Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ASSOCIATED BANC-CORP | form8-kcoverpage.htm |

INVESTOR PRESENTATION FIRST QUARTER 2016 ASSOCIATED BANC-CORP

FORWARD-LOOKING STATEMENTS Important note regarding forward-looking statements: Statements made in this presentation which are not purely historical are forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995. This includes any statements regarding management’s plans, objectives, or goals for future operations, products or services, and forecasts of its revenues, earnings, or other measures of performance. Such forward-looking statements may be identified by the use of words such as “believe”, “expect”, “anticipate”, “plan”, “estimate”, “should”, “will”, “intend”, “outlook”, or similar expressions. Forward-looking statements are based on current management expectations and, by their nature, are subject to risks and uncertainties. Actual results may differ materially from those contained in the forward-looking statements. Factors which may cause actual results to differ materially from those contained in such forward-looking statements include those identified in the Company’s most recent Form 10-K and subsequent SEC filings. Such factors are incorporated herein by reference. Trademarks: All trademarks, service marks, and trade names referenced in this material are official trademarks and the property of their respective owners. 1

Loans2 Deposits2 WI 36% IL 24% MN 11% In Footprint3 11% Other 18% 1861 OUR FOOTPRINT AND FRANCHISE Company YE 2015 Headquarters: Green Bay, WI Employees: ~4,400 Branches: 215 Fastest growing bank in Wisconsin1 Financials YE 2015 Assets: Over $27 billion Loans: $19 billion Deposits: $21 billion Revenue: $1 billion Business Full range of banking services, insurance, and other financial solutions Serving over one million customers in over 100 communities Extensive affinity programs featuring the Green Bay Packers, Milwaukee Brewers, and Minnesota Wild 1 – FDIC 2015 U.S. Bank Branch Summary of Deposits; growth rates from June 30, 2014 to June 30, 2015 2 – Period end as of December 31, 2015; Loan pie chart excludes $0.4 billion installment and credit card portfolio 3 – Includes Missouri, Indiana, Ohio, Michigan and Iowa 2 WI 65% IL 28% MN 7%

ASB Mortgage Portfolio FICO Score3 ATTRACTIVE MIDWEST MARKETS 3.4% 3.5% 4.3% 4.4% 4.7% 5.0% IA MN WI IN OH National Average Midwest holds ~30% of all U.S. manufacturing jobs2 1 – U.S. Census Bureau, Annual Estimates of the Resident Population, 2015 2 – U.S. Bureau of Labor Statistics, Manufacturing Industry Employees, December 2015 3 – Weighted average of the December 31, 2015 principal balance and borrowers’ FICO score retrieved in October 2015 4 – U.S. Bureau of Labor Statistics, Total Nonfarm Employees, December 2015 Midwest holds ~20% of the U.S. population1 Large, Centrally Located Demographic Base Manufacturing Centric Strong Consumer Credit Low Unemployment Rates4 3 770

Enhanced Customer Experience Organic Balance Sheet Growth Diverse Business Lines Disciplined Credit Approach Expense Control Prudent Capital Management 1. We are committed to providing efficient solutions that improve each customer’s experience and which help them better manage their finances across multiple platforms 2. We are focused on organically expanding our relationships, with existing and new customers, across our Upper Midwest footprint and in select national businesses 3. We have a diverse set of loan and fee-based businesses which should produce balanced revenue streams through the cycle 4. We have robust internal portfolio management controls, ensuring we grow loan exposures in a balanced and diversified manner over time 5. We continue to invest in our businesses while containing and controlling expenses 6. We prudently and efficiently deploy capital 1 2 3 4 5 6 MANAGEMENT PRIORITIES 4 Driving Long-Term Shareholder Value Creation

ROBUST AFFINITY PROGRAMS ENHANCED CUSTOMER EXPERIENCE CHALLENGER PHILOSOPHY We have pursued an ambitious agenda to differentiate Associated Bank We are focused on removing barriers that stand in the way of delivering a great customer experience We share compelling messages to invite consumers and business owners to challenge their bank and begin a new relationship with Associated Bank We connect with customers by tapping into their hobbies, interests, and passions from sports to arts entertainment We connect with customers and prospects through unique, interactive game-day experiences, social media campaigns, and client and community events 5 All trademarks, service marks, and trade names referenced in this material are official trademarks and the property of their respective owners.

MULTI- CHANNEL INITIATIVES ENHANCED CUSTOMER EXPERIENCE OUTSTANDING CUSTOMER SERVICE Our Wisconsin-based customer care team supports all business lines 24/7, 365 days a year We believe that providing extraordinary service leads to customer satisfaction and loyalty We deliver financial products and services through efficient, seamless, multi-channel experiences We are constantly evolving our digital delivery model to meet the changing preferences of our customers We seek to engage with our customers in their preferred medium—in person, calls, online, chats, emails, and social media 6 J.D. Power 2015 Certified Contact Center Program SM recognition is based on successful completion of an audit and exceeding a customer satisfaction benchmark through a survey of recent servicing interactions. For more information, visit www.jdpower.com/ccc.

