Attached files

| file | filename |

|---|---|

| 8-K - 8-K - A10 Networks, Inc. | atenq42015pressrelease8k.htm |

| EX-99.1 - EXHIBIT 99.1 - A10 Networks, Inc. | february92016pressreleaseb.htm |

A10 Networks – Q4 2015 Earnings - February 9, 2016 1 | P a g e

A10 Networks – Q4 2015 Earnings - February 9, 2016 2 | P a g e Thank you all for joining us today. I am pleased to welcome you to A10 Networks fourth quarter and year 2015 financial results conference call. This call is being recorded and webcast live and may be accessed for one year via the A10 Networks website, www.a10networks.com. Joining me today are A10’s Founder & CEO, Lee Chen; A10’s CFO, Greg Straughn; and our VP of Global Sales, Ray Smets. Before we begin, I would like to remind you that shortly after the market closed today, A10 Networks issued a press release announcing its fourth quarter and year 2015 financial results. Additionally, A10 published a presentation along with its prepared comments for this call and supplemental trended financial statements. You may access the press release, presentation with prepared comments, and trended financial statements on the investor relations section of the company’s website www.a10networks.com.

A10 Networks – Q4 2015 Earnings - February 9, 2016 3 | P a g e During the course of today’s call, management will make forward-looking statements, including statements regarding our projections for our first quarter operating results, our expectations for future revenue growth, profitability and operating margin, expectations of customer buying patterns and the growth of our business generally. These statements are based on current expectations and beliefs as of today, February 9, 2016. A10 disclaims any obligation to update information contained in these forward-looking statements whether as a result of new information, future events, or otherwise. These forward-looking statements involve a number of risks and uncertainties, some of which are beyond our control that could cause actual results to differ materially. We disclaim any obligation to update these forward- looking statements as a result of future events or otherwise. For a more detailed description of these risks and uncertainties, please refer to our most recent 10-Q filed on November 6th.

A10 Networks – Q4 2015 Earnings - February 9, 2016 4 | P a g e Please note that with the exception of revenue, financial measures discussed today are on a non-GAAP basis and have been adjusted to exclude certain charges. A reconciliation between GAAP and non-GAAP measures can be found in the press release issued today and on the trended quarterly financial statements posted on the company’s website. We will provide our current expectations for the first quarter of 2016 on a non-GAAP basis. However, we will not make available a reconciliation of non-GAAP guidance measures to corresponding GAAP measures on a forward-looking basis due to high variability and low visibility with respect to the charges, which are excluded from these non-GAAP measures. Before I turn the call over to Lee, I’d like to announce that management will attend the Morgan Stanley Technology, Media, and Telecom Conference in San Francisco and we hope to see many of you there. Now I would like to turn the call over to Lee for opening remarks.

A10 Networks – Q4 2015 Earnings - February 9, 2016 5 | P a g e

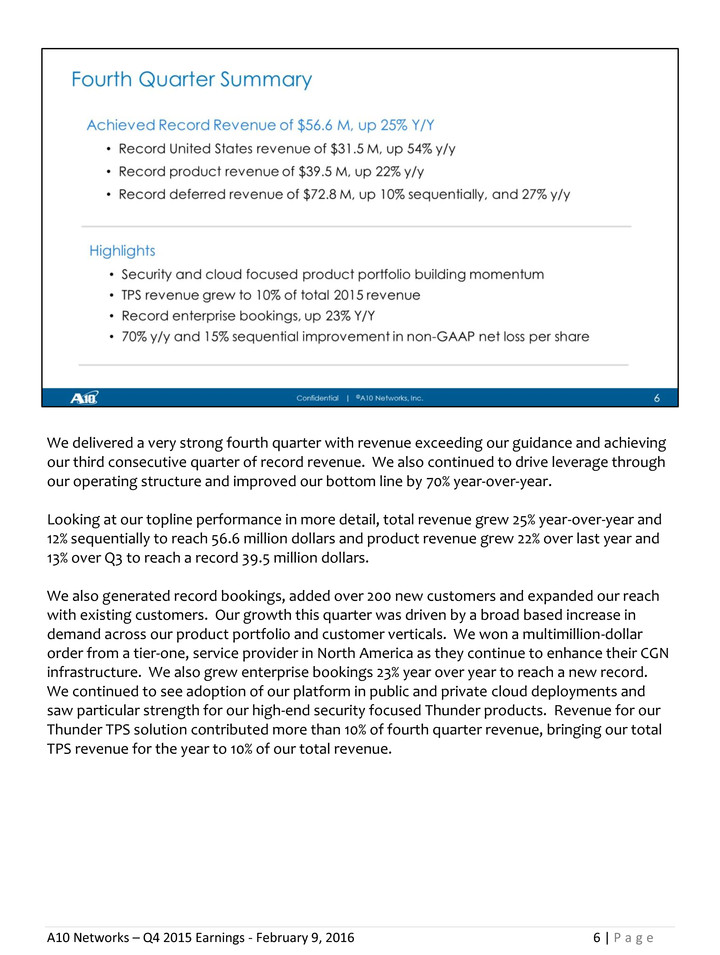

A10 Networks – Q4 2015 Earnings - February 9, 2016 6 | P a g e We delivered a very strong fourth quarter with revenue exceeding our guidance and achieving our third consecutive quarter of record revenue. We also continued to drive leverage through our operating structure and improved our bottom line by 70% year-over-year. Looking at our topline performance in more detail, total revenue grew 25% year-over-year and 12% sequentially to reach 56.6 million dollars and product revenue grew 22% over last year and 13% over Q3 to reach a record 39.5 million dollars. We also generated record bookings, added over 200 new customers and expanded our reach with existing customers. Our growth this quarter was driven by a broad based increase in demand across our product portfolio and customer verticals. We won a multimillion-dollar order from a tier-one, service provider in North America as they continue to enhance their CGN infrastructure. We also grew enterprise bookings 23% year over year to reach a new record. We continued to see adoption of our platform in public and private cloud deployments and saw particular strength for our high-end security focused Thunder products. Revenue for our Thunder TPS solution contributed more than 10% of fourth quarter revenue, bringing our total TPS revenue for the year to 10% of our total revenue.

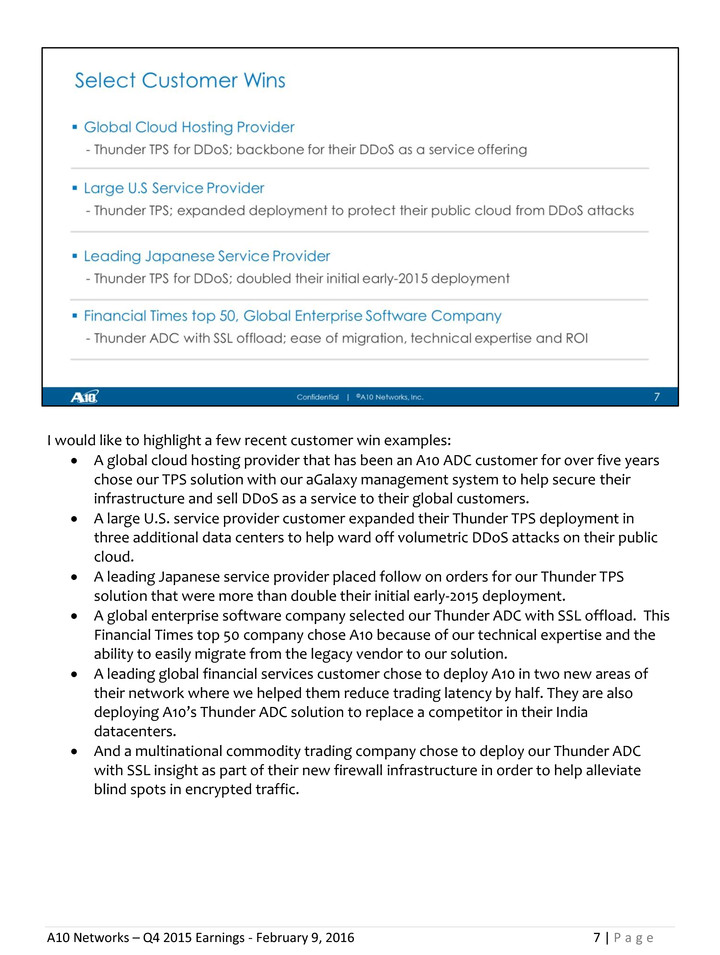

A10 Networks – Q4 2015 Earnings - February 9, 2016 7 | P a g e I would like to highlight a few recent customer win examples: A global cloud hosting provider that has been an A10 ADC customer for over five years chose our TPS solution with our aGalaxy management system to help secure their infrastructure and sell DDoS as a service to their global customers. A large U.S. service provider customer expanded their Thunder TPS deployment in three additional data centers to help ward off volumetric DDoS attacks on their public cloud. A leading Japanese service provider placed follow on orders for our Thunder TPS solution that were more than double their initial early-2015 deployment. A global enterprise software company selected our Thunder ADC with SSL offload. This Financial Times top 50 company chose A10 because of our technical expertise and the ability to easily migrate from the legacy vendor to our solution. A leading global financial services customer chose to deploy A10 in two new areas of their network where we helped them reduce trading latency by half. They are also deploying A10’s Thunder ADC solution to replace a competitor in their India datacenters. And a multinational commodity trading company chose to deploy our Thunder ADC with SSL insight as part of their new firewall infrastructure in order to help alleviate blind spots in encrypted traffic.

