Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Horsehead Holding Corp | d62839d8k.htm |

| EX-99.2 - EX-99.2 - Horsehead Holding Corp | d62839dex992.htm |

| EX-99.3 - EX-99.3 - Horsehead Holding Corp | d62839dex993.htm |

Exhibit 99.1

|

|

Exhibit 99.1

C O N F I D E N T I A L F E B R U A R Y 2 0 16

M A T E R I A L S F O R R E S T R I C T E D A D H O C S E C U R E D C R E D I T O R S

|

|

C O N F I D E N T I A L H OR S E H E A D H O L D I N G C O R P .

Disclaimer

Cautionary Note Regarding Forward-Looking Statements

Many of the statements included in this presentation constitute “forward-looking statements” intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. In particular, they include statements relating to expected disbursements, projections and forecasts, future actions, future operating and financial performance, and the Company’s future financial results. These forward-looking statements are based on current expectations and projections about future events. Readers are cautioned that forward-looking statements are not guarantees of future operating and financial performance or results and involve substantial risks and uncertainties that cannot be predicted or quantified, and, consequently, the actual receipts, disbursements and performance of the Company may differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to, factors described from time to time in the Company’s reports filed with the SEC (including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained therein).

|

|

H O R S E H E A D H O L D I N G C O R P .

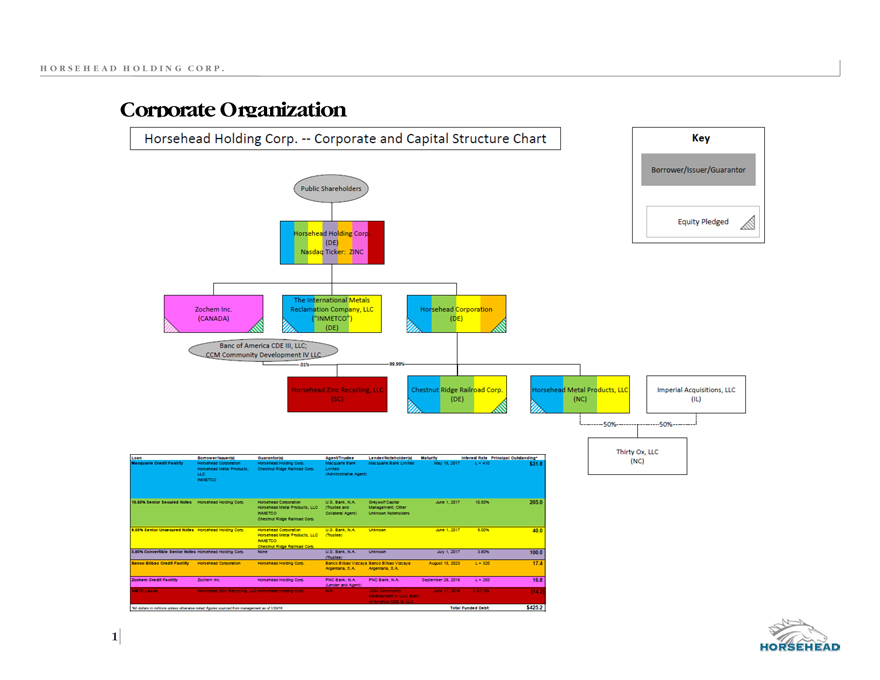

Corporate Organization

| 1 |

|

Horsehead Holding Corp. -- Corporate and Capital Structure Chart

|

|

H O R S E H E A D H O L D I N G C O R P .

Review of Consolidated DIP Budget

RAS and Horsehead Management have developed the Consolidated DIP Budget which was presented in the blowout materials

Current Situation:

Accounts Payable is approximately $45—50 million

At present the Company does not have any significant trade terms

Predominately COD or cash due that week with vendors

DIP Budget reflects the shutdown of Mooresboro, however run rate operations are not evident until weeks 6 to 8

Receipts:

Horsehead & HMP, Inmetco, Zochem operating receipts are driven based on forecasted production schedule. There is a 30 day lag

from when sales are made to collection of cash

Inmetco invoices twice a month

Zochem has several large customers that pay once a month

Horsehead & HMP reflect the receipt of cash from sales made prior to the shutdown of Mooresboro. Mooresboro related

operating receipts do not burn off until the week ended March 19, 2016

Other Receipts

Week ended February 27, March 26 and April 30 reflect Harmonized Sales Tax (HST) rebates, for amounts paid weekly primarily

for purchased metals at Zochem, from the Canada Revenue Agency

Beyond period—$2.0 million reflects receipt of Inmetco fire insurance proceeds in June

| 2 |

|

|

|

H O R S E H E A D H O L D I N G C O R P .

Review of Consolidated DIP Budget (cont’d)

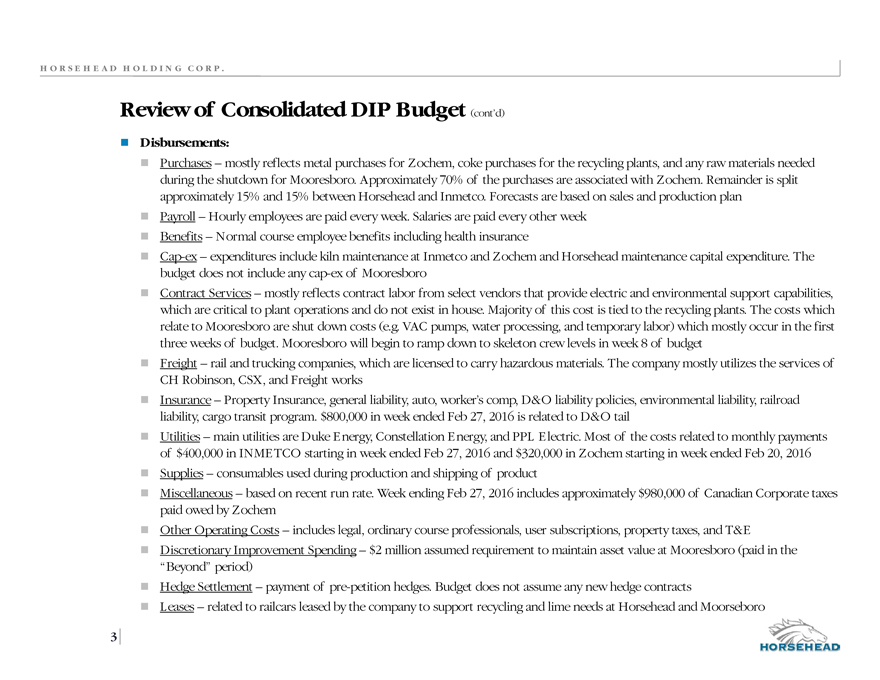

Disbursements:

Purchases – mostly reflects metal purchases for Zochem, coke purchases for the recycling plants, and any raw materials needed

during the shutdown for Mooresboro. Approximately 70% of the purchases are associated with Zochem. Remainder is split

approximately 15% and 15% between Horsehead and Inmetco. Forecasts are based on sales and production plan

Payroll – Hourly employees are paid every week. Salaries are paid every other week

Benefits – Normal course employee benefits including health insurance

Cap-ex – expenditures include kiln maintenance at Inmetco and Zochem and Horsehead maintenance capital expenditure. The

budget does not include any cap-ex of Mooresboro

Contract Services – mostly reflects contract labor from select vendors that provide electric and environmental support capabilities,

which are critical to plant operations and do not exist in house. Majority of this cost is tied to the recycling plants. The costs which

relate to Mooresboro are shut down costs (e.g. VAC pumps, water processing, and temporary labor) which mostly occur in the first

three weeks of budget. Mooresboro will begin to ramp down to skeleton crew levels in week 8 of budget

Freight – rail and trucking companies, which are licensed to carry hazardous materials. The company mostly utilizes the services of

CH Robinson, CSX, and Freight works

Insurance – Property Insurance, general liability, auto, worker’s comp, D&O liability policies, environmental liability, railroad

liability, cargo transit program. $800,000 in week ended Feb 27, 2016 is related to D&O tail

Utilities – main utilities are Duke Energy, Constellation Energy, and PPL Electric. Most of the costs related to monthly payments

of $400,000 in INMETCO starting in week ended Feb 27, 2016 and $320,000 in Zochem starting in week ended Feb 20, 2016

Supplies – consumables used during production and shipping of product

Miscellaneous – based on recent run rate. Week ending Feb 27, 2016 includes approximately $980,000 of Canadian Corporate taxes

paid owed by Zochem

Other Operating Costs – includes legal, ordinary course professionals, user subscriptions, property taxes, and T&E

Discretionary Improvement Spending – $2 million assumed requirement to maintain asset value at Mooresboro (paid in the

“Beyond” period)

Hedge Settlement – payment of pre-petition hedges. Budget does not assume any new hedge contracts

Leases – related to railcars leased by the company to support recycling and lime needs at Horsehead and Moorseboro

| 3 |

|

|

|

H O R S E H E A D H O L D I N G C O R P .

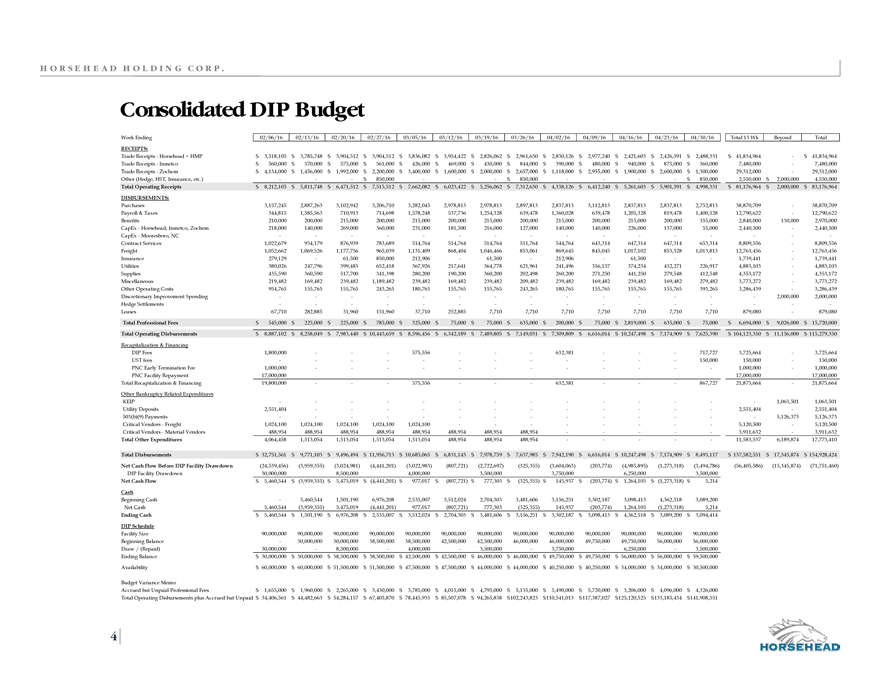

Consolidated DIP Budget

Week Ending 02/06/16 02/13/16 02/20/16 02/27/16 03/05/16 03/12/16 03/19/16 03/26/16 04/02/16 04/09/16 04/16/16 04/23/16 04/30/16 Total 13 Wk Beyond Total

RECEIPTS:

Trade Receipts—Horsehead + HMP $ 3,518,105 $ 3,785,748 $ 3,904,512 $ 3,904,512 $ 3,836,082 $ 3,954,422 $ 2,826,062 $ 2,961,630 $ 2,830,126 $ 2,977,240 $ 2,421,603 $ 2,426,591 $ 2,488,331 $ 41,834,964 —$ 41,834,964

Trade Receipts—Inmetco $ 560,000 $ 570,000 $ 575,000 $ 561,000 $ 426,000 $ 469,000 $ 430,000 $ 844,000 $ 390,000 $ 480,000 $ 940,000 $ 875,000 $ 360,000 7,480,000 — 7,480,000

Trade Receipts—Zochem $ 4,134,000 $ 1,456,000 $ 1,992,000 $ 2,200,000 $ 3,400,000 $ 1,600,000 $ 2,000,000 $ 2,657,000 $ 1,118,000 $ 2,955,000 $ 1,900,000 $ 2,600,000 $ 1,300,000 29,312,000 — 29,312,000

Other (Hedge, HST, Insurance, etc.) ———$ 850,000 ———$ 850,000 ————$ 850,000 2,550,000 $ 2,000,000 4,550,000

Total Operating Receipts $ 8,212,105 $ 5,811,748 $ 6,471,512 $ 7,515,512 $ 7,662,082 $ 6,023,422 $ 5,256,062 $ 7,312,630 $ 4,338,126 $ 6,412,240 $ 5,261,603 $ 5,901,591 $ 4,998,331 $ 81,176,964 $ 2,000,000 $ 83,176,964

DISBURSEMENTS:

Purchases 3,157,245 2,887,263 3,102,942 3,206,710 3,282,045 2,978,813 2,978,813 2,897,813 2,837,813 3,112,813 2,837,813 2,837,813 2,752,813 38,870,709 — 38,870,709

Payroll & Taxes 344,815 1,585,563 710,913 714,698 1,578,248 537,736 1,254,328 639,478 1,360,028 639,478 1,205,328 819,478 1,400,528 12,790,622 — 12,790,622

Benefits 210,000 200,000 215,000 200,000 215,000 200,000 215,000 200,000 215,000 200,000 215,000 200,000 355,000 2,840,000 130,000 2,970,000

CapEx—Horsehead, Inmetco, Zochem 218,000 140,000 269,000 360,000 231,000 181,500 216,000 127,000 140,000 140,000 226,000 137,000 55,000 2,440,500 — 2,440,500

CapEx—Mooresboro, NC ———————————— — — -

Contract Services 1,022,679 934,179 876,939 783,689 514,764 514,764 514,764 511,764 544,764 643,314 647,314 647,314 653,314 8,809,556 — 8,809,556

Freight 1,052,662 1,069,526 1,177,756 965,039 1,131,409 868,404 1,046,466 853,061 869,645 845,045 1,017,102 853,528 1,013,813 12,763,456 — 12,763,456

Insurance 279,129 — 61,500 850,000 212,906 — 61,500 — 212,906 — 61,500 ——1,739,441 — 1,739,441

Utilities 380,026 247,796 399,483 652,418 367,926 217,641 364,778 621,961 241,496 356,157 374,234 432,271 226,917 4,883,103 — 4,883,103

Supplies 435,590 360,590 517,700 341,398 280,200 190,200 360,200 202,498 260,200 271,250 441,250 279,548 412,548 4,353,172 — 4,353,172

Miscellaneous 219,482 169,482 239,482 1,189,482 239,482 169,482 239,482 209,482 239,482 169,482 239,482 169,482 279,482 3,773,272 — 3,773,272

Other Operating Costs 954,765 155,765 155,765 243,265 180,765 155,765 155,765 243,265 180,765 155,765 155,765 155,765 393,265 3,286,439 — 3,286,439

Discretionary Improvement Spending ———————————— — 2,000,000 2,000,000

Hedge Settlements ———————————— — — -

Leases 67,710 282,885 31,960 151,960 37,710 252,885 7,710 7,710 7,710 7,710 7,710 7,710 7,710 879,080 — 879,080

Total Professional Fees $ 545,000 $ 225,000 $ 225,000 $ 785,000 $ 325,000 $ 75,000 $ 75,000 $ 635,000 $ 200,000 $ 75,000 $ 2,819,000 $ 635,000 $ 75,000 $ 6,694,000 $ 9,026,000 $ 15,720,000

Total Operating Disbursements $ 8,887,102 $ 8,258,049 $ 7,983,440 $ 10,443,659 $ 8,596,456 $ 6,342,189 $ 7,489,805 $ 7,149,031 $ 7,309,809 $ 6,616,014 $ 10,247,498 $ 7,174,909 $ 7,625,390 $ 104,123,350 $ 11,156,000 $ 115,279,350

Recapitalization & Financing

DIP Fees 1,800,000 ——— 575,556 ——— 632,381 ——— 717,727 3,725,664 — 3,725,664

UST fees ———————————— 150,000 150,000 — 150,000

PNC Early Termination Fee 1,000,000 ————————————1,000,000 — 1,000,000

PNC Facility Repayment 17,000,000 17,000,000 17,000,000

Total Recapitalization & Financing 19,800,000 ——— 575,556 ——— 632,381 ——— 867,727 21,875,664 — 21,875,664

Other Bankruptcy Related Expenditures

KEIP ———————————— — 1,063,501 1,063,501

Utility Deposits 2,551,404 ————————————2,551,404 — 2,551,404

503(b)(9) Payments ———————————— — 5,126,373 5,126,373

Critical Vendors—Freight 1,024,100 1,024,100 1,024,100 1,024,100 1,024,100 ————————5,120,500 — 5,120,500

Critical Vendors—Material Vendors 488,954 488,954 488,954 488,954 488,954 488,954 488,954 488,954 —————3,911,632 — 3,911,632

Total Other Expenditures 4,064,458 1,513,054 1,513,054 1,513,054 1,513,054 488,954 488,954 488,954 —————11,583,537 6,189,874 17,773,410

Total Disbursements $ 32,751,561 $ 9,771,103 $ 9,496,494 $ 11,956,713 $ 10,685,065 $ 6,831,143 $ 7,978,759 $ 7,637,985 $ 7,942,190 $ 6,616,014 $ 10,247,498 $ 7,174,909 $ 8,493,117 $ 137,582,551 $ 17,345,874 $ 154,928,424

Net Cash Flow Before DIP Facility Drawdown (24,539,456) (3,959,355) (3,024,981) (4,441,201) (3,022,983) (807,721) (2,722,697) (325,355) (3,604,063) (203,774) (4,985,895) (1,273,318) (3,494,786) (56,405,586) (15,345,874) (71,751,460)

DIP Facility Drawdown 30,000,000 8,500,000 4,000,000 3,500,000 3,750,000 6,250,000 3,500,000

Net Cash Flow $ 5,460,544 $ (3,959,355) $ 5,475,019 $ (4,441,201) $ 977,017 $ (807,721) $ 777,303 $ (325,355) $ 145,937 $ (203,774) $ 1,264,105 $ (1,273,318) $ 5,214

Cash

Beginning Cash — 5,460,544 1,501,190 6,976,208 2,535,007 3,512,024 2,704,303 3,481,606 3,156,251 3,302,187 3,098,413 4,362,518 3,089,200

Net Cash 5,460,544 (3,959,355) 5,475,019 (4,441,201) 977,017 (807,721) 777,303 (325,355) 145,937 (203,774) 1,264,105 (1,273,318) 5,214

Ending Cash $ 5,460,544 $ 1,501,190 $ 6,976,208 $ 2,535,007 $ 3,512,024 $ 2,704,303 $ 3,481,606 $ 3,156,251 $ 3,302,187 $ 3,098,413 $ 4,362,518 $ 3,089,200 $ 3,094,414

DIP Schedule

Facility Size 90,000,000 90,000,000 90,000,000 90,000,000 90,000,000 90,000,000 90,000,000 90,000,000 90,000,000 90,000,000 90,000,000 90,000,000 90,000,000

Beginning Balance — 30,000,000 30,000,000 38,500,000 38,500,000 42,500,000 42,500,000 46,000,000 46,000,000 49,750,000 49,750,000 56,000,000 56,000,000

Draw / (Repaid) 30,000,000 — 8,500,000 — 4,000,000 — 3,500,000 — 3,750,000 — 6,250,000 — 3,500,000

Ending Balance $ 30,000,000 $ 30,000,000 $ 38,500,000 $ 38,500,000 $ 42,500,000 $ 42,500,000 $ 46,000,000 $ 46,000,000 $ 49,750,000 $ 49,750,000 $ 56,000,000 $ 56,000,000 $ 59,500,000

Availability $ 60,000,000 $ 60,000,000 $ 51,500,000 $ 51,500,000 $ 47,500,000 $ 47,500,000 $ 44,000,000 $ 44,000,000 $ 40,250,000 $ 40,250,000 $ 34,000,000 $ 34,000,000 $ 30,500,000

Budget Variance Memo:

Accrued but Unpaid Professional Fees $ 1,655,000 $ 1,960,000 $ 2,265,000 $ 3,430,000 $ 3,785,000 $ 4,015,000 $ 4,795,000 $ 5,135,000 $ 5,490,000 $ 5,720,000 $ 3,206,000 $ 4,096,000 $ 4,326,000

Total Operating Disbursements plus Accrued but Unpaid $ 34,406,561 $ 44,482,663 $ 54,284,157 $ 67,405,870 $ 78,445,935 $ 85,507,078 $ 94,265,838 $ 102,243,823 $ 110,541,013 $ 117,387,027 $ 125,120,525 $ 133,185,434 $ 141,908,551

| 4 |

|

|

|

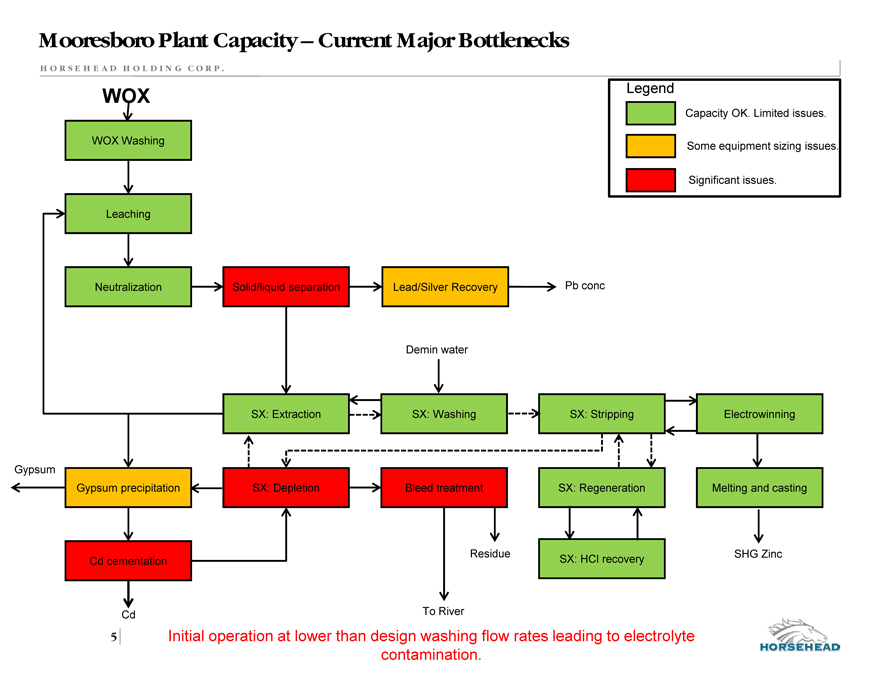

Mooresboro Plant Capacity – Current Major Bottlenecks

H OR S E H E A D H O L D I N G C O R P .

WOX Legend

Capacity OK. Limited issues.

WOX Washing Some equipment sizing issues.

Significant issues.

Leaching

Neutralization Solid/liquid separation Lead/Silver Recovery Pb conc

Demin water

SX: Extraction SX: Washing SX: Stripping Electrowinning

Gypsum

Gypsum precipitation SX: Depletion Bleed treatment SX: Regeneration Melting and casting

Cd cementation Residue SX: HCl recovery SHG Zinc

Cd To River

5 Initial operation at lower than design washing flow rates leading to electrolyte

contamination.

|

|

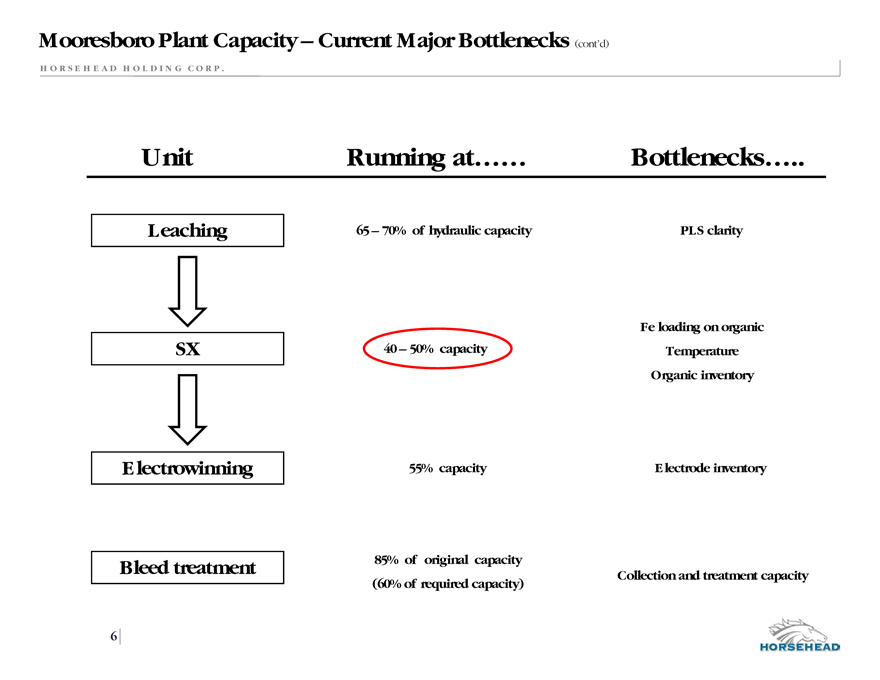

Mooresboro Plant Capacity – Current Major Bottlenecks (cont’d)

H OR S E H E A D H O L D I N G C O R P .

Unit Running at…… Bottlenecks…

Leaching 65 – 70% of hydraulic capacity PLS clarity

Fe loading on organic

SX 40 – 50% capacity Temperature

Organic inventory

Electrowinning 55% capacity Electrode inventory

Bleed treatment 85% of original capacity

(60% of required capacity) Collection and treatment capacity

| 6 |

|

|

|

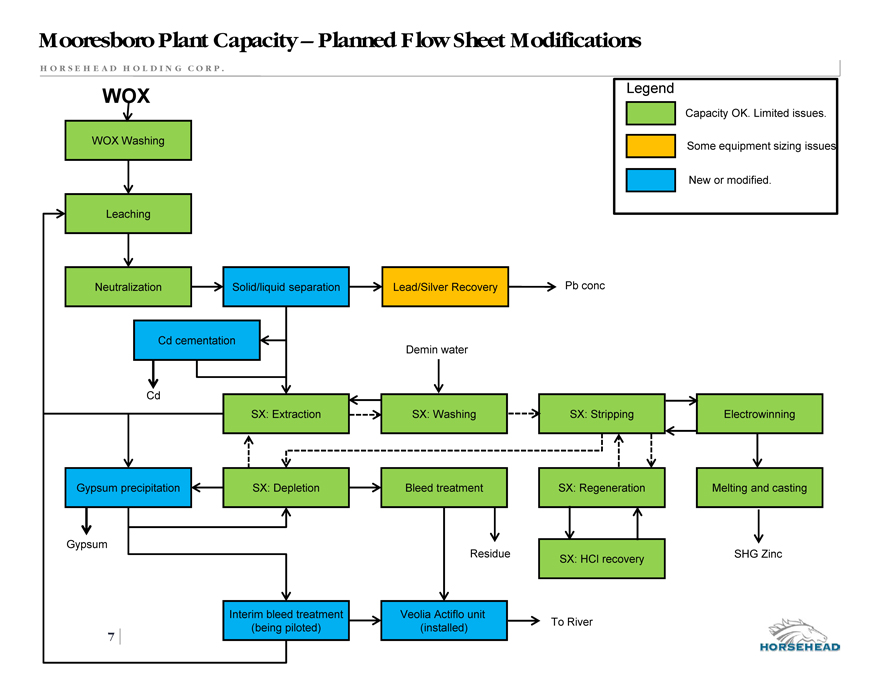

Mooresboro Plant Capacity – Planned Flow Sheet Modifications

H OR S E H E A D H O L D I N G C O R P .

WOX Legend

Capacity OK. Limited issues.

WOX Washing Some equipment sizing issues.

New or modified.

Leaching

Neutralization Solid/liquid separation Lead/Silver Recovery Pb conc

Cd cementation

Demin water

Cd

SX: Extraction SX: Washing SX: Stripping Electrowinning

Gypsum precipitation SX: Depletion Bleed treatment SX: Regeneration Melting and casting

Gypsum

Residue SX: HCl recovery SHG Zinc

Interim bleed treatment Veolia Actiflo unit

(being piloted) (installed) To River

7

|

|

H O R S E H E A D H O L D I N G C O R P .

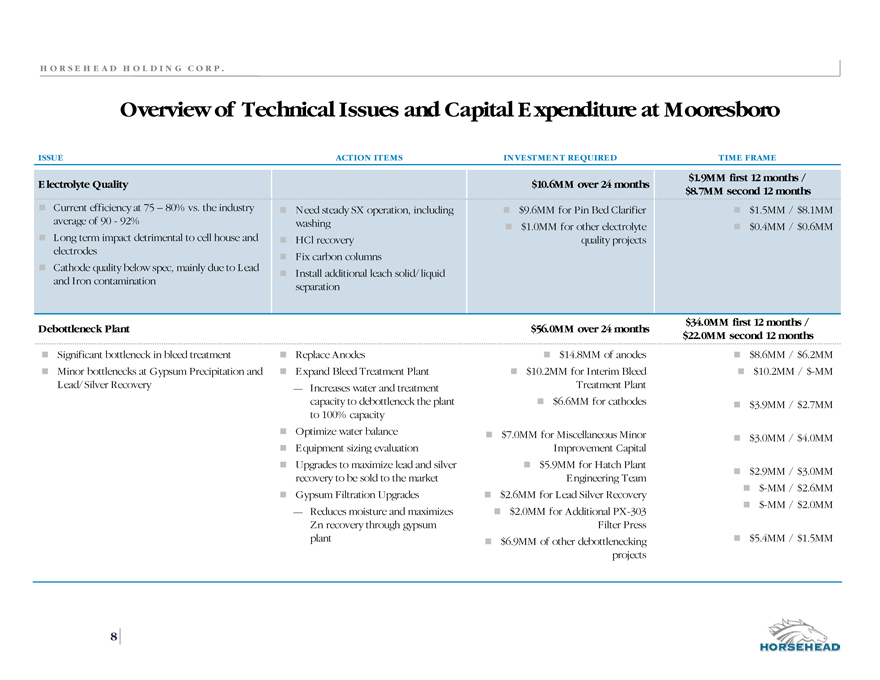

Overview of Technical Issues and Capital Expenditure at Mooresboro

ISSUE

Electrolyte Quality

Current efficiency at 75 – 80% vs. the industry average of 90—92% Long term impact detrimental to cell house and electrodes Cathode quality below spec, mainly due to Lead and Iron contamination

ACTION ITEMS

Need steady SX operation, including washing HCl recovery Fix carbon columns Install additional leach solid/liquid separation

INVESTMENT REQUIRED

$10.6MM over 24 months

$9.6MM for Pin Bed Clarifier $1.0MM for other electrolyte quality projects

TIME FRAME

$1.9MM first 12 months / $8.7MM second 12 months

$1.5MM / $8.1MM $0.4MM / $0.6MM

Debottleneck Plant

Significant bottleneck in bleed treatment Minor bottlenecks at Gypsum Precipitation and Lead/Silver Recovery

Replace Anodes

Expand Bleed Treatment Plant

- Increases water and treatment

capacity to debottleneck the plant

to 100% capacity

Optimize water balance

Equipment sizing evaluation

Upgrades to maximize lead and silver

recovery to be sold to the market

Gypsum Filtration Upgrades

- Reduces moisture and maximizes

Zn recovery through gypsum

plant

$56.0MM over 24 months

$14.8MM of anodes

$10.2MM for Interim Bleed

Treatment Plant

$6.6MM for cathodes

$7.0MM for Miscellaneous Minor

Improvement Capital

$5.9MM for Hatch Plant

Engineering Team

$2.6MM for Lead Silver Recovery

$2.0MM for Additional PX-303

Filter Press

$6.9MM of other debottlenecking

projects

$34.0MM first 12 months /

$22.0MM second 12 months

$8.6MM / $6.2MM

$10.2MM / $-MM

$3.9MM / $2.7MM

$3.0MM / $4.0MM

$2.9MM / $3.0MM

$-MM / $2.6MM

$-MM / $2.0MM

$5.4MM / $1.5MM

| 8 |

|

|

|

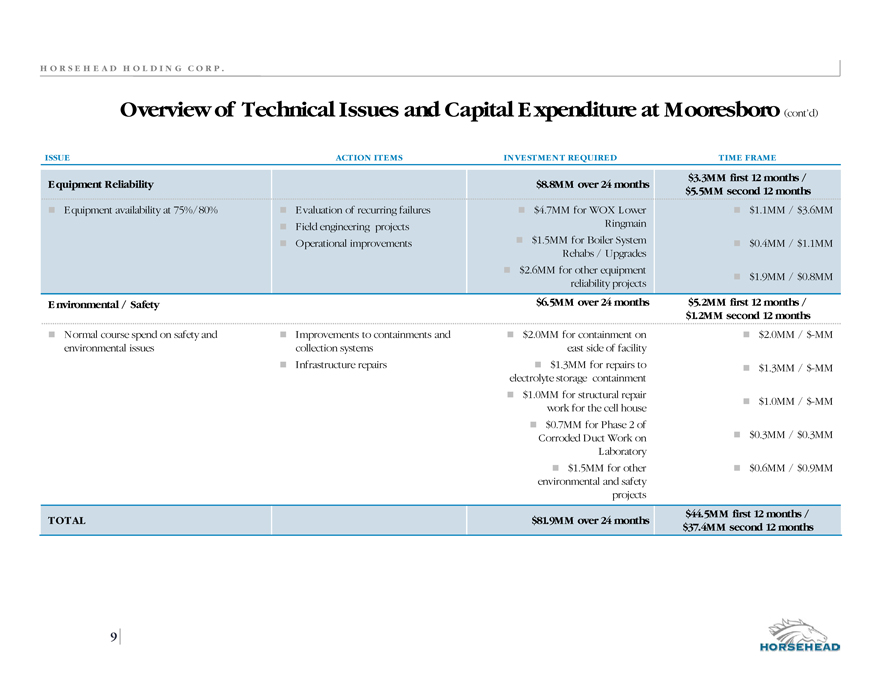

H OR S E H E A D H O L D I N G C O R P .

Overview of Technical Issues and Capital Expenditure at Mooresboro (cont’d)

ISSUE ACTION ITEMS INVESTMENT REQUIRED TIME FRAME

Equipment Reliability

Equipment availability at 75%/80%

Evaluation of recurring failures Field engineering projects Operational improvements

$8.8MM over 24 months

$4.7MM for WOX Lower

Ringmain

$1.5MM for Boiler System

Rehabs / Upgrades

$2.6MM for other equipment

reliability projects

$3.3MM first 12 months /

$5.5MM second 12 months

$1.1MM / $3.6MM

$0.4MM / $1.1MM

$1.9MM / $0.8MM

Environmental / Safety

Normal course spend on safety and environmental issues

Improvements to containments and collection systems Infrastructure repairs

$6.5MM over 24 months

$2.0MM for containment on

east side of facility

$1.3MM for repairs to

electrolyte storage containment

$1.0MM for structural repair

work for the cell house

$0.7MM for Phase 2 of

Corroded Duct Work on

Laboratory

$1.5MM for other

environmental and safety

projects

$5.2MM first 12 months /

$1.2MM second 12 months

$2.0MM / $-MM

$1.3MM / $-MM

$1.0MM / $-MM

$0.3MM / $0.3MM

$0.6MM / $0.9MM

TOTAL $81.9MM over 24 months $44.5MM first 12 months /

$37.4MM second 12 months

9

|

|

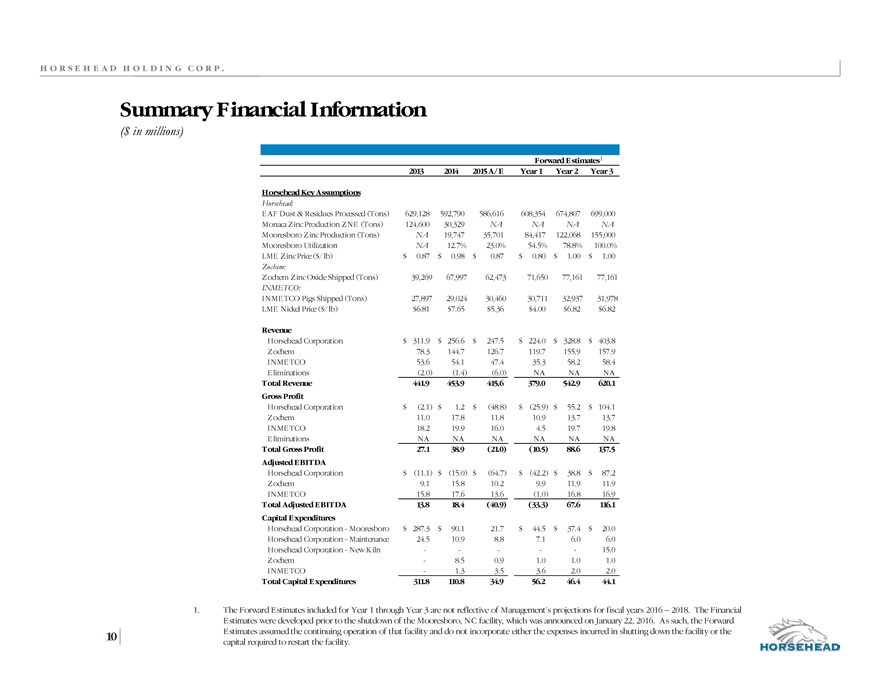

H O R S E H E A D H O L D I N G C O R P .

Summary Financial Information

($ in millions)

Forward Estimates1

2013 2014 2015 A/E Year 1 Year 2 Year 3

Horsehead Key Assumptions

Horsehead:

E AF Dust & Residues Processed (Tons) 629,128 592,790 586,616 608,354 674,807 699,000

Monaca Zinc Production ZNE (Tons) 124,600 30,329 NA NA NA NA

Mooresboro Zinc Production (Tons) NA 19,747 35,701 84,417 122,068 155,000

Mooresboro Utilization NA 12.7% 23.0% 54.5% 78.8% 100.0%

LME Zinc Price ($/ lb) $ 0.87 $ 0.98 $ 0.87 $ 0.80 $ 1.00 $ 1.00

Zochem:

Zochem Zinc Oxide Shipped (Tons) 39,269 67,997 62,473 71,650 77,161 77,161

INMETCO:

INME TCO Pigs Shipped (Tons) 27,897 29,024 30,460 30,711 32,937 31,978

LME Nickel Price ($/ lb) $6.81 $7.65 $5.36 $4.00 $6.82 $6.82

Revenue

Horsehead Corporation $ 311.9 $ 256.6 $ 247.5 $ 224.0 $ 328.8 $ 403.8

Zochem 78.3 144.7 126.7 119.7 155.9 157.9

INME TCO 53.6 54.1 47.4 35.3 58.2 58.4

E liminations (2.0) (1.4) (6.0) NA NA NA

Total Revenue 441.9 453.9 415.6 379.0 542.9 620.1

Gross Profit

Horsehead Corporation $ (2.1) $ 1.2 $ (48.8) $ (25.9) $ 55.2 $ 104.1

Zochem 11.0 17.8 11.8 10.9 13.7 13.7

INME TCO 18.2 19.9 16.0 4.5 19.7 19.8

E liminations NA NA NA NA NA NA

Total Gross Profit 27.1 38.9 (21.0) (10.5) 88.6 137.5

Adjusted EBITDA

Horsehead Corporation $ (11.1) $ (15.0) $ (64.7) $ (42.2) $ 38.8 $ 87.2

Zochem 9.1 15.8 10.2 9.9 11.9 11.9

INME TCO 15.8 17.6 13.6 (1.0) 16.8 16.9

Total Adjusted EBITDA 13.8 18.4 (40.9) (33.3) 67.6 116.1

Capital Expenditures

Horsehead Corporation—Mooresboro $ 287.3 $ 90.1 21.7 $ 44.5 $ 37.4 $ 20.0

Horsehead Corporation—Maintenance 24.5 10.9 8.8 7.1 6.0 6.0

Horsehead Corporation—New Kiln—————15.0

Zochem— 8.5 0.9 1.0 1.0 1.0

INME TCO— 1.3 3.5 3.6 2.0 2.0

Total Capital Expenditures 311.8 110.8 34.9 56.2 46.4 44.1

1. The Forward Estimates included for Year 1 through Year 3 are not reflective of Management’s projections for fiscal years 2016 – 2018. The Financial

Estimates were developed prior to the shutdown of the Mooresboro, NC facility, which was announced on January 22, 2016. As such, the Forward

10 Estimates assumed the continuing operation of that facility and do not incorporate either the expenses incurred in shutting down the facility or the

capital required to restart the facility.

|

|

H OR S E H E A D H O L D I N G C O R P .

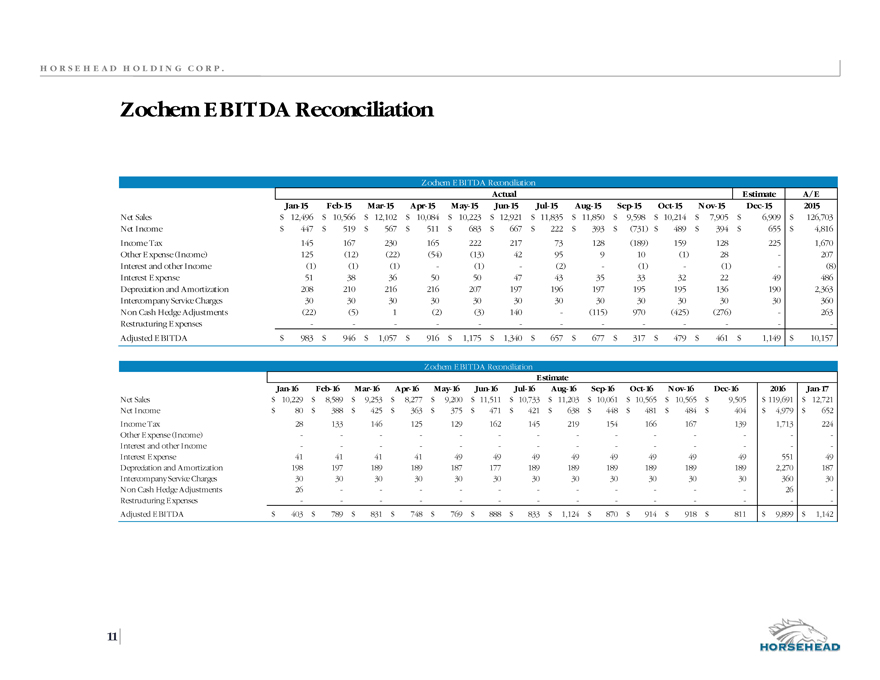

Zochem EBITDA Reconciliation

Zochem E BITDA Reconciliation

Actual Estimate A/E

Jan-15 Feb-15 Mar-15 Apr-15 May-15 Jun-15 Jul-15 Aug-15 Sep-15 Oct-15 Nov-15 Dec-15 2015

Net Sales $ 12,496 $ 10,566 $ 12,102 $ 10,084 $ 10,223 $ 12,921 $ 11,835 $ 11,850 $ 9,598 $ 10,214 $ 7,905 $ 6,909 $ 126,703

Net Income $ 447 $ 519 $ 567 $ 511 $ 683 $ 667 $ 222 $ 393 $ (731) $ 489 $ 394 $ 655 $ 4,816

Income Tax 145 167 230 165 222 217 73 128 (189) 159 128 225 1,670

Other E xpense (Income) 125 (12) (22) (54) (13) 42 95 9 10 (1) 28 — 207

Interest and other Income (1) (1) (1) — (1) — (2) — (1)— (1) — (8)

Interest E xpense 51 38 36 50 50 47 43 35 33 32 22 49 486

Depreciation and Amortization 208 210 216 216 207 197 196 197 195 195 136 190 2,363

Intercompany Service Charges 30 30 30 30 30 30 30 30 30 30 30 30 360

Non Cash Hedge Adjustments (22) (5) 1 (2) (3) 140 — (115) 970 (425) (276) — 263

Restructuring E xpenses ——— — — ——— — — — -

Adjusted E BITDA $ 983 $ 946 $ 1,057 $ 916 $ 1,175 $ 1,340 $ 657 $ 677 $ 317 $ 479 $ 461 $ 1,149 $ 10,157

Zochem E BITDA Reconciliation

Estimate

Jan-16 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Aug-16 Sep-16 Oct-16 Nov-16 Dec-16 2016 Jan-17

Net Sales $ 10,229 $ 8,589 $ 9,253 $ 8,277 $ 9,200 $ 11,511 $ 10,733 $ 11,203 $ 10,061 $ 10,565 $ 10,565 $ 9,505 $ 119,691 $ 12,721

Net Income $ 80 $ 388 $ 425 $ 363 $ 375 $ 471 $ 421 $ 638 $ 448 $ 481 $ 484 $ 404 $ 4,979 $ 652

Income Tax 28 133 146 125 129 162 145 219 154 166 167 139 1,713 224

Other E xpense (Income) ———— — — —————— — -

Interest and other Income ———— — — —————— — -

Interest E xpense 41 41 41 41 49 49 49 49 49 49 49 49 551 49

Depreciation and Amortization 198 197 189 189 187 177 189 189 189 189 189 189 2,270 187

Intercompany Service Charges 30 30 30 30 30 30 30 30 30 30 30 30 360 30

Non Cash Hedge Adjustments 26 ——— — — —————— 26 -

Restructuring E xpenses ———— — — —————— — -

Adjusted E BITDA $ 403 $ 789 $ 831 $ 748 $ 769 $ 888 $ 833 $ 1,124 $ 870 $ 914 $ 918 $ 811 $ 9,899 $ 1,142

11

|

|

H OR S E H E A D H O L D I N G C O R P .

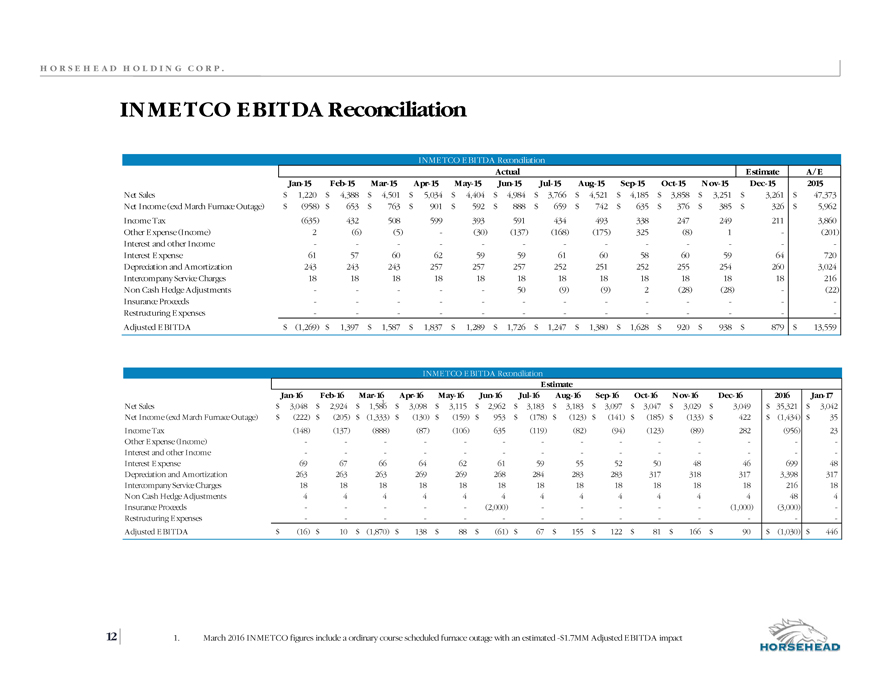

INMETCO EBITDA Reconciliation

INME TCO E BITDA Reconciliation

Actual Estimate A/E

Jan-15 Feb-15 Mar-15 Apr-15 May-15 Jun-15 Jul-15 Aug-15 Sep-15 Oct-15 Nov-15 Dec-15 2015

Net Sales $ 1,220 $ 4,388 $ 4,501 $ 5,034 $ 4,404 $ 4,984 $ 3,766 $ 4,521 $ 4,185 $ 3,858 $ 3,251 $ 3,261 $ 47,373

Net Income (excl March Furnace Outage) $ (958) $ 653 $ 763 $ 901 $ 592 $ 888 $ 659 $ 742 $ 635 $ 376 $ 385 $ 326 $ 5,962

Income Tax (635) 432 508 599 393 591 434 493 338 247 249 211 3,860

Other E xpense (Income) 2 (6) (5) — (30) (137) (168) (175) 325 (8) 1 — (201)

Interest and other Income ———— —— ——— — — — -

Interest E xpense 61 57 60 62 59 59 61 60 58 60 59 64 720

Depreciation and Amortization 243 243 243 257 257 257 252 251 252 255 254 260 3,024

Intercompany Service Charges 18 18 18 18 18 18 18 18 18 18 18 18 216

Non Cash Hedge Adjustments ———— — 50 (9) (9) 2 (28) (28) — (22)

Insurance Proceeds ———— —— ——— — — — -

Restructuring E xpenses ———— —— ——— — — — -

Adjusted E BITDA $ (1,269) $ 1,397 $ 1,587 $ 1,837 $ 1,289 $ 1,726 $ 1,247 $ 1,380 $ 1,628 $ 920 $ 938 $ 879 $ 13,559

INME TCO E BITDA Reconciliation

Estimate

Jan-16 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Aug-16 Sep-16 Oct-16 Nov-16 Dec-16 2016 Jan-17

Net Sales $ 3,048 $ 2,924 $ 1,5861 $ 3,098 $ 3,115 $ 2,962 $ 3,183 $ 3,183 $ 3,097 $ 3,047 $ 3,029 $ 3,049 $ 35,321 $ 3,042

Net Income (excl March Furnace Outage) $ (222) $ (205) $ (1,333) $ (130) $ (159) $ 953 $ (178) $ (123) $ (141) $ (185) $ (133) $ 422 $ (1,434) $ 35

Income Tax (148) (137) (888) (87) (106) 635 (119) (82) (94) (123) (89) 282 (956) 23

Other E xpense (Income) ——————— ——— — — — -

Interest and other Income ——————— ——— — — — -

Interest E xpense 69 67 66 64 62 61 59 55 52 50 48 46 699 48

Depreciation and Amortization 263 263 263 269 269 268 284 283 283 317 318 317 3,398 317

Intercompany Service Charges 18 18 18 18 18 18 18 18 18 18 18 18 216 18

Non Cash Hedge Adjustments 4 4 4 4 4 4 4 4 4 4 4 4 48 4

Insurance Proceeds —————(2,000)— ——— — (1,000) (3,000) -

Restructuring E xpenses ——————— ——— — — — -

Adjusted E BITDA $ (16) $ 10 $ (1,870) $ 138 $ 88 $ (61) $ 67 $ 155 $ 122 $ 81 $ 166 $ 90 $ (1,030) $ 446

12 1. March 2016 INMETCO figures include a ordinary course scheduled furnace outage with an estimated -$1.7MM Adjusted EBITDA impact

|

|

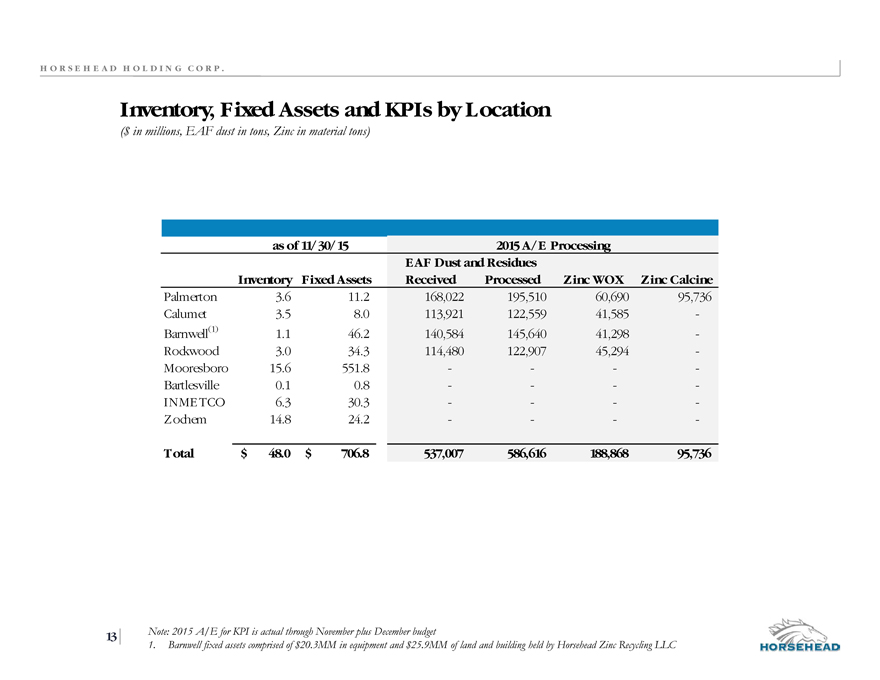

H OR S E H E A D H O L D I N G C O R P .

Inventory, Fixed Assets and KPIs by Location

($ in millions, EAF dust in tons, Zinc in material tons)

as of 11/30/15 2015 A/E Processing

EAF Dust and Residues

Inventory Fixed Assets Received Processed Zinc WOX Zinc Calcine

Palmerton 3.6 11.2 168,022 195,510 60,690 95,736

Calumet 3.5 8.0 113,921 122,559 41,585 -

Barnwell(1) 1.1 46.2 140,584 145,640 41,298 -

Rockwood 3.0 34.3 114,480 122,907 45,294 -

Mooresboro 15.6 551.8 — —

Bartlesville 0.1 0.8 — —

INME TCO 6.3 30.3 — —

Zochem 14.8 24.2 — —

Total $ 48.0 $ 706.8 537,007 586,616 188,868 95,736

13 Note: 2015 A/E for KPI is actual through November plus December budget

1. Barnwell fixed assets comprised of $20.3MM in equipment and $25.9MM of land and building held by Horsehead Zinc Recycling LLC