Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - IRIDEX CORP | d225577d8k.htm |

Nasdaq: IRIX January 2016 Exhibit 99.1

Safe Harbor Participation in this presentation requires that you be aware of the Federal legislation regarding forward-looking statements. Accordingly, during the course of this presentation we may make forward-looking statements regarding future events or the future performance of the Company. We caution you that such statements are just predictions that involve risks and uncertainties, and that actual events or results could differ materially. We discuss a number of the risks in our business in detail in the Company’s SEC reports, including our latest Form 10-K and our latest Form 10-Q.

IRIDEX Corp A leading global provider of innovative laser systems, delivery devices, consumables and services to the Ophthalmology market.

Glaucoma Retinal Diseases Retinal Diseases & Glaucoma

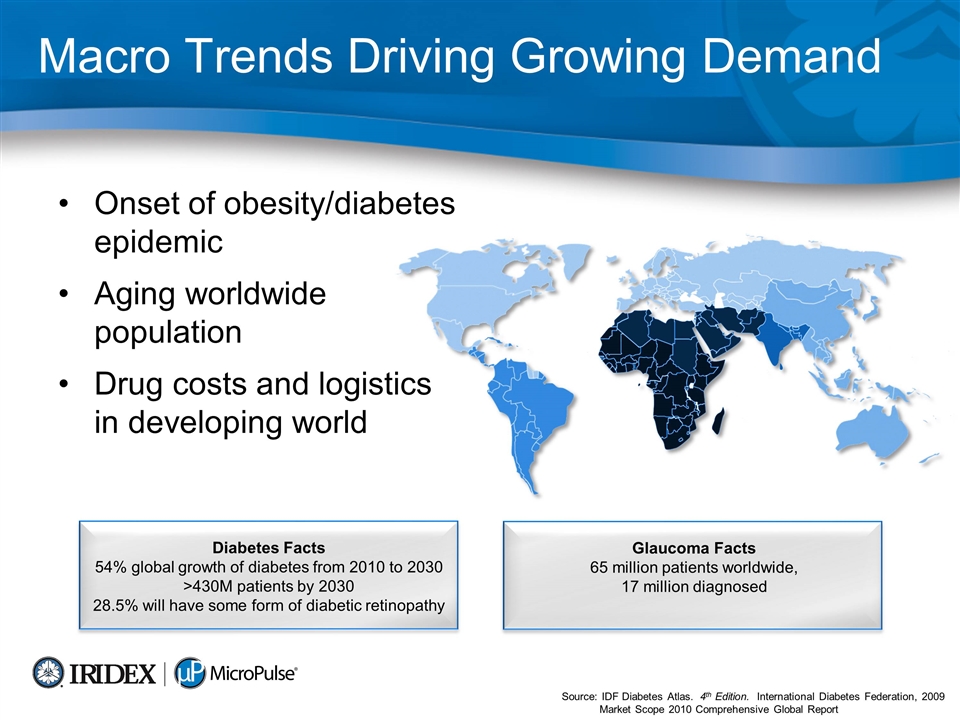

Macro Trends Driving Growing Demand Onset of obesity/diabetes epidemic Aging worldwide population Drug costs and logistics in developing world Source: IDF Diabetes Atlas. 4th Edition. International Diabetes Federation, 2009 Market Scope 2010 Comprehensive Global Report Diabetes Facts 54% global growth of diabetes from 2010 to 2030 >430M patients by 2030 28.5% will have some form of diabetic retinopathy Glaucoma Facts 65 million patients worldwide, 17 million diagnosed

Changing Landscape in the US Fee for service model breaking down Efficiency driving better utilization of healthcare dollars

Value Based Medicine Becoming a global theme Costs are prohibitive Logistics are difficult