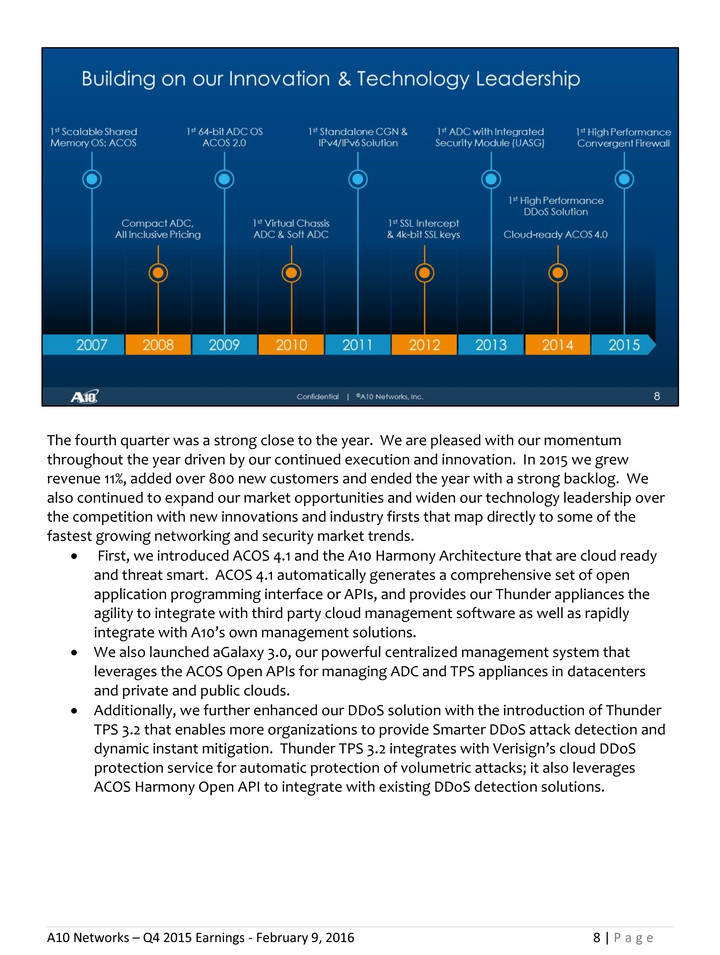

A10 Networks – Q4 2015 Earnings - February 9, 2016 8 | P a g e The fourth quarter was a strong close to the year. We are pleased with our momentum throughout the year driven by our continued execution and innovation. In 2015 we grew revenue 11%, added over 800 new customers and ended the year with a strong backlog. We also continued to expand our market opportunities and widen our technology leadership over the competition with new innovations and industry firsts that map directly to some of the fastest growing networking and security market trends. First, we introduced ACOS 4.1 and the A10 Harmony Architecture that are cloud ready and threat smart. ACOS 4.1 automatically generates a comprehensive set of open application programming interface or APIs, and provides our Thunder appliances the agility to integrate with third party cloud management software as well as rapidly integrate with A10’s own management solutions. We also launched aGalaxy 3.0, our powerful centralized management system that leverages the ACOS Open APIs for managing ADC and TPS appliances in datacenters and private and public clouds. Additionally, we further enhanced our DDoS solution with the introduction of Thunder TPS 3.2 that enables more organizations to provide Smarter DDoS attack detection and dynamic instant mitigation. Thunder TPS 3.2 integrates with Verisign’s cloud DDoS protection service for automatic protection of volumetric attacks; it also leverages ACOS Harmony Open API to integrate with existing DDoS detection solutions.

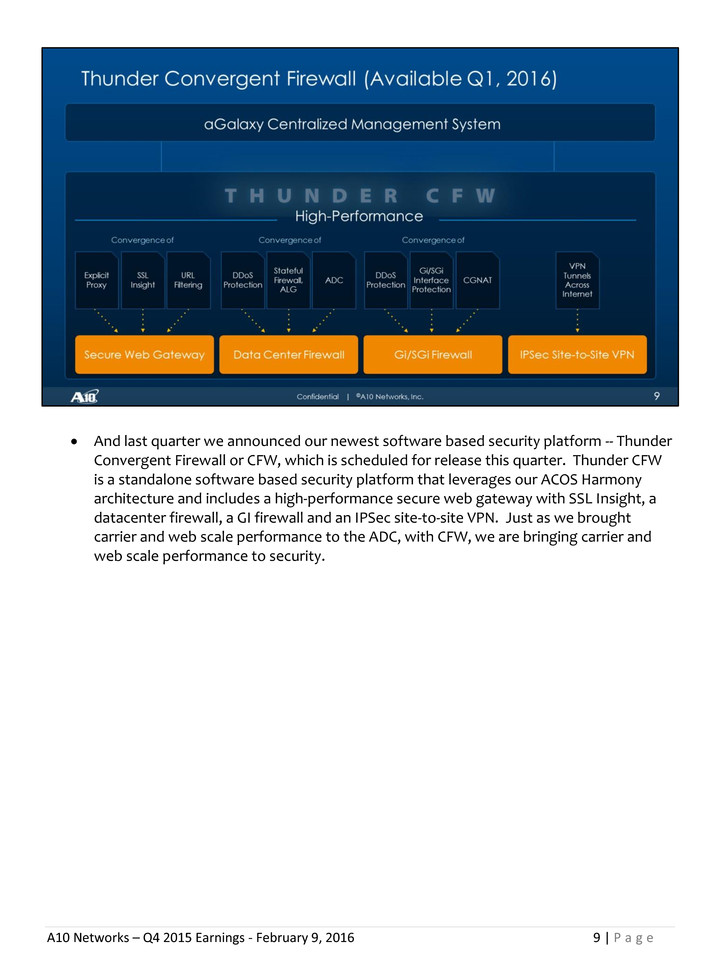

A10 Networks – Q4 2015 Earnings - February 9, 2016 9 | P a g e And last quarter we announced our newest software based security platform -- Thunder Convergent Firewall or CFW, which is scheduled for release this quarter. Thunder CFW is a standalone software based security platform that leverages our ACOS Harmony architecture and includes a high-performance secure web gateway with SSL Insight, a datacenter firewall, a GI firewall and an IPSec site-to-site VPN. Just as we brought carrier and web scale performance to the ADC, with CFW, we are bringing carrier and web scale performance to security.

