Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - SIRONA DENTAL SYSTEMS, INC. | t1600318_ex31-2.htm |

| EX-32.2 - EXHIBIT 32.2 - SIRONA DENTAL SYSTEMS, INC. | t1600318_ex32-2.htm |

| EX-31.1 - EXHIBIT 31.1 - SIRONA DENTAL SYSTEMS, INC. | t1600318_ex31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - SIRONA DENTAL SYSTEMS, INC. | t1600318_ex32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

| FORM 10-Q |

| (Mark One) | þ | Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| For the quarterly period ended December 31, 2015 | ||

| or | ||

| ¨ | Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |

| For the transition period from ___________to ___________ | ||

| Commission file number 000-22673 | ||

|

Sirona Dental Systems, Inc. (Exact name of registrant as specified in its charter) | ||

| Delaware | 11-3374812 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

|

30-30 47th Avenue, Suite 500, Long Island City, New York |

11101 | |

| (Address of principal executive offices) | (Zip Code) |

| (718) 482-2011 |

| (Registrant’s telephone number, including area code) |

| Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. |

Yes þ No ¨

|

| Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). | Yes þ No ¨ |

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one): |

Large accelerated filer þ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨ |

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | Yes ¨ No þ |

As of January 29, 2016, the number of shares outstanding of the Registrant’s Common Stock, par value $.01 per share, was 56,026,652.

FORWARD-LOOKING STATEMENTS

This Form 10-Q Quarterly Report contains forward-looking statements that involve risk and uncertainties. All statements, other than statements of historical facts, included in this report regarding the Company, its financial position, products, business strategy and plans and objectives of management of the Company for future operations, are forward-looking statements. When used in this report, words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “objectives,” “plans” and similar expressions, or the negatives thereof or variations thereon or comparable terminology as they relate to the Company, its products or its management, identify forward-looking statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Actual results could differ materially from those contemplated by the forward-looking statements as a result of various factors, including, but not limited to, those contained in the “Risk Factors” set forth in Part I, Item 1A of our Annual Report on Form 10-K for the fiscal year ended September 30, 2015. All forward looking statements speak only as of the date of this Report and are expressly qualified in their entirety by the cautionary statements included in this report. We undertake no obligation to update or revise forward-looking statements which may be made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events other than required by law.

i

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2015

ii

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2015

CONSOLIDATED STATEMENTS OF INCOME

| Three months ended | ||||||||||

| December 31, | ||||||||||

| (In millions, except for share and per share amounts) (Unaudited) | Notes | 2015 | 2014 | |||||||

| REVENUE | $ | 304.2 | $ | 293.0 | ||||||

| Cost of goods sold | (130.2 | ) | (130.1 | ) | ||||||

| GROSS PROFIT | 174.0 | 162.9 | ||||||||

| Selling, general and administrative expense | (96.4 | ) | (87.8 | ) | ||||||

| Research and development expense | (13.3 | ) | (14.8 | ) | ||||||

| Net other operating income (loss) | 6 | 2.4 | 2.5 | |||||||

| OPERATING INCOME | 66.7 | 62.8 | ||||||||

| Gain (loss) on foreign currency transactions | 2.9 | (2.2 | ) | |||||||

| Gain (loss) on derivative instruments | 7 | (1.0 | ) | 0.4 | ||||||

| Interest income (expense) | (0.9 | ) | (0.9 | ) | ||||||

| Other income (expense) | (0.4 | ) | 0.7 | |||||||

| INCOME BEFORE TAXES | 67.3 | 60.8 | ||||||||

| Income tax benefit (expense) | 8 | (15.5 | ) | (14.0 | ) | |||||

| NET INCOME | 51.8 | 46.8 | ||||||||

| Net (income) loss attributable to noncontrolling interests | (0.5 | ) | (0.8 | ) | ||||||

| NET INCOME ATTRIBUTABLE TO SIRONA DENTAL SYSTEMS, INC. | $ | 51.3 | $ | 46.0 | ||||||

| INCOME PER SHARE | ||||||||||

| (attributable to Sirona Dental Systems, Inc. common shareholders) | 9 | |||||||||

| Basic | $ | 0.92 | $ | 0.83 | ||||||

| Diluted | $ | 0.91 | $ | 0.82 | ||||||

| Weighted average shares - basic | 55,914,865 | 55,416,418 | ||||||||

| Weighted average shares - diluted | 56,513,670 | 56,290,177 | ||||||||

The accompanying Notes are an integral part of these financial statements.

| 1 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2015

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

| Three months ended | ||||||

| December 31, | ||||||

|

(In millions) (Unaudited) |

Notes | 2015 | 2014 | |||

| NET INCOME | $ | 51.8 | $ | 46.8 | ||

| OTHER COMPREHENSIVE INCOME (LOSS), NET OF TAX | 11 | |||||

| Cumulative translation adjustment | (29.2) | (34.5) | ||||

| Derivative financial hedging instruments | 0.1 | (0.1) | ||||

| Unrecognized elements of pension cost | (0.4) | (0.6) | ||||

| TOTAL OTHER COMPREHENSIVE INCOME (LOSS) | (29.5) | (35.2) | ||||

| TOTAL COMPREHENSIVE INCOME (LOSS) | 22.3 | 11.6 | ||||

| Comprehensive (income) loss attributable to noncontrolling interests | (0.4) | (0.7) | ||||

| COMPREHENSIVE INCOME (LOSS) ATTRIBUTABLE TO SIRONA DENTAL SYSTEMS, INC. SHAREHOLDERS | $ | 21.9 | $ | 10.9 | ||

The accompanying Notes are an integral part of these financial statements.

| 2 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2015

| December 31, | September 30, | |||||

|

(In millions, except for share and par value amounts) (Unaudited) |

Notes | 2015 | 2015 | |||

| ASSETS | ||||||

| CURRENT ASSETS | ||||||

| Cash and cash equivalents | $ | 485.0 | $ | 517.8 | ||

| Restricted cash | 0.5 | 0.6 | ||||

| Accounts receivable, net of allowance for doubtful accounts | 192.9 | 154.9 | ||||

| of $1.7 and $1.4, respectively | ||||||

| Inventories, net | 12 | 131.9 | 129.4 | |||

| Deferred tax assets | 8 | 27.3 | 26.0 | |||

| Prepaid expenses and other current assets | 28.8 | 33.7 | ||||

| Income tax receivable | 8 | 9.4 | 14.2 | |||

| TOTAL CURRENT ASSETS | 875.8 | 876.6 | ||||

| Property, plant and equipment, net of accumulated depreciation | 202.7 | 208.3 | ||||

| of $196.3 and $191.4, respectively | ||||||

| Goodwill | 572.9 | 585.9 | ||||

| Restricted cash | 0.5 | 0.5 | ||||

| Intangible assets, net of accumulated amortization | 207.3 | 216.8 | ||||

| of $490.6 and $495.6, respectively | ||||||

| Other non-current assets | 2.6 | 3.3 | ||||

| Deferred tax assets | 8 | 11.5 | 10.9 | |||

| TOTAL ASSETS | $ | 1,873.3 | $ | 1,902.3 | ||

| LIABILITIES AND SHAREHOLDERS' EQUITY | ||||||

| CURRENT LIABILITIES | ||||||

| Trade accounts payable | $ | 49.2 | $ | 65.3 | ||

| Short-term financial liabilities | 53.1 | 23.1 | ||||

| Income taxes payable | 8 | 17.7 | 14.8 | |||

| Deferred tax liabilities | 8 | 0.4 | 0.7 | |||

| Accrued liabilities and deferred income | 182.9 | 191.2 | ||||

| TOTAL CURRENT LIABILITIES | 303.3 | 295.1 | ||||

| Long-term financial liabilities | 4.7 | 57.1 | ||||

| Deferred tax liabilities | 8 | 96.5 | 100.5 | |||

| Other non-current liabilities | 20.2 | 21.5 | ||||

| Pension related provisions | 60.4 | 62.4 | ||||

| Deferred income | 21.0 | 24.8 | ||||

| TOTAL LIABILITIES | 506.1 | 561.4 | ||||

| SHAREHOLDERS' EQUITY | ||||||

| Preferred stock ($0.01 par value; 5,000,000 shares authorized; | 0 | 0 | ||||

| none issued and outstanding) | ||||||

| Common stock ($0.01 par value; 95,000,000 shares authorized; | 0.6 | 0.6 | ||||

|

58,415,061 shares issued; 55,943,562 shares outstanding at Dec. 31, 2015; 58,367,468 shares issued; 55,895,969 shares outstanding at Sept. 30, 2015) |

||||||

| Additional paid-in capital | 705.9 | 702.6 | ||||

| Treasury stock, at cost | (132.0) | (132.0) | ||||

|

2,471,499 shares held at cost at Dec. 31, 2015; 2,471,499 shares held at cost at Sept. 30, 2015 |

||||||

| Retained earnings | 998.1 | 946.1 | ||||

| Accumulated other comprehensive income (loss) | 11 | (208.5) | (179.1) | |||

| TOTAL SIRONA DENTAL SYSTEMS, INC. SHAREHOLDERS' EQUITY | 1,364.1 | 1,338.2 | ||||

| NONCONTROLLING INTERESTS | 3.1 | 2.7 | ||||

| TOTAL SHAREHOLDERS' EQUITY | 1,367.2 | 1,340.9 | ||||

| TOTAL LIABILITIES & SHAREHOLDERS' EQUITY | $ | 1,873.3 | $ | 1,902.3 |

The accompanying Notes are an integral part of these financial statements.

