Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MULTI FINELINE ELECTRONIX INC | d29616d8k.htm |

| EX-2.1 - EX-2.1 - MULTI FINELINE ELECTRONIX INC | d29616dex21.htm |

| EX-3.1 - EX-3.1 - MULTI FINELINE ELECTRONIX INC | d29616dex31.htm |

| EX-99.1 - EX-99.1 - MULTI FINELINE ELECTRONIX INC | d29616dex991.htm |

| EX-99.3 - EX-99.3 - MULTI FINELINE ELECTRONIX INC | d29616dex993.htm |

| EX-99.5 - EX-99.5 - MULTI FINELINE ELECTRONIX INC | d29616dex995.htm |

| EX-99.4 - EX-99.4 - MULTI FINELINE ELECTRONIX INC | d29616dex994.htm |

DSBJ To Acquire MFLEX Employee Meeting February 4, 2016 Exhibit 99.2

Safe Harbor Statement This presentation contains forward-looking statements made pursuant to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements represent the Company’s current expectations or beliefs concerning future events, plans, strategies, or objectives that are subject to change, and actual results may differ materially from the forward-looking statements. Without limiting the foregoing, the words “expect,” “plan”, “believe,” “seek,” estimate,” “aim,” “intend,” “anticipate,” “believe,” and similar expressions are intended to identify forward-looking statements. Forward-looking statements may involve known and unknown risks over which the Company has no control. Those risks include, without limitation (i) the risk that the proposed transaction may not be completed in a timely manner, or at all, which may adversely affect the Company’s business and the price of its common stock, (ii) the failure to satisfy all of the closing conditions of the proposed transaction, including the adoption of the Merger Agreement by the Company’s stockholders and the receipt of certain governmental and regulatory approvals in the U.S. and in the People’s Republic of China, (iii) the occurrence of any event, change or other circumstance that could give rise to the termination of the definitive agreement, (iv) the effect of the announcement or pendency of the proposed transaction on the Company’s business, operating results, and relationships with customers, suppliers and others, (v) risks that the proposed transaction may disrupt the Company’s current plans and business operations, (vi) potential difficulties retaining employees as a result of the proposed transaction, (vii) risks related to the diverting of management’s attention from the Company’s ongoing business operations, and (viii) the outcome of any legal proceedings that may be instituted against the Company related to the definitive agreement or the proposed transaction. In addition, the Company’s actual performance and results may differ materially from those currently anticipated due to a number of risks including, without limitation: (i) the conditions of markets generally and the industries in which the Company operates, including recent volatility in the Company’s key industry segments, (ii) the Company’s ability to diversify its product applications, expand its customer base, and enter into new market segments as a result of the proposed transaction, and (iii) other events and factors disclosed previously and from time to time in the Company’s filings with the SEC, including the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2015. Forward-looking statements speak only as of the date of this communication or the date of any document incorporated by reference in this document. Except as required by applicable law, the Company does not undertake to update these forward-looking statements to reflect future events or circumstances.

Announcement Overview This afternoon, we announced Suzhou Dongshan Precision Manufacturing Co., Ltd. (DSBJ) will acquire MFLEX for $23.95 per share This represents a premium of 40.8% over the closing stock price on February 3, 2016 and a premium of 52.2% over the thirty-day volume-weighted average closing stock price The proposed transaction values MFLEX’s equity at approximately $610.0 million (all-cash) Following the closing of the transaction, expected in the third quarter of 2016, we will operate as an independent business unit of DSBJ under the strong MFLEX brand Maintain headquarters in Irvine and manufacturing facilities in Suzhou Management expected to remain in place and we anticipate our organizational structure to remain substantially the same as it is today In the meantime, it will be business as usual at MFLEX We will operate as two independent, separate companies until the transaction closes We will continue to provide our customers with timely delivery of high quality flexible printed circuits and assemblies