A10 Networks – Q4 2015 Earnings - February 9, 2016 10 | P a g e Our advanced technology platform is at the core of our ability to add new customers, expand our reach within our existing customers and quickly bring new products to market. We believe the trends we see in the market today are in direct alignment with our product strategy and strengths as a company. We serve the high end of the market and our customers include some of the most demanding enterprise, service provider and cloud provider networks. When we look into 2016 and beyond, we see the growing transition to the cloud as an opportunity to grow our business given our technology differentiation. Our application and security platform is designed to deliver carrier and web-scale application and security performance, integrate with third party cloud management software or our powerful centralized management system with real-time troubleshooting. Furthermore, we have a strong brand and relationships with the very companies that are investing in and building public and private cloud infrastructures, as well as software as a service and Web 2.0 providers. In fact, 19 of our 20 top booking customers in 2015 were in one of these categories. Furthermore, half of the companies in the leaders and visionary section of Gartner’s 2015 Cloud Infrastructure as a Service magic quadrant are A10 customers. In summary, we believe that with our highly scalable, flexible ACOS software platform we are well positioned to grow as more security features and functions continue to converge onto cloud-ready platform and as more networks are virtualized and transition to the cloud. Over the past year, we believe we have made substantial progress in executing our strategy to build a strong foundation for long-term growth, while at the same time, improving our bottom line.

A10 Networks – Q4 2015 Earnings - February 9, 2016 11 | P a g e

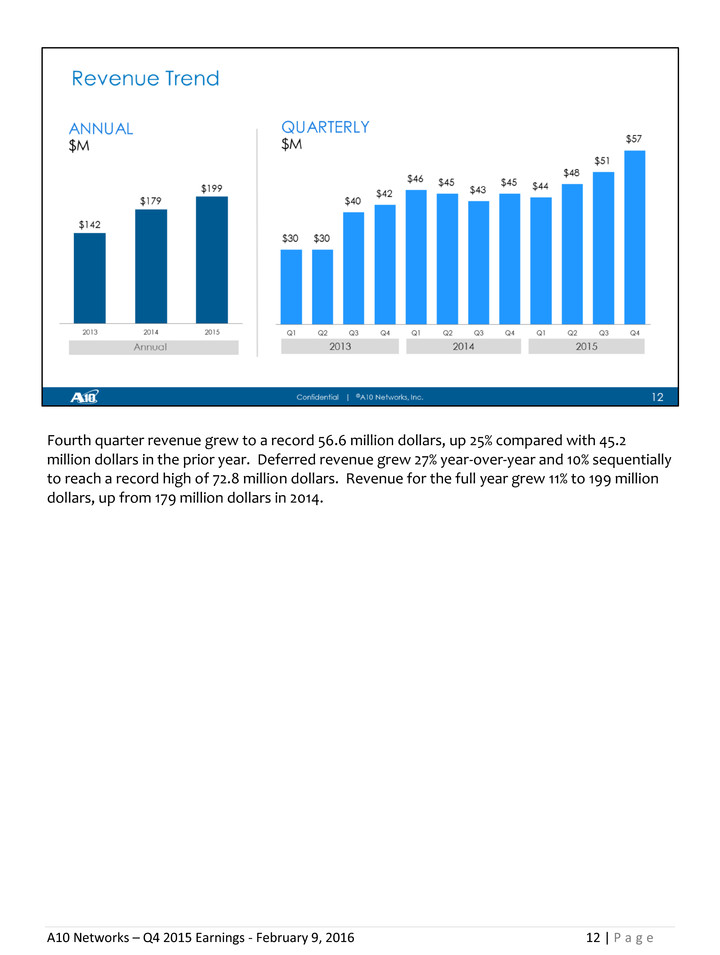

A10 Networks – Q4 2015 Earnings - February 9, 2016 12 | P a g e Fourth quarter revenue grew to a record 56.6 million dollars, up 25% compared with 45.2 million dollars in the prior year. Deferred revenue grew 27% year-over-year and 10% sequentially to reach a record high of 72.8 million dollars. Revenue for the full year grew 11% to 199 million dollars, up from 179 million dollars in 2014.

