Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Mahwah Bergen Retail Group, Inc. | v428833_8k.htm |

Exhibit 99.1

2016 ICR Conference January 12 th , 2016

Safe harbor This presentation contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward - looking statements are based on current expectations and are indicated by words or phrases such as “anticipate, “estimate,” “expect,” “project,” “plan,” “we believe,” “will,” “would” and similar words or phrases, and involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to be materially different from the future results, performance or achievements expressed in or implied by such forward - looking statements. Detailed information concerning those risks and uncertainties are readily available in our Annual Report on Form 10 - K for the Fiscal Year Ended July 25, 2015 (“Fiscal 2015 10 - K”) which has been filed with the U.S. Securities and Exchange Commission. We undertake no obligation to publicly update or revise any forward - looking statements, whether as a result of new information, future events or otherwise. Where indicated, certain financial information herein has been presented on a non - GAAP basis. This basis adjusts for non - recurring items that management believes are not indicative of the Company’s underlying operating performance. In addition, we present the financial performance measure of earnings before interest, taxes, depreciation and amortization (“EBITDA”), which has also been adjusted for these non - recurring items. These measures may not be directly comparable to similar measures used by other companies and should not be considered a substitute for performance measures in accordance with GAAP such as operating income and net income. Reference should be made to the Company’s annual earnings releases for all periods and the Fiscal 2015 10 - K for the nature of such adjustments and for a reconciliation of such non - GAAP measures to the Company’s financial results prepared in accordance with GAAP.

Vision “Serve our shareholders and create value by becoming a family of leading brands with $10 billion in sales and top - tier profitability” 3

FY18 EBITDA outlook 4 496 374 246 621 685 1,001 FY13 EBITDA FY15 EBITDA* FY16 EBITDA** Guidance FY18 EBITDA*** Outlook * Presented on a pro - forma basis, inclusive of full year combined company results ** Represents mid - range of FY16 full year guidance *** As presented at company 2015 Investor Day (10/28/15) ($ million) Deal Synergies Legacy ANN (incl. $85M cost savings) Legacy ASNA 513 338 150

Key investment highlights » Significant near - term profit growth opportunity – Justice recovery – Integration synergies – Cost savings » Accelerating free cash flow » Well - diversified portfolio » Seasoned management teams 5

Enterprise focus areas » ANN integration » Gross margin rate accretion » Omni - channel capability » Fleet optimization » Expense management » Brand strength and relevance » Cash flow management 6

ANN integration – major initiatives » Supply chain / west coast DC East Coast Inbound West Coast Inbound Current Retail DC Network East Coast Inbound West Coast Inbound Future Retail DC Network = Distribution Center 7 = Port of Entry Etna DC Etna DC West Coast DC

ANN integration – major initiatives » Supply chain / west coast DC » Non - merchandise procurement Facilities Logistics/ Transportation IT/ Telecom Marketing Store Operations Corporate Services Total Addressable Enterprise Spend: $1.1B 8

ANN integration – major initiatives » Supply chain / west coast DC » Non - merchandise procurement » Hybrid sourcing model 9

$7 $ 48 $ 148 $235 ANN integration – run rate synergy capture / cost savings $ Million 10

