Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WESTERN ALLIANCE BANCORPORATION | coverpage-pressrelease1231.htm |

| EX-99.1 - EXHIBIT 99.1 - WESTERN ALLIANCE BANCORPORATION | pressrelease-12312015.htm |

4th Quarter Earnings Call 2015 January 22, 2016

2 Financial Highlights ▪ Net income of $58.5 million and earnings per share of $0.57, compared to $55.9 million and $0.55 per share for Q3 2015, and $40.4 million and $0.46 per share for Q4 2014 ▪ Net interest margin of 4.67%, compared to 4.59% in Q3 2015, and 4.44% in Q4 2014 ▪ Efficiency ratio of 45.2%, compared to 46.8% in Q3 2015, and 49.3% in Q4 2014 ▪ Total loans of $11.14 billion, up $348 million from prior quarter and total deposits of $12.03 billion, up $420 million from prior quarter ▪ Nonperforming assets (nonaccrual loans and repossessed assets) decreased to 0.65% of total assets, from 0.76% at September 30, 2015 ▪ Net loan charge-offs (annualized) to average loans outstanding of 0.02%, compared to net loan recoveries to average loans outstanding of 0.08% in Q3 2015 and 0.04% in Q4 2014 ▪ Tangible common equity ratio of 9.2% and tangible book value per share, net of tax, of $12.54, compared to 8.9% and $11.86, respectively, at September 30, 2015 ▪ Net income of $194.2 million and earnings per share of $2.03, compared to $148.0 million and $1.67 per share for 2014 ▪ Return on average assets and return on tangible common equity ratio of 1.56% and 17.83%, compared to 1.50% and 18.52% in 2014 ▪ Net interest margin of 4.51%, compared to 4.42% in 2014 ▪ Total loan and deposit increase, including acquisition of Bridge, of $2.74 billion and $3.10 billion, respectively, from December 31, 2014 ▪ Net loan recoveries to average loans outstanding of 0.06% and nonperforming assets (nonaccrual loans and repossessed assets) to total assets of 0.65%, compared to 0.07% and 1.18%, respectively, in 2014 ▪ Tangible common equity ratio of 9.2% and tangible book value per share, net of tax, of $12.54, compared to 8.6% and $10.21, respectively, at December 31, 2014 Note: Prior period financial results for 2015 have been adjusted to reflect the adoption of the accounting guidance in ASU 2016-01, Recognition and Measurement of Financial Assets and Financial Liabilities. See the supplemental schedule at the end of the press release for the impact that adoption had on prior period financial results. Q4 2015 HIGHLIGHTS FULL YEAR 2015 HIGHLIGHTS 2

3 Quarterly Consolidated Financial Results $ in millions, except EPS Q4 2015 HIGHLIGHTS ▪ Net Interest Income rose $5.9 million (4.3%) driven by loan growth ▪ Operating Non-Interest Expense increased $0.6 million (0.8%) driven by higher non-compensation costs of $3.1 and lower compensation costs of $2.5 million ▪ Provision for Credit Losses driven by ongoing increase in loan balances ▪ Following early adoption of new accounting rules for junior subordinated debt, gains and losses from January 1, 2015 forward are no longer recorded through earnings Q4-15 Q3-15 Q4-14 Net Interest Income $ 143.3 $ 137.4 $ 102.1 Operating Non-Interest Income 9.4 8.5 6.7 Net Operating Revenue $ 152.8 $ 145.9 $ 108.8 Operating Non-Interest Expense (72.8) (72.2) (56.8) Pre-Tax, Pre-Provision Income $ 79.9 $ 73.7 $ 52.0 Provision for Credit Losses (2.5) — (0.3) Gains on OREO and Other Assets 0.4 0.1 1.1 Debt Valuation and Other Fair Market Value Adjustments — — 1.4 Acquisition and Other 0.1 (0.8) 0.3 Pre-tax Income $ 77.9 $ 73.0 $ 54.5 Income Tax (19.3) (17.1) (14.1) Net Income $ 58.5 $ 55.9 $ 40.4 Preferred Dividend (0.2) (0.2) (0.3) Net Income Available to Common $ 58.4 $ 55.7 $ 40.1 Average Diluted Shares Outstanding 102.0 101.5 88.0 Earnings Per Share $ 0.57 $ 0.55 $ 0.46 3

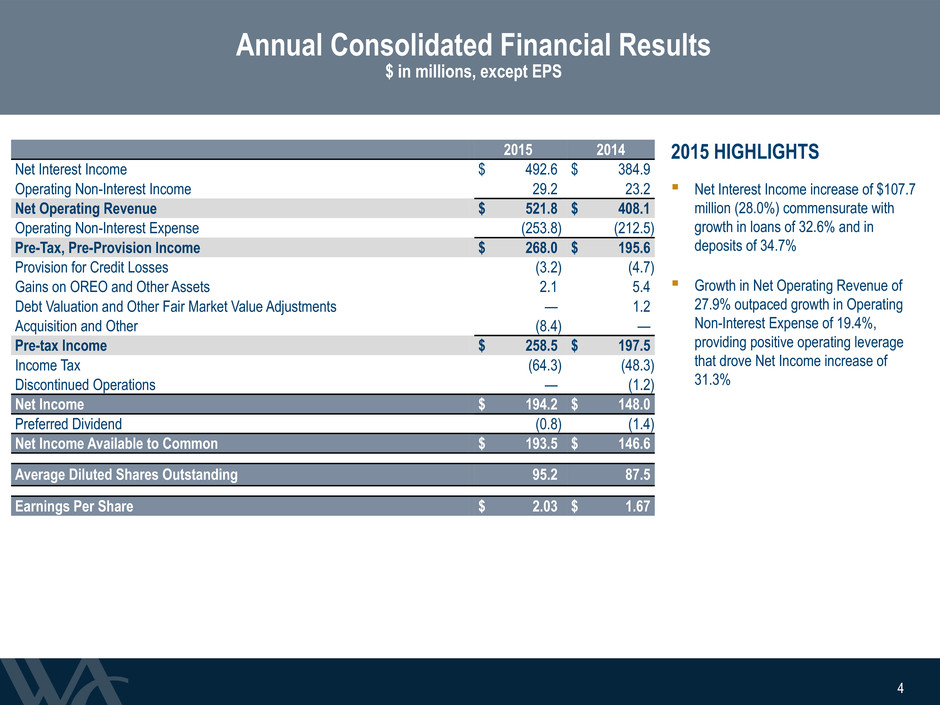

4 Annual Consolidated Financial Results $ in millions, except EPS 2015 HIGHLIGHTS ▪ Net Interest Income increase of $107.7 million (28.0%) commensurate with growth in loans of 32.6% and in deposits of 34.7% ▪ Growth in Net Operating Revenue of 27.9% outpaced growth in Operating Non-Interest Expense of 19.4%, providing positive operating leverage that drove Net Income increase of 31.3% 2015 2014 Net Interest Income $ 492.6 $ 384.9 Operating Non-Interest Income 29.2 23.2 Net Operating Revenue $ 521.8 $ 408.1 Operating Non-Interest Expense (253.8) (212.5) Pre-Tax, Pre-Provision Income $ 268.0 $ 195.6 Provision for Credit Losses (3.2) (4.7) Gains on OREO and Other Assets 2.1 5.4 Debt Valuation and Other Fair Market Value Adjustments — 1.2 Acquisition and Other (8.4) — Pre-tax Income $ 258.5 $ 197.5 Income Tax (64.3) (48.3) Discontinued Operations — (1.2) Net Income $ 194.2 $ 148.0 Preferred Dividend (0.8) (1.4) Net Income Available to Common $ 193.5 $ 146.6 Average Diluted Shares Outstanding 95.2 87.5 Earnings Per Share $ 2.03 $ 1.67 4

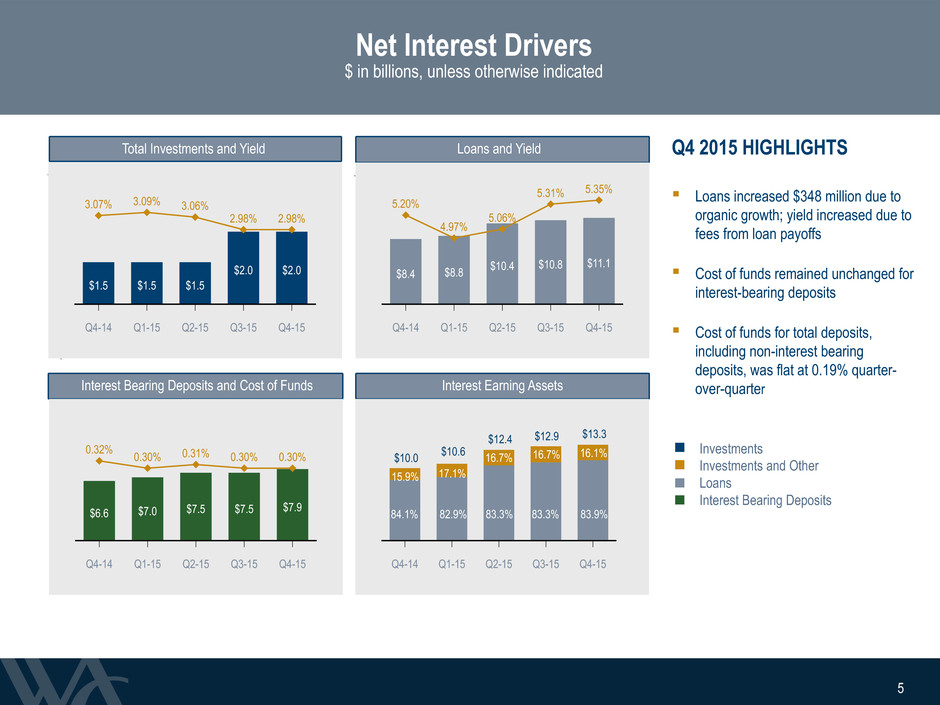

5 Net Interest Drivers $ in billions, unless otherwise indicated Interest Bearing Deposits and Cost of Funds Loans and Yield Interest Earning Assets Q4-14 Q1-15 Q2-15 Q3-15 Q4-15 Q4 2015 HIGHLIGHTS ▪ Loans increased $348 million due to organic growth; yield increased due to fees from loan payoffs ▪ Cost of funds remained unchanged for interest-bearing deposits ▪ Cost of funds for total deposits, including non-interest bearing deposits, was flat at 0.19% quarter- over-quarter Total Investments and Yield Q4-14 Q1-15 Q2-15 Q3-15 Q4-15 3.07% 3.09% 3.06% 2.98% 2.98% $1.5 $1.5 $1.5 $2.0 $2.0 Q4-14 Q1-15 Q2-15 Q3-15 Q4-15 5.20% 4.97% 5.06% 5.31% 5.35% $8.4 $8.8 $10.4 $10.8 $11.1 Q4-14 Q1-15 Q2-15 Q3-15 Q4-15 0.32% 0.30% 0.31% 0.30% 0.30% $6.6 $7.0 $7.5 $7.5 $7.9 84.1% 82.9% 83.3% 83.3% 83.9% 15.9% $10.0 Investments Investments and Other Loans Interest Bearing Deposits 17.1% 16.7% 16.7% 16.1% $10.6 $12.4 $12.9 $13.3 5

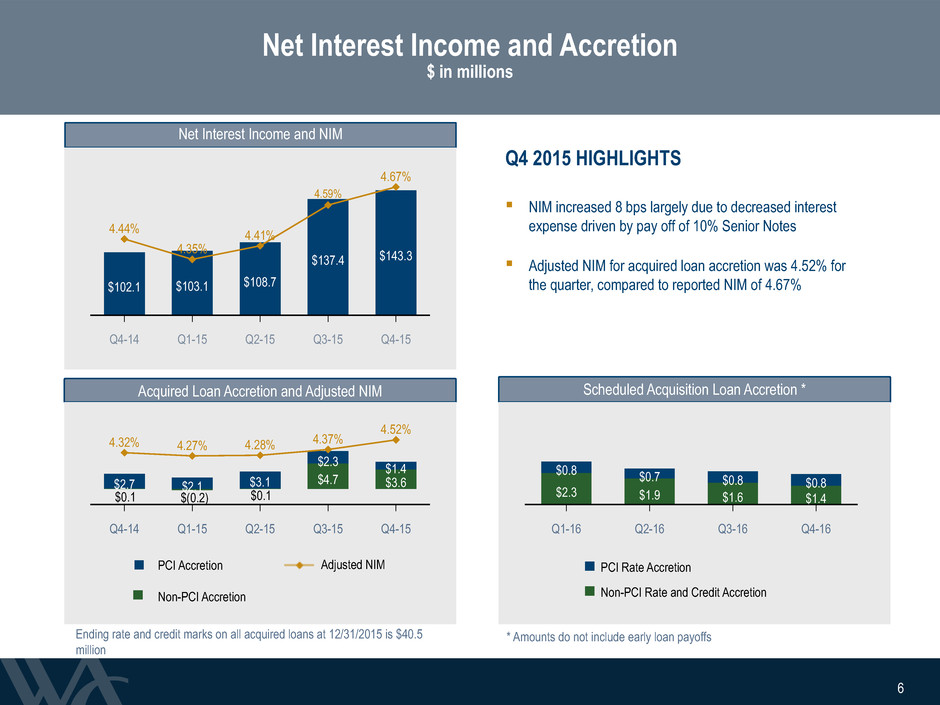

6 Net Interest Income and Accretion $ in millions Q4 2015 HIGHLIGHTS ▪ NIM increased 8 bps largely due to decreased interest expense driven by pay off of 10% Senior Notes ▪ Adjusted NIM for acquired loan accretion was 4.52% for the quarter, compared to reported NIM of 4.67% Net Interest Income and NIM Acquired Loan Accretion and Adjusted NIM Q4-14 Q1-15 Q2-15 Q3-15 Q4-15 4.44% 4.35% 4.41% 4.59% 4.67% $102.1 $103.1 $108.7 $137.4 $143.3 Non-PCI Accretion PCI Accretion Adjusted Net Interest Margin, excluding accretion Q4-14 Q1-15 Q2-15 Q3-15 Q4-15 $4.7 $3.6$2.7 $2.1 $3.1 $2.3 $1.4 4.32% 4.27% 4.28% 4.37% 4.52% $0.1 Scheduled Acquisition Loan Accretion * Non-PCI Rate and Credit Accretion PCI Rate Accretion Q1-16 Q2-16 Q3-16 Q4-16 $2.3 $1.9 $1.6 $1.4 $0.8 $0.7 $0.8 $0.8 $0.1 $(0.2) * Amounts do not include early loan payoffsEnding rate and credit marks on all acquired loans at 12/31/2015 is $40.5 million PCI Accretion Non-PCI Accretion PCI Rate Accretion Non-PCI Rate and Credit Accretion Adjusted NIM 6

7 Q4-14 Q1-15 Q2-15 Q3-15 Q4-15 $33.1 $32.5 $32.4 $43.7 $41.2 $7.1 $6.9 $7.2 $9.3 $9.8$5.8 $7.1 $7.3 $8.4 $10.5$10.8 $7.7 $7.7 $10.8 $11.3 Operating Expenses and Efficiency $ in millions Q4 2015 HIGHLIGHTS ▪ The Efficiency Ratio improved to 45.2% as revenue increases of $6.9 million outpaced expense increases of $0.6 million ▪ Compensation Expense decreased $2.5 million as a result of normalized bonus accrual compared to prior quarter ▪ Professional Fees and Data Processing costs increased $2.1 million and Other Expenses increased $0.5 million Operating Expenses and Efficiency Ratio Breakdown of Operating Expenses Other Professional Fees + Data Processing Occupancy + Insurance Compensation Q4-14 Q1-15 Q2-15 Q3-15 Q4-15 49.3% 46.7% 44.7% 46.8% 45.2% $56.8 $54.2 $54.6 $72.2 $72.8 7

8 Pre-Tax, Pre-Provision Operating Income, Net Income, and ROA $ in millions Pre-Tax, Pre-Provision Operating Income and ROA Q4-14 Q1-15 Q2-15 Q3-15 Q4-15 $52.0 $54.5 $59.7 $73.7 $79.9 2.00% 2.03% 2.14% 2.16% 2.28% Q4-14 Q1-15 Q2-15 Q3-15 Q4-15 $40.4 $40.4 $39.5 $55.9 $58.5 1.56% 1.50% 1.41% 1.64% 1.67% Pre-Tax, Pre-Provision Income and Net Income and related ROA quarter-over quarter increases are a result of organic growth and revenue increasing at a faster rate than expenses, assisted in part by an 8bps increase in Net Interest Margin Net Income and ROA 8

9 Consolidated Balance Sheet $ in millions ▪ Total Loans increased $348 million (3.2%) over prior quarter and $2.74 billion (32.6%) over prior year ▪ Deposits increased $420 million (3.6%) over prior quarter and $3.10 billion (34.7%) over prior year ▪ Increased deposits helped provide liquidity to reduce Borrowings by $161 million ▪ Shareholders' Equity increased $8 million primarily driven by $58.5 million in Net Income and the payoff of $70.5 million in SBLF Preferred Stock ▪ Tangible Book Value/Share increased $0.68 (5.7%) over prior quarter and $2.33 (22.8%) over prior year Q4 2015 HIGHLIGHTSQ4-15 Q3-15 Q4-14 Investments & Cash $ 2,267 $ 2,319 $ 1,712 Total Loans 11,136 10,788 8,398 Allowance for Credit Losses (119) (117) (110) Other Assets 991 966 601 Total Assets $ 14,275 $ 13,956 $ 10,601 Deposits $ 12,030 $ 11,610 $ 8,931 Borrowings 399 560 486 Other Liabilities 254 202 183 Total Liabilities $ 12,683 $ 12,372 $ 9,600 Shareholders' Equity 1,592 1,584 1,001 Total Liabilities and Equity $ 14,275 $ 13,956 $ 10,601 Tangible Book Value Per Share $ 12.54 $ 11.86 $ 10.21 9

10 Loan Growth and Portfolio Composition $ in millions Q4 2015 HIGHLIGHTS ▪ Quarter-over-quarter loan growth driven by: ◦ C&I $303 million ◦ CRE, Non Owner Occ $72 million ▪ Year-over-year loan growth driven by: ◦ C&I $1.74 billion ◦ Construction & Land $385 million ◦ CRE, Owner Occ $370 million $2.74 BILLION YEAR OVER YEAR GROWTH Q4-14 Q1-15 Q2-15 Q3-15 Q4-15 $3,532 $3,725 $4,765 $4,964 $5,267 $1,733 $1,818 $2,039 $2,144 $2,103$2,053 $2,114 $2,209 $2,211 $2,283 $748 $843 $1,003 $1,122 $1,133 $332 $319 $345 $347 $350 4.0% 20.6% 24.4% 42.1% 8.9% 3.1% 18.9% 20.5% 47.3% 10.2% Growth * Total increase in loans includes $1.44 billion from the acquisition of Bridge on June 30, 2015 Residential and Consumer Construction & Land CRE, Non-Owner Occupied CRE, Owner Occupied Commercial & Industrial $8,398 $8,819 +421 $10,361 +1,542 * $10,788 +427 $11,136 +348 10

11 Q4-14 Q1-15 Q2-15 Q3-15 Q4-15 $2,288 $2,657 $3,924 $4,077 $4,094 $855 $937 $1,001 $1,024 $1,028 $3,870 $4,121 $4,734 $4,673 $5,297$1,918 $1,947 $1,747 $1,836 $1,611 Deposit Growth and Composition $ in millions Q4 2015 HIGHLIGHTS ▪ Quarter-over-quarter deposit growth driven by: ◦ Savings and MMDA growth of $624 million, ◦ Offset by CD decrease of $225 million ▪ Year-over-year deposit growth driven by: ◦ Non-Int Bearing DDA growth of $1.81 billion ◦ Savings and MMDA growth of $1.43 billion, ◦ Offset by CD decrease of $307 million 9.6% 21.5% 25.6% 43.3% 8.5% 13.4% 34.0% 44.1% $3.10 BILLION YEAR OVER YEAR GROWTH * Total increase in deposits includes $1.74 billion from the acquisition of Bridge on June 30, 2015 CDs Savings and MMDA NOW Non-Interest Bearing DDA Growth $11,407 +1,745 * $9,662 +731 $8,931 $11,610 +203 $12,030 +420 11

12 Adversely Graded Assets to Total Assets NPA's to Total Assets Q4-14 Q1-15 Q2-15 Q3-15 Q4-15 3.07% 2.77% 2.69% 2.70% 2.54% 1.18% 1.11% 0.88% 0.76% 0.65% OREO Non-Performing Loans Classified Accruing Loans Special Mention Loans Q4-14 Q1-15 Q2-15 Q3-15 Q4-15 $57 $64 $59 $58 $44 $68 $61 $59 $48 $48 $90 $76 $101 $109 $119 $98 $100 $132 $153 $142 Adversely Graded Loans and Non-Performing Assets * $ in millions NPA’s Adversely Graded Loans $367 Accruing TDRs total $71 million as of 12/31/2015 $313 $301 $351 $353 * Amounts are net of total PCI credit and interest rate discounts of $24 million as of 12/31/2015 12 Special Mention Loans OREO

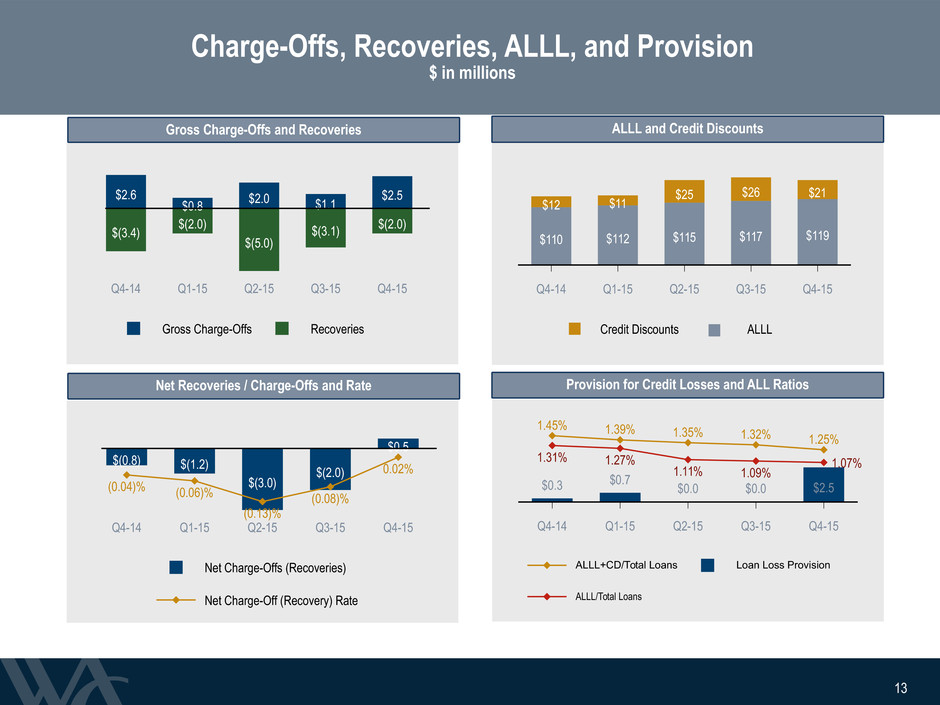

13 Gross Charge-Offs Recoveries Q4-14 Q1-15 Q2-15 Q3-15 Q4-15 $2.6 $0.8 $2.0 $1.1 $2.5 $(3.4) $(2.0) $(5.0) $(3.1) $(2.0) Charge-Offs, Recoveries, ALLL, and Provision $ in millions Gross Charge-Offs and Recoveries Net Recoveries / Charge-Offs and Rate ALLL+CD/Total Loans Loan Loss Provision ALLL/Total Loans Q4-14 Q1-15 Q2-15 Q3-15 Q4-15 1.45% 1.39% 1.35% 1.32% 1.25% $0.3 $0.7 $0.0 $0.0 $2.5 1.31% 1.27% 1.11% 1.09% 1.07% Net Charge-Offs (Recoveries) Net Charge-Off (Recovery) Rate Q4-14 Q1-15 Q2-15 Q3-15 Q4-15 $(0.8) $(1.2) $(3.0) $(2.0) $0.5 (0.04)% (0.06)% (0.13)% (0.08)% 0.02% ALLL and Credit Discounts ALLL Credit Discounts Q4-14 Q1-15 Q2-15 Q3-15 Q4-15 $110 $112 $115 $117 $119 $12 $11 $25 $26 $21 Provision for Credit Losses and ALL Ratios 13 Credit Discounts ALLL

14 Adjusted for Effect of No Reserve for Acquired Loans Reported Less: Acquired Loans* Adjusted Allowance for Credit Losses $ 119 $ 119 Total Loans Held for Investment 11,113 1,537 9,576 Ratio 1.07% 1.24% Adjusted for Effect of Acquired Loans Booked at Discount Reported Plus: Credit Discount* Adjusted Allowance for Credit Losses $ 119 $ 21 $ 140 Total Loans Held for Investment 11,113 21 11,134 Ratio 1.07% 1.25% * Western Liberty, Centennial and Bridge acquisitions Allowance for Credit Losses December 31, 2015 $ in millions 14

15 ROTCE TBV/Share Q4-14 Q1-15 Q2-15 Q3-15 Q4-15 18.2% 17.3% 16.0% 19.0% 18.6% $10.21 $10.72 $11.25 $11.86 $12.54 Capital Total Capital Common Equity Tier 1 Tier 1 Leverage Tangible Common Equity Q4-14 Q1-15 Q2-15 Q3-15 Q4-15 11.7% 11.3% 12.2% 12.1% 12.1% 9.0% 9.1% 9.1% 9.5% 9.7% 9.8% 10.0% 9.9% 9.8% 8.6% 8.5% 8.7% 8.9% 9.2% Capital Ratios Basel I Basel III ROTCE and TBV/Share 15

16 Outlook 1st Quarter 2016 ▪ Loan and Deposit Growth ▪ Interest Margin ▪ Operating Efficiency ▪ Asset Quality 16