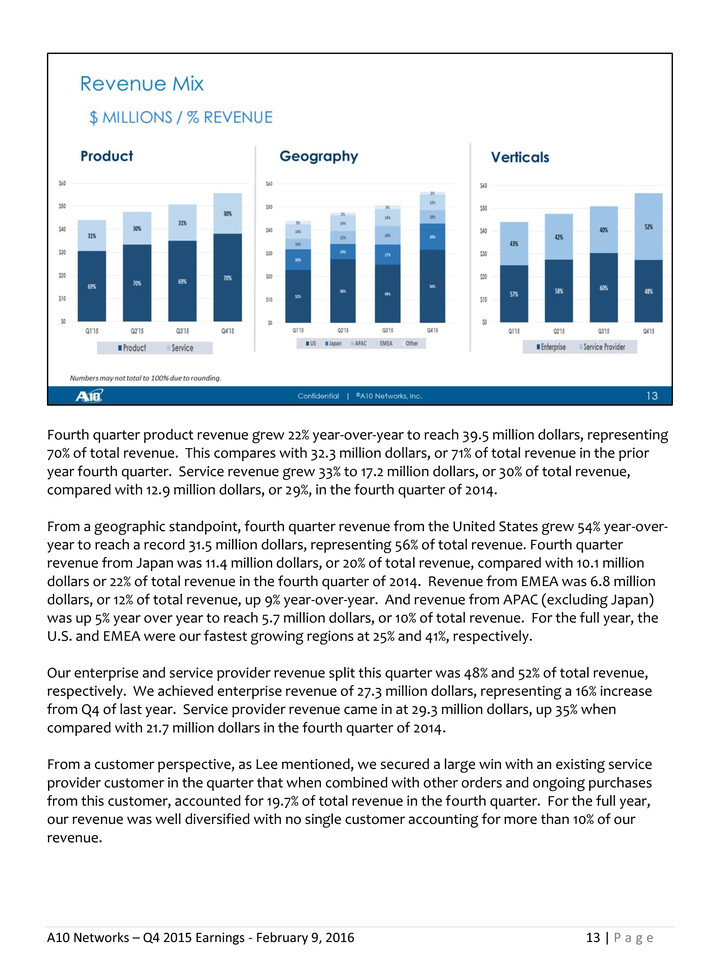

A10 Networks – Q4 2015 Earnings - February 9, 2016 13 | P a g e Fourth quarter product revenue grew 22% year-over-year to reach 39.5 million dollars, representing 70% of total revenue. This compares with 32.3 million dollars, or 71% of total revenue in the prior year fourth quarter. Service revenue grew 33% to 17.2 million dollars, or 30% of total revenue, compared with 12.9 million dollars, or 29%, in the fourth quarter of 2014. From a geographic standpoint, fourth quarter revenue from the United States grew 54% year-over- year to reach a record 31.5 million dollars, representing 56% of total revenue. Fourth quarter revenue from Japan was 11.4 million dollars, or 20% of total revenue, compared with 10.1 million dollars or 22% of total revenue in the fourth quarter of 2014. Revenue from EMEA was 6.8 million dollars, or 12% of total revenue, up 9% year-over-year. And revenue from APAC (excluding Japan) was up 5% year over year to reach 5.7 million dollars, or 10% of total revenue. For the full year, the U.S. and EMEA were our fastest growing regions at 25% and 41%, respectively. Our enterprise and service provider revenue split this quarter was 48% and 52% of total revenue, respectively. We achieved enterprise revenue of 27.3 million dollars, representing a 16% increase from Q4 of last year. Service provider revenue came in at 29.3 million dollars, up 35% when compared with 21.7 million dollars in the fourth quarter of 2014. From a customer perspective, as Lee mentioned, we secured a large win with an existing service provider customer in the quarter that when combined with other orders and ongoing purchases from this customer, accounted for 19.7% of total revenue in the fourth quarter. For the full year, our revenue was well diversified with no single customer accounting for more than 10% of our revenue.

