Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION - SharkReach, Inc. | shrk_ex311.htm |

| EX-32.1 - CERTIFICATION - SharkReach, Inc. | shrk_ex321.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

x

For the fiscal year ended: SEPTEMBER 30, 2015

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

¨

For the transition period from: ___________ to ___________

Commission file number: 333-185509

SHARKREACH, INC. (FORMERLY ONLINE SECRETARY, INC.) |

(Exact name of registrant as specified in its charter) |

Nevada 46-0912423 (State or Other Jurisdiction of Incorporation or Organization) (IRS Employer Identification Number)

205 Pier Avenue, Suite

101, Hermosa Beach,

CA 90254

Telephone No.: (902) 802-8847

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Check whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting Company.

Large accelerated filer | ¨ | Accelerated filer | ¨ |

Non-accelerated filer | ¨ | Smaller reporting Company | x |

(Do not check if a smaller reporting Company) |

|

| |

Indicate by check mark whether the registrant is a shell company (as defined in rule 12b-2 of the Exchange Act). Yes x No ¨

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of the last business day of the registrant's most recently completed second fiscal quarter: $18,500.

As of January 07, 2016, the total issued and outstanding shares were 44,919,932.

SharkReach, Inc.

Annual Report on Form 10-K

Table of Contents

| Page Number |

| |||

PART I | |||||

|

|

|

|

| |

Item 1 | Business |

|

| 3 |

|

Item 1A | Risk Factors |

|

| 5 |

|

Item 1B | Unresolved Staff Comments |

|

| 5 |

|

Item 2 | Properties |

|

| 5 |

|

Item 3 | Legal Proceedings |

|

| 5 |

|

|

|

|

|

|

|

PART II | |||||

|

|

|

|

|

|

Item 5 | Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

|

| 6 |

|

Item 6 | Selected Financial Data |

|

| 6 |

|

Item 7 | Management's Discussion and Analysis of Financial Condition and Results of Operations |

|

| 6 |

|

Item 7A | Quantitative and Qualitative Disclosure about Market Risk |

|

| 7 |

|

Item 8 | Financial Statements and Supplementary Data |

|

| 8 |

|

Item 9 | Changes an Disagreements With Accountants on Accounting and Financial Disclosure |

|

| 20 |

|

Item 9A | Controls and Procedures |

|

| 20 |

|

Item 9B | Other Information |

|

| 22 |

|

|

|

|

|

| |

PART III | |||||

|

|

|

|

|

|

Item 10 | Directors, Executive Officers and Corporate Governance |

|

| 23 |

|

Item 11 | Executive Compensation |

|

| 24 |

|

Item 12 | Security Ownership of Certain Beneficial Owners and Management |

|

| 24 |

|

Item 13 | Certain Relationships and Related Transactions and Director Independence |

|

| 25 |

|

Item 14 | Principal Accounting Fees and Services |

|

| 25 |

|

|

|

|

|

|

|

PART IV | |||||

|

|

|

|

|

|

Item 15 | Exhibits and Financial Statement Schedules |

|

| 26 |

|

| 2 |

PART I

ITEM 1: BUSINESS

Overview

On August 31, 2012, Mr. Joshi, president and sole director, incorporated the Company in the State of Nevada and established a fiscal year end of September 30. The objective of this corporation is to provide online secretarial services through the Company's developing website.

The original business plan was to provide services to clients such as: booking appointments, scheduling meetings, typing services, phone calls, text messages and or email reminders and confirming appointments. The intend was also to provide live-person call service centers for personal and business use. If a person needs to cancel or decline an appointment or invitation but wants to save time or avoid conversations, they can get our secretaries to make the call for them. This service will be available for personal or business use.

Subsequent to the year end and on October 13, 2015 the Company closed the acquisition of assets pursuant to a certain Asset Purchase Agreement (the "Asset Purchase Agreement"), by and between the Company and SharkReach, Inc., a Nevada corporation ("SharkReach"), dated September 29, 2015.

Under the terms and conditions of the Asset Purchase Agreement, the Company offered and sold 24,750,000 shares of common stock of the Company in consideration for substantially all of the assets of SharkReach, which include, among other things, the trade-name "SharkReach," software, source code, object code, client lists, accounts, contracts and goodwill. Subsequent to closing the Company changed its name to SharkReach, Inc.

The 24,750,000 shares of common stock of the Company offered and sold in consideration for certain assets of SharkReach are subject to a 12-month lock-up period under which such shares may not be resold or otherwise transferred, except in a distribution of the shares by SharkReach to SharkReach shareholders, who must agree to the terms of the lock-up in order to receive such shares as part of a distribution. After the initial 12-month lockup period, the 24,750,000 shares may be resold only at a rate of 1/12 of a shareholder's holding at a price of greater than $0.25 per share. All lockup restrictions will be terminated after 24 months.

In addition, but waived as a closing condition, the Company must enter into employment agreements with three current employees of SharkReach. Each employment agreement must have a term of a minimum of three years and contain terms that are mutually acceptable to both the Company and the employee.

On October 19, 2015 the Company filed with the Secretary of State of the State of Nevada a Certificate of Amendment to its Articles of Incorporation to (i) change its name from "Online Secretary, Inc." to "SharkReach, Inc.", and (ii) increase its authorized capital from 75,000,000 shares of common stock to 200,000,000 shares of common stock. The change of name of the Company took effect on the OTC Markets on November 5, 2015.

Effective on November 25, 2015, the Company's new ticker symbol for its shares of common stock quoted on the OTC Markets, in connection with its change of name to SharkReach, Inc. will be SHRK.

