Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - WESTMORELAND COAL Co | exh99-2_8k021016.htm |

| 8-K - 8-K - WESTMORELAND COAL Co | f8k_021016i701.htm |

WESTMORELAND COAL COMPANY February 4, 2016 Westmoreland Coal Company Update NASDAQ:WLB NYSE:WMLP westmoreland.com westmorelandmlp.com

1 WESTMORELAND COAL COMPANY This presentation contains “forward-looking statements.” Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects” and similar references to future periods. Examples of forward-looking statements include, but are not limited to, statements we make throughout this presentation regarding recent acquisitions and their anticipated effects on us. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. We therefore caution you against relying on any of these forward-looking statements. They are statements neither of historical fact nor guarantees or assurances of future performance. Important factors that could cause actual results to differ materially from those in the forward-looking statements include political, economic, business, competitive, market, weather and regulatory conditions and the following: Our ability to manage Westmoreland Resource Partners, LP (“WMLP”); Our efforts to effectively integrate recently acquired operations (including San Juan, Canadian and Ohio operations) with our existing business and our ability to manage our expanded operations following the acquisition; Our ability to realize growth opportunities and cost synergies as a result of the addition of operations and across our existing operations; Our substantial level of indebtedness; Declines in the export prices for coal, including its effects on our Coal Valley mine; The ability of our hedging arrangement with respect to our Roanoke Valley Power Facility (“ROVA”) to generate free cash flow due to the fully hedged position through March 2019; Changes in our post-retirement medical benefit and pension obligations and the impact of the recently enacted healthcare legislation on our employee health benefit costs; Inaccuracies in our estimates of our coal reserves; Our potential inability to expand or continue current coal operations due to limitations in obtaining bonding capacity for new mining permits, or increases in our mining costs as a result of increased bonding expenses; The effect of prolonged maintenance or unplanned outages at our operations or those of our major power generating customers; The inability to control costs, recognize favorable tax credits or receive adequate train traffic at our open market mine operations; Competition within our industry and with producers of competing energy sources; Existing and future laws including legislation, regulations and court judgments or orders affecting both our coal mining operations and our customers’ coal usage, governmental policies and taxes, including those aimed at reducing emissions of elements such as mercury, sulfur dioxides, nitrogen oxides, particulate matter or greenhouse gases; The effect of the Environmental Protection Agency’s and Canadian and provincial governments’ inquiries and regulations on the operations of the power plants to which we provide coal; and Other factors that are described under the heading “Risk Factors” in our reports filed with the Securities and Exchange Commission, including our Annual Reports on Form 10-K and our Quarterly Reports on Form 10-Q. Unless otherwise specified, the forward-looking statements in this presentation speak as of the date of this presentation. Factors or events that could cause our actual results to differ may emerge from time-to-time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statements, whether because of new information, future developments or otherwise, except as may be required by law. Reserve engineering is a process of estimating underground accumulations of coal that cannot be measured in an exact way. The accuracy of any reserve estimate depends on the quality of available data, the interpretation of such data and price and cost assumptions made by our reserve engineers. In addition, the results of mining, testing and production activities may justify revision of estimates that were made previously. If significant, such revisions would change the schedule of any further production and development of reserves. Accordingly, reserve estimates may differ from the quantities of coal that are ultimately recovered. Forward Looking Statements

2 WESTMORELAND COAL COMPANY San Juan Mine

3 WESTMORELAND COAL COMPANY Source: Company filings, SNL Longwall underground mine adjacent to power plant customer Surface operations began in 1973 and transitioned to underground in 2002 Current reserves of 23 Mst; 148 Mst of resources Coal hauled via conveyor from underground working faces to the surface stackout A truck and loader fleet moves coal to crushing facilities or stockpiles for blending Westmoreland Completes San Juan Mine Acquisition OVERVIEW LOCATION 491 64 64 64 64 550 550 491 Shiprock Farmington Bloomfield Aztec Cedar La Plata Mine San Juan Underground Mine San Juan Surface Mine Four Corners Power Plant San Juan Generating Station San Juan Mine Business Update and Guidance Westmoreland assumed operations on February 1, 2016 Marks beginning of the coal supply agreement Total purchase price of $127 million subject to post-closing working capital adjustments Purchase price reduction for January cash flow offset by normal royalty and prepaid payments made prior to close Financing provided to Westmoreland subsidiary through a ring fenced $125 million loan 100% of net cash flow from the operation goes towards paying down the loan Interest rate escalates over term; weighted average of 10% plus LIBOR [first twelve months is 7.25% plus LIBOR] Bankruptcy remote structure provides for no impact to Westmoreland’s current debt arrangements Arrangement allows for early repayment with no penalties TRANSACTION SUMMARY

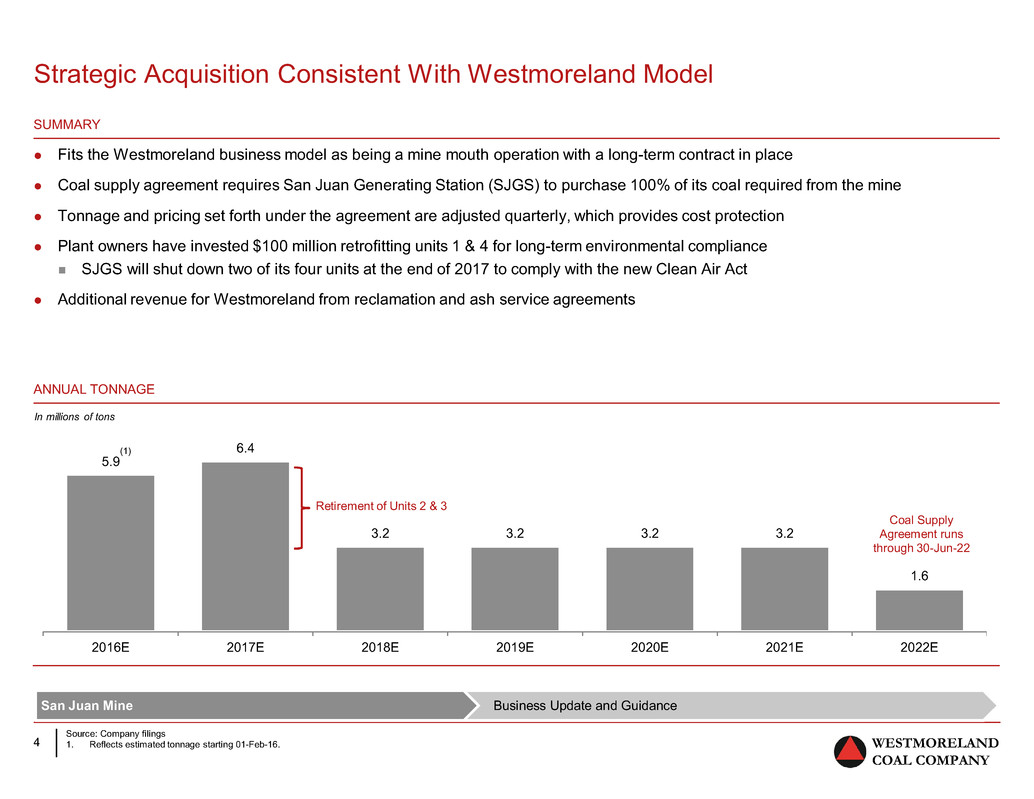

4 WESTMORELAND COAL COMPANY Source: Company filings 1. Reflects estimated tonnage starting 01-Feb-16. Strategic Acquisition Consistent With Westmoreland Model Fits the Westmoreland business model as being a mine mouth operation with a long-term contract in place Coal supply agreement requires San Juan Generating Station (SJGS) to purchase 100% of its coal required from the mine Tonnage and pricing set forth under the agreement are adjusted quarterly, which provides cost protection Plant owners have invested $100 million retrofitting units 1 & 4 for long-term environmental compliance SJGS will shut down two of its four units at the end of 2017 to comply with the new Clean Air Act Additional revenue for Westmoreland from reclamation and ash service agreements SUMMARY ANNUAL TONNAGE In millions of tons (1) 5.9 6.4 3.2 3.2 3.2 3.2 1.6 2016E 2017E 2018E 2019E 2020E 2021E 2022E Coal Supply Agreement runs through 30-Jun-22 Retirement of Units 2 & 3 San Juan Mine Business Update and Guidance (1)

5 WESTMORELAND COAL COMPANY Business Update and Guidance

6 WESTMORELAND COAL COMPANY Consolidated Full Year Estimates San Juan Mine Business Update and Guidance 2015 results expected to be within range of revised guidance provided in October 2015 Estimate is preliminary and subject to change due to non-cash actuarial adjustments 2016 guidance inclusive of San Juan acquisition Guidance issued Oct 2015 Coal Sales (Mst) 54.0 - 56.0 53.0 - 60.0 Adjusted EBITDA (US$ mm) $215 - $225 $235 - $275 Capex $70 - $75 $59 - $71 Reclamation, Def. Revenue, OPEB $25 - $34 $26 - $34 Cash Interest $68 $90 Free Cash Flow $48 - $52 $60 - $80 2015 2016

7 WESTMORELAND COAL COMPANY WESTMORELAND COAL COMPANY WESTMORELAND RESOURCE PARTNERS WESTMORELAND SAN JUAN, LLC Coal Sales (Mst) 42.0 - 46.0 6.0 - 8.0 5.0 - 6.0 53.0 - 60.0 Adjusted EBITDA (US$ mm) $135 - $150 $60 - $75 $40 - $50 $235 - $275 Capex $41 - $45 $15 - $19 $3 - $7 $59 - $71 Reclamation, Def. Revenue, OPEB $21 - $27 $5 - $7 -- $26 - $34 Cash Interest $55 $28 $7 $90 Free Cash Flow $18 - $23 $12 - $21 $30 - $36 $60 - $80 2016 Guidance by Entity San Juan Mine Business Update and Guidance Includes ~$20 to $25 million in negative cash flows from non-core assets Midpoint loss of $12.5 million for Coal Valley – Take or pay rail & port contracts end in 2017 Midpoint loss of $10.0 million for ROVA – Agreements expire in Q1 2019

8 WESTMORELAND COAL COMPANY $252 $10 $210 $45 ($8) ($2) $255 ($25) ($10) ($7) Original Guidance (Feb 2015) Newcastle Pricing (Coal Valley) Northern App Pricing (Ohio) Beulah Contract Expiration Reduced Canadian Sales & Capital Recovery PJM Power Pricing (ROVA) Fuel Savings and Other Base Business excl. San Juan San Juan 2016 Guidance Note: Shown in US$ millions. 1. Midpoint of original 2015 guidance range. 2. Midpoint of 2016 guidance range. EBITDA Bridge from 2015 to 2016 Guidance (1) (2) San Juan Mine Business Update and Guidance

9 WESTMORELAND COAL COMPANY 2016 Objectives Integrate San Juan Mine into Westmoreland operations Maximize free cash flow through base business operating model Optimize dragline, shovel and mobile fleet performance Take advantage of leasing opportunities Reduce corporate and administrative costs Monetize working capital balances (restricted cash, inventory) Use free cash flow to pay down debt Minimize the impact of and evaluate opportunities for non-core assets Coal Valley Mine ROVA Power Facility San Juan Mine Business Update and Guidance