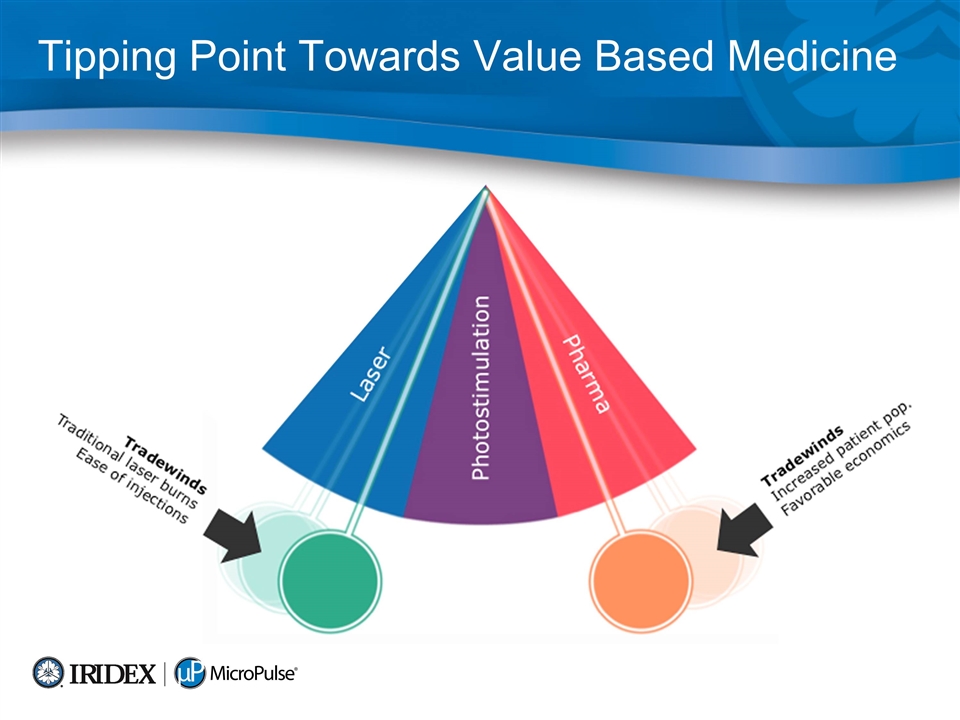

Tipping Point Towards Value Based Medicine

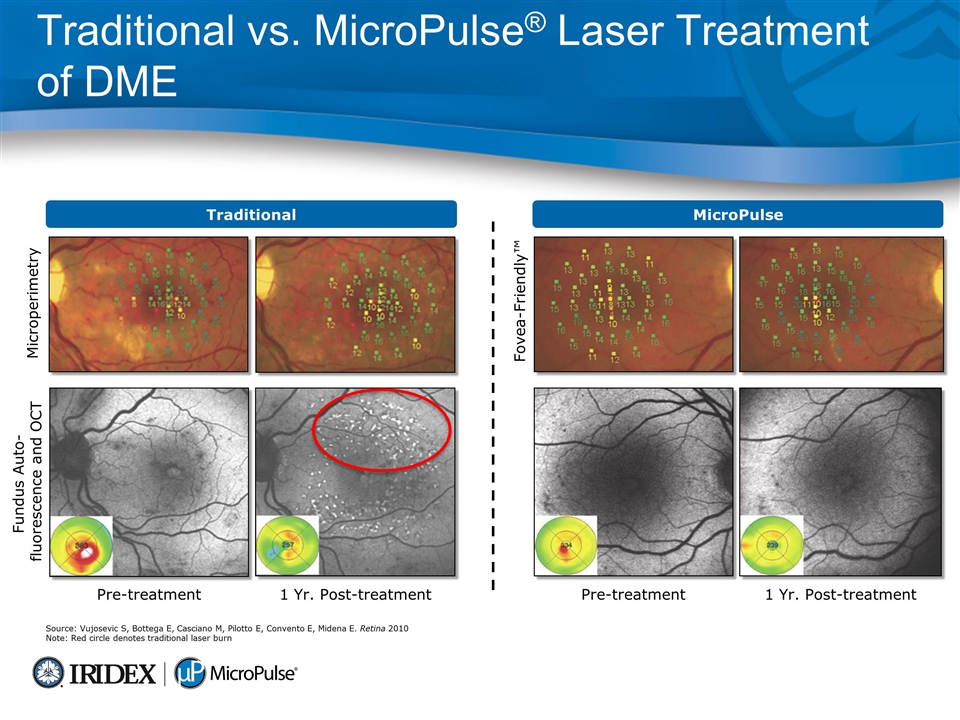

Pre-treatment Fundus Auto- fluorescence and OCT Microperimetry 1 Yr. Post-treatment Traditional vs. MicroPulse® Laser Treatment of DME Pre-treatment 1 Yr. Post-treatment Fovea-Friendly™ Source: Vujosevic S, Bottega E, Casciano M, Pilotto E, Convento E, Midena E. Retina 2010 Note: Red circle denotes traditional laser burn Traditional MicroPulse

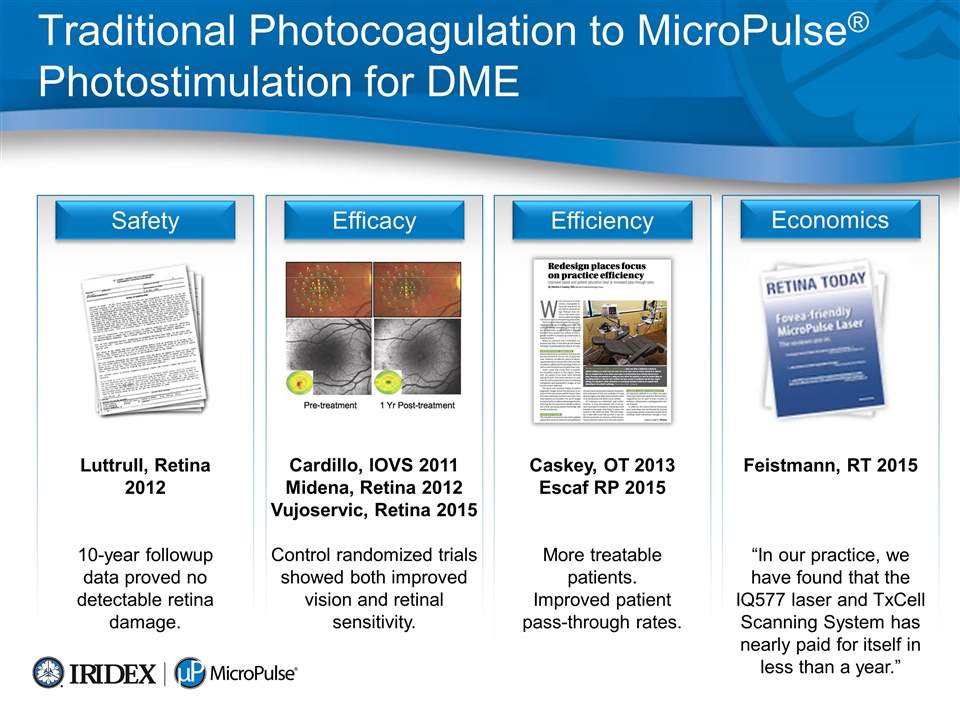

Efficacy Traditional Photocoagulation to MicroPulse® Photostimulation for DME Cardillo, IOVS 2011 Midena, Retina 2012 Vujoservic, Retina 2015 Control randomized trials showed both improved vision and retinal sensitivity. Efficiency Caskey, OT 2013 Escaf RP 2015 More treatable patients. Improved patient pass-through rates. Economics Feistmann, RT 2015 “In our practice, we have found that the IQ577 laser and TxCell Scanning System has nearly paid for itself in less than a year.” Safety Luttrull, Retina 2012 10-year followup data proved no detectable retina damage.

