Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HTG MOLECULAR DIAGNOSTICS, INC | d121064d8k.htm |

Exhibit 99.1

HTG

HTG

HTG

This presentation

contains forward-looking statements that involve substantial risks and uncertainties. All statements, other than statements of historical facts, contained in this presentation, including statements regarding our timeline strategy, future operations,

future product development, prospects and plans and objectives are forward-looking statements. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,”

“predict,” “project,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue,” and similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our

forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in forward-looking statements, including due to risks involved in the development and commercialization of products,

replacement of existing technologies and outcome of relationships with third parties. The forward-looking statements contained in this presentation reflect our current views with respect to future events, and we assume no obligation to update any

forward-looking statements except as required by applicable law.

8 January 2016 © HTG Molecular Diagnostics, Inc. 2

HTG investment highlights

HTG

Disruptive technology positioned to replace & consolidate

existing tests in $2B+ markets. ( FISH, Flo Cytometry, IHC)

Growing pipeline of late stage BioPharma collaborations with potential to lead to high valued companion

diagnostic tests

Well positioned for continued execution of strategic milestones

Enabling precision medicine at the local level

1/8/2016 3

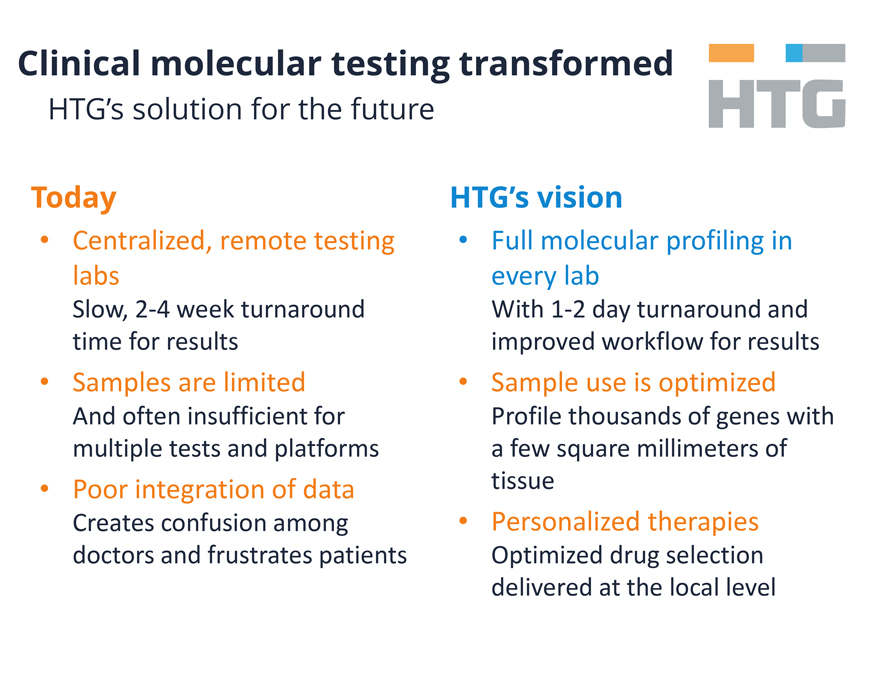

Clinical molecular testing transformed

HTG’s solution for the future

HTG

Today

Centralized, remote testing labs

Slow, 2-4 week turnaround time for results

Samples are limited And often insufficient for

multiple tests and platforms

Poor integration of data Creates confusion among doctors and frustrates patients