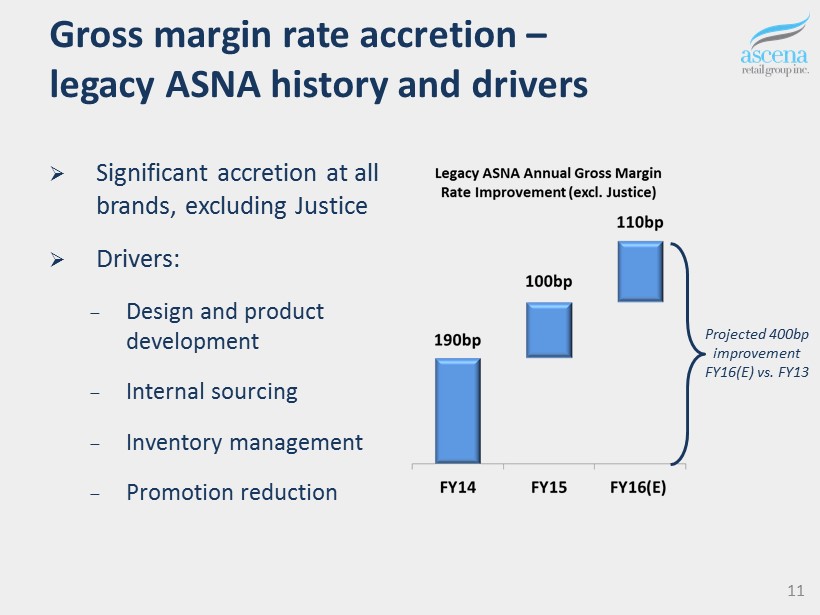

Gross margin rate accretion – legacy ASNA history and drivers » Significant accretion at all brands, excluding Justice » Drivers: ‒ Design and product development ‒ Internal sourcing ‒ Inventory management ‒ Promotion reduction 11 Projected 400bp improvement FY16(E) vs. FY13

Gross margin rate accretion – forward expectations and drivers 50 30 25 40 25 Justice Selling Model Lane Bryant Rate Initiatives Omni- Channel Internal Sourcing ANN Rate Recovery $170M of rate - driven EBITDA growth FY16(E) – FY18(P) 12 $ Million

Omni - channel capability » In - store demand, out - of - stock fulfillment » Buy online, return in store » Online demand, ship - from - store fulfillment » Buy online, pick - up in store » Responsive mobile design 13

Fleet optimization – format diversification 14 Strip 44% Mall 31% Outlet 14% Lifestyle 11% Format Store Count Strip 2,184 Mall 1,513 Outlet 688 Lifestyle 545 Total 4,930

Fleet optimization – store count changes 193 174 140 115 31 37 (1) 5 (14) (8) (30) (30) FY13 FY14 FY15 FY16(E) FY13 FY14 FY15 FY16(E) FY13 FY14 FY15 FY16(E) Gross new store count Net new store count Net store count change e xcluding maurices Memo: legacy ASNA fleet 15

Expense management » Historical operating expense growth ‒ Shared service capacity build - out ‒ Brand capability development » Brand level initiatives » Enterprise opex opportunity assessment 16

Brand strength and relevance 17

Brand - relevant philanthropy 18

202 270 187 17 39 336 483 299 300 FY13 FY14 FY15 FY16 Guide Pro-Forma Cash flow management – normalizing capital expenditures 19 ($ million) Legacy ASNA $225 - $250M Historical capex figures shown are presented on an accrual basis 390 / IT

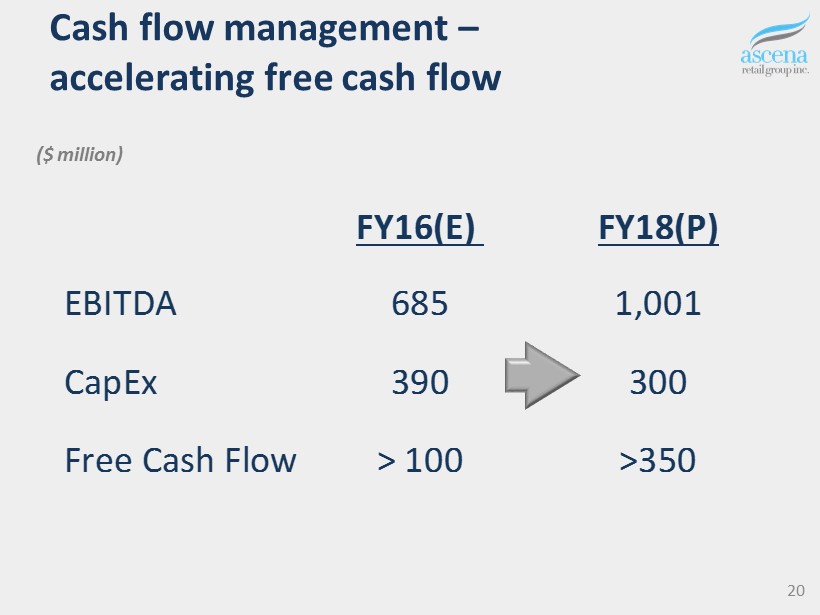

Cash flow management – accelerating free cash flow 20 ($ million) FY16(E) FY18(P) EBITDA 685 1,001 CapEx 390 300 Free Cash Flow > 100 >350

Key investment highlights » Significant near - term profit growth opportunity – Justice recovery – Integration synergies – Cost savings » Accelerating free cash flow » Well - diversified portfolio » Seasoned management teams 21