Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MANITOWOC CO INC | d114434d8k.htm |

| EX-99.1 - EX-99.1 - MANITOWOC CO INC | d114434dex991.htm |

| EX-99.2 - EX-99.2 - MANITOWOC CO INC | d114434dex992.htm |

| EX-99.4 - EX-99.4 - MANITOWOC CO INC | d114434dex994.htm |

Exhibit 99.3

FOODSERVICE BUSINESS

This description includes information regarding the Foodservice Business of The Manitowoc Company, Inc., which will be operated by Manitowoc Foodservice, Inc. following the Spin-Off. Unless otherwise indicated or the context otherwise requires, the information included in this description assumes the completion of the Spin-Off. We can provide no assurance that the Spin-Off will be completed on the timetable currently contemplated or at all. Please refer to “Certain Terms” on page 14 of this exhibit for a glossary of defined terms used in this description.

Our Company

MFS is one of the world’s leading commercial foodservice equipment companies. We design, manufacture and service an integrated portfolio of hot and cold category products and have one of the industry’s broadest portfolios of products. We are recognized by our customers and channel partners for the quality, reliability, and durability of our products, as well as our track record of innovation. Our capabilities span cooking, holding, food-preparation, beverage-dispensing technologies, ice-making, and refrigeration, which allow us to equip entire commercial kitchens and serve the world’s growing demand for food prepared away from home. We supply foodservice equipment to commercial and institutional foodservice operators such as full-service restaurants, quick-service restaurant chains, hotels, caterers, supermarkets, convenience stores, business and industry, hospitals, schools and other institutions. For the twelve-month period ended September 30, 2015, we generated pro forma revenue of $1,553 million and pro forma Adjusted EBITDA of $222 million, representing a 14.3% pro forma Adjusted EBITDA margin. See Exhibit 99.4 to Manitowoc ParentCo’s Current Report on Form 8-K, filed on January 29, 2016, to which this description is also an exhibit.

We sell in more than 100 countries globally, across the Americas, Europe and the Middle East, and Asia. Our products, services and solutions are marketed through a worldwide network of over three thousand dealers and distributors under 23 well-established and recognized brands: Cleveland, Convotherm, Dean, Delfield, Fabristeel, Frymaster, Garland, Inducs, Kolpak, Koolaire, Lincoln, Manitowoc Beverage Systems, Manitowoc Ice, Manitowoc KitchenCare, Merco, Merrychef, Moorwood Vulcan, Multiplex, RDI Systems, Servend, TRUpour, U.S. Range, and Welbilt. All of our products are supported by KitchenCare, our aftermarket repair and parts service business.

Our scale and expertise enable us to serve a global customer base in continually evolving foodservice markets. We differentiate ourselves by uniquely integrating food, equipment, digital technologies, and people to increase efficiency throughout the food preparation cycle, and create winning customer and consumer experiences. Our customers and channel partners trust us and our food-inspiring technologies to serve their diverse needs on a global basis.

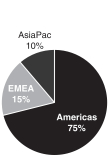

As of September 30, 2015, we had approximately 5,500 employees operating in more than 42 locations in 12 countries. Our global footprint contributes to strong revenue diversity with approximately 75% of 2015 sales through September 30 generated in the Americas, 15% generated in Europe, the Middle East and Africa, and the remaining 10% generated in Asia.

1

Our Products

We offer a wide variety of foodservice equipment solutions, under the following six principal categories:

| % of Reve- nue |

Product Type |

Description | Illustrative Products |

|||||||||||||

| Cold Products | Beverage Dispensers & Related Products |

n | We produce beverage dispensers, blended ice machines, ice/beverage dispensers, beer coolers, post-mix dispensing valves, backroom equipment and support system components and related equipment for use by quick-service restaurant chains, convenience stores, bottling operations, movie theaters, and the soft-drink industry. Our beverage and related products are sold under the Servend, Multiplex, TRUpour, and Manitowoc Beverage Systems brand names. |

|

||||||||||||

| ~50% | Ice Machines, Flakers, & Storage |

n | We design, manufacture and sell ice machines under the Manitowoc and Koolaire brand names. Our ice machines make ice in cube, nugget and flake form. The ice-cube machines are available either as self-contained units, which make and store ice, or as modular units, which make ice, but do not store it. |

|

|

| ||||||||||

| Refrigerator & Freezer Equipment |

n | We design, manufacture and sell commercial upright and undercounter refrigerators and freezers, blast freezers, blast chillers and cook-chill systems under the Delfield brand name. We manufacture modular and fully assembled walk-in refrigerators, coolers and freezers, and prefabricated cooler and freezer panels for use in the construction of refrigerated storage rooms and environmental systems under the Kolpak brand name. We also design and manufacture customized refrigeration systems under the RDI Systems brand name. |

|

|||||||||||||

2

| % of Reve- nue |

Product Type |

Description | Illustrative Products | |||||||||

| Hot Products |

~35% |

Primary Cooking Equipment |

n | We design, manufacture and sell a broad array of ranges, griddles, grills, combi ovens, convection ovens, conveyor ovens, induction cookers, broilers, tilt fry pans/kettles/skillets, braising pans, cheese melters/salamanders, cook stations, table top and countertop cooking/frying systems, fryers, steam jacketed kettles, and steamers. We sell traditional ovens, combi ovens, convection ovens, conveyor ovens, rapid-cooking ovens, range and grill products under the Convotherm, Garland, Lincoln, Merrychef, U.S. Range, and other brand names. Fryers and frying systems are marketed under the Frymaster and Dean brand names, while steam equipment is manufactured and sold under the Cleveland brand. |

| |||||||

| Serving, Warming, & Storage Equipment |

n | We design, manufacture, and sell a range of cafeteria and buffet equipment stations, bins, boxes, warming cabinets, warmers, display and deli cases, and insulated and refrigerated salad and food bars. Our equipment stations, cases, food bars and food serving lines are marketed under the Delfield, Fabristeel, Frymaster, Merco and other brand names. |

| |||||||||

| Services | ~15% | Aftermarket parts and service solutions |

n | We provide parts and aftermarket service as well as a wide variety of solutions under the KitchenCare brand name. Through our KitchenCare service, we manage a comprehensive factory-authorized service network, assuring proper installation, preventative maintenance, spare parts supply and maximum customer uptime on all MFS appliances. |

| |||||||

3

Our End Markets and Customers

We serve an end-customer base representing a wide variety of foodservice providers, including large multinational and regional chain restaurants; convenience stores and retail stores; chain and independent casual and family dining restaurants; independent restaurants and caterers; lodging, resort, leisure and convention facilities; healthcare facilities; schools and universities; large business and industrial customers; and many other foodservice outlets. We serve some of the largest and most widely recognized multinational and regional businesses in the foodservice and hospitality industries. The following table presents a selection of our customers.

Select top MFS customers

The following tables provide information about our top 5 end customers and top 5 dealer customers, including details on revenue contribution and length of relationship.

Top 5 end customers

| Customer |

% of FY 2014 Revenue |

# of Years |

||||||

| End Customer 1 |

10.0 | % | 52 | |||||

| End Customer 2 |

4.9 | % | 25 | |||||

| End Customer 3 |

3.9 | % | 55 | |||||

| End Customer 4 |

2.2 | % | 33 | |||||

| End Customer 5 |

1.3 | % | 48 | |||||

4

Top 5 dealer customers

| Customer |

% of FY 2014 Revenue |

# of Years |

||||||

| Dealer Customer 1 |

5.1 | % | 27 | |||||

| Dealer Customer 2 |

5.1 | % | 6 | |||||

| Dealer Customer 3 |

4.7 | % | 26 | |||||

| Dealer Customer 4 |

3.9 | % | 6 | |||||

| Dealer Customer 5 |

2.9 | % | 55 | |||||

Additionally, we have a strong base of mid-sized customers and continuously focus on expanding it further. According to Euromonitor International, many mid-size chains exhibited growth above 20% in 2014, particularly in the Asia and Latin America regions, reflecting the increasing power of local players and strong demand for chained versions of local favorites. Driven by a clear pattern of investment in locally-owned chains and concepts featuring local cuisine, we believe that growth in this foodservice segment is expected to continue over the long term.

We enjoy longstanding relationships with our customers, including an average of 40-year relationships with our top five end-user customers. These long-standing relationships are predicated on the superior quality product that we have consistently delivered to our customers. We strive to meet our customer needs for product differentiation, productivity, and safety, which in turn drives the need for constant innovation.

We typically do not have long-term contracts with our customers; however, large chains frequently authorize specific foodservice equipment manufacturers as approved vendors for particular products, and thereafter, sales are made locally or regionally to end customers via kitchen equipment suppliers, dealers or distributors. Many large quick-service restaurant chains refurbish or open a large number of outlets, or implement menu changes requiring investment in new equipment, over a short period of time. When this occurs, these customers often choose a small number of manufacturers whose approved products may or must be purchased by restaurant operators. We work closely with our customers to develop the products they need and to become approved vendors for these products.

We sell our products to a diverse range of end-use markets, with restaurants constituting our largest end-use market. Trends in urbanization and globalization have resulted in more food consumed outside the home, resulting in increased restaurant demand for foodservice equipment. Additionally, increases in disposable income, employment, investment in new establishments, and a desire for increased convenience will drive demand for foodservice equipment over the next several years. We expect that we will benefit from these trends, as foodservice providers will need modern and efficient equipment to fulfill their needs in the kitchen and successfully compete against other industry participants.

We sell our products through a worldwide network of over 3,000 dealers and distributors in over 100 countries. We believe our network is differentiated from competitors in that we serve as a single source for a broad portfolio of leading brands and product categories. This allows us to provide one face to our customers for multiple brands with relevant culinary and ingredients expertise and appropriate key account management for our larger global chain customers. We support our sales efforts with a variety of marketing efforts including trade-specific advertising, cooperative distributor merchandising, digital marketing, and marketing at a variety of industry trade shows.

5

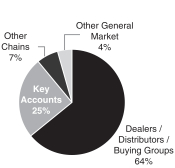

The charts below provide our sales breakdown across diverse geographies, end markets, sales channels and top customers.

| Year-to-Date Q3 2015 Geographic Exposure (1) |

2015 Estimated End Markets (2) |

Year-to-Date Q3

2015 | ||

|

|

|

| ||

| (1) | Reflects year-to-date net sales by destination for the nine months ended September 30, 2015. |

| (2) | Source: National Restaurant Association. Pie chart details 2015 estimated U.S. foodservice industry sales by end market. |

| (3) | Reflects year-to-date gross sales for the nine months ended September 30, 2015. Includes all third party product sales. |

Our Industry

We operate in the foodservice equipment industry, which is part of the greater foodservice industry. Global foodservice sales, which account for the value of all food prepared away from home, is the most important driver of our industry. The global foodservice industry was estimated at approximately $2.7 trillion in 2014 according to Euromonitor International, and is expected to grow by approximately $800 billion during the 2014 – 2018 period. According to Euromonitor International, the U.S. foodservice market accounted for approximately 19%, or $506 billion, of the total global foodservice market in 2014. With foodservice equipment sales estimated to represent approximately 1% of total foodservice sales, or $27 billion, there is significant potential for growth in demand for equipment over the next several years.

Primary end markets for foodservice equipment include restaurants, travel and leisure, retail, education, business and industry, and healthcare. Demand in the restaurant segment, our largest end market within the U.S. foodservice industry, is driven by consumer disposable income, employment, investment in new establishments, and the underlying trend for increased convenience. We believe that these trends will continue to support further industry growth over the next several years.

According to Technomic, a foodservice consulting/research firm based in Chicago, 2015 U.S. foodservice sales came in stronger than expected with real growth of 2.3%, the highest rate since 2007. Furthermore, the National Restaurant Association’s Restaurant Performance Index has shown positive growth every month since the last time it went barely negative in February 2013, resulting in 35 consecutive months of growth. Technomic expects this growth to continue in the near-term, with an industry-wide sales growth forecast for 2016 of 4.9% on a nominal basis, or 2.5% real sales growth. Technomic also expects long term industry growth, with a nominal compound annual growth rate (“CAGR”) of approximately 2% during the 2015-2020 period, with some foodservice industry sectors, such as healthcare or fast casual dining, expected to grow at a nominal CAGR of 4-6% during the same time period. Additionally, as a more health conscious public is forsaking convenience foods for

6

fresh, natural alternatives and is focusing on how its food is made, sourced, handled, and prepared, demand for foodservice equipment is expected to rise as foodservice providers adapt to evolving tastes and demands.

On a global level, the demand for affordable dining is expected to continue to increase. Consumers in every market are expected to continue gravitating towards more informal options, a trend seen among both high income consumers looking to save during a slow economic recovery, and lower income consumers new to foodservice looking for accessible entry points. For foodservice equipment operators in emerging markets, this offers enormous room for innovation, particularly in terms of format, as consumers new to eating out look to experiment with a variety of brands and experiences.

Within the restaurant industry, growing trends towards enhancing food safety and waste reduction are expected to drive demand for foodservice equipment. According to the World Health Organization, as populations worldwide become increasingly urbanized and globalized, people are more often eating outside of the home and the global food chain is becoming increasingly complex. Food providers have an ever greater responsibility to ensure food safety for consumers. High quality foodservice equipment can help these providers meet this challenge. Additionally, restaurants are striving to reduce waste and promote sustainability. According to the Food and Agriculture Organization of the United Nations (“FAO”), approximately one third of all food produced globally gets either lost or wasted each year. Modern and efficient foodservice equipment can promote energy efficiency in the kitchen, prevent premature spoilage, and reduce waste.

Overall, we believe that continued growth in demand for foodservice equipment will result from the development of new-restaurant concepts in the U.S., the expansion of U.S. and foreign chains into international markets, the replacement and upgrade of existing equipment and new equipment requirements resulting from menu changes. We expect to benefit from these trends, and grow market penetration alongside our customers as they expand into new service categories and geographies. We believe we are well-positioned to take advantage of worldwide growth opportunities with global and regional new product introductions, improvement in operational excellence, and other strategic initiatives.

We compete with many larger competitors, including Ali Group S.p.A., Dover Corp., Hoshizaki Electric Co., Illinois Tool Works, Inc., Middleby Corp., Rational AG and Standex International Corp. We maintain our competitive leadership through our innovative designs, quality of products, aftermarket support services, product performance and low maintenance costs. These attributes support our leading positions in many of our key product categories.

7

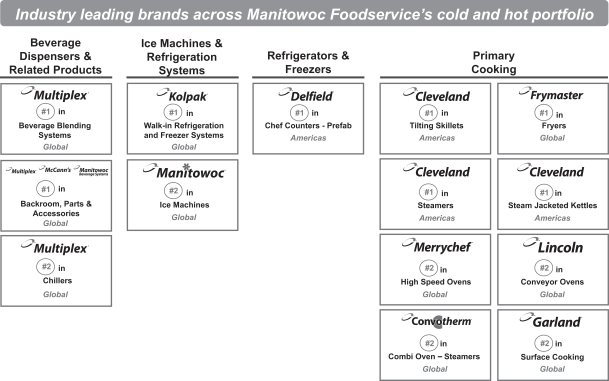

The table below shows a select list of our leading brands within the foodservice industry.

Source: Company estimates based on aggregation of both internally and externally sourced data points as well as comparisons of product features and capabilities versus the competition. Third party market share data is not available for all regions and brands such that there is not one reliable, global source of information for the Company’s products, except for certain categories of ice machines and ice storage bins.

Our Competitive Strengths

Our competitive strengths derive from combining deep industry expertise and an understanding of our markets, our history of investment in research and development, successful product innovation and long-standing customer relationships.

Comprehensive Portfolio of Hot and Cold Professional Kitchen Equipment

We offer a full suite of integrated hot and cold kitchen equipment products and services, which provides us with significant cross-selling opportunities and allows us to keep ahead of evolving industry trends. We also provide aftermarket service through our KitchenCare offering, which allows us to support our customers throughout their product lifecycles. Our broad suite of products and services enables us to design, outfit and service commercial kitchens in a harmonized, efficient way and maintain a disciplined focus on targeting our fast-growing customer base with the right products for each need, at the right price.

8

12 Market Leading Brands Holding #1 or #2 Positions

We sell our products under 23 long-standing and well-recognized brands, many of which command leading market positions among their respective peers. These established brands resonate with customers for their superior quality and reliability, resulting in long-time customers who are continually looking for new solutions from their preferred brand names. In particular, our Manitowoc cube ice machines, Frymaster fryers and Cleveland steamers, kettles and skillets have the #1 position in the markets they serve and have 50+ year legacies of strong brand recognition and customer satisfaction.

Diversified Exposure through Extensive Geographic and Customer Channel Networks as well as End Markets

We manufacture in 20 locations across 9 countries, providing us with the scale to serve the largest global customers and the local market expertise to leverage international growth. Approximately 31% of sales were generated internationally during the nine-month period ended September 30, 2015, and we grew sales outside of the Americas by 5% from 2012 to 2014. We work closely with channel partners to identify emerging global opportunities, particularly in high growth markets including Asia Pacific (“APAC”), Latin America, and Middle East and Africa (“MEA”). Our footprint enables us to build our products close to intended end markets, and apply our developed markets expertise in emerging markets. Our worldwide network of over 3,000 dealers and distributors allows us to serve our customer base globally and grow alongside them as they enter new markets.

We are also exposed to a variety of end markets. Restaurants currently constitute our largest end market, where we serve many top multinational chains as well as mid-sized chains. Beyond the restaurant industry, we sell our foodservice equipment in end markets such as travel and leisure and education. This diversified exposure limits the risk to any one end market.

Long-Standing Customer Relationships

Customers recognize our product offerings for their reliability, superior quality, and innovative nature. Through new product introductions, product upgrades, and our KitchenCare aftermarket service, we are able to support our customers’ foodservice equipment needs throughout the product lifecycle. Our customers represent many of the foodservice industry’s leading players and are continuously looking for ways to differentiate themselves from their competitors. In order to win new customers and help expand their market share, we help these foodservice providers to create customized solutions for their unique kitchen needs. As a result, we have cultivated decades-long relationships with our customers as they repeatedly look to Manitowoc branded products for the most innovative and valuable solutions.

Steady Revenue Base from Replacement Demand and KitchenCare

A substantial portion of foodservice equipment revenue industry-wide is generated by replacement demand. According to Foodservice Equipment & Supplies, approximately 62% of equipment purchases to be made by U.S. commercial businesses in 2016 will be to replace existing equipment, approximately 20% will be for renovations, and approximately 11% will be related to eco-friendly demand, while only 7% will be driven by new construction. High replacement demand mitigates the volatility inherent in new construction, and typical product lifecycles provide visibility into future product demand. Additionally, our end-customers often need equipment upgrades to enable them to improve productivity and food safety, reduce labor costs, respond to enhanced hygiene, environmental and menu requirements or reduce energy consumption.

9

Our aftermarket service offering, KitchenCare, provides support services to our entire product spectrum, allowing us to support and service customers throughout the product lifecycle. KitchenCare provides us with a steady stream of revenue given our large installed base of foodservice products and predictable maintenance cycles.

Recognized as an Innovation Leader

In addition to our broad base of established products, we have a strong track record of working with customers to provide innovative, unique kitchen solutions that will help them stay competitive. These solutions often require customized cooking, cooling and freezing equipment. Over the past decade, we have developed a number of products that improve the kitchens of our customers, such as the Multiplex Blend-In-Cup Beverage Machine, which makes blended beverages easier to prepare and reduces pitcher waste, and the Frymaster Oil Conserving Fryer, which uses 40% less oil and produces twice as much food as frypots double its size.

To develop and test the new products that we deliver, we have established Education and Technology Centers in both the U.S. (Florida) and China (Hangzhou). These centers are used for menu ideation, food development and sensory testing, as well as a means to train our customers and marketing representatives in new products.

Our innovative capabilities have been recognized by outside parties over the years. Since 2005, the National Restaurant Association has awarded the Company with twenty nine Kitchen Innovation Awards across the Company’s different brands. In 2014, Foodservice Equipment & Supplies magazine awarded both the Frymaster and Manitowoc Ice brands, for the fifteenth consecutive year, with the Best-In-Class award. Many of these products are also energy efficient; Energy Star named us an Energy Star Partner for the sixth consecutive year in 2015.

We believe that product development is important to our success given that a supplier’s ability to provide customized or innovative foodservice equipment is a primary factor for customers making their purchasing decisions. We are focused on delivering high performance, efficient kitchens with innovative features that meet specific culinary needs and enhance our customers’ ability to compete in the marketplace.

Focus on Right-Sizing and Simplifying the Business

We have identified various opportunities across our business where can improve efficiencies and drive margin expansion through right-sizing our operations and business simplification. To improve our footprint, we are planning to close plants that are no longer beneficial to operate, including the Cleveland and Irwindale facilities. Additionally, we have implemented a reduction in force initiative to fit headcount to our new scale. To reach our business simplification targets, we have implemented product rationalizations, product line simplifications, and KitchenCare operating improvements. We estimate that the impact of these initiatives to our operating income will be approximately $100 million in the aggregate over the next three years, although there is no guarantee that these savings will be achieved.

As a standalone foodservice company, we will be focused on implementing our right-sizing and simplification initiatives with a view to bringing our profitability more in line with our peers.

10

Exposure to Positive Demographic and Other Mega-Trends

Multiple overlapping demographic and mega-trends support the increasing demand for foodservice equipment. Steady increases in the size of the global population in general and the middle class in particular, coupled with increased international travel and continued growth in per capita income, are leading to increased dining outside the home and associated demand for professional foodservice equipment.

Within the restaurant industry, growing trends in food safety and waste reduction are expected to drive demand for foodservice equipment. According to the World Health Organization, as populations worldwide become increasingly urbanized and globalized, people are more often eating outside of the home and the global food chain is becoming increasingly complex. Amid these challenges, high quality foodservice equipment will help foodservice providers prepare food in a safe and sanitary environment. Additionally, restaurants are striving to reduce waste and promote sustainability. According to the FAO, approximately one third of all food produced globally gets either lost or wasted each year. Modern and efficient foodservice equipment can promote energy efficiency in the kitchen, prevent premature spoilage, and reduce waste.

Highly Experienced Management Team

Our senior management team has an average of approximately 20 years of experience in the food, beverage, agriculture and foodservice equipment industries, and many of them have exceptional product- and market-specific knowledge and expertise. Our team consists of members with extensive work experience and achievement at The Manitowoc Company, Inc., as well as members who have recently joined MFS with significant industry experience. This diverse mix provides us with deep company and industry knowledge, as well as a fresh perspective which will position us for success as a standalone foodservice company.

Our Business Strategy

Our primary objective is to provide high quality and reliable foodservice equipment products and solutions to our customers and to grow our revenues, profitability and cash flow. The key elements of our strategy are:

Drive Increased Profitability

We believe we can significantly improve the profitability of our business and are implementing several cost saving initiatives and operating strategies to drive increased margins. We are committed to improving our margins by focusing on fewer, higher-margin products and markets, value-based pricing, and effective sourcing, as well as by driving operational excellence in our existing plants. Actions that we have already taken include plant rationalizations (including the pending closures of our Cleveland and Irwindale facilities), KitchenCare operating improvements, headcount reductions, and product line simplifications. Through these as well as other operational initiatives and as mentioned above under “—Our Competitive Strengths—Focus on right-sizing and simplifying the business,” we expect savings of approximately $100 million in the aggregate over the next three years, although there is no guarantee that these savings will be achieved.

11

Grow Customer Base and Deepen Customer Penetration

We believe our broad product portfolio and leading brands position us to achieve profitable growth above the average industry rate by further growing the number of customers we serve and improving customer overall satisfaction. We continue to be a trusted provider to the largest companies in the foodservice industry and plan to further expand our reach to select, high potential mid-sized companies where we can offer strong customer satisfaction. We are working closely with our channel partners to identify emerging high value customers and provide them with our high-quality products and support services.

Drive International Expansion

Our global footprint positions us to capitalize on growth in developed and emerging markets. Approximately 31% of sales were generated internationally during the nine-month period ended September 30, 2015, and we grew our international sales by 5% from 2012 to 2014. We will work closely with channel partners to identify emerging global opportunities, particularly in high growth markets including markets including APAC, Latin America, and MEA.

We continue to invest in the APAC region, which is expected to remain the largest driver of aggregate global foodservice sales growth over the next few years. We currently have four manufacturing facilities in Asia and a technology center in China, demonstrating our commitment to building lasting relationships with a broad base of Asian foodservice providers. We also have three test kitchens across the region, and partner closely with Asian chefs and distributors to produce foodservice equipment specifically tailored to meet the unique demands of local customers.

In Latin America, MFS enjoys longstanding business relationships with end customers in the fast growing segments of the foodservice industry such as convenience stores, local chains, global chains, and retail and institutional. We also have well-established sales and aftermarket support networks in over 30 countries and territories, which are supported by a strong team of employees in the sales, technical support and culinary areas. MFS owns manufacturing facilities in Tijuana, Mexico and Monterrey, Mexico, a distribution hub in Mexico City, as well as a sales and service training center in Monterrey, Mexico.

Our engagement in MEA continues to grow as we invest in the expansion of our sales team to serve our customers in this region. We are working diligently on realigning and reinforcing our distribution channels in MEA. Our demonstration kitchen in Jebel Ali Free Zone in Dubai, United Arab Emirates is just one example of our commitment to and engagement with this region.

Selectively Pursue Strategic Acquisitions and Partnerships

Our industry is fragmented and we believe there is significant opportunity for continued consolidation through acquisitions and partnerships. We have a long track record of acquisitions and believe that we are well positioned to expand our product offerings, geographic footprint and customer base through acquisitions and related strategic alliance activities. Although our initial debt load will preclude significant acquisitions within the short term, consistent with our strategy we will actively evaluate potential acquisition opportunities for MFS on an ongoing basis. We seek to manage liabilities, integration and other risks associated with acquisitions through due diligence, favorable acquisition contracts, and careful planning and integration of the acquired businesses.

12

Expand the Frontier of Foodservice Innovation

To remain a leader in our industry and continue to grow our reputation as one of the most innovative companies in our industry, we continuously leverage our suppliers to source innovation and refresh existing products with new, locally-relevant, food-inspiring technologies, while simultaneously finding new ways to integrate these products and create cohesive kitchen systems. Our innovation, co-creation and customization capabilities uniquely position us to develop solutions that are truly adapted to different ways of cooking and preparing food, whether for new menus or new geographies.

Continue to Attract and Foster Industry-Leading Talent

Our people are key to our success. As of September 30, 2015, we had approximately 5,500 employees. Our employees embody and personify our iconic brands and strive to understand and best serve our customers. We continue to recruit talented professionals and strive to make our company a great place to have a long-term career.

13

In this description, unless otherwise indicated or the context otherwise requires:

| • | The “Company,” “MFS,” “we,” “our” and “us” refer to Manitowoc Foodservice, Inc. and its consolidated subsidiaries, after giving effect to the Internal Reorganization (as defined herein). |

| • | “Crane Business” means the businesses or operations of Manitowoc ParentCo other than the Foodservice Business (as defined herein). |

| • | The “Distribution” refers to the distribution of Manitowoc Foodservice common stock on a pro rata basis to the holders of Manitowoc ParentCo common stock. |

| • | “Foodservice Business” means (1) the businesses and operations conducted by the Foodservice segment of Manitowoc ParentCo and its affiliates (including, for purposes of this definition, Manitowoc Foodservice and its affiliates) prior to the consummation of the Spin-Off, and (2) except as otherwise expressly provided in the Separation and Distribution Agreement (as defined herein), any terminated, divested or discontinued businesses or operations that at the time of such termination, divestiture or discontinuation related to the Foodservice Business (as described in the foregoing clause (1)) as then conducted. |

| • | The “Internal Reorganization” refers to the series of internal transactions pursuant to which Manitowoc ParentCo will separate the assets and liabilities of the Crane Business and the Foodservice Business, to the extent such separation has not already occurred. |

| • | “Manitowoc Foodservice” refers to Manitowoc Foodservice, Inc. and not to any of its subsidiaries or affiliates. |

| • | “Manitowoc ParentCo” refers to The Manitowoc Company, Inc. and its consolidated subsidiaries, other than, for all periods following the consummation of the Spin-Off, Manitowoc Foodservice and its subsidiaries. |

| • | The “Spin-Off” refers collectively to (a) the Internal Reorganization, (b) the Company’s contribution of the Foodservice Business to Manitowoc Foodservice and (c) the Distribution. |

14