| 3 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2015

CONSOLIDATED STATEMENTS OF CASH FLOWS

| Three months ended | ||||

| December 31, | ||||

|

(In millions) (Unaudited) |

2015 | 2014 | ||

| OPERATING ACTIVITIES | ||||

| NET INCOME | $ | 51.8 | $ | 46.8 |

| ADJUSTMENTS TO RECONCILE NET INCOME TO NET CASH PROVIDED BY (USED IN) OPERATING ACTIVITIES | ||||

| Depreciation and amortization | 15.9 | 17.9 | ||

| (Gain) loss on derivative instruments and foreign currency transactions | (1.9) | 1.8 | ||

| Deferred income taxes | (4.1) | (4.6) | ||

| Share-based compensation expense | 4.2 | 3.1 | ||

| Other adjustments | 0.1 | 0.1 | ||

| TOTAL ADJUSTMENTS TO RECONCILE NET INCOME TO OPERATING CASH FLOWS | 14.2 | 18.3 | ||

| CHANGES IN ASSETS AND LIABILITIES | ||||

| Accounts receivable | (40.8) | (44.2) | ||

| Inventories | (5.1) | (8.6) | ||

| Trade accounts payable | (14.6) | (12.2) | ||

| Other current and non-current assets | 4.8 | 2.5 | ||

| Other current and non-current liabilities | (9.0) | (2.5) | ||

| Current income taxes | 8.0 | 4.1 | ||

| EFFECT OF CHANGES IN ASSETS AND LIABILITIES ON OPERATING CASH FLOWS | (56.7) | (60.9) | ||

| NET CASH PROVIDED BY (USED IN) OPERATING ACTIVITIES | 9.3 | 4.2 | ||

| INVESTING ACTIVITIES | ||||

| Investment in property, plant and equipment | (11.0) | (12.3) | ||

| Proceeds from sale of property, plant and equipment | 0.5 | (0.1) | ||

| Purchase of intangible assets | - | (0.2) | ||

| NET CASH PROVIDED BY (USED IN) INVESTING ACTIVITIES | $ | (10.5) | $ | (12.6) |

The accompanying Notes are an integral part of these financial statements.

| 4 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2015

CONSOLIDATED STATEMENTS OF CASH FLOWS

| Three months ended | ||||

| December 31, | ||||

|

(In millions) (Unaudited) |

2015 | 2014 | ||

| FINANCING ACTIVITIES | ||||

| Repayments of short-term and long-term debt | $ | (22.6) | $ | - |

| Purchase of treasury stock | - | (1.2) | ||

| Common shares issued under share based compensation plans | 0.2 | 2.1 | ||

| Tax effect of common shares issued under share based compensation plans | (1.2) | (0.5) | ||

| NET CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES | (23.6) | 0.4 | ||

| CHANGE IN CASH AND CASH EQUIVALENTS | (24.8) | (8.0) | ||

| Effect of exchange rate change on cash and cash equivalents | (8.0) | (6.7) | ||

| Cash and cash equivalents at beginning of period | 517.8 | 382.8 | ||

| CASH AND CASH EQUIVALENTS AT END OF PERIOD | $ | 485.0 | $ | 368.1 |

| SUPPLEMENTAL INFORMATION | ||||

| GENERAL | ||||

| Interest paid | $ | 0.9 | $ | 0.4 |

| Interest capitalized | 0.1 | 0.1 | ||

| Income taxes paid | 10.7 | 10.9 | ||

The accompanying Notes are an integral part of these financial statements.

| 5 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2015

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (condensed)

| 1 | GENERAL |

THE COMPANY AND ITS OPERATIONS

Sirona Dental Systems, Inc. (“Sirona,” the “Company,” “we,” “us,” and “our” refer to Sirona Dental Systems, Inc. and its consolidated subsidiaries) is the leading global manufacturer of high-quality, technologically-advanced dental equipment, and is focused on developing, manufacturing, and marketing innovative systems and solutions for dentists around the world. We offer a broad range of products across all major segments of the dental technology market including CEREC and our other CAD/CAM systems, digital intra oral and 2D and 3D panoramic imaging systems, treatment centers, and instruments. The Company acquired Schick Technologies, Inc. (“Schick”) in 2006, in a transaction accounted for as a reverse acquisition (the “Exchange”), further expanding our global presence and product offerings and strengthening our research and development capabilities. Sirona has served equipment dealers and dentists worldwide for more than 130 years. The Company’s headquarters is located in Long Island City, New York with its primary facility located in Bensheim, Germany, as well as other support, manufacturing, assembling, and sales and service facilities located around the globe.

| 2 | BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

BASIS OF PRESENTATION

The accompanying unaudited interim condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”). All amounts are reported in millions of U.S. Dollars ($), except per share amounts or as otherwise disclosed.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Fiscal Year

The Company’s fiscal year is October 1 to September 30.

Principles of Consolidation

The consolidated financial statements include, after eliminating inter-company transactions and balances, the accounts of Sirona Dental Systems, Inc. and its subsidiaries.

Use of Estimates

Preparation of the interim financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions related to the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities as at the reporting date and the reported amounts of revenues and expenses for the interim period. Actual results could differ from those estimates. Certain information and footnote disclosures normally included in financial statements prepared in accordance with U.S. GAAP have been condensed or omitted pursuant to such rules and regulations. However, the Company believes that the disclosures are adequate to make the information not misleading. The year-end consolidated financial data was derived from the audited consolidated financial statements, but does not include all disclosures required by U.S. GAAP. These condensed consolidated financial statements should be read in conjunction with the Consolidated Financial Statements and the Notes thereto included in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2015.

| 6 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2015

In the opinion of management, all adjustments considered necessary to present fairly the Company’s financial position as of December 31, 2015, and the results of operations and cash flows for the three months ended December 31, 2015 and 2014, respectively, as applicable to interim periods have been made. The results of operations for the three months ended December 31, 2015 are not necessarily indicative of the operating results for the full fiscal year or future periods.

Foreign Currency

The functional currency for foreign operations has been determined in all cases to be the local currency. Assets and liabilities of foreign subsidiaries are translated into U.S. Dollars using period-end exchange rates, while revenues and expenses are translated into U.S. Dollars using weighted average exchange rates for the period. Resulting adjustments are recorded in shareholders’ equity as a component of accumulated other comprehensive income. Gains or losses resulting from transactions in other than the functional currency are reflected in the consolidated statements of income in Gain (loss) on foreign currency transactions, except for intra-group transactions of a long-term nature, which are recorded in shareholders’ equity as a component of accumulated other comprehensive income.

| 3 | ACCOUNTING STANDARDS ISSUED |

Changes to accounting principles generally accepted in the United States (“U.S. GAAP”) are established by the Financial Accounting Standards Board (“FASB”) in the form of Accounting Standards Updates (“ASUs”). The Company considers the applicability and impact of all ASUs. ASUs not listed below were assessed and determined to be either (i) not applicable, (ii) are expected to have a minimal impact on our consolidated financial statements, or (iii) their adoption had an immaterial impact on our consolidated financial statements.

