Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HEALTHCARE TRUST OF AMERICA, INC. | hta201502188-k.htm |

| EX-99.1 - EXHIBIT 99.1 - HEALTHCARE TRUST OF AMERICA, INC. | ex99102182015.htm |

99.1 4Q 2015 Supplemental Information Exhibit 99.2

Company Overview Company Information 3 Current Period Highlights 4 Financial Highlights 5 Company Snapshot 6 Financial Information FFO, Normalized FFO, Normalized FAD and Adjusted EBITDA 7 Capitalization, Interest Expense and Covenants 8 Debt Composition and Maturity Schedule 9 Portfolio Information Investment Activity 10 Regional Portfolio Distribution and Key Markets and Top 75 MSA Concentration 11 Same-Property Performance and NOI 12 Portfolio Diversification by Type and Historical Campus Proximity 13 Tenant Lease Expirations and Historical Leased Rate 14 Key Health System Relationships and In-House Property Management and Leasing 15 Health System Relationship Highlights 16 Financial Statements Consolidated Balance Sheets 17 Consolidated Statements of Operations 18 Consolidated Statements of Cash Flows 19 Reporting Definitions 20 Forward-Looking Statements: Certain statements contained in this report constitute forward-looking statements within the meaning of the safe harbor from civil liability provided for such statements by the Private Securities Litigation Reform Act of 1995 (set forth in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act). Such statements include, in particular, statements about our plans, strategies and prospects and estimates regarding future medical office building market performance. Additionally, such statements are subject to certain risks and uncertainties, as well as known and unknown risks, which could cause actual results to differ materially and in adverse ways from those projected or anticipated. Therefore, such statements are not intended to be a guarantee of our performance in future periods. Forward-looking statements are generally identifiable by the use of such terms as “expect,” “project,” “may,” “should,” “could,” “would,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “continue,” “opinion,” “predict,” “potential,” “pro forma” or the negative of such terms and other comparable terminology. Readers are cautioned not to place undue reliance on these forward-looking statements. We cannot guarantee the accuracy of any such forward-looking statements contained in this report, and we do not intend to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law. Any such forward-looking statements reflect our current views about future events, are subject to unknown risks, uncertainties, and other factors, and are based on a number of assumptions involving judgments with respect to, among other things, future economic, competitive and market conditions, all of which are difficult or impossible to predict accurately. To the extent that our assumptions differ from actual results, our ability to meet such forward-looking statements, including our ability to generate positive cash flow from operations, provide dividends to stockholders, and maintain the value of our real estate properties, may be significantly hindered. Forward-looking statements express expectations of future events. All forward-looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties that could cause actual events or results to differ materially from those projected. Due to these inherent uncertainties, our stockholders are urged not to place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date made. In addition, we undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to projections over time, except as required by law. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. Additional information concerning us and our business, including additional factors that could materially affect our financial results, is included herein and in our other filings with the SEC. Table of Contents 4Q 2015 I Supplemental Information Healthcare Trust of America, Inc. I 2

Company Information Healthcare Trust of America, Inc. (NYSE: HTA) is a publicly traded real estate investment trust that acquires, owns and operates medical office buildings. Since its formation in 2006, HTA has invested $3.6 billion in medical office buildings and other healthcare assets comprising 15.5 million square feet across 28 states. HTA listed on the New York Stock Exchange in June of 2012 and has a consistent track record of generating stockholder returns. HTA invests in key markets with above average growth and healthcare infrastructure that are capable of servicing long-term patient demand. Within each key market, HTA focuses on acquiring medical office buildings on health system campuses, in community-core locations, or near university medical centers. The portfolio consists of medical office buildings that are core-critical, a key part of the integrated delivery of healthcare, and that continue to complement the HTA’s institutional asset management and leasing platform. HTA’s business strategy is defined by establishing critical mass within key markets which allows HTA’s asset management and in-house leasing platform to drive earnings growth, capitalize on synergies and maximize expense efficiencies, and build lasting tenant relationships, which is designed to lead to tenant retention, rent growth and long-term value creation across the portfolio. Company Overview Executive Management Scott D. Peters I Chairman, Chief Executive Officer and President Robert A. Milligan I Chief Financial Officer, Secretary and Treasurer Mark D. Engstrom I Executive Vice President - Acquisitions Amanda L. Houghton I Executive Vice President - Asset Management Dan M. Klein I Executive Vice President - Business Development Contact Information Corporate Headquarters Healthcare Trust of America, Inc. I NYSE: HTA 16435 North Scottsdale Road, Suite 320 Scottsdale, Arizona 85254 480.998.3478 www.htareit.com Investor Relations Robert A. Milligan I Chief Financial Officer, Secretary and Treasurer 16435 North Scottsdale Road, Suite 320 Scottsdale, Arizona 85254 480.998.3478 info@htareit.com Transfer Agent Computershare P.O. Box 30170 College Station, Texas 77842-3170 888.801.0107 4Q 2015 I Supplemental Information Healthcare Trust of America, Inc. I 3

Operating • Normalized FFO: Increased 12.1% to $50.7 million, compared to Q4 2014. • Normalized FFO Per Share: $0.39 per diluted share, an increase of $0.02 per diluted share, or 5.4%, compared to Q4 2014. • Normalized FAD: $0.35 per diluted share, or $44.9 million, an increase of $0.03 per diluted share, or 9.4%, compared to Q4 2014. • Same-Property Cash NOI: Increased $1.9 million, or 3.1%, to $62.5 million, compared to Q4 2014. Same-Property rental revenue increased $1.4 million, or 2.1%, to $70.3 million, compared to Q4 2014. The increase was primarily due to in place lease rental escalators for 94% of HTA’s leased portfolio that did not have a lease expiration in 2015. Portfolio • Investments: During the quarter, HTA completed investments of $26.3 million, increasing total year-to-date investments to $280.9 million. This included investments (91% leased and approximately 118,000 square feet of GLA) located in our key markets of Boston and Charleston. • Leasing: During the quarter, HTA entered into new and renewal leases on approximately 268,000 square feet of GLA, or 1.7% of its portfolio. Quarter-to-date, renewal leases included tenant improvements of $1.34 per square foot per year of the lease term and approximately one week of free rent per year of the lease term. Tenant retention for the Same-Property portfolio was 75% by GLA for the quarter. • Leased Rate: At the end of the year, the leased rate by GLA was 92.0%. For the Same-Property portfolio the leased rate was 92.5% by GLA. Balance Sheet and Liquidity • Balance Sheet: At the end of the year, HTA had total leverage, measured by debt to capitalization, of 31.4% and total liquidity of $639.6 million, including $626.5 million of availability on its unsecured revolving credit facility and $13.1 million of cash and cash equivalents. • Debt: HTA ended the year with a weighted average remaining term on the debt portfolio, including extension options, of 4.8 years from 5.6 years as of Q4 2014. Company Overview Current Period Highlights 4Q 2015 I Supplemental Information Healthcare Trust of America, Inc. I 4

