Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - LOCAL Corp | d127823d8k.htm |

Exhibit 99

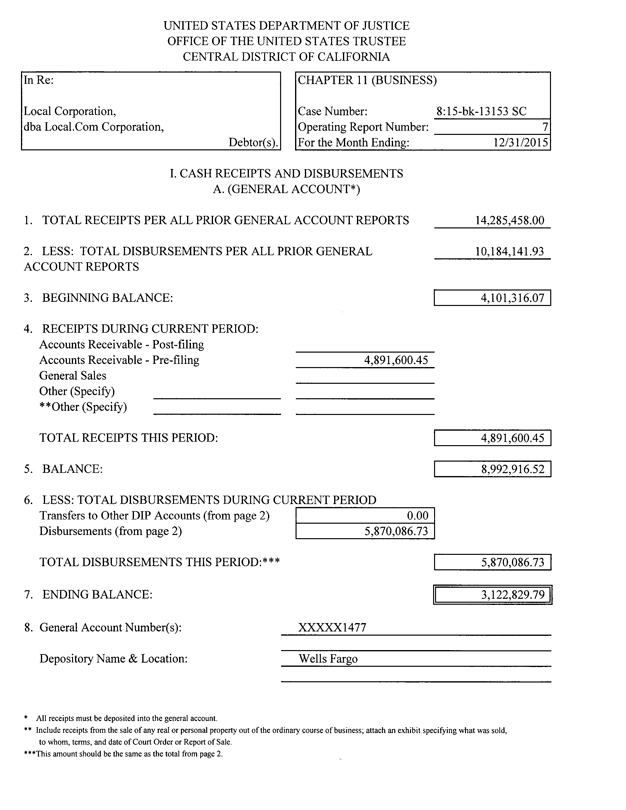

UNITED STATES DEPARTMENT OF JUSTICE OFFICE OF THE UNITED STATES TRUSTEE CENTRAL DISTRICT OF CALIFORNIA

In Re: CHAPTER 11 (BUSINESS)

Local Corporation, Case Number: 8:15-bk-13153 SC

dba Local.Com Corporation, Operating Report Number: 7

Debtor(s). For the Month Ending: 12/31

/2015

I. CASH RECEIPTS AND DISBURSEMENTS

A. (GENERAL ACCOUNT*)

1. TOTAL RECEIPTS PER ALL PRIOR GENERAL ACCOUNT REPORTS 14,285,458.00

2. LESS: TOTAL

DISBURSEMENTS PER ALL PRIOR GENERAL ACCOUNT REPORTS 10,184,141.93

3. BEGINNING BALANCE: 4,101,316.07

4. RECEIPTS DURING CURRENT PERIOD:

Accounts Receivable - Post-filing

Accounts Receivable - Pre-filing 4,891,600.45

General Sales

Other (Specify)

** Other (Specify)

TOTAL RECEIPTS THIS PERIOD: 4,891,600.45

5. BALANCE: 8,992,916.52

6. LESS: TOTAL DISBURSEMENTS DURING CURRENT PERIOD

Transfers to Other DIP Accounts (from page

2) 0.00

Disbursements (from page 2) 5,870,086.73

TOTAL DISBURSEMENTS THIS

PERIOD:*** 5,870,086.73

7. ENDING BALANCE: 3,122,829.79

8. General Account

Number(s): XXXXX1477

Depository Name & Location: Wells Fargo

* All

receipts must be deposited into the general account.

** Include receipts from the sale of any real or personal property out of the ordinary course of business;

attach an exhibit specifying what was sold, to whom, terms, and date of Court Order or Report of Sale.

