Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Baxalta Inc | d141413d8k.htm |

| EX-99.1 - EX-99.1 - Baxalta Inc | d141413dex991.htm |

Baxalta Incorporated Fourth Quarter 2015 Financial Results And Business Performance Update February 16 , 2016 th Exhibit 99.2 |

| Baxalta Performance Update | Q4 2015 | Page 2

Forward-Looking Statements And

GAAP Reconciliation

“Safe Harbor” Statement under the Private Securities

Litigation Reform Act of 1995: This presentation includes forward-looking statements

concerning expectations, prospects, estimates and other matters

that are dependent upon future events or developments. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond Baxalta's control and which could cause actual results to differ materially from those in the forward-looking statements,

including, but not limited to, the following:

demand for and market acceptance of risks for new and existing products; product development risks; product quality or patient safety concerns; future actions of regulatory bodies and other governmental authorities, including the FDA and

foreign counterparts; failures with respect to

compliance programs; future actions of third-parties, including payers; U.S. healthcare reform and other global austerity measures; pricing, reimbursement, taxation and rebate policies of government agencies and private payers; the

impact of competitive

products

and

pricing,

including

generic

competition,

drug

reimportation

and

disruptive

technologies;

global,

trade

and

tax

policies; accurate identification of and execution on business

development and R&D opportunities and realization of anticipated benefits; fluctuations in supply and demand and the pricing of plasma-based therapies; the availability of acceptable raw

materials and component supply; the inability to

create timely production capacity or other manufacturing or supply difficulties; the ability to successfully achieve the intended results of the spin-off from Baxter International Inc.; the ability to enforce owned or in-licensed

patents, or the patents of third parties preventing

or restricting manufacture, sale or use of affected products or technology; the impact of global economic conditions; fluctuations in foreign exchange and interest rates; any changes in law concerning the taxation of income, including income

earned outside the United States; actions by tax

authorities in connection with ongoing tax audits; breaches or failures of Baxalta’s information technology systems; loss of key employees or inability to identify and recruit new employees; the outcome of pending or future

litigation; the adequacy of Baxalta’s cash

flows from operations to meet its ongoing cash obligations and fund its investment program; the inability to complete the proposed combination with Shire plc (Shire) due to failure to obtain the approval of Baxalta’s or Shire’s stockholders or the failure to satisfy other conditions to completion of the proposed combination; the failure to obtain regulatory approvals required for the

proposed combination, or required regulatory

approvals delaying the proposed combination or causing the parties to abandon the proposed combination; the occurrence of any event, change or other circumstance that could give rise to the termination of the

merger agreement related

to

the

proposed

combination;

the

amount

of

the

costs,

fees,

expenses

and

charges

related

to

the

proposed

combination;

the

effect

of the announcement of the proposed combination on Baxalta’s

client relationships, operating results and business generally, including without limitation the ability to retain key employees; the potential diversion of Baxalta’s management’s attention resulting from the proposed combination and of the combined company’s management’s attention resulting from integration issues after

the proposed combination; and other risks

identified in Baxalta’s Securities and Exchange Commission (SEC) filings, all of which are available on Baxalta’s website, as well as other risks related to the proposed combination identified in Shire’s respective filings with the

SEC. This presentation reflects

management’s

views

as

of

February

16,

2016.

Except

to

the

extent

required

by

applicable

law,

we

undertake

no

obligation

to

update or revise any forward-looking statement.

Non-GAAP Financial Measures:

The financial information included in this presentation includes financial measures that are not calculated in accordance with generally accepted accounting principles (GAAP). Reconciliations of the GAAP to non-GAAP financial

measures can be found

on

slides

40

-

46. |

Table Of Contents |

Baxalta Performance Update | Q4 2015 | Page 4

Achieving ~20 new product launches by 2020

• Advancing the pipeline with key milestone achievements and 3 key approvals in

2015

• Driving enhanced value from new products with 2015 sales of ~$300

million

Sustaining growth and value across the portfolio

• Generating positive sales momentum across broad and diversified portfolio

• Demonstrating compelling commercial, regulatory, operational & financial execution

Augmenting portfolio with disciplined M&A

initiatives •

Maximizing value with ONCASPAR leukemia portfolio

acquisition •

Accelerating innovation with strategic collaborations and

partnerships Creating value with compelling financial

profile •

Exceeding guidance in 2H 2015 across key financial

metrics •

Delivering strong Q4 2015 results with sales growth* of 10%

(constant currency) and adjusted EPS of

$0.57** *Growth

compares

to

2014

pro

forma

sales

**Financial

results

and

guidance

exclude

special

items

and

are

presented

on

an

adjusted

basis;

refer

to

slides

40

–

46

for

information

regarding

non-GAAP

measures

used

throughout

the

presentation

Strong Execution Validates Baxalta’s

Commitment To Enhancing Shareholder Value

|

Baxalta Performance Update | Q4 2015 | Page 5

$2,840

$787

$1,750

$766

$87

Hemophilia

Inhibitor Therapies

Immunoglobulin Therapies

BioTherapeutics

Oncology

$6.2B

+10% cc

Capabilities

100+ countries of

operation

Leadership

$6 billion global

biopharmaceutical

leader

Value

~20

new product

launches expected

by 2020

2015 Sales By Product Category*

$ In Millions

2015 Sales By Geography*

$ In Millions

*Growth compares to 2014 pro forma sales; 1H 2015 results include

pro forma adjustments $3,315

$2,915

U.S.

International

$6.2B

+10% cc

Driving Sustainable Growth And Value

|

Baxalta Performance Update | Q4 2015 | Page 6

Strong ADVATE and FEIBA

FY performance

ADYNOVATE approval and

launch in U.S.

