Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PEABODY ENERGY CORP | d101759d8k.htm |

| EX-99.1 - EX-99.1 - PEABODY ENERGY CORP | d101759dex991.htm |

| EX-99.2 - EX-99.2 - PEABODY ENERGY CORP | d101759dex992.htm |

Overview of Select Assets Exhibit 99.3

Disclaimer Peabody or its affiliates and representatives make no representation or warranty, express or implied, as to any matter reflected in or relating to this presentation. Certain statements and information in this presentation are forward looking in nature and based on numerous assumptions that Peabody believes are reasonable, but they are open to a wide range of uncertainties and business risks that may cause actual results or outcomes to differ materially from expectations. These factors are difficult to accurately predict and may be beyond the control of relevant parties. Actual future results may vary significantly from the projections, estimates, forecasts and other forward-looking information in this presentation. The recipient must make its own inquiries regarding the assumptions, uncertainties and contingencies that may affect future value, operations and results, and the impact that a variation in future outcomes may have. Nothing in this presentation is intended to constitute a contract or an offer to enter into a contract, or to be binding or to create legal obligations or rights.

Kayenta Location Map Navajo Generating Station Kayenta Mine RR from Mine to Plant, ~100 miles

Kayenta Overview Product 10,600 Btu, 10.1% Ash, 13.3% Moisture, 1.2 #SO2 Ownership Operates through a lease agreement with the Navajo Nation & Hopi Tribe Location Near Kayenta, AZ on reservation lands on the Black Mesa highland plateau Overview Kayenta is a mine-mouth operation providing 100% of its sold production to the Navajo Generation Station (NGS) power plant Kayenta produces thermal coal for the NGS near Page, AZ through a cost-plus sales contract More than 90% of the workforce is Native American Minable Reserves 215.0Mt Major Equipment Operates three draglines (1 - 2570 and 2 – 8750) with supporting truck fleets 24 Dozers, 18 haul trucks, 3 Excavators, 17 Loaders, 2 Backhoe Loaders Transportation Dedicated closed loop electric train; ~100 mile rail line Geology Multi-seam, ranging from 3 to 15 feet (1) Proven & Probable Reserves as of December 31, 2014; sourced from 10-K Tons Sold (Mt)

Kayenta Summary Financial Statistics Margin Per Ton (1) (1) Expected tons sold in Q4’15 of ~1.4Mt.

Midwest Selected Operations Locations

Wild Boar Overview Product 11,000 Btu, 9.3% Ash, 14.0% Moisture, 5.9 lbs. SO2 Ownership 100% owner operator Location Lynnville, IN Overview Began production in 2010 Surface mines operating a combination of truck and shovel and tractor push Average projected strip ratio (total yards / tons produced) over the next 3 years: ~19.65 Operates 24 hours per day, 7 days per week, year-round Prep plant has capacity of 650tph and is located near Wild Boar and Somerville UMI servicing both operations Minable Reserves 15Mt Major Equipment 21 Dozers, 8 Excavators, 7 Haul Trucks, 11 Dump Trucks, 2 Loaders Transportation Rail (NS, ISRR and CSX), Rail to Barge (via Ohio River MP 772.5) Geology Seams mined: Indiana 5 and 5A (1) Proven & Probable Reserves as of December 31, 2014; sourced from 10-K Tons Sold (Mt)

Wild Boar Summary Financial Statistics Margin Per Ton

Francisco UG Overview Product Thermal: 11,500 Btu, 8.6% Ash, 12.1% Moisture, 6.1 lbs. SO2 Ownership 100% owner operator Location Near Francisco in Gibson County, IN Overview Began production in 2003 Underground mine operating 3 split-air CM supersections utilizing battery coal haulers Operates two 8-hour shifts, 5.5 days a week, year-round Prep Plant has capacity of 650tph Minable Reserves 31.0Mt Major Equipment 36 Coal Haulers, 29 Continuous Miners, 19 Roof Bolters, 13 Scoops Transportation Rail (NS), Truck Geology Seams mined: Indiana 5 (1) Proven & Probable Reserves as of December 31, 2014; sourced from 10-K Tons Sold (Mt)

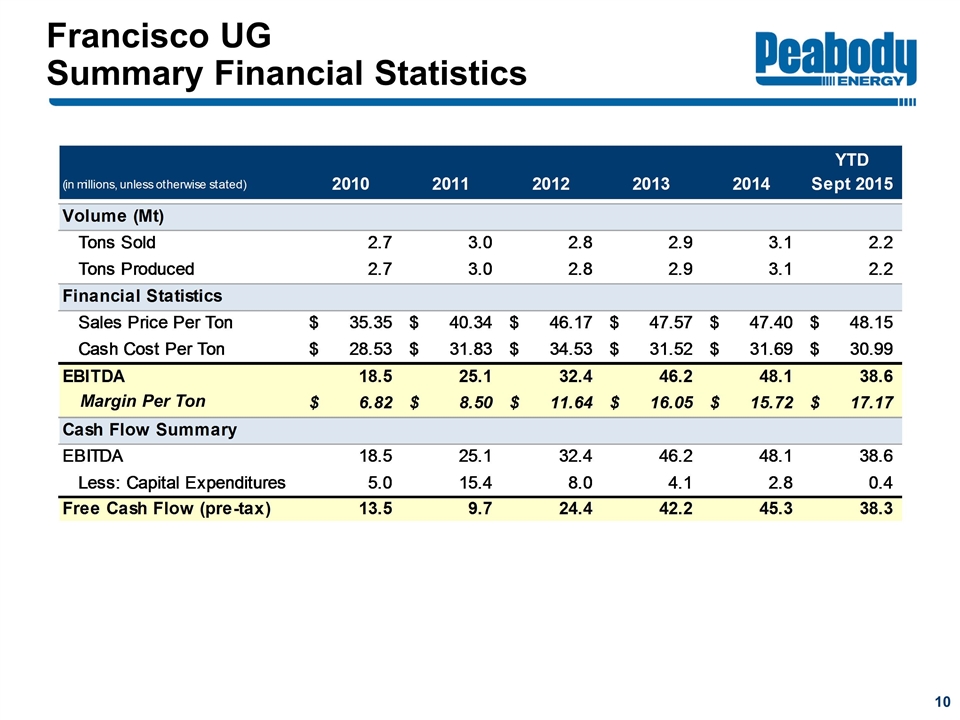

Francisco UG Summary Financial Statistics Margin Per Ton

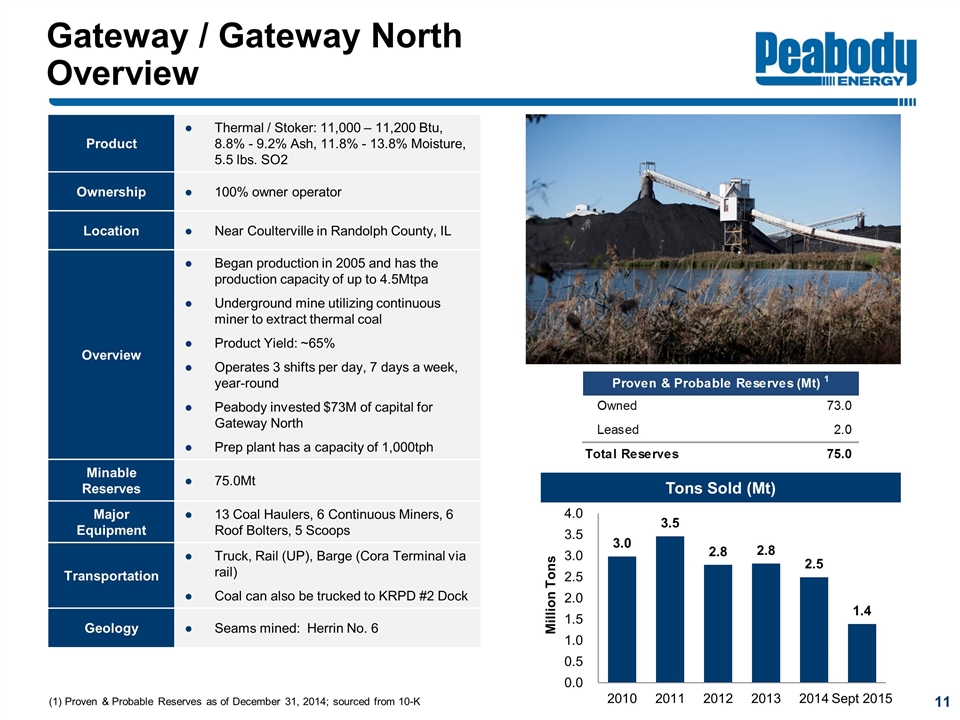

Gateway / Gateway North Overview Product Thermal / Stoker: 11,000 – 11,200 Btu, 8.8% - 9.2% Ash, 11.8% - 13.8% Moisture, 5.5 lbs. SO2 Ownership 100% owner operator Location Near Coulterville in Randolph County, IL Overview Began production in 2005 and has the production capacity of up to 4.5Mtpa Underground mine utilizing continuous miner to extract thermal coal Product Yield: ~65% Operates 3 shifts per day, 7 days a week, year-round Peabody invested $73M of capital for Gateway North Prep plant has a capacity of 1,000tph Minable Reserves 75.0Mt Major Equipment 13 Coal Haulers, 6 Continuous Miners, 6 Roof Bolters, 5 Scoops Transportation Truck, Rail (UP), Barge (Cora Terminal via rail) Coal can also be trucked to KRPD #2 Dock Geology Seams mined: Herrin No. 6 (1) Proven & Probable Reserves as of December 31, 2014; sourced from 10-K Tons Sold (Mt)

Gateway / Gateway North Summary Financial Statistics Margin Per Ton (1) (1) Cash cost per ton expected to decrease going forward.

Other Information(1) 13 Bonding Requirements as of 9/30/15 (dollars in thousands) Consolidating Balance Sheet – September 30, 2015 Unaudited (dollars in thousands) (1) Peabody also inadvertently included in a spreadsheet provided to