(1) Refer to page 20 for the reporting definitions of NOI, Annualized Adjusted EBITDA, Normalized FFO and Normalized FAD. (2) Refer to page 12 for a reconciliation of GAAP Net Income to NOI. (3) Refer to page 7 for a reconciliation of GAAP Net Income to Annualized Adjusted EBITDA. (4) Refer to page 7 for a reconciliation of GAAP Net Income Attributable to Common Stockholders to Normalized FFO and FAD. (5) Calculated as the increase in Same-Property Cash NOI for the quarter as compared to the same period in the previous year. (6) Calculated as EBITDA divided by interest expense (excluding change in fair market value of derivatives) and scheduled principal payments. (7) For the periods 4Q14 through 3Q15, amounts have been adjusted to reflect the retrospective presentation of the early adoption of ASU 2015-03 and 2015-15 as of December 31, 2015. (8) Calculated as the common stock price on the last trading day of the period multiplied by the total diluted common shares outstanding at the end of the period, plus total debt outstanding at the end of the period. Refer to page 8 for details. Financial Highlights (unaudited and dollars in thousands, except per share data) Three Months Ended 4Q15 3Q15 2Q15 1Q15 4Q14 INCOME ITEMS Revenues $ 102,049 $ 103,942 $ 99,311 $ 98,520 $ 94,996 NOl (1)(2) 71,514 71,021 70,074 67,823 66,667 Annualized Adjusted EBITDA (1)(3) 267,476 265,024 267,072 254,684 249,956 Normalized FFO (1)(4) 50,737 50,001 48,537 46,645 45,252 Normalized FAD (1)(4) 44,889 44,683 44,446 44,306 39,972 Net income attributable to common stockholders per diluted share $ 0.08 $ 0.05 $ 0.07 $ 0.05 $ 0.17 Normalized FFO per diluted share 0.39 0.39 0.38 0.37 0.37 Normalized FAD per diluted share 0.35 0.35 0.35 0.35 0.32 Same-Property Cash NOI growth (5) 3.1% 3.1% 3.0% 3.0% 3.3% Fixed charge coverage ratio (6) 3.84x 3.77x 3.61x 3.56x 3.83x As of 4Q15 3Q15 2Q15 1Q15 4Q14 ASSETS Gross real estate investments $ 3,635,612 $ 3,600,705 $ 3,606,922 $ 3,408,576 $ 3,372,820 Total assets (7) 3,172,300 3,170,712 3,208,757 3,039,246 3,031,384 CAPITALIZATION Total debt (7) $ 1,590,696 $ 1,567,091 $ 1,629,676 $ 1,448,758 $ 1,402,195 Total capitalization (7)(8) 5,068,666 4,728,097 4,674,296 4,990,683 4,824,033 Total debt/capitalization (7) 31.4% 33.1% 34.9% 29.0% 29.1% Company Overview 4Q 2015 I Supplemental Information Healthcare Trust of America, Inc. I 5

Gross real estate investments (1) $ 3.6 Total portfolio GLA (2) 15.5 Leased rate 92.0% Same-Property portfolio tenant retention rate (YTD) 80% % of GLA on-campus/aligned 97% % of invested dollars in key markets & top 75 MSAs 91% Investment grade tenants (3) 45% Credit rated tenants (3) 61% Weighted average remaining lease term for all buildings (4) 5.6 Weighted average remaining lease term for single-tenant buildings (4) 7.3 Weighted average remaining lease term for multi-tenant buildings (4) 4.7 Credit ratings (by Moody’s and Standard & Poor’s) Baa2(Stable)/BBB(Stable) Cash and cash equivalents (2) $ 13.1 Debt/capitalization 31.4% Weighted average interest rate per annum on portfolio debt (5) 3.30% Building Type Presence in Top MSAs Company Snapshot (as of December 31, 2015) Company Overview 4Q 2015 I Supplemental Information Healthcare Trust of America, Inc. I 6 (1) Amount represented in billions. (2) Amounts represented in millions. (3) Amounts based on annualized base rent. (4) Amounts presented in years. (5) Includes the impact of interest rate swaps. % of Portfolio (based on GLA) % of Portfolio (based on invested dollars)

FFO, Normalized FFO and Normalized FAD Three Months Ended Year Ended 4Q15 4Q14 4Q15 4Q14 Net income attributable to common stockholders $ 10,372 $ 21,192 $ 32,931 $ 45,371 Depreciation and amortization expense 38,626 35,923 152,846 140,269 Gain on sales of real estate, net — (16,128) (152) (27,894) Impairment 926 — 2,581 — FFO attributable to common stockholders $ 49,924 $ 40,987 $ 188,206 $ 157,746 Acquisition-related expenses 1,190 898 4,555 9,545 (Gain) loss on change in fair value of derivative financial instruments, net (2,310) 2,013 769 2,870 (Gain) loss on extinguishment of debt, net (16) — (123) 4,663 Noncontrolling income from partnership units included in diluted shares 166 238 514 490 Other normalizing items, net (1)(2) 1,783 1,116 1,999 1,325 Normalized FFO attributable to common stockholders $ 50,737 $ 45,252 $ 195,920 $ 176,639 Other income (23) (8) (114) (49) Non-cash compensation expense 1,262 1,103 5,724 4,382 Straight-line rent adjustments, net (1,082) (1,927) (6,917) (8,106) Amortization of below and above market leases/leasehold interests, net 595 661 2,350 2,553 Deferred revenue - tenant improvement related (183) (217) (645) (620) Amortization of deferred financing costs and debt discount/premium, net 683 656 3,128 2,394 Recurring capital expenditures, tenant improvements and leasing commissions (7,100) (5,548) (21,122) (22,045) Normalized FAD attributable to common stockholders $ 44,889 $ 39,972 $ 178,324 $ 155,148 Net income attributable to common stockholders per diluted share $ 0.08 $ 0.17 $ 0.26 $ 0.37 FFO adjustments per diluted share, net 0.31 0.16 1.21 0.93 FFO attributable to common stockholders per diluted share $ 0.39 $ 0.33 $ 1.47 $ 1.30 Normalized FFO adjustments per diluted share, net 0.00 0.04 0.06 0.16 Normalized FFO attributable to common stockholders per diluted share $ 0.39 $ 0.37 $ 1.53 $ 1.46 Normalized FAD adjustments per diluted share, net (0.04) (0.05) (0.14) (0.18) Normalized FAD attributable to common stockholders per diluted share $ 0.35 $ 0.32 $ 1.39 $ 1.28 Weighted average diluted common shares outstanding 128,965 123,732 128,004 121,168 Adjusted EBITDA Three Months Ended 4Q15 Net income $ 10,573 Depreciation and amortization expense 38,955 Interest expense and net change in fair value of derivative financial instruments 12,020 EBITDA $ 61,548 Acquisition-related expenses 1,190 Impairment 926 Non-cash compensation expense 1,262 Pro forma impact of acquisitions 176 Gain on extinguishment of debt and other normalizing items, net 1,767 Adjusted EBITDA 66,869 Annualized Adjusted EBITDA $ 267,476 FFO, Normalized FFO, Normalized FAD and Adjusted EBITDA (unaudited and in thousands, except per share data) Financial Information 4Q 2015 I Supplemental Information Healthcare Trust of America, Inc. I 7 (1) For the three months and year ended December 31, 2014, other normalizing items primarily include the write-off of deferred financing costs related to refinancing our credit facility, which is not included in amortization of deferred financing costs and debt discount/premium. (2) For the three months and year ended December 31, 2015, other normalizing items primarily include the acceleration of management fees paid in connection with an acquisition- related management agreement that was entered into at the time of acquisition for our Florida portfolio that was acquired in December 2013.