VONVENDI U.S. approval

Advancing Gene

Therapy

programs

Enhanced supply position

Strong market acceptance

of HYQVIA

Acquired SuppreMol

innovative technology

Advanced two biosimilar

anti-TNFs in Phase III

Completed ONCASPAR

acquisition

Received EU approval of

ONCASPAR

Preparing to launch

ONIVYDE

Collaborating with

Symphogen

on

check-point

inhibitors

Hematology*

Q4 2015

FY 2015

Immunology*

Q4 2015

FY 2015

Oncology

Q4 2015

FY 2015

*Growth

is

at

constant

currency

and

compares

to

2014

pro

forma

sales;

1H 2015

results

include

pro

forma

adjustments

for

Immunology

Generating Positive Momentum Across Portfolio

|

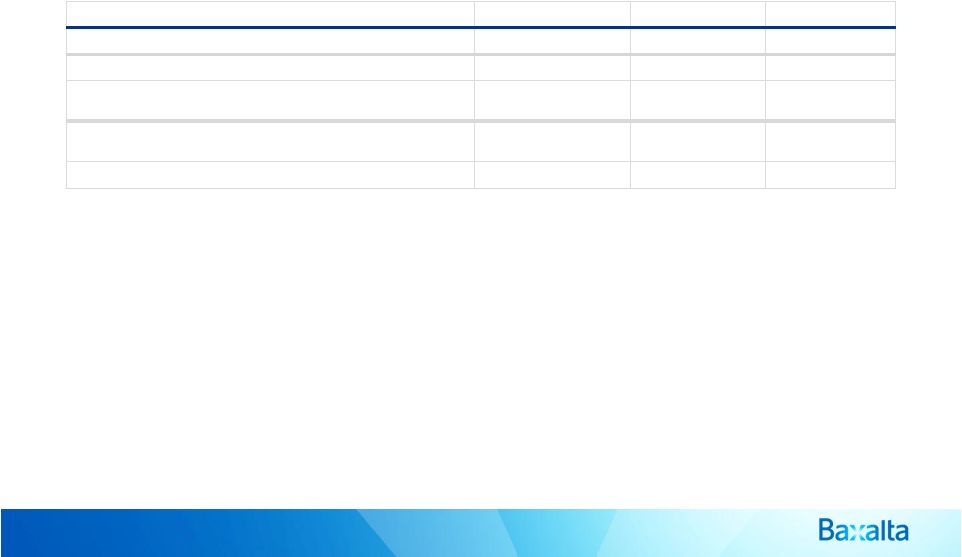

Baxalta Performance Update | Q4 2015 | Page 7

Exceeding Sales Expectations

Across All Product Categories

% Growth At Constant Currency

*FY 2015 original guidance does not include pro forma

adjustments **Growth compares to 2014 pro forma

sales; 1H 2015 results include pro forma adjustments

FY 2015

Original

*

(Q1 Conference Call)

FY

2015

Guidance

**

(Q3 Conference Call)

FY 2015

Actual Results

**

Hemophilia

0%

-

2%

~3%

+4%

Inhibitor

Therapies

8%+

10% -

11%

+16%

Hematology

2% -

3%

~5%

+7%

Immunoglobulin

Therapies

6% -

8%

~9%

+9%

BioTherapeutics

2%

-

4%

~10%

+16%

Immunology

5% -

7%

~9%

+11%

Oncology

N/A

~$80M

$87M

Baxalta

~4%

~8%

+10% |

Baxalta Performance Update | Q4 2015 | Page 8

New Product

Launches By 2020

New Product Revenue

~$300 Million

2015 Actual Results

~$750 Million

2016 Guidance

Key Regulatory

Approvals

New Products In

Regulatory Review

20% IGSC

U.S./EU

ONIVYDE

EU

Our Pipeline Is Delivering Results

|

Baxalta Performance Update | Q4 2015 | Page 9

ADYNOVATE

Launched in U.S.; met primary endpoint in Phase III pediatric

study VONVENDI

Received

U.S. regulatory approval

OBIZUR

Received EU

approval; recently launched in EU

BAX 826

Initiated

Phase I trial targeting once-weekly dosing regimen for

hemophilia A Gene

Therapy

FIX

Progressed Phase I/II open-label study (8 patients

dosed) HYQVIA

Initiated Phase III trial for patients with CIDP

20% IGSC

Submitted for U.S. and EU regulatory approval for PI

BAX 923

Initiated pivotal trial in chronic plaque psoriasis; met primary

endpoint in PK study BAX 2200

Met

primary

endpoints

in

Phase

III

trials

in

chronic

plaque

psoriasis

and

rheumatoid

arthritis

Sanquin

Received positive CHMP opinion

to begin production for EU for IG therapies

ONCASPAR

Received EU approval for use in

combination therapy to treat ALL

ONIVYDE

Submitted European MAA; FDA

approval granted to Merrimack

Symphogen

Established strategic collaboration

to accelerate

innovation in immuno-oncology

Oncology

Immunology

Hematology

Achieving Key Milestones |

Baxalta Performance Update | Q4 2015 | Page 10

~20 New Launches Expected By 2020

Indicates the product has been approved or launched

Oncology

Immunology

Hematology

ADYNOVATE and Oncology geographic expansion included; excludes

additional externally-sourced assets

ONIVYDE

1 line Metastatic

Pancreatic Cancer

[EU]

ONIVYDE

Pancreatic Cancer

Post-Gemcitabine

[EU]

Etanercept

(BAX 2200)

[EU]

Adalimumab

(BAX 923)

[U.S. & EU]

Imalumab

(BAX 069)

Malignant Ascites

[U.S.]