ADOPTED

There were no ASUs adopted during the current period, which had a material impact on our consolidated financial statements.

NOT YET ADOPTED

In May 2015, the FASB issued ASU 2015-05, Customer’s Accounting for Fees Paid in a Cloud Computing Arrangement, which provides guidance to customers about whether a cloud computing arrangement includes a software license. If such an arrangement contains a software license, the software license element of that arrangement should be accounted for consistent with the acquisition of other software licenses. If such an arrangement does not include a software license, the arrangement should be accounted for as a service contract. ASU 2015-05 is effective for public entities for fiscal years, and interim periods within those years, beginning after December 15, 2015, which corresponds to the Company’s fiscal year beginning October 1, 2016, with early adoption permitted. The new guidance permits either prospective or retrospective adoption. We are currently evaluating the potential impact of adoption on our consolidated financial statements and have not yet selected an adoption method.

In April 2015, the FASB issued ASU 2015-03, Simplifying the Presentation of Debt Issuance Costs, which requires an entity to present such costs related to a recognized debt liability as a direct deduction from the carrying amount of that debt liability on the balance sheet rather than as an asset. ASU 2015-03 is effective for public entities for fiscal years, and interim periods within those years, beginning after December 15, 2015, which corresponds to the Company’s fiscal year beginning October 1, 2016, with early adoption permitted. Currently, we do not expect a material impact of adoption on our consolidated financial statements.

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers, which provides updated guidance on revenue recognition principles that will supersede most current conceptual and industry-specific revenue recognition guidance and thus enhance comparability of revenue recognition practices across

| 7 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2015

entities, industries, jurisdictions, and capital markets. The key principle of this updated guidance is that entities should recognize revenue to depict the transfer of goods or services to customers at an amount reflecting the consideration to which an entity expects to be entitled in exchange for those goods or services. The new guidance prescribes a five-step analysis of transactions to determine how and when to recognize revenue. In addition, the new guidance provides for capitalization of certain costs of obtaining or fulfilling a contract with a customer as well as enhanced disclosure requirements to enable a better understanding of the nature, amount, timing, and uncertainty of revenue and cash flows arising from contracts with customers. ASU 2014-09 is effective for public entities for fiscal years, and interim periods within those years, beginning after December 15, 2016. The new guidance permits the use of either a retrospective or cumulative effect transition method. In July 2015, the FASB approved a one-year deferral of the effective date to apply to fiscal years, and interim periods within those years, beginning after December 15, 2017, which corresponds to the Company’s fiscal year beginning October 1, 2018, with early adoption as of the original effective date permitted. We have not yet selected a transition method or adoption date and are evaluating the expected impact of adoption on our consolidated financial statements.

| 4 | BUSINESS COMBINATIONS |

MERGERS

On September 15, 2015, the Company and DENTSPLY International, Inc. (“DENTSPLY”) announced that the Board of Directors of both companies had unanimously approved a definitive Agreement and Plan of Merger (the “Merger Agreement”) under which the companies will combine in an all-stock merger. DENTSPLY is a leading manufacturer and distributor of dental and other consumable medical device products. The Merger Agreement provides that, upon the terms and subject to the conditions set forth in the Merger Agreement, Sirona will merge with and into a wholly-owned subsidiary of DENTSPLY, with Sirona surviving as a wholly-owned subsidiary of DENTSPLY. Upon completion of the merger, the combined company's name will be changed to DENTSPLY SIRONA Inc. Subject to the terms and conditions of the Merger Agreement, if the merger is completed, each outstanding share of Sirona common stock will be converted into the right to receive 1.8142 shares of common stock of DENTSPLY, with cash paid in lieu of any fractional shares of common stock of DENTSPLY that a Sirona stockholder would otherwise have been entitled to receive.

The Merger Agreement contains certain termination rights for both the Company and DENTSPLY, including if the merger is not consummated on or before March 15, 2016 (which is subject to extension under certain circumstances but generally not beyond December 15, 2016) and if the approval of the stockholders of either the Company or DENTSPLY is not obtained. The Merger Agreement further provides that, upon termination of the Merger Agreement under specified circumstances, including termination of the Merger Agreement by the Company or DENTSPLY as a result of an adverse change in the recommendation of the other party’s board of directors, (i) the Company may be required to pay a termination fee of $205.0 million to DENTSPLY and DENTSPLY may be required to pay a termination fee of $280.0 million to the Company and (ii) either company may be required to reimburse the other company for merger-related expenses of up to $15.0 million.

The transaction is subject to the receipt of regulatory approvals and other customary closing conditions, including the approval of stockholders of both Sirona and DENTSPLY. For additional information related to the merger refer to DENTSPLY’S Registration Statement on Form S-4 which was filed with the SEC on October 29, 2015.

On January 11, 2016, special shareholder meetings were held by both the Company and DENTSPLY. At these meetings, the stockholders of each company approved all proposals necessary to complete the merger. Receipt of certain regulatory approvals and other customary closing conditions remain outstanding; however, the transaction is still expected to be completed in the second quarter of Fiscal 2016.

| 8 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2015

| 5 | EMPLOYEE SHARE-BASED COMPENSATION |

ASC 718, Compensation – Stock Compensation, requires that all share based compensation arrangements, including grants of stock option awards to employees, be recognized based on the estimated fair value of the share-based payment award.

EQUITY INCENTIVE PLAN

Stock options, restricted stock shares, restricted stock units (“RSU”), and performance-based stock units (“PSU”) have been issued to employees, directors, and consultants under the Company’s 2015 Long-Term Incentive Plan (“2015 Plan”). The 2015 Plan provides for granting in total up to 6,825,000 stock options, incentive shares, restricted stock shares, RSU’s, PSU’s, and other forms of equity-based awards to employees, directors, consultants, and advisers. To cover the exercise of options and vesting of RSU’s and PSU’s, the Company generally issues new shares from its authorized but unissued share pool. As of December 31, 2015, 6,651,987 shares were available for future grant under the 2015 Plan.

Restricted and Performance-Based Stock Units

In the three months ended December 31, 2015, the Company granted 152,170 RSU’s with a value of $109.06, representing the closing price of the Company’s common stock at the grant date. There were no PSU’s granted.

The RSU’s will vest three years from the date of the grant. RSU’s do not have voting rights or rights to dividends prior to vesting. The value of each RSU grant is determined by the closing price at the date of grant. Share-based compensation expense for the entire award is recognized straight-line over the service period.

Stock Options

In the three months ended December 31, 2015, the Company did not grant any stock options.

COMPENSATION COSTS

The following table summarizes compensation expense charged to income for stock-based compensation and additional information for the three months ended December 31, 2015:

| Compensation Expense | Three months ended | |||

| December 31, | ||||

| (In millions) | 2015 | 2014 | ||

| Compensation expense (1) | $ | 4.2 | $ | 3.1 |

| (1) For the first three months ended December 31, 2015 and 2014, this included a compensation charge of $0.1 million and $0.2 million, respectively, for share-based awards in connection with the CFO Transition. | ||||

| 9 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2015

RESTRICTED AND PERFORMANCE-BASED STOCK UNIT ACTIVITY

The following is a summary of Sirona’s RSU and PSU activity for the three months ended December 31, 2015:

| RSU and PSU Activity | Three months ended | |||||||

| December 31, | ||||||||

| 2015 | ||||||||

| Restricted stock units | Performance-based stock units | |||||||

| Number of shares |

Weighted average market price at grant |

Number of shares |

Weighted average market price at grant | |||||

| Outstanding at beginning of period | 434,734 | $ | 69.62 | 79,570 | $ | 75.64 | ||

| Granted | 152,170 | 109.06 | - | - | ||||

| Vested | (60,756) | 59.27 | - | - | ||||

| Outstanding at end of period | 526,148 | $ | 82.22 | 79,570 | $ | 75.64 | ||

STOCK OPTION ACTIVITY

The following is a summary of Sirona’s stock option activity for the three months ended December 31, 2015:

| Stock Option Activity | Three months ended | |||

| December 31, | ||||

| 2015 | ||||

| Number of options | Weighted average exercise price | |||

| Outstanding at beginning of period | 966,464 | $ | 48.48 | |

| Exercised | (8,027) | 27.03 | ||

| Outstanding at end of period | 958,437 | $ | 48.66 | |

| thereof vested and exercisable | 650,661 | |||

| 10 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2015

| 6 | NET OTHER OPERATING INCOME (LOSS) |

The components of net other operating income (loss) for the periods under report are as follows:

| Net Other Operating Income (Loss) | Three months ended | |||

| December 31, | ||||

| (In millions) | 2015 | 2014 | ||

| Income resulting from the amortization of the deferred income related to the Patterson exclusivity payment | $ | 2.5 | $ | 2.5 |

| Other miscellaneous gain (loss) | (0.1) | - | ||

| Net other operating income (loss) | $ | 2.4 | $ | 2.5 |

DEFERRED INCOME

Effects of remeasurement of the Patterson Exclusivity Payment from U.S. Dollar to Euro are reflected in the statement of income. For the periods under report, these effects were as follows:

|

Deferred Income (Patterson Exclusivity Payment) |

Three months ended | |||

| December 31, | ||||

| (In millions) | 2015 | 2014 | ||

| Foreign currency transaction gain (loss) resulting from the remeasurement of the deferred income related to the Patterson exclusivity payment | $ | (0.6) | $ | (1.0) |

| 7 | DERIVATIVE INSTRUMENTS AND HEDGING STRATEGIES |

RISKS AND EXPOSURE

Our operations are exposed to market risks from changes in foreign currency exchange rates and interest rates. In the normal course of business, these risks are managed through a variety of strategies, including the use of derivatives.

Interest Rate Risk

The Company is exposed to interest rate risk associated with fluctuations in the interest rates on its variable interest rate debt. In order to manage this risk, the Company enters into interest rate swap agreements, when appropriate, based upon market conditions.

Foreign Currency Exposure

Although the U.S. Dollar is Sirona’s reporting currency, it conducts its business in many currencies, and its local functional currency varies depending on the country of operation, which exposes the Company to market risk associated with foreign currency exchange rate movements. The Company hedges certain foreign currency transaction exposure through foreign exchange forward contracts.

| 11 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2015

CASH FLOW HEDGES

Interest Rate

The Company uses interest rate swaps to convert a portion of its debt's variable interest rate to a fixed interest rate. Interest rate swaps have been established for 100% of the interest for the Facility A Term Loan under the Senior Facilities Agreement until November 2016. The interest rate swaps fix the LIBOR element of interest payable on 100% of the principal amount of the Facility A Term Loan for defined three month interest periods over the entire term of the loan. The defined interest rates fixed for each three month interest period range from 1.270% to 1.285%. Settlement of the swaps is required on a quarterly basis. These swaps are designated as hedging instruments under ASC 815. These instruments were immaterial for all periods under report. The Company enters into interest rate swap contracts infrequently as they are only used to manage interest rate risk on long-term debt instruments.

Foreign Currency

The Euro is the functional currency for many of Sirona’s subsidiaries, including its primary sales and manufacturing operations in Germany. During the periods under review, the U.S. Dollar/Euro exchange rate fluctuated significantly, thereby impacting Sirona’s financial results. In order to hedge portions of the transactional exposure to fluctuations in exchange rates, based on forecasted and firmly-committed cash flows, Sirona enters into foreign exchange forward contracts (currently: USD, AUD, and JPY). These forward foreign currency contracts are intended to reduce short-term effects of changes in exchange rates. The Company enters into forward contracts that are considered to be economic hedges but which are not considered hedging instruments under ASC 815. As of December 31, 2015, these contracts had notional amounts totaling $23.7 million. These agreements are relatively short-term (generally not exceeding six months).

The fair value carrying amount of the Company's derivative instruments at December 31, 2015 is described in Note 14 Fair Value Measurements.

The following tables summarize the impact of gains and losses from the fair value changes of the Company’s derivative instruments reported in our condensed consolidated statements of income for the periods under report:

| Derivatives Designated as Cash Flow Hedging Instruments | ||||

| Amount of Gain (Loss) Recognized in Accumulated Other Comprehensive Income |

For the three months ended | |||

| December 31, | ||||

| (In millions) | 2015 | 2014 | ||

| Interest rate swap contracts | $ | (0.2) | $ | (0.1) |

| 12 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2015

| Derivatives Not Designated as Hedging Instruments | |||||

| Amount of Gain (Loss) Recognized in Income on Derivative Instruments |

Three months ended | ||||

| December 31, | |||||

| (In millions) | 2015 | 2014 | Affected Line Item in the Statement of Income | ||

| Foreign exchange contracts | $ | (1.0) | $ | 0.4 | Gain (loss) on derivative instruments, net |

| 8 | INCOME TAXES |

For the first three months of fiscal year 2016, an estimated effective tax rate of 23.0% has been applied (prior year period: 23.0%). The income tax provision for the first three months ended December 31, 2015, was $15.5 million (prior year period: $14.0 million). The actual effective tax rate for fiscal year 2015 was 22.6%.

The Company's effective tax rate may vary significantly from period to period, and can be influenced by many factors. These factors include, but are not limited to, changes to statutory tax rates in the jurisdictions where the Company has operations, changes in the mix of earnings amongst jurisdictions with differing statutory tax rates (including as a result of business acquisitions and dispositions), changes in the valuation of deferred tax assets and liabilities, the results of audits and examinations of previously filed tax returns, tax planning initiatives, tax characteristics of income, as well as the timing and deductibility of expenses for tax purposes. The Company's effective tax rate differs from the U.S. federal statutory rate of 35% primarily as a result of lower statutory tax rates on foreign earnings at the Company’s operations outside of the United States. The distribution of lower-taxed foreign earnings to the U.S. would generally increase the Company's effective tax rate.

With limited exception, the Company and its subsidiaries are no longer subject to U.S. federal, state and local or non-U.S. income tax examinations by taxing authorities for tax returns filed with respect to periods prior to fiscal year 2009.

The Company makes no provision for deferred U.S. income taxes on undistributed foreign earnings because as of December 31, 2015, it remained management’s intention to continue to indefinitely reinvest such earnings in foreign operations. In making this determination, the Company also evaluates its expected cash requirements in the United States. These earnings relate to ongoing operations and, as of December 31, 2015, the approximate amount of undistributed foreign earnings amounted to $816.9 million. Because of the availability of U.S. foreign tax credits as well as other factors, it is not practicable to determine the income tax liability that would be payable if such earnings were not reinvested indefinitely.

| 13 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2015

| 9 | INCOME PER SHARE |

The computation of basic and diluted income per share is as follows:

| Income per Share | Three months ended | |||

| December 31, | ||||

| (In millions, except share and per share amounts) |

2015 | 2014 | ||

| Net income attributable to Sirona Dental Systems, Inc. common shareholders | $ | 51.3 | $ | 46.0 |

| Weighted average shares outstanding - basic | 55,914,865 | 55,416,418 | ||

| Dilutive effect of stock-based compensation (1) | 598,805 | 873,759 | ||

| Weighted average shares outstanding - diluted | 56,513,670 | 56,290,177 | ||

| Net income per share | ||||

| Basic | $ | 0.92 | $ | 0.83 |

| Diluted | $ | 0.91 | $ | 0.82 |

| (1) There were no stock options excluded from the computation of diluted earnings per share for the periods under report. | ||||

| 10 | SEGMENT REPORTING |

SEGMENT RESULTS

The following tables reflect the results of the Company’s reportable segments under the Company’s management reporting system. The segment performance measure used to monitor segment performance is gross profit (‘‘Segment Performance Measure’’) excluding the impact of the acquisition of control of the Sirona business by Sirona Holdings Luxco S.C.A. (“Luxco”) – the former controlling shareholder, a Luxembourg-based holding entity owned by funds managed by Madison Dearborn Partners (“MDP”); Beecken Petty O’Keefe and management of Sirona through a leveraged buyout transaction on June 30, 2005 (the “MDP Transaction”); and the Exchange. This measure is considered by management to better reflect the performance of each segment as it eliminates the need to allocate centrally incurred costs and significant purchase accounting impacts that the Company does not believe are representative of the performance of the segments. Furthermore, the Company monitors performance geographically by region. As the Company manages its business on both a product and a geographical basis, U.S. GAAP requires segmental disclosure based on product information.