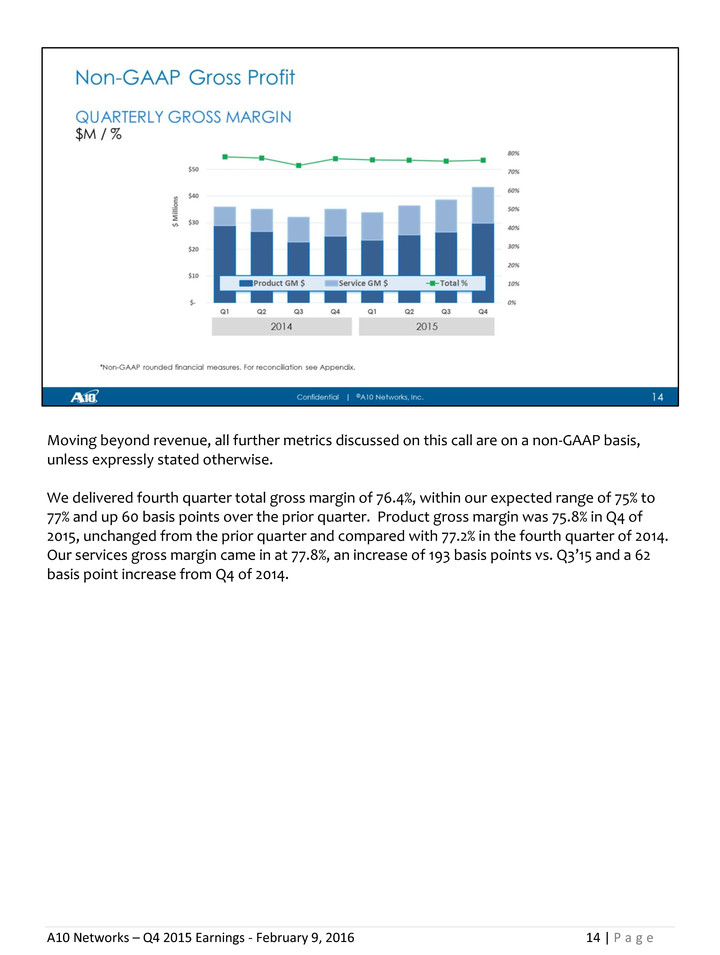

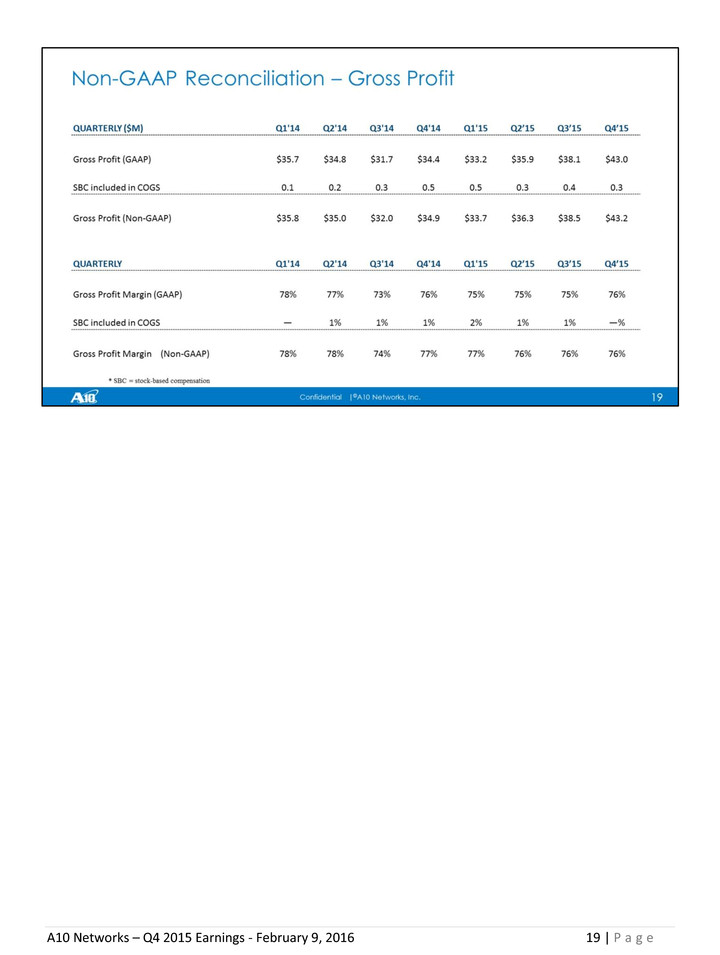

A10 Networks – Q4 2015 Earnings - February 9, 2016 14 | P a g e Moving beyond revenue, all further metrics discussed on this call are on a non-GAAP basis, unless expressly stated otherwise. We delivered fourth quarter total gross margin of 76.4%, within our expected range of 75% to 77% and up 60 basis points over the prior quarter. Product gross margin was 75.8% in Q4 of 2015, unchanged from the prior quarter and compared with 77.2% in the fourth quarter of 2014. Our services gross margin came in at 77.8%, an increase of 193 basis points vs. Q3’15 and a 62 basis point increase from Q4 of 2014.