ONIVYDE

1

line Gastric

Cancer

[EU]

IG 10% HYQVIA

CIDP

[U.S.]

rFVIIa

(BAX 817)

[U.S.]

rADAMTS13

hTTP

(BAX 930)

[U.S.]

Alpha-1

GvHD

[U.S.]

Imalumab (BAX 069)

3 line Metastatic

Colorectal

[U.S.]

ONCASPAR

Lyophilized

ALL

[EU]

Calaspargase

pegol

ALL

[U.S.]

20% IGSC

[U.S. & EU]

ADYNOVATE

(BAX 855)

[Japan]

ONCASPAR

ALL

[Japan]

ONIVYDE

Pancreatic Cancer

Post-Gemcitabine

[Japan]

EHL rFVIII

PSA

(BAX 826)

[U.S.]

2015

2016

2018 -

2020

2017

ONCASPAR

Lyophilized

ALL

[U.S.]

ADYNOVATE

(BAX 855)

[U.S.]

RIXUBIS

[EU]

VONVENDI

(BAX 111)

[U.S.]

FEIBA

Recon Reduction

[U.S.]

OBIZUR CHAWI

Surgery

[U.S.]

GT FIX

(BAX 335)

[U.S.]

ADYNOVATE

(BAX 855)

[EU]

OBIZUR

[EU]

ONCASPAR

ALL

[EU]

st

st

rd |

Baxalta Performance Update | Q4 2015 | Page 11

Acquisitions

Partnerships

Advancing External Innovation Through

Successful Partnerships And Acquisitions

|

Baxalta Performance Update | Q4 2015 | Page 12 Leadership • Established $6 billion global biopharmaceutical leader focused on orphan diseases

• Well positioned in attractive and growing markets with differentiated therapies • Strong global channels and patient relationships and potential to broaden access in

emerging markets

Capabilities

• Leader in creating dynamic business models to improve patient access & utilization

• Attractive business development and licensing partner • Best-in-class global biologic manufacturing network with proprietary technology

platforms, such as gene therapy

Value

• Robust and balanced late-stage pipeline spanning core therapeutic disease areas

• Driving acceleration in sales and profitability with ~20 new products by 2020

• Attractive financial profile with compelling cash flow generation and disciplined

capital allocation approach

Baxalta: A Compelling & Unique

Investment Opportunity |

Baxalta Performance Update | Q3 2015 | Page 2

Baxalta

Q4 2015 Performance Update

Innovation Highlights |

Baxalta Performance Update | Q4 2015 | Page 14

Building A Robust And Diverse Pipeline:

Key Programs*

Program

Pre-Clinical

Phase I

Phase II

Phase III

Reg. Review

Approved

EHL rFVIII PEG (BAX 855)

EU

Japan

U.S.

VONVENDI (BAX 111)

EU

U.S.

OBIZUR: Acquired Hemophilia A

EU

rADAMTS13 (BAX 930)

FIX Gene Therapy (BAX 335)

EHL rFVIII

PSA (BAX 826)

FVIII Gene Therapy (BAX 888)

Anti-TFPI: Hemophilia

20% IGSC: PID

U.S. & EU

HYQVIA: CIDP

Etanercept

(BAX 2200)

Adalimumab

(BAX 923)

Pivotal

Alpha-1 GvHD

Fc

RIIb

(SM101): SLE

Fc

RIIb

(SM2X1): Myasthenia Gravis

Fc

RIIb

(SM301): Allergic Asthma

ONCASPAR

EU

Calaspargase pegol

ONIVYDE: 2

nd

Line Pancreatic Cancer

EU

ONIVYDE: Gastric 1

st

Line

ONIVYDE: Pancreatic 1

st

Line

Imalumab

(BAX 069): Colorectal

Imalumab (BAX 069): Malignant Ascites

*Key Programs = programs with $200M+ peak sales

potential |

Baxalta Performance Update | Q4 2015 | Page 15

Broadest Portfolio Of Hemophilia Treatments

Strength Of Hemophilia Portfolio

Delivers Sustainable Growth

• EHL category represents ~35% of U.S. patient share by 2020; ~45% by 2025 • Non-factor therapies penetration expected to be limited - Real-world efficacy and safety unknown - BXLT owns relevant IP in applicable countries related to procoagulant antibodies that bind FIX - Slower adoption OUS - Eclipsed by entry of gene therapy • Continued investment drives hemophilia leadership beyond 2020 - Gene Therapy: BAX 335 and BAX 888 - Early stage SubQ (e.g. anti-TFPI) Focusing On The Most Important Goal: Bleed Protection Portfolio Advancement Towards Elevated & Sustained Factor Levels ADVATE Base FVIII ADYNOVATE BAX 826 Extended Half-Life BAX 335 BAX 888 Gene Therapy >10% shown to be associated with decrease in annual joint bleeds >10% shown to be associated with decrease in annual joint bleeds den Uijl IEM et al. Haemophilia. 2011, 17: 849-853; chart adapted from den Uijl, et al,

2011 |

Baxalta Performance Update | Q4 2015 | Page 16

Transforming Hemophilia Care

With Gene Therapy

Gene Therapy Offers A Potentially Game-Changing Treatment

Option For Patients •

Elevated trough direct-factor replacement with multi-year

re-dosing potential •

Development hurdles include wider patient eligibility, immune

response, and re-dosing

options •

Baxalta leadership based on AAV8 progress and IP

strength BAX 335 (FIX)

• AAV8 technology with Padua transgene yielding seven-fold increase in activity • 8 patients dosed in clinic - FIX expression was observed in all patients in medium to high dose cohort - 1 patient demonstrated sustained 20% - 25% expression for more than 12 months with no bleeding events • Expected launch timing: 2020 BAX 888 (FVIII) • Leveraging successful AAV8 technology from FIX clinical trials with B-domain deleted transgene • Expect to begin Phase I/II clinical trial in 2016 • Expected launch timing: 2023 |