| 14 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2015

| Segment Performance | Three months ended | |||

| December 31, | ||||

| (In millions) | 2015 | 2014 | ||

| Revenue External | ||||

| Dental CAD/CAM Systems | $ | 123.6 | $ | 98.2 |

| Imaging Systems | 105.2 | 108.0 | ||

| Treatment Centers | 48.9 | 54.0 | ||

| Instruments | 26.5 | 32.8 | ||

| Total | $ | 304.2 | $ | 293.0 |

|

Segment performance measure (gross profit) |

||||

| Dental CAD/CAM Systems | $ | 86.9 | $ | 68.4 |

| Imaging Systems | 59.6 | 63.4 | ||

| Treatment Centers | 19.3 | 21.5 | ||

| Instruments | 11.4 | 13.4 | ||

| Total Segments | $ | 177.2 | $ | 166.7 |

RECONCILIATION OF THE RESULTS OF THE SEGMENT PERFORMANCE MEASURE TO THE CONSOLIDATED STATEMENTS OF INCOME

The following table provides a reconciliation of the total results of operations of the Company’s business segments under management reporting to the consolidated financial statements. The differences shown between management reporting and U.S. GAAP for the three months ended December 31, 2015 and 2014 are due to the impact of purchase accounting and certain other corporate items. These effects are not included in the segment performance measure as the Company does not believe these to be representative of the performance of each segment.

| 15 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2015

| Reconciliation of Segment Performance Measure to Consolidated Statement of Income |

Three months ended | |||

| December 31, | ||||

| (In millions) | 2015 | 2014 | ||

| Consolidated revenue | $ | 304.2 | $ | 293.0 |

| Segment performance measure (gross profit) | ||||

| Total segments | 177.2 | 166.7 | ||

| Differences management reporting vs. U.S. GAAP (including step-up depreciation and amortization and certain other corporate items) | (3.2) | (3.8) | ||

| Consolidated gross profit | 174.0 | 162.9 | ||

| Selling, general and administrative expense | (96.4) | (87.8) | ||

| Research and development expense | (13.3) | (14.8) | ||

| Net other operating income (loss) | 2.4 | 2.5 | ||

| Gain (loss) on foreign currency transactions | 2.9 | (2.2) | ||

| Gain (loss) on derivative instruments | (1.0) | 0.4 | ||

| Interest income (expense) | (0.9) | (0.9) | ||

| Other income (expense) | (0.4) | 0.7 | ||

| Income before taxes | $ | 67.3 | $ | 60.8 |

CONCENTRATION OF REVENUE

A substantial portion of our revenue comes from two distributors accounting for more than 10% of revenues. Patterson Companies, Inc. (“Patterson”) and Henry Schein, Inc. (“Henry Schein”) accounted for revenues and accounts receivable for the three months ended December 31, 2015 compared to the three months ended December 31, 2014 as shown in the table below. These revenues were earned across all segments, with a significant portion of revenues with Patterson being earned in the CAD/CAM and Imaging segments. No other customer accounted for more than 10% of revenues.

| 16 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2015

| Concentration of Revenue | Three months ended | |||

| December 31, | ||||

| (In millions, except for percent amounts) | 2015 | 2014 | ||

| Top Customers | ||||

| Revenues | ||||

| Patterson Dental Company, Inc. | 36% | 35% | ||

| Henry Schein, Inc. | 12% | 13% | ||

| Total of customers > 10% revenues | 48% | 48% | ||

| Accounts Receivable | ||||

| Patterson Dental Company, Inc. | $ | 88.4 | $ | 69.8 |

| Henry Schein, Inc. | 11.6 | 13.8 | ||

| Total Accounts Receivable of customers > 10% revenues | $ | 100.0 | $ | 83.6 |

| 11 | ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS) |

The components and development of accumulated other comprehensive income (loss) for the periods under report are as follows:

| Accumulated Other Comprehensive Income (Loss) |

Three months ended | |||||||

| December 31, | ||||||||

| 2015 | ||||||||

| (In millions) | Cumulative translation adjustments |

Unrecognized elements of pension cost |

Net gain (loss) from hedging instruments |

Total | ||||

| Balance at beginning of period | $ | (189.1) | $ | 10.2 | $ | (0.2) | $ | (179.1) |

| Current increase (decrease) | (29.2) | (0.6) | (0.2) | (30.0) | ||||

| Income tax (expense) benefit | - | 0.2 | 0.3 | 0.5 | ||||

| Balance at end of period | (218.3) | 9.8 | (0.1) | (208.6) | ||||

| Other comprehensive income (loss) attributable to noncontrolling interests, net of tax | (0.1) | - | - | (0.1) | ||||

| Balance at end of period attributable to Sirona Dental Systems, Inc. shareholders | $ | (218.2) | $ | 9.8 | $ | (0.1) | $ | (208.5) |

| 17 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2015

| Accumulated Other Comprehensive Income (Loss) |

Three months ended | |||||||

| December 31, | ||||||||

| 2014 | ||||||||

| (In millions) | Cumulative translation adjustments |

Unrecognized elements of pension cost |

Net gain (loss) from hedging instruments |

Total | ||||

| Balance at beginning of period | $ | (85.6) | $ | 13.2 | $ | (0.4) | $ | (72.8) |

| Current increase (decrease) | (34.5) | (0.9) | (0.1) | (35.5) | ||||

| Income tax (expense) benefit | - | 0.3 | - | 0.3 | ||||

| Balance at end of period | (120.1) | 12.6 | (0.5) | (108.0) | ||||

| Other comprehensive income (loss) attributable to noncontrolling interests, net of tax | (0.1) | - | - | (0.1) | ||||

| Balance at end of period attributable to Sirona Dental Systems, Inc. shareholders | $ | (120.0) | $ | 12.6 | $ | (0.5) | $ | (107.9) |

| 12 | INVENTORIES |

The components of net inventories for the periods under report are as follows:

| Inventories | December 31, | September 30, | ||

| (In millions) | 2015 | 2015 | ||

| Finished goods | $ | 97.2 | $ | 92.9 |

| Work in progress | 14.4 | 14.1 | ||

| Raw materials | 40.4 | 42.0 | ||

| Inventories, gross | 152.0 | 149.0 | ||

| Inventory reserve | (20.1) | (19.6) | ||

| Inventories, net | $ | 131.9 | $ | 129.4 |

| 18 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2015

| 13 | PRODUCT WARRANTY |

The following table provides the components of and changes in the product warranty accrual for the periods under report:

| Product Warranty | Three months ended | |||

| December 31, | ||||

| (In millions) | 2015 | 2014 | ||

| Balance at beginning of the period | $ | 7.8 | $ | 7.6 |

| Accruals for warranties issued | 7.9 | 4.7 | ||

| Warranty settlements made | (6.8) | (4.8) | ||

| Translation adjustment | (0.2) | (0.2) | ||

| Balance at end of the period | $ | 8.7 | $ | 7.3 |

| 14 | FAIR VALUE MEASUREMENTS |

The Company applies the provisions of ASC 820, Fair Value Measurements and Disclosures, for assets and liabilities that are recognized or disclosed at fair value in the financial statements on a recurring basis. ASC 820 defines fair value as the price that would be received from selling an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. When determining the fair value measurements for assets and liabilities that are required to be recorded or disclosed at fair value, the Company considers the principal or most advantageous market in which it would transact and the market-based risk measurements or assumptions that market participants would use in pricing the asset or liability, such as inherent risk, transfer restrictions, and the credit risk of the Company and counterparties to the arrangement.

ASC 820 establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value into three levels. A financial instrument’s categorization within the fair value hierarchy is based upon the lowest level of input that is available and significant to the fair value measurement. ASC 820 establishes and prioritizes the following three levels of inputs that may be used to measure fair value:

| Level 1 | Quoted prices in active markets for identical assets or liabilities. |

| Level 2 | Observable inputs other than quoted prices in active markets for identical assets and liabilities, quoted prices for identical or similar assets or liabilities in inactive markets, or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities. |

| Level 3 | Inputs that are generally unobservable and typically reflect management’s estimates of assumptions that market participants would use in pricing the asset or liability. |

| 19 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2015

FAIR VALUE OF FINANCIAL INSTRUMENTS

Financial instruments consist of cash, cash equivalents, accounts receivable, accounts payable, foreign currency forward contracts, interest rate swaps, and certain liabilities related to business acquisitions primarily resulting from earn-out features. The carrying amounts of cash, cash equivalents, accounts receivable and accounts payable approximate their respective fair values because of the short maturity and nature of these items. The fair value of the foreign currency forward contracts and interest rate swaps is determined by the estimated cash flows of those contracts and swaps. The fair values of the acquisition-related liabilities are based on discounted valuations of commercial assumptions made by Company management of stipulations governed in the underlying purchase agreements.

ASSETS/LIABILITIES MEASURED AT FAIR VALUE ON A RECURRING BASIS

The following table presents the Company’s assets and liabilities measured at fair value on a recurring basis for the periods under report:

| Assets and Liabilities Measured at Fair Value - Recurring Basis |

December 31, | |||||||

| 2015 | ||||||||

|

Quoted in Active Markets for Identical Instruments (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

Total | |||||

| (In millions) | Foreign Exchange |

|||||||

| Assets | ||||||||

|

Cash Equivalents (money market funds) |

$ | 243.6 | $ | - | $ | - | $ | 243.6 |

| Liabilities | ||||||||

| Derivative Liabilities | - | (0.6) | - | (0.6) | ||||

| Business Combination-related liabilities | - | - | (7.1) | (7.1) | ||||

| Total | $ | 243.6 | $ | (0.6) | $ | (7.1) | $ | 235.9 |

| 20 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2015

| Assets and Liabilities Measured at Fair Value - Recurring Basis |

September 30, | |||||||

| 2015 | ||||||||

|

Quoted in Active Markets for Identical Instruments (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

Total | |||||

| (In millions) | Foreign Exchange |

|||||||

| Assets | ||||||||

|

Cash Equivalents (money market funds) |

$ | 213.9 | $ | - | $ | - | $ | 213.9 |

| Derivative Assets | - | 0.6 | - | 0.6 | ||||

| Liabilities | ||||||||

| Derivative Liabilities | - | (0.1) | - | (0.1) | ||||

| Business Combination-related liabilities | - | - | (7.1) | (7.1) | ||||

| Total | $ | 213.9 | $ | 0.5 | $ | (7.1) | $ | 207.3 |

There was no change in the fair value of the business acquisition-related liabilities for the period under report. A total for all acquisitions of $0.2 million (expense) was recorded in other income (expense) in the income statement for the three months ended December 31, 2015.

In the Company’s December 31, 2015 and September 30, 2015 Consolidated Balance Sheet, derivative assets and derivative liabilities are classified as prepaid expenses and other current assets and accrued liabilities and deferred income, respectively.

The Company did not elect the fair value option for any other eligible financial instruments.

| 21 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2015

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

INTRODUCTION

Except as otherwise indicated or unless context otherwise requires, the terms “Sirona”, the “Company”, “we”, “us”, and “our” refer to Sirona Dental Systems, Inc. and its consolidated subsidiaries.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A) is intended to provide the reader of our financial statements with a narrative, from the perspective of our management, on our business, financial condition, results of operations, liquidity, and certain other factors that may affect our future results. Unless expressly stated otherwise, the comparisons presented in this MD&A refer to the same period in the prior year.

Our MD&A should be read in conjunction with the Consolidated Financial Statements included elsewhere in this report and the MD&A included in our Annual Report on Form 10-K for the fiscal year ended September 30, 2015. Actual results and the timing of certain events may differ significantly from those projected in forward-looking statements due to a number of factors, including those set forth in “Operations Review” in this Item and elsewhere in this Report.

All amounts in this section are reported in millions of U.S. Dollars ($), except as otherwise disclosed.

Non-GAAP Financial Measures

Certain income statement information is presented on an adjusted basis. Such information represents non-GAAP financial measures. Sirona supplementally presents this information because it believes doing so facilitates a better comparison of its operating results from period to period without regard to certain significant items, which management believes do not reflect Sirona’s operating performance in the ordinary, ongoing and customary course of its operations. For a listing and definitions of our current non-GAAP financial measures as well as a reconciliation of these measures to the most comparable GAAP measure, please refer to “Non-GAAP Financial Measures” within “Operations Review” in this MD&A.

EXECUTIVE OVERVIEW OF SIRONA’S BUSINESS AND PERFORMANCE

Business

Sirona is the leading global manufacturer of high-quality, technologically-advanced dental equipment, and is focused on developing, manufacturing, and marketing innovative systems and solutions for dentists around the world. The Company is uniquely positioned to benefit from several trends in the global dental industry, such as technological innovation, increased use of CAD/CAM systems in restorative dentistry, the shift to digital imaging, favorable demographic trends, and growing patient focus on dental health and cosmetic appearance. The Company’s headquarters is in Long Island City, New York, and its largest facility is located in Bensheim, Germany.

Sirona has a long tradition of innovation in the dental industry. The Company introduced the first dental electric drill over 130 years ago, the first dental X-ray unit approximately 100 years ago, the first dental computer-aided design/computer-aided manufacturing (CAD/CAM) system 30 years ago, and numerous other significant innovations in dentistry. Sirona continues to make significant investments in research and development (“R&D”), and its track record of innovative and profitable new products continues today. Sirona has the broadest product portfolio in the industry and is capable of fully outfitting and integrating a dental practice.

The majority of our revenues derive from the manufacture and sale of dental equipment. In addition, we also provide sales and after-sales service support to dentists and distributors through our growing sales and service infrastructure.

| 22 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2015

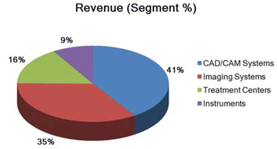

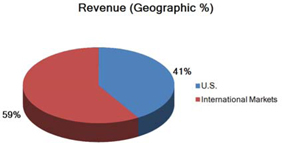

Sirona manages its commercial operations on both a product and geographic basis and maintains four segments: 1) Dental CAD/CAM Systems, 2) Imaging Systems, 3) Treatment Centers, and 4) Instruments. Products from each category are marketed in all geographical sales regions.

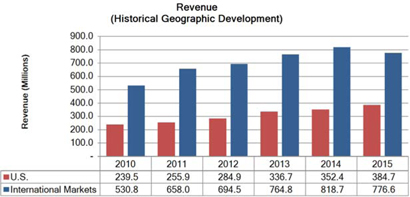

Our business has grown substantially in the past several fiscal years, driven by numerous high-tech product introductions, a continued expansion of our global sales and service infrastructure, and strong relationships with key distribution partners, namely Patterson in the U.S. and Henry Schein in Europe.

U.S.: Revenues have been driven by innovative products, particularly in the CAD/CAM and Imaging segments.

International Markets: Sirona has been able to grow revenues in international markets by gaining market share with its innovative, best-in-class product solutions as well as through expansion of its local presence and distribution channels by establishing sales and service locations in countries such as Australia, Brazil, China, Italy, Japan, Russia, Slovakia, South Africa, South Korea, and Turkey. The expansion helped to increase market share but also contributed to higher SG&A expenses.

Sirona has been able to grow by often being first-to-market and establishing a strong distribution network as these countries’ dental markets expanded. Additionally, increasing demand for best-in-class dental technology and growing middle class populations demanding better dental care in these markets have increased demand for Sirona’s products.

Current Performance at a Glance

The following is a synopsis of our performance for the three months ended December 31, 2015:

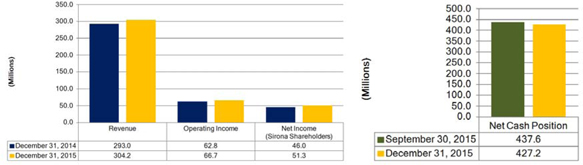

| · | Revenue: For the three months ended December 31, 2015, reported revenue increased 3.8%. On a Local Currency basis, total revenues were up 11.6% over the prior-year period (8.2% organic growth and 3.4% via business acquisitions (prior year period: up 3.8% Local Currency). We continued to see growing demand for products across all segments. CAD/CAM grew in all regions, particularly in the U.S., while Imaging was especially strong in Germany. Instruments and Treatment Centers benefited from our expanded distribution agreement with Patterson in the U.S. Geographically, Local Currency growth was driven primarily by the U.S. |

| 23 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2015

|

|

| · | Operating Income: Operating income increased $3.9 million, or 6.2%, compared to the same period last year. |

Highlights: Gross profit increased by $11.1 million, primarily as the result of the increase in reported revenues. Gross profit margin benefitted from foreign exchange developments and improved to 57.2% (prior year period: 55.6%). We incurred merger-related expenses during the current period and continued to invest in the expansion of our sales and service infrastructure in key markets and in research and development for new products and services. As a result, SG&A expenses increased $8.6 million, while R&D expenses were below the prior-year period by $1.5 million, both of which were favorably impacted by foreign exchange fluctuations.

| · | Net Income: Net income attributable to Sirona shareholders was $51.3 million, an increase of $5.3 million, or 11.5%, over the prior year. |

| · | Cash Position: At December 31, 2015, the Company had cash and cash equivalents of $485.0 million and total debt of $57.8 million, resulting in net cash of $427.2 million, or a decrease of $10.4 million compared to September 30, 2015. This decrease was driven by a debt repayment and foreign exchange fluctuations. |

Significant Factors Affecting Our Operating Performance

Foreign Currency Fluctuations

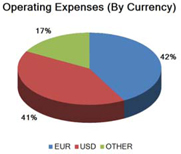

Fluctuations in exchange rates impact Sirona’s financial results. Although the U.S. Dollar is Sirona’s reporting currency, Sirona conducts its business in many currencies, and its functional currencies vary depending on the country of operation. As a percent of total revenues, sales and operating expenses(1) in Euro, U.S. Dollar, and all other currencies(2) for the three months ended December 31, 2015 were approximately as follows:

| 24 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2015

|

|

| (1) | cost of goods sold, SG&A, R&D, and other operating expenses |

| (2) | most importantly: Japanese Yen, Australian Dollar, Chinese Yuan Renminbi, and Brazilian Real |

The single most significant influencing factor is the U.S. Dollar/Euro exchange rate. During the periods under review, the U.S. Dollar/Euro exchange rate has fluctuated significantly. The following table presents the relevant U.S. Dollar/Euro exchange rate information for the period(s) under report:

| Fluctuations in Exchange Rates (USD/EUR) |

Three months ended | |||

| December 31, | ||||

| (In U.S. Dollars) | 2015 | 2014 | ||

| Exchange rate used to calculate items in Sirona's financial statements: | ||||

| Period-end(1) | $ | 1.0893 | $ | 1.2155 |

| Average(2) | 1.0954 | 1.2490 | ||

| Fluctuations during the period: | ||||

| Low(3) | $ | 1.0548 | $ | 1.2155 |

| High(4) | 1.1435 | 1.2814 | ||

| (1) Closing rate as of the balance sheet date. | ||||

| (2) Average exchange rate for the period. | ||||

| (3) Lowest daily exchange rate for the period. | ||||

| (4) Highest daily exchange rate for the period. | ||||

Although Sirona does not apply hedge accounting for foreign currency derivatives, it has entered into foreign exchange forward contracts to help mitigate foreign currency exposure. As these agreements are short-term (generally not exceeding six months) and do not cover all underlying exposures, continued fluctuation in exchange rates could materially affect Sirona’s results of operations.

Loans made to Sirona under the Senior Facilities Agreement entered into on November 14, 2011, are denominated in the functional currency of the respective borrowers. See “Liquidity and Capital Resources” for a discussion of our Senior Facilities Agreement. However, intra-group loans and other intra-group monetary assets and liabilities are often denominated in the functional currency of only one of the parties to the agreements. Where intra-group loans are of a long-term investment nature, the potential fluctuations in exchange rates are reflected within other comprehensive income, whereas exchange rate fluctuations for short-term intra-group loans and other short-term intra-group transactions are recorded in the consolidated statements of income. These fluctuations may be significant in any period.

| 25 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2015

The MDP Transaction and the Exchange

The assets and liabilities acquired in the MDP Transaction and the Exchange were partially stepped up to fair value, and a related deferred tax liability was recorded. The excess of the total purchase price over the fair value of the net assets acquired, including IPR&D, which were expensed at the date of closing of the MDP Transaction and the Exchange, was allocated to goodwill and is subject to periodic impairment testing.

Sirona’s cost of goods sold, R&D, SG&A expense and operating results have been and will continue to be materially affected by depreciation and amortization costs resulting from the step-up to fair value of Sirona’s assets and liabilities.

For more detailed information concerning factors affecting our operating results, please refer to “Significant Factors that Affect Sirona’s Results of Operations” in the MD&A section of our Annual Report on Form 10-K for the fiscal year ended September 30, 2015.

| 26 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2015

OPERATIONS REVIEW

CURRENT QUARTER

| Operations Review | Three months ended | |||||||||||

| December 31, | ||||||||||||

| 2015 | 2014 | Change | ||||||||||

| (In millions, except for percent amounts) |

||||||||||||

| REVENUE | $ | 304.2 | 100.0% | $ | 293.0 | 100.0% | $ | 11.2 | 3.8% | |||

| Dental CAD/CAM Systems | 123.6 | 40.6% | 98.2 | 33.5% | 25.4 | 25.9% | ||||||

| Imaging Systems | 105.2 | 34.6% | 108.0 | 36.9% | (2.8) | (2.6%) | ||||||

| Treatment Centers | 48.9 | 16.1% | 54.0 | 18.4% | (5.1) | (9.4%) | ||||||

| Instruments | 26.5 | 8.7% | 32.8 | 11.2% | (6.3) | (19.2%) | ||||||

| COST OF GOODS SOLD | (130.2) | (42.8%) | (130.1) | (44.4%) | (0.1) | (0.1%) | ||||||

| GROSS PROFIT (1) | 174.0 | 57.2% | 162.9 | 55.6% | 11.1 | 6.8% | ||||||

| Dental CAD/CAM Systems | 86.9 | 70.3% | 68.4 | 69.7% | 18.5 | 27.0% | ||||||

| Imaging Systems | 59.6 | 56.7% | 63.4 | 58.7% | (3.8) | (6.0%) | ||||||

| Treatment Centers | 19.3 | 39.5% | 21.5 | 39.8% | (2.2) | (10.2%) | ||||||

| Instruments | 11.4 | 43.0% | 13.4 | 40.9% | (2.0) | (14.9%) | ||||||

| Corporate (unallocated) | (3.2) | (3.8) | 0.6 | 15.8% | ||||||||

| Selling, general and administrative expense | (96.4) | (31.7%) | (87.8) | (30.0%) | (8.6) | (9.8%) | ||||||

| Research and development | (13.3) | (4.4%) | (14.8) | (5.1%) | 1.5 | 10.1% | ||||||

| Net other operating income (expense) | 2.4 | 0.8% | 2.5 | 0.9% | (0.1) | (4.0%) | ||||||

| OPERATING INCOME | 66.7 | 21.9% | 62.8 | 21.4% | 3.9 | 6.2% | ||||||

| Gain (loss) on foreign currency transactions, net | 2.9 | 1.0% | (2.2) | (0.8%) | 5.1 | 231.8% | ||||||

| Gain (loss) on derivative instruments | (1.0) | (0.3%) | 0.4 | 0.1% | (1.4) | (350.0%) | ||||||

| Interest expense, net | (0.9) | (0.3%) | (0.9) | (0.3%) | - | 0.0% | ||||||

| Other income (expense) | (0.4) | (0.1%) | 0.7 | 0.2% | (1.1) | (157.1%) | ||||||

| INCOME BEFORE TAXES | 67.3 | 22.1% | 60.8 | 20.8% | 6.5 | 10.7% | ||||||

| Income tax provision | (15.5) | (5.1%) | (14.0) | (4.8%) | (1.5) | (10.7%) | ||||||

| NET INCOME | 51.8 | 17.0% | 46.8 | 16.0% | 5.0 | 10.7% | ||||||

| Less: Net income attributable to noncontrolling interests | (0.5) | (0.2%) | (0.8) | (0.3%) | 0.3 | 37.5% | ||||||

| NET INCOME ATTRIBUTABLE TO SIRONA DENTAL SYSTEMS, INC. | $ | 51.3 | 16.9% | $ | 46.0 | 15.7% | $ | 5.3 | 11.5% | |||

| (1) Percentages refer to the percent of total revenues except for segment gross profit information, where percentages refer to segment gross profit margin. | ||||||||||||

| 27 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2015

Revenue

For the three months ended December 31, 2015, revenue was $304.2 million, an increase of $11.2 million, or 3.8% (increased 11.6% Local Currency). Local Currency growth of 11.6% (8.2% organic growth and 3.4%, or $10.1 million, of growth via business acquisitions) was offset by a 7.8% unfavorable foreign exchange impact on our reported revenue. This was driven by the continued weakness of the Euro and other major currencies (such as Australian Dollar, Brazilian Real, Japanese Yen, etc.) during the quarter and impacted all segments. Revenue developed by segment and geographically as follows:

By segment:

| · | CAD/CAM Systems (increased 25.9% - up 33.8% Local Currency): Segment revenues were $123.6 million (prior year period: $98.2 million), an increase of $25.4 million reported compared to an increase of $33.2 million in Local Currency ($23.1 million, or 23.5%, organic growth and $10.1 million, or 10.3%, via business acquisitions). Overall revenue growth was led by the U.S. |

| · | Imaging Systems (decreased 2.6% - up 2.8% Local Currency): Segment revenues were $105.2 million (prior year period: $108.0 million), a decrease of $2.8 million reported compared to an increase of $3.0 million in Local Currency. Local Currency revenue growth was driven by international markets, particularly Germany, where we experienced strong demand for our Orthophos line. |

| · | Treatment Centers (decreased 9.4% - up 1.3% Local Currency): Segment revenues were $48.9 million (prior year period: $54.0 million), a decrease of $5.1 million reported compared to an increase of $0.7 million in Local Currency. Our Treatment Center segment revenues grew 1.3% Local Currency against a strong first quarter in the prior year, benefiting from the introduction into the U.S market via our expanded distribution agreement with Patterson. |

| · | Instruments (decreased 19.2% - down 8.6% Local Currency): Segment revenues were $26.5 million (prior year period: $32.8 million), a decrease of $6.3 million reported compared to a decrease of $2.8 million in Local Currency. Local Currency revenues were down compared to a very strong prior year, primarily due to the timing of tender business in international markets. |

Geographically:

| · | U.S. (increased 20.9%): Overall, U.S. revenues experienced shifts in momentum from Imaging to strong demand for our CAD/CAM products. Revenues grew 11.2% organically and 9.7% via business acquisitions. |

| · | International Markets (decreased 5.6% - increased 6.5% Local Currency): Local Currency revenues experienced steady growth in Germany, with increased demand for our Imaging products, as well as in other international markets outside of Europe. Reported revenues were significantly impacted by the weakness of the Euro and other major currencies compared to the prior-year period. |

Cost of Goods Sold and Gross Profit

Cost of Goods Sold

For the three months ended December 31, 2015, cost of goods sold was $130.2 million, an increase of $0.1 million, or 0.1%. Cost of goods sold as a percentage of sales decreased to 42.8% (prior year period: 44.4%). Cost of goods sold benefited mainly from the weakness of the Euro during the period. Amortization and depreciation expense resulting from the step-up to fair values of tangible and intangible assets, included in cost of goods sold, declined by $1.7 million compared to the prior-year period.

| 28 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2015

Gross Profit

For the three months ended December 31, 2015, gross profit was $174.0 million, an increase of $11.1 million, or 6.8%, compared to an increase in revenue of $11.2 million, or 3.8%. Gross profit margin was 57.2% (prior year period: 55.6%). The 1.6% increase in the gross profit margin was mainly due to the abovementioned favorable foreign exchange effects.

By segment, gross profit and gross profit margin developed in the three months ended December 31, 2015, compared to the three months ended December 31, 2014 as follows:

| · | CAD/CAM Systems: Segment gross profit was $86.9 million (prior year period: $68.4 million), an increase of $18.5 million compared to an increase of $25.4 million in reported segment revenue. Segment gross profit margin was 70.3% (prior year period: 69.7%). The 0.6% improvement was primarily due to favorable foreign exchange effects. |

| · | Imaging Systems: Segment gross profit was $59.6 million (prior year period: $63.4 million), a decrease of $3.8 million compared to a decrease of $2.8 million in reported segment revenue. Segment gross profit margin was 56.7% (prior year period: 58.7%). The 2.0% decline was primarily due to unfavorable product mix, which was partially offset by benefits from the weakening of the Euro. |

| · | Treatment Centers: Segment gross profit was $19.3 million (prior year period: $21.5 million), a decrease of $2.2 million compared to a decrease of $5.1 million in reported segment revenue. Segment gross profit margin was 39.5% (prior year period: 39.8%). The 0.3% decline was driven by lower sales of our comfort line and repositioning of certain products in targeted markets. |

| · | Instruments: Segment gross profit was $11.4 million (prior year period: $13.4 million), a decrease of $2.0 million compared to a decrease of $6.3 million in reported segment revenue. Segment gross profit margin was 43.0% (prior year period: 40.9%). The 2.1% improvement was largely the result of improved manufacturing efficiencies. |

Selling, General, and Administrative

For the three months ended December 31, 2015, SG&A expense was $96.4 million, an increase of $8.6 million, or 9.8%. The increase in SG&A expense included $2.1 million of merger and acquisition costs. The remaining increase was primarily driven by the general increase in sales volume. We continue to invest in the expansion of our sales and service infrastructure in growth markets.

Research and Development

R&D expense for the three months ended December 31, 2015, was $13.3 million, a decrease of $1.5 million, or 10.1%. The decrease was mostly driven by the weakness of the Euro. As a percentage of revenue, R&D expense was 4.4% (prior year period: 5.1%).

Net Other Operating Income (Loss)

Net other operating income (loss) for the three months ended December 31, 2015, compared to the three months ended December 31, 2014 was as follows:

| 29 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2015

| Net Other Operating Income (Loss) | Three months ended | |||

| December 31, | ||||

| (In millions) | 2015 | 2014 | ||

| Income resulting from the amortization of the deferred income related to the Patterson exclusivity payment | $ | 2.5 | $ | 2.5 |

| Other miscellaneous gain (loss) | (0.1) | - | ||

| Net other operating income (loss) | $ | 2.4 | $ | 2.5 |

Gain (Loss) on Foreign Currency Transactions and Derivative Instruments

Foreign Currency Transactions

The gain on foreign currency transactions for the three months ended December 31, 2015 amounted to $2.9 million (prior year period: loss of $2.2 million). The components of these results are as follows:

| Gain (Loss) on Foreign Currency Transactions |

Three months ended | |||

| December 31, | ||||

| (In millions) | 2015 | 2014 | ||

| Unrealized non-cash foreign exchange gain (loss) from translation adjustment of deferred income related to the Patterson exclusivity payment | $ | (0.6) | $ | (1.0) |

| Unrealized non-cash foreign exchange gain (loss) on short-term intra-group loans | 0.6 | (0.5) | ||

| Gain (loss) on other foreign currency transactions (1) | 2.9 | (0.7) | ||

| Gain (Loss) on Foreign Currency Transactions | $ | 2.9 | $ | (2.2) |

| (1) For the three months ended December 31, 2015 and 2014, the gain (loss) on other foreign currency transactions related to the revaluation of short-term assets and liabilities and realized transactions, both of which were primarily impacted by the fluctuations between the Yen/Euro, Euro/U.S. Dollar, and Real/Euro exchange rates. | ||||

Derivative Instruments

For the three months ended December 31, 2015, the loss on derivative instruments was $1.0 million (prior year period: gain of $0.4 million). In both periods, the results related to foreign currency hedges.

Income Tax Provision

For the three months ended December 31, 2015, Sirona recorded a profit before income taxes of $67.3 million (prior year period: $60.8 million), an income tax provision of $15.5 million (prior year period: $14.0 million), and an estimated effective tax rate applied for the quarter of 23.0% (prior year period: 23.0%). The estimated effective tax rate is primarily driven by the expected mix of earnings across different jurisdictions.

| 30 |

SIRONA DENTAL SYSTEMS, INC.

AND SUBSIDIARIES

FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2015

NON-GAAP FINANCIAL MEASURES (unaudited)

To supplement our consolidated financial statements, operations review, and our business outlook, we currently use the following non-GAAP financial measures (unaudited):

| · | Local Currency, |

| · | Non-GAAP Adjusted Net Income, and |

| · | Non-GAAP Adjusted Earnings Per Diluted Share, |

Management recognizes that the use of these non-GAAP measures has limitations, including the fact that they might not be comparable with similar non-GAAP measures used by other companies and that management must exercise judgment in determining which types of charges and other items should be excluded from its non-GAAP financial measures. Management currently compensates for these limitations by providing full disclosure of each non-GAAP financial measure and a reconciliation to the most directly comparable GAAP measure. The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.