Attached files

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015 | |

or | |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to | |

COMMISSION FILE NUMBER: 001-33988

Graphic Packaging Holding Company

(Exact name of registrant as specified in its charter)

Delaware | 26-0405422 |

(State of incorporation) | (I.R.S. employer identification no.) |

1500 Riveredge Parkway, Suite 100, Atlanta, Georgia | 30328 |

(Address of principal executive offices) | (Zip Code) |

(770) 240-7200

Registrant’s telephone number, including area code:

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered |

Common Stock, $0.01 par value per share | New York Stock Exchange |

Series A Junior Participating Preferred Stock Purchase Rights | New York Stock Exchange |

Associated with the Common Stock | |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer þ | Accelerated filer o | Non-accelerated filer o | Smaller reporting company o |

(Do not check if a smaller reporting company) | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

The aggregate market value of voting and non-voting common equity held by non-affiliates at June 30, 2015 was approximately $4.5 billion.

As of February 10, 2016 there were approximately 323,007,535 shares of the registrant’s Common Stock, $0.01 par value per share outstanding.

1

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the registrant’s definitive Proxy Statement for the 2016 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

2

TABLE OF CONTENTS OF FORM 10-K

MINE SAFETY DISCLOSURES | ||

EXECUTIVE OFFICERS OF THE REGISTRANT | ||

3

INFORMATION CONCERNING FORWARD-LOOKING STATEMENTS

Certain statements regarding the expectations of Graphic Packaging Holding Company (“GPHC” and, together with its subsidiaries, the “Company”), including, but not limited to, the availability of net operating losses to offset U. S. federal income taxes, capital investment, costs to comply with certain environmental regulations, available cash and liquidity, depreciation and amortization, interest expense, pension expense and pension plan contributions and postretirement health care benefit payments, in this report constitute “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Such statements are based on currently available operating, financial and competitive information and are subject to various risks and uncertainties that could cause actual results to differ materially from the Company’s historical experience and its present expectations. These risks and uncertainties include, but are not limited to, inflation of and volatility in raw material and energy costs, changes in consumer buying habits and product preferences, competition with other paperboard manufacturers and product substitution, the Company’s ability to implement its business strategies, including strategic acquisitions, productivity initiatives and cost reduction plans, the Company’s debt level, currency movements and other risks of conducting business internationally, and the impact of regulatory and litigation matters, including those that could impact the Company’s ability to utilize its net operating losses to offset taxable income and those that impact the Company's ability to protect and use its intellectual property. Undue reliance should not be placed on such forward-looking statements, as such statements speak only as of the date on which they are made and the Company undertakes no obligation to update such statements, except as may be required by law. Additional information regarding these and other risks is contained in Part I, Item 1A., Risk Factors.

4

PART I

ITEM 1. | BUSINESS |

Overview

Graphic Packaging Holding Company (“GPHC” and, together with its subsidiaries, the “Company”) is committed to providing consumer packaging that makes a world of difference. The Company is a leading provider of paper-based packaging solutions for a wide variety of products to food, beverage and other consumer product companies. The Company operates on a global basis, is one of the largest producers of folding cartons in the United States ("U.S."), and holds leading market positions in coated unbleached kraft paperboard and coated-recycled paperboard.

The Company’s customers include many of the world’s most widely recognized companies and brands with prominent market positions in beverage, food and other consumer products. The Company strives to provide its customers with packaging solutions designed to deliver marketing and performance benefits at a competitive cost by capitalizing on its low-cost paperboard mills and converting plants, its proprietary carton and packaging designs, and its commitment to quality and service.

Acquisitions and Dispositions

On October 1, 2015, the Company acquired the converting assets of Staunton, VA-based Carded Graphics, LLC. ("Carded"), an award-winning folding carton producer with a strong regional presence in the food, craft beer and other consumer product markets.

On February 4, 2015, the Company completed the acquisition of certain assets of Cascades Norampac Division ("Cascades") in Canada. Cascades primarily services the food and beverage markets and operates three folding carton converting facilities located in Cobourg, Ontario, Mississauga, Ontario and Winnipeg, Manitoba along with a thermo mechanical pulp ("TMP") mill located in Jonquiere, Quebec and a coated recycled board mill located in East Angus, Quebec. The Jonquiere mill was closed in the third quarter of 2015.

On January 2, 2015, the Company acquired Rose City Printing and Packaging Inc. ("Rose City") through the purchase of all of the issued and outstanding stock of its parent company, Rose City Holding Company. Rose City services food and beverage markets and operates two folding carton converting facilities located in Gresham, OR and Vancouver, WA. The Carded, Cascades, and Rose City transactions are all referred to collectively as the "North American Acquisitions."

On June 30, 2014, the Company completed the sale of its multi-wall bag business. Products included multi-wall bags, such as pasted valve, pinched bottom, sewn open mouth and woven polypropylene, and coated paper. Key end-markets included food and agriculture, building and industrial materials, chemicals, minerals, and pet foods.

On May 23, 2014, the Company acquired the business of Benson Box Holdings Limited ("Benson"), a leading food, beverage, and retail packaging company in the United Kingdom. Benson operates four folding carton facilities that converted approximately 80,000 tons of paperboard annually into folding cartons for the food, beverage and healthcare industries.

On February 3, 2014, the Company completed the sale of its labels business.

On September 30, 2013, the Company completed the sale of certain assets related to the flexible plastics business and the sale of its uncoated-recycled board (“URB”) mill.

Capital Allocation Plan and Equity Offerings

Capital Allocation Plan

On February 4, 2015, the Company's board of directors authorized a share repurchase program to allow management to purchase up to $250 million of the Company's issued and outstanding shares of common stock through open market purchases, privately

5

negotiated transactions and Rule 10b5-1 plans. During 2015, the Company repurchased 4.6 million shares, or approximately $63 million, of its common stock under this program at an average price of $13.60.

On February 4, 2015, May 20, 2015, July 30, 2015 and November 19, 2015, the Company's board of directors declared a regular quarterly dividend of $0.05 per common share. During 2015, the Company declared and paid cash dividends of approximately $66 million and $49 million, respectively.

Equity Offerings

During the first and second quarters of 2014, certain shareholders of the Company sold approximately 30 million and 43.7 million shares of common stock in two secondary public offerings at $9.85 and $10.45 per share, respectively. The shares were sold by certain affiliates of TPG Capital, L.P. (the “TPG Entities”), certain Coors family trusts and the Adolph Coors Foundation (the “Coors Family Stockholders”), Clayton, Dubilier & Rice Fund V Limited Partnership (the “CD&R Fund”) and Old Town, S.A. (“Old Town”), and together with the TPG Entities, the Coors Family Stockholders, the Adolph Coors Foundation, and the CD&R Fund, the "Selling Stockholders"). Following the completion of the offering in the second quarter, these Selling Stockholders no longer held shares of the Company's common stock.

Products

The Company reports its results in three segments:

Paperboard Mills includes the seven North American paperboard mills which produce primarily coated unbleached kraft (“CUK”) and coated recycled board (“CRB”). The majority of the paperboard is consumed internally to produce paperboard packaging for the Americas and Europe Paperboard Packaging segments. The remaining paperboard is sold externally to a wide variety of paperboard packaging converters and brokers. The Paperboard Mills segment Net Sales represent the sale of paperboard to external customers.

Americas Paperboard Packaging includes paperboard packaging folding cartons sold primarily to Consumer Packaged Goods ("CPG") companies serving the food, beverage, and consumer product markets in the Americas.

Europe Paperboard Packaging includes paperboard packaging folding cartons sold primarily to CPG companies serving the food, beverage and consumer product markets in Europe.

The Company also operates in three geographic areas: Americas, Europe and Asia Pacific.

For reportable segment and geographic area information for each of the last three fiscal years, see Note 16 in the Notes to Consolidated Financial Statements included herein under “Item 8., Financial Statements and Supplementary Data."

