Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - XCel Brands, Inc. | v428742_8k.htm |

Exhibit 99.1

Investor Presentation January 12 - 13, 2016 I LOVE XCEL BRANDS (NASDAQ:XELB)

Safe Harbor Statement 2 Certain statements in this presentation, as well as certain oral statements made by management during the presentation, constitute “forward - looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 . These statements include, without limitation, statements expressed or implied regarding our plans and milestones, plans to fund our current activities, statements concerning our strategic relationships and activities, strategy, future operations and expansion, future financial position, future sales and revenues, projected costs, and market penetration . In some cases, forward - looking statements can be identified by terminology such as “may, “will”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential”, “continue”, “intends”, “could”, or negative of such terms or other comparable terminology . These statements are based on our current expectations and assumptions and are not guarantees of future performance . You should not place undue reliance on our forward - looking statements, which are subject to a multitude of known and unknown risks and uncertainties that could cause actual results, future circumstance or events to differ materially from those stated in or implied by the forward - looking statements . These risks and uncertainties include, but are not limited to, the ability of our licensees to produce, market and sell quality products bearing our brand names, continued market acceptance of our brands and any future brands we acquire, our ability to service our significant debt obligations, our ability to raise capital for any future acquisitions, concentration of a substantial portion of our licensing revenue from a limited number licensees, our dependence on QVC, restrictions in our agreements with QVC and other licensees on our ability to sell products with certain retailers, our dependence on promotional services of our spokesperson, limitations on our ownership of the H Halston brands, impacts on our H Halston brands resulting from the operations of the related Halston brands by their owner, our ability to manage expected future growth, our ability to identify and acquire additional trademarks, competition for licensees, competition in our licensee’s markets, our ability to protect our intellectual property, our dependence on our CEO and other key executive officers, the success of our e - commerce strategy and other risks and uncertainties detailed from time to time in our public disclosure documents or other filings with the Securities and Exchange Commission . Additional risks and uncertainties relating to us and our business can be found in the “Risk Factors” section of our latest annual report on Form 10 - K as well as in our other public filings . The forward - looking statements are made as of the date hereof, and we disclaim any intention and have no obligation or responsibility, except as required by law, to update or revise any forward - looking statements, whether as a result of new information, future events or otherwise .

Agenda 3 » INDUSTRY UPDATE » COMPANY OVERVIEW Working Capital Light, Owned Dynamic Brands, Virtual Vertical, Highly Scalable, Strong Growth » OUR BRANDS Dynamic Brands, Omni - Channel Distribution » HISTORICAL PERFORMANCE Consistent Growth of Revenues and Earnings, Strong Balance Sheet » FUTURE GROWTH OPPORTUNITIES Organic and Acquisitions

FLIPBOARD UPDATE » Disruptive forces are impacting all sectors » The Way People Shop Will Continue to Change » Companies Must Move Toward Where Things Are Going » Sales and Follower Satisfaction Are Achieved Through responsive delivery of great Products The Retail Industry is Being Disrupted 4

Xcel Brands - Innovation for the Retail Industry 5 Xce l Brands Inc . (NASDAQ : XELB) is a media and brand management company that owns , li c en s e s, de sign s , manages production of products, generates media content an d m arket s a portfolio of dynami c consume r brands that engage our customers and followers

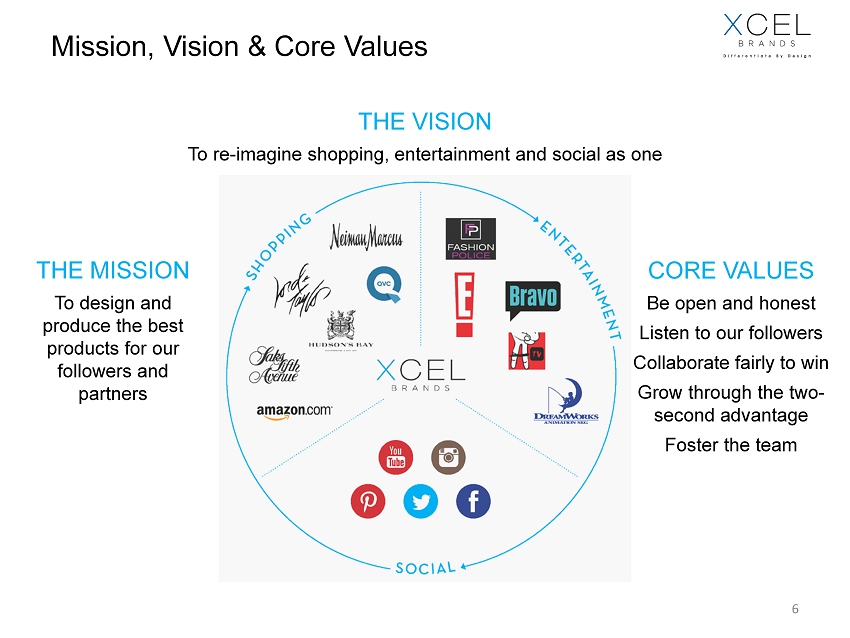

Mission, Vision & Core Values 6 THE MISSION To design and produce the best products for our followers and partners THE VISION To re - imagine shopping, entertainment and social as one CORE VALUES Be open and honest L isten to our followers Collaborate fairly to win G row through the two - second advantage Foster the team

Strategy 7 Xcel’s strategy is to monetize the convergence of shopping , entertainment and social We accomplish this through four key tactics : » We own and license dynamic brands featuring designers and creative directors who have significant media presence » We develop captivating media content and engage in conversations with customers » We design products through a quick - time response (QTR) model that reacts to both qualitative and quantitative customer feedback. We act as a virtual vertical without taking inventory risk. » We collaborate with media companies QVC, The Shopping Channel, and DreamWorks (Awesomeness TV) collectively reaching 350 million households, 100 million social media followers and 1 billion YouTube views per month.

Highly Differentiated Business Model 8 TRADITIONAL LICENSING TRADITIONAL WHOLESALE FAST - FASHION Inventory Position - - Inventory Turnover - - Supply Chain Management - Responsiveness / Lead Time Long Lead Long Lead Fast Fast Design - Distribution Channels Retail, E - Comm Retail, E - Comm Retail, E - Comm Omni (All) Media Content Print / Social Print Print / Social Print / Social / TV Organic Growth

Omni - Channel Distribution 9 Interactive Television Wholesale Specialty » QVC, Inc. » The Shopping Channel (Canada) » CJo Shopping (Korea) » Hudson Bay Company » Lord & Taylor » Better Dept Stores » Michael’s » 1800 Flowers » Hewlett Packard » Best Buy » Johnson & Johnson

Our Brands 10 Interactive Television Wholesale Specialty (1) (1) Highline Collective is a new brand projected to be launched at Lord & Taylor and The Bay in 2016.

11

12

13

14

Interactive Television ISAAC MIZRAHI LIVE H BY HALSTON C. WONDER JUDITH RIPKA 15

16 Wholesale H HALSTON IMNYC / ISAAC MIZRAHI NEW YORK HIGHLINE COLLECTIVE JUDITH RIPKA LTD C. WONDER LIMITED (1) (1) Highline Collective is a new brand projected to be launched at Lord & Taylor and The Bay in 2016.

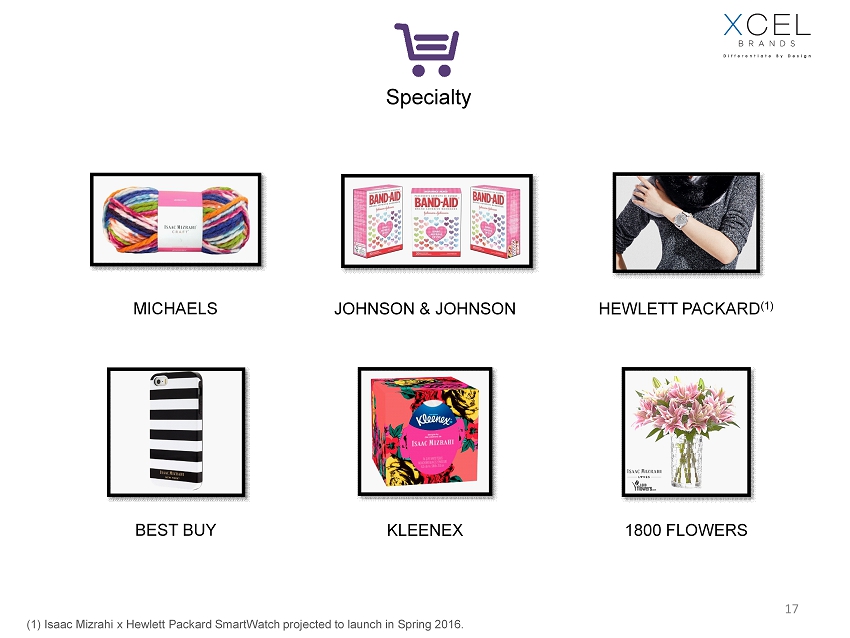

17 Specialty JOHNSON & JOHNSON MICHAELS HEWLETT PACKARD (1) KLEENEX BEST BUY 1800 FLOWERS (1) Isaac Mizrahi x Hewlett Packard SmartWatch projected to launch in Spring 2016.

Best In Class Retail Partners 18 Our brands are distributed through an Omni - Channel Sales strategy through best - in - class retail partners across Direct - Response Television, Bricks - and - Mortar, and Digital channels including :

$114.0MM $142.0MM $212.0MM $380.0MM $457.0MM Retail Sales and EBITDA Scorecard 19 (1) Retail Sales, Revenue and Adjusted EBITDA measurements for 2015 are preliminary and subject to change. We have not completed our year - end closing procedures and our auditors have not completed their final audit procedures for the year ended December 31, 2015, and there can be no as sur ance that our final results for the year will not differ from these estimates, including as a result of year - end closing procedures and/or audit adjustments, and th at such changes are not material. These statements should not be viewed as a substitute for complete audited financial statements to be prepared in accordance wit h GAAP (Generally Accepted Accounting Principles) or as a measure of our actual performance. (2) Adjusted EBITDA is a non - GAAP unaudited term. See Exhibit I for the definition of Adjusted EBITDA and a reconciliation to net in come (loss). (3) We anticipate Adjusted EBITDA to be between $9.0MM and $9.2MM. $ 1.350B 2011 (pro - forma) 2012 2013 2014 2015 (unaudited preliminary) (1) ▪ EST. SALES AT RETAIL $114MM $142MM $212MM $380MM $457MM $4.5MM $3.9MM $7.0MM $9.1MM $12.7MM $13.4MM $21.7MM $ 27.9MM ▪ Xcel Brands Revenue - $12.7MM $13.4MM $20.7MM $27.9MM ▪ Xcel Brands Adjusted EBITDA (2) - $4.5MM $4.2MM $7.0MM $9.1MM (3)

Strong Balance Sheet 20 As of December 31 , 2015 *, Xcel had $ 16 . 9 MM of cash against $ 29 . 3 MM of Senior Debt, which results in Net Debt ( 4 ) of $ 12 . 4 MM and an effective leverage ratio based on 2015 preliminary Adjusted EBITDA of 1 . 4 x, which is one of the lowest leverage ratios in the industry . * Numbers are unaudited as of December 31, 2015 based upon internal figures and subject to change. (1) Total Debt based upon balance sheet balance in accordance with GAAP, and includes Senior Loans with Bank Hapoalim, Seller Not es and Contingent Obligations (2) Earn - Outs based upon achieving certain targets as disclosed in the Company’s latest financial filings, payable in cash or stock at the Company’s option. (3) Seller Notes include $0.75MM payable in cash, and the remainder payable in cash or stock at the Company’s option. (4) Net Debt is calculated as Senior Debt less Cash and Cash Equivalents. (5) Leverage ratio based upon preliminary 2015 Adjusted EBITDA of $9.1MM, divided by Net Debt. See Exhibit I for a definition of Adj usted EBITDA and a reconciliation to net income (loss). Earn - Outs (2) $6.9.4MM Seller Notes (3) $5.4MM Senior Debt $29.3MM Cash $16.9MM Net Debt $12.4MM Adjusted EBITDA (5) $ 9.1MM 1.4X