Baxalta Performance Update | Q4 2015 | Page 17

Additional Benefits Of FVIII May Not

Be Replicated By Mimetics

Non-Factor Approaches (i.e. ACE 910)

Face Important Safety And Efficacy

Limitations:

• Lower affinity for FIXa and FX compared to FVIII • Only ~10% of the catalytic efficacy of FVIII • Does not bind to the platelet surface like FVIII does • Caused non-neutralizing antibodies in 3 of 18 patients In a primate model study, hyperplasia and vascular proliferation in the joint were found, despite the presence of ACE 910 4 1 Kitazawa et al. Nat Med. 2012;18(10):1570-1574; 2 Soeda et al. Poster presented at WFH World Congress; May 11-15; Melbourne, Australia; 3 Phase 1 study of ACE910 in healthy volunteers and hemophilia A patients; 4 Muto et al. Blood 2014; 124(20): 3165-3171 FVIII Replacement Therapies Set High Bar For Hemophilia Treatments Inflammation Vascular Integrity (aging population) Platelet Function Bone Remodeling Emerging Hypothesis on FVIII Benefits Beyond the Bleed 1 2 1 3 Wound Healing |

Baxalta Performance Update | Q4 2015 | Page 18

Introducing Novel SuppreMol

Treatments With Significant Potential

IgG Immune

Complex Scavenger

Fc

RIIB

Agonist

(IgG)

IgE

Competitive

Antagonist

Mechanism

Receptor fragment protein

binds to circulating immune

complexes

Monoclonal antibody binds to

inhibitory receptor to actively down

regulate immune response

Inhibits IgE

mediated

allergic response

Indications

Immune complex

mediated diseases

(e.g. SLE, IgA Nephropathy)

Autoimmune diseases with

antibody mediated or more

complex mechanisms

Allergies or allergic

response diseases

Development

Successful Phase IIa

study (SLE)

Pre-clinical

Exploratory R&D

Advancing innovation with novel technology platforms

Addressing patient populations with significant unmet

need Expanding breadth of Immunology business

Targeting attractive markets with significant

revenue potential |

Baxalta Performance Update | Q4 2015 | Page 19

Exciting Oncology Growth Prospects

Value

Proposition

• Integral component of many ALL treatment guidelines • 90% cure rate for children; 50% in young adults; 30% in adults • High relapse rate in older patients • Standard of care in 1 line ALL therapy for children in U.S. and Germany • Statistically significant survival benefit - 5-FU/LV of 6.1 months versus 4.2 months - 5-FU/LV of 3.1 months versus 1.5 months • Already in ESMO Guidelines • Manageable adverse event and toxicity profile Exciting Potential • Annual sales trending at ~$200M • Accelerates Baxalta’s rapid entry into Oncology; leverages global presence • Strengthens pipeline with additional indications and NME • Complements current partnerships • Priority FDA approval in 6 months • Exclusive OUS rights • Over 15k gemcitabine-exposed mPaCa patients in the EU5 (2 line) • Expand to 1 line treatment and additional indications Recent Milestones • Completed acquisition • Granted EU approval • Granted U.S. approval • Filed in EU (2 line) 2020 Market Opportunity st st nd nd |

Baxalta Performance Update | Q4 2015 | Page 20

2016 Pipeline Catalysts

Oncology

Immunology

Hematology

BAX 2200

Etanercept

(EU)

ADYNOVATE

(EU)

ADYNOVATE

(U.S. Pediatric)

Regulatory

Filings

Calaspargase Pegol

(Phase III Data)

Clinical

Advancements

BAX 923

(Pivotal: Last Subject

Dosed)

Gene Therapy FIX

(Phase II: Last Subject

Dosed)

Gene Therapy FVIII

(Initiate Phase I)

VONVENDI

Pediatric & Prophylactic

(Initiate Phase III)

20% IGSC

(U.S. & EU)

ADYNOVATE

(Japan)

ONIVYDE

Pancreatic 2 Line

(EU)

Product

Approvals

MyPKFiT

(U.S.)

BAX 826

(Initiate Phase I)

HYQVIA

CIDP

(Initiate Phase III)

Alpha-1

GvHD

(Initiate Phase III)

ONCASPAR

(EU)

Indicates the milestone has been achieved

nd

ONIVYDE

Pancreatic 1 Line

(Initiate Phase III)

st |

Baxalta Performance Update | Q3 2015 | Page 2

Baxalta

Q4 2015 Performance Update

Financial Summary |

Baxalta Performance Update | Q4 2015 | Page 22

2H 2015 Adjusted Financial Results*

Q3 2015

Actual Results

Q4 2015

Actual Results

2H 2015

Actual Results

Sales ($ in

Millions) Growth**

$1,595

+13%

$1,763

+10%

$3,358

+12%

Gross Margin

61.9%

63.8%

62.9%

Operating Margin

31.2%

29.0%

30.1%

EBITDA Margin

34.4%

32.1%

33.2%

Tax Rate

22.1%

20.9%

21.5%

Diluted EPS

$0.56

$0.57

$1.13

*Financial results exclude special items and are presented on an

adjusted basis; refer to slides 40 -

46 for information regarding non-GAAP measures used

throughout the presentation **Growth rates are at

constant currency and compare to 2014 pro forma sales |

Baxalta Performance Update | Q4 2015 | Page 23

Exceeding Guidance Across

Key Financial Metrics*

2H 2015

Guidance

(Investor Conference)

2H 2015

Guidance

(Q3 Conference Call)