HTG’s vision

Full molecular profiling in every lab

With 1-2 day turnaround and improved workflow for results

Sample use is optimized Profile

thousands of genes with a few square millimeters of tissue

Personalized therapies Optimized drug selection delivered at the local level

HTG

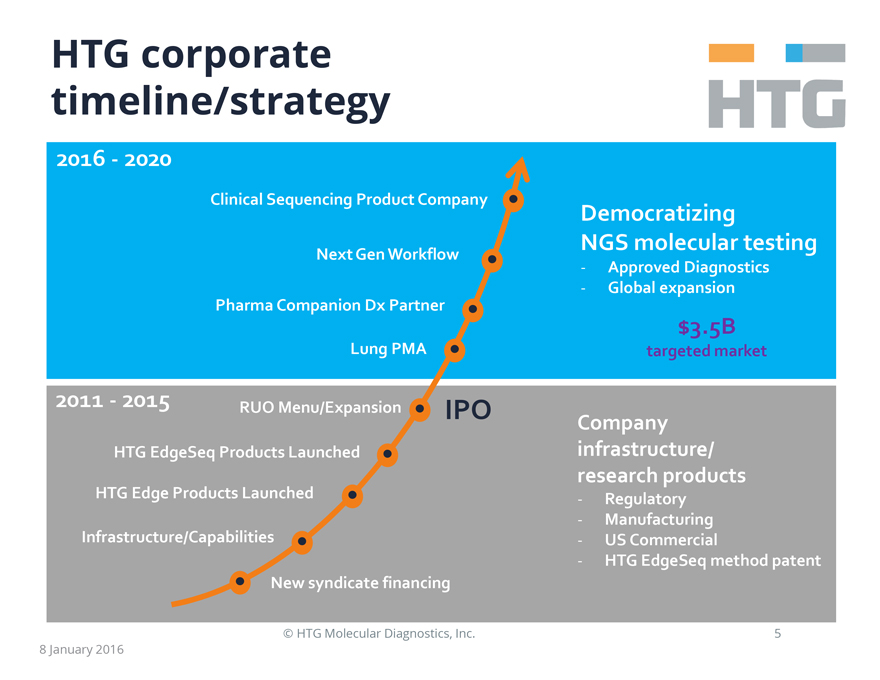

HTG corporate

timeline/strategy

2016 - 2020

Clinical Sequencing Product Company

Next Gen Workflow

Pharma Companion Dx Partner

Lung PMA

Democratizing NGS molecular testing

- Approved Diagnostics

- Global expansion

$3.5B

targeted market

2011 - 2015

RUO Menu/Expansion IPO

HTG EdgeSeq Products Launched

HTG Edge Products Launched

Infrastructure/Capabilities

New syndicate financing

Company infrastructure/research products

- Regulatory

- Manufacturing

- US Commercial

- HTG EdgeSeq method patent

© HTG Molecular Diagnostics, Inc.

8 January 2016 5

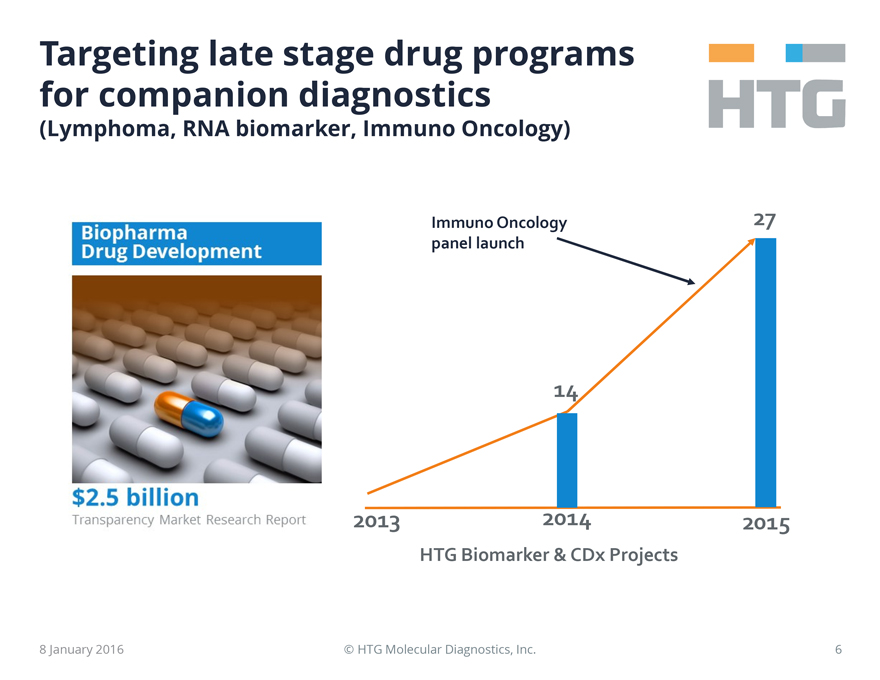

Targeting late stage drug programs for companion diagnostics

(Lymphoma, RNA biomarker, Immuno Oncology)

HTG

Biopharma Drug Development

$2.5 billion

Transparency Market Research Report

Immuno Oncology panel launch

27

14

2013 2014 2015

HTG Biomarker & CDx Projects

8 January 2016 © HTG Molecular Diagnostics, Inc. 6

BioPharma A

The Case of

the Assay Failure

HTG

Problem Statement – in a 300 case phase II study,

over 50% of the samples failed to yield a diagnostic result by RNASeq because of lack of sample or poor sample quality causing clinical development of the compound to be stopped

HTG Solution – A subset of these samples from this same cohort tested using HTG EdgeSeq Oncology Biomarker Panel Assay (OBP) yielded diagnostic results in over 90% of the

cases because HTG assay requires far less sample than RNASeq

Resulting Status – the BioPharma has now contracted with HTG to test the rest of the 300 cases

from the phase II study and reassess clinical development for the compound.