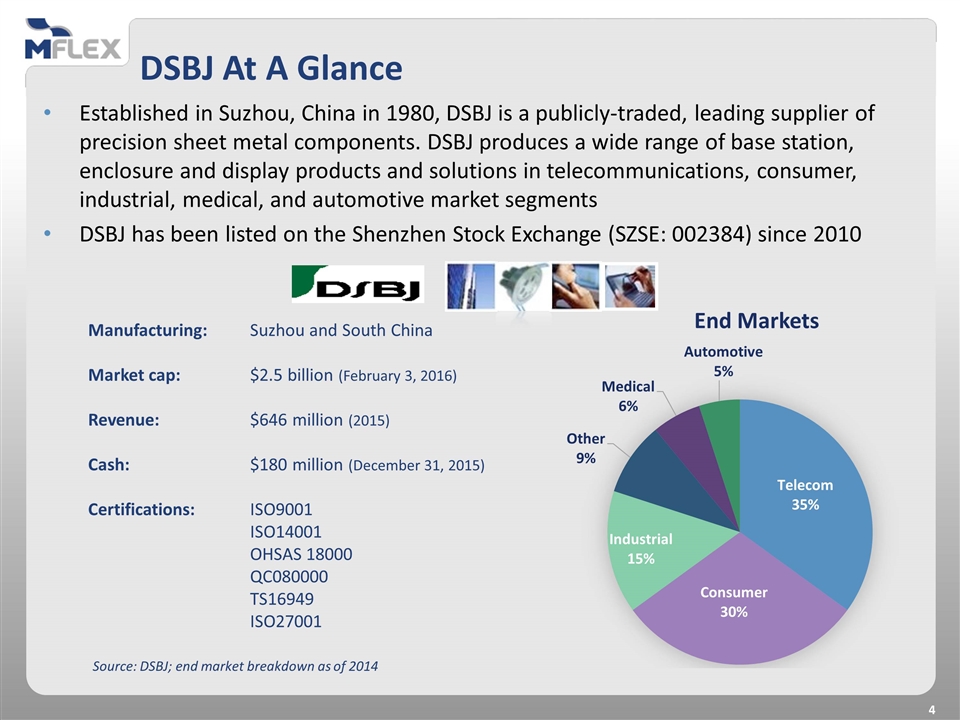

DSBJ At A Glance Established in Suzhou, China in 1980, DSBJ is a publicly-traded, leading supplier of precision sheet metal components. DSBJ produces a wide range of base station, enclosure and display products and solutions in telecommunications, consumer, industrial, medical, and automotive market segments DSBJ has been listed on the Shenzhen Stock Exchange (SZSE: 002384) since 2010 End Markets Manufacturing:Suzhou and South China Market cap: $2.5 billion (February 3, 2016) Revenue:$646 million (2015) Cash:$180 million (December 31, 2015) Certifications:ISO9001 ISO14001 OHSAS 18000 QC080000 TS16949 ISO27001 Source: DSBJ; end market breakdown as of 2014