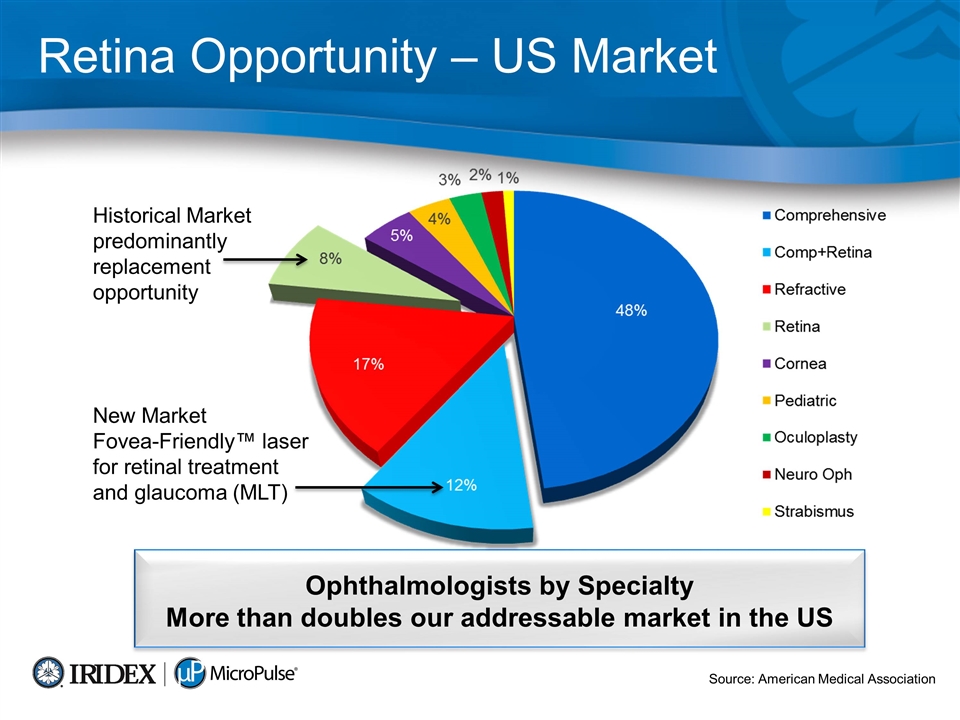

Source: American Medical Association Retina Opportunity – US Market Historical Market predominantly replacement opportunity New Market Fovea-Friendly™ laser for retinal treatment and glaucoma (MLT) Ophthalmologists by Specialty More than doubles our addressable market in the US

Retinal Diseases & Glaucoma Glaucoma Retinal Diseases

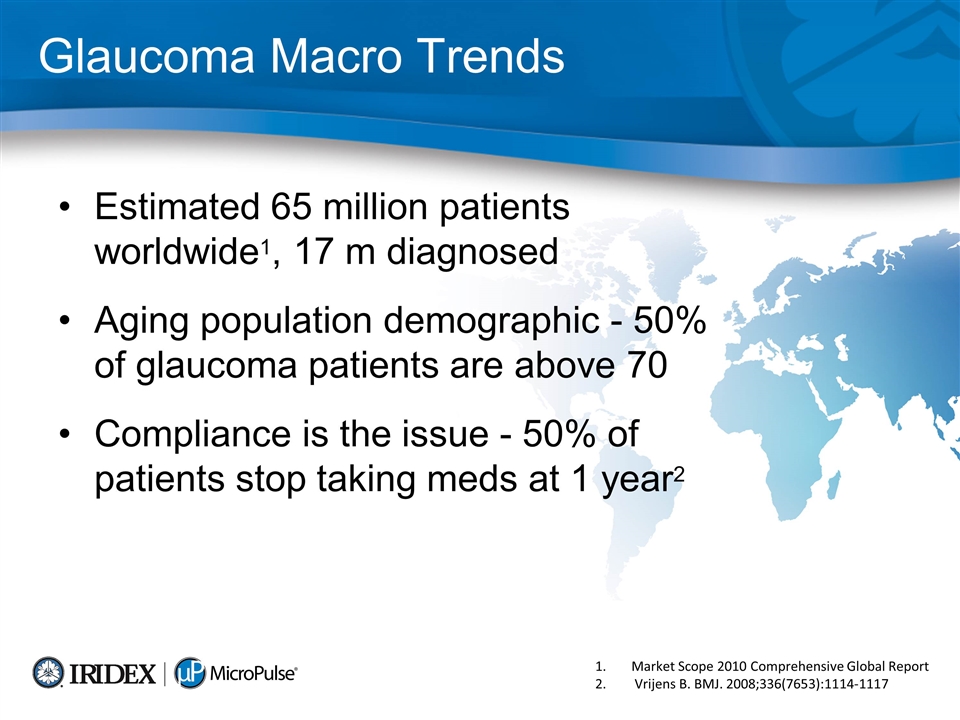

Market Scope 2010 Comprehensive Global Report Vrijens B. BMJ. 2008;336(7653):1114-1117 Glaucoma Macro Trends Estimated 65 million patients worldwide1, 17 m diagnosed Aging population demographic - 50% of glaucoma patients are above 70 Compliance is the issue - 50% of patients stop taking meds at 1 year2

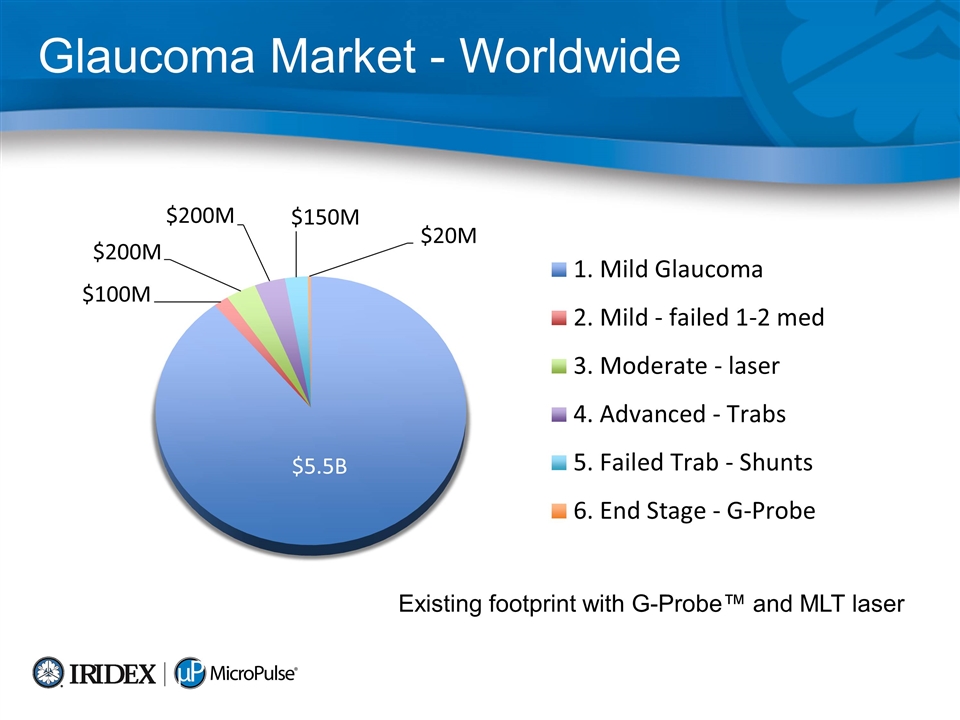

Glaucoma Market - Worldwide Existing footprint with G-Probe™ and MLT laser

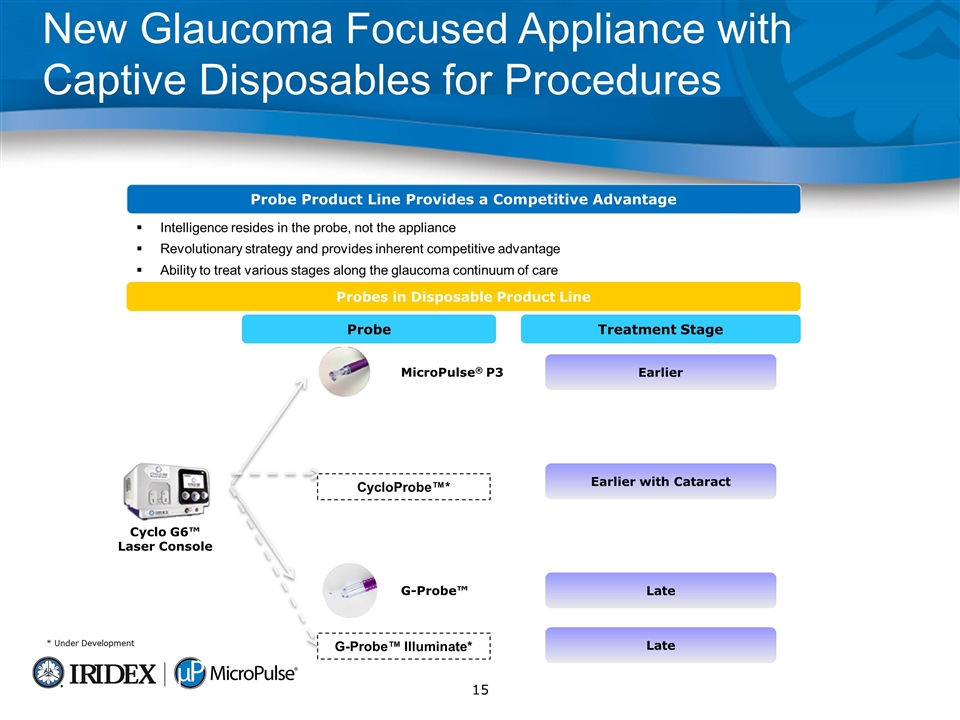

Intelligence resides in the probe, not the appliance Revolutionary strategy and provides inherent competitive advantage Ability to treat various stages along the glaucoma continuum of care New Glaucoma Focused Appliance with Captive Disposables for Procedures Cyclo G6™ Laser Console Probes in Disposable Product Line Probe Probe Product Line Provides a Competitive Advantage Treatment Stage MicroPulse® P3 Earlier G-Probe™ Late Late Earlier with Cataract * Under Development CycloProbe™* G-Probe™ Illuminate*

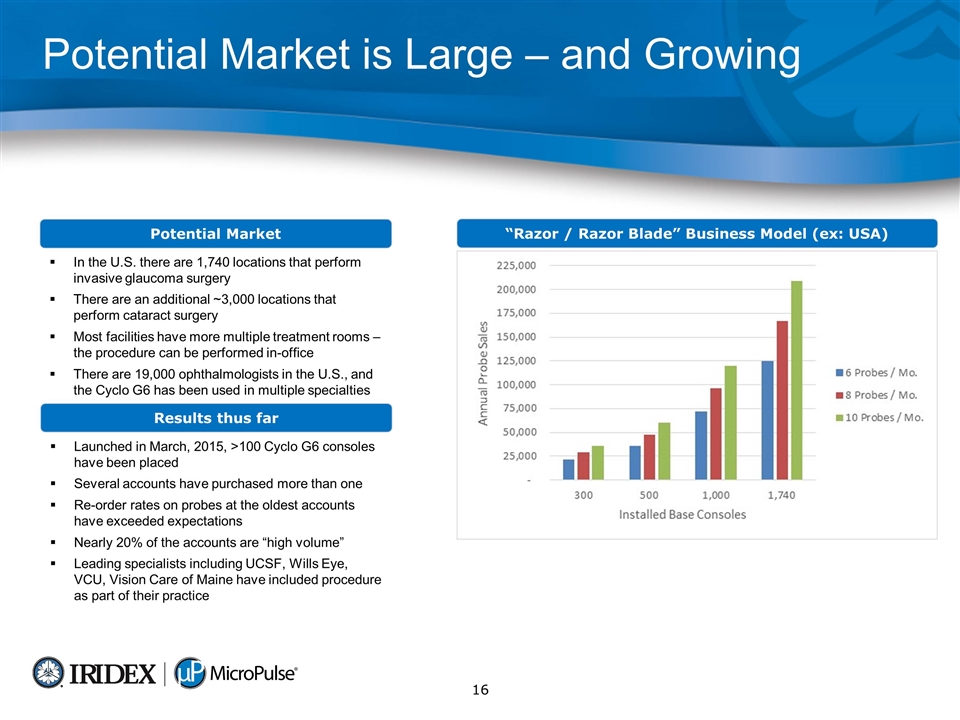

In the U.S. there are 1,740 locations that perform invasive glaucoma surgery There are an additional ~3,000 locations that perform cataract surgery Most facilities have more multiple treatment rooms – the procedure can be performed in-office There are 19,000 ophthalmologists in the U.S., and the Cyclo G6 has been used in multiple specialties Potential Market is Large – and Growing Potential Market Launched in March, 2015, >100 Cyclo G6 consoles have been placed Several accounts have purchased more than one Re-order rates on probes at the oldest accounts have exceeded expectations Nearly 20% of the accounts are “high volume” Leading specialists including UCSF, Wills Eye, VCU, Vision Care of Maine have included procedure as part of their practice Results thus far “Razor / Razor Blade” Business Model (ex: USA)

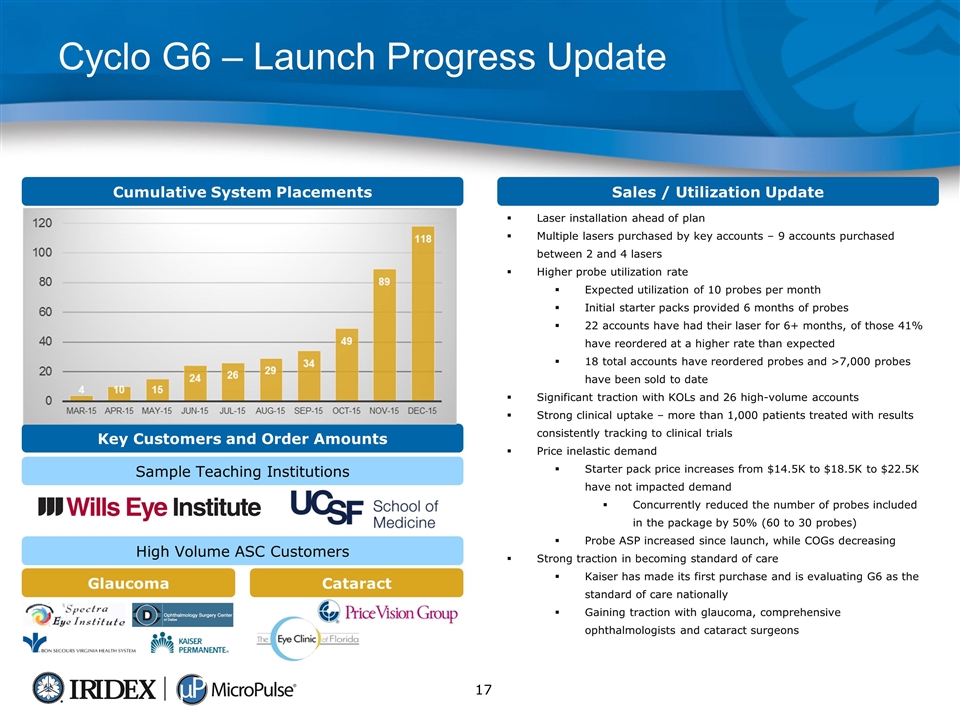

Cyclo G6 – Launch Progress Update Cumulative System Placements Sales / Utilization Update Key Customers and Order Amounts Laser installation ahead of plan Multiple lasers purchased by key accounts – 9 accounts purchased between 2 and 4 lasers Higher probe utilization rate Expected utilization of 10 probes per month Initial starter packs provided 6 months of probes 22 accounts have had their laser for 6+ months, of those 41% have reordered at a higher rate than expected 18 total accounts have reordered probes and >7,000 probes have been sold to date Significant traction with KOLs and 26 high-volume accounts Strong clinical uptake – more than 1,000 patients treated with results consistently tracking to clinical trials Price inelastic demand Starter pack price increases from $14.5K to $18.5K to $22.5K have not impacted demand Concurrently reduced the number of probes included in the package by 50% (60 to 30 probes) Probe ASP increased since launch, while COGs decreasing Strong traction in becoming standard of care Kaiser has made its first purchase and is evaluating G6 as the standard of care nationally Gaining traction with glaucoma, comprehensive ophthalmologists and cataract surgeons Sample Teaching Institutions High Volume ASC Customers Glaucoma Cataract

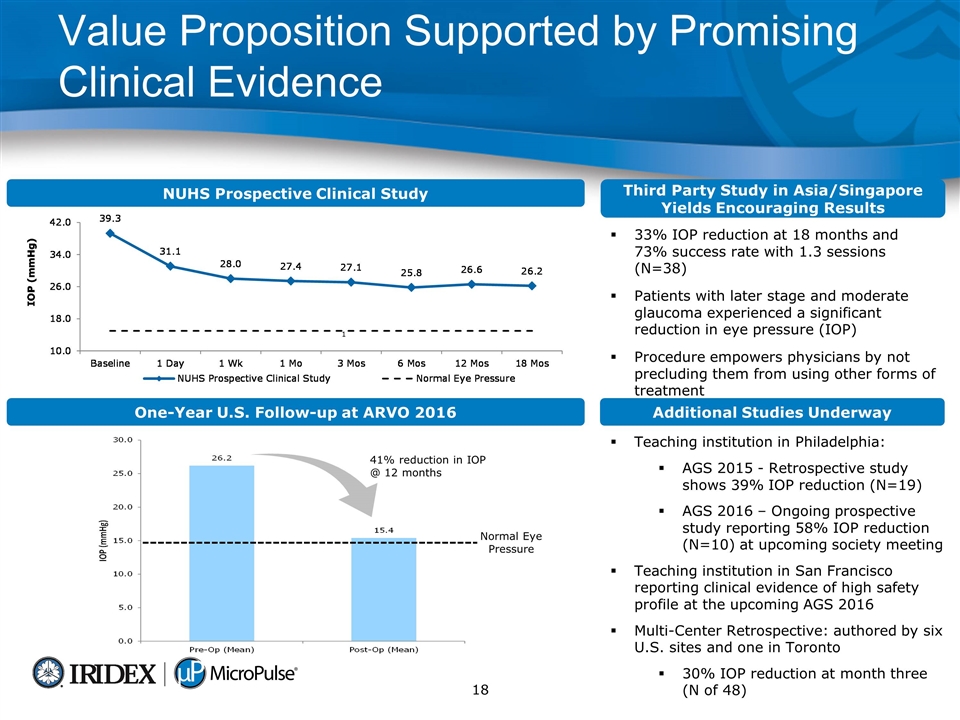

Value Proposition Supported by Promising Clinical Evidence NUHS Prospective Clinical Study Additional Studies Underway Teaching institution in Philadelphia: AGS 2015 - Retrospective study shows 39% IOP reduction (N=19) AGS 2016 – Ongoing prospective study reporting 58% IOP reduction (N=10) at upcoming society meeting Teaching institution in San Francisco reporting clinical evidence of high safety profile at the upcoming AGS 2016 Multi-Center Retrospective: authored by six U.S. sites and one in Toronto 30% IOP reduction at month three (N of 48) 33% IOP reduction at 18 months and 73% success rate with 1.3 sessions (N=38) Patients with later stage and moderate glaucoma experienced a significant reduction in eye pressure (IOP) Procedure empowers physicians by not precluding them from using other forms of treatment Third Party Study in Asia/Singapore Yields Encouraging Results One-Year U.S. Follow-up at ARVO 2016 1 41% reduction in IOP @ 12 months Normal Eye Pressure

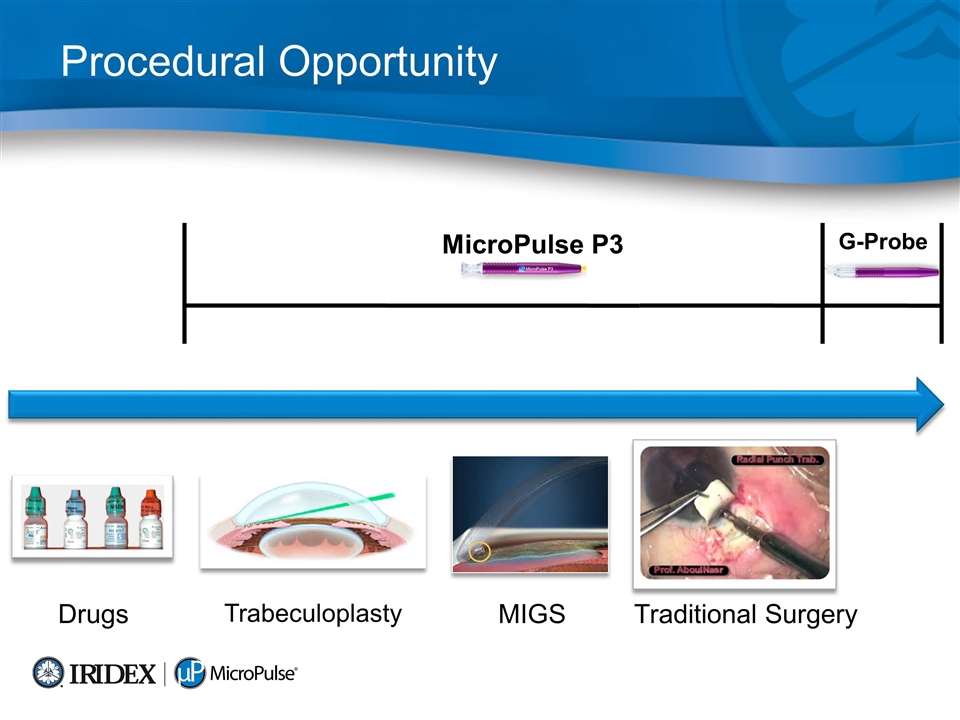

Procedural Opportunity MicroPulse P3 G-Probe Drugs Trabeculoplasty MIGS Traditional Surgery

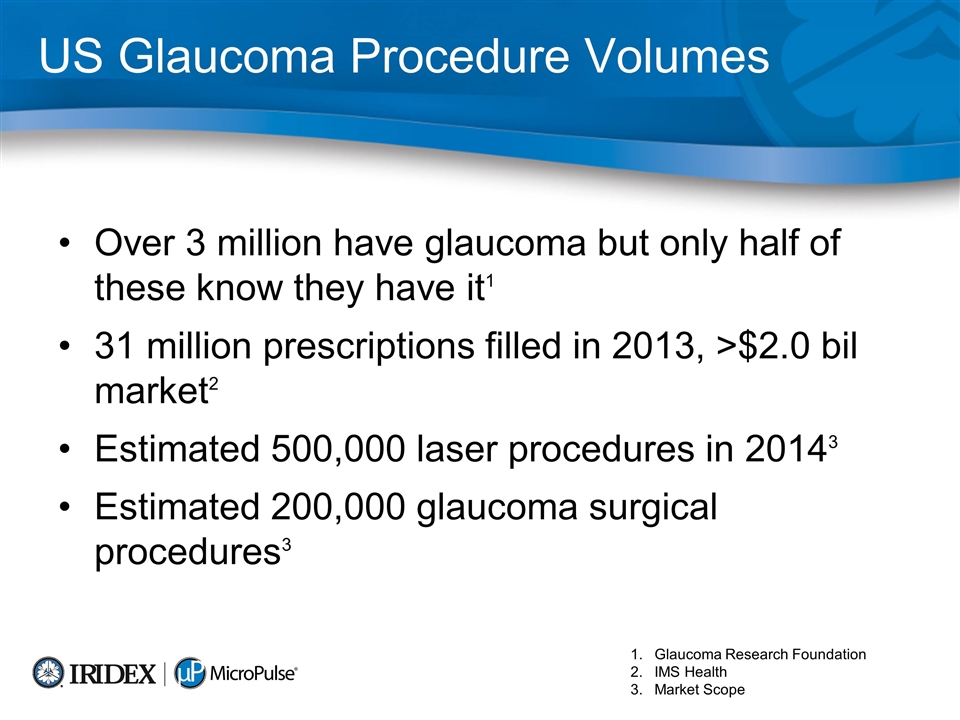

US Glaucoma Procedure Volumes Over 3 million have glaucoma but only half of these know they have it1 31 million prescriptions filled in 2013, >$2.0 bil market2 Estimated 500,000 laser procedures in 20143 Estimated 200,000 glaucoma surgical procedures3 Glaucoma Research Foundation IMS Health Market Scope

Financial Metrics and Model

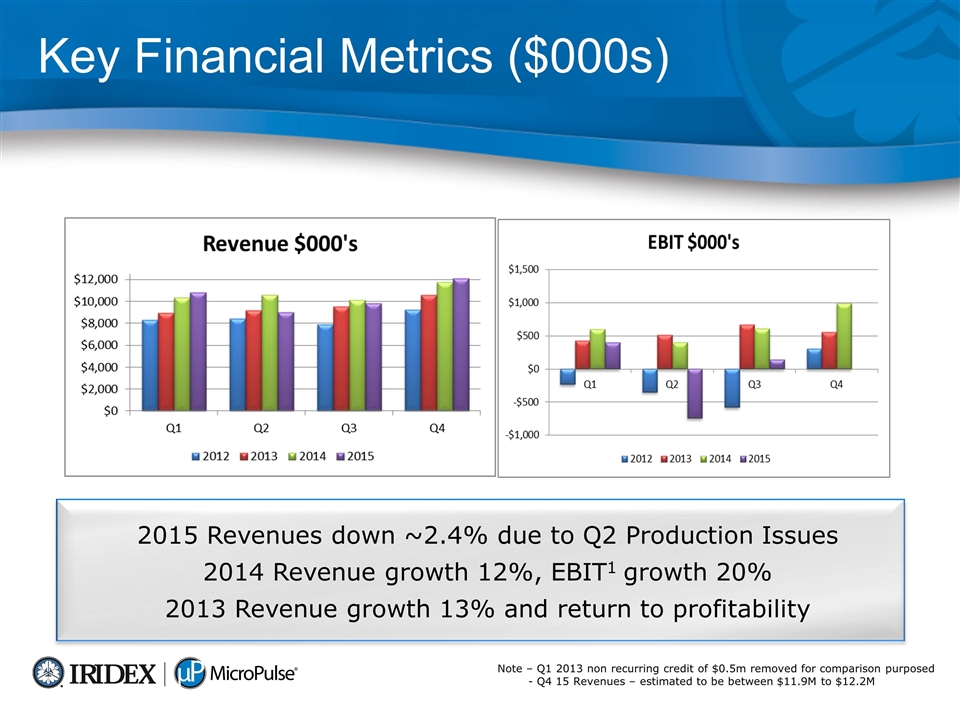

2015 Revenues down ~2.4% due to Q2 Production Issues 2014 Revenue growth 12%, EBIT1 growth 20% 2013 Revenue growth 13% and return to profitability Key Financial Metrics ($000s) Note – Q1 2013 non recurring credit of $0.5m removed for comparison purposed - Q4 15 Revenues – estimated to be between $11.9M to $12.2M

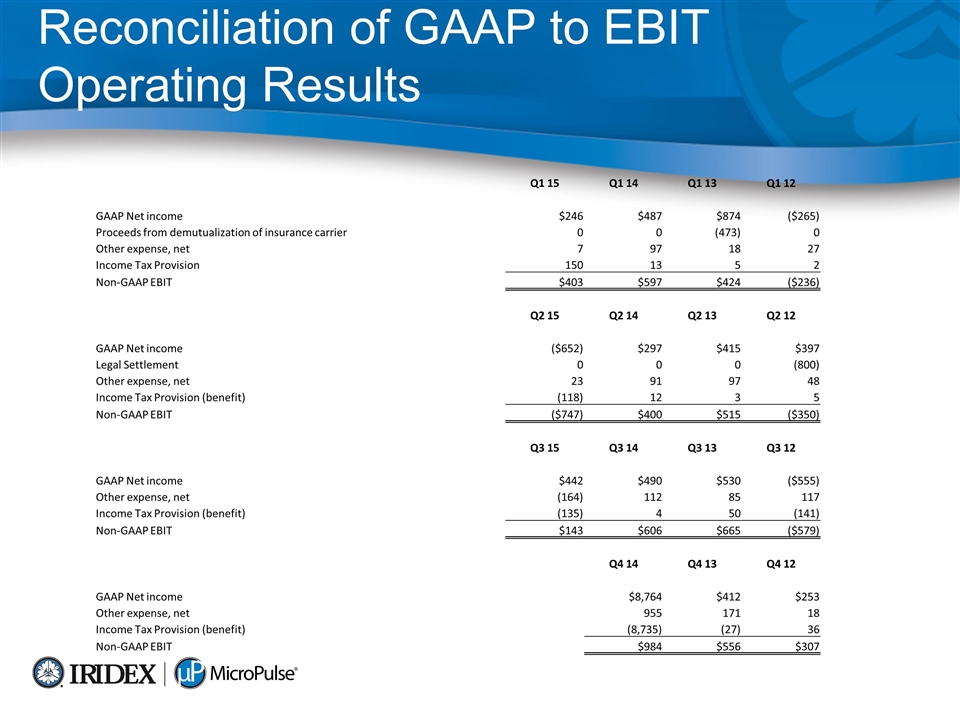

Reconciliation of GAAP to EBIT Operating Results Q1 15 Q1 14 Q1 13 Q1 12 GAAP Net income $246 $487 $874 ($265) Proceeds from demutualization of insurance carrier 0 0 (473) 0 Other expense, net 7 97 18 27 Income Tax Provision 150 13 5 2 Non-GAAP EBIT $403 $597 $424 ($236) Q2 15 Q2 14 Q2 13 Q2 12 GAAP Net income ($652) $297 $415 $397 Legal Settlement 0 0 0 (800) Other expense, net 23 91 97 48 Income Tax Provision (benefit) (118) 12 3 5 Non-GAAP EBIT ($747) $400 $515 ($350) Q3 15 Q3 14 Q3 13 Q3 12 GAAP Net income $442 $490 $530 ($555) Other expense, net (164) 112 85 117 Income Tax Provision (benefit) (135) 4 50 (141) Non-GAAP EBIT $143 $606 $665 ($579) Q4 14 Q4 13 Q4 12 GAAP Net income $8,764 $412 $253 Other expense, net 955 171 18 Income Tax Provision (benefit) (8,735) (27) 36 Non-GAAP EBIT $984 $556 $307

Financial Model Goals 60% consumable, 40% equipment 50/50 retina and glaucoma 40/60 US and International 55+% gross margin, 15+% operating margin

Summary of Revenue Drivers Macro population trends MicroPulse® Technology a paradigm shift Introduction of Cyclo G6™ portfolio within glaucoma – procedure focus Profitable product line extensions within retina

Why IRIDEX Now Proprietary products Attractive markets Recurring revenue Strong balance sheet Organic and acquisitive growth Value upside>downside

January 2016