Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Capital Bank Financial Corp. | a8-kx701filingfeb2016.htm |

February 2016

Safe Harbor Statement 2 February 2016 Forward-Looking Statements Information in this presentation contains forward-looking statements. Any statements about our expectations, beliefs, plans, predictions, forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward- looking. These statements are often, but not always, made through the use of words or phrases such as “anticipate,” “believes,” “can,” “could,” “may,” “predicts,” “potential,” “should,” “will,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “intends” and similar words or phrases. Accordingly, these statements are only predictions and involve estimates, known and unknown risks, assumptions and uncertainties that could cause actual results to differ materially from those expressed in them. Our actual results could differ materially from those anticipated in such forward-looking statements as a result of several factors more fully described under the caption “Risk Factors” in the annual report on Form 10-K and other periodic reports filed by us with the Securities and Exchange Commission. Any or all of our forward-looking statements in this presentation may turn out to be inaccurate. The inclusion of this forward-looking information should not be regarded as a representation by us or any other person that the future plans, estimates or expectations contemplated by us will be achieved. We have based these forward- looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward looking statements including, but not limited to: (1) changes in general economic and financial market conditions; (2) changes in the regulatory environment; (3) economic conditions generally and in the financial services industry; (4) changes in the economy affecting real estate values; (5) our ability to achieve loan and deposit growth; (6) the completion of future acquisitions or business combinations and our ability to integrate any acquired businesses into our business model; (7) projected population and income growth in our targeted market areas; (8) competitive pressures in our markets and industry; (9) our ability to attract and retain key personnel; (10) changes in accounting policies or judgments; and (11) volatility and direction of market interest rates and a weakening of the economy which could materially impact credit quality trends and the ability to generate loans. All forward-looking statements are necessarily only estimates of future results and actual results may differ materially from expectations. You are, therefore, cautioned not to place undue reliance on such statements which should be read in conjunction with the other cautionary statements that are included elsewhere in this presentation. Further, any forward-looking statement speaks only as of the date on which it is made and we undertake no obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events.

Additional Information and Where to Find It 3 February 2016 This communication is being made in respect of the proposed merger transaction involving Capital Bank Financial or CommunityOne. Capital Bank Financial filed on December 18, 2015 a registration statement on Form S-4 with the SEC that included a preliminary joint proxy statement of Capital Bank Financial and CommunityOne that will also constitute a prospectus of Capital Bank Financial. Capital Bank Financial and CommunityOne will mail the definitive joint proxy statement/prospectus to Capital Bank Financial’s and CommunityOne’s stockholders seeking any required stockholder approvals. Before making any voting or investment decision, investors and security holders of Capital Bank Financial and CommunityOne are urged to carefully read the entire registration statement and joint proxy statement/prospectus, as well as any amendments or supplements to these documents, because they contain important information about the proposed transaction. The documents filed by Capital Bank Financial and CommunityOne with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, the documents filed by Capital Bank Financial may be obtained free of charge at Capital Bank Financial’s website at http://investor.capitalbank-us.com/ and the documents filed by CommunityOne may be obtained free of charge at CommunityOne’s website at http://ir.community1.com/. Alternatively, these documents, can be obtained free of charge from Capital Bank Financial upon written request to Capital Bank Financial Corp., Attention: Secretary, 4725 Piedmont Row Drive, Suite 110 Charlotte, North Carolina 28210 or from CommunityOne upon written request to CommunityOne Bancorp, Attention: Secretary, 1017 E. Morehead Street, Suite 200, Charlotte, North Carolina 28204. Capital Bank Financial, CommunityOne, their directors, executive officers and certain other persons may be deemed to be participants in the solicitation of proxies from Capital Bank Financial’s and CommunityOne’s stockholders in favor of the approval of the merger. Information about the directors and executive officers of Capital Bank Financial and their ownership of Capital Bank Financial common stock is set forth in the proxy statement for Capital Bank Financial’s 2015 annual meeting of stockholders, as previously filed with the SEC on April 30, 2015. Information about the directors and executive officers of CommunityOne and their ownership of CommunityOne common stock is set forth in the proxy statement for CommunityOne’s 2015 annual meeting of stockholders, as previously filed with the SEC on April 7, 2015. Stockholders may obtain additional information regarding the interests of such participants by reading the registration statement and the proxy statement/prospectus.