8 January 2016 © HTG Molecular Diagnostics, Inc. 7

Targeting translational research centers for diagnostic development

HTG

Translational Medicine

Science Translational Medicine

$7.7 billion

Wells Fargo Genomic Tools Report

Stanford MEDICINE

Freidenrich Center for Translational Research

THE UNIVERSITY OF TEXAS

MD Anderson Cancer Center

Making Cancer History*

Worldwide innovative networking in personalized cancer medicine

NIH NATIONAL CANCER INSTITUTE

Inova Translational Medicine INSTITUTE

PROOF

Centre of | Centre d’ EXCELLENCE Biomarker solutions for health care. Biomarqueurs - Solutions en soins de sante.

UNC

SCHOOL OF MEDICINE

School of Medicine

UNIVERSITY OF COLORADO ANSCHUTZ MEDICAL CAMPUS

8 January 2016 © HTG Molecular Diagnostics, Inc. 8

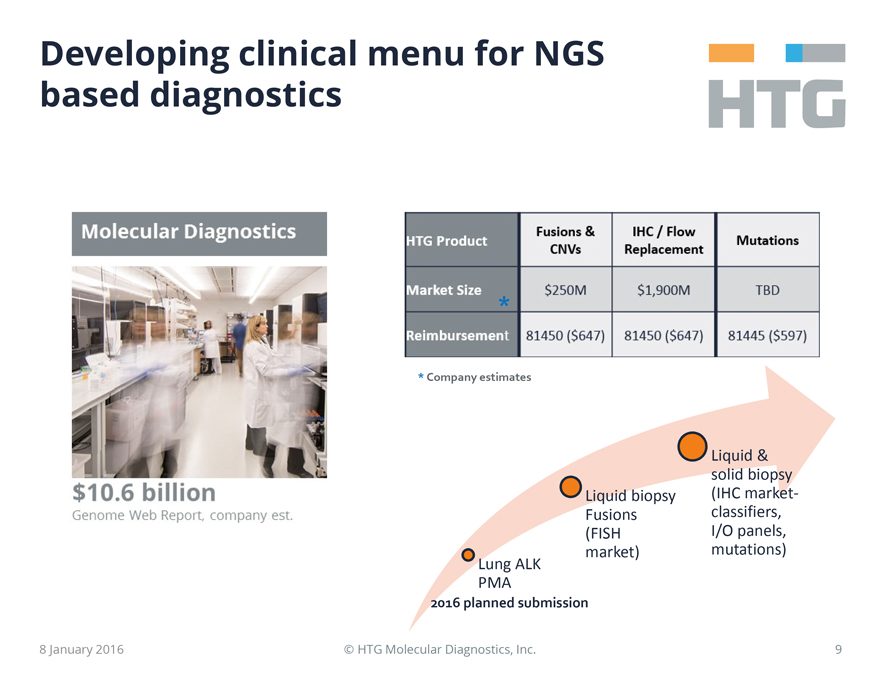

HTG

Developing clinical

menu for NGS based diagnostics

Molecular Diagnostics

$10.6 billion

Genome Web Report, company est.

HTG Product Fusions & CNVs IHC / Flow

Replacement Mutations

Market Size * $250M $1,900M TBD

Reimbursement 81450

($647) 81450 ($647) 81445 ($597)

* Company estimates

Lung ALK PMA

2016 planned submission

Liquid biopsy Fusions (FISH market)

Liquid & solid biopsy (IHC market-classifiers, I/O panels, mutations)