***This amount should be the same as the total from page 2.

Page

1

of 12

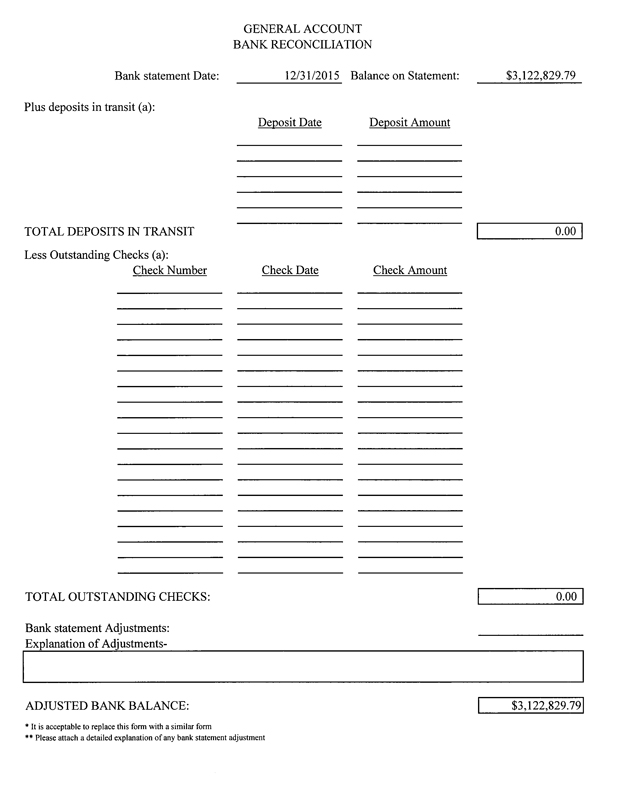

GENERAL ACCOUNT BANK RECONCILIATION

Bank statement

Date: 12/31/2015

Balance on Statement: $3,122,829.79

Plus deposits in transit

(a):

Deposit Date Deposit Amount

TOTAL DEPOSITS IN TRANSIT 0.00

Less Outstanding Checks (a): Check Number Check Date Check Amount

TOTAL OUTSTANDING CHECKS:

0.00

Bank statement Adjustments:

Explanation of Adjustments-

ADJUSTED BANK BALANCE: $3,122,829.79

* It is acceptable to replace this form with a similar

form

** Please attach a detailed explanation of any bank statement adjustment

Page

2

of 12

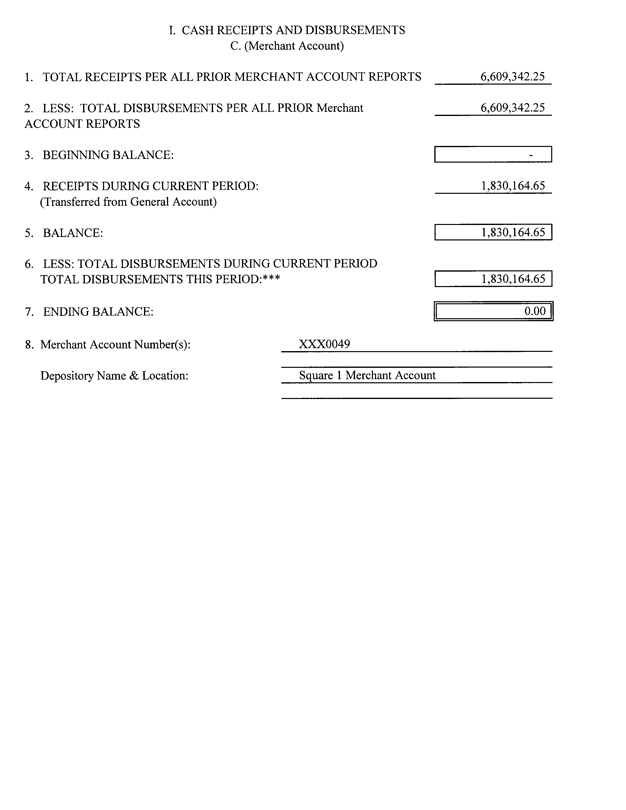

I. CASH RECEIPTS AND DISBURSEMENTS C. (Merchant Account)

1. TOTAL RECEIPTS PER ALL PRIOR MERCHANT ACCOUNT REPORTS 6,609,342.25

2. LESS: TOTAL

DISBURSEMENTS PER ALL PRIOR Merchant ACCOUNT REPORTS 6,609,342.25

3. BEGINNING BALANCE: -

4. RECEIPTS DURING CURRENT PERIOD:

(Transferred from General Account) 1,830,164.65

5. BALANCE: 1,830,164.65

6. LESS: TOTAL DISBURSEMENTS DURING CURRENT PERIOD TOTAL

DISBURSEMENTS THIS PERIOD:*** 1,830,164.65

7. ENDING BALANCE: 0.00

8.