Capitalization Secured mortgages $ 327,018 Unsecured term loans 455,000 Unsecured senior notes 600,000 Unsecured revolving credit facility 218,000 Deferred financing costs, net (8,411) Discount, net (911) Total debt $ 1,590,696 Stock price (as of December 31, 2015) $ 26.97 Total diluted common shares outstanding 128,957 Equity capitalization $ 3,477,970 Total capitalization $ 5,068,666 Total undepreciated assets $ 3,848,444 Debt/capitalization 31.4% Debt/undepreciated assets 41.3% Debt/annualized adjusted EBITDA ratio 5.9x Equity - 69% Secured debt - 6% Unsecured debt - 25% Financial Information Capitalization, Interest Expense and Covenants (as of December 31, 2015, dollars and shares in thousands, except stock price) 4Q 2015 I Supplemental Information Healthcare Trust of America, Inc. I 8 Interest Expense Covenants Three Months Ended Year Ended 4Q15 4Q14 4Q15 4Q14 Interest related to derivative financial instruments $ 862 $ 1,756 $ 3,140 $ 5,904 (Gain) loss on change in fair value of derivative financial instruments, net (2,310) 2,013 769 2,870 Total interest related to derivative financial instruments, including net change in fair value of derivative financial instruments (1,448) 3,769 3,909 8,774 Interest related to debt 13,468 13,783 54,967 51,585 Total interest expense $ 12,020 $ 17,552 $ 58,876 $ 60,359 Interest expense excluding net change in fair value of derivative financial instruments $ 14,330 $ 15,539 $ 58,107 $ 57,489 Bank Loans Required 4Q15 Total leverage 60% 41% Secured leverage 30% 8% Fixed charge coverage 1.50x 3.84x Unencumbered leverage 60% 39% Unencumbered coverage 1.75x 5.87x Senior Notes Required 4Q15 Total leverage 60% 42% Secured leverage 40% 9% Unencumbered asset coverage 150% 246% Interest coverage 1.50x 4.25x

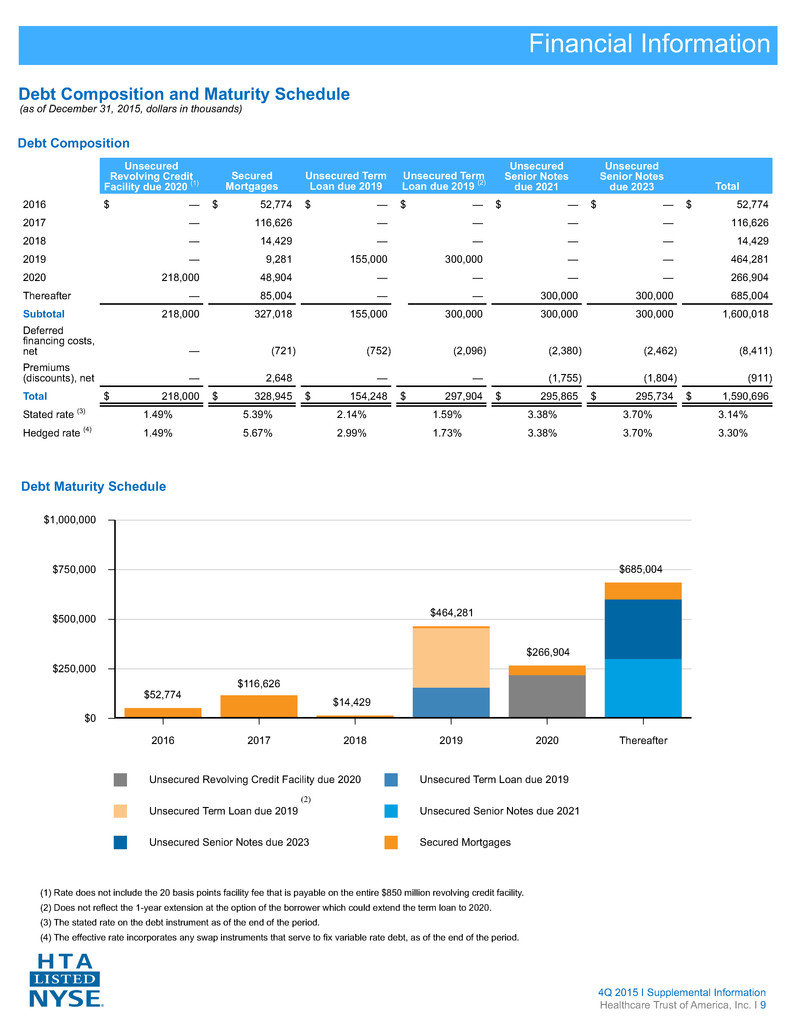

Financial Information Debt Composition and Maturity Schedule (as of December 31, 2015, dollars in thousands) 4Q 2015 I Supplemental Information Healthcare Trust of America, Inc. I 9 Unsecured Revolving Credit Facility due 2020 (1) Secured Mortgages Unsecured Term Loan due 2019 Unsecured Term Loan due 2019 (2) Unsecured Senior Notes due 2021 Unsecured Senior Notes due 2023 Total 2016 $ — $ 52,774 $ — $ — $ — $ — $ 52,774 2017 — 116,626 — — — — 116,626 2018 — 14,429 — — — — 14,429 2019 — 9,281 155,000 300,000 — — 464,281 2020 218,000 48,904 — — — — 266,904 Thereafter — 85,004 — — 300,000 300,000 685,004 Subtotal 218,000 327,018 155,000 300,000 300,000 300,000 1,600,018 Deferred financing costs, net — (721) (752) (2,096) (2,380) (2,462) (8,411) Premiums (discounts), net — 2,648 — — (1,755) (1,804) (911) Total $ 218,000 $ 328,945 $ 154,248 $ 297,904 $ 295,865 $ 295,734 $ 1,590,696 Stated rate (3) 1.49% 5.39% 2.14% 1.59% 3.38% 3.70% 3.14% Hedged rate (4) 1.49% 5.67% 2.99% 1.73% 3.38% 3.70% 3.30% Debt Composition (1) Rate does not include the 20 basis points facility fee that is payable on the entire $850 million revolving credit facility. (2) Does not reflect the 1-year extension at the option of the borrower which could extend the term loan to 2020. (3) The stated rate on the debt instrument as of the end of the period. (4) The effective rate incorporates any swap instruments that serve to fix variable rate debt, as of the end of the period. Debt Maturity Schedule Unsecured Revolving Credit Facility due 2020 Unsecured Term Loan due 2019 Unsecured Term Loan due 2019 Unsecured Senior Notes due 2021 Unsecured Senior Notes due 2023 Secured Mortgages $1,000,000 $750,000 $500,000 $250,000 $0 2016 2017 2018 2019 2020 Thereafter $52,774 $116,626 $14,429 $464,281 $266,904 $685,004 (2)