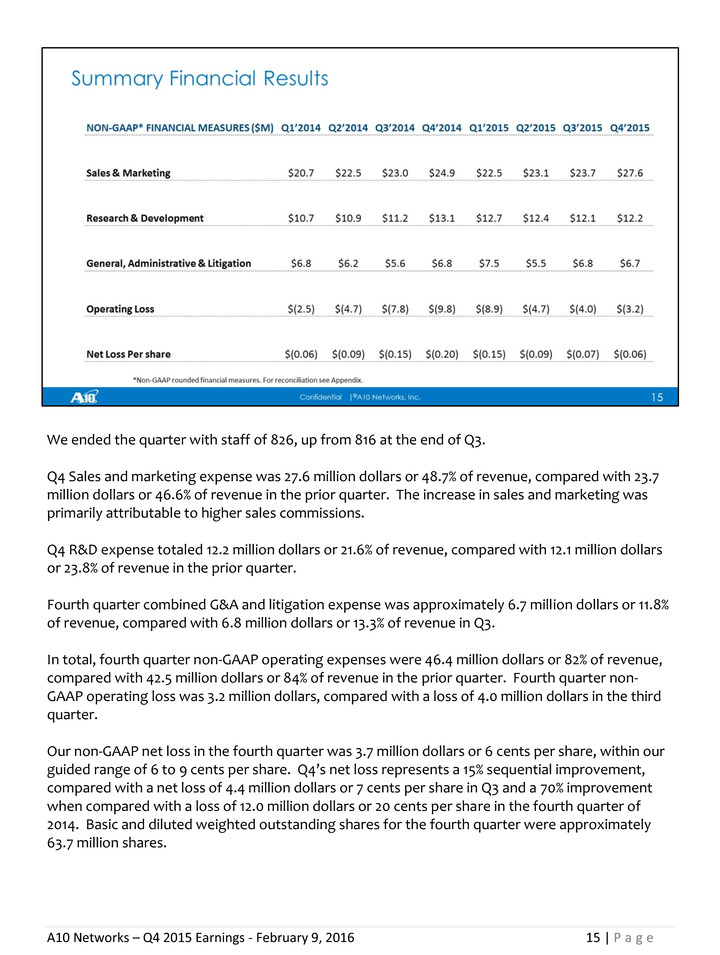

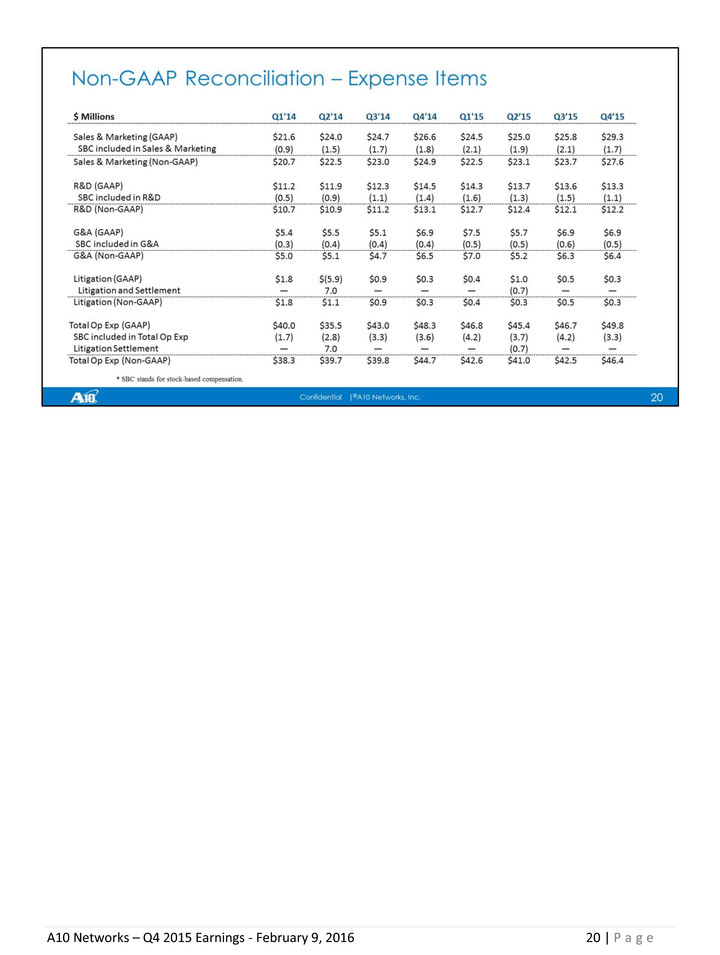

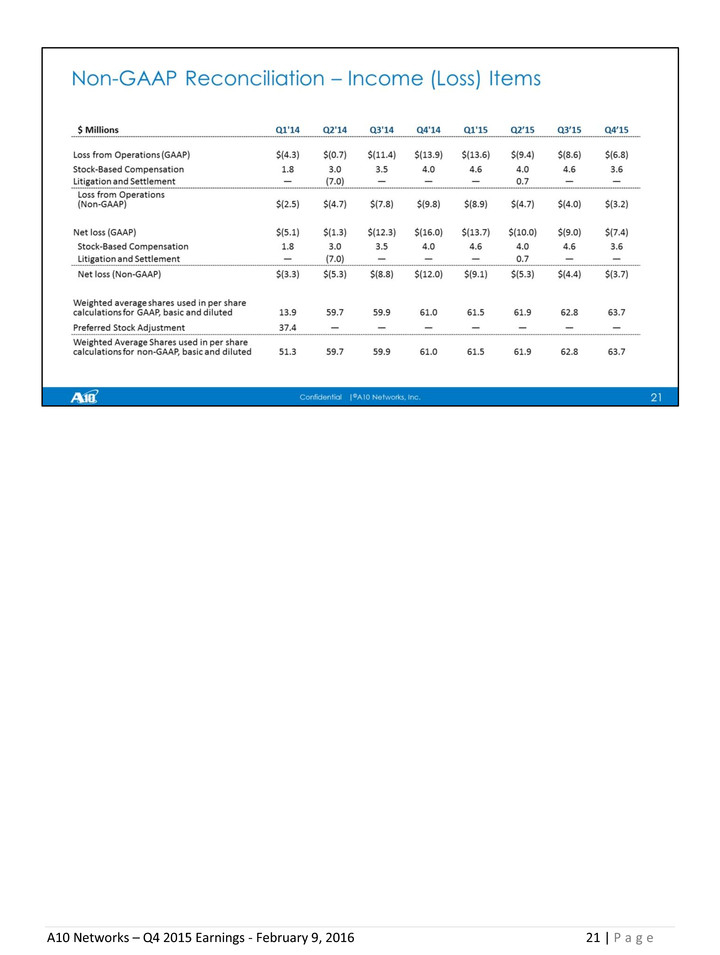

A10 Networks – Q4 2015 Earnings - February 9, 2016 15 | P a g e We ended the quarter with staff of 826, up from 816 at the end of Q3. Q4 Sales and marketing expense was 27.6 million dollars or 48.7% of revenue, compared with 23.7 million dollars or 46.6% of revenue in the prior quarter. The increase in sales and marketing was primarily attributable to higher sales commissions. Q4 R&D expense totaled 12.2 million dollars or 21.6% of revenue, compared with 12.1 million dollars or 23.8% of revenue in the prior quarter. Fourth quarter combined G&A and litigation expense was approximately 6.7 million dollars or 11.8% of revenue, compared with 6.8 million dollars or 13.3% of revenue in Q3. In total, fourth quarter non-GAAP operating expenses were 46.4 million dollars or 82% of revenue, compared with 42.5 million dollars or 84% of revenue in the prior quarter. Fourth quarter non- GAAP operating loss was 3.2 million dollars, compared with a loss of 4.0 million dollars in the third quarter. Our non-GAAP net loss in the fourth quarter was 3.7 million dollars or 6 cents per share, within our guided range of 6 to 9 cents per share. Q4’s net loss represents a 15% sequential improvement, compared with a net loss of 4.4 