Paperboard Packaging

The Company’s paperboard packaging products deliver brand, marketing and performance benefits at a competitive cost. The Company supplies paperboard cartons and carriers designed to protect and contain products while providing:

• | convenience through ease of carrying, storage, delivery, dispensing of product and food preparation for consumers; |

• | a smooth surface printed with high-resolution, multi-color graphic images that help improve brand awareness and visibility of products on store shelves; and |

• | durability, stiffness and wet and dry tear strength; leak, abrasion and heat resistance; barrier protection from moisture, oxygen, oils and greases, as well as enhanced microwave heating performance. |

The Company provides a wide range of paperboard packaging solutions for the following end-use markets:

• | beverage, including beer, soft drinks, energy drinks, teas, water and juices; |

• | food, including cereal, desserts, frozen, refrigerated and microwavable foods and pet foods; |

6

• | prepared foods, including snacks, quick-serve foods for restaurants and food service products; and |

• | household products, including dishwasher and laundry detergent, health care and beauty aids, and tissues and papers. |

The Company’s packaging applications meet the needs of its customers for:

Strength Packaging. The Company's products provide sturdiness to meet a variety of packaging needs, including tear and wet strength, puncture resistance, durability and compression strength (providing stacking strength to meet store display packaging requirements).

Promotional Packaging. The Company offers a broad range of promotional packaging options that help differentiate its customers’ products in the marketplace. These promotional enhancements improve brand awareness and visibility on store shelves.

Convenience Packaging. These packaging solutions improve package usage and food preparation:

• | beverage multiple-packaging — multi-packs for beer, soft drinks, energy drinks, teas, water and juices; |

• | active microwave technologies — substrates that improve the preparation of foods in the microwave; and |

• | easy opening and closing features — dispensing features, pour spouts and sealable liners. |

Barrier Packaging. The Company provides packages that protect against moisture, grease, oil, oxygen, sunlight, insects and other potential product-damaging factors.

Paperboard Mills and Converting Plants

The Company produces paperboard at its mills; prints, cuts, folds, and glues (“converts”) the paperboard into folding cartons at its converting plants; and designs and manufactures specialized, proprietary packaging machines that package bottles and cans and, to a lesser extent, non-beverage consumer products. The Company also installs its packaging machines at customer plants and provides support, service and advanced performance monitoring of the machines.

The Company offers a variety of laminated, coated and printed packaging structures that are produced from its CUK and CRB, as well as other grades of paperboard that are purchased from third-party suppliers.

Below is the production at each of the Company’s paperboard mills during 2015:

Location | Product | # of Machines | 2015 Net Tons Produced | |

West Monroe, LA | CUK | 2 | 798,988 | |

Macon, GA | CUK | 2 | 643,018 | |

Kalamazoo, MI | CRB | 2 | 477,987 | |

Battle Creek, MI | CRB | 2 | 184,944 | |

Middletown, OH | CRB | 1 | 158,716 | |

Santa Clara, CA | CRB | 1 | 137,729 | |

West Monroe, LA | Corrugated Medium | 1 | 120,851 | |

West Monroe, LA (1) | Kraft Paper | 1 | 38,452 | |

East Angus, Québec (2) | CRB | 1 | 72,218 | |

Jonquiere, Québec (2) (3) | TMP | 1 | 68,878 | |

(1) Machine permanently shutdown in October 2015.

(2) Acquired in February 2015 as part of the Cascades acquisition.

(3) Facility was closed in the third quarter of 2015.

The Company consumes most of its coated board output in its carton converting operations, which is an integral part of the customer value proposition. In 2015, approximately 83% of mill production of CUK and CRB was consumed internally.

7

CUK Production. The Company is the largest of four worldwide producers of CUK. CUK is manufactured from pine-based wood fiber and is a specialized high-quality grade of coated paperboard with excellent wet and dry tear strength characteristics and printability for high resolution graphics that make it particularly well-suited for a variety of packaging applications. Both wood and recycled fibers are pulped, formed on paper machines, and clay-coated to provide an excellent printing surface for superior quality graphics and appearance characteristics.

CRB Production. The Company is the largest North American producer of CRB. CRB is manufactured entirely from recycled fibers, primarily old corrugated containers (“OCC”), doubled-lined kraft cuttings from corrugated box plants (“DLK”), old newspapers (“ONP”), and box cuttings. The recycled fibers are re-pulped, formed on paper machines, and clay-coated to provide an excellent printing surface for superior quality graphics and appearance characteristics.

Containerboard/Kraft Paper. The Company manufactures corrugated medium and kraft paper for internal use and sale in the open market. Corrugated medium is combined with linerboard to make corrugated containers. Kraft paper is used primarily to make grocery bags and sacks. In October 2015, the Company shutdown the kraft paper machine at West Monroe, LA and sold the book of business.

The Company converts CUK and CRB, as well as other grades of paperboard, into cartons at converting plants the Company operates in various locations globally, including a converting plant associated with its joint venture in Japan, contract converters and at licensees outside the U.S. The converting plants print, cut, fold and glue paperboard into cartons designed to meet customer specifications.

Joint Venture

The Company is a party to a joint venture called Rengo Riverwood Packaging, Ltd. (in Japan) in which it holds a 50% ownership interest. The joint venture agreement covers CUK supply, use of proprietary carton designs and marketing and distribution of packaging systems.

Marketing and Distribution

The Company markets its products principally to multinational beverage, food, and other well-recognized consumer product companies. The beverage companies include Anheuser-Busch, Inc., MillerCoors LLC, PepsiCo, Inc. and The Coca-Cola Company, among others. Consumer product customers include Kraft Heinz Company., General Mills, Inc., Nestlé USA, Inc., Kellogg Company, HAVI Global Solutions, LLC and Kimberly-Clark Corporation, among others. The Company also sells paperboard in the open market to independent and integrated paperboard converters.

Distribution of the Company’s principal products is primarily accomplished through sales offices in the U.S., Australia, Brazil, China, France, Germany, Italy, Japan, Mexico, Spain, the Netherlands and the United Kingdom, and, to a lesser degree, through broker arrangements with third parties.

During 2015, the Company did not have any one customer that represented 10% or more of its net sales.

Competition

Although a relatively small number of large competitors hold a significant portion of the paperboard packaging market, the Company’s business is subject to strong competition. The Company and WestRock Company are the two major CUK producers in the U.S. Internationally, The Klabin Company in Brazil and Stora Enzo in Sweden produce similar grades of paperboard.

In beverage packaging, cartons made from CUK compete with substitutes such as plastics and corrugated packaging for packaging glass or plastic bottles, cans and other primary containers. Although plastics and corrugated packaging may be priced lower than CUK, the Company believes that cartons made from CUK offer advantages over these materials in areas such as distribution, brand awareness, carton designs, package performance, package line speed, environmental friendliness and design flexibility.

In non-beverage consumer packaging, the Company’s paperboard competes with WestRock CUK, as well as CRB and solid bleach sulfate ("SBS") from numerous competitors, and internationally, folding boxboard and white-lined chip. There are a large number of producers in the paperboard markets. Suppliers of paperboard compete primarily on the basis of price, strength and printability of their paperboard, quality and service.

8

Raw Materials

The paperboard packaging produced by the Company comes from pine trees and recycled fibers. Pine pulpwood, paper and recycled fibers (including DLK and OCC) and energy used in the manufacture of paperboard, as well as poly sheeting, plastic resins and various chemicals used in the coating of paperboard, represent the largest components of the Company’s variable costs of paperboard production.

For the West Monroe, LA and Macon, GA mills, the Company relies on private landowners and the open market for all of its pine pulpwood and recycled fiber requirements, supplemented by CUK clippings that are obtained from its converting operations. The Company believes that adequate supplies from both private landowners and open market fiber sellers currently are available in close proximity to meet its fiber needs at these mills.

The paperboard grades produced at the Kalamazoo, MI, Battle Creek, MI, Middletown, OH, Santa Clara, CA, and East Angus, Quebec mills are made from 100% recycled fiber. The Company procures its recycled fiber from external suppliers and internal converting operations. The market price of each of the various recycled fiber grades fluctuates with supply and demand. The Company’s internal recycled fiber procurement function enables the Company to obtain low prices for its recycled fiber given the Company’s highly fragmented supplier base. The Company believes there are adequate supplies of recycled fiber to serve its mills.

