Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Sino Agro Food, Inc. | v428839_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - Sino Agro Food, Inc. | v428839_ex99-1.htm |

Exhibit 99.2

ADMISSION DOCUMENT

For admission to Trading of Common Shares on

Merkur Market

SINO AGRO FOOD, INC.

(A Public Company incorporated under the Laws of the State of Nevada, United States)

This admission document (the "Admission Document") has been prepared by Sino Agro Food, Inc. (the "Company" or "Sino Agro Food") solely for use in connection with the admission to trading of the Company's common shares, each with a par value of USD 0.001 (the "Common Shares") on Merkur Market (the "Admission to Trading").

Investing in the Common Shares and the VPS Registered Common Shares involves a high degree of risk. See section 1 "Risk factors".

THIS ADMISSION DOCUMENT SERVES AS AN ADMISSION DOCUMENT ONLY, AS REQUIRED BY THE MERKUR MARKET ADMISSION RULES. THIS ADMISSION DOCUMENT DOES NOT CONSTITUE AN OFFER TO BUY, SUBSCRIBE OR SELL ANY OF THE SECURITIES DESCRIBED HEREIN, AND NO SECURITIES ARE BEING OFFERED OR SOLD PURSUANT HERETO.

Merkur Market is a multilateral trading facility operated by Oslo Børs ASA. Merkur Market is subject to the rules in the Securities Trading Act and the Securities Trading Regulations that apply to such marketplaces. These rules apply to companies admitted to trading on Merkur Market, as do the marketplace’s own rules, which are less comprehensive than the rules and regulations that apply to companies listed on Oslo Børs and Oslo Axess. Merkur Market is not a regulated market, and is therefore not subject to the Stock Exchange Act or to the Stock Exchange Regulations. Investors should take this into account when making investment decisions.

Manager

12 January 2016

IMPORTANT INFORMATION

This Admission Document has been prepared by the Company in connection with the admission to trading of the Company's Common Shares on Merkur Market.

For the definitions of terms used throughout this Admission Document, see section 13 and 14 of this Admission Document.

The Company has furnished the information in this Admission Document. This Admission Document has been prepared to comply with the Merkur Market Admission Rules. Oslo Stock Exchange has reviewed and approved this Admission Document in accordance with the Merkur Market Admission Rules. The Oslo Stock Exchange has not controlled or approved the accuracy or completeness of the information included in this Admission Document. The approval by the Oslo Stock Exchange only relates to the information included in accordance with pre-defined disclosure requirements. The Oslo Stock Exchange has not made any form of control or approval relating to corporate matters described, or referred to, in this Admission Document. The Admission Document has been published in an English version only.

The Company is incorporated under the laws of the State of Nevada, the Nevada Revised Statutes (the "NRS"). In order to facilitate the registration and trading of the Common Shares in the form of VPS Registered Common Shares on Merkur Market, the Company has entered into a registrar agreement (the "Registrar Agreement") with Nordea Bank Norge ASA (the "VPS Registrar") for the registration of the beneficial interests in certain of its Common Shares, in book-entry form with the Norwegian Central Securities Depository ("VPS"). Such Common Shares are in this Admission Document referred to as "VPS Registered Common Shares". Under the Registrar Agreement, the VPS Registrar is registered as holder of the Common Shares in the Company's register in DTC. Under the Registrar Agreement, the VPS Registrar will register the beneficial interests in such Common Shares in book-entry form in the VPS in the form of VPS Registered Common Shares under the same ISIN as for the Common Shares. Therefore, it is not the Common Shares issued in accordance with the NRS that will be traded on Merkur Market, but the beneficial interests in such Common Shares registered in the VPS (in book-entry form) as VPS Registered Common Shares. For a further description of the VPS registration of the VPS Registered Common Shares, see section 8.2 "VPS registration of the VPS Registered Common Shares".

All inquiries relating to this Admission Document should be directed to the Company or the Manager. No other person has been authorized to give any information, or make any representation, on behalf of the Company and/or the Manager in connection with the Admission to Trading, if given or made, such other information or representation must not be relied upon as having been authorized by the Company and/or the Manager.

The information contained herein is as of the date hereof and subject to change, completion or amendment without notice. There may have been changes affecting the Company or its subsidiaries (together the "Group") subsequent to the date of this Admission Document. Any new material information and any material inaccuracy that might have an effect on the assessment of the Common Shares and/or the VPS Registered Common Shares arising after the publication of this Admission Document and before the Admission to Trading will be published and announced promptly in accordance with the Merkur Market Admission Rules. Neither the delivery of this Admission Document nor the completion of the Admission to Trading at any time after the date hereof will, under any circumstances, create any implication that there has been no change in the Group's affairs since the date hereof or that the information set forth in this Admission Document is correct as of any time since its date.

The distribution of this Admission Document in certain jurisdictions may be restricted by law. This Admission Document does not constitute an offer of, or an invitation to purchase, the securities described herein and no securities are being offered or sold pursuant to this Admission Document in any jurisdiction. No one has taken any action that would permit a public offering of the Common Shares or the VPS Registered Common Shares. Accordingly, neither this Admission Document nor any advertisement or any other offering material may be distributed or published in any jurisdiction except under circumstances that will result in compliance with any applicable laws and regulations. Sino Agro Food requires persons in possession of this Admission Document to inform themselves about and to observe any such restrictions.

The Common Shares and the VPS Registered Common Shares are subject to restrictions on transferability and resale and may not be transferred or resold except as permitted under applicable securities laws and regulations. Any failure to comply with these restrictions may constitute a violation of the securities laws of any such jurisdiction. Investors should be aware that they may be required to bear the financial risks of this investment for an indefinite period of time.

This Admission Document shall be governed by and construed in accordance with Norwegian law. The courts of Norway, with Oslo District Court (Nw: Oslo tingrett) as legal venue, shall have exclusive jurisdiction to settle any dispute which may arise out of or in connection with the Admission Document.

TABLE OF CONTENTS

| 1 | RISK FACTORS | 6 |

| 1.1 | Risks associated with the Group's operations | 6 |

| 1.2 | Risks associated with the industry in which the Group operates | 10 |

| 1.3 | Risks related to doing business in China | 11 |

| 1.4 | Risks related to the political and legal environment | 13 |

| 1.5 | Risks Relating to the Common Shares and the VPS Registered Common Shares | 16 |

| 2 | PERSONS RESPONSIBLE | 18 |

| 3 | INDUSTRY OVERVIEW | 19 |

| 3.1 | Economic outlook China | 19 |

| 3.2 | Agriculture in China | 19 |

| 3.3 | China's support foragriculture | 19 |

| 3.4 | Agricultural consumption | 20 |

| 3.5 | Expenditure on food | 20 |

| 3.6 | Food preferences | 21 |

| 3.7 | The market for aquatic products and aquaculture in China | 21 |

| 3.8 | The market for meat in China | 22 |

| 3.9 | The market for fertilizer in China | 24 |

| 3.10 | Market for fruits and vegetables in China | 24 |

| 4 | INFORMATION ABOUT THE ISSUER | 26 |

| 4.1 | Corporate information | 26 |

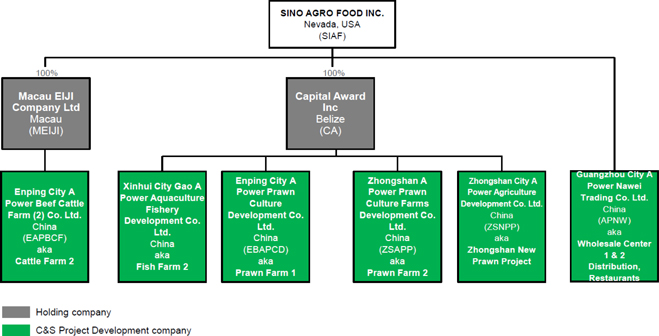

| 4.2 | Legal structure | 26 |

| 4.3 | History | 29 |

| 4.4 | Business model | 30 |

| 4.5 | Business overview | 32 |

| 4.6 | Aquaculture division | 33 |

| 4.7 | Integrated Cattle Farm division (SJAP) | 36 |

| 4.8 | Organic Fertilizer (HSA) division | 41 |

| 4.9 | Cattle farms (MEIJI) division | 42 |

| 4.10 | Plantation division | 43 |

| 4.11 | Marketing & Trading Division | 43 |

| 4.12 | Project Development Division | 44 |

| 4.13 | Intellectual Property Rights | 46 |

| 4.14 | Borrowings, loans receivables and contractual obligations | 47 |

| 4.15 | Material Agreements | 50 |

| 4.16 | Legal and arbitration proceedings | 54 |

| 4.17 | Spin-off | 55 |

| 5 | BOARD OF DIRECTORS, MANAGEMENT, EMPLOYEES, AND CORPORATE GOVERNANCE | 56 |

| 5.1 | Board of Directors | 56 |

| 5.2 | Management | 58 |

| 5.3 | Stock option plans | 59 |

| 5.4 | Benefits upon termination | 60 |

| 5.5 | Employees | 60 |

| 5.6 | Board committees | 60 |

| 5.7 | Corporate Governance | 61 |

| 5.8 | Conflicts of interest etc. | 61 |

| 5.9 | Ownership structure | 61 |

| 6 | GENERAL INFORMATION | 63 |

| 6.1 | Presentation of Financial Information and Certain Other Information | 63 |

| 6.2 | Cautionary note regarding forward-looking statements | 64 |

| 7 | FINANCIAL INFORMATION | 66 |

| 7.1 | Independent auditors | 66 |

| 7.2 | Working capital statement | 66 |

| 7.3 | Related party transactions and certain relationships | 66 |

| 8 | CORPORATE INFORMATION AND DESCRIPTION OF SHARE CAPITAL | 68 |

| 8.1 | Authorized and issued share capital | 68 |

| 8.2 | VPS registration of the VPS Registered Common Shares | 68 |

| 8.3 | Share capital history | 69 |

| 8.4 | Share repurchase and treasury shares | 71 |

| 8.5 | Other financial instruments | 71 |

| 8.6 | Articles of Incorporation, By-laws and Nevada law | 71 |

| 9 | INFORMATION CONCERNING THE SECURITIES TO BE ADMITTED TO TRADING | 79 |

| 9.1 | Admission to trading of the Common Shares | 79 |

| 9.2 | The rights conferred by the Common Shares and the VPS Registered Common Shares | 79 |

| 9.3 | Payout policy | 79 |

| 9.4 | Legal constraints on the distribution of dividends | 79 |

| 10 | SECURITIES TRADING ON MERKUR MARKET | 80 |

| 10.1 | Trading and settlement | 80 |

| 10.2 | Information, control and surveillance | 80 |

| 10.3 | The VPS and transfer of VPS Registered Common Shares | 80 |

| 10.4 | Nominee accounts | 81 |

| 10.5 | Foreign investment in shares admitted to trading in Norway | 81 |

| 10.6 | Insider trading | 82 |

| 11 | TAXATION | 83 |

| 11.1 | United States taxation | 83 |

| 11.2 | Norwegian tax rules | 84 |

| 11.3 | Double Taxation Agreement with the US | 86 |

| 12 | ADDITIONAL INFORMATION | 87 |

| 12.1 | Manager and advisers | 87 |

| 12.2 | Documents incorporated by reference | 87 |

| 13 | DEFINED TERMS AND ABBREVIATIONS | 89 |

| 14 | GLOSSARY OF TECHNICAL TERMS | 92 |

| APPENDICES | ||

| APPENDIX 1: | ARTICLES OF INCORPORATION | A1 |

| APPENDIX 2: | BYLAWS | A2 |

5

| 1 | RISK FACTORS |

Investing in the Common Shares and the VPS Registered Common Shares involves inherent risks. This section 1 "Risk Factors" contains an overview of the risk factors that are known to the Company and considered material by it. Prospective investors should consider, among other things, the risk factors set out in this Admission Document before making an investment decision, and should consult his or her own expert advisors as to the suitability of an investment in the Common Shares and the VPS Registered Common Shares. An investment in the Common Shares and the VPS Registered Common Shares is suitable only for investors who understand the risk factors associated with this type of investment and who can afford a loss of all or part of the investment. If any of the following risks actually occurs, individually or together with other circumstances, the Company's business, financial position, cash flow and operating results could be materially and adversely affected, which may cause a decline in the value and trading price for the Common Shares and the VPS Registered Common Shares that could result in a loss of all or part of any investment in the Common Shares and the VPS Registered Common Shares.

The order in which the risks are presented below is not intended to provide an indication of the likelihood of their occurrence nor of their severity or significance. The information in this section is as of the date of this Admission Document.

| 1.1 | Risks associated with the Group's operations |

| 1.1.1 | Current global economic and credit environment |

Since 2008, global market and economic conditions have been disrupted and volatile as a consequence of the global financial crisis and the ongoing sovereign debt crisis of Portugal, Ireland, Italy, Greece and Spain has caused further concerns of growth, inflation and poor liquidity. Concerns subsequent to the global financial crisis include increased energy costs, geopolitical issues, the availability and cost of credit, the United States mortgage market sub-prime collapse and a declining residential real estate market in the United States. These factors have contributed to an increased volatility and diminished expectations for the economy and the markets going forward. These factors, combined with volatile oil prices, declining business and consumer confidence and increased unemployment, have precipitated a global recession. It is difficult to predict how long the current economic conditions will persist, whether they will deteriorate further, and whether any of the Company's products, if not all of them, will be adversely affected. In addition, should United States interest rates be raised, the growth of the US economy could be hampered and its stock markets could see declines. Such a development would negatively affect the Company's business, financial condition and results of operation.

| 1.1.2 | Need for additional financing to expand the business |

The Group's capital requirements in connection with the planned vertically integrated development and growth plan of its business are significant. Although the Company has sufficient liquidity to operate within its planned scale of operations for the next twelve months calculated from the first date of admission to trading on Merkur Market; to accomplish the capital projects objectives according to the Group's five year plan and to execute the Group's business strategy, the Group expects that it will need access to additional capital on appropriate terms for project funding requirements either as debt or equity at the appropriate time. The Group currently has no commitments with any third party to obtain such additional financing and it cannot be assured that the Company will be able to obtain the requisite additional financing on any terms and, if the Company is able to raise additional funds, it may be necessary for the Company to issue additional securities at a discount from the market price and on other terms which may be disadvantageous to the Group and its shareholders, and thereby negatively affecting the Company's business, financial condition and results of operation. In addition, under the terms of the Company's Note (as defined below) issued to ECAB (as defined below), ECAB has a right of first refusal, for as long as any note is outstanding, exercisable for thirty (30) calendar days after notice to the Note-holder, to make loans to the Company and its subsidiaries or to purchase securities proposed to be offered and sold by the Company or its subsidiaries. There can be no assurance that the remaining shareholders of the Company will be permitted to or able to participate in any new offering of Common Shares, and consequently risk a dilution of their holding.