17 Forward-Looking Statements This presentation contains forward-looking statements that relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. Examples of forward-looking statements include, among others, statements we make regarding the integration of Bridge Capital Holdings, the performance of the combined company, and any guidance, outlook, or expectations relating to loan and deposit growth, interest margin, operating efficiency, and asset quality. The forward-looking statements contained herein reflect our current views about future events and financial performance and are subject to risks, uncertainties, assumptions and changes in circumstances that may cause our actual results to differ significantly from historical results and those expressed in any forward-looking statement. Some factors that could cause actual results to differ materially from historical or expected results include, among others: the risk factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014 as filed with the Securities and Exchange Commission; changes in general economic conditions, either nationally or locally in the areas in which we conduct or will conduct our business; inflation, interest rate, market and monetary fluctuations; increases in competitive pressures among financial institutions and businesses offering similar products and services; higher defaults on our loan portfolio than we expect; changes in management’s estimate of the adequacy of the allowance for credit losses; legislative or regulatory changes or changes in accounting principles, policies or guidelines; supervisory actions by regulatory agencies which may limit our ability to pursue certain growth opportunities, including expansion through acquisitions; management’s estimates and projections of interest rates and interest rate policy; the execution of our business plan; and other factors affecting the financial services industry generally or the banking industry in particular. Any forward-looking statement made by us in this presentation is based only on information currently available to us and speaks only as of the date on which it is made. We do not intend and disclaim any duty or obligation to update or revise any industry information or forward-looking statements, whether written or oral, that may be made from time to time, set forth in this presentation to reflect new information, future events or otherwise. 17