Changing customer preferences has driven our continued investment in digital platforms ATMs, direct deposit activity, and mobile and online bill pay (ACH and wire) account for the vast majority of our customers’ deposit and withdrawal activity EVOLVING DELIVERY MODEL 7 Jan 12 Dec 15 Jan 12 Dec 15 Jan 12 Dec 15 Jan 12 Dec 15 Branch – Deposit and Withdrawal Activity Check Processing ATM – Deposit and Withdrawal Activity ACH and Wire Activity

ORGANIC LOAN GROWTH (AVERAGE BALANCES, $ IN BILLIONS) $2.1 $1.8 $1.6 $1.5 $1.5 $3.9 $4.4 $4.6 $4.9 $5.5 $3.0 $3.4 $3.7 $4.0 $4.2 $4.3 $5.1 $5.8 $6.5 $7.0 2011 2012 2013 2014 2015 Home Equity & Installment Residential Mortgage Commercial Real Estate Commercial & Business $18.3 $15.7 $16.8 $14.7 $13.3 8 Cumulative Change +$2.7 billion, +64% +$1.2 billion, +42% +$1.6 billion, +42% ($0.6 billion), (30%)

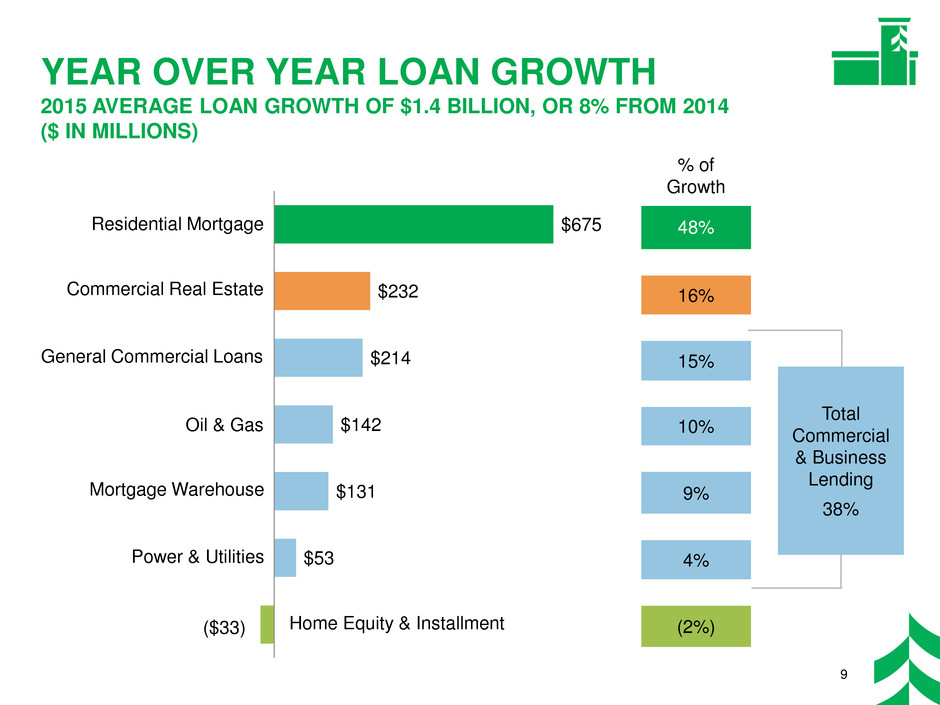

($33) $53 $131 $142 $214 $232 $675 YEAR OVER YEAR LOAN GROWTH 2015 AVERAGE LOAN GROWTH OF $1.4 BILLION, OR 8% FROM 2014 ($ IN MILLIONS) Home Equity & Installment Power & Utilities Oil & Gas Mortgage Warehouse Residential Mortgage Commercial Real Estate General Commercial Loans % of Growth 48% 16% 15% 10% 9% 4% (2%) 9 Total Commercial & Business Lending 38%

$2.9 $2.2 $1.8 $1.6 $1.6 $3.4 $3.9 $4.2 $4.2 $4.5 $1.0 $1.1 $1.2 $1.2 $1.3 $1.9 $2.1 $2.8 $3.0 $3.2 $5.1 $6.1 $7.3 $7.6 $9.2 2011 2012 2013 2014 2015 Money market deposits Interest-bearing demand deposits Savings deposits Noninterest-bearing demand deposits Time deposits ORGANIC DEPOSIT GROWTH (AVERAGE BALANCES, $ IN BILLIONS) Cumulative Change $4.1 billion, +79% $1.3 billion, +64% +$0.3 billion, +35% +$1.2 billion, +34% ($1.3 billion), (45%) 10 $14.4 $15.6 $17.4 $17.6 $19.9 Fastest growing bank in Wisconsin1 1 – FDIC 2015 U.S. Bank Branch Summary of Deposits; growth rates from June 30, 2014 to June 30, 2015

$737 $26 $87 $107 $329 $969 Network transaction deposits Time deposits Savings deposits Interest-bearing demand deposits Noninterest-bearing demand deposits Money market deposits YEAR OVER YEAR DEPOSIT GROWTH 2015 AVERAGE GROWTH OF $2.3 BILLION, OR 13% FROM 2014 ($ IN MILLIONS) % of Growth 43% 15% 5% 4% <1% 33% 11 Net Customer Deposits 67%

