Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - CMS ENERGY CORP | d55322d8k.htm |

Exhibit 99.1

Exhibit 99.1

Investor Call January 27, 2016

Jackson Gas Plant

Among lowest acquisition cost ever

Compressor station

#1 LDC in gas storage

Cross Winds Energy Park

#2 in renewable sales in the Great Lakes area

This presentation is made as of the date hereof and contains “forward-looking statements” as defined in Rule 3b-6 of the

Securities Exchange Act of 1934, Rule 175 of the Securities Act of 1933, and relevant legal decisions. The forward-looking statements are subject to risks and

uncertainties. All forward-looking statements should be considered in the context of the risk and other factors detailed from time to time in CMS Energy’s and Consumers Energy’s Securities and Exchange Commission filings. Forward-looking

statements should be read in conjunction with “FORWARD-LOOKING STATEMENTS AND

INFORMATION” and “RISK FACTORS” sections of CMS Energy’s and

Consumers Energy’s Form 10-K for the year ended

December 31, 2014 and as updated in subsequent 10-Qs. CMS Energy’s and Consumers Energy’s

“FORWARD-LOOKING

STATEMENTS AND INFORMATION” and “RISK FACTORS” sections are incorporated herein by reference and discuss important factors

that could cause CMS Energy’s and Consumers Energy’s results to differ materially from those anticipated in such statements. CMS Energy and Consumers Energy undertake no obligation to update any of the information presented herein to

reflect facts, events or circumstances after the date hereof.

The presentation also includes non-GAAP measures when describing CMS Energy’s results of

operations and financial performance. A reconciliation of each of these measures to the most directly comparable GAAP measure is posted on our website at www.cmsenergy.com.

CMS Energy provides historical financial results on both a reported (Generally Accepted Accounting Principles) and adjusted (non-GAAP) basis and provides forward-looking guidance

on an adjusted basis. Management views adjusted earnings as a key measure of the company’s present operating financial performance, unaffected by discontinued operations, asset sales, impairments, regulatory items from prior years, or other

items. These items have the potential to impact, favorably or unfavorably, the company’s reported earnings in future periods.

Investors and others should note

that CMS Energy routinely posts important information on its website and considers the Investor Relations section, www.cmsenergy.com/investor-relations, a channel of distribution.

| 1 |

Agenda

Dividend

Succession Plan

Earnings Call Preview

| 2 |

Dividend

Raised annual dividend 7% from $1.16 to

$1.24

Tenth year consecutive increase

| 3 |

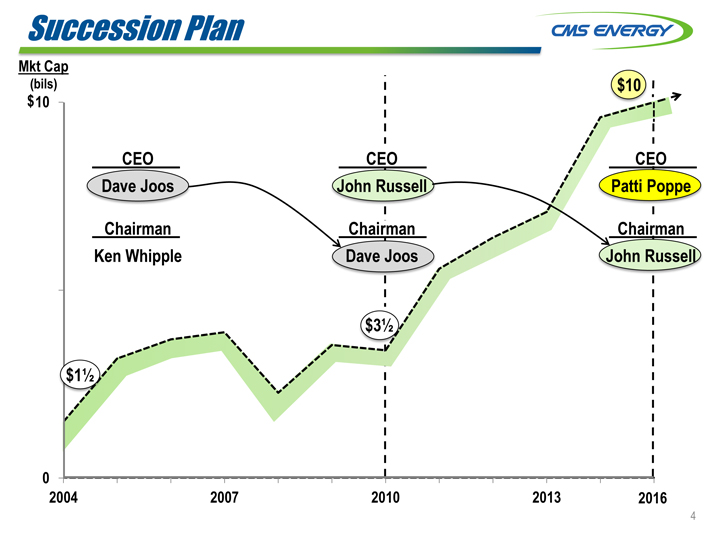

Succession Plan

Mkt Cap

(bils) $10

$ 10

CEO CEO CEO

Dave Joos John Russell Patti Poppe

Chairman Chairman Chairman

Ken Whipple Dave Joos John Russell

$3

$1

0

2004 2007 2010 2013 2016

| 4 |

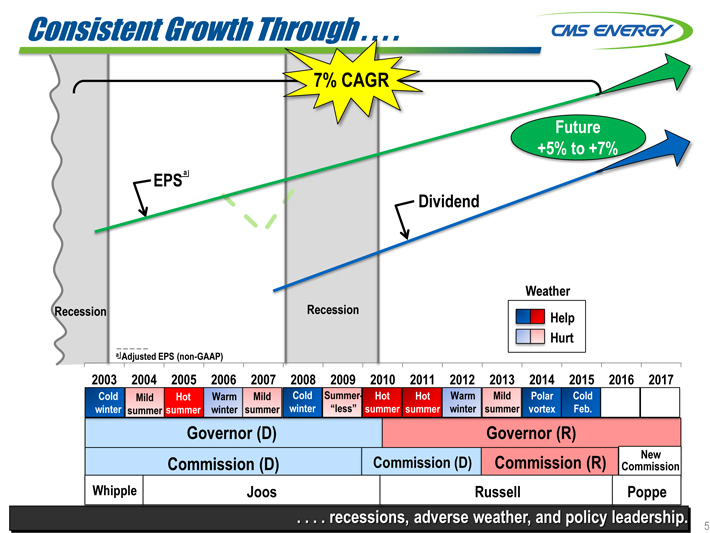

Consistent Growth Through . . . .

7% CAGR

Future

+5% to +7%

Weather

Recession Recession Help

Hurt

a Adjusted EPS (non-GAAP)

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Cold Mild Hot Warm

Mild Cold Summer- Hot Hot Warm Mild Polar Cold

winter summer summer winter summer winter “less” summer summer winter summer vortex Feb.

Governor (D) Governor(R)

Commission (D) Commission (D) Commission

(R) Commission New

Whipple Joos Russell Poppe

. . . . recessions,

adverse weather, and policy leadership.

| 5 |

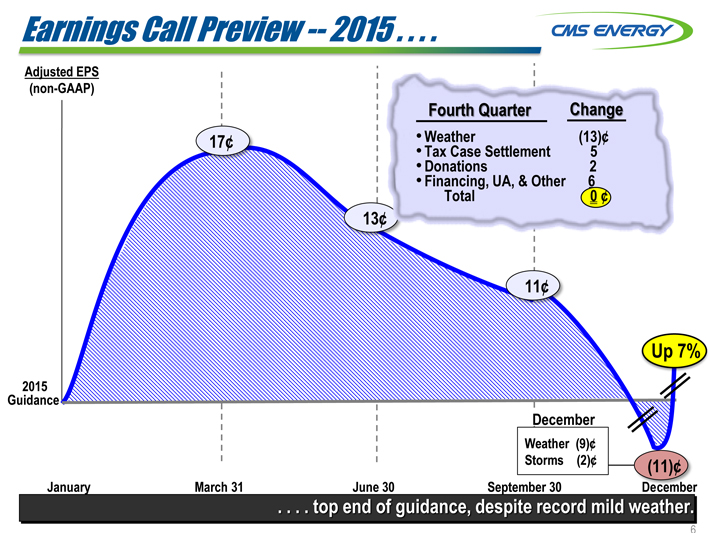

Earnings Call Preview — 2015 . . . .

Adjusted

EPS

(non-GAAP)

Fourth Quarter Change

17¢ • Weather(13)¢

• Tax Case Settlement 5

• Donations 2

• Financing, UA, & Other 6

Total 0 ¢

13¢

11¢

Up 7%

2015

Guidance

December

Weather(9)¢

Storms(2)¢(11)¢

January March 31 June 30 September 30

. . . . top end of guidance, despite record mild weather.

6

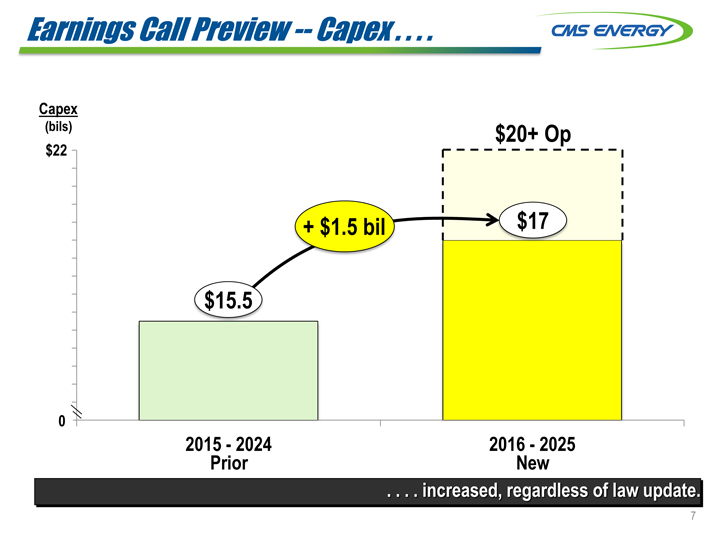

Earnings Call Preview — Capex . . . .

Capex

(bils) $20+ Op

$22

+ $1.5 bil $17

$15.5

0

2015—2024 2016—2025

Prior New

. . . . increased, regardless of law update.

| 7 |

Q & A

February 4th, 9:00 AM, Year-End

Earnings Call and Business Update

| 8 |

GAAP Reconciliation

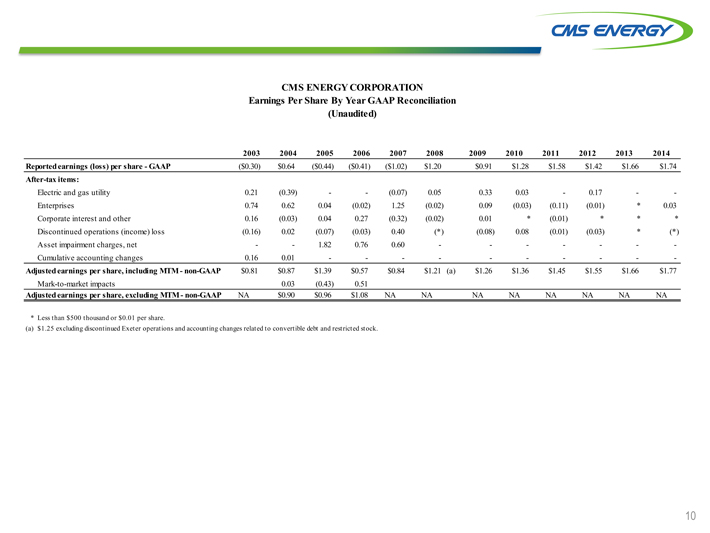

CMS ENERGY CORPORATION

Earnings Per Share By Year

GAAP Reconciliation

(Unaudited)

2003 2004 2005 2006 2007 2008 2009 2010 2011

2012 2013 2014

Reported earnings (loss) per share—GAAP($0.30) $0.64($0.44)($0.41)($1.02) $1.20 $0.91 $1.28 $1.58 $1.42 $1.66 $1.74

After-tax items:

Electric and gas utility 0.21(0.39) —(0.07) 0.05 0.33 0.03—0.17

—

Enterprises 0.74 0.62 0.04(0.02) 1.25(0.02) 0.09(0.03)(0.11)(0.01)* 0.03

Corporate interest and other 0.16(0.03) 0.04 0.27(0.32)(0.02) 0.01*(0.01)***

Discontinued operations (income) loss(0.16) 0.02(0.07)(0.03) 0.40(*)(0.08) 0.08(0.01)(0.03)*(*)

Asset impairment charges, net — 1.82 0.76 0.60 — — — -

Cumulative

accounting changes 0.16 0.01 — — — — —

Adjusted earnings per share, including MTM—non-GAAP $0.81 $0.87 $1.39 $0.57 $0.84 $1.21

(a) $1.26 $1.36 $1.45 $1.55 $1.66 $1.77

Mark-to-market impacts 0.03(0.43) 0.51

Adjusted earnings per share, excluding MTM—non-GAAP NA $0.90 $0.96 $1.08 NA NA NA NA NA NA NA NA

| * | Less than $500 thousand or $0.01 per share. |

(a) $1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and restricted stock.

10