In North America, the Company also converts a variety of other paperboard grades such as SBS, in addition to paperboard that is supplied to its converting operations from its own mills. The Company purchases such paperboard requirements, including additional CRB, from outside vendors. The majority of external paperboard purchases are acquired through long-term arrangements with other major industry suppliers. The Company's European converting plants consume CUK supplied from the Company's mills and also converts other paperboard grades such as white-lined chip and folding box board purchased from external suppliers.

Energy

Energy, including natural gas, fuel oil and electricity, represents a significant portion of the Company’s manufacturing costs. The Company has entered into contracts designed to manage risks associated with future variability in cash flows and price risk related to future energy cost increases for a portion of its natural gas requirements at its U.S. mills. The Company’s hedging program for natural gas is discussed in Note 9 in the Notes to Consolidated Financial Statements included herein under “Item 8., Financial Statements and Supplementary Data.”

Backlog

Orders from the Company’s principal customers are manufactured and shipped with minimal lead time. The Company did not have a material amount relating to backlog orders at December 31, 2015 or 2014.

Seasonality

The Company’s net sales, income from operations and cash flows from operations are subject to moderate seasonality, with demand usually increasing in the late spring through early fall due to increases in demand for beverage and food products.

Research and Development

The Company’s research and development team works directly with its sales, marketing and consumer insights personnel to understand long-term consumer and retailer trends and create relevant new packaging. These innovative solutions provide customers with differentiated packaging to meet customer needs. The Company’s development efforts include, but are not limited to, extending the shelf life of customers’ products; reducing production and waste costs; enhancing the heat-managing characteristics of food packaging; improving the sturdiness and compression strength of packaging to meet store display needs; and refining packaging appearance through new printing techniques and materials.

Sustainability represents one of the strongest trends in the packaging industry and the Company focuses on developing more sustainable and eco-friendly manufacturing processes and products. The Company’s strategy is to combine sustainability with innovation to create new packaging solutions for its customers.

For more information on research and development expenses see Note 1 in the Notes to Consolidated Financial Statements included herein under “Item 8., Financial Statements and Supplementary Data.”

Patents and Trademarks

9

As of December 31, 2015, the Company had a large patent portfolio, presently owning, controlling or holding rights to more than 1,900 U.S. and foreign patents, with more than 700 U.S. and foreign patent applications currently pending. The Company’s patent portfolio consists primarily of patents relating to packaging machinery, manufacturing methods, structural carton designs, active microwave packaging technology and barrier protection packaging. These patents and processes are significant to the Company’s operations and are supported by trademarks such as Fridge Vendor®, IntegraPakTM, MicroFlex-Q® , MicroRite®, Quilt Wave®, Qwik Crisp®, Tite-Pak®, and Z-Flute®. The Company takes significant steps to protect its intellectual property and proprietary rights.

Culture and Employees

The Company’s corporate vision — Inspired packaging. A world of difference. — and values of integrity, respect, accountability, relationships and teamwork guide employee behavior, expectations and relations. The Company’s ongoing efforts to build a high-performance culture and improve the manner in which work is done across the Company includes a significant focus on continuous improvement utilizing processes like Lean Sigma and Six Sigma.

As of December 31, 2015, the Company had approximately 12,000 employees worldwide, of which approximately 51% were represented by labor unions and covered by collective bargaining agreements or covered by works councils in Europe. As of December 31, 2015, 881 of the Company’s employees were working under expired contracts, which are currently being negotiated, and 962 were covered under collective bargaining agreements that expire within one year. The Company considers its employee relations to be satisfactory.

Environmental Matters

The Company is subject to federal, state and local environmental regulations and employs a team of professionals in order to maintain compliance at each of its facilities. For additional information on such regulation and compliance, see “Environmental Matters” in “Item 7., Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 13 in the Notes to Consolidated Financial Statements included herein under “Item 8., Financial Statements and Supplementary Data.”

Available Information

The Company’s website is located at http://www.graphicpkg.com. The Company makes available, free of charge through its website, its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as soon as reasonably practicable after such materials are electronically filed or furnished to the Securities and Exchange Commission (the “SEC”). The Company also makes certain investor presentations and access to analyst conference calls available through its website. The information contained or incorporated into the Company’s website is not a part of this Annual Report on Form 10-K.

The SEC maintains an Internet website that contains reports, proxy and information statements, and other information regarding issuers like the Company that file electronically with the SEC at http://www.SEC.gov.

10

Item 1A. | RISK FACTORS |

The following risks could affect (and in some cases have affected) the Company's actual results and could cause such results to differ materially from estimates or expectations reflected in certain forward-looking statements:

The Company's financial results could be adversely impacted if there are significant increases in prices for raw materials, energy, transportation and other necessary supplies, and the Company is unable to raise prices, or improve productivity to reduce costs.

Limitations on the availability of, and increases in, the costs of raw materials, including petroleum-based materials, energy, wood, transportation and other necessary goods and services, could have an adverse effect on the Company's financial results. Because negotiated sales contracts and the market largely determine the pricing for its products, the Company is at times limited in its ability to raise prices and pass through to its customers any inflationary or other cost increases that the Company may incur.

The Company uses productivity improvements to reduce costs and offset inflation. These include global continuous improvement initiatives that use statistical process control to help design and manage many types of activities, including production and maintenance. The Company's ability to realize anticipated savings from these improvements is subject to significant operational, economic and competitive uncertainties and contingencies, many of which are beyond the Company's control. If the Company cannot successfully implement cost savings plans, it may not be able to continue to compete successfully against other manufacturers. In addition, any failure to generate the anticipated efficiencies and savings could adversely affect the Company's financial results.

Changes in consumer buying habits and preferences for products could have an effect on our sales volumes.

Changing consumer dietary habits and preferences have slowed sales growth for many of the food and beverage products the Company packages. If these trends continue, the Company’s financial results could be adversely affected.

Competition and product substitution could have an adverse effect on the Company's financial results.

The Company competes with other paperboard manufacturers and carton converters, both domestically and internationally. The Company's products compete with those made from other manufacturers' CUK board, as well as SBS and CRB, and other board substrates. Substitute products include plastic, shrink film and corrugated containers. In addition, while the Company has long-term relationships with many of its customers, the underlying contracts may be re-bid or renegotiated from time to time, and the Company may not be successful in renewing such contracts on favorable terms or at all. The Company works to maintain market share through efficiency, product innovations and strategic sourcing to its customers; however, pricing and other competitive pressures may occasionally result in the loss of a customer relationship.

The Company's future growth and financial results could be adversely impacted if the Company is unable to identify strategic acquisitions and to successfully integrate the acquired businesses.

The Company has made several acquisitions in recent years. The Company's ability to continue to make strategic acquisitions and to integrate the acquired businesses successfully, including obtaining anticipated cost savings or synergies and expected operating results within a reasonable period of time, is an important factor in the Company's future growth. If the Company is unable to realize the expected revenue and cash flow growth and other benefits from its acquisitions, the Company may be required to spend additional time or money on integration efforts that would otherwise have been spent on the development and expansion of its business.

The Company may not be able to develop and introduce new products and adequately protect its intellectual property and proprietary rights, which could harm its future success and competitive position.

The Company works to increase market share and profitability through product innovation and the introduction of new products. The inability to develop new or better products that satisfy customer and consumer preferences in a timely manner may impact the Company's competitive position.

11

The Company's future success and competitive position also depends, in part, upon its ability to obtain and maintain protection for certain proprietary carton and packaging machine technologies used in its value-added products, particularly those incorporating the Fridge Vendor, IntegraPak, MicroFlex-Q, MicroRite, Quilt Wave, Qwik Crisp, Tite-Pak, and Z-Flute technologies. Failure to protect the Company's existing intellectual property rights may result in the loss of valuable technologies or may require it to license other companies' intellectual property rights. It is possible that any of the patents owned by the Company may be invalidated, rendered unenforceable, circumvented, challenged or licensed to others or any of its pending or future patent applications may not be issued within the scope of the claims sought by the Company, if at all. Further, others may develop technologies that are similar or superior to the Company's technologies, duplicate its technologies or design around its patents, and steps taken by the Company to protect its technologies may not prevent misappropriation of such technologies.