4 Creating Regional Bank Franchise in SE Growth Markets February 2016 CommunityOne* Capital Bank * Subject to regulatory and shareholder approval. *

5 Commitment to Profitability and Returns February 2016 See reconciliation of non-GAAP measures in appendix. Progress Toward Double-Digit Core ROTCE Goal Achieved Core ROA Goal of 1.00% 0% 1.00% 0.0% 0.2% 0.4% 0.6% 0.8% 1.0% 1.2% 8.75% 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 10%

6 Fourth Quarter Highlights ■ Reported EPS of $0.34 and record core EPS of $0.41 up 41% y/y ■ Generated $487 million of new loans, and grew total loan portfolio 17% annualized q/q and 13% y/y ■ Grew total deposits by $295 mm, up 12% y/y ■ Drove core noninterest expense down 15% y/y and core efficiency ratio to 59% ■ Achieved core ROA target of 1.00% ■ Repurchased 1.2 million shares ■ Announced acquisition of CommunityOne, with closing now anticipated in 2Q and systems conversion during Memorial Day weekend February 2016 See reconciliation of non-GAAP measures in appendix.

Fourth Quarter Financial Summary 7 February 2016 See reconciliation of non-GAAP measures in appendix. ■ Net interest income increased by $0.4 million sequentially, with loan growth offsetting 12 bps in NIM compression ■ Provision includes $2.3 mm for new loans and $1.2 mm impairment reversal for legacy portfolio ■ Noninterest expense includes non-core charges of $5.0 mm pre-tax ■ Non-interest income includes $1.5 mm in FDIC expense, of which $1 mm reflects recoveries due to the FDIC associated with the legacy portfolio impairment reversal ($ mm's except per share data, growth rates, and metrics) 4Q15 3Q15 4Q14 Net interest income 62.1 0.7% 1.2% Provision (reversal) 1.1 36% -271% Non-interest income 10.6 -7% 0% Non-interest expense 47.8 -1% -6% Pretax income 23.8 0% 10% Net income 15.0 -2% 9% Per share $0.34 3% 17% Core adjustments 3.3 NM NM Core Net Income 18.3 19% 31% Per share $0.41 24% 41% Key Metrics 4Q15 3Q15 4Q14 Net interest margin 3.70% 3.82% 4.05% Core fee ratio 14.5% 15.7% 14.1% Core efficiency ratio 58.9% 66.0% 70.5% Core ROA 1.00% 0.87% 0.83% Core ROTCE 8.7% 7.1% 6.2% % change Non-core adjustments detail $ 000s Cancellation of debit card processing contract 4,215 Conversion, merger, and restructuring 738 Securities gains (54) Total pre-tax 4,899 Tax effect of adjustments (1,625) Total after-tax 3,274

New ROA Target for 2017 8 February 2016 Core Return on Average Assets See reconciliation of non-GAAP measures in appendix. 1.00% 1.10% 4Q 15 P ro vi si on P A A ru n- of f Lo an a nd D ep os it G ro w th B al an ce S he et O pt im iz at io n C os t S av in gs A cq ui si tio n of C om m un ity O ne 20 17 T ar ge t 1.10% ■ NIM compression from purchase accounting ■ Planning for reduced recoveries ■ Sustain high quality loan and deposit growth ■ Balance sheet optimization ■ Further cost savings at CommunityOne and Capital Bank ■ Committed to double-digit ROTCE

Generated $487 mm of New Loans 9 February 2016 New Loans by Geography New Loans by Product $ mm’s $ mm’s 87 92 161 155 145 196 138 200 234 199 175 86 128 101 143 $457 $316 $489 $490 $487 4Q14 1Q15 2Q15 3Q15 4Q15 Florida Carolinas Tennessee 233 139 210 160 217 83 65 91 126 98 141 112 188 204 172 $457 $316 $489 $490 $487 4Q14 1Q15 2Q15 3Q15 4Q15 Commercial CRE Consumer Includes loan purchases of $43 mm, $14 mm, and $33 mm in 4Q15, 3Q15, and 2Q15, respectively

Total Deposits Up 12% Y/Y 10 February 2016 Cost of Deposits Deposit Balances $ mm’s 0.34% 0.34% 0.36% 0.39% 0.40% 0.15% 0.15% 0.15% 0.15% 0.15% 0.39% 0.38% 0.39% 0.40% 0.40% 4Q14 1Q15 2Q15 3Q15 4Q15 Total Core Contractual 1,054 1,115 1,132 1,099 1,121 1,384 1,405 1,367 1,252 1,383 1,398 1,416 1,471 1,442 1,609 1,419 1,428 1,522 1,773 1,747 5,255 5,364 5,492 5,566 5,860 4Q14 1Q15 2Q15 3Q15 4Q15 Noninterest demand NOW Savings & Money Market Time Deposits % of Total 27% 24% 19% 30%