Property Market Date Acquired % Leased at Acquisition Purchase Price (1) GLA WellStar MOBs (2 buildings) Atlanta, GA March 98% $ 35,300 117 Tryon MOBs (2 buildings) Raleigh, NC April 100 18,670 67 Community Health MOB Indianapolis, IN April 96 38,050 126 Medical University of South Carolina MOB Charleston, SC May 100 10,600 39 Rex Healthcare - Cary MOB Raleigh, NC May 100 21,390 64 670 Albany Street at Boston Medical Center Boston, MA June 100 101,500 161 Diley Ridge MOB Columbus, OH July 100 11,500 46 Hilliard MOB Columbus, OH September 100 13,400 47 Stetson MOB Boston, MA November 81 21,100 103 Total $ 271,510 770 Portfolio Information Investment Activity (as of December 31, 2015, dollars and GLA in thousands) 2015 Acquisitions Annual Investments (2) 4Q 2015 I Supplemental Information Healthcare Trust of America, Inc. I 10 Dispositions Acquisitions $1,000,000 $800,000 $600,000 $400,000 $200,000 $0 2007 2008 2009 2010 2011 2012 2013 2014 2015 $82,885 $413,150 $542,976 $455,950 $802,148 $68,314 $294,937 $397,826 $439,530 (1) Excludes $9.4 million of additional investments which include the expansion of HTA’s Raleigh Medical Center Campus and a corporate office building in Charleston. (2) Excludes real estate notes receivable. $271,510 (1) 2015 Dispositions Property Location Date Disposed Disposition Price GLA MOB Portfolio (4 buildings) NY, WI, GA July $ 33,895 167 Pearland MOB Pearland, TX July 1,000 20 Lakeview MOB Sun City, AZ August 790 5 Total $ 35,685 192 $35,685

Region Investment % of Investment Total GLA % of Portfolio Annualized Base Rent % of Annualized Base Rent Southwest $ 1,060,647 29.6% 4,299 27.8% $ 93,646 29.2% Southeast 1,046,324 29.2 4,782 30.9 95,453 29.7 Northeast 885,465 24.8 3,486 22.6 79,576 24.8 Midwest 585,844 16.4 2,886 18.7 52,424 16.3 Total $ 3,578,280 100% 15,453 100% $ 321,099 100% Key Markets Investment % of Investment Total GLA % of Portfolio Annualized Base Rent % of Annualized Base Rent Boston, MA $ 384,900 10.8% 947 6.1% $ 29,847 9.3% Dallas, TX 223,448 6.2 682 4.4 19,187 6.0 Phoenix, AZ 189,641 5.3 1,017 6.6 18,830 5.9 Albany, NY 179,253 5.0 880 5.7 16,558 5.2 Greenville, SC 179,070 5.0 965 6.3 17,622 5.5 Miami, FL 173,807 4.9 887 5.7 17,274 5.4 Atlanta, GA 156,743 4.4 663 4.3 13,075 4.1 Indianapolis, IN 155,700 4.4 977 6.3 14,565 4.5 Pittsburgh, PA 148,612 4.2 1,094 7.1 20,175 6.3 Houston, TX 148,065 4.1 673 4.4 15,709 4.9 Tampa, FL 123,593 3.5 383 2.5 8,729 2.7 Denver, CO 111,700 3.1 371 2.4 8,812 2.7 Raleigh, NC 100,260 2.8 434 2.8 9,543 3.0 White Plains, NY 92,750 2.6 276 1.8 6,804 2.1 Charleston, SC 65,101 1.8 253 1.6 4,869 1.5 Orlando, FL 62,300 1.7 289 1.9 6,031 1.9 Honolulu, HI 47,250 1.3 142 0.9 3,742 1.2 Columbus, OH 46,800 1.3 208 1.3 2,847 0.9 Austin, TX 29,250 0.8 83 0.5 2,042 0.5 2,618,243 73.2 11,224 72.6 236,261 73.6 Additional Top 75 MSAs 634,771 17.7 2,764 17.9 55,471 17.3 Total Key Markets & Top 75 MSAs $ 3,253,014 90.9% 13,988 90.5% $ 291,732 90.9% Portfolio Information Regional Portfolio Distribution and Key Markets and Top 75 MSA Concentration (as of December 31, 2015, dollars and GLA in thousands) Regional Portfolio Distribution Key Markets and Top 75 MSA Concentration (1) (1) Key markets are titled based on HTA’s concentration in the respective Metropolitan Statistical Area (“MSA”). 4Q 2015 I Supplemental Information Healthcare Trust of America, Inc. I 11

Three Months Ended Sequential Year-Over-Year 4Q15 3Q15 4Q14 $ Change % Change $ Change % Change Rental revenue $ 70,323 $ 69,520 $ 68,892 $ 803 1.2% $ 1,431 2.1% Tenant recoveries 16,743 19,177 18,058 (2,434) (12.7) (1,315) (7.3) Total rental income 87,066 88,697 86,950 (1,631) (1.8) 116 0.1 Expenses 24,579 26,990 26,319 (2,411) (8.9) (1,740) (6.6) Same-Property Cash NOI $ 62,487 $ 61,707 $ 60,631 $ 780 1.3% $ 1,856 3.1% As of 4Q15 3Q15 4Q14 Number of buildings 271 271 271 GLA 13,511 13,511 13,491 Leased GLA, end of period 12,499 12,481 12,476 Leased %, end of period 92.5% 92.4% 92.5% NOI Three Months Ended 4Q15 4Q14 Net income $ 10,573 $ 21,457 General and administrative expenses 6,349 6,810 Acquisition-related expenses 1,190 898 Depreciation and amortization expense 38,955 36,086 Impairment 926 — Interest expense and net change in fair value of derivative financial instruments 12,020 17,552 Gain on sales of real estate, net — (16,128) Gain on extinguishment of debt, net (16) — Other expense (income) 1,517 (8) NOI $ 71,514 $ 66,667 NOI percentage growth 7.3% NOI $ 71,514 $ 66,667 Straight-line rent adjustments, net (1,082) (1,927) Amortization of below and above market leases/leasehold interests, net 595 661 Lease termination fees (17) (9) Cash NOI $ 71,010 $ 65,392 Notes receivable interest income — (31) Non Same-Property Cash NOI (8,523) (4,730) Same-Property Cash NOI $ 62,487 $ 60,631 Same-Property Cash NOI percentage growth 3.1% 4Q 2015 I Supplemental Information Healthcare Trust of America, Inc. I 12 Portfolio Information Same-Property Performance and NOI (as of December 31, 2015, unaudited and dollars and GLA in thousands) Same-Property Performance

