Attached files

| file | filename |

|---|---|

| 8-K - 8-K - IDEX CORP /DE/ | iex-20160127x8k.htm |

EX 99.1

For further information: TRADED: NYSE (IEX)

Investor Contact:

Heath Mitts

Senior Vice President and Chief Financial Officer

(847) 498-7070

WEDNESDAY, JANUARY 27, 2016

IDEX REPORTS 21 PERCENT ADJUSTED OPERATING MARGIN

WITH $3.55 OF ADJUSTED EPS FOR 2015

LAKE FOREST, IL, JANUARY 27 - IDEX Corporation (NYSE: IEX) today announced its financial results for the three- and twelve- month periods ended December 31, 2015.

2015 Highlights

• | Adjusted EPS of $3.55 with adjusted operating margin of 21.0 percent, up 30 basis points |

• | Gross margin of 44.8 percent, up 60 basis points |

• | Free cash flow of $322 million, 114 percent of net income |

• | Repurchased 2.8 million shares of common stock for $210 million |

• | Deployed $200 million to acquire Novotema, Alfa Valvole and CiDRA Precision Services |

• | Sold the Ismatec business for a pre-tax gain of $18.1 million, or 17 cents per share |

Full Year 2015

Orders of $2 billion were down 5 percent (-2 percent organic, +1 percent acquisitions and -4 percent foreign currency translation) compared with the prior year. Sales of $2 billion were down 6 percent (-4 percent organic, +2 percent acquisitions and -4 percent foreign currency translation) compared with the prior year.

Gross margin of 44.8 percent was up 60 basis points from the prior year, while adjusted operating margin of 21.0 percent was up 30 basis points from the prior year.

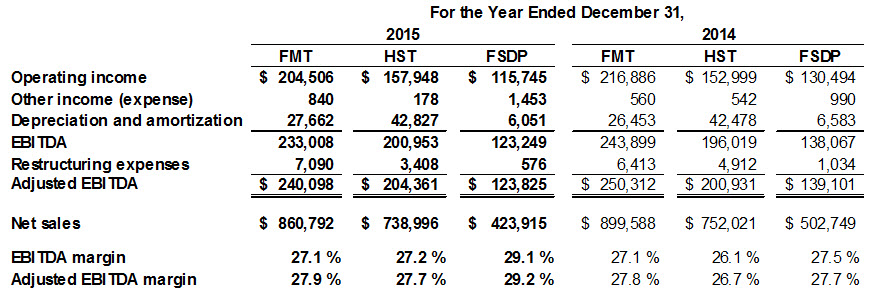

Adjusted net income of $277 million decreased 4 percent from the prior year, while adjusted earnings per share of $3.55 decreased 2 cents, or 1 percent, from the prior year. Adjusted EBITDA of $505 million was 25 percent of sales and covered interest expense by over 12 times, while free cash flow of $322 million was 114 percent of net income.

Fourth Quarter 2015

Orders of $495 million were down 4 percent (-4 percent organic, +3 percent acquisitions and -3 percent foreign currency translation) compared with the prior year period. Sales of $500 million were down 5 percent (-4 percent organic, +2 percent acquisitions and -3 percent foreign currency translation) compared with the prior year period.

Gross margin of 44.7 percent was up 100 basis points from the prior year period, while adjusted operating margin of 21.0 percent was up 40 basis points from the prior year period.

Adjusted net income of $72 million increased 2 percent compared with the prior year period, while adjusted earnings per share of 94 cents increased 5 cents, or 6 percent, from the prior year period. Adjusted EBITDA of $126 million was 25 percent of sales and covered interest expense by over 12 times, while free cash flow of $88 million was 130 percent of net income.

The Company repurchased 409 thousand shares of common stock for $31 million in the fourth quarter of 2015.

Fourth quarter and full year 2015 net income and earnings per share included a $2.6 million, or 3 cents per share, income tax benefit as a result of a decrease in the Italian statutory tax rate enacted in December 2015.