million dollars or 7 cents per share in Q3 and a 70% improvement when compared with a loss of 12.0 million dollars or 20 cents per share in the fourth quarter of 2014. Basic and diluted weighted outstanding shares for the fourth quarter were approximately 63.7 million shares.

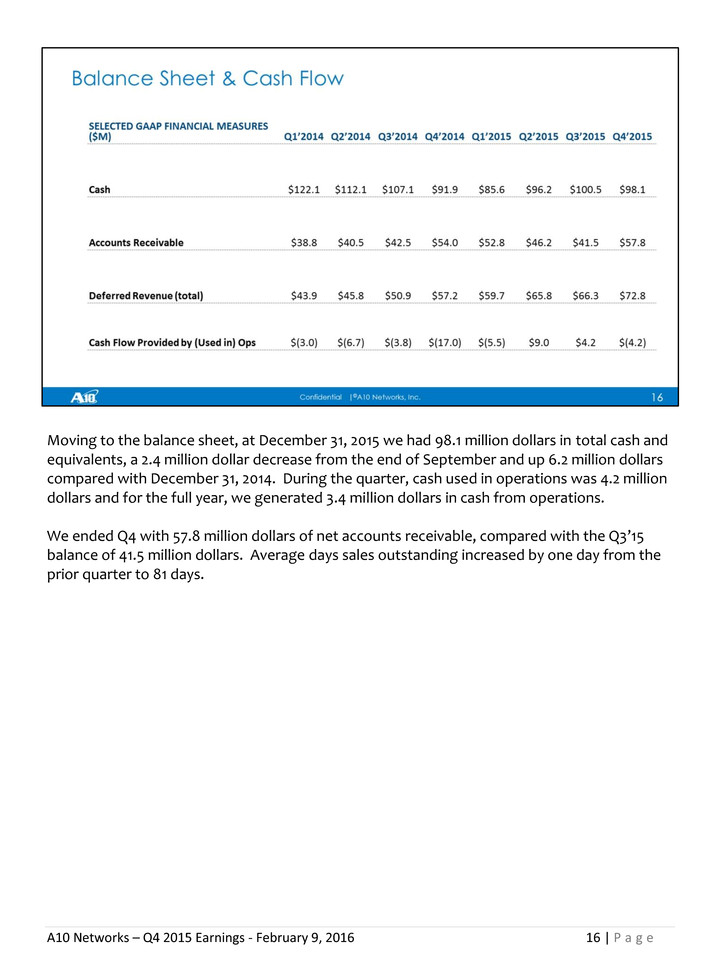

A10 Networks – Q4 2015 Earnings - February 9, 2016 16 | P a g e Moving to the balance sheet, at December 31, 2015 we had 98.1 million dollars in total cash and equivalents, a 2.4 million dollar decrease from the end of September and up 6.2 million dollars compared with December 31, 2014. During the quarter, cash used in operations was 4.2 million dollars and for the full year, we generated 3.4 million dollars in cash from operations. We ended Q4 with 57.8 million dollars of net accounts receivable, compared with the Q3’15 balance of 41.5 million dollars. Average days sales outstanding increased by one day from the prior quarter to 81 days.

A10 Networks – Q4 2015 Earnings - February 9, 2016 17 | P a g e

A10 Networks – Q4 2015 Earnings - February 9, 2016 18 | P a g e

A10 Networks – Q4 2015 Earnings - February 9, 2016 19 | P a g e

A10 Networks – Q4 2015 Earnings - February 9, 2016 20 | P a g e

A10 Networks – Q4 2015 Earnings - February 9, 2016 21 | P a g e

A10 Networks – Q4 2015 Earnings - February 9, 2016 22 | P a g e