Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EQUITY BANCSHARES INC | d110390d8k.htm |

| EX-99.1 - EX-99.1 - EQUITY BANCSHARES INC | d110390dex991.htm |

2015 Results Presentation January 29, 2016 Exhibit 99.2

Forward Looking Statements This presentation has been prepared by Equity Bancshares, Inc. (“Equity or EQBK” or the “Company”) solely for informational purposes based on its own information, as well as information from public sources. This presentation has been prepared to assist interested parties in making their own evaluation of EQBK and does not purport to contain all of the information that may be relevant. In all cases, interested parties should conduct their own investigation and analysis of EQBK and the information included in the prospectus related to the offering. This presentation does not constitute an offer to sell, nor a solicitation of an offer to buy, any securities of EQBK by any person in any jurisdiction in which it is unlawful for such person to make such an offering or solicitation. Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of the securities of EQBK or passed upon the accuracy or adequacy of this presentation. Any representation to the contrary is a criminal offense. Except as otherwise indicated, this presentation speaks as of the date hereof. The delivery of this presentation shall not, under any circumstances, create any implication that there has been no change in the affairs of the Company after the date hereof. Market data used in this presentation has been obtained from independent industry sources and publications as well as from research reports prepared for other purposes. Industry publications and surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable. EQBK has not independently verified the data obtained from these sources. Forward-looking information obtained from these sources is subject to the same qualifications and the additional uncertainties regarding the other forward-looking statements in this presentation. From time to time, EQBK may make forward-looking statements that reflect the Company’s views with respect to, among other things, projected growth, future financial performance, and management’s long-term performance goals. Words such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would” and “outlook,” or the negative version of those words or other comparable words are intended to identify forward-looking statements, but are not the exclusive means of identifying such statements. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about the Company’s industry and its business, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond the Company’s control. Accordingly, you are cautioned that any such forward-looking statements are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the expected results expressed or implied by such forward-looking statements. Any forward-looking statement speaks only as of the date on which it was made, and unless otherwise required by law, the Company does not undertake any obligation to update or review any forward-looking statements, whether as a result of new information, future developments or otherwise.

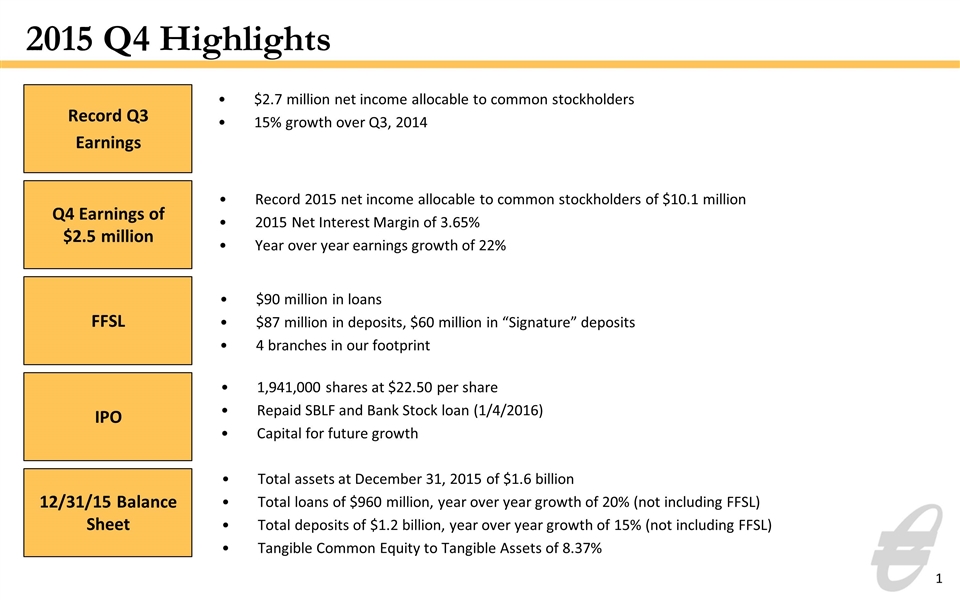

$2.7 million net income allocable to common stockholders 15% growth over Q3, 2014 1 Record 2015 net income allocable to common stockholders of $10.1 million 2015 Net Interest Margin of 3.65% Year over year earnings growth of 22% $90 million in loans $87 million in deposits, $60 million in “Signature” deposits 4 branches in our footprint 1,941,000 shares at $22.50 per share Repaid SBLF and Bank Stock loan (1/4/2016) Capital for future growth Total assets at December 31, 2015 of $1.6 billion Total loans of $960 million, year over year growth of 20% (not including FFSL) Total deposits of $1.2 billion, year over year growth of 15% (not including FFSL) Tangible Common Equity to Tangible Assets of 8.37% 2015 Q4 Highlights Record Q3 Earnings Q4 Earnings of $2.5 million FFSL IPO 12/31/15 Balance Sheet

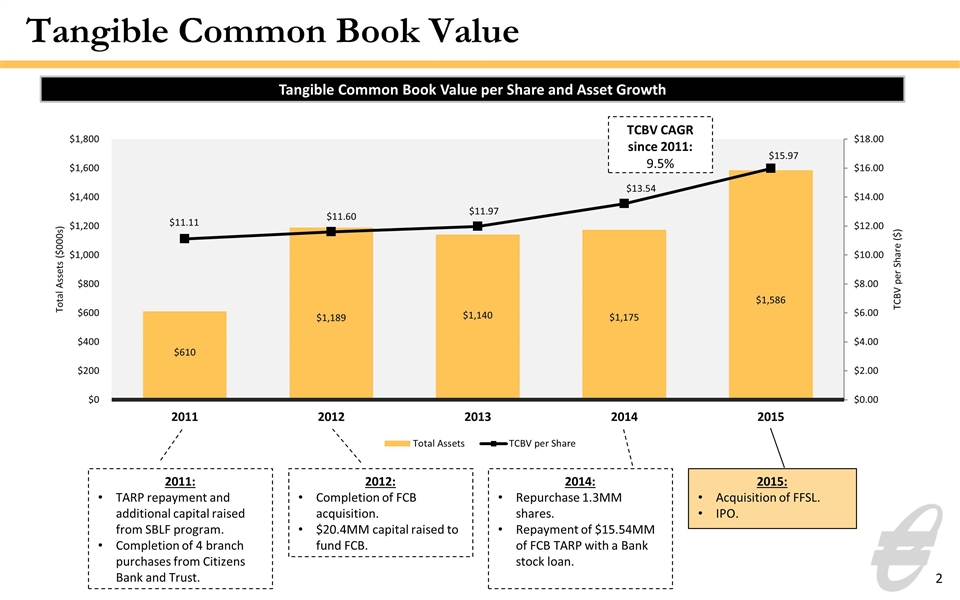

Tangible Common Book Value 2 Tangible Common Book Value per Share and Asset Growth 2011: TARP repayment and additional capital raised from SBLF program. Completion of 4 branch purchases from Citizens Bank and Trust. 2012: Completion of FCB acquisition. $20.4MM capital raised to fund FCB. 2014: Repurchase 1.3MM shares. Repayment of $15.54MM of FCB TARP with a Bank stock loan. 2015: Acquisition of FFSL. IPO. TCBV CAGR since 2011: 9.5%

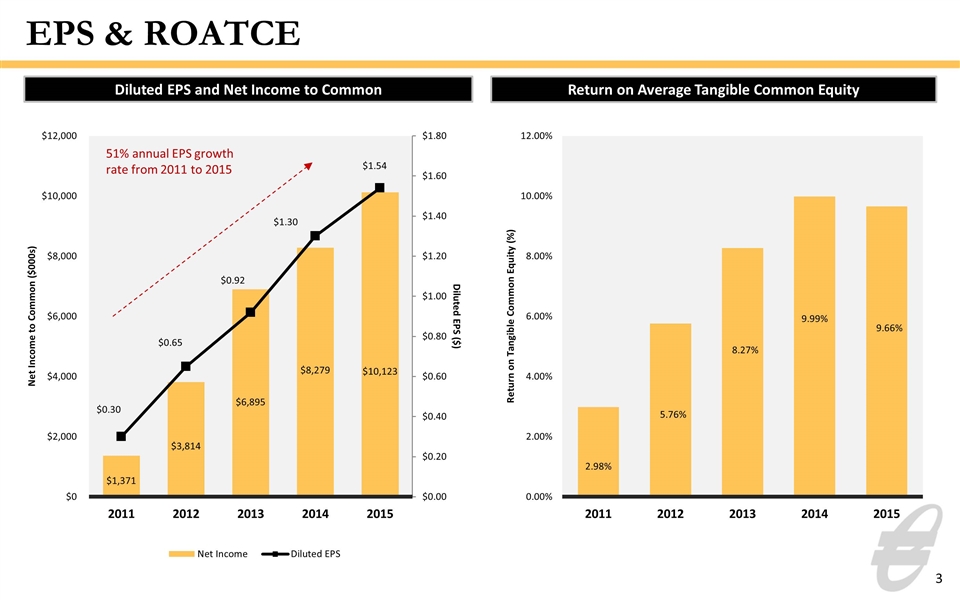

EPS & ROATCE Diluted EPS and Net Income to Common Return on Average Tangible Common Equity 51% annual EPS growth rate from 2011 to 2015 3

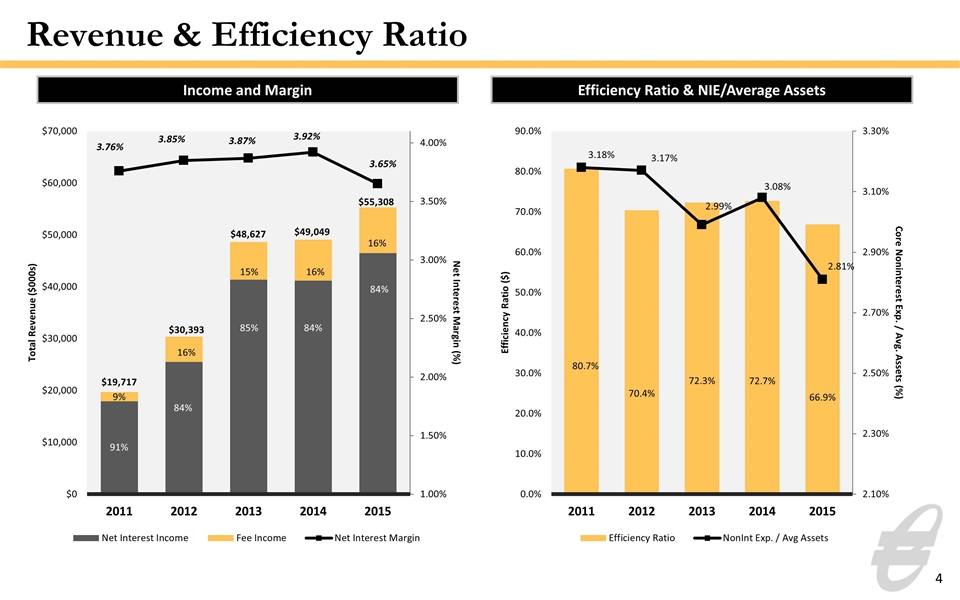

Revenue & Efficiency Ratio Efficiency Ratio & NIE/Average Assets Income and Margin 4 91% 84% 85% 84% 84% 9% 16% 15% 16% 16% $19,717 $30,393 $48,627 $49,049 $55,308

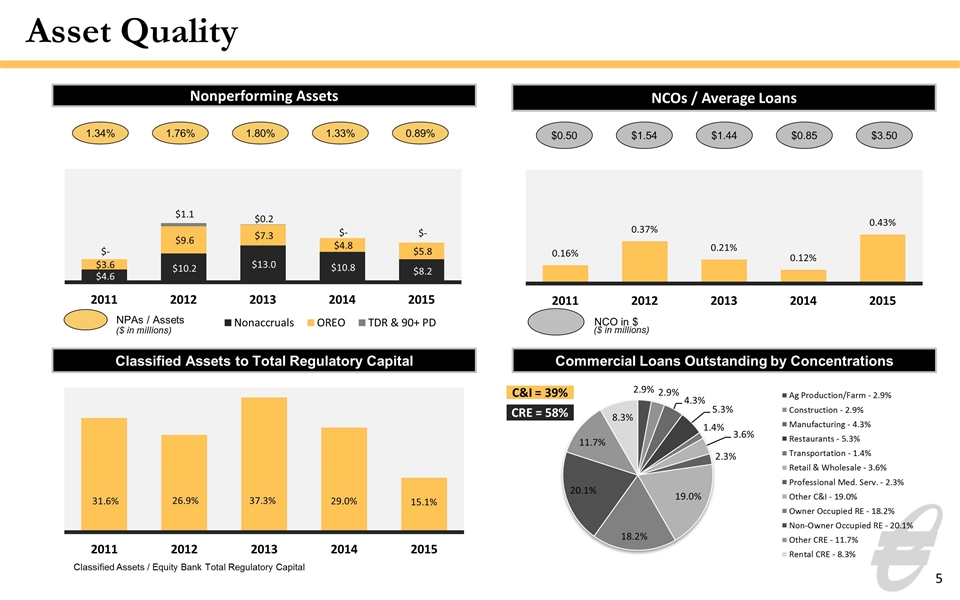

Asset Quality 5 Nonperforming Assets 1.34% 1.76% 1.80% 1.33% NPAs / Assets 0.89% NCOs / Average Loans $0.50 $1.54 $1.44 $0.85 $3.50 NCO in $ ($ in millions) Commercial Loans Outstanding by Concentrations Classified Assets to Total Regulatory Capital CRE = 58% C&I = 39% ($ in millions) Classified Assets / Equity Bank Total Regulatory Capital

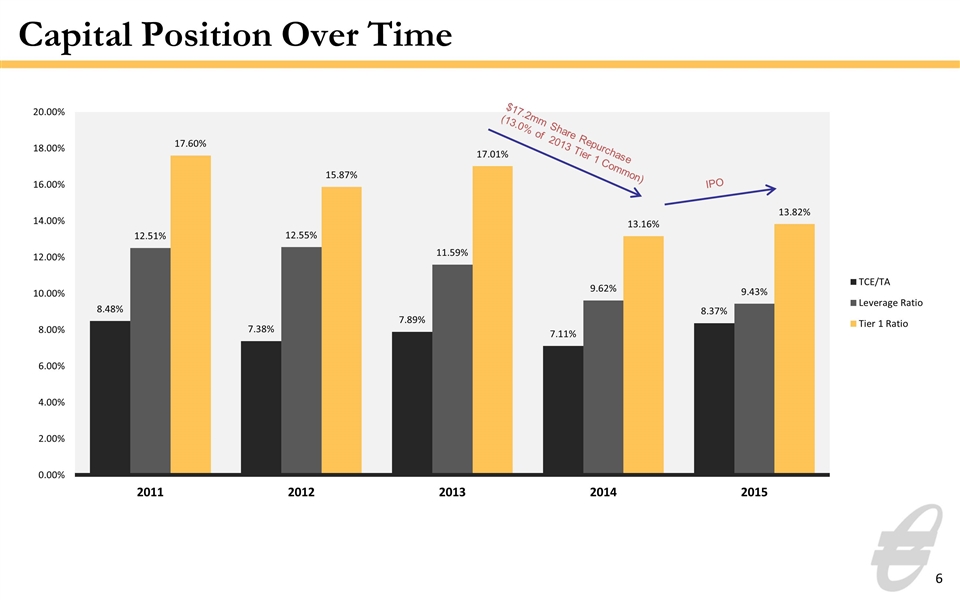

Capital Position Over Time $17.2mm Share Repurchase (13.0% of 2013 Tier 1 Common) 6 IPO

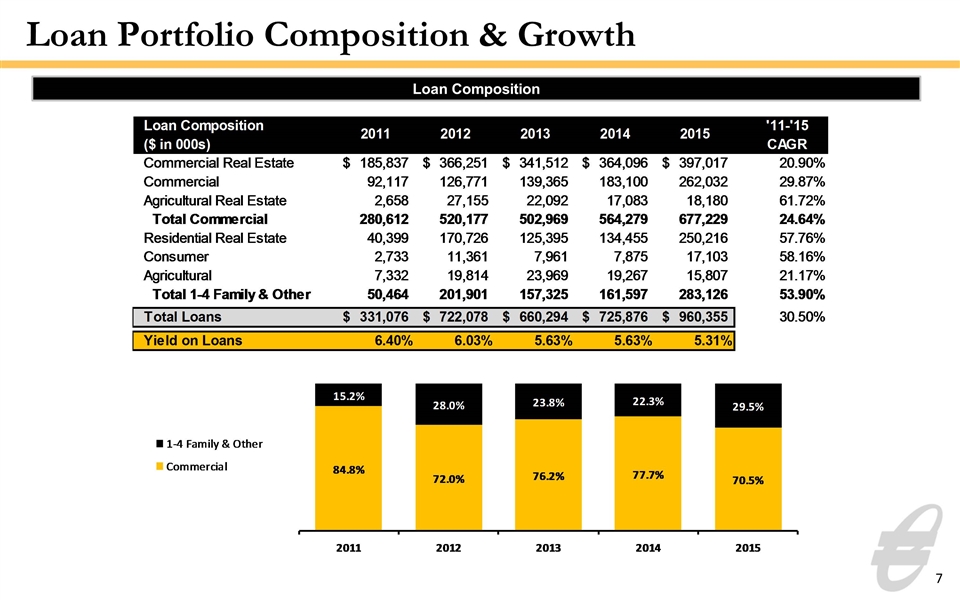

Loan Portfolio Composition & Growth Loan Composition 7 Deposit Portfolio Mix Deposit Composition 2011 2012 2013 2014 2015 '11-'15CAGR ($ in 000s) Time Deposits $,227,022 $,400,003 $,363,210 $,342,160 $,438,612 0.17897105003543534 Signature Deposits ,252,388 ,593,125 ,584,109 ,639,017 ,777,302 0.32473884357339511 Total Deposits $,479,410 $,993,128 $,947,319 $,981,177 $1,215,914 0.2619697434944972 Cost of Deposits 1.3899999999999999E-2 8.3000000000000001E-3 5.3E-3 4.8999999999999998E-3 5.4999999999999997E-3 Deposit Portfolio Mix 2011 2012 2013 2014 2015 Signature Deposits 0.52645543480528145 0.59722915877913019 0.61659166553188527 0.65127596753694794 0.63927383022154527 Time Deposits 0.47354456519471849 0.40277084122086981 0.38340833446811473 0.348724032463052 0.36072616977845473 Loan Composition Loan Composition 2011 2012 2013 2014 2015 '11-'15CAGR ($ in 000s) Commercial Real Estate $,185,837 $,366,251 $,341,512 $,364,096 $,397,017 0.20898031431105868 Commercial 92,117 ,126,771 ,139,365 ,183,100 ,262,032 0.29868443808531397 Agricultural Real Estate 2,658 27,155 22,092 17,083 18,180 0.61718507869826023 Total Commercial ,280,612 ,520,177 ,502,969 ,564,279 ,677,229 0.2463996746705388 Residential Real Estate 40,399 ,170,726 ,125,395 ,134,455 ,250,216 0.57756083387584578 Consumer 2,733 11,361 7,961 7,875 17,103 0.58164191622718531 Agricultural 7,332 19,814 23,969 19,267 15,807 0.21173248032537351 Total 1-4 Family & Other 50,464 ,201,901 ,157,325 ,161,597 ,283,126 0.53903862862770291 Total Loans $,331,076 $,722,078 $,660,294 $,725,876 $,960,355 0.30504661817370793 Yield on Loans 6.4000000000000001E-2 6.0299999999999999E-2 5.6300000000000003E-2 5.6300000000000003E-2 5.3100000000000001E-2 Loan Composition 2011 2012 2013 2014 2015 Commercial 0.84757578320385651 0.72038893305155394 0.76173492413985289 0.77737657671558225 0.70518610305564089 1-4 Family & Other 0.15242421679614349 0.27961106694844601 0.23826507586014714 0.22262342328441773 0.29481389694435911 Deposit Portfolio Mix Deposit Composition 2011 2012 2013 2014 2015 '11-'15CAGR ($ in 000s) Time Deposits $,227,022 $,400,003 $,363,210 $,342,160 $,438,612 0.17897105003543534 Signature Deposits ,252,388 ,593,125 ,584,109 ,639,017 ,777,302 0.32473884357339511 Total Deposits $,479,410 $,993,128 $,947,319 $,981,177 $1,215,914 0.2619697434944972 Cost of Deposits 1.3899999999999999E-2 8.3000000000000001E-3 5.3E-3 4.8999999999999998E-3 5.4999999999999997E-3 Deposit Portfolio Mix 2011 2012 2013 2014 2015 Signature Deposits 0.52645543480528145 0.59722915877913019 0.61659166553188527 0.65127596753694794 0.63927383022154527 Time Deposits 0.47354456519471849 0.40277084122086981 0.38340833446811473 0.348724032463052 0.36072616977845473 Loan Composition Loan Composition 2011 2012 2013 2014 2015 '11-'15CAGR ($ in 000s) Commercial Real Estate $,185,837 $,366,251 $,341,512 $,364,096 $,397,017 0.20898031431105868 Commercial 92,117 ,126,771 ,139,365 ,183,100 ,262,032 0.29868443808531397 Agricultural Real Estate 2,658 27,155 22,092 17,083 18,180 0.61718507869826023 Total Commercial ,280,612 ,520,177 ,502,969 ,564,279 ,677,229 0.2463996746705388 Residential Real Estate 40,399 ,170,726 ,125,395 ,134,455 ,250,216 0.57756083387584578 Consumer 2,733 11,361 7,961 7,875 17,103 0.58164191622718531 Agricultural 7,332 19,814 23,969 19,267 15,807 0.21173248032537351 Total 1-4 Family & Other 50,464 ,201,901 ,157,325 ,161,597 ,283,126 0.53903862862770291 Total Loans $,331,076 $,722,078 $,660,294 $,725,876 $,960,355 0.30504661817370793 Yield on Loans 6.4000000000000001E-2 6.0299999999999999E-2 5.6300000000000003E-2 5.6300000000000003E-2 5.3100000000000001E-2 Loan Composition 2011 2012 2013 2014 2015 Commercial 0.84757578320385651 0.72038893305155394 0.76173492413985289 0.77737657671558225 0.70518610305564089 1-4 Family & Other 0.15242421679614349 0.27961106694844601 0.23826507586014714 0.22262342328441773 0.29481389694435911

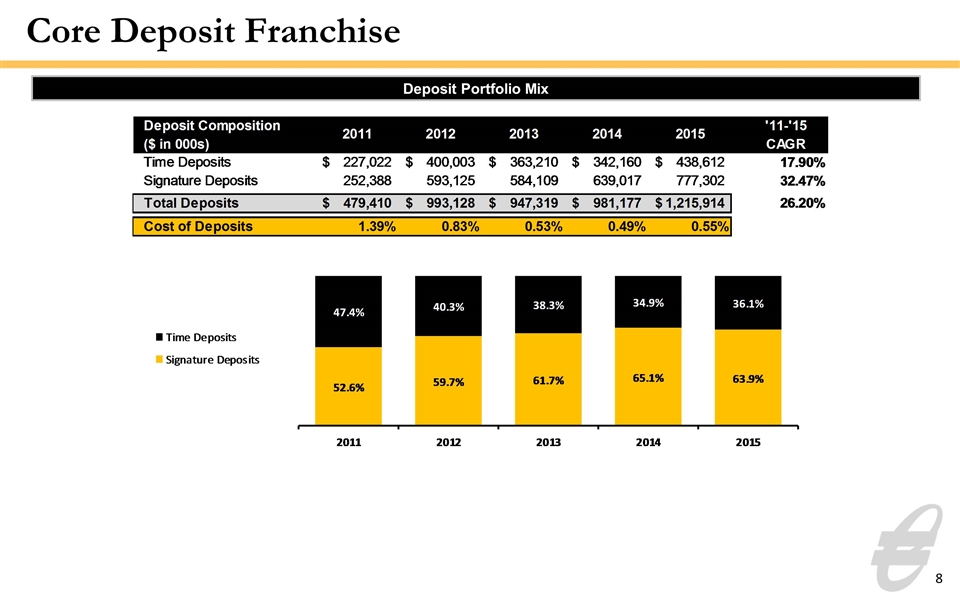

Core Deposit Franchise Deposit Portfolio Mix 8 Deposit Portfolio Mix Deposit Composition 2011 2012 2013 2014 2015 '11-'15CAGR ($ in 000s) Time Deposits $,227,022 $,400,003 $,363,210 $,342,160 $,438,612 0.17897105003543534 Signature Deposits ,252,388 ,593,125 ,584,109 ,639,017 ,777,302 0.32473884357339511 Total Deposits $,479,410 $,993,128 $,947,319 $,981,177 $1,215,914 0.2619697434944972 Cost of Deposits 1.3899999999999999E-2 8.3000000000000001E-3 5.3E-3 4.8999999999999998E-3 5.4999999999999997E-3 Deposit Portfolio Mix 2011 2012 2013 2014 2015 Signature Deposits 0.52645543480528145 0.59722915877913019 0.61659166553188527 0.65127596753694794 0.63927383022154527 Time Deposits 0.47354456519471849 0.40277084122086981 0.38340833446811473 0.348724032463052 0.36072616977845473 Loan Composition Loan Composition 2011 2012 2013 2014 2015 '11-'15CAGR ($ in 000s) Commercial Real Estate $,185,837 $,366,251 $,341,512 $,364,096 $,397,017 0.20898031431105868 Commercial 92,117 ,126,771 ,139,365 ,183,100 ,262,032 0.29868443808531397 Agricultural Real Estate 2,658 27,155 22,092 17,083 18,180 0.61718507869826023 Total Commercial ,280,612 ,520,177 ,502,969 ,564,279 ,677,229 0.2463996746705388 Residential Real Estate 40,399 ,170,726 ,125,395 ,134,455 ,250,216 0.57756083387584578 Consumer 2,733 11,361 7,961 7,875 17,103 0.58164191622718531 Agricultural 7,332 19,814 23,969 19,267 15,807 0.21173248032537351 Total 1-4 Family & Other 50,464 ,201,901 ,157,325 ,161,597 ,283,126 0.53903862862770291 Total Loans $,331,076 $,722,078 $,660,294 $,725,876 $,960,355 0.30504661817370793 Yield on Loans 6.4000000000000001E-2 6.0299999999999999E-2 5.6300000000000003E-2 5.6300000000000003E-2 5.3100000000000001E-2 Loan Composition 2011 2012 2013 2014 2015 Commercial 0.84757578320385651 0.72038893305155394 0.76173492413985289 0.77737657671558225 0.70518610305564089 1-4 Family & Other 0.15242421679614349 0.27961106694844601 0.23826507586014714 0.22262342328441773 0.29481389694435911 Deposit Portfolio Mix Deposit Composition 2011 2012 2013 2014 2015 '11-'15CAGR ($ in 000s) Time Deposits $,227,022 $,400,003 $,363,210 $,342,160 $,438,612 0.17897105003543534 Signature Deposits ,252,388 ,593,125 ,584,109 ,639,017 ,777,302 0.32473884357339511 Total Deposits $,479,410 $,993,128 $,947,319 $,981,177 $1,215,914 0.2619697434944972 Cost of Deposits 1.3899999999999999E-2 8.3000000000000001E-3 5.3E-3 4.8999999999999998E-3 5.4999999999999997E-3 Deposit Portfolio Mix 2011 2012 2013 2014 2015 Signature Deposits 0.52645543480528145 0.59722915877913019 0.61659166553188527 0.65127596753694794 0.63927383022154527 Time Deposits 0.47354456519471849 0.40277084122086981 0.38340833446811473 0.348724032463052 0.36072616977845473 Loan Composition Loan Composition 2011 2012 2013 2014 2015 '11-'15CAGR ($ in 000s) Commercial Real Estate $,185,837 $,366,251 $,341,512 $,364,096 $,397,017 0.20898031431105868 Commercial 92,117 ,126,771 ,139,365 ,183,100 ,262,032 0.29868443808531397 Agricultural Real Estate 2,658 27,155 22,092 17,083 18,180 0.61718507869826023 Total Commercial ,280,612 ,520,177 ,502,969 ,564,279 ,677,229 0.2463996746705388 Residential Real Estate 40,399 ,170,726 ,125,395 ,134,455 ,250,216 0.57756083387584578 Consumer 2,733 11,361 7,961 7,875 17,103 0.58164191622718531 Agricultural 7,332 19,814 23,969 19,267 15,807 0.21173248032537351 Total 1-4 Family & Other 50,464 ,201,901 ,157,325 ,161,597 ,283,126 0.53903862862770291 Total Loans $,331,076 $,722,078 $,660,294 $,725,876 $,960,355 0.30504661817370793 Yield on Loans 6.4000000000000001E-2 6.0299999999999999E-2 5.6300000000000003E-2 5.6300000000000003E-2 5.3100000000000001E-2 Loan Composition 2011 2012 2013 2014 2015 Commercial 0.84757578320385651 0.72038893305155394 0.76173492413985289 0.77737657671558225 0.70518610305564089 1-4 Family & Other 0.15242421679614349 0.27961106694844601 0.23826507586014714 0.22262342328441773 0.29481389694435911

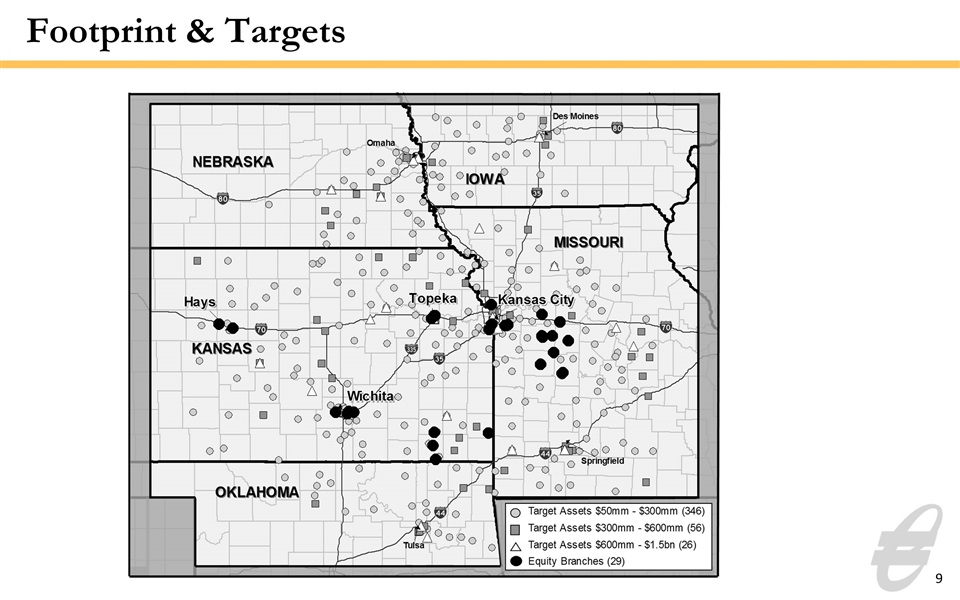

Footprint & Targets 9

Appendix 10

The subsequent tables present non-GAAP reconciliations of the following calculations: Tangible Common Equity (TCE) to Tangible Assets (TA) ratio Tangible Book Value per Common Share Return on average tangible common equity (ROATCE) Efficiency Ratio 11

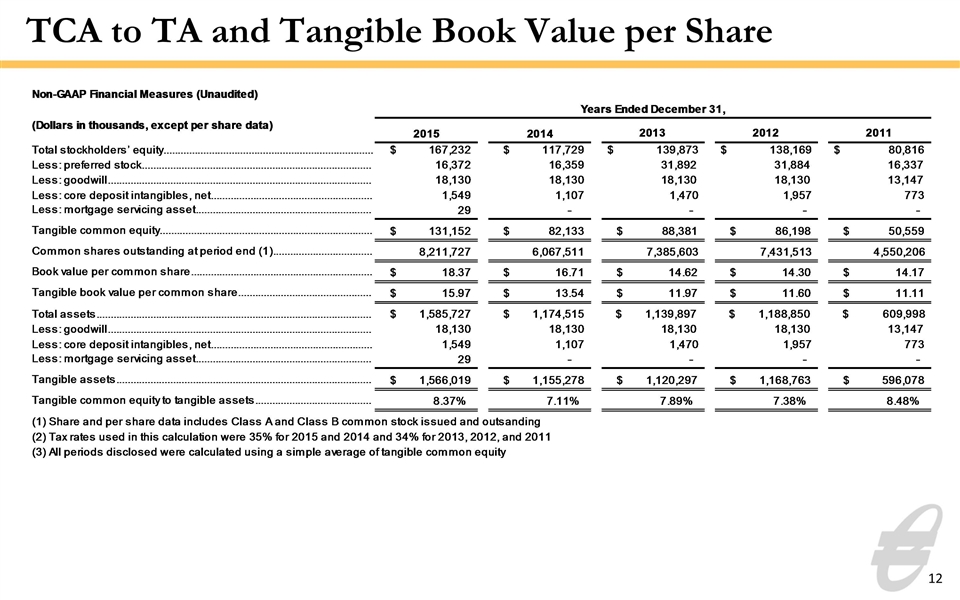

TCA to TA and Tangible Book Value per Share 12 Non-GAAP Financial Measures (Unaudited) Years Ended December 31, (Dollars in thousands, except per share data) 2015 2014 2013 2012 2011 Total stockholders’ equity $,167,232 $,117,729 $,139,873 $,138,169 $80,816 Less: preferred stock 16,372 16,359 31,892 31,884 16,337 Less: goodwill 18,130 18,130 18,130 18,130 13,147 Less: core deposit intangibles, net 1,549 1,107 1,470 1,957 773 Less: mortgage servicing asset 29 0 0 0 0 Tangible common equity $,131,152 $82,133 $88,381 $86,198 $50,559 Common shares outstanding at period end (1) 8,211,727 6,067,511 7,385,603 7,431,513 4,550,206 Book value per common share $18.371287793663868 $16.707015446696349 $14.620471747533681 $14.301932863469389 $14.170567222670797 Tangible book value per common share $15.971305426982656 $13.536522636712155 $11.966660000544303 $11.598983948490705 $11.111365067867256 Total assets $1,585,727 $1,174,515 $1,139,897 $1,188,850 $,609,998 Less: goodwill 18,130 18,130 18,130 18,130 13,147 Less: core deposit intangibles, net 1,549 1,107 1,470 1,957 773 Less: mortgage servicing asset 29 0 0 0 0 Tangible assets $1,566,019 $1,155,278 $1,120,297 $1,168,763 $,596,078 Tangible common equity to tangible assets 8.3748664607517537E-2 7.1093710777838756E-2 7.8890687023173325E-2 7.3751479127932701E-2 8.481943638248686E-2 (1) Share and per share data includes Class A and Class B common stock issued and outsanding (2) Tax rates used in this calculation were 35% for 2015 and 2014 and 34% for 2013, 2012, and 2011 (3) All periods disclosed were calculated using a simple average of tangible common equity Non-GAAP Financial Measures, continued (Unaudited) Years Ended December 31, (Dollars in thousands, except per share data) 2015 2014 2013 2012 2011 Total average stockholders' equity $,137,936 $,123,174 $,137,913 $,102,032 $75,253 Less: average intangible assets and preferred stock 31,294 37,917 50,623 33,653 25,148 Average tangible common equity (1) (3) $,106,642 $85,257 $87,290 $68,379 $50,105 Net income allocable to common stockholders (1) 10,123 8,279 6,895 3,814 1,371 Amortization of core deposit intangible 275 363 487 192 182 Less: tax effect of amortization of core deposit intangible (2) -96 -,127 -,166 -65 -62 Adjusted net income allocable to common stockholders $10,302 $8,515 $7,216 $3,941 $1,491 Return on average tangible common equity (ROATCE) 9.6603589580090396E-2 9.98744971087418E-2 8.2666972161759653E-2 5.7634653914213428E-2 2.9757509230615709E-2 Non-interest expense $38,575 $35,645 $35,137 $22,900 $15,918 Less: merger expenses 1,691 0 0 1,519 0 Less: loss on debt extinguishment 316 0 0 0 0 Non-interest expense, excluding merger expenses and loss on debt extinguishment $36,568 $35,645 $35,137 $21,381 $15,918 Net interest income $46,262 $41,361 $41,235 $25,570 $17,890 Non-interest income $9,802 $8,674 $7,892 $4,826 $2,252 Less: net gains on sales and settlement of securities 756 986 500 3 425 Less: net gain on acquisition 682 0 0 0 0 Non-interest income, excluding net gains on sales and settlement of securities and net gain on acquisition $8,364 $7,688 $7,392 $4,823 $1,827 Efficiency ratio 0.6694248160216747 0.72672225733450224 0.72258210459209904 0.70348435495015305 0.8073236293553786 ____________________ (1) Share and per share data includes Class A and Class B common stock issued and outsanding (2) Tax rates used in this calculation were 35% for 2015 and 2014 and 34% for 2013, 2012, and 2011 (3) All periods disclosed were calculated using a simple average of tangible common equity Non-GAAP Financial Measures (Unaudited) Years Ended December 31, (Dollars in thousands, except per share data) 2015 2014 2013 2012 2011 Total stockholders’ equity $,167,232 $,117,729 $,139,873 $,138,169 $80,816 Less: preferred stock 16,372 16,359 31,892 31,884 16,337 Less: goodwill 18,130 18,130 18,130 18,130 13,147 Less: core deposit intangibles, net 1,549 1,107 1,470 1,957 773 Less: mortgage servicing asset 29 0 0 0 0 Tangible common equity $,131,152 $82,133 $88,381 $86,198 $50,559 Common shares outstanding at period end (1) 8,211,727 6,067,511 7,385,603 7,431,513 4,550,206 Book value per common share $18.371287793663868 $16.707015446696349 $14.620471747533681 $14.301932863469389 $14.170567222670797 Tangible book value per common share $15.971305426982656 $13.536522636712155 $11.966660000544303 $11.598983948490705 $11.111365067867256 Total assets $1,585,727 $1,174,515 $1,139,897 $1,188,850 $,609,998 Less: goodwill 18,130 18,130 18,130 18,130 13,147 Less: core deposit intangibles, net 1,549 1,107 1,470 1,957 773 Less: mortgage servicing asset 29 0 0 0 0 Tangible assets $1,566,019 $1,155,278 $1,120,297 $1,168,763 $,596,078 Tangible common equity to tangible assets 8.3748664607517537E-2 7.1093710777838756E-2 7.8890687023173325E-2 7.3751479127932701E-2 8.481943638248686E-2 (1) Share and per share data includes Class A and Class B common stock issued and outsanding (2) Tax rates used in this calculation were 35% for 2015 and 2014 and 34% for 2013, 2012, and 2011 (3) All periods disclosed were calculated using a simple average of tangible common equity Non-GAAP Financial Measures, continued (Unaudited) Years Ended December 31, (Dollars in thousands, except per share data) 2015 2014 2013 2012 2011 Total average stockholders' equity $,137,936 $,123,174 $,137,913 $,102,032 $75,253 Less: average intangible assets and preferred stock 31,294 37,917 50,623 33,653 25,148 Average tangible common equity (1) (3) $,106,642 $85,257 $87,290 $68,379 $50,105 Net income allocable to common stockholders (1) 10,123 8,279 6,895 3,814 1,371 Amortization of core deposit intangible 275 363 487 192 182 Less: tax effect of amortization of core deposit intangible (2) -96 -,127 -,166 -65 -62 Adjusted net income allocable to common stockholders $10,302 $8,515 $7,216 $3,941 $1,491 Return on average tangible common equity (ROATCE) 9.6603589580090396E-2 9.98744971087418E-2 8.2666972161759653E-2 5.7634653914213428E-2 2.9757509230615709E-2 Non-interest expense $38,575 $35,645 $35,137 $22,900 $15,918 Less: merger expenses 1,691 0 0 1,519 0 Less: loss on debt extinguishment 316 0 0 0 0 Non-interest expense, excluding merger expenses and loss on debt extinguishment $36,568 $35,645 $35,137 $21,381 $15,918 Net interest income $46,262 $41,361 $41,235 $25,570 $17,890 Non-interest income $9,802 $8,674 $7,892 $4,826 $2,252 Less: net gains on sales and settlement of securities 756 986 500 3 425 Less: net gain on acquisition 682 0 0 0 0 Non-interest income, excluding net gains on sales and settlement of securities and net gain on acquisition $8,364 $7,688 $7,392 $4,823 $1,827 Efficiency ratio 0.6694248160216747 0.72672225733450224 0.72258210459209904 0.70348435495015305 0.8073236293553786 ____________________ (1) Share and per share data includes Class A and Class B common stock issued and outsanding (2) Tax rates used in this calculation were 35% for 2015 and 2014 and 34% for 2013, 2012, and 2011 (3) All periods disclosed were calculated using a simple average of tangible common equity

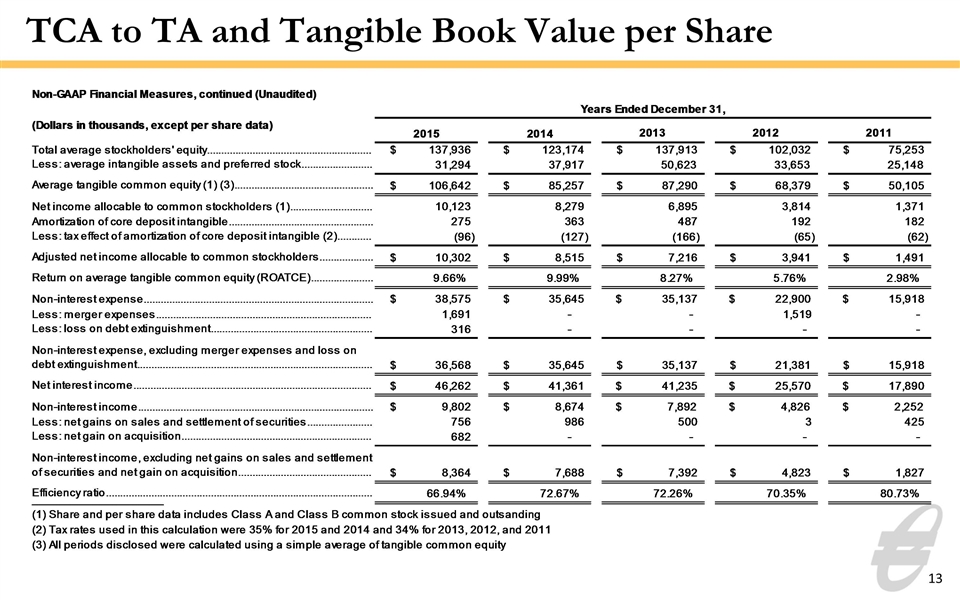

TCA to TA and Tangible Book Value per Share 13 Non-GAAP Financial Measures (Unaudited) Years Ended December 31, (Dollars in thousands, except per share data) 2015 2014 2013 2012 2011 Total stockholders’ equity $,167,232 $,117,729 $,139,873 $,138,169 $80,816 Less: preferred stock 16,372 16,359 31,892 31,884 16,337 Less: goodwill 18,130 18,130 18,130 18,130 13,147 Less: core deposit intangibles, net 1,549 1,107 1,470 1,957 773 Less: mortgage servicing asset 29 0 0 0 0 Tangible common equity $,131,152 $82,133 $88,381 $86,198 $50,559 Common shares outstanding at period end (1) 8,211,727 6,067,511 7,385,603 7,431,513 4,550,206 Book value per common share $18.371287793663868 $16.707015446696349 $14.620471747533681 $14.301932863469389 $14.170567222670797 Tangible book value per common share $15.971305426982656 $13.536522636712155 $11.966660000544303 $11.598983948490705 $11.111365067867256 Total assets $1,585,727 $1,174,515 $1,139,897 $1,188,850 $,609,998 Less: goodwill 18,130 18,130 18,130 18,130 13,147 Less: core deposit intangibles, net 1,549 1,107 1,470 1,957 773 Less: mortgage servicing asset 29 0 0 0 0 Tangible assets $1,566,019 $1,155,278 $1,120,297 $1,168,763 $,596,078 Tangible common equity to tangible assets 8.3748664607517537E-2 7.1093710777838756E-2 7.8890687023173325E-2 7.3751479127932701E-2 8.481943638248686E-2 (1) Share and per share data includes Class A and Class B common stock issued and outsanding (2) Tax rates used in this calculation were 35% for 2015 and 2014 and 34% for 2013, 2012, and 2011 (3) All periods disclosed were calculated using a simple average of tangible common equity Non-GAAP Financial Measures, continued (Unaudited) Years Ended December 31, (Dollars in thousands, except per share data) 2015 2014 2013 2012 2011 Total average stockholders' equity $,137,936 $,123,174 $,137,913 $,102,032 $75,253 Less: average intangible assets and preferred stock 31,294 37,917 50,623 33,653 25,148 Average tangible common equity (1) (3) $,106,642 $85,257 $87,290 $68,379 $50,105 Net income allocable to common stockholders (1) 10,123 8,279 6,895 3,814 1,371 Amortization of core deposit intangible 275 363 487 192 182 Less: tax effect of amortization of core deposit intangible (2) -96 -,127 -,166 -65 -62 Adjusted net income allocable to common stockholders $10,302 $8,515 $7,216 $3,941 $1,491 Return on average tangible common equity (ROATCE) 9.6603589580090396E-2 9.98744971087418E-2 8.2666972161759653E-2 5.7634653914213428E-2 2.9757509230615709E-2 Non-interest expense $38,575 $35,645 $35,137 $22,900 $15,918 Less: merger expenses 1,691 0 0 1,519 0 Less: loss on debt extinguishment 316 0 0 0 0 Non-interest expense, excluding merger expenses and loss on debt extinguishment $36,568 $35,645 $35,137 $21,381 $15,918 Net interest income $46,262 $41,361 $41,235 $25,570 $17,890 Non-interest income $9,802 $8,674 $7,892 $4,826 $2,252 Less: net gains on sales and settlement of securities 756 986 500 3 425 Less: net gain on acquisition 682 0 0 0 0 Non-interest income, excluding net gains on sales and settlement of securities and net gain on acquisition $8,364 $7,688 $7,392 $4,823 $1,827 Efficiency ratio 0.6694248160216747 0.72672225733450224 0.72258210459209904 0.70348435495015305 0.8073236293553786 ____________________ (1) Share and per share data includes Class A and Class B common stock issued and outsanding (2) Tax rates used in this calculation were 35% for 2015 and 2014 and 34% for 2013, 2012, and 2011 (3) All periods disclosed were calculated using a simple average of tangible common equity Non-GAAP Financial Measures (Unaudited) Years Ended December 31, (Dollars in thousands, except per share data) 2015 2014 2013 2012 2011 Total stockholders’ equity $,167,232 $,117,729 $,139,873 $,138,169 $80,816 Less: preferred stock 16,372 16,359 31,892 31,884 16,337 Less: goodwill 18,130 18,130 18,130 18,130 13,147 Less: core deposit intangibles, net 1,549 1,107 1,470 1,957 773 Less: mortgage servicing asset 29 0 0 0 0 Tangible common equity $,131,152 $82,133 $88,381 $86,198 $50,559 Common shares outstanding at period end (1) 8,211,727 6,067,511 7,385,603 7,431,513 4,550,206 Book value per common share $18.371287793663868 $16.707015446696349 $14.620471747533681 $14.301932863469389 $14.170567222670797 Tangible book value per common share $15.971305426982656 $13.536522636712155 $11.966660000544303 $11.598983948490705 $11.111365067867256 Total assets $1,585,727 $1,174,515 $1,139,897 $1,188,850 $,609,998 Less: goodwill 18,130 18,130 18,130 18,130 13,147 Less: core deposit intangibles, net 1,549 1,107 1,470 1,957 773 Less: mortgage servicing asset 29 0 0 0 0 Tangible assets $1,566,019 $1,155,278 $1,120,297 $1,168,763 $,596,078 Tangible common equity to tangible assets 8.3748664607517537E-2 7.1093710777838756E-2 7.8890687023173325E-2 7.3751479127932701E-2 8.481943638248686E-2 (1) Share and per share data includes Class A and Class B common stock issued and outsanding (2) Tax rates used in this calculation were 35% for 2015 and 2014 and 34% for 2013, 2012, and 2011 (3) All periods disclosed were calculated using a simple average of tangible common equity Non-GAAP Financial Measures, continued (Unaudited) Years Ended December 31, (Dollars in thousands, except per share data) 2015 2014 2013 2012 2011 Total average stockholders' equity $,137,936 $,123,174 $,137,913 $,102,032 $75,253 Less: average intangible assets and preferred stock 31,294 37,917 50,623 33,653 25,148 Average tangible common equity (1) (3) $,106,642 $85,257 $87,290 $68,379 $50,105 Net income allocable to common stockholders (1) 10,123 8,279 6,895 3,814 1,371 Amortization of core deposit intangible 275 363 487 192 182 Less: tax effect of amortization of core deposit intangible (2) -96 -,127 -,166 -65 -62 Adjusted net income allocable to common stockholders $10,302 $8,515 $7,216 $3,941 $1,491 Return on average tangible common equity (ROATCE) 9.6603589580090396E-2 9.98744971087418E-2 8.2666972161759653E-2 5.7634653914213428E-2 2.9757509230615709E-2 Non-interest expense $38,575 $35,645 $35,137 $22,900 $15,918 Less: merger expenses 1,691 0 0 1,519 0 Less: loss on debt extinguishment 316 0 0 0 0 Non-interest expense, excluding merger expenses and loss on debt extinguishment $36,568 $35,645 $35,137 $21,381 $15,918 Net interest income $46,262 $41,361 $41,235 $25,570 $17,890 Non-interest income $9,802 $8,674 $7,892 $4,826 $2,252 Less: net gains on sales and settlement of securities 756 986 500 3 425 Less: net gain on acquisition 682 0 0 0 0 Non-interest income, excluding net gains on sales and settlement of securities and net gain on acquisition $8,364 $7,688 $7,392 $4,823 $1,827 Efficiency ratio 0.6694248160216747 0.72672225733450224 0.72258210459209904 0.70348435495015305 0.8073236293553786 ____________________ (1) Share and per share data includes Class A and Class B common stock issued and outsanding (2) Tax rates used in this calculation were 35% for 2015 and 2014 and 34% for 2013, 2012, and 2011 (3) All periods disclosed were calculated using a simple average of tangible common equity