As of 4Q15 3Q15 2Q15 1Q15 4Q14 Off-campus aligned 27% 27% 26% 25% 25% On-campus 70 70 70 71 71 On-campus/aligned 97% 97% 96% 96% 96% Off-campus/non-aligned 3 3 4 4 4 Total 100% 100% 100% 100% 100% Number of Buildings Number of States GLA % of Total GLA Annualized Base Rent % of Annualized Base Rent Medical Office Buildings Single-tenant 73 17 3,760 24.3% $ 76,311 23.8% Multi-tenant 213 24 10,457 67.7 212,742 66.3 Other Healthcare Facilities Hospitals 10 4 655 4.2 23,016 7.2 Senior care 9 3 581 3.8 9,030 2.7 Total 305 28 15,453 100% $ 321,099 100% Number of Buildings Number of States GLA % of Total GLA Annualized Base Rent % of Annualized Base Rent Net-Lease/Gross-Lease Net-lease 195 26 9,994 64.7% $ 215,828 67.2% Gross-lease 110 15 5,459 35.3 105,271 32.8 Total 305 28 15,453 100% $ 321,099 100% (1) Percentages shown as percent of total GLA. Portfolio Information Portfolio Diversification by Type and Historical Campus Proximity (as of December 31, 2015, dollars and GLA in thousands) Portfolio Diversification by Type Historical Campus Proximity (1) 4Q 2015 I Supplemental Information Healthcare Trust of America, Inc. I 13

As of 4Q15 3Q15 2Q15 1Q15 4Q14 Total portfolio leased rate 92.0% 92.0% 91.7% 91.7% 92.0% On-campus/aligned leased rate 92.1% 92.1% 92.0% 92.0% 92.2% Off-campus/non-aligned leased rate 88.7% 88.4% 83.1% 84.4% 86.5% Expiration Number of Expiring Leases Total GLA of Expiring Leases % of GLA of Expiring Leases Annualized Base Rent of Expiring Leases % of Total Annualized Base Rent Month-to-month 138 235 1.7% $ 4,909 1.5% 2016 366 1,146 8.1 25,651 8.0 2017 378 1,456 10.3 32,352 10.1 2018 330 1,693 11.9 35,193 11.0 2019 254 1,191 8.4 28,961 9.0 2020 243 1,155 8.1 28,118 8.8 2021 231 1,705 12.0 37,681 11.7 2022 148 1,095 7.7 25,861 8.1 2023 68 760 5.3 14,958 4.7 2024 72 1,256 8.8 26,404 8.2 2025 68 407 2.9 8,985 2.8 Thereafter 115 2,114 14.8 52,026 16.1 Total 2,411 14,213 100% $ 321,099 100% 4Q 2015 I Supplemental Information Healthcare Trust of America, Inc. I 14 Portfolio Information Tenant Lease Expirations and Historical Leased Rate (as of December 31, 2015, dollars and GLA in thousands) Tenant Lease Expirations Historical Leased Rate