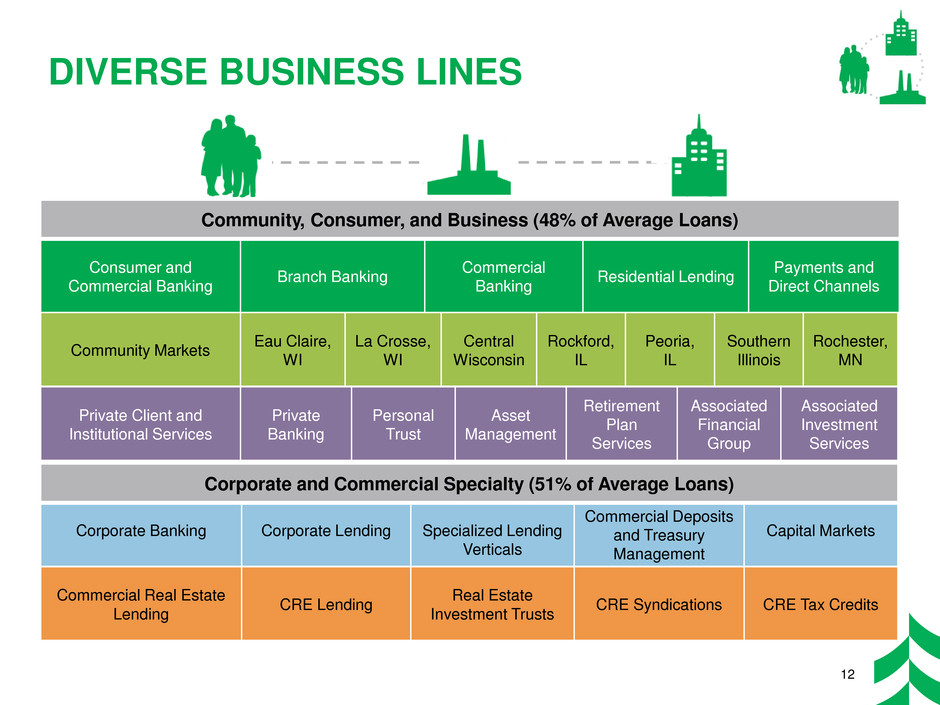

Consumer and Commercial Banking Branch Banking Commercial Banking Residential Lending Payments and Direct Channels Community Markets Eau Claire, WI La Crosse, WI Central Wisconsin Rockford, IL Peoria, IL Southern Illinois Rochester, MN Private Client and Institutional Services Private Banking Personal Trust Asset Management Retirement Plan Services Associated Financial Group Associated Investment Services Corporate Banking Corporate Lending Specialized Lending Verticals Commercial Deposits and Treasury Management Capital Markets Commercial Real Estate Lending CRE Lending Real Estate Investment Trusts CRE Syndications CRE Tax Credits Community, Consumer, and Business (48% of Average Loans) Corporate and Commercial Specialty (51% of Average Loans) DIVERSE BUSINESS LINES 12

Insurance commissions 23% Service charges on deposit accounts 20% Card-based and other nondeposit fees 15% Trust service fees 15% Mortgage banking, net 10% Brokerage and annuity commissions 5% Capital market fees, net 3% Other2 9% Commercial and business lending 29% Commercial real estate lending 19% Residential mortgage 23% Investments and other 20% Retail 9% BALANCED REVENUE STREAMS 1 – Interest Income on a fully tax-equivalent basis 2 – Other includes Bank owned life insurance income; Asset gains, net; Investment securities gains, net; and Other 13 $774 million 70% $328 million 30% 2015 Interest Income Composition1 2015 Noninterest Income Composition

Asset Class Mix YE 2009 Asset Class Mix YE 2015 DISCIPLINED CREDIT APPROACH 14 Asset Class Target Range Retail: 30 - 40% C&BL: 30 - 40% CRE: 25 - 35% Year End 2015 Retail: 39% C&BL: 38% CRE: 23% Geography Focused on in-footprint growth, and select national specialty businesses and markets Industry Industry and property type caps ensure granular diversification Internal Portfolio Management P ur po se fu l D iv er si fic at io n Residential mortgage 19% Home equity 13% Installment 6% CRE investor 18% Real estate construction 10% Commercial and business 34% Residential mortgage 31% Home equity 6% Installment 2% CRE investor 17% Real estate construction 6% Commercial and business 38%

C&BL by Industry CRE by Industry Residential Mortgage by Geography ($7.1 billion) ($4.4 billion) ($5.8 billion) Manufacturing 20% Other 11% Oil & Gas 11% Finance & Insurance 11% Real Estate 10% Wholesale Trade 9% Power & Utilities 10% Retail Trade 4% Health Care and Soc. Assist. 5% Profsnl, Scientific, and Tech Svs 4% Rental and Leasing Svs 3% Transport. and Whsing 2% Wisconsin 30% Illinois 15% Minnesota 10% Texas2 11% In-Footprint1 8% Other 26% C&BL by State ($7.1 billion) Multi-Family 21% Office / Mixed Use 20% Construction 27% Retail 19% Industrial 6% Other 3% Hotel / Motel 4% CRE by State ($4.4 billion) Wisconsin 33% Illinois 22% Minnesota 9% In Footprint1 23% Texas 2% Other 11% Wisconsin 39% Illinois 38% Minnesota 14% In- Footprint1 8% Other 1% Home Equity by State ($1.0 billion) Wisconsin 67% Illinois 18% Minnesota 13% Other 2% 1 – Includes Missouri, Indiana, Ohio, Michigan and Iowa 2 – Principally reflects the oil and gas portfolio C&BL by Geography CRE by Geography ome Equity by Geography ($7.1 billion) ($4.4 billion) ($1.0 billion) LOANS BY INDUSTRY AND STATE DECEMBER 2015 PERIOD END BALANCES 15