The Company could experience material disruptions at our facilities.

Although the Company takes appropriate measures to minimize the risk and effect of material disruptions to the business conducted at our facilities, natural disasters such as hurricanes, tornadoes, floods and fires, as well as other unexpected disruptions such as the unavailability of critical raw materials, power outages and equipment failures can reduce production and increase manufacturing costs. These types of disruptions could materially adversely affect our earnings, depending upon the duration of the disruption and our ability to shift business to other facilities or find other sources of materials or energy. Any losses due to these events may not be covered by our existing insurance policies or may be subject to certain deductibles.

The Company is subject to the risks of doing business in foreign countries.

The Company has converting plants in eight foreign countries and sells its products worldwide. For 2015, before intercompany eliminations, net sales from operations outside of the U.S. represented approximately 23% of the Company’s net sales. The Company’s revenues from foreign sales fluctuate with changes in foreign currency exchange rates. The Company pursues a currency hedging program in order to reduce the impact of foreign currency exchange fluctuations on financial results. At December 31, 2015, approximately 19% of its total assets were denominated in currencies other than the U.S. dollar.

The Company is also subject to the following significant risks associated with operating in foreign countries:

• | Compliance with and enforcement of environmental, health and safety and labor laws and other regulations of the foreign countries in which the Company operates; |

• | Export compliance; |

• | Imposition or increase of withholding and other taxes on remittances and other payments by foreign subsidiaries; and |

• | Imposition of new or increases in investment and other requirements by foreign governments. |

The Company’s information technology systems could suffer interruptions, failures or breaches and our business operations could be disrupted adversely effecting results of operations and the Company’s reputation.

The Company’s information technology systems, some of which are dependent on services provided by third parties, serve an important role in the operation of the business. These systems could be damaged or cease to function properly due to any number of causes, such as catastrophic events, power outages, security breaches, computer viruses or cyber-based attacks. The Company has contingency plans in place to prevent or mitigate the impact of these events, however, if they are not effective on a timely basis, business interruptions could occur which may adversely impact results of operations.

Increased cyber-security threats also pose a potential risk to the security of the Company’s information technology systems, as well as the confidentiality, integrity and availability of data stored on those systems. Any breach could result in disclosure or misuse of confidential or proprietary information, including sensitive customer, vendor, employee or financial information. Such event could cause damage to the Company’s reputation and result in significant recovery or remediation costs, which may adversely impact results of operations.

12

The Company is subject to environmental, health and safety laws and regulations, and costs to comply with such laws and regulations, or any liability or obligation imposed under new laws or regulations, could negatively impact its financial condition and results of operations.

The Company is subject to a broad range of foreign, federal, state and local environmental, health and safety laws and regulations, including those governing discharges to air, soil and water, the management, treatment and disposal of hazardous substances, the investigation and remediation of contamination resulting from releases of hazardous substances, and the health and safety of employees. The Company cannot currently assess the impact that future emission standards, climate control initiatives and enforcement practices will have on the Company's operations and capital expenditure requirements. Environmental liabilities and obligations may result in significant costs, which could negatively impact the Company's financial position, results of operations or cash flows. See Note 13 in the Notes to Consolidated Financial Statements included herein under “Item 8., Financial Statements and Supplementary Data.”

The Company's indebtedness may adversely affect its financial condition and its ability to react to changes in its business.

As of December 31, 2015, the Company had an aggregate principal amount of $1,889.2 million of outstanding debt. Because of the Company's debt level, a portion of its cash flows from operations will be dedicated to payments on indebtedness and the Company's ability to obtain additional financing for working capital, capital expenditures, acquisitions or general corporate purposes may be restricted in the future.

Additionally, the Company’s Second Amended and Restated Credit Agreement dated October 1, 2014 (as amended, the “Credit Agreement”) and the indentures governing its 4.75% Senior Notes due 2021 and the 4.875% Senior Notes due 2022 (the “Indentures”) prohibit or restrict, among other things, the disposal of assets, the incurrence of additional indebtedness (including guarantees), payment of dividends, share repurchases, loans or advances and certain other types of transactions. These restrictions could limit the Company’s flexibility to respond to changing market conditions and competitive pressures. The debt obligations and restrictions may also leave the Company more vulnerable to a downturn in general economic conditions or its business, or unable to carry out capital expenditures that are necessary or important to its growth strategy and productivity improvement programs.

Approximately 34% of the Company’s debt is subject to variable rates of interest and exposes the Company to increased debt service obligations in the event of increased interest rates.

The Company's pension plans are currently underfunded, and the Company may be required to make cash payments to the plans, reducing the cash available for its business.

The Company's cash flows may be adversely impacted by the Company's pension funding obligations. The Company's pension funding obligations are dependent upon multiple factors resulting from actual plan experience and assumptions of future experience. The Company has unfunded obligations of $191.7 million under its domestic and foreign defined benefit pension plans. The funded status of these plans is dependent upon various factors, including returns on invested assets, the level of certain market interest rates and the discount rate used to determine the pension obligations. Unfavorable returns on the plan assets or unfavorable changes in applicable laws or regulations could materially change the timing and amount of required plan funding, which would reduce the cash available to the Company for other purposes.

ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

13

ITEM 2. | PROPERTIES |

Headquarters

The Company leases its principal executive offices in Atlanta, GA.

Operating Facilities

A listing of the principal properties owned or leased and operated by the Company is set forth below. The Company’s buildings are adequate and suitable for the business of the Company and have sufficient capacity to meet current requirements. The Company also leases certain smaller facilities, warehouses and office space throughout the U.S. and in foreign countries from time to time.

Location | Related Products or Use of Facility |

Mills: | |

Battle Creek, MI | CRB |

East Angus, Québec | CRB |

Kalamazoo, MI | CRB |

Macon, GA | CUK |

Middletown, OH | CRB |

Santa Clara, CA | CRB |

West Monroe, LA | CUK; Containerboard; Research and Development |

Other: | |

Atlanta, GA(a) | Research and Development, Packaging Machinery and Design |

Concord, NH(a) | Research and Development, Design Center |

Crosby, MN | Packaging Machinery Engineering, Design and Manufacturing |

Louisville, CO(a) | Research and Development |

North American Converting Plants: | International Converting Plants: | |

Atlanta, GA(a) | Mitchell, SD | Bremen, Germany(a) |

Carol Stream, IL | North Portland, OR | Bristol, Avon, United Kingdom |

Centralia, IL | Oroville, CA(a) | Coalville, United Kingdom(a) |

Charlotte, NC | Pacific, MO | Gateshead, United Kingdom(a) |

Cobourg, Ontario(a) | Perry, GA | Hoogerheide, Netherlands |

Elk Grove, IL (a)(b) | Piscataway, NJ(a) | New Castle Upon Tyne, United Kingdom(a) |

Fort Smith, AR (b) | Queretaro, Mexico(a) | Igualada, Barcelona, Spain |

Gordonsville, TN(a) | Renton, WA(c) | Jundiai, Sao Paulo, Brazil |

Gresham, OR(a) | Solon, OH | Leeds, United Kingdom |

Irvine, CA | Staunton, VA | Masnieres, France(a) |

Kalamazoo, MI | Tuscaloosa, AL | Portlaoise, Ireland(a) |

Kendallville, IN | Vancouver, WA(a) | Sneek, Netherlands |

Lawrenceburg, TN | Valley Forge, PA | |

Lumberton, NC | Wausau, WI | |

Marion, OH | West Monroe, LA (b) | |

Menasha, WI | Winnipeg, Manitoba | |

Mississauga, Ontario(a) | ||

14

Note:

(a) | Leased facility. |

(b) | Multiple facilities in this location. |

(c) | Facility scheduled to close in February 2016. |

15

ITEM 3. | LEGAL PROCEEDINGS |

The Company is a party to a number of lawsuits arising in the ordinary conduct of its business. Although the timing and outcome of these lawsuits cannot be predicted with certainty, the Company does not believe that disposition of these lawsuits will have a material adverse effect on the Company’s consolidated financial position, results of operations or cash flows. See Note 13 in the Notes to Consolidated Financial Statements included herein under “Item 8., Financial Statements and Supplementary Data.”

ITEM 4. | MINE SAFETY DISCLOSURES |

Not Applicable.

EXECUTIVE OFFICERS OF THE REGISTRANT

Pursuant to General Instruction G.(3) of Form 10-K, the following list is included as an unnumbered item in Part I of this Report in lieu of being included in the definitive proxy statement that will be filed within 120 days after December 31, 2015.

David W. Scheible, 59, was appointed Chairman of the Board of GPHC on May 22, 2013. He was appointed to the Board of Directors of GPHC upon its formation (under the name New Giant Corporation) in June 2007. Mr. Scheible served as President and Chief Executive Officer of GPHC from March 2008 through May 2015, and as Chief Executive Officer from June through December 2015. Prior to the closing of the Company's acquisition of Altivity Packaging, LLC (the "Altivity Transaction") in March 2008, he had served as a director, President and Chief Executive Officer of Graphic Packaging Corporation ("GPC") since January 1, 2007. Prior to that time, Mr. Scheible had served as Chief Operating Officer of GPC since October 2004. Mr. Scheible served as Executive Vice President of Commercial Operations from August 2003 until October 2004. Mr. Scheible served as the Chief Operating Officer of Graphic Packaging International Corporation ("GPIC") from 1999 until August 2003. He also served as President of GPIC's Flexible Division from January to June 1999. Previously, Mr. Scheible was affiliated with the Avery Dennison Corporation, working most recently as its Vice President and General Manager of the Specialty Tape Division from 1995 through 1999 and Vice President and General Manager of the Automotive Division from 1993 to 1995. Mr. Scheible serves on the Board of Directors of Benchmark Electronics, Inc., a provider of integrated electronics manufacturing, design and engineering services. Mr. Scheible also serves on the boards of Flint Group S.A. and Cancer Treatment Centers of America.

Michael P. Doss, 49, is the President and Chief Executive Officer of GPHC. Prior to January 1, 2016, Mr. Doss held the position of President and Chief Operating Officer from May 20, 2015 through December 31, 2015 and Chief Operating Officer from January 1, 2014 until May 19, 2015. Prior to these positions he served as the Executive Vice President, Commercial Operations of GPHC. Prior to this position, Mr. Doss held the position of Senior Vice President, Consumer Packaging Division. Prior to the Altivity Transaction, he had served as Senior Vice President, Consumer Products Packaging of GPC since September 2006. From July 2000 until September 2006, he was the Vice President of Operations, Universal Packaging Division. Mr. Doss was Director of Web Systems for the Universal Packaging Division prior to his promotion to Vice President of Operations. Since joining GPIC in 1990, Mr. Doss has held positions of increasing management responsibility, including Plant Manager at the Gordonsville, TN and Wausau, WI plants.

Stephen R. Scherger, 51, is the Senior Vice President and Chief Financial Officer of GPHC. From October 1, 2014 through December 31, 2014, Mr. Scherger was the Senior Vice President - Finance. From April 2012 through September 2014, Mr. Scherger served as Senior Vice President, Consumer Packaging Division. Mr. Scherger joined GPHC in April of 2012 from MeadWestvaco Corporation, where he served as President, Beverage and Consumer Electronics. Mr. Scherger was with MeadWestvaco Corporation from 1986 to 2012 and held positions including Vice President, Corporate Strategy; Vice President and General Manager, Beverage Packaging; Vice President and CFO, Papers Group, Vice President Asia Pacific and Latin America, Beverage Packaging, CFO Beverage Packaging and other executive-level positions.

Carla J. Chaney, 45, is the Senior Vice President, Human Resources of GPHC, a position she has held since July 15, 2013. Ms. Chaney joined GPHC from Exide Technologies, a leading global supplier of stored electrical energy. Ms. Chaney was with Exide Technologies from February 2012 to July 2013 and served most recently as Executive Vice President, Human Resources and Communications. Prior to Exide Technologies, Ms. Chaney held a variety of leadership roles with Newell Rubbermaid, Inc. from 2004 to 2011, including Group Vice President, Human Resources for the Home & Family business segment, Regional Vice

16

President, Human Resources, EMEA; Corporate Vice President, Global Organization and People Development; and Vice President, Human Resources, Culinary Lifestyles Business. Ms. Chaney also worked for Georgia-Pacific from 1992 to 2004.

Alan R. Nichols, 53, is the Senior Vice President, Mills Division of GPHC. He served as Vice President, Mills from August 2008 until March 2009. From March 2008 until August 2008, Mr. Nichols was Vice President, CRB Mills. Prior to the Altivity Transaction, Mr. Nichols served as Vice President, CRB Mills for Altivity Packaging, LLC from February 2007 until March 2008 and was the Division Manufacturing Manager, Mills for Altivity Packaging and the Consumer Products Division of Smurfit-Stone Container Corporation from August 2005 to February 2007. From February 2001 until August 2005, Mr. Nichols was the General Manager of the Wabash Mill for Smurfit-Stone.

Michael R. Schmal, 63, served as the Senior Vice President, Beverage Packaging Division of GPHC through December 31, 2015. Prior to the Altivity Transaction, he had served as Senior Vice President, Beverage of GPC since August 2003. From October 1996 until August 2003, Mr. Schmal was the Vice President and General Manager, Brewery Group of Riverwood Holding, Inc. Prior to that time, Mr. Schmal held various positions with Riverwood Holding, Inc. since 1981.

Lauren S. Tashma, 49, is the Senior Vice President, General Counsel and Secretary of GPHC, serving in this position since February, 2014. Previously, Ms. Tashma served as Senior Vice President, General Counsel and Secretary of Fortune Brands Home & Security, Inc., a global consumer products company, where she led the legal, compliance and EHS functions. Prior to that, Ms. Tashma had various roles with Fortune Brands, Inc., including Vice President and Associate General Counsel.

Michael S. Ukropina, 49, is the Senior Vice President, Consumer Packaging Division of GPHC. Beginning in August 2014, Mr. Ukropina served as the Senior Vice President, Strategy. Mr. Ukropina joined the Company in August of 2014 from ASG Worldwide, a specialty consumer packaging company, where he led ASG as President and CEO from 2012 to 2014. Prior to that, Mr. Ukropina was an officer with International Paper and his work there from 1993 to 2011 included positions such as Vice President and General Manager, Shorewood Packaging; Vice President of Operations for xpedx; and Director of Finance & Planning for Industrial Packaging. During that time, Mr. Ukropina led packaging growth strategies across multiple businesses in Latin America, Europe and Asia.

Joseph P. Yost, 48, is the Senior Vice President, Global Beverage and Europe of GPHC. Prior to September 1, 2015, Mr. Yost served as Senior Vice President, Europe from March 1, 2014 to August 31, 2015 and Senior Vice President, European Chief Integration Officer/Chief Financial Officer from February 2013 until February, 2014. From 2009 until February 2013, Mr. Yost was the Senior Vice President, Supply Chain of GPHC. From 2006 to 2009, he served as Vice President, Operations Support - Consumer Packaging for Graphic Packaging International, Inc. Mr. Yost has also served in the following positions: Director, Finance and Centralized Services from 2003 to 2006 with Graphic Packaging International, Inc. and from 2000 to 2003 with GPC; Manager, Operations Planning and Analysis - Consumer Products Division from 1999 to 2000 with GPC; and other management positions from 1997 to 1999 with Fort James Corporation.

17

PART II

ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

GPHC’s common stock (together with the associated stock purchase rights) is traded on the New York Stock Exchange under the symbol “GPK.” The historical range of the high and low sales price per share for each quarter of 2015 and 2014 are as follows:

2015 | 2014 | ||||||||||||

High | Low | High | Low | ||||||||||

First Quarter | $ | 16.14 | $ | 13.37 | $ | 10.60 | $ | 9.10 | |||||

Second Quarter | 15.16 | 13.52 | 11.87 | 9.19 | |||||||||

Third Quarter | 15.28 | 12.62 | 13.02 | 11.26 | |||||||||

Fourth Quarter | 14.46 | 12.17 | 14.09 | 10.76 | |||||||||

On February 4, 2015, the Company's board of directors authorized a share repurchase program to allow management to purchase up to $250 million of the Company's issued and outstanding shares of common stock through open market purchases, privately negotiated transactions and Rule 10b5-1 plans. During 2015, the Company repurchased approximately 4.6 million shares, or $63 million, under this repurchase program at an average price of $13.60.