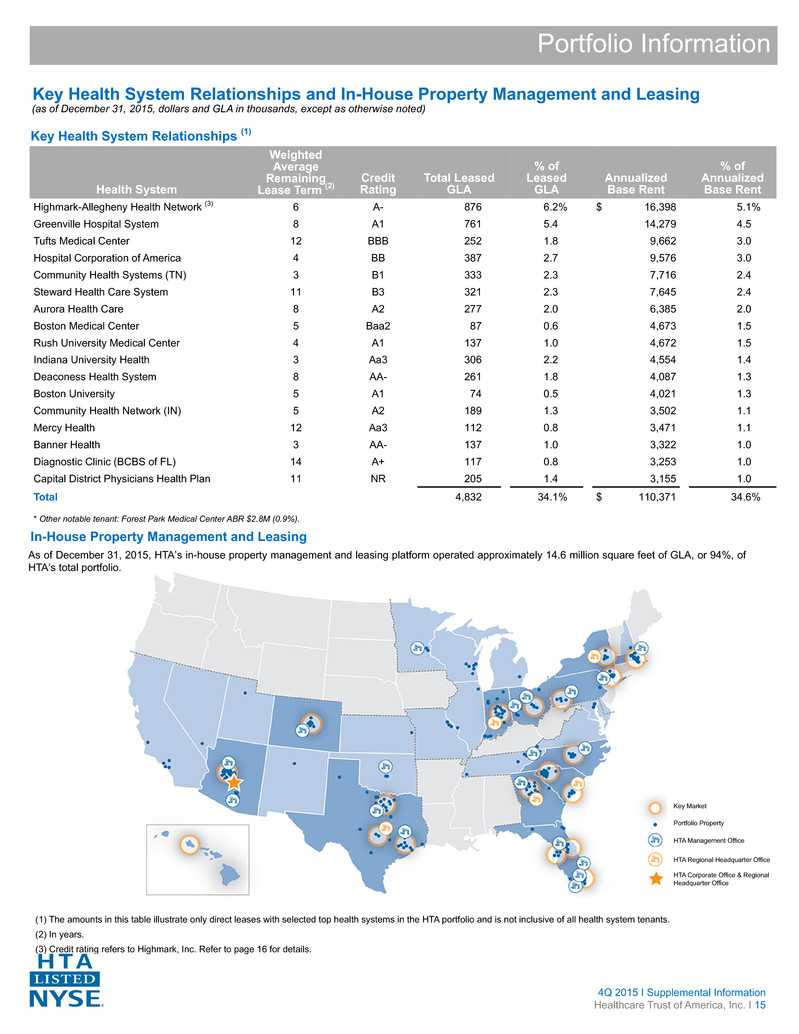

Health System Weighted Average Remaining Lease Term (2) Credit Rating Total Leased GLA % of Leased GLA Annualized Base Rent % of Annualized Base Rent Highmark-Allegheny Health Network (3) 6 A- 876 6.2% $ 16,398 5.1% Greenville Hospital System 8 A1 761 5.4 14,279 4.5 Tufts Medical Center 12 BBB 252 1.8 9,662 3.0 Hospital Corporation of America 4 BB 387 2.7 9,576 3.0 Community Health Systems (TN) 3 B1 333 2.3 7,716 2.4 Steward Health Care System 11 B3 321 2.3 7,645 2.4 Aurora Health Care 8 A2 277 2.0 6,385 2.0 Boston Medical Center 5 Baa2 87 0.6 4,673 1.5 Rush University Medical Center 4 A1 137 1.0 4,672 1.5 Indiana University Health 3 Aa3 306 2.2 4,554 1.4 Deaconess Health System 8 AA- 261 1.8 4,087 1.3 Boston University 5 A1 74 0.5 4,021 1.3 Community Health Network (IN) 5 A2 189 1.3 3,502 1.1 Mercy Health 12 Aa3 112 0.8 3,471 1.1 Banner Health 3 AA- 137 1.0 3,322 1.0 Diagnostic Clinic (BCBS of FL) 14 A+ 117 0.8 3,253 1.0 Capital District Physicians Health Plan 11 NR 205 1.4 3,155 1.0 Total 4,832 34.1% $ 110,371 34.6% * Other notable tenant: Forest Park Medical Center ABR $2.8M (0.9%). As of December 31, 2015, HTA’s in-house property management and leasing platform operated approximately 14.6 million square feet of GLA, or 94%, of HTA’s total portfolio. Portfolio Information Key Health System Relationships and In-House Property Management and Leasing (as of December 31, 2015, dollars and GLA in thousands, except as otherwise noted) Key Health System Relationships (1) In-House Property Management and Leasing (1) The amounts in this table illustrate only direct leases with selected top health systems in the HTA portfolio and is not inclusive of all health system tenants. (2) In years. (3) Credit rating refers to Highmark, Inc. Refer to page 16 for details. 4Q 2015 I Supplemental Information Healthcare Trust of America, Inc. I 15 Key Market Portfolio Property HTA Management Office HTA Regional Headquarter Office HTA Corporate Office & Regional Headquarter Office

Boston Medical Center (Baa2), located in the historic South End Medical cluster of Boston, Massachusetts, is a private, not-for-profit academic center seeing more than one million patient visits a year. BMC is the primary teaching affiliate for the Boston University’s School of Medicine, and is the busiest trauma and emergency services center in New England. They have initiated a $300 million campus redesign which will include an additional 400,000 SF for inpatient services. As a recognized leader in groundbreaking medical research, BMC received approximately $120 million in 2014 to fund over 500 research and service projects. Community Health Systems, Inc. (B1), headquartered in Franklin, Tennessee, is one of the nation’s leading operators of general acute care hospitals. The organization includes 196 affiliated hospitals in 29 states with approximately 30,000 licensed beds. Affiliated hospitals are dedicated to providing quality healthcare for local residents and contribute to the economic development of their communities. Based on the unique needs of each community served, these hospitals offer a wide range of diagnostic, medical and surgical services in inpatient and outpatient settings. Greenville Health System (A1), located in Greenville, South Carolina, is a public not-for-profit academic healthcare delivery system committed to medical excellence through clinical care, education and research. GHS is a health resource for its community and a leader in transforming the delivery of healthcare for the benefit of people and communities served. The University of South Carolina School of Medicine Greenville is located on GHS’ Greenville Memorial Medical Campus. The medical school is focused on transforming healthcare by training physicians to connect with communities, patients, colleagues and technology in a new, more progressive way. Highmark-Allegheny Health Network (A-), based in Pittsburgh, Pennsylvania, is a diversified healthcare partner that serves members across the United States through its businesses in health insurance, dental insurance, vision care and reinsurance. Highmark is the fourth largest BlueCross and Blue Shield-affiliated company. In 2013, Highmark and West Penn Allegheny combined to create an integrated care delivery model which they believe will preserve an important community asset that provides high-quality, efficient health care for patients. Highmark’s mission is to deliver high quality, accessible, understandable and affordable experiences, outcomes and solutions to their customers. Hospital Corporation of America (BB), based in Nashville, Tennessee, HCA was one of the nation’s first hospital companies. Today, they are a company comprised of locally managed facilities that includes approximately 165 hospitals, 115 freestanding surgery centers in 20 states and England employing approximately 204,000 people. Approximately four to five percent of all inpatient care delivered in the country today is provided by HCA facilities. HCA is committed to the care and improvement of human life and strives to deliver high quality, cost effective healthcare in the communities they serve. Indiana University Health (Aa3), based in Indianapolis, Indiana, is Indiana’s most comprehensive healthcare system. A unique partnership with Indiana University School of Medicine, one of the nation’s leading medical schools, gives patients access to innovative treatments and therapies. IU Health is comprised of hospitals, physicians and allied services dedicated to providing preeminent care throughout Indiana and beyond. Steward Health Care System (B3), located in Boston, Massachusetts, is a community-based accountable care organization and community hospital network with 3,000 physicians, 10 hospital campuses, 24 affiliated urgent care providers, home care, hospice and other services. The system serves more than one million patients annually in over 150 communities in the greater Boston area. Other Steward Health Care entities include Steward Medical Group, Steward Health Care network, and Steward Home Care. Tenet Healthcare System (B1), located in Dallas, Texas, is a leading health care services company. Through its network, Tenet operates 84 hospitals, over 400 outpatient centers and has over 130,000 employees. Across the network, compassionate, quality care is provided to millions of patients through a wide range of services. Tenet is affiliated with Conifer Health Solutions, which helps hospitals, employers and health insurance companies improve the efficiency and performance of their operations and the health of the people they serve. Tufts Medical Center (BBB), located in Boston, Massachusetts, is a 415-bed academic medical center, providing everything from routine and emergency care to treating the most complex diseases and injuries affecting adults and children throughout New England. Tufts Medical Center is the principal teaching hospital for Tufts University School of Medicine, and has consistently been ranked in the top quartile of major academic medical centers in the country by The University Health System Consortium. WellStar Health System (Aa3), located in Atlanta, Georgia, is a leading not-for-profit health system with over 1,300 beds in the Southeast. Today, the WellStar Health System is comprised of five hospitals, seven urgent care centers, 16 satellite diagnostic imaging centers, over 500 primary care providers, and over 12,000 employees. The WellStar Kennestone Hospital in Marietta is the only Level II trauma center in Cobb County which contributes to the fact that WellStar serves more emergency room patients than any other health system in Georgia. Portfolio Information Health System Relationship Highlights 4Q 2015 I Supplemental Information Healthcare Trust of America, Inc. I 16