NIM Compression In Line with Forecast 11 February 2016 Net Interest Margin (NIM) See reconciliation of non-GAAP measures in appendix. 4.05% 3.96% 3.94% 3.82% 3.70% 3.38% 3.26% 3.25% 3.19% 3.21% 4Q14 1Q15 2Q15 3Q15 4Q15 GAAP NIM Contractual NIM ■ NIM declined 12 bps primarily due to reduced income from purchase accounting ■ Contractual NIM excluding purchase accounting stable sequentially and down only 17 bps year-over-year

Total Non-interest Income Flat y/y 12 February 2016 Non-interest Income Before FDIC Expense $ mm’s See reconciliation of non-GAAP measures in appendix. Non-interest Income Detail $ mm’s 4Q14 3Q15 4Q15 Services charges on deposits 5.3 5.5 4.9 Debit card income 3.0 3.1 3.0 Fees on mortgage loans sold 1.1 1.0 0.9 Investment advisory and trust fees 1.2 0.9 0.6 Other 3.5 2.4 2.7 Non-interest Income ex FDIC expense 14.0 12.8 12.1 FDIC indemnification asset expense (3.4) (1.4) (1.5) Non-interest Income 10.6 11.4 10.6 10.6 9.9 10.4 11.4 10.6 3.4 2.4 2.5 1.4 1.5 14.0 12.4 12.9 12.8 12.1 4Q14 1Q15 2Q15 3Q15 4Q15 FDIC indemnification asset expense Total Non-interest Income ■ FDIC indemnification asset expenses includes $1 mm of recoveries due to legacy asset impairment reversal

Core Noninterest Expense Down 15% Y/Y 13 February 2016 Non-interest Expense $ mm’s See reconciliation of non-GAAP measures in appendix. Core Efficiency Ratio 58.9% 40% 45% 50% 55% 60% 65% 70% 75% 80% Target 60% 48.6 47.9 46.5 45.7 42.8 50.9 52.6 49.5 48.3 47.8 4Q14 1Q15 2Q15 3Q15 4Q15 Non-core adjustments REO expense Core non-interest expense, before REO

Liquidity and Capital Ratios Remain Strong 14 February 2016 ■ The company repurchased $1.2mm shares of stock during 4Q, returning $41 mm to investors including dividends ■ Cumulative 22% of shares retired since going public ■ Modified duration of investments was 4.6 years at December 31, 2015, down from 4.7 years at September 30, 2015 Tier 1 Leverage Ratio1 (1) 4Q15 capital ratio is preliminary. Liquidity 14.3% 14.4% 14.7% 13.6% 12.7% 4Q14 1Q15 2Q15 3Q15 4Q15 Cash / Equivalents 11% Agency MBS 45% Agency CMBS 24% Agency CMO 9% Corporate Bonds 6% Trust Preferred 2% SBA / Other 2% Muni 1%

Diversified Portfolio by Loan Type and Geography 15 February 2016 Portfolio by Geography Portfolio by Loan Type 1-4 C&D 2% Other C&D 4% Non-owner Occupied CRE 15% Multifamily 1% C&I 23% Owner Occupied CRE 20% 1-4 Resi 18% Jr. Lien / HELOC 7% Auto 7% Consumer / Other 3% Florida 30% North Carolina 35% South Carolina 11% Tennessee 16% Other 8%

Diversified Portfolio by Collateral and Industry 16 February 2016 CRE Portfolio by Collateral Commercial Loans by Industry Manufacturing 11% Real Estate 10% Medical 8% Financial Services 8% Entertainment 7% Wholesale 6% Professional Services 6% Convenience Store 6% Religious Organizations 6% Transportation 5% Retail 5% Dealership 4% Mining 4% Construction 4% Other Services 2% Publishing 2% Other 6% 1-4 Resi Construction 7% 1-4 Resi Land 5% Commercial Construction 6% Commercial Land 5% Office 20% Retail 14% Hotel/Motel 10% Warehouse /Industrial 7% Assisted Living 4% Restaurant 4% Service Station 1% Mobile Home Park 1% Show room 1% Other CRE 8% Multifamily 7%

