operating Income and Adjusted EPS exclude amortization, restructuring and special items (2) See Reconciliation of non-GAAP Financial Measures on slides 18 - 21 (3) Operating cash flow is negatively impacted by approximately $110 million of net non-recurring items related to the Covance acquisition (4) Adjusted for approximately $110 million of net non-recurring items related to the Covance acquisition The following consolidated results include Covance as of February 19, 2015; prior to February 19, 2015, all consolidated results exclude Covance Twelve Months Twelve Months Ended 12/31/15 Ended 12/31/14 % Change Net Revenue $8,505.7 $6,011.6 41.5% Adjusted Operating Income(1) (2) $1,446.9 $1,028.3 40.7% Adjusted Operating Margin 17.0% 17.1% (10 bps) Adjusted EPS(1) (2) $7.91 $6.80 16.3% Operating Cash Flow(3) $982.4 $739.0 32.9% Less: Capital Expenditures ($255.8) ($203.5) (25.7%) Free Cash Flow $726.6 $535.5 35.7% Free Cash Flow, Excluding Acquisition-Related Charges(4) $836.6 $535.5 56.2%

5 FOURTH QUARTER PRO FORMA SEGMENT RESULTS (DOLLARS IN MILLIONS) (1) Adjusted Operating Income excludes amortization, restructuring and special items (2) See Reconciliation of non-GAAP Financial Measures on slides 18 - 21 Pro forma results assume that the acquisition of Covance closed on January 1, 2014 4Q15 4Q14 % Change Net Revenue LabCorp Diagnostics $1,551.4 $1,486.9 4.3% Covance Drug Development $691.4 $660.1 4.7% Total Net Revenue $2,242.8 $2,147.0 4.5% Adjusted Operating Income(1) (2) LabCorp Diagnostics $293.3 $273.3 7.3% Adjusted Operating Margin 18.9% 18.4% 50 bps Covance Drug Development $110.4 $89.8 22.9% Adjusted Operating Margin 16.0% 13.6% 240 bps Unallocated Corporate Expense ($35.5) ($35.4) (0.3%) Total Adjusted Operating Income $368.2 $327.7 12.4% Total Adjusted Operating Margin 16.4% 15.3% 110 bps

6 2015 PRO FORMA SEGMENT RESULTS (DOLLARS IN MILLIONS) (1) Adjusted Operating Income excludes amortization, restructuring and special items (2) See Reconciliation of non-GAAP Financial Measures on slides 18 - 21 Pro forma results assume that the acquisition of Covance closed on January 1, 2014 Twelve Months Twelve Months Ended 12/31/15 Ended 12/31/14 % Change Net Revenue LabCorp Diagnostics $6,210.6 $5,922.2 4.9% Covance Drug Development $2,628.7 $2,610.5 0.7% Total Net Revenue $8,839.3 $8,532.7 3.6% Adjusted Operating Income(1) (2) LabCorp Diagnostics $1,239.8 $1,129.4 9.8% Adjusted Operating Margin 20.0% 19.1% 90 bps Covance Drug Development $371.5 $340.3 9.2% Adjusted Operating Margin 14.1% 13.0% 110 bps Unallocated Corporate Expense ($134.1) ($136.4) 1.7% Total Adjusted Operating Income $1,477.2 $1,333.3 10.8% Total Adjusted Operating Margin 16.7% 15.6% 110 bps