6

| 1.1.3 | Operating as a vertically integrated operator |

In most developed counties, risks of agriculture operations are shared to a certain degree by different sectors in the agricultural industry. For example:

| · | Research and development are often initiated and supported by government departments; |

| · | Primary producers are mainly concerned with the growing risks of the produce; |

| · | Marketing companies assume the risks of marketing the produce; |

| · | Trading houses sell the produce and assume the credit risks of the sales; and |

| · | Logistics companies assume the risks of transporting the produce. |

As a vertically integrated operator, the Company assumes all the above-mentioned risks. China is a developing country, and compared to other developed nations its agriculture industry is not modern. Thus, the Company is developing its business operation in a vertically integrated manner in order to achieve reasonable profit margins. Although the multiple layers of profits generated through vertical integration may compensate to some degree for the variety of risks that the Company faces through the multiple operations, the overall risk remains significant.

| 1.1.4 | Land Use Rights |

The legal and administrative procedures required to secure leasing of land in China is a long and complicated process. The Company leases land that is either collective owned land or state owned land. The lease term varies from 27 to 60 years. As further described in section 4.15.3 below, there are certain uncertainties (e.g. the lease term may not exceed 30 years and not all transfers have yet been registered accordingly) in respect of certain leased land due to the fact that not all requirements have been fulfilled or not yet registered. As of the date of this information, the mentioned registration processes are still pending on approval by relevant authorities. However, the Company is protected from these uncertainties in agreements with the relevant local Chinese partners and relevant registration processes have been initiated. During this process the Company is largely dependent on its contracting Chinese local partners and good relationships with the authorities who control the administrative process.

The Company's subsidiary Hunan Shenghua A Power Agriculture Co. Ltd. ("HSA") has acquired land use rights for certain state owned land for which it has not obtained a land use right certificate. Accordingly, such land cannot, for the time being, be lawfully mortgaged or transferred. Moreover, the Company's subsidiary Capital Award Inc. ("CA") has entered into an agreement for the acquisition of the contractual operating and use rights of certain collective owned land for which transfer procedures have not been completed. CA is not an enterprise registered in mainland China and therefore, according to Chinese law, cannot acquire the contractual operating and use rights of collective owned land. However, Sino Agro Food is currently in negotiations to designate one of its Chinese subsidiaries for the purpose of entering into a new agreement. In this respect, the Company is preparing the draft of agreement for one of its subsidiaries to acquire the operation and land use right of the mentioned block of land aiming to complete such process on or before end of March 2016.

There can be no assurance that the Company can hold all of the leased land on its current terms and conditions. In the event that the Company's lease of land is subject to a challenge that it has been improperly leased there is no assurance that the Company will not lose such leased land, which would affect the Company's business, financial condition and results of operation in a material adverse manner.

| 1.1.5 | Risks associated with the Zhongshan New Prawn Construction Project |

In March of 2014, Sino Agro Food announced that its subsidiary, CA, was granted a contract to build an 8,000 MU prawn and agriculture center in Zhongshan City. CA has been engaged to provide construction and development services, as well as consulting support in the form of management, supervision, and training. The contract price for phase 1 of the project is stipulated at USD 160 million +/- 15 %. If project costs exceed this number, there are no provisions in the agreement providing for extra compensation. However, under Chinese law, CA is entitled to be compensated if the Chinese party has asked for work in excess of what the estimate in the current contract is based on. There is no assurance that actual project costs will not exceed the contract price. If such risks materialize, and the Company is not awarded extra compensation, the Company's business, financial condition and results of operation may be affected in a material adverse manner.

7

| 1.1.6 | No assurance of successful expansion of operations |

The significant increase in the scope and the scale of the products facilities launch and infrastructure cost, including the hiring of additional personnel, has resulted in significantly higher operating expenses. As a result, the Company anticipates that the operating expenses will continue to increase as production is ramped up. Expansion of the operations may also cause a significant demand on the management, finances and other resources. The ability to manage the anticipated future growth, should it occur, will depend upon a significant expansion of accounting and other internal management systems and the implementation and subsequent improvement of a variety of systems, procedures and controls. There can be no assurance that significant problems in these areas will not occur. Any failure to expand these areas and implement and improve such systems, procedures and controls in an efficient manner at a pace consistent with the business could lead to the quality of products and services suffering and have a material adverse effect on the Company, its business, financial condition and results of operations.

| 1.1.7 | Expansion production capacity |

Part of the Group's future growth strategy is to increase production capacity to meet increasing demand for existing goods. Assuming that the Group obtains sufficient funding to increase production capacity, any projects that the Company undertakes to increase such capacity may not be constructed on the anticipated timetable or within budget. The Company may also experience quality control issues as the Group implements these production upgrades. Any material delay in completing these projects, or any substantial increase in costs or quality issues in connection with these projects, could materially delay the ability to bring products to the market and adversely affect the Company, its business, financial condition and results of operation.

| 1.1.8 | Change in Chinese policy toward the agriculture industry |

As producers active in the agriculture industry, the Company's subsidiaries are largely presently exempt from income tax and enjoy various incentive grants and subsidies given by the Chinese government. If the Chinese government were to change its presently favorable policy toward the agriculture industry, there is a risk that the Company could no longer take advantage of the present tax-related privileges, which would adversely affect the Company's business, financial condition and results of operation. Certain of the Company's Chinese subsidiaries are still in the process of applying for tax exemptions for 2015. It is standard procedure that a company exempted from VAT and income tax according to applicable tax law shall be subject to annual prior approval by the competent tax authorities. There is no legal risk that a tax exemption will not be granted if the application is duly made and all application documents are complete and valid as required by the relevant tax authorities. In so far the Chinese Government is maintaining all tax related privileges for the Agriculture industry and the Company is expecting that will continue for a number more years.

| 1.1.9 | Intellectual Property |

The Company's patents, trademarks, trade secrets, copyrights and other intellectual property rights are important assets. Various events outside of the Company's control may pose a threat to its intellectual property rights as well as to its products and services. For example, effective intellectual property protection may not be available in China and other countries in which the Company's products are sold. Also, although the Company has registered its trademark in China, the Company's efforts to protect its proprietary rights may not be sufficient or effective. Any significant impairment of the Company's intellectual property rights could harm the Company's business or its ability to compete and hurt the Company's results of operation. Also, protecting intellectual property rights is both costly and time consuming, and policing unauthorized use of the Company's proprietary technology can be difficult and expensive. Any unauthorized use of the Group's intellectual property could make it more expensive for the Group to do business and harm the Company's operating results.

In November 2008, the Company's Hong Kong subsidiary, Tri-way Industries Limited ("TRW"), entered into an agreement with the inventor of a patent concerning the sale and purchase of the master licence rights of a patent relating to methods of processing plant straw into animal fodder and industrialisation of product of plant straw fodder. The patent assignment has not yet been registered with the relevant Chinese authorities and accordingly, under Chinese law, the patent shall not appose to third parties who are in good faith. Moreover, in May 2009, TRW (as licensor) entered into a sub-licence agreement with a related party concerning the sub-licensing of the above-mentioned patent. The licence period is 50 years; however, as effective patent protection for the patent is 20 years, the excess part of the term is void under Chinese law. The parties have no intention to perform the sub-licence agreement, and the contracting parties have terminated the said agreement accordingly.

8

In June 2011, the Company's Chinese subsidiary, Qinghai Sanjiang A Power Agriculture Co. Ltd. ("SJAP"), entered into an agreement with a related party pursuant to which the related party transferred certain trademarks as well as a microbial patent. An evaluation report was not filed with the transaction. Although this is not a formal requirement under Chinese law, this failure to file the evaluation report may lead to the contract being challenged in the future on the basis of unfairness. Moreover, as the transferor is not the owner of the trademark, the said agreement is void under Chinese law and SJAP has therefore not obtained ownership of the aforementioned trademarks. If SJAP uses the trademark without prior consent of the trademark owner, this would constitute trademark infringement. SJAP is intending to write off such arrangement in their book and not to use the relevant trademark.

The Company's success mainly depends on the ability to use and develop technology and product designs without infringing upon the intellectual property rights of third parties. The Group may be subject to litigation involving claims of patent infringement or violations of other intellectual property rights of third parties. Holders of patents and other intellectual property rights potentially relevant to Sino Agro Food's product offerings may be unknown to the Company, which may make it difficult for the Company to acquire a license on commercially acceptable terms. There may also be technologies licensed to the Company that are subject to infringement or other corresponding allegations or claims by third parties which may damage the Company's ability to rely on such technologies. In addition, although the Company endeavors to ensure that companies that work with the Group possess appropriate intellectual property rights or licenses, the Company cannot fully avoid the risks of intellectual property rights infringement created by suppliers of components used in the Group's products or by companies the Group works with in cooperative research and development activities. The Company's current or potential competitors may have obtained or may obtain patents that will prevent, limit or interfere with the Company's ability to make, use or sell its products. The defense of intellectual property claims, including patent infringement suits, and related legal and administrative proceedings can be both costly and time consuming, and may significantly divert the efforts and resources of the Company's technical personnel and management. These factors could effectively prevent the Company from pursuing some or all of its business operations and result in customers or potential customers deferring, cancelling or limiting their purchase or use of the Company's products, which may have a material adverse effect on the Company's business, financial condition and results of operations.

| 1.1.10 | Employees |

Sino Agro Food's performance largely depends on the talents, knowledge, skills and know-how and efforts of highly skilled individuals and in particular, the expertise held by the chief executive officer, Mr. Solomon Lee. His absence, were it to occur, could materially and adversely impact the development and implementation of the projects and businesses. The Company's future success depends on its continuing ability to identify, hire, develop, motivate and retain highly skilled personnel for all areas in the organization. Sino Agro Food's continued ability to compete effectively depends on its ability to attract new technology developers and to retain and motivate existing contractors. If one or more of the executive officers are unable or unwilling to continue in their present positions, Sino Agro Food may not be able to replace them readily, if at all. Therefore, the business may be severely disrupted, and Sino Agro Food may incur additional expenses to recruit and retain new officers. In addition, if any of the Company's executives joins a competitor or forms a competing company, Sino Agro Food may lose some of its customers. These factors would have a negative effect on the Company's business, financial condition and results of operation.

| 1.1.11 | Competition |

The markets for the products sold by Sino Agro Food are both competitive and price sensitive. Many of Sino Agro Food's competitors have significant financial, operations, sales and marketing resources and experience in research and development and compete with the Company by offering lower prices. Competitors could develop new technologies that compete with the products on achieving a lower unit price. If a competitor develops superior technology or cost-effective alternatives to the products and services, the business could be seriously harmed as they may achieve a lower price for the same quality, which would affect the Company's business, financial condition and results of operation.

The markets for some of the products are also subject to specific competitive risks because these markets are highly price competitive. The competitors have competed in the past by lowering prices on certain products. If they do so again, Sino Agro Food may be forced to respond by lowering its prices. This would reduce sales revenues and increase losses. Failure to anticipate and respond to price competition may also impact sales and aggravate losses.

9

| 1.1.12 | Risks related to customers |

The Group has a few major customers whose business in periods represents approximately 40-75 percent of the Group's total revenue. The dependence on a few major customers results in an increased exposure to business and credit risks. In the event of a substantial reduction in orders from any of the Group's major customers, termination of a business relationship with any of these customers or if full payment is not received from any of them, this could have a material adverse effect on the Group's business, financial condition and results of operation.

| 1.1.13 | Financial reporting |

The Company prepares its consolidated financial statements in accordance with US GAAP, which requires management to make assumptions and estimates that affect the reported amounts of assets and liabilities and disclosure of contingent liabilities at the dates of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting periods covered thereby. Actual results could differ from these estimates. Further, a change in the regulations regarding financial reporting might affect the valuation of the Company's assets and liabilities. These factors might negatively impact the Company's financial condition and results of operation.

| 1.1.14 | Sino Agro Food is a holding company |

According to the specific characteristics of agricultural production in China, Sino Agro Food has given its subsidiaries and their farms a certain degree of independence in their decision-making processes. On one hand, this independence increases the sense of ownership at all levels, on the other hand it has also increased the difficulty of the integration of operation and management as a practical matter. In the event the Company is not able to successfully manage its subsidiaries this will result in operating difficulties and have a negative impact on the Company's business.

| 1.1.15 | The Company has announced an intention to spin-off its aquaculture operations |

On November 11, 2015, the Company announced its plan to spin-off and seek a separate listing of its aquaculture operations on the Oslo Stock Exchange (please refer to section 4.17 below for a further description). There can be no assurance that the contemplated spin-off and subsequent listing of its aquaculture operations will occur, nor that such spin-off will be successful. There can furthermore be no assurance that the remaining parts of the Group, in the event that the spin-off is implemented, will be attractive to investors. These factors could have a negative effect on the Company's business, financial condition and results of operation.

| 1.2 | Risks associated with the industry in which the Group operates |

| 1.2.1 | Potential environmental factors on the assets |

Sino Agro Food's financial and operating performance may be adversely affected by epidemics, adverse weather conditions, natural disasters and other catastrophes which are unpredictable and outside of Sino Agro Food's control. For example, in early 2003, several economies in Asia, including China, were affected by the outbreak of severe acute respiratory syndrome, or "SARS". During May and June of 2003, many businesses in China were closed by the PRC government to prevent transmission of SARS. The Company's business could be materially and adversely affected by the effects of such or other epidemics or outbreaks. In April 2009, an outbreak of H1N1 flu first occurred in Mexico and quickly spread to other countries, including the United States and China. In the last decade, China has suffered health epidemics related to the outbreak of avian influenza and SARS. Any prolonged occurrence or recurrence of such epidemics or other adverse public health developments in China may have a material adverse effect on the Company and its business, financial condition and results of operation. Furthermore, the 2008 Sichuan earthquake also had a negative impact on many businesses in the region, and future earthquakes or similar adverse weather conditions may have a significant negative impact on the Group's business.

| 1.2.2 | Sino Agro Food's agricultural assets are situated in three provinces in China and crop disease, severe weather, natural disasters and other conditions affecting the environment, including the effects of climate change, could result in substantial losses and weaken the Company's financial condition |

Sino Agro Food's agricultural operations are situated in Qinghai Province, Hunan and Guangdong Province. Qinghai Province in particular is subject to occasional periods of drought. Crops require water in different quantities at different times during the growth cycle. The limited water resource at any given point can adversely impact production. The Company's cropping and pasture land presently comprises over 5,000 acres, an area too big and too costly to afford drip irrigation systems for the Company's crops. Hunan, the district of Linli, in which Sino Agro Food has over 300 acres of crop and pasture land, may from time to time be subject to flooding that could affect the Company's agriculture production. In Enping, Guangdong, the Company's HU plants (see description in section 4.10 below) are very susceptible to dry and wet seasonal variation that could also affect the Company's agriculture production.

10

Crop disease, severe weather conditions, such as floods, droughts, windstorms and hurricanes, and natural disasters, may adversely affect the Company's supply of one or more products, reduce its sales volumes, increase its unit production costs or prevent or impair its ability to ship products as planned. Since a significant portion of the Company's costs are fixed and contracted in advance of each operating year, volume declines due to production interruptions or other factors could result in increases in unit production costs, which could result in substantial losses and weaken the Company's financial condition. The Company may experience crop disease, insect infestation, severe weather and other adverse environmental conditions from time to time. Severe weather conditions may occur with higher frequency or may be less predictable in the future due to the effects of climate change.

An occurrence of such an event might result in material disruptions to the Company's operations, to the operations of its customers or suppliers, resulting in a decline in the agriculture industry. There can be no assurance that the Company's facilities or products will not be affected by any such occurrence in the future, which occurrence may lead to adverse conditions to the Company's operations and financial results.

| 1.2.3 | Fluctuation in price of agricultural products |

Because agricultural products are commodities, Sino Agro Food is not able to predict with certainty what price Sino Agro Food will receive for its products. Additionally, the growth cycle of such products in many instances dictates when such products must be marketed to achieve the maximum profitability. Excessive supplies tend to cause severe price competition and lower prices throughout the industry affected. Conversely, shortages may drive the prices higher. Shortages often result from adverse growing conditions which can reduce the availability of the agricultural products affected. Since multiple variables can affect supply and demand, the Company cannot accurately predict or control from year to year what prices, either favorable or unfavorable, it will receive from the market.

In addition, general public perceptions regarding the quality, safety or health risks associated with particular food products could reduce demand and prices for some of the Company's products. To the extent that consumer preferences evolve away from products that Sino Agro Food produce for health or other reasons, and Sino Agro Food is unable to modify its products or to develop products that satisfy new consumer preferences, there will be a decreased demand for the products. However, even if market prices are unfavorable, some of the Company's agricultural products which are ready to be, or have been, harvested must be brought to market promptly. A decrease in the selling price received for the Company's products due to the factors described above could have a material adverse effect on the Company and its business, financial condition and results of operation.

| 1.2.4 | The risk of product contamination and product liability claims |

The sales of the products may involve risk of injury to consumers. Such injuries may result from tampering by unauthorized personnel, product contamination or spoilage, including the presence of foreign objects, substances, chemicals, or residues introduced during the growing, packing, storage, handling or transportation phases. While the Company is subject to governmental inspection and regulations and believe the facilities comply in all material respects with all applicable laws and regulations, including internal product safety policies, Sino Agro Food cannot be sure that consumption of its products will not cause a health-related illness in the future or that Sino Agro Food will not be subject to claims or lawsuits relating to such matters. Even if a product liability claim is unsuccessful, the negative publicity surrounding any assertion that Sino Agro Food's products caused illness or injury could adversely affect its reputation with existing and potential customers and the brand image. The Company does not maintain product liability insurance. These factors could impact the Company's business, financial condition and results of operation in a material adverse manner.

| 1.3 | Risks related to doing business in China |

| 1.3.1 | Requirement to hold certain licenses according to PRC law |

Sino Agro Food holds various permits, business licenses, and approvals authorizing Sino Agro Food's operations and activities, which are subject to periodic review and reassessment by the Chinese authorities. Standards of compliance necessary to pass such reviews change from time to time and differ from jurisdiction to jurisdiction, leading to a degree of uncertainty. Some of the existing permits are also due to expire during the next year. In this respect, all applicable permits and licenses have been renewed. However if any future renewals, or new permits, business licenses or approvals required in connection with existing or new facilities or activities, are not granted or are delayed, or if existing permits, business licenses or approvals are revoked or substantially modified, Sino Agro Food may not be able to continue to operate its facilities which would have a material adverse effect on the Company. If new standards are applied to renewals or new applications, it could result in additional costs to meet these new standards, which may adversely affect the Company and its business, financial condition and results of operation.

11

| 1.3.2 | The PRC economic cycle |

Sino Agro Food believes that the rapid growth of the Chinese economy before 2008 generally led to higher levels of inflation. In addition, China's economy has more recently experienced a decrease in its growth rate. A number of factors have contributed to this deceleration, including appreciation of the RMB, which has adversely affected China's exports. The deceleration of China's economic growth may have been exacerbated by the recent global crisis in the financial services and credit markets, which has resulted in significant volatility and dislocation in the global capital markets. It is uncertain how long the global crisis in the financial services and credit markets will continue and the significance of the adverse impact it may have on the global economy in general or the Chinese economy in particular. Slowing economic growth in China could have a negative impact on the Company and its business, financial condition and results of operation.

| 1.3.3 | Currency fluctuations and restrictions on currency exchange |

The exchange rate of the RMB is currently managed by the Chinese government. On July 21, 2005, the People's Bank of China, with the authorization of the State Council of the PRC, announced that the RMB exchange rate would no longer be pegged to the USD and would float based on market supply and demand with reference to a basket of currencies. According to public reports, the governor of the People's Bank of China has stated that the basket is composed mainly of the USD, the Euro, the Japanese Yen and the South Korean Won. Also considered, but playing smaller roles, are the currencies of Singapore, the United Kingdom, Malaysia, Russia, Australia, Canada and Thailand. The weight of each currency within the basket has not been announced.

The initial adjustment of the RMB exchange rate was an approximate 2 percent revaluation from an exchange rate of 8.28 RMB per USD to 8.11 RMB per USD. The People's Bank of China also announced that the daily trading price of the USD against the RMB in the inter-bank foreign exchange market would be allowed to float within a band of 0.3 percent around the central parity published by the People's Bank of China, while the trading prices of the non-USD currencies against the RMB would be allowed to move within a certain band announced by the People's Bank of China. The People's Bank of China has stated that it will make adjustments of the RMB exchange rate band when necessary according to market developments as well as the economic and financial situation. In a later announcement published on May 18, 2007, the band was extended to 0.5 percent. Since July 2008, the RMB has traded at 6.83 RMB per USD. Recent reports indicate an upward revaluation in the value of the RMB against the USD may be allowed. The People's Bank of China announced on June 19, 2010 its intention to allow the RMB to move more freely against the basket of currencies, which increases the possibility of sharp fluctuations in the value of the RMB in the near future and thus the unpredictability associated with the RMB exchange rate.

Despite this change in its exchange rate regime, the Chinese government continues to manage the valuation of the RMB. The value of Sino Agro Food's securities will be indirectly affected by the foreign exchange rate between the USD and the RMB. Appreciation or depreciation in the value of the RMB relative to the USD would affect Sino Agro Food's financial results reported in USD terms without giving effect to any underlying change in its business. Fluctuations in the exchange rate will also affect the relative value of any dividend Sino Agro Food issue that will be exchanged into USD, as well as earnings from, and the value of, any USD-denominated investments the Company makes in the future.

The income statements of the Company's operations are converted into USD at the average exchange rates in each applicable period. To the extent the USD strengthens against foreign currencies, the conversion of these foreign currencies denominated transactions would result in reduced revenue, operating expenses and net income for the international operations. Similarly, to the extent the USD weakens against foreign currencies, the conversion of these foreign currency denominated transactions would result in increased revenue, operating expenses and net income for the international operations. Sino Agro Food is also exposed to foreign exchange rate fluctuations as it converts the financial statements of foreign subsidiaries into USD in consolidation. If there is a change in foreign currency exchange rates, the conversion of the foreign subsidiaries' financial statements into USD will lead to a translation gain or loss, which is recorded as a component of other comprehensive income. In addition, Sino Agro Food has certain assets and liabilities that are denominated in currencies other than the relevant entity's functional currency. Changes in the functional currency value of these assets and liabilities create fluctuations that will lead to a transaction gain or loss.

12

| 1.3.4 | Limited hedging transactions are available in China |

Very limited hedging transactions are available in China to reduce the Company's exposure to exchange rate fluctuations. To date, Sino Agro Food has not entered into any hedging transactions. While Sino Agro Food may enter into hedging transactions in the future, the availability and effectiveness of these transactions may be limited, and the Company may not be able to successfully hedge its exposure at all. In addition, foreign currency exchange losses may be magnified by PRC exchange control regulations that restrict the Company's ability to convert RMB into foreign currencies, which would negatively affect the Company's business, financial condition and results of operation.

| 1.3.5 | Under the PRC Enterprise Income Tax Law, Sino Agro Food may be classified as a "resident enterprise" |

On March 16, 2007, the National People's Congress in the PRC approved and promulgated a new tax law, the PRC Enterprise Income Tax Law, (the "EIT Law"), which took effect on January 1, 2008. Under the EIT Law, enterprises are classified as resident enterprises and non-resident enterprises. An enterprise established outside of China with "de facto management bodies" within China is considered a "resident enterprise", meaning that it can be treated in a manner similar to a Chinese enterprise for enterprise income tax purposes. The implementing rules of the EIT Law define "de facto management bodies" as a managing body that in practice exercises "substantial and overall management and control over the production and operations, personnel, accounting, and properties" of the enterprise; however, it remains unclear whether the PRC tax authorities would deem Sino Agro Food's managing body as being located within China. Due to the short history of the EIT Law and lack of applicable legal precedents, the PRC tax authorities determine the PRC tax resident treatment of a foreign company on a case-by-case basis. If the Company is considered a "resident enterprise" this could have a negative impact on the Company and its business, financial condition and results of operation.

| 1.4 | Risks related to the political and legal environment |

| 1.4.1 | Sino Agro Food's business, financial condition, results of operations and prospects are affected significantly by economic, political and legal developments in China |

Although in recent years the Chinese government has implemented measures emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets and the establishment of sound corporate governance in business enterprises, a substantial portion of the productive assets in China is still owned by the Chinese government. The Chinese government also exercises significant control over Chinese economic growth through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies.

Since 1979, PRC legislation and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. However, China has not developed a fully integrated legal system and recently enacted laws and regulations may not sufficiently cover all aspects of economic activities in China. In particular, because these laws and regulations are relatively new, the interpretation and enforcement of these laws and regulations involve uncertainties. In addition, the PRC legal system is based in part on government policies and internal rules (some of which are not published on a timely basis or at all) that may have a retroactive effect. As a result, Sino Agro Food may not be aware of any violation of these policies and rules until sometime after any such potential violation which could adversely affect the Company and its business, financial condition and results of operation.

The Chinese government has enacted some laws and regulations dealing with matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. However, China's experience in implementing, interpreting and enforcing these laws and regulations is limited, and the Company's ability to enforce commercial claims or to resolve commercial disputes is unpredictable. The resolution of these matters may be subject to the exercise of considerable discretion by agencies of the Chinese government, and forces unrelated to the legal merits of a particular matter or dispute may influence their determination. Any rights Sino Agro Food may have to specific performance, or to seek an injunction under PRC law, in either of these cases, are severely limited, and without a means of recourse by virtue of the Chinese legal system, the Company may be unable to prevent these situations from occurring, and thereby the Company's business, financial condition and results of operation might be adversely affected.

13

| 1.4.2 | Contract drafting, interpretation and enforcement in China involve significant uncertainty |

Sino Agro Food has entered into numerous contracts governed by PRC law, many of which are material to the business. As compared with contracts in the United States, contracts governed by PRC law tend to contain less detail and to not be as comprehensive in defining contracting parties' rights and obligations. As a result, contracts in China are more vulnerable to disputes and legal challenges. In addition, contract interpretation and enforcement in China is not as developed as in the west, and the result of any contract dispute is subject to significant uncertainties. Therefore, Sino Agro Food cannot assure investors that it will not be subject to disputes under its material contracts, and if such disputes arise, Sino Agro Food cannot assure investors that it will prevail. Such disputes might negatively affect the Company's business, financial condition and results of operation.

Sino Agro Food cannot assure its shareholders that the Company will be able to enforce any of its material agreements or that remedies will be available outside of China. The system of laws and the enforcement of existing laws in China may not be as certain in implementation and interpretation as in more developed jurisdictions. The Company's potential inability to enforce or obtain a remedy under any of its current or future agreements could result in a significant loss of business, opportunities or capital. Moreover, China does not have treaties providing for the reciprocal recognition and enforcement of judgments of courts with the United States, Norway and many other Western countries. Further, it is unclear if extradition treaties now in effect between the United States and China would permit effective enforcement of criminal penalties of the federal securities laws.

| 1.4.3 | The application of PRC regulations relating to the overseas admission to trading of PRC domestic companies is uncertain |

On August 8, 2006, six PRC government agencies jointly issued the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors (the "New M&A Rules"), which became effective on September 8, 2006. The New M&A Rules purport, among other things, to require offshore "special purpose vehicles", that are (i) formed for the purpose of overseas listing of the equity interests of PRC companies via acquisition and (ii) are controlled directly or indirectly by PRC companies and/or PRC individuals, to obtain the approval of the China Securities Regulatory Commission (the "CSRC") prior to the listing and trading of their securities on overseas stock exchanges. On September 21, 2006, pursuant to the New M&A Rules and other PRC laws, the CSRC published on its official website relevant guidance with respect to the listing and trading of PRC domestic enterprises' securities on overseas stock exchanges, including a list of application materials regarding the listing on overseas stock exchanges by special purpose vehicles. The Company was and is not required to obtain the approval of CSRC under the New M&A Rules in connection with the admission to trading on Merkur Market because Sino Agro Food is not a special purpose vehicle formed or controlled by PRC individuals.

However, there are substantial uncertainties regarding the interpretation, application and enforcement of these rules, and CSRC has yet to promulgate any written provisions or formally to declare or state whether the overseas listing of a PRC-related company structured similar to Sino Agro Food is subject to the approval of CSRC. Any violation of these rules could result in fines and other penalties on the Company's operations in China, restrictions or limitations on remitting dividends outside of China, and other forms of sanctions that may cause a material and adverse effect on the Company.

| 1.4.4 | Capital outflow policies in the PRC |

The PRC has adopted currency and capital transfer regulations. These regulations may require that the Company comply with complex regulations for the movement of capital. The Company's Chinese subsidiaries must also obtain tax clearance certificates from the Chinese tax authorities to prove that all taxes have been duly paid before transferring or distributing cash to the Company. As a result of the aforementioned restrictions, the Company may not be able to remit all income earned and proceeds received in connection with its operations or from the sale of the operating subsidiary to the United States or to the shareholders, which might have a negative impact on the Company's business, financial condition and results of operation.

14

| 1.4.5 | The use of the allocated land may be subject to challenges in the future |

All land use rights that Sino Agro Food owns are land use rights relating to allocated land. The local governmental authorities have granted such land use rights to the Company for free use or at a discounted levy rate given a contribution to the development of the local economy. However, pursuant to the Catalogue on Allocated Land issued by the Ministry of Land Resources of the PRC (the "Catalogue"), the land use rights for allocated land may only be granted to those specific projects which are in compliance with the Catalogue, subject to the approval of the competent governmental authorities. Sino Agro Food, as a privately owned agricultural producer, may not be qualified to be granted such land use rights for allocated land according to the Catalogue. Consequently, the use of such land may be subject to challenge in the future, and the legal consequences could include the confiscation of such land by the governmental authorities or a demand that the Company pay a market price for purchasing the land use rights for such land and converting the allocated land use right to a granted land use right, which would have a material negative impact on the Company's business, financial condition and results of operation.

| 1.4.6 | No insurance coverage |

Sino Agro Food currently do not purchase property insurance for its properties, including raw materials, semi-manufactured goods, manufactured goods, buildings and machinery equipment, livestock, and the Company currently does not carry any product liability or other similar insurance, nor does it have business liability or business disruption insurance coverage for its operations in the PRC. There is no insurance covering risks incurred through seasonal variation consequences. In this respect, Sino Agro Food as an engineering based company has qualified personnel and staff to manage and to limit the occurrence of these relevant risk factors; however there is no guarantee that accidents or force majeure events will not happen, and if they happen, the consequences may have a material adverse effect on Sino Agro Food's business, financial condition and results of operations.

| 1.4.7 | Chinese banks do not provide capital guarantee insurance |

Banks and other financial institutions in the PRC and overseas do not provide insurance for funds held on deposit. A significant portion of the Company's assets are in the form of cash deposited with banks in the PRC and overseas, and in the event of bank failure, Sino Agro Food may not have access to, or may lose entirely, funds on deposit. Depending upon the amount of cash maintained in a bank that fails, the inability to have access to such cash deposits could have a material negative impact on the Company and its business, financial condition and results of operation.

| 1.4.8 | Labor laws in the PRC |

On June 29, 2007, the PRC government promulgated a new labor law, namely, the Labor Contract Law of the PRC (the "New Labor Contract Law"), which became effective on January 1, 2008. The New Labor Contract Law imposes greater liabilities on employers and significantly affects the cost of an employer's decision to reduce its workforce. Further, it requires that certain terminations be based upon seniority and not merit. In the event Sino Agro Food decides to significantly change or decrease its workforce, the New Labor Contract Law could adversely affect the ability to effect such changes in a manner that is most advantageous to the business or in a timely and cost-effective manner, thus materially and adversely affecting the Company.

| 1.4.9 | Bribery and corruption |

Sino Agro Food is subject to the United States Foreign Corrupt Practices Act of 1977, which generally prohibits United States companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Foreign companies, including some that may compete with Sino Agro Food, may not be subject to these prohibitions. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices occur from time to time in China. The Company cannot state, with any certainty, that its employees or agents will not engage in such conduct for which the Company might be held responsible. In the event that the Company's employees or agents are found to have engaged in such practices, Sino Agro Food could suffer severe penalties and other consequences that may have a material adverse effect on its business, financial condition and results of operation.

15

| 1.5 | Risks Relating to the Common Shares and the VPS Registered Common Shares |

| 1.5.1 | Provisions in the Company's organizational documents could make it difficult for its holders of Common Shares and VPS Registered Common Shares to replace or remove the current Board of Directors or have the effect as discouraging, delaying or preventing a merger or acquisition, which may adversely affect the market price of the Common Shares and the VPS Registered Common Shares |

Pursuant to the Company's Articles of Incorporation, as amended by a certificate of the designations, powers, preferences and rights of the Series A Preferred Shares dated 6 August 2010, the outstanding shares of series A preferred stock ("Series A Preferred Shares") shall vote together with the Common Shares as a single class and, regardless of the number of Series A Preferred Shares outstanding and as long as at least one Series A Preferred Share is outstanding, shall represent 80 percent of all votes entitled to be cast at any annual or special meeting of shareholders of the Company or action by written consent of shareholders. The voting rights of the VPS Registered Common Shares mirror the voting rights of the Common Shares, and is described in further detail below under the heading "There are certain risks connected to the VPS Registered Common Shares being registered in the VPS". Each outstanding Series A Preferred Share shall represent its proportionate share of the 80 percent which is allocated to the outstanding Series A Preferred Shares. The Company currently has 100 Series A Preferred Shares issued and outstanding, and consequently the holders of the Common Shares and the VPS Registered Common Shares will have no or limited chance of influencing the governance and operation of the Company.

| 1.5.2 | The price of the Common Shares and the VPS Registered Common Shares may fluctuate significantly. |

The trading price of the Common Shares and the VPS Registered Common Shares could fluctuate significantly in response to a number of factors beyond the Group's control, including quarterly variations in operating results, adverse business developments, changes in financial estimates and investment recommendations or ratings by securities analysts, significant contracts, acquisitions or strategic relationships, publicity about the Group its products and services or its competitors, lawsuits against the Group, unforeseen liabilities, changes to the regulatory environment in which it operates or general market conditions.

In recent years, and in particular during the past few weeks, the stock market has experienced extreme price and volume fluctuations. This volatility has had a significant impact on the market price of securities issued by many companies, including companies in the industry in which the Group operates. Those changes may occur without regard to the operating performance of these companies. The price of the Common Shares and the VPS Registered Common Shares may therefore fluctuate based upon factors that have little or nothing to do with the Group, and these fluctuations may materially affect the price of its Common Shares and VPS Registered Common Shares respectively.

Following the access to trading on the Merkur Market, the Common Shares of the Company will be trading on two markets, namely the Merkur Market in the form of VPS Registered Common Shares and the OTCQB in the form of Common Shares. The trading price between the two market places may deviate and a fluctuation in one market may impact the pricing of the VPS Registered Common Shares and the Common Shares respectively in the other market.

| 1.5.3 | Investors may not be able to exercise their voting rights for VPS Registered Common Shares registered in a nominee account |

Beneficial owners of VPS Registered Common Shares that are registered in a nominee account (such as through brokers, dealers or other third parties) may not be able to vote such shares unless their ownership is re-registered in their names with the VPS prior to the Company's shareholder meetings. The Company cannot guarantee that beneficial owners of the VPS Registered Common Shares will receive the notice of a meeting of shareholders of the Company in time to instruct their nominees to either effect a re-registration of their VPS Registered Common Shares or otherwise vote for their VPS Registered Common Shares in the manner desired by such beneficial owners.

| 1.5.4 | Future issuance of Common Shares or other securities may dilute the holdings of shareholders and could materially affect the price of the Common Shares and the VPS Registered Common Shares. |

It is possible that the Company in the future may decide to offer additional shares or other securities in order to secure financing of new projects, in connection with unanticipated liabilities or expenses or for any other purposes. Any such additional offering would reduce the proportionate ownership and voting interests of holders of Common Shares and VPS Registered Common Shares, and could also adversely affect the earnings per share and the net asset value per share of the Company. Further, any offering by the Company could have a material adverse effect on the market price of the Common Shares and the VPS Registered Common Shares.

16

| 1.5.5 | Shareholders outside the United States are subject to exchange rate risk. |

The Common Shares traded on the OTCQB are priced in USD and the VPS Registered Common Shares traded on Merkur Market will be priced in NOK. Any future dividends will be declared in USD; however, payment on the VPS Registered Common Shares will be made in NOK. Accordingly, any VPS Shareholder outside the United States is subject to adverse movements in NOK against the USD and any VPS Shareholder located outside Norway is in addition subject to adverse movements in NOK against their local currency as the foreign currency equivalent of any dividends paid on the VPS Registered Common Shares or price received in connection with sale of such VPS Registered Common Shares.

| 1.5.6 | There are certain risks associated with the VPS Registered Common Shares being registered in the VPS. |

The underlying Common Shares represented by VPS Registered Common Shares are registered in DTC in the name of the VPS Registrar, which holds the underlying Common Shares as a nominee on behalf of the beneficial owners (the "VPS Shareholders"). For the purpose of enabling trading of the VPS Registered Common Shares on Merkur Market, the Company maintains a register in the VPS, where the beneficial ownership interests in the underlying Common Shares and transfer of such beneficial ownership interests are recorded in the form of VPS Registered Common Shares.

The Company has entered into a Registrar Agreement with the VPS Registrar where the VPS Registrar is appointed as registrar and nominee, in order to provide for the registration of each investor's beneficial ownership in the underlying Common Shares in the VPS on investors' individual VPS accounts in the form of VPS Registered Common Shares.

In accordance with market practice in Norway and system requirements of the VPS, the beneficial ownership of investors is registered in the VPS under the name of a "share" and the beneficial ownership is traded on the Merkur Market as "shares" in the Company. Investors who purchase shares (although recorded as owners of the

VPS Registered Common Shares in the VPS will have no direct rights against the Company.

Each VPS Registered Common Share represents evidence of beneficial ownership of one of the underlying Common Shares for the purposes of Norwegian law; however, such ownership would not necessarily be recognized by a United States or other court. The VPS Registered Common Shares are freely transferable with delivery and settlement through the VPS-system. Investors must look solely to the VPS Registrar for the payment of dividends, for the exercise of voting rights attached to the VPS Registered Common Shares and for all other rights arising in respect of the VPS Registered Common Shares.

17

| 2 | PERSONS RESPONSIBLE |

This Admission Document has been prepared by Sino Agro Food, Inc. in connection with the admission to trading of the Common Shares on the Merkur Market.

The Board of Directors of Sino Agro Food, Inc. accepts responsibility for the information contained in this Admission Document. The Board of Directors confirm that, having taken all reasonable care to ensure that such is the case, the information contained in this Admission document is, to the best of the Company's knowledge, in accordance with the facts and contains no omissions likely to affect its import.

12 January, 2016

The Board of Directors of Sino Agro Food, Inc.

| Solomon Lee, Chairman of the Board | Peter Tan Paoy Teik, Director | |

| Chen Bor Hann, Director | Nils-Erik Sandberg, Director | |

| Koi Ming Yap, Director | Daniel Ritchey, Director | |

| Lim Chang Soh, Director |

18

| 3 | INDUSTRY OVERVIEW |

This section discusses the industry in which the Group operates. Certain of the information in this section relating to market environment, market developments, growth rates, market trends, industry trends, competition and similar information are estimates based on data compiled by professional organisations, consultants and analysts, in addition to market data from other external and publicly available sources, see section 6.1 "General Information—Presentation of Financial and Other Information—Sources of Industry and Market Data".

| 3.1 | Economic outlook China |

China's economy is at present second only to that of the United States, having overtaken Japan's role as number two in 20101. The OECD expects that China's real GDP will grow by 7.1 percent in 2015 and by 6.9 percent in 20162. The IMF expects that China will be the world's largest economy in 2017 with 18.3 percent of the world economy. The United States' share of the world economy is expected to fall to 17.9 percent by 20173.

The strong growth in China has delivered major improvements in living standards and poverty has been reduced dramatically.4 Based on the World Bank's classification, China recently graduated from lower to upper middle-income status. A growing emphasis on improving access to health and education as well as high investment in infrastructure have helped spread the benefits of growth nationally including in rural areas, where incomes have enjoyed consistently strong gains.

| 3.2 | Agriculture in China |

China is the world's largest agricultural economy. It is the leading producer of many agricultural commodities such as pork, horticultural products, rice and cotton and also the largest consumer of many agricultural products, such as pork, rice and soybeans. While China generally has been successful in meeting its rapidly rising demand for food and grains by increasing domestic production, it has emerged as a leading global importer of several agricultural commodities, including cotton, soybeans, vegetable oils, and animal hides. As its domestic agricultural production has grown, China has also become the largest exporter in global markets for several horticultural products, including mandarin oranges, apples, apple juice, garlic and other vegetables.

China's increasingly important position in global agricultural markets followed decades of gradual growth in domestic food production and consumption. After the introduction of market-based reforms in 1978 that included the elimination of the collective production system and relaxation of government direction over certain farmer production and marketing decisions, Chinese agricultural output grew significantly. Between 1978 and 2008, China almost doubled its production of grains (rice, wheat and corn) and quadrupled its production of meats; the production of fruit and milk was about 30 times greater in 2008 than in 1978. During these three decades, population growth of about 1 percent annually, coupled with annual per capita income growth of 8 percent, fueled a large increase in demand for more and higher-value agricultural products, especially by China's large and growing middle class. China's rapid growth in food consumption was largely met by domestic production growth, enabling it to remain self-sufficient in most major commodities.

About 40 percent of China's population of 1.3 billion is employed in the agricultural sector, and agriculture contributes about 11 percent to China's GDP.5

| 3.3 | China's support foragriculture |

China's government support for agriculture is low compared to that of developed countries, such as the United States and European Union, but in line with that of other rapidly growing economies, according to USITC. As measured by the OECD's PSE6, the amount of support provided to Chinese farmers was low (and sometimes negative) during the 1990's, but gradually rose during the period 2008-2010. Compared with other countries at a similar level of development, including Brazil, Mexico, Russia, and South Africa, China's support for farmers falls in the middle of the range. China's PSE reflects changes in the central government's policy priorities from grain self-sufficiency and low consumer prices toward a stronger focus on raising farm household incomes, according to USITC.

1 The World Bank: China 2030, Building a Modern, Harmonious, and Creative Society (pages 3, 376-377), 2013

2 OECD Economic Outlook No. 92 (database)/OECD economic surveys: China 2013

3 IMP, October 2012

4 The World Bank; China 2030, Building a Modern, Harmonious, and Creative Society, 2013 (pages 3, 376-377)

5 USITC: China’s Agricultural Trade: Competitive Conditions and Effects on U.S. Exports, March 2011 pages 1-1 and 1-8

6 OECD: PSE is defined as the estimated monetary value of transfers from consumers and taxpayers to farmers, expressed as a percentage of gross farm receipts (defined as the value of total farm production at farmgate prices), plus budgetary support

19

Government support to China's agricultural sector indicates that Chinese policymakers are placing a renewed emphasis on the rural economy. Indirect support, in the form of general services, is very high relative to similar support programs in other countries, due largely to investments in agricultural infrastructure. General services include modern research and extension services, food safety agencies, and agricultural price information services, most of which provide benefits to producers and consumers throughout the economy. Compared with direct payments to farmers, general services support is less production-distorting to the sector.

| 3.4 | Agricultural consumption |

China is a major global consumer of agricultural products. It consumes one-third of the world's rice, one-fourth of all corn, and half of all pork and cotton, and it is the largest consumer of oilseeds and most edible oils. The traditional Chinese diet centers around staple foods (mainly grains and starches), which account for nearly half of the daily caloric intake. Average Chinese per capita consumption recently stabilized at approximately 3,000 calories per day, one of the highest levels among Asian countries.

Chinese food consumption is influenced by factors such as population size and demographics, income, food prices, and general preferences. Per capita income growth and urbanization are the two factors most responsible for altering recent consumption patterns in China. Rising income translates into higher per capita food consumption, while increasing urbanization is driving diversification of food choices because of greater availability and choice offered through increasingly diverse sales outlets.

Chinese consumers generally fall into one of three categories: rural consumers; urban low-income consumers; or urban high-income consumers. Although urban high-income consumers can afford to buy more and better-quality food, the ubiquity of food outlets in cities means that nearly every urban resident, regardless of income, has available an increasingly diverse food selection. Compared to rural diets, urban diets contain less grain and more non-staple items, including processed and convenience foods. Rural migrants to cities tend to adopt the urban diet.

| 3.5 | Expenditure on food |