Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ARRIS International plc | d121104d8k.htm |

Forward-Looking Statements Statements in this presentation, including those related to the projected 2015 results, outlook for 2016 and beyond, expected revenues and net income, gross margins, operating expenses, income taxes, the impacts of the Pace acquisition, acceptance of certain ARRIS products, the general market outlook, and industry trends, are forward-looking statements. These statements involve risks and uncertainties that may cause actual results to differ materially from those set forth in these statements. Among other things, projected results are based on preliminary estimates, assumptions and projections that management believes to be reasonable at this time, but are largely beyond management’s control; failure to realize the expected benefits of the Pace acquisition, significant transaction costs and/or unknown liabilities; ARRIS is dependent upon customer decisions to purchase the Company’s products - these decisions can be deferred and customers also may select competitor products; and because the market in which ARRIS operates is volatile and actions taken and contemplated may not achieve the desired impact. Other factors that could cause results to differ materially from current expectations include: the uncertain current global economic climate and financial markets, and their impact on our customers’ plans and access to capital; the impact of the strong U.S. dollar; the impact of rapidly changing technologies; the impact of competition on product development and pricing; the ability of ARRIS to react to changes in general industry and market conditions; rights to intellectual property and the current trend toward increasing patent litigation, market trends and the adoption of industry standards; possible acquisitions and dispositions; the impact of pending M&A transactions within both the customer and supplier base, including the acquisition of the proposed acquisition of Time Warner by Charter, the proposed acquisition by Frontier Communications of several properties owned by Verizon, and the proposed acquisitions of Suddenlink and Cablevision by Altice. These factors are not intended to be an all-encompassing list of risks and uncertainties that may affect the Company’s business. Additional information regarding these and other factors can be found in ARRIS’ reports filed with the Securities and Exchange Commission, including Quarterly Report on Form 10-Q for the period ended September 30, 2015 filed by ARRIS Group, Inc. (as predecessor to ARRIS International) and the Form S-4 (file no. 333-205442) filed by ARRIS. In providing forward-looking statements, the Company expressly disclaims any obligation to update publicly or otherwise these statements, whether as a result of new information, future events or otherwise, except as required by law. Exhibit 99.1 Safe Harbor 18th Annual Needham Growth Conference 12 January 2016

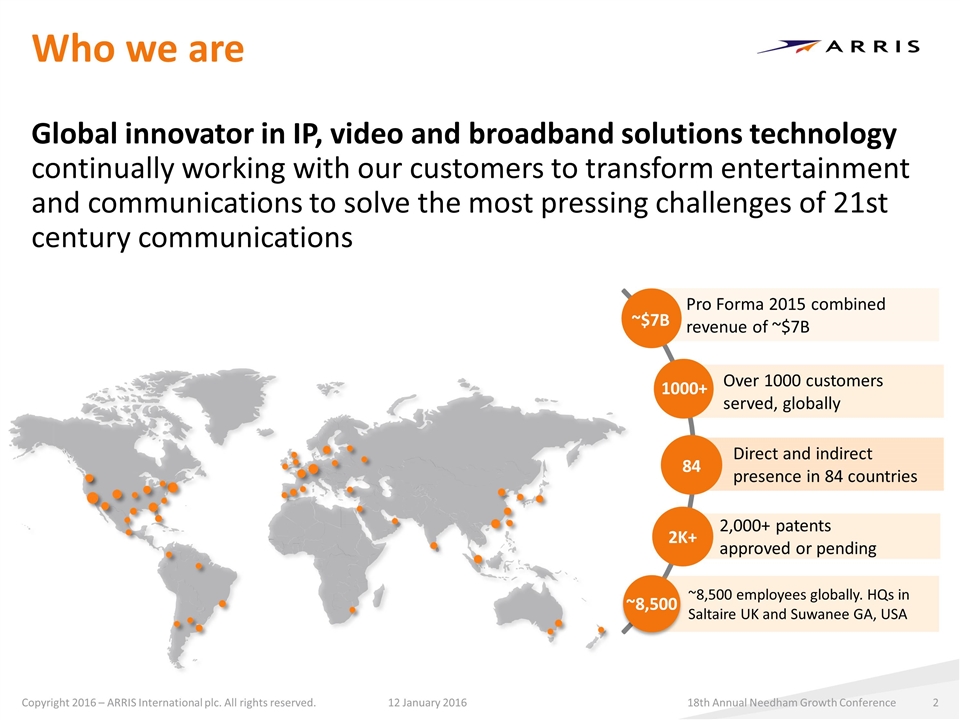

Who we are Global innovator in IP, video and broadband solutions technology continually working with our customers to transform entertainment and communications to solve the most pressing challenges of 21st century communications 18th Annual Needham Growth Conference 12 January 2016 ~$7B 1000+ 84 2K+ ~8,500 Direct and indirect presence in 84 countries Pro Forma 2015 combined revenue of ~$7B Over 1000 customers served, globally 2,000+ patents approved or pending ~8,500 employees globally. HQs in Saltaire UK and Suwanee GA, USA

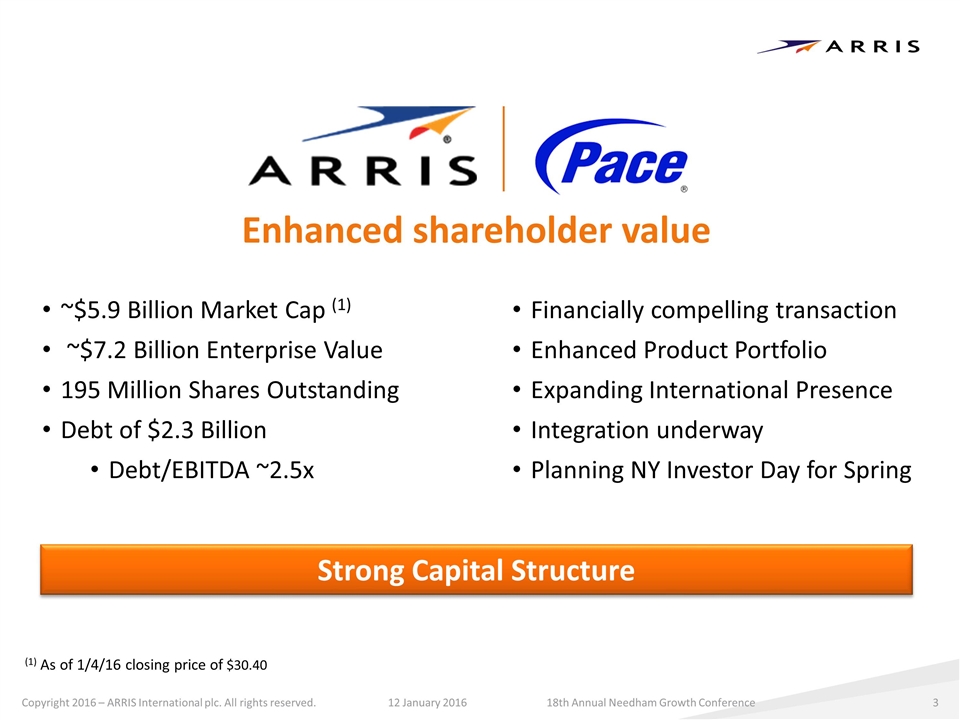

Enhanced shareholder value ~$5.9 Billion Market Cap (1) ~$7.2 Billion Enterprise Value 195 Million Shares Outstanding Debt of $2.3 Billion Debt/EBITDA ~2.5x 12 January 2016 (1) As of 1/4/16 closing price of $30.40 Financially compelling transaction Enhanced Product Portfolio Expanding International Presence Integration underway Planning NY Investor Day for Spring Strong Capital Structure 18th Annual Needham Growth Conference

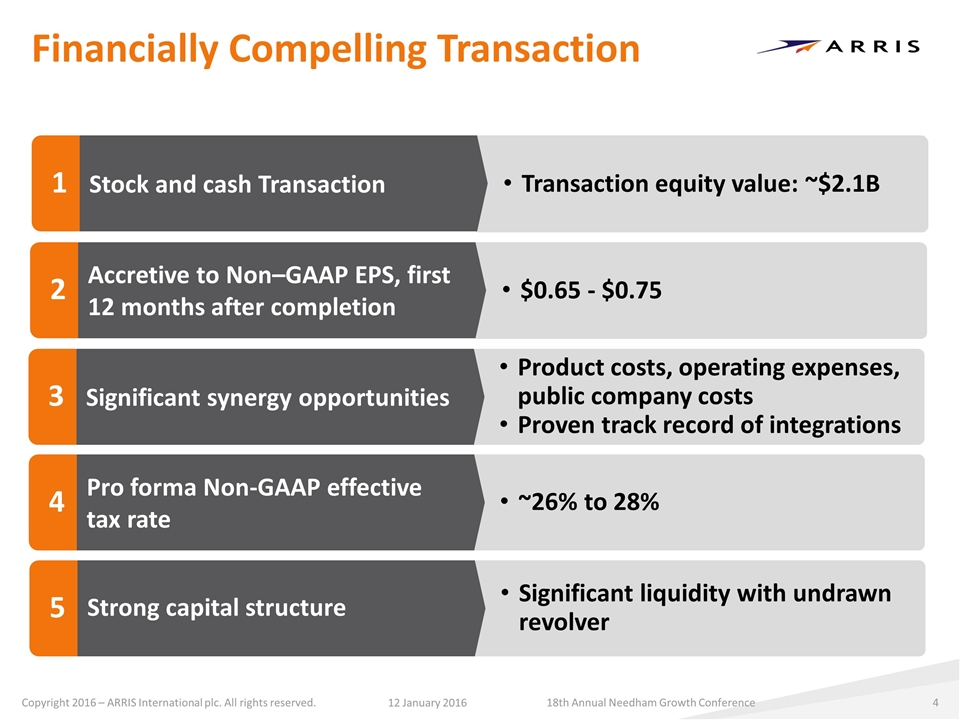

Financially Compelling Transaction 12 January 2016 3 Product costs, operating expenses, public company costs Proven track record of integrations Significant synergy opportunities 5 Significant liquidity with undrawn revolver Strong capital structure 4 ~26% to 28% Pro forma Non-GAAP effective tax rate 2 $0.65 - $0.75 Accretive to Non–GAAP EPS, first 12 months after completion 1 Transaction equity value: ~$2.1B Stock and cash Transaction 18th Annual Needham Growth Conference