2H 2015

Actual Results

Sales Growth**

2% -

3%

8% -

9%

12%

Gross Margin

58%

-

59%

~62%

63%

Operating Margin

~29%

~31%

30%

EBITDA Margin

~33%

~35%

33%

Tax Rate

23% -

24%

~23%

21.5%

Diluted EPS

N/A

$1.11 -

$1.13

$1.13

*Financial results and guidance exclude special items and are

presented on an adjusted basis; refer to slides 40

- 46 for information regarding non-GAAP

measures used throughout the presentation **Growth

rates are at constant currency and compare to 2014 pro forma sales |

Baxalta Performance Update | Q4 2015 | Page 24

Driving Strong Financial Results:

Q4 And 2H 2015

Adjusted Sales Growth*

% Sales Growth At Constant Currency

Adjusted EPS**

$ Per Diluted Share

Guidance

Q4 2015

10%

2H 2015

12%

Guidance

Q4 2015

$0.57

2H 2015

$1.13

Guidance

Guidance

*Growth rates are at constant currency and compare to 2014 pro

forma sales **Financial results and guidance exclude

special items and are presented on an adjusted basis;

refer to slides 40 -

46 for information regarding non-GAAP measures used

throughout the presentation |

Baxalta Performance Update | Q4 2015 | Page 25

Enhancing Strong Gross Margin Profile*

2H 2015 Gross Margin

% Of Sales

58% -

59%

~62%

63%

55%

60%

65%

Investor

Conference

Guidance

Revised

Guidance

(Q3 Conference Call)

2H 2015

Actual

Results

Gross Margin Drivers

• Favorable product mix driven by: - Strong sales of higher-margin therapies - ONCASPAR leukemia portfolio acquisition - rFVIII share retention • Modest price improvements • Foreign currency hedge gains Q4 2015 Gross Margin = 63.8% *Financial results and guidance exclude special items and are presented on an adjusted basis;

refer to slides 40 -

46 for information regarding non-GAAP measures used

throughout the presentation |

Baxalta Performance Update | Q4 2015 | Page 26

Investing To Accelerate Future Growth

R&D

Expense

• Successfully meeting key milestones, advancing clinical trials • Building out medical affairs and R&D infrastructure • Balancing and prioritizing investments across disease areas • Advancing novel therapies through acquisitions and collaborations SG&A Expense • Selectively expanding our specialty sales force • Investing in marketing initiatives to prepare and launch new products: - ADYNOVATE - VONVENDI - Oncology therapies • Integrating ONCASPAR leukemia portfolio acquisition • Adding appropriate level of support to global infrastructure Building A Powerhouse In Product Development Transforming Into A Leading Biotech Company |

Baxalta Performance Update | Q4 2015 | Page 27

Q1 2016 Financial Guidance

Guidance Reflects:

• Building strong sales momentum across all three businesses • Absorbing expected foreign currency headwinds (i.e., lower hedge gains) in gross margin with positive mix benefits • Investing to drive future growth - Benefiting from expanded specialty sales

force

- Preparing for new product launches - Building out Oncology and global infrastructure - Prioritizing R&D investments Q1 2016 Guidance* Hematology 4% - 5% Immunology 5% - 7% Oncology ~$50Mw

Total Sales Growth

(Constant Currency)

8% -

9%

Total Sales Growth

(Actual Rates)

4% -

5%

Diluted EPS**

$0.44 -

$0.46

*Growth

rates

are

at

constant

currency

unless

indicated

otherwise

and

compare

to

2014

pro

forma

sales

**Financial

guidance

excludes

special

items

and

is

presented

on

an

adjusted

basis;

refer

to

slides

40

-

46

for

information

regarding

non-GAAP

measures

used

throughout

the

presentation |

Baxalta Performance Update | Q3 2015 | Page 2

Baxalta

Q4 2015 Performance Update

Business Review |

Baxalta Performance Update | Q4 2015 | Page 29

Hematology

Positioned For Growth

• Strengthening our hematology leadership with broad portfolio of treatment options • Building personalized care through patient-centric innovation • Elevating access to treatment and standards of care globally • Diversifying to transform care in adjacent blood disorders Extending Legacy Of Leadership In Hematology Strengthening leadership and sustainability Differentiated inhibitor portfolio First recombinant Von Willebrand factor Strong global presence and growth Hematology FY 2015 Growth* Q4 2015 Growth* *Growth rates are at constant currency |

Baxalta Performance Update | Q4 2015 | Page 30

Hematology: Q4 And FY 2015 Results*

Hemophilia

• Enhancing access and elevating standards of care globally • Maintaining leadership with broad portfolio of rFVIII treatment options: - Q4 U.S. sales growth in high single digits - Successful U.S. ADYNOVATE launch (including stocking orders) - Cumulative U.S. patient share loss of 3-4 points - Driving conversion in Brazil and Russia Inhibitor Therapies • FEIBA growth driven by: - Robust demand and conversion to prophylaxis - New tender sales in developing markets - Favorable geographic mix and modest price benefit • Contribution of OBIZUR for acquired hemophilia A Q4 2015 FY 2015 $ In Millions U.S. Int. Total U.S. Int. Total Hemophilia $375 $425 $800 $1,339 $1,501 $2,840 Growth +9% +1% +4% +5% +4% +4% Inhibitor Therapies $85 $145 $230 $295 $492 $787 Growth +25% +8% +14% +35% +9% +16% Hematology $460 $570 $1,030 $1,634 $1,993 $3,627 Growth +12% +2% +6% +9% +5% +7% *Growth rates are at constant currency |

Baxalta Performance Update | Q4 2015 | Page 31

9%

7%

9%

8%

2%

4%

7%

4%

0%

5%

10%

15%

20%

Q1 14

Q2 14

Q3 14

Q4 14

Q1 15

Q2 15

Q3 15

Q4 15

Hematology: Quarterly Sales Growth

Hemophilia

% Sales Growth At Constant Currency

9%

2%

17%

33%

18%

12%

22%

14%

0%

10%

20%

30%

40%

Q1 14

Q2 14

Q3 14

Q4 14

Q1 15

Q2 15

Q3 15

Q4 15

Inhibitor Therapies

% Sales Growth At Constant Currency

|

Baxalta Performance Update | Q4 2015 | Page 32

Unique And Attractive Global FVIII Market

Distinct Market Characteristics

• High brand loyalty and very low patient turnover despite eight competitors • Safety and efficacy are top considerations • Trusted safety profile requires years of real-world experience to establish • Individualized patient needs vary by segment • Patients require significant dose customization to achieve zero bleeds • Low patient switching due to concern regarding inhibitor development ~ $6.5B OUS Established Markets OUS Emerging Markets U.S. PUPs Prophylaxis On Demand 2014 Global FVIII Market |

Baxalta Performance Update | Q4 2015 | Page 33

Positioned To Grow And Lead EHL

• ADYNOVATE launched in U.S. during Q4 2015 - Single-digit price premium to ADVATE on an annual cost of therapy basis - Manufacturing capacity in place to support launch • Strong IP Position - First approval of EHL product utilizing proprietary PEG technology - Exclusive licenses to Nektar Therapeutics FVIII patents and patent applications • U.S. pediatric and EU filing expected in Q1 2016; no inhibitors in pediatric study to date • Japan approval expected in 1H 2016; initiated PUP study in Q4 2015 ADYNOVATE: Blockbuster Potential ADYNOVATE To Stabilize U.S. rFVIII Patient Share Based on ADVATE: global rFVIII leader Extended half-life of 1.4 – 1.5 fold Simple, twice-weekly dosing 95% reduction in median ABR; 40% zero bleeds No patients developed inhibitors Among fastest development in hemophilia

A: ~4 years from Phase I to approval Key Attributes |

Baxalta Performance Update | Q4 2015 | Page 34

Immunology

Positioned For Growth

• Building leadership in global markets characterized by robust demand • Capitalizing on a broad, differentiated IG portfolio • Improving supply with flexible, cost- effective capacity to support demand • Bolstering future growth with novel treatments Capitalizing On Transformational Differentiation FY 2015 Growth* Q4 2015 Growth* Immunology Capitalizing on transformational differentiation Bolstering future growth with novel treatments Optimizing global footprint with flexible supply Driving global awareness and demand *Growth rates are at constant currency and compare to 2014 pro forma results; 1H 2015 includes pro forma

adjustments |

Baxalta Performance Update | Q4 2015 | Page 35

Immunology: Q4 And FY 2015 Results*

Immunoglobulin Therapies

• Enhancing penetration in under- treated diseases • Improved supply position • Continued strength of HYQVIA - Increased share in PID segment; annual sales run-rate approaching ~$150 million - Uptake supported by competitive gains; building momentum in EU markets - Difficult growth comparison due to ~$35 million stocking impact in Q4 2014 BioTherapeutics • Strong albumin growth, particularly in China • Alpha-1 therapies benefiting from: - Specialty sales force focus - Improved reimbursement • Increased contract-manufacturing revenues Q4 2015 FY 2015 $ In Millions U.S. Int. Total U.S. Int. Total Immunoglobulin Therapies $370 $103 $473 $1,350 $400 $1,750 Growth +1% +8% +3% +6% +17% +9% BioTherapeutics $69 $138 $207 $258 $508 $766 Growth +11% +28% +22% +6% +21% +16% Immunology $439 $241 $680 $1,608 $908 $2,516 Growth +3% +18% +8% +6% +19% +11% *Growth rates are at constant currency and compare to 2014 pro forma results; 1H 2015 includes pro forma

adjustments |

Baxalta Performance Update | Q4 2015 | Page 36

2%

3%

-2%

13%

9%

13%

12%

3%

-5%

0%

5%

10%

15%

Q1 14

Q2 14

Q3 14

Q4 14

Q1 15

Q2 15

Q3 15

Q4 15

Immunology: Quarterly Sales Growth

Immunoglobulin Therapies

% Sales Growth At Constant Currency

-11%

15%

21%

19%

24%

4%

14%

22%

-15%

-5%

5%

15%

25%

35%

Q1 14

Q2 14

Q3 14

Q4 14

Q1 15

Q2 15

Q3 15

Q4 15

Pro Forma BioTherapeutics*

% Sales Growth At Constant Currency

*2014 constant currency growth rates do not include pro forma

adjustments |

Baxalta Performance Update | Q4 2015 | Page 37

Capitalizing On Transformational

Differentiation With HYQVIA

IGSC

~45%

IGIV

~55%

HYQVIA Source Of Patients

Internal Estimates

Global PID Indication: ~8% CAGR*

% By Route Of Administration In 2020

$3.0B

GGL

Cannibalization

~25%

Competitive IV/SC

~50% Naïve ~25% Capturing SubQ Leadership Position With HYQVIA By 2020 *2015 – 2020 CAGR |

Baxalta Performance Update | Q4 2015 | Page 38

Flexible And Cost-Effective Capacity

Supports Future Demand Growth

0

5

10

15

20

2015

2020

2025

8%+ CAGR

Cost-Effective Expansion

• Disciplined investment in capacity to support 8% annual growth in demand • Internal network combined with Sanquin CMO provides cost-effective and flexible network • Opportunities exist to expand footprint beyond 2022 to support additional growth Baxalta Fractionation Capacity** Liters In Millions Los Angeles, CA Netherlands (Sanquin CMO) Pisa & Rieti, Italy Lessines, Belgium Vienna, Austria Covington, GA* *Expected to be operational in 2018 **Capacity represents internal estimates |

Baxalta Performance Update | Q4 2015 | Page 39

Oncology

Positioned For Growth

• Capitalizing on an attractive and growing market • Focusing on orphan diseases and targeted populations with significant unmet need • Collaborating with leading R&D partners to provide differentiated treatment options • Leveraging existing global commercial capabilities and footprint Building A Focused, Targeted Oncology Business FY 2015 Sales Q4 2015 Sales Oncology FDA approval reflects significance of unmet medical need Enhancing portfolio with new chemical entities Extracting value with geographic and indication expansions Accelerating innovation in immuno-oncology Calaspargase Pegol |

GAAP To Pro Forma Non-GAAP Reconciliations |

| Baxalta Performance Update | Q4 2015 | Page 41

Notice To Investors

Non-GAAP Financial Measures:

The financial information included in these schedules includes financial measures that are not calculated in accordance with generally accepted accounting principles (GAAP). Reconciliations of the GAAP to

non-GAAP financial measures can be found on

pages 42 - 46. The non-GAAP financial

measures include “adjusted gross margin”,

“adjusted operating income,” “adjusted EBITDA,” and “adjusted diluted earnings per share”. Non-GAAP financial measures may provide a more complete understanding of the Company’s operations and may facilitate an

additional analysis of the Company’s results

of operations, particularly in evaluating performance from one period to another. The Company has presented “adjusted operating income,” which excludes interest and other (income)

expense and intangible asset amortization; and

“adjusted EBITDA” which, in addition to the previous adjustments, also excludes depreciation expense. Additionally, the non-GAAP financial measures presented exclude the impact of certain special

items, which are excluded because they are highly

variable, difficult to predict, and of a size that may substantially impact the Company’s operations and can facilitate an additional analysis of the Company’s results of operations,

particularly in evaluating performance from one

period to another. Upfront and milestone payments related to collaborative arrangements that have been expensed as research and development (R&D) are uncertain and often result

in a different payment and expense recognition

pattern than internal R&D activities and therefore are typically excluded as special items. Intangible asset amortization is excluded to facilitate an evaluation of current and past operating

performance, particularly in terms of cash returns,

and is similar to how management internally assesses performance. The Company’s management uses non-GAAP financial measures to evaluate the Company’s performance and provides

them to investors as a supplement to the

Company’s reported results, as they believe this information provides additional insight into the Company’s operating performance by disregarding certain nonrecurring items. The

non-GAAP financial measures used by the Company

may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies. In addition, these non-GAAP financial measures should not be

considered in isolation, as a substitute for, or as

superior to, financial measures calculated in accordance with GAAP, and the Company’s financial results calculated in accordance with GAAP and reconciliations to those financial

statements should be carefully

evaluated. |

Baxalta Performance Update | Q4 2015 | Page 42

Pro Forma Sales Reconciliation: Q4 2015

% Growth @ Actual Rates

% Growth @ Constant Rates

U.S. International Total U.S. International Total U.S. International Total U.S. International Total Hemophilia $375 $425 $800 $343 $491 $834 9% (13%) (4%) 9% 1% 4% Inhibitor Therapies 85 145 230 68 153 221 25% (5%) 4% 25% 8% 14% Hematology $460 $570 $1,030 $411 $644 $1,055 12% (11%) (2%) 12% 2% 6% Immunoglobulin Therapies 370 103 473 366 113 479 1% (9%) (1%) 1% 8% 3% Pro Forma BioTherapeutics 69 138 207 62 121 183 11% 14% 13% 11% 28% 22% Pro Forma Immunology $439 $241 $680 $428 $234 $662 3% 3% 3% 3% 18% 8% Oncology $45 $8 $53 $ - $ - $ - N/M N/M N/M N/M N/M N/M Pro Forma Total Baxalta $944 $819 $1,763 $839 $878 $1,717 13% (7%) 3% 13% 8% 10% % Growth @ Actual Rates % Growth @ Constant Rates U.S. International Total U.S. International Total U.S. International Total U.S. International Total Hemophilia $1,339 $1,501 $2,840 $1,281 $1,703 $2,984 5% (12%) (5%) 5% 4% 4% Inhibitor Therapies 295 492 787 219 525 744 35% (6%) 6% 35% 9% 16% Hematology $1,634 $1,993 $3,627 $1,500 $2,228 $3,728 9% (11%) (3%) 9% 5% 7% Immunoglobulin Therapies 1,350 400 1,750 1,272 405 1,677 6% (1%) 4% 6% 17% 9% Pro Forma BioTherapeutics 258 508 766 244 460 704 6% 10% 9% 6% 21% 16% Pro Forma Immunology $1,608 $908 $2,516 $1,516 $865 $2,381 6% 5% 6% 6% 19% 11% Oncology $73 $14 $87 $ - $ - $ - N/M N/M N/M N/M N/M N/M Pro Forma Total Baxalta $3,315 $2,915 $6,230 $3,016 $3,093 $6,109 10% (6%) 2% 10% 10% 10% Pro Forma Net Sales Reconciliations % Growth @ Actual Rates % Growth @ Constant Rates U.S. International Total U.S. International Total U.S. International Total U.S. International Total BioTherapeutics $69 $138 $207 $62 $87 $149 11% 59% 39% 11% 78% 50% Pro forma MSA revenue - - - - 34 34 Pro Forma BioTherapeutics $69 $138 $207 $62 $121 $183 11% 14% 13% 11% 28% 22% % Growth @ Actual Rates % Growth @ Constant Rates U.S. International Total U.S. International Total U.S. International Total U.S. International Total BioTherapeutics $258 $426 $684 $244 $303 $547 6% 41% 25% 6% 56% 34% Pro forma MSA revenue - 82 $82 - 157 157 Pro Forma BioTherapeutics $258 $508 $766 $244 $460 $704 6% 10% 9% 6% 21% 16% Q4 2015 Q4 2014 YTD 2015 YTD 2014 Q4 2015 Q4 2014 YTD 2015 YTD 2014 |