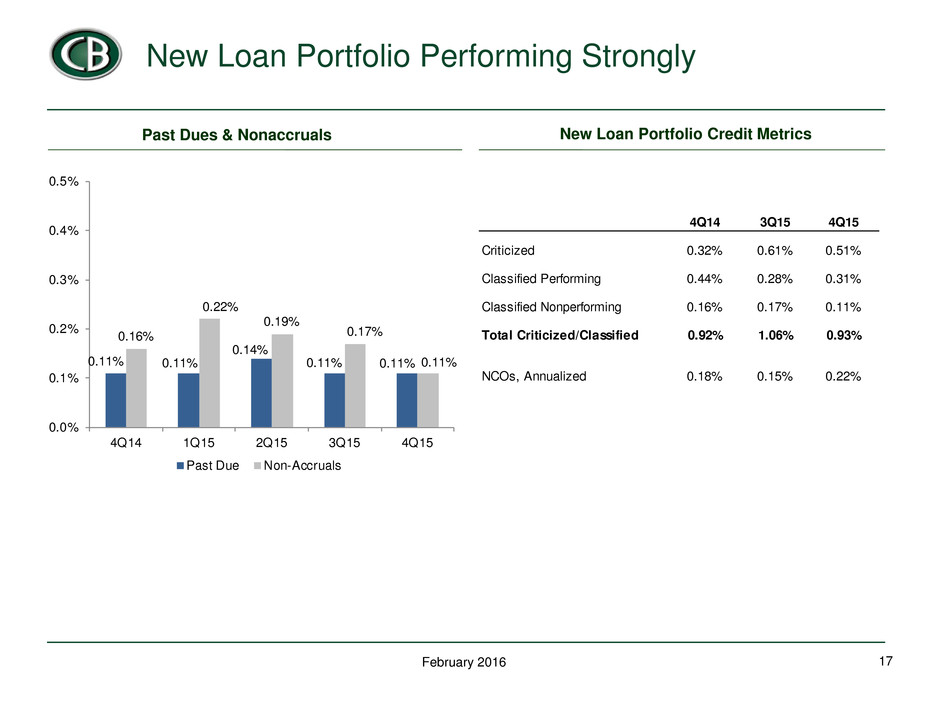

New Loan Portfolio Performing Strongly 17 February 2016 New Loan Portfolio Credit Metrics Past Dues & Nonaccruals 0.11% 0.11% 0.14% 0.11% 0.11% 0.16% 0.22% 0.19% 0.17% 0.11% 0.0% 0.1% 0.2% 0.3% 0.4% 0.5% 4Q14 1Q15 2Q15 3Q15 4Q15 Past Due Non-Accruals 4Q14 3Q15 4Q15 Criticized 0.32% 0.61% 0.51% Classified Performing 0.44% 0.28% 0.31% Classified Nonperforming 0.16% 0.17% 0.11% Total Criticized/Classified 0.92% 1.06% 0.93% NCOs, Annualized 0.18% 0.15% 0.22%

Special Assets Down 72% Since 2012 18 February 2016 Special Assets Nonperforming Loans / Total Loans $ mm’s Legacy Credit Expenses Down 75% y/y $ mm’s 832 577 349 253 224 154 129 78 55 53 986 706 427 308 277 2012 2013 2014 3Q15 4Q15 Loans REO -72% 7.7% 5.8% 2.6% 1.5% 1.2% 2012 2013 2014 3Q15 4Q15 4Q14 3Q15 4Q15 Provision (reversal) on legacy loans (1.4) 0.5 (1.2) FDIC indemnification asset expense 3.4 1.4 1.5 OREO valuation expense 1.6 2.1 0.3 (Gains) losses on sales of OREO (0.4) (0.4) (0.8) Foreclosed asset related expense 0.6 0.9 0.4 Loan workout expense 1.4 0.2 0.7 Salaries and employee benefits 1.0 0.8 0.6 Total legacy credit expense 6.1 5.5 1.5

19 2016 Outlook February 2016 Loan Growth Low single-digit in 1H, picking up to 10% rate in 2H NIM - Continued purchase accounting run-off - Higher deposit costs + Balance sheet optimization + Fed rate hike(s) Noninterest Income 1Q deposit and mortgage fees seasonally low Noninterest Expense Higher in 1Q on accruals Cost savings to follow CommunityOne closing/integration Core ROAA 1.00-1.05% by year-end 1Q seasonally lower See reconciliation of non-GAAP measures in appendix.