OIL AND GAS PORTFOLIO $754 $780 $757 $758 $752 2.26% 3.46% 3.43% 3.83% 5.58% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% $500 $550 $600 $650 $700 $750 $800 4Q 2014 1Q 2015 2Q 2015 3Q 2015 4Q 2015 Period End Oil & Gas Loans Related Reserves % ($ in millions) Borrowing base redeterminations are performed at least twice per year ‒ Based on detailed engineering reports and discounted cash flow forecast analysis We proactively risk grade and reserve accordingly against our loan portfolio Lower market pricing has led to downward rating migration within the portfolio Increased reserves to $42 million at year end Portfolio Mix Underwriting ~$1 billion in exposure 4% of total loans Approximately 50 credits ~40% of exposure is private- equity sponsored Exclusively focused on the upstream sector Exposure is approximately 65% oil and 35% gas1 100% of loans are reserve secured ~96% of exposure is in shared national credits 1 – Based on borrowers’ percentage revenue from oil/gas 16

$360 $381 $397 $390 $391 $14 $52 $67 $75 $80 $84 $241 $227 $209 $209 $208 2011 2012 2013 2014 2015 Other Technology and Equipment Personnel - Acquisition Personnel - Legacy 71% 71% 69% 69% 68% Branch Closures & Staffing Initiatives Enhanced Automation Operational Efficiencies Technology Investments Compliance Branch Upgrades Marketing Investments Talent Acquisition Fully Tax-Equivalent Efficiency Ratio1 2015 = 68% Goal = Peer Average or Better Fully Tax-Equivalent Efficiency Ratio1 1 – The fully tax-equivalent efficiency ratio is a non-GAAP financial measure, which we define as noninterest expense (which includes the provision for unfunded commitments), excluding other intangible amortization, divided by the sum of fully tax-equivalent net interest income plus noninterest income, excluding investment securities gains / losses, net. Please refer to the appendix for a reconciliation of this measure to “efficiency ratio” as defined by the Federal Reserve. $653 $675 $681 $679 $697 EXPENSE CONTROL 17

Funding Organic Growth Paying a Competitive Dividend Non-organic Growth Opportunities Share Buybacks and Redemptions PRUDENT CAPITAL MANAGEMENT Prudent capital management has brought capital into our target CET1 range of 8.0% - 9.5% Well positioned for changing economic cycles and future challenges In January 2016, repurchased ~$20 million of common stock In February 2016, expect to retire $430 million of senior debt; prefunded redemption in 2014 12.2% 11.6% 11.5% 9.7% 9.5% 6.7% 9.5% 9.8% 9.9% 9.9% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 2011 2012 2013 2014 2015 Chart Title CET1 ROCET1 ROATCE 2011 2012 2013 2014 2015 $0.04 $0.23 $0.33 $0.37 $0.41 6% 23% 30% 32% 34% Dividends and Dividend Payout Ratio2 18 1 2 3 4 1 – Return on average common equity Tier 1 (ROCET1) and return on average tangible common equity (ROATCE). Management considers these financial measures to be critical metrics with which to analyze and evaluate financial condition and capital strength. These are non-GAAP financial measures. Please refer to the appendix for a reconciliation of average tangible common equity and common equity Tier 1. 2 – Ratio is based upon basic earnings per common share 1 1

2016 OUTLOOK Balance Sheet High single digit annual average loan growth Maintain Loan to Deposit ratio under 100% Net Interest Margin Modest upward trend, assuming additional Federal Reserve action to raise rates Noninterest Income Flat to prior year, excluding investment securities gains Non Noninterest Expense Approximately flat to prior year Capital Continue to follow stated corporate priorities for capital deployment Provision Expected to increase with loan growth and changes in risk grade or other indications of credit quality 19

APPENDIX

CONSUMER AND COMMERCIAL BANKING Nearly 1,900 colleagues servicing individuals and small business owners across four business units; approximately a $7 billion loan portfolio Branch Banking offers simplified customer solutions across multiple channels with best-in-class customer service Commercial Banking provides business customers, with $30 million or less in annual revenue, a comprehensive suite of financial and risk management solutions Residential Lending ranked as Wisconsin’s top mortgage originator for the 7th year in a row and has been recognized as a Fannie Mae STAR performer Payments and Direct Channels offers a variety of digital payment solutions to help customers better manage their finances Strategic Advantages 2015 Highlights Strong digital adoption; mobile banking use is up 35% year- over-year Consolidated 13 additional branches; now down over 30% from peak One in three consumer checking households is tied to one of our sports sponsorships In 2015, approximately 55% of all consumer checking accounts opened were tied to one of our sponsorships In addition to offering affinity products, Associated became the bank of the Green Bay Packers in 1919; and, we have long-term relationships with the Milwaukee Brewers and Minnesota Wild for commercial banking and employee benefits, respectively 21 All trademarks, service marks, and trade names referenced in this material are official trademarks and the property of their respective owners. Spotlight: Affinity Sponsorships

Rochester La Crosse Rockford Peoria COMMUNITY MARKETS Over 350 colleagues support our seven community markets; nearly a $1 billion loan portfolio Launched in mid 2014, our strategy created virtual community banks with our full suite of financial and risk management solutions in non-metro markets The localized approach ensures the customer experience is at the forefront of decisions and actions Community market presidents are positioned as active community partners and financial leaders Community market presidents have previously held market leadership positions including: senior business leaders, community market presidents, and community bank executives Strategic Advantages 2015 Highlights In 2015, grew deposits by 7% Significant team build out including five of seven community market presidents 22 Southern Illinois Eau Claire Central WI

