Attached files

| file | filename |

|---|---|

| 8-K - 8-K - XEROX CORP | xrx1231158-ker.htm |

| EX-99.2 - EXHIBIT 99.2 - XEROX CORP | ex992xrx1231158-ker.htm |

| EX-99.1 - EXHIBIT 99.1 - XEROX CORP | ex991xrx1231158-ker.htm |

| EX-99.4 - EXHIBIT 99.4 - XEROX CORP | ex994xrx1231158-ker.htm |

| EX-10.(S) - EXHIBIT 10(S) - XEROX CORP | ex10sxrx1231158-ker.htm |

Fourth-Quarter 2015 Earnings Presentation January 29, 2016 Ursula Burns Chairman & CEO Leslie Varon Chief Financial Officer (Interim)

Forward Looking Statements 2 This presentation contains “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “will,” “should” and similar expressions, as they relate to us, are intended to identify forward-looking statements. These statements reflect management’s current beliefs, assumptions and expectations, including with respect to the proposed separation of the Business Process Outsourcing ("BPO") business from the Document Technology and Document Outsourcing business, the expected timetable for completing the separation, the future financial and operating performance of each business, the strategic and competitive advantages of each business, future opportunities for each business and the expected amount of cost reductions that may be realized in the cost transformation program, and are subject to a number of factors that may cause actual results to differ materially. Such factors include but are not limited to: changes in economic conditions, political conditions, trade protection measures, licensing requirements and tax matters in the United States and in the foreign countries in which we do business; changes in foreign currency exchange rates; our ability to successfully develop new products, technologies and service offerings and to protect our intellectual property rights; the risk that multi-year contracts with governmental entities could be terminated prior to the end of the contract term and that civil or criminal penalties and administrative sanctions could be imposed on us if we fail to comply with the terms of such contracts and applicable law; the risk that our bids do not accurately estimate the resources and costs required to implement and service very complex, multi-year governmental and commercial contracts, often in advance of the final determination of the full scope and design of such contracts or as a result of the scope of such contracts being changed during the life of such contracts; the risk that subcontractors, software vendors and utility and network providers will not perform in a timely, quality manner; service interruptions; actions of competitors and our ability to promptly and effectively react to changing technologies and customer expectations; our ability to obtain adequate pricing for our products and services and to maintain and improve cost efficiency of operations, including savings from restructuring actions and the relocation of our service delivery centers; the risk that individually identifiable information of customers, clients and employees could be inadvertently disclosed or disclosed as a result of a breach of our security systems; the risk in the hiring and retention of qualified personnel; the risk that unexpected costs will be incurred; our ability to recover capital investments; the risk that our Services business could be adversely affected if we are unsuccessful in managing the start-up of new contracts; the collectability of our receivables for unbilled services associated with very large, multi-year contracts; reliance on third parties, including subcontractors, for manufacturing of products and provision of services; our ability to expand equipment placements; interest rates, cost of borrowing and access to credit markets; the risk that our products may not comply with applicable worldwide regulatory requirements, particularly environmental regulations and directives; the outcome of litigation and regulatory proceedings to which we may be a party; the possibility that the proposed separation of the BPO business from the Document Technology and Document Outsourcing business will not be consummated within the anticipated time period or at all, including as the result of regulatory, market or other factors; the potential for disruption to our business in connection with the proposed separation; the potential that BPO and Document Technology and Document Outsourcing do not realize all of the expected benefits of the separation; and other factors that are set forth in the “Risk Factors” section, the “Legal Proceedings” section, the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section and other sections of our Quarterly Reports on Form 10-Q for the quarters ended, March 31, 2015, June 30, 2015 and September 30, 2015 and our 2014 Annual Report on Form 10-K filed with the Securities and Exchange Commission. Xerox assumes no obligation to update any forward-looking statements as a result of new information or future events or developments, except as required by law.

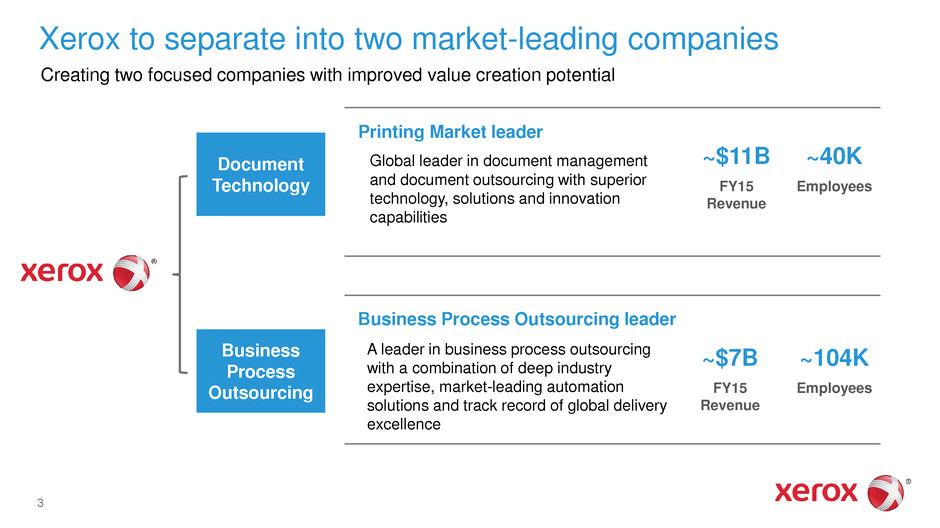

Business Process Outsourcing Document Technology Xerox to separate into two market-leading companies 3 Printing Market leader Business Process Outsourcing leader Global leader in document management and document outsourcing with superior technology, solutions and innovation capabilities A leader in business process outsourcing with a combination of deep industry expertise, market-leading automation solutions and track record of global delivery excellence Creating two focused companies with improved value creation potential ~$11B FY15 Revenue ~40K Employees ~$7B FY15 Revenue ~104K Employees

4 Compelling rationale for two companies 4 Best-positions both companies to capitalize on value creation opportunities Enhanced Strategic and Operational Focus Distinct and Clear Financial Profiles Compelling Investment Cases Focus on continued operational discipline and capturing transformative productivity while making selective investments in growth areas Strong, annuity-based profitability and free cash flow generation Strong cash generation track record, targeting investment grade credit rating and shareholder-friendly capital allocation Focus on leadership in attractive market segments to provide differentiated solutions and delivery excellence Positioned for profitable revenue growth with large base of recurring revenues, high retention rates EPS expansion through growth, margin improvement and disciplined investments Document Technology Business Process Outsourcing Simplified Organizational Structure and Resources Able to adapt to evolving market dynamics through simplified organizational and decision-making processes Nimbler and narrower with greater ability to attract and retain talent, drive innovation and pursue growth opportunities

Document Technology: Global Leader in $90B Document Management and Outsourcing Market 5 The first name in printing, helping clients harness the benefits of document management in an increasingly interconnected, digital world • Annuity driven revenue, more than 70% • Strong cost discipline • Strong free cash flow generation • Targeting investment grade credit rating Financials Key Offerings Market Perspective • Addressable market of ~$90B, declining low single digits • Well positioned in areas of growth • High-end color • Managed Print Services (MPS) and Workflow • Global presence in ~180 countries ~$11B FY15 Revenue 24 quarters Equipment Revenue Share Leader MPS leader across all industry reports Broadest Portfolio of cut-sheet digital color products and solutions, investing in aqueous ink jet Leader in A3 Market opportunity in underpenetrated A4 market Next Generation MPS industry leading approach with unparalleled global delivery capabilities Note: Revenue breakdown excludes Other segment (~5%) 13% 40% 16% 31% Entry Mid High-End Doc Outsourcing

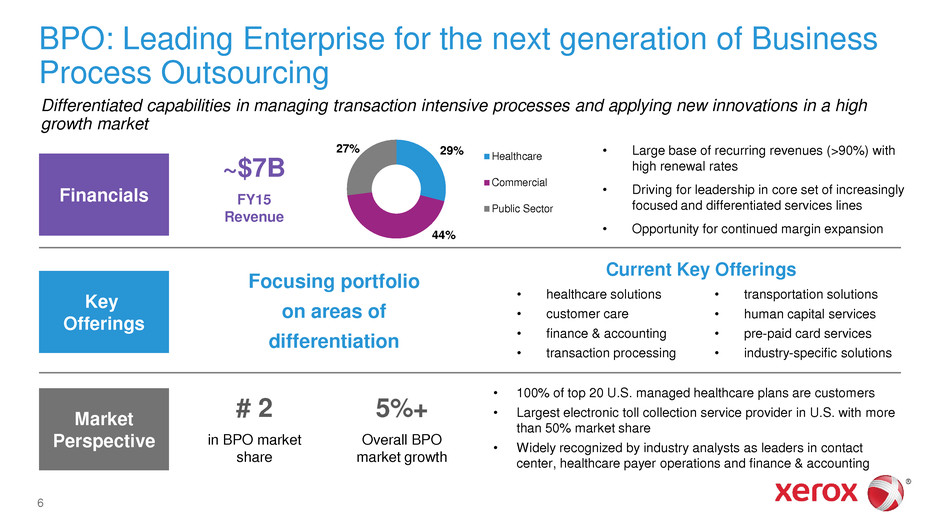

BPO: Leading Enterprise for the next generation of Business Process Outsourcing 6 Differentiated capabilities in managing transaction intensive processes and applying new innovations in a high growth market • Large base of recurring revenues (>90%) with high renewal rates • Driving for leadership in core set of increasingly focused and differentiated services lines • Opportunity for continued margin expansion Financials Key Offerings • 100% of top 20 U.S. managed healthcare plans are customers • Largest electronic toll collection service provider in U.S. with more than 50% market share • Widely recognized by industry analysts as leaders in contact center, healthcare payer operations and finance & accounting ~$7B FY15 Revenue # 2 in BPO market share 5%+ Overall BPO market growth • healthcare solutions • customer care • finance & accounting • transaction processing • transportation solutions • human capital services • pre-paid card services • industry-specific solutions Focusing portfolio on areas of differentiation Current Key Offerings Financials Key Offerings Market Perspective 29% 44% 27% Healthcare Commercial Public Sector

3 Year Strategic Transformation Program Comprehensive program to deliver operational competitiveness and agility, spans both Document Technology and Business Process Outsourcing businesses • Focus on sustainable strategic and operational initiatives • Strong track record of delivering productivity and executing cost initiatives Incremental savings of $600M over 3 years, bringing the combined cumulative savings to $2.4B • Includes ongoing productivity initiatives that offset revenue pressures • Incremental transformation program savings support margin expansion • Targeting $700M annualized savings in 2016 Strategic transformation program to focus on: Organization structure Support function and infrastructure optimization RD&E optimization Incremental supply chain outsourcing Labor productivity and automation Service delivery consolidation and efficiency 7

Value for all Stakeholders Employees • Simplified and focused decision making • Direct alignment of performance and incentives • Attractive career development paths Clients • Rapid response to changing needs • Services delivery excellence • Continued innovation expertise Investors • Unique and compelling investment cases • Better positions companies for long-term value creation • Optimized capital structures and capital allocation priorities 8

Transaction Structure • Separation into two strong, independent, publicly-traded companies • Intended to be tax-free to Xerox shareholders for federal income tax purposes Timing • Transaction is expected to be completed by year-end 2016 • Subject to market, regulatory and other conditions Key Steps to Completion • Finalize Transaction Structure • Capital Structure • Standalone Financials / Audit • Operating and Shared Services Agreements • Management & Governance • SEC Review Process Closing Conditions • Final approval by Xerox Board of Directors • Customary regulatory approvals • Securing any necessary financings • Other customary conditions 9 Transaction Overview

4th Quarter Earnings

Fourth-Quarter Overview 1Adjusted EPS, Constant Currency (CC) and Operating Margin: see Non-GAAP Financial Measures 2GAAP EPS from Continuing Operations 11 Adjusted EPS1 of 32 cents; GAAP EPS2 of 27 cents Total revenue of $4.7B, down 8% or 5% CC1 Services revenue down 3% or flat CC1; margin of 9.4% • Document Outsourcing revenue up 3%, BPO revenue down 2% CC1 • Margin up 130 bps sequentially and above our expectations Document Technology revenue down 13% or 10% CC1; margin of 11.8% • Revenue pressured by lower U.S. supplies sales and continued developing markets weakness • Margin within target range of 11 to 13% Operating margin1 of 9.2%, down 120 bps YOY Cash from operations of $878M, $1.6B FY • Strong capital returns, $1.3B in share repurchase and $0.3B in dividends full-year • Ending cash balance of $1.4B

Earnings (in millions, except per share data) Q4 2015 B/(W) YOY Comments Revenue $ 4,653 $ (380) Decline driven by Document Technology and currency Gross Margin 31.3% (0.8) pts RD&E $ 145 $ 5 SAG $ 883 $ 59 Adjusted Operating Income1 $ 428 $ (96) Lower revenues pressure margin; accelerating productivity initiatives and launching strategic transformation program Operating Income % of Revenue 9.2% (1.2) pts Adjusted Other, net1 $ 46 $ 53 Restructuring lower by $41M YOY Equity Income $ 32 $ (9) Adjusted Tax Rate1 20.9% 4.4 pts Better driven by US tax law changes Adjusted Net Income – Xerox1 $ 333 $ (24) Adjusted EPS1 $ 0.32 $ 0.01 Guidance range $0.28 - $0.30 Amortization of intangible assets (0.05) - Deferred tax liability adjustment - (0.04) GAAP EPS2 $ 0.27 $ (0.03) 1Adjusted Operating Income, Adjusted Other, net, Adjusted Tax Rate, Adjusted Net Income – Xerox and Adjusted EPS: see Non-GAAP Financial Measures 2GAAP EPS from Continuing Operations 12

Services Segment Revenue flat at CC1 • Document Outsourcing up 3%, BPO down 2% Margin of 9.4% up sequentially and above guidance of 9.0% Seeing benefits of new Services operating model, expect further improvement in 2016 Signings • New business signings3 up 22% YOY, down 1% TTM • Includes FL Tolling • BPO/DO renewal rate of 78% in Q4, 84% FY Segment Margin Trend Revenue Growth Trend (CC1) 13 1Constant currency (CC): see Non-GAAP Financial Measures 2Adjusted for the HE charge: see Non-GAAP Financial Measures 3New Business Signings = ARR (Annual Recurring Revenue) + NRR (Non-Recurring Revenue) Signings (TCV) Q4 FY Business Process Outsourcing $2.9 $8.4 Document Outsourcing $1.1 $3.1 Total $4.0B $11.5B YOY Growth 26% 8% TTM Growth 8% 8% 8.6% 8.5% 9.1% 9.8% 7.5% 7.5% 8.1% 2 9.4% 6% 8% 10% 12% Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 0% 1% 1% 3% 1% 1% 0% 2 0% 0% 2% 4% Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q4 % B/(W) YOY Adj2 FY % B/(W) YOY (in millions) 2015 Act Cur CC1 2015 Act Cur CC1 Total Revenue $2,638 (3)% - $10,253 (3)% - Segment Profit $249 (7)% $835 (13)% Segment Margin 9.4% (0.4) pts 8.1% (0.9) pts

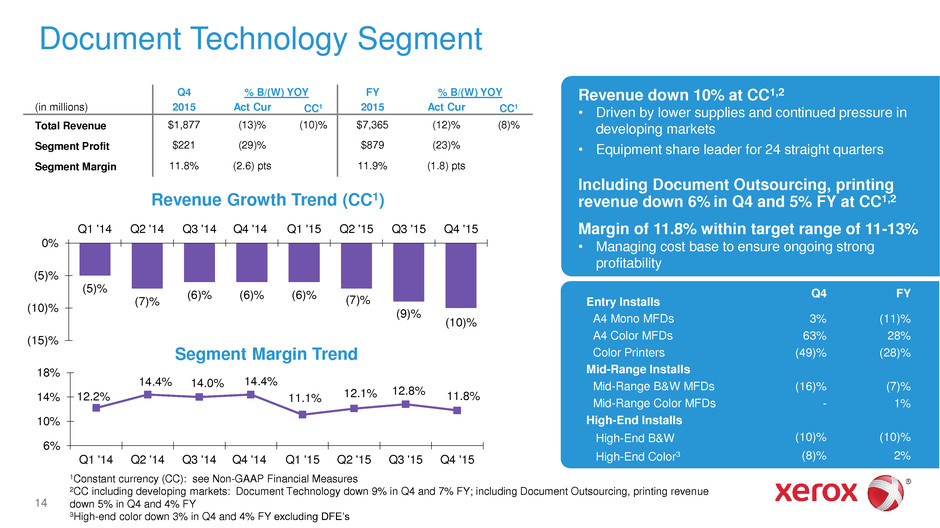

Document Technology Segment Segment Margin Trend Revenue Growth Trend (CC1) Revenue down 10% at CC1,2 • Driven by lower supplies and continued pressure in developing markets • Equipment share leader for 24 straight quarters Including Document Outsourcing, printing revenue down 6% in Q4 and 5% FY at CC1,2 Margin of 11.8% within target range of 11-13% • Managing cost base to ensure ongoing strong profitability Q4 FY Entry Installs A4 Mono MFDs 3% (11)% A4 Color MFDs 63% 28% Color Printers (49)% (28)% Mid-Range Installs Mid-Range B&W MFDs (16)% (7)% Mid-Range Color MFDs - 1% High-End Installs High-End B&W (10)% (10)% High-End Color3 (8)% 2% 14 1Constant currency (CC): see Non-GAAP Financial Measures 2CC including developing markets: Document Technology down 9% in Q4 and 7% FY; including Document Outsourcing, printing revenue down 5% in Q4 and 4% FY 3High-end color down 3% in Q4 and 4% FY excluding DFE’s (5)% (7)% (6)% (6)% (6)% (7)% (9)% (10)% (15)% (10)% (5)% 0% Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 12.2% 14.4% 14.0% 14.4% 11.1% 12.1% 12.8% 11.8% 6% 10% 14% 18% Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q4 % B/(W) YOY FY % B/(W) YOY (in millions) 2015 Act Cur CC1 2015 Act Cur CC1 Total Revenue $1,877 (13)% (10)% $7,365 (12)% (8)% Segment Profit $221 (29)% $879 (23)% Segment Margin 11.8% (2.6) pts 11.9% (1.8) pts

Cash From Ops $878M in Q4, $1.6B FY • Free Cash Flow $798M in Q4, $1.3B FY Higher contribution from working capital CAPEX $80M in Q4, $342M FY Acquisitions $9M in Q4, $210M FY Share Repurchase of $1.3B FY Common Stock Dividends $71M in Q4, $302M FY Cash Flow 15 1Accounts receivable includes collections of deferred proceeds from sales of receivables and finance receivables includes collections on beneficial interest from sales of finance receivables 2Adjusted to exclude impact of HE charge (in millions) Q4 2015 FY 2015 Net Income $ 290 $ 506 HE Charge add back (after-tax) - 241 Depreciation and amortization2 280 1,155 Restructuring and asset impairment charges (5) 186 Restructuring payments (17) (98) Contributions to defined benefit pension plans (161) (309) Inventories 153 (101) Accounts receivable and Billed portion of finance receivables1,2 308 254 Accounts payable and Accrued compensation 143 38 Equipment on operating leases (81) (291) Finance receivables1 (47) 38 Other 15 (8) Cash from Operations $ 878 $ 1,611 Cash from Investing $ (19) $ 508 Cash from Financing $ (278) $ (2,074) Change in Cash and Cash Equivalents 564 (43) Ending Cash and Cash Equivalents $ 1,368 $ 1,368

0 2,000 4,000 6,000 8,000 10,000 2011 2012 2013 2014 2015 Finance Debt Core Debt Finance Assets Capital Structure Core debt level managed to maintain investment grade rating Over half of Xerox debt supports finance assets $7.4B of debt at year-end 16 Financing and Leverage • Xerox’s value proposition includes leasing of Xerox equipment • Maintain 7:1 leverage ratio of debt to equity on these finance assets Debt and Finance Asset Trend (in millions) Q4 2015 (in billions) Fin. Assets Debt Financing $ 4.5 $ 3.9 Core - 3.5 Total Xerox $ 4.5 $ 7.4 $

Capital Allocation Enhances Shareholder Returns Share Repurchase of $1.3B FY • Reduced shares ~10% in 2015 Acquisitions of $210M FY Common Stock dividends of $302M FY Announcing 11% common dividend increase2 to 31 cents per share annually 17 Share Repurchase Program Dividend Program 1Ending fully diluted: see Non-GAAP Financial Measures 2Dividend effective for common dividend payable on April 29, 2016 Shares Repurchased ($M) Shares Outstanding (ending fully diluted1, in millions) Dividend per share (annualized) $0.17 $0.23 $0.25 $0.28 $0.312 $0.00 $0.20 $0.40 2012 2013 2014 2015 2016E $701 $1,052 $696 $1,071 $1,302 $0 $800 $1,600 2011 2012 2013 2014 2015 1,391 1,271 1,235 1,159 1,046 800 1,200 1,600 2011 2012 2013 2014 2015

2016 Guidance (reflects new reporting basis) Notes: • Revenue growth guidance excluding potential divestitures • Constant Current calculation to include developing markets beginning in 2016 • Segment definitions to be adjusted to move Education/Student Loan business to the Other Segment and to exclude retirement related costs • Separation and related costs are not yet finalized and thus are not included in EPS or cash flow guidance 1Constant Currency (CC), Adjusted EPS and Free Cash Flow: see Non-GAAP Financial Measures 2GAAP EPS from Continuing Operations Earnings - Revenue trend to improve modestly • Currency remains a headwind of (1) to (2) pts - Margin improvement in Services; Document Technology margin consistent YOY - Adjusted EPS growth driven by lower shares and Services profit growth Cash Flow - Strong underlying cash flow, decrease from $1.6B in 2015 driven by: • CA/MT Health Enterprise settlement related cash outflows • Higher restructuring related to strategic transformation - Continued focus on shareholder returns • 11% Common Dividend increase • >50% of FCF targeted for Dividends and Share Repurchase Q1 Guidance - Adjusted EPS of $0.21 to $0.24 - GAAP EPS of $0.05 to $0.08 • Includes ~$100M of pre-tax restructuring 18 2016 Revenue Growth @ CC1 Down 2 - 4% Services Revenue Growth @ CC1 Flat to up 3% Segment Margin 8% - 9.5% Document Technology Revenue Growth @ CC1 Down 5 - 7% Segment Margin 12% - 14% Adjusted EPS1 (excl restructuring, retirement related costs, separation and related costs) $1.10 - $1.20 GAAP EPS2 $0.66 - $0.76 Cash From Ops $1.3 - $1.5B CAPEX $0.3B Free Cash Flow1 $1.0 - $1.2B Share Repurchase/Dividends > 50% FCF Acquisitions $100 - $400M Debt Repayment Maintain investment grade

Xerox Confidential Separation is the best path to enhance shareholder value Key Takeaways • Two strong market-leading companies positioned to capture unique industry opportunities and maximize value • Each company with resources and focus to capitalize on growth opportunities in its respective market segment • Leverage each company’s distinct growth profile, operating model and cash flow characteristics to optimize capital structure and capital allocation • Strong operational execution in 2016 is foundational to success 19

Appendix

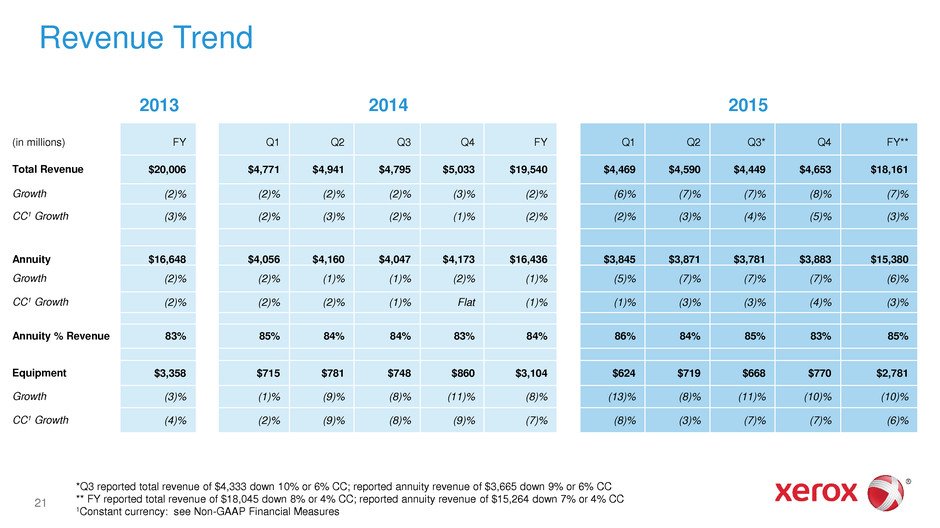

Revenue Trend (in millions) FY Q1 Q2 Q3 Q4 FY Q1 Q2 Q3* Q4 FY** Total Revenue $20,006 $4,771 $4,941 $4,795 $5,033 $19,540 $4,469 $4,590 $4,449 $4,653 $18,161 Growth (2)% (2)% (2)% (2)% (3)% (2)% (6)% (7)% (7)% (8)% (7)% CC1 Growth (3)% (2)% (3)% (2)% (1)% (2)% (2)% (3)% (4)% (5)% (3)% Annuity $16,648 $4,056 $4,160 $4,047 $4,173 $16,436 $3,845 $3,871 $3,781 $3,883 $15,380 Growth (2)% (2)% (1)% (1)% (2)% (1)% (5)% (7)% (7)% (7)% (6)% CC1 Growth (2)% (2)% (2)% (1)% Flat (1)% (1)% (3)% (3)% (4)% (3)% Annuity % Revenue 83% 85% 84% 84% 83% 84% 86% 84% 85% 83% 85% Equipment $3,358 $715 $781 $748 $860 $3,104 $624 $719 $668 $770 $2,781 Growth (3)% (1)% (9)% (8)% (11)% (8)% (13)% (8)% (11)% (10)% (10)% CC1 Growth (4)% (2)% (9)% (8)% (9)% (7)% (8)% (3)% (7)% (7)% (6)% 2014 21 2015 2013 *Q3 reported total revenue of $4,333 down 10% or 6% CC; reported annuity revenue of $3,665 down 9% or 6% CC ** FY reported total revenue of $18,045 down 8% or 4% CC; reported annuity revenue of $15,264 down 7% or 4% CC 1Constant currency: see Non-GAAP Financial Measures

Segment Revenue Trend (in millions) FY Q1 Q2 Q3 Q4 FY Q1 Q2 Q3* Q4 FY** Services $10,479 $2,585 $2,651 $2,623 $2,725 $10,584 $2,514 $2,569 $2,532 $2,638 $10,253 Growth 2% Flat 1% 1% 1% 1% (3)% (3)% (3)% (3)% (3)% CC1 Growth 2% Flat 1% 1% 3% 1% 1% 1% Flat Flat Flat Document Technology $8,908 $2,044 $2,126 $2,029 $2,159 $8,358 $1,830 $1,880 $1,778 $1,877 $7,365 Growth (6)% (4)% (6)% (6)% (8)% (6)% (10)% (12)% (12)% (13)% (12)% CC1 Growth (6)% (5)% (7)% (6)% (6)% (6)% (6)% (7)% (9)% (10)% (8)% Other $619 $142 $164 $143 $149 $598 $125 $141 $139 $138 $543 Growth (10)% 3% (1)% (1)% (12)% (3)% (12)% (14)% (3)% (7)% (9)% CC1 Growth (10)% 3% (2)% (2)% (11)% (3)% (11)% (14)% (2)% (7)% (9)% 2014 22 2015 2013 *Q3 reported Services revenue of $2,416 down 8% or 4% CC **FY reported Services revenue of $10,137 down 4% or 1% CC 1Constant currency: see Non-GAAP Financial Measures

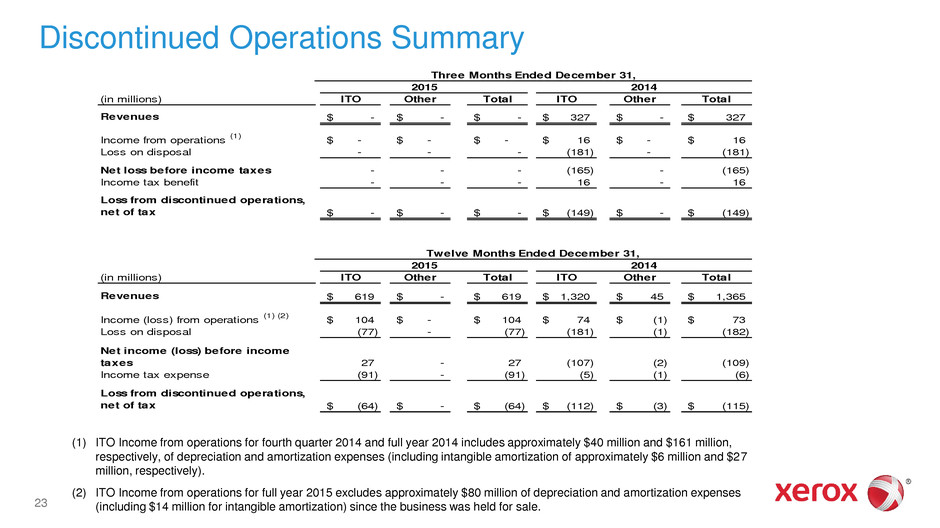

Discontinued Operations Summary (1) ITO Income from operations for fourth quarter 2014 and full year 2014 includes approximately $40 million and $161 million, respectively, of depreciation and amortization expenses (including intangible amortization of approximately $6 million and $27 million, respectively). (2) ITO Income from operations for full year 2015 excludes approximately $80 million of depreciation and amortization expenses (including $14 million for intangible amortization) since the business was held for sale. (in millions) ITO Other Total ITO Other Total Revenues -$ -$ -$ 327$ -$ 327$ Income from operations (1) -$ -$ -$ 16$ -$ 16$ Loss on disposal - - - (181) - (181) Net loss before income taxes - - - (165) - (165) Income tax benefit - - - 16 - 16 Loss from discontinued operations, net of tax -$ -$ -$ (149)$ -$ (149)$ (in millions) ITO Other Total ITO Other Total Revenues 619$ -$ 619$ 1,320$ 45$ 1,365$ Income (loss) from operations (1) (2) 104$ -$ 104$ 74$ (1)$ 73$ Loss on disposal (77) - (77) (181) (1) (182) Net income (loss) before income taxes 27 - 27 (107) (2) (109) Income tax expense (91) - (91) (5) (1) (6) Loss from discontinued operations, net of tax (64)$ -$ (64)$ (112)$ (3)$ (115)$ Three Months Ended December 31, 2015 2014 Twelve Months Ended December 31, 2015 2014 23

2016 Planned Reporting Changes

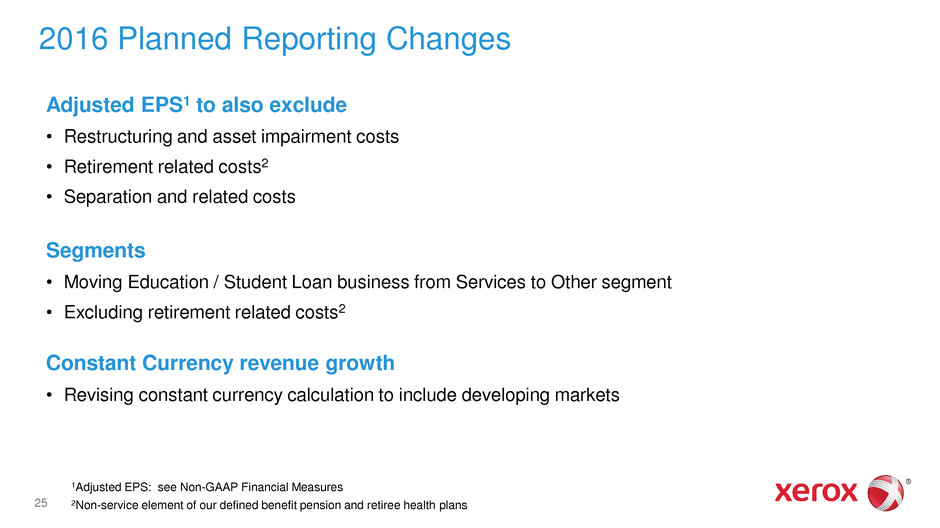

2016 Planned Reporting Changes Adjusted EPS1 to also exclude • Restructuring and asset impairment costs • Retirement related costs2 • Separation and related costs Segments • Moving Education / Student Loan business from Services to Other segment • Excluding retirement related costs2 Constant Currency revenue growth • Revising constant currency calculation to include developing markets 25 1Adjusted EPS: see Non-GAAP Financial Measures 2Non-service element of our defined benefit pension and retiree health plans

Revised 2015 EPS - New Reporting Basis 26 (1) Net income (loss) and EPS from continuing operations attributable to Xerox. (2) The tax impact on the Adjusted Pre‐Tax Income from continuing operations is calculated under the same accounting principles applied to the As Reported Pre-Tax Income under ASC 740, which employs an annual effective tax rate method to the results - See Effective Tax Rate reconciliation. (3) Average shares for the calculation of adjusted EPS include 27 million of shares associated with our Series A convertible preferred stock. (in millions; except per share amounts) Net Income Diluted EPS Net Income Diluted EPS Net (Loss) Income Diluted EPS Net Income Diluted EPS Net Income Diluted EPS As Reported (1) 191$ 0.16$ 107$ 0.09$ (31)$ (0.04)$ 285$ 0.27$ 552$ 0.49$ Amortization of intangible assets 77 79 77 77 310 Software impairment - 146 - - 146 HE charge - - 389 - 389 Restructuring charges - Xerox 14 11 20 (5) 40 Retirement related costs 42 10 30 34 116 Income tax on adjustments (2) (47) (90) (198) (45) (380) Restructuring charges - Fuji Xerox 1 1 2 - 4 Adjusted - revised 278$ 0.24$ 264$ 0.23$ 289$ 0.27$ 346$ 0.33$ 1,177$ 1.07$ Memo: Adjusted - previous basis 239$ 0.21$ 246$ 0.22$ 258$ 0.24$ 333$ 0.32$ 1,076$ 0.98$ 1,154 1,132 1,078 1,046 1,103 FY 2015 Weighted average shares - adjusted EPS (3) Q1 Q2 Q3 Q4

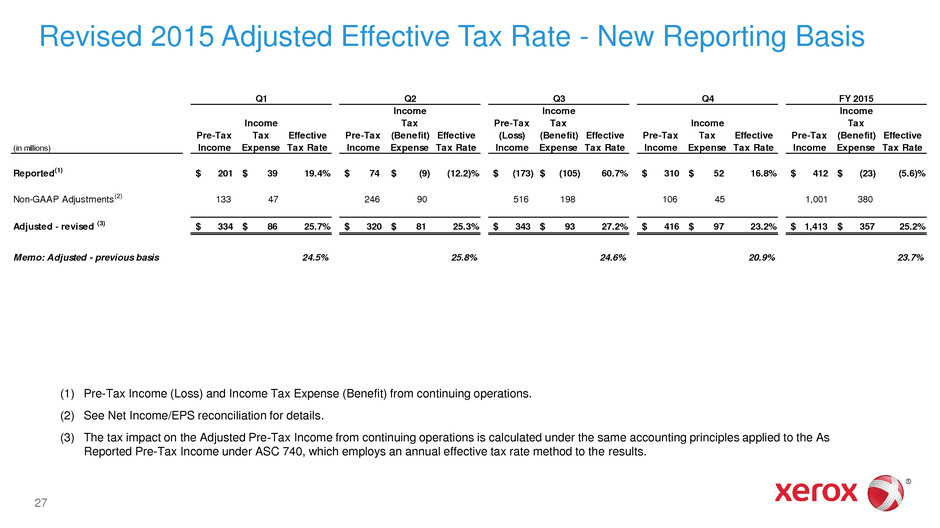

Revised 2015 Adjusted Effective Tax Rate - New Reporting Basis 27 (1) Pre-Tax Income (Loss) and Income Tax Expense (Benefit) from continuing operations. (2) See Net Income/EPS reconciliation for details. (3) The tax impact on the Adjusted Pre‐Tax Income from continuing operations is calculated under the same accounting principles applied to the As Reported Pre-Tax Income under ASC 740, which employs an annual effective tax rate method to the results. Q1 Q2 Q3 Q4 (in millions) Pre-Tax Income Income Tax Expense Effective Tax Rate Pre-Tax Income Income Tax (Benefit) Expense Effective Tax Rate Pre-Tax (Loss) Income Income Tax (Benefit) Expense Effective Tax Rate Pre-Tax Income Income Tax Expense Effective Tax Rate Pre-Tax Income Income Tax (Benefit) Expense Effective Tax Rate R ported(1) $ 201 $ 39 19.4% $ 74 $ (9) (12.2)% $ (173) $ (105) 60.7% $ 310 $ 52 16.8% $ 412 $ (23) (5.6)% Non-GAAP Adjustments(2) 133 47 246 90 516 198 106 45 1,001 380 Adjusted - revised (3) $ 334 $ 86 25.7% $ 320 $ 81 25.3% $ 343 $ 93 27.2% $ 416 $ 97 23.2% $ 1,413 $ 357 25.2% Memo: Adjusted - previous basis 24.5% 25.8% 24.6% 20.9% 23.7% FY 2015

Revised 2015 Segments - New Reporting Basis 28 (in $ millions) Reported Adj Reported Education/ Retirement Adj Revised FY 15 FY15 Student Loan Related Costs FY15 Revenues Services 10,137 10,253 (175) 10,078 Document Technology 7,365 7,365 7,365 Other 543 543 175 718 Total Revenues 18,045 18,161 - 18,161 Segment Profit (Loss) Services 446 835 (51) 29 813 Document Technology 879 879 81 960 Other (267) (267) 51 6 (210) Segment Profit (Loss) 1,058 1,447 - 116 1,563 Segment Margin Services 4.4% 8.1% 8.1% Document Technology 11.9% 11.9% 13.0% Other (49.2%) (49.2%) (29.3%) Segment Margin 5.9% 8.0% 8.6% New Reporting Basis

Revised 2015 Segments - New Reporting Basis 29 (in $ millions) Q1 Q2 Q3 Q4 Full Year Adjusted Q3 Full Year Revenues Services 2,467 2,526 2,367 2,602 9,962 2,483 10,078 Document Technology 1,830 1,880 1,778 1,877 7,365 1,778 7,365 Other 172 184 188 174 718 188 718 Total Revenues 4,469 4,590 4,333 4,653 18,045 4,449 18,161 4469 Segment Profit (Loss) Services 187 181 (196) 252 424 193 813 Document Technology 232 235 248 245 960 248 960 Other (47) (62) (55) (46) (210) (55) (210) Segment Profit (Loss) 372 354 (3) 451 1,174 386 1,563 Segment Margin Services 7.6% 7.2% (8.3%) 9.7% 4.3% 7.8% 8.1% Document Technology 12.7% 12.5% 13.9% 13.1% 13.0% 13.9% 13.0% Other (27.3%) (33.9%) (29.0%) (26.6%) (29.3%) (29.0%) (29.3%) Segment Margin 8.3% 7.7% (0.1%) 9.7% 6.5% 8.7% 8.6% Revised 2015 Adjusted for HE charge Revised 2015

Non-GAAP Measures

“Adjusted Revenue, Costs and Expenses, and Margin”: During third quarter 2015, we recorded a pre-tax charge – the Health Enterprise (HE) charge – of $389 million ($241 million after-tax or 23 cents per share), which included a $116 million reduction to revenues. As a result of the significant impact of the HE charge on our reported revenues, costs and expenses as well as key metrics for the full-year period, we excluded the impact of this charge. In addition to the magnitude of the charge and its impact on our reported results, we excluded the HE charge due to the fact that it was primarily a unique charge associated with the conclusion, reached after a series of discussions, that fully completing our HE platform implementations in California and Montana was no longer considered probable. “Adjusted Earnings Measures”: To better understand the trends in our business, we believe it is necessary to adjust the following amounts determined in accordance with GAAP to exclude the effects of certain items as well as their related income tax effects. • Net income and Earnings per share (EPS) • Effective tax rate In addition to the HE charge, the above items were also adjusted for the following items: Amortization of intangible assets. The amortization of intangible assets is driven by our acquisition activity which can vary in size, nature and timing as compared to other companies within our industry and from period to period. The use of intangible assets contributed to our revenues earned during the periods presented and will contribute to our future period revenues as well. Amortization of intangible assets will recur in future periods. Software impairment charge (Q2 2015) - The software impairment charge is excluded due to its non-cash impact and the unique nature of the item both in terms of the amount and the fact that it was the result of a specific management action involving a change in strategy in our Government Healthcare Solutions business. Deferred tax liability adjustment (Q4 2014) - The deferred tax liability adjustment was excluded due to its non-cash impact and the unusual nature of the item both in terms of the amount and the fact that it was the result of an infrequent change in a tax treaty impacting future distributions from Fuji Xerox. Non-GAAP Financial Measures 31

“Operating Income/Margin”: We also calculate and utilize operating income and margin earnings measures by adjusting our pre-tax income and margin amounts to exclude certain items. In addition to the HE charge and the amortization of intangible assets, operating income and margin also excludes Other expenses, net as well as Restructuring and asset impairment charges. Other expenses, net is primarily comprised of non-financing interest expense and also includes certain other non-operating costs and expenses. Restructuring charges consist of costs primarily related to severance and benefits paid to employees pursuant to formal restructuring and workforce reduction plans. Asset impairment charges include costs incurred for those assets sold, abandoned or made obsolete as a result of our restructuring actions, exiting from a business or other strategic business changes. Such charges are expected to yield future benefits and savings with respect to our operational performance. We exclude these amounts in order to evaluate our current and past operating performance and to better understand the expected future trends in our business. “Constant Currency”: To better understand trends in our business, we believe that it is helpful to adjust revenue to exclude the impact of changes in the translation of foreign currencies into U.S. dollars. We refer to this adjusted revenue as “constant currency.” Currencies for developing market countries (Latin America, Brazil, Middle East, India, Eurasia and Central-Eastern Europe) that we operate in are reported at actual exchange rates for both actual and constant revenue growth rates because (1) these countries historically have had volatile currency and inflationary environments and (2) our subsidiaries in these countries have historically taken pricing actions to mitigate the impact of inflation and devaluation. Management believes the constant currency measure provides investors an additional perspective on revenue trends. Currency impact can be determined as the difference between actual growth rates and constant currency growth rates. “Free Cash Flow”: To better understand trends in our business, we believe that it is helpful to adjust cash flows from operations to exclude amounts for capital expenditures including internal use software. Management believes this measure gives investors an additional perspective on cash flow from operating activities in excess of amounts required for reinvestment. It provides a measure of our ability to fund acquisitions, dividends and share repurchase. It is also used to measure our yield on market capitalization. A reconciliation of this non-GAAP financial measure and the most directly comparable measure calculated and presented in accordance with GAAP is set forth in the slide entitled “2016 Guidance”. Non-GAAP Financial Measures 32

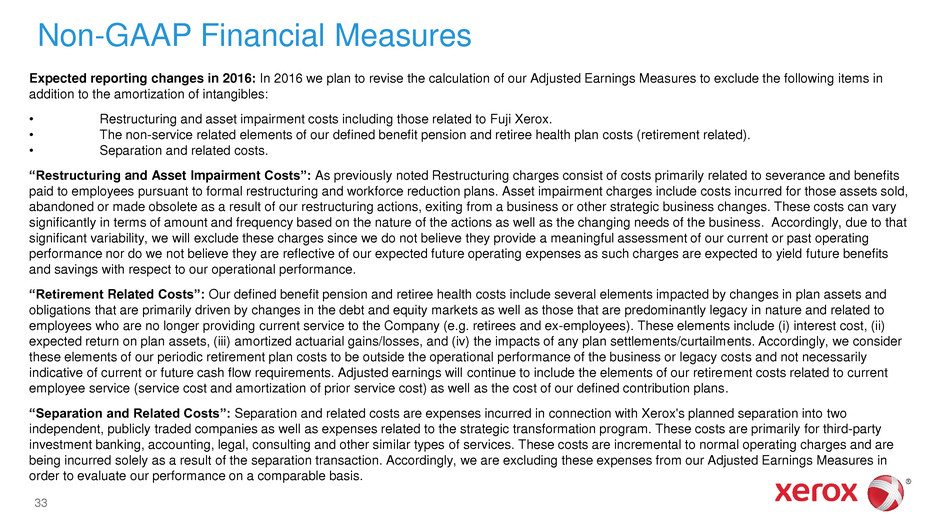

Expected reporting changes in 2016: In 2016 we plan to revise the calculation of our Adjusted Earnings Measures to exclude the following items in addition to the amortization of intangibles: • Restructuring and asset impairment costs including those related to Fuji Xerox. • The non-service related elements of our defined benefit pension and retiree health plan costs (retirement related). • Separation and related costs. “Restructuring and Asset Impairment Costs”: As previously noted Restructuring charges consist of costs primarily related to severance and benefits paid to employees pursuant to formal restructuring and workforce reduction plans. Asset impairment charges include costs incurred for those assets sold, abandoned or made obsolete as a result of our restructuring actions, exiting from a business or other strategic business changes. These costs can vary significantly in terms of amount and frequency based on the nature of the actions as well as the changing needs of the business. Accordingly, due to that significant variability, we will exclude these charges since we do not believe they provide a meaningful assessment of our current or past operating performance nor do we not believe they are reflective of our expected future operating expenses as such charges are expected to yield future benefits and savings with respect to our operational performance. “Retirement Related Costs”: Our defined benefit pension and retiree health costs include several elements impacted by changes in plan assets and obligations that are primarily driven by changes in the debt and equity markets as well as those that are predominantly legacy in nature and related to employees who are no longer providing current service to the Company (e.g. retirees and ex-employees). These elements include (i) interest cost, (ii) expected return on plan assets, (iii) amortized actuarial gains/losses, and (iv) the impacts of any plan settlements/curtailments. Accordingly, we consider these elements of our periodic retirement plan costs to be outside the operational performance of the business or legacy costs and not necessarily indicative of current or future cash flow requirements. Adjusted earnings will continue to include the elements of our retirement costs related to current employee service (service cost and amortization of prior service cost) as well as the cost of our defined contribution plans. “Separation and Related Costs”: Separation and related costs are expenses incurred in connection with Xerox's planned separation into two independent, publicly traded companies as well as expenses related to the strategic transformation program. These costs are primarily for third-party investment banking, accounting, legal, consulting and other similar types of services. These costs are incremental to normal operating charges and are being incurred solely as a result of the separation transaction. Accordingly, we are excluding these expenses from our Adjusted Earnings Measures in order to evaluate our performance on a comparable basis. Non-GAAP Financial Measures 33

“Constant Currency”: We also plan to revise our calculation of the currency impact on revenue growth, or constant currency revenue growth, to include the currency impacts from the developing market countries (Latin America, Brazil, Middle East, India, Eurasia and Central-Eastern Europe), which are currently excluded from the calculation. Over past few years the exchange markets for the currencies of all countries - developed countries and developing market countries - have experienced significant volatility and unpredictability. Additionally, due to the changing nature of the global economy and the increased economic dependencies among all countries, the currency exchange markets in the developing market countries are no longer materially different from those in the developed countries. As a result of these market dynamics and economic changes, we currently manage our exchange risk in our developing market countries in a similar manner to the exchange risk in our developed market countries, and therefore the exclusion of the developing market countries from the calculation of the currency effect is no longer warranted. Applying this revised methodology in 2015 would have increased the constant currency revenue growth rate by about 1% for both the Total Company and the Document Technology segment. The impact of this change was not material for 2014. NOTE: The above noted changes are effective for our 2016 reporting. When these measures are presented in 2016, the prior year measures will be revised accordingly to conform to the changes. Management believes that all of these non-GAAP financial measures provide an additional means of analyzing the current period’s results against the corresponding prior period’s results. However, these non-GAAP financial measures should be viewed in addition to, and not as a substitute for, the Company’s reported results prepared in accordance with GAAP. Our non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP measures and should be read only in conjunction with our consolidated financial statements prepared in accordance with GAAP. Our management regularly uses our supplemental non-GAAP financial measures internally to understand, manage and evaluate our business and make operating decisions. These non-GAAP measures are among the primary factors management uses in planning for and forecasting future periods. Compensation of our executives is based in part on the performance of our business based on these non-GAAP measures. Unless otherwise noted, reconciliations of these non-GAAP financial measures and the most directly comparable measures calculated and presented in accordance with GAAP are set forth on the following slides. Non-GAAP Financial Measures 34

(1) Net income and EPS from continuing operations attributable to Xerox. (2) Average shares for the calculation of adjusted EPS include 27 million of shares associated with the Series A convertible preferred stock. (3) Represents common shares outstanding at December 31, 2015 as well as shares associated with our Series A convertible preferred stock plus dilutive potential common shares as used for the calculation of diluted earnings per share in fourth quarter 2015. 35 Q4 GAAP EPS to Adjusted EPS Track (in millions; except per share amounts) Net Income EPS Net Income EPS Reported(1) $ 285 $ 0.27 $ 349 $ 0.30 Adjustments: Amortization of intangible assets 48 0.05 52 0.05 Deferred tax liability adjustment - - (44) (0.04) Adjusted 333$ $ 0.32 357$ $ 0.31 Weighted average shares for adjusted EPS(2) 1,046 1,171 Fully diluted shares at end of period(3) 1,046 1,159 Three Months Ended Three Months Ended December 31, 2015 December 31, 2014

(1) Net income and EPS from continuing operations attributable to Xerox. (2) Average shares for the calculation of adjusted EPS include 27 million of shares associated with the Series A convertible preferred stock. (3) Represents common shares outstanding at December 31, 2015 as well as shares associated with our Series A convertible preferred stock plus dilutive potential common shares as used for the calculation of diluted earnings per share in fourth quarter 2015. 36 FY GAAP EPS to Adjusted EPS Track (in millions; except per share amounts) Net Income EPS Net Income EPS Reported(1) $ 552 $ 0.49 $ 1,128 $ 0.94 Adjustments: Amortization of intangible assets 193 0.18 196 0.17 Software impairment 90 0.08 - - HE Charge 241 0.23 - - Deferred tax liability adjustment - - (44) (0.04) Adjusted 1,076$ $ 0.98 1,280$ $ 1.07 Weighted average shares for adjusted EPS(2) 1,103 1,199 Fully diluted shares at end of period(3) 1,046 1,159 Year Ended Year Ended December 31, 2015 December 31, 2014

37 GAAP EPS to Adjusted EPS Guidance Track Note: Adjusted EPS guidance excludes amortization of intangible assets, restructuring and asset impairment costs and certain retirement related costs. Separation and related costs are not yet finalized and thus are not included in EPS guidance, but will be excluded from Adjusted EPS in the future. Q1 2016 FY 2016 GAAP EPS from Continuing Operations $0.05 - $0.08 $0.66 - $0.76 Non-GAAP Adjustments $0.16 $0.44 Adjusted EPS $0.21 - $0.24 $1.10 - $1.20 Earnings Per Share

Q4 Adjusted Operating Income/Margin (1) Profit and Revenue from continuing operations 38 (in millions) Profit Revenue Margin Profit Revenue Margin Reported Pre-tax Income (1) 310$ 4,653$ 6.7% 348$ 5,033$ 6.9% Adjustments: Amortization of intangible assets 77 83 Restructuring and asset impairment charges (5) 36 Other expenses, net 46 57 Adjusted Operating Income/Margin 428$ 4,653$ 9.2% 524$ 5,033$ 10.4% Three Months Ended Three Months Ended December 31, 2015 December 31, 2014

FY Adjusted Operating Income/Margin (1) Profit and Revenue from continuing operations 39 (in millions) Profit Revenue Margin Profit Revenue Margin Reported Pre-tax Income (1) 412$ 18,045$ 2.3% 1,206$ 19,540$ 6.2% Adjustments: Amortization of intangible assets 310 315 Restructuring and asset impairment charges 186 128 HE charge 389 116 - Other expenses, net 233 232 Adjusted Operating Income/Margin 1,530$ 18,161$ 8.4% 1,881$ 19,540$ 9.6% December 31, 2015 December 31, 2014 Year Ended Year Ended

Q4 and FY Adjusted Other, Net 40 (in millions) December 31, 2015 December 31, 2014 Other expenses, net - Reported 46$ 57$ Adjustments: Xerox restructuring charge (5) 36 Net income attributable to noncontrolling interests 5 6 Other expenses, net - Adjusted 46$ 99$ (in millions) December 31, 2015 December 31, 2014 Other expenses, net - Reported 233$ 232$ Adjustments: Xerox restructuring charge 186 128 Net income attributable to noncontrolling interests 18 23 Other expenses, net - Adjusted 437$ 383$ Three Months Ended Year Ended

Q4 and FY Adjusted Effective Tax Rate (1) Pre-Tax Income and Income Tax Expense (Benefit) from continuing operations 41 (in millions) Pre-Tax Income Income Tax Expense Effective Tax Rate Pre-Tax Income Income Tax Expense Effective Tax Rate Reported(1) 310$ 52$ 16.8% 348$ 34$ 9.8% Adjustments: Amortization of intangible assets 77 29 83 31 Deferred tax liability adjustment - - - 44 Adjusted 387$ 81$ 20.9% 431$ 109$ 25.3% (in millions) Pre-Tax Income Income Tax (Benefit) Expense Effective Tax Rate Pre-Tax Income Income Tax Expense Effective Tax Rate Report d(1) 412$ (23)$ (5.6%) 1,206$ 215$ 17.8% Adjustments: Amortization of intangible assets 310 117 315 119 Software impairment 146 56 - - HE charge 389 148 - - Deferred tax liability adjustment - - - 44 Adjusted 1,257$ 298$ 23.7% 1,521$ 378$ 24.9% December 31, 2015 December 31, 2014 Three Months Ended Three Months Ended December 31, 2015 December 31, 2014 Year Ended Year Ended

Q4 and FY Services Revenue Breakdown Note: The above table has been revised to reflect the reclassification of the ITO business to Discontinued Operations and excludes intercompany revenue. 42 % CC % 2015 2015 CC (in millions) 2015 2014 Change Change 2015 2014 2013 % Change % Change Busin ss Processing Outsourcing 1,786$ 1,858$ (4%) (2%) 6,872$ 7,218$ 7,161$ (5%) (3%) Document Outsourcing 852 867 (2 ) 3 3,265 3,366 3,318 (3 ) 3 Total Revenue - Services 2,638$ 2,725$ (3%) -% 10,137$ 10,584$ 10,479$ (4%) (1%) As Adjusted: Business Processing Outsourcing 6,988$ 7,218$ 7,161$ (3%) (1%) Total Revenue - Services 10,253$ 10,584$ 10,479$ (3 ) - Three Months Ended December 31, Year Ended December 31,

FY Adjusted Total Revenue/Margin (1) Revenue from continuing operations. 43 (in millions) Total Revenue Annuity Revenue Outsourcing, Maintenance and Rentals Revenue Total Segment Profit Total Segment Margin Reported(1) 18,045$ 15,264$ 12,951$ 1,058$ 5.9% Adjustment: HE Charge 116 116 116 389 Adjusted 18,161$ 15,380$ 13,067$ 1,447$ 8.0% December 31, 2015 Year Ended

FY Adjusted Services Segment (1) Revenue from continuing operations. 44 (in millions) Annuity Revenue BPO Revenue Segment Revenue % of Total Revenue Segment Profit Segment Margin Reported(1) 9,644$ 6,872$ 10,137$ 56% 446$ 4.4% Adjustment: HE Charge 116 116 116 389 Adjusted 9,760$ 6,988$ 10,253$ 56% 835$ 8.1% Year Ended December 31, 2015

FY Adjusted Key Financial Ratios (1) Revenue from continuing operations. 45 (in millions) Gross Margin RD&E as % of Revenue SAG as % of Revenue Reported(1) 29.2% 3.1% 19.7% Adjustment: HE Charge 1.9% - (0.1)% Adjusted 31.1% 3.1% 19.6% December 31, 2015 Year Ended