“In 2015 IDEX once again expanded gross margin and adjusted operating margin by 60 and 30 basis points, respectively. Our teams were well prepared to deliver productivity, despite the growth of global markets being hampered by depressed oil prices, slow North American industrial activity, and the contraction of China’s economy. In the second half of the year, we also executed a restructuring plan, which will provide approximately $12 million of savings in 2016. | |

Value creation through focused capital deployment is key to our 2016 success. Investments in long-term organic growth opportunities continue to be made, while shareholder dividends are funded and share repurchases continue at a balanced pace. In 2015 we deployed $200 million toward the strategic acquisitions of Alfa Valvole, Novotema and CiDRA Precision Services. With strong free cash flow, balance sheet capacity, and a healthy pipeline of opportunities, we now expect to significantly exceed this level of M&A activity in 2016. | |

The current contraction of global industrial economies will continue to pressure our end markets, creating an unstable 2016, resulting in roughly flat organic growth. Productivity will remain a focus allowing us to expand full year 2016 operating margins and deliver full year 2016 EPS of $3.60 to $3.70, with first quarter EPS in the range of 80 to 82 cents.” | |

Andrew K. Silvernail | |

Chairman and Chief Executive Officer | |

Fourth Quarter 2015 Segment Highlights

Fluid & Metering Technologies

• | Sales of $215 million reflected a 5 percent decrease compared to the fourth quarter of 2014 (-5 percent organic, +3 percent acquisition and -3 percent foreign currency translation). |

• | Adjusted operating margin of 25.3 percent represented a 40 basis point increase compared with the fourth quarter of 2014 primarily due to productivity improvements partially offset by lower volume. |

• | Adjusted EBITDA of $61.7 million resulted in an adjusted EBITDA margin of 28.7 percent, a 90 basis point increase compared with the fourth quarter of 2014. |

Health & Science Technologies

• | Sales of $187 million reflected a 1 percent decrease compared to the fourth quarter of 2014 (-2 percent organic, +3 percent acquisitions and -2 percent foreign currency translation). |

• | Adjusted operating margin of 22.3 percent represented a 60 basis point decrease compared with the fourth quarter of 2014 primarily due to lower volume. |

• | Adjusted EBITDA of $52.5 million resulted in an adjusted EBITDA margin of 28.1 percent, a 40 basis point decrease compared with the fourth quarter of 2014. |

Fire & Safety/Diversified Products

• | Sales of $98 million reflected a 10 percent decrease compared to the fourth quarter of 2014 (-6 percent organic and -4 percent foreign currency translation). |

• | Adjusted operating margin of 25.3 percent represented a 280 basis point increase compared with the fourth quarter of 2014 primarily due to favorable mix within the Dispensing platform along with productivity improvements across the entire segment, partially offset by lower volume. |

• | Adjusted EBITDA of $26.7 million resulted in an adjusted EBITDA margin of 27.2 percent, a 290 basis point increase compared with the fourth quarter of 2014. |

For the fourth quarter of 2015, Fluid & Metering Technologies contributed 43 percent of sales, 44 percent of operating income and 43 percent of EBITDA; Health & Science Technologies accounted for 37 percent of sales, 35 percent of operating income and 38 percent of EBITDA; and Fire & Safety/Diversified Products represented 20 percent of sales, 21 percent of operating income and 19 percent of EBITDA.

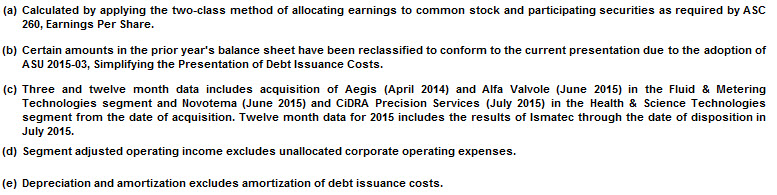

Non-U.S. GAAP Measures of Financial Performance

The Company supplements certain U.S. GAAP financial performance metrics with non-U.S. GAAP financial performance metrics in order to provide investors with better insight and increased transparency while also

allowing for a more comprehensive understanding of the financial information used by management in its decision making. Reconciliations of non-U.S. GAAP financial performance metrics to their most comparable U.S. GAAP financial performance metrics are defined and presented below and in no way are considered a substitute for, nor superior to, the financial data prepared in accordance with U.S. GAAP. There were no adjustments to U.S. GAAP financial performance metrics other than the items noted below.