Also, on February 4, 2015, May 20, 2015, July 30, 2015 and November 19, 2015 the Company's board of directors declared a regular quarterly dividend of $0.05 per common share. During 2015, the Company declared and paid cash dividends of approximately $66 million and $49 million, respectively. There were no dividends paid prior to 2015. GPHC depends on its domestic subsidiaries, primarily GPII, for cash to pay dividends. Unless GPHC receives dividends, distributions or transfers from such domestic subsidaries, it cannot pay cash dividends on its common stock, because it has no independent operations. Such dividends, distributions or transfers from GPHC’s domestic subsidiaries may be restricted because the terms of the GPII’s debt agreements and indentures limit its ability to make such payments to the Company. See "Item 1A-Risk Factors" and Note - 5 in the Notes to Consolidated Financial Statements in "Item 8-Financial Statements and Supplementary Data."

On February 10, 2016, there were 1,441 stockholders of record and approximately 51,000 beneficial holders of GPHC’s common stock.

During the fourth quarter of 2015, pursuant to the share repurchase program described above, the Company purchased shares of its common stock as follows:

Issuer Purchases of Equity Securities

Period (2015) | Total Number of Shares Purchased | Average Price Paid Per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Maximum Number of Shares That May Yet Be Purchased Under the Publicly Announced Program (a) | |||||||||

October 1, through October 31, | — | $ | — | — | — | ||||||||

November 1, through November 30, | 1,421,650 | $ | 13.59 | 2,825,077 | 15,192,156 | ||||||||

December 1, through December 31, | 1,575,134 | $ | 13.13 | 4,625,211 | 14,575,217 | ||||||||

Total | 2,996,784 | ||||||||||||

(a) Based on the closing price of the Company's common stock as of the end of each period.

18

Total Return to Stockholders

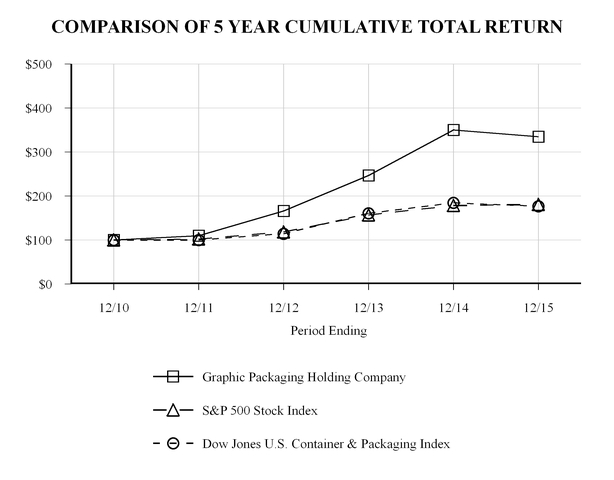

The following graph compares the total returns (assuming reinvestment of dividends) of the common stock of the Company, the Standard & Poor’s (“S&P”) 500 Stock Index and the Dow Jones (“DJ”) U.S. Container & Packaging Index. The graph assumes $100 invested on December 31, 2010 in GPHC’s common stock and each of the indices. The stock price performance on the following graph is not necessarily indicative of future stock price performance.

12/31/2010 | 12/31/2011 | 12/31/2012 | 12/31/2013 | 12/31/2014 | 12/31/2015 | ||||||||||||||||||

Graphic Packaging Holding Company | $ | 100.00 | $ | 109.51 | $ | 166.07 | $ | 246.79 | $ | 350.13 | $ | 334.63 | |||||||||||

S&P 500 Stock Index | 100.00 | 102.11 | 118.45 | 156.82 | 178.29 | 180.75 | |||||||||||||||||

Dow Jones U.S. Container & Packaging Index | 100.00 | 100.14 | 114.27 | 160.79 | 184.45 | 176.50 | |||||||||||||||||

19

ITEM 6. | SELECTED FINANCIAL DATA |

The selected consolidated financial data set forth below should be read in conjunction with “Item 7., Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Consolidated Financial Statements of the Company and the Notes to Consolidated Financial Statements included herein under “Item 8., Financial Statements and Supplementary Data.”

Year Ended December 31, | |||||||||||||||

In millions, except per share amounts | 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||

Statement of Operations Data: | |||||||||||||||

Net Sales | $ | 4,160.2 | $ | 4,240.5 | $ | 4,478.1 | $ | 4,337.1 | $ | 4,206.3 | |||||

Income from Operations | 427.1 | 227.8 | 341.6 | 322.4 | 190.3 | ||||||||||

Net Income | 230.1 | 89.0 | 146.7 | 120.1 | 275.2 | ||||||||||

Net Loss (Income) Attributable to Noncontrolling Interests | — | 0.7 | (0.1 | ) | 2.5 | 1.7 | |||||||||

Net Income Attributable Graphic Packaging Holding Company | 230.1 | 89.7 | 146.6 | 122.6 | 276.9 | ||||||||||

Net Income Attributable to Graphic Packaging Holding Company Per Share Basis: | |||||||||||||||

Basic | $ | 0.70 | $ | 0.27 | $ | 0.42 | $ | 0.31 | $ | 0.74 | |||||

Diluted | $ | 0.70 | $ | 0.27 | $ | 0.42 | $ | 0.31 | $ | 0.73 | |||||

Balance Sheet Data: | |||||||||||||||

(as of period end) | |||||||||||||||

Cash and Cash Equivalents | $ | 54.9 | $ | 81.6 | $ | 52.2 | $ | 51.5 | $ | 271.8 | |||||

Total Assets (a) | 4,256.1 | 4,137.6 | 4,373.1 | 4,482.0 | 4,575.8 | ||||||||||

Total Debt (a) | 1,875.5 | 1,957.7 | 2,338.3 | 2,317.8 | 2,352.4 | ||||||||||

Total Equity | 1,101.7 | 1,012.3 | 1,062.3 | 972.3 | 1,166.7 | ||||||||||

Additional Data: | |||||||||||||||

Depreciation and Amortization | $ | 280.5 | $ | 270.0 | $ | 277.4 | $ | 266.8 | $ | 278.4 | |||||

Capital Spending | 244.1 | 201.4 | 209.2 | 203.3 | 160.1 | ||||||||||

(a) As of December 31, 2015, the Company adopted Accounting Standards Update ("ASU") No. 2015-03 (ASU No. 2015-03) Interest-Imputation of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs and ASU No. 2015-17, Income Taxes(Topic 740): Balance Sheet Classification of Deferred Taxes (ASU No. 2015-17). The adoption ASU No. 2015-03 permits for retrospective reclassification of debt issuance costs previously reported in Total Assets to be presented as a direct reduction of Total Debt. The adoption of ASU No 2015-17 permits retrospective reclassification of previously reported Current Deferred Tax Assets to Deferred Tax Liabilities. All necessary reclassifications have been reflected in the table above. See Note 1 in the Notes to Consolidated Financial Statements included herein under “Item 8., Financial Statements and Supplementary Data.”

20

ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

INTRODUCTION

This management’s discussion and analysis of financial condition and results of operations is intended to provide investors with an understanding of the Company’s past performance, its financial condition and its prospects. The following will be discussed and analyzed:

Overview of Business

Overview of 2015 Results

Results of Operations

Financial Condition, Liquidity and Capital Resources

Critical Accounting Policies

New Accounting Standards

Business Outlook

OVERVIEW OF BUSINESS

The Company’s objective is to strengthen its position as a leading provider of paperboard packaging solutions. To achieve this objective, the Company offers customers its paperboard, cartons and packaging machines, either as an integrated solution or separately. Cartons and carriers are designed to protect and contain products. Product offerings include a variety of laminated, coated and printed packaging structures that are produced from the Company’s CUK and CRB, as well as other grades of paperboard that are purchased from third party suppliers. Innovative designs and combinations of paperboard, films, foils, metallization, holographics and embossing are customized to the individual needs of the customers.

Prior to the sale of the Company's multi-wall bag business on June 30, 2014, the Company was also a leading supplier of flexible packaging in North America. Flexible Packaging products included multi-wall bags, such as pasted valve, pinched bottom, sewn open mouth and woven polypropylene, and coated paper. Coated paper products included institutional french fry packaging, barrier pouch rollstock and freezer paper. Key end-markets included food and agriculture, building and industrial materials, chemicals, minerals and pet foods.

The Company is implementing strategies (i) to expand market share in its current markets and to identify and penetrate new markets; (ii) to capitalize on the Company’s customer relationships, business competencies, mills and converting assets; (iii) to develop and market innovative, sustainable products and applications; and (iv) to continue to reduce costs by focusing on operational improvements. The Company’s ability to fully implement its strategies and achieve its objectives may be influenced by a variety of factors, many of which are beyond its control, such as inflation of raw material and other costs, which the Company cannot always pass through to its customers, and the effect of overcapacity in the worldwide paperboard packaging industry.

Significant Factors That Impact The Company’s Business and Results of Operations

Impact of Inflation. The Company’s cost of sales consists primarily of energy (including natural gas, fuel oil and electricity), pine pulpwood, chemicals, secondary fibers, purchased paperboard, paper, aluminum foil, ink, plastic films and resin, depreciation expense and labor. Inflation increased year over year costs by $9.0 million in 2015 and increased year over year costs by $75.6 million in 2014. The inflation costs in 2015 primarily related to labor and benefits ($27.9 million) and wood ($6.8 million), partially offset by lower costs for chemicals ($8.4 million), energy ($10.0 million), primarily due to the price of natural gas, freight ($4.6 million), fiber ($0.8 million), external board ($0.8 million), and other ($1.1 million).

21

Because the price of natural gas experiences significant volatility, the Company has entered into contracts designed to manage risks associated with future variability in cash flows caused by changes in the price of natural gas. The Company has entered into natural gas swap contracts to hedge prices for a portion of its expected usage for 2016 and 2017. Since negotiated sales contracts and the market largely determine the pricing for its products, the Company is at times limited in its ability to raise prices and pass through to its customers any inflationary or other cost increases that the Company may incur.

Commitment to Cost Reduction. In light of consistent margin pressure throughout the packaging industry, the Company has programs in place that are designed to reduce costs, improve productivity and increase profitability. The Company utilizes a global continuous improvement initiative that uses statistical process control to help design and manage many types of activities, including production and maintenance. This includes a Six Sigma process focused on reducing variable and fixed manufacturing and administrative costs. The Company expanded its continuous improvement initiative to include the deployment of Lean Sigma principles into manufacturing and supply chain services.

The Company’s ability to continue to successfully implement its business strategies and to realize anticipated savings and operating efficiencies is subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the Company’s control. If the Company cannot successfully implement the strategic cost reductions or other cost savings plans it may not be able to continue to compete successfully against other manufacturers. In addition, any failure to generate the anticipated efficiencies and savings could adversely affect the Company’s financial results.

Competition and Market Factors. As some products can be packaged in different types of materials, the Company’s sales are affected by competition from other manufacturers’ CUK and CRB board and other paper substrates such as SBS. Additional substitute products also include plastic, shrink film and corrugated containers. In addition, while the Company has long-term relationships with many of its customers, the underlying contracts may be re-bid or renegotiated from time to time, and the Company may not be successful in renewing on favorable terms or at all. The Company works to maintain market share through efficiency, product innovation and strategic sourcing to its customers; however, pricing and other competitive pressures may occasionally result in the loss of a customer relationship.

In addition, the Company’s sales have historically been driven by consumer buying habits in the markets its customers serve. Changes in consumer dietary habits and preferences, increases in the costs of living, unemployment rates, access to credit markets, as well as other macroeconomic factors, may negatively affect consumer spending behavior. New product introductions and promotional activity by the Company’s customers and the Company’s introduction of new packaging products also impact its sales.

Debt Obligations. The Company has aggregate principal amount of $1,889.2 million of outstanding debt obligations as of December 31, 2015. This debt has consequences for the Company, as it requires a portion of cash flow from operations to be used for the payment of principal and interest, exposes the Company to the risk of increased interest rates and restricts the Company’s ability to obtain additional financing. Covenants in the Company’s Credit Agreement and Indentures also restrict, among other things, the disposal of assets, the incurrence of additional indebtedness (including guarantees), payment of dividends, loans or advances and certain other types of transactions. The Credit Agreement also requires compliance with a maximum consolidated leverage ratio and a minimum consolidated interest coverage ratio. The Company’s ability to comply in future periods with the financial covenants will depend on its ongoing financial and operating performance, which in turn will be subject to many other factors, many of which are beyond the Company’s control. See “Covenant Restrictions” in “Financial Condition, Liquidity and Capital Resources” for additional information regarding the Company’s debt obligations.

The debt and the restrictions under the Credit Agreement and Indentures could limit the Company’s flexibility to respond to changing market conditions and competitive pressures. The outstanding debt obligations and the restrictions may also leave the Company more vulnerable to a downturn in general economic conditions or its business, or unable to carry out capital expenditures that are necessary or important to its growth strategy and productivity improvement programs.

22

OVERVIEW OF 2015 RESULTS

This management’s discussion and analysis contains an analysis of Net Sales, Income from Operations and other information relevant to an understanding of the Company's results of operations.

• | Net Sales in 2015 decreased by $80.3 million or 1.9%, to $4,160.2 million from $4,240.5 million in 2014 primarily due to the sale of multi-wall bag and labels businesses in 2014, unfavorable exchange rates and lower pricing, partially offset by the North American and Benson acquisitions. |

• | Income from Operations in 2015 increased by $199.3 million or 87.5%, to $427.1 million from $227.8 million in 2014 primarily due to the loss on sale of multi-wall bag in 2014 and cost savings through continuous improvement programs, partially offset by unfavorable exchange rates, the lower pricing, and higher costs, primarily for labor and benefits. |

Acquisitions

• | On October 1, 2015, the Company acquired the converting assets of Staunton, VA-based Carded Graphics, LLC. ("Carded"), an award winning folding carton producer with a strong regional presence in the food, craft beer and other consumer product markets. |

• | On February 4, 2015, the Company completed the acquisition of certain assets of Cascades Norampac Division ("Cascades") in Canada. Cascades services the food and beverage markets and operates three folding carton converting facilities located in Cobourg, Ontario, Mississauga, Ontario and Winnipeg, Manitoba along with a thermo mechanical pulp mill located in Jonquiere, Quebec and a coated recycled board mill located in East Angus, Quebec. The Jonquiere mill was shutdown in the third quarter of 2015. |

• | On January 2, 2015, the Company acquired Rose City Printing and Packaging Inc. ("Rose City") through the purchase of all of the issued and outstanding stock of its parent company, Rose City Holding Company. Rose City services food and beverage markets and operates two folding carton converting facilities located in Gresham, OR and Vancouver, WA. The Carded, Cascades, and Rose City transactions are all referred to collectively as the "North American Acquisitions." |

Capital Allocations

• | On February 4, 2015, the Company's board of directors authorized a share repurchase program to allow management to purchase up to $250 million of the Company's issued and outstanding shares of common stock through open market purchases, privately negotiated transactions and Rule 10b5-1 plans. During 2015, the Company repurchased approximately 4.6 million shares, or approximately $63 million, of its common stock under this program at an average price of $13.60. |

• | On February 4, 2015, May 20, 2015, July 30, 2015 and November 19, 2015, the Company's board of directors declared a regular quarterly dividend of $0.05 per common share. During 2015, the Company declared and paid cash dividends of approximately $66 million and $49 million, respectively. |

23

RESULTS OF OPERATIONS

Year Ended December 31, | |||||||||

In millions | 2015 | 2014 | 2013 | ||||||

Net Sales | $ | 4,160.2 | $ | 4,240.5 | $ | 4,478.1 | |||

Income from Operations | $ | 427.1 | $ | 227.8 | $ | 341.6 | |||

Interest Expense, Net | (67.8 | ) | (80.7 | ) | (101.9 | ) | |||

Loss on Modification or Extinguishment of Debt | — | (14.4 | ) | (27.1 | ) | ||||

Income before Income Taxes and Equity Income of Unconsolidated Entities | $ | 359.3 | $ | 132.7 | $ | 212.6 | |||

Income Tax Expense | (130.4 | ) | (45.4 | ) | (67.4 | ) | |||

Income before Equity Income of Unconsolidated Entities | $ | 228.9 | $ | 87.3 | $ | 145.2 | |||

Equity Income of Unconsolidated Entities | 1.2 | 1.7 | 1.5 | ||||||

Net Income | $ | 230.1 | $ | 89.0 | $ | 146.7 | |||

2015 COMPARED WITH 2014

Net Sales

The components of the change in Net Sales are as follows:

Year Ended December 31, | |||||||||||||||||||||||

Variances | |||||||||||||||||||||||

In millions | 2014 | Price | Volume/Mix | Divestitures | Foreign Exchange | 2015 | Increase (Decrease) | Percent Change | |||||||||||||||

Consolidated | $ | 4,240.5 | $ | (15.6 | ) | $ | 265.9 | $ | (221.6 | ) | $ | (109.0 | ) | $ | 4,160.2 | $ | (80.3 | ) | (1.9 | )% | |||

The Company's Net Sales in 2015 decreased by $80.3 million or 1.9%, to $4,160.2 million from $4,240.5 million for the same period in 2014. Excluding net sales of the divestitures of the Company's multi-wall bag and label businesses in 2014 of $221.6 million, net sales increased $141.3 million. The increase was due primarily to the North American and Benson Acquisitions of approximately $303.3 million, partially offset by unfavorable foreign currency exchange rates of $109.0 million, lower pricing due to deflationary cost pass throughs and settlements. Volumes were even with prior year as decreases due to the continuation of soft demand in key markets for certain consumer products, primarily cereal and frozen and dry foods, were offset by new products. Global beverage volumes were essentially even with prior year as declines in soft drink and big beer were offset by increases in craft beer, specialty beverage (energy drinks and teas) and open market beverage. The unfavorable currency impact was primarily in Europe and the United Kingdom.

Income (Loss) from Operations

The components of the change in Income (Loss) from Operations are as follows:

24

Year Ended December 31, | |||||||||||||||||||||||||||||

Variances | |||||||||||||||||||||||||||||

In millions | 2014 | Price | Volume/Mix | Divestitures | Inflation | Foreign Exchange | Other (a) | 2015 | Increase (Decrease) | Percent Change | |||||||||||||||||||

Consolidated | $ | 227.8 | $ | (15.6 | ) | $ | 12.1 | $ | 178.9 | $ | (9.0 | ) | $ | (29.2 | ) | $ | 62.1 | $ | 427.1 | $ | 199.3 | 87.5 | % | ||||||

(a) | Includes the Company’s cost reduction initiatives, combination-related expenses and sale of businesses. |

The Company's Income from Operations for 2015 increased $199.3 million or 87.5%, to $427.1 million from $227.8 million for the same period in 2014 primarily due to the loss on sale of multi-wall bag in 2014, cost savings through continuous improvement programs as well as general and administrative cost savings following the divestitures in 2014 and lower integration costs and synergies related to the Benson Acquisition. These increases were partially offset by unfavorable foreign currency exchange rates, inflation and the lower pricing. The inflation costs in 2015 primarily related to labor and benefits ($27.9 million) and wood ($6.8 million), partially offset by lower costs for chemicals ($8.4 million), energy ($10.0 million), primarily due to the price of natural gas, freight ($4.6 million), fiber ($0.8 million), external board ($0.8 million), and other ($1.1 million).

Interest Expense, Net

Interest Expense, Net decreased by $12.9 million to $67.8 million in 2015 from $80.7 million in 2014. Interest Expense, Net decreased due to both lower total debt levels and lower interest rates on the Company’s debt. As of December 31, 2015, approximately 34% of the Company’s total debt was subject to floating interest rates.

Income Tax Expense

During 2015, the Company recognized Income Tax Expense of $130.4 million on Income before Income Taxes and Equity Income of Unconsolidated Entities of $359.3 million. During 2014, the Company recognized Income Tax Expense of $45.4 million on Income before Income Taxes and Equity Income of Unconsolidated Entities of $132.7 million. The effective tax rate for 2015 was different than the statutory rate primarily due to the mix and levels between foreign and domestic earnings, including losses in jurisdictions with full valuation allowances, as well as the effects of certain discrete tax items. The Company has NOLs of approximately $470 million for U.S. federal income tax purposes, which may be used to offset future taxable income.

Equity Income of Unconsolidated Entities

Equity Income of Unconsolidated Entities was $1.2 million in 2015 and $1.7 million in 2014 and is related to the Company’s equity investment in the joint venture, Rengo Riverwood Packaging, Ltd.

25

2014 COMPARED WITH 2013

Net Sales

The components of the change in Net Sales are as follows:

Year Ended December 31, | |||||||||||||||||||||||

Variances | |||||||||||||||||||||||

In millions | 2013 | Price | Volume/Mix | Divestitures | Foreign Exchange | 2014 | Increase (Decrease) | Percent Change | |||||||||||||||

Consolidated | $ | 4,478.1 | $ | 78.1 | $ | 75.2 | $ | (388.1 | ) | $ | (2.8 | ) | $ | 4,240.5 | $ | (237.6 | ) | (5.3 | )% | ||||

The Company’s Net Sales in 2014 decreased by $237.6 million, or 5.3% to $4,240.5 million from $4,478.1 million in 2013. The decrease was due primarily to the sale of the Company's multi-wall bag and labels businesses in 2014 and the specialty plastics and URB mill in 2013, representing approximately $388.1 million of the decrease in net sales, and lower volume in the consumer product and beverage markets. In the beverage markets, brand name beer sales were down partially offset by increases at the craft brewers. Soft drink sales also decreased in 2014 although to a lesser extent than beer. Declines in the market demand for frozen foods, cereal and dry foods resulted in lower volumes for consumer products. These decreases were partially offset by an increase of approximately $115 million due to the Benson acquisition and higher pricing due to inflationary cost past throughs. New product introductions in both beverage and consumer products also helped offset market related volume declines.

26

Income (Loss) from Operations

The components of the change in Income (Loss) from Operations are as follows:

Year Ended December 31, | |||||||||||||||||||||||||||||

Variances | |||||||||||||||||||||||||||||

In millions | 2013 | Price | Volume/Mix | Divestitures | Inflation | Foreign Exchange | Other(a) | 2014 | Increase (Decrease) | Percent Change | |||||||||||||||||||

Consolidated | $ | 341.6 | $ | 78.1 | $ | (2.5 | ) | $ | (14.5 | ) | $ | (75.6 | ) | $ | (5.2 | ) | $ | (94.1 | ) | $ | 227.8 | $ | (113.8 | ) | (33.3 | )% | |||

(a) | Includes the Company’s cost reduction initiatives and integration related expenses. |

The Company’s Income from Operations in 2014 decreased by $113.8 million, or 33.3%, to $227.8 million from $341.6 million in 2013. The decrease was due primarily to the loss on the sale of the multi-wall bag and labels businesses, the first quarter impact of severe weather and related power outages resulting in lost production, higher manufacturing and freight costs, charges related to acquisition and integration activities, and inflation. Inflation during the period was primarily related to higher labor and benefits ($33.8 million), energy ($13.2 million), externally purchased board ($11.4 million), wood ($7.0 million), inks and coatings ($3.7 million) freight ($2.5 million) and other costs ($0.5 million), partially offset by lower secondary fiber costs ($2.5 million). These decreases were partially offset by higher pricing, the Benson Acquisition, synergies in Europe, the gain on the sale of the flexible plastics business and cost savings through continuous improvement programs and manufacturing initiatives.

Interest Expense, Net