SharkReach is a native marketing and sponsor embedded content creation company. SharkReach brings together influencers and brands to create dynamic, unique social marketing campaigns resulting in high brand awareness and leads for our clients. SharkReach is an early stage, influencer driven, native marketing and sponsor embedded content creation company.

| 3 |

SharkReach focuses on all social media platforms and is designed to allow brands the opportunity to execute strategic brand messaging. We accomplished this through the use of promoted custom content including: photos, videos, games, apps, contests and promotions. We strategically embed these items with influencer and celebrity attachments.

Mr. Joshi resigned on September 04, 2015 and was replaced by Mr. Troy Grant on the same date and remains the President, Secretary, Treasurer and sole director of the Company.

Our business office is located at 205 Pier Avenue, Suite 101, Hermosa Beach, CA, 90254; our telephone number is 888.481.6161 and our fax number is 888.481.6161. Our United States and registered statutory office is located at 205 Pier Avenue, Suite 101, Hermosa Beach, CA, 90254.

The Company requires approximately $450,000 in working capital to pay up-front costs to its influencers, in order to commence contracted campaigns. We anticipate that additional funding, if we obtain it, will be in the form of equity financing from the sale of our common stock. However, we cannot provide investors with any assurance that we will be able to raise sufficient funding from the sale of shares to fund additional expenditures. We do not currently have any arrangements in place for any future equity financing. Our limited operating history and our lack of significant tangible capital assets makes it unlikely that we will be able to obtain significant financing in the near future. If such financing is not available on satisfactory terms, we may be unable to continue or expand our business. Equity financing could result in additional dilution to existing shareholders.

Plan of Operation

During the next twelve months the Company will focus on increasing awareness its brand and garnering sales.

Assuming the Company successfully raises sufficient capital, the company will attempt to become cash flow positive as early as 2016.

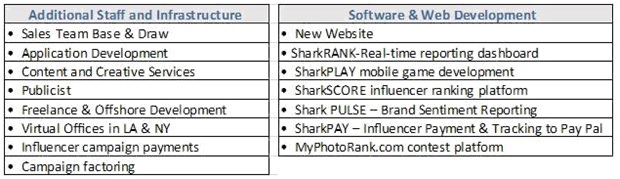

Assuming the Company successfully raises sufficient capital, tasks which the Company intends to accomplish in the following 12 months are as follows:

| 4 |

It is the Company's plan to build an improved system on the SharkReach platform that will enable their influencers to view their campaigns in real-time, and the amount of income they are earning. They will then be able to withdraw earnings once they have completed their campaigns via PayPal, with payments being made directly to their bank accounts. We believe this method of enhanced transparency will help to reduce the number of Influencers requiring up-front payments.

The Company is currently working on other campaign factoring options, in an effort to find a reasonable alternative to paying influencers up-front.

ITEM 1A. RISK FACTORS

We are a smaller reporting company as defined in Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

ITEM 1B. UNRESOLVED STAFF COMMENTS

We are a smaller reporting company as defined in Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

ITEM 2. PROPERTIES

The Company entered into a 1-year renewable lease and have office located at 205 Pier Avenue, Suite 101, Hermosa Beach, CA, 90254, our telephone number is 888.481.6161 and our fax number is 888.481.6161. The Company does not own or rent any property

ITEM 3. LEGAL PROCEEDINGS

There is no material pending legal proceedings to which our company is a party or of which any of our property is the subject, and no such proceedings are known by us to be contemplated.

There is no material proceeding to which any director, officer, or affiliate of our company, or any owner of record or beneficial owner of more than 5% of any class of voting securities of our company, or any associate of any such director, officer, affiliate of our company, or security holder is a party adverse to our company or has a material interest adverse to our company.

| 5 |

PART II

ITEM 5. MARKET FOR REGISTRANTS COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASE OF EQUITY SECURITIES

The Company's common stock, par value $.00001 per share, is traded in the OTC Markets Groups' OTC Pink under the symbol "SHRK." As of September 30, 2015 the Company was not actively trading and therefore there is no range of high and low prices for the Company's common stock presented.

The company has not paid cash dividends and does not anticipate paying any cash dividends in the foreseeable future and has no outstanding options.

ITEM 6. SELECTED FINANCIAL DATA

We are a smaller reporting company as defined in Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

ITEM 7. MANAGEMENT DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our financial statements and related notes included elsewhere in this report.

This annual report contains forward looking statements relating to our Company's future economic performance, plans and objectives of management for future operations, projections of revenue mix and other financial items that are based on the beliefs of, as well as assumptions made by and information currently known to, our management. The words "expects", "intends", "believes", "anticipates", "may", "could", "should" and similar expressions and variations thereof are intended to identify forward- looking statements. The cautionary statements set forth in this section are intended to emphasize that actual results may differ materially from those contained in any forward looking statement.

Our auditor's report on our September 30, 2015 financial statements expresses an opinion that substantial doubt exists as to whether we can continue as an ongoing business. Since our officer and director may be unwilling or unable to loan or advance us additional capital, we believe that if we do not raise additional capital over the next 12 months, we may be required to suspend or cease the implementation of our business plans. See "September 30, 2015 Audited Financial Statements - Auditors Report."

As of September 30, 2015, the Company had $414 cash on hand and in the bank. Management believes this amount will not satisfy our cash requirements for the next twelve months or until such time that additional proceeds are raised. We plan to satisfy our future cash requirements - primarily the working capital required for the development of our course guides and marketing campaign and to offset legal and accounting fees - by additional equity financing. This will likely be in the form of private placements of common stock.