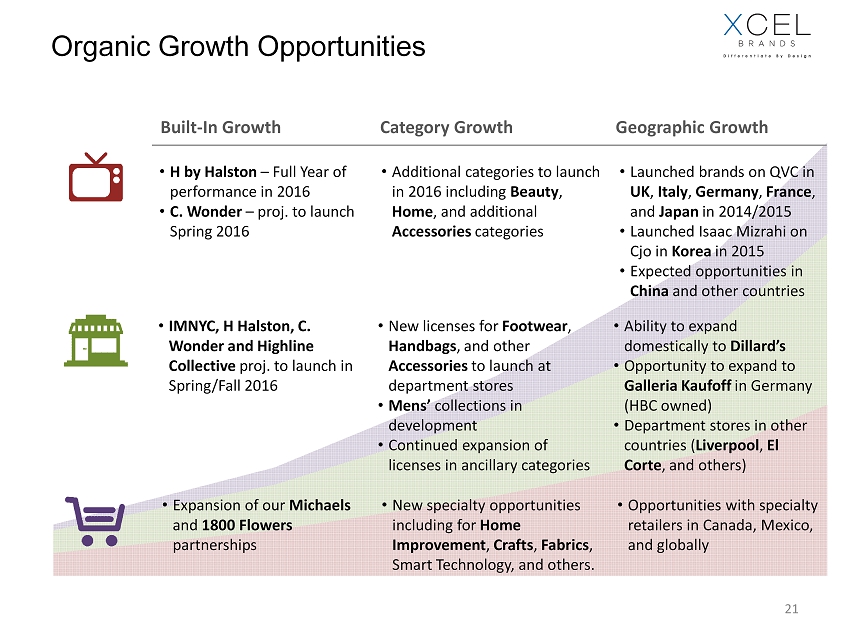

• Expansion of our Michaels and 1800 Flowers partnerships • New specialty opportunities including for Home Improvement , Crafts , Fabrics , Smart Technology, and others. • Opportunities with specialty retailers in Canada, Mexico, and globally • IMNYC, H Halston, C. Wonder and Highline Collective proj. to launch in Spring/Fall 2016 • New licenses for Footwear , Handbags , and other Accessories to launch at department stores • Mens’ collections in development • Continued expansion of licenses in ancillary categories • Ability to expand domestically to Dillard’s • Opportunity to expand to Galleria Kaufoff in Germany (HBC owned) • Department stores in other countries ( Liverpool , El Corte , and others) Built - In Growth Category Growth Geographic Growth Organic Growth Opportunities 21 • H by Halston – Full Year of performance in 2016 • C. Wonder – proj. to launch Spring 2016 • Additional categories to launch in 2016 including Beauty , Home , and additional Accessories categories • Launched brands on QVC in UK , Italy , Germany , France , and Japan in 2014/2015 • Launched Isaac Mizrahi on Cjo in Korea in 2015 • Expected opportunities in China and other countries

Acquisition Strategy and Brand Development Xcel is seeking to acquire brands that are : x Strategic x Synergistic x A ccretive 22

Summary 23 » Xcel Brands is built to develop innovative solutions to address the changes in our industry. » Xcel’s “Virtual Vertical” business model is working capital light but its design, sourcing, and marketing infrastructure provides a highly scalable platform for strong organic growth. » We own dynamic, iconic brands that engage customers through media and an Omni - Channel sales strategy. » We have a strong track record of growth in both revenues and net income, and a strong and stable balance sheet. » We are well - positioned to continue to grow through built - in growth from launches of brands that have been acquired and/or developed in 2015, organic growth of our existing brands, and acquisitions of new brands in the future.

Exhibit I Reconciliation of Net Income (loss) to Adjusted EBITDA 25 Exhibit I Reconciliation of Net Income (Loss) to Adjusted EBITDA Year Ended December 31, (Millions) 2012 2013 2014 2015 (Preliminary, Unaudited) Net income (loss) $ 4.28 $ 1.53 $ (1.03) $ 2.26 Depreciation and amortization 0.86 0.87 0.93 1.39 Interest expense and other finance costs 2.18 1.73 1.49 1.80 Stock - based compensation 4.62 4.81 5.15 4.68 Other state and local franchise taxes 0.05 0.14 0.08 0.10 Gain on reduction of contingent obligation (6.30) (5.12) (0.60) (3.00) Loss (gain) on extinguishment of debt (0.42) 1.35 - 1.37 Income tax provision (benefit) (0.77) (1.32) (0.10) 0.26 Loss from discontinued operations, net - 0.16 1.08 0.28 Other non - cash adjustments - - 0.01 - Adjusted EBITDA $ 4.50 $ 4.15 $ 7.01 $ 9.14 Adjusted EBITDA is a non - GAAP unaudited term, which we define as net income (loss), exclusive of stock - based compensation, interest and finance expense, loss on extinguishment of debt, gain on reduction of contingent obligations, other non - cash adjustments, loss from discontinued operations, net, depreciation and amortization, income taxes and other state and local franchise taxes . Management uses EBITDA as measures of operating performance to assist in comparing performance from period to period on a consistent basis and to identify business trends

relating to the Company's results of operations . Management believes this financial performance measurement is also useful because it provides supplemental information to assist investors in evaluating the Company's financial results . This measure should not be considered in isolation or as alternatives to net income (loss) or any other measure of financial performance calculated and presented in accordance with U . S . GAAP . Given that Adjusted EBITDA is not deemed to be in accordance with U . S . GAAP and is susceptible to varying calculations, our Adjusted EBITDA may not be comparable to similarly titled measures of other companies, including companies in our industry, because other companies may calculate Adjusted EBITDA in a different manner than we calculate Adjusted EBITDA . In evaluating Adjusted EBITDA, you should be aware that in the future we may or may not incur expenses similar to some of the adjustments in this presentation . Our presentation of Adjusted EBITDA does not imply that our future results will be unaffected by these expenses or any unusual or non - recurring items . When evaluating our performance, you should consider Adjusted EBITDA alongside other financial performance measures, including our net income (loss) and other U . S . GAAP measurements .