certain holders of Peabody's debt in columns entitled "2016 Prior Plan" the following information (in thousands, except per ton amounts): Tons Sold – Francisco Underground, 2,913; Gateway – –; Gateway North – 2,658; Wild Boar – 2,011; Kayenta – 7,800; Tons Produced – Francisco Underground, 2,913; Gateway – –; Gateway North – 2,658; Wild Boar – 2,011; Kayenta – 7,800; Sales Price per Ton – Francisco Underground, $42.00; Gateway – –; Gateway North – $39.46; Wild Boar – $43.24; Kayenta – $41.97; Cash Cost per Ton – Francisco Underground, $36.67; Gateway – –; Gateway North – $25.95; Wild Boar – $32.45; Kayenta – $32.24; Margin per Ton – Francisco Underground, $5.33; Gateway – –; Gateway North – $13.51; Wild Boar – $10.79; Kayenta – $9.73; EBITDA – Francisco Underground, $15,535; Gateway – –; Gateway North – $35,915; Wild Boar – $21,687; Kayenta – $75,901; Capital Expenditures – Francisco Underground, $15,535; Gateway – –; Gateway North – $35,915; Wild Boar – $21,687; Kayenta – $75,901; Bonding Requirements – Francisco Underground, $15,535; Gateway – –; Gateway North – $35,915; Wild Boar – $21,687; Kayenta – $75,901. This information is outdated and has not been utilized by Peabody for any purpose. Peabody therefore does not view this information as either relevant or material; accordingly, this information should not be relied upon for any purpose.