Further to the Asset Acquisition discussed earlier the Company will focus on increasing awareness of its brand and garnering sales during the next twelve months. Assuming the Company successfully raises sufficient capital, the company will attempt to become cash flow positive as early as 2016. However, additional equity financing may not be available to us on acceptable terms or at all, and thus we could fail to satisfy our future cash requirements.

| 6 |

If SharkReach, Inc. is unsuccessful in raising the additional proceeds through a private placement offering it will then have to seek additional funds through debt financing, which would be highly difficult for a new development stage company to secure. Therefore, the company is highly dependent upon the success of the anticipated private placement offering and failure thereof would result in the Company having to seek capital from other sources such as debt financing, which may not even be available to the company. However, if such financing were available, because the Company is a development stage company with no operations to date, it would likely have to pay additional costs associated with high risk loans and be subject to an above market interest rate. At such time these funds are required, management would evaluate the terms of such debt financing and determine whether the business could sustain operations and growth and manage the debt load. If the Company cannot raise additional proceeds via a private placement of its common stock or secure debt financing it would be required to cease business operations. As a result, investors in the Company common stock would lose all of their investment.

We did not generate any revenue during the fiscal year ended September 30, 2015. As of the fiscal year ended September 30, 2015 we had $414 of cash on hand in the bank. We incurred operating expenses in the amount of $33,686 in the fiscal year ended September 30, 2015. These operating expenses were comprised of professional fees and office and general expenses. Since inception we have incurred accumulated deficit of $63,951.

Further to Item I, "business overview", above the Company closed the acquisition of assets pursuant to a certain Asset Purchase Agreement by and between the Company and SharkReach, Inc., a Nevada corporation. Please refer to Item I, "overview" & "plan of operations", for more detail.

Off Balance Sheet Arrangements.

The Company does not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on the Company's financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We are a smaller reporting company as defined in Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

| 7 |

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

SHARKREACH, INC.

(FORMERLY ONLINE SECRETARY, INC.)

FINANCIAL STATEMENTS

(Expressed in United States Dollars)

AS OF AND FOR YEARS ENDED SEPTEMBER 30, 2015 AND 2014

Reports of Independent Registered Public Accounting Firms |

|

| 9-10 |

|

|

|

|

| |

Balance Sheets |

|

| 11 |

|

|

|

|

| |

Statements of Operations |

|

| 12 |

|

|

|

|

| |

Statements of Changes in Shareholders' Deficit |

|

| 13 |

|

|

|

|

| |

Statements of Cash Flows |

|

| 14 |

|

|

|

|

| |

Notes to the Financial Statements |

|

| 15 |

|

| 8 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and

Stockholders of SharkReach, Inc.

We have audited the accompanying balance sheet of SharkReach, Inc. (the "Company") as of September 30, 2015, and the related statements of operations, stockholders' deficit, and cash flows for the year then ended. SharkReach, Inc.'s management is responsible for these financial statements. Our responsibility is to express an opinion on these financial statements based on our audit. The financial statements of the Company as of September 30, 2014 and for the year then ended were audited by other auditors, whose report dated December 16, 2014, expressed an unqualified opinion on those financial statements.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of SharkReach, Inc. as of September 30, 2015, and the results of its operations and its cash flows for the year then ended in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company has no principal operations or significant revenue producing activities, which raises substantial doubt about its ability to continue as a going concern. Management's plans in regard to these matters is also described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Anton and Chia, LLP

Anton and Chia, LLP

Newport Beach, CA

January 14, 2016

| 9 |

PLS CPA, A PROFESSIONAL CORP. u 4725 MERCURY STREET #210 u SAN DIEGO u CALIFORNIA 92111 u TELEPHONE (858) 722-5953 u FAX (858) 761-0341 u FAX (858) 433-2979 u E-MAIL changgpark@gmail.com u

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Stockholders

Online Secretary, Inc.

We have audited the accompanying balance sheet of Online Secretary, Inc. as of September 30, 2014 and the related statements of operations, changes in shareholders' deficit and cash flows for the year ended September 30, 2014. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statements presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, thefinancial statements referred to above present fairly, in all material respects, the financial position of Online Secretary, Inc. as of September 30, 2014, and the result of its operations and its cash flows for the year ended September 30, 2014 in conformity with U.S. generally accepted accounting principles.

The financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to thefinancial statements, the Company's losses from operations raise substantial doubt about its ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s /PLS CPA

PLS CPA, A Professional Corp.

December 16, 2014

San Diego, CA 92111

Registered with the Public Company Accounting Oversight Board

| 10 |

SHARKREACH, INC. | |||

(FORMERLY ONLINE SECRETARY, INC.) | |||

BALANCE SHEETS |

| September 30, |

|

| September 30, |

| |||

As at |

| 2015 |

|

| 2014 |

| ||

|

|

|

|

|

| |||

ASSETS |

|

|

|

|

|

| ||

Current |

|

|

|

|

|

| ||

Cash |

| $ | 414 |

|

| $ | 1,414 |

|

Prepaid expenses |

|

| - |

|

|

| 1,850 |

|

TOTAL ASSETS |

|

| 414 |

|

|

| 3,264 |

|

|

|

|

|

|

|

|

| |

LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) |

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

Loans from related party |

| $ | 2,854 |

|

| $ | 2,854 |

|

Trade and other payables |

|

| 43,011 |

|

|

| 12,175 |

|

TOTAL CURRENT LIABILITIES |

|

| 45,865 |

|

|

| 15,029 |

|

Stockholders' deficit |

|

|

|

|

|

|

|

|

Capital stock |

|

|

|

|

|

|

|

|

Authorized 75,000,000 shares of common stock, $0.000012 par value, Issued and outstanding 1,057,420,000 shares as of September 30, 2015 and as of September 30, 2014 (1) |

|

| 12,740 |

|

|

| 12,740 |

|

Additional Paid in Capital |

|

| 5,760 |

|

|

| 5,760 |

|

Accumulated Deficit |

|

| (63,951 | ) |

|

| (30,265 | ) |

TOTAL STOCKHOLDERS' DEFICIT |

|

| (45,451 | ) |

|

| (11,765 | ) |

TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT |

| $ | 414 |

|

| $ | 3,264 |

|

_____________

(1) All common share amounts and per share amounts in these financial statements reflect a 83-for-1 share forward split of the issued and outstanding shares of common stock of the Company, effective October 21, 2015 including retroactive adjustment of common share amounts. See note 5 and note 7.

The accompanying notes are an integral part of these financial statements.

| 11 |

SHARKREACH, INC. | |||||

(FORMERLY ONLINE SECRETARY, INC.) | |||||

STATEMENTS OF OPERATIONS |

| Years ended |

| ||||||

| 2015 |

|

| 2014 |

| |||

|

|

|

|

|

| |||

OPERATING EXPENSES |

|

|

|

|

|

| ||

General and administrative |

| $ | 5,307 |

|

| $ | 5,142 |

|

Professional fees |

|

| 28,379 |

|

|

| 10,300 |

|

Loss from operations |

|

| (33,686 | ) |

|

| (15,442 | ) |

|

|

|

|

|

|

|

| |

Net Loss |

| $ | (33,686 | ) |

| $ | (15,442 | ) |

|

|

|

|

|

|

|

| |

Basic and diluted loss per share |

| $ | (0.00 | ) |

| $ | (0.00 | ) |

|

|

|

|

|

|

|

| |

Weighted average number of common shares outstanding, basic and diluted (2) |

|

| 1,057,420,000 |

|

|

| 1,053,217,710 |

|

(2) All common share amounts and per share amounts in these financial statements reflect a 83-for-1 share forward split of the issued and outstanding shares of common stock of the Company, effective October 21, 2015 including retroactive adjustment of common share amounts. See note 5 and note 7.

The accompanying notes are an integral part of these financial statements.

| 12 |

SHARKREACH, INC. | |||||

(FORMERLY ONLINE SECRETARY, INC.) | |||||

STATEMENT OF CHANGES IN SHAREHOLDERS' EQUITY |

| Share capital |

|

| Additional |

|

|

|

|

| Total |

| |||||||||

| Number |

|

| Value |

|

| Paid-in |

|

| Deficit |

|

| Shareholders' |

| ||||||

| # |

|

| $ |

|

| $ |

|

| $ |

|

| $ |

| ||||||

Balance, September 30, 2013 (3) |

|

| 1,037,500,000 |

|

|

| 12,500 |

|

|

|

|

|

| (14,823 | ) |

|

| (2,323 | ) | |

Shares issued for cash |

|

| 19,920,000 |

|

|

| 240 |

|

|

| 5,760 |

|

|

| - |

|

|

| 6,000 |

|

Net loss |

|

| - |

|

|

| - |

|

|

| - |

|

|

| (15,442 | ) |

|

| (15,442 | ) |

Balance, September 30, 2014 (3) |

|

| 1,057,420,000 |

|

|

| 12,740 |

|

|

| 5,760 |

|

|

| (30,265 | ) |

|

| (11,765 | ) |

Net loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (33,686 | ) |

|

| (33,686 | ) |

Balance, September 30, 2015 (3) |

|

| 1,057,420,000 |

|

|

| 12,740 |

|

|

| 5,760 |

|

|

| (63,951 | ) |

|

| (45,451 | ) |

(3) All common share amounts and per share amounts in these financial statements reflect a 83-for-1 share forward split of the issued and outstanding shares of common stock of the Company, effective October 21, 2015 including retroactive adjustment of common share amounts. See note 5 and note 7.

The accompanying notes are an integral part of these financial statements.

| 13 |

SHARKREACH, INC. | |||

(FORMERLY ONLINE SECRETARY, INC.) | |||

STATEMENTS OF CASH FLOWS |

| Years ended |

| ||||||

| 2015 |

|

| 2014 |

| |||

|

|

|

|

|

| |||

Operating Activities |

|

|

|

|

|

| ||

Loss for the year |

| $ | (33,686 | ) |

| $ | (15,442 | ) |

Changes in working capital items: |

|

|

|

|

|

|

|

|

Prepaid expenses |

|

| 1,850 |

|

|

| 310 |

|

Trade and other payables |

|

| 30,836 |

|

|

| 9,812 |

|

Cash used in operating activities |

|

| (1,000 | ) |

|

| (5,320 | ) |

|

|

|

|

|

|

|

| |

Financing activities |

|

|

|

|

|

|

|

|

Proceeds from sale of common stock |

|

| - |

|

|

| 6,000 |

|

Loan from related party |

|

| - |

|

|

| 700 |

|

| Cash provided by financing activities |

|

| - |

|

|

| 6,700 |

|

Net change in cash during the year |

|

| (1,000 | ) |

|

| 1,380 |

|

Cash, beginning of the year |

|

| 1,414 |

|

|

| 34 |

|

Cash, end of the year |

| $ | 414 |

|

| $ | 1,414 |

|

|

|

|

|

|

|

|

| |

Supplemental disclosure of cash flow information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Cash paid for income taxes |

|

| - |

|

|

| - |

|

Cash paid for interest |

|

| - |

|

|

| - |

|

The accompanying notes are an integral part of the financial statements

| 14 |

SHARKREACH, INC.

(FORMERLY ONLINE SECRETARY, INC.)

NOTES TO THE FINANCIAL STATEMENTS

September 30, 2015

NOTE 1 - NATURE OF OPERATIONS AND BASIS OF PRESENTATION

On August 31, 2012, Mr. Joshi, president and sole director, incorporated the Company in the State of Nevada and established a fiscal year end of September 30. The objective of this corporation is to provide online secretarial services through the Company's developing website.

The original business plan was to provide services to clients such as: booking appointments, scheduling meetings, typing services, phone calls, text messages and or email reminders and confirming appointments. The intend was also to provide live-person call service centers for personal and business use. If a person needs to cancel or decline an appointment or invitation but wants to save time or avoid conversations, they can get our secretaries to make the call for them. This service will be available for personal or business use.

Subsequent to the year end and on October 13, 2015 the Company closed the acquisition of assets pursuant to a certain Asset Purchase Agreement (the "Asset Purchase Agreement"), by and between the Company and SharkReach, Inc., a Nevada corporation ("SharkReach"), dated September 29, 2015.

Under the terms and conditions of the Asset Purchase Agreement, the Company offered and sold 24,750,000 shares of common stock of the Company in consideration for substantially all of the assets of SharkReach, which include, among other things, the trade-name "SharkReach," software, source code, object code, client lists, accounts, contracts and goodwill. Substantially all of the business of SharkReach is now the business of the Company. Subsequent to closing the Company changed its name to SharkReach, Inc.

On October 19, 2015 the Company filed with the Secretary of State of the State of Nevada a Certificate of Amendment to its Articles of Incorporation to (i) change its name from "Online Secretary, Inc." to "SharkReach, Inc.", and (ii) increase its authorized capital from 75,000,000 shares of common stock to 200,000,000 shares of common stock. The change of name of the Company took effect on the OTC Markets on November 5, 2015.

Effective on November 25, 2015, the Company's new ticker symbol for its shares of common stock quoted on the OTC Markets, in connection with its change of name to SharkReach, Inc. will be SHRK.

SharkReach is a native marketing and sponsor embedded content creation company. SharkReach brings together influencers and brands to create dynamic, unique social marketing campaigns resulting in high brand awareness and leads for our clients. SharkReach is an early stage, influencer driven, native marketing and sponsor embedded content creation company.

SharkReach focuses on all social media platforms and is designed to allow brands the opportunity to execute strategic brand messaging. We accomplished this through the use of promoted custom content including: photos, videos, games, apps, contests and promotions. We strategically embed these items with influencer and celebrity attachments.

| 15 |

SHARKREACH, INC.

(FORMERLY ONLINE SECRETARY, INC.)

NOTES TO THE FINANCIAL STATEMENTS

September 30, 2015

The business of SharkReach is now the principal business of the Company. Mr. Joshi resigned on September 04, 2015 and was replaced by Mr. Troy Grant on September 04, 2015 which remains the President, Secretary, Treasurer and sole director of the Company.

The Company is currently in the development stage as defined under FASB ASC915-10, "Development Stage Entities" and has as yet no products. All activities of the Company to date relate to its organization, initial funding and share issuances.

NOTE 2 - GOING CONCERN

The Company's financial statements are prepared in accordance with generally accepted accounting principles applicable to a going concern. This contemplates the realization of assets and the liquidation of liabilities in the normal course of business. Currently, the Company has does not have material assets, nor does it have operations or a source of revenue sufficient to cover its operation costs and allow it to continue as a going concern. The Company has an accumulated deficit since inception of $63,951. The Company will be dependent upon the raising of additional capital through placement of our common stock in order to implement its business plan, or merge with an operating company. There can be no assurance that the Company will be successful in either situation in order to continue as a going concern. The Company is funding its initial operations by way of issuing Founder's shares. These financial statements do not include any adjustments relating to the recoverability and classification of recorded assets or the amounts of and classification of liabilities that might be necessary in the event the company cannot continue in existence. Accordingly, these factors raise substantial doubt as to the Company's ability to continue as a going concern. The officers and directors have committed to advancing certain operating costs of the Company, including Legal, Audit, Transfer Agency and Edgarizing costs.

NOTE 3 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The financial statements present the balance sheet, statements of operations, stockholders' equity deficit and cash flows of the Company. These financial statements are presented in United States dollars and have been prepared in accordance with accounting principles generally accepted in the United States.

Cash and Cash Equivalents

For the purposes of the statements of cash flows, the Company considers highly liquid financial instruments purchased with a maturity of three months or less to be cash equivalent. At September 30, 2015 and September 30, 2014, the Company has no cash equivalents.

| 16 |

SHARKREACH, INC.

(FORMERLY ONLINE SECRETARY, INC.)

NOTES TO THE FINANCIAL STATEMENTS

September 30, 2015

Use of Estimates and Assumptions

Preparation of the financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect certain reported amounts and disclosures. Accordingly, actual results could differ from those estimates.

Income Taxes

The Company follows the liability method of accounting for income taxes. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax balances. Deferred tax assets and liabilities are measured using enacted or substantially enacted tax rates expected to apply to the taxable income in the years in which those differences are expected to be recovered or settled. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the date of enactment or substantive enactment.

Net Loss per Share

Basic loss per share includes no dilution and is computed by dividing loss available to common stockholders by the weighted average number of common shares outstanding for the period. Dilutive loss per share reflects the potential dilution of securities that could share in the losses of the Company. Because the Company does not have any potentially dilutive securities, the accompanying presentation is only of basic loss per share.

Recent Accounting Pronouncements

The Company has implemented all new accounting pronouncements that are in effect and that may impact its financial statements and does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

Fair Value of Financial Instruments

The Company has determined the estimated fair value of financial instruments using available market information and appropriate valuation methodologies. The fair value of financial instruments classified as current assets or liabilities approximate their carrying value due to the short-term maturity of the instruments.

NOTE 4 - RELATED PARTY

On September 30, 2015 and on September 30, 2014, the Company had loan from related party of $2,854 and 2,854, respectively. The loan was from the Director of the Company by paying expenses on behalf of the Company. The advance is interest free and is due on demand. The Director is expecting the loans to be repaid. As of September 30, 2015, there is no demand from the Director to repay the loan.

| 17 |

SHARKREACH, INC.

(FORMERLY ONLINE SECRETARY, INC.)

NOTES TO THE FINANCIAL STATEMENTS

September 30, 2015

NOTE 5 - CAPITAL STOCK

All common share amounts and per share amounts in these financial statements reflect a 83-for-1 share forward split of the issued and outstanding shares of common stock of the Company, effective October 21, 2015 including retroactive adjustment of common share amounts.

Further SAB Topic 4.C, a capital structure change to a stock dividend, stock split or reverse split occurs after the date of the latest reported balance sheet but before the release of the financial statements or the effective date of the registration statement, whichever is later. Such changes in the capital structure must be given retroactive effect in the financial statements. Given this treatment the Issued and outstanding shares is 1,057,420,000 reflected in the financial statements and as at September 30, 2015.

On October 13, 2015 Mr. Grant redeemed 12,198,796 shares of common stock with Online Secretary, leaving Mr. Grant holding 301,204 shares of common stock. Following the redemption, the issued and outstanding shares of the Company amounts to 44,919,932.

As of September 30, 2015, the Company has not granted any stock options and has not incurred any stock- based compensation.

NOTE 6 - INCOME TAXES

Accounting for Uncertainty in Income Taxes when it is more likely than not that a tax asset cannot be realized through future income the Company must allow for this future tax benefit. We provided a full valuation allowance on the net deferred tax asset, consisting of net operating loss carry forwards, because management has determined that it is more likely than not that we will not earn income sufficient to realize the deferred tax assets during the carry forward period.

The components of the Company's deferred tax asset and reconciliation of income taxes computed at the statutory rate to the income tax amount recorded as of September 30, 2014 and 2013 are as follows:

| September 30, |

|

| September 30, |

| |||

|

| 2015 |

|

| 2014 |

| ||

Net Operating loss carry forward |

|

| 63,951 |

|

|

| 30,265 |

|

Effective Tax rate |

|

| 34 | % |

|

| 34 | % |

Deferred Tax assets |

|

| 21,743 |

|

|

| 10,290 |

|

Less: Valuation allowance |

|

| (21,743 | ) |

|

| (10,290 | ) |

Net Deferred tax asset |

|

| - |

|

|

| - |

|

The net federal operating loss carry forward will expire between 2027 and 2028. This carry forward may be limited upon the consummation of a business combination under IRC Section 381.

| 18 |

SHARKREACH, INC.

(FORMERLY ONLINE SECRETARY, INC.)

NOTES TO THE FINANCIAL STATEMENTS

September 30, 2015

NOTE 7 - SUBSEQUENT EVENTS

Subsequent to the year end and on October 13, 2015 the Company closed the acquisition of assets pursuant to a certain Asset Purchase Agreement (the "Asset Purchase Agreement"), by and between the Company and SharkReach, Inc., a Nevada corporation ("SharkReach"), dated September 29, 2015.

Under the terms and conditions of the Asset Purchase Agreement, the Company offered and sold 24,750,000 shares of common stock of the Company in consideration for substantially all of the assets assets of SharkReach, which assets include, among other things, the trade-name "SharkReach," software, source code, object code, client lists, accounts, contracts and goodwill. Substantially all of the business of SharkReach is now the business of the Company. Subsequent to closing the Company changed its name to SharkReach, Inc.

The 24,750,000 shares of common stock of the Company offered and sold in consideration for certain assets of SharkReach are subject to a 12-month lock-up period under which such shares may not be resold or otherwise transferred, except in a distribution of the shares by SharkReach to SharkReach shareholders, who must agree to the terms of the lock-up in order to receive such shares as part of a distribution. After the initial 12-month lockup period, the 24,750,000 shares may be resold only at a rate of 1/12 of a shareholder's holding at a price of greater than $0.25 per share. All lockup restrictions will be terminated after 24 months.

In addition, but waived as a closing condition, the Company must enter into employment agreements with three current employees of SharkReach. Each employment agreement must have a term of a minimum of three years and contain terms that are mutually acceptable to both the Company and the employee.

On October 19, 2015 the Company filed with the Secretary of State of the State of Nevada a Certificate of Amendment to its Articles of Incorporation to (i) change its name from "Online Secretary, Inc." to "SharkReach, Inc.", and (ii) increase its authorized capital from 75,000,000 shares of common stock to 200,000,000 shares of common stock. The change of name of the Company took effect on the OTC Markets on November 5, 2015.

Effective on November 25, 2015, the Company's new ticker symbol for its shares of common stock quoted on the OTC Markets, in connection with its change of name to SharkReach, Inc. will be SHRK.

SharkReach is a native marketing and sponsor embedded content creation company. SharkReach brings together influencers and brands to create dynamic, unique social marketing campaigns resulting in high brand awareness and leads for our clients. SharkReach is an early stage, influencer driven, native marketing and sponsor embedded content creation company.

SharkReach focuses on all social media platforms and is designed to allow brands the opportunity to execute strategic brand messaging. We accomplished this through the use of promoted custom content including: photos, videos, games, apps, contests and promotions. We strategically embed these items with influencer and celebrity attachments.

| 19 |

ITEM 9. CHANGES AND DISAGREEMENTS WITH ACCOUNTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

Our auditors are Anton and Chia, LLP. There have not been any changes in or disagreements with our accountants on accounting, financial disclosure or any other matter.

ITEM 9A. CONTROLS AND PROCEDURES

In accordance with Rule 13a-15(b) of the Securities Exchange Act of 1934 as amended (the "Exchange Act"), as of the end of the period covered by this Annual Report on Form 10-K, the Company's management evaluated, with the participation of the Company's principal executive and financial officer, the effectiveness of the design and operation of the Company's disclosure controls and procedures (as defined in Rule 13a-15(e) or Rule 15d-15(e) under the Exchange Act). Disclosure controls and procedures are defined as those controls and other procedures of an issuer that are designed to ensure that the information required to be disclosed by the issuer in the reports it files or submits under the Act is recorded, processed, summarized and reported, within the time periods specified in the Commission's rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by an issuer in the reports that it files or submits under the Act is accumulated and communicated to the issuer's management, including its principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure. Based on that Evaluation he concluded that the Registrant's disclosure controls and procedures are ineffective in gathering, analyzing and disclosing information needed to satisfy the registrant's disclosure obligations under the Exchange Act. Based upon an evaluation of the effectiveness of disclosure controls and procedures, our Company's principal executive and principal financial officer has concluded that as of the end of the period covered by this Annual Report on Form 10K our disclosure controls and procedures (as defined in Rules 13a-15(e) or 15d-15(e) under the Exchange Act) are not effective because of the material weaknesses in our disclosure controls and procedures, which is identified below. It should be noted that the design of any system of controls is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions, regardless of how remote.

The material weaknesses in our disclosure control procedures are as follows:

1 . Lack of formal policies and procedures necessary to adequately review significant accounting transactions. The Company utilizes a third party independent contractor for the preparation of its financial statements. Although the financial statements and footnotes are reviewed by our management, we do not have a formal policy to review significant accounting transactions and the accounting treatment of such transactions. The third party independent contractor is not involved in the day to day operations of the Company and may not be provided information from management on a timely basis to allow for adequate reporting/consideration of certain transactions.

| 20 |

2 . Audit Committee and Financial Expert. The Company does not have a formal audit committee with a financial expert, and thus the Company lacks the board oversight role within the financial reporting process.

We intend to initiate measures to remediate the identified material weaknesses including, but not necessarily limited to, the following:

| · | Establishing a formal review process of significant accounting transactions that includes participation of the Chief Executive Officer, the Chief Financial Officer and the Company's corporate legal counsel. | |

| · | Form an Audit Committee that will establish policies and procedures that will provide the Board of Directors a formal review process that will among other things, assure that management controls and procedures are in place and being maintained consistently. |

Our management is responsible for establishing and maintaining adequate internal control over financial reporting for the company (as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act). Internal control over financial reporting is to provide reasonable assurance regarding the reliability of our financial reporting for external purposes in accordance with accounting principles generally accepted in the United States of America. Internal control over financial reporting includes maintain records that in reasonable detail accurately and fairly reflect our transactions; providing reasonable assurance that transactions are recorded as necessary for preparation of our financial statements; providing reasonable assurance that receipts and expenditures of company assets are made in accordance with management authorization; and providing reasonable assurance that unauthorized acquisition , use or disposition of company assets that could have a material effect on our financial statements would be prevented or detected.

As of September 30, 2015, management assessed the effectiveness of the Company's internal control over financial reporting based on the criteria for effective internal control over financial reporting established in SEC guidance on conducting such assessments. Based on this evaluation under the COSO Framework, our management concluded that our internal control over financial reporting is not effective as of September 30, 2015. In making this assessment, our management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission ("COSO") in Internal Control-Integrated Framework. Based on that evaluation, they concluded that, as of September 30, 2015, such internal controls and procedures were not effective to detect the inappropriate application of US GAAP rules as more fully described below. This was due to deficiencies that existed in the design or operation of our internal control over financial reporting that adversely affected our internal controls and that may be considered to be material weaknesses.

The matters involving internal controls and procedures that the Company's management considered to be material weaknesses under the standards of the Public Company Accounting Oversight Board were: (1) lack of a functioning audit committee and lack of a majority of outside directors on the Company's board of directors, resulting in ineffective oversight in the establishment and monitoring of required internal controls and procedures; (2) inadequate segregation of duties consistent with control objectives; (3) insufficient written policies and procedures for accounting and financial reporting with respect to the requirements and application of US GAAP and SEC disclosure requirements; and (4) ineffective controls over period end financial disclosure and reporting processes. The aforementioned material weaknesses were identified by the Company's Chief Financial Officer in connection with the review of our financial statements as of September 30, 2013 and communicated to our management.

| 21 |

Management believes that the material weaknesses set forth in items (2), (3) and (4) above did not have an effect on the Company's financial results. However, management believes that the lack of a functioning audit committee and lack of a majority of outside directors on the Company's board of directors, resulting in ineffective oversight in the establishment and monitoring of required internal controls and procedures can result in the Company's determination to its financial statements for the future years.

We are committed to improving our financial organization. As part of this commitment, we will create a position to segregate duties consistent with control objectives and will increase our personnel resources and technical accounting expertise within the accounting function when funds are available to the Company: i) Appointing one or more outside directors to our board of directors who shall be appointed to the audit committee of the Company resulting in a fully functioning audit committee who will undertake the oversight in the establishment and monitoring of required internal controls and procedures; and ii) Preparing and implementing sufficient written policies and checklists which will set forth procedures for accounting and financial reporting with respect to the requirements and application of US GAAP and SEC disclosure requirements.

Management believes that the appointment of more outside directors, who shall be appointed to a fully functioning audit committee, will remedy the lack of a functioning audit committee and a lack of a majority of outside directors on the Company's Board. In addition, management believes that preparing and implementing sufficient written policies and checklists will remedy the following material weaknesses (i) insufficient written policies and procedures for accounting and financial reporting with respect to the requirements and application of US GAAP and SEC disclosure requirements; and (ii) ineffective controls over period end financial close and reporting processes. Further, management believes that the hiring of additional personnel who have the technical expertise and knowledge will result proper segregation of duties and provide more checks and balances within the department. Additional personnel will also provide the cross training needed to support the Company if personnel turn over issues within the department occur. This coupled with the appointment of additional outside directors will greatly decrease any control and procedure issues the company may encounter in the future.

We will continue to monitor and evaluate the effectiveness of our internal controls and procedures and our internal controls over financial reporting on an ongoing basis and are committed to taking further action and implementing additional enhancements or improvements, as necessary and as funds allow.

There have been no changes in our internal controls over financial reporting that occurred during the quarter ended September 30, 2015 that have materially affected or are reasonably likely to materially affect, our internal controls over financial reporting.

This annual report does not include an attestation report of the Company's independent registered public accounting firm regarding internal control over financial reporting. Management's report was not subject to attestation by the Company's independent registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit the Company to provide management report in the Annual Report.

ITEM 9B. OTHER INFORMATION

None

| 22 |

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Departure of Directors or Certain Officers

As of September 4, 2015, Vijay Joshi resigned as sole Director, President, Secretary, Treasurer, Principal Executive Officer and Principal Financial Officer of the Company

Election of Directors; Appointment of Certain Officers

As of September 4, 2015 Troy Grant, has been appointed as sole Director, President, Secretary, Treasurer, Principal Executive Officer and Principal Financial Officer and is the sole member of the Board of Directors of the Company.

There are no transactions between Mr. Grant and the Company that are reportable under Item 404(a) of Regulation S-K. There are no family relationships among our directors or executive officers.

A brief description of the background experience of our new officer and director is as follows:

Mr. Grant was born September 11, 1973 and graduated from St. Francis Xavier University with a Bachelor of Business degree. Since June of 2011 Mr. Grant has been the CEO, Director and Co-Founder of Elcora Resources Inc. a publicly traded company on the TSE Venture Exchange. Mr. Grant has experience in corporate financing, mergers and acquisitions, business strategies and planning. For 9 months prior to his position with Elcora Mr. Grant was employed at Grafton Securities in institutional sales.

Significant Employees

The Company does not, at present, have any employees other than the current officer and director. We have not entered into any employment agreements, as we currently do not have any employees other than the current officer and director.

Family Relations

There are no family relationships among the Directors and Officers of SharkReach, Inc.

| 23 |

Involvement in Legal Proceedings

No executive Officer or Director of the Company has been convicted in any criminal proceeding (excluding traffic violations) or is the subject of a criminal proceeding that is currently pending.

No executive Officer or Director of the Company is the subject of any pending legal proceedings.

No Executive Officer or Director of the Company is involved in any bankruptcy petition by or against any business in which they are a general partner or executive officer at this time or within two years of any involvement as a general partner, executive officer, or Director of any business.

ITEM 11. EXECUTIVE COMPENSATION.

Our current executive officer and director has not and does not receive any compensation and has not received any restricted shares awards, options or any other payouts. As such, we have not included a Summary Compensation Table.

There are no current employment agreements between the Company and its executive officer and director. Our executive officer and director has agreed to work without remuneration until such time as we receive revenues that are sufficiently necessary to provide proper salaries to the officer and compensate the director for participation. Our executive officer and director has the responsibility of determining the timing of remuneration programs for key personnel based upon such factors as positive cash flow, shares sales, product sales, estimated cash expenditures, accounts receivable, accounts payable, notes payable, and a cash balances. At this time, management cannot accurately estimate when sufficient revenues will occur to implement this compensation, or the exact amount of compensation.

There are no annuity, pension or retirement benefits proposed to be paid to officers, directors or employees of the corporation in the event of retirement at normal retirement date pursuant to any presently existing plan provided or contributed to by Company.

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

Title of Class |

| Name and Address of Beneficial Owner |

| Amount and Nature of Beneficial Owner |

|

| Percent of Class |

| |

|

|

|

|

|

|

|

| ||

Common Stock |

| Troy Grant, 111 Ahmadi Crescent, Bedford, NS B4A 4B9 |

|

| 1,037,500,000 |

|

| 71.40 | % |

| All Beneficial Owners as a Group |

|

| 1,037,500,000 |

|

| 71.40% (1 person) |

| |

| 24 |

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

Currently, there are no contemplated transactions that the Company may enter into with our officers, directors or affiliates. If any such transactions are contemplated, we will file such disclosure in a timely manner with the Commission on the proper form making such transaction available for the public to view.

The Company has no formal written employment agreement or other contracts with our current officer and director and there is no assurance that the services to be provided by him will be available for any specific length of time in the future. Mr. Grant anticipates devoting at a minimum of fifteen hours per week to the Company's affairs. The amounts of compensation and other terms of any full time employment arrangements would be determined, if and when, such arrangements become necessary.

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

For the fiscal year ended September 30, 2015 and 2014 we expect to incur approximately $10,000 and $10,000 in fees to our principal independent accountants for professional services rendered in connection with the audit of financial statements.

During the fiscal year ended September 30, 2015 and 2014, we did not incur any other fees for professional services rendered by our principal independent accountants for all other non-audit services which may include, but not limited to, tax related services, actuarial services or valuation services.

| 25 |

PART IV

ITEM 15. EXHIBITS

3.1 |

| Articles of Incorporation of Online Secretary, Inc. (incorporated by reference from our Registration Statement on Form S-1 filed on December 17, 2012) |

|

|

|

3.2 |

| Bylaws of Online Secretary, Inc. (incorporated by reference from our Registration Statement on Form S-1 filed on December 17, 2012) |

|

|

|

31.1 |

| Rule 13(a)-14(a)/15(d)-14(a) Certification of Chief Executive Officer |

|

|

|

31.2 |

| Rule 13(a)-14(a)/15(d)-14(a) Certification of Chief Financial Officer * |

|

|

|

32.1 |

| Section 1350 Certification of Chief Executive Officer |

|

|

|

32.2 |

| Section 1350 Certification of Chief Financial Officer ** |

|

|

|

101 |

| XBRL Interactive Data Files |

___________

* Included in Exhibit 31.1

** Included in Exhibit 32.1

| 26 |

SIGNATURES

In accordance with the requirements of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| SharkReach, Inc. |

| |

| Dated: January 14, 2016 | By: | /s/ Troy Grant |

|

|

| Troy Grant |

|

|

| President, Secretary Treasurer Principal Executive Officer Principal Financial Officer |

|

27