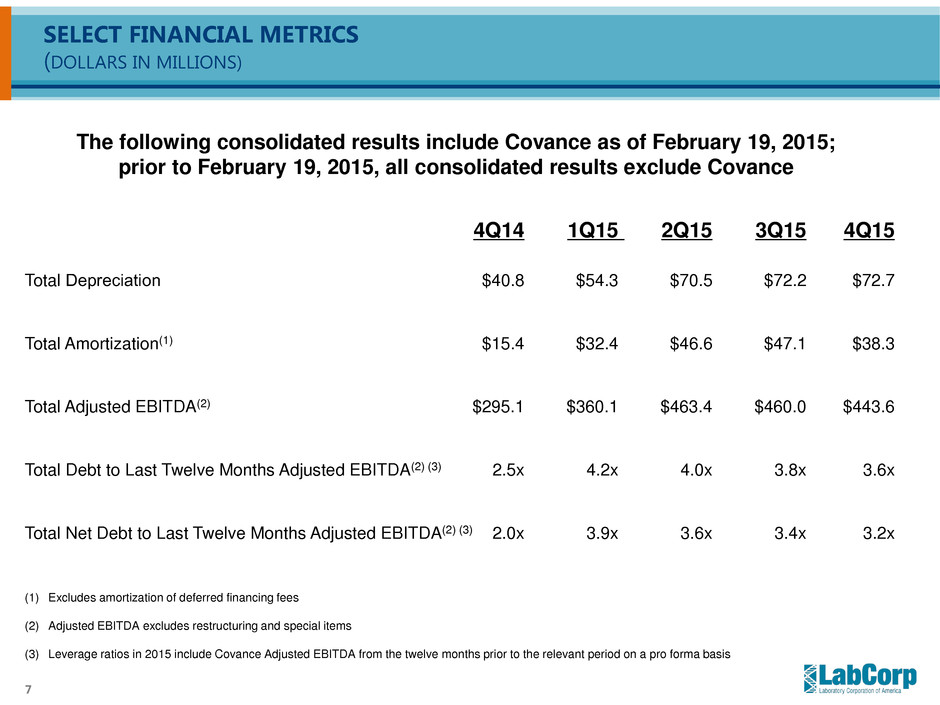

7 SELECT FINANCIAL METRICS (DOLLARS IN MILLIONS) 4Q14 1Q15 2Q15 3Q15 4Q15 Total Depreciation $40.8 $54.3 $70.5 $72.2 $72.7 Total Amortization(1) $15.4 $32.4 $46.6 $47.1 $38.3 Total Adjusted EBITDA(2) $295.1 $360.1 $463.4 $460.0 $443.6 Total Debt to Last Twelve Months Adjusted EBITDA(2) (3) 2.5x 4.2x 4.0x 3.8x 3.6x Total Net Debt to Last Twelve Months Adjusted EBITDA(2) (3) 2.0x 3.9x 3.6x 3.4x 3.2x (1) Excludes amortization of deferred financing fees (2) Adjusted EBITDA excludes restructuring and special items (3) Leverage ratios in 2015 include Covance Adjusted EBITDA from the twelve months prior to the relevant period on a pro forma basis The following consolidated results include Covance as of February 19, 2015; prior to February 19, 2015, all consolidated results exclude Covance

8 COVANCE DRUG DEVELOPMENT: SELECT FINANCIAL METRICS(1) (DOLLARS IN MILLIONS) Backlog at 9/30/15 $6,653 Fourth Quarter 2015 Covance Drug Development Net Revenue (693) Fourth Quarter 2015 Net Orders 816 Foreign Exchange Impact (38) Backlog at 12/31/15 $6,738 Fourth Quarter 2015 Net Book-to-Bill 1.18 Trailing Twelve Month Net Book-to-Bill(2) 1.23 (1) Does not tie due to rounding (2) Assumes that the acquisition of Covance closed on January 1, 2015

9 (1) Revenues recognized in over 30 currencies; the largest foreign currency accounts for less than 10% of total net revenue Segment Distribution LabCorp Diagnostics 69.2% Covance Drug Development 30.8% USA 80.8% Geographic Distribution Rest of World(1) 19.2% FOURTH QUARTER 2015 NET REVENUE DISTRIBUTION

10 (1) Revenues recognized in over 30 currencies; the largest foreign currency accounts for less than 10% of total net revenue Segment Distribution LabCorp Diagnostics 70.3% Covance Drug Development 29.7% USA 80.9% Geographic Distribution Rest of World(1) 19.1% 2015 PRO FORMA NET REVENUE DISTRIBUTION Pro forma results assume that the acquisition of Covance closed on January 1, 2015

11 FOURTH QUARTER 2015 FOREIGN EXCHANGE IMPACT TO PRO FORMA NET REVENUE(1) (DOLLARS IN MILLIONS) Year over Year Dollars % Growth Consolidated Net Revenue, as Reported $2,243 4.5% Foreign Exchange Impact $27 1.3% Net Revenue, Constant Currency $2,270 5.8% LabCorp Diagnostics Net Revenue, as Reported $1,551 4.3% Foreign Exchange Impact $12 0.8% Net Revenue, Constant Currency $1,563 5.1% Covance Drug Development Net Revenue, as Reported $691 4.7% Foreign Exchange Impact $15 2.3% Net Revenue, Constant Currency $706 7.0% Pro forma results assume that the acquisition of Covance closed on January 1, 2014 (1) Does not tie due to rounding

12 2015 FOREIGN EXCHANGE IMPACT TO PRO FORMA NET REVENUE(1) (DOLLARS IN MILLIONS) Year over Year Dollars % Growth Consolidated Net Revenue, as Reported $8,839 3.6% Foreign Exchange Impact $143 1.7% Net Revenue, Constant Currency $8,982 5.3% LabCorp Diagnostics Net Revenue, as Reported $6,211 4.9% Foreign Exchange Impact $48 0.8% Net Revenue, Constant Currency $6,259 5.7% Covance Drug Development Net Revenue, as Reported $2,629 0.7% Foreign Exchange Impact $95 3.6% Net Revenue, Constant Currency $2,723 4.3% Pro forma results assume that the acquisition of Covance closed on January 1, 2014 (1) Does not tie due to rounding

13 2016 FINANCIAL GUIDANCE Excluding the impact of amortization, restructuring and special items, guidance for 2016 is: Current Guidance (assumes foreign exchange rates effective as of January 31, 2016) Total net revenue growth: 7.5% – 9.5%(1) LabCorp Diagnostics net revenue growth: 3.5% – 5.5%(2) Covance Drug Development net revenue growth: 2% – 5%(3) Adjusted EPS: $8.45 – $8.85 Free cash flow: $900 Million – $950 Million (1) Includes the impact from approximately 100 basis points of negative currency. (2) Includes the impact from approximately 50 basis points of negative currency. (3) Includes the impact from approximately 200 basis points of negative currency.

14 2014 PRO FORMA SEGMENT NET REVENUE RECONCILIATION (DOLLARS IN MILLIONS) (1) Adjustments include the removal of LabCorp’s legacy clinical trial services business and the addition of Covance’s nutritional chemistry and food safety business. (2) Adjustments include the addition of LabCorp’s legacy clinical trial services business and the removal of Covance’s nutritional chemistry and food safety business. 1Q14 2Q14 3Q14 4Q14 FY14 LabCorp as reported $1,431 $1,516 $1,552 $1,513 $6,012 Adjustments(1) (17) (22) (25) (26) (89) LabCorp Diagnostics $1,414 $1,494 $1,527 $1,487 $5,922 Covance as reported $620 $639 $627 $634 $2,521 Adjustments(2) 17 22 25 26 89 Covance Drug Development $637 $661 $652 $660 $2,610

15 2014 PRO FORMA SEGMENT RECONCILIATION (DOLLARS IN MILLIONS) (1) During the fourth quarter of 2015, the Company refined its methodology for the calculation of unallocated corporate expenses, which impacts LabCorp Diagnostics Adjusted Segment Operating Income. The Company believes that this new allocation methodology better matches the corporate cost of services being consumed by the LabCorp Diagnostics segment. This methodology has been applied to prior periods for comparative purposes, as shown above. 1Q14 2Q14 3Q14 4Q14 FY14 LabCorp Diagnostics Adjusted Operating Income, as reported $264.9 $308.9 $305.6 $280.9 $1,160.3 Adjustments(1) (7.4) (7.9) (8.0) (7.6) (30.9) LabCorp Diagnostics Adjusted Operating Income, revised $257.5 $301.0 $297.6 $273.3 $1,129.4 LabCorp Diagnostics Adjusted Operating Margin, revised 18.2% 20.1% 19.5% 18.4% 19.1% Covance Drug Development Adjusted Operating Income, as reported $77.3 $84.7 $88.5 $89.8 $340.3 Adjustments -- -- -- -- -- Covance Drug Development Adjusted Operating Income, revised $77.3 $84.7 $88.5 $89.8 $340.3 Covance Drug Development Adjusted Operating Margin, revised 12.1% 12.8% 13.6% 13.6% 13.0% Total Unallocated Corporate Expenses, as reported $39.3 $41.9 $43.1 $43.0 $167.3 Adjustments(1) (7.4) (7.9) (8.0) (7.6) (30.9) Total Unallocated Corporate Expenses, revised $31.9 $34.0 $35.1 $35.4 $136.4 Total Unallocated Corporate Expenses as a % of Total Net Revenue 1.6% 1.6% 1.6% 1.6% 1.6%

16 2015 PRO FORMA SEGMENT RECONCILIATION (DOLLARS IN MILLIONS) (1) During the fourth quarter of 2015, the Company refined its methodology for the calculation of unallocated corporate expenses, which impacts LabCorp Diagnostics Adjusted Segment Operating Income. The Company believes that this new allocation methodology better matches the corporate cost of services being consumed by the LabCorp Diagnostics segment. This methodology has been applied to prior periods for comparative purposes, as shown above. 1Q15 2Q15 3Q15 4Q15 FY15 LabCorp Diagnostics Adjusted Operating Income, as reported $300.1 $347.1 $330.2 Adjustments(1) (10.4) (10.1) (10.4) LabCorp Diagnostics Adjusted Operating Income, revised $289.7 $337.0 $319.8 $293.3 $1,239.8 LabCorp Diagnostics Adjusted Operating Margin, revised 19.5% 21.4% 20.0% 18.9% 20.0% Covance Drug Development Adjusted Operating Income, as reported $74.2 $89.9 $97.0 Adjustments -- -- -- Covance Drug Development Adjusted Operating Income, revised $74.2 $89.9 $97.0 $110.4 $371.5 Covance Drug Development Adjusted Operating Margin, revised 11.9% 14.0% 14.5% 16.0% 14.1% Total Unallocated Corporate Expenses, as reported $41.8 $46.0 $41.7 Adjustments(1) (10.4) (10.1) (10.4) Total Unallocated Corporate Expenses, revised $31.4 $35.9 $31.3 $35.5 $134.1 Total Unallocated Corporate Expenses as a % of Total Net Revenue 1.5% 1.6% 1.4% 1.6% 1.5%

17 2014 PRO FORMA SEGMENT ADJUSTED OPERATING INCOME RECONCILIATION (DOLLARS IN MILLIONS) (1) Adjustments include the removal of unallocated corporate expenses and LabCorp’s legacy clinical trial services business, as well as the addition of Covance’s nutritional chemistry and food safety business. Unallocated corporate expenses in 2014 were: Q1 ($26.1 million), Q2 ($27.6 million), Q3 ($28.3 million), Q4 ($27.5 million) and full-year ($109.5 million). (2) During the fourth quarter of 2015, the Company refined its methodology for the calculation of unallocated corporate expenses, which impacts LabCorp Diagnostics Adjusted Segment Operating Income. The Company believes that this new allocation methodology better matches the corporate cost of services being consumed by the LabCorp Diagnostics segment. This methodology has been applied to prior periods for comparative purposes, as shown above. Refer to slide 15 for additional detail. (3) Adjustments include the removal of unallocated corporate expenses and Covance’s nutritional chemistry and food safety business, as well as the addition of LabCorp’s legacy clinical trial services business. Unallocated corporate expenses in 2014 were: Q1 ($5.7 million), Q2 ($6.4 million), Q3 ($6.8 million), Q4 ($7.8 million) and full-year ($26.7 million). 1Q14 2Q14 3Q14 4Q14 FY14 LabCorp as reported $210.8 $253.4 $252.8 $234.4 $951.4 Amortization 21.0 22.0 18.3 15.4 76.7 Adjustments(1)(2) 25.7 25.6 26.5 23.5 101.3 LabCorp Diagnostics(2) $257.5 $301.0 $297.6 $273.3 $1,129.4 Covance as Reported $71.0 $76.1 $79.7 $77.7 $304.5 Adjustments(3) 6.3 8.6 8.8 12.1 35.8 Covance Drug Development $77.3 $84.7 $88.5 $89.8 $340.3

18 RECONCILIATION OF NON-GAAP FINANCIAL MEASURES The following consolidated results include Covance as of February 19, 2015; prior to February 19, 2015, all consolidated results exclude Covance Adjusted Operating Income 2015 2014 2015 2014 Operating Income 243.5$ 219.0$ 1,002.9$ 910.4$ Acquisition-related costs 1.1 - 119.1 - Restructuring and other special charges 54.0 2.4 113.9 17.8 Consulting fees and executive transition expenses 10.4 13.2 25.6 23.4 Settlement costs 12.2 - 12.2 - Wind-down of minimum volume contract operations 5.7 - 5.7 - Project LaunchPad system implementation costs 3.0 - 3.0 - Amortization of intangibles and other assets 38.3 15.4 164.5 76.7 Adjusted operating income 368.2$ 250.0$ 1,446.9$ 1,028.3$ Adjusted EPS Diluted earnings per common share 1.11$ 1.39$ 4.34$ 5.91$ Restructuring and special items 0.61 0.15 2.44 0.34 Amortization expense 0.26 0.11 1.13 0.55 Adjusted EPS 1.98$ 1.65$ 7.91$ 6.80$ Three Months Ended December 31, Twelve Months Ended December 31, LABORATORY CORPORATION OF AMERICA HOLDINGS Reconciliation of Non-GAAP Financial Measures (in millions, except per share data)

19 RECONCILIATION OF NON-GAAP FINANCIAL MEASURES The following consolidated results include Covance as of February 19, 2015; prior to February 19, 2015, all consolidated results exclude Covance Free Cash Flow: 2015 2014 2015 2014 Net cash provided by operating activities 384.6$ 213.7$ 982.4$ 739.0$ Less: Capital expenditures (85.1) (46.3) (255.8) (203.5) Free cash flow 299.5$ 167.4$ 726.6$ 535.5$ LABORATORY CORPORATION OF AMERICA HOLDINGS Reconciliation of Non-GAAP Financial Measures (in millions, except per share data) Three Months Ended December 31, Twelve Months Ended December 31,

20 1) During the fourth quarter of 2015, the Company recorded net restructuring and special items of $54.0 million. The charges included $25.3 million in severance and other personnel costs along with $17.0 million in facility-related costs associated with facility closures and general integration initiatives. A substantial portion of these costs relates to the planned closure of two Covance Drug Development segment (“CDD”) operations that serviced a minimum volume contract that expired on October 31, 2015. In addition, the Company recorded asset impairments of $11.9 million relating to CDD customer service applications that will no longer be used. The Company reversed previously established reserves of $0.2 million in unused facility- related costs. The Company incurred additional legal and other costs of $5.7 million relating to the wind-down of the minimum volume contract operations. The Company also recorded $10.1 million in consulting expenses relating to fees incurred as part of its Covance integration costs and compensation analysis, along with $1.1 million in short-term equity retention arrangements relating to the acquisition of Covance and $0.3 million of accelerated equity compensation relating to the announced retirement of a Company executive (all recorded in selling, general and administrative expenses). During the fourth quarter, the Company paid $12.2 million in settlement costs and litigation expenses related to the resolution of a federal court putative class action lawsuit. In addition, the Company incurred $3.0 million of non-capitalized costs associated with the implementation of a major system as part of its Project LaunchPad business process improvement initiative. The after tax impact of these charges decreased net earnings for the quarter ended December 31, 2015, by $63.2 million and diluted earnings per share by $0.61 ($63.2 million divided by 103.2 million shares). During the first three quarters of 2015, the Company recorded net restructuring and other special charges of $59.9 million. The charges included $33.9 million in severance and other personnel costs along with $12.1 million in costs associated with facility closures and general integration initiatives. The Company reversed previously established reserves of $0.9 million in unused facility-related costs. In addition, the Company recorded asset impairments of $14.8 million relating to lab and customer service applications that will no longer be used. The Company also recorded $15.3 million of consulting expenses relating to fees incurred as part of Project LaunchPad as well as Covance integration costs, along with $4.3 million in short-term equity retention arrangements relating to the acquisition of Covance (all recorded in selling, general and administrative expenses). In addition, the Company recorded a non-cash loss of $2.3 million, upon the dissolution of one of its equity investments (recorded in other, net in the accompanying Consolidated Statements of Operations). During the first quarter of 2015, the Company recorded $166.0 million of one-time costs associated with its acquisition of Covance. The costs included $79.5 million of Covance employee equity awards, change in control payments and short-term retention arrangements that were accelerated or triggered by the acquisition transaction (recorded in selling, general and administrative expenses in the accompanying Consolidated Statements of Operations). The acquisition costs also included advisor and legal fees of $33.9 million (recorded in selling, general and administrative expenses in the accompanying Consolidated Statements of Operations), $15.2 million of deferred financing fees associated with the Company’s bridge loan facility as well as a make-whole payment of $37.4 million paid to call Covance’s private placement debt outstanding at the purchase date (both amounts recorded in interest expense in the accompanying Consolidated Statements of Operations). The after tax impact of these charges decreased net earnings for the twelve months ended December 31, 2015, by $245.7 million and diluted earnings per share by $2.44 ($245.7 million divided by 100.6 million shares). RECONCILIATION OF NON-GAAP FINANCIAL MEASURES - FOOTNOTES

21 2) During the fourth quarter of 2014, the Company recorded net restructuring and special items of $2.4 million. The charges included $0.7 million in severance and other personnel costs along with $1.7 million in facility-related costs associated with facility closures and general integration initiatives. In addition to these net restructuring charges, the Company recorded $13.2 million in consulting expenses relating to fees incurred as part of Project LaunchPad as well as legal fees associated with its Covance, Inc. acquisition (all such fees are recorded in selling, general and administrative). In conjunction with the financing of the Covance transaction, the Company incurred $4.7 million in bridge financing fees and wrote-off $1.3 million in deferred financing costs relating to its prior credit agreement which was replaced with a new credit facility. These Covance-related financing costs are recorded in interest expense. The after tax impact of these combined charges decreased net earnings for the three months ended December 31, 2014, by $13.3 million and diluted earnings per share by $0.15 ($13.3 million divided by 86.3 million shares). During the first three quarters of 2014, the Company recorded net restructuring and special items of $15.4 million. The charges included $9.9 million in severance and other personnel costs along with $6.6 million in costs associated with facility closures and general integration initiatives. The Company reversed previously established reserves of $0.4 million in unused severance and $0.7 million in unused facility-related costs. In addition, the Company recorded $10.1 million in consulting expenses relating to fees incurred as part of Project LaunchPad as well as legal fees associated with its LipoScience acquisition and one-time CFO transition costs (all such fees are recorded in selling, general and administrative). The after tax impact of these combined charges decreased net earnings for the year ended December 31, 2014, by $29.1 million and diluted earnings per share by $0.34 ($29.1 million divided by 86.4 million shares). 3) The Company continues to grow the business through acquisitions and uses Adjusted EPS Excluding Amortization as a measure of operational performance, growth and shareholder returns. The Company believes adjusting EPS for amortization provides investors with better insight into the operating performance of the business. For the quarters ended December 31, 2015 and 2014, intangible amortization was $38.3 million and $15.4 million, respectively ($26.9 million and $9.5 million net of tax, respectively) and decreased EPS by $0.26 ($26.9 million divided by 103.2 million shares) and $0.11 ($9.5 million divided by 86.2 million shares), respectively. For the twelve months ended December 31, 2015 and 2014, intangible amortization was $164.5 million and $76.7 million, respectively ($113.5 million and $47.3 million net of tax, respectively) and decreased EPS by $1.13 ($113.5 million divided by 100.6 million shares) and $0.55 ($47.3 million divided by 86.4 million shares), respectively. RECONCILIATION OF NON-GAAP FINANCIAL MEASURES - FOOTNOTES