Attached files

| FIRST AMENDED AND RESTATED |  | |

| ARTICLES OF INCORPORATION | ||

| OF HELPFUL ALLIANCE COMPANY |

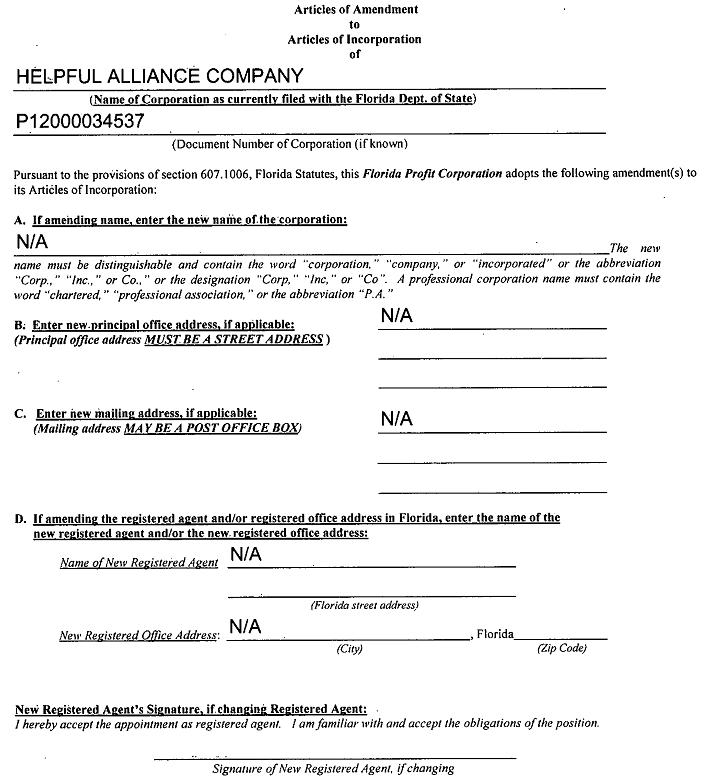

Helpful Alliance Company (the “Corporation”), a for-profit corporation duly organized and existing under the Title XXXVI Chapter 607 Florida Business Corporation Act (the “Florida Law”), hereby certifies that:

FIRST. The name of the Corporation is Helpful Alliance Company.

SECOND. The original Articles of Incorporation of the Corporation were filed with the Florida Secretary of State on April 11, 2012.

THIRD. The original Articles of Incorporation of the Corporation are hereby being amended and restated in accordance with Sections §607.0202, §607.1001, §607.1005, §607.1006 and §607.1007 of Florida Law. All amendments to the Articles of Incorporation reflected herein (this “Restated Articles”) are being amended and restated by the majority of incorporators of the Corporation in accordance with Section 607.1005 of Florida Law. The Articles of Incorporation of the Corporation shall be amended and restated to read in full as follows:

ARTICLE I

The name of the Corporation is Helpful Alliance Company.

ARTICLE II

The address of the Corporation’s registered office in the State of Florida is the address of its Registered Agent at 150 SE 2nd Avenue, Suite 1010, Miami, F1 33139.

The name of its registered agent at such address is Stefania Bologna Esq.

ARTICLE III

The purpose of the Corporation is to engage in any lawful act or activity for which a corporation may be organized under the Florida Law.

ARTICLE IV

A. Classes of Stock. The Corporation is authorized to issue shares of capital stock to be designated, respectively, “Class A Common Stock,” “Class B Common Stock,” “Common Stock” and “Preferred Stock.”

| Page 1 of 15 |

The Corporation is authorized to issue the total of 2,500,000,000 (Two Billion Five Hundred Million) shares, of which

| (1) | 100,000,000 shares of undesignated Preferred Stock, par value $0.0001 per share (the “Preferred Stock”), and | |

| (2) | 100,000,000 (One Hundred Million) shares of Class A Common Stock, par value $0.0001 per share (the “Class A Common Stock”), and | |

| (3) | 800,000,000 (Eight Hundred Million) shares of Class B Common Stock, par value $0.0001 per share (the “Class B Common Stock”), and | |

| (4) | 1,500,000,000 (One Billion Five Hundred Million) shares of Common Stock, par value $0.0001 per share (the “Common Stock”), |

B. Preferred Stock. The Board of Directors of,the Corporation (the “Board of Directors”) is authorized, subject to any limitations prescribed by law, to provide for the issuance of shares of Preferred Stock in series, and by filing an amendment to these Restated Articles pursuant to the applicable section of the Florida Law (such amendment being hereinafter referred to as a “Preferred Stock Designation”), to establish from time to time the number of shares to be included in each such series, and to fix the designation, powers, preferences, and rights of the shares of each such series and any qualifications, limitations or restrictions thereof. The number of authorized shares of Preferred Stock may be increased or decreased (but not below the number of shares thereof then outstanding) by the affirmative vote of the holders of a majority of the voting power of all of the outstanding shares of stock of the Corporation entitled to vote thereon, without a vote of the holders of the Preferred Stock, or of any series thereof, unless a vote of any such holders is required pursuant to the terms of any Preferred Stock Designation.

C. Class.A and Class B Common Stock. The powers, rights, qualifications, limitations and restrictions of the shares of the Class A Common Stock and Class B Common Stock are as follows:

1. Voting Rights.

(a) General Right to Vote Together: Exception. Except as otherwise expressly provided herein or required by applicable law, the holders of Class A Common Stock and Class B Common Stock shall vote together as one class on all matters submitted to a vote of the stockholders: provided. however, subject to the terms of any Preferred Stock Designation, the number of authorized shares of Class A Common Stock or Class B Common Stock may be increased or decreased (but not below the number of shares thereof then outstanding) by the affirmative vote of the holders of a majority of the voting power of the stock of the Corporation entitled to vote in accordance with Florida Law.

(b) Voting Per Share. Except as otherwise expressly provided herein or required by applicable law, on any matter that is submitted to a vote of the stockholders, each holder of Class A Common Stock shall be entitled to ten (10) votes for each such share, and each holder of Class B Common Stock shall be entitled to one (1) vote for each such share.

| Page 2 of 15 |

2. Identical Rights. Except as otherwise expressly provided herein or required by applicable law, shares of Class A Common Stock and Class B Common Stock shall have the same rights and privileges and rank equally, share ratably and be identical in all respects as to all matters, including, without limitation:

(a) Dividends and Distributions. Shares of Class A Common Stock and Class B Common Stock shall be treated equally, identically and ratably, on a per share basis, with respect to any preference allocated to the holders of Preferred Stock and the holders of Common Stock, in relation to the Distribution paid by the Corporation, unless different treatment of shares of each such class is approved by the affirmative vote of the holders of a majority of the outstanding shares of the Corporation, voting together as a single class.

(b) Subdivision, or Combination. If the Corporation subdivides or combines the outstanding shares of Class A Common Stock or shares of Class B Common Stock, the outstanding shares of the other such class shall be subdivided or combined in the same proportion and manner, unless different treatment of the shares of each such class is approved by the affirmative vote of the holders of a majority of the outstanding shares of Class A Common Stock and shares of Class B Common Stock, each voting separately as a class.

(c) Equal Treatment in a Change of Control or any Merger Transaction. In connection with any Change of Control Transaction, shares of Class A Common Stock and shares of Class B Common Stock shall be treated equally, identically and ratably, on a per share basis, with respect to any consideration into which such shares are converted or any consideration paid or otherwise distributed to stockholders of the Corporation, unless different treatment of the shares of each such class is approved by the affirmative vote of the holders of a majority of the outstanding shares of Class A Common Stock and shares of Class B Common Stock, each voting separately as a class. Any merger or consolidation of the Corporation with or into any other entity, which is not a Change of Control Transaction, shall require approval by the affirmative vote of the holders of a majority of the outstanding shares of Class A Common Stock and shares of Class B Common Stock, each voting separately as a class, unless (i) the shares of Class A Common Stock and shares of Class B Common Stock remain outstanding and no other consideration is received in respect thereof or (ii) such shares are converted on a pro rata basis into shares of the surviving or parent entity in such transaction having identical rights to the shares of Class A Common Stock and shares of Class B Common Stock, respectively.

| Page 3 of 15 |

3. Final Conversion of Class A Common Stock and Class B Common Stock. On the Final Conversion Date (as defined below in Section 4(b)), each one (1) issued and outstanding share of Class A Common Stock and each one (1) issued and outstanding share of Class B Common Stock shall automatically, without any further action, convert into one (1) share of Common Stock. Following such conversion, the reissuance of shares of Class A Common Stock and shares of Class B Common Stock shall be prohibited, and such shares shall be retired and cancelled in accordance with Florida Law and if the filing with the Florida Secretary of State is required thereby, upon such retirement and cancellation, all references to the Class A Common Stock and Class B Common Stock in the Restated Articles shall be eliminated.

4. Voluntary and Automatic Conversion of Class A and Class B Common Stock.

(a) Voluntary Conversion. Each one (1) share of Class A Common Stock shall be convertible into one (1) share of Class B Common Stock at the option of the holder thereof at any time upon written notice to the transfer agent of the Corporation without any action from stockholders. Notwithstanding of the above, each one (1) share of Class A Common Stock shall be convertible into one (1) share of Common Stock at the option of the holder thereof at any time upon written notice to the transfer agent of the Corporation, provided that such conversion is approved by the affirmative vote of a majority of all holders of the outstanding shares of all classes of stock, voting together as a single class in accordance with Florida Law, and, each one (1) share of Class B Common Stock shall be convertible into one (1) share of Common Stock at the option of the holder thereof at any time upon written notice to the transfer agent of the Corporation, provided that such conversion is approved by the affirmative vote of a majority of all holders of the outstanding shares of all classes of stock, voting together as a single class in accordance with Florida Law, unless any restriction for such conversion is expressly provided otherwise.

(b) Automatic Conversion. Each one (1) share of Class A Common Stock shall automatically convert into one (1) share of Class B Common Stock upon the earliest of:

(i) the date specified by affirmative vote of the holders of at least sixty-six and two-thirds (662/3) percent of the outstanding shares of Class A Common Stock, voting as a single class;

(ii) a Transfer of such share: provided that no such automatic conversion shall occur in the case of a Transfer by a Class A Stockholder, for tax or estate planning purposes, to any of the persons or entities listed in clauses (A) through (F) in this Section 49(b) (each, a “Permitted Transferee”) and from any such Permitted Transferee back to such Class A Stockholder and/or any other Permitted Transferee established by or for such Class A Stockholder:

(A) a trust for the benefit of such Class A Stockholder or persons other than the Class A Stockholder so long as the Class A Stockholder has sole dispositive power and exclusive Voting Control with respect to the shares of Class A Common Stock held by such trust; provided such Transfer does not involve any payment of cash, securities, property or other consideration (other than an interest in such trust) to the Class A Stockholder and, provided. further. that in the event such Class A Stockholder no longer has sole dispositive power and exclusive Voting Control with respect to the shares of Class A Common Stock held by such trust, each share of Class A Common Stock then held by such trust shall automatically convert into one (1) fully paid and nonassessable share of Class B Common Stock;

| Page 4 of 15 |

(B) a trust under the terms of which such Class A Stockholder has retained a “qualified interest” within the meaning of §2702(b)(l) of the Internal Revenue Code and/or a reversionary interest so long as the Class A Stockholder has sole dispositive power and exclusive Voting Control with respect to the shares of Class A Common Stock held by such trust: provided. however. that in the event the Class A Stockholder no longer has sole dispositive power and exclusive Voting Control with respect to the shares of Class A Common Stock held by such trust, each share of Class A Common Stock then held by such trust shall automatically convert into one (1) fully paid and nonassessable share of Class B Common Stock;

(C) an Individual Retirement Account, as defined in Section 408(a) of the Interna! Revenue Code, or a pension, profit sharing, stock bonus or other type of plan or trust of which such Class A Stockholder is a participant or beneficiary and which satisfies the requirements for qualification under Section 401 of the Internal Revenue Code: provided that in each case such Class A Stockholder has sole dispositive power and exclusive Voting Control with respect to the shares of Class A Common Stock held in such account, plan or trust, and provided. further. that in the event the Class A Stockholder no longer has sole dispositive power and exclusive Voting Control with respect to the shares of Class B Common Stock held by such account, plan or trust, each share of Class A Common Stock then held by such trust shall automatically convert into one (1) fully paid and nonassessable share of Class B Common Stock;

(D) a corporation in which such Class A Stockholder directly, or indirectly through one or more Permitted Transferees, owns shares with sufficient Voting Control in such corporation, or otherwise has legally enforceable rights, such that the Class A Stockholder retains sole dispositive power and exclusive Voting Control with respect to the shares of Class A Common Stock held by such corporation; provided that in the event the Class A Stockholder no longer owns sufficient shares or no longer has sufficient legally enforceable rights to ensure the Class A Stockholder to retain sole dispositive power and exclusive Voting Control with respect to the shares of Class A Common Stock held by such corporation, each share of Class A Common Stock then held by such corporation shall automatically convert into one (1) fully paid and nonassessable share of Class B Common Stock;

(E) a partnership in which such Class A Stockholder directly, or indirectly through one or more Permitted Transferees, owns partnership interests with sufficient Voting Control in the partnership, or otherwise has legally enforceable rights, such that the Class A Stockholder retains sole dispositive power and exclusive Voting Control with respect to the shares of Class A Common Stock held by such partnership; provided that in the event the Class A Stockholder no longer owns sufficient partnership interests or no longer has sufficient legally enforceable rights to ensure the Class A Stockholder to retain sole dispositive power and exclusive Voting Control with respect to the shares of Class A Common Stock held by such partnership, each share of Class A Common Stock then held by such partnership shall automatically convert into one (1) fully paid and nonassessable share of Class B Common Stock; or

| Page 5 of 15 |

(F) a limited liability company in which such Class A Stockholder directly, or indirectly through one or more Permitted Transferees, owns membership interests with sufficient Voting Control in the limited liability company, or otherwise has legally enforceable rights, such that the Class A Stockholder retains sole dispositive power and exclusive Voting Control with respect to the shares of Class A Common Stock held by such limited liability company; provided that in the event the Class A Stockholder no longer owns sufficient membership interests or no longer has sufficient legally enforceable rights to ensure the Class A Stockholder to retain sole dispositive power and exclusive Voting Control with respect to the shares of Class A Common Stock held by such limited liability company, each share of Class A Common Stock then held by such limited liability company shall automatically convert into one (1) fuliy paid and nonassessable share of Class B Common Stock; and

(iii) the date specified by a written notice and certification request of the Corporation to the holder of such share of Class A Common Stock requesting a certification, in a form satisfactory to the Corporation, verifying such holder’s ownership of Class A Common Stock and confirming that a conversion to Class B Common Stock has not occurred, which date shall not be less than ninety (90) calendar days after the date of such notice and certification request: provided that no such automatic conversion pursuant to this subsection (iii) shall occur in the case of a Class A Stockholder or its Permitted Transferees that furnishes a certification satisfactory to the Corporation prior to the specified date.

(c) Conversion Upon Death or Disability. Each share of Class A Common Stock held of record by a Class A Stockholder who is a natural person, or by such Class A Stockholder’s Permitted Transferees, shall automatically, without any further action, convert into one (1) fully paid and nonassessable share of Class B Common Stock upon the death of such Class A Stockholder, or solely with respect to each share of Class A Common Stock held of record by the Founder, or by the Founder’s Permitted Transferees, upon the death or Disability of the Founder; provided, however. that, with respect to the shares of Class A Common Stock held of record by the Founder or the Founder’s Permitted Transferees, each share of Class A Common Stock held of record by the Founder or the Founder’s Permitted Transferees shall automatically convert into one (1) fully paid and nonassessable share of Class B Common Stock upon that date which is the earlier of: (a) six (6) months after the date of death or Disability of the Founder, and (b) the date upon which the Founder Trustees cease to hold exclusive Voting Control over such shares of Class A Common Stock.

(d) Procedures. The Corporation may, from time to time, establish such policies and procedures relating to the conversion of the Class A Common Stock into Class B Common Stock and the general administration of this dual class stock structure, including the issuance of stock Articles s with respect thereto, as it may deem necessary or advisable, and may from time to time request that holders of shares of Class A Common Stock furnish certifications, affidavits or other proof to the Corporation as it deems necessary to verify the ownership of Class A Common Stock and to confirm that a conversion into Class B Common Stock has not occurred. A determination by the Secretary of the Corporation that a Transfer results in a conversion to Class B Common Stock shall be conclusive and binding.

| Page 6 of 15 |

(e) Immediate Effect. In the event of a conversion of Class A Common Stock shares into shares of Class B Common Stock pursuant to this Section 4(e) and upon the conversion of any then- outstanding Class A Common Stock and Class B Common Stock into Common Stock upon the Final Conversion Date, such conversion(s) shall be deemed to have been made at the time that the Transfer of shares occurred (in the case of a conversion of Class A Common Stock into Class B Common Stock) or immediately upon the Final Conversion Date (in the case of the conversion of Class A Common Stock and Class B Common Stock into Class C Common Stock). Upon any conversion of Class A Common Stock into Class B Common Stock, all rights of the holder of shares of Class A Common Stock shall cease and the person or persons in whose names or names the Articles are representing the shares of Class B Common Stock are to be issued shall be treated for all purposes as having become the record holder or holders of such shares of Class B Common Stock. Upon conversion of Class A Common Stock or Class B Common Stock into Class B Common Stock on the Final Conversion Date, all rights of holders of shares of Class A Common Stock and Class B Common Stock shall cease and the person or persons in whose name or names the Articles are representing the shares of Class C Common Stock are to be issued shall be treated for all purposes as having become the record holder or holders of such shares of Class C Common Stock. Shares of Class A Common Stock that are converted into shares of Class B Common Stock as provided in this Section D.4 shall be retired and may not be reissued.

(f) Reservation of Stock. The Corporation shall at all times reserve and keep available out of authorized but unissued shares of Class B Common Stock, solely for the purpose of effecting the conversion of the shares of Class A Common Stock, such number of its shares of Class B Common Stock as shall from time to time be sufficient to effect the conversion of all outstanding shares of Class A Common Stock into shares of Class B Common Stock. The Corporation shall further at all times reserve and keep available out of its authorized but unissued shares of Class C Common Stock, solely for the purpose of effecting the conversion of Class A Common Stock and Class B Common Stock into Class C Common Stock upon the Final Conversion Date or otherwise in accordance herewith, such number of shares of Class C Common Stock as shall be sufficient to effect the conversion of all outstanding shares of Class A Common Stock and Class B Common Stock.

(g) Restriction on Free Trading. In the case the Corporation undertakes a public offering of securities under the Act, the Shares of Class A Common Stock and Class B Common Stock shall be restricted from free trading, subject to the conversion into the Shares of Class C Common Stock, in accordance with Section 3 and Section 4 above.

| Page 7 of 15 |

E. Rights of Common Stock. Except as otherwise provided herein or required by law, each holder of Common Stock shall be entitled to one (1) vote for each such share on any matter that is submitted to a vote of stockholders and shall otherwise have the rights conferred by applicable law in respect of such shares.

No shares of Common Stock shall be issued, unless such issuance is approved by the affirmative vote of the holders of a majority of the outstanding shares of Preferred Stock, Class A Common Stock and Class B Common Stock then outstanding, each voting as a separate class.

The holders of Common Stock shall have the right to receive dividends in preference to the holders of Class A Common Stock and the holders of Class B Common Stock, when and as declared by the Board of Directors of the Corporation.

In the event of liquidation, dissolution or winding up of the Corporation, The holders of Common Stock shall have the right to receive distribution in preference to the holders of Class A Common Stock and the holders of Class B Common Stock, sharing ratably in the net assets of the Corporation legally available for distribution to stockholders, after the payment of all of liabilities of the Corporation, and subject to the satisfaction of any liquidation preference granted to the holders of any outstanding shares of Preferred Stock.

Notwithstanding of the above, the shares of Common Stock shall have other rights identical to the rights of Class A Common Stock and Class B Common Stock and shall be treated equally and ratably, on a per share basis, with respect to any preference allocated to the holders of Preferred Stock, unless different treatment of shares of each such class is approved by the affirmative vote of the holders of a majority of all outstanding shares of the Corporation, voting together as a single class, assuming, for the purposes of this voting, that each share of Class A Common Stock has one (1) vote per share.

F. No Further Issuances. Except for the issuance of Class B Common Stock issuable upon exercise of Rights outstanding at the Effective Time or a dividend payable in accordance with Article IV, Section 2(a), the Corporation shall not at any time after the Effective Time issue any additional shares of Class A Common Stock and Class B Common Stock, unless such issuance is approved by the affirmative vote of the holders of a majority of the outstanding shares of all stockholders of the Corporation, each voting together as a single class, assuming the Class A Common Stock and Class B Common Stock each have one (1) vote per share.

| Page 8 of 15 |

ARTICLE V

The following terms, where capitalized in these Restated Articles, shall have the meanings ascribed to them in this Article V:

“Change of Control Share Issuance” means the issuance by the Corporation, in a transaction or series of related transactions, of voting securities representing more than two percent (2%) of the total voting power (assuming the Class A-Common Stock and Class B Common Stock each have one (1) vote per share) of the Corporation before such issuance to any person or persons acting as a group as contemplated in Rule 13d-5(b) under the Exchange Act (or any successor provision) that immediately prior to such transaction or series of related transactions held fifty percent (50%) or less of the total voting power of the Corporation (assuming the Class A Common Stock and Class B Common Stock each have one (1) vote per share), such that, immediately following such transaction or series of related transactions, such person or group of persons would hold more than fifty percent (50%) of the total voting power of the Corporation (assuming the Class A Common Stock and Class B Common Stock each have one (1) vote per share).

“Change of Control transaction” means (i) the sale, lease, exchange, or other disposition (other than liens and encumbrances created in the ordinary course of business, including liens or encumbrances to secure indebtedness for borrowed money that are approved by the Corporation’s Board of Directors, so long as no foreclosure occurs in respect of any such lien or encumbrance) of all or substantially all of the Corporation’s property and assets (which shall for such purpose include the property and assets of any direct or indirect subsidiary of the Corporation), provided that any sale, lease, exchange or other disposition of property or assets exclusively between or among the Corporation and any direct or indirect subsidiary or subsidiaries of the Corporation shall not be deemed a “Change of Control Transaction(ii) the merger, consolidation, business combination, or other similar transaction of the Corporation with any other entity, other than a merger, consolidation, business combination, or other similar transaction that would result in the voting securities of the Corporation outstanding immediately prior thereto continuing to represent (either by remaining outstanding or by being converted into voting securities of the surviving entity or its parent) more than fifty percent (50%) of the total voting power represented by the voting securities of the Corporation and more than fifty percent (50%) of the total number of outstanding shares of the Corporation’s capital stock, in each case as outstanding immediately after such merger, consolidation, business combination, or other similar transaction, and the stockholders of the Corporation immediately prior to the merger, consolidation, business combination, or other similar transaction own voting securities of the Corporation, the surviving entity or its parent immediately following the merger, consolidation, business combination, or other similar transaction in substantially the same proportions (vis a vis each other) as such stockholders owned the voting securities of the Corporation immediately prior to the transaction; (iii) the recapitalization, liquidation, dissolution, or other similar transaction involving the Corporation, other than a recapitalization, liquidation, dissolution, or other similar transaction that would result in the voting securities of the Corporation outstanding immediately prior thereto continuing to represent (either by remaining outstanding or being converted into voting securities of the surviving entity or its parent) more than fifty percent (50%) of the total voting power represented by the voting securities of the Corporation and more than fifty percent of the total number of outstanding shares of the Corporation’s capital stock, in each case as outstanding immediately after such recapitalization, liquidation, dissolution or other similar transaction, and the stockholders of the Corporation immediately prior to the recapitalization, liquidation, dissolution or other similar transaction own voting securities of the Corporation, the surviving entity or its parent immediately following the recapitalization, liquidation, dissolution or other similar transaction in substantially the same proportions (vis a vis each other) as such stockholders owned the voting securities of the Corporation immediately prior to the transaction; and (iv) any Change of Control Share Issuance.

| Page 9 of 15 |

“Compensatory Plan” means any plan, contract, or arrangement which provides for the sale, grant, or other issuance of equity securities of the Corporation to any employee, director, or consultant of the Corporation or any direct or indirect subsidiary of the Corporation.

“Controlled Company Exemption” means, if and to the extent otherwise applicable to the Corporation, the exemptions from the corporate governance rules and requirements of the Securities Exchange available to any company that constitutes a “controlled company” within the meaning of the corporate governance rules and requirements of the Securities Exchange.

“Disability” means permanent and total disability such that the Founder is unable to engage in any substantial gainful activity by reason of any medically determinable mental impairment which can be expected to result in death or which has lasted or can be expected to last for a continuous period of not less than 12 months as determined by a licensed medical practitioner. In the event of a dispute whether the Founder has suffered a Disability, no Disability of the Founder shall be deemed to have occurred unless and until an affirmative ruling regarding such Disability has been made by a court of competent jurisdiction, and such ruling has become final and non-appealable.

“Distribution” means (i) any dividend or distribution of cash, property or shares of the Corporation’s capital stock; and (ii) any distribution following or in connection with any liquidation, dissolution or winding up of the Corporation, either voluntary or involuntary.

“Exchange Act” means the United States Securities Exchange Act of 1934, as amended.

“Final Conversion Date” means 8:00 a.m. in New York City, New York on the first Trading Day falling on or after the date on which then outstanding shares of Class A Common Stock and the then outstanding Class B Common Stock are converted into Common Stock.

“Founder” means each of the parties named in the Company Formation Agreement of Helpful Alliance Company dated May 1, 2012.

“Founder Trustee” means Sergey V. Gurin (provided that, upon the expiration or termination of his (or any successor’s) service as the president of the Corporation, the successor president of the Corporation shall be substituted as a Founder Trustee), or any successors to the persons designated by the Founder and approved by resolution of not less than sixty-six and two-thirds percent (662/3%) of the stockholders or by resolution of not less than sixty-six and two-thirds percent (66 %) of the Board of Directors, in each case in their capacities as voting trustees pursuant to a written voting trust agreement entered into by the Founder.

| Page 10 of 15 |

“Rights” means any option, warrant, conversion right or contractual right of any kind to acquire shares of the Corporation’s authorized but unissued capital stock.

“SEC” means the United States Securities and Exchange Commission.

“Securities Acf” means the United States Securities Act of 1933, as amended.

“Securities Exchange” means, at any time, the registered national securities exchange on which the Corporation’s equity securities are then principally listed or traded, which shall be either the New York Stock Exchange or NASDAQ Global Market (or similar national quotation system of the NASDAQ Stock Market) (“NASDAQ”) or any successor exchange of either the New York Stock Exchange or NASDAQ.

“Trading Day” means any day on which the Securities Exchange is open for trading.

“Transfer” of a share of Stock shall mean any sale, assignment, transfer, conveyance, hypothecation or other transfer or disposition of such share or any legal or beneficial interest in such share, whether or not for value and whether voluntary or involuntary or by operation of law. A ” Transfer” shall also include, without limitation, (i) a transfer of a share of Stock to a broker or other nominee (regardless of whether or not there is a corresponding change in beneficial ownership) or (ii) the transfer of, or entering into a binding agreement with respect to, Voting Control over a share of a share of Stock, by proxy or otherwise, other than the Transfer of exclusive Voting Control with respect to shares of Class A Common Stock of the Founder as permitted in Article IV, Section D.4(c); provided. however, that the following shall not be considered a “Transfer(a) the grant of a proxy to officers or directors of the Corporation at the request of the Board of Directors of the Corporation in connection with actions to be taken at an annual or special meeting of stockholders; (b) the pledge of shares of Stock by a stockholder that creates a mere security interest in such shares pursuant to a bona fide loan or indebtedness transaction so long as the stockholder continues to exercise Voting Control over such pledged shares; provided. however. that a foreclosure on such shares of Stock or other similar action by the pledge shall constitute a “Transferor (c) the fact that, as of the Effective Time or at any time after the Effective Time, the spouse of any holder of a share of Stock possesses or obtains an interest in such holder’s shares of Stock arising solely by reason of the application of the community property laws of any jurisdiction, so long as no other event or circumstance shall exist or have occurred that constitutes a “Transfer” of such shares of Stock.

“Voting Control” with respect to a share of Stock means the exclusive power (whether directly or indirectly) to vote or direct the voting of such share of Stock by proxy, voting agreement, or otherwise.

| Page 11 of 15 |

ARTICLE VI

A. Board Size. The initial Board of Directors of the Corporation shall comprise 3 (Three) members comprising the three shareholders of the Corporation. Subject to the rights of the holders of any series of Preferred Stock to elect additional directors under specified circumstances, the total number of authorized directors constituting the Board of Directors (the “ Whole Board”) may change from time to time by the holders of Preferred Stock, Class A Common Stock, Class B Common Stock, and Class C Common Stock, voting together, pursuant to a resolution adopted by a majority of such stockholders.

B. Classified Board Structure. After the re-election of the initial Board, the directors, other than any who may be elected by the holders of any series of Preferred Stock under specified circumstances, shall be divided into three (3) classes as nearly equal in size as is practicable, hereby designated Class I, Class II and Class III. The Board of Directors may assign members of the Board of Directors already in office to such classes at the time such classification becomes effective. The term of office of the Class I directors shall expire at the first regularly-scheduled annual meeting of the stockholders following the Effective Time, the term of office of the Class II directors shall expire at the third annual meeting of the stockholders following the Effective Time, and the term of office of the Class III directors shall expire at the fifth annual meeting of the stockholders following the Effective Time. At each annual meeting of stockholders, commencing with the first regularly scheduled annual meeting of stockholders following the Effective Time, each of the successors elected to replace the directors of a Class whose term shall have expired at such annual meeting shall be elected to hold office for the same term and until the next respective successor shall have been duly elected and qualified.

Notwithstanding the foregoing provisions of this Article VI, each director shall serve until his or her successor is duly elected and qualified or until his or her death, resignation, or removal. If the number of directors is hereafter changed, any newly created directorships or decrease in directorships shall be so apportioned among the classes as to make all classes as nearly equal in number as is practicable, provided that no decrease in the number of directors constituting the Board of Directors shall shorten the term of any incumbent director.

C. Removal: Vacancies. Any director may be removed from office by the stockholders of the Corporation only for cause. Vacancies occurring on the Board of Directors for any reason and newly created directorships resulting from an increase in the authorized number of directors may be filled only by vote of a majority of the remaining members of the Board of Directors, although less than a quorum, or by a sole remaining director, at any meeting of the Board of Directors. A person elected to fill a vacancy or newly created directorship shall hold office until the next election of the class for which such director shall have been chosen and until his or her successor shall be duly elected and qualified.

| Page 12 of 15 |

ARTICLE VII

The following provisions are inserted for the management of the business and the conduct of the affairs of the Corporation, and for further definition, limitation and regulation of the powers of the Corporation and of its directors and stockholders:

A. Board Power. The business and affairs of the Corporation shall be managed by or under the direction of the Board of Directors. In addition to the powers and authority expressly conferred by the Florida Law or by these Restated Articles or the Bylaws of the Corporation, the Board of Directors is hereby empowered to exercise all such powers and do all such acts and things as may be exercised or done by the Corporation.

B. Written Ballot. Elections of directors need not be by written ballot unless otherwise provided in the Bylaws of the Corporation.

C. Bylaws, In furtherance and not in limitation of the powers conferred by the Florida Law, the Board of Directors is expressly authorized to adopt, amend or repeal the Bylaws of the Corporation.

D. Special Meetings. Special meetings of the stockholders may be called only by (i) the Board of Directors pursuant to a resolution adopted by a majority of the Whole Board; (ii) the chairman of the Board of Directors; (iii) the chief executive officer of the Corporation; or (iv) the president of the Corporation.

E. Stockholder Actions. Subject to the rights of the holders of any series of Preferred Stock, any action required or permitted to be taken by the stockholders of the Corporation may be effected at a duly called annual or special meeting of stockholders of the Corporation or may be effected by a written consent by such stockholders.

F. No Cumulative Voting. No stockholder will be permitted to cumulate votes at any election of directors.

G. No Reliance on the Controlled Company Exemption. At any time during which shares of capital stock of the Corporation are listed for trading on the Securities Exchange, the Corporation shall not rely upon the Controlled Company Exemption.

| Page 13 of 15 |

ARTICLE VIII

A. Director Exculpation. To the fullest extent permitted by the Florida Law, as the same exists or as may hereafter be amended, a director of the Corporation shall not be personally liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as a director except for liability (a) for any breach of the director’s duty of loyalty to the Corporation or its stockholders; (b) for acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law; (c) under Florida Law; or (d) for any transaction from which the director derived any improper personal benefit. If the Florida Law is amended, after approval by the stockholders of this Article VIII to authorize corporate action further eliminating or limiting the personal liability of directors, then the liability of a director of the Corporation shaii be eliminated or limited to the fullest extent permitted by the Florida Law, as so amended.

B. Indemnification. The Corporation shall have the power to indemnify to the fullest extent permitted by law any person made or threatened to be made a party to an action or proceeding, whether criminal, civil, administrative or investigative, by reason of the fact that he, his testator or intestate is or was a director, officer, employee or agent of the Corporation, any predecessor of the Corporation or any subsidiary or affiliate of the Corporation, or serves or served at any other enterprise as a director, officer, employee or agent at the request of the Corporation or any predecessor to the Corporation. The Corporation shall indemnify any person made or threatened to be made a party to an action or proceeding, whether criminal, civil, administrative or investigative, by reason of the fact that he, his testator or intestate is or was a director or officer of the Corporation or any predecessor of the Corporation, or serves or served at any other enterprise as a director or officer at the request of the Corporation, any predecessor to the Corporation or any subsidiary or affiliate of the Corporation as and to the extent (and on the terms and subject to the conditions) set forth in the Bylaws of the Corporation or in any contract of indemnification entered into by the Corporation and any such person.

C. Vested Rights. Neither any amendment nor repeal of this Article VIII, nor the adoption of any provision of these Restated Articles inconsistent with this Article VIII, shall eliminate or reduce the effect of this Article VIII in respect of any matter occurring, or any action or proceeding accruing or arising or that, but for this Article VIII, would accrue or arise, prior to such amendment, repeal or adoption of an inconsistent provision.

ARTICLE IX

Unless the Corporation consents in writing to the selection of an alternative forum, the Court of the State of Florida shall be the sole and exclusive forum for (i) any derivative action or proceeding brought on behalf of the Corporation; (ii) any action asserting a claim of breach of a fiduciary duty owed by any director, officer or other employee of the Corporation to the Corporation or the Corporation’s stockholders; (iii) any action asserting a claim against the Corporation arising pursuant to any provision of the Florida Law, the Restated Articles or the Bylaws of the Corporation; or (iv) any action asserting a claim against the Corporation governed by the internal affairs doctrine. Any person or entity purchasing or otherwise acquiring any interest in shares of capital stock of the Corporation shall be deemed to have notice of and to have consented to the provisions of this Article IX.

| Page 14 of 15 |

ARTICLE X

If any provision of this Restated Articles becomes or is declared on any ground by a court of competent jurisdiction to be illegal, unenforceable or void, portions of such provision, or such provision in its entirety, to the extent necessary, shall be severed from this Restated Articles , and the court will replace such illegal, void or unenforceable provision of this Restated Articles with a valid and enforceable provision that most accurately reflects the Corporation’s intent, in order to achieve, to the maximum extent possible, the same economic, business and other purposes of the illegal, void or unenforceable provision. The balance of this Restated Articles shall be enforceable in accordance with its terms.

Except as provided in Article VIII above, the Corporation reserves the right to amend, alter, change or repeal any provision contained in this Restated Articles , in the manner now or hereafter prescribed by statute, and all rights conferred upon stockholders herein are granted subject to this reservation; provided, however, that, notwithstanding any other provision of this Restated Articles or any provision of law that might otherwise permit a lesser vote or no vote, but in addition to any vote of the holders of any class or series of the stock of this Corporation required by law or by this Restated Articles , (i) the affirmative vote of the holders of at least eighty percent (80%) of the voting power of the outstanding shares of stock of the Corporation entitled to vote generally in the election of directors, voting together as a single class, shall be required to amend or repeal, or adopt any provision of this Restated Articles inconsistent with, ARTICLE VI, ARTICLE VII, ARTICLE VIII or this ARTICLE X and (ii) the affirmative vote of a majority of the outstanding shares of Class A Common Stock and the affirmative vote of a majority of the outstanding shares of Class B Common Stock, each voting separately as a class, shall be required to amend or repeal, or adopt any provision of this Restated Articles inconsistent with, ARTICLE IV, ARTICLE V or this clause (ii) of ARTICLE X of this Restated Articles.

IN WITNESS WHEREOF, this First Amended and Restated Articles have been executed on behalf of the Corporation by the President of the Corporation, entering into effect on May 1, 2012.

| Page 15 of 15 |

| Page 1 of 4 |

| Page 2 of 4 |

| Page 3 of 4 |

| Page 4 of 4 |