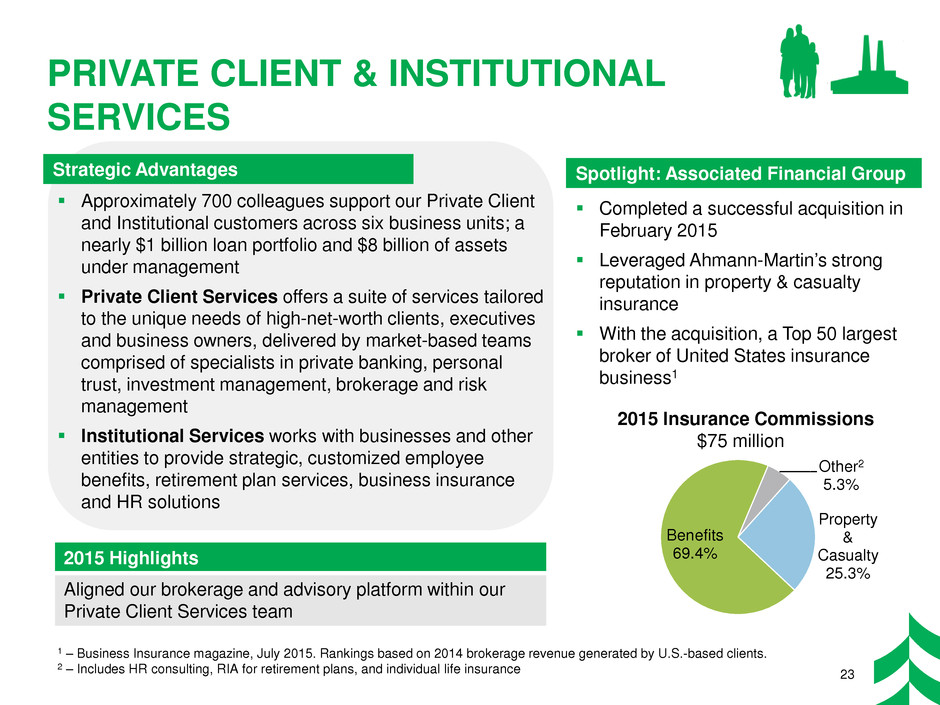

PRIVATE CLIENT & INSTITUTIONAL SERVICES Approximately 700 colleagues support our Private Client and Institutional customers across six business units; a nearly $1 billion loan portfolio and $8 billion of assets under management Private Client Services offers a suite of services tailored to the unique needs of high-net-worth clients, executives and business owners, delivered by market-based teams comprised of specialists in private banking, personal trust, investment management, brokerage and risk management Institutional Services works with businesses and other entities to provide strategic, customized employee benefits, retirement plan services, business insurance and HR solutions Strategic Advantages 2015 Highlights Aligned our brokerage and advisory platform within our Private Client Services team Spotlight: Associated Financial Group Completed a successful acquisition in February 2015 Leveraged Ahmann-Martin’s strong reputation in property & casualty insurance With the acquisition, a Top 50 largest broker of United States insurance business1 2015 Insurance Commissions $75 million Property & Casualty 25.3% Benefits 69.4% Other2 5.3% 23 1 – Business Insurance magazine, July 2015. Rankings based on 2014 brokerage revenue generated by U.S.-based clients. 2 – Includes HR consulting, RIA for retirement plans, and individual life insurance

Treasury and Capital Market Solutions Receivables, Payables, Fraud Protection, Information and Card Services International Trade Services, Interest Rate and Commodity Derivatives, Syndications, Foreign Exchange Specialized Lending Solutions Financial Institutions Mortgage Warehouse Healthcare Oil & Gas Insurance Power & Utilities Asset Based Lending Leasing Geography Green Bay Milwaukee Madison Minneapolis Chicago St. Louis Indianapolis Columbus Cincinnati Houston CORPORATE BANKING Approximately 250 colleagues in four business units; a nearly $5.5 billion loan portfolio Creative, relationship-oriented teams build loyal, long- lasting client relationships and deliver a consistent, thoughtful credit approach Corporate Lending serves large and complex customers, including Specialized Industries Commercial Deposits and Treasury Management and Capital Markets provide products and solutions focused on customer needs and supported by high- touch, in-market service Strategic Advantages 2015 Highlights Opened a new Commodities Desk to service our Oil & Gas clients Expanded our investment banking referral capabilities #1 Bookrunner in Reuters League Tables for CRE transactions under $75 million (11th for all transactions) 1 Spotlight: Comprehensive Solutions 24 1 – Rank by number of deals less than $75 million (equal credit to all bookrunners), Thomson Reuters League Table Results

COMMERCIAL REAL ESTATE LENDING Approximately a $4 billion diversified lending platform, including Real Estate Investment Trust, For-Sale Housing and Tax Credit Financing, and supported by over 100 colleagues Customized real estate financing provided by local and experienced lending teams Relationship-focused customer strategy with complementary products and services including syndications, derivatives, commercial deposit and treasury management, and insurance Strategic Advantages 2015 Highlights The Real Estate Investment Trust lending business grew average balances by approximately $250 million Opened loan production offices in Cleveland and Dallas #1 Bookrunner in Reuters League Tables for CRE transactions under $75 million (11th for all transactions)1 1 – Rank by number of deals less than $75 million (equal credit to all bookrunners), Thomson Reuters League Table Results Spotlight: 25 Geography Green Bay Milwaukee Madison Minneapolis Chicago St. Louis Indianapolis Detroit Cincinnati Cleveland Dallas Specialized Lending Solutions Construction Financing Real Estate Investment Trust Tax Credit Financing For Sale Housing Customized Solutions