Baxalta Performance Update | Q4 2015 | Page 43

Pro Forma Sales Reconciliation: Q3 2015

% Growth @ Actual Rates

% Growth @ Constant Rates

U.S. International Total U.S. International Total U.S. International Total U.S. International Total Hemophilia $337 $390 $727 $318 $437 $755 6% (11%) (4%) 6% 7% 7% Inhibitor Therapies 78 130 208 55 132 187 42% (2%) 11% 42% 14% 22% Hematology $415 $520 $935 $373 $569 $942 11% (9%) (1%) 11% 9% 10% Immunoglobulin Therapies 334 101 435 305 102 407 10% (1%) 7% 10% 19% 12% Pro Forma BioTherapeutics 64 127 191 60 121 181 7% 5% 6% 7% 18% 14% Pro Forma Immunology $398 $228 $626 $365 $223 $588 9% 2% 6% 9% 18% 13% Oncology $28 $6 $34 $ - $ - $ - N/M N/M N/M N/M N/M N/M Pro Forma Total Baxalta $841 $754 $1,595 $738 $792 $1,530 14% (5%) 4% 14% 12% 13% % Growth @ Actual Rates % Growth @ Constant Rates U.S. International Total U.S. International Total U.S. International Total U.S. International Total Hemophilia $964 $1,076 $2,040 $938 $1,212 $2,150 3% (11%) (5%) 3% 5% 4% Inhibitor Therapies 210 347 557 151 372 523 39% (7%) 7% 39% 9% 17% Hematology $1,174 $1,423 $2,597 $1,089 $1,584 $2,673 8% (10%) (3%) 8% 6% 7% Immunoglobulin Therapies 980 297 1,277 906 292 1,198 8% 2% 7% 8% 21% 11% Pro Forma BioTherapeutics 189 370 559 182 339 521 4% 9% 7% 4% 18% 13% Pro Forma Immunology $1,169 $667 $1,836 $1,088 $631 $1,719 7% 6% 7% 7% 19% 12% Oncology $28 $6 $34 $ - $ - $ - N/M N/M N/M N/M N/M N/M Pro Forma Total Baxalta $2,371 $2,096 $4,467 $2,177 $2,215 $4,392 9% (5%) 2% 9% 10% 10% Pro Forma Net Sales Reconciliations % Growth @ Actual Rates % Growth @ Constant Rates U.S. International Total U.S. International Total U.S. International Total U.S. International Total BioTherapeutics $64 $127 $191 $60 $79 $139 7% 61% 37% 7% 81% 49% Pro forma MSA revenue - - - - 42 42 Pro Forma BioTherapeutics $64 $127 $191 $60 $121 $181 7% 5% 6% 7% 18% 14% % Growth @ Actual Rates % Growth @ Constant Rates U.S. International Total U.S. International Total U.S. International Total U.S. International Total BioTherapeutics $189 $288 $477 $182 $216 $398 4% 33% 20% 4% 48% 28% Pro forma MSA revenue - 82 82 - 123 123 Pro Forma BioTherapeutics $189 $370 $559 $182 $339 $521 4% 9% 7% 4% 18% 13% Q3 2015 Q3 2014 YTD 2015 YTD 2014 Q3 2015 Q3 2014 YTD 2015 YTD 2014 |

Baxalta Performance Update | Q4 2015 | Page 44

GAAP To Non-GAAP Reconciliation:

Gross Margin

$ in millions

Q3 2015

Q4 2015

2H 2015

Gross Margin

$962

$1,082

$2,044

Gross Margin Percentage

60.3%

61.4%

60.9%

Adjustments for special items

25 42

67 Adjusted

Gross Margin $987

$1,124

$2,111

Adjusted Gross Margin Percentage

61.9%

63.8%

62.9% |

Baxalta Performance Update | Q4 2015 | Page 45

GAAP To Non-GAAP Reconciliation:

Operating Income And EBITDA

GAAP-to-Non-GAAP Reconciliation

Operating Income and EBITDA

$ in millions

Q3 2015

Q4 2015

2H 2015

Pre-tax Income

$354

$123

$477

Pre-tax Income Margin

22.2%

7.0%

14.2%

Adjustments for special items

140

366

506 Adjusted

Pre-tax Income

494

489

983 Adjusted Pre-tax

Income Margin 31.0%

27.7%

29.3%

Remove: Net interest expense

23

22

45 Remove:

Other (income) expense, net

(19)

1 (18)

Adjusted Operating Income

498

512

1,010 Adjusted Operating Income

Margin 31.2%

29.0%

30.1%

Remove: Depreciation

50

54

104 Adjusted

EBITDA $548

$566

$1,114

Adjusted EBITDA Margin

34.4%

32.1%

33.2% |

Baxalta Performance Update | Q4 2015 | Page 46

GAAP To Non-GAAP Reconciliation:

Diluted EPS

Q3 2015

Q4 2015

2H 2015

Diluted EPS

$0.45

$0.14

$0.59

Adjustments for special items

0.11

0.43

0.54 Adjusted

Diluted EPS $0.56

$0.57

$1.13

Baxalta has also presented guidance for Q1 2016 using the non-GAAP measure of Adjusted Diluted EPS. Baxalta

projects that Q1 2016 GAAP Diluted EPS would be

lower than Q1 2016 Adjusted Diluted EPS by approximately $0.03 per diluted share, with a reconciling item of intangible asset amortization expense. |