8 January 2016

© HTG Molecular Diagnostics, Inc. 9

HTG EdgeSeq technology

Provides the Solution

HTG

Multiplexing

Allows analysis of thousands of molecular targets

Extremely Small Samples

Produce robust data and profiles

No DNA/RNA Extraction

Proprietary patented chemistry

Automated Platform

With minimal labor, simple user interfaces, and turnkey analytics

Multi-Parameter Testing

Measures multiple molecular applications

Quick Turnaround

With sample to result in 24 to 36 hours

High Data Quality

From many sample types, including formalin fixed paraffin embedded tissue

(FFPE) and liquid biopsies

8 January 2016 © HTG Molecular Diagnostics, Inc. 10

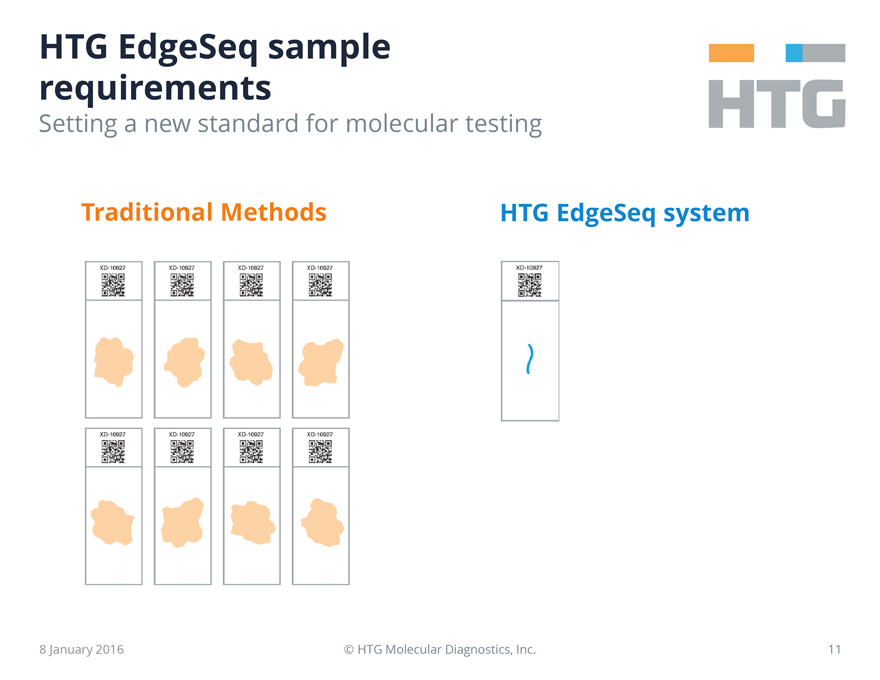

HTG EdgeSeq sample requirements

Setting a new standard for molecular testing

HTG

Traditional Methods

XD-10927 XD-10927 XD-10927 XD-10927

XD-10927 XD-10927 XD-10927 XD-10927

HTG EdgeSeq system

XD-10927

8 January 2016 © HTG Molecular Diagnostics, Inc. 11

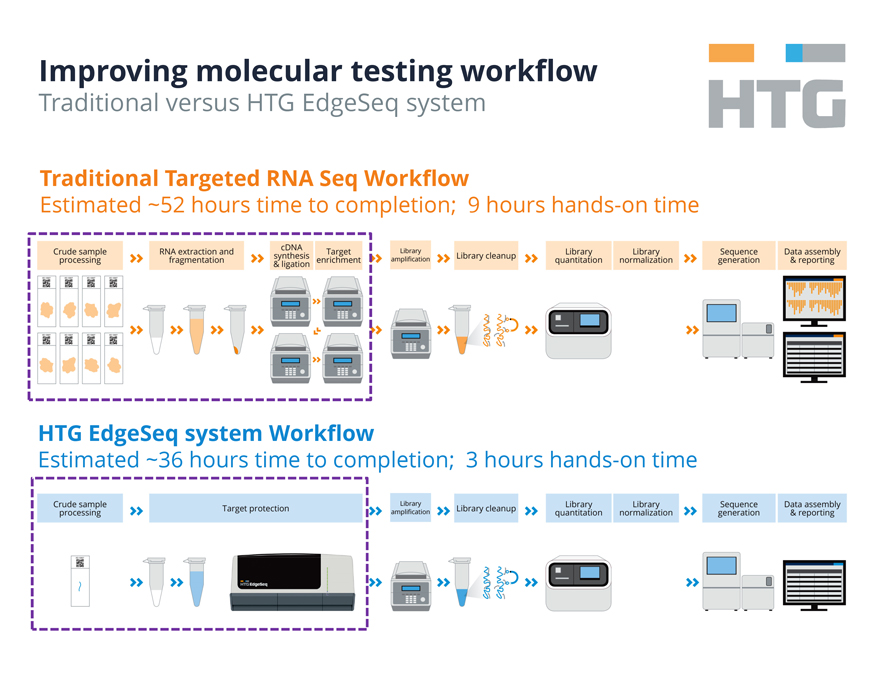

Improving molecular testing workflow

Traditional versus HTG EdgeSeq system

HTG

Traditional Targeted RNA Seq Workflow

Estimated ~52 hours time to completion; 9 hours hands-on

time

Crude sample processing RNA extraction and fragmentation cDNA synthesis & ligation Target enrichment

Library amplification Library cleanup Library quantitation Library normalization Sequence generation Data assembly & reporting

HTG EdgeSeq system Workflow

Estimated ~36 hours time to completion; 3 hours hands-on time

Crude sample processing Target protection Library amplification Library cleanup Library quantitation Library normalization Sequence generation Data assembly &

reporting

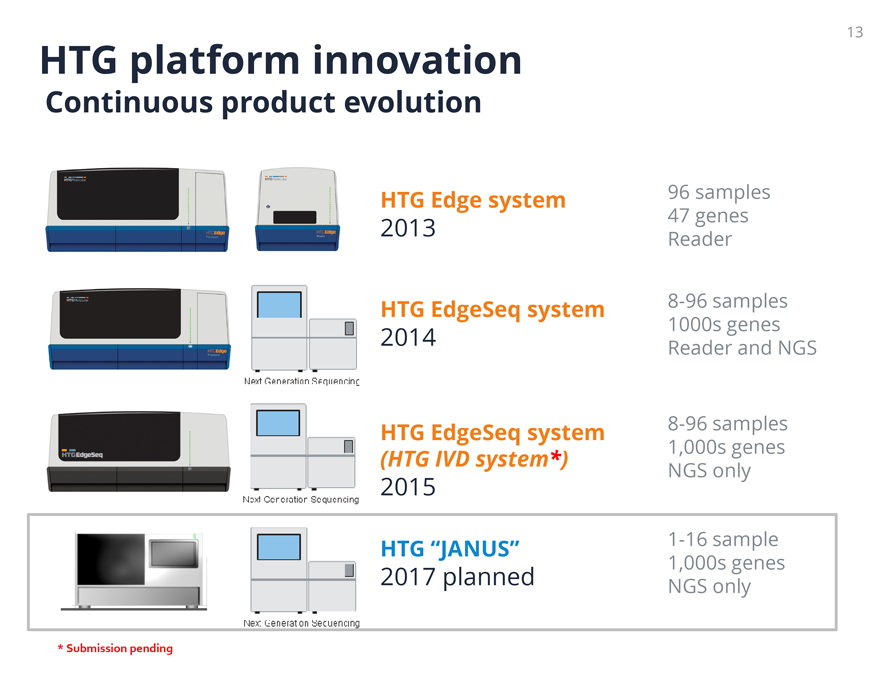

HTG platform innovation

Continuous product evolution

HTG Edge system 2013 96 samples 47 genes Reader

Next Generation Sequencing HTG EdgeSeq system 2014 8-96 samples 1000s genes Reader and NGS

Next Generation Sequencing HTG EdgeSeq system (HTG IVD system*) 2015 8-96 samples 1,000s genes NGS only

HTGEdgeSeq

Next Generation Sequencing HTG “JANUS” 2017 planned 1-16 sample 1,000s

genes NGS only

* Submission pending

13

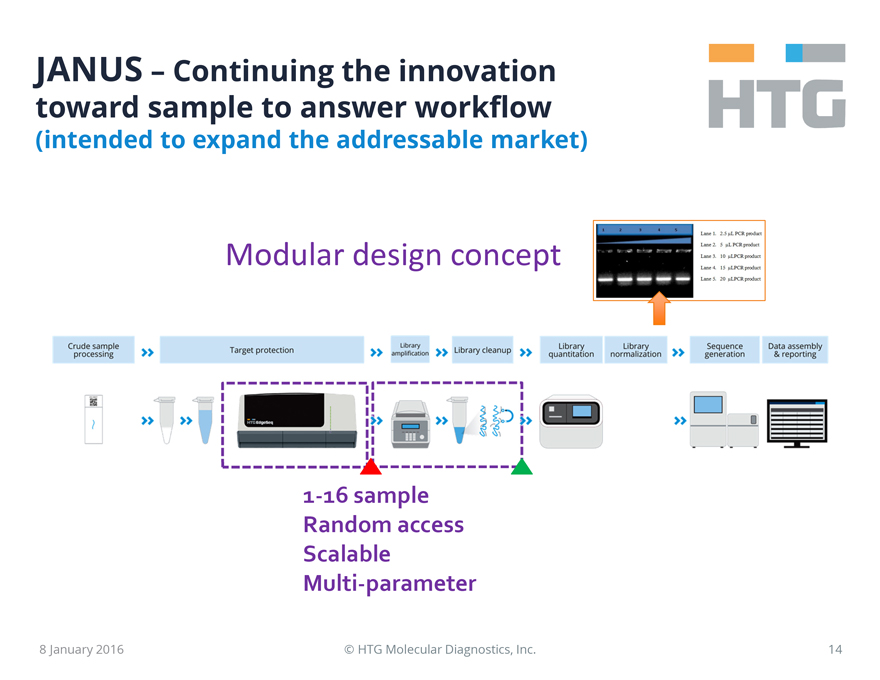

JANUS - Continuing the innovation toward sample to answer workflow

(intended to expand the addressable market)

HTG

Modular design concept

1 2 3 4 5

Lane 1. 2.5 uL PCR product

Lane 2. 5 uL PCR product

Lane 3. 10 uLPCR product

Lane 4. 15 uLPCR product

Lane 5. 20 uLPCR product

Crude sample processing Target protection Library amplification

Library cleanup Library quantitation Library normalization Sequence generation Data assembly & reporting

1-16 sample Random access Scalable Multi-parameter

8 January 2016 © HTG Molecular Diagnostics, Inc. 14

HTG forms IVD test development agreement with Illumina

October 30, 2014

HTG

HTG EdgeSeq

HTG Molecular

Sample Plate

Lot 0000

Part 00000000

Store at 15-30°C

Expires 12.31.25

illumina®

8 January 2016 © HTG Molecular Diagnostics, Inc. 15

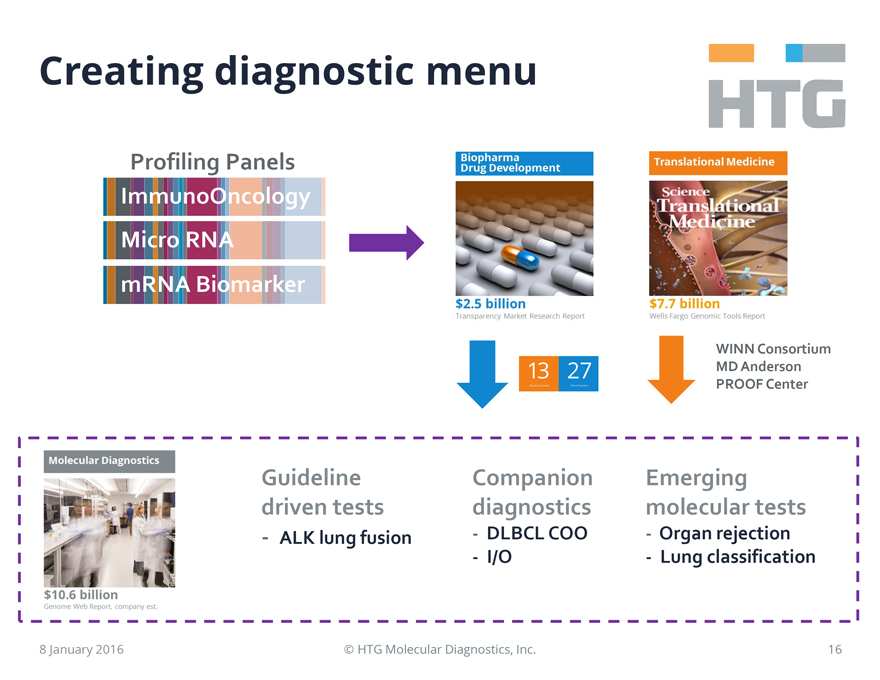

Creating diagnostic menu

HTG

Profiling Panels

ImmunoOncology

Micro RNA

mRNA Biomarker

Biopharma Drug Development

$2.5 billion

Transparency Market Research Report

13 Biopharma Clients

27 Active Programs

Translational Medicine

Science Translational Medicine

$7.7 billion Wells Fargo Genomic Tools Report

WINN Consortium MD Anderson PROOF Center

Molecular Diagnostics

$10.6 billion

Genome Web Report, company est.

Guideline driven tests

- ALK lung fusion

Companion

diagnostics

- DLBCL COO

- I/O

Emerging molecular tests

- Organ rejection

- Lung classification

8 January 2016

© HTG Molecular Diagnostics, Inc.

16

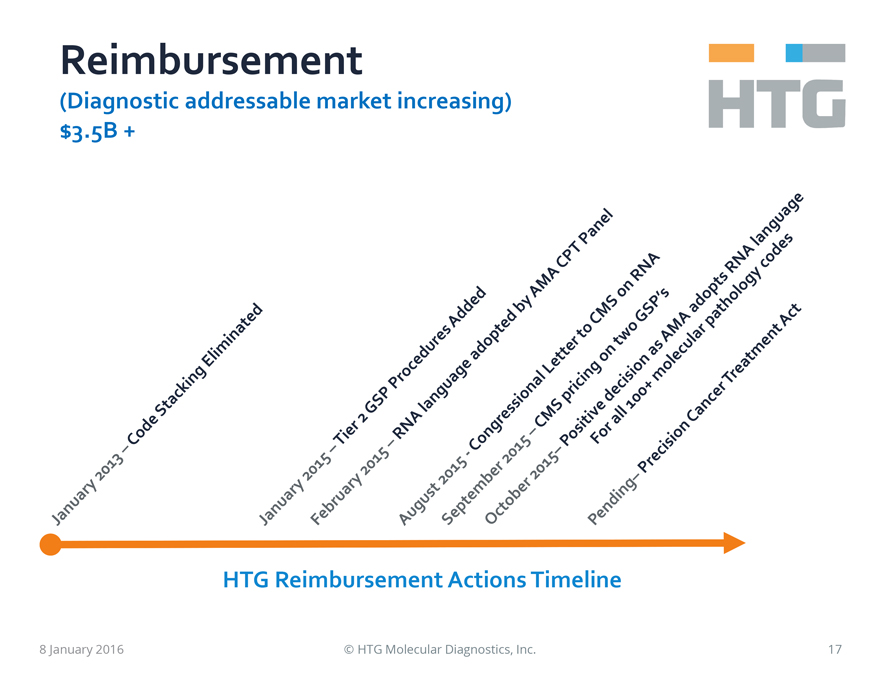

Reimbursement

(Diagnostic

addressable market increasing) $3.5B +

HTG

January 2013 – Code Stacking

Eliminated

January 2015 – Tier 2 GSP Procedures Added

February 2015

– RNA language adopted by AMA CPT Panel

August 2015 – Congressional Letter to CMS on RNA

September 2015 – CMS pricing on two GSP’s

October 2015 – Positive decision as

AMA adopts RNA language

For all 100+ molecular pathology codes

Pending –

Precision Cancer Treatment Act

HTG Reimbursement Actions Timeline

8 January

2016 © HTG Molecular Diagnostics, Inc. 17

HTG’s reimbursement summary – POSITIVE

HTG

HTG customers will now be able to access the molecular pathology codes for reimbursement.

(>100 codes)

HTG’s initial clinical menu is expected to utilize the GSP’s (General Sequencing Procedure Codes) with pricing from CMS of $597 and $647

Expect potential upside with local coverage decisions

Pricing should support

our business model

HTG has a Z-Code for Lung Fusion assay and will file technical dossier early 2016 utilizing CPT 81445

HTG collaborating with congressional leaders to further support improved reimbursement for molecular pathology

PAMA does not affect HTG as we do not have a CLIA lab

8 January 2016 © HTG Molecular

Diagnostics, Inc. 18

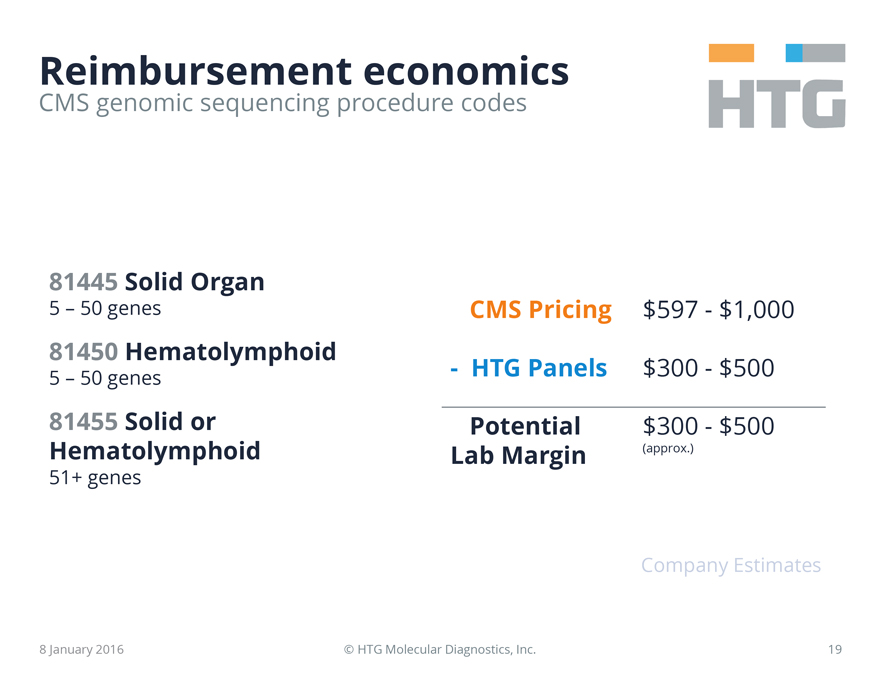

Reimbursement economics

CMS genomic sequencing procedure codes

HTG

81445 Solid Organ

5 – 50 genes

81450 Hematolymphoid

5 – 50 genes

81455 Solid or Hematolymphoid

51+ genes

CMS Pricing $597 - $1,000

- HTG Panels $300 - $500

Potential Lab Margin $300 - $500 (approx.)

Company Estimates

8 January 2016 © HTG Molecular Diagnostics, Inc. 19

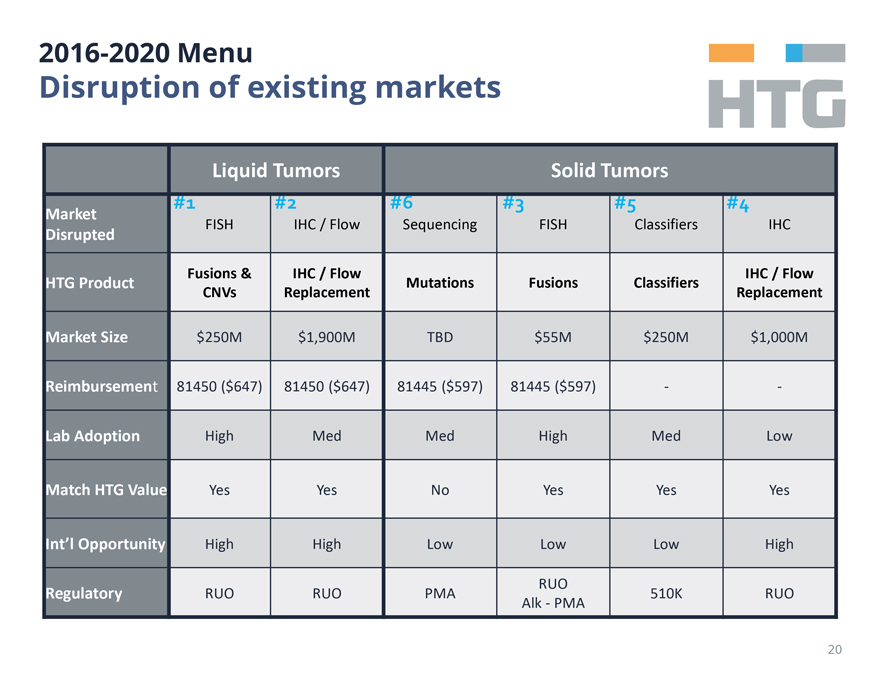

2016-2020 Menu

Disruption

of existing markets

HTG

Liquid Tumors Solid Tumors

#1 FISH #2 IHC / Flow #6 Sequencing #3 FISH #5 Classifiers #4 IHC

Market Disrupted

HTG Product Fusions & CNVs IHC / Flow Replacement Mutations Fusions Classifiers IHC / Flow Replacement

Market Size $250M $1,900M TBD $55M $250M $1,000M

Reimbursement 81450 ($647) 81450 ($647) 81445

($597) 81445 ($597) - -

Lab Adoption High Med Med High Med Low

Match HTG

Value Yes Yes No Yes Yes Yes

Int’l Opportunity High High Low Low Low High

Regulatory RUO RUO PMA RUO Alk-PMA 510K RUO

20

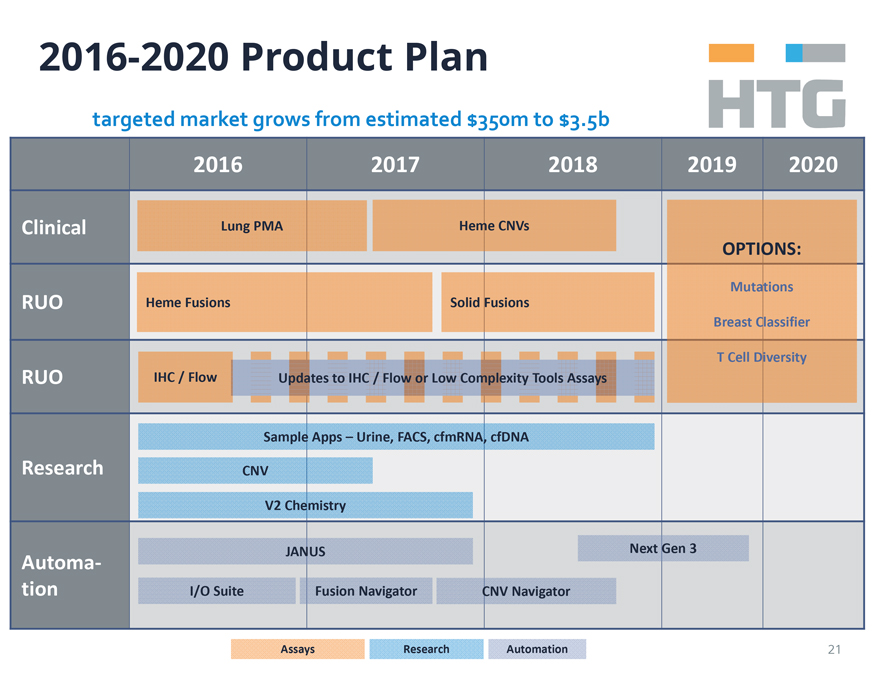

2016-2020 Product Plan

targeted market grows from estimated $350m to $3.5b

HTG

2016 2017 2018

Clinical Lung PMA Heme CNVs OPTIONS:

RUO Heme Fusions Solid Fusions Mutations Breast Classifier

RUO IHC / Flow Updates to IHC /

Flow or Low Complexity Tools Assays T Cell Diversity

Sample Apps – Urine, FACS, cfmRNA, cfDNA

Research CNV V2 Chemistry

Automa-

tion JANUS Next Gen 3 I/O Suite Fusion Navigator CNV Navigator

Assays Research Automation 21

Empowering precision medicine at the local level

HTG

HTGEdgeSeq

8 January 2016 © HTG Molecular Diagnostics, Inc. 22