Merchant Account Number(s): XXX0049

Depository Name & Location: Square 1 Merchant Account

Page

3

of 12

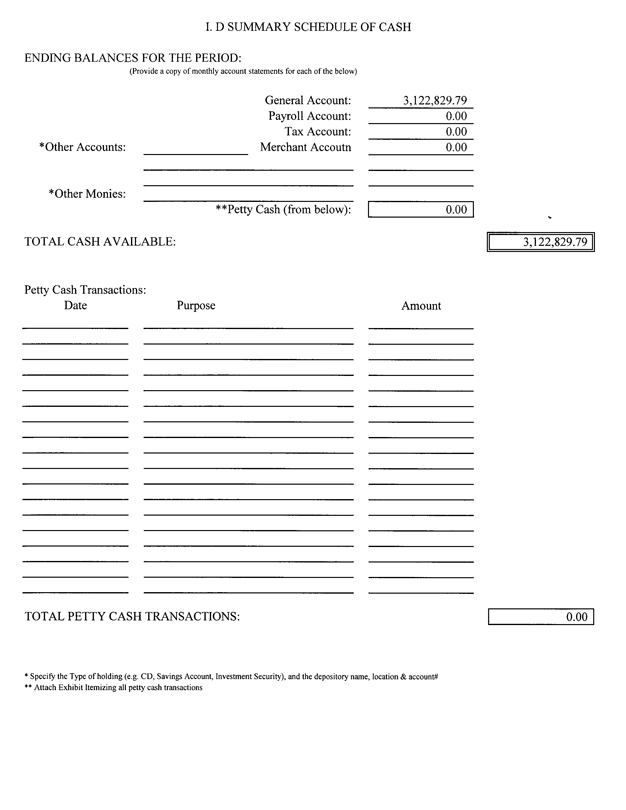

I. D SUMMARY SCHEDULE OF CASH

ENDING BALANCES FOR

THE PERIOD:

(Provide a copy of monthly account statements for each of the below)

General Account:

3,122,829.79

Payroll Account:

0.00

Tax Account:

0.00

* Other Accounts:

Merchant Accoutn

0.00

* Other Monies:

**Petty Cash (from below):

0.00

TOTAL CASH AVAILABLE:

3,122,829.79

Petty Cash Transaction

Date

Purpose

Amount

TOTAL PETTY CASH TRANSACTIONS:

0.00

* Specify the Type of holding (e.g. CD, Savings Account, Investment Security), and the depository name, location & account#

** Attach Exhibit Itemizing all petty cash transactions

Page

4

of 12

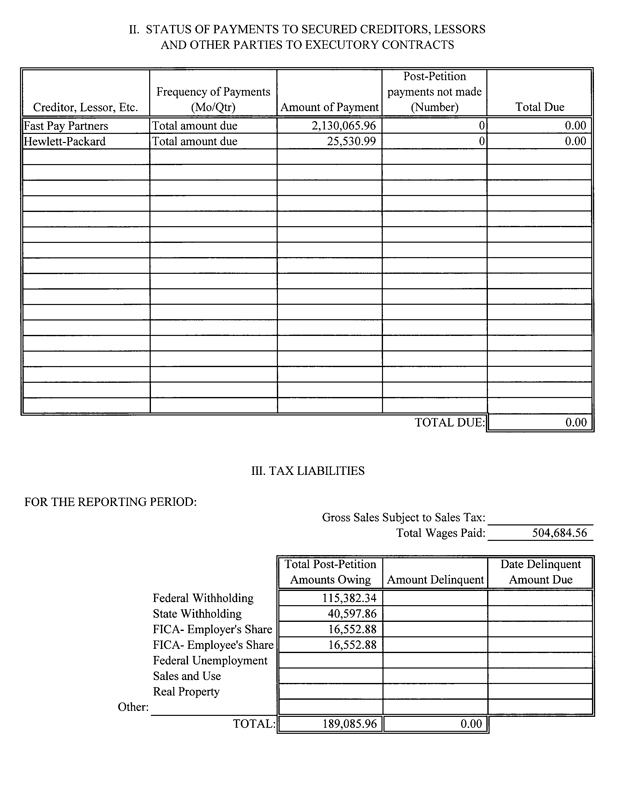

II. STATUS OF PAYMENTS TO SECURED CREDITORS, LESSORS AND OTHER PARTIES TO EXECUTORY CONTRACTS

Creditor, Lessor, Etc.

Frequency of Payments (Mo/Qtr)

Amount of Payment

Post-Petition payments not made (Number)

Total Due

Fast Pay Partners Total amount due 2,130,065.96 0 0.00

Hewlett-Packard Total amount due 25,530.99 0 0.00

TOTAL DUE: 0.00

III. TAX LIABILITIES

FOR THE REPORTING PERIOD:

Gross Sales Subject to Sales Tax:

Total Wages Paid:

504,684.56

Total Post-Petition Amounts Owing

Amount Delinquent

Date Delinquent Amount Due

Federal Withholding 115,382.34

State Withholding 40,597.86

FICA- Employer’s Share 16,552.88

FICA- Employee’s Share 16,552.88

Federal Unemployment

Sales and Use

Real Property

Other:

TOTAL: 189,085.96 0.00

Page

5

of 12

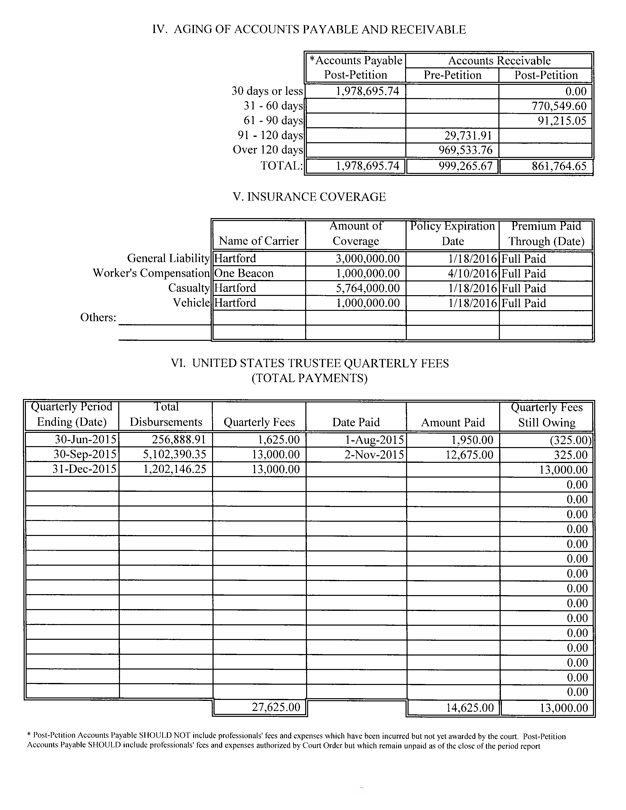

IV. AGING OF ACCOUNTS PAYABLE AND RECEIVABLE

*Accounts Payable Post-Petition Accounts Receivable

Pre-Petition

Post-Petition

30 days or less 1,978,695.74 0.00

31 - 60 days 770,549.060

61 - 90 days 91,215.05

91 -120 days 29,731.91

Over 120 days 969,533.76

TOTAL: 1,978,695.74 999,265.67 861,764.65

V. INSURANCE COVERAGE

Name of Carrier Amount of Coverage Policy Expiration Date Premium Paid Through (Date)

General

Liability Hartford 3,000,000.00 1/18/2016 Full Paid

Worker’s Compensation One Beacon 1,000,000.00 4/10/2016 Full Paid

Casualty Hartford 5,764,000.00 1/18/2016 Full Paid

Vehicle Hartford 1,000,000.00 1/18/2016

Full Paid

Others:

VI. UNITED STATES TRUSTEE QUARTERLY FEES (TOTAL PAYMENTS)

Quarterly Period Ending (Date)

Total Disbursements

Quarterly Fees Date Paid Amount Paid Quarterly Fees Still Owing

30-Jun-2015 256,888.91

1,625.00 1-Aug-2015 1,950.00 (325.00)

30-Sep-2015 5,102,390.35 13,000.00 2-Nov-2015 12,675.00 325.00

31-Dec-2015 1,202,146.25 13,000.00 13,000.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

27,625.00

14,625.00

13,000.00

* Post-Petition Accounts Payable SHOULD NOT include professionals’ fees and

expenses which have been incurred but not yet awarded by the court. Post-Petition Accounts Payable SHOULD include professionals’ fees and expenses authorized by Court Order but which remain unpaid as of the close of the period report

Page

6

of 12

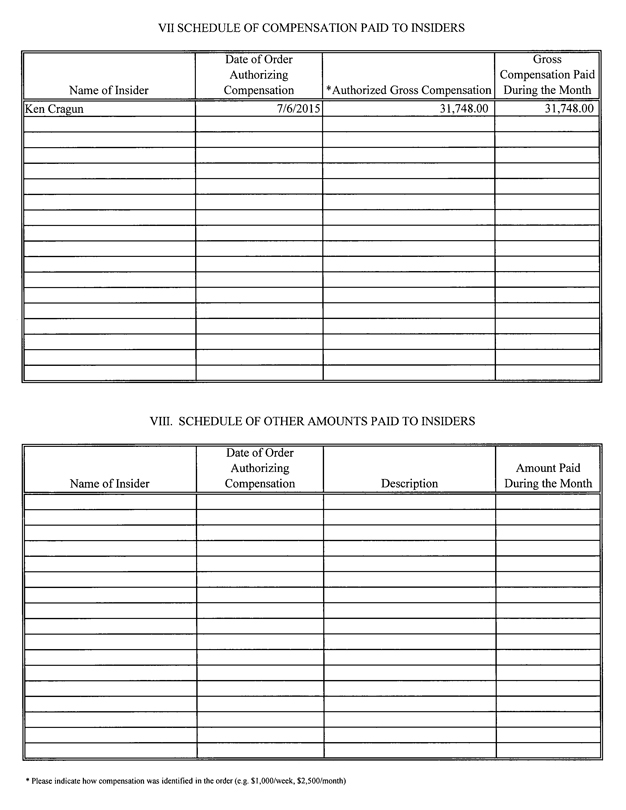

VII SCHEDULE OF COMPENSATION PAID TO INSIDERS

Name

of Insider

Date of Order Authorizing Compensation

*Authorized Gross

Compensation

Gross Compensation Paid During the Month

Ken Cragun

7/6/2015

31,748.00

31,748.00

VIII. SCHEDULE OF OTHER AMOUNTS PAID TO INSIDERS

Name of Insider

Date of Order Authorizing Compensation

Description

Amount Paid During the Month

* Please indicate how compensation was identified in the order (e.g. $1,000/week, $2,500/month)

Page

7

of 12

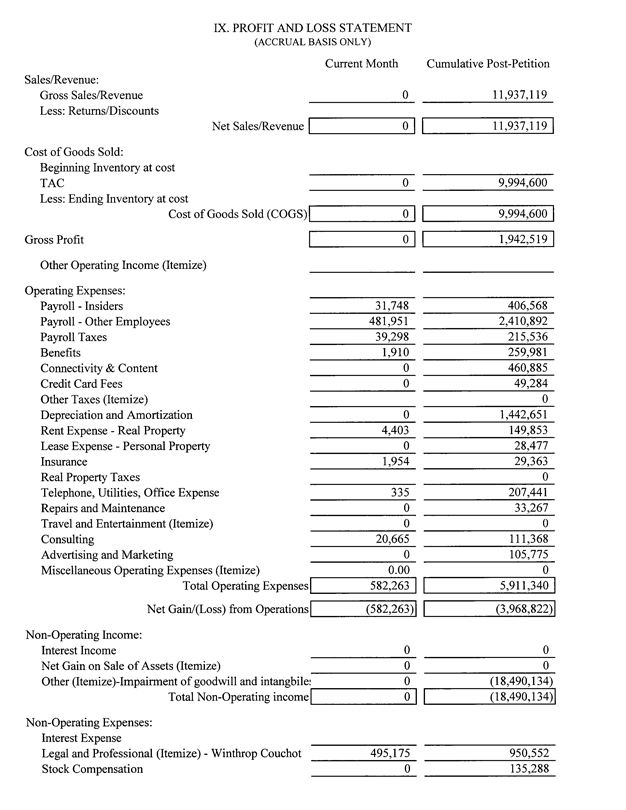

IX. PROFIT AND LOSS STATEMENT

(ACCRUAL BASIS ONLY)

Current Month

Cumulative Post-Petition

Sales/Revenue:

Gross Sales/Revenue 0 11,937,119

Less: Returns/Discounts

Net Sales/Revenue 0 11,937,119

Cost of Goods Sold:

Beginning Inventory at cost

TAC 0 9,994,600

Less: Ending Inventory at cost

Cost of Goods Sold (COGS) 0 9,994,600

Gross Profit 0 1,942,519

Other Operating Income (Itemize)

Operating Expenses:

Payroll - Insiders 31,748 406,568

Payroll - Other Employees 481,951 2,410,892

Payroll Taxes 39,298 215,536

Benefits 1,910 259,981

Connectivity & Content 0 460,885

Credit Card Fees 0 49,284

Other Taxes (Itemize) 0

Depreciation and Amortization 0 1,442,651

Rent Expense - Real Property 4,403 149,853

Lease Expense - Personal Property 0 28,477

Insurance 1,954 29,363

Real Property Taxes 0

Telephone, Utilities, Office Expense 335 207,441

Repairs and Maintenance 0 33,267

Travel and Entertainment (Itemize) 0 0

Consulting 20,665 111,368

Advertising and Marketing 0 105,775

Miscellaneous Operating Expenses (Itemize) 0.00 0

Total Operating Expenses 582,263 5,911,340

Net Gain/(Loss) from Operations

(582,263) (3,968,822)

Non-Operating Income:

Interest Income 0 0

Net Gain on Sale of Assets (Itemize) 0 0

Other (Itemize)-Impairment of goodwill and intangbile

0 (18,490,134)

Total Non-Operating income 0 (18,490,134)

Non-Operating

Expenses:

Interest Expense

Legal and Professional (Itemize) - Winthrop

Couchot 495,175 950,552

Stock Compensation 0 135,288

Page

8

of 12

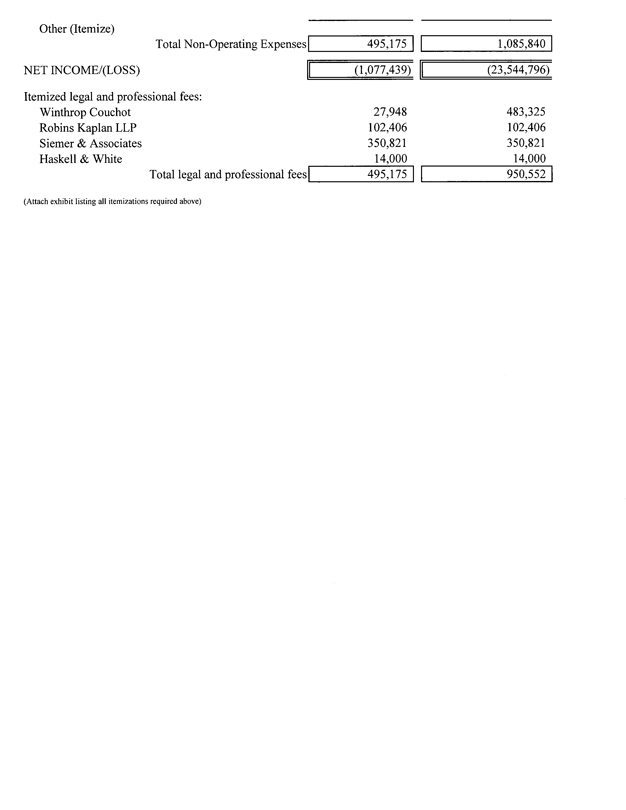

Other (Itemize)

Total Non-Operating Expenses

495,175 1,085,840

NET INCOME/(LOSS) (1,077,439) (23,544,796)

Itemized legal

and professional fees:

Winthrop Couchot 27,948 483,325

Robins Kaplan LLP

102,406 102,406

Siemer & Associates 350,821 350,821

Haskell & White

14,000 14,000

Total legal and professional fees 495,175 950,552

(Attach

exhibit listing all itemizations required above)

Page

9

of 12

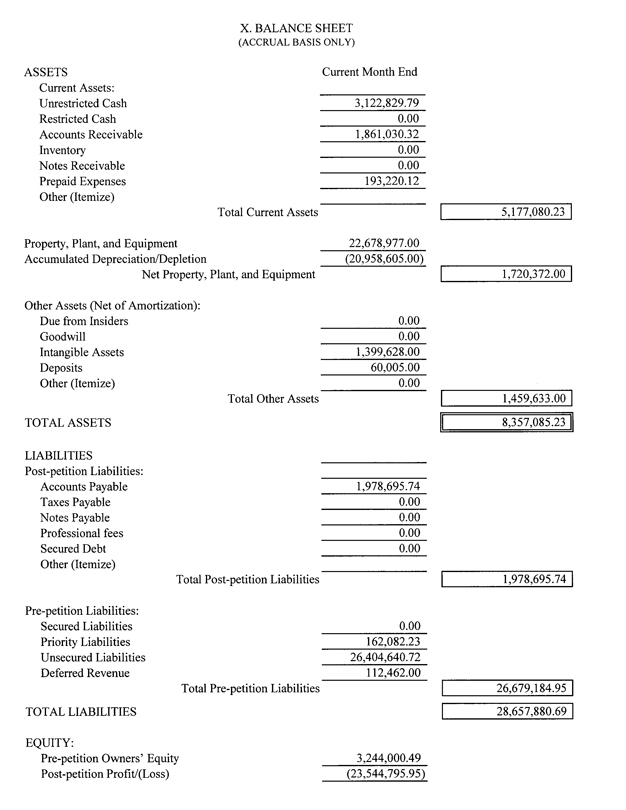

X. BALANCE SHEET

(ACCRUAL BASIS ONLY)

ASSETS

Current Month End

Current Assets:

Unrestricted Cash 3,122,829.79

Restricted Cash 0.00

Accounts Receivable 1,861,030.32

Inventory 0.00

Notes Receivable 0.00

Prepaid Expenses 193,220.12

Other (Itemize)

Total Current Assets 5,177,080.23

Property, Plant, and Equipment 22,678,977.00

Accumulated Depreciation/Depletion (20,958,605.00)

Net Property, Plant, and Equipment

1,720,372.00

Other Assets (Net of Amortization):

Due from Insiders 0.00

Goodwill 0.00

Intangible Assets 1,399,628.00

Deposits 60,005.00

Other (Itemize) 0.00

Total Other Assets 1,459,633.00

TOTAL ASSETS 8,357,085.23

LIABILITIES

Post-petition Liabilities:

Accounts Payable 1,978,695.74

Taxes Payable 0.00

Notes Payable 0.00

Professional fees 0.00

Secured Debt 0.00

Other (Itemize)

Total Post-petition Liabilities 1,978,695.74

Pre-petition Liabilities:

Secured Liabilities 0.00

Priority Liabilities 162,082.23

Unsecured Liabilities 26,404,640.72

Deferred Revenue 112,462.00

Total Pre-petition Liabilities 26,679,184.95

TOTAL LIABILITIES 28,657,880.69

EQUITY:

Pre-petition Owners’ Equity 3,244,000.49

Post-petition Profit/(Loss) (23,544,795.95)

Page

10

of 12

Direct Charges to Equity

0.00

TOTAL EQUITY

(20,300,795.46)

TOTAL LIABILITIES & EQUITY

8,357,085.23

Page

11

of 12

XI. QUESTIONNAIRE

No

Yes

1. Has the debtor-in-possession made any payments on its pre-petition unsecured debt,

except as have been authorized by the court? If “Yes”, explain below: X No Yes

2. Has the debtor-in-possession during this reporting period provided

compensation or remuneration to any officers, directors, principals, or other insiders without appropriate authorization? If “Yes”, explain below: X

3.

State what progress was made during the reporting period toward filing a plan of reorganization Completed a Section 363 asset sale to Media.net

4. Describe

potential future developments which may have a significant impact on the case: Collecting receivables and looking to make a distrubution to unsecured creditors

5.

Attach copies of all Orders granting relief from the automatic stay that were entered during the reporting period. No Yes

6. Did you receive any exempt income this

month, which is not set forth in the operating report? If “Yes”, please set forth the amounts and sources of the income below.

I, Kenneth S. Cragun,

Chief Financial Officer, declare under penalty of perjury that I have fully read and understood the foregoing debtor-in- possession operating report and that the information contained herein is true and complete to the best of my knowledge.

1-14-16

Date

Principal for debtor-in-possession

Page

12

of 12