• | Adjusted operating income is calculated as operating income plus restructuring expenses less the gain on sale of a business. |

• | Adjusted operating margin is calculated as adjusted operating income divided by net sales. |

• | Adjusted net income is calculated as net income plus restructuring expenses less the gain on sale of a business, net of the statutory tax expense/benefit. |

• | Consolidated EBITDA is calculated as net income plus interest expense plus provision for income taxes plus depreciation and amortization; while segment EBITDA is calculated as operating income plus or minus other income (expense) plus depreciation and amortization. |

• | Adjusted EBITDA is calculated as EBITDA plus restructuring expenses less the gain on sale of a business. |

• | Free cash flow is calculated as cash flow from operating activities less capital expenditures plus the excess tax benefit from share-based compensation. |

Conference Call to be Broadcast over the Internet

IDEX will broadcast its fourth quarter earnings conference call over the Internet on Thursday, January 28, 2016 at 9:30 a.m. CT. Chairman and Chief Executive Officer Andy Silvernail and Senior Vice President and Chief Financial Officer Heath Mitts will discuss the Company’s recent financial performance and respond to questions from the financial analyst community. IDEX invites interested investors to listen to the call and view the accompanying slide presentation, which will be carried live on its website at www.idexcorp.com. Those who wish to participate should log on several minutes before the discussion begins. After clicking on the presentation icon, investors should follow the instructions to ensure their systems are set up to hear the event and view the presentation slides, or download the correct applications at no charge. Investors will also be able to hear a replay of the call by dialing 877.660.6853 (or 201.612.7415 for international participants) using the ID #13620002.

Forward-Looking Statements

This news release contains “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. These statements may relate to, among other things, capital expenditures, acquisitions, cost reductions, cash flow, revenues, earnings, market conditions, global economies and operating improvements, and are indicated by words or phrases such as “anticipate,” “estimate,” “plans,” “expects,” “projects,” “forecasts,” “should,” “could,” “will,” “management believes,” “the company believes,” “the company intends,” and similar words or phrases. These statements are subject to inherent uncertainties and risks that could cause actual results to differ materially from those anticipated at the date of this news release. The risks and uncertainties include, but are not limited to, the following: economic and political consequences resulting

from terrorist attacks and wars; levels of industrial activity and economic conditions in the U.S. and other countries around the world; pricing pressures and other competitive factors, and levels of capital spending in certain industries - all of which could have a material impact on order rates and IDEX’s results, particularly in light of the low levels of order backlogs it typically maintains; its ability to make acquisitions and to integrate and operate acquired businesses on a profitable basis; the relationship of the U.S. dollar to other currencies and its impact on pricing and cost competitiveness; political and economic conditions in foreign countries in which the company operates; interest rates; capacity utilization and the effect this has on costs; labor markets; market conditions and material costs; and developments with respect to contingencies, such as litigation and environmental matters. Additional factors that could cause actual results to differ materially from those reflected in the forward-looking statements include, but are not limited to, the risks discussed in the “Risk Factors” section included in the Company’s most recent annual report on Form 10-K filed with the SEC and the other risks discussed in the Company’s filings with the SEC. The forward-looking statements included here are only made as of the date of this news release, and management undertakes no obligation to publicly update them to reflect subsequent events or circumstances, except as may be required by law. Investors are cautioned not to rely unduly on forward-looking statements when evaluating the information presented here.

About IDEX

IDEX Corporation is an applied solutions company specializing in fluid and metering technologies, health and science technologies, and fire, safety and other diversified products built to its customers’ exacting specifications. Its products are sold in niche markets to a wide range of industries throughout the world. IDEX shares are traded on the New York Stock Exchange and Chicago Stock Exchange under the symbol “IEX”.

For further information on IDEX Corporation and its business units, visit the company’s website at www.idexcorp.com.

(Financial reports follow)