As of 4Q15 4Q14 ASSETS Real estate investments: Land $ 303,706 $ 287,755 Building and improvements 2,901,157 2,665,777 Lease intangibles 430,749 419,288 3,635,612 3,372,820 Accumulated depreciation and amortization (676,144) (549,976) Real estate investments, net 2,959,468 2,822,844 Cash and cash equivalents 13,070 10,413 Restricted cash and escrow deposits 15,892 20,799 Receivables and other assets, net (1) 141,703 133,840 Other intangibles, net 42,167 43,488 Total assets (1) $ 3,172,300 $ 3,031,384 LIABILITIES AND EQUITY Liabilities: Debt (1) $ 1,590,696 $ 1,402,195 Accounts payable and accrued liabilities 94,933 101,042 Derivative financial instruments - interest rate swaps 2,370 2,888 Security deposits, prepaid rent and other liabilities 46,295 32,687 Intangible liabilities, net 26,611 12,425 Total liabilities (1) 1,760,905 1,551,237 Commitments and contingencies Redeemable noncontrolling interests 4,437 3,726 Equity: Preferred stock, $0.01 par value; 200,000,000 shares authorized; none issued and outstanding — — Class A common stock, $0.01 par value; 1,000,000,000 shares authorized; 127,026,839 and 125,087,268 shares issued and outstanding as of December 31, 2015 and 2014, respectively 1,270 1,251 Additional paid-in capital 2,328,806 2,281,932 Cumulative dividends in excess of earnings (950,652) (836,044) Total stockholders’ equity 1,379,424 1,447,139 Noncontrolling interests 27,534 29,282 Total equity 1,406,958 1,476,421 Total liabilities and equity (1) $ 3,172,300 $ 3,031,384 Financial Statements Consolidated Balance Sheets (unaudited and in thousands, except share data) 4Q 2015 I Supplemental Information Healthcare Trust of America, Inc. I 17 (1) For the year ended December 31, 2014, amounts have been adjusted to reflect the retrospective presentation of the early adoption of ASU 2015-03 and 2015-15 as of December 31, 2015.

Three Months Ended Year Ended 4Q15 4Q14 4Q15 4Q14 Revenues: Rental income $ 101,983 $ 94,896 $ 403,553 $ 369,571 Interest and other operating income 66 100 269 1,934 Total revenues 102,049 94,996 403,822 371,505 Expenses: Rental 30,535 28,329 123,390 113,508 General and administrative 6,349 6,810 25,578 24,947 Acquisition-related 1,190 898 4,555 9,545 Depreciation and amortization 38,955 36,086 154,134 140,432 Impairment 926 — 2,581 — Total expenses 77,955 72,123 310,238 288,432 Income before other income (expense) 24,094 22,873 93,584 83,073 Interest expense: Interest related to derivative financial instruments (862) (1,756) (3,140) (5,904) Gain (loss) on change in fair value of derivative financial instruments, net 2,310 (2,013) (769) (2,870) Total interest related to derivative financial instruments, including net change in fair value of derivative financial instruments 1,448 (3,769) (3,909) (8,774) Interest related to debt (13,468) (13,783) (54,967) (51,585) Gain on sales of real estate, net — 16,128 152 27,894 Gain (loss) on extinguishment of debt, net 16 — 123 (4,663) Other (expense) income (1,517) 8 (1,426) 49 Net income $ 10,573 $ 21,457 $ 33,557 $ 45,994 Net income attributable to noncontrolling interests (201) (265) (626) (623) Net income attributable to common stockholders $ 10,372 $ 21,192 $ 32,931 $ 45,371 Earnings per common share - basic: Net income attributable to common stockholders $ 0.08 $ 0.17 $ 0.26 $ 0.38 Earnings per common share - diluted: Net income attributable to common stockholders $ 0.08 $ 0.17 $ 0.26 $ 0.37 Weighted average common shares outstanding: Basic 127,035 122,439 126,074 119,904 Diluted 128,965 123,732 128,004 121,168 4Q 2015 I Supplemental Information Healthcare Trust of America, Inc. I 18 Financial Statements Consolidated Statements of Operations (unaudited and in thousands, except per share data)

Year Ended 4Q15 4Q14 4Q13 Cash flows from operating activities: Net income $ 33,557 $ 45,994 $ 24,684 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation, amortization and other 151,614 137,188 119,904 Share-based compensation expense 5,724 4,383 5,648 Bad debt expense 828 312 453 Gain on sales of real estate, net (152) (27,894) — Impairment 2,581 — — (Gain) loss on extinguishment of debt, net (123) 4,663 — Change in fair value of derivative financial instruments 769 2,870 (10,796) Changes in operating assets and liabilities: Receivables and other assets, net (7,508) (9,252) (15,931) Accounts payable and accrued liabilities (6,284) 12,262 14,789 Security deposits, prepaid rent and other liabilities 10,089 (2,027) 9,073 Net cash provided by operating activities 191,095 168,499 147,824 Cash flows from investing activities: Investments in real estate (279,334) (307,271) (340,307) Acquisition of note receivable — (11,924) — Proceeds from sales of real estate 34,629 78,854 — Capital expenditures (29,270) (29,037) (25,382) Collection of real estate notes receivable — 28,520 — Issuance of real estate notes receivable — — (8,520) Restricted cash, escrow deposits and other assets 4,711 (18,844) (491) Net cash used in investing activities (269,264) (259,702) (374,700) Cash flows from financing activities: Proceeds from unsecured senior notes — 297,615 297,558 Borrowings on unsecured revolving credit facility 454,000 294,000 158,000 Payments on unsecured revolving credit facility (272,000) (313,000) (175,000) Borrowings on unsecured term loans 100,000 — — Payments on unsecured term loans — (100,000) — Payments on secured real estate term loan and mortgage loans (94,856) (92,236) (156,963) Deferred financing costs (204) (12,112) (3,651) Derivative financial instrument termination payments — (1,675) (1,195) Security deposits (243) (1,025) 1,225 Proceeds from issuance of common stock, net 44,324 152,014 240,657 Repurchase and cancellation of common stock (1,667) (1,056) (522) Dividends (146,372) (137,158) (129,360) Payment on earnout liability — — (92) Distributions to noncontrolling interest of limited partners (2,156) (1,832) (1,656) Net cash provided by financing activities 80,826 83,535 229,001 Net change in cash and cash equivalents 2,657 (7,668) 2,125 Cash and cash equivalents - beginning of year 10,413 18,081 15,956 Cash and cash equivalents - end of year $ 13,070 $ 10,413 $ 18,081 Financial Statements Consolidated Statements of Cash Flows (unaudited and in thousands) 4Q 2015 I Supplemental Information Healthcare Trust of America, Inc. I 19

4Q 2015 I Supplemental Information Healthcare Trust of America, Inc. I 20 Reporting Definitions Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (“Adjusted EBITDA”): Is presented on an assumed annualized basis. We define Adjusted EBITDA for HTA as net income computed in accordance with GAAP plus: (i) depreciation and amortization; (ii) interest expense and net change in the fair value of derivative financial instruments; (iii) gain or loss on sales of real estate; (iv) acquisition-related expenses; (v) impairment; (vi) non-cash compensation expense; (vii) pro forma impact of our acquisitions/dispositions; and (viii) gain or loss on extinguishment of debt. We consider Adjusted EBITDA an important measure because it provides additional information to allow management, investors, and our current and potential creditors to evaluate and compare our core operating results and our ability to service debt. Annualized Base Rent: Annualized base rent is calculated by multiplying contractual base rent for the end of the period by 12 (excluding the impact of abatements, concessions, and straight-line rent). Cash Net Operating Income (“Cash NOI”): Cash NOI is a non-GAAP financial measure which excludes from NOI: (i) straight-line rent adjustments; (ii) amortization of below and above market leases/leasehold interests; and (iii) lease termination fees. HTA believes that Cash NOI provides another measurement of the operating performance of its operating assets. Additionally, HTA believes that Cash NOI is a widely accepted measure of comparative operating performance of real estate investment trusts (“REITs”). However, HTA’s use of the term Cash NOI may not be comparable to that of other REITs as they may have different methodologies for computing this amount. Cash NOI should not be considered as an alternative to net income or loss (computed in accordance with GAAP) as an indicator of our financial performance. Cash NOI should be reviewed in connection with other GAAP measurements. Credit Ratings: Credit ratings of our tenants or their parent companies. Funds from Operations (“FFO”): HTA computes FFO in accordance with the current standards established by the National Association of Real Estate Investment Trusts (“NAREIT”). NAREIT defines FFO as net income or loss attributable to common stockholders (computed in accordance with GAAP), excluding gains or losses from the sales of real estate property and impairment write-downs of depreciable assets, plus real estate depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. HTA presents this non-GAAP financial measure because it considers it an important supplemental measure of its operating performance and believes it is frequently used by securities analysts, investors and other interested parties in the evaluation of REITs. Historical cost accounting assumes that the value of real estate assets diminishes ratably over time. Since real estate values have historically risen or fallen based on market conditions, many industry investors have considered the presentation of operating results for real estate companies that use historical cost accounting to be insufficient by themselves. Because FFO excludes depreciation and amortization unique to real estate, among other items, it provides a perspective not immediately apparent from net income or loss attributable to common stockholders. HTA’s methodology for calculating FFO may be different from methods utilized by other REITs and, accordingly, may not be comparable to such other REITs. FFO should not be considered as an alternative to net income or loss attributable to common stockholders (computed in accordance with GAAP) as an indicator of our financial performance, nor is it indicative of cash available to fund cash needs. FFO should be reviewed in connection with other GAAP measurements. Gross Leasable Area (“GLA”): Gross leasable area (in square feet). Gross Real Estate Investments: Based on acquisition price. Leased Rate: Leased rate represents the percentage of total GLA that is leased, including month-to-month leases and leases which have been executed, but which have not yet commenced, as of the date reported. Metropolitan Statistical Area (“MSA”): Is a geographical region with a relatively high population density at its core and close economic ties throughout the area. MSAs are defined by the Office of Management and Budget. Net Operating Income (“NOI”): NOI is a non-GAAP financial measure that is defined as net income or loss (computed in accordance with GAAP) before: (i) general and administrative expenses; (ii) acquisition-related expenses; (iii) depreciation and amortization expense; (iv) impairment; (v) interest expense and net change in fair value of derivative financial instruments; (vi) gain or loss on sales of real estate; (vii) gain or loss on extinguishment of debt; and (viii) other income or expense. HTA believes that NOI provides an accurate measure of the operating performance of its operating assets because NOI excludes certain items that are not associated with the management of the properties. Additionally, HTA believes that NOI is a widely accepted measure of comparative operating performance of REITs. However, HTA’s use of the term NOI may not be comparable to that of other REITs as they may have different methodologies for computing this amount. NOI should not be considered as an alternative to net income or loss (computed in accordance with GAAP) as an indicator of our financial performance. NOI should be reviewed in connection with other GAAP measurements. Normalized Funds Available for Distribution (“Normalized FAD”): HTA computes Normalized FAD, which excludes from Normalized FFO: (i) other income or expense; (ii) non-cash compensation expense; (iii) straight-line rent adjustments; (iv) amortization of below and above market leases/leasehold interests; (v) deferred revenue - tenant improvement related; (vi) amortization of deferred financing costs and debt premium/discount; and (vii) recurring capital expenditures, tenant improvements and leasing commissions. HTA believes this non-GAAP financial measure provides a meaningful supplemental measure of our operating performance. Normalized FAD should not be considered as an alternative to net income or loss attributable to common stockholders (computed in accordance with GAAP) as an indicator of our financial performance, nor is it indicative of cash available to fund cash needs. Normalized FAD should be reviewed in connection with other GAAP measurements. Normalized Funds From Operations (“Normalized FFO”): HTA computes Normalized FFO, which excludes from FFO: (i) acquisition-related expenses; (ii) gain or loss on change in fair value of derivative financial instruments; (iii) gain or loss on extinguishment of debt; (iv) noncontrolling income or loss from partnership units included in diluted shares; and (v) other normalizing items. HTA presents this non-GAAP financial measure because it allows for the comparison of our operating performance to other REITs and between periods on a consistent basis. HTA’s methodology for calculating Normalized FFO may be different from the methods utilized by other REITs and, accordingly, may not be comparable to other REITs. Normalized FFO should not be considered as an alternative to net income or loss attributable to common stockholders (computed in accordance with GAAP) as an indicator of our financial performance, nor is it indicative of cash available to fund cash needs. Normalized FFO should be reviewed in connection with other GAAP measurements. Off-Campus/Non-Aligned: A building or portfolio that is not located on or adjacent to a healthcare or hospital campus or does not have a majority alignment with a recognized healthcare system. On-Campus/Aligned: On-campus refers to a property that is located on or adjacent to a healthcare or hospital campus. Aligned refers to a property that is not on a healthcare or hospital campus, but anchored by a healthcare system. Recurring Capital Expenditures, Tenant Improvements and Leasing Commissions: Represents amounts paid for: (i) recurring capital expenditures required to maintain and re-tenant our properties, (ii) second generation tenant improvements; and (iii) leasing commissions paid to secure new tenants. Excludes capital expenditures and tenant improvements for recent acquisitions that were contemplated in the purchase price or closing agreements. Retention: Tenant Retention is defined as the sum of the total leased GLA of tenants that renewed a lease during the period over the total GLA of leases that renewed or expired during the period. Same-Property Cash Net Operating Income (“Same-Property Cash NOI”): Same-Property Cash NOI means those investment properties that were owned and operated by HTA during the entire span of all periods presented, excluding properties intended for disposition in the near term, notes receivable interest income and certain non-routine items. Same- Property Cash NOI should not be considered as an alternative to net income or loss (computed in accordance with GAAP) as an indicator of our financial performance. Same- Property Cash NOI should be reviewed in connection with other GAAP measurements.