$613 $626 $646 $681 $676 2011 2012 2013 2014 2015 Net Interest Income 4.27% 3.98% 3.78% 3.60% 3.37% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% $140 $144 $148 $153 $157 $161 $165 $169 $174 $178 3.26% 3.30% 3.17% 3.08% 2.84% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% $- $4 $8 $12 $16 $20 $24 $28 $32 $36 $40 $44 $48 $52 $56 $60 $64 $68 $72 $76 $80 $84 $88 $92 $96 $1 0 $104 $108 $112 $116 $120 $124 $128 $132 $136 $140 $144 $148 $152 $156 $160 $164 $168 $172 $176 $180 3.70% 3.50% 3.32% 3.14% 4Q 2011 4Q 2012 4Q 2013 4Q 2014 4Q 2015 ($ in millions) 0.53% 0.30% 0.22% 0.20% 0.22% 4Q 2011 4Q 2012 4Q 2013 4Q 2014 4Q 2015 Interest Bearing Deposit Costs Other Funding Costs 0.51% 0.35% 0.78% 0.35% 0.41% Total Loan Yield Total Interest-earning Yield - 37 bps Net Interest Margin 3.81% Yield on Interest-earning Assets Net Interest Income & Net Interest Margin Cost of Interest-bearing Liabilities NET INTEREST INCOME AND MARGIN TRENDS 26

$236 $220 $224 $227 $256 $37 $93 $89 $63 $72 2011 2012 2013 2014 2015 Mortgage Banking (net) and Other Noninterest Income Core Fee-based Revenue NONINTEREST INCOME TRENDS ($ IN MILLIONS) Mortgage Banking (net) Income Other Noninterest Income2 1 – Core Fee-based Revenue = Trust service fees plus Service charges on deposit accounts plus Card-based and other nondeposit fees plus Insurance commissions plus Brokerage and annuity commissions. 2 – Other Noninterest Income = Total Noninterest Income minus net Mortgage Banking Income minus Core Fee-based Revenue. $273 1 Insurance Commissions $13 $64 $49 $21 $32 2011 2012 2013 2014 2015 $24 $29 $40 $42 $40 2011 2012 2013 2014 2015 $46 $47 $44 $44 $75 2011 2012 2013 2014 2015 $313 $313 $290 $328 27

5,056 4,915 4,584 4,320 4,378 4Q 2011 4Q 2012 4Q 2013 4Q 2014 4Q 2015 $360 $381 $397 $390 $405 $293 $294 $284 $289 $292 2011 2012 2013 2014 2015 Personnel Other Noninterest Expense NONINTEREST EXPENSE TRENDS ($ IN MILLIONS) Technology and Equipment Spend Other Non-Personnel Spend2 1 – The fully tax-equivalent efficiency ratio is a non-GAAP financial measure, which we define as noninterest expense (which includes the provision for unfunded commitments), excluding other intangible amortization, divided by the sum of fully tax-equivalent net interest income plus noninterest income, excluding investment securities gains / losses, net. Please refer to the appendix for a reconciliation of this measure to “efficiency ratio” as defined by the Federal Reserve. 2 – Other Non-Personnel Spend = Total Noninterest Expense less Personnel and Technology and Equipment spend 3 – FTE = Average Full Time Equivalent Employees Fully Tax-Equivalent Efficiency Ratio1 FTE3 Trend $653 $241 $227 $209 $209 $208 2011 2012 2013 2014 2015 $52 $67 $75 $80 $84 2011 2012 2013 2014 2015 $675 $681 $679 $697 71% 71% 69% 69% 68% 28

$566 $361 $235 $190 $302 4.04% 2.34% 1.48% 1.08% 1.61% 0.50% 1.50% 2.50% 3.50% 4.50% 5.50% $- $48 $126 204 $ 832 640 $ 48 526 $604 872 $ 680 4 8 $926 $1004 812 $1 620 48 $1326 404 $1 852 660 $1 48 72 6 $1804 892 $1 6200 48 $ 122 6 204 $ 8232 640 $ 42 8 526 $ 60 2 4 872 $ 6280 48 $ 922 6 3004 $ 812 3 620 $ 48 3326 $ 404 3 8 52 $ 660 3 48 $ 726 3804 $ 892 3 6400 $ 48 124 6 $ 204 8432 $ 6 40 44 8 $ 526 604 4 $ 872 6480 $ 48 924 6 $5004 812 $5 620 4 8 $5326 404 $5 852 660 $5 48 726 $5804 892 $5 6600 2011 2012 2013 2014 2015 Potential Problem Loans PPLs / Total Loans CREDIT QUALITY TRENDS ($ IN MILLIONS) $357 $253 $185 $177 $178 2.54% 1.64% 1.17% 1.01% 0.95% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% $- $4 8 $12 6 $20 4 $28 32 $ 6 40 $ 4 48 $52 6 $60 4 $68 72 $ 6 80 $ 4 88 $92 6 $100 4 $108 12 $1 6 20 $1 4 28 $132 6 $140 4 $148 52 $1 6 60 $1 4 68 $172 6 $180 4 $188 92 $1 6 200 $ 4 208 $ 12 2 6 $ 20 2 4 $ 28 232 $ 6 240 $ 4 248 $ 52 2 6 $ 60 2 4 $ 68 272 $ 6 280 $ 4 288 $ 92 2 6 $300 4 $308 12 $3 6 20 $3 4 28 $332 6 $340 4 $348 52 $3 6 60 $3 4 68 $372 6 $380 4 $388 92 $3 6 400 2011 2012 2013 2014 2015 Nonaccrual Loans Nonaccrual Loans / Total Loans $151 $84 $39 $15 $30 1.13% 0.57% 0.25% 0.09% 0.16% 0.00% 0.50% 1.00% 1.50% 2.00% $- $4 $8 $12 $16 $20 $24 $28 $32 $36 $40 $44 $48 $52 $56 $60 $64 $68 $72 $76 $80 $84 $88 $92 $96 $100 $104 $108 $112 $116 $120 $124 $128 $132 $136 $140 $144 $148 $152 $156 $160 $164 $168 $172 2011 2012 2013 2014 2015 Net Charge Offs NCOs / Avg Loans 106% 118% 145% 150% 154% 2.70% 1.93% 1.69% 1.51% 1.47% 1.00% 1.50% 2.00% 2.50% 3.00% 0% 80% 160% 2011 2012 2013 2014 2015 ALLL / Nonaccrual Loans ALLL / Total Loans Potential Problem Loans to Total Loans Nonaccrual Loans to Total Loans Net Charge Offs to Average Loans Allowance to Total Loans 29