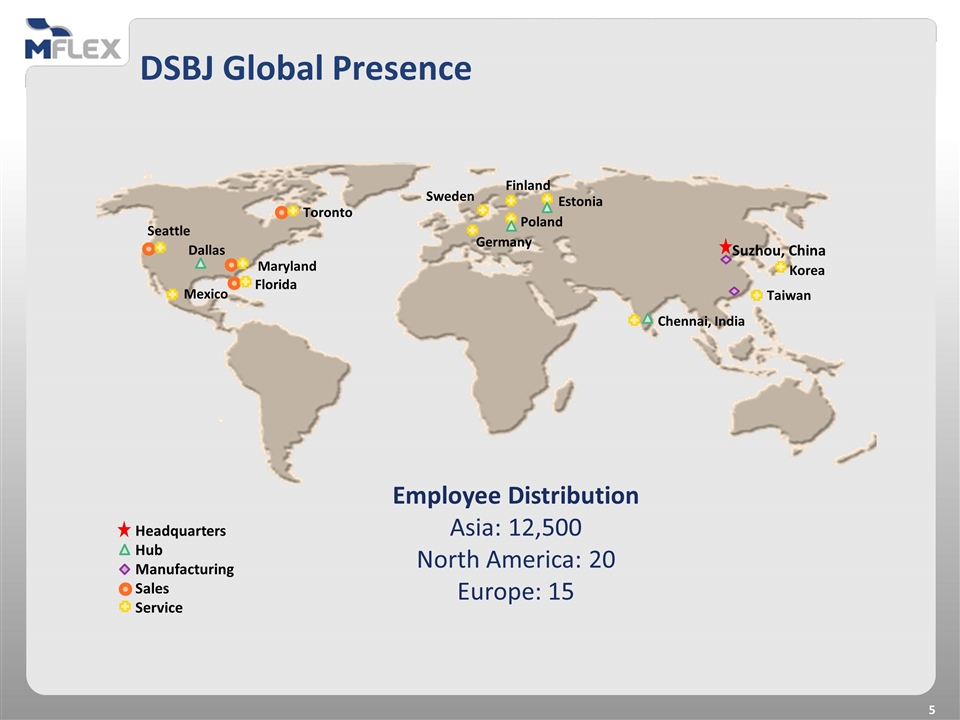

DSBJ Global Presence Headquarters Hub Manufacturing Sales Service Taiwan Chennai, India Suzhou, China Korea Finland Sweden Germany Poland Estonia Dallas Mexico Seattle Maryland Florida Toronto Employee Distribution Asia: 12,500 North America: 20 Europe: 15

Strategic Drivers of DSBJ’s Acquisition of MFLEX MFLEX: Is a leading global provider of high-quality, technologically advanced flexible printed circuits and assemblies Has a marquee customer base and long history of supplying the leading mobile industry players Possesses market-leading electronics interconnect technology Has a robust application engineering infrastructure Is known for its scale and quick time to market Has a strong, experienced management team and employee base

Benefits of the Transaction MFLEX’s Board of Directors unanimously approved the transaction as it: Realizes significant, immediate cash value for our stockholders Offers new opportunities for our employees Supports the future needs of our customers Positions MFLEX within a larger manufacturing conglomerate, which will open new market opportunities for our flexible printed circuit and assembly solutions, supporting our long-term growth outlook The combined company: Shares a common heritage in Suzhou, with collectively 18,000 employees in the area, and nearly 20,000 employees worldwide Will have over $1 billion in revenue (based on 2015 sales figures) Will possess the scale and resources to accelerate growth and market diversification

Timeline & Communications Current transaction schedule: Announced: February 4, 2016 Expected close: Third quarter 2016 (subject to shareholder and various regulatory approvals and other customary closing conditions) Stay tuned for additional details and updates. In the meantime, please refer all questions to the following: Media Inquiries: Reza Meshgin (949) 453-6834 Investor Relations: Tom Kampfer (949) 453-6830 Human Resources: CP Lee +(86)512-82286549 Some reminders: We need to stay focused on the business and continue to execute to achieve our goals for 2016 Please refrain from speculation regarding the transaction

Final Thoughts This is a critical milestone in the history of our company that we believe will benefit our employees and all of our stakeholders Working together with DSBJ, we believe we can expand MFLEX’s brand and leadership in the mobility space, while accelerating our market opportunities in the automotive, industrial, display, and other fast-growing consumer segments In the meantime, it remains business as usual as we continue to operate as two independent, separate companies until the transaction closes We thank you in advance for your support during this transitionary period and thereafter as we become part of the DSBJ family

Additional Information and Where to Find It In connection with the proposed transaction, the Company will be filing relevant materials with the Securities and Exchange Commission (the “SEC”), including a preliminary proxy statement on Schedule 14A. Promptly after filing its definitive proxy statement with the SEC, the Company will mail or otherwise make available the definitive proxy statement and a proxy card to each stockholder entitled to vote at the special meeting relating to the proposed transaction. Company stockholders and other investors are advised to carefully read these materials (including any amendments or supplements thereto) and any other relevant documents filed with the SEC in respect of the proposed transaction when they become available, as those documents will contain important information about the proposed transaction and the parties to the proposed transaction. Company stockholders and other investors may obtain free copies of the definitive proxy statement, the preliminary proxy statement and other relevant materials in connection with the proposed transaction (when they become available), along with other documents filed by the Company with the SEC, at the SEC’s website (http://www.sec.gov) or through the investor relations section of the Company’s website (http://www.mflex.com). Participants in the Solicitation The Company and its directors and executive officers may be deemed participants under SEC rules in the solicitation of proxies from the Company’s stockholders in favor of the proposed transaction. Information about the Company’s directors and executive officers and their interests in the solicitation, which may, in some cases, differ from those of the Company’s stockholders generally, will be included in the proxy statement filed with the SEC in connection with the proposed transaction. Additional information about these directors and executive officers is available in the Company’s proxy statement for its 2015 Annual Meeting of Stockholders, which was filed with the SEC on January 21, 2015, and in the Company’s Transition Report on Form 10-K, which was filed with the SEC on February 13, 2015. To the extent that holdings of the Company’s securities by the Company’s directors and executive officers have changed since the amounts printed in the latest proxy statement or Form 10-K, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC.