Attached files

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________________________________________________________________________________

FORM 10-K

þ ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2015

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

________________________________________________________________________________________________________________________

Commission File Number 1-13884

CAMERON INTERNATIONAL CORPORATION

(Exact name of Registrant as specified in its charter)

Delaware | 76-0451843 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

1333 West Loop South | ||

Suite 1700 | ||

Houston, Texas | 77027 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code (713) 513-3300

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock, Par Value $0.01 Per Share | New York Stock Exchange | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer þ | Accelerated filer o |

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

The aggregate market value of the Common Stock, par value $0.01 per share, held by non-affiliates of the registrant as of June 30, 2015, our most recently completed second fiscal quarter, was approximately $8,048,562,581. For purposes of the determination of the above statement amount only, all the directors and executive officers of the registrant are presumed to be affiliates. The number of shares of Common Stock, par value $.01 per share, outstanding as of January 15, 2016 was 191,599,032.

________________________________________________________________________________________________________________________

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s 2016 Proxy Statement for the Annual Meeting of Stockholders are incorporated by reference into Part III.

TABLE OF CONTENTS

ITEM | PAGE | |

PART I | ||

1. | ||

1A. | ||

1B. | ||

2. | ||

3. | ||

4. | ||

PART II | ||

5. | ||

6. | ||

7. | ||

7A. | ||

8. | ||

9. | ||

9A. | ||

9B. | ||

PART III | ||

10. | ||

11. | ||

12. | ||

13. | ||

14. | ||

PART IV | ||

15. | ||

2

PART I

GLOSSARY OF TERMS

Actuator. A hydraulic or electric motor used to open or close valves.

Blowout Preventer or BOP. A hydraulically operated system of safety valves installed at the wellhead during drilling and completion operations for the purpose of preventing an increase of high-pressure formation fluids — oil, gas or water — in the wellbore from turning into a “blowout” of the well.

BOP stack. A set of two or more BOPs used to ensure pressure control of a well. A typical stack configuration has the ram BOPs on the bottom and the annular BOPs at the top. Ram BOPs consist of two halves of a cover known as ram blocks that are forced together by hydraulic cylinders to seal the wellbore, in some cases by shearing through the drillpipe. Annular BOPs contain a sealing element which resembles a large rubber doughnut that is mechanically squeezed inward to seal on either the drillpipe, casing or the open hole.

Casing. Large-diameter pipe lowered into an open hole and cemented in place.

Choke. A type of valve used to control the rate and pressure of the flow of production from a well or through flowlines.

Christmas tree. An assembly of valves, pipes and fittings used to control the flow of oil and gas from a well.

Controls. A device which allows the remote triggering of an actuator to open or close a valve.

Drawworks. The machine on the rig consisting of a large-diameter steel spool, brakes, a power source and assorted auxiliary devices. The primary function of the drawworks is to reel out and reel in the drilling line, a large diameter wire rope, in a controlled fashion.

Drilling stack. A vertical arrangement of blowout prevention equipment installed at the top of the casing at a wellhead to provide maximum pressure integrity in the event of a well control incident for drilling and completion operations.

Elastomer. A rubberized pressure control sealing element used in drilling and wellhead applications.

Manifold. An arrangement of piping or valves designed to control, distribute and often monitor fluid flow.

Reservoir. A subsurface body of rock having sufficient porosity and permeability to store and transmit fluids.

Riser. Pipe used to connect the wellbore of offshore wells to drilling or production equipment on the surface, and through which drilling fluids or hydrocarbons travel.

Semisubmersible. A particular type of floating vessel that is supported primarily on large pontoon-like structures submerged below the sea surface.

Subsea tree. An assembly of valves, actuators and ancillary equipment connected to the top of the casing of a well located on the sea floor to direct and control the flow of oil and gas from the well.

Topdrive. A device that turns the drillstring.

Valve. A device used to control the rate of flow in a line, to open or shut off a line completely, or to serve as an automatic or semi-automatic safety device.

Wellhead. The equipment installed at the surface of a wellbore to maintain control of a well and including equipment such as the casing head, tubing head and Christmas tree.

3

ITEM 1. BUSINESS

Cameron International Corporation (Cameron or the Company) provides flow equipment products, systems and services to worldwide oil and gas industries through four reporting segments – Subsea, Surface, Drilling and Valves & Measurement (V&M). For additional business segment information for each of the three years in the period ended December 31, 2015, see Note 16 of the Notes to Consolidated Financial Statements, which Notes are included in Part II, Item 8 of this Annual Report on Form 10-K.

In 1920, Jim Abercrombie, Ed Lorehn, Harry Cameron and several other partners incorporated an oilfield repair shop in Houston, Texas under the name Cameron Iron Works (CIW). Abercrombie subsequently invented and CIW manufactured the industry’s first blowout preventer for use in oil and gas well drilling. CIW grew rapidly due to sales of blowout preventers and other oilfield equipment. In the early 1940’s, CIW entered the market for defense-related equipment becoming a major supplier of anti-submarine and other naval armaments to the U.S. Navy. CIW also became a leading supplier of forged metal products for both defense and oilfield applications replacing less durable cast metal components of the day. CIW subsequently expanded into various other flow control, valve and pressure control equipment businesses acquiring Joy Petroleum Equipment and McEvoy-Willis wellhead equipment prior to its acquisition by Cooper Industries, Inc. in 1989.

Cameron was incorporated in its current form as a Delaware corporation on November 10, 1994, when Cooper Industries transferred all of the assets and liabilities of its Petroleum and Industrial Equipment segment into this new entity. Following this, the Company operated as a wholly-owned subsidiary of Cooper Industries from 1994 until June 30, 1995, when it was spun-off as a separate stand-alone company and renamed Cooper Cameron Corporation. The Company subsequently changed its name to Cameron International Corporation in May 2006. Since becoming a stand-alone company, Cameron has made numerous acquisitions, including the 1996 acquisition of Ingram Cactus Company, the 1998 acquisition of Orbit Valve International, Inc., 2004’s acquisition of Petreco International, Inc., the purchase of substantially all of the businesses within the Flow Control segment of Dresser, Inc. in 2005, the acquisition of NATCO Group Inc. (NATCO) in 2009 and the acquisition of the TTS Energy Division from TTS Group, ASA in 2012. In 2013, Cameron and Schlumberger Limited joined together to form OneSubsea, a venture established to manufacture and develop products, systems and services for the subsea oil and gas market. Cameron is a 60% owner and manager of OneSubsea. Cameron has also sold various operations during the time it has been a stand-alone company, including its Reciprocating Compression business in June 2014 and its Centrifugal Compression business, which closed effective January 1, 2015.

On August 26, 2015, Cameron and Schlumberger Limited ("Schlumberger") announced that the companies had entered into an Agreement and Plan of Merger (the “Merger Agreement”) whereby a U.S. subsidiary of Schlumberger would acquire all of the issued and outstanding stock of Cameron. Under the terms of the agreement, Cameron shareholders will receive 0.716 shares of Schlumberger common stock and a cash payment of $14.44 in exchange for each Cameron common share. The Merger Agreement was unanimously approved by the board of directors of both companies and has been approved by Cameron's stockholders. The Merger will be consummated upon receipt of required regulatory consents and approvals, expected to occur during the first quarter of 2016. Schlumberger stockholders are not required to vote on the Merger Agreement. Should Cameron terminate the Merger Agreement in specified circumstances, the Company would be required to pay Schlumberger a termination fee equal to $321 million.

In advance of the anticipated closing of the merger with Schlumberger, the Company has continued to operate as a separate publicly traded company bound by all of the obligations, practices and requirements associated therewith. Specifically, the common stock of Cameron has continued to trade on the New York Stock Exchange under the symbol “CAM”. The Company’s Internet address is www.c-a-m.com. General information about Cameron, including its Corporate Governance Principles, charters for the committees of the Company’s board of directors, Code of Conduct, and Codes of Ethics for Management Personnel, including Senior Financial Officers, and Directors, has been maintained in the Governance and Compliance sections of the Company’s website. The Company has made available on its website its annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities and Exchange Act of 1934, as amended (the Exchange Act) as soon as reasonably practicable after the Company electronically files or furnishes them to the United States Securities and Exchange Commission (the SEC). Information filed by the Company with the SEC is also available at www.sec.gov or may be read and copied at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. Information regarding operations of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330.

Any reference to Cameron, its segments or other businesses within this Form 10-K as being a leader, leading provider, leading manufacturer, or having a leading position is based on the amount of equipment installed worldwide and available industry data.

4

Markets and Products

Subsea Segment

The Subsea segment delivers integrated solutions, technologies, products, systems and services to the subsea oil and gas market, including petrotechnical services, flow assurance consulting, subsea production systems wellheads, subsea trees, manifolds and flowline connectors, subsea processing systems for the enhanced recovery of hydrocarbons, swivel and marine systems, metering systems, control systems, connectors and subsea services designed to maximize reservoir recovery and extend the life of each field. The Subsea segment includes the operations of OneSubsea, a business jointly owned by Cameron (60%) and Schlumberger (40%). Products and services are marketed under the Cameron®, OneSubsea®, FasTrac™, HyFleX, FRIEND™, and MARS™ brand names, among others, through a worldwide network of sales and marketing employees, supported by agents in some international locations. The Company’s custom process systems products are marketed under the Cameron®, Consept™, Cynara®, Hydromation®, KCC™, Metrol™, Mozley®, NATCO®, Petreco®, Porta-test®, Unicel™, and Vortoil® brand names, among others. Due to the technical nature of many of the products offered and the complexity of the subsea field layouts and designs, the marketing effort is further supported by a staff of engineering employees.

On January 6, 2015, the Company announced the execution of definitive agreements between OneSubsea, Helix Energy Solutions Group, Inc. and Schlumberger for a non-incorporated alliance formed to develop technologies and to deliver equipment and services designed to provide customers with more cost effective and more efficient subsea well intervention solutions, particularly for deep and ultra-deepwater basins and high well pressure environments.

Surface Segment

Cameron’s Surface segment designs and manufactures complete wellhead and Christmas tree systems for onshore and offshore topside applications – from conventional to high-pressure, high temperature systems, to specialized systems for dry completions and heavy oil. The Surface segment, with its extensive global installed base of equipment, is the industry’s largest provider of surface completion and production equipment and has a large services footprint in each of its served markets. A complete portfolio of API 6A valves, chokes and actuators is marketed primarily to oil and gas operators under the Cameron®, Camrod™, IC™, McEvoy®, Tundra™, Willis® and WKM® brand names, among others.

One of the major services provided by the Surface segment is CAMSHALE™ production solutions, which specializes in shale oil and natural gas production. CAMSHALE products and services offered in multi-stage fracturing operations include time savings wellhead systems, reliable frac trees and manifolds, an innovative frac fluid delivery system called Monoline™, equipment for flowback and well testing, and production.

New technology developments and increased market penetration, along with robust customer spending in recent years for exploration and production, particularly within unconventional resource regions of North America, contributed to an increase in demand for the Company’s equipment and services during 2013 and 2014.

Drilling Segment

The Drilling segment of Cameron is one of the leading global suppliers of integrated drilling systems for onshore and offshore applications to shipyards, drilling contractors, exploration and production companies and rental tool companies. Drilling equipment that is designed and manufactured includes ram and annular BOPs, control systems, drilling risers, drilling valves, choke and kill manifolds, diverter systems, top drives, drawworks, mud pumps, pipe handling equipment, other rig products and parts and services. The products are marketed by a staff of sales and marketing employees and agents supported by an engineering group under the Cameron®, EVO®, H&H CUSTOM™, H&H Melco™, LeTourneau®, Sense™ and Townsend™ brand names, among others.

The Drilling segment significantly enhanced its product offerings to its customers with the mid-2012 acquisition of TTS Energy Division from TTS Group ASA, a Norwegian company (TTS). TTS provides high performance drilling equipment in the form of drilling equipment packages or capital equipment sales for both onshore and offshore rigs internationally.

Cameron’s Drilling segment continues to be a primary supplier of BOPs and related equipment to the drilling industry. The level of major project awards for new drilling equipment is often influenced by construction cycles for new build deepwater drillships and semi-submersibles, as well as shallow water jack-up rigs. In recent years, the level of such awards was strong during the 2006 – 2008 and 2011 – 2013 time periods. Currently, there is virtually no market for new jackup or deepwater drillships and semi-submersibles due to a significant oversupply of such rigs.

5

Valves & Measurement Segment

The V&M segment provides valves and measurement systems primarily used to control, direct and measure the flow of oil and gas as they are moved from individual wellheads through flow lines, gathering lines and transmission systems to refineries, petrochemical plants and industrial centers for processing. Equipment used in these environments is generally required to meet demanding standards set by the American Petroleum Institute and the American Society of Mechanical Engineers.

Products include gate valves, ball valves, butterfly valves, Orbit® rising stem ball valves, double block & bleed valves, plug valves, globe valves, check valves, actuators, chokes and parts and services, as well as measurement products such as totalizers, turbine meters, flow computers, chart recorders, ultrasonic flow meters and sampling systems.

This equipment and the related services are marketed through a worldwide network of combined sales and marketing employees, as well as distributors and agents in selected international locations. Due to the technical nature of many of the products, the marketing effort is further supported by a staff of engineering employees. Customers include oil and gas majors, independent producers, engineering and construction companies, pipeline operators, drilling contractors and major chemical, petrochemical and refining companies.

The product lines included in this segment are as follows:

Valves & Automation

Valves and Automation products are sold into the exploration, production, subsea, transmission and storage and liquefied natural gas (LNG) markets, primarily in North America and to upstream markets in Asia-Pacific, Africa and the Middle East. In order to expand the Company’s downstream industrial valve offerings, Douglas Chero, a forged gate, globe and check valve manufacturer located in Italy, was acquired during 2013.

Valves and Automation products are marketed under the brand names AOP™, Demco®, Douglas Chero™, Dynatorque™, Maxtorque™, Navco®, Newco®, Nutron®, OIC®, Techno™, Texstream™, Thornhill Craver®, Wheatley®, WKM®, Cameron®, Entech™, Grove®, Ledeen™, Ring-O®, TK®, General Valve®, Orbit® and TBV™, among others.

Measurement Systems -

The V&M segment also designs, manufactures and distributes measurement products, systems and solutions to the global oil and gas, process and power industries. Brand names for these products include Barton®, Caldon®, Clif Mock™, Jiskoot™, Linco™ and Nuflo™.

Services -

In addition to the above, V&M provides preventative maintenance, OEM spare parts, repair, field service, asset management and remanufactured products for valves and actuators through service centers situated in strategic locations around the world.

Market Issues

The success of hydraulic fracturing activities in recent years has led to increased supplies of oil and natural gas in North America. This, combined with various other factors such as, (i) strong production levels from the Organization of Petroleum Exporting Countries (OPEC) and certain other resource-rich countries, (ii) weakness in world demand for petroleum due to slowing economic growth in certain regions, and (iii) the strong U.S. dollar, in which a significant portion of world trade in petroleum products occurs, has contributed to a dramatic decline in commodity prices which began during the latter half of 2014, and has continued through early 2016. The Company cannot predict the timing of improvement in market conditions.

The weakness in commodity prices had an unfavorable impact on demand across all of our major product and service offerings, with resulting significant declines in the Company's orders, revenues, earnings, and backlog. Based on the Company’s long history in the energy sector, we believe such declines in commodity prices and demand are cyclical in nature. During such cyclical downturns, we take steps to adjust our commercial, manufacturing and support operations as appropriate to ensure that the Company remains competitive and financially sound.

During 2015, and despite adverse market conditions, Cameron continued to maintain a leadership position in the global market for the supply of oilfield equipment and service due in part to it broad array of technologically-advanced pressure-control products and its international network of plant and service center facilities that provide broad market coverage of the world’s major oil and gas producing regions. Cameron believes that it is well-positioned to serve these markets, even during downturns. Plant and service center facilities around the world in major oil and gas producing regions provide broad market coverage. Information relating to revenues generated from shipments to various geographic regions of the world is set forth on page 23

6

of “Management’s Discussion and Analysis of Financial Condition and Results of Operations of Cameron International Corporation” included in Part II, Item 7 of this Annual Report on Form 10-K and incorporated herein by reference. The markets beyond North America were important to Cameron in 2015, accounting for nearly 62% of the Company's revenues, down from 64% in 2014 and up from 61% in 2013.

The Company provides its products and services for both onshore and offshore applications. In 2015, approximately 49% of the Company's revenue was derived from the offshore market, as compared to 62% in 2014.

Also, see Part I, Item 1A for a discussion of other risk factors, some of which are market related, that could affect the Company’s financial condition and future results.

New Product Development

For the years ended December 31, 2015, 2014 and 2013, research and product development expenditures, including amounts incurred on projects designed to enhance or add to its existing product offerings, totaled approximately $140 million, $128 million and $83 million, respectively. The Subsea segment accounted for 52%, 58% and 44% of each respective year’s total costs.

On January 6, 2015, the Company announced the execution of definitive agreements between OneSubsea, Helix Energy Solutions Group, Inc. and Schlumberger for a non-incorporated alliance formed to develop technologies and to deliver equipment and services designed to provide customers with more cost effective and more efficient subsea well intervention solutions, particularly for deep and ultra-deepwater basins and high well pressure environments.

Cameron has also provided funding for university research in both the United States and Brazil for the development of advanced materials that dampen vibration that could be caused by ocean currents in subsea environments. Cameron's researchers have also worked with a variety of technical partners around the world in developing elastomer seals that perform better in low temperature, high pressure environments.

OneSubsea continues to focus on new technology development in areas such as life of field services, processing, controls, optimization and high pressure and high temperature applications and in the integration of subsea and subsurface technologies to increase recovery and lower intervention costs. For example, in the summer of 2015 OneSubsea delivered the world's first successful subsea compressor for deployment in the Gullfaks field in Norway. The system consisted of a 420-ton protective structure, a compressor station with two 5-megawatt compressors totaling 650 tonnes, and all necessary topsides equipment for power supply and control of the system. This system is expected by our customer to increase the recovery rate from Gullfaks South Brent from 63% to 73%.

Monoethylene glycol (MEG) reclamation technology is a continued focus for product improvement and enhancement in the Subsea segment. The latest generation of Cameron’s brine displacement solution was launched in 2013 as PureMEG®. The latest developments include divalent salt removal systems and improved salt management processes. These enhancements are targeted to provide better reliability and OPEX.

The CDX Compact Deaeration technology was launched by the Subsea segment during 2015. This packed bed reactor solution is designed to provide substantial space and weight savings as compared to traditional vacuum deaeration solutions utilized offshore for seawater flooding. This is the result of a 3 year development that is in the final stage of field demonstration testing.

Over the last three years, Cameron’s Surface segment has developed a number of products to serve the hydraulic fracturing (frac) market. The F-T90 horizontal frac tree is ultra-compact in design to reduce frac stack height. In 2014, Cameron expanded the F-T90™ fleet to include 5” 15,000-psi trees in both Canada and the U.S. The Monoline™ Frac Fluid Delivery System (FFDS) eliminates a significant number of frac iron connections, eliminates the need for expensive safety strapping, reduces footprint and reduces wellsite clutter for added safety benefits. Cameron’s rotating casing hanger facilitates running the casing string in highly deviate wells, reducing both rig time and the risk of stuck pipe. The tension hanger designed by Cameron allows for the tubing string to be pulled straighter on completion to allow for artificial lift solutions that are required later for almost all shale wells. Throughout the life of the frac wells, the new CAM20-MT™ Interchanger Multi-Trim choke provides a cost-effective solution that allows fast actuated adjustments to keep up with changing well conditions and is designed for fast and easy replacement of internals if they get damaged by sand or proppant.

During 2011, the Company’s Drilling segment delivered the industry’s first and only 13⅝” 25,000-psi BOP stack for use in a high-pressure application in the Gulf of Mexico. In 2009, the Drilling segment introduced, in another first, an 18¾” 20,000-psi BOP stack, which had the characteristics of reduced height and weight found in the EVO® BOP that was introduced in 2007 as a compact, lighter version of Cameron’s traditional subsea BOP. Also during 2008, the Company introduced the Sea Pressure Accumulator™ (SPA™), a complement to the EVO BOP, which uses seawater pressure instead of traditional nitrogen-charged

7

accumulator bottles to power the BOP rams. In 2012, Cameron developed a derivative system of SPA called Sea Pressure Reduction Assembly (SPRA™), which reduces hydrostatic seawater effects on the EVO BOP operating system. This, in turn, makes more efficient use of existing accumulator capacity. Another highlight of 2012 was the development of the stab-in connection system (STiCS™). The STiCS system provides an automated means of safely and quickly connecting heavy choke and kill hoses to the riser slip joint which saves hours of rig time.

In addition, the Company's Drilling segment introduced the Mark IV™ HA control systems and Mark IV control POD. The Mark IV system – featuring an industry-first three-POD design option – improves operational reliability of the drilling system through redundancy and simplified POD design. Each control POD within the system has also been improved to include 33% more available functions to accommodate eighty-cavity stacks, a 50% reduction in internal tubing to reduce leak paths, and a 26% smaller footprint than its predecessor.

The Company's V&M segment continues to develop products focused on serving its upstream, midstream, and downstream customers. Cameron engineers have worked with its technology partners to develop solutions for the most challenging of environments and applications. For example, in 2014 Cameron extended the capability of its Grove B4 and B5 product lines to accommodate low temperature critical service applications down to -120°C. Additionally, there is continued focus on subsea 15k HPHT applications. In 2015, a suite of sealing technologies were developed capable of withstanding temperatures up to 400°F.

In 2015, V&M continued to add to its leading quarter turn product portfolio when it launched the WKM Triple Offset Butterfly valve to service its downstream market segments. The true triple offset geometry of this valve allows for bubble-tight sealing to create a fully bi-directional, zero-leakage shut-off valve to API 598 requirements for the power and steam, petrochemical, tank and terminal, upstream production, refining, and gas processing markets, in addition to other industrial applications. The reliable performance of this valve aims to reduce customers’ OPEX spend in critical applications.

Competition

Cameron competes in all areas of its operations with a number of other companies, some of which have financial and other resources comparable to or greater than those of Cameron.

Cameron has a leading position in the petroleum oil field equipment markets. In these markets, Cameron competes principally with Balon Corporation, Circor International, Inc., Dover Corporation, Dril-Quip, Inc., Emerson Process Management, FlowServ Corp., FMC Technologies, Inc., GE Oil & Gas Group, Master Flo (a Stream-Flo Industries Ltd. company), National Oilwell Varco Inc., PBV-USA, Inc. (a Zy-Tech Global Industries company), Petrovalve (a Flotek Industries, Inc. company), Pibiviese, Robbins & Myers Fluid Management Group, SPX Corporation’s Flow Technology Segment, and Tyco International Ltd.

The principal competitive factors in the oil field equipment markets are technology, quality, service and price. Cameron believes several factors give it a strong competitive position in these markets. Most significant are Cameron’s broad product offering, its worldwide presence and reputation, its service and repair capabilities, its expertise in high-pressure technology and its experience in alliance and partnership arrangements with customers and other suppliers.

Manufacturing

Cameron has manufacturing facilities worldwide that conduct a broad variety of processes, including machining, fabrication, assembly and testing, using a variety of forged and cast alloyed steels and stainless steel as the primary raw materials. Cameron has, at various times, rationalized plants and products, closed various manufacturing facilities, moved product lines to achieve economies of scale, and upgraded other facilities. Cameron maintains advanced manufacturing, quality assurance and testing equipment geared to the specific products that it manufactures and uses process automation in its manufacturing operations.

Cameron’s test capabilities are critical to its overall processes. The Company has the capability to test most equipment at rated operating conditions, measuring all operating parameters, efficiency and emissions.

All of Cameron’s Asian, European and Latin American manufacturing plants are ISO certified and API licensed, and most of the U.S. plants are ISO certified. ISO is an internationally recognized verification system for quality management.

Backlog

Cameron’s backlog was approximately $6.6 billion at December 31, 2015 (approximately 51% of which is expected to be shipped during 2016), as compared to $9.5 billion at December 31, 2014, and $11.1 billion at December 31, 2013. Backlog consists of customer orders for which a purchase order or contract has been received, satisfactory credit or financing arrangements exist and delivery is scheduled.

8

Patents, Trademarks and Other Intellectual Property

As part of its ongoing research, development and manufacturing activities, Cameron seeks patents, when appropriate, to protect its inventions. Cameron owns 620 active United States patents and 1,135 active non-U.S. patents. During 2015, Cameron filed 221 U.S. and 281 non-U.S. patent applications.

Although, in the aggregate, these patents are of considerable importance to the provision of many of Cameron's products and services, Cameron does not consider any single patent or group of patents to be material to its business as a whole.

Trademarks are also of considerable importance to the marketing of Cameron’s products. Cameron considers the CAMERON® trademark to be important to its business as a whole. Other important trademarks used by Cameron are included under “Markets and Products” above. Cameron has registered trademarks in countries where such registration is deemed important.

Cameron also relies on trade secret protection for its confidential and proprietary information. To protect its information, Cameron routinely enters into confidentiality agreements with its employees, partners and suppliers, for example. There can be no assurance, however, that others will not independently obtain similar information or otherwise gain access to Cameron’s trade secrets.

Employees

As of December 31, 2015, Cameron had approximately 23,000 employees, of which nearly 21% were represented by labor unions.

Over 2,200 employees are covered by union contracts which are slated to expire during 2016, the majority of which are in Brazil and Romania.

9

Executive Officers of the Registrant

Name and Age | Present Principal Position and Other Material Positions Held During Last Five Years |

R. Scott Rowe (44) | President and Chief Executive Officer since October 2015. President and Chief Operating Officer from October 2014 to October 2015. Vice President from August 2012 to October 2014. Chief Executive Officer of OneSubsea from March 2014 to October 2014. President of the Subsea Systems division of Cameron from August 2012 to March 2014 and President of the Production Systems division of OneSubsea from June 2013 to March 2014. President of the Engineered and Process Valves division from April 2010 to August 2012. President Process Valves division and Aftermarket from May 2008 to April 2010. Vice President and General Manager of the Distributed Valves division from January 2007 to May 2008. Vice President of Operations of the Valves and Measurement divisions from August 2005 to January 2007. |

William C. Lemmer (71) | Senior Vice President and General Counsel since May 2008, Senior Vice President, General Counsel and Secretary from July 2007 to May 2008. Vice President, General Counsel and Secretary from July 1999 to July 2007. Vice President, General Counsel and Secretary of Oryx Energy Company from 1994 to March 1999. |

Charles M. Sledge (50) | Senior Vice President and Chief Financial Officer since November 2008. Vice President and Chief Financial Officer from April 2008 to November 2008. Vice President and Corporate Controller from July 2001 to March 2008. Senior Vice President, Finance and Treasurer from 1999 to June 2001, and Vice President, Controller from 1996 to 1999, of Stage Stores, Inc., a chain of family apparel stores. |

Dennis S. Baldwin (55) | Vice President, Controller and Chief Accounting Officer since March 2014. Senior Vice President and Chief Accounting Officer of KBR, Inc. from August 2010 to March 2014. Vice President and Chief Accounting Officer of McDermott International from October 2007 to August 2010. |

Steven P. Geiger (62) | Vice President and Chief Administrative Officer since October 2014. Vice President, Human Resources from January 2014 to September 2014. Vice President of Human Resources and Operational Excellence from June 2013 to December 2013. Vice President of Operational Excellence from February 2013 to June 2013. Senior Vice President at Senn-Delaney Leadership Consulting Group from July 2008 to February 2013. Also served as Interim Chief Operating Officer of James Cancer Hospital, Ohio State University, from January 2010 to June 2010. |

Hunter W. Jones (56) | Vice President since May 2015 and President, Drilling Systems since June 2015. Vice President and General Manager, Drilling Systems from October 2013 to June 2015. Vice President, Enterprise Services and Chief Information Officer from October 2012 to October 2013. Vice President and Chief Information Officer August 2009 to October 2012. Vice President, Supply Chain Management and Six Sigma from June 2002 to October 2005. Vice President, Quality and Global Procurement from May 2000 to June 2002. |

Douglas E. Meikle (52) | Vice President since May 2015 and President of Valves and Measurement since October 2014. Vice President Operational Excellence from February 2014 to October 2014. Vice President Enterprise Services from October 2013 to February 2014. Chief Executive Officer of Stork Technical Services from January 2009 to October 2013. Vice President of Halliburton from May 1998 to December 2008. |

Stefan Radwanski (59) | Vice President since June 2015 and Vice President and Division GM, Surface Systems since November 2013 Vice President, Sales and Marketing from July 2005 to November 2013. Director of Sales & Marketing from February 2004 to June 2005. Senior Vice President, Business Development of Sodexho France from April 2003 to February 2004. Senior Vice President of ABB Vetco Gray from April 1999 to April 2002. |

Steven W. Roll (56) | Vice President since May 2015 and President of Process Systems since January 2014. Vice President, Atlantic Region of McDermott International Inc. from December 2011 to September 2013. Vice President, Sales, Marketing, Business Development and Operational Strategy of McDermott from June 2008 to November 2011. |

10

ITEM 1A. RISK FACTORS

Factors That May Affect Financial Condition and Future Results

The current downturn and past downturns in the oil and gas industry have had a negative effect on the Company’s sales, the Company's customers' ability to pay and the Company's profitability.

Demand for most of the Company’s products and services, and therefore its revenue, depends to a large extent upon the level of capital expenditures related to oil and gas exploration, development, production, processing and transmission. Declines, as well as anticipated declines, in oil and gas prices could negatively affect the level of these activities, and could result in the cancellation, modification or rescheduling of existing orders and the ability of our customers to pay. For example, oil prices began declining during the third quarter of 2014 and continued to decline through early 2016. Average daily prices for West Texas Intermediate and Brent crude during 2015 were each down more than 42% from 2014. Similarly, natural gas prices declined from an average of $4.35 per MMBtu during 2014 to $2.61 per MMBtu for 2015. These declines in commodity prices began to impact the average number of working rigs which began declining in late 2014 and continued to decline during 2015. Globally, the average rig count for 2015 was down 35% from 2014, with even steeper declines occurring in the United States and Canada. These market conditions negatively affected 2015 results and are expected to continue to significantly affect future results as exploration and production activity levels and, therefore, demand for the Company’s products and services, as well as our customers' ability to pay continue to decline. During 2015, numerous deepwater projects were deferred and deepwater rigs idled. Efforts are also being made by drilling contractors to defer deliveries of new deepwater rigs currently under construction. In addition to a decline in future orders and revenues, the Company expects to incur additional costs as it continues to adjust, as necessary, its commercial, manufacturing and support operations levels to meet expected future customer demand. See also the discussion in “Market Conditions” above for 2015 as compared to 2014.

Cancellation, downsizing or delays of orders in backlog are possible.

As described above, commodity prices have declined significantly since mid-2014 which has resulted in various oil and gas exploration and production companies implementing spending cuts or deferrals in their 2015 capital spending plans, as well as headcount reductions, with continued cuts and deferrals expected for 2016. At current price levels, certain projects, particularly those in deepwater environments and unconventional resource regions, may become uneconomical for the risk involved. Certain customers that are more highly leveraged may also experience concerns regarding future projected cash flows based on current price levels. These factors could result in existing orders in backlog being cancelled, downsized or future shipment dates may be delayed, all of which could further negatively impact the Company’s future profitability.

Cameron will be subject to business uncertainties and certain operating restrictions until completion of the merger with Schlumberger.

In connection with the pending merger with Schlumberger, some of the suppliers and customers of Cameron may delay or defer sales and purchasing decisions, which could negatively impact revenues, earnings and cash flows regardless of whether the merger is completed. Additionally, Cameron has agreed in the merger agreement to refrain from taking certain actions with respect to our business and financial affairs during the pendency of the merger, which restrictions could be in place for an extended period of time if completion of the merger is delayed and could adversely impact Cameron’s ability to execute certain of our business strategies and their financial condition, results of operations or cash flows.

Cameron may be unable to attract and retain key employees during the pendency of the merger.

In connection with the pending merger with Schlumberger, current and prospective employees of Cameron may experience uncertainty about their future roles with the combined company following the merger, which may materially adversely affect the ability of Cameron to attract and retain key personnel while the merger is pending. Key employees may depart because of issues relating to the uncertainty and difficulty of integration or a desire not to remain with the combined company following the merger. Accordingly, no assurance can be given that Cameron will be able to attract and retain key employees to the same extent that Cameron has been able to in the past.

Failure to complete the merger with Schlumberger could negatively impact Cameron.

If the pending merger with Schlumberger is not completed, Cameron's ongoing businesses and the market price of its common stock may be adversely affected and Cameron will be subject to several risks; including Cameron being required, under certain circumstances, to pay a termination fee of $321 million to Schlumberger; Cameron having to pay certain costs relating to the merger; and diverting the focus of Cameron management from pursuing other opportunities that could be beneficial to Cameron; in each case, without realizing any of the benefits that might have resulted if the pending merger had been completed.

11

Portions of the backlog for our Subsea and Drilling segments are subject to heightened execution risk.

Cameron is involved in projects to provide customers with deepwater stacks and complete drilling packages for jackup rigs and, through our Subsea segment, is a significant participant in the subsea systems projects market. Some of the projects for these markets carry heightened execution risk because of their scope and complexity, in terms of both technical and logistical requirements. Such projects (i) may often involve long lead times, (ii) are larger in financial scope, (iii) require substantial engineering resources to meet the technical requirements of the project and (iv) often involve the application of existing technology to new environments and, in some cases, may require the development of new technology. As a subset of its total backlog at December 31, 2015, the Company had projects fitting this risk profile that amounted to approximately $914 million in its Drilling segment and approximately $1.8 billion in its Subsea segment. To the extent the Company experiences unplanned difficulties in meeting the technical and/or delivery requirements of the projects, the Company’s earnings or liquidity could be negatively impacted. The Company accounts for its drilling and subsea projects, as it does its separation projects, using accounting rules for construction-type and production-type contracts. Factors that may affect future project costs and margins include the ability to properly execute the engineering and design phases consistent with our customers’ expectations, production efficiencies obtained, and the availability and costs of labor, materials and subcomponents. These factors can impact the accuracy of the Company’s estimates and materially impact the Company’s future period earnings. If the Company experiences cost overruns, the expected margin could decline. If this were to occur, in accordance with the accounting guidance, the Company would record a cumulative adjustment to reduce the margin previously recorded on the related project in the period a change in the estimate is needed. Deepwater stack and jackup complete drilling packages, and subsea systems projects, accounted for approximately 8% and 14%, respectively, of total revenues for 2015.

As a designer, manufacturer, installer and servicer of oil and gas pressure control equipment, the Company may be subject to liability, personal injury, property damage and environmental contamination should such equipment fail to perform to specifications.

Cameron provides products and systems to customers involved in oil and gas exploration, development and production, as well as in certain other industrial markets. Some of the Company’s equipment is designed to operate in high-temperature and/or high-pressure environments on land, on offshore platforms and on the seabed, and some equipment is designed for use in hydraulic fracturing operations. Cameron also provides parts and repair services at numerous facilities located around the world, as well as at customer sites for this type of equipment. Because of applications to which the Company’s products and services are put, particularly those involving the high temperature and/or pressure environments, a failure of such equipment, or a failure of our customer to maintain or operate the equipment properly, could cause damage to the equipment, damage to the property of customers and others, personal injury and environmental contamination, onshore or offshore, leading to claims against Cameron.

Certain of the Company’s risk mitigation strategies may not be fully effective.

The Company relies on customer indemnifications and third-party insurance as part of its risk mitigation strategy. There is, however, an increasing reluctance of customers to provide what had been typical oilfield indemnifications for pollution, consequential losses, property damage, and personal injury and death, and a reluctance, even refusal, of counterparties to honor their contractual indemnity obligations when given. In addition, insurance companies may refuse to honor their policies.

An example of both is the Company’s experience in the Deepwater Horizon matter. The Company’s customer denied that it owed any indemnification under its contract with us, and when called on to participate in the Company’s settlement with BP Exploration and Production Inc., one of the seven insurers refused to provide coverage. The Company subsequently sued its insurer and won a judgment for the full policy amount plus interest and costs, but the insurer continues to litigate the matter.

The implementation of an upgraded business information system may disrupt the Company’s operations or its system of internal controls.

The Company has a project underway to upgrade its SAP business information systems worldwide. The first stage of this multi-year effort was completed at the beginning of the third quarter of 2011 with the deployment of the upgraded system to the Company’s process systems and compression businesses. Since then, other businesses and business functions have been migrated in stages. As of December 31, 2015, nearly all businesses within the V&M segment, the Surface segment, the Drilling segment, the Company’s worldwide engineering and human resource functions, as well as other corporate office activities are now operating on the upgraded system. The OneSubsea business is scheduled to begin using the upgraded system in 2016. The Drilling segment and the OneSubsea business are major contributors to the Company’s consolidated revenues and income before income taxes.

12

As this system continues to be deployed throughout the Company, delays or difficulties may be encountered in effectively and efficiently processing transactions and conducting business operations, including project management, until such time as personnel are familiar with all appropriate aspects and capabilities of the upgraded systems.

The Company’s operations and information systems are subject to cybersecurity risks.

Cameron continues to increase its dependence on digital technologies to conduct its operations. Many of the Company’s files are digitized and more employees are working in almost paperless environments. Additionally, the hardware, network and software environments to operate SAP, the Company’s main enterprise-wide operating system, have been outsourced to third parties. Other key software products used by the Company to conduct its operations either reside on servers in remote locations or are operated by the software vendors or other third parties for the Company’s use as “cloud-based” or “web-based” applications. The Company has also outsourced certain information technology development, maintenance and support functions. As a result, the Company is exposed to potentially severe cyber incidents at both its internal locations and outside vendor locations that could result in a theft of intellectual property and/or disruption of its operations for an extended period of time resulting in the loss of critical data and in higher costs to correct and remedy the effects of such incidents.

Fluctuations in currency markets can impact the Company’s profitability.

The Company has established multiple “Centers of Excellence” facilities for manufacturing such products as subsea trees, subsea chokes, subsea production controls and blowout preventers. These production facilities are located in the United Kingdom, Brazil, Romania, Italy, Norway and other European and Asian countries. To the extent the Company sells these products in U.S. dollars, the Company’s profitability is eroded when the U.S. dollar weakens against the British pound, the euro, the Brazilian real and certain Asian currencies, including the Singapore dollar. Alternatively, profitability is enhanced when the U.S. dollar strengthens against these same currencies. For further information on the use of derivatives to mitigate certain currency exposures, see Part II, Item 7A, “Quantitative and Qualitative Disclosures about Market Risk” below and Note 19 of the Notes to Consolidated Condensed Financial Statements.

The Company’s operations expose it to risks of non-compliance with numerous countries’ import and export laws and regulations, and with various nations’ trade laws and regulations including U.S. sanctions.

The Company’s operations expose it to anti-boycott, economic sanctions, export, import, and other trade regulations in multiple jurisdictions. In addition to using “Centers of Excellence” for manufacturing products to be delivered around the world, the Company imports raw materials, semi-finished goods and finished products into many countries for use in country or for manufacturing and/or finishing for re-export and import into another country for use or further integration into equipment or systems. This movement of raw materials, semi-finished or finished products involves exports and imports that can be subject to regulation by multiple jurisdiction. In addition, the Company conducts business, organizes and owns legal entities and engages employees, vendors and customers in and from various countries, and these activities and parties are subject to various, and sometimes divergent, economic sanctions, anti-boycott and other trade regulations. The Company has undergone and will likely continue to undergo governmental audits to determine compliance with export and customs laws and regulations. As a result, compliance with multiple trade sanctions and embargoes and import and export laws and regulations poses a constant challenge and risk to the Company.

From time to time, the Company has received inquiries from U.S. governmental agencies, including the U.S. Securities and Exchange Commission ("SEC") and the U.S. Department of the Treasury's Office of Foreign Assets Control, regarding compliance with certain of these laws and regulations. Currently, the Company is responding to an inquiry from the Department of Justice regarding the compliance with U.S. economic sanctions against Iran. See the discussion in Part II, Item 9B.

The Company’s operations require it to deal with a variety of cultures and countries, as well as agents and other intermediaries, exposing it to anti-corruption compliance risks.

Doing business on a worldwide basis necessarily involves exposing the Company and its operations to risks inherent in complying with the laws and regulations of a number of different nations. These laws and regulations include various anti-bribery and anti-corruption laws. Investigations of non-compliance, even when no wrongdoing is found, as well as penalties and other costs associated with violations of these laws could have an adverse impact on the Company's financial statements and results.

In addition to bribery and corruption risks which exist around the world, the Company does business and has operations in a number of countries that are generally perceived as presenting a higher than normal risk of corruption. Maintaining and administering an effective anti-bribery compliance program under the U.S. Foreign Corrupt Practices Act (FCPA), the United Kingdom’s Bribery Act of 2010, and similar statutes of other nations in these environments present greater challenges to the Company than is the case in other countries. Additionally, the Company’s business involves the use of agents and other intermediaries, such as customs brokers. As a result, the risk to the Company of compliance violations is increased because

13

actions taken by any of them when attempting to conduct business on our behalf could be imputed to us by law enforcement authorities.

From time to time, the Company has received inquiries from U.S. government agencies, including the SEC and the U.S. Department of Justice regarding compliance with certain of these laws and regulations. The Company is currently responding to an inquiry from the SEC and Department of Justice regarding anti-bribery matters. See the discussion in Part II, Item 9B.

Additionally, these risks can negatively effect our customers and, therefore, the Company itself. As an example, various employees and former employees of the Company’s primary customer in Brazil are being investigated currently over allegations of bribery and other acts of corruption. This investigation, along with the current recessionary economic conditions in Brazil, is, at present, having a negative impact on future orders and growth prospects for the Company’s operations in Brazil. Sales to customers in Brazil accounted for approximately 4% of the Company’s consolidated revenues during 2015 and 6% in 2014.

Our Compliance Programs May Not Prevent Violations of Applicable Laws and Regulations

We have an ethics and compliance program that is designed to deter or detect violations of applicable laws and regulations through the application of our policies and procedures, Code of Conduct, Ethics Helpline, training, internal controls, investigation and remediation activities, and other activities. However, our ethics and compliance program may not be fully effective in preventing all employees, contractors or intermediaries from violating or circumventing our compliance requirements or applicable laws and regulations. Violations of applicable laws and regulations can result in fines and penalties, criminal sanctions, administrative remedies, and restrictions on our business conduct, and could have an adverse effect on our reputation and our business, our operating results, and financial condition.

The Company’s operations expose it to political and economic risks and instability due to changes in economic conditions, civil unrest, foreign currency fluctuations, and other risks, such as local content requirements, inherent to international businesses.

The political and economic risks of doing business on a worldwide basis include the following:

• | volatility in general economic, social and political conditions; |

• | the effects of civil unrest and, in some cases, military action on the Company’s business operations, customers and employees, such as that recently occurring in several countries in the Middle East and in Venezuela; |

• | exchange controls or other similar measures which result in restrictions on repatriation of capital and/or income, such as those involving the currencies of, and the Company’s operations in, Angola and Nigeria; and |

• | reductions in the number or capacity of qualified personnel. |

Cameron also has manufacturing and service operations that are essential parts of its business in other developing countries and volatile areas in Africa, Latin America and other countries that were part of the Former Soviet Union, the Middle East, and Central and South East Asia. Operating in certain of these regions has increased the Company’s risk of identifying and hiring sufficient numbers of qualified personnel to meet customer demand in selected locations. The Company also purchases a large portion of its raw materials and components from a relatively small number of foreign suppliers in China, India and other developing countries. The ability of these suppliers to meet the Company’s demand could be adversely affected by the factors described above.

In addition, customers in countries such as Angola and Nigeria increasingly are requiring the Company to accept payments in the local currencies of these countries. These currencies do not currently trade actively in the world’s foreign exchange markets. The government of Angola devalued its currency during 2015, resulting in a loss of $9 million being recorded by the Company on its kwanza-denominated net assets. Angola further devalued its currency an additional 15%, effective January 1, 2016.

Increasingly, some of the Company’s customers, particularly the national oil companies, have required a certain percentage, or an increased percentage, of local content in the products they buy directly or indirectly from the Company. This requires the Company to add to or expand manufacturing capabilities in certain countries that are presently without the necessary infrastructure or human resources in place to conduct business in a manner as typically done by Cameron. This increases the risk of untimely deliveries, cost overruns and defective products.

The Company’s operations expose it to risks resulting from differing and/or increasing tax rates.

Economic conditions around the world have resulted in decreased tax revenues for many governments, which have led and could continue to lead to changes in tax laws in countries where the Company does business, including further changes in the United States. Changes in tax laws could have a negative impact on the Company’s future results.

14

The Company is subject to environmental, health and safety laws and regulations that expose the Company to potential liability and proposed new regulations that would restrict activities to which the Company currently provides equipment and services.

The Company’s operations are subject to a variety of national and state, provincial and local laws and regulations, including laws and regulations relating to the protection of the environment. The Company is required to invest financial and managerial resources to comply with these laws and expects to continue to do so in the future. To date, the cost of complying with governmental regulation has not been material, but the fact that such laws or regulations are frequently changed makes it impossible for the Company to predict the cost or impact of such laws and regulations on the Company’s future operations. The modification of existing laws or regulations or the adoption of new laws or regulations imposing more stringent environmental restrictions could adversely affect the Company.

The Company provides equipment and services to companies employing hydraulic fracturing or “fracking” and could be adversely impacted by additional regulations of this enhanced recovery technique.

Environmental concerns have been raised regarding the potential impact on underground water supplies of hydraulic fracturing which involves the pumping of water and certain chemicals under pressure into a well to break apart shale and other rock formations in order to increase the flow of oil and gas embedded in these formations. On March 20, 2015, the U.S. Interior Department’s Bureau of Land Management (BLM) released a final rule regulating hydraulic fracturing activities on Federal and Indian lands. The final rule includes new well-bore integrity requirements, imposes standards for interim storage of recovered waste fluids, and requires notifications and waiting periods for key parts of the fracturing process, which could lead to delays in fracturing and/or drilling operations. The rule also mandates disclosure of the chemicals used in the process. Additionally, on April 7, 2015, the U.S. Environmental Protection Agency (EPA) published a proposed rule that would prohibit the disposal of unconventional oil and natural gas wastewater at publicly owned treatment works.

A number of U.S. states have also proposed regulations regarding disclosure of chemicals used in fracking operations or have temporarily suspended issuance of permits for such operations. The State of New York implemented a statewide ban on hydraulic fracturing at the beginning of 2015 which limits natural gas production from a portion of the Marcellus Shale region. Additionally, the United States EPA issued rules, which became effective in January 2015, designed to limit the release of volatile organic compounds, or pollutants, from natural gas wells that are hydraulically fractured.

Should these regulations, or additional regulations and bans by governments, continue to restrict or further curtail hydraulic fracturing activities, the Company’s revenues and earnings could be negatively impacted.

Enacted and proposed climate protection regulations and legislation may impact the Company’s operations or those of its customers.

The EPA has made a finding under the United States Clean Air Act that greenhouse gas emissions endanger public health and welfare and enacted regulations requiring monitoring and reporting by certain facilities and companies of greenhouse gas emissions. In June 2014, the EPA, acting under President Obama’s Climate Action Plan, proposed its Clean Power Plan, which would set U.S. state-by-state guidelines for power plants to meet by 2030 to cut their carbon emissions by 30% nationwide from 2005 levels. The guidelines are also intended to cut pollution, nitrogen oxides and sulfur dioxide by more than 25% during the same period. Under the Clean Power Plan, States are to develop plans to meet state-specific goals to reduce carbon pollution and submit those plans to the EPA by June 2016, with a later deadline provided under certain circumstances. While these proposed rules may hasten the switch from coal to cleaner burning fuels such as natural gas, the overall long-term economic impact of the Plan is uncertain at this point.

Carbon emission reporting and reduction programs have also expanded in recent years at the state, regional and national levels with certain countries having already implemented various types of cap-and-trade programs aimed at reducing carbon emissions from companies that currently emit greenhouse gases.

To the extent the Company’s customers are subject to these or other similar proposed or newly enacted laws and regulations, the Company is exposed to risks that the additional costs by customers to comply with such laws and regulations could impact their ability or desire to continue to operate at current or anticipated levels in certain jurisdictions, which could negatively impact their demand for the Company’s products and services.

To the extent Cameron becomes subject to any of these or other similar proposed or newly enacted laws and regulations, the Company expects that its efforts to monitor, report and comply with such laws and regulations, and any related taxes imposed on companies by such programs, will increase the Company’s cost of doing business in certain jurisdictions, including the United States, and may require expenditures on a number of its facilities and possibly on modifications of certain of its products.

15

The Company could also be impacted by new laws and regulations establishing cap-and-trade and by those that might favor the increased use of non-fossil fuels, including nuclear, wind, solar and bio-fuels or that are designed to increase energy efficiency. If the proposed or newly executed laws have the effect of dampening demand for oil and gas production, they could lower spending by customers for the Company’s products and services.

Environmental Remediation

The Company’s worldwide operations are subject to domestic and international regulations with regard to air, soil, waste management, and water quality as well as other environmental matters such as resource conservation. The Company, through its Health, Safety and Environmental (HSE) Management System and corporate third-party regulatory compliance audit program, believes it is in substantial compliance with these regulations.

The Company is heir to a number of older manufacturing plants that conducted operations in accordance with the standards of the time, but which have since changed. The Company has undertaken clean-up efforts at these sites and now conducts its business in accordance with current standards and/or regulatory requirements. The Company’s clean-up efforts have yielded limited releases of liability from regulators in some instances, and have allowed sites with no current operations to be sold. The Company conducts environmental due diligence prior to all new site acquisitions. For further information, refer to Note 20 of the Notes to Consolidated Condensed Financial Statements.

Environmental Sustainability

The Company has pursued environmental sustainability in a number of ways. Processes are monitored in an attempt to minimize waste produced and conserve natural resources where possible. All of the waste disposal firms used by the Company are carefully selected in an attempt to prevent any future Superfund involvements. Actions are taken in an attempt to minimize the generation of hazardous wastes and to minimize air emissions. Recycling of process wastewater is a common practice. Best management practices related to spill prevention and storm water pollution prevention are used in an effort to prevent contamination of soil and ground water on the Company’s sites and neighboring facilities.

Cameron has implemented a corporate HSE Management System that incorporates many of the principles of ISO 14001 and OHSAS 18001. The HSE Management System contains a set of corporate standards that are required to be implemented and verified by each business unit. Cameron also has a corporate regulatory compliance audit program which uses independent third-party auditors to audit facilities on a regular basis to verify facility compliance with the relevant country, region and local environmental, health and safety laws and regulations. Audit reports are circulated to the senior management of the Company and to the appropriate business unit. The compliance program requires corrective and preventative actions be taken by a facility to remedy all findings of non-compliance which are tracked on the corporate HSE data base and monitored by corporate HSE staff.

The Company's 2014 Sustainability Report, issued in June 2015, is available on our website at www.c-a-m.com/company.

ITEM 1B. UNRESOLVED STAFF COMMENTS

There were no unresolved comments from the SEC staff at the time of filing of this Form 10-K.

ITEM 2. PROPERTIES

The Company manufactures, markets and sells its products and provides services throughout the world, operating facilities in numerous countries ranging in size from approximately 100 square feet to approximately 500,000 square feet. In addition to its manufacturing facilities, the Company owns and leases land, warehouses, distribution centers, service and storage facilities, sales and administrative offices. The Company leases its corporate headquarters office space for the staff of its segments in Houston, Texas.

16

The table below shows the number of significant operating manufacturing, warehouse, distribution and service facilities and sales and administrative offices by business segment and geographic area at December 31, 2015. The location and square footage information also includes land owned and leased.

Americas | Asia/Pacific and Middle East | Europe/Africa/ Caspian/Russia | Total | ||||||||

Subsea ― | |||||||||||

Number of locations | 46 | 11 | 45 | 102 | |||||||

Square footage: | |||||||||||

Owned | 3,611,348 | — | 492,406 | 4,103,754 | |||||||

Leased | 830,817 | 802,295 | 1,664,266 | 3,297,378 | |||||||

Surface ― | |||||||||||

Number of locations | 70 | 25 | 28 | 123 | |||||||

Square footage: | |||||||||||

Owned | 1,326,950 | — | 682,704 | 2,009,654 | |||||||

Leased | 895,839 | 1,772,780 | 261,556 | 2,930,175 | |||||||

Drilling ― | |||||||||||

Number of locations | 33 | 2 | 15 | 50 | |||||||

Square footage: | |||||||||||

Owned | 1,498,525 | — | 430,556 | 1,929,081 | |||||||

Leased | 887,592 | 452,022 | 263,879 | 1,603,493 | |||||||

V&M ― | |||||||||||

Number of locations | 55 | 22 | 13 | 90 | |||||||

Square footage: | |||||||||||

Owned | 1,437,670 | 18,729 | 758,640 | 2,215,039 | |||||||

Leased | 1,325,394 | 725,571 | 191,741 | 2,242,706 | |||||||

Corporate ― | |||||||||||

Number of locations | 10 | 6 | 8 | 24 | |||||||

Square footage: | |||||||||||

Owned | 75,165 | — | — | 75,165 | |||||||

Leased | 230,312 | 198,027 | 141,187 | 569,526 | |||||||

Total ― | |||||||||||

Number of locations | 214 | 66 | 109 | 389 | |||||||

Square footage: | |||||||||||

Owned | 7,949,658 | 18,729 | 2,364,306 | 10,332,693 | |||||||

Leased | 4,169,954 | 3,950,695 | 2,522,629 | 10,643,278 | |||||||

The Company’s operations in the “Americas” are mainly located in North and South America. The Company’s operations in the “Asia/Pacific and Middle East” region are mainly located on the Asian continent, in countries considered to be on the Pacific rim of the Asian continent or in the area of the world commonly known as the “Middle East”. The Company’s operations in “Europe/Africa/Caspian/Russia” are mainly located in the United Kingdom, Norway, on the European continent, in Angola, Algeria, Nigeria, Russia and areas surrounding the Caspian Sea.

Cameron believes its facilities are suitable for their present and intended purposes and are adequate for the Company’s current and anticipated level of operations.

17

ITEM 3. LEGAL PROCEEDINGS

The Company is subject to a number of contingencies, including litigation, tax contingencies and environmental matters.

Litigation

The Company has been and continues to be named as a defendant in a number of multi-defendant, multi-plaintiff tort lawsuits. At December 31, 2015, the Company’s Consolidated Balance Sheet included a liability of approximately $21 million for such cases. The Company believes, based on its review of the facts and law, that the potential exposure from these suits will not have a material adverse effect on its consolidated results of operations, financial condition or liquidity.

Tax and Other Contingencies

The Company has legal entities in over 50 countries. As a result, the Company is subject to various tax filing requirements in these countries. The Company prepares its tax filings in a manner which it believes is consistent with such filing requirements. However, some of the tax laws and regulations to which the Company is subject require interpretation and/or judgment. Although the Company believes that adequate provisions for the tax liabilities for periods ending on or before the balance sheet date have been made in the financial statements; to the extent a taxing authority believes the Company has not prepared its tax filings in accordance with the authority’s interpretation of the tax laws and regulations, the Company could be exposed to additional taxes.

The Company has been assessed customs duties and penalties by the government of Brazil totaling almost $34 million at December 31, 2015, including interest accrued at local country rates, following a customs audit for the years 2003-2010. The Company filed an administrative appeal and believes a majority of this assessment will ultimately be proven to be incorrect because of numerous errors in the assessment, and because the government has not provided appropriate supporting documentation for the assessment. As a result, the Company currently expects no material adverse impact on its results of operations or cash flows as a result of the ultimate resolution of this matter. No amounts have been accrued for this assessment as of December 31, 2015 as no loss is currently considered probable.

Environmental Matters

The Company is currently identified as a potentially responsible party (PRP) for one site designated for cleanup under the Comprehensive Environmental Response Compensation and Liability Act (CERCLA). The Osborne site is a landfill into which a predecessor of the Reciprocating Compression operation in Grove City, Pennsylvania deposited waste. Remediation was completed in 2011 and remaining costs relate to ongoing ground water monitoring. The Company is also a party with de minimis exposure at other sites covered by CERCLA or similar state laws.

The Company is engaged in site cleanup under the Voluntary Cleanup Plan of the Texas Commission on Environmental Quality ("TCEQ") at a former manufacturing site in Houston, Texas. In 2001, the Company discovered that contaminated underground water from this site had migrated under an adjacent residential area. Pursuant to applicable state regulations, the Company notified the affected homeowners. Concerns over the impact on property values of the underground water contamination and its public disclosure led to a number of claims by homeowners. The Company has settled these claims, primarily as a result of the settlement of a class action lawsuit, and is obligated to reimburse certain homeowners for any diminution in value of their property due to concerns over contamination at the time of the property's sale. As required, the Company has and will continue to notify surrounding property owners of testing and monitoring results, including concentration levels and migration patterns. The Company continues to monitor the situation to determine whether additional remedial measures would be appropriate. The Company believes, based on its review of the facts and law, that any potential exposure from existing agreements as well as any possible new claims that may be filed with respect to this underground water contamination will not have a material adverse effect on its financial position or results of operations. The Company's Consolidated Balance Sheet included a noncurrent liability of approximately $7 million for these matters as of December 31, 2015.

Additionally, the Company has discontinued operations at a number of other sites which had been active for many years and which may have yet undiscovered contamination. The Company does not believe, based upon information currently available, that there are any material environmental liabilities existing at these locations. At December 31, 2015, the Company's Consolidated Balance Sheet included a noncurrent liability of approximately $5 million for these environmental matters.

ITEM 4. MINE SAFETY DISCLOSURES

N/A.

18

PART II

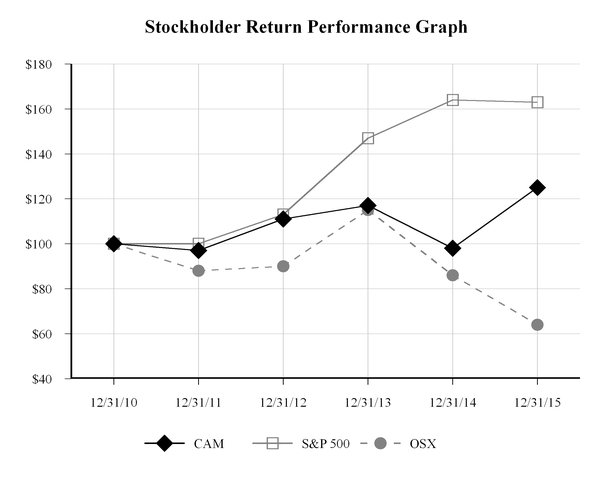

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES