Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CIMPRESS plc | q2fy16earnings8-k.htm |

| EX-99.3 - EXHIBIT 99.3 Q2 FY16 EARNINGS PRESENTATION SCRIPT - CIMPRESS plc | q2_fy16earningsscript.htm |

| EX-99.1 - EXHIBIT 99.1 Q2 FY16 EARNINGS RELEASE - CIMPRESS plc | q2_fy16earningsrelease.htm |

CIMPRESS N.V. Q2 Fiscal Year 2016 Earnings presentation, commentary & financial results supplement January 27, 2016 1

2 Safe Harbor Statement This presentation and the accompanying notes contain statements about our future expectations, plans, and prospects of our business that constitute forward-looking statements for purposes of the safe harbor provisions under the Private Securities Litigation Reform Act of 1995, including but not limited to our expectations for the growth and development of our business, the development and success of our mass customization platform, our planned investments in our business, and the anticipated effects of those investments, our expected acquisition of WIRmachenDRUCK, and the anticipated effects of that acquisition, and our outlook described in the section of the presentation entitled “Looking Ahead.” Forward-looking projections and expectations are inherently uncertain, are based on assumptions and judgments by management, and may turn out to be wrong. The acquisition of WIRmachenDRUCK is subject to customary closing conditions, and if either party fails to satisfy those conditions, then the acquisition may be delayed or may not close at all. Our actual results may differ materially from those indicated by these forward-looking statements as a result of various important factors, including but not limited to flaws in the assumptions and judgments upon which our forecasts are based; our failure to execute our strategy; our inability to make the investments in our business that we plan to make; our failure to develop our mass customization platform or to realize the anticipated benefits of such a platform; our failure to manage the growth and complexity of our business and expand our operations; the failure of WIRmachenDRUCK and the other businesses we acquire or invest in to perform as expected; costs and disruptions caused by acquisitions and strategic investments; development and success of our strategic partnerships; the willingness of purchasers of customized marketing services and products to shop online; unanticipated changes in our markets, customers, or business; competitive pressures; our failure to maintain compliance with the covenants in our senior secured revolving credit facility and senior unsecured notes or to pay our debts when due; changes in the laws and regulations that affect our business; general economic conditions; and other factors described in our Form 10-Q for the fiscal quarter ended September 30, 2015 and the other documents we periodically file with the U.S. Securities and Exchange Commission.

3 Presentation Organization & Call Details • Q2 FY2016 Overview • Q2 FY2016 Operating and financial results • Looking ahead • Supplementary information • Reconciliation of GAAP to non-GAAP results Live Q&A Session: THURSDAY MORNING January 28, 2016, 7:30 a.m. EST Link from ir.cimpress.com Hosted by: Robert Keane President & CEO Sean Quinn CFO

4 Our Objectives • Strategic: To be the world leader in mass customization – Producing, with the reliability, quality and affordability of mass production, small individual orders where each and every one embodies the personal relevance inherent to customized physical products • Financial: To maximize intrinsic value per share – Defined as (a) the unlevered free cash flow per share that, in our best judgment, will occur between now and the long-term future, appropriately discounted to reflect our cost of capital, minus (b) net debt per share

5 Q2 Financial Performance • Good revenue growth year-over-year – Constant Currency • 10% excluding acquisitions in last 4 quarters • 20% consolidated, including recent acquisitions – Reported (USD) Growth • 13% consolidated revenue growth at reported currency rates • Adjusted NOPAT up versus last year – Increased investments more than offset by increased profits in Vistaprint and Upload and Print businesses, lower taxes attributable to current period 5 Consolidated

6 Vistaprint Business Unit • Continued traction with customer value proposition changes – 8% constant-currency growth – 3% reported revenue growth – Double-digit repeat bookings growth – Positive new customer bookings growth – Continued growth in gross profit per customer – Focus categories growing faster than VBU average • VBU ad spend down due to typical fluctuations and year-over-year currency movements 6 TTM Bookings: New & Repeat Mix* Q2FY14 Q3FY14 Q4FY14 Q1FY15 Q2FY15 Q3FY15 Q4FY15 Q1FY16 Q2FY16 71% 72% 72% 72% 73% 73% 73% 73% 74% 29% 28% 28% 28% 27% 27% 27% 27% 26% VBU Advertising Spend Q2FY14 Q3FY14 Q4FY14 Q1FY15 Q2FY15 Q3FY15 Q4FY15 Q1FY16 Q2FY16 $82 $61 $52 $56 $76 $65 $59 $62 $73 24% 24% 20% 22% 22% 24% 22% 23% 21% Note: In Q1 2016, Cimpress moved its retail and strategic partner program into a separate business unit. The results of this program were formerly reported as part of the Vistaprint Business Unit and are now included in the All Other Business Units reportable segment. All historical results presented here exclude the results of this program for ease of comparison. *In Q2 2016, TTM bookings: New & Repeat Mix for VBU was recast to reflect a change in the calculation approach for Corporate Solutions bookings.

7 • Upload and Print Y/Y growth: – 31% constant-currency growth excluding recent acquisitions – 128% constant-currency revenue growth – 112% reported revenue growth • Pixartprinting announced North American expansion • Integration activities progressing as expected across the portfolio Upload and Print Business Units 7 Note: In Q1 2016, Cimpress created a new reportable segment: Upload and Print Business Units, which includes the results of druck.at, Easyflyer, Exagroup, Pixartprinting, Printdeal and Tradeprint. These businesses were formerly included in our All Other reportable segment (with the exception of Tradeprint which was acquired during Q1 2016).

8 BU Key Brands Albumprinter Most of World Corporate Solutions Retail partners that sell our products (branded or white- labeled), franchise businesses, others • All Other business units Y/Y growth: – 8% constant-currency revenue growth – (4)% reported revenue growth • New Corporate Solutions Business Unit – Focused on merchant partnership relationships, moved out of VBU in Q1 FY16 – Retail partnership with Staples extended through end of FY2016 All Other Business Units 8 What businesses are in this reportable segment? Note: In Q2 2016, revenue from the Corporate Solutions Business Unit was recast to reflect a change in the calculation approach.

9 Mass Customization Platform 9 • Remain at the early stages of this multi- year project • Q2 progress highlights – Talent and software technology investments continue to ramp – Additional wins for acquisition integration in procurement, product availability – Columbus: continued SKU ramp (now available to varying degrees on Vistaprint sites in NA, EU, India and Exaprint) – Holiday peak: enabled orders to be produced across multiple facilities (owned and outsourced)

10 Adjusted Net Operating Profit by Segment Quarterly, USD in millions In USD millions. Please see reconciliation of non-GAAP measures at the end of this presentation. Adjusted NOP Adjusted NOP Margin Vistaprint Business Unit 35% 30% 25% 20% 15% 10% 5% 0% Q2 FY 14 Q3 FY 14 Q4 FY 14 Q1 FY 15 Q2 FY 15 Q3 FY 15 Q4 FY 15 Q1 FY 16 Q2 FY 16 $102 $58 $73 $71 $109 $69 $74 $66 $118 Adjusted NOP Adjusted NOP Margin Upload and Print Business Units 35% 30% 25% 20% 15% 10% 5% 0% Q2 FY 14 Q3 FY 14 Q4 FY 14 Q1 FY 15 Q2 FY 15 Q3 FY 15 Q4 FY 15 Q1 FY 16 Q2 FY 16 $— $— $5 $5 $6 $3 $12 $11 $15 Adjusted NOP Adjusted NOP Margin All Other Business Units 35% 30% 25% 20% 15% 10% 5% 0% -5% Q2 FY 14 Q3 FY 14 Q4 FY 14 Q1 FY 15 Q2 FY 15 Q3 FY 15 Q4 FY 15 Q1 FY 16 Q2 FY 16 $3 $2 $4 $1 $8 $— $(1) $(1) $7

Q2 FY2016 Financial & Operating Metrics

12 Q2 FY2016: Revenue Growth Consolidated Total Revenue (reported, USD in millions) Total Revenue Q2FY14 Q3FY14 Q4FY14 Q1FY15 Q2FY15 Q3FY15 Q4FY15 Q1FY16 Q2FY16 $371 $286 $338 $334 $440 $340 $380 $376 $496 Year-over-Year Constant Currency Growth excl. TTM acquisitions and joint ventures Year-over-Year Constant Currency Growth Q2FY14 Q3FY14 Q4FY14 Q1FY15 Q2FY15 Q3FY15 Q4FY15 Q1FY16 Q2FY16 6% (1)% 4% 6% 7% 11% 13% 11% 10% 19% 21% 23% 26% 22% 21% 20% Revenue Growth (Constant Currency)

13 In USD millions. Please see reconciliation of non-GAAP measures at the end of this presentation. Adjusted NOPAT Adjusted NOPAT Margin Adjusted NOPAT 18% 13% 8% 3% -2% Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 Q3 FY15 Q4 FY15 Q1 FY16 Q2 FY16 $56 $— $26 $23 $67 $16 $20 $16 $83 TTM Adjusted NOPAT TTM Q414 TTM Q115 TTM Q215 TTM Q315 TTM Q415 TTM Q116 TTM Q216 $84 $104 $116 $131 $125 $119 $134 Q2 FY2016: Profit Metrics GAAP Net Income GAAP Net Income Margin GAAP Net Income (Loss) 18% 13% 8% 3% -2% Q2FY14 Q3FY14 Q4FY14 Q1FY15 Q2FY15 Q3FY15 Q4FY15 Q1FY16 Q2FY16 $41 $1 $1 $24 $64 $9 $(4) $10 $58 GAAP Operating Income GAAP Operating Income Margin GAAP Operating Income 20% 15% 10% 5% 0% Q2FY14 Q3FY14 Q4FY14 Q1FY15 Q2FY15 Q3FY15 Q4FY15 Q1FY16 Q2FY16 $53 $5 $20 $17 $60 $4 $15 $12 $68

14 Currency Impacts • Impact on both GAAP Net Income and Adjusted NOPAT: – Reduced our YoY revenue growth by 700 bps – More limited impact on bottom line due to natural offsets, and an active currency hedging program ($3.3M realized hedging gains) • Additional below-the-line currency impacts on GAAP Net Income but excluded from Adjusted NOPAT: – Unrealized net gains of $3.2M related to cash flow currency hedges and intercompany loan balances – Net losses of $0.8M from revaluing working capital balances and other balance sheet items

15 Land & Facilities Mfg & Automation Other CapEx as % of revenue TTM Capital Expenditures Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 Q3 FY15 Q4 FY15 Q1 FY16 Q2 FY16 5% 5% 6% 5% 5% 5% 5% 5% 5% Cash Flow and ROIC Highlights TTM Cash Flow from Operations Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 Q3 FY15 Q4 FY15 Q1 FY16 Q2 FY16 $140 $135 $149 $201 $245 $243 $229 $202 $198 TTM Free Cash Flow¹ In USD millions except percentages. Please see reconciliation of non-GAAP measures at the end of this presentation. ¹ Free cash flow does not include the value of capital leases. Consolidated $66 $66 $72 $71 $65 $68 $76 $84 $84 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 Q3 FY15 Q4 FY15 Q1 FY16 Q2 FY16 $64 $58 $66 $118 $167 $161 $144 $109 $102 TTM Adjusted Return on Invested Capital Q4FY14 Q1FY15 Q2FY15 Q3FY15 Q4FY15 Q1 FY16 Q2 FY16 16% 18% 19% 20% 18% 17% 18%

16 Debt Related Metrics *Our borrowing ability under our senior secured credit facility can be limited by our debt covenants each quarter. These covenants may limit our borrowing capacity depending on our leverage, other indebtedness, such as notes, capital leases, letters of credit, and other debt, as well as other factors that are outlined in our credit agreement filed as an exhibit in our Form 8-Ks filed on February 13, 2013, January 22, 2014, and September 25, 2014. All Adjusted EBITDA and credit facility availability info in USD millions. Please see reconciliation of non-GAAP measures at the end of this presentation. Availability under our senior secured credit facility (In USD, millions)* 12/31/2015 Maximum aggregate available for borrowing $838.0 Outstanding borrowings of senior secured credit facilities ($271.6) Remaining amount $566.4 Limitations to borrowing due to debt covenants and other obligations* ($1.6) Amount available for borrowing as of December 31, 2015 $564.7 Consolidated Quarterly Adjusted EBITDA Q2FY14 Q3FY14 Q4FY14 Q1FY15 Q2FY15 Q3FY15 Q4FY15 Q1FY16 Q2FY16 $74.8 $25.6 $48.6 $50.7 $97.0 $42.6 $50.2 $50.3 $111.8 TTM Adjusted EBITDA Q4FY14 Q1FY15 Q2FY15 Q3FY15 Q4FY15 Q1FY16 Q2FY16 $181.1 $199.8 $222.0 $239.0 $240.6 $240.2 $255.0

Looking Ahead

18 Forward-Looking Commentary • YTD results reflect the strength of the underlying profitability of the business • "Major" and "Diverse Other" organic investment spending outlined at our investor day in August is largely on track YTD, though a little lower than expected particularly in capital expenditures • We will continue to invest in the second half of the year in pursuit of long- term value creation • Expected acquisition of WIRmachenDRUCK ◦ Expect to close transaction in early February ◦ Continue to expect acquisition to add to revenue, adjusted NOPAT, adjusted EBITDA and FCF in FY16, but to be slightly dilutive to GAAP net income • GAAP effective tax rate now expected to be roughly 15% - 20% for fiscal 2016; cash taxes should be higher

19 Summary • Clear priorities – Strategic: to be the world leader in mass customization – Financial: to maximize intrinsic value per share • Solid progress midway through FY 2016 – Investments in technology for common mass customization platform – Continued traction of Vistaprint brand repositioning – Acquisitions performing well • Remain confident in ability to meet our objectives

Q&A Session Please go to ir.cimpress.com for the live Q&A call at 7:30 am EST on January 28, 2016

Q2 Fiscal Year 2016 Financial and Operating Results Supplement

22 *All acquisitions included as of acquisition date. For a description of acquisitions and joint ventures that are excluded from constant currency growth, please see reconciliation to reported revenue growth rates at the end of this presentation. Revenue Growth Rates* Consolidated FY13 FY14 FY15 FY16 16% constant currency growth 8% constant currency growth 23% constant currency growth 21% constant currency growth Constant-Currency Reported Constant-Currency Excl. TTM Acquisitions and Joint Ventures Reported Excl. TTM Acquisitions and Joint Ventures 30% 25% 20% 15% 10% 5% 0% -5% Q3FY13 Q4FY13 Q1FY14 Q2FY14 Q3FY14 Q4FY14 Q1FY15 Q2FY15 Q3FY15 Q4FY15 Q1FY16 Q2FY16 20% 13% 10% 3%

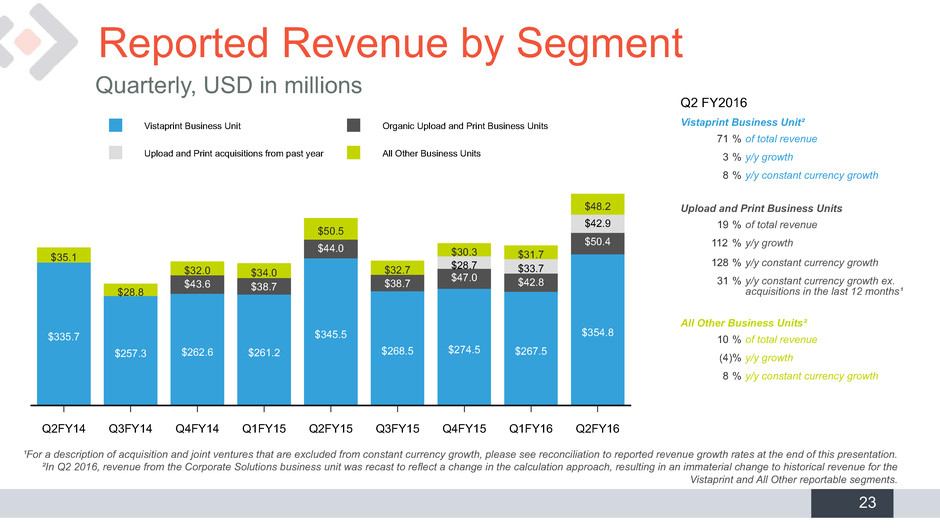

23 Reported Revenue by Segment Quarterly, USD in millions Q2 FY2016 Vistaprint Business Unit² 71 % of total revenue 3 % y/y growth 8 % y/y constant currency growth Upload and Print Business Units 19 % of total revenue 112 % y/y growth 128 % y/y constant currency growth 31 % y/y constant currency growth ex. acquisitions in the last 12 months¹ All Other Business Units² 10 % of total revenue (4)% y/y growth 8 % y/y constant currency growth ¹For a description of acquisition and joint ventures that are excluded from constant currency growth, please see reconciliation to reported revenue growth rates at the end of this presentation. ²In Q2 2016, revenue from the Corporate Solutions business unit was recast to reflect a change in the calculation approach, resulting in an immaterial change to historical revenue for the Vistaprint and All Other reportable segments. Vistaprint Business Unit Organic Upload and Print Business Units Upload and Print acquisitions from past year All Other Business Units Q2FY14 Q3FY14 Q4FY14 Q1FY15 Q2FY15 Q3FY15 Q4FY15 Q1FY16 Q2FY16 $335.7 $257.3 $262.6 $261.2 $345.5 $268.5 $274.5 $267.5 $354.8 $43.6 $38.7 $44.0 $38.7 $47.0 $42.8 $50.4 $28.7 $33.7 $42.9 $35.1 $28.8 $32.0 $34.0 $50.5 $32.7 $30.3 $31.7 $48.2

24 Constant Currency Revenue Growth Upload & Print 140% 120% 100% 80% 60% 40% 20% Q1 FY 15 Q2 FY 15 Q3 FY 15 Q4 FY 15 Q1 FY 16 Q2 FY 16 100% 118% 128% 34% 31% 31% All Other 50% 40% 30% 20% 10% 0% -10% Q1 FY 15 Q2 FY 15 Q3 FY 15 Q4 FY 15 Q1 FY 16 Q2 FY 16 24% 48% 26% 7% 7% 8% 11% 8% 16% (4)% 4% Vistaprint 50% 40% 30% 20% 10% 0% Q1 FY 15 Q2 FY 15 Q3 FY 15 Q4 FY 15 Q1 FY 16 Q2 FY 16 5% 7% 11% 11% 8% 8% In Q4 FY2015, we recognized $4.0M of previously deferred revenue related to group buying activities, a benefit to the year-over-year growth rate for Vistaprint Business Unit in that period.

25 Share-Based Compensation Q3FY13 Q4FY13 Q1FY14 Q2FY14 Q3FY14 Q4FY14 Q1FY15 Q2FY15 Q3FY15 Q4FY15 Q1FY16 Q2FY16 $8.2 $8.1 $8.4 $7.9 $5.6 $5.9 $5.7 $6.4 $6.6 $5.3 $6.2 $6.1 Note: Share-based compensation excludes SBC-related tax adjustment. The period from Q3 FY13 to Q2 FY14 includes expense related to the RSA grants as part of the Webs acquisition. Consolidated FY13 $32.9 FY14 $27.8 FY15 $24.1 FY16 $12.3 Quarterly, USD in millions

26 Balance Sheet Highlights Balance Sheet highlights, USD in millions, at period end 12/31/2014 3/31/2015 6/30/2015 9/30/2015 12/31/2015 Total assets $1,022.9 $1,032.2 $1,299.8 $1,343.7 $1,302.5 Cash and cash equivalents $77.9 $134.2 $103.6 $93.8 $73.2 Total current assets $178.3 $220.6 $216.1 $217.4 $197.4 Property, plant and equipment, net $391.0 $391.8 $467.5 $495.1 $490.6 Goodwill and intangible assets $399.9 $364.1 $551.7 $564.2 $540.7 Total liabilities $755.6 $783.6 $992.6 $1,168.5 $1,079.6 Current liabilities $295.1 $233.1 $305.7 $311.9 $340.0 Long-term debt $377.6 $411.3 $493.0 $637.3 $528.4 Shareholders’ Equity attributable to Cimpress NV $256.2 $234.9 $248.9 $109.7 $157.7 Treasury shares (in millions) 11.5 11.3 10.9 12.7 12.6 Consolidated

Appendix Including a Reconciliation of GAAP to Non-GAAP Financial Measures

28 About Non-GAAP Financial Measures • To supplement Cimpress' consolidated financial statements presented in accordance with U.S. generally accepted accounting principles, or GAAP, Cimpress has used the following measures defined as non-GAAP financial measures by Securities and Exchange Commission, or SEC, rules: adjusted EBITDA, free cash flow, trailing twelve month return on invested capital, adjusted NOPAT, adjusted NOP by segment, constant-currency revenue growth and constant- currency revenue growth excluding revenue from acquisitions and joint ventures from the past twelve months. Please see the next two slides for definitions of these items. • The presentation of non-GAAP financial information is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with GAAP. For more information on these non-GAAP financial measures, please see the tables captioned “Reconciliations of Non-GAAP Financial Measures” included at the end of this release. The tables have more details on the GAAP financial measures that are most directly comparable to non-GAAP financial measures and the related reconciliation between these financial measures. • Cimpress' management believes that these non-GAAP financial measures provide meaningful supplemental information in assessing our performance and liquidity by excluding certain items that may not be indicative of our recurring core business operating results, which could be non-cash charges or discrete cash charges that are infrequent in nature. These non-GAAP financial measures also have facilitated management’s internal comparisons to Cimpress' historical performance and our competitors’ operating results.

29 Non-GAAP Financial Measures Definitions Non-GAAP Measure Definition Free Cash Flow FCF = Cash Flow from Operations – Capital Expenditures – Purchases of Intangible assets not related to acquisitions – Capitalized Software Expenses + Payment of contingent consideration in excess of acquisition-date fair value + Gains on proceeds from insurance Adjusted Net Operating Profit After Tax (Adjusted NOPAT) Adjusted NOPAT is defined as GAAP Operating Income minus cash taxes attributable to the current period (see definition below), with the following adjustments: exclude the impact of M&A related items including acquisition-related amortization and depreciation, the change in fair value of contingent consideration, and expense for deferred payments or equity awards that are treated as compensation expense; exclude the impact of unusual items such as discontinued operations, restructuring charges, and impairments; include the interest expense related to our Waltham office lease, and include realized gains or losses from currency forward contracts that are not included in operating income as we do not apply hedge accounting. Cash Taxes Attributable to the Current Period included in Adjusted NOPAT As part of our calculation of Adjusted NOPAT, we subtract the cash taxes attributable to the current period operations, which we define as the actual cash taxes paid or to be paid adjusted for any non-operational items and excluding the excess tax benefit from equity awards. Adjusted NOP by Segment Adjusted Net Operating Profit as defined above in Adjusted NOPAT definition, less cash taxes which are not allocated to segments. Trailing Twelve Month Return on Invested Capital ROIC = Adjusted NOPAT / (Debt + Redeemable Non-Controlling Interest + Total Shareholders Equity – Excess Cash) Adjusted NOPAT is defined below. Excess cash is cash and equivalents > 5% of last twelve month revenues; if negative, capped at zero Operating leases have not been converted to debt Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (Adjusted EBITDA) Adjusted EBITDA = Operating Income + Depreciation and Amortization + Share-based compensation expense + Earn-out related charges + Realized gains or losses on currency forward contracts Constant-Currency Revenue Growth Constant-currency revenue growth is estimated by translating all non-U.S. dollar denominated revenue generated in the current period using the prior year period’s average exchange rate for each currency to the U.S. dollar Constant Currency Revenue Growth, excluding TTM Acquisitions Constant-currency revenue growth excluding revenue from trailing twelve month acquisitions excludes the impact of currency as defined above and, for Q2, revenue from druck.at, Easyflyer, Exagroup, Alcione, and Tradeprint.

30 Reconciliation: Free Cash Flow Q2 FY15 Q2 FY16 YTD Q2FY15 YTD Q2FY16 Net cash provided by operating activities $138,224 $133,959 $190,844 $159,676 Purchases of property, plant and equipment ($18,268) ($19,156) ($34,952) ($43,549) Purchases of intangible assets not related to acquisitions ($60) ($45) ($145) ($402) Capitalization of software and website development costs ($3,910) ($7,217) ($7,449) ($12,127) Proceeds from insurance related to investing activities $— $1,549 $— $3,624 Free cash flow $115,986 $109,090 $148,298 $107,222 In thousands Reference: Value of capital leases $6,560 $624 $9,761 $3,017

31 Reconciliation: Free Cash Flow TTM, In thousands TTM Q2 FY14 TTM Q3 FY14 TTM Q4 FY14 TTM Q1 FY15 TTM Q2 FY15 TTM Q3 FY15 TTM Q4 FY15 TTM Q1 FY16 TTM Q2 FY16 Net cash provided by operating activities $139,733 $134,740 $148,580 $201,323 $244,520 $242,948 $228,876 $201,973 $197,708 Purchases of property, plant and equipment ($65,800) ($66,475) ($72,122) ($71,229) ($64,905) ($68,228) ($75,813) ($83,522) ($84,410) Purchases of intangible assets not related to acquisitions ($499) ($500) ($253) ($263) ($279) ($252) ($250) ($522) ($507) Capitalization of software and website development costs ($8,946) ($9,427) ($9,749) ($11,474) ($12,779) ($14,927) ($17,323) ($18,694) ($22,001) Payment of contingent consideration in excess of acquisition-date fair value $— $— $— $— $— $1,249 $8,055 $8,055 $8,055 Proceeds from insurance related to investing activities $— $— $— $— $— $— $— $2,075 $3,624 Free cash flow $64,488 $58,338 $66,456 $118,357 $166,557 $160,790 $143,545 $109,365 $102,469 Reference: Value of capital leases $— $— $300 $3,501 $10,061 $10,061 $13,193 $12,385 $6,449

32 Reconciliation: Adjusted NOPAT Quarterly, In thousands Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 Q3 FY15 Q4 FY15 Q1 FY16 Q2 FY16 GAAP Operating income $52,522 $5,239 $19,744 $16,859 $59,888 $4,341 $15,236 $12,085 $67,609 Less: Cash taxes attributable to current period (see below) ($6,309) ($5,282) ($3,241) ($5,313) ($7,353) ($4,666) ($7,656) ($6,833) ($4,362) Exclude expense (benefit) impact of: Acquisition-related amortization and depreciation $2,353 $2,228 $5,838 $6,908 $5,468 $4,514 $7,374 $9,782 $9,655 Earn-out related charges¹ $— $— $2,192 $3,677 $3,701 $7,512 $385 $289 $3,413 Share-based compensation related to investment consideration $1,929 $— $440 $497 $1,100 $1,499 $473 $802 $1,735 Certain impairments² $— $— $— $— $— $— $— $— $3,022 Restructuring costs $2,986 $128 $2,866 $— $154 $520 $2,528 $271 $110 Less: Interest expense associated with Waltham lease $— $— $— $— $— $— $— ($350) ($2,001) Include: Realized gains on currency forward contracts not included in operating income $2,470 ($2,132) ($2,177) ($17) $4,178 $1,802 $1,487 $316 $3,319 Adjusted NOPAT $55,951 $181 $25,662 $22,611 $67,136 $15,522 $19,827 $16,362 $82,500 ¹ Includes expense recognized for the change in fair value of contingent consideration and compensation expense related to cash-based earn-out mechanisms dependent upon continued employment. ² Includes the impact of impairments or abandonments of goodwill and other long-lived assets as defined by ASC 350 - "Intangibles - Goodwill and Other" or ASC 360 - "Property, plant, and equipment." Cash taxes paid in the current period $6,761 $3,216 $5,824 $5,296 $2,261 $3,089 $3,639 $4,709 $6,036 Less: cash taxes related to prior periods ($1,473) ($44) ($3,288) ($2,860) ($588) ($1,103) ($925) $359 ($2,463) Plus: cash taxes attributable to the current period but not yet paid $588 $1,103 $1,485 $936 $608 $1,420 $3,703 $921 $718 Plus: cash impact of excess tax benefit on equity awards attributable to current period $1,290 $1,864 $77 $2,796 $5,927 $2,115 $2,094 $1,709 $936 Less: installment payment related to the transfer of IP in a prior year ($857) ($857) ($857) ($855) ($855) ($855) ($855) ($865) ($865) Cash taxes attributable to current period $6,309 $5,282 $3,241 $5,313 $7,353 $4,666 $7,656 $6,833 $4,362

33 Reconciliation: Adjusted NOPAT TTM, In thousands Cash taxes paid in the current period $18,484 $21,097 $16,597 $16,470 $14,285 $13,698 $17,473 Less: cash taxes related to prior periods ($6,521) ($7,665) ($6,780) ($7,839) ($5,476) ($2,257) ($4,132) Plus: cash taxes attributable to the current period but not yet paid $6,036 $4,112 $4,132 $4,449 $6,667 $6,652 $6,762 Plus: cash impact of excess tax benefit on equity awards attributable to current period $5,552 $6,027 $10,664 $10,915 $12,932 $11,845 $6,854 Less: installment payment related to the transfer of IP in a prior year ($3,428) ($3,426) ($3,424) ($3,422) ($3,420) ($3,430) ($3,440) Cash taxes attributable to current period $20,123 $20,145 $21,189 $20,573 $24,988 $26,508 $23,517 ¹ Includes expense recognized for the change in fair value of contingent consideration and compensation expense related to cash-based earn-out mechanisms dependent upon continued employment. ² Includes the impact of impairments or abandonments of goodwill and other long-lived assets as defined by ASC 350 - "Intangibles - Goodwill and Other" or ASC 360 - "Property, plant, and equipment." TTM Q414 TTM Q115 TTM Q215 TTM Q315 TTM Q415 TTM Q116 TTM Q216 GAAP Operating income $85,914 $94,364 $101,730 $100,832 $96,324 $91,550 $99,271 Less: Cash taxes attributable to current period (see below) ($20,123) ($20,145) ($21,189) ($20,573) ($24,988) ($26,508) ($23,517) Exclude expense (benefit) impact of: Acquisition-related amortization and depreciation $12,723 $17,327 $20,442 $22,728 $24,264 $27,138 $31,325 Earn-out related charges¹ $2,192 $5,869 $9,570 $17,082 $15,275 $11,887 $11,599 Share-based compensation related to investment consideration $4,363 $2,866 $2,037 $3,536 $3,569 $3,874 $4,509 Certain impairments² $0 $0 $0 $0 $0 $0 $3,022 Restructuring costs $5,980 $5,980 $3,148 $3,540 $3,202 $3,473 $3,429 Less: Interest expense associated with Waltham lease $0 $0 $0 $0 $0 ($350) ($2,351) Include: Realized gains on currency forward contracts not included in operating income ($7,048) ($1,856) ($148) $3,786 $7,450 $7,783 $6,924 Adjusted NOPAT $84,001 $104,405 $115,590 $130,931 $125,096 $118,847 $134,211

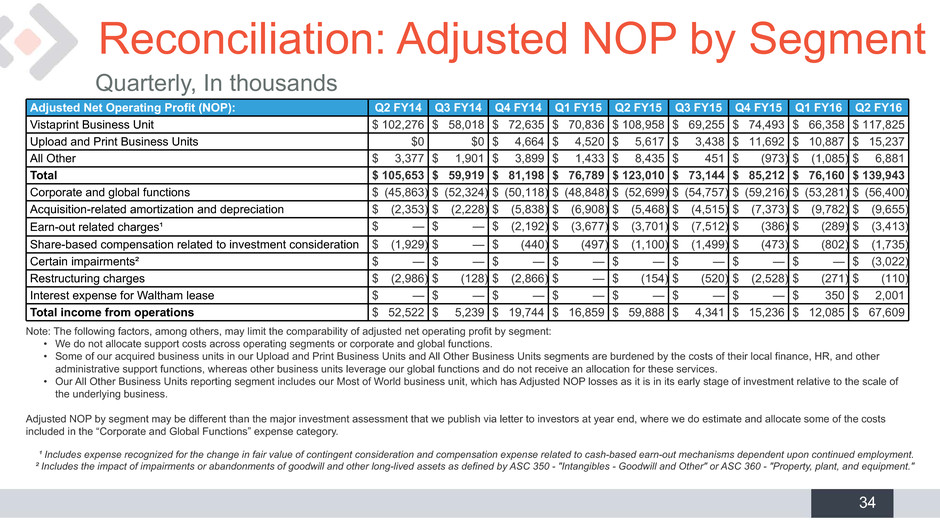

34 Reconciliation: Adjusted NOP by Segment Quarterly, In thousands Adjusted Net Operating Profit (NOP): Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 Q3 FY15 Q4 FY15 Q1 FY16 Q2 FY16 Vistaprint Business Unit $ 102,276 $ 58,018 $ 72,635 $ 70,836 $ 108,958 $ 69,255 $ 74,493 $ 66,358 $ 117,825 Upload and Print Business Units $0 $0 $ 4,664 $ 4,520 $ 5,617 $ 3,438 $ 11,692 $ 10,887 $ 15,237 All Other $ 3,377 $ 1,901 $ 3,899 $ 1,433 $ 8,435 $ 451 $ (973) $ (1,085) $ 6,881 Total $ 105,653 $ 59,919 $ 81,198 $ 76,789 $ 123,010 $ 73,144 $ 85,212 $ 76,160 $ 139,943 Corporate and global functions $ (45,863) $ (52,324) $ (50,118) $ (48,848) $ (52,699) $ (54,757) $ (59,216) $ (53,281) $ (56,400) Acquisition-related amortization and depreciation $ (2,353) $ (2,228) $ (5,838) $ (6,908) $ (5,468) $ (4,515) $ (7,373) $ (9,782) $ (9,655) Earn-out related charges¹ $ — $ — $ (2,192) $ (3,677) $ (3,701) $ (7,512) $ (386) $ (289) $ (3,413) Share-based compensation related to investment consideration $ (1,929) $ — $ (440) $ (497) $ (1,100) $ (1,499) $ (473) $ (802) $ (1,735) Certain impairments² $ — $ — $ — $ — $ — $ — $ — $ — $ (3,022) Restructuring charges $ (2,986) $ (128) $ (2,866) $ — $ (154) $ (520) $ (2,528) $ (271) $ (110) Interest expense for Waltham lease $ — $ — $ — $ — $ — $ — $ — $ 350 $ 2,001 Total income from operations $ 52,522 $ 5,239 $ 19,744 $ 16,859 $ 59,888 $ 4,341 $ 15,236 $ 12,085 $ 67,609 Note: The following factors, among others, may limit the comparability of adjusted net operating profit by segment: • We do not allocate support costs across operating segments or corporate and global functions. • Some of our acquired business units in our Upload and Print Business Units and All Other Business Units segments are burdened by the costs of their local finance, HR, and other administrative support functions, whereas other business units leverage our global functions and do not receive an allocation for these services. • Our All Other Business Units reporting segment includes our Most of World business unit, which has Adjusted NOP losses as it is in its early stage of investment relative to the scale of the underlying business. Adjusted NOP by segment may be different than the major investment assessment that we publish via letter to investors at year end, where we do estimate and allocate some of the costs included in the “Corporate and Global Functions” expense category. ¹ Includes expense recognized for the change in fair value of contingent consideration and compensation expense related to cash-based earn-out mechanisms dependent upon continued employment. ² Includes the impact of impairments or abandonments of goodwill and other long-lived assets as defined by ASC 350 - "Intangibles - Goodwill and Other" or ASC 360 - "Property, plant, and equipment."

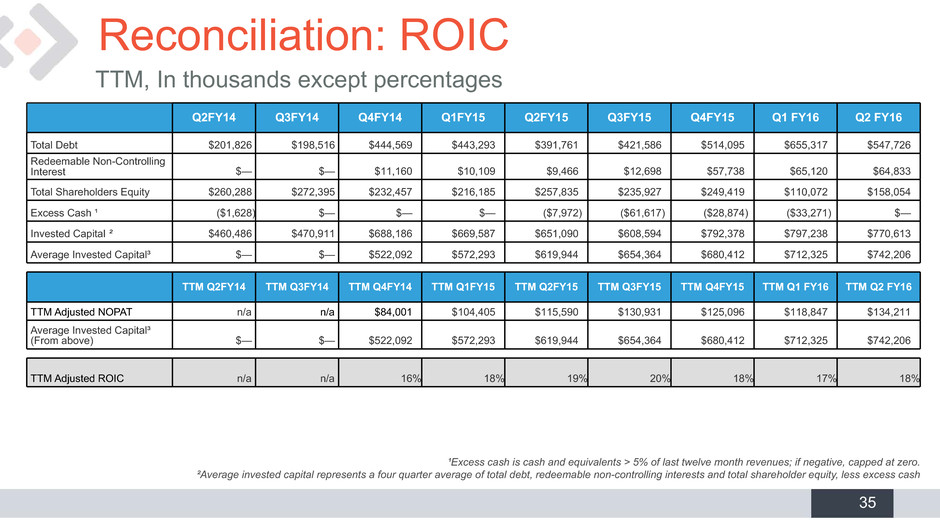

35 Reconciliation: ROIC ¹Excess cash is cash and equivalents > 5% of last twelve month revenues; if negative, capped at zero. ²Average invested capital represents a four quarter average of total debt, redeemable non-controlling interests and total shareholder equity, less excess cash TTM, In thousands except percentages Q2FY14 Q3FY14 Q4FY14 Q1FY15 Q2FY15 Q3FY15 Q4FY15 Q1 FY16 Q2 FY16 Total Debt $201,826 $198,516 $444,569 $443,293 $391,761 $421,586 $514,095 $655,317 $547,726 Redeemable Non-Controlling Interest $— $— $11,160 $10,109 $9,466 $12,698 $57,738 $65,120 $64,833 Total Shareholders Equity $260,288 $272,395 $232,457 $216,185 $257,835 $235,927 $249,419 $110,072 $158,054 Excess Cash ¹ ($1,628) $— $— $— ($7,972) ($61,617) ($28,874) ($33,271) $— Invested Capital ² $460,486 $470,911 $688,186 $669,587 $651,090 $608,594 $792,378 $797,238 $770,613 Average Invested Capital³ $— $— $522,092 $572,293 $619,944 $654,364 $680,412 $712,325 $742,206 TTM Q2FY14 TTM Q3FY14 TTM Q4FY14 TTM Q1FY15 TTM Q2FY15 TTM Q3FY15 TTM Q4FY15 TTM Q1 FY16 TTM Q2 FY16 TTM Adjusted NOPAT n/a n/a $84,001 $104,405 $115,590 $130,931 $125,096 $118,847 $134,211 Average Invested Capital³ (From above) $— $— $522,092 $572,293 $619,944 $654,364 $680,412 $712,325 $742,206 TTM Adjusted ROIC n/a n/a 16% 18% 19% 20% 18% 17% 18%

36 Reconciliation: Adjusted EBITDA1,2 Quarterly, In thousands Q2FY14 Q3FY14 Q4FY14 Q1FY15 Q2FY15 Q3FY15 Q4FY15 Q1FY16 Q2FY16 Operating Income $52,522 $5,239 $19,744 $16,859 $59,888 $4,341 $15,236 $12,085 $67,609 Depreciation and amortization $16,839 $16,881 $22,936 $24,459 $22,895 $22,325 $27,808 $30,226 $31,805 Share-based compensation expense $7,873 $5,591 $5,936 $5,742 $6,384 $6,638 $5,311 $6,190 $6,066 Proceeds from Insurance $0 $0 $0 $0 $0 $0 $0 $1,584 $1,553 Interest Expense for Waltham lease $0 $0 $0 $0 $0 $0 $0 ($350) ($2,001) Earn-out related charges $0 $0 $2,192 $3,677 $3,701 $7,512 $386 $289 $3,413 Realized gain/(loss) on currency forward contracts ($2,386) ($2,132) ($2,177) ($17) $4,178 $1,802 $1,487 $316 $3,319 Adjusted EBITDA $74,848 $25,579 $48,631 $50,720 $97,046 $42,618 $50,228 $50,340 $111,764 Note: In Q2 FY16 the definition of adjusted EBITDA used in external reporting was modified to include impact of proceeds from insurance and interest expense related to our Waltham lease resulting in a change to adjusted EBITDA for Q1 FY16. ¹This deck uses the definition of Adjusted EBITDA as outlined above and therefore does not include the pro forma impact of acquisitions; however, the senior unsecured notes' covenants allow for the inclusion of pro forma impacts to Adjusted EBITDA. ²Adjusted EBITDA includes 100% of the results of our consolidated subsidiaries and therefore does not give effect to adjusted EBITDA attributable to non-controlling interests. This is to most closely align to our debt covenant and cash flow reporting.

37 Reconciliation: Adjusted EBITDA1,2 TTM, In thousands TTM Q4FY14 TTM Q1FY15 TTM Q2FY15 TTM Q3FY15 TTM Q4FY15 TTM Q1FY16 TTM Q2FY16 Operating Income $85,914 $94,364 $101,730 $100,832 $96,324 $91,550 $99,271 Depreciation and amortization $72,281 $81,115 $87,171 $92,615 $97,487 $103,254 $112,164 Share-based compensation expense $27,785 $25,142 $23,653 $24,700 $24,075 $24,523 $24,205 Proceeds from Insurance $0 $0 $0 $0 $0 $1,584 $3,137 Interest Expense for Waltham lease $0 $0 $0 $0 $0 ($350) ($2,351) Earn-out related charges $2,192 $5,869 $9,570 $17,082 $15,276 $11,888 $11,600 Realized gain/(loss) on currency forward contracts ($7,048) ($6,712) ($148) $3,786 $7,450 $7,783 $6,924 Adjusted EBITDA $181,124 $199,778 $221,976 $239,015 $240,612 $240,232 $254,950 Note: In Q2 FY16 the definition of adjusted EBITDA used in external reporting was modified to include impact of proceeds from insurance and interest expense related to our Waltham lease resulting in a change to adjusted EBITDA for Q1 FY16. ¹This deck uses the definition of Adjusted EBITDA as outlined above and therefore does not include the pro forma impact of acquisitions; however, the senior unsecured notes' covenants allow for the inclusion of pro forma impacts to Adjusted EBITDA. ²Adjusted EBITDA includes 100% of the results of our consolidated subsidiaries and therefore does not give effect to adjusted EBITDA attributable to non-controlling interests. This is to most closely align to our debt covenant and cash flow reporting.

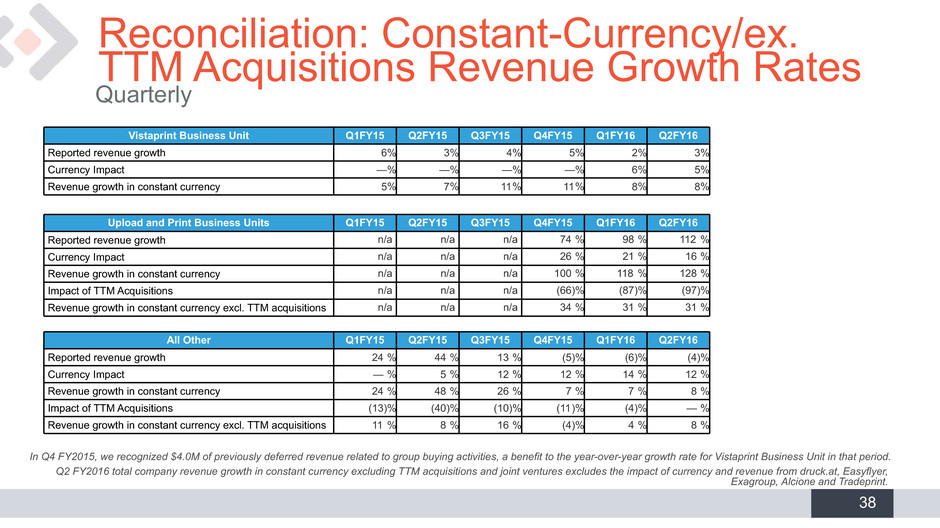

38 Reconciliation: Constant-Currency/ex. TTM Acquisitions Revenue Growth Rates Q2 FY2016 total company revenue growth in constant currency excluding TTM acquisitions and joint ventures excludes the impact of currency and revenue from druck.at, Easyflyer, Exagroup, Alcione and Tradeprint. Quarterly Vistaprint Business Unit Q1FY15 Q2FY15 Q3FY15 Q4FY15 Q1FY16 Q2FY16 Reported revenue growth 6% 3% 4% 5% 2% 3% Currency Impact —% —% —% —% 6% 5% Revenue growth in constant currency 5% 7% 11% 11% 8% 8% Upload and Print Business Units Q1FY15 Q2FY15 Q3FY15 Q4FY15 Q1FY16 Q2FY16 Reported revenue growth n/a n/a n/a 74 % 98 % 112 % Currency Impact n/a n/a n/a 26 % 21 % 16 % Revenue growth in constant currency n/a n/a n/a 100 % 118 % 128 % Impact of TTM Acquisitions n/a n/a n/a (66)% (87)% (97)% Revenue growth in constant currency excl. TTM acquisitions n/a n/a n/a 34 % 31 % 31 % All Other Q1FY15 Q2FY15 Q3FY15 Q4FY15 Q1FY16 Q2FY16 Reported revenue growth 24 % 44 % 13 % (5)% (6)% (4)% Currency Impact — % 5 % 12 % 12 % 14 % 12 % Revenue growth in constant currency 24 % 48 % 26 % 7 % 7 % 8 % Impact of TTM Acquisitions (13)% (40)% (10)% (11)% (4)% — % Revenue growth in constant currency excl. TTM acquisitions 11 % 8 % 16 % (4)% 4 % 8 % In Q4 FY2015, we recognized $4.0M of previously deferred revenue related to group buying activities, a benefit to the year-over-year growth rate for Vistaprint Business Unit in that period.

39 Total Company Q3FY13 Q4FY13 Q1FY14 Q2FY14 Q3FY14 Q4FY14 Q1FY15 Q2FY15 Q3FY15 Q4FY15 Q1FY16 Q2FY16 Reported Revenue Growth 12% 12% 9% 6% (1)% 21 % 21 % 19 % 19 % 13 % 13 % 13 % Currency Impact —% —% —% —% — % (2)% — % 4 % 7 % 9 % 8 % 7 % Revenue Growth in Constant Currency 12% 12% 9% 6% (1)% 19 % 21 % 23 % 26 % 22 % 21 % 20 % Impact of TTM Acquisitions & JVs —% —% —% —% — % (15)% (15)% (16)% (15)% (9)% (10)% (10)% Revenue growth in constant currency ex. TTM acquisitions & JVs 12% 12% 9% 6% (1)% 4 % 6 % 7 % 11 % 13 % 11 % 10 % Reported revenue growth rate ex. TTM acquisitions & JVs 12% 12% 9% 6% (1)% 5 % 6 % 3 % 4 % 3 % 3 % 3 % Reconciliation: Constant-Currency/ex. TTM Acquisition Revenue Growth Rates Quarterly Q2 FY2016 total company revenue growth in constant currency excluding TTM acquisitions and joint ventures excludes the impact of currency and revenue from druck.at, Easyflyer, Exagroup, Alcione and Tradeprint.