$3 $3 $7 $17 $27 $26 $29 $42 4Q 2014 1Q 2015 2Q 2015 3Q 2015 4Q 2015 Specific Energy Reserve Total Energy Related Reserve OIL AND GAS CREDIT PROFILE Oil and Gas Loans Outstanding, $ millions 4Q 2014 1Q 2015 2Q 2015 3Q 2015 4Q 2015 Pass $725 $706 $658 $587 $522 Criticized / Classified 29 74 88 158 210 Nonaccrual - - 11 13 20 Total Oil and Gas Loans $754 $780 $757 $758 $752 Potential Problem Loans $ millions 4Q 2014 1Q 2015 2Q 2015 3Q 2015 4Q 2015 Oil and Gas $0 $39 $60 $84 $124 Other Commercial and Industrial 109 99 66 108 107 Total Commercial and Industrial $109 $138 $126 $192 $231 Oil & Gas % 0% 28% 48% 44% 54% 30

HIGH QUALITY SECURITIES ($ IN MILLIONS) 31 $4,937 $4,966 $5,420 $5,810 $6,152 3.11% 2.97% 2.66% 2.63% 2.50% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% $- $0.01326395265 . 78911047$0 0 . 4369825 .2 82134$0 760 . 736993125 . 851$0 47 0 .403629425 . 68$0 81945 70 . 33659725 $0. 86112470 . 63689702$0 5 . 841547 0 . 938 619$0 325 . 8718479 0 . 236$0 49625 . 81 0011470 . 53$ 679921 5 1. 831447 0 $ . 836209221 5 . 861747$ 3 0 . 136391 525 . 891404$ 70 . 4361 69825 .5 821$ 347 0 . 731 6996125 . 8$ 516470 1.703629425 $ . 881948 71 0 . 3365972$ 5 . 8911241 7 0 . 63689$2 0025 . 8415470 . 931 6$2 19325 . 8718472 0 . 23$2 649625 . 8301147 0 $2. 53679924 5 . 831447$2 0 . 836509225 . 86174$2 76 0 . 13639525 . 891$2 7047 0 . 43669825 .8 8$2 213470 . 736999125 $2. 8516470 3.00362942$ 5 . 881941 7 3 0 . 33659$ 725 . 8211243 70 . 636$ 893025 . 8413 5470 . 93$ 4 619325 . 83 71847 5 0 $ . 23649625 3. 8601147$ 0 . 53679923 7 5 . 83144$ 70 . 8368093 225 . 861$ 747 9 0 . 1363 39525 . 8$ 914 00470 . 43669825 $ .1 84 213470 . 73699212$ 5 4. 851647 0 .303629$ 424 5 . 881944 70 . 336$ 594 725 . 85112470 . 63$ 64 896025 . 841547 0 $ . 934 7 619325 . 871847$ 8 0 4. 23649625 . 890114$ 74 0 . 53679925 0 5 . 831$ 447 0 . 8361095 225 . 8$ 617472 0 . 1365 39525 $ . 89130470 . 435 66982$ 5 .4 821347 0 5. 73699$ 5125 . 8516475 0 .6036$ 29425 . 881945 7 70 . 33$ 659725 . 88115 247 0 $ . 636899025 . 85 41547$ 0 . 936 0 619325 . 87184$ 71 0 6. 23649625 . 8201$ 147 6 0 . 53679923 5 . 8$ 31446 70 . 836409225 $ . 8616 7475 0 Dec 2011 Dec 2012 Dec 2013 Dec 2014 Dec 2015 Period End Fair Value Annual Average Yield Investment Type Amortized Cost Fair Value Duration (Yrs) GNMA CMBS $1,982 $1,955 3.70 GNMA MBS & CMOs 1,689 1,673 4.50 Agency & Other MBS & CMOs 1,432 1,458 2.79 Municipals 1,044 1,060 5.79 Corporates & Other 5 5 2.36 Treasury 1 1 1.13 Strategic Portfolio $6,153 $6,152 4.06 Membership Stock 147 147 Total Portfolio $6,300 $6,299 Net Unamortized Premium 111 GNMA CMBS 32% GNMA CMOs 20% GNMA MBS 8% Other MBS 19% Other CMOs 4% Municipals 17% Other 0.1% Fair Value Composition Risk Weighting Profile Portfolio Detail Portfolio and Yield Trends 77% 40% 1% <1% 22% 60% Dec 2014 Dec 2015 20% RWA Other RWA 0% RWA

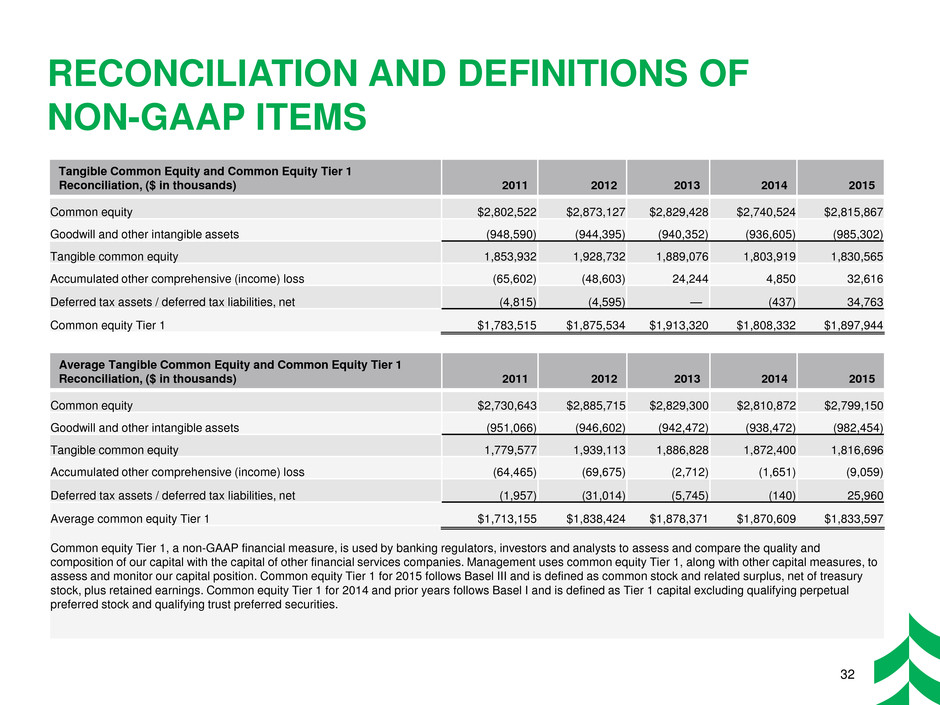

RECONCILIATION AND DEFINITIONS OF NON-GAAP ITEMS 32 Tangible Common Equity and Common Equity Tier 1 Reconciliation, ($ in thousands) 2011 2012 2013 2014 2015 Common equity $2,802,522 $2,873,127 $2,829,428 $2,740,524 $2,815,867 Goodwill and other intangible assets (948,590) (944,395) (940,352) (936,605) (985,302) Tangible common equity 1,853,932 1,928,732 1,889,076 1,803,919 1,830,565 Accumulated other comprehensive (income) loss (65,602) (48,603) 24,244 4,850 32,616 Deferred tax assets / deferred tax liabilities, net (4,815) (4,595) — (437) 34,763 Common equity Tier 1 $1,783,515 $1,875,534 $1,913,320 $1,808,332 $1,897,944 Average Tangible Common Equity and Common Equity Tier 1 Reconciliation, ($ in thousands) 2011 2012 2013 2014 2015 Common equity $2,730,643 $2,885,715 $2,829,300 $2,810,872 $2,799,150 Goodwill and other intangible assets (951,066) (946,602) (942,472) (938,472) (982,454) Tangible common equity 1,779,577 1,939,113 1,886,828 1,872,400 1,816,696 Accumulated other comprehensive (income) loss (64,465) (69,675) (2,712) (1,651) (9,059) Deferred tax assets / deferred tax liabilities, net (1,957) (31,014) (5,745) (140) 25,960 Average common equity Tier 1 $1,713,155 $1,838,424 $1,878,371 $1,870,609 $1,833,597 Common equity Tier 1, a non-GAAP financial measure, is used by banking regulators, investors and analysts to assess and compare the quality and composition of our capital with the capital of other financial services companies. Management uses common equity Tier 1, along with other capital measures, to assess and monitor our capital position. Common equity Tier 1 for 2015 follows Basel III and is defined as common stock and related surplus, net of treasury stock, plus retained earnings. Common equity Tier 1 for 2014 and prior years follows Basel I and is defined as Tier 1 capital excluding qualifying perpetual preferred stock and qualifying trust preferred securities.

RECONCILIATION AND DEFINITIONS OF NON-GAAP ITEMS (CONTINUED) 33 Efficiency Ratio Reconciliation 2011 2012 2013 2014 2015 Federal Reserve efficiency ratio 73.33% 72.92% 71.05% 70.28% 69.93% Fully tax-equivalent adjustment (1.73) (1.61) (1.46) (1.36) (1.42) Other intangible amortization (0.51) (0.43) (0.41) (0.39) (0.30) Fully tax-equivalent efficiency ratio 71.09% 70.88% 69.18% 68.53% 68.21% The efficiency ratio is defined by the Federal Reserve guidance as noninterest expense (which includes the provision for unfunded commitments) divided by the sum of net interest income plus noninterest income, excluding investment securities gains / losses, net. The fully tax-equivalent efficiency ratio is noninterest expense (which includes the provision for unfunded commitments), excluding other intangible amortization, divided by the sum of fully tax-equivalent net interest income plus noninterest income, excluding investment securities gains / losses, net. Management believes the fully tax-equivalent efficiency ratio, which adjusts net interest income for the tax-favored status of certain loans and investment securities, to be the preferred industry measurement as it enhances the comparability of net interest income arising from taxable and tax-exempt sources.