20 Capital Bank Investment Highlights ■ Experienced management team with institutional track record ■ Positioned in Southeastern growth markets ■ Disciplined and sustainable growth story ■ Focused on deploying capital and improving profitability ■ Attractive valuation February 2016

Appendix 21 February 2016

Reconciliation of Core Noninterest Income / Expense 22 February 2016 $ 000's 4Q15 3Q15 2Q15 1Q15 4Q14 Net interest income $62,078 $61,637 $60,685 $59,729 $61,351 Reported non-interest income 10,597 11,418 10,363 9,920 10,594 Less: Securities gains (losses), net 54 (43) (57) 90 513 Core non-interest income $10,543 $11,461 $10,420 $9,830 $10,081 Reported non-interest expense $47,756 $48,346 $49,502 $52,647 $50,932 Less: Stock-based compensation expense – – – 95 239 Contingent value right expense – – 4 116 334 Severance expense – 63 14 111 – Restructuring expense – 23 178 2,341 – Loss on extinguishment of debt – – 1,438 – – Conversion costs and merger 33 – – – – Contract termination 4,215 – – – – Conversion and severance expenses (conversion and merger expenses and salaries and employee benefits) 704 – – – – Core non-interest expense $42,804 $48,260 $47,868 $49,984 $50,359 Core Fee Ratio* 14.5% 15.7% 14.7% 14.1% 14.1% Efficiency Ratio** 65.7% 66.2% 69.7% 75.6% 70.8% Core Efficiency Ratio*** 58.9% 66.0% 67.3% 71.9% 70.5% * Core Fee Ratio: Core non-interest income / (Net interest income + Core non-interest income) ** Efficiency Ratio: Non-interest expense / (Net interest income + Non-interest income) ***Core Efficiency Ratio: Core non-interest expense / (Net interest income + Core non-interest income)

Reconciliation of Core Net Income 23 February 2016 $ 000's Quarter Quarter Quarter Quarter Quarter Quarter Ended Ended Ended Ended Ended Ended 4Q15 4Q15 3Q15 3Q15 4Q14 4Q14 $15,021 $15,021 $15,321 $15,321 $13,836 $13,836 Pre-Tax After-tax Pre-Tax After-tax Pre-Tax After-tax Non-Interest Income Security losses / (gains)* (54) (33) 43 26 (513) (313) Non-Interest Expense - - - - 239 146 - - - - 334 334 - - 63 39 - - 32 20 23 14 - - 33 20 - - - - 673 673 4,215 2,594 - - - - Tax effect of adjustments* (1,625) NA (50) NA 107 NA 18,295 18,295 15,400 15,400 14,003 14,003 Average Assets $7,332,516 $7,087,882 $6,749,124 Tangible Common Equity $836,643 $872,075 $910,155 ** ROA 0.82% 0.86% 0.82% *** Core ROA 1.00% 0.87% 0.83% **** Core ROTCE 8.7% 7.1% 6.2% * Tax effected at an income tax rate of 37.0% ** ROA: Annualized net income / average assets Net income Adjustments Restructuring expense* Conversion costs and merger tax deductible* Legal merger non deductible Core Net Income Stock-based compensation expense* Contingent Value Right expense Contract termination Severance expense *

Tangible Book Value 24 February 2016 (In thousands, except per share data) December 31, 2015 Total common shareholders' equity $986,265 Intangibles, net of taxes 143,863 Tangible book value* $842,402 Common shares outstanding 43,143 Tangible book value per share $19.53 * Tangible book value is equal to book value less goodwill and core deposit intangibles, net of related deferred tax liabilities.

Contractual Net Interest Margin 25 February 2016 (1) Excludes purchase accounting adjustments $ 000s Average Earning Assets Net Interest Income Net Interest Margin December 31, 2015 Reported 6,698,719 62,544 3.70% Purchase accounting impact (50,768) 8,460 0.49% Contractual Net Interest Margin (1) 3.21% September 30, 2015 Reported 6,442,167 69,167 3.82% Purchase accounting impact (55,281) 10,381 0.63% Contractual Net Interest Margin (1) 3.19% June 30, 2015 Reported 6,221,394 67,696 3.94% Purchase accounting impact (63,174) 10,711 0.69% Contractual Net Interest Margin (1) 3.25% March 31, 2015 Reported 6,168,668 66,572 3.96% Purchase accounting impact (73,831) 10,790 0.70% Contractual Net Interest Margin (1) 3.26% December 31, 2014 Reported 6,045,748 61,723 4.05% Purchase accounting impact (79,632) 10,295 0.67